This presentation contains forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) which involve significant risks

and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements, including factors discussed in “Forward-

Looking Statements” in the Company’s 2007 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at the Securities and Exchange

Commission’s internet website (www.sec.gov) and to which reference is hereby made. Except as required by law, the Company assumes no obligation to update

any forward-looking statements, and undue reliance should not be placed on these statements.

Forward Looking Statements

November 13, 2008

Sandler O’Neill + Partners

East Coast Financial Conference

Michael P. Daly

President and CEO

Phone: (413) 236-3194

Email: mdaly@berkshirebank.com

P.O. Box 1308, Pittsfield, MA 01202-1308 -- Executive Offices – 66 West Street, Pittsfield, MA 01201

David H. Gonci

Corporate Finance Officer

Phone: (413) 281-1973

Email: dgonci@berkshirebank.com

Kevin P. Riley

EVP and CFO

Phone: (413) 236-3195

Email: kriley@berkshirebank.com

1

Our Growing Regional Franchise

$2.6 billion in assets

48 total stores

38 bank branches

10 insurance offices

Three-state franchise

Massachusetts, New York and Vermont

Largest locally headquartered regional

financial services company in primary market

$800 million in wealth management assets

under management

Insurance agency with 100 professionals

Strong growth from organic, de novo and acquisition strategies

Distinctive culture as America’s Most Exciting Bank SM

2

Experienced Management Team

20

30

9

34

27

22

26

Total

Years of Experience

Health Care

Telecommunications

3

President, Berkshire

Insurance Group

John Millet

Bank of Boston

14

SVP, Wealth Management

Thomas Barney

Bank of America

2

SVP, Retail Banking

Sean Gray

Bank of America

2

EVP, Chief Risk Officer

Shepard Rainie

TD Banknorth

2

EVP, Commercial Banking

Michael Oleksak

KeyBank

1

EVP and CFO

Kevin Riley

Bank of Boston

22

President and CEO

Michael Daly

Former Vice-Chairman of General Electric

and retired CEO of Honeywell; Former

board member of JPMorgan Chase

Non-Executive Chairman of

the Board since 2002

Lawrence Bossidy

Background

BHLB

Title

Name

3

Delivering a Superior Customer Experience

Execution

Six Sigma

Productivity

Profitability

Our Brand

Promise

4

Building a Distinctive Culture

Our Vision

To be a world class

financial services

company through an

engaging and

exciting environment

where customers

want to do business

and employees want

to work.

