Michael P. Daly

President and Chief Executive Officer

Berkshire Bank – “America’s Most Exciting Bank”

P. O. Box 1308

Pittsfield, MA 01202-1308

Phone: (413) 236-3194

Email: mdaly@berkshirebank.com

Kevin P. Riley

Chief Financial Officer

Berkshire Bank – “America’s Most Exciting Bank”

P. O. Box 1308

Pittsfield, MA 01202-1308

Phone: (413) 236-3195

Email: kriley@berkshirebank.com

1

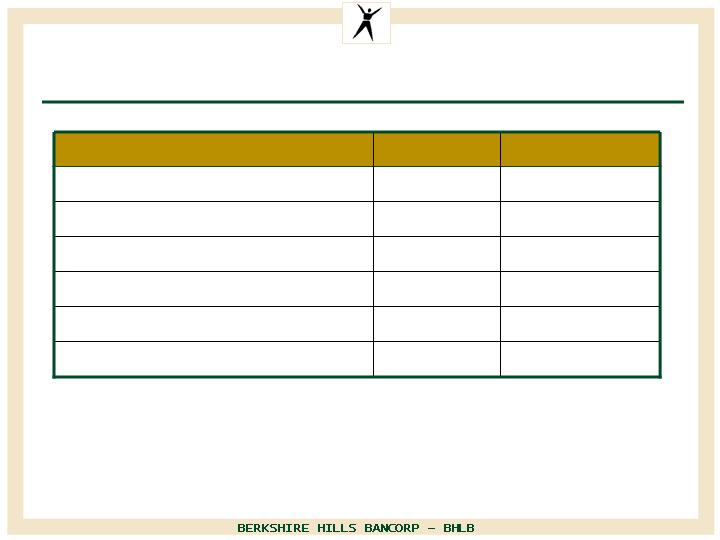

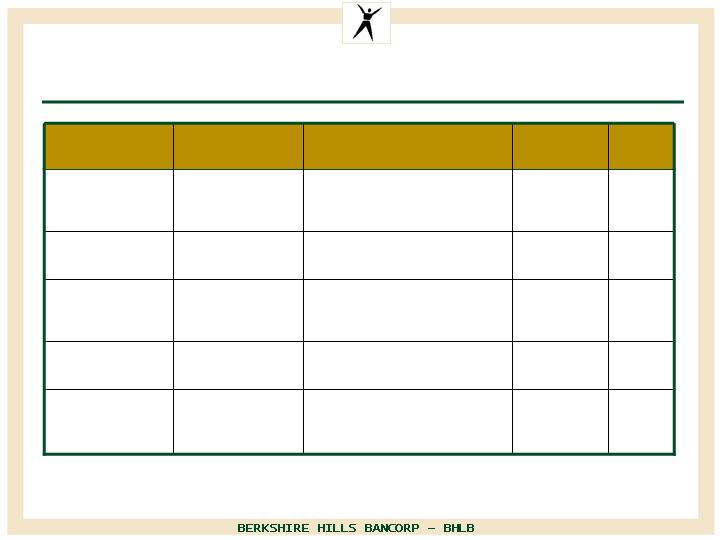

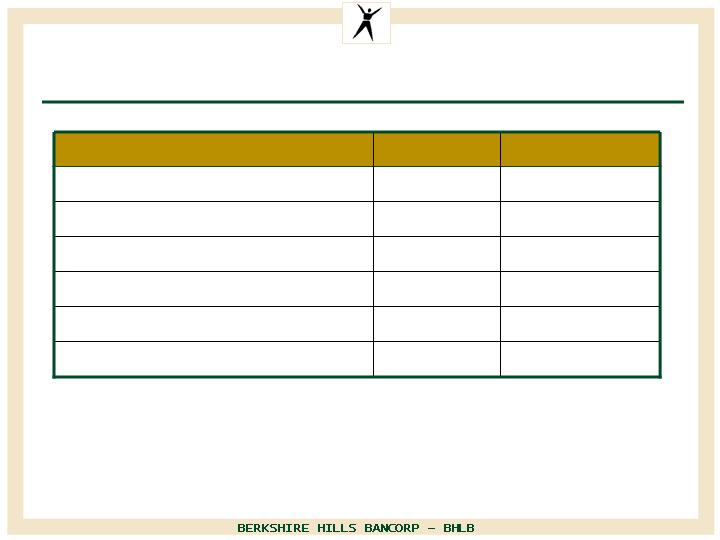

Experienced Management Team

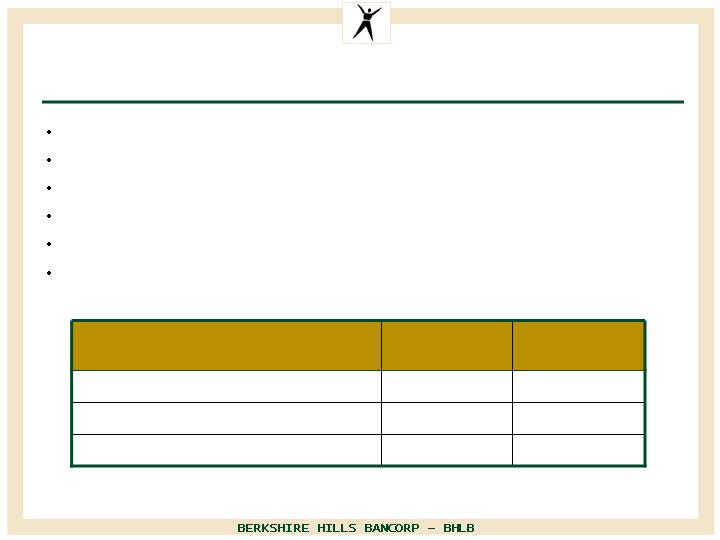

30 (First Agricultural Bank)

55

SVP/Human Resources

Linda Johnston

14 (Fleet Investment Services, Bank of

Boston’s Private Bank)

54

SVP/Wealth management

Tom Barney

2 (Former owner MassOne)

57

President, Berkshire Insurance

Ross Gorman

2 (Bank of America)

55

EVP/Chief Risk Officer

Shep Rainie

2 (TD Banknorth)

49

EVP/Commercial Head

Mike Oleksak

2 (Bank of America, Citizens)

31

SVP/Retail Head

Sean Gray

1 (former CFO KeyBank)

48

EVP/CFO

Kevin Riley

22 (Bank of Boston)

46

President/CEO

Mike Daly

