Exhibit 99.1

BerkshireHills BancorpSM Life is exciting. Let us help. 2018 SUMMARY ANNUAL REPORT MOVING FORWARD TOGETHER

Richard M. Marotta Chief Executive Officer PURPOSE To financially empower our communities and help everyone realize life’s exciting moments. CULTURE A culture that fosters respect, ethical behavior, diversity and inclusion, creates an environment where all employees belong and can reach their full potential. VISION To succeed as a relationship-driven financial institution by operating responsibly, investing in our people and communities and fostering a strong sense of belonging while creating sustainable returns. FOOTPRINT With corporate headquarters in Boston, we operate in six Northeastern states and in targeted national markets as the premier banking institution with a reputation for local responsiveness and engagement. Moving Forward Together Dear Shareholders, Customers and Employees: Berkshire Bank is defined by our commitment to providing our customers and our communities with the scale and resources of a big bank, but with local decision-making. This is a model that engages our employees, supports our communities, and creates enduring returns for our investors. Our 2018 results reflect that commitment, as we hit key earnings and operational targets and achieved record return on assets. All are important accomplishments during our first full year of operating above the $10 billion asset mark. Additional highlights include: • Improved profitability • Full year earnings per share increased by 65% to $2.29 • Non-GAAP adjusted earnings per share increased by 18% to $2.71 • Revenue grew 12% driven by increased product and service offerings to our Northeast markets • Return on assets improved by 61% to 0.90% • Return on equity improved by 54% to 6.8% • Non-GAAP adjusted return on tangible common equity improved by 14% to 13.5% • Fully integrated the operations of Commerce Bank and Trust Company • Announced a definitive agreement to acquire SI Financial Group in Connecticut 2018 PROFIT GROWTH 12% REVENUE 65% EPS 91% EARNINGS 1 2018 SUMMARY ANNUAL REPORT

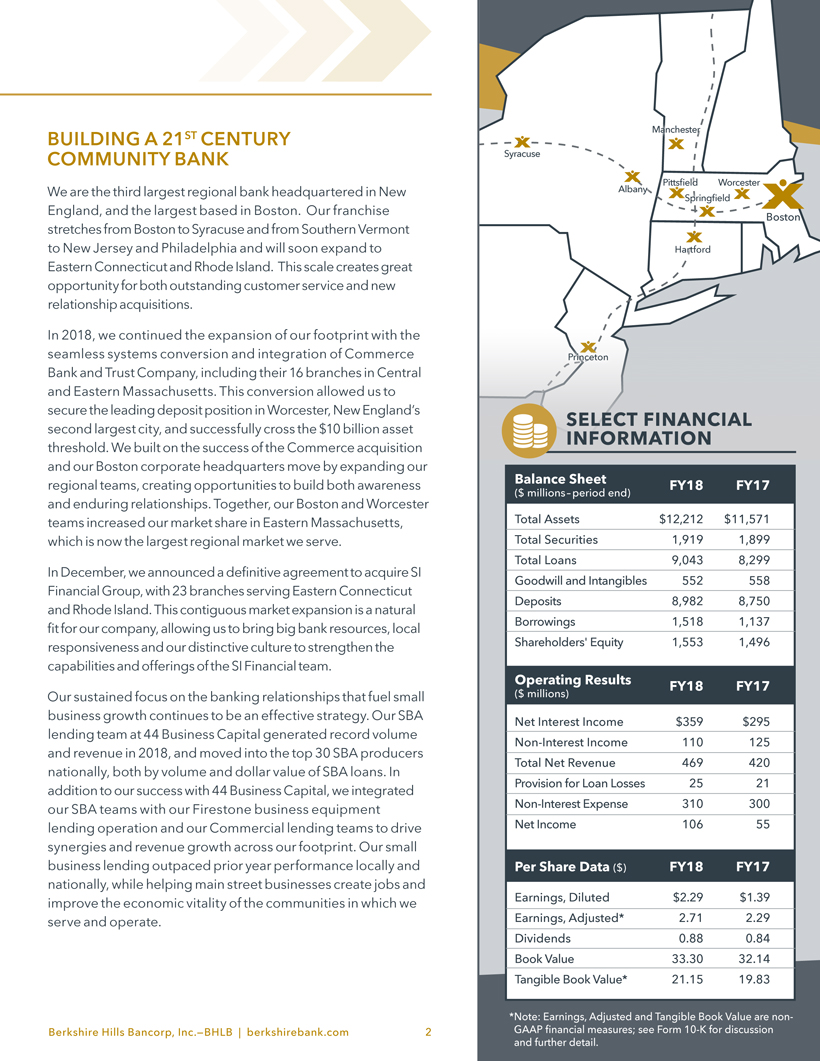

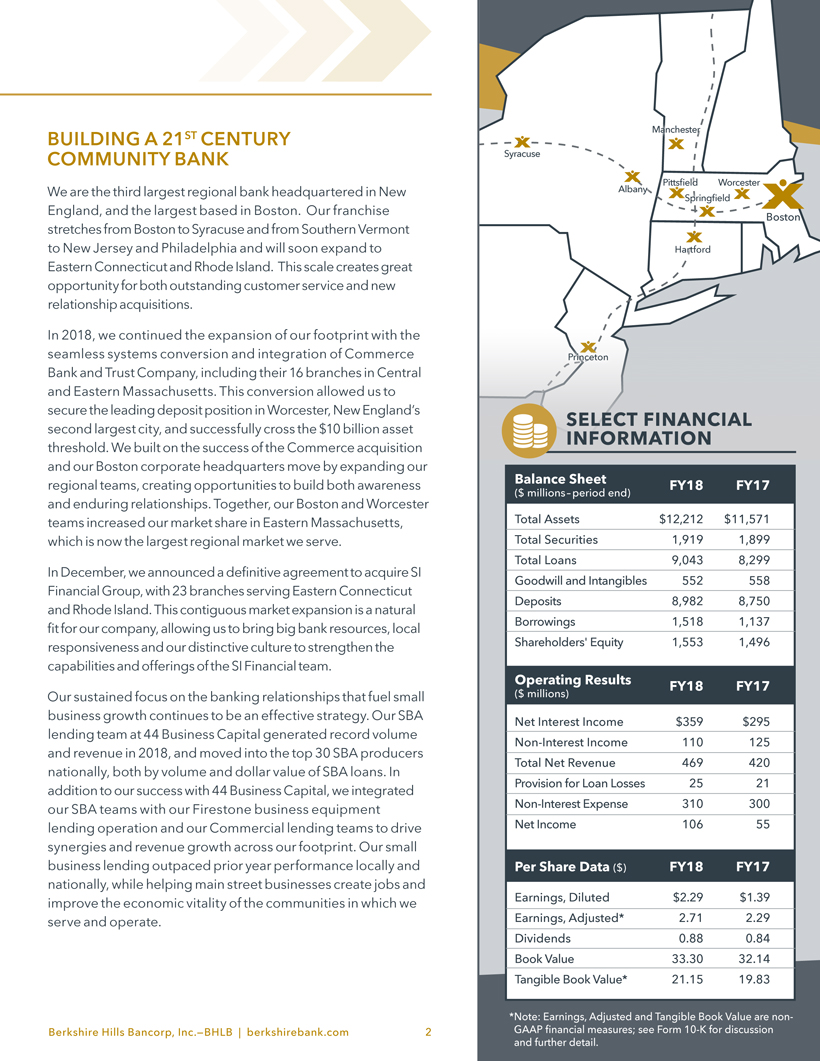

