Exhibit 99.1

Tm Bioscience

Letter to Shareholders

Q3 2006

Dear Shareholders,

Our Company has accomplished much over the past five years, growing a business that we believe will have a significant impact on healthcare. We are the first Company to successfully commercialize an FDA approved human genetic test in the U.S., our Cystic Fibrosis (CF) test. This product line now generates a recurring revenue stream while showcasing our capability to bring innovative products to market. Now our ID-Tag™ Respiratory Viral Panel (RVP) is poised to become a significant driver of growth over the coming year. It has the potential to become a worldwide standard in public health screening programs, patient diagnosis, and infection control programs in a wide variety of medical environments. The magnitude of the opportunity for our new genetic tests like the RVP is significantly greater than that of our CF franchise.

At the same time, substantial resources are required for the commercialization of our new products on a global basis. Resources required to expand our sales force, our technical support team, for product development and global distribution are significant. Within the context of the capital markets, securing resources for this purpose comes at a high price to shareholders. We are therefore examining other options. Securing global market access to fully exploit our next wave of products is our main priority.

For several months, we have been working towards securing a strategic partner to assist us in the world wide commercialization of our product pipeline. This process has evolved into inquiries regarding the possible sale or merger of our business. Our Management team and Board of Directors have decided to explore all opportunities with the objective of enhancing shareholder value.

It is also in the best interest of our customers that we seek a strategic business partner. We do not want to spread ourselves too thinly, especially in customer service functions. Our Company has developed strong relationships with our customers based upon the quality of our products and the quality of our customer service. We are among the highest rated in the sector. The result of a successful transaction will be an expanded customer service infrastructure and more products in our menu.

During the third quarter of 2006, in parallel with these activities, we continued to focus on securing regulatory clearance in the U.S. and Europe for our next wave of products. Subsequent to the end of the quarter, we were pleased to report that our ID-Tag™ Respiratory Viral Panel (RVP) has received CE mark status and can now be marketed for diagnostic purposes in Europe and other countries where the CE mark is recognized. This is an important step in our strategy for making the ID-Tag™ RVP product a worldwide standard for use in public health programs, infection control applications and for individual patient diagnosis. Next, we anticipate gaining clearance for the RVP from the FDA in early 2007. As Dr. Donald Low, Microbiologist-in-Chief at Mount Sinai Hospital (Toronto) and the newly appointed Chair of our Scientific Advisory Board remarked, “The ID-Tag™ RVP brings clinical diagnostics into the 21st century.”

We also advanced our companion test for Warfarin, which we expect will achieve FDA clearance as an IVD in the first half of 2007, with the goal of having the approval coincide with the relabelling of the drug Warfarin. During the third quarter, we launched this product as an IUO and it has started to generate initial sales. A recent report issued by FDA experts (AEI-Brookings Joint Centre for Regulatory Studies, Nov. 2006) concluded that formally integrating genetic testing into routine Warfarin prescribing could help avoid 17,000 strokes annually and reduce healthcare spending in the U.S. by $1.1 billion.

These are two of the numerous products we are advancing at Tm into a genetic testing market that holds enormous potential. We are leaders in this market but if we are to maintain this position and grow, we must support our commercialization activities fully. I would like to thank everyone at Tm Bioscience for their continued hard work during the quarter. I would also like to thank our shareholders for your ongoing support.

Gregory Hines, B.Sc., C.I.M.

President and CEO

Management’s discussion and analysis of operating results

Vision

The vision of Tm Bioscience (“Tm” or the “Company”) is to revolutionize healthcare by bringing genetic testing into mainstream healthcare. Tm is changing the way healthcare professionals manage patients by providing them with affordable, innovative, faster and more accurate tools to diagnose disease and personalize medicine.

Overview

Tm is a DNA-based diagnostics company. From 2000 to 2005, the Company focused its resources on building a commercialization engine for the design, development, manufacture, marketing and selling of genetic tests, also referred to as “DNA-based tests,” “nucleic acid tests” or “molecular diagnostics.” For 2006 and beyond, the Company has been focused on leveraging this engine to become the global leader in at least one of the three segments of the genetic testing market for which it is developing products: human genetics, personalized medicine and infectious disease.

On November 13, 2006, the Company announced that it has initiated a process to explore strategic alternatives to enhance shareholder value, including, but not limited to, the sale or merger of the Company with another entity offering strategic opportunities. The Board of Directors of the Company has established a Special Committee of Directors to review, consider and analyze all potential strategic opportunities. The strategic alternatives process is aimed at enhancing shareholder value by placing the Company in a position to further realize the growth potential inherent in its existing products and more importantly secure the global reach and scale required to fully exploit its next wave of products.

In the Management’s Discussion and Analysis of Operating Results (MD&A) section of the Tm 2005 Annual Report, the Company outlines the market drivers for its products, the capabilities of the Company to commercialize its products, its key performance measurements, and provides details on the execution of Tm’s strategy. This quarterly MD&A refers to, and should be read in conjunction, with the 2005 annual MD&A.

Third Quarter Highlights:

During the third quarter of 2006, much of the Company’s efforts were focused on establishing a market presence and developing the commercial footprint for its ID-Tag™ Respiratory Viral Panel (RVP) and advancing this product towards FDA and CE mark clearance. Subsequent to end of the quarter, the Company announced that the RVP test had achieved European regulatory clearance (CE mark). The Company is providing the final information in its FDA submission for the RVP and anticipates in-vitro diagnostic (IVD) clearance in the near term. The North American arm of the clinical trial program identified clinical results that were at least 98.5% concordance with current gold standards (DFA plus culture).

Tm started selling the RVP test to select distributors in Europe and to early access partners in the second quarter of 2006. During the third quarter, Tm continued to expand its network of distribution partners by signing a distribution agreement with RAMCON A/S to commercialize the product in Denmark, Sweden, Finland and Norway. Tm intends to continue to sign distribution agreements for the ID-Tag™ RVP across Europe, Asia and other regions over the coming months while its U.S.-based sales force targets customers in North America directly.

More than 40 leading healthcare institutions, including community hospitals, pediatric hospitals, reference laboratories and public health laboratories located across North America, Europe and Asia have entered into the Company’s Early Access Program and clinical trials program to assess and become familiar with the RVP test. These efforts are expected to facilitate the rapid commercialization of the ID-Tag™ RVP now that EU regulatory clearance has been achieved and U.S. clearance is expected shortly.

In keeping with the growing complexities of its business, and supporting the Company’s efforts to develop products for the Infectious Diseases market segment, the Company appointed Dr. Donald Low as Chairman of its Scientific Advisory Board in the third quarter. With more than 30 years of experience, Dr. Low is recognized world-wide as an authority in the area of emerging infectious diseases.

From its Personalized Medicine product menu, during the quarter the Company launched the IUO version of its companion test for Warfarin and continues to advance this product towards FDA clearance as an IVD, expected in early 2007. Initial modest sales of this product were recorded during the second quarter.

At the same time, Tm continued to realize revenue from its existing product menu, primarily from sales of products from its industry leading Cystic Fibrosis (CF) franchise.

Market drivers

Tm is developing products for three major segments of the overall DNA testing market. The Company has significantly penetrated the Human Genetics (Tag-It™) segment of the molecular diagnostics market, which is dominated by cystic fibrosis testing. The Company’s menu of CF products currently generates the majority of Tm’s recurring revenue. For 2006, Tm has dedicated most of its resources to the advancement of six products within the Personalized Medicine (Tag-It™ PGx) and Infectious Diseases (ID-Tag™) market segments. The market opportunities for these products are expected to each eventually exceed that of the cystic fibrosis market: by volume of tests performed, because within the infectious disease markets, tests are more likely to be repeated in an individual’s lifetime; and by revenue potential because for two of these products, Tm has obtained proprietary genetic content making the products novel to Tm and therefore the Company expects that they will command a higher price.

Capabilities - Our commercialization engine

Over the past five years, the Company has focused its resources on building a commercialization engine for the design, development, manufacture, regulatory approval, marketing and selling of genetic tests, with a focus on high throughput genotyping. The main components of Tm’s commercialization engine are discussed in the Company’s 2005 Annual Report.

