EXHIBIT 99.1

Our Growing Franchise

$2.5 billion in assets

38 bank branches and

10 insurance offices

Three-state franchise –

Massachusetts, New York,

and Vermont

Only locally headquartered

financial services company in

primary market

$800 million in assets

under management

Insurance agency with

almost 100 professionals

Strong growth from organic,

de novo, and acquisition

strategy

Distinctive culture as

America’s Most Exciting

BankSM

Expanded executive team

Attractive, stable markets

Diversified revenues with

strong commercial

components

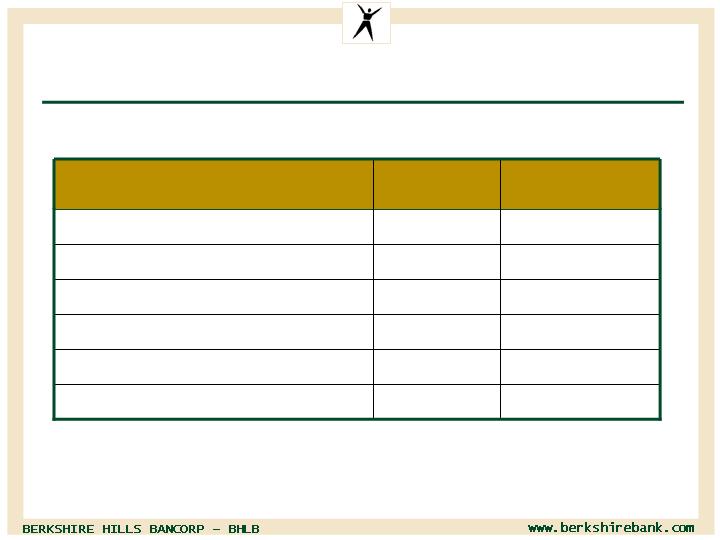

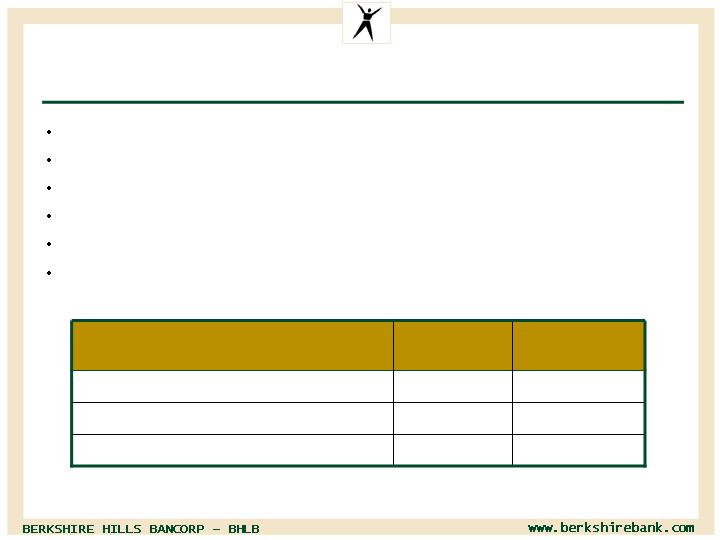

31.78

31.15

29.63

Total book value

14.36

13.76

15.70

Tangible book value

0.31

0.58

0.56

Dividends paid

1.13

1.44

1.29

Net earnings, diluted

$1.13

$1.90

$2.00

Core earnings, diluted

Per Share Data

1.14

1.14

1.14

Loan loss allowance/total loans

0.42

0.45

0.35

Non-performing assets/total assets

0.15%

0.34%

0.07%

Net charge-offs/average loans

Asset Quality

60.60

62.94

58.46

Efficiency ratio

3.43

3.26

3.24

Net interest margin

0.94

0.60

0.53

GAAP return on assets

7.10

4.69

4.40

GAAP return on equity

0.94

0.79

0.83

Core return on assets

7.10%

6.17%

6.87%

Core return on equity

Performance

2,546.9

2,513.4

2,149.6

Total assets

11.8

13.5

11.3

Net income

13.9

20.8

19.6

Operating cash earnings

$54.9

$88.6

$72.3

Revenue

6 Mo

2008

FY 2007

FY 2006

Results (in millions)

Financial Highlights

Network of 48 stores

38 Banking

10 Insurance

Note: See last page for reconciliation of non-GAAP data. 2007 net

charge-offs/average loans measured 0.11% before one charge related to

2006 borrower fraud.