6 (retired Chairman & CEO of Honeywell

and Allied Signal; Former Vice chair of GE)

72

Non-Executive Chairman

Larry Bossidy

Years with Company

(previous company)

Age

Position

Name

2

Creating Value

Veteran management team

Diverse revenue sources

Performance driven

Strong commercial orientation

Differentiated brand and culture

Leader in core markets

Opportunity for growth in new markets

3

Building a Distinctive Culture

Vision

To be a world-class

financial services

company through an

engaging and exciting

environment where

customers want to do

business and

employees want to

work.

Core Values

4

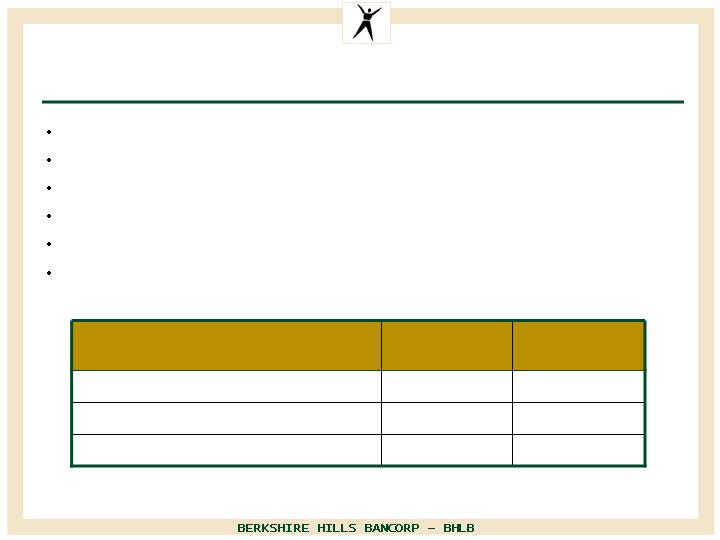

Solid First Quarter 2008 Results

65.5%

60.1%

Efficiency ratio

16.1%

33.5%

Fees/Net interest income + fees

3.33%

3.41%

NIM

5.62%

7.4%

ROE

0.87%

0.97%

ROA

(2%)

4%

Change in EPS (year-to-year)

Regional Peer

BHLB

Performance Measure

Note: Institutions considered for regional peer comparison are WBS, PBCT, NAL, WASH, INDB, FNFG and NBTB

Peer measures are based on median average per SNL

5

2008 Plan for Earnings Growth

EPS of $2.16 (14% growth from core 2007)

