Keefe, Bruyette & Woods

Regional Bank Conference

Michael P. Daly

President and Chief Executive Officer

Boston, Massachusetts

March 1, 2006

Cautionary Statement

Statements contained in this presentation contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and

expectations of management as well as the assumptions made using information currently available to

management. Since these statements reflect the views of management concerning future events, these

statements involve risks, uncertainties and assumptions. These risks and uncertainties include among

others, changes in market interest rates and general and regional economic conditions, changes in

government regulations, changes in accounting principles and the quality or composition of the loan and

investment portfolios and other factors that may be described in Berkshire Hills Bancorp, Inc.’s quarterly

reports on Form 10-Q for the quarters ended March 31, June 30 and September 30 and in its 2004 annual

report on Form 10-K, each filed with the Securities and Exchange Commission, which are available at

the Securities and Exchange Commission’s internet website ( www.sec.gov) and to which reference is

hereby made. Therefore, actual future results may differ significantly from results discussed in the

forward-looking statements.

You are cautioned not to place undue reliance on any forward-looking statements, which speak

only as of March 1, 2006. Except as required by applicable law

or regulation, Berkshire Hills Bancorp, Inc. undertakes no obligation to update

any forward-looking statements, to reflect events or circumstances that occur

after March 1, 2006.

Today’s Agenda

Culture and people

Growth

Asset quality

Asset liability management

Operational efficiencies

Strategic capital allocation

3

Culture and People

Attract and retain good people

Strengthen team, stay focused,

single vision, pay for performance

Continually strengthen board

Instill culture of enthusiasm,

teamwork and energy

Team transformation

Culture and