See last page

Investor contacts:

$279 Million

Market capitalization

44,000

Average share trading volume

8%

Insider ownership

56%

Institutional ownership

10.4 Million

Common shares outstanding

$0.16

Current quarterly dividend

$33.00 - $19.50

52 Week Price Range:

BHLB

Stock Information

Note: Data as of 07/22/08

Kevin P. Riley

EVP and CFO

Phone: (413) 236-3195

Email: kriley@berkshirebank.com

P.O. Box 1308, Pittsfield, MA 01202-1308

David H. Gonci

Corporate Finance Officer

Phone: (413) 281-1973

Email: dgonci@berkshirebank.com

Shepard D. Rainie

EVP and Chief Risk Officer

Phone: (413) 236-3176

Email: srainie@berkshirebank.com

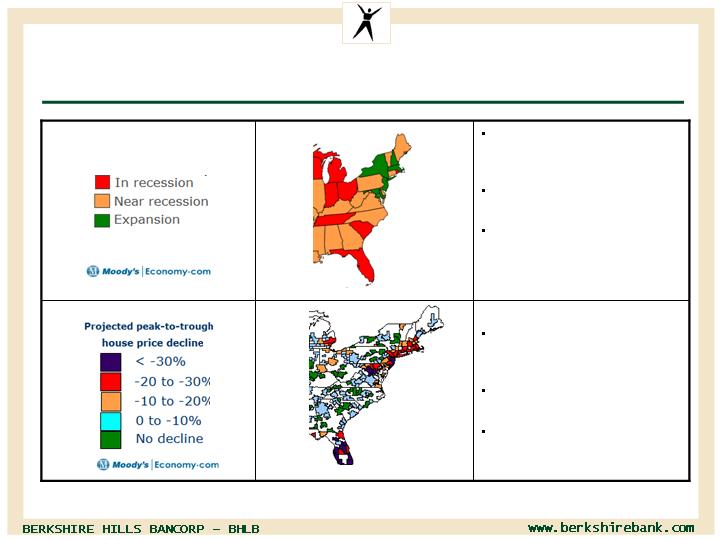

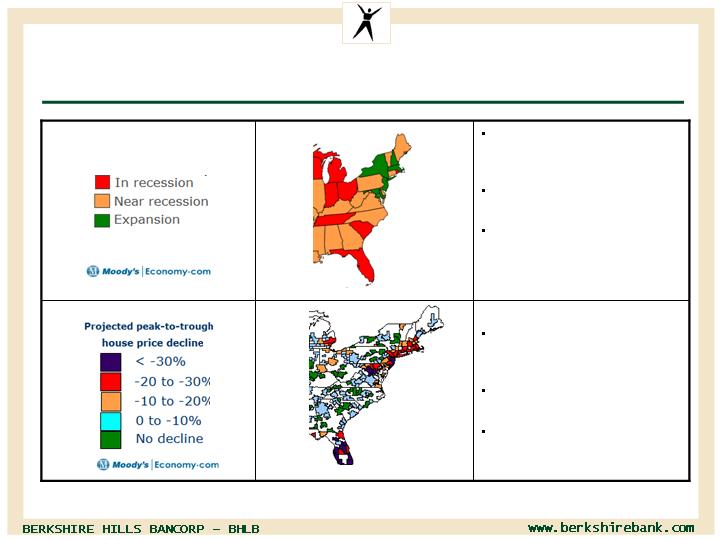

Attractive Markets – MA, NY, VT

Residential property values

more stable in Western MA

Foreclosures remain low

Albany prices – no decline

(As of May 2008)

HOUSE PRICES

Berkshire markets still

expanding

Low unemployment

IBM announces $1.5 billion

New York Tech Valley

investment (July 2008)

(As of May 2008)

ECONOMIES

Slide 2

Building a Distinctive Culture

Our Vision

Core Values

Slide 3

Creating Value

Veteran management team

Diverse revenue sources

Performance driven

Differentiated brand and culture

Leader in core markets

Opportunity for growth in new markets

Slide 4

Solid First Half 2008 Results

64.34%

60.60%

Efficiency ratio

22.49%

31.21%

Fee Income/Revenues

3.42%

3.43%

Net Interest Margin

7.44%

7.10%

Return on Equity

0.71%

0.94%

Return on Assets

(12%)

6%

Change in EPS (year-to-year)