Fee income growth of 20%

Higher NIM – from liability sensitive to

neutral/asset sensitive

Modest loan growth: 6% - 8%

Commercial real estate, C & I and residential

Look for expansion opportunities

Return excess capital to shareholders

6

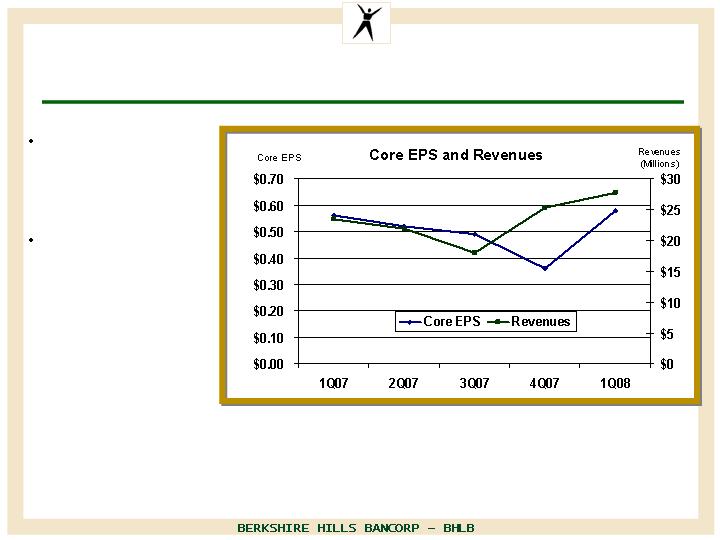

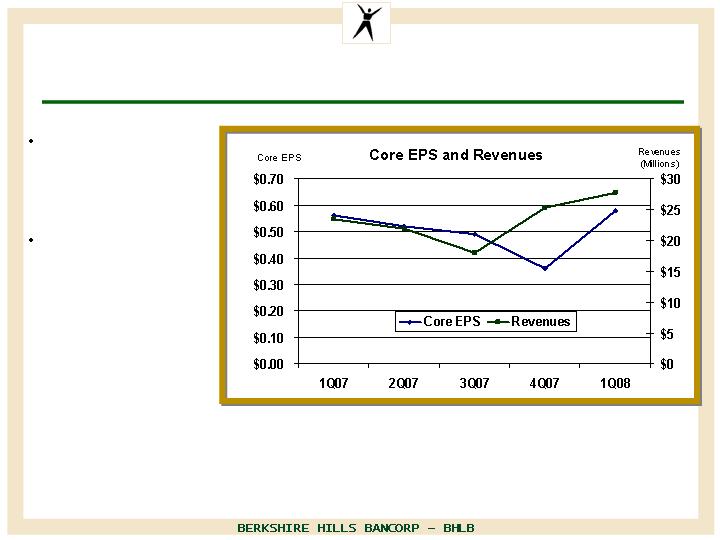

Record Revenues and Earnings per Share in 2008

Revenue growth

from acquisitions

and organic

growth

Core EPS

benefiting from

higher margins

and efficiencies

Note: Core and GAAP EPS the same in last five quarters except for 3Q07 (core $0.49 and GAAP $0.10) and 4Q07 (core $0.36

and GAAP $0.29). Difference in 3Q07 was due to balance sheet restructuring and Factory Point merger integration costs.

Difference in 4Q07 was due to merger integration and other nonrecurring expense restructuring costs.

