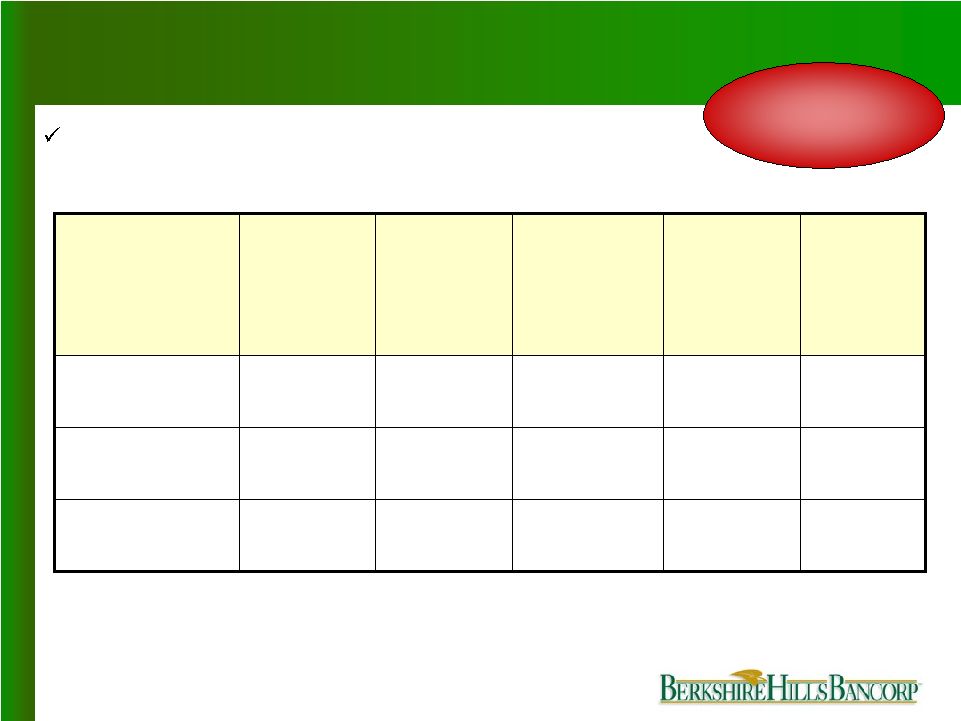

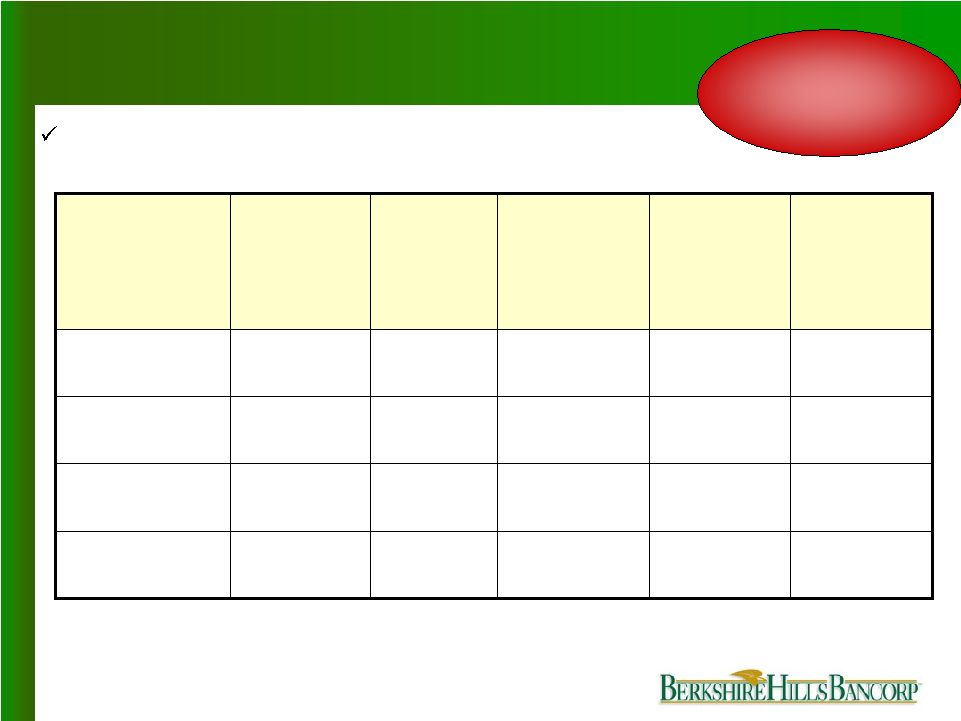

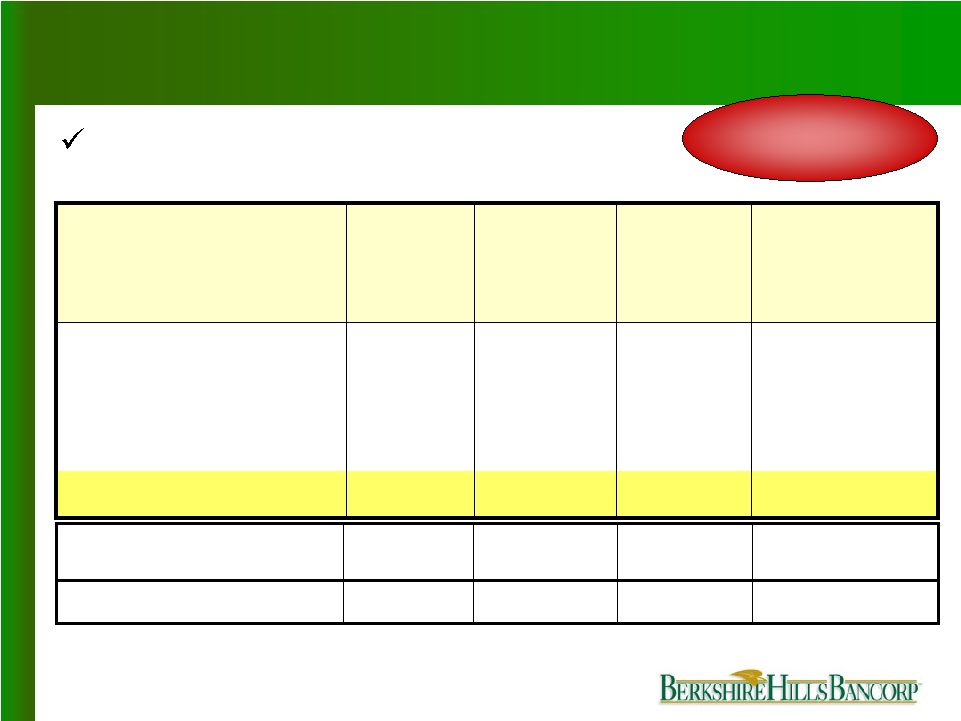

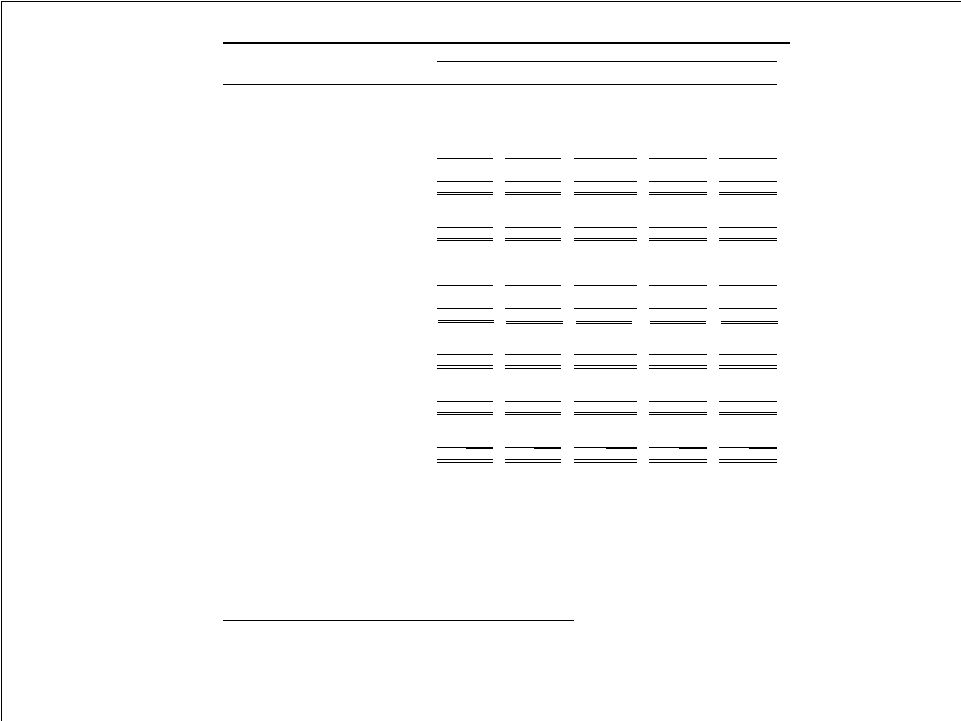

Mar. 31, Dec. 31, Sept. 30, June 30, Mar. 31, 2006 2005 2005 2005 2005 (Dollars in thousands, except per share data) Net income 4,818 $ 4,838 $ 4,746 $ (4,608) $ 3,252 $ Less: Gain on sale of securities, net (497) (882) (832) (1,388) (429) Plus: Termination of ESOP - 168 - 8,667 - Plus: Merger and conversion expense - 352 828 963 - Adj: Income taxes 164 119 1 (139) 150 Core income (A) 4,485 4,595 4,743 3,495 2,973 Plus: Amort. Intang. Assets (net of taxes) 320 322 322 105 20 Tangible core income (B) 4,805 $ 4,917 $ 5,065 $ 3,600 $ 2,993 $ Total non-interest income 4,091 $ 4,297 $ 3,955 $ 3,916 $ 2,744 $ Less: Gain on sale of securities, net (497) (882) (832) (1,388) (429) Total core non-interest income (C) 3,594 $ 3,415 $ 3,123 $ 2,528 $ 2,315 $ Total non-interest expense 11,225 $ 11,800 $ 11,600 $ 18,061 $ 7,536 $ Less: Termination of ESOP - (168) - (8,667) - Less: Merger and conversion expense - (352) (828) (963) - Core