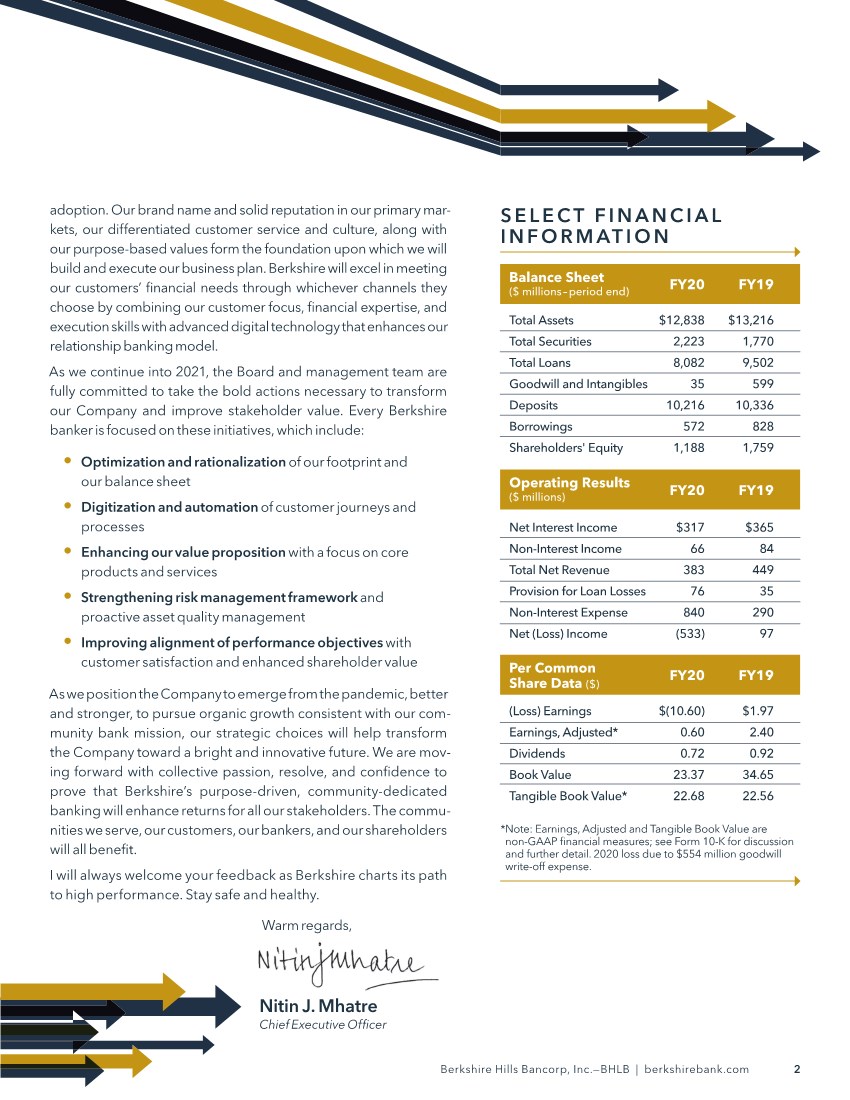

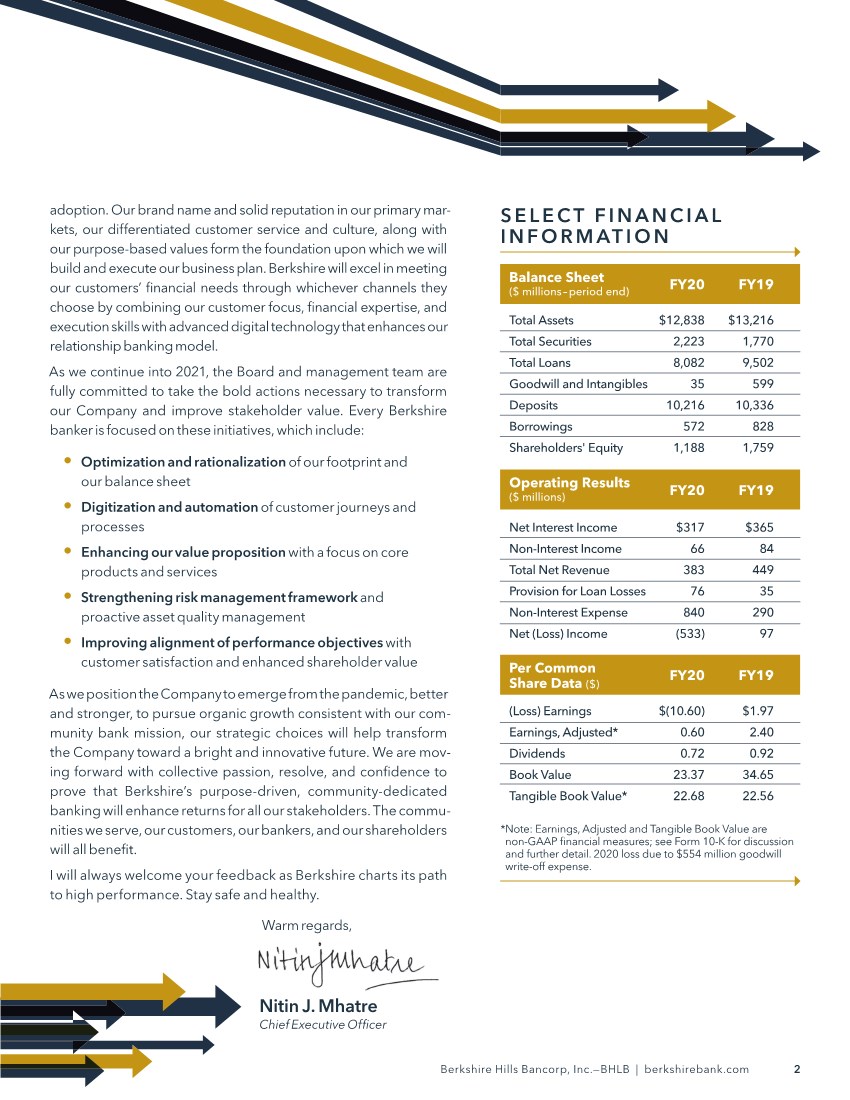

| adoption. Our brand name and solid reputation in our primary mar- kets, our differentiated customer service and culture, along with our purpose-based values form the foundation upon which we will build and execute our business plan. Berkshire will excel in meeting our customers’ financial needs through whichever channels they choose by combining our customer focus, financial expertise, and execution skills with advanced digital technology that enhances our relationship banking model. As we continue into 2021, the Board and management team are fully committed to take the bold actions necessary to transform our Company and improve stakeholder value. Every Berkshire banker is focused on these initiatives, which include: • Optimization and rationalization of our footprint and our balance sheet • Digitization and automation of customer journeys and processes • Enhancing our value proposition with a focus on core products and services • Strengthening risk management framework and proactive asset quality management • Improving alignment of performance objectives with customer satisfaction and enhanced shareholder value As we position the Company to emerge from the pandemic, better and stronger, to pursue organic growth consistent with our com- munity bank mission, our strategic choices will help transform