7

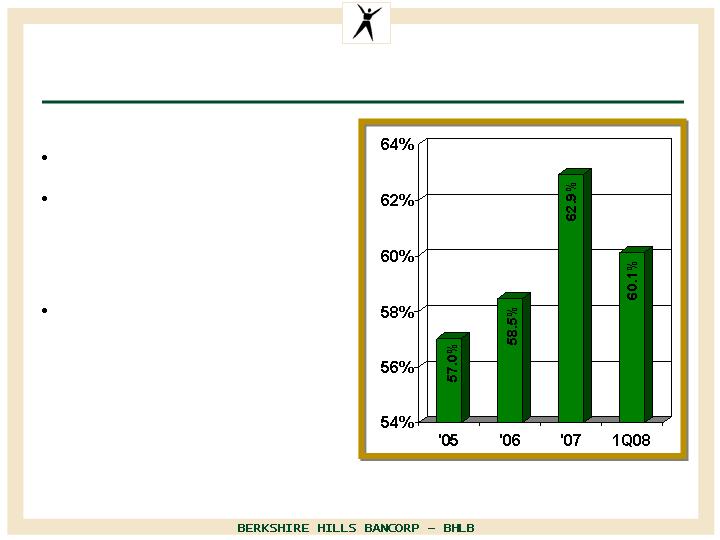

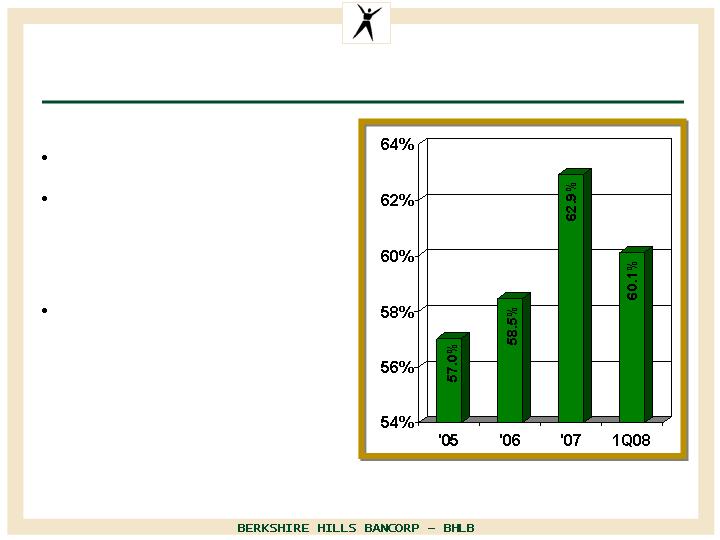

Efficiency Ratio Now Improving

Bank ratio 58% - 60%

Insurance co. ratio is low

60% in Q1 & Q2 and low 70%

in Q3 & Q4 – contingency

revenue

Bank ratio will improve as

synergies from Factory Point

are realized and de novo

branches grow

Note: Efficiency ratio is computed by dividing total tangible core non-interest expense by the sum of total net

interest income on a fully taxable equivalent basis and total core non-interest income.