Instrument partnership

Products from Tm are currently optimized to run on the Luminex xMAP system. According to Luminex, during its third quarter it expanded its own commercial footprint to more than 3900 systems placed in academic institutions, major pharmaceutical companies, large clinical and public health laboratories, bio-defense facilities and major medical institutions as well as community hospitals worldwide.

Research and Product Development

As communicated in the Company’s press release of October 4, 2006, the initial trial results received from European customers on the RVP demanded product design modifications which were undertaken by the research department and completed in the third quarter.

In addition, the Company’s Research Scientists continued to develop a prototype of the Sepsis product, and finalized the Warfarin test which was launched as an IUO during the quarter. Notable in the initiatives undertaken in research was the prototyping of a rapid version of the RVP test on the Luminex instrument. This advanced platform provides the basis for use of the Company’s multiplex chemistries in a method competitive in turn-around time with singleplex real-time PCR . The Company believes that this rapid version of its platform will improve the competitiveness of Tm’s current and future products by making them competitive with real-time PCR tests in terms of hands-on time and turn-around time. The Company believes that this new version of its multiplex platform will open up significant new markets for it to exploit.

Marketing and Sales

During the third quarter, the Company signed a distribution agreement with RAMCON A/S to commercialize the RVP test across Scandinavia. Earlier in the year, the Company signed distribution agreements for Turkey and Holland. Management continues to aggressively pursue distribution agreements, anticipating signing additional distributors for its RVP test in Europe and Asia now that the European approval has been attained.

A principal method of market development used by the Company over the last three years has been the Early Access Program, which the Company initially implemented with certain of the leading academic and commercial laboratories in the United States. The Early Access Program allows these laboratories and more recently large tertiary care hospitals (some of the biggest potential consumers of the Company’s products) to familiarize themselves with the Company’s products and technology prior to their commercialization. These customers provide the Company with feedback on the design, the composition and the performance of these products. In the second quarter, the Company announced that more than 25 leading healthcare institutions and laboratories across North America, Europe and Asia were enrolled in the Early Access Program specifically for the ID-Tag™ RVP. During the third quarter, Tm continued to enroll additional participants wanting access to the RVP. The Company also continued to add participants into the program for its Tag-It™ PGx Warfarin companion test.

Regulatory and Intellectual Property

Over the past five years, the Company has built an infrastructure to commercialize In-Vitro Diagnostic genetic tests. Evidenced by the approval of the Company’s Cystic Fibrosis test, which is approved by FDA, Health Canada and CE Marked in Europe as an IVD, this commercialization engine has been effective in producing products to the highest regulatory standards. This competitive advantage has not been fully realized in the marketplace as competitive products, produced to an ASR (Analyte Specific Reagent) standard, have continued to be used by the largest U.S. based laboratories to produce “Homebrew” tests. On September 7, 2006 the FDA released a Draft Guidance entitled “Commercially Distributed Analyte Specific Reagents (ASRs): Frequently Asked Questions” which signaled that changes in the ASR marketplace could be expected following the comment period on this Draft Guidance (expected to end December 6, 2006). Tm views this expected change as an opportunity. While many of the Company’s own products are sold as ASR’s and may be impacted in the short-term by these changes, Tm’s

commercialization engine has proven to be effective in meeting the more stringent IVD regulations. Tm’s rich pipeline of products includes four products currently sold as ASR’s where development toward IVD status has already started. This will minimize the impact of any changes in the ASR regulations on the Company. In addition, should the changes be implemented as described in the Draft Guidance, the Company would expect to see a significant increase in its Cystic Fibrosis business as Tm is the market leader in CF IVD testing and because the FDA should force companies to obey the regulations or withdraw their CF products.

A key focus for Tm in 2006 and 2007 is to seek regulatory clearance for a number of its products in the Personalized Medicine and Infectious Disease segments. During the quarter, Regulatory Affairs, along with Product Development, drove high priority programs for regulatory approval and manufacturing of the Warfarin and RVP tests, as well as for other products in the Company’s menu. The FDA’s delay in the re-labeling of the drug Warfarin combined with the increased clinical trial effort required subsequent to the redesign of the RVP test have delayed these product launches. The FDA has recently committed to the Warfarin label change in the coming months. They have also recognized a significant link between P450 2D6 genetic abnormalities and the use of the drug tamoxifen. This has caused the Company to reprioritize its FDA submission program for the next 6 months. The revised schedule has the RVP submitted, followed by Warfarin and P450 2D6. These will be followed by P450 2C19 and P450 2C9 in the first part of 2007.

Administration and Human Resources

On October 11, 2006 the Company announced the departure of Dr. Brad Popovich, a director of the Company and Chairman of the Company’s scientific advisory board. He has been replaced on the scientific advisory board by Dr. Donald Low. With more than 30 years of experience, Dr. Low is recognized world-wide as an authority in the area of emerging infectious diseases. He is the Medical Director of the Public Health Laboratories for the Province of Ontario and Chair of the Pandemic Influenza Planning Executive Committee.

During the quarter, the Company concluded employment contracts with its executive team, concluding a process undertaken by the compensation committee in late 2005 which involved industry benchmarking and reflects industry practice. All Company executives now have employment agreements in place.

Key Performance Measurements

Footprint - Tm’s reach into the marketplace

During the third quarter, the Company continued to add new customers for its commercially available menu of products. The Company also continued to promote the adoption of additional product offerings to its existing customer base. To date, approximately 50% of Tm’s customers have adopted two or more products from the Company’s menu.

In North America, sales efforts have been increasingly oriented towards preparations for regulatory clearance and subsequent commercial launch of Tm’s next wave of products. Large hospital based laboratories have been the key targets for the Company’s first infectious disease product, the ID-Tag™ Respiratory Viral Panel. Leading institutions that are potential customers for the Company’s Personalized Medicine products, such as major contract research organizations (CROs), have been important targets of the Company’s sales force as well.

Outside of North America, the Company continued to add to its distribution network for its ID-Tag™ Respiratory Viral Panel during the quarter, and anticipates signing additional distribution agreements as part its global commercialization strategy for this product.

Velocity - The breadth and rate of growth of Tm’s product pipeline

In early 2006, the Company expanded its product menu, achieving initial sales of the ID-Tag™ Respiratory Viral Panel that are expected to grow in the last quarter of 2006 and accelerate throughout 2007 now that regulatory clearance has been secured in Europe and is expected shortly in the U.S.. From its Personalized Medicine product menu, Tm is enhancing the regulatory status of its three available drug metabolism tests focused on the P450 family of enzymes. In addition, during the quarter the Company made the IUO version of its companion test for Warfarin commercially available and will be submitting the test for IVD clearance by the FDA in the first half of 2007. The Personalized Medicine menu will be further strengthened during 2007 with the planned launch of the Company’s test for Sepsis. Including RVP, Tm is currently targeting six products for regulatory clearance, which will significantly enhance its leadership position in the increasingly scrutinized regulatory environment which exists in the U.S.

The Company has increased its focus on infectious disease. The Company’s Scientific Advisory Board has recommended a number of potential product candidates for evaluation. Specifically, Tm is evaluating product opportunities in the areas of testing for central nervous system infections, bacterial pneumonia, and gastro-intestinal infections. All three products have been identified by the Company's Scientific Advisory Board as being significant opportunities that are unmet medical needs not served by current technologies. These opportunities are a good fit for Tm's technology and product development capabilities. These products would be commercialized within 1-2 years if the Company decides to pursue these product opportunities.

Innovation - Tm’s ability to create proprietary products that will revolutionize medicine

For 2006 and beyond, Tm is focused on developing novel, proprietary genetic tests. These products will be innovative because they will contain unique biomarkers and/or leverage the competitive advantages of the Tag-It™ Universal Array platform to address unmet medical needs. Examples of this innovation are the ID-Tag™ Respiratory Viral Panel and the Sepsis test.