SNL Bank and Thrift

Median

(as of 7/23/08)

BHLB

Performance Measure

Slide 5

2008 Plan for Earnings Growth

EPS of $2.16 – 14% growth from core 2007

Record earnings of $22.4 million – 26% growth from core

2007

Higher net interest margin – from liability sensitive to

neutral/asset sensitive

Modest loan growth – low single digit

Fee income at 30% of revenue – emphasis on wealth

management and insurance

Efficiency ratio of 61%

Slide 6

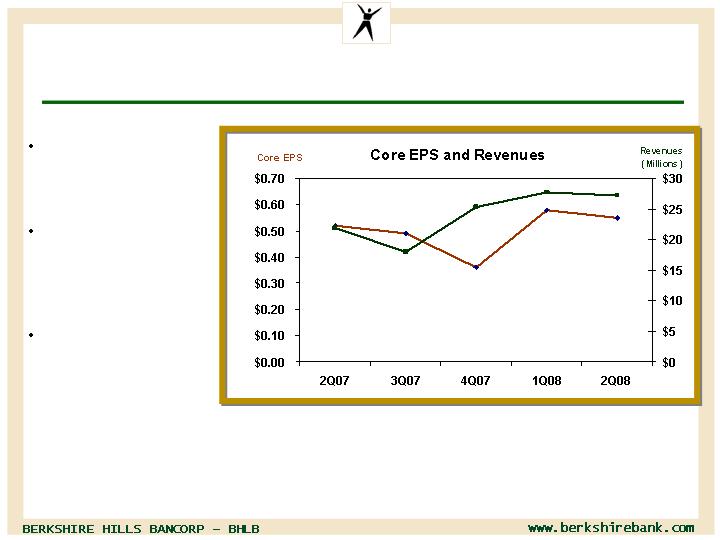

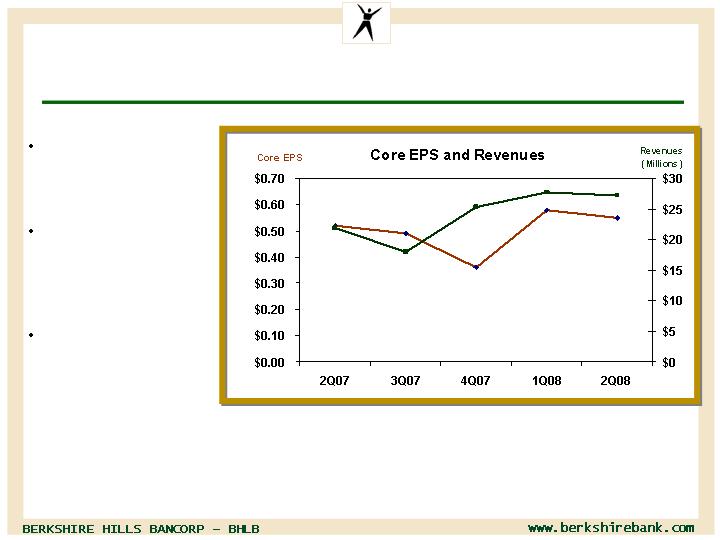

Record Revenues and Earnings per Share in 2008

Revenue growth

from acquisitions

and organic growth

2008 core EPS up

6% benefiting from

higher margins and

efficiencies

Pre-provision core

EPS up 15% in Q2

2008

Note: Core and GAAP EPS the same in last five quarters except for 3Q07 (core $0.49 and GAAP $0.10) and 4Q07 (core $0.36

and GAAP $0.29). Difference in 3Q07 was due to balance sheet restructuring and Factory Point merger integration costs.

Difference in 4Q07 was due to merger integration and other nonrecurring expense restructuring costs.