People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

4

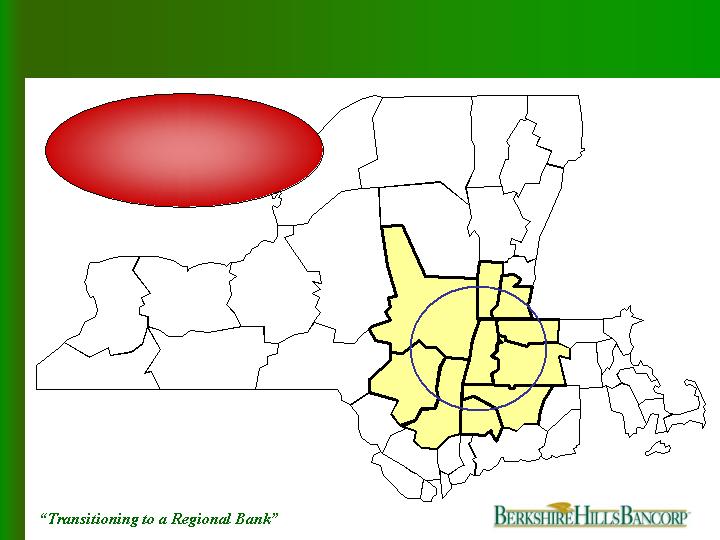

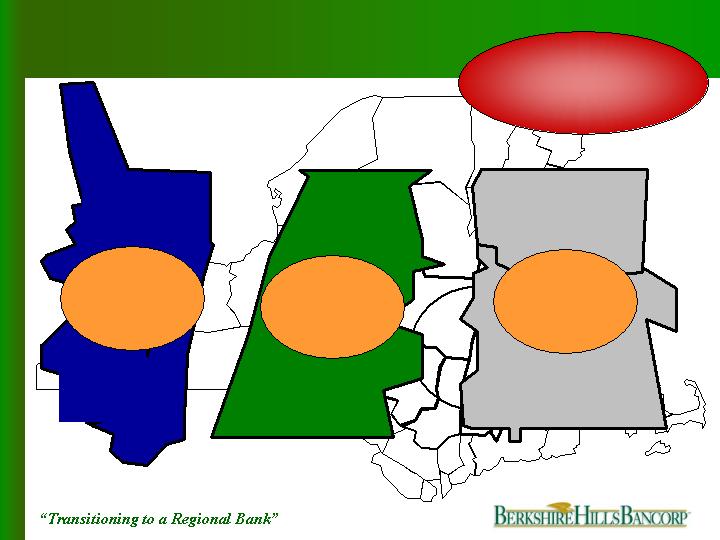

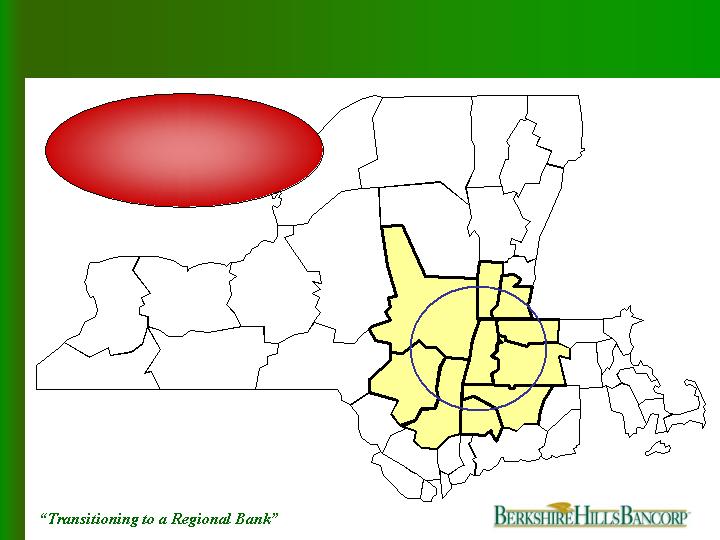

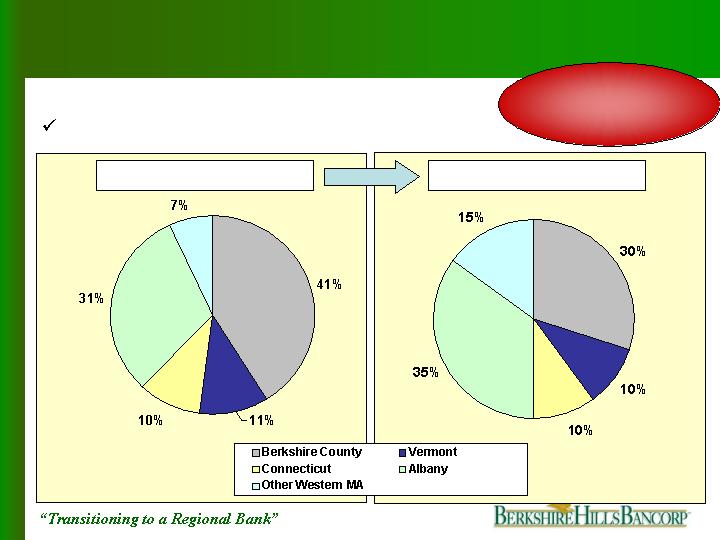

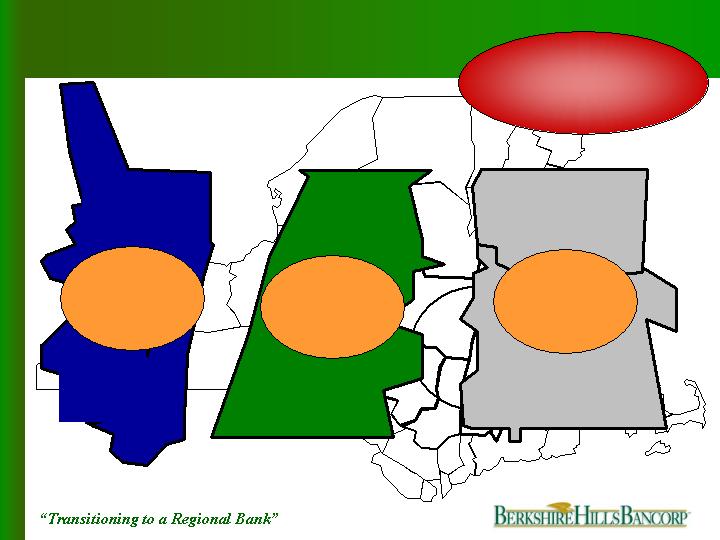

Profile

Berkshire County, MA

Pioneer Valley, MA

Capital Region, NY

5

State chartered savings bank with commercial bank balance sheet

Ownership Profile – December 31, 2005

Institutional holders

41%

Insiders*

9%

Individuals

43%

Foundation

7%

Corporate Profile – December 31, 2005

Market capitalization

$291 million

Assets

$2.0 billion

Loans

$1.42 billion

Deposits

$1.37 billion

Employees

399 FTE’s

Operations

24 full-service branches

10 free standing ATMs

*Not including options

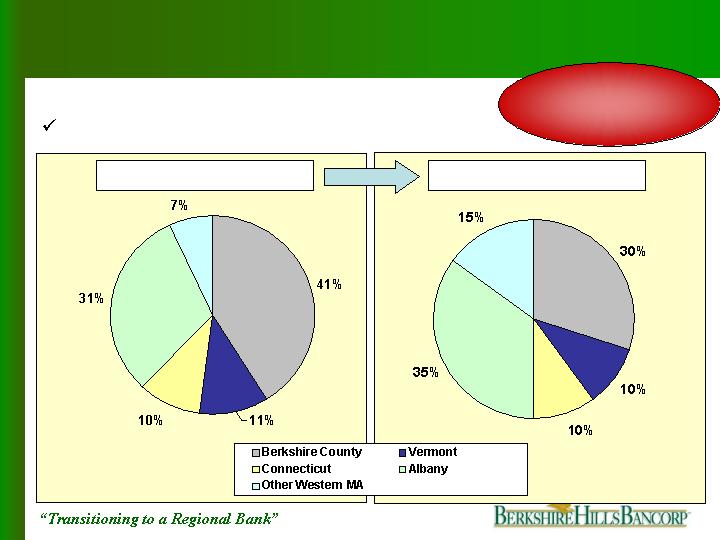

3

$41

New York State

24

$1,371

Total

Branches

12/31/05

Deposits

(millions)

Market

$473

$857

10

11

Pioneer Valley

Berkshire County

Primary Market Area

Our values will drive

our success in

expanded markets

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

6

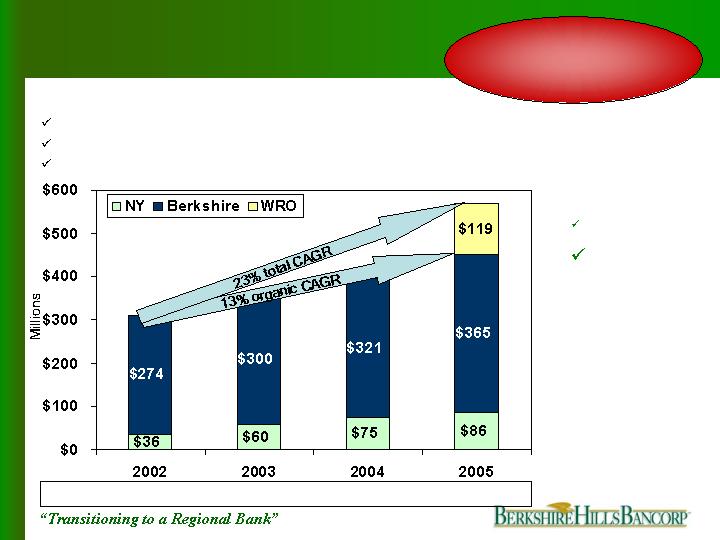

Growth

Significant annual

growth in every

division

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

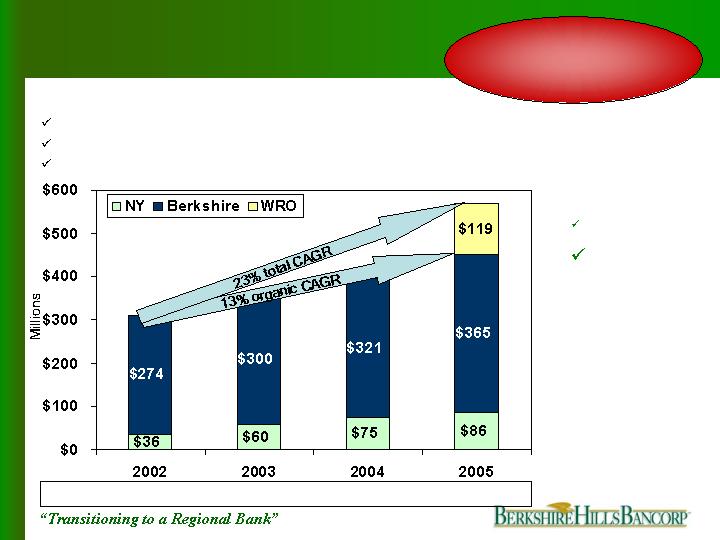

Core Deposits

$795

Core deposit compound growth rate excluding Woronoco = 6%

Core deposit compound growth = 21%

Core deposits in NY represent 40% of total deposits of $41 million

7

Growth

Significant annual

growth in every

division

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

$570

Compound growth rate since 2002 exclusive of Woronoco = 13%

Compound growth rate since 2002 = 23%

Strong growth trends in NY despite lack of meaningful branch network

Commercial Loans

$310

$360

$396

Total

8

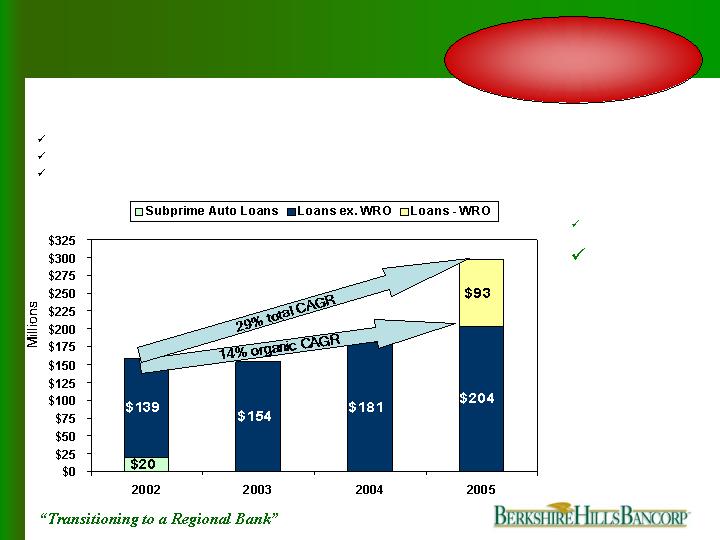

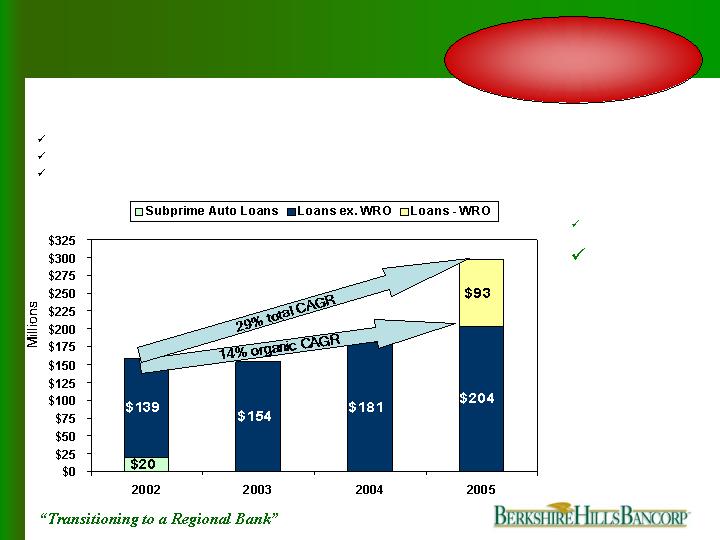

Growth

Significant annual

growth in every

division

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

Compound growth rate since 2002 exclusive of Woronoco and sub-prime auto loans = 14%