Core Values

5

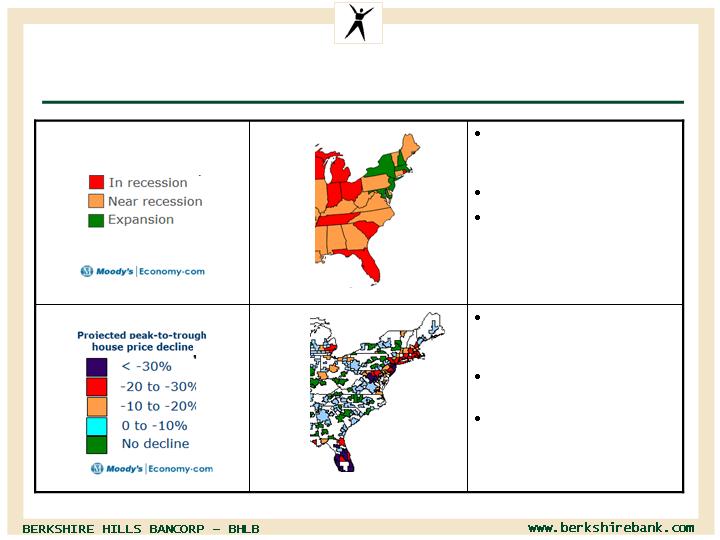

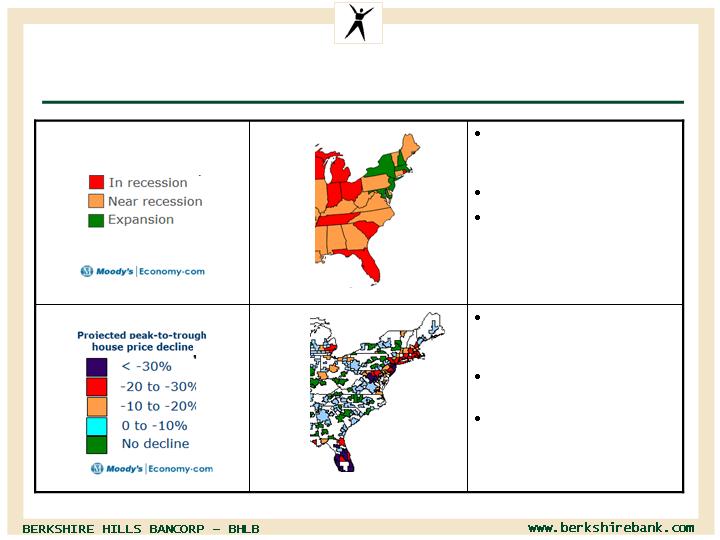

Attractive Markets – MA, NY, VT

Residential property

values more stable in

Western MA

Foreclosures remain

low

Albany prices –

continued appreciation

House Prices

Massachusetts

reported 1% economic

growth in September

Low unemployment

IBM and AMD

announce $6 billion

total New York Tech

Valley investments

(Jul/Oct 2008)

Economies

(As of May 2008)

(As of May 2008)

6

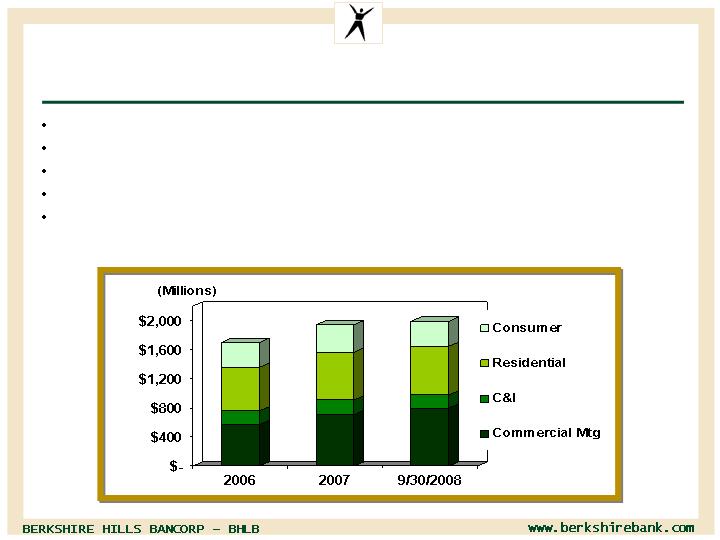

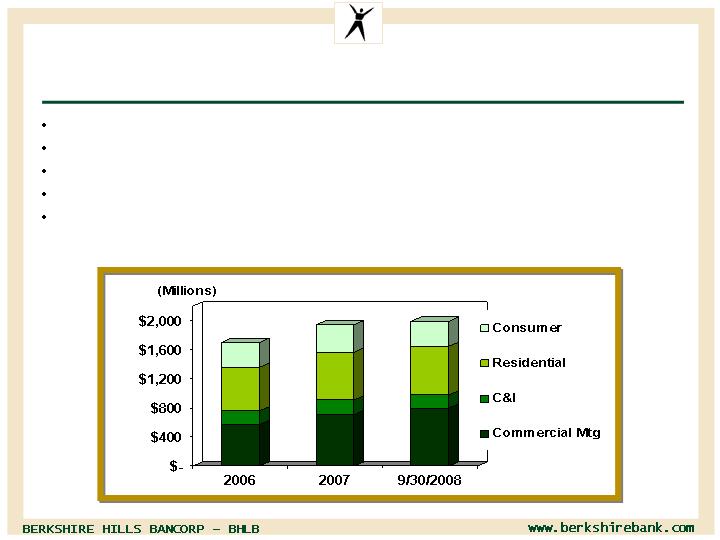

Loan Mix Managed for Quality Growth

5% organic CAGR excluding indirect auto

Higher growth in commercial real estate – 12% organic CAGR

Indirect lending running off at 37% annual rate

Residential and home equity focus on retail side

Strong credit disciplines - no high LTV or sub-prime or Alt A loan programs

17%

34%

9%

40%

$1,992

7

Diversified Commercial Loan Portfolio

100%

Total ($976 million as of 9/30/08)