8

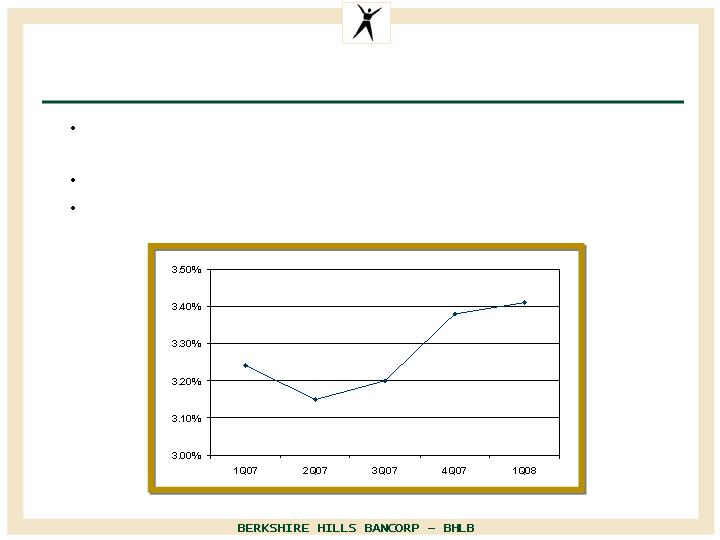

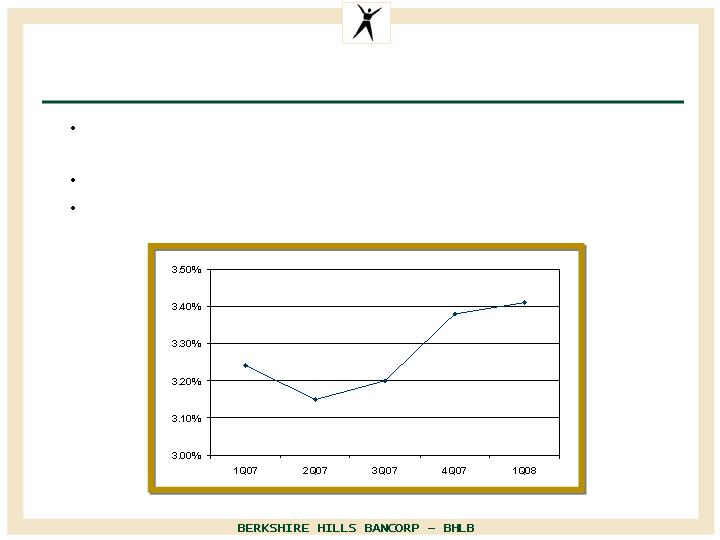

Net Interest Margin Highest in Three Years

Benefited from Factory Point acquisition and balance sheet

restructuring in Q3 2007

Utilize interest rate swaps to manage interest rate risk

Diligent pricing on deposit and loan products

9

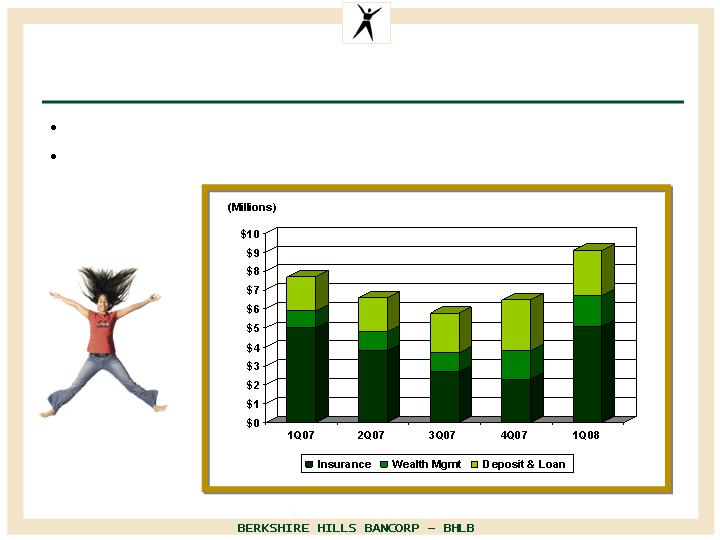

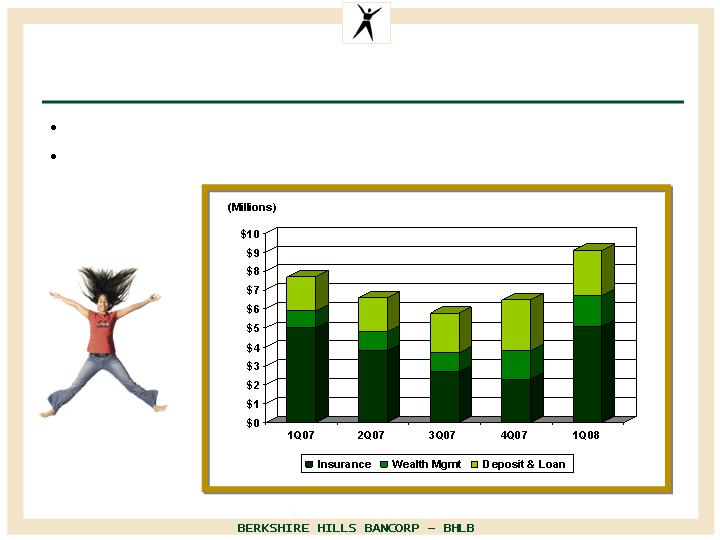

Fee Income Growing Strongly

Fees provide 30% of revenue

Fee growth of 20% estimated for 2008

10

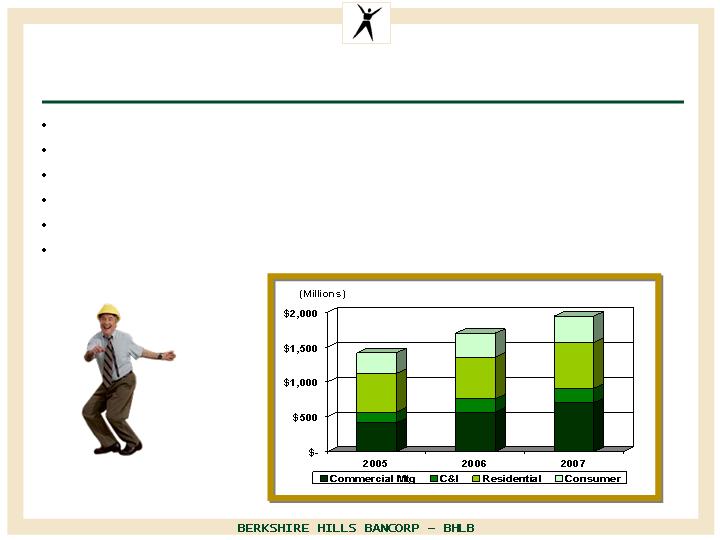

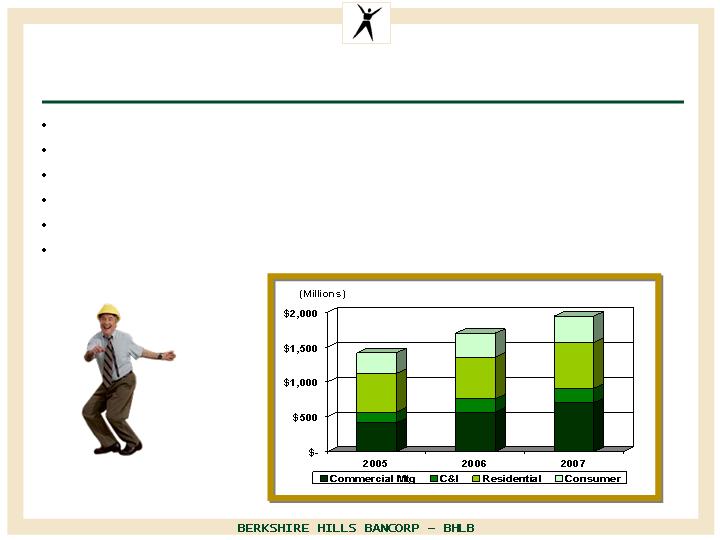