Revenue

Core EPS

.55

27.2

Slide 7

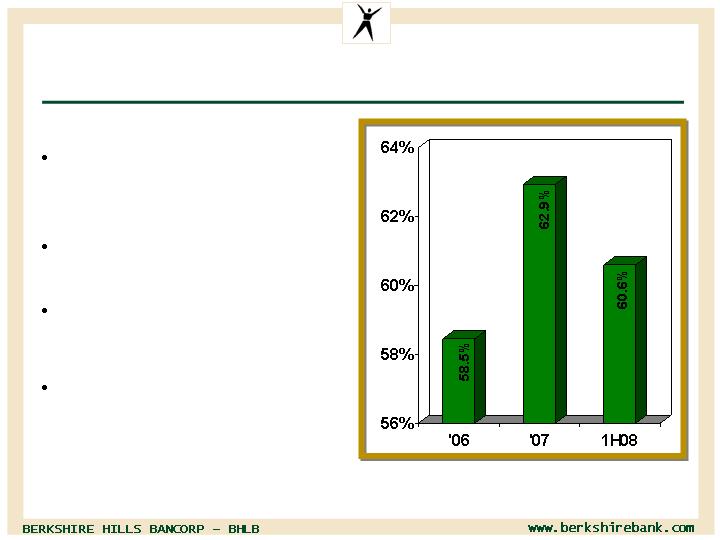

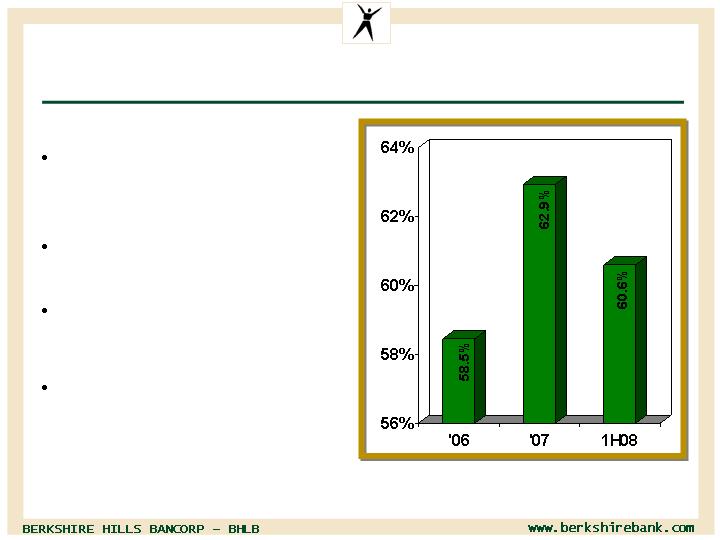

Efficiency Ratio Now Improving

Spike in 2007 from

insurance acquisition and

de novo branches

Bank ratio 58 – 60%

excluding insurance

Benefiting from higher

margins, growth, and

expense control

Insurance ratio 66% due to

different revenue/cost mix

Note: Efficiency ratio is computed by dividing total tangible core non-interest expense by the sum of total net

interest income on a fully taxable equivalent basis and total core non-interest income.