Execution - Our Strategy

Building shareholder value

The Company believes that significant shareholder value will be created through the exploitation of four dynamics. These dynamics, which represent the Company’s overarching strategy for securing a significant and profitable presence in the rapidly growing genetic testing market, are to:

| | • | Demonstrate a capability to commercialize tests, from initial design through to global distribution |

| | • | Deliver standardized quality products compliant with global regulatory requirements |

| | • | Commercialize a broad and ever-growing menu of products |

| | • | Establish a customer base that consistently adopts Tm’s products |

The Company’s strategy has been constructed to successfully exploit these dynamics by adding product menu at the highest velocity possible. The Company plans to enhance its offering, within

each of its three key market segments, with tailored strategies that have been developed to drive growth. Details of these strategies are described in further detail in the Company’s 2005 Annual Report with an update on the execution of these strategies provided below.

Human Genetics

Tag-It™ - Do I have a genetic disease?

The Company has significantly penetrated the Human Genetics (Tag-It™) segment of the molecular diagnostics market with its menu of CF products, which currently generates the majority of Tm’s recurring revenue. The Company now estimates that it has secured approximately 30%-35% market share of the U.S. CF testing market and maximized its visibility within this market. An estimated 50% of the CF market is accounted for by demand from the two largest reference laboratories in the U.S., LabCorp and Quest. In the fourth quarter of 2005, LabCorp adopted the Tag-It™ reagents which LabCorp has commercialized into an expanded panel for testing 70 mutations in the CFTR gene to supplement a competing product they offer. LabCorp continues to see growth in the use of Tag-It™ reagents since that time. Quest does not purchase CF products from Tm but does purchase the Tag-It™ AJP reagents which it launched in the third quarter, adding to the Company’s recurring revenues. Along with a strong established customer base in the CF market, the Company believes that its uniquely comprehensive CF product line combined with the IVD status and Conformité Européene (CE) marking of its Tag-It�� Cystic Fibrosis kit, place the Company in a position to capture additional CF market share.

Personalized Medicine

Tag-It™ PGx - Can I safely take this drug? Will it be effective for me?

Tm’s objective within the Personalized Medicine market segment is to establish the Company as the market leader. The Company has developed a comprehensive strategy for achieving this goal which includes:

| | • | Securing IVD regulatory status for the Company’s PGx products |

| | • | Driving physician adoption of PGx tests |

| | • | Offering the most comprehensive PGx menu available on the market |

| | • | Gaining market share with Contract Research Organizations and large pharmaceutical companies |

Highlighting the third quarter of 2006, Tm expanded its PGx menu by launching the IUO version of its companion test for Warfarin.

P450 2D6 and tamoxifen - the emerging story.

In October 2006, the FDA held a sub-committee meeting to discuss the possibility of re-labeling the drug tamoxifen. Tamoxifen is used by oncologists to prevent breast cancer recurrence. The company's P450-2D6 test is of potentially significant utility to identify women who will not benefit from long-term use of tamoxifen, due to an enzymatic inability to metabolize tamoxifen into its active form. If the FDA decides to re-label tamoxifen to recommend genotyping prior to prescribing the drug, Tm's P450-2D6 test could be useful in identifying which women would benefit from the drug. The Company estimates that more than 500,000 women in the U.S. alone are currently taking tamoxifen for prevention of breast cancer recurrence.

P450 - The Tag-It™ PGx Mutation Detection Kits for P450-2D6, P450-2C9 and P450-2C19

As previously described, the Company’s focus on the clinical requirements for RVP during the second quarter resulted in a reprioritization on the Company’s FDA submission plans. Following RVP and Warfarin, the Company will be submitting its P450 2D6 test and then its 2C9 and 2C19 assays. During the third quarter, Tm continued to make progress towards these objectives in conjunction with its validation partners.

Warfarin - The Tag-It™ PGx CYP2C9+VKORC1 Mutation Detection Kit

Tm has developed a companion test for Warfarin which it expects to submit for FDA clearance in the first half of 2007. The FDA’s Clinical Pharmacology Subcommittee of the Advisory Committee on Pharmaceutical Science voted in November 2005 in favor of changing Warfarin’s label to reflect the fact that genetic information from two genes, CYP450 2C9 and VKORC1, can be useful in deciding a patient’s individual dose. The Company continues to anticipate the FDA may re-label Warfarin early in the new year.

Tm’s goal is to secure a dominant position in this market upon the anticipated re-labeling of Warfarin. During the second quarter, the Company initiated an Early Access Program (EAP) for the Tag-It™ PGx CYP2C9+VKORC1 Mutation Detection Kit with key customers and opinion leaders. The Company continues to support key opinion leaders in educational events that will drive the adoption of genetic testing in this area. During the third quarter, the Company launched this product as an IUO and it has started to generate initial sales. The Company expects to submit this product for FDA clearance as an IVD in 2007 with the goal of having the approval coincide with the relabelling of Warfarin.

Sepsis - The Tag-It™ Severe Sepsis Test

In early 2006, Tm acquired an exclusive commercial license to patents from Sirius Genomics for specific biomarkers related to two drugs, Xigris® and vasopressin, used to treat severe sepsis. These biomarkers can also be used to predict the patient’s risk of death from sepsis creating a genetic test with three intended uses. The Company sees this test as an innovative clinical tool which will provide intensivists with a new paradigm in the management of septic patients. Tm plans to incorporate these markers into a companion diagnostic and prognostic test for use by critical care physicians in order to treat patients with severe sepsis more effectively. Given the large market potential of this test as well as its potential importance in the selection of drugs and therapies that impact patient morbidity and mortality, the Company expects this test to achieve notable market penetration across North America and Europe. The Company intends to submit this product for FDA clearance as an IVD and for CE marking with clearance anticipated in 2007. The Company anticipates completing its data analysis for submission of initial claims to the FDA in the form of an Investigational Device Exemption (IDE) request near the end of the year.

Infectious Diseases

ID-Tag™ - Have I acquired an infection?

The ID-Tag™ Respiratory Viral Panel (RVP)

The ID-Tag™ Respiratory Viral Panel is a proprietary, comprehensive test for the detection of the majority of strains and subtypes of respiratory viruses, including respiratory syncytial virus (RSV) A and B, influenza A (with subtyping) and influenza B. Tm is positioning the ID-Tag™ Respiratory Viral Panel as an essential diagnostic tool in the diagnosis and management of respiratory viral illnesses.

The Company expects that the ID-Tag™ Respiratory Viral Panel will address two key markets. First, the test will be positioned as a cornerstone diagnostic product in the clinical setting for the more efficient management and treatment of patients who may be infected by respiratory viruses. The product is also expected to play a key role in improving influenza surveillance efforts and helping to manage potential pandemic threats such as those posed by the Avian Flu. The Company is actively promoting its adoption within the global public health community.

In the U.S. and Canada, Tm’s sales force is directly marketing the ID-Tag™ Respiratory Viral Panel to hospital based laboratories and public health labs. To drive sales, Tm is establishing market presence by enabling key customers and thought leaders to gain experience with the test through its Early Access Program and its clinical trial program. In the third quarter, Tm continued to enroll laboratories, adding to the more than 40 leading healthcare institutions and laboratories across North America, Europe and Asia participating in the programs as of the third quarter. Tm is also raising awareness of the product among clinical and public health labs through tradeshows and public relations and advertising campaigns. Notably, during the third quarter, Dr. Richard Janeczko, Chief Scientific Officer of the Company, presented the RVP at a key pandemic surveillance conference held in Singapore attended by world leading experts in infectious diseases.

Tm started selling the RVP test to select distributors in Europe and to early access partners in the second quarter of 2006. During the third quarter, Tm continued to expand its network of distribution partners by signing a distribution agreement with RAMCON A/S to commercialize the product in Denmark, Sweden, Finland and Norway. Tm intends to continue to sign distribution agreements for the ID-Tag™ Respiratory Viral Panel across Europe and Asia over the coming months while its U.S.-based sales force targets customers in North America directly.