non-interest expense 11,225 11,280 10,772 8,431 7,536 Less: Amortization of intangible assets (478) (481) (481) (156) (30) Total core tangible non-interest expense (D) 10,747 $ 10,799 $ 10,291 $ 8,275 $ 7,506 $ Total average assets 2,043,749 $ 2,032,098 $ 2,065,251 $ 1,563,945 $ 1,311,023 $ Less: Average intangible assets (99,318) (99,862) (100,955) (38,879) (7,254) Total average tangible assets (E) 1,944,431 $ 1,932,236 $ 1,964,296 $ 1,525,066 $ 1,303,769 $ Total average stockholders' equity 250,305 $ 246,307 $ 241,540 $ 164,717 $ 132,053 $ Less: Average intangible assets (99,318) (99,862) (100,955) (38,879) (7,254) Total average tangible stockholders' equity (F) 150,987 $ 146,445 $ 140,585 $ 125,838 $ 124,799 $ Total stockholders' equity, period-end 247,637 $ 246,066 $ 245,531 $ 244,497 128,426 Less: Intangible assets, period-end (99,163) (99,616) (99,742) (102,167) (7,235) Total tangible stockholders' equity, period-end (G) 148,474 $ 146,450 $ 145,789 $ 142,330 $ 121,191 $ Total shares outstanding (thousands) (H) 8,601 8,540 8,564 8,594 5,835 Average diluted shares