Slide 8

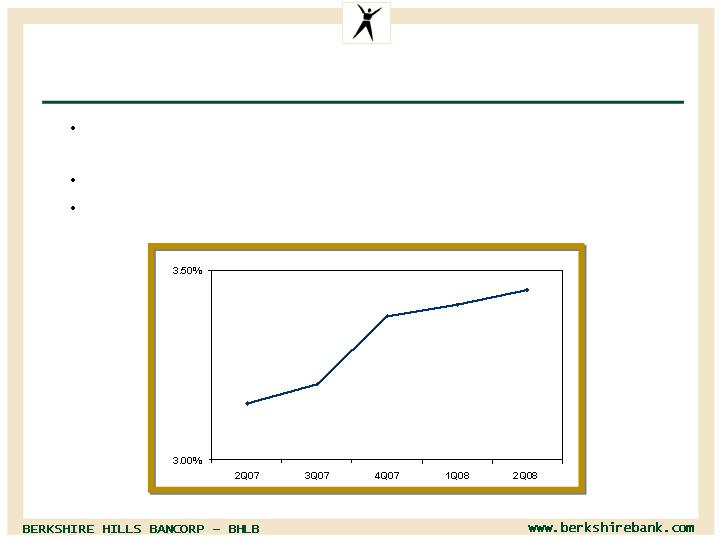

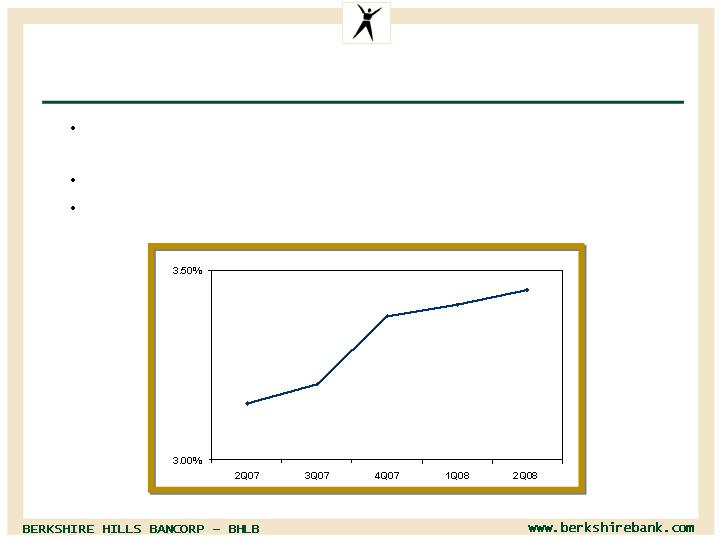

Net Interest Margin Highest Since 2003

Benefited from Factory Point acquisition and balance sheet

restructuring in Q3 2007

Utilizing interest rate swaps to manage interest rate risk

Diligent pricing on deposit and loan products

3.45%

Slide 9

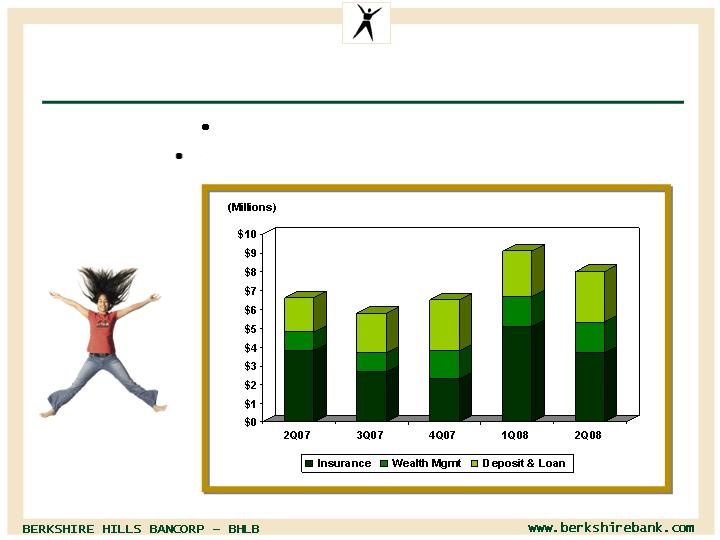

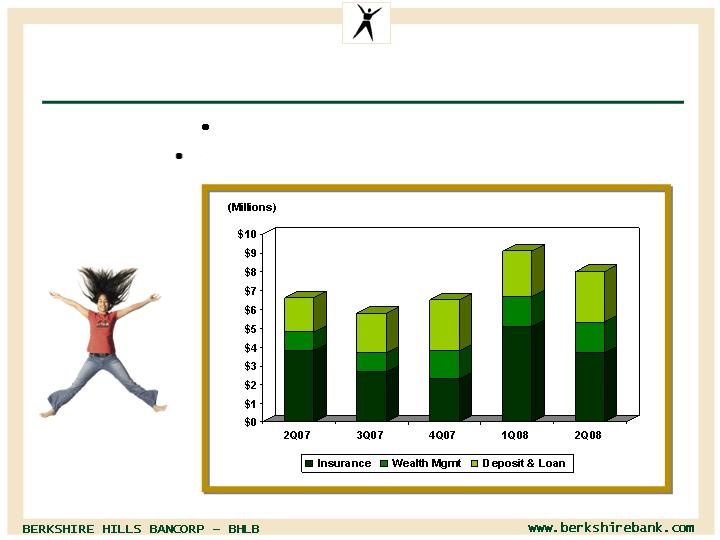

Fee Income Growing Strongly

Fees provide 30% of revenue

Fee growth of 20% estimated for 2008

Slide 10

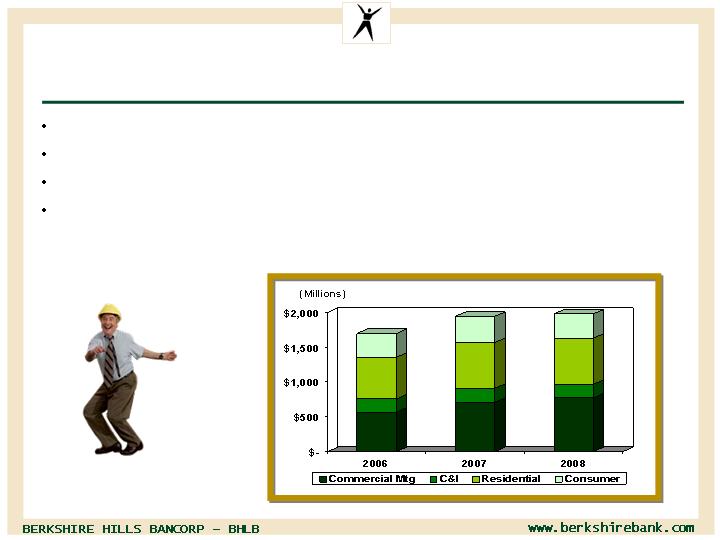

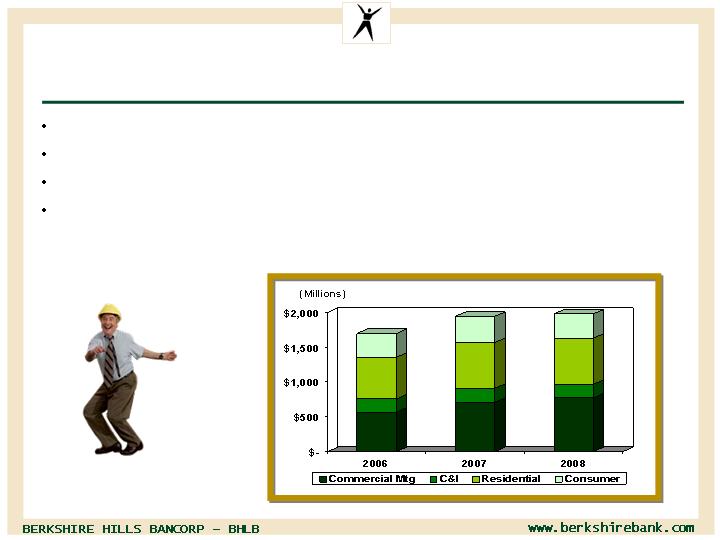

Loan Mix Managed for Quality Growth

Higher growth in commercial real estate, and commercial & industrial

Indirect lending running off

Residential and home equity focus on retail side

Strong credit disciplines