Loan Mix Managed for Quality Growth

17% CAGR, 10% CAGR without acquisitions

Higher growth in commercial real estate and C & I

Limited emphasis on indirect lending

Residential and home equity focus on retail side

Strong credit disciplines – no high LTV or sub-prime and Alt A loan programs

Modest growth planned in 2008: 6% - 8%

11

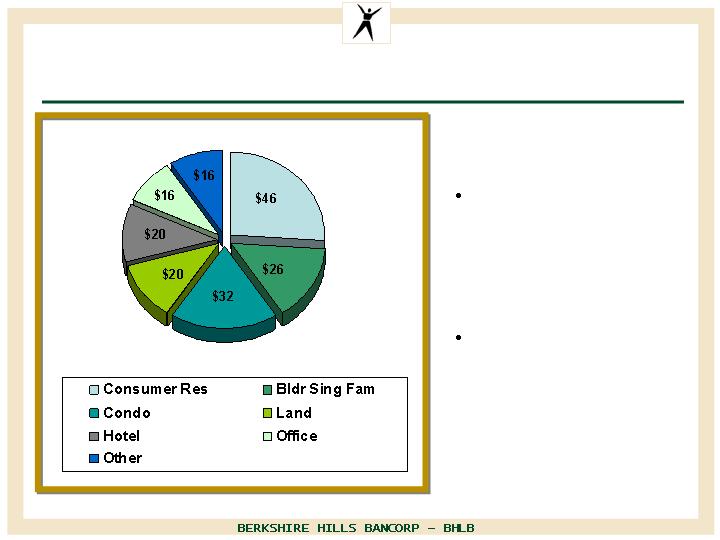

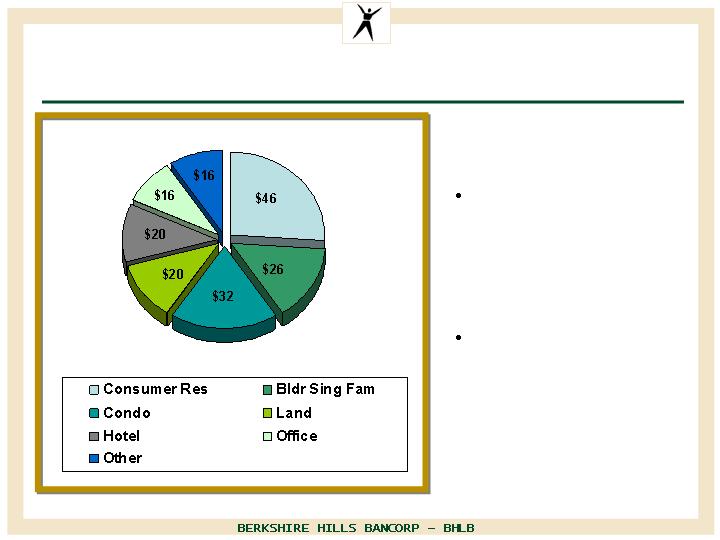

Diversified Construction and Development Loans

$176 MM

portfolio was 9%

of total loans at

3/31/08

0.23% C&D non-

accruing ($400M)

at 3/31/08

A/O 3/31/08

(millions)

