Tm Bioscience - First Quarter Report 2006 - Restated

Management’s Discussion and Analysis of Operating Results

Vision

The vision of Tm Bioscience (“Tm” or the “Company”) is to revolutionize healthcare by bringing genetic testing into mainstream healthcare. Tm Bioscience is changing the way healthcare professionals manage patients by providing them with affordable, innovative, faster and more accurate tools to diagnose disease and personalize medicine.

Overview

Tm Bioscience is a DNA-based diagnostics company. From 2000 to 2005, the Company focused its resources on building a commercialization engine for the design, development, manufacture, marketing and selling of genetic tests, also referred to as “DNA-based tests”, “nucleic acid tests” or “molecular diagnostics”. For 2006 and beyond, the Company is focused on leveraging this engine to become the global leader in at least one of the three segments of the genetic testing market for which it is developing products: human genetics, personalized medicine and infectious disease.

In the Management’s Discussion and Analysis of Operating Results (MD&A) section of the Tm Bioscience 2005 Annual Report, the Company outlined the market drivers for its products, the capabilities of the Company to commercialize its products, key performance measurements, and provided details on the execution of Tm’s strategy. This quarterly MD&A refers to, and should be read in conjunction with, the 2005 annual MD&A.

First Quarter Highlights

The first quarter of 2006 provided a number of external validation events confirming the value of Tm’s technology, capability and approach. Specifically, the Company:

| | • | Received European CE mark (European equivalent to in vitro diagnostic (IVD)) on its flagship Tag-It™ Cystic Fibrosis test. |

| | • | Expanded its commercial footprint, signing supply agreements with a number of new customers including: Jacobi Medical Center; St. Joseph’s Hospital and Medical Center; Montreal Children’s Hospital of the McGill University Health Centre. |

| | • | Signed a multi-year extension of its partnership agreement with Luminex. |

| | • | Subsequent to the end of the quarter, signed its first regional distribution agreement for its ID-Tag™ Respiratory Viral Panel (RVP), a genetic test aimed at accurately identifying between 20 respiratory infections in humans, including the H5 subtype responsible for the global spread of avian flu. |

The Company is advancing several significant products and product initiatives to further expand its opportunities into the highest growth areas of the DNA testing market. Building from a significant market share in the human genetics segment with its flagship Cystic Fibrosis product menu, during the first quarter of 2006, Tm Bioscience:

| | • | Made the ID-Tag™ RVP commercially available for customer evaluations. To drive sales, Tm is establishing market presence by enabling key customers and thought leaders to gain experience with the test through an Early Access Program. The Company is also focused on gaining regulatory clearance for the test as an IVD and is undertaking validation studies to generate data for regulatory submissions in the second quarter of 2006. |

| | • | Secured an agreement for innovative genetic content in the field of systemic infections (sepsis), a market which the Company expects could generate $100M in revenue in the first three years after the launch of its test, slated for the second half of 2007. |

| | • | Secured a co-exclusive license, along with Roche, to a genetic patent associated with the second most frequent variation in a drug metabolism gene in Caucasians implicated in the metabolism of 25% of the most commonly prescribed drugs. |

Market drivers

Tm Bioscience is developing products for three major segments of the overall DNA testing market. The Company has significantly penetrated the Human Genetics (Tag-It™) segment of the molecular diagnostics market which is dominated by cystic fibrosis (CF) testing. The Company’s menu of CF products currently generate the majority of Tm’s recurring revenue. For 2006, Tm has dedicated most of its resources to the commercialization of six products within the Personalized Medicine (Tag-It™ PGx) and Infectious Diseases (ID-Tag™) market segments. The market opportunities for these products are expected to each exceed that of the Cystic Fibrosis market; by volume of tests performed because within these markets, significantly more patients present with symptoms requiring a diagnosis; by revenue potential because for two of these products, Tm has obtained proprietary genetic content making the products novel to Tm and therefore the Company expects that they will command higher prices.

Capabilities - Our commercialization engine

Over the past five years, the Company has focused its resources on building a commercialization engine for the design, development, manufacture, marketing and selling of genetic tests, with a focus on high throughput genotyping. This engine is now well established and the Company anticipates modest investment to further increase the capacity of this engine to meet growing demand for the Company’s commercial products. The main components of Tm’s commercialization engine are discussed in the Company’s 2005 Annual Report. During the first quarter, the Company’s capabilities were further strengthened in the following areas:

Instrument partnership:

In March 2006, the Company and Luminex signed a multi-year extension of their platform partnership agreement, which grants Tm rights to commercialize DNA-based molecular diagnostics that operate on Luminex’s xMAP® technology platform. The renegotiated agreement incorporates similar terms to the original agreement, including the ability for Tm to distribute Luminex’s xMAP systems such as the new LX200 instrument.

According to Luminex, during the quarter it expanded its own commercial footprint to more than 3400 systems placed in academic institutions, major pharmaceutical companies, large clinical and public health laboratories, bio-defense facilities, and major medical institutions as well as community hospitals worldwide.

Research and Product Development:

To meet the high-volume requirements of Tm’s largest customers, solutions were developed to automate the processes for performing a test. Tm Tag-It™ products with automation are expected to be commercially available in Q2 of 2006.

During the quarter, resources were dedicated to finalizing protocols aimed at streamlining the process for performing Tag-It™ tests with the goal of making tests simpler to use and reducing turnaround time. Tag-It™ products incorporating these revised protocols are also expected to be available in the first half of 2006. Customer validation of these platform enhancements commenced in early 2006.

Manufacturing

Tm’s engineered capacity is up to 6 million tests per year. In the first quarter, the Company successfully transferred from Product Development to Manufacturing the manufacturing protocol of coupling Tag-It™ Universal Array oligonucleotides to Luminex xMAP® beads at 3 times the previous batch size. This was a key step in the Company’s scale-up activities and is suitable for manufacturing in batches of finished products of 400,000 tests/batch.