12%

Services – All other

7%

Services – Health, education, religion

15%

Misc. commercial

10%

Retailers

7%

Apartments

9%

Real estate developers

13%

Lodging

27%

Commercial real estate - Rental (office, retail, etc.)

Loans are to relationships in and around our markets

Commercial construction only 7% of total loans

8

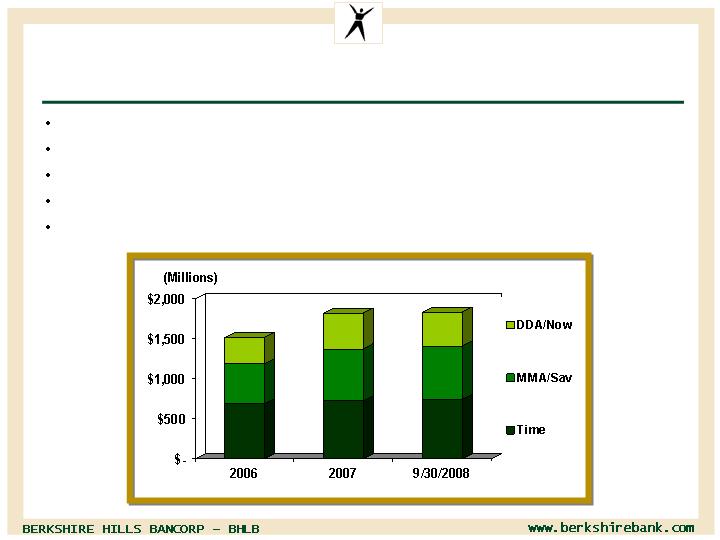

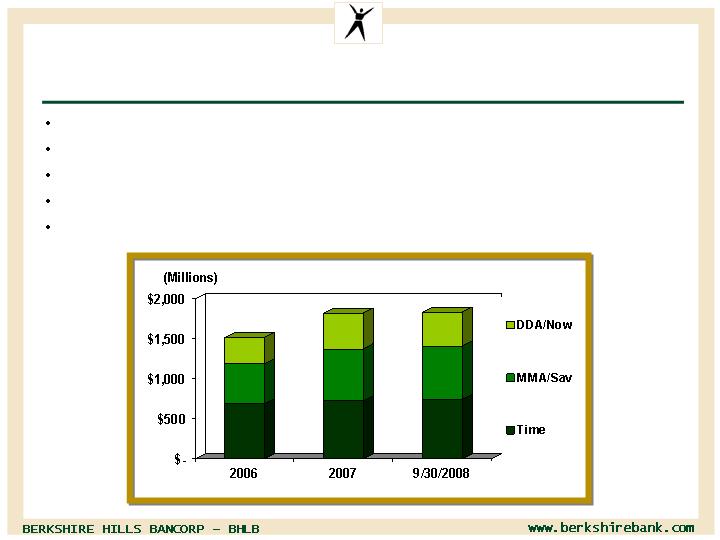

Favorable Deposit Growth

5% core deposit organic CAGR

Strong 28% growth in checking balances including Vermont

Targeted run-off of higher cost municipal and brokered deposits

Growing deposit base in New York and Pioneer Valley

Reduction in deposit costs contributing to higher net interest margin

23%

37%

40%

$1,837

9

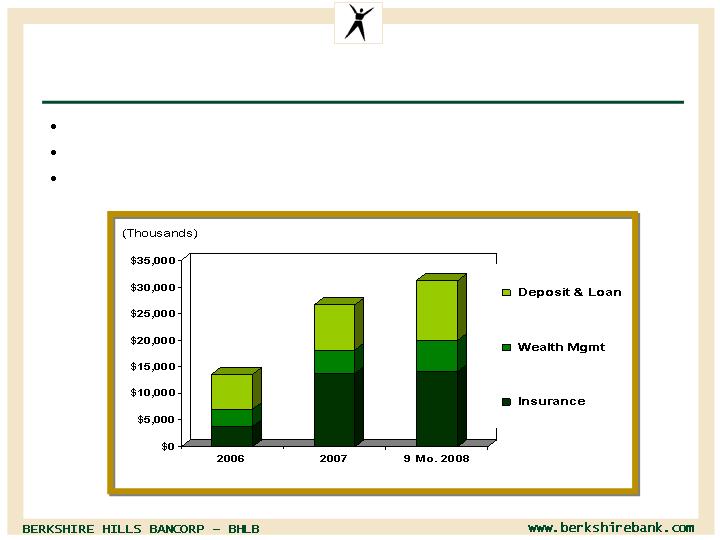

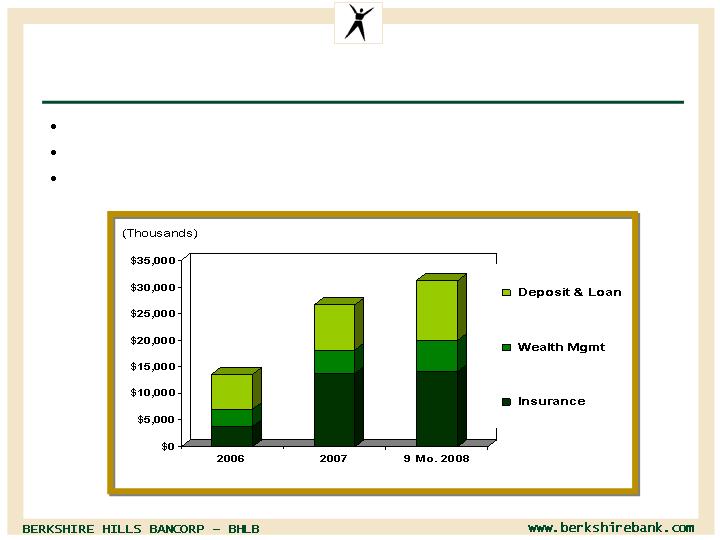