BUILDING A 21ST CENTURY COMMUNITY BANK We are the third largest regional bank headquartered in New England, and the largest based in Boston. Our franchise stretches from Boston to Syracuse and from Southern Vermont to New Jersey and Philadelphia and will soon expand to Eastern Connecticut and Rhode Island. This scale creates great opportunity for both outstanding customer service and new relationship acquisitions. In 2018, we continued the expansion of our footprint with the seamless systems conversion and integration of Commerce Bank and Trust Company, including their 16 branches in Central and Eastern Massachusetts. This conversion allowed us to secure the leading deposit position in Worcester, New England’s second largest city, and successfully cross the $10 billion asset threshold. We built on the success of the Commerce acquisition and our Boston corporate headquarters move by expanding our regional teams, creating opportunities to build both awareness and enduring relationships. Together, our Boston and Worcester teams increased our market share in Eastern Massachusetts, which is now the largest regional market we serve. In December, we announced a definitive agreement to acquire SI Financial Group, with 23 branches serving Eastern Connecticut and Rhode Island. This contiguous market expansion is a natural fit for our company, allowing us to bring big bank resources, local responsiveness and our distinctive culture to strengthen the capabilities and offerings of the SI Financial team. Our sustained focus on the banking relationships that fuel small business growth continues to be an effective strategy. Our SBA lending team at 44 Business Capital generated record volume and revenue in 2018, and moved into the top 30 SBA producers nationally, both by volume and dollar value of SBA loans. In addition to our success with 44 Business Capital, we integrated our SBA teams with our Firestone business equipment lending operation and our Commercial lending teams to drive synergies and revenue growth across our footprint. Our small business lending outpaced prior year performance locally and nationally, while helping main street businesses create jobs and improve the economic vitality of the communities in which we serve and operate. SELECT FINANCIAL INFORMATION Balance Sheet FY18 FY17 ($ millions - period end) Total Assets $12,212 $11,571 Total Securities 1,919 1,899 Total Loans 9,043 8,299 Goodwill and Intangibles 552 558 Deposits 8,982 8,750 Borrowings 1,518 1,137 Shareholders' Equity 1,553 1,496 Operating Results FY18 FY17 ($ millions) Net Interest Income $359 $295 Non-Interest Income 110 125 Total Net Revenue 469 420 Provision for Loan Losses 25 21 Non-Interest Expense 310 300 Net Income 106 55 Per Share Data ($) FY18 FY17 Earnings, Diluted $ 2.29 $ 1.39 Earnings, Adjusted* 2.71 2.29 Dividends 0.88 0.84 Book Value 33.30 32.14 Tangible Book Value* 21.15 19.83 *Note: Earnings, Adjusted and Tangible Book Value are non-GAAP financial measures; see Form 10-K for discussion and further detail. Berkshire Hills Bancorp, Inc. BHLB | berkshirebank.com 2

