UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008.

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (No Fee Required) |

For the transition period from to .

Commission file number 001-34143

RACKSPACE HOSTING, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 74-3016523 |

(State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

5000 Walzem Rd.

San Antonio, Texas 78218

(Address of principal executive offices, including Zip Code)

(210) 312-4000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange of which registered |

| Common Stock, par value $0.001 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer, large accelerated filer and a smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer þ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of June 30, 2008, the last business day of our most recently completed second fiscal quarter; our common stock was not listed on any exchange or over-the counter market. Our common stock began trading on the New York Stock Exchange on August 8, 2008. As of December 31, 2008, the aggregate market value of the voting stock held by non-affiliates was $287,930,138 based on the number of shares held by non-affiliates of the registrant as of December 31, 2008, and based on the reported last sale price of our common stock on December 31, 2008. Shares of our common stock held by each officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that persons are affiliates for any other purposes.

On February 25, 2009, 117,568,172 shares of the registrant’s Common Stock, $0.001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Registrant’s 2009 Annual Meeting of Stockholders to be filed within 120 days of the Registrant’s fiscal year ended December 31, 2008 are incorporated by reference into Part III of this Form 10-K.

RACKSPACE HOSTING, INC.

TABLE OF CONTENTS

Rackspace®, Fanatical®, Fanatical Support®, and MOSSO® are our registered service marks. Net Promoter® is a registered trademark of Bain & Company, Fred Reichheld and Satmetrix Systems, Inc.; NPS is a service mark of Bain & Company, Inc. EVA® is a registered trademark of Stern Stewart & Co. and EVAdimensions. Other trademarks and tradenames appearing in this report are the property of their respective holders. We do not intend our use or display of other companies’ tradenames, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this Annual Report on Form 10-K that are subject to risks and uncertainties. Forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section and Section 21E of the Securities Exchange Act of 1934, as amended, are subject to the “safe harbor” created by those sections. The forward-looking statements in this report are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “aspires,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will” or “would” or the negative of these terms and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements. We discuss many of these risks, uncertainties and other factors in this document in greater detail under the heading “Risk Factors.” We believe it is important to communicate our expectations to our investors. However, there may be events in the future that we are not able to predict accurately or over which we have no control. The risks described in “Risk Factors” included in this report, as well as any other cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Before you invest in our common stock, you should be aware that the occurrence of the events described in “Risk Factors” and elsewhere in this report could harm our business.

Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this filing. You should read this document completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

2

PART I

ITEM 1—BUSINESS

Rackspace Hosting, Inc. was incorporated in Delaware on March 7, 2000 under the name Rackspace.com, Inc. However, our operations began in 1998 as a limited partnership, which became our subsidiary through a corporate reorganization completed on August 21, 2001. The company’s name was changed to Rackspace Hosting, Inc. on June 5, 2008 through a merger with one of its wholly-owned subsidiaries. Our principal executive offices are located at 5000 Walzem Rd., San Antonio, Texas 78218. Our telephone number is (210) 312-4000. Our website address is www.rackspace.com. References to “we,” “our,” “our company,” “us,” “the company,” “Rackspace Hosting,” or “Rackspace” refer to Rackspace Hosting, Inc. and its consolidated subsidiaries. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and the related Notes for additional information regarding the business and our operating results. Changes to our Business section from prior filings are a reflection of a competitive and changing business environment and our adaptations with respect to our product and services set.

Overview

Rackspace Hosting is a world leader in hosting and cloud computing. Our rapid growth over the last decade has been fueled by our commitment to our unique brand of customer service known as Fanatical Support®.

Hosting is at the center of a multi-year shift that is changing the way businesses buy IT services. New cloud computing technologies, which deliver greater simplicity and more meaningful cost savings to businesses, make hosting even more compelling for a broader market. We are pioneering an emerging category, Hybrid Hosting, which combines the benefits of both traditional dedicated hosting and emerging cloud hosting. Hybrid Hosting provides businesses the best of both worlds, allowing IT departments to lower costs without sacrificing the benefits of dedicated hosting. As businesses move to on-demand IT and Hybrid Hosting, we believe Fanatical Support will be more valuable to them than ever before.

We are a global company. Our corporate headquarters is located in San Antonio, with other operations located in the United States (U.S.), the United Kingdom (U.K.), the Netherlands, and Hong Kong. Our services are sold to businesses in more than 120 countries. In 2008 we had net revenues of $531.9 million and as of December 31, 2008, we served more than 53,000 business customers of all sizes. To date, we manage more than 47,000 servers, 1,000,000 email accounts, and 83,000 cloud hosting domains. No single customer accounted for more than 1% of net revenues in the past three years.

The Hosting Industry

Since our inception in 1998, strong growth has made us a leader in hosting. Hosting is best described as IT services delivered on demand over the Internet. Hosting providers act as an extension of businesses’ IT departments.

Today, there are three ways that businesses can fulfill their IT requirements. The first is commonly called“do it yourself,” or DIY. DIY is an approach to managing IT services where a business retains complete ownership and responsibility for ongoing maintenance and management of servers, software, networking equipment, etc. Companies may choose to house this equipment in their own facilities, or may rent data center space from a colocation provider. The second approach isoutsourcing, where businesses transfer full responsibility for their IT systems, operations, and employees to a third party.Hosting is the third approach, and we believe it delivers a simpler, better quality and more cost-competitive solution than do-it-yourself or outsourcing. Our broad service suite provides customers the flexibility to choose the best combination of dedicated hosting and cloud computing services to meet their unique IT needs.

3

The hosting industry emerged in the 1990’s to serve a need created by the rapid adoption of the Internet by consumers and businesses worldwide. Early hosting demand was driven by companies setting up simple websites during the “dot com” boom. These companies did not have the skills or resources to connect their websites to the Internet, so they turned to hosting companies to perform this task. We believe demand for hosting will continue for three reasons:

| 1. | Smaller companies still do not have in-house resources to manage complicated websites, and they do not want to purchase expensive hardware with scarce capital. Yet they must have an increasingly robust, reliable online presence in order to succeed in today’s market. |

| 2. | Larger companies that do have specialized, dedicated IT resources would rather deploy these resources to more strategic areas of their business rather than managing servers or running a website. |

| 3. | As companies have experienced the benefits of using hosting providers to manage their web sites, they have become more comfortable with the concept of hosting providers managing additional IT services. |

Today, the hosting market opportunity extends well beyond its roots and includes a broad continuum of services from simple websites to complex, mission-critical IT applications and support. We believe the trend toward on-demand IT Services is in its infancy and will drive growth over the coming years.