the Company toward a bright and innovative future. We are mov- ing forward with collective passion, resolve, and confidence to prove that Berkshire’s purpose-driven, community-dedicated banking will enhance returns for all our stakeholders. The commu- nities we serve, our customers, our bankers, and our shareholders will all benefit. I will always welcome your feedback as Berkshire charts its path to high performance. Stay safe and healthy. Warm regards, Nitin J. Mhatre Chief Executive Of ficer * Note: Earnings, Adjusted and Tangible Book Value are non-GAAP financial measures; see Form 10-K for discussion and further detail. 2020 loss due to $554 million goodwill write-off expense. SELECT FINANCIAL INFORMATION $(10.60) 0.60 0.72 23.37 22.68 $1.97 2.40 0.92 34.65 22.56 (Loss) Earnings Earnings, Adjusted* Dividends Book Value Tangible Book Value* FY20 FY19 Per Common Share Data ($) $317 66 383 76 840 (533) $365 84 449 35 290 97 Net Interest Income Non-Interest Income Total Net Revenue Provision for Loan Losses Non-Interest Expense Net (Loss) Income Operating Results ($ millions) FY20 FY19 Total Assets Total Securities Total Loans Goodwill and Intangibles Deposits Borrowings Shareholders' Equity $12,838 2,223 8,082 35 10,216 572 1,188 $13,216 1,770 9,502 599 10,336 828 1,759 Balance Sheet ($ millions – period end) FY20 FY19 2 Berkshire Hills Bancorp, Inc.—BHLB | berkshirebank.com |