Fee Income Growing Strongly

Fees provide 30% of revenue

Fee growth 20% for 2008 YTD

Insurance and Wealth Management provide 64% of total fees

Annualized

36%

19%

45%

$31,250

10

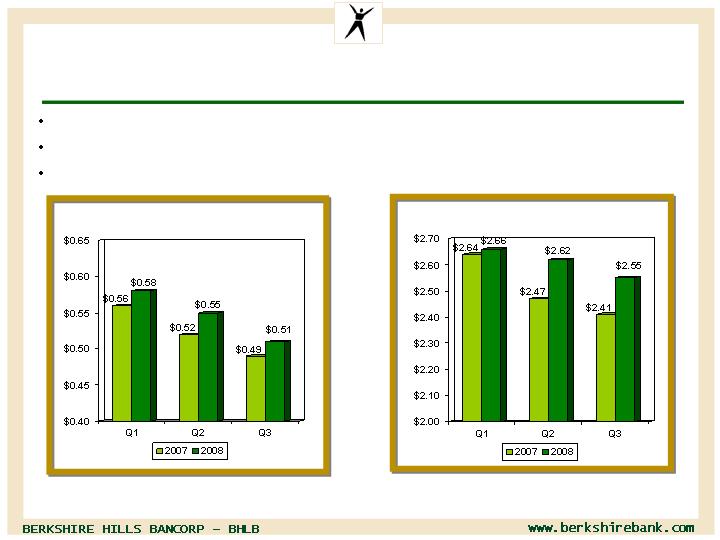

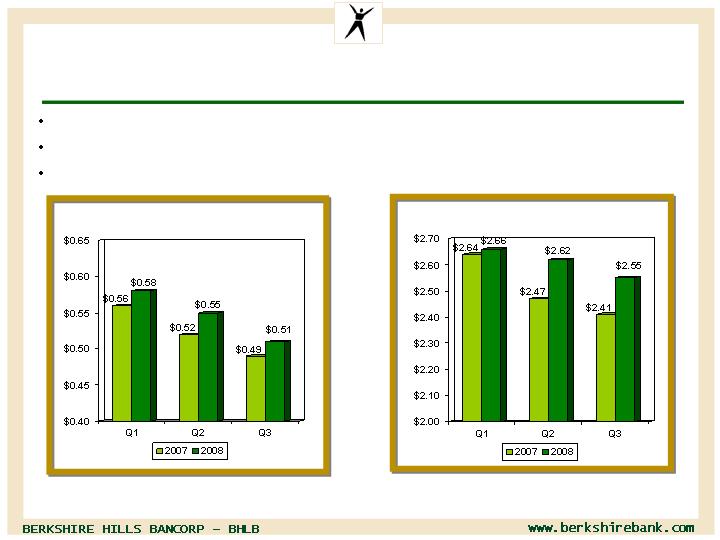

Record Revenues and Earnings per Share in 2008

Core EPS up 4%, pre-provision core EPS up 11%

Revenue growth from acquisitions and organic growth

Seasonal first half revenue and earnings from insurance business

Note: Core and GAAP EPS the same in all quarters except for 3Q07 (core $0.49 and GAAP $0.10) due to balance sheet and expense

restructuring and Factory Point merger integration costs. Core and GAAP revenue per share the same in all periods except for 3Q07 due to

balance sheet restructuring costs.

Core Earnings per Share

Core Revenue Per Share

11

Solid Nine Month 2008 Results

1.13%

0.44%

Non-performing assets / assets

0.31%

0.16%

Net loan charge-offs / loans

67.1%

61.1%

Efficiency ratio

11.3%

29.7%

Fee income / operating revenue

3.43%

3.45%

Net interest margin

6.3%

15.0%

Return on average tangible equity

5.0%

6.8%

Return on average equity

0.54%

0.90%

Return on average assets

(21.6%)

4.5%

Change in core EPS (year-over-year)

SNL Bank &

Thrift Median (1)

BHLB

Performance Measure

(1) Median value for all exchange traded banks and thrifts in SNL Financial’s data universe as of 10/31/08.

Exceeding industry performance on all measures

12

Net Interest Margin Highest Since 2003

Benefited from Factory Point acquisition and balance sheet restructuring in Q3 2007

Favorable shift in deposit composition in recent periods, reducing reliance on time