Compound growth rate since 2002 exclusive of sub-prime auto loans = 29%

Auto loan portfolios’ average FICO at 716 at 12/31/05

Consumer Loans

$297

9

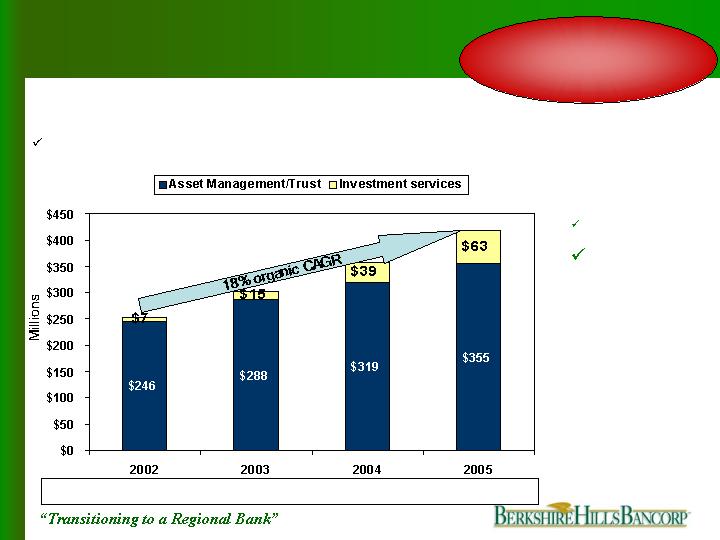

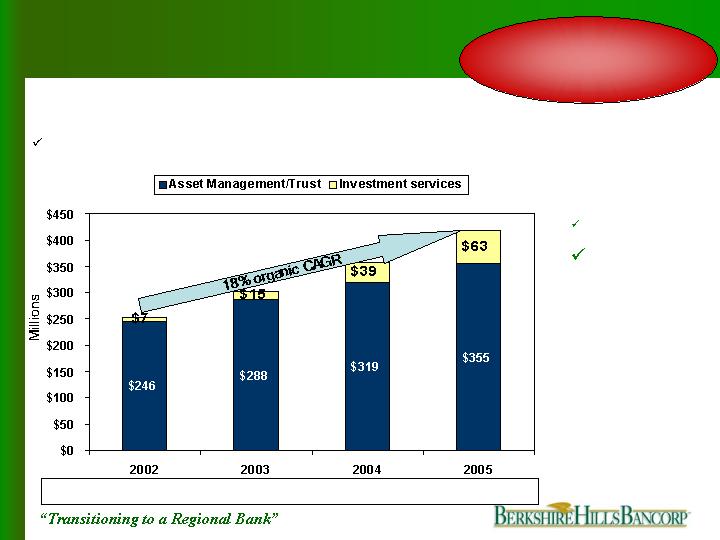

Growth

Significant annual

growth in every

division

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

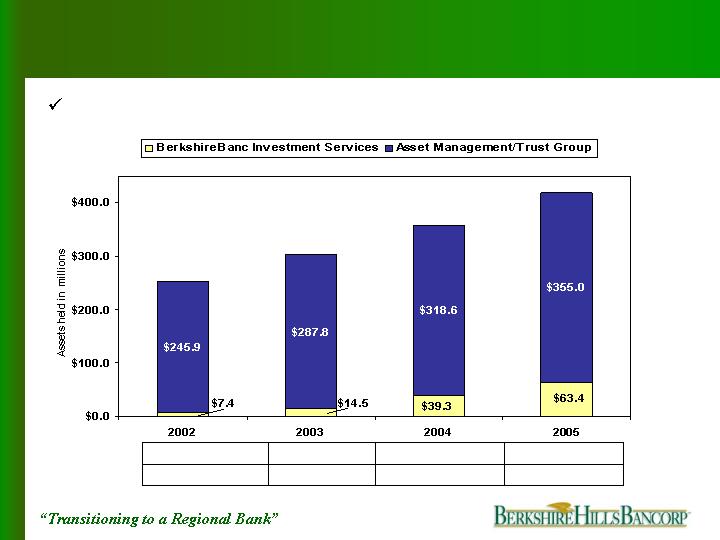

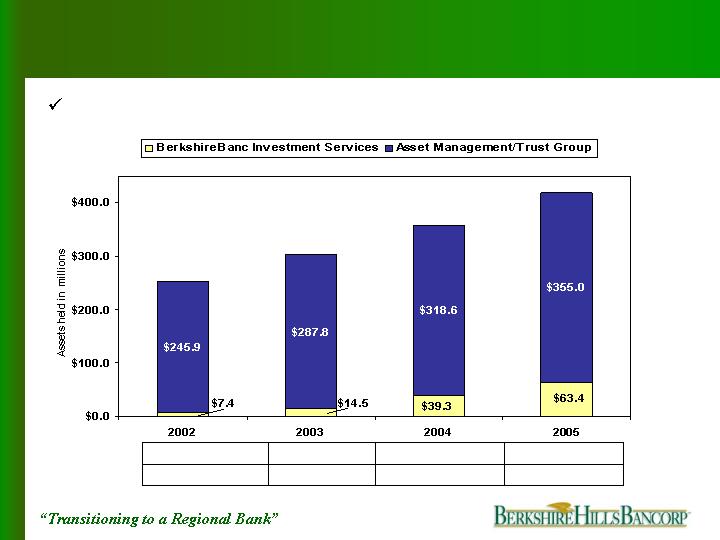

Assets under management compounded growth rate = 18%

Wealth Management Asset Growth

$418

$253

$303

$358

Total

10

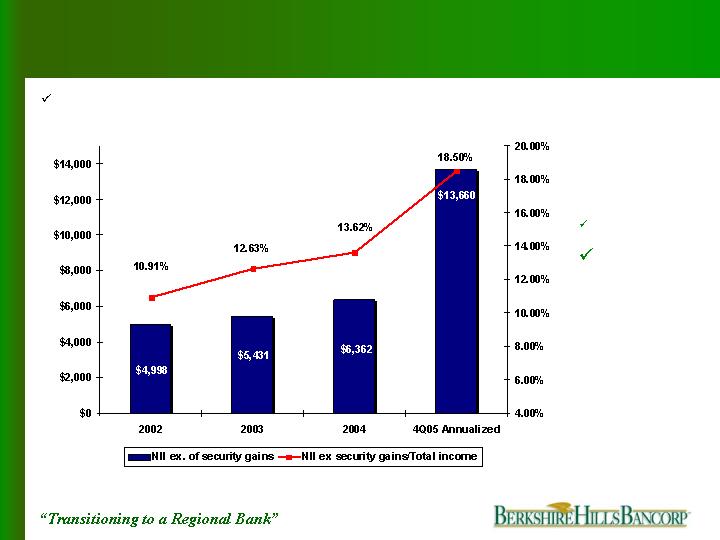