AWARDS • United Nations IMPACT2030 Innovation Award For Leadership & Collaboration with Human Capital Investments - Small-Medium Enterprise (International) • Halo Award presented by Engage For Good Gold Halo Award Winner 2018 Top Employee Community Engagement Program in North America - XTEAM • Invest In Others National Corporate Philanthropy Award Winner Financial Institutions (National) • PR Daily Corporate Social Responsibility Award XTEAM Volunteer Program - Top Volunteer Program in North America • Boston Business Journal Top Charitable Contributors List 6th Straight Year 2013-2018 • Communitas Awards 2018 International Leadership Award Winner for Corporate Social Responsibility & Community Service • SBA 7(a) Ranked #23 in Loan Volume 375 Loans for $179M SBA Fiscal Year 2018, Gross Loan Approvals For more information, check out our CORPORATE RESPONSIBILITY REPORT: ir.berkshirebank.com We also saw strong activity across all of our banking regions and business lines, including retail, commercial, wealth, insurance, and in our specialty businesses. A 21st century bank provides innovative solutions through multiple delivery channels, reaching customers where they are. We opened two new branches in Connecticut and New York featuring our distinctive branch layout and MyTellerSM Interactive Teller Machines (ITM), which combines state-of-the-art virtual technology with the human touch of traditional teller service and extended service hours. Additionally, we expanded our team of MyBankers® who offer one point of contact and exceptional service at no cost, for any customer interested in a committed banking relationship. Our team of MyBankers® expands our geographic reach and service availability with personalized concierge level responsiveness. More information on this service and on our other offerings can be found on our new berkshirebank.com website. ENHANCING OUR CULTURE Strong financial performance is only one component of a successful corporation. A business that operates responsibly, invests in its people and communities, and creates a best-in-class workplace