Marketing and Sales

Subsequent to the end of the quarter, the Company signed its first regional distribution agreement (for Turkey) for its ID-Tag™ Respiratory Viral Panel. Management continues to explore opportunities to sign distribution agreements in each of its product areas for territories outside of North America and in particular anticipates signing additional distributors for its respiratory panel.

Regulatory and Intellectual Property

A key focus for Tm in 2006 will be to seek regulatory clearance for a number of its products, notably in the Personalized Medicine and Infectious Diseases segments.

As part of its strategy to develop innovative products, Tm will on an ongoing basis seek to acquire intellectual property rights to unique genetic content. During the first quarter of 2006, the Company acquired rights to patents from EPIDAUROS, giving Tm co-exclusivity to a biomarker for the second-most frequent variation in the CYP2D6 gene in Caucasians. Tm also acquired rights to genetic content from Sirius Genomics in the field of systemic infections (sepsis), which will lead to products that the Company expects could generate $100M in revenue in the first three years after the launch of its test, slated for the second half of 2007.

Key performance measurements

Footprint - Tm’s reach into the marketplace

The Company acquired a number of new customers in the first quarter including:

| | • | Montreal Children’s Hospital of the McGill University Health Centre |

| | • | St. Joseph’s Hospital and Medical Center |

The Company continued to promote the adoption of additional product offerings to its existing customer base. To date, approximately 50% of Tm’s customers have adopted two or more products from the Company’s menu.

Sales efforts in 2006 have been increasingly oriented towards leading institutions in the PGx market such as leading contract research organizations (CROs).

Subsequent to the end of the quarter, the Company also expanded its footprint outside of North America by signing its first regional distribution agreement, for Turkey, for its ID-Tag™ Respiratory Viral Panel.

Velocity - The breadth and rate of growth of Tm’s product pipeline

During the quarter, the Company expanded its product pipeline by launching the ID-Tag™ Respiratory Viral Panel, currently for Investigational Use Only (IUO). In 2006, the Company anticipates submitting several products from its Personalized Medicine product menu, along with the ID-Tag™ Respiratory Viral Panel, for FDA clearance.

Innovation - Tm’s ability to create proprietary products that will revolutionize medicine

For 2006, Tm is focused on developing novel, proprietary genetic tests. These products will be innovative because they will contain unique biomarkers and/or leverage the competitive advantages of the Tag-It™ Universal Array platform to address unmet medical needs. During the first quarter of 2006, the Company secured unique genetic content from both EPIDAUROS and Sirius Genomics.

Execution - Our strategy

Building shareholder value

The Company believes that significant shareholder value will be created through the exploitation of four dynamics. These dynamics, which represent the Company’s overarching strategy for securing a significant and profitable presence in the rapidly growing genetic testing market, are to:

| | • | demonstrate a capability to commercialize tests, from initial design through to global distribution; |

| | • | deliver standardized quality products compliant with global regulatory requirements; |

| | • | commercialize a broad and ever-growing menu of products; and |

| | • | establish a customer base that consistently adopts Tm’s products. |

The Company’s strategy has been constructed to successfully exploit these dynamics by adding product menu at the highest velocity possible. The Company plans to enhance its offering, within each of its three key market segments, with tailored strategies which have been developed to drive growth. Details of these strategies are described in further detail in the Company’s 2005 Annual Report with an update on the execution of these strategies provided below.

Human Genetics

Tag-it™ - Do I have a genetic disease?

The Company has significantly penetrated the Human Genetics (Tag-It™) segment of the molecular diagnostics market with its menu of CF products, which currently generates the majority of Tm’s recurring revenue. The Company now estimates that it has secured approximately 30%-35% market share of the U.S. CF testing market and maximized its visibility within this market. The majority of the remaining share of the CF market that has not been secured by Tm is accounted for by demand from the two largest reference laboratories in the U.S., LabCorp and Quest. In the fourth quarter of 2005, LabCorp adopted the Tag-It™ reagents which LabCorp has commercialized into an expanded panel for testing 70 mutations in the CFTR gene to supplement a competing product they offer. LabCorp has seen significant growth in the use of Tag-It™ reagents since that time. Quest does not purchase CF products from Tm but does purchase the Tag-It™ AJP reagents.

Along with a strong established customer base in the CF market, the Company believes that its uniquely comprehensive CF product line combined with the IVD status and CE Marking (“Conformité Européene”) of its Tag-It™ Cystic Fibrosis kit, place the Company in a strong competitive position to capture additional CF market share. Improvements to the Tag-It™ platform with respect to automation and assay streamlining will provide Tm’s CF tests further competitive leverage with the largest reference laboratories.

Personalized Medicine

Tag-It™ PGx - Can I safely take this drug? Will it be effective for me?

Tm Bioscience’s objective within the Personalized Medicine market segment is to establish the Company as the market leader. The Company has developed a comprehensive strategy for achieving this goal which includes:

| | • | Driving physician adoption of PGx tests |

| | • | Offering the most comprehensive PGx menu available on the market |

| | • | Securing IVD regulatory status for the Company’s PGx products |

| | • | Gaining market share with Contract Research Organizations and large pharmaceutical companies |

During the first quarter of 2006, Tm Bioscience made significant progress towards expanding its PGx menu with unique and novel products:

P450 - The Tag-It™ PGx Mutation Detection Kits for P450-2D6, P450-2C9 and P450-2C19

During the quarter, Tm announced it had signed an agreement with EPIDAUROS Biotechnologie AG (Bernried, Germany) for a co-exclusive commercial license to EPIDAUROS’ patents on the second most prevalent biomarker in Caucasians related to the P450-CYP2D6 gene, which is associated with an enzyme that metabolizes approximately 25% of all prescription drugs. Only one other company has a license to this genetic marker. Tm and EPIDAUROS have negotiated an agreement whereby no other licenses for this variant will be granted for the term of Tm’s license. The Company intends to submit all three of its PGx P450 products to the FDA in 2006 with clearance as IVD’s anticipated for late 2006 or early 2007.