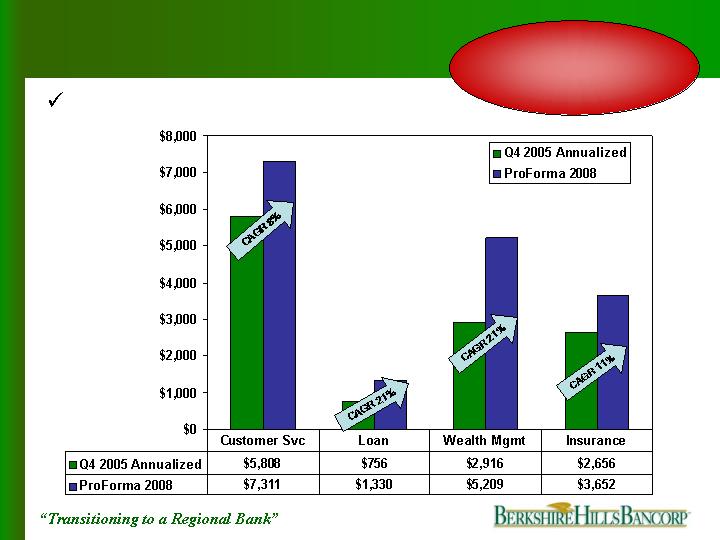

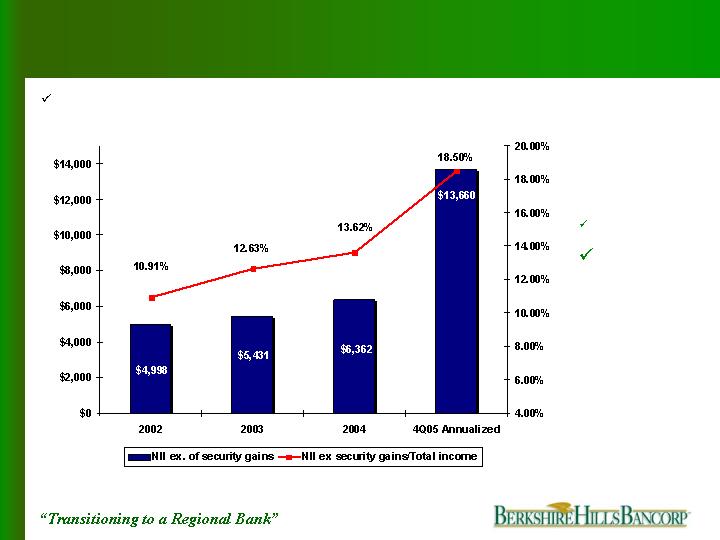

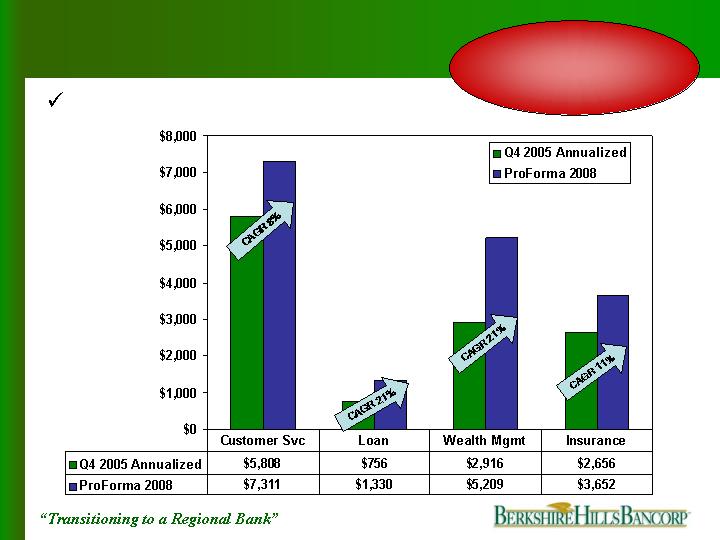

Main drivers of non-interest income: wealth management, insurance, loan service

and customer service fees

Non-Interest Income

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

Note: Exclusive of security gains

11

0.15

810.5

1.13

0.14

1,152

2004

0.35

280.4

1.13

0.40

3,199

2003

0.87

275.5

1.43

0.72

5,241

2002

0.07

1096.0

0.92

0.08

1,186

2005

NCOs/avg. loans (%)

Allowance/NPLs (%)

Allowance/loans (%)

NPAs/loans + REO (%)

NPAs ($000s)