12

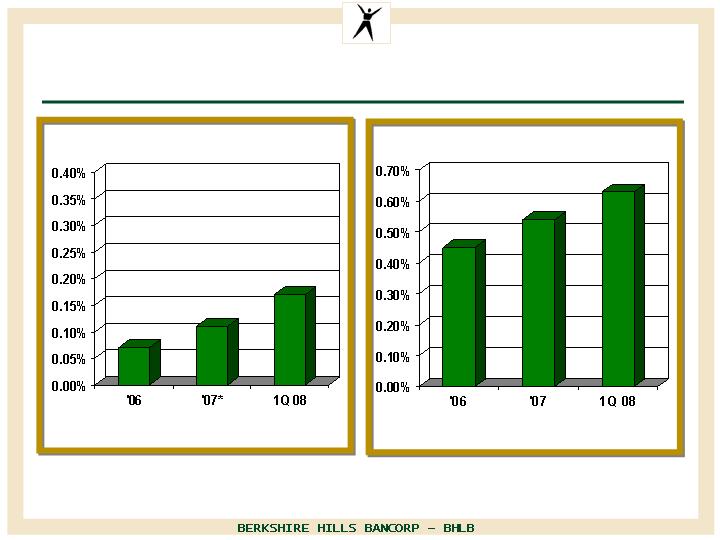

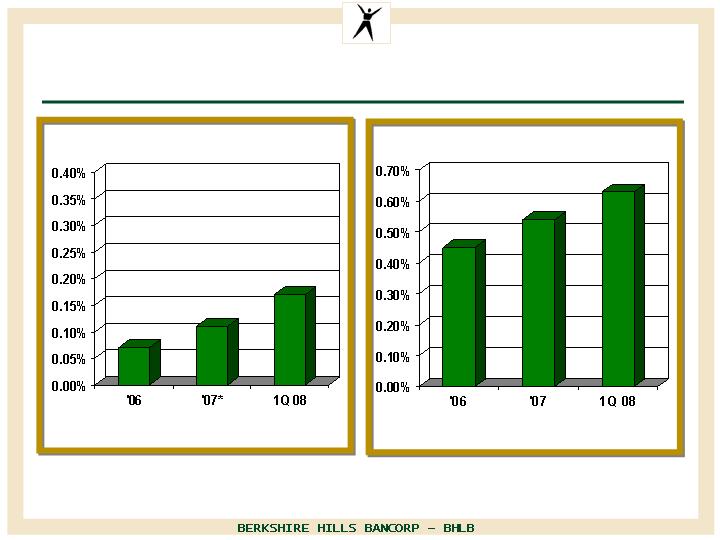

Solid Credit Quality

* Excludes $4 million (0.23%) charge

for one fraud related commercial loan

Nonperforming Loans to Total Loans

Net Charge-offs to Average Loans

Annualized

13

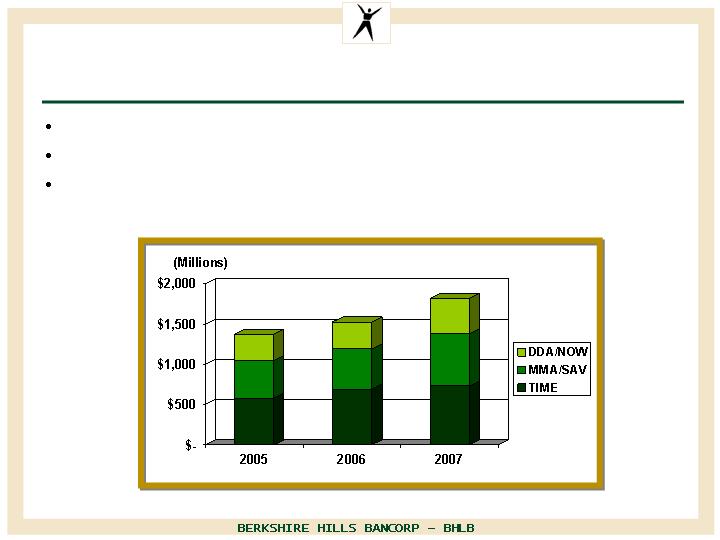

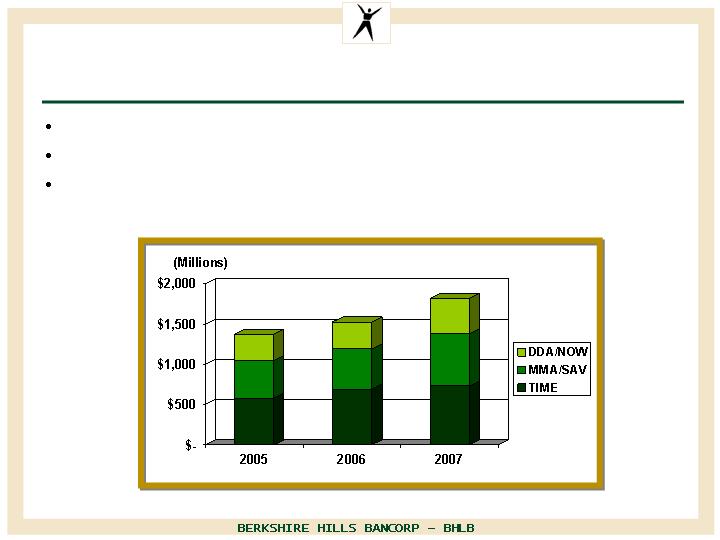

Favorable Deposit Growth

Strong growth in MMA, DDA/NOW

Growing deposit base in New York and Pioneer Valley

Cash management and electronic banking – commercial growth

14

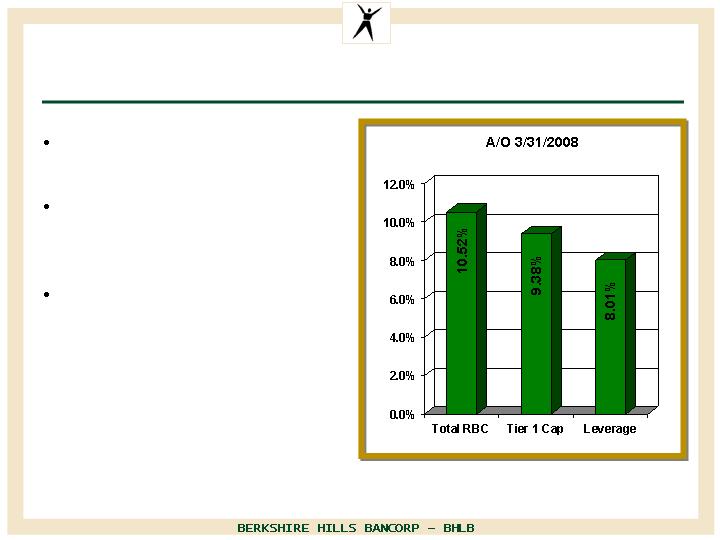

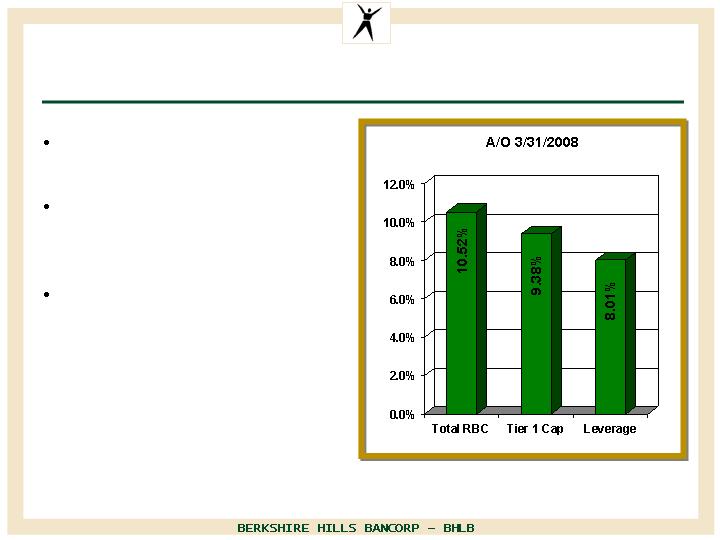

Well Capitalized

Bank continues to exceed

well capitalized standards

Ample liquidity at holding

company – unsecured

borrowing facilities

Cash contributions from

insurance group fund

holding company

obligations

15

Opportunistic Expansion

Jun 05

$850 MM in

assets

Extended franchise to

Springfield/Hartford corridor

Pioneer Valley, MA

(Springfield area)

Woronoco Bancorp,

Inc.

2005 to

2007

$136 MM in

Deposits as

of 3/31/08

Capital Region de novo

expansion – opened 9 branches

since 2005

Capital Region, NY

(Albany area)

De novo expansion

Oct 06

$9 MM in

insurance

revenues

Foundation for Berkshire

Insurance Group

Western MA

5 Western MA

insurance agencies

Sep 07