Warfarin - The Tag-It™ PGx CYP2C9+VKORC1 Mutation Detection Kit

Tm Bioscience is developing a companion test for Warfarin which it expects to submit for FDA clearance in 2006. The FDA’s Clinical Pharmacology Subcommittee of the Advisory Committee on Pharmaceutical Science voted in November 2005 in favor of changing Warfarin’s label to reflect the fact that genetic information from two genes, CYP450 2C9 and VKORC1, can be useful in deciding a patient’s individual dose. The Company understands that the FDA will convene a meeting in June 2006 to reach a consensus on this issue and anticipates the FDA may relabel Warfarin in Q4, 2006.

Tm’s goal is to secure a dominant position in this market upon the anticipated relabeling of Warfarin. Subsequent to the end of the quarter, the Company initiated an Early Access Program (EAP) for the Tag-It™ PGx CYP2C9+VKORC1 Mutation Detection Kit with key customers and opinion leaders. The Company intends to submit this product for FDA clearance as an IVD in 2006 with clearance anticipated for late 2006 or early 2007.

Sepsis - The Tag-It™ Severe Sepsis Test

During the quarter, Tm signed an agreement with Sirius Genomics (Vancouver, Canada) for an exclusive commercial license to patents from Sirius for specific biomarkers related to two drugs used to treat severe sepsis, Xigris® and vasopressin. Tm Bioscience will incorporate these markers into a companion diagnostic for use by critical care physicians in order to treat patients with severe sepsis more effectively. Given the large market potential of this test as well as its potential importance in the selection of drugs and therapies that impact patient morbidity and mortality, the Company expects this test to achieve notable market penetration across North America and Europe, anticipating revenue that could be in excess of $100 million in the aggregate over the first three years following commercial launch. The Company intends to submit this product for regulatory clearance in 2006 with clearance anticipated for the second half of 2007. As part of the agreement, Tm retains a three year right of first refusal to commercialize two further sepsis related products based on future genetic discoveries made by Sirius.

Infectious Diseases

ID-Tag™ - Have I acquired a deadly infection?

In January 2006, the Company made the ID-Tag™ RVP commercially available for evaluation purposes. The ID-Tag™ RVP is a comprehensive assay for the detection of various strains of viruses and subtypes, including H5 (Avian Flu). The Company expects that the ID-Tag™ RVP will address two key markets. First, it is expected to serve as a cornerstone diagnostic product in the clinical setting for the more efficient management and treatment of patients who may be infected by respiratory viruses. The product is also expected to play a key role in managing the potential pandemic threats posed by the Avian Flu and SARS, and the Company is actively promoting its adoption within the global public health community.

To drive sales, Tm is establishing market presence by enabling key customers and thought leaders to gain experience with the test through an EAP which was actively securing participants during the quarter. Tm is also planning to raise awareness of the product among clinical and public health labs through tradeshows and public relations and advertising campaigns. The Company is focused on gaining regulatory clearance for the test as an IVD and in conjunction with select EAP partners is undertaking validation studies to generate data for regulatory

submissions in the U.S. in the second quarter of 2006 and in Europe and Canada in the third quarter with approvals anticipated in the third and fourth quarters of 2006.

Tm’s sales force will be directly marketing the product to hospital based laboratories in the U.S. and Canada. The Company is in discussion with distributors for selling the product outside of the North America and subsequent to the end of the quarter signed its first distribution agreement with a major diagnostics distributor to commercialize the product in Turkey.

Other opportunities

The Company’s core focus remains on developing proprietary tests for human genetics, pharmacogenetics and infectious disease. However, through partnerships the Company believes it can leverage its technology and cGMP manufacturing capabilities to address significant opportunities in other sectors and improve manufacturing efficiency.

In June, 2005 the Company announced it had signed a five-year agreement to supply custom Tag-It™ reagents to InterGenetics (Oklahoma City, Oklahoma) for OncoVue™. According to InterGenetics, Oncovue™ has been developed as the first genetic-based Breast Cancer Risk Test relevant to all women. The agreement anticipates InterGenetics will purchase a minimum of $7.5 million in reagents from Tm over the five year period. The agreement is contingent on the Company delivering Tag-It™ reagents which perform according to InterGenetics’ specifications. Tm has now delivered a final set of reagents to InterGenetics’ specifications. InterGenetics had received regulatory input in the U.S. from the FDA which has required it to reschedule its commercial launch. As the timing for the finalization of InterGenetics’ discussions with the FDA are currently uncertain, the Company’s delivery of commercial products to InterGenetics cannot be predicted at this time.

Quarterly Results

Summary

For the quarter ended March 31, 2006, the Company reported a net loss of $4,148,806 or ($0.09) per share, compared with a net loss of $3,445,552 or ($0.09) per share, for the corresponding period in 2005, for an increase in net loss of $703,254. For 2006, the growth in revenues of $1,832,791 to $2,908,074 and the increase in cost of goods sold of $1,022,038 to $1,616,305 led to a 44% gross margin, as compared with 2005. Increases in sales, general and administrative expenses of $1,408,498 reflect the Company’s investments in the medical and regulatory, marketing and business development and technical support functions, as well as in the newly formed intellectual property and human resources functions. This was driven by product line growth, expanded licensing activities, increased marketing program expenditures and the Company’s drive to secure FDA clearance on a large number of products in 2006. Other contributing factors were increases in facilities, professional services and validation and verification materials, while research and development expense decreased by $12,482. Interest expense from long-term debt increased by $136,976, $3,846 of which related to an increase in cash interest paid, due to an increase in net debt of $2.0 million associated with the refinancing of its debenture with a convertible instrument in November of 2005, which was partially offset by a lower interest rate. Other non-operating expenses decreased by $21,491 due to an increase in interest income on short-term investments which was partially offset by an increase in state tax expenses.