Asset Quality

Reduce credit risk

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

Portfolio well protected…

Positioned for growth

12

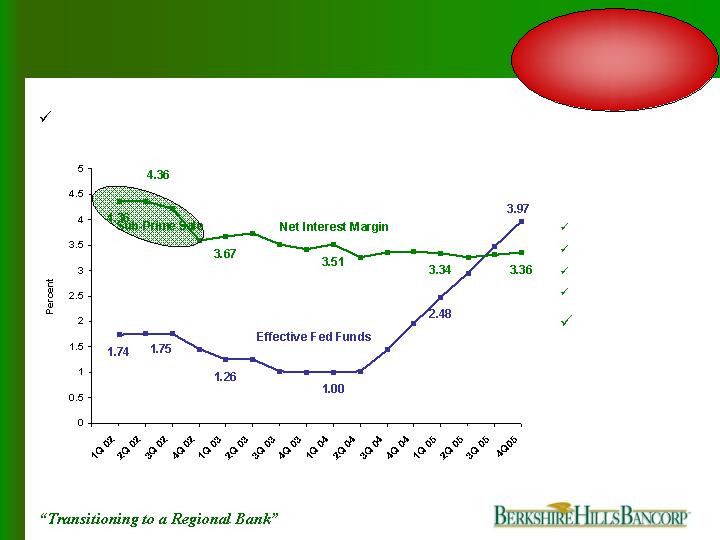

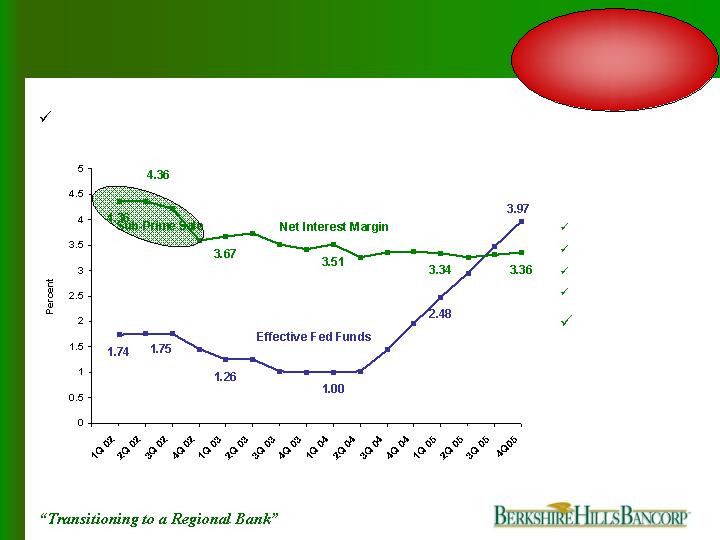

Stable margins against rising rates and flattening yield curve

Asset Liability Management

Effective interest

rate risk

management

Culture and People

People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

13

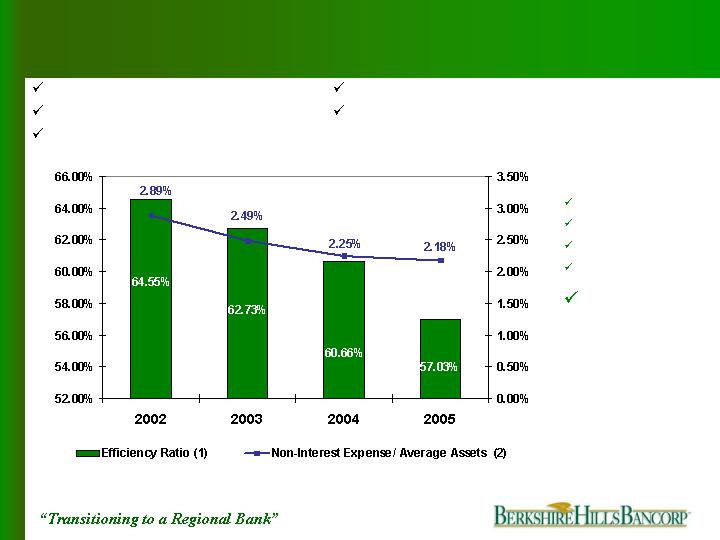

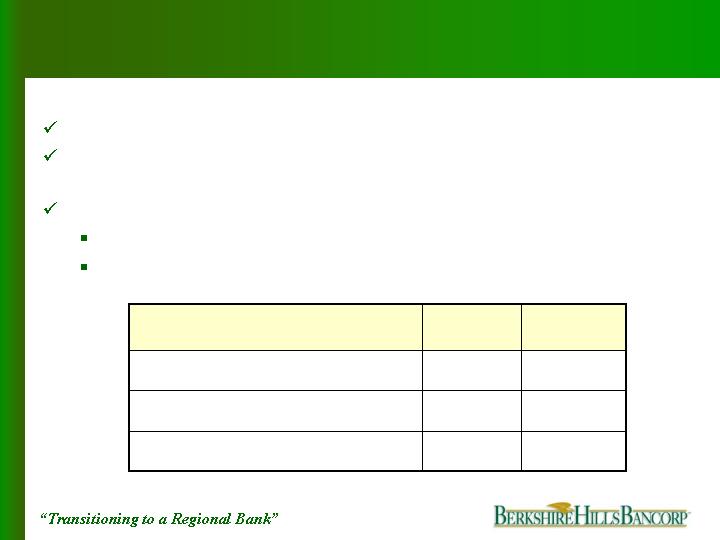

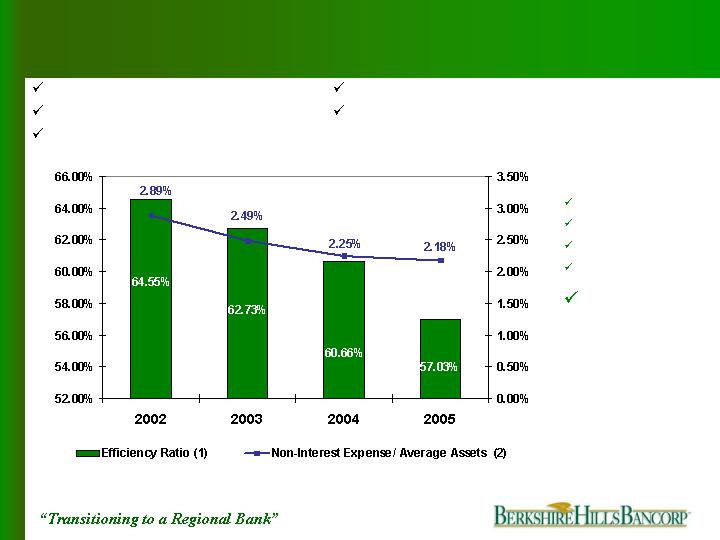

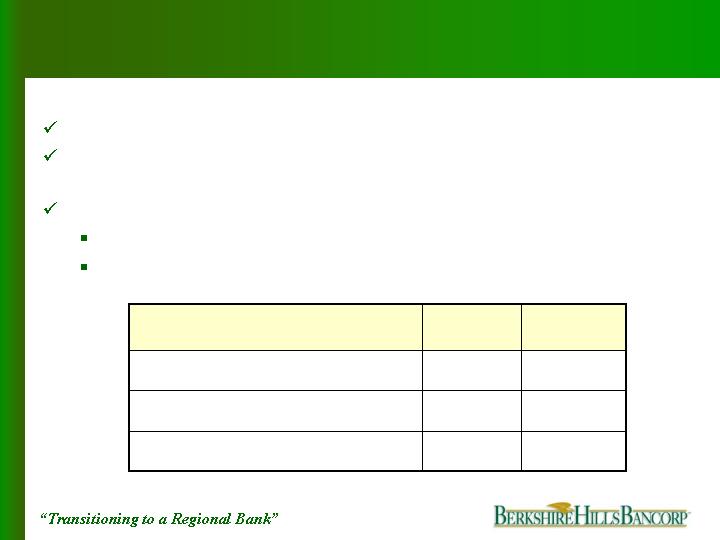

Operating Efficiencies

Reorganization

Sale of sub-prime loans

Sale of EastPoint Technologies

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

(1)

Exclusive of merger and conversion expenses, other non-recurring items, and amortization of intangible assets

(2)

Exclusive of merger and conversion expenses and other non-recurring items

Achieved 37% cost saves - WRO acq

Six Sigma

14

Operating Efficiencies

Six Sigma – Improving business performance

11 employees certified as Green Belts

9 additional Green Belt candidates in progress

Hired 2 certified Black Belts

Projects range from sales to marketing to recruiting

36% ROI

$250,000 gross

savings

Berkshire Six Sigma…is the new way to think about how we do business.

Growth is a function of achieving performance excellence in all that we do.