Cloud Computing and Hosting

Cloud computing is one of the most widely discussed topics in IT today. We believe it is also central to the future of the hosting industry and have made it a key element of our hosting strategy. In simple terms, cloud computing refers to pooled computing resources, delivered on-demand, over the Internet. In the same manner that electricity is delivered on-demand from large scale power plants, cloud computing is delivered from large, centralized data centers to businesses all over the world.

Today, our core offering, managed hosting, requires dedicated servers for each customer deployment. Most of these dedicated resources, which are designed to meet peak processing demands, are underutilized during non-peak hours. Cloud technologies allow hosting providers to effectively provision and manage a pool of computing resources (or a “cloud”) across a larger base of customers. Cloud technologies deliver more computing resources to businesses when they need them. At the same time, cloud computing substantially lowers the cost of IT services. We believe these compelling benefits will continue to drive migration from server rooms and corporate data centers to the cloud.

We believe cloud computing is a paradigm shift in IT and we are investing heavily to take advantage of these new technologies. In addition to three acquisitions (Webmail.us, Slicehost, and Jungle Disk), we have built large teams of experts devoted to research and development around these technologies. We view cloud computing as a natural extension of our core hosting offering. We also believe our ability to provide Hybrid Hosting, backed by Fanatical Support, provides us a competitive advantage in the hosting marketplace.

Our Service Suite

We sell a broad suite of hosting and cloud computing offerings, all backed by Fanatical Support.

Dedicated Hosting—Dedicated hosting delivers a customer-specific, dedicated server, located in our secure, business-class data centers. Our customers have full administrator privileges and are responsible for most administrative functions. We provide a customer management portal and other management tools.

| | • | | Managed Hosting—Our core service offering is managed hosting. This service removes the burden of managing the data center, network, hardware devices, and operating system software from the customer. We became an industry leader in the managed hosting category early in our |

4

| | company history, taking standard service expectations in the industry and exceeding them. Customers place high value on the added benefits of managed hosting, and continue to make us their preferred choice for managed hosting. Despite the emergence of cloud computing, we believe managed hosting will remain a key service offering as companies continue to demand dedicated equipment that will meet specific performance or security needs. We remain committed to innovating new products and services and have added several notable services to the core managed hosting offerings. |

| | • | | Platform hosting (managed colocation)—Platform hosting serves the demands of highly technical customers who require ordering and provisioning support. Managed colocation customers manage most or all of their software and applications. Some customers supply their own, non-standard hardware. We manage the data centers, networks and some standard hardware devices. Our platform hosting service is often combined with traditional managed hosting, allowing customers the flexibility to customize service levels for each hosting service component. |

Cloud Hosting—Our cloud hosting services allow businesses to run their custom applications, similar to managed hosting, but using the new technologies of cloud computing. There are multiple varieties of cloud hosting services that are priced on a pay-per-use basis and that can be quickly and easily scaled up or down on demand. Today we offer Cloud Servers, Cloud Files, and Cloud Sites. Cloud Servers allow customers to purchase “slices” of servers, load their applications onto those virtual servers, and pay only for the capacity they use. Cloud Files allow customers to purchase storage services by the gigabyte. Cloud Sites allow customers to deploy their applications to a cluster of servers that will scale processing on demand and as required by the application. Although these cloud services are emerging technologies and in the early phases of development, they offer the true promise of cloud computing – auto scaling, no hardware or software management, simple deployment.

Cloud Applications—This cloud category, often called “software-as-a-service”, delivers applications provisioned and ready for end-customers to use. These services require limited support from the customer’s IT department, and they remove the IT burden and expense of managing and maintaining software and hardware. We currently offer email, collaboration, and file back-up cloud applications. These cloud applications are priced on a pay-per-use basis, can be purchased and used quickly. Our cloud applications have experienced strong growth over the last year. We believe the future market opportunity for cloud applications will be substantial.

Hybrid Hosting—We believe that traditional dedicated hosting and emerging cloud computing services, when combined, are a powerful solution for IT departments. Each service has specific and unique customer benefits. As a result, we will offer Hybrid Hosting, a suite of dedicated hosting and cloud computing services that can be easily combined to address the changing and diverse needs of our customers today and in the future.

Competition

Given the significant market potential of hosting and cloud computing, we operate in a rapidly evolving and highly competitive environment.

Our principal areas of competition include:

Do-it-Yourself Solutions—Businesses may choose to house and maintain their own IT systems, or use a colocation provider to house IT hardware and provide connectivity. Companies that provide colocation services include AT&T, Equinix, SAVVIS, Switch & Data, and other telecommunications companies. We believe that over time it will be hard for the vast majority of businesses to replicate the capabilities or achieve the low costs of service providers making the do-it-yourself option less attractive.

IT Outsourcing Providers—Businesses may choose to outsource their entire IT systems and staff to an outsourcing provider. Companies that provide IT outsourcing include CSC, EDS, and IBM. Outsourcing has long

5

been an option for only the largest companies due to the cost, complexity and duration of outsourcing contracts. Rarely is this a viable option for small and medium businesses with rapidly changing needs.

Hosting and Cloud Computing Providers—Businesses may choose to use a hosting or cloud computing provider other than us to provide services and support for their IT systems. Competitors include AT&T, Pipex, SAVVIS, Terremark, The Planet, Verio, and others. We also face competition from large Internet companies such as Microsoft, Google, and Amazon, who are making investments in cloud computing today.

Our Approach and Sources of Competitive Advantage

We are focused on creating sustainable competitive advantage in two key areas. First, our vision is to be recognized as one of the world’s great service companies. Since companies must trust their hosting provider with their mission critical IT assets, service reputation is a key selection criterion. Second, we operate with a financial discipline that keeps costs low, thereby generating returns that exceed our cost of capital. While companies will pay a premium for a high level of service, keeping the commodity elements of our business at a low cost is a critical element of success. These two key principles form the foundation of our business model, which includes the following elements:

Fanatical Support—We believe that excellent customer service creates customer loyalty, which in turn leads to higher profits and growth. We call our unique, industry-leading customer service model “Fanatical Support,” because our entire company is focused on going above and beyond expectations in order to delight the customer. Fanatical Support builds loyalty, which in turn delivers three key benefits:

| | 1. | Loyal customers buy more. Customer loyalty increases the tenure of customers and the longer they stay the more they tend to buy from us, leading to higher revenues and a higher revenue per customer ratio. |

| | 2. | Loyal customers rarely leave, which means that new customers need not be acquired to fill in the revenue gap left by the departing customers. Furthermore, loyal customers refer other customers. Both help in saving customer acquisition costs and reduce the amount of sales and marketing costs that we need to spend to generate revenue growth. |

| | 3. | Loyal customers can be served more cost effectively. After initial provisioning, the average cost of serving a customer is reduced, leading to higher average profits and profit margins over time. |

As a measure of customer satisfaction, we use the Net Promoter Score (NPS®), developed by Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc. to track the likelihood that customers will refer us to friends or colleagues. Surveys are conducted monthly and analyzed to determine areas for improvement. Over time, we have built up a knowledge base of what customers consider “must haves,” what customers would like to see in terms of incremental improvement, and, most importantly, what customers would perceive as “delighters” that create loyalty.