Sales and Cost of goods sold

Total quarterly revenues increased by $1,832,791 from $1,075,283 in 2005 to $2,908,074 in 2006. Product sales for the first quarter of 2006 were $2,500,364, an increase of 140% over 2005 product sales of $1,041,936. This growth is primarily driven by the mid-2005 launch of the CFplus™ test by Genzyme and by the adoption by the growing customer base of the Company’s expanded menu selections, primarily Tag-It™ Ashkenazi Jewish Panel (AJP) and Tag-It™ CF70 reagents. Luminex instrument placements continued in the quarter through direct customer

purchases and the Company’s reagent rental programs. Instrument sales were $293,123 for the first quarter of 2006 as compared with $nil in 2005. Licensing and development fees received in the quarter reflect royalties on the sales by Luminex of “FlexMap beads”™, development fees reflecting the on-going pro-rata recognition of deferred milestone revenue and contract research fees. These fees grew from $33,347 in the first quarter of 2005 to $114,587 in 2006 due primarily to $81,627 in revenue earned from the collaborative development program for the Oncovue™, Intergenetics breast cancer risk test, and the pro-rata recognition of the milestone payment received from Genzyme in the second quarter of 2005.

Standard reagent product margins were 57% for the quarter ended March 31, 2006 as compared with 63% for the same period in 2005. Standard reagent product margin is calculated by subtracting standard reagent cost of goods sold and genetic content royalties costs from reagent product sales. The result is then divided by reagent product sales for the period. The measure of standard reagent product margins provides information on the margins of the Company excluding inefficiencies and yield volatility associated with the early stages of the Company’s manufacturing and revenue scale-up. The 6% decline is due in part to the additional amortization associated with the Abbott fundamental patent licensed in the third quarter of 2005 and in part to non-recurring favourable adjustments in the first quarter of 2005 to royalties which had been overpaid in 2004. In addition, the Company recognized a royalty charge in anticipation of concluding an agreement for certain markers related to its cystic fibrosis products.

This quarter includes improvements in operational efficiency with period charges for the first quarter representing 7% of total cost of goods sold down from 22% in the first quarter of 2005, and reduced inventory adjustments representing 2.6% of total cost of goods sold in the first quarter of 2006 as against 10.4% for the corresponding period in 2005.

Cost of goods sold for the quarter also includes instrument costs of $288,046 (2005 - $nil) and custom development costs of $71,383 associated with the work done for Intergenetics. Total margins were 44% and 45% for the first quarters of 2006 and 2005, respectively.

Expenses

Total expenses, excluding cost of goods sold, for the three-month period ended March 31, 2006 increased by $1,396,016 to $4,669,805 as compared with $3,273,789 in the same period in 2005. Sales, general and administration (SG&A) for the first quarter of 2006 grew by $1,408,498 to $3,642,404 from $2,233,906 in 2005, driven primarily by headcount growth in the medical and regulatory, marketing and business development, and technical support functions, as well as in the newly formed intellectual property and human resources functions. The increase in headcount reflects the Company’s growing customer base and expanded licensing activities as well as its 2006 drive for regulatory clearance on multiple products. In Marketing, product managers were added to specifically support the growth into new markets, and to support the increased presence within existing markets. During 2006, the Company improved its employee benefits plan in order to remain competitive within the market. Other contributing factors were increases in facilities related to headcount growth, increased marketing program expenditures on the new products, professional services and validation and verification materials.

Research and development expense decreased by $12,482 to $1,027,401 in the first quarter of 2006 from $1,039,883 in the same period in 2005, primarily due to variability in the use of reagents and consumables costs associated with specific projects.

Interest expense from long-term debt increased from $574,548 in the first quarter of 2005 to $711,524 in the first quarter in 2006, an increase of $136,976. The increased interest expense reflects the increased debt resulting from the Company’s debenture refinancing concluded in November of 2005. Of the increase, cash interest paid accounted for $3,846, while non-cash interest charges related to accretion of related warrant expense constitutes the balance.

Capital and Liquidity

Working capital at March 31, 2006 was $4,172,988 including cash and cash equivalents and short-term investments of $7,514,788, compared with $12,807,061 and $16,014,629, respectively

as at December 31, 2005.

The purchase of capital assets for the quarter amounted to $537,683 and intangible assets to $4,020,481. For the fourth quarter of 2005, the amounts were $1,144,266 and $71,231 respectively. The majority of capital asset additions in the first quarter ($429,842) related to the completion of the product development laboratory expansion undertaken in the third quarter of 2005. An additional $66,676 relates to headcount related capital such as furniture and computer equipment.

The purchase of intangible assets relates primarily to the exclusive commercial license agreement signed by the Company on March 17, 2006 with Sirius Genomics Inc. for specific biomarkers related to drugs used to treat severe sepsis and risk of sepsis.

Under the terms of the agreement, the Company will provide up front payments totalling $4,000,000 to acquire the license. These license payments have been accounted for as an intangible asset and will be amortized over 5 years. Until the Company commercializes a product resulting from the biomarkers, the amortization will be charged to research and development, after which time it will be charged to cost of goods sold.

The $4,000,000 of license payments to Sirius have a right of offset against royalties payable to Sirius upon commercialization of products developed by the Company from the biomarkers. The up front payments are comprised of two separate payments of $2,000,000 each. The first $2,000,000 was due upon signing of the agreement, and was paid on April 3, 2006, and the second payment is due September 6, 2006

The $4,000,000 up front payments bear interest on an annual rate at a floor of 10%, a ceiling of 25% and a rate between the floor and ceiling that varies in accordance with Sirius’ performance.

Interest earned forms part of the right of set-off against future royalties payable to Sirius. As receipt of the interest is contingent on the successful commercialization of products by the Company, the interest is not being accrued at this time.

Development costs incurred will be shared equally between the two parties. Commercialization costs incurred will be shared equally until such time as a product operating profit is generated, after which time they will be included in the calculation of net profit. The Company will pay a royalty to Sirius equal to 50% of the net profit on the commercialization of the products. Any such payments will be made to Sirius after offset of the up front payments plus accrued interest.

On December 12, 2003, the Company entered into an agreement with the Ministry of Industry of the Government of Canada under which the government will invest up to $7,300,000 of the Company's $25,000,000 project to establish novel processes, capabilities and facilities relating to the development of several genetic tests. The Company did not receive any funds from TPC in the first quarter (2005 - $nil), however funds of $551,384 were received in the second quarter bringing the outstanding balance of the TPC funds advanced to $3,651,410. Over the course of 2006, the Company expects to file claims with TPC for reimbursement totalling approximately $2.0 million.