15

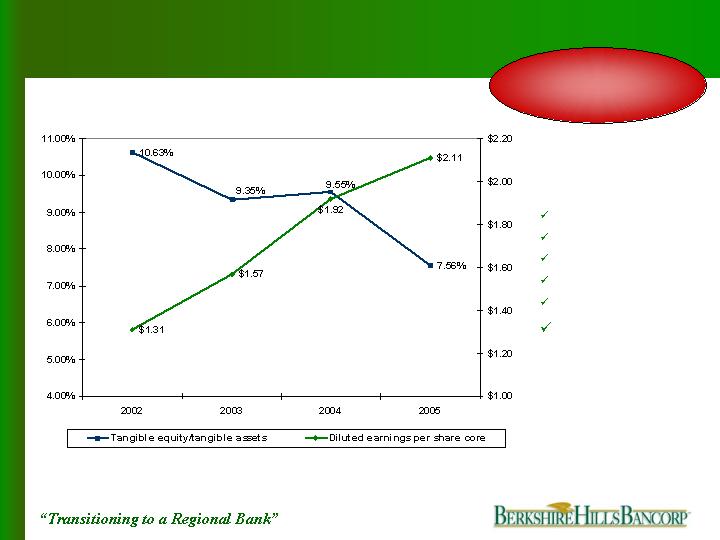

Stock buybacks

Expansion

Woronoco acquisition

De novo branches

Fee income

Divested sub-prime auto loans 2000 - 2003

Divested technology company 2004

Strategic Capital Allocation

Returned capital

to shareholders &

invested for future

growth

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

16

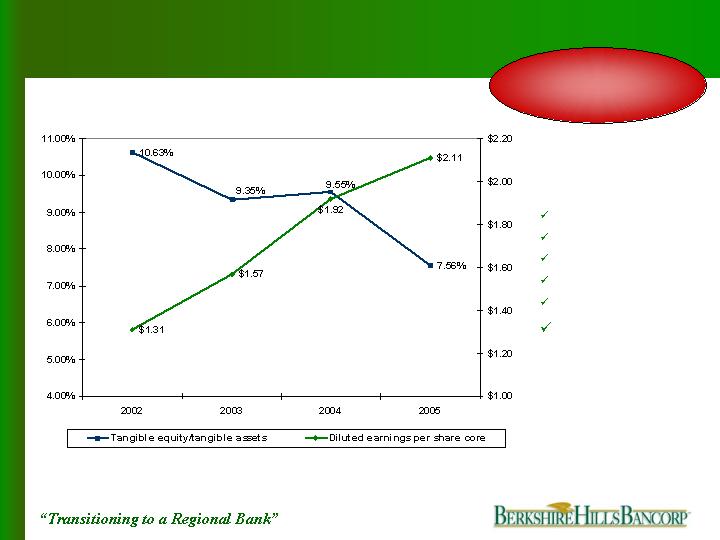

Strategic Capital Allocation

Effectively

employed

excess capital

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

17

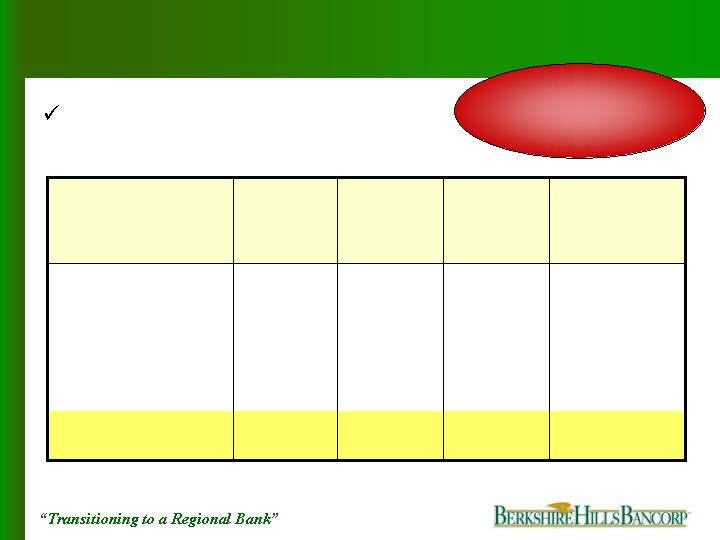

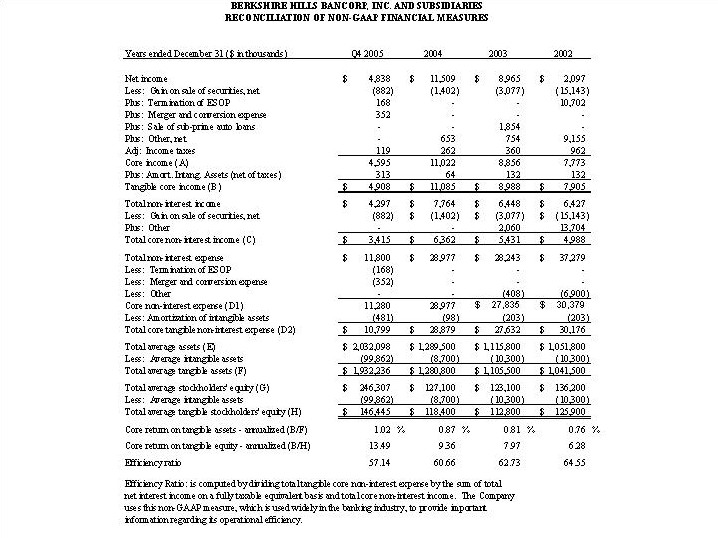

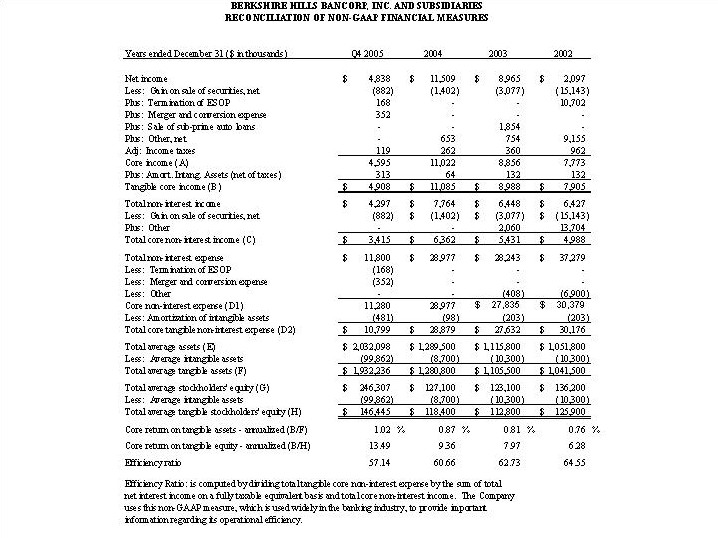

Where We Are Now

1.02

0.87

0.81

0.76

Core Tangible ROA %

7.89

9.06

7.28

1.54

ROE

0.96

0.89

0.80

0.20

ROA

*Annualized

**Please see appendix for reconciliation of non-GAAP financial measures

62.73

3.61

7.97

2003

4Q05*

2004

2002

57.14

60.66

64.55

Efficiency ratio %

Key Measures**

3.36

3.37

4.18

Net interest margin (FTE)%

13.49

9.36

6.28

Core Tangible ROE %

Successful

turnaround

Culture and People

Growth

Asset Quality

Asset Liability

Efficiencies

Capital Allocation

18

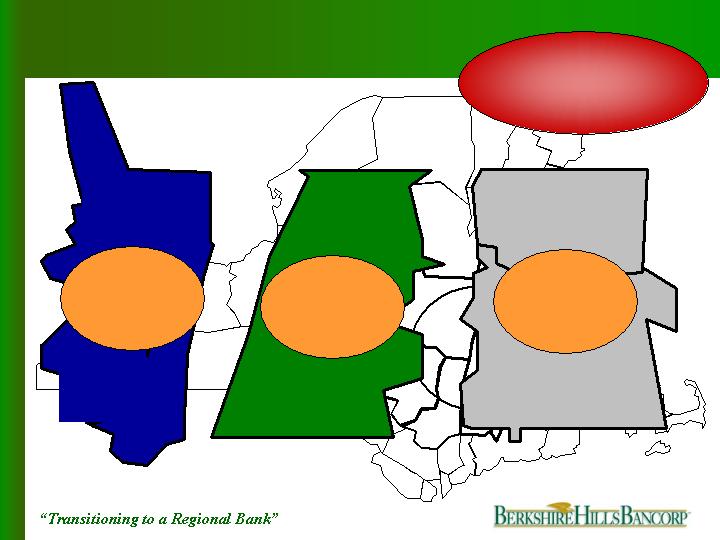

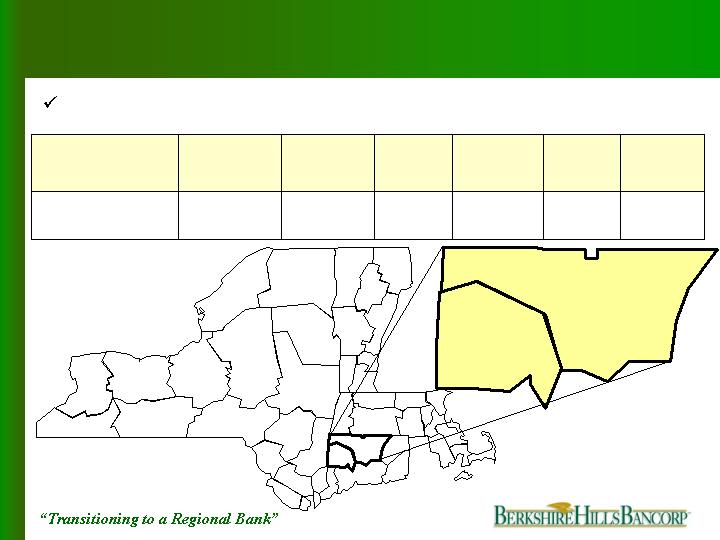

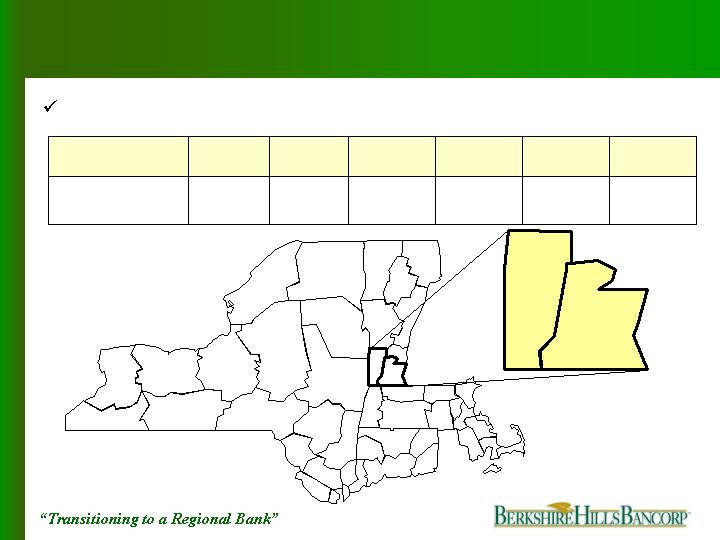

Regional Growth

Extend our

success beyond

Berkshire County

19

Competition

Regional bank

niche opportunity

Capital Region

Under $1.5 Billion

48 banks & CUs

$30 Billion +

6 - B of A, Citizens

HSBC, Key,

M&T, & Banknorth

$1.5 - $30 Billion

4 – First Niagara,

NBT, Trustco &

Berkshire Bank

Berkshire County

Under $1.5 Billion

19 banks & CUs

$30 Billion +

2- Citizens & Banknorth

$1.5 - $30 Billion

1 – Berkshire Bank

Pioneer Valley

Under $1.5 Billion

39 banks & CUs

$30 Billion +

4 – B of A, Citizens,

Sovereign & Banknorth

$1.5 - $30 Billion

2 – Chittenden &

Berkshire Bank

20

4,000

3,500

800

Mortgage Originations

(2004) ($millions)

2,801

3,185

2,418

Population/ branch

13.9

9.1

2.7

Deposits 6/05 ($billions)

3.46%

2.23%

-1.65%

5 Year projected growth

$49,634

618

Pioneer

Valley

Capital

Region

Berkshire

County

$46,954

133

$51,351

818

Median HH income

Population (000s)

Regional growth opportunity

Retail Banking

Opportunities in

contiguous markets

21

Retail Banking - Deposit Gathering

De novo branching

Double number of

branches by 2008

6

0

0

6

2006

50

24

Total

11

11

Berkshire County

10

3

2005

18

Pioneer Valley

21

New York

2008

Projected Yr End

22

Retail Banking – Deposit Gathering

Strategy and goals

Maintain

Berkshire County

dominance

Branding

Centers of influence

Improve calling effort

Municipal banking

Deposit insurance fund

Double Pioneer

Valley market

share

Gain 3% market

share in Capital

Region

23

Retail Banking - Deposit Gathering

46%

$2,000

N/A

$1,371

Total

724%

$338

<1%

$ 41

New York State

$748

$914

Projected