Fanatical Support is a result of our unique culture. Our employees are called Rackers, and are rewarded for going above and beyond to serve customers. The highest form of recognition is the Straightjacket Award, which is given to the employee who best demonstrates Fanatical Support in action. We are also very selective in our hiring process. Our philosophy is that technical and functional literacy can be taught, but personality is ingrained. We strive to hire employees with the personality traits which fit well within our culture and our teams. Periodically, we conduct employee engagement surveys as a measure of cultural health, and reward those managers that create an engaging and high-performance environment. In 2008 and 2009, Fortune magazine ranked us in the top 50 of its list of “100 Best Companies to Work For.” We firmly believe that our unique culture is a point of sustained differentiation, because corporate culture cannot be easily or quickly replicated by competitors.

Hosting and Cloud Computing Specialist—We are focused exclusively on hosting and cloud computing. Modern computing infrastructure is complex and ever-changing, so this specialist focus has allowed the company to build a productized set of services that are repeatable, efficient, high-quality and valuable to customers. Ouremployees, systems, management practices and organizational processes are tuned to continuously improve our

6

high-volume hosting and cloud computing offerings. Many of our competitors have to balance their hosting and cloud computing lines of business with other areas of focus. These other products and services compete internally for the resources and talent needed to make hosting successful. Our exclusive focus on hosting enables us to more rapidly and accurately deploy, upgrade and scale our systems and services. This focus has generated industry-leading revenue growth, profitability and customer satisfaction.

Broad Suite of Services—We offer an industry-leading breadth of hosting services. Our Hybrid Hosting model allows customers the flexibility to combine both traditional and emerging services for a solution that best addresses their unique IT requirements.

Many hosting providers offer a limited set of services, or rely on third party reselling relationships to complete their hosting portfolio. Our broad service suite allows us to deliver the right offering at the right budget for the customer. Additionally, customers who host their entire environment with us benefit from the simplicity of working with one hosting specialist, rather than managing multiple providers.

Disciplined Use of Capital and Management of Profitability—We have achieved net income profitability since the first quarter of 2004 through focused management of capital and profitability. We use the Economic Value Added model (EVA®) as a tool to help ensure our growth and capital investments create stockholder value. Virtually all capital expenditures are evaluated against this metric using a standard cost of capital. As an example, EVA is calculated for each contract with customers, and as necessary, salespeople will substitute products and services to ensure we can deliver the right mix of value, service, and performance to the customer while still remaining profitable.

We are also very careful with our facility and data center expansion practices. Currently, we sell to businesses in more than 120 countries. Unlike a colocation provider, we do not need to be located near our customers, allowing us to build centralized, cost-optimized facilities with teams of highly-trained staff. We strive to locate our regional facilities and data centers in lower-cost locations, which reduces rent, power and labor costs. We also focus on just-in-time expansion, by either leasing or building sections of data centers in increments so that capital expenditures are more closely matched to revenue growth.

By being careful with capital, we have preserved funds for promising new business ideas such as cloud computing. Over the last 18 months, we have made three acquisitions that have expanded our product set into cloud computing (cloud hosting and cloud applications). We will continue to identify and pursue strategic investments that have the potential to generate savings, enhance our competitive advantage, and increase our capabilities to serve customers.

Economies of Scale—We have achieved a critical mass that generates long term cost advantages. Like any service that moves from distributed to centralized production, scale is a factor in ensuring costs are low enough to drive mass adoption. We are able to generate significant cost advantages based on our large installed customer base and growth profile. We purchase large quantities of computing and data center assets, which allows us to negotiate higher volume pricing contracts. We are also able to make larger R&D investments than many of our smaller competitors due to our ability to spread these costs across a larger base of revenue. We will continue to pursue scale, especially in emerging technologies like cloud computing, where we believe that winning customers and gaining traction yield strategic advantages over time.

Research and Development

For the years ended December 31, 2006, 2007, and 2008, we recognized $2.0 million, $8.6 million, and $10.8 million of research and development expense, respectively. Our research and development efforts are focused on developing new services including:

| | • | | Deployment of new technologies to address emerging trends, such as cloud computing; |

| | • | | Development and enhancement of proprietary tools; and |

| | • | | Development and enhancement of processes for sales and support. |

7

Intellectual Property Rights

We rely on a combination of patent, copyright, trademark, service mark and trade secret laws in the U.S., the European Union, and various countries in Asia, South America, and elsewhere, and contractual restrictions to establish and protect certain proprietary rights in our data, applications, and services. We also currently have one patent and no patent applications in the U.S. We have trademarks registered or pending in the U.S., the European Union, and various countries in Asia, South America, and elsewhere for our name and certain words and phrases that we use in our business. We rely on copyright laws to protect software and certain other elements of our proprietary technologies, although to date we have not registered for copyright protection. We also enter into confidentiality and invention assignment agreements with our employees and consultants and confidentiality agreements with other third parties, and we actively monitor access to our proprietary technologies.

In addition, we license third-party software and other technologies that are used in the provision of or incorporated into some elements of our services.

Employees

As of December 31, 2008, we employed 2,611 Rackers, a net increase of 590, or 29.2%, relative to the headcount as of December 31, 2007. None of our employees are represented by a collective bargaining agreement, nor have we experienced any work stoppages. We believe that our relations with our employees are good.

Sales and Marketing

Our service suite is sold via direct sales and through third-party channel partners. Our direct sales model is based on centralized sales teams with leads generated primarily from customer referrals and corporate marketing efforts. This model also includes a centralized enterprise field sales force, which targets select businesses in that segment. Our channel partners include management and technical consultancies, technology integrators, software application providers, and web developers.

Our marketing efforts generate interest and market demand by communicating the advantages of our services and unique support model. Our marketing activities include web-based paid and natural search, participation in technology trade shows, conferences and customer events, advertisements in traditional and electronic (web- and email-based) media, and targeted regional public relations activities.

Our Support Team Structure

Our support teams generally consist of 12 to 20 Rackers, including an account manager who is a customer’s single point of contact and advocate within Rackspace Hosting. Each support team also consists of technical specialists to meet ongoing customer needs.