Operating activities used $7,941,677 of cash in the quarter. $3,318,715 of the cash used related to the consolidated statement of loss and deficit, and $4,622,962 was used by changes in non-cash working capital balances. Of the $4,622,962, trade receivables increased $1,064,471 from year-end, caused by a single customer order received and filled late in the quarter for $1,144,000 which was subsequently collected. Inventory increased by $519,035 rowing primarily to an increase in finished goods inventory to support forecast revenue growth and to optimize lot production efficiencies.

Finally, accounts payable and accrued liabilities increased by $2,412,985 attributable primarily to the $4,000,000 accrual of the Sirius up front payment which was offset by the payment of two non-recurring accruals, the first being the final instalment of the license rights to certain intangible property secured from Abbott Laboratories, which was made in January 2006, and the second being payments against the construction work performed in the second half of 2005 related to the completion of the product development laboratory and equipment.

In the first quarter of 2006, foreign exchange loss was $25,879 as compared to a gain of $1,611 during the first quarter of 2005. This amount is comprised of a loss of $40,004 related to U.S. denominated long-term debt and a gain of $14,125 due to the declining Canadian dollar against the Company’s U.S. dollar denominated receivables.

At quarter end, 93% of the Company’s accounts receivable were denominated in U.S. dollars. This exposure was more than offset as 18% of the Company’s accounts payable and accruals, as well as the convertible portion of its long term debt is also denominated in U.S. dollars. The Company’s net exposure to the U.S. dollar at quarter end is a liability of $12,637,258 (measured in CDN dollars). A 1% appreciation or devaluation of the Canadian against the U.S. dollar would result in a net foreign exchange gain or loss respectively of $126,373.

Since its inception, the Company has been financing its infrastructure and product development as well as its commercialization activities from public equity financing, debt and revenue from the sales of its products and licenses related to its technologies. The Company has also received funds from government agencies and from development agreements with Corporate partners. As at March 31, 2006, the Company had working capital of $4.1 million and cash and cash equivalents and short-term investments of $7.5 million. The Company expects revenue and margins from its existing products to continue to grow significantly quarter over quarter through 2006. The Company will also be investing in enhancing the regulatory status of its product menu, and undertaking significant marketing and sales efforts in the areas of PGx and infectious disease. In order to pursue its expanded regulatory drive, submit products for FDA certification in 2006, as well as open new markets for its RVP and sepsis tests, all the while continuing to serve its growing customer base, the Company foresees a need for growth capital in the future. Management remains responsive to market conditions and may seek additional capital from traditional sources or through strategic partnerships as opportunities arise.

Quarterly selected financial information 2006, 2005 and 2004

| | | | 2006 | | 2005 | | 2004 |

| | | | 1st quarter | | | 4th quarter | | | 3rd quarter | | | 2nd quarter | | | 1st quarter | | | | 4th quarter | | | 3rd quarter | | | 2nd quarter | |

Revenue | | $ | 2,908,074 | | $ | 2,401,329 | | $ | 2,207,652 | | $ | 1,989,906 | | $ | 1,075,283 | | | $ | 1,369,985 | | $ | 1,098,954 | | $ | 502,773 | |

Net Loss | | | ($4,148,806 | ) | | ($4,956,963 | ) | | ($3,089,168 | ) | | ($3,675,783 | ) | | ($3,445,552 | ) | | | ($3,291,392 | ) | | ($3,039,447 | ) | | ($3,430,697 | ) |

Net Loss per share | | $ | (0.09 | ) | $ | (0.12 | ) | $ | (0.07 | ) | $ | (0.10 | ) | $ | (0.09 | ) | | $ | (0.09 | ) | $ | (0.09 | ) | $ | (0.10 | ) |

Contractual arrangements and commitments

| | | | Total | | | Less than 1 year | | | 1 - 3 years | | | 4 - 5 years | | | After 5 years | |

| Convertible debenture | | $ | 11,908,627 | | $ | 4,959,407 | | $ | 6,949,220 | | | ¾ | | | ¾ | |

| TPC | | $ | 5,203,511 | | | ¾ | | $ | 472,749 | | $ | 4,287,124 | | $ | 443,638 | |

| Operating leases | | $ | 2,748,466 | | $ | 945,015 | | $ | 1,785,128 | | $ | 18,323 | | | ¾ | |

| Purchase obligations | | $ | 220,320 | | $ | 213,811 | | $ | 3,004 | | $ | 3,004 | | $ | 501 | |

Deferred share Units(1) | | $ | 377,825 | | $ | 20,500 | | | ¾ | | | ¾ | | $ | 357,325 | |

Total Contractual Arrangements | | $ | 20,458,749 | | $ | 6,138,733 | | $ | 9,210,101 | | $ | 4,308,451 | | $ | 801,464 | |

| | (1) | - Payment of Deferred share units is not made until the last business day in December of the first calendar year commencing after the director leaves the Board, and may be in cash or in common shares of the Company, at the discretion of the director. As the directors are elected annually, the DSUs which are not currently due have been classified as ‘After 5 years’. |

Changes and adoptions of accounting policies

Intangible assets

Intangible assets related to genetic marker licenses which are acquired during the research and development phase of a product’s life are amortized from the date of acquisition, over a 5 year expected product life cycle inclusive of the research and development period.