Deposits

2008

4.6%

31.7%

Estimated

Market

Share

Projected

Growth

Through 2008

Deposits

12/31/05

(millions)

Market

$473

$857

58%

7%

Pioneer Valley

Berkshire County

Regional growth goals

90% of projected

growth from outside

Berkshire County

24

Retail Banking - Mortgages

42%

$781

N/A

$549

Total

605%

33%

13%

$141

$361

$291

.5%

2%

$20

12%

$271

Projected

Mortgages

2005-2008

(millions)

Estimated

Market Share

Projected

Growth

Through 2008

Mortgages

12/31/05

(millions)

Market

$258

Capital Region

Pioneer Valley

Berkshire County

Regional growth

42% three

year growth

25

Retail Banking - Mortgages

Strategy and goals

Engage branch personnel

Triple outside origination staff

Capitalize on second home market and

metropolitan relocation

26

Retail Banking - Mortgages

Portfolio protected

Interest only loans: None

Uninsured mortgages with LTV in excess

of 80%: None

Losses 2000 – 2005: None

Average LTV: 61%

Average FICO: 728

Average delinquency 2005: 0.22%

Maintain credit

standards

27

Retail Banking – Consumer Lending

32%

$169

1.2%

$128

Total

1050%

13%

19%

$23

$71

$75

.1%

5%

$2

12%

$63

Projected

Equity Lines

2005-2008

(Millions)

Estimated

Market

Share

Projected

Growth

Through

2008

Equity Lines

12/31/05

(Millions)

Market

$63

Capital Region

Pioneer Valley

Berkshire County

Equity Lines

Regional growth

32% three year

growth

28

Retail Banking - Consumer Lending

Equity Lines

Maintain credit quality

HELOC

LTV in excess of 80%: None

Losses 2002 - 2005: None

Average FICO 2004-2005: 756

Average LTV: 55%

Average delinquency 2005: 0.14%

Maintain credit

standards

29

Indirect Auto

Regional growth opportunity

Retail Banking - Consumer Lending

20

60

35

34

2008

Active

BHLB

Dealers

21%

34%

8%

94%

2005

Penetration

27%

15

73

Southern

Vermont

45%

45

132

Capital

Region

29%

94%

2008

Penetration

10

34

2005

Active

BHLB

Dealers

# of

Dealers

Market

122

36

Pioneer Valley

Berkshire

County

Opportunity in

contiguous markets

30

Retail Banking – Consumer Lending

Indirect Auto

Regional growth goals

Absolutely no

subprime loans

12/31/05 - $148 Million

2008 - $268 Million

81% growth

31

Retail Banking - Consumer Lending

Strategy and goals

Advertise service

Benefit from Six Sigma principles

Answers in 30 minutes

Payments to dealers same day

Call program on high quality dealers

Utilization of branch network

Continue personal contact…people dealing with people

Absolutely no

subprime loans

32

Retail Banking - Consumer Lending

Indirect Lending

Maintain credit quality

Sub-prime loans since 2001: None

Average FICO of portfolio: 716

Average 2005 FICO: 732

Average delinquency 2005: 0.45%

Losses 2005: 0.43%

Maintain credit

standards

33

Retail Banking

27%

45%

45%

42%

46%

% Increase

$17,009

$3,213

$432

$781

$2,000

Projected

2008

(billions)