347

665

198

768

1,978

Slide 11

Favorable Deposit Growth

Strong growth in checking accounts

Growing deposit base in New York and Pioneer Valley

Personal core deposit growth offsetting high cost

municipal run-off

418

676

717

1,811

Slide 12

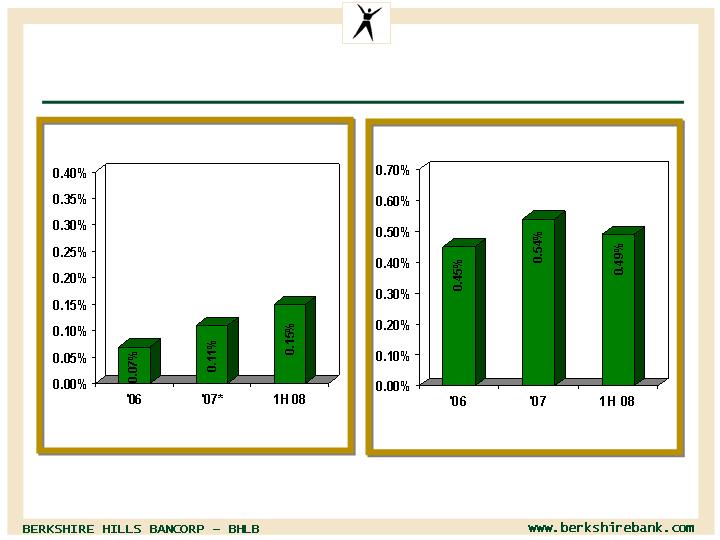

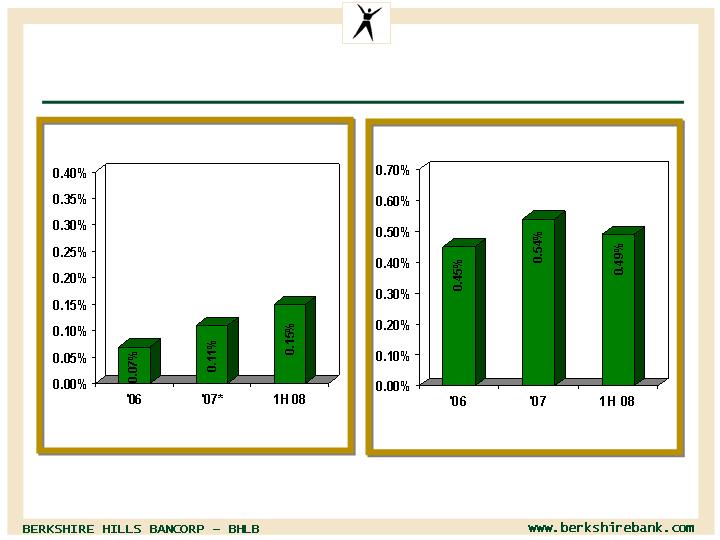

Solid Credit Quality

* Excludes $4 million (0.23%) charge

for one fraud related commercial loan

Nonperforming Loans to Total Loans

Net Charge-offs to Average Loans

Annualized

Slide 13

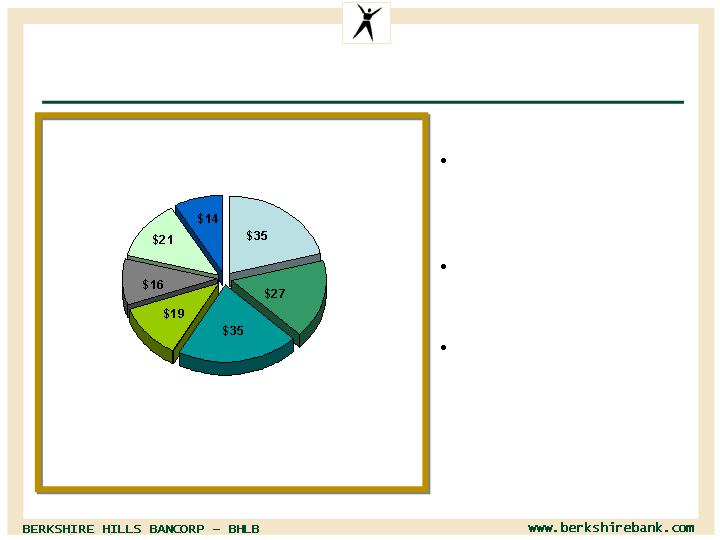

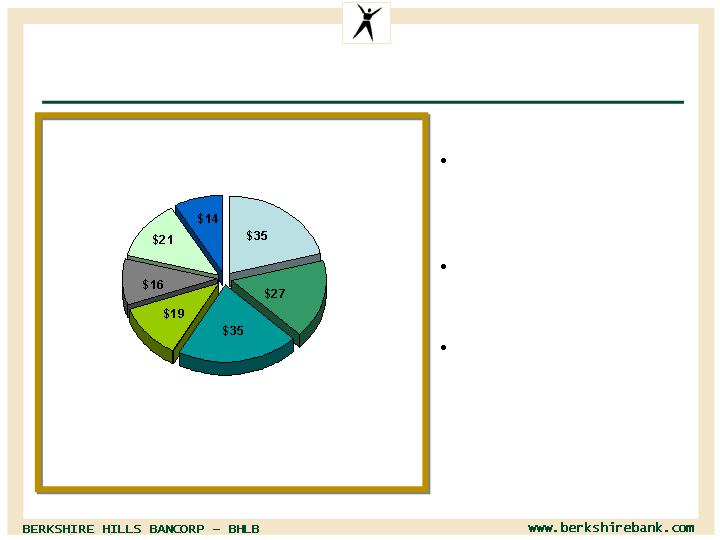

Diversified Construction and Development Loans

$132 million Commercial

C&D portfolio was 7% of

total loans at 6/30/08

No C&D non-accruing at

6/30/08

$35 million Consumer

Construction portfolio to

individuals for single

home construction

as of 6/30/08

(millions)

Other

Consumer

Residential

Builder

Single Family

Condo

Land

Hotel

Office

Slide 14

Seasoned Home Equity Portfolio

$174 million balance at 6/30/08 (9% of total loans)

66% of balance acquired with Woronoco ($86 million in

2005) and Factory Point ($29 million in 2007)

Conforming underwriting, maximum 80% CLTV

No sub prime or Alt A programs

Negligible delinquencies and charge-offs

Residential portfolio also conforming and performing well

Slide 15

Conservative Investment Portfolio

Unrealized loss of 21 basis points on $242 million total 6/30/08

No Government Sponsored Enterprise (GSE) equity securities except

FHLB Boston stock

$14 million corporate debt securities with $1.4 million unrealized loss

(includes $9 million trust preferred)