deposits and boosting transaction accounts acquired through commercial

relationships

Disciplined approach to loan pricing throughout the organization

13

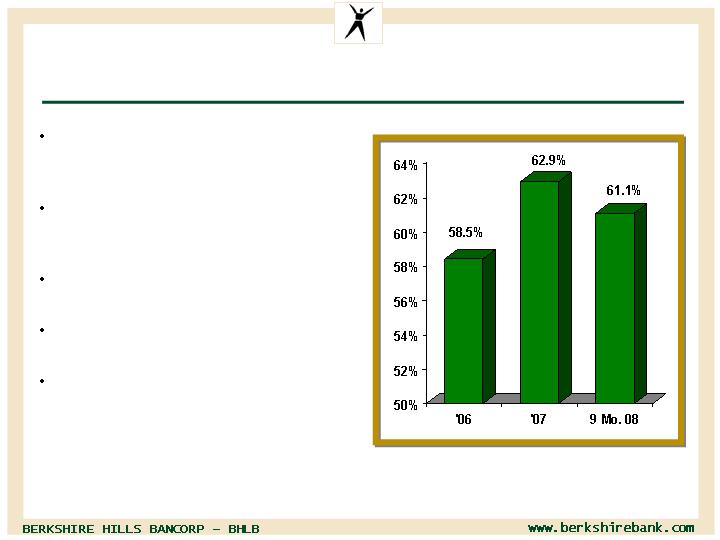

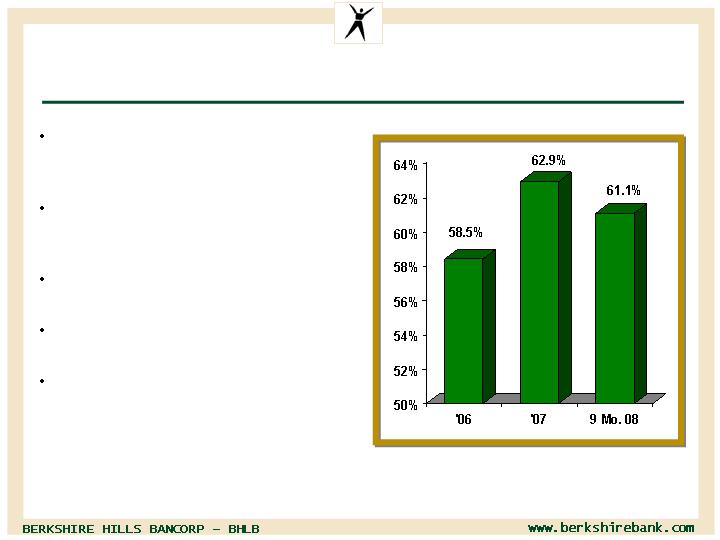

Positive Operating Leverage

and Improved Efficiency Ratio

Change in 2007 due to

insurance acquisition and de

novo branches

Bank ratio 58- 60% excluding

insurance and including 10

de novo branches

Benefiting from higher margins,

growth and expense control

Insurance ratio 67% due to

different revenue/cost mix

Six Sigma process engineering

enhances efficiency,

effectiveness, integration and

scalability

Note: Efficiency ratio is computed by dividing total tangible core non-interest expense by the sum of total net interest

income on a fully taxable equivalent basis and total core non-interest income.

14

Positive Operating Leverage Expected in Q4 2008

+4%

Core non-interest expense

+6%

Core non-interest income

+7%

Net interest income

Six consecutive quarters of net interest income growth

Non-interest income growing despite soft markets in insurance

and wealth management

Bottom line benefiting from maturing of 10 de novo branches

(Change compared to Q4 2007)