Financial Information About Geographic Areas

Total net revenues from U.S. operations were $170.5 million, $260.7 million, and $383.5 million for 2006, 2007, and 2008, respectively. Net revenues from operations outside the U.S., substantially all of which was derived from sales by our U.K. operations, were $53.5 million, $101.3 million, and $148.4 million for 2006, 2007, and 2008, respectively.

8

ITEM IA—RISK FACTORS

Risks Related to Our Business and Industry

Our operating results may be adversely impacted by worldwide political and economic uncertainties and specific conditions in the markets we address. As a result, the market price of our common stock may further decline.

Recently general worldwide economic conditions have experienced a deterioration due to credit conditions resulting from the recent financial crisis affecting the banking system and financial markets and other factors, slower economic activity, concerns about inflation and deflation, volatility in energy costs, decreased consumer confidence, reduced corporate profits and capital spending, the ongoing effects of the war in Iraq and Afghanistan, recent international conflicts and terrorist and military activity, and the impact of natural disasters and public health emergencies. These conditions make it extremely difficult for both us and our customers to accurately forecast and plan future business activities, and they could cause U.S. and foreign businesses to slow spending on our services, which could delay and lengthen our new customer sales cycle and cause existing customers to do one or more of the following:

| | • | | Cancel or reduce planned expenditures for our services; |

| | • | | Seek to lower their costs by renegotiating their contracts with us; |

| | • | | Move their hosting services in-house; or |

| | • | | Switch to lower-priced solutions provided by us or our competitors. |

Customer collections are our primary source of cash. We have historically grown through a combination of an increase in new customers and revenue growth from our existing customers. If the current market conditions continue to deteriorate we may experience a substantial decrease in revenue from our customer base, including through reductions in their commitments to us, and/or longer new customer sales cycles. If these events were to occur, we could experience a decrease in revenues and reduction in operating margins. Furthermore, during challenging economic times our customers may face issues gaining timely access to sufficient credit, which could result in an impairment of their ability to make timely payments to us. If that were to occur, we may be required to increase our allowance for doubtful accounts. We cannot predict the timing, strength or duration of any economic slowdown or subsequent economic recovery. If the economy or markets in which we operate do not continue at their present levels or continue to deteriorate, we may record additional charges related to the impairment of goodwill and other long-lived assets, and our business, financial condition and results of operations could be materially and adversely affected.

Finally, like many other stocks, our stock price has decreased recently during the onset of the economic downturn. If investors have concerns that our business, financial condition and results of operations will be negatively impacted by a continued worldwide economic downturn, our stock price could further decrease.

If we are unable to manage our growth effectively our financial results could suffer and our stock price could decline.

The growth of our business and our service offerings has strained our operating and financial resources. Further, we intend to continue to expand our overall business, customer base, headcount, and operations. Creating a global organization and managing a geographically dispersed workforce will require substantial management effort and significant additional investment in our operating and financial system capabilities and controls. If our information systems are unable to support the demands placed on them by our growth, we may be forced to implement new systems which would be disruptive to our business. We may be unable to manage our expenses effectively in the future due to the expenses associated with these expansions, which may negatively impact our gross margins or operating expenses. If we fail to improve our operational systems or to expand our

9

customer service capabilities to keep pace with the growth of our business, we could experience customer dissatisfaction, cost inefficiencies, and lost revenue opportunities, which may materially and adversely affect our operating results.

If we overestimate our data center capacity requirements, our operating margins and profitability could be adversely affected.

The costs of construction, leasing, and maintenance of our data centers constitute a significant portion of our capital and operating expenses. In order to manage growth and ensure adequate capacity for new and existing customers while minimizing unnecessary excess capacity costs, we continuously evaluate our short and long-term data center capacity requirements. Due to the lead time in expanding existing data centers or building new data centers, we are required to estimate demand for our services as far as two years into the future. We currently plan to increase our infrastructure as required through the expansion and addition of data centers in the U.S. and internationally. In contrast to our data centers that we have established to date, several of which were acquired relatively inexpensively as distressed assets of third parties, our current expansion plans may require us to pay full market rates for new data center facilities. If we overestimate the demand for our services and therefore overbuild our data center capacity or commit to long term facility leases, our operating margins could be materially reduced, which would materially impair our profitability.

If we underestimate our data center capacity requirements, our financial results and services could be impaired.

If we underestimate our data center capacity requirements, we may not be able to service any expanding needs of our existing customers, or we may be required to limit new customer acquisition while we work to increase data center capacity to satisfy demand, either of which may materially impair our revenue growth.

Our physical infrastructure is concentrated in very few facilities and any failure in our physical infrastructure or services could lead to significant costs and disruptions and could reduce our revenues, harm our business reputation and have a material adverse effect on our financial results.

Our network and power supplies and data centers are subject to various points of failure, and a problem with our generators, uninterruptible power supply, or UPS, routers, switches, or other equipment, whether or not within our control, could result in service interruptions for some or all of our customers or equipment damage. Because our hosting services do not require geographic proximity of our data centers to our customers, our hosting infrastructure is consolidated into a few large facilities. Accordingly, any failure or downtime in one of our data center facilities could affect a significant percentage of our customers. While data backup services are included in our hosting services, the majority of our customers do not elect to pay the additional fees required to store their backup data offsite in a separate facility. The total destruction or severe impairment of any of our data center facilities could result in significant downtime of our services and the loss of vast amounts of customer data. Since our ability to attract and retain customers depends on our ability to provide customers with highly reliable service, even minor interruptions in our service could harm our reputation. The services we provide are subject to failure resulting from numerous factors, including:

| | • | | Human error or accidents (such as an airplane crash into one of our facilities, some of which are located near major airports); |

| | • | | Internet connectivity downtime; |

| | • | | Improper building maintenance by the landlords of the buildings in which our facilities are located; |

| | • | | Physical or electronic security breaches; |

10

| | • | | Fire, earthquake, hurricane, tornado, flood, and other natural disasters; |

| | • | | Sabotage and vandalism; and |

| | • | | Failure by us or our vendors to provide adequate service to our equipment. |

Additionally, in connection with the expansion or consolidation of our existing data center facilities from time to time, there is an increased risk that service interruptions may occur as a result of server relocation or other unforeseen construction-related issues.