Restatements

(a) Intangible Assets

The Company reviewed its accounting for the rights acquired from Sirius Genomics Inc. (“Sirius”) on March 17, 2006 and has determined that the amounts payable for the rights should be classified as an intangible asset related to a marker license rather than a license fee advance. The Company has therefore reclassified the first $2,000,000 payment to Sirius as an intangible asset and has recorded the second $2,000,000 payment as an intangible asset and an accrued liability as at the inception of the agreement. The second payment had been previously disclosed in the Management Discussion and Analysis as a commitment due within one year and in the notes to the consolidated financial statements. As an intangible asset with an economic life associated with the related products, the value of the marker license will be amortized straight line over 5 years. Until the first commercial sale, the amortization will be charged to research and development, after which it will be charged to cost of goods sold. For the three month period ended March 31, 2006, the Company has charged amortization expense of $31,111 on this intangible asset to research and development. These non-cash adjustments are reflected in the consolidated financial statements. In addition, the agreement with Sirius provides for interest to be earned by the Company on the payments made with respect to acquiring the rights to the markers. As the collection of these amounts form part of a right of offset related to future royalties payable to Sirius which is predicated on the commercial success of the associated commercial product, the Company will not recognize any interest earned on the payments until they are realized through the right of offset.

(b) Royalties

Under CICA Handbook Section 3290, Contingencies, the Company is required to accrue amounts for contingent liabilities which are likely to occur. Such a situation existed in the first quarter of 2006 when negotiations with the owner of a genetic license for certain markers incorporated in the Company’s cystic fibrosis test had progressed to a point where an agreement was determined to be likely, but where the Company was still negotiating on the royalty rate to achieve the best possible outcome. It is the Company’s view that a reasonable assessment of a royalty rate given the uncertainty surrounding the outcome of the negotiations would be $20,000 USD . The Company has accrued $23,212 as a one time charge to cost of goods sold for this estimated content license. This non-cash adjustment is reflected in the financial statements.

Critical accounting estimates

Provision for doubtful accounts

The Company relies on its credit approval process and historical experience to evaluate the exposure to the potential for non-performing receivables. At quarter end, trade accounts receivable were outstanding from large and financially sound commercial laboratories. Management estimates that no further provision for doubtful account is required as at March 31, 2006.

Inventory provisions

At quarter-end, the Company performed a full count and reconciliation of its physical inventory. In addition, substantial work was performed to ensure that:

| | • | an appropriate amount of labour and overhead expense was included in year-end inventory balances based on normalized capacity; |

| | • | the full cost of inventories were realizable in the context of the Company’s existing and prospective sales contracts and |

| | • | the volume of inventories did not exceed a reasonable forecast of future sales. |

Based on these reviews, management has provided appropriately for realization of inventory balances as at March 31, 2006 by expensing $21,260 during the first quarter of 2006 (2005 - $40,093) and maintaining a provision of $25,776 as at March 31, 2006 (2005 - $68,054).

Equity based instruments

Each time the Company issued equity based instruments, including common share purchase warrants, agent’s compensation options and employee stock options, a value was derived for the instrument using the Black-Scholes option pricing model. The application of this pricing model requires the determination of several variables, including the price volatility of the Company’s stock over a relevant timeframe, a conversion or exercise assumption related to the particular instrument, the determination of a relevant risk free rate and an assumption of the Company’s dividend policy in the future. Management has adopted a consistent implementation of the Black-Scholes model, source of variables and application of a framework to determine appropriate inputs.

Warranties

It is the Company’s revenue recognition policy to provide for estimated warranty expense when product revenue is recognized. Beginning in the third quarter of fiscal 2004, the Company introduced a second form of warranty, reagent rental-based warranty, in addition to its existing product-based warranty. The reagent rental warranty provides service coverage to Luminex instruments placed with customers on reagent rental programs.

With respect to the product-based warranty, the Company’s customers continue to validate specific production lots which each customer had previously ascertained had met appropriate performance characteristics. As a result, management determined that no product warranty provision was required at March 31, 2006 (2005 - nil). Management has provided $61,248 with respect to reagent rental-based instrument extended warranty obligations at March 31, 2006 (2005 - $nil).

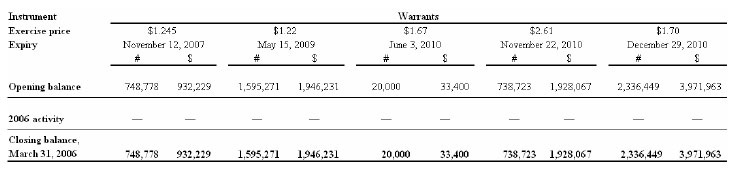

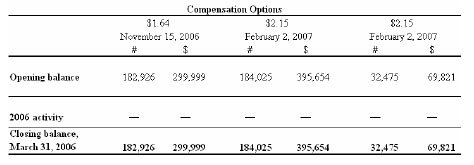

Warrants and compensation options

The following charts depict the potential cash value to the Company of outstanding warrants and compensation options as at March 31, 2006:

Royalties

The Company in engaged in negotiations related to a license for genetic markers on its cystic fibrosis products. The Company has determined that a contract will likely be concluded and has estimated a royalty of $20,000 USD based on the Company’s prior experience and expectations. The final royalty rate agreed may be materially higher.

Subsequent Event

On September 5, 2006, the Company amended its agreement with Sirius to defer the $2,000,000 license payment originally due on September 6, 2006 to the earlier of 90 days following receipt by the Company from Sirius of certain data related to the biomarkers required for regulatory submission and October 12, 2007. In connection with this deferral, the Company will pay interest at an annual rate of 16.6% on the deferred amount until the funds are paid to Sirius. As well, interest on the first license payment made in April 2006 will not begin to accrue interest in favour of the Company to be offset against future royalty payments to Sirius until October 12, 2007. Interest accruing in favour of the Company on the second license payment will begin accruing from the date of such payment.

Risks and uncertainties

Prospects for companies in the biotechnology industry generally may be regarded as uncertain given the nature of the industry and, accordingly, investments in biotechnology companies should be regarded as speculative. Biotechnology research and development involves a high and significant degree of risk. An investor should carefully consider the risks and uncertainties described herein and in the Company’s annual information form for the financial year ended December 31, 2005, as well as other information contained in this Management’s Discussion and Analysis of Operating Results. Additional risks and uncertainties not presently known to the Company or that the Company believes to be immaterial may also adversely affect the Company’s business. If any one or more of these risks occur, the Company’s business, financial condition and results of operations could be seriously harmed. Further, if the Company fails to meet the expectations of the public, the market price of the Company’s common share could decline.