Quarterly Results

Summary

For the quarter ended September 30, 2006, the Company reported a net loss of $5,645,628 or ($0.12) per share, compared with a net loss of $3,089,168 or ($0.07) per share, for the corresponding period in 2005, an increase in net loss of $2,556,460. For the nine months ended September 30, 2006 and 2005, the net loss was $14,783,936 and $10,210,503 and the per share loss was ($0.31) and ($0.26), respectively. For the quarter ended September 30, 2006, revenues grew $413,642 to $2,621,294 as compared to the same period in 2005, an increase of 19%. Gross margins for the current period were 29%, as compared to gross margin of 51% in the corresponding period in 2005; the decrease is due primarily to increased royalties related to the Abbott fundamental patent which began amortizing in the fourth quarter of 2005, increased Luminex royalties associated with the contract renegotiation concluded in the first quarter of 2006 and a one time charge related to the conclusion of a negotiation with a cystic fibrosis genetic marker owner. The remaining decrease relates to increased provision charges related to inventory described in the Management Discussion and Analysis section on Inventory. For the nine months ended September 30, 2006 and 2005, revenue growth of $3,331,313 or 63% and the increase in cost of goods sold of $2,380,004 resulted in a 39% gross margin (46% for 2005). For the nine months ended September 30, 2006, increases in sales, general and administrative expenses of $4,678,364 ($1,323,874 for the three months ended September 30, 2006) reflect the Company’s investments in the medical and regulatory, marketing and business development and quality assurance functions, as well as in the intellectual property and human resources functions. This was driven by product line growth, expanded licensing activities, increased marketing

program expenditures and the Company’s drive to secure FDA clearance on a large number of products in 2006. Other contributing factors were increases in facilities, professional services and validation studies and design control activities associated with RVP and Warfarin product trials and securing EAPs for the Warfarin, but more particularly the RVP products.

For the nine months ended September 30, 2006, research and development expense increased by $826,668 (increased by $650,308 for the three months ending September 30, 2006) primarily due to amortization charges for the Sirius sepsis biomarkers and increased expenses related to materials consumption for RVP and Warfarin and the Company’s work on FDA submissions for its P450 tests which offset the inclusion of Scientific Research and Experimental Development (SR&ED) tax credits received in the second quarter of 2006.

For the nine months ended September 30, 2006, interest expense from long-term debt increased by $295,750 ($149,237 for the three months ended September 30, 2006). The increased interest expense reflects a higher effective interest rate on the unsecured subordinated debentures as well as increased debt resulting from additional funds advanced from Technology Partnerships Canada which grew by 127% year over year. The year-to-date change incorporates a decrease of $2,228 ($26,236 for the three months ended September 30, 2006) in cash interest paid.

Gain on foreign exchange increased by $281,812 for the nine months ended September 30, 2006 ($48,779 for the three months ended September 30, 2006) due to the strengthening Canadian dollar and its effect on the U.S. dollar denominated debt. For the nine months ended September 30, 2006, other financial (expense) income increased from a net expense in 2005 of $191,221 to $223,997 in 2006; for the three months ended September 30, 2006, other financial (expense) income increased from a net expense of $43,213 to $186,500. This increase related primarily to the deferred financing cost amortization associated with the convertible debenture financing concluded in the fourth quarter of 2005 and the debenture financing of the second quarter of 2006 which is being amortized over a short time period.

Sales and Cost of Goods Sold

Year-to-date revenues increased by $3,331,313, or 63%, from $5,272,841 in 2005 to $8,604,154 in 2006 with year-to-date product sales in 2006 of $7,691,237 as compared with $4,646,704 for the same period in 2005, for growth of $3,044,533, or 66%. This growth is primarily driven by sales to Genzyme and by the recurring purchases by Quest and LabCorp, two of the largest diagnostic laboratories in the U.S., of the Company’s expanded menu selections, primarily Tag-It™ AJP and Tag-It™ CF70 reagents.

Total quarterly revenues increased by $413,642, or 19%, from $2,207,652 in 2005 to $2,621,294 in 2006. Product sales for the third quarter of 2006 were $2,285,593, an increase of 15% over 2005 product sales of $1,987,119. This quarterly growth is primarily driven by increased demand from Genzyme since their mid-2005 launch of the CFplus™ test and continued market uptake of the Tag-It™ Ashkenazi Jewish Panel (AJP).

The product revenues for the third quarter of 2006 reflect a 21% decline from second quarter revenues of $2,905,280. Sales in the third quarter were reduced by timing related to large purchases of CF reagents by key customers in the second quarter. The Company had anticipated that growth of RVP and Warfarin product sales in the third quarter would offset any timing reductions on other products, however, design changes to the RVP test based on feedback from the FDA and the Company’s EAPs delayed regulatory submission, impacting third quarter sales. The Company is now expecting a ramp in sales of the RVP to commence in the fourth quarter.

Luminex instrument placements continued in the quarter through direct customer purchases of $303,479 for the third quarter of 2006 as compared with $188,075 in 2005. Year-to-date instrument sales in 2006 were $734,562 compared to $537,498 in 2005. At September 30, 2006,

instrument sales represented 9% of the total year-to-date revenues (2005 - 10%) and 12% of the quarterly revenues (2005 - 9%).

Licensing and development fees received in the quarter reflect royalties on the sales by Luminex of FlexMap beads™, development fees reflecting the on-going pro-rata recognition of deferred milestone revenue and contract research fees. These fees grew from $88,639 in the first three quarters of 2005 to $178,356 in the same period in 2006 due primarily to revenue earned in the first quarter of 2006 from the custom development program for the Oncovue™, Intergenetics breast cancer risk test, and the pro-rata recognition of the milestone payment received from Genzyme in the second quarter of 2005.

Standard reagent product margins were 43% for the quarter ended September 30, 2006 as compared with 63% for the same period in 2005. Year-to-date standard reagent product margins were 54% for 2006 as compared with 62% in 2005. Standard reagent product margin is calculated by subtracting standard reagent cost of goods sold, intellectual property licensing costs and reagent rental depreciation from reagent product sales. The result is then divided by reagent product sales for the period. The measure of standard reagent product margins provides information on the margins of the Company excluding inefficiencies and yield volatility associated with the early stages of the Company’s manufacturing and revenue scale-up.

The 20% quarterly comparative decline is due primarily to growth in the Company’s royalties expense related to the Abbott fundamental patent which began amortizing in the fourth quarter of 2005, increased Luminex royalties associated with the contract renegotiation concluded in the first quarter of 2006 and a one-time charge related to the conclusion of a negotiation with a cystic fibrosis genetic marker owner.

This quarter includes a decrease in yield and an increase in capacity utilization as compared to the same period in 2005. Period charges related to shrinkage, scrap and excess and obsolescence (collectively the yield expense) were 6% of revenue for the third quarter of 2006 compared to 0% of revenue in the third quarter of 2005, primarily related to provision increases for manufacturing process impacts and design changes as detailed in the Management Discussion and Analysis section on Inventory. Year-to-date yield expense increased from 3% in 2005 to 5% of revenue at the end of the third quarter 2006.

Capacity utilization was higher in the third quarter of 2006, with a period expense representing 2% of revenue, down from 6% of revenue the third quarter of 2005. Overall capacity utilization for the year-to-date reflects this overall trend with a decrease in the associated period expense from 7% of revenue in 2005 to 5% of revenue in 2006. With the Company’s expanding customer base from the prospective launch of the RVP and Warfarin tests, the Company continues to expect improvements in capacity utilization and a declining impact of yield expense on margins.

Cost of goods sold for the quarter also includes instrument costs of $282,768 (2005 - $185,476). Year-to-date cost of goods sold for the first three quarters of 2006 includes instrument costs of $702,210 (2005 - $521,146). Total margins were 29% for the third quarter of 2006 as compared to 51% for the third quarter of 2005. Total margins were 39% for the first three quarters of 2006 as compared with 46% of the same period of 2005.

Expenses

Total expenses, excluding cost of goods sold, for the three-month period ended September 30, 2006 increased by $1,974,182 to $5,367,568 as compared with $3,393,386 in the same period in 2005. Year-to-date total expenses, excluding cost of goods sold were $15,918,259 in 2006, compared to $10,413,227 in 2005. Sales, general and administration (SG&A) for the third quarter of 2006 grew by $1,323,874 to $4,055,297 from $2,731,423 in 2005. Year-to-date SG&A was $12,295,738 in 2006 and $7,617,374 in 2005 and reflect the Company’s investments in the

medical and regulatory, marketing and business development and quality assurance functions, as well as in the intellectual property and human resources functions. The increase in headcount reflects the Company’s growing customer base and expanded licensing activities as well as its 2006 drive for regulatory clearance on multiple products. In Marketing, product managers were added to specifically drive growth into new markets, and to a lesser extent, increase presence within existing markets and product lines. During 2006, the Company improved its employee benefits plan in order to remain competitive within the market resulting in an increase in expenses. Other contributing factors were increases in facilities related to headcount growth, increased marketing program expenditures on the new products, professional services and validation studies and design control activities associated with RVP and Warfarin clinical trials and EAPs. Additionally, professional services associated with strategic planning and consultancy, legal advisory services and professional accounting services related to the Company’s compliance and reporting requirement which grew in the quarter and year-to-date.