We have experienced interruptions in service in the past, due to such things as power outages, power equipment failures, cooling equipment failures, routing problems, hard drive failures, database corruption, system failures, software failures, and other computer failures. For example, during the fourth quarter of 2007, our data center operations in Grapevine, Texas were impaired for several hours due to separate incidents of simultaneous system failures. The system failures included the loss of our utility delivery systems which were damaged by two separate vehicle-related accidents as well as problems with certain redundant power and cooling systems in the data center. These system failures resulted in downtime for a substantial portion of the servers located in the facility. As a result of this downtime, we extended approximately $3.4 million in credits to our customers and may have suffered damage to our reputation with our customers. While we have not experienced larger than normal customer attrition following these events, the extent of any damage to our reputation is difficult to assess. Although we have taken certain steps to avoid this situation through upgrades to our cooling equipment and other infrastructure, service interruptions due to equipment failures, natural disasters, accidents, or otherwise could still occur and materially impact our business.

Any future interruptions could:

| | • | | Cause our customers to seek damages for losses incurred; |

| | • | | Require us to replace existing equipment or add redundant facilities; |

| | • | | Damage our reputation as a reliable provider of hosting services; |

| | • | | Cause existing customers to cancel or elect to not renew their contracts; or |

| | • | | Make it more difficult for us to attract new customers. |

Any of these events could materially increase our expenses or reduce our revenues, which would have a material adverse effect on our operating results.

Customers with mission-critical applications could potentially expose us to lawsuits for their lost profits or damages, which could impair our financial condition.

Because our hosting services are critical to many of our customers’ businesses, any significant disruption in our services could result in lost profits or other indirect or consequential damages to our customers. Although we require our customers to sign agreements that contain provisions attempting to limit our liability for service outages, we cannot assure you that a court would enforce any contractual limitations on our liability in the event that one of our customers brings a lawsuit against us as the result of a service interruption or other Internet site or application problems that they may ascribe to us. The outcome of any such lawsuit would depend on the specific facts of the case and any legal and policy considerations that we may not be able to mitigate. In such cases, we could be liable for substantial damage awards that may significantly exceed our liability insurance coverage by unknown but significant amounts, which could seriously impair our financial condition.

11

If we do not prevent security breaches, we may be exposed to lawsuits, lose customers, suffer harm to our reputation, and incur additional costs.

We rely on third-party suppliers to protect our equipment and hardware against breaches in security and cannot be certain that they will provide adequate security. The services we offer involve the transmission of large amounts of sensitive and proprietary information over public communications networks as well as the processing and storage of confidential customer information. Unauthorized access, computer viruses, accidents, employee error or malfeasance, fraudulent service plan orders, intentional misconduct by computer “hackers”, and other disruptions can occur that could compromise the security of our infrastructure, thereby exposing such information to unauthorized access by third parties and leading to interruptions, delays or cessation of service to our customers. Techniques used to obtain unauthorized access to, or to sabotage, systems change frequently and generally are not recognized until launched against a target, so we may be unable to implement security measures in a timely manner or, if and when implemented, these measures could be circumvented as a result of accidental or intentional actions by parties within or outside of our organization. Any breaches that may occur could expose us to increased risk of lawsuits, loss of existing or potential customers, harm to our reputation and increases in our security costs. Although we typically require our customers to sign agreements that contain provisions attempting to limit our liability for security breaches, we cannot assure you that a court would enforce any contractual limitations on our liability in the event that one of our customers brings a lawsuit against us as the result of a security breach that they may ascribe to us. The outcome of any such lawsuit would depend on the specific facts of the case and legal and policy considerations that we may not be able to mitigate. In such cases, we could be liable for substantial damage awards that may significantly exceed our liability insurance coverage by unknown but significant amounts, which could seriously impair our financial condition.

Terrorist activity throughout the world and military action to counter terrorism could adversely impact our operating results.

Terrorist attacks and other acts of violence, as well as governments’ responses to such activities, may have an adverse effect on business, financial, and general economic conditions internationally. Terrorist activities may disrupt our ability to provide our services or may increase our costs due to the need to provide enhanced security, which would have a material adverse effect on our business and results of operations. These circumstances may also adversely affect our ability to attract and retain customers, our ability to raise capital, and the operation and maintenance of our facilities. We may not have adequate property and liability insurance to cover catastrophic events or attacks brought on by terrorist attacks and other acts of violence. In addition, we depend heavily on the physical infrastructure, particularly as it relates to power, that exists in the markets in which we operate. Any damage to such infrastructure in these markets where we operate may materially and adversely affect our operating results.

We rely on third-party hardware that may be difficult to replace or could cause errors or failures of our service, which could adversely affect our operating results or harm our reputation.

We rely on hardware acquired from third parties in order to offer our services. This hardware may not continue to be available on commercially reasonable terms in quantities sufficient to meet our business needs, which could adversely affect our ability to generate revenue. Any errors or defects in third-party hardware could result in errors or a failure of our service, which could harm our reputation and operating results. Indemnification from hardware providers, if any, would likely be insufficient to cover any damage to our business or our customers resulting from such hardware failure.

We rely on third-party software that may be difficult to replace or which could cause errors or failures of our service that could lead to lost customers or harm to our reputation.

We rely on software licensed from third parties to offer our services. This software may not continue to be available to us on commercially reasonable terms, or at all. Any loss of the right to use any of this software could result in delays in the provisioning of our services until equivalent technology is either developed by us, or, if

12

available, is identified, obtained, and integrated, which could harm our business. Any errors or defects in third-party software could result in errors or a failure of our service which could harm our operating results by adversely affecting our revenues or operating costs.

We provide service level commitments to our customers, which could require us to issue credits for future services if the stated service levels are not met for a given period and could significantly decrease our revenues and harm our reputation.

Our customer agreements provide that we maintain certain service level commitments to our customers relating primarily to network uptime, critical infrastructure availability, and hardware replacement. If we are unable to meet the stated service level commitments, we may be contractually obligated to provide these customers with credits for future services. As a result, a failure to deliver services for a relatively short duration could cause us to issue these credits to a large number of affected customers. In addition, we cannot be assured that our customers will accept these credits in lieu of other legal remedies that may be available to them. Our failure to meet our commitments could also result in substantial customer dissatisfaction or loss. Because of the loss of future revenues through these credits, potential customer loss and other potential liabilities, our revenue could be significantly impacted if we cannot meet our service level commitments to our customers.

If we are unable to maintain a high level of customer service, customer satisfaction and demand for our services could suffer.

We believe that our success depends on our ability to provide customers with quality service that not only meets our stated commitments, but meets and then exceeds customer service expectations. If we are unable to provide customers with quality customer support in a variety of areas, we could face customer dissatisfaction, decreased overall demand for our services, and loss of revenues. In addition, our inability to meet customer service expectations may damage our reputation and could consequently limit our ability to retain existing customers and attract new customers, which would adversely affect our ability to generate revenue and negatively impact our operating results.

We may not be able to continue to add new customers and increase sales to our existing customers, which could adversely affect our operating results.