15

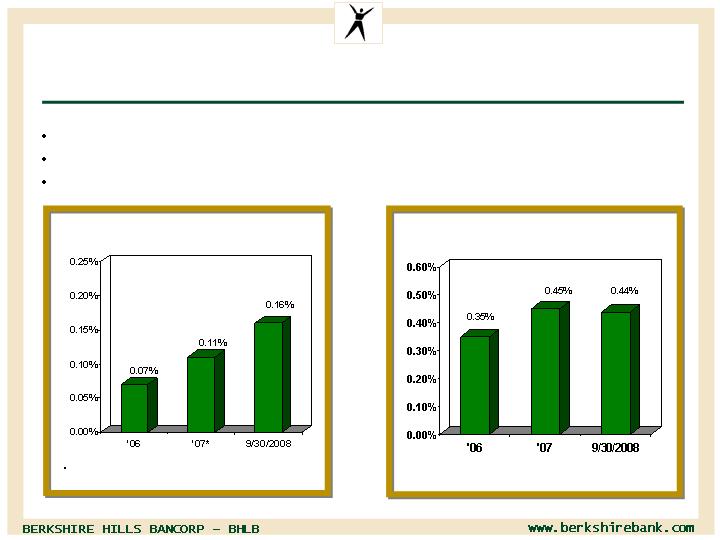

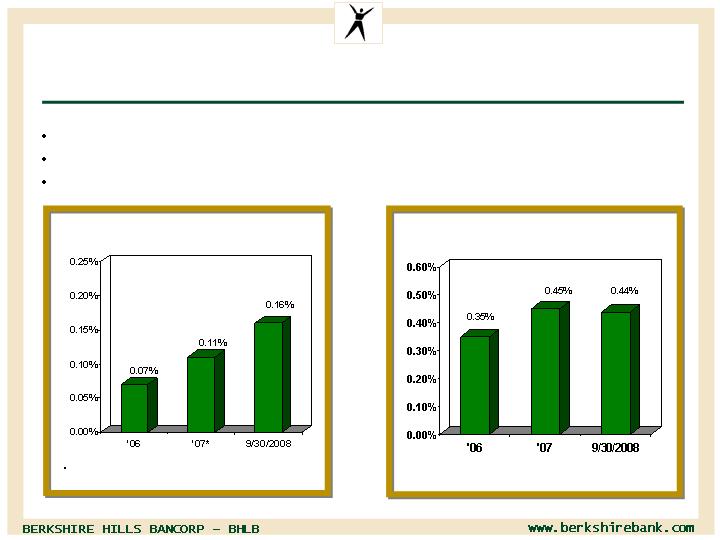

Solid Credit Quality

Excludes $4 million (0.23%) charge for one fraud related

commercial loan

Nonperforming Assets

to Total Assets

Net Charge-offs to Average Loans

Annualized

Total delinquencies only 1.00% of total loans at 9/30/08

Only four loans over $1 million totaling $6.8 million delinquent at 9/30/08

Delinquent and non-performing loan ratios down over last twelve months

16

Consistent Allowance Coverage

231%

1.14%

169%

2Q08

221%

182%

Allowance / Non-performing loans

1.15%

1.14%

Allowance / loans

132%

102%

Provision / charge-offs

3Q08

1Q08

Provision covering charge-offs and loan growth

Allowance increased by $5.5 million (40%) in Q3 2006

17

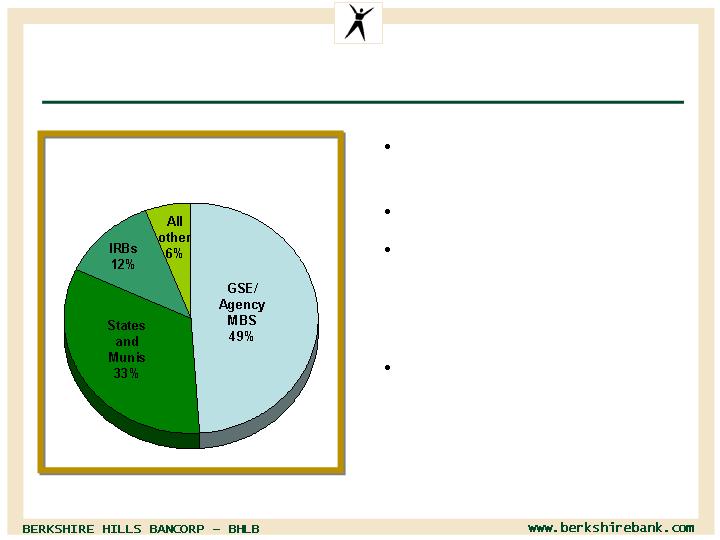

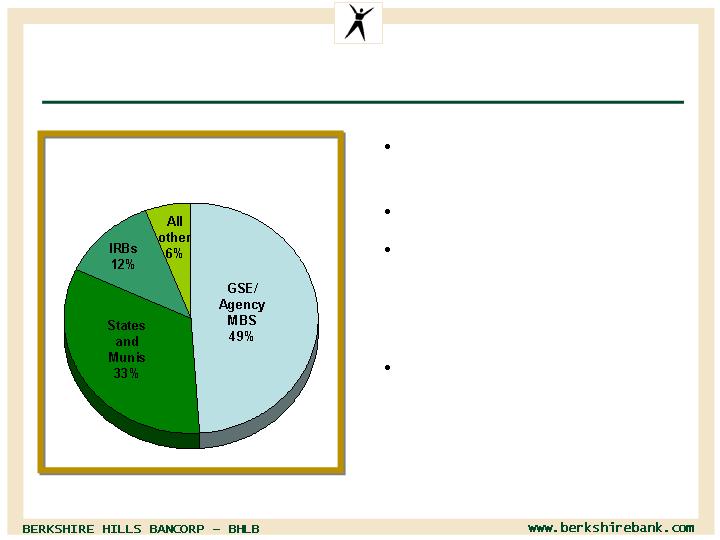

Conservative Investment Portfolio

No Fannie Mae or Freddie

Mac equities

No impairment write-offs

Corporate bonds total $14

million, all performing and

investment grade including

$9 million trust preferreds

Total investment portfolio

unrealized loss $4.2 million

at 09/30/08

Total Portfolio - $247 Million

9/30/08

18

Raising Capital to Support Growth

$232

Pro forma tangible equity

40

Application for TARP CPP

39

Follow-on stock offering w/over-allotment

$153

Tangible equity 09/30/08

(Millions)

Supplementing internal 15% tangible capital generation

Increasing tangible equity/assets to 9.4% pro forma from 6.4%. Goal

to remain above 7% after long term reinvestment

Increase tangible book value per share by 8% to $15.70 from $14.58

Note: GAAP equity increasing from $333 million to $411 million pro forma. GAAP equity/assets increasing to 15.6% from

13.0%. GAAP book value per share decreasing to $30.41from $31.71.

19

Success in M & A and de Novo Expansion

Jun 05

$769 MM in

assets

Extended franchise to

Springfield/Hartford corridor

Pioneer Valley, MA

(Springfield area)

Woronoco Bancorp,

Inc.

2005 to

2007

$158 MM in

Deposits as

of 9/30/08

Extended franchise to Northeast

New York – 10 de novo branches

Capital Region, NY

(Albany area)

De novo expansion

Oct 06

$9 MM in

insurance