will inevitably mitigate risk and deliver higher returns. Our internal culture has been and always will be a priority. It is the foundation of a 21st century community bank. When our people thrive, our company thrives. At the start of 2018, we implemented a new hourly minimum wage of $15, and during the year, implemented the new Massachusetts Equal Pay Act requirements. These measures help to ensure that women and men who have similar experience and do comparable work receive the same wage. While raising our minimum wage and working towards gender pay equity are the start, we must have a workforce that reflects the communities we serve. We grew quickly from a small community bank in Western Massachusetts to a full-service financial institution with operations in six states and select national markets. Now we must settle in and focus on creating a culture that mirrors our evolution. Berkshire Bank has built on our longstanding legacy of responsible business practices by naming a senior leader for corporate responsibility and culture. Together with our Board, we will collaboratively enhance our social responsibility programs and our employee performance. Our inaugural corporate social responsibility report (available on our investor relations website) details the meaningful impact these efforts have had on our community. We also partnered with a diversity consultant to advise management on creating a culture of belonging. These collective efforts, combined with disciplined expense management and our improving profitability, will contribute to our success moving forward. 3 2018 SUMMARY ANNUAL REPORT

FOSTERING SUSTAINABLE COMMUNITIES & RESPONSIBLE BUSINESS PRACTICES We understand the important connection between the vitality of our communities and the success of our business. We seek to contribute to our communities through employee volunteerism and the Berkshire Bank Foundation. In 2018, our XTEAM® Employee Volunteer Program achieved 100 percent employee participation for the third straight year, providing over 40,000 hours of service through 342 volunteer events. In addition, Berkshire Bank and its Foundation provided $4.2 million in contributions to organizations engaged in important work throughout our footprint. As a result, Berkshire Bank was honored by the United Nations with the IMPACT2030 Innovation Award for its XTEAM® Employee Volunteer Program, a Gold Halo Award from Engage For Good as the Top North American employee