For the nine months ended September 30, 2006, research and development expense increased by $826,668 (increased by $650,308 for the three months ending September 30, 2006) primarily due to amortization charges for the Sirius sepsis biomarkers and increased expenses related to materials consumption for RVP and Warfarin and the Company’s work on FDA submissions for its P450 tests which offset the inclusion of Scientific Research and Experimental Development tax credits received in the second quarter of 2006.

Interest expense from long-term debt increased from $692,055 in the third quarter of 2005 to $841,292 in the third quarter in 2006, an increase of $149,237 (increase of $295,750 from $1,938,698 to $2,234,448, for the nine months ended the same date). This can be attributed to an increase in net debt of $2.0 million associated with the refinancing of its debenture with a convertible instrument in November 2005 as well the unsecured subordinated debentures of $6.24 million concluded in August. A significant portion of the year-to-date increase is a result of additional advances from TPC in late 2005 and the second and third quarters of 2006.

For the nine months ended September 30, 2006, other financial income (expense) increased from a net expense in 2005 of ($191,221) to ($223,997). The third quarter increase of ($143,287) in other financial (expense) income from net expense of ($43,213) in 2005 to ($186,500) in 2006 can be attributed to an increase in amortization of financing costs and a decrease in interest income on short-term investments.

Capital and Liquidity

Working capital at September 30, 2006 was a deficiency of ($5,664,876) including cash and cash equivalents and short-term investments of $4,738,710, compared with $12,807,061 and $16,014,629, respectively as at December 31, 2005.

The purchase of capital assets for the quarter amounted to $526,685 and intangible assets to $10,800. For the third quarter of 2005, these amounts were $124,691 and $2,417,032 respectively. The majority of capital asset additions in the third quarter of 2006 relate to Luminex instruments which the Company has placed in a variety of evaluation studies with potential customers, primarily for the evaluation of the Company’s RVP test by early access partners. The majority of the balance relates to headcount related purchases such as furniture and computer equipment, for the departments discussed above. The fundamental Abbott patent represents the majority of the third quarter of 2005 intangible asset purchases.

Operating activities, on a net basis, used $3,227,024 of cash in the quarter. $4,199,704 of the cash used related to the consolidated statement of loss and deficit, and $972,680 was provided by changes in non-cash working capital balances. Of the $972,680, trade receivables decreased $548,026 in the third quarter due to increased collection efforts, as well as a reduction in larger

customer orders received and filled late in the quarter. Accounts payable and accrued liabilities increased by $477,999 which was attributable to increases in accruals related to royalties, professional fees and current deferred share units.

In the third quarter of 2006, foreign exchange gain was $1,114 as compared to a loss of $47,665 during the third quarter of 2005. This amount relates to the strengthening Canadian dollar against the Company’s U.S. dollar denominated long term debt, offset by a net positive U.S. dollar position in trade receivables and payables.

At quarter end, 99% of the Company’s trade accounts receivable was denominated in U.S. dollars. This exposure was more than offset as 41% of the Company’s accounts payable and accruals, as well as the convertible portion of its long-term debt is also denominated in U.S. dollars. The Company’s net exposure to the U.S. dollar at quarter end is a liability of $12,087,241 (measured in CDN dollars). A 1% appreciation or devaluation of the Canadian against the U.S. dollar would result in a net foreign exchange gain or loss respectively of approximately $120,000.

On March 17, 2006, the Company signed an agreement with Sirius for an exclusive commercial license to patents from Sirius for specific biomarkers related to drugs used to treat severe sepsis and risk of sepsis.

Under the terms of the agreement, the Company provides up front payments totalling $4,000,000. The $4,000,000 of payments to Sirius have a set-off right against royalties payable to Sirius upon commercialization of products developed by the Company from the biomarkers. and have been accounted for as an intangible asset. The up front payments are comprised of two separate payments of $2,000,000 each. The first $2,000,000 was due upon signing of the agreement, and was paid on April 3, 2006, and the second payment was due September 6, 2006.

On September 5, 2006, the Company amended its agreement with Sirius to defer the $2,000,000 license payment originally due on September 6, 2006 to the earlier of 90 days following receipt by the Company from Sirius of certain data related to the biomarkers required for regulatory submission and October 12, 2007. In connection with this deferral, the Company will pay interest at an annual rate of 16.6% on the deferred amount until the funds are paid to Sirius. As well, the first license payment made in April 2006 will not begin to accrue interest in favour of the Company to be offset against future royalty payments to Sirius until October 12, 2007. Interest accruing in favour of the Company on the second license payment will begin accruing from the date of such payment.

On August 15, 2006, the Company completed a debt financing consisting of unsecured subordinated debentures [“Debentures”] with an aggregate principal amount of $6,240,000.

The debentures have a term of 12 months, with monthly payments of interest until maturity when the principal becomes due and payable. The debentures carry a coupon of 11% and may be repaid in whole or in part at the Company’s option at any time prior to the maturity date. Concurrent with the closing, the Company issued to the lenders a total of 1,560,000 common share purchase warrants which are exercisable at a price of $1.15 per warrant, entitle the holder to acquire one common share of the Company and are exercisable until close of business on August 15, 2011.

On December 12, 2003, the Company entered into an agreement with the Ministry of Industry of the Government of Canada under which the government will invest up to $7,300,000 of the Company's $25,000,000 project to establish novel processes, capabilities and facilities relating to the development of several genetic tests. Funds of $645,790 were received from TPC in the third quarter of 2006 (2005 - nil) bringing the outstanding balance of the TPC funds advanced to $4,297,200.

The program initially stated a project completion date of July 31, 2006. Management is currently in the process of obtaining an extension of the program and expansion of the projects that are deemed to be eligible expenditures under the program. Management believes that the Company’s TPC agreement will be extended and that future claims to the full available loan will be recovered. If the Company were only able to submit claims up until July 31, 2006, the amount of the Other Asset after accretion for any claims submitted up to the project completion date would be reversed, with the corresponding charge to Contributed Surplus since this amount relates to warrants issued to TPC during fiscal 2005 based on the full value of the expected financing.

On November 13, 2006, the Company announced that its Board of Directors has initiated a process to explore strategic alternatives to enhance shareholder value, including, but not limited to, the sale or merger of the Company with another entity offering strategic opportunities. The Board of Directors of the Company has established a Special Committee of Directors to review, consider and analyze potential strategic opportunities. The Company has retained the investment banking firms Leerink Swann & Company (Boston, Massachusetts) and Westwind Partners (Toronto, Ontario) as financial advisors in this process.

The Company believes that such a strategic alternative will provide the Company the capital required to fully exploit its business plan. The Company provides no assurance that the initiation of this process to explore strategic alternatives will result in a transaction. No decision has been made to enter into any transaction at this time. The Company continues to explore other sources of capital but believes that a strategic transaction provides the most cost effective source at this time.