Forward-looking statement

This Management’s Discussion and Analysis of Operating Results and accompanying President’s message for the interim period ended March 31, 2006 contains certain forward-looking statements with respect to Tm Bioscience Corporation. These include statements about management’s expectations, beliefs, intentions or strategies for the future, which are indicated by words such as “vision”, “may”, “will”, “should”, “plan”, “anticipate”, “believe”, “intend”, “potential”, “estimate”, “forecast”, “project”, “predict” and “expect” or the negative of these terms or other similar expressions concerning matters that are not historical facts. In particular, statements regarding the Company’s future operating results, economic performance and product

development efforts are or involve forward-looking statements. More specifically, statements about the planned development of diagnostic genetic tests, including the Company’s ID-Tag™ RVP panel and sepsis tests, the potential efficacy of such tests, the anticipated timing of the commercial launch, the approximate revenues and earnings that will be generated by such tests and the market penetration Tm will obtain for such tests, are forward-looking statements.

These forward-looking statements are based on certain factors and assumptions. The Company has assumed that it will submit its PGx, sepsis, warfarin and ID-Tag™ RVP tests for regulatory approval as disclosed above (and in the case of the sepsis test, possibly 2007), that it will receive the necessary regulatory approvals from the FDA, European and Canadian regulatory authorities within one year of submission, and that as part of such approval the FDA and European regulatory authorities will have reviewed, as required, clinical and analytical validation of the sepsis, RVP, warfarin and PGx tests. The Company has also assumed that it will have sufficient capital to develop and commercially roll-out and manufacture sufficient quantities of its tests and that phamacogenomic testing and genetic testing for infectious diseases including sepsis will become more widespread. With respect to the sepsis test specifically, the Company has assumed that it will be able to successfully develop the sepsis test in two versions, as a real-time assay and in a Tag-It ™ format. With respect to revenue generation and market penetration of the sepsis test, the Company has assumed that it will launch the sepsis test in the United States in both forms (i.e., as a real-time assay and in a Tag-It ™ format) following receipt of the necessary regulatory approvals, that it will be able to sell the sepsis test at a price ranging from U.S.$300 to U.S.$500 per test, that there will be reimbursement available for this test by both private and public healthcare insurers, that there will be approximately 750,000 sepsis cases a year in each of the United States and the European Union, that the Company will achieve approximately 20% market penetration in both markets by the third year following launch, that the $U.S./$Cdn. exchange rate and the Euro/$Cdn. exchange rate will remain relatively constant at current rates, that the Company will sell the product directly to hospitals, that there will be no other directly competing technological or competitive advances in the treatment of sepsis, that Xigris® and vasopressin will continue to be widely used in the treatment of sepsis, that the Company will continue to enjoy the exclusive use of the patents to be licensed from Sirius, that these patents are and will remain valid and enforceable and that sufficient revenue and earnings will be generated from the sepsis test to recover the $4 million licence fee advance paid to Sirius in the forecast timeframe. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking statements are not guarantees of future performance and by their nature necessarily involve risks and uncertainties that could cause the actual results to differ materially from those contemplated by such statements including, without limitation: the risk that the factors and assumptions underlying the forward-looking statements may prove to be incorrect; the difficulty of predicting regulatory approvals particularly the timing and conditions precedent to obtaining any regulatory approval; market acceptance and demand for new products; the availability of appropriate genetic content and other materials required for the Company’s products; the Company’s ability to manufacture its products on a large scale; the protection of intellectual property connected with genetic content; the impact of competitive products, currency fluctuations; risks associated with the Company’s manufacturing facility; and any other similar or related risks and uncertainties. Additional risks and uncertainties affecting the Company can be found in the Company’s 2005 Annual report, available on SEDAR at www.sedar.com. If any of these risks or uncertainties were to materialize, actual results of the Company could vary materially from those that are expressed or implied by these forward-looking statements.

You should not place undue importance on forward-looking statements and should not rely on them as of any other date. Except as may be required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Other Information

Additional information relating to the Company, including the Company’s most recently filed annual information form, can be found on SEDAR at www.sedar.com.

Consolidated Financial Statements

Tm Bioscience Corporation

March 31, 2006

Statement of Management Responsibility

The accompanying consolidated financial statements are the responsibility of Management and have been approved by the Audit Committee on behalf of the Board of Directors of the Company. Management is responsible for and has prepared and presented the consolidated financial statements in accordance with accounting principles generally accepted in Canada and has made any significant accounting judgments and estimates required. Management has ensured that financial information contained elsewhere in this Quarterly Report is consistent with the consolidated financial statements.

Management has developed and maintains systems of internal controls designed to provide reasonable assurance that reliable and relevant financial information is produced. Policies and procedures are designed to give reasonable assurance that transactions are properly authorized, assets are safeguarded and financial records properly maintained to provide reliable consolidated financial statements.

The Board of Directors is responsible for reviewing and approving the consolidated financial statements and ensuring management meets their financial reporting responsibilities.

The Audit Committee consists solely of directors who are not officers of the Company and reviews with Management and the external auditors, the quarterly consolidated financial statements of the Company prior to final approval. The Audit Committee also meets during the year with Management and the external auditors to discuss internal control issues, auditing matters, and financial reporting issues. External auditors have free access to the Audit Committee without obtaining prior Management approval.

| November 16, 2006 | Greg Hines, B.Sc., C.I.M. | James Pelot, B.Comm., CA |

| | President and CEO | Chief Financial Officer |

Tm Bioscience Corporation

Interim Report

(Unaudited)

CONSOLIDATED BALANCE SHEETS

[see Basis of Presentation - note 1]

| | | | | | Restated | | | | |

| | | As at March 31, | | | As at March 31, | | | As at December 31, | |

| | | | 2006 | | | 2006 | | | 2005 | |

| | | | $ | | | $ | | | | |

| | | | | | | [note3] | | | | |

ASSETS [note 7[b]] | | | | | | | | | | |

Current | | | | | | | | | | |

| Cash and cash equivalents | | | | | | 2,429,106 | | | 8,972,594 | |

Short-term investments [note 4] | | | 5,085,682 | | | 5,085,682 | | | 7,042,035 | |