$391 MM in

assets

Extended franchise to Southern

Vermont

Manchester, VT

Factory Point

Bancorp, Inc

Jan 08

$50 MM

assets under

management

Established wealth management

presence in NY

Albany, NY

The Center for

Financial Planning

Date

Assets/

Value

Strategic Accomplishment

Location

Acquired

Business

16

Acquisition Strategy

Open to flexible partnering structures

Utilize strong management for growth of

combined institution

Strengthen tangible book value

Identify specific and desired targets

Fill in or new market expansion

Strong market opportunity

Non-bank acquisitions

Focus on established businesses

Insurance and wealth management

Goal to be accretive in one year

Open to other types of financial services firms

Remain flexible in regards to deal terms

17

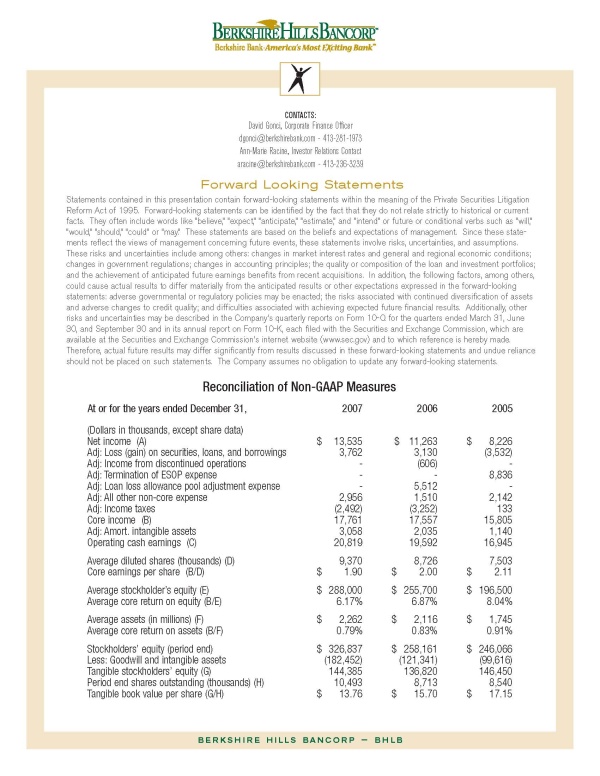

Why Invest in Berkshire Hills

Strong and experienced management team

Distinctive culture and core values

Strong credit culture and asset quality discipline

Above average growth in loans, deposits and fee income

Earnings performance at record levels and growing

Stock valuation metrics are attractive for long term return

250%

180%

Price/Tangible book

140%

80%

Price/Book

13.9X

11.6X

Price/EPS (forward 4Q for BHLB)

SNL Bank

and Thrift

Berkshire

a/o 5/28/08

18