Quarterly selected financial information 2006, 2005 and 2004

| | 2006 | 2005 | 2004 |

| | 3rd quarter | 2nd quarter | 1st quarter | 4th quarter | 3rd quarter | 2nd quarter | 1st quarter | 4th quarter |

Revenue | $2,621,294 | $3,074,786 | $2,908,074 | $2,401,329 | $2,207,652 | $1,989,906 | $1,075,283 | $1,369,985 |

Net Loss | ($5,645,628) | ($4,989,502) | ($4,148,806) | ($4,956,963) | ($3,089,168) | ($3,675,783) | ($3,445,552) | ($3,291,392) |

Net Loss per share | $(0.12) | $(0.10) | $(0.09) | $(0.12) | $(0.07) | $(0.10) | $(0.09) | $(0.09) |

Contractual arrangements and commitments

| | Total | Less than 1 year | 1 - 3 years | 4 - 5 years | After 5 years |

| Convertible debenture | $9,561,400 | $4,721,180 | $4,840,220 | ¾ | ¾ |

| Debenture | $6,868,103 | $6,868,103 | ¾ | ¾ | ¾ |

| TPC | $7,442,257 | $113,621 | $2,202,823 | $5,125,813 | ¾ |

| Operating leases | $2,306,629 | $978,085 | $1,328,544 | ¾ | ¾ |

| Purchase obligations | $880,319 | $796,729 | $60,793 | $22,797 | ¾ |

Deferred share units(1) | $507,804 | $122,875 | ¾ | ¾ | $384,929 |

Total Contractual Arrangements | $27,566,512 | $13,600,593 | $8,432,380 | $5,148,610 | $384,929 |

| | (1) | Payment of Deferred share units is not made until the last business day in December of the first calendar year commencing after the director leaves the Board, and may be in cash or in common shares of the Company, at the discretion of the director. As the directors are elected annually, the DSUs which are not currently due have been classified as ‘After 5 years’. |

Disclosure controls

The Company's Chief Executive Officer and Chief Financial Officer have evaluated the Company's disclosure controls and procedures and have concluded that such controls and procedures are effective, as at the end of the period covered by this report.

Critical accounting estimates

During the second quarter of 2006, the Company commenced a capital lease of equipment. The “Capital assets” portion of the Company’s Significant Accounting Policies as reported in its 2005 Annual Report is hereby expanded as per the addition below:

Capital assets

Capital assets include equipment under capital lease which is recorded at the present value of the future minimum lease payments less accumulated depreciation. The rate and method used to depreciate equipment under capital lease over its estimated useful life is as follows:

| Equipment under capital lease | 5 years straight-line |

Provision for doubtful accounts

The Company relies on its credit approval process and historical experience to evaluate the exposure to the potential for non-performing receivables. At September 30, 2006, trade accounts receivable were outstanding from large and financially sound commercial laboratories. Based on its assessment of collectibility, Management provisioned a further $33,400, bringing its provision for doubtful accounts to $57,900 as at September 30, 2006.

Inventory

At quarter-end, the Company performed a count of 50% of total inventory cost and completed a full reconciliation of its physical inventory. In addition, substantial work was performed to ensure:

| | • | an appropriate amount of labour and overhead expense was included in period-end inventory balances based on normalized capacity; |

| | • | the full cost of inventories were realizable in the context of the Company’s existing and prospective sales contracts; and |

| | • | the volume of inventories did not exceed a reasonable forecast of future sales. |

Based on these reviews and as further discussed below, management has provided appropriately for realization of inventory balances as at September 30, 2006.

The Company incurs inventory related charges which have three primary business drivers: design changes, excess or short-dated materials due to changes in the sales forecast, and manufacturing process issues. Design changes are associated with new product offerings which may develop performance issues in the field early in their life cycle and optimization work on existing product offerings. Design changes by their nature are difficult to forecast. In order to identify excess materials, the Company’s sales forecast is updated quarterly for historical trends and current market data and, to generate a provision, is applied to “equivalent” units of inventory held as raw materials, work-in-process and finished goods. Short dated goods are identified from a materials ageing report and provisioned accordingly. Manufacturing process issues are

captured as either non-conforming materials (i.e. those which fail QC and are not reworkable) identified by the Company’s quality system or material which, due to changes in manufacturing processes or scaling, is unlikely to be or has not been consumed prior to its expiry in order to achieve the current sales forecast. This category is also not generally forecastable outside of a specific design change occurring.

During the quarter, the Company increased its provision by $84,011 from $158,730 at June 30, 2006 to $242,741 as at September 30, 2006. This quarter-over-quarter increase is due primarily to provision for non-conforming materials related to certain products, as well as for materials which are short dated and are not expected to be used prior to their expiry. The majority of these are for a key constituent of the Company’s test which is purchased in the lowest commercially-available quantity but which has been estimated to be in excess of forecast usage.

Equity based instruments

Each time the Company issued equity based instruments, including common share purchase warrants, agent’s compensation options and employee stock options, a value was derived for the instrument using the Black-Scholes option pricing model. The application of this pricing model requires the determination of several variables, including the price volatility of the Company’s stock over a relevant timeframe, a conversion or exercise assumption related to the particular instrument, the determination of a relevant risk free rate and an assumption of the Company’s dividend policy in the future. Management has adopted a consistent implementation of the Black-Scholes model, source of variables and application of a framework to determine appropriate inputs.

Warranties

It is the Company’s revenue recognition policy to provide for estimated warranty expense when product revenue is recognized. Beginning in the third quarter of fiscal 2004, the Company introduced a second form of warranty, instrument-based warranty, in addition to its existing product-based warranty. The instrument-based warranty provides service coverage to Luminex instruments placed with customers on reagent rental programs and where supplemental warranty coverage has been included with the sale of Luminex instruments to customers.

With respect to the product-based warranty, the Company’s customers continue to validate specific production lots which each customer had previously ascertained had met appropriate performance characteristics. As a result, management determined that no product warranty provision was required at September 30, 2006 (2005 - nil).

Beginning in 2006, for the instrument-based warranty, the Company began subcontracting its warranty obligations to a third party for those instruments beyond the initial warranty coverage extended by its instrument partner Luminex. Based on this practice and upon review of the Company’s experience to date in 2006, management has provided $22,636 as its net obligation for instrument-based warranty obligation to customers at September 30, 2006 (2005 - $22,802).

Royalties

The Company is engaged in negotiations related to a license for genetic markers on its cystic fibrosis products. The Company has determined that a contract will likely be concluded and has revised its royalty expense rate to 2% of applicable sales. Based on this royalty rate, the amount accrued at September 30, 2006 is $272,245 and the charge to expense for the three month and nine month periods ended September 30, 2006 was $249,891 and $272,245, respectively.

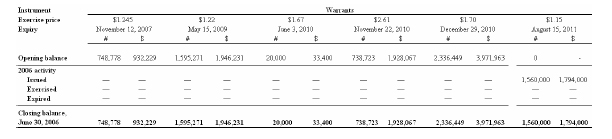

Warrants and compensation options

The following charts depict the potential cash value to the Company of outstanding warrants and compensation options as at September 30, 2006:

Risks and uncertainties

Prospects for companies in the biotechnology industry generally may be regarded as uncertain given the nature of the industry and, accordingly, investments in biotechnology companies should be regarded as speculative. Biotechnology research and development involves a high and significant degree of risk. An investor should carefully consider the risks and uncertainties described herein and in the Company’s annual information form for the financial year ended December 31, 2005, as well as other information contained in this Management’s Discussion and Analysis of Operating Results. Additional risks and uncertainties not presently known to the Company or that the Company believes to be immaterial may also adversely affect the Company’s business. If any one or more of these risks occur, the Company’s business, financial condition and results of operations could be seriously harmed. Further, if the Company fails to meet the expectations of the public, the market price of the Company’s common share could decline.

Forward-looking statements

This Management’s Discussion and Analysis of Operating Results and accompanying President’s message for the interim period ended September 30, 2006 contains certain forward-looking statements with respect to Tm. These include statements about management’s expectations, beliefs, intentions or strategies for the future, which are indicated by words such as “vision”, “may”, “will”, “should”, “plan”, “anticipate”, “believe”, “intend”, “potential”, “estimate”, “forecast”, “project”, “predict” and “expect” or the negative of these terms or other similar expressions concerning matters that are not historical facts. In particular, statements regarding the Company’s future operating results, economic performance and product development efforts are or involve forward-looking statements. More specifically, statements about the planned development of diagnostic genetic tests, including the Company’s ID-Tag™ RVP panel and sepsis tests, the potential efficacy of such tests, the anticipated timing of the commercial launch,

the approximate revenues and earnings that will be generated by such tests and the market penetration Tm will obtain for such tests, are forward-looking statements.