volunteer program, and PR Daily’s Corporate Social Responsibility Award. SHAREHOLDER FOCUS Delivering returns for our shareholders is of the utmost importance. Berkshire Bank’s book value per share gained 4% during the year. We increased our quarterly cash dividend by 5% in January 2018, and then increased it by another 5% in January 2019. In June, Berkshire’s stock was added to the S&P SmallCap 600® index, widening our visibility. With our larger size, we implemented debt ratings from a recognized credit rating agency, earning an investment-grade rating on our senior debt. We have a lot to be proud of, and as I look forward, I am enthusiastic about the opportunities we have around the footprint. We are dedicated to pursuing efficiencies and deploying our capital and liquidity to drive profitability and strengthen our enterprise. I am grateful to our Board and our leadership team for their dedication to our mission. We all thank our customers, employees, and shareholders for their continuing support. Sincerely, Richard M. Marotta Chief Executive Officer MyBanker®: The size of your wallet will never drive the quality of your service. MyTellerSM: Customers bank on their schedule with new teller technology and extended hours. Mobile Banking: It's like a Berkshire branch right in your hand. DRIVING PROFITABILITY Adjusted ROTCE 14% ROE 7% 2014 2015 2016 2017 2018 Note: Adjusted ROTCE is a non-GAAP financial measure; see our Form 10-K for discussion and further detail. Berkshire Hills Bancorp, Inc.–BHLB | berkshirebank.com 4

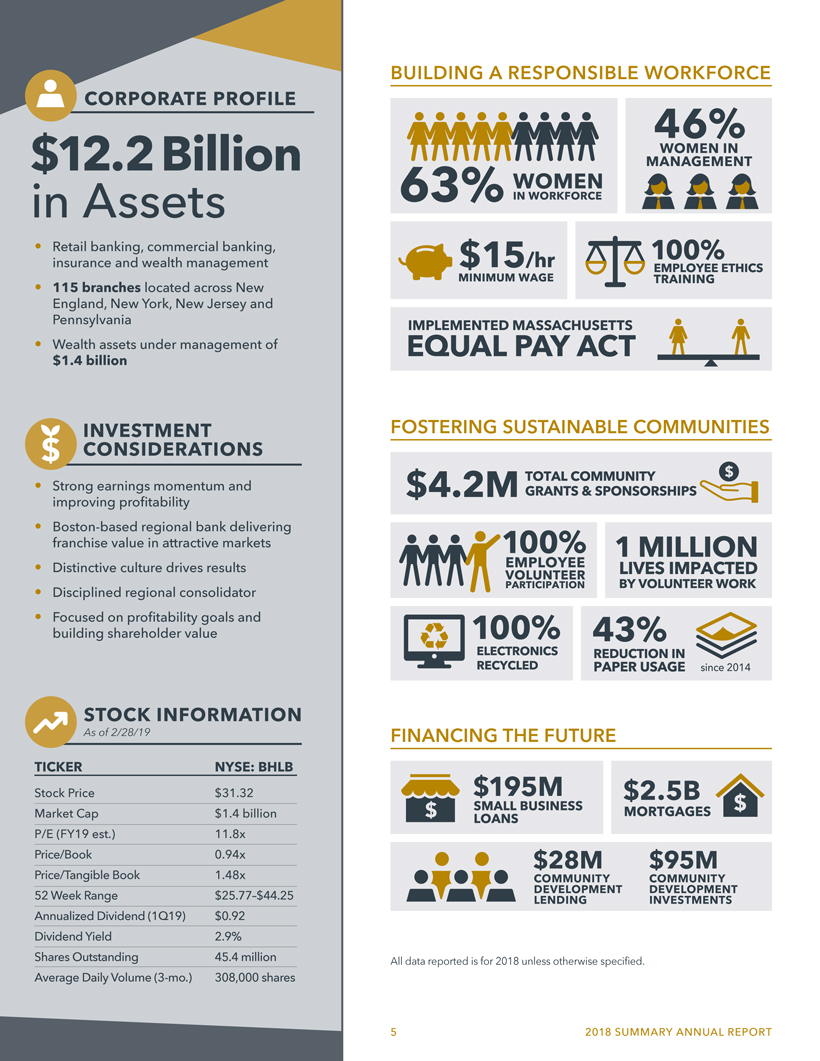

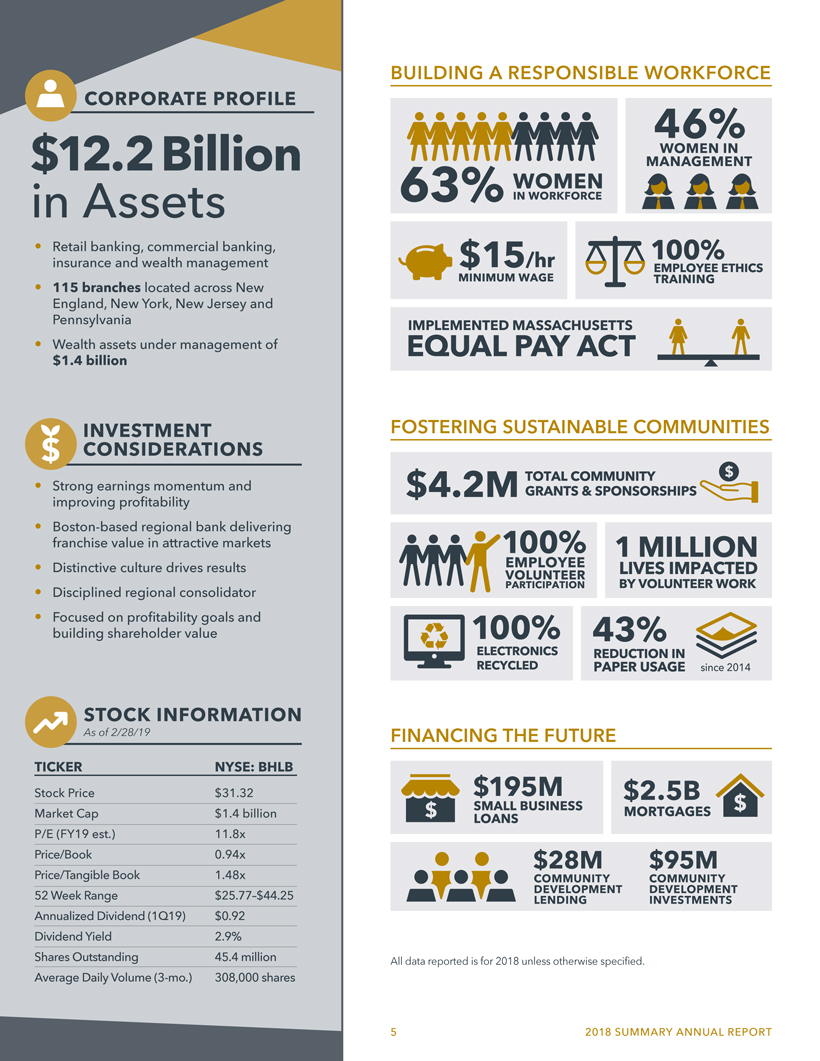

CORPORATE PROFILE $12.2 Billion in Assets • Retail banking, commercial banking, insurance and wealth management • 115 branches located across New England, New York, New Jersey and Pennsylvania • Wealth assets under management of $1.4 billion INVESTMENT CONSIDERATIONS • Strong earnings momentum and improving profitability • Boston-based regional bank delivering franchise value in attractive markets • Distinctive culture drives results • Disciplined regional consolidator • Focused on profitability goals and building shareholder value STOCK INFORMATION As of 2/28/19 TICKER NYSE: BHLB Stock Price $31.32 Market Cap $1.4 billion P/E (FY19 est.) 11.8x Price/Book 0.94x Price/Tangible Book 1.48x 52 Week Range $25.77-$44.25 Annualized Dividend (1Q19) $0.92 Dividend Yield 2.9% Shares Outstanding 45.4 million Average Daily Volume (3-mo.) 308,000 shares BUILDING A RESPONSIBLE WORKFORCE 63% women in workforce 46% women in management $15/hr minimum wage 100% employee ethics training Implemented massachusetts Equal pay act FOSTERING SUSTAINABLE COMMUNITIES $4.2M total community grants & sponsorships $ 100% employee volunteer participation 1 million lives impacted by volunteer work 100% electronics recycled 43% reduction in paper usage since 2014 FINANCING THE FUTURE $195M small business loans $2.5B mortgages $ $28M community development lending $95M community development investments All data reported is for 2018 unless otherwise specified. 5 2018 SUMMARY ANNUAL REPORT

LEADERSHIP TEAM Richard M. Marotta Scott J. Houghtaling Chief Executive Officer EVP, Regional Commercial Leader - New York Sean A. Gray President and Chief Operating Officer Gregory D. Lindenmuth SEVP, Chief Risk Officer James M. Moses SEVP, Chief Financial Officer Georgia Melas SEVP, Chief Credit Officer George F. Bacigalupo SEVP, Commercial Banking Wm. Gordon Prescott SEVP, General Counsel and Mark N. Foster Corporate Security EVP, Regional Commercial Leader - Eastern Massachusetts and ABL Deborah A. Stephenson SEVP, Compliance and Regulatory Tami M. Gunsch SEVP & Director of Gary F. Urkevich Relationship Banking EVP, IT and Project Management BOARD OF DIRECTORS William J. Ryan Cornelius D. Mahoney Chairman of the Board, Former Chairman, President & Former Chairman & CEO CEO of Woronoco Bancorp, Inc. & of TD Banknorth Woronoco Savings Bank Paul T. Bossidy Richard M. Marotta President & CEO of Chief Executive Officer Patripabre Capital LLC of Berkshire Hills Bancorp, Inc. David M. Brunelle Pamela A. Massad, Esq. Co-Founder and Managing Director Of Counsel with Fletcher Tilton PC of North Pointe Wealth Management Laurie Norton Moffatt Robert M. Curley Director & CEO of the Berkshire Bank New York Chairman, Norman Rockwell Museum Former Chairman & President for Citizens Bank in New York Richard J. Murphy Executive Vice President & John B. Davies Chief Operating Officer of the Former Executive Vice President Tri-City ValleyCats of Massachusetts Mutual Life Insurance Company Patrick J. Sheehan Owner & Manager of J. Williar Dunlaevy Sheehan Health Group Former Chairman & CEO of Legacy Bancorp, Inc. D. Jeffrey Templeton & Legacy Banks Owner & President of The Mosher Company, Inc. OFFICIAL BANK OF THE PAN-MASS CHALLENGE Berkshire Bank has made a four-year commitment to support the organization’s