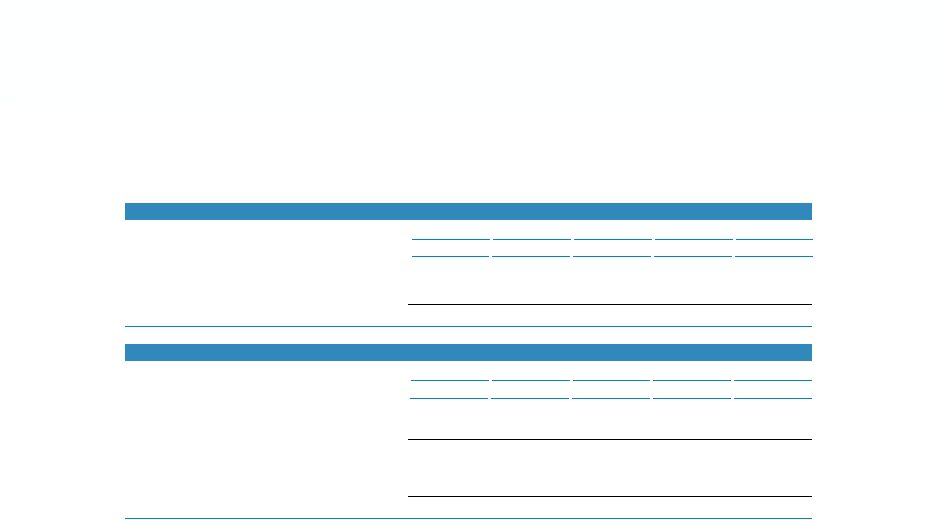

Preliminary Summary of Tax Attributes SUMMARY OF TAX ATTRIBUTES (a) Federal NOLs Research Credits State NOLs Expiration Date NOL Available Less: Corvas NOL Limited Carryover to Next Year Amount Available (c) Amount Available (c) 2014 $- $- $- $- $125,594,672 2015 - - - - 74,360,807 2016 - - - - 135,729,603 2017 - - - - 524,542 2018 13,110,385 (12,293,254) 817,131 340,854 - 2019 17,720,799 (11,783,691) 5,937,108 430,367 38,285 2020 29,758,768 (14,812,354) 14,946,414 379,082 87,658 2021 41,531,738 (21,448,110) 20,083,628 736,995 314,404 2022 49,371,858 (19,181,594) 30,190,264 344,111 6,397,816 2023 48,053,228 (12,946,611) 35,106,617 508,556 12,323,821 2024 73,910,646 - 73,910,646 1,200,055 16,952,495 2025 74,831,142 - 74,831,142 1,606,282 19,707,361 2026 85,549,309 - 85,549,309 2,987,484 13,943,212 2027 102,403,107 - 102,403,107 2,832,666 23,093,319 2028 67,852,236 - 67,852,236 1,406,007 15,864,847 2029 125,475,151 - 125,475,151 1,447,575 3,048,728 2030 344,271,643 - 344,271,643 7,140,910 430,000,781 2031 267,706,320 - 267,706,320 2,747,834 619,469,955 2032 312,709,139 - 312,709,139 1,382,822 742,623,682 2033 211,944,842 - 211,944,842 - 511,809,208 Total $1,866,200,311 ($92,465,614) $1,773,734,697 $25,491,600 $2,751,885,197 (a) As of December 31, 2013. The historical information presented above does not reflect the impact of any restructuring or other transaction involving the Company. (b) The 2013 Form 1120 Corporate Tax Return includes the Corvas NOLs and therefore indicates that $1,866,200,311 NOLs are available. However, §382 would limit 100% of the use of these NOLs and therefore the Company has reduced them to $1,733,734,697. (c) Full amount available is eligible for carryover. 100% by §382 (b) |