$3 million corporate equity securities with $0.1 million unrealized

gain

$108 million GSE/Agency MBS portfolio with $1.1 million unrealized

gain

$112 million municipal portfolio with $0.3 million unrealized loss

Slide 16

Solid Capital Footings

Tangible equity at 6.3% of assets at 6/30/08, up from 6.2% at year-end

2007

Core return on tangible equity of 19% in first half of 2008 – strong

tangible capital formation rate

Tangible book value of $14.36 at 6/30/08, growing at 8% annualized rate

in first half of 2008

Stock buybacks on 4.5% of outstanding shares in last three quarters

due to slower growth and surplus capital generation

Note: Equity to assets was 13.0% at 6/30/08 and 12/31/07. Book value per share was $31.78 and $31.15 at those dates, respectively.

Measures based on tangible equity are adjusted to subtract goodwill and intangible assets from equity (and from assets where applicable).

Core return on tangible equity is based on operating cash earnings as shown in the reconciliation table on the last page.

Slide 17

Why Invest in Berkshire Hills

Strong and experienced management team

Distinctive culture and core values

Strong credit culture and asset quality discipline

Above average growth in loans, deposits and fee income

Earnings performance at record levels and growing

Stock valuation metrics are attractive for long term return

260%

180%

Price/Tangible book

140%

80%

Price/Book

15.4X

12.0X

Price/EPS (BHLB 2008 est EPS; SNL trailing EPS)

SNL Bank

and Thrift

Berkshire

as of 7/22/08 ($25.99 BHLB Close)

(data rounded)

Slide 18

FOR QUESTIONS, PLEASE CONTACT:

David Gonci, Corporate Finance Officer

413-281-1973 - dgonci@berkshirebank.com

Ann-Marie Racine, Investor Relations Contact

413-236-3239 - aracine@berkshirebank.com

Forward Looking Statements

This presentation contains forward-looking statements (within the meaning of the Private Securities Litigation Reform

Act of 1995) which involve significant risks and uncertainties. Actual results may differ materially from the results

discussed in these forward-looking statements, including factors discussed in “Forward-Looking Statements” in the

Company’s 2007 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at the

Securities and Exchange Commission’s internet website (www.sec.gov) and to which reference is hereby made.

Except as required by law, the Company assumes no obligation to update any forward-looking statements, and undue

reliance should not be placed on these statements.

$14.36

$13.76

$15.70

Tangible book value per share (G/H)

10,385

10,493

8,713

Period end shares outstanding (thousands) (H)

149,131

144,385

136,820

Tangible stockholders’ equity (G)

(180,905)

(182,452)

(121,341)

Less: Goodwill and intangible assets

$330,036

$326,837

$258,161

Stockholders’ equity (period end)

0.94%

0.79%

0.83%

Average core return on assets (B/F)

$2,511

$2,262

$2,116

Average assets (millions) (F)

7.10%

6.17%

6.87%

Average core return on equity (B/E)

$331,400

$288,000

$255,700

Average stockholder’s equity (E)

$1.13

$1.90

$2.00

Core earnings per share (B/D)

10,420

9,370

8,726

Average diluted shares (thousands) (D)

13,873

20,819

19,592

Operating cash earnings (C)

2,103

3,058

2,035

Adj: Amort. intangible assets

11,770

17,761

17,557

Core Income (B)

(701)

(2,492)

(3,252)

Adj: Income taxes

683

2,956

904

Adj: All other non-core items

-

-

5,512

Adj: Loan loss allowance pool adjustment expense

26

3,762

3,130

Adj: Loss on securities, loans and borrowings

$11,762

$13,535

$11,263

Net Income (A)

6 Mo. 2008

FY 2007

FY 2006

(Dollars in thousands, except share data)

Note: Management uses non-GAAP financial measures to provide supplemental perspectives. They are not substitutes for GAAP

measures, and do not depict amounts that accrue directly to the benefit of stockholders. We calculate core income and related

measures in order to gauge the underlying earnings power of the Company. We calculate operating cash earnings to measure cash core

earnings (before amortization of intangibles), which we view as the underlying cash generation for the benefit of stockholders. The

efficiency ratio is adjusted for non-core income and expense because non-core items are not generally related to the efficiency of

operations. Average diluted shares for 2006 core income per share totaled 8,786,000.

www.berkshirebank.com

Reconciliation of Non-GAAP Financial Measures