Trade accounts receivable [note 10] | | | 2,309,804 | | | 2,309,804 | | | 1,245,333 | |

| Other accounts receivable | | | 892,071 | | | 892,071 | | | 613,680 | |

Inventory [note 5] | | | 4,138,749 | | | 4,138,749 | | | 3,619,714 | |

| Prepaid expenses | | | 348,035 | | | 348,035 | | | 46,305 | |

Total current assets | | | 15,203,447 | | | 15,203,447 | | | 21,539,661 | |

| Capital assets, net | | | 4,561,845 | | | 4,561,845 | | | 4,340,712 | |

Intangible assets, net [notes 3 and 6] | | | 2,681,195 | | | 6,650,084 | | | 2,765,363 | |

| Deferred financing costs, net | | | 711,665 | | | 711,665 | | | 777,901 | |

| Other asset | | | 1,438,347 | | | 1,438,347 | | | 1,438,347 | |

License fee advances [note 3] | | | 2,000,000 | | | - | | | - | |

| | | | 26,596,499 | | | 28,565,388 | | | 30,861,984 | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | |

Current | | | | | | | | | | |

Accounts payable and accrued liabilities [notes 3 and 10] | | | 5,599,619 | | | 7,622,831 | | | 6,049,940 | |

| Current portion of deferred revenue | | | 122,497 | | | 122,497 | | | 123,805 | |

Current portion of long-term debt [note 7] | | | 3,235,966 | | | 3,235,966 | | | 2,476,582 | |

| Income taxes payable | | | 49,165 | | | 49,165 | | | 82,273 | |

Total current liabilities | | | 9,007,247 | | | 11,030,459 | | | 8,732,600 | |

| Deferred leasehold inducement | | | 332,020 | | | 332,020 | | | 348,118 | |

| | | | | | | | | | | |

| Deferred revenue | | | 112,036 | | | 112,036 | | | 123,970 | |

| | | | | | | | | | | |

Deferred share units [note 9] | | | 357,325 | | | 357,325 | | | 301,075 | |

| | | | | | | | | | | |

Long-term debt [note 7] | | | 8,378,027 | | | 8,378,027 | | | 9,033,181 | |

Total liabilities | | | 18,186,655 | | | 20,209,867 | | | 18,538,944 | |

Shareholders' equity | | | | | | | | | | |

Capital stock [note 8] | | | 66,871,280 | | | 66,871,280 | | | 66,871,280 | |

| | | | | | | | | | | |

Contributed surplus [note 8] | | | 10,119,242 | | | 10,119,242 | | | 9,937,955 | |

| Deficit | | | (68,580,678 | ) | | (68,635,001 | ) | | (64,486,195 | ) |

Total shareholders' equity | | | 8,409,844 | | | 8,355,521 | | | 12,323,040 | |

| | | | 26,596,499 | | | 28,565,388 | | | 30,861,984 | |

See accompanying notes

On behalf of the Board:

| | | |

| Director (Signed) Gregory C. Hines | | Director (Signed) John R. Frederick |

Tm Bioscience Corporation

Interim Report

(Unaudited)

CONSOLIDATED STATEMENTS OF LOSS AND DEFICIT

| | | | | | Three Months Ended | | | | |

| | | | | | | March 31 | | | | |

| | | | | | | Restated | | | | |

| | | | 2006 | | | 2006 | | | 2005 | |

| | | | $ | | | $ | | | | |

| | | | | | | [note3] | | | | |

| | | | | | | | | | | |

Revenue | | | 2,908,074 | | | 2,908,074 | | | 1,075,283 | |

| | | | | | | | | | | |

Expenses | | | | | | | | | | |

| Cost of goods sold | | | 1,593,093 | | | 1,616,305 | | | 594,267 | |

| Research and development, net | | | 996,290 | | | 1,027,401 | | | 1,039,883 | |

| Sales, general and administrative | | | 3,642,404 | | | 3,642,404 | | | 2,233,906 | |

| | | | | | | | | | | |

| | | | 6,231,787 | | | 6,286,110 | | | 3,868,056 | |

Loss before the undernoted | | | (3,323,713 | ) | | (3,378,036 | ) | | (2,792,773 | ) |

| Interest expense on long-term debt | | | (711,524 | ) | | (711,524 | ) | | (574,548 | ) |

| Other financial expense, net | | | (47,640 | ) | | (47,640 | ) | | (69,131 | ) |

Loss before income taxes | | | (4,082,877 | ) | | (4,137,200 | ) | | (3,436,452 | ) |

| Income tax expense | | | (11,606 | ) | | (11,606 | ) | | (9,100 | ) |

Net loss for the period | | | (4,094,483 | ) | | (4,148,806 | ) | | (3,445,552 | ) |

| Deficit, beginning of period | | | (64,486,195 | ) | | (64,486,195 | ) | | (49,318,729 | ) |

| | | | | | | | | | | |

Deficit, end of period | | | (68,580,678 | ) | | (68,635,001 | ) | | (52,764,281 | ) |

Basic and diluted loss per common share[note 8] | | | (0.09 | ) | | (0.09 | ) | | (0.09 | ) |

| | | | | | | | | | | |

Weighted average number of common shares outstanding[note 8] | | | 47,715,224 | | | 47,715,224 | | | 37,674,137 | |

| Basic and diluted | | | | | | | | | | |

See accompanying notes

Tm Bioscience Corporation

Interim Report

(Unaudited)

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | Three Months Ended | | | | |

| | | | | | March 31 | | | | |

| | | | | | Restated | | | | |

| | | | 2006 | | | 2006 | | | 2005 | |

| | | | $ | | | $ | | | | |

| | | | | | | [note3] | | | | |

OPERATING ACTIVITIES | | | | | | | | | | |

| | | | | | | | | | | |

| Net loss for the period | | | (4,094,483 | ) | | (4,148,806 | ) | | (