riders, volunteers and donors in their efforts to make an impact in the fight against cancer. As part of Berkshire’s sponsorship, an employee team will participate in the weekend charity ride, and its nationally acclaimed corporate volunteer program, XTEAM®, will assist in various roles along the route. The dimock center Healing and caring for the community for over 150 years. PROUD SUPPORTER OF THE DIMOCK CENTER Founded in 1862 as the New England Hospital for Women and Children, the Dimock Center heals and uplifts individuals, families and the community. Operating in Roxbury, The Dimock Center serves communities in Boston and across the state, providing comprehensive, holistic Health and Community Care, Behavioral Health Services, and Child and Family Services to more than 19,000 people annually. Berkshire Hills Bancorp, Inc.–BHLB | berkshirebank.com 6

CORPORATE OFFICES Berkshire Hills Bancorp, Inc. 60 State Street Boston, MA 02109 800.773.5601 berkshirebank.com STOCK LISTING Berkshire Hills Bancorp, Inc. is listed on the New York Stock Exchange under the symbol “BHLB”. INVESTOR INFORMATION Investor Relations Attn: Erin Duggan Berkshire Hills Bancorp, Inc. 800.773.5601 investorrelations@berkshirebank.com TRANSFER AGENT AND REGISTRAR Shareholders who wish to change the name, address, or ownership of stock, report lost stock certificates, inquire about the Dividend Reinvestment Plan or consolidate stock accounts should contact: Broadridge Corporate Issuer Solutions, Inc. P.O. Box 1342 Brentwood, NY 11717 844.458.9357 shareholder@broadridge.com shareholder.broadridge.com/bhlb 2018 ANNUAL MEETING OF SHAREHOLDERS Thursday, May 16, 2019 | 10 a.m. ET Museum of African American History 46 Joy Street Boston, MA 02114 BHLB LISTED NYSE.This document contains forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995). There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire's most recently filed reports on Forms 10-K and 10-Q, which are available on the SEC's website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements. Banking products are provided by Berkshire Bank: Member FDIC; Equal Housing Lender. Berkshire Bank is a Massachusetts chartered bank. Insurance and investment products as well as investment securities and obligations of Berkshire Hills Bancorp, Inc. are not FDIC-insured, are not a bank deposit, “NOT guaranteed BY THE BANK,” “NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY” and may lose value.