Our growth is dependent on our ability to continue to attract new customers while retaining and expanding our service offerings to existing customers. Growth in the demand for our services may be inhibited and we may be unable to sustain growth in our customer base, for a number of reasons, such as:

| | • | | Our inability to market our services in a cost-effective manner to new customers; |

| | • | | The inability of our customers to differentiate our services from those of our competitors or our inability to effectively communicate such distinctions; |

| | • | | Our inability to successfully communicate to businesses the benefits of hosting; |

| | • | | The decision of businesses to host their Internet sites and web infrastructure internally or in colocation facilities as an alternative to the use of our hosting services; |

| | • | | Our inability to penetrate international markets; |

| | • | | Our inability to expand our sales to existing customers; |

| | • | | Our inability to strengthen awareness of our brand; and |

| | • | | Reliability, quality or compatibility problems with our services. |

A substantial amount of our past revenue growth was derived from purchases of service upgrades by existing customers. Our costs associated with increasing revenues from existing customers are generally lower than costs associated with generating revenues from new customers. Therefore, a reduction in the rate of revenue

13

increase from our existing customers, even if offset by an increase in revenues from new customers, could reduce our operating margins.

Any failure by us to continue attracting new customers or grow our revenues from existing customers could have a material adverse effect on our operating results.

Our existing customers could elect to reduce or terminate the services they purchase from us because we do not have long-term contracts with our customers, which could adversely affect our operating results.

Our customer contracts for our services typically have initial terms of one to two years, which unless terminated, may be renewed or automatically extended on a month-to-month basis. Our customers have no obligation to renew their services after their initial contract periods expire. Moreover, our customers could cancel their service agreements before they expire. Our costs associated with maintaining revenue from existing customers are generally much lower than costs associated with generating revenue from new customers. Therefore, a reduction in revenue from our existing customers, even if offset by an increase in revenue from new customers, could reduce our operating margins. Any failure by us to continue to retain our existing customers could have a material adverse effect on our operating results.

Our corporate culture has contributed to our success, and if we cannot maintain this culture, we could lose the innovation, creativity, and teamwork fostered by our culture, and our operating results may be harmed.

We believe that a critical contributor to our success has been our corporate culture, which we believe fosters innovation, creativity, and teamwork. If we implement more complex organizational management structures because of growth or other structural changes, we may find it increasingly difficult to maintain the beneficial aspects of our corporate culture. This could negatively impact our future operating results. In addition, being a public traded company may create disparities in personal wealth among our employees, which may adversely impact relations among employees and our corporate culture.

If we fail to hire and retain qualified employees and management personnel, our growth strategy and our operating results could be harmed.

Our growth strategy depends on our ability to identify, hire, train, and retain IT professionals, technical engineers, operations employees, and sales and senior management personnel who maintain relationships with our customers and who can provide the technical, strategic, and marketing skills required for our company to grow. There is a shortage of qualified personnel in these fields, specifically in the San Antonio, Texas area, where we are headquartered and a majority of our employees are located, and we compete with other companies for this limited pool of potential employees. There is no assurance that we will be able to recruit or retain qualified personnel, and this failure could cause our operations and financial results to be negatively impacted.

Our success and future growth also depends to a significant degree on the skills and continued services of our management team, especially Graham Weston, our Chairman, and A. Lanham Napier, our President and Chief Executive Officer. We do not have employment agreements with any members of our management team, including Messrs. Weston and Napier, nor do we maintain key man insurance on any of our management team, although we have recently begun the application process to acquire key man insurance for Mr. Napier.

Our operating results may fluctuate significantly, which could make our future results difficult to predict and could cause our operating results to fall below investor or analyst expectations.

Our operating results may fluctuate due to a variety of factors, including many of the risks described in this section, which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our operating results for any prior periods as an indication of our future operating performance. Fluctuations in our revenue can lead to even greater fluctuations in our operating

14

results. Our budgeted expense levels depend in part on our expectations of long-term future revenue. Given relatively fixed operating costs related to our personnel and facilities, any substantial adjustment to our expenses to account for lower than expected levels of revenue will be difficult and take time. Consequently, if our revenue does not meet projected levels, our operating expenses would be high relative to our revenue, which would negatively affect our operating performance.

If our revenue or operating results do not meet or exceed the expectations of investors or securities analysts, the price of our common stock may decline.

Increased energy costs, power outages, and limited availability of electrical resources may adversely affect our operating results.

Our data centers are susceptible to increased regional, national or international costs of power and to electrical power outages. Our customer contracts do not allow us to pass on any increased costs of energy to our customers, which could harm our business. Further, power requirements at our data centers are increasing as a result of the increasing power demands of today’s servers. Increases in our power costs could harm our operating results and financial condition.

Since we rely on third parties to provide our data centers with power sufficient to meet our needs, our data centers could have a limited or inadequate amount of electrical resources necessary to meet our customer requirements. We attempt to limit exposure to system downtime due to power outages by using backup generators and power supplies. However, these protections may not limit our exposure to power shortages or outages entirely. Any system downtime resulting from insufficient power resources or power outages could damage our reputation and lead us to lose current and potential customers, which would harm our operating results and financial condition.

Increased Internet bandwidth costs and network failures may adversely affect our operating results.

Our success depends in part upon the capacity, reliability, and performance of our network infrastructure, including the capacity leased from our Internet bandwidth suppliers. We depend on these companies to provide uninterrupted and error-free service through their telecommunications networks. Some of these providers are also our competitors. We exercise little control over these providers, which increases our vulnerability to problems with the services they provide. We have experienced and expect to continue to experience interruptions or delays in network service. Any failure on our part or the part of our third-party suppliers to achieve or maintain high data transmission capacity, reliability or performance could significantly reduce customer demand for our services and damage our business.

As our customers’ usage of telecommunications capacity increases, we will need to make additional investments in our capacity to maintain adequate data transmission speeds, the availability of which may be limited or the cost of which may be on terms unacceptable to us. If adequate capacity is not available to us as our customers’ usage increases, our network may be unable to achieve or maintain sufficiently high data transmission capacity, reliability or performance. In addition, our business would suffer if our network suppliers increased the prices for their services and we were unable to pass along the increased costs to our customers.

We may not be able to renew the leases on our existing facilities on terms acceptable to us, if at all, which could adversely affect our operating results.

We do not own the facilities occupied by our current data centers, but occupy them pursuant to commercial leasing arrangements. The initial terms of our existing data center leases expire over a period ranging from 2009 to 2027, with each having at least one renewal period of no less than three years, except two of our data centers located in the U.K., which have no contractual renewal terms. Upon the expiration or termination of our data center facility leases, we may not be able to renew these leases on terms acceptable to us, if at all. If we fail to

15

renew any data center lease and are required to move the data center to a new facility, we would face significant challenges due to the technical complexity, risk, and high costs of relocating the equipment. For example, if we are required to migrate customer servers to a new facility, such migration could result in significant downtime for our affected customers. This could damage our reputation and lead us to lose current and potential customers, which would harm our operating results and financial condition.

