Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

RAX similar filings

- 20 May 09 Departure of Directors or Certain Officers

- 11 May 09 Rackspace Hosting Reports First Quarter 2009 Results

- 11 Mar 09 Regulation FD Disclosure

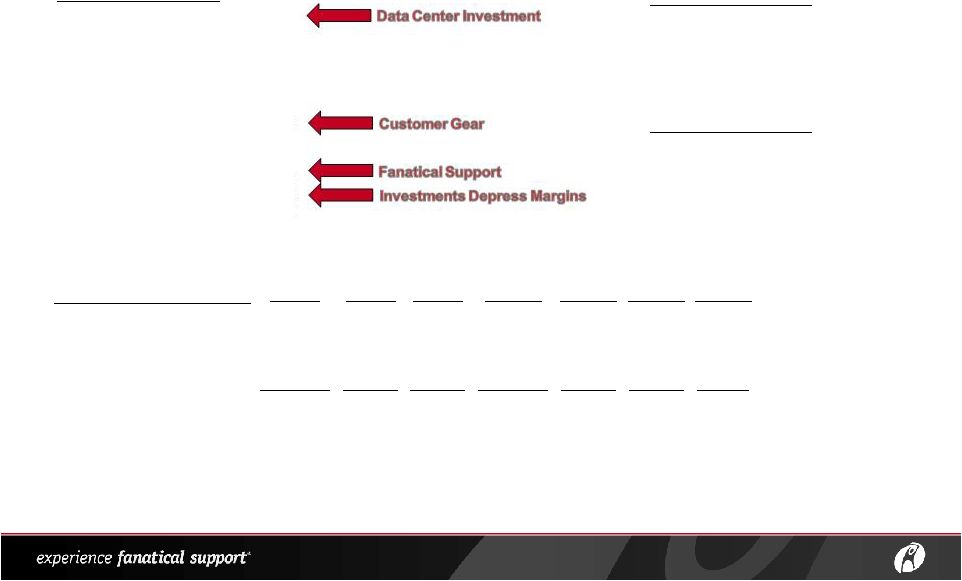

- 2 Mar 09 This presentation contains "forward-looking" statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever

- 19 Feb 09 Rackspace Hosting Reports 2008 Results

- 11 Feb 09 Rackspace Hosting Continues Expansion with New Data Center in Virginia

- 12 Dec 08 Departure of Directors or Principal Officers

Filing view

External links