13%

13%

12%

13%

CAGR

$13,431

Pretax income

(annualized 4Q05)

$2,217

Total

$297

$549

12/31/2005

Annualized

(billions)

$1,371

Consumer loans

Mortgages

Deposits

Growth

34

Commercial Banking

Massachusetts

Why we have been successful

Not a priority for large banks

Smaller banks have been acquired

Mid-cap borrowers prefer local relationship

Community involvement leads to business

Corporate commitment to commercial banking

Growth plan

Maintain dominance in Berkshire County

Opportunity from Woronoco acquisition

Robust growth in Capital Region

Regional presence in adjacent markets with quality leadership

Consistent growth

35

Commercial Banking

New York Region - Why

Ignored Market

Pioneer Valley - Why

Lack of focus by larger banks

Tech Valley growth initiative

Demand for regional bank presence

Lack of focus by larger banks

Demand for regional bank presence

Leveraging investment in WRO

36

1%

3%

36%

BHLB estimated market share

86

119

365

BHLB commercial loans ($M)

47,926

32,216

7,781

Total business revenues ($M)

4,250

23,736

Pioneer

Valley

Capital

Region

Berkshire

County

1,025

6,984

6,300

31,434

Estimated commercial loans ($M)

Total businesses

Commercial Banking

Regional growth opportunity

Opportunity in

contiguous markets

37

Deposits

(billion)

Sales

(billion)

Businesses

Median

HH

Income

Projected

Growth

Population

(000s)

Market

$76.9

$7.7

$19.1

$2.7

50,207

6,984

2.74%

-1.65%

1,039

133

$60,534

$46,954

Northern Connecticut

Berkshire County

Potential growth in northern Connecticut

Commercial Banking

38

Deposits

(billion)

Sales

(billion)

Businesses

Median HH

Income

Projected

Growth

Population

(000s)

Market

$5.3

$7.7

$1.5

$2.7

5,241

6,984

1.07%

-1.65%

81

133

$43,769

$46,954

Southern Vermont

Berkshire County

Commercial Banking

Potential growth in southern Vermont

39

Commercial Banking

72%

$21,419

$12,455

Pretax income

(annualized 4Q05)

95%

$1,109

$570

Totals

301%

131%

$345

$275

1%

3%

$489

Projected

Commercial

Loans 2008

(millions)

36%

Estimated

Current

Market Share

34%

Percentage

Increase

2005 - 2008

Commercial

Loans

12/31/05

(millions)

Market

$86

$119

$365

Capital Region

Pioneer Valley

Berkshire County

Regional growth goals

40

Wealth Management

16.9%

18.4%

19.3%

Annual growth rate

$418.4

$357.9

$302.3

$253.3

Assets under management

$253.3

$302.3

$357.9

$418.4

41

Wealth Management

Client centered/consultative wealth

management relationship

Financial planning platform with 5 CFPs

Investment management capabilities are not

outsourced

Credible investment results – 10 year history

Emphasis on personal investment management

Strategy and goals

Key to our strategy

going forward

42

Wealth Management

$14.8

$11.2

$2.4

Estimated

Market

(billions)

90%

$795

$418

Total

$186

$84

$525

Projected

AUM 2008

(millions)

<1%

<1%

16%

Estimated

Market

Share

Projected

Growth

Through

2008

AUM

12/31/05

(millions)

Market

$2

$23

$393

9200%

265%

34%

Capital Region

Pioneer Valley

Berkshire

County

Regional growth

43

Insurance – An Emerging Business

Referral source of over 400 people

Captive audience with existing customers

Qualified leads through lending activities

Additional lines of business

Life

Disability

Health

Expect 15-20% pretax profit margin within 3 years

Overview

44

Financial Highlights

Service fee income

44% three year

Growth; 13% CAGR

45

Remain well capitalized

Execute de novo branching and commercial banking strategy without

raising capital

Capital alternatives

Trust preferred

Subordinated debt

Capital Management

10.1%

11.1%

Total risk based capital (bank)

7.4%

7.8%

Tier 1 leverage capital (bank)

7.0%

7.6%

Tangible equity/assets

ProForma

12/31/08

12/31/2005

46

Wrap – Up

Strategic Highlights

47

Wrap up

Strategic Highlights

Maintain focus on our strengths

Culture and people

Growth

Asset quality

Asset liability management

Operational efficiencies

Strategic capital allocation

48

Wrap up

Competition

Regional bank

niche opportunity

Capital Region

Under $1.5 Billion

48 banks & CUs

$30 Billion +

6 - B of A, Citizens

HSBC, Key,

M&T, & Banknorth

$1.5 - $30 Billion

4 – First Niagara,

NBT, Trustco &

Berkshire Bank

Berkshire County

Under $1.5 Billion

19 banks & CUs

$30 Billion +

2- Citizens & Banknorth

$1.5 - $30 Billion

1 – Berkshire Bank

Pioneer Valley

Under $1.5 Billion

39 banks & CUs

$30 Billion +

4 – B of A, Citizens,

Sovereign & Banknorth

$1.5 - $30 Billion

2 – Chittenden &

Berkshire Bank

49

Wrap up

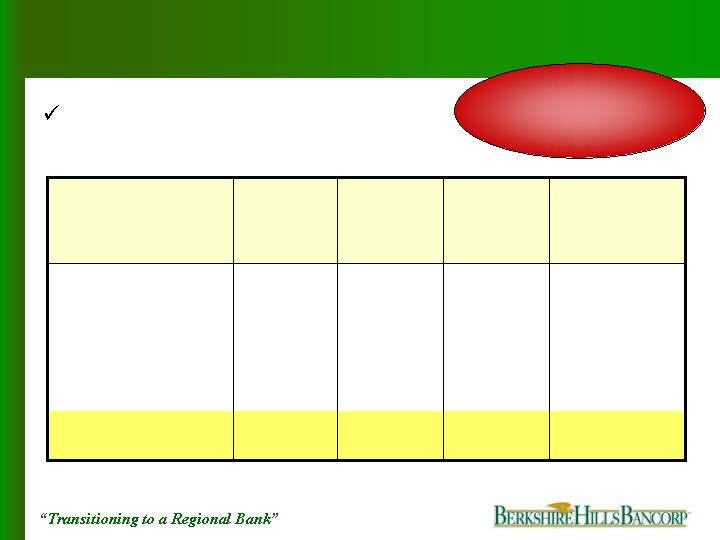

Financial Highlights

1.03%

1.02%

Return on tangible assets

3.36%

57.14%

13.49%

Actual Q4 2005

Annualized

ProForma

FY 2008

3.49%

Net interest margin

57.62%

Efficiency ratio

14.10%

Return on tangible equity

50

Wrap up

Strategic Highlights

Summary

Significant

organic growth

Double branch

network size

Double

commercial loans

Double size of

wealth management

Emerging

insurance

business

44% increase in

total fee income

46% increase in

deposits

55% increase in

consumer loans

42% increase in

mortgages

51

KBW Regional Bank Conference

March 1, 2006

If you have any questions, please contact:

Wayne F. Patenaude , CFA

Senior Vice President and CFO

(413) 236-3195

wpatenaude@berkshirebank.com

Company website: www.berkshirebank.com

52

Appendix

53

54