Even if we are able to renew the leases on our existing data centers, we expect that rental rates, which will be determined based on then-prevailing market rates with respect to the renewal option periods and which will be determined by negotiation with the landlord after the renewal option periods, will be higher than rates we currently pay under our existing lease agreements. If we fail to increase revenue in our existing data centers by amounts sufficient to offset any increases in rental rates for these facilities, our operating results may be materially and adversely affected.

We could be required to repay substantial amounts of money to certain state and local governments if we lose tax exemptions or grants previously awarded to us, which could adversely affect our operating results.

On August 3, 2007, we entered into a lease for approximately 67 acres of land and a 1.2 million square foot facility in Windcrest, Texas, which is in the San Antonio, Texas area, to house our corporate headquarters and potentially a future data center operation.

In connection with this lease, we also entered into a Master Economic Incentives Agreement with the Cities of Windcrest and San Antonio, Texas; Bexar County; and certain other parties, pursuant to which we agreed to locate existing and future employees at the new facility location. The agreement requires that we meet certain employment levels each year, with an ultimate employee base requirement of 4,500 jobs by December 31, 2012. In addition, the agreement requires that the median compensation of those employees be no less than $51,000 per year. In exchange for meeting these employment obligations, the parties agreed to enter into the lease structure, pursuant to which, as a lessee of the Windcrest Economic Development Corporation, we will not be subject to most of the property taxes associated with the property for a 14 year period. If we fail to meet these job creation requirements, we could lose a portion or all of the tax benefit being provided during the 14-year period by having to make payments in lieu of taxes (PILOT) to the City of Windcrest. The amount of the PILOT payment would be calculated based on the amount of taxes that would have been owed for that period if the property were not exempt, and then such amount would be adjusted pursuant to certain factors, such as the percentage of employment achieved compared to the stated requirements.

Further, we entered into an agreement with the State of Texas under which we have received $5.0 million, and could receive up to an additional $17.0 million in state enterprise fund grants in three subsequent installments on the condition that we meet certain employment levels each year, with a requirement that we ultimately create at least 4,000 new jobs in the State of Texas paying an average compensation of at least $56,000 per year (subject to a 2% per year increase commencing in 2009) by December 31, 2012. We must sustain these jobs through December 31, 2018. To the extent we fail to meet these requirements, we would be required to repay all or a portion of the grants plus interest.

In October 2008, we received a grant in partnership with the State of Texas and Alamo Community College District, which will provides us the opportunity to be reimbursed for up to $4.7 million for certain training expenses conducted through Alamo Community College over the next three years. In order to fulfill our requirements, we must meet the employment requirements defined in the grant with the State of Texas from the state enterprise fund.

In the current economic environment, unless we are able to modify the terms of our agreements, it is probable we will not fulfill the job creation requirements levels for the end of 2009. We are currently seeking to modify all such agreements. The loss of any anticipated tax benefits or grants described above or the repayment of the grant funds from the State of Texas could have a material adverse effect on our liquidity or results of operations.

16

We have significant debt obligations that include restrictive covenants limiting our flexibility to manage our business; failure to comply with these covenants could trigger an acceleration of our outstanding indebtedness and adversely affect our financial position and operating results.

As of December 31, 2008, outstanding indebtedness under our credit facility totaled $200.0 million, with an outstanding letter of credit of $0.8 million. Our credit facility requires that we maintain specific financial ratios and comply with covenants, including financial covenants, which contain numerous restrictions on our ability to incur additional debt, pay dividends or make other restricted payments, sell assets, enter into affiliate transactions and take other actions. Our existing credit facility is, and any future financing arrangements may be, secured by all of our assets. If we are unable to meet the terms of the financial covenants or if we breach any of these covenants, a default could result under one or more of these agreements, which may require us to repay all amounts owing under our credit facility. As of December 31, 2007, we were not in compliance with the fixed charge coverage ratio covenant. However, we received a waiver from the financial institution in April 2008, and, as of December 31, 2008, we are in compliance with the covenants.

If we are unable to generate sufficient cash available to repay our debt obligations when they become due and payable, either when they mature or in the event of a default, we may not be able to obtain additional debt or equity financing on favorable terms, if at all, which may negatively impact our ability to continue as a going concern.

We also have substantial equipment lease obligations, which totaled approximately $89.7 million as of December 31, 2008. The payment obligations under these equipment leases are secured by a significant portion of the hardware used in our data centers. If we are unable to generate sufficient cash flow from our operations or cash from other sources in order to meet the payment obligations under these equipment leases, we may lose the right to possess and operate the equipment used in our data centers, which would substantially impair our ability to provide our services, which could have a material adverse effect on our liquidity or results of operations.

We may require additional capital and may not be able to secure additional financing on favorable terms to meet our future capital needs, which could adversely affect our financial position and result in stockholder dilution.

In order to fund future growth, we will be dependent on significant capital expenditures. We may need to raise additional funds through equity or debt financings in the future in order to meet our operating and capital needs. We may not be able to secure additional debt or equity financing on favorable terms, or at all, at the time when we need such funding. If we are unable to raise additional funds, we may not be able to pursue our growth strategy and our business could suffer. If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution in their percentage ownership of our company, and any new equity securities we issue could have rights, preferences, and privileges senior to those of holders of our common stock. In addition, any debt financing that we may obtain in the future could have restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions.

We are exposed to commodity and market price risks that have the potential to substantially influence our profitability and liquidity.

We are a large consumer of power. During 2008, we paid approximately $13.2 million to utility companies to power our data centers. We anticipate an increase in our consumption of power in the future as our sales grow. Power costs vary by locality and are subject to substantial seasonal fluctuations. Our largest exposure to energy prices currently exists at our Grapevine, Texas facility in the Dallas-Fort Worth area, where the energy market is deregulated. Power costs have historically risen with general costs of energy, and continued increases in electricity costs may negatively impact our gross margins or operating expenses. We periodically evaluate the advisability of entering into fixed price utilities contracts. If we choose not to enter into a fixed price contract, we expose our cost structure to this commodity price risk.