These forward-looking statements are based on certain factors and assumptions. The Company has assumed that it will submit its PGx, Sepsis, Warfarin and ID-Tag™ RVP tests for regulatory approval in 2006 (and in the case of the sepsis test, possibly 2007), that it will receive the necessary regulatory approvals from the FDA and European regulatory authorities within one year of submission, and that as part of such approval the FDA and European regulatory authorities will have reviewed, as required, clinical and analytical validation of the sepsis, RVP, Warfarin and PGx tests. The Company has also assumed that it will have sufficient capital to develop and commercially roll-out and manufacture sufficient quantities of its tests and that phamacogenomic testing and genetic testing for infectious diseases including sepsis will become more widespread. With respect to the sepsis test specifically, the Company has assumed that it will be able to successfully develop the sepsis test in two versions, as a real-time assay and in a TAG-IT TM format. With respect to revenue generation and market penetration of the sepsis test, the Company has assumed that it will launch the sepsis test in the United States in both forms (i.e., as a real-time assay and in a TAG-IT TM format) following receipt of the necessary regulatory approvals, that it will be able to sell the sepsis test at a price ranging from U.S.$300 to U.S.$500 per test, that there will be reimbursement available for this test by both private and public healthcare insurers, that there will be approximately 750,000 sepsis cases a year in each of the United States and the European Union, that the Company will achieve approximately 20% market penetration in both markets by the third year following launch, that the $U.S./$Cdn. exchange rate and the Euro/$Cdn. exchange rate will remain relatively constant at current rates, that the Company will sell the product directly to hospitals, that there will be no other directly competing technological or competitive advances in the treatment of sepsis, that Xigris® and vasopressin will continue to be widely used in the treatment of sepsis, that the Company will continue to enjoy the exclusive use of the patents to be licensed from Sirius, that these patents are and will remain valid and enforceable and that sufficient revenue and earnings will be generated from the sepsis test to recover the $4 million licence fee advance paid to Sirius in the forecast timeframe. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

The Company has also provided forward-looking information on its initiation of a process to explore strategic alternatives to enhance shareholder value, including, but not limited to, the sale or merger of the Company with another entity offering strategic opportunities. While the Company has received several inquiries, it provides no assurance that the initiation of a process to explore strategic alternatives will result in a transaction. No decision has been made to enter into any transaction at this time. The Company does not currently intend to disclose developments with respect to the exploration of strategic alternatives unless and until its Board of Directors has approved a specific transaction.

Forward-looking statements are not guarantees of future performance and by their nature necessarily involve risks and uncertainties that could cause the actual results to differ materially from those contemplated by such statements including, without limitation: the risk that the factors and assumptions underlying the forward-looking statements may prove to be incorrect; the difficulty of predicting regulatory approvals, particularly the timing and conditions precedent to obtaining any regulatory approval; market acceptance and demand for new products; the availability of appropriate genetic content and other materials required for the Company’s products; the Company’s ability to manufacture its products on a large scale; the protection of intellectual property connected with genetic content; the impact of competitive products, currency fluctuations; risks associated with the Company’s manufacturing facility; and any other similar or

related risks and uncertainties. Additional risks and uncertainties affecting the Company can be found in the Company’s 2005 Annual report, available on SEDAR at www.sedar.com. If any of these risks or uncertainties were to materialize, actual results of the Company could vary materially from those that are expressed or implied by these forward-looking statements.

You should not place undue importance on forward-looking statements and should not rely on them as of any other date. Except as may be required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Other Information

Additional information relating to the Company, including the Company’s most recently filed annual information form, can be found on SEDAR at www.sedar.com.

Consolidated Financial Statements

Tm Bioscience Corporation

September 30, 2006

Statement of Management Responsibility

The accompanying consolidated financial statements are the responsibility of Management and have been approved by the Audit Committee on behalf of the Board of Directors of the Company. Management is responsible for and has prepared and presented the consolidated financial statements in accordance with accounting principles generally accepted in Canada and has made any significant accounting judgments and estimates required. Management has ensured that financial information contained elsewhere in this Quarterly Report is consistent with the consolidated financial statements.

Management has developed and maintains systems of internal controls designed to provide reasonable assurance that reliable and relevant financial information is produced. Policies and procedures are designed to give reasonable assurance that transactions are properly authorized, assets are safeguarded and financial records properly maintained to provide reliable consolidated financial statements.

The Board of Directors is responsible for reviewing and approving the consolidated financial statements and ensuring Management meets their financial reporting responsibilities.

The Audit Committee consists solely of directors who are not officers of the Company and reviews with Management and the external auditors the quarterly consolidated financial statements of the Company prior to final approval. The Audit Committee also meets during the year with Management and the external auditors to discuss internal control issues, auditing matters, and financial reporting issues. External auditors have free access to the Audit Committee without obtaining prior Management approval.

| November 16, 2006 | Greg Hines, B.Sc., C.I.M. President and CEO | James Pelot, B.Comm., CA Chief Financial Officer |

Tm Bioscience Corporation

Interim Report

(Unaudited)

CONSOLIDATED BALANCE SHEETS

[See Basis of Presentation - note 1]

| | | | As at September 30, | | | As at December 31, | |

| | | 2006 | | | 2005 | |

| | | | | | $ | |

ASSETS[note 7[b]] | | | | | | | |

Current | | | | | | | |

| Cash and cash equivalents | | | 4,703,710 | | | 8,972,594 | |

Short-term investments [note 3] | | | 35,000 | | | 7,042,035 | |

Trade accounts receivable [note 12] | | | 2,244,059 | | | 1,245,333 | |

| Other accounts receivable | | | 495,218 | | | 613,680 | |

Inventory [note 4] | | | 3,580,216 | | | 3,619,714 | |

| Prepaid expenses | | | 289,754 | | | 46,305 | |

Total current assets | | | 11,347,957 | | | 21,539,661 | |

Capital assets, net [note 5] | | | 4,951,063 | | | 4,340,712 | |

Intangible assets, net [note 6] | | | 6,129,972 | | | 2,765,363 | |

Deferred financing costs, net[note 8] | | | 793,869 | | | 777,901 | |

| Other asset | | | 1,028,356 | | | 1,438,347 | |

| | | | 24,251,217 | | | 30,861,984 | |

| | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIENCY) | | | | | | | |

Current | | | | | | | |

Accounts payable and accrued liabilities [note 12] | | | 7,840,198 | | | 6,049,940 | |

| Current portion of deferred revenue | | | 155,398 | | | 123,805 | |

Current portion of long-term debt [note 7] | | | 8,970,536 | | | 2,476,582 | |

Current portion of obligation under capital lease [note 11] | | | 19,200 | | | — | |

| Income taxes payable | | | 27,501 | | | 82,273 | |

Total current liabilities | | | 17,012,833 | | | 8,732,600 | |

| Deferred leasehold inducement | | | 290,595 | | | 348,118 | |

| Deferred revenue | | | 65,242 | | | 123,970 | |

Deferred share units [note 10] | | | 384,929 | | | 301,075 | |

Long-term debt [note 7] | | | 7,828,922 | | | 9,033,181 | |

Obligation under capital lease [note 11] | | | 57,124 | | | — | |

Total liabilities | | | 25,639,645 | | | 18,538,944 | |

Shareholders' equity (deficiency) | | | | | | | |

Capital stock [note 9] | | | 66,871,280 | | | 66,871,280 | |

Contributed surplus [note 9] | | | 11,010,423 | | | 9,937,955 | |

| Deficit | | | (79,270,131 | ) | | (64,486,195 | ) |

Total shareholders' equity (deficiency) | | | (1,388,428 | ) | | 12,323,040 | |

| | | | 24,251,217 | | | 30,861,984 | |

Commitments [note 11]

See Accompanying notes

On behalf of the Board:

Tm Bioscience Corporation

Interim Report

(Unaudited)