outstanding (thousands) (I) 8,755 8,813 8,856 6,257 5,691 Core earnings per share (A/I) 0.51 $ 0.52 $ 0.54 $ 0.53 $ 0.52 $ Tangible book value per share (G/H) 17.26 $ 17.15 $ 17.04 $ 16.56 $ 20.77 $ Core return on tangible assets (B/E) 0.98 % 1.02 % 1.04 % 0.94 % 0.91 % Core return on tangible equity (B/F) 12.63 13.49 14.47 11.42 9.52 Core tangible non-interest income to assets (C/E) 0.74 0.71 0.64 0.66 0.71 Core tangible non-interest exp to assets (D/E) 2.21 2.24 2.10 2.17 2.30 Efficiency ratio 57.48 57.00 55.17 57.65 59.56 Efficiency ratio is computed by dividing total tangible core non-interest expense by the sum of total net interest income on a fully taxable equivalent basis and total core non-interest income. The Company uses this non-GAAP measure, which is used widely in the banking industry, to provide important information regarding its operational efficiency. Note: Ratios are annualized and based on average balance sheet amounts, where applicable. BERKSHIRE HILLS BANCORP, INC. AND SUBSIDIARIES RECONCILIATION OF NON-GAAP FINANCIAL MEASURES At or for the Quarters Ended |