17

The majority of our customers are invoiced, and substantially all of our expenses are paid, by us or our subsidiaries in the functional currency of our company or our subsidiaries, respectively. However, some of our customers are currently invoiced in currencies other than the applicable functional currency, such as the Euro. As a result, we may incur foreign currency losses based on changes in exchange rates between the date of the invoice and the date of collection. In addition, large changes in foreign exchange rates relative to our functional currencies could increase the costs of our services to non-U.S. customers relative to local competitors, thereby causing us to lose existing or potential customers to these local competitors. As a result, our results of operations and cash flows are subject to fluctuations due to changes in foreign currency exchange rates. Further, as we grow our international operations, our exposure to foreign currency risk could become more significant. To date, we have not entered into any hedging contracts, although we may do so in the future.

If we are unable to adapt to evolving technologies and customer demands in a timely and cost-effective manner, our ability to sustain and grow our business may suffer.

Our market is characterized by rapidly changing technology, evolving industry standards, and frequent new product announcements, all of which impact the way in which hosting services are marketed and delivered. These characteristics are magnified by the continued rapid growth of the Internet and the intense competition in our industry. To be successful, we must adapt to our rapidly changing market by continually improving the performance, features, and reliability of our services and modifying our business strategies accordingly. We could also incur substantial costs if we need to modify our services or infrastructure in order to adapt to these changes. For example, our data center infrastructure could require improvements due to the development of new systems to deliver power to or eliminate heat from the servers we house or as a result of the development of new server technologies that require levels of critical load and heat removal that our facilities are not designed to provide. We may not be able to timely adapt to changing technologies, if at all. Our ability to sustain and grow our business would suffer if we fail to respond to these changes in a timely and cost-effective manner.

New technologies or industry standards have the potential to replace or provide lower cost alternatives to our hosting services. Additionally, the adoption of such new technologies or industry standards could render our services obsolete or unmarketable. We cannot guarantee that we will be able to identify the emergence of these new service alternatives successfully and modify our services accordingly, or develop and bring new products and services to market in a timely and cost-effective manner to address these changes. In addition, if and when we do identify the emergence of new service alternatives and bring new products and services to market, those new products and services may need to be made available at lower price points than our then-current services.

Our failure to provide services to compete with new technologies or the obsolescence of our services could lead us to lose current and potential customers or could cause us to incur substantial costs, which would harm our operating results and financial condition. Our introduction of new service alternative products and services that have lower price points than current offerings may result in our existing customers switching to the lower cost products, which could reduce our revenue and have a material adverse effect of our operating results.

We may not be able to compete successfully against current and future competitors.

The market for hosting services is highly competitive. We expect that we will face additional competition from our existing competitors as well as new market entrants in the future.

Our current and potential competitors vary by size and service offerings and by geographic region. These competitors may elect to partner with each other or with focused companies like us to grow their businesses. They include:

| | • | | Do-it-yourself solutions with a colocation partner such as AT&T, Equinix, SAVVIS, Switch & Data, and telecommunications companies; |

| | • | | IT outsourcing providers such as CSC, EDS, and IBM; |

18

| | • | | Hosting providers such as AT&T, Pipex, SAVVIS, Terremark, The Planet, and Verio; and |

| | • | | Large Internet companies such as Microsoft, Google, and Amazon. |

The primary competitive factors in our market are: customer service and technical expertise; security reliability and functionality; reputation and brand recognition; financial strength; breadth of services offered; and price.

Many of our current and potential competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, greater brand recognition, and more established relationships in the industry than we do. As a result, some of these competitors may be able to:

| | • | | Develop superior products or services, gain greater market acceptance, and expand their service offerings more efficiently or more rapidly; |

| | • | | Adapt to new or emerging technologies and changes in customer requirements more quickly; |

| | • | | Bundle hosting services with other services they provide at reduced prices; |

| | • | | Take advantage of acquisition and other opportunities more readily; |

| | • | | Adopt more aggressive pricing policies and devote greater resources to the promotion, marketing, and sales of their services; and |

| | • | | Devote greater resources to the research and development of their products and services. |

We may be accused of infringing the proprietary rights of others, which could subject us to costly and time-consuming litigation and require us to discontinue services that infringe the rights of others.

There may be intellectual property rights held by others, including issued or pending patents, trademarks, and service marks, that cover significant aspects of our technologies, branding or business methods, including technologies and intellectual property we have licensed from third parties. Companies in the technology industry, and other patent and trademark holders seeking to profit from royalties in connection with grants of licenses, own large numbers of patents, copyrights, trademarks, service marks, and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. These or other parties could claim that we have misappropriated or misused intellectual property rights and any such intellectual property claim against us, regardless of merit, could be time consuming and expensive to settle or litigate and could divert the attention of our technical and management personnel. An adverse determination also could prevent us from offering our services to our customers and may require that we procure or develop substitute services that do not infringe. For any intellectual property rights claim against us or our customers, we may have to pay damages, indemnify our customers against damages or stop using technology or intellectual property found to be in violation of a third party’s rights. We may be unable to replace those technologies with technologies that have the same features or functionality and that are of equal quality and performance standards on commercially reasonable terms or at all. Licensing replacement technologies and intellectual property may significantly increase our operating expenses or may require us to restrict our business activities in one or more respects. We may also be required to develop alternative non-infringing technology and intellectual property, which could require significant effort, time, and expense.

Our use of open source software could impose limitations on our ability to provide our services, which could adversely affect our financial condition and operating results.

We utilize open source software, including Linux-based software, in providing a substantial portion of our services. The terms of many open source licenses have not been interpreted by U.S. courts, and there is a risk that such licenses could be construed in a manner that could impose unanticipated conditions or restrictions on our ability to offer our services. Additionally, the use and distribution of open source software can lead to greater risks than the use of third-party commercial software, as open source software does not come with warranties or other contractual protections regarding infringement claims or the quality of the code. From time to time parties

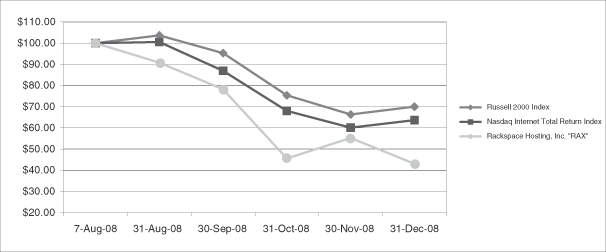

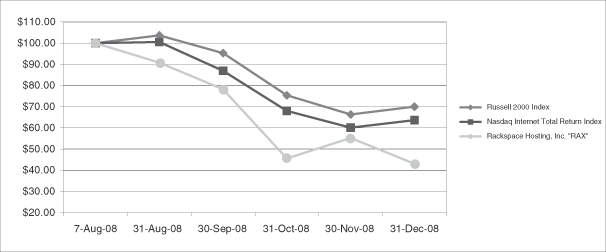

19