revenues

Foundation for Berkshire

Insurance Group

Western MA

5 Western MA

insurance agencies

Sep 07

$339 MM in

assets

Extended franchise to Southern

Vermont

Manchester, VT

Factory Point

Bancorp, Inc

Jan 08

$50 MM

assets under

management

Established wealth management

presence in NY

Albany, NY

The Center for

Financial Planning

Date

Assets/

Value

Strategic Accomplishment

Location

Acquired

Business

Proven acquiror with a track record of successful integration

Successful 10 branch New York de novo investment

20

Favorable Valuation Compared to Peers

Note: Pricing as of 11/03/08. BHLB book value pricing ratios include adjustments for October stock offering.

2008 estimated EPS is from First Call Median EPS estimates

Price /

12.9

171

88

322

2,566

BHLB

Pittsfield, MA

26.88

Berkshire Hills Bancorp, Inc.

15.7

273

159

Peer median

16.0

280

223

474

2,725

TMP

Ithaca, NY

49.00

Tompkins Financial Corporation

12.8

249

159

349

2,768

WASH

Westerly, RI

21.92

Washington Trust Bancorp, Inc.

14.6

267

156

476

3,477

INDB

Rockland, MA

29.26

Independent Bank Corp.

17.1

340

159

833

4,767

CBU

De Witt, NY

25.53

Community Bank System, Inc.

15.5

320

215

905

5,335

NBTB

Norwich, NY

27.83

NBT Bancorp Inc.

19.3

267

118

1,896

9,008

FNFG

Lockport, NY

16.00

First Niagara Financial Group, Inc.

2008

EPS

(%)

TBV

(%)

Book

Value

(%)

Market

Cap.

($mm)

Total

Assets

($mm)

Ticker

City, State

Price

Company

Pricing multiples below peers

21

Why Invest in

Strong and experienced management team

Distinctive culture and core values

Favorable position in attractive markets

Strong credit culture and asset quality discipline

Above average growth in loans, deposits and fee income

Diversified revenues with strong commercial components

Earnings performance at record levels and growing

Performance driven with improving profitability measures

Strategy and track record as a regional consolidator, growing

and diversifying our financial services offerings and pursuing

a leading share in attractive Northeastern markets

Stock valuation metrics are attractive for long term return

22