CONSOLIDATED STATEMENTS OF LOSS AND DEFICIT

| | | | Three Months Ended | | | Nine Months Ended | |

| | | | September 30, | | | September 30, | |

| | | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

| | | | $ | | | $ | | | $ | | | $ | |

Revenue | | | 2,621,294 | | | 2,207,652 | | | 8,604,154 | | | 5,272,841 | |

| | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | |

| Cost of goods sold | | | 1,868,462 | | | 1,085,810 | | | 5,230,025 | | | 2,850,021 | |

| Research and development, net | | | 1,312,271 | | | 661,963 | | | 3,622,521 | | | 2,795,853 | |

| Sales, general and administrative | | | 4,055,297 | | | 2,731,423 | | | 12,295,738 | | | 7,617,374 | |

| | | | 7,236,030 | | | 4,479,196 | | | 21,148,284 | | | 13,263,248 | |

Loss before the undernoted | | | (4,614,736 | ) | | (2,271,544 | ) | | (12,544,130 | ) | | (7,990,407 | ) |

| Interest expense on long-term debt | | | (841,292 | ) | | (692,055 | ) | | (2,234,448 | ) | | (1,938,698 | ) |

| Gain (loss) on foreign exchange | | | 1,114 | | | (47,665 | ) | | 245,326 | | | (36,486 | ) |

| Other financial expense | | | (186,500 | ) | | (43,213 | ) | | (223,997 | ) | | (191,221 | ) |

Loss before income taxes | | | (5,641,414 | ) | | (3,054,477 | ) | | (14,757,249 | ) | | (10,156,812 | ) |

| Income tax expense | | | (4,214 | ) | | (34,691 | ) | | (26,687 | ) | | (53,691 | ) |

Net loss for the period | | | (5,645,628 | ) | | (3,089,168 | ) | | (14,783,936 | ) | | (10,210,503 | ) |

| Deficit, beginning of period | | | (73,624,503 | ) | | (56,440,064 | ) | | (64,486,195 | ) | | (49,318,729 | ) |

Deficit, end of period | | | (79,270,131 | ) | | (59,529,232 | ) | | (79,270,131 | ) | | (59,529,232 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| per common share[note 9] | | | (0.12 | ) | | (0.07 | ) | | (0.31 | ) | | (0.26 | ) |

| | | | | | | | | | | | | | |

Weighted average number of | | | | | | | | | | | | | |

common shares outstanding [note 9] | | | | | | | | | | | | | |

| Basic and diluted | | | 47,715,224 | | | 40,212,064 | | | 47,715,224 | | | 39,903,417 | |

See Accompanying notes

Tm Bioscience Corporation Interim Report

(Unaudited)

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | Three Months Ended | | | Nine Months Ended | |

| | | | September 30, | | | September 30, | |

| | | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

| | | | $ | | | $ | | | $ | | | $ | |

OPERATING ACTIVITIES | | | | | | | | | | | | | |

| Net loss for the period | | | (5,645,628 | ) | | (3,089,168 | ) | | (14,783,936 | ) | | (10,210,503 | ) |

| Add (deduct) items not involving cash: | | | | | | | | | | | | | |

Depreciation and amortization | | | 694,801 | | | 312,777 | | | 1,800,554 | | | 891,679 | |

Amortization of deferred leasehold inducement | | | (25,327 | ) | | (15,684 | ) | | (57,523 | ) | | (45,377 | ) |

Accretion of loan discount [note 7] | | | 267,010 | | | 362,084 | | | 698,923 | | | 967,757 | |

Amortization of deferred financing costs [note 8] | | | 97,180 | | | 99,109 | | | 230,387 | | | 294,096 | |

Stock option compensation expense and deferred | | | | | | | | | | | | | |

share units [note 10] | | | 229,034 | | | 127,216 | | | 587,925 | | | 491,415 | |

Government loan interest accrual [note 7] | | | 184,340 | | | 68,595 | | | 475,875 | | | 195,336 | |

(Gain) loss on foreign exchange | | | (1,114 | ) | | 47,665 | | | (245,326 | ) | | 36,485 | |

| | | | (4,199,704 | ) | | (2,087,406 | ) | | (11,293,121 | ) | | (7,379,112 | ) |

| Change in non-cash working capital balances related | | | | | | | | | | | | | |

to operations: | | | | | | | | | | | | | |

Decrease (increase) in trade accounts receivable | | | 548,026 | | | (118,210 | ) | | (998,726 | ) | | (842,320 | ) |

Decrease (increase) in other accounts receivable | | | 29,121 | | | (203,468 | ) | | 118,462 | | | (261,212 | ) |

(Increase) decrease in inventory | | | (33,805 | ) | | (962,524 | ) | | 39,498 | | | (1,265,204 | ) |

(Increase) decrease in prepaid expenses | | | (666 | ) | | 65,246 | | | (243,449 | ) | | (24,434 | ) |

(Increase) decrease in deferred revenue | | | (37,937 | ) | | 42,944 | | | (27,135 | ) | | 20,270 | |

Increase (decrease) in accounts payable and | | | | | | | | | | | | | |

accrued liabilities | | | 477,999 | | | 395,356 | | | (384,236 | ) | | 1,143,444 | |

(Decrease) increase in income taxes payable | | | (10,058 | ) | | 14,007 | | | (54,772 | ) | | 33,007 | |

Cash used in operating activities | | | (3,227,024 | ) | | (2,854,055 | ) | | (12,843,479 | ) | | (8,575,561 | ) |

INVESTING ACTIVITIES | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Purchase of capital assets | | | (526,685 | ) | | (124,691 | ) | | (1,570,189 | ) | | (775,805 | ) |

| Purchase of intangible assets | | | (10,800 | ) | | - | | | (2,121,609 | ) | | (40,890 | ) |

| Purchase of short-term investments | | | - | | | (7,296,456 | ) | | (10,769,762 | ) | | (28,417,685 | ) |

| Sale of short-term investments | | | - | | | 8,926,697 | | | 17,776,797 | | | 24,041,853 | |

Cash (used in) provided by investing activities | | | (537,485 | ) | | 1,505,550 | | | 3,315,237 | | | (5,192,527 | ) |

FINANCING ACTIVITIES | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Increase in deferred leasehold inducement | | | - | | | 168,680 | | | - | | | 168,680 | |

Proceeds from long-term debt [note 7] | | | 6,885,790 | | | - | | | 7,437,174 | | | - | |

Repayment of long-term debt [note 7] | | | (942,160 | ) | | - | | | (1,892,841 | ) | | - | |

| Repayment of capital lease obligation | | | (7,392 | ) | | - | | | (7,392 | ) | | - | |

Debt issuance costs [note 7[c]] | | | (277,583 | ) | | - | | | (277,583 | ) | | - | |

| Share issuance costs | | | - | | | - | | | - | | | (772,542 | ) |

| Net change in share capital | | | - | | | 55,468 | | | - | | | 13,576,490 | |

Cash provided by financing activities | | | 5,658,655 | | | 224,148 | | | 5,259,358 | | | 12,972,628 | |

Net increase (decrease) in cash and cash equivalents | | | | | | | | | | | | | |

during the period | | | 1,894,146 | | | (1,124,357 | ) | | (4,268,884 | ) | | (795,460 | ) |

| Cash and cash equivalents, beginning of period | | | 2,809,564 | | | 1,662,125 | | | 8,972,594 | | | 1,333,228 | |

Cash and cash equivalents, end of period | | | 4,703,710 | | | 537,768 | | | 4,703,710 | | | 537,768 | |

| | | | | | | | | | | | | | |

Supplemental cash flow information | | | | | | | | | | | | | |

| Income taxes paid | | | 16,658 | | | - | | | 94,406 | | | - | |

| Interest paid | | | 235,142 | | | 261,378 | | | 773,379 | | | 775,607 | |

| | | | | | | | | | | | | | |

| Non-cash investing and financing activities related to | | | | | | | | | | | | | |

capital lease [note 5] | | | - | | | - | | | (81,000 | ) | | - | |

See Accompanying notes

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2006

(Unaudited)

1. BASIS OF PRESENTATION

These consolidated financial statements of Tm Bioscience Corporation ["Tm" or the "Company"] have been prepared in accordance with Canadian generally accepted accounting principles on a going concern basis which presumes the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

As at September 30, 2006, the Company had a working capital deficiency of $5,664,876 and an accumulated deficit of $79,270,131 resulting from losses in the current and prior periods. As the Company is in the early stages of commercialization for its products, the Company’s ability to continue operations is uncertain and is dependent upon its ability to obtain sufficient financing and improve operating results.

These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue operations in the normal course of business. Such adjustments could be material.

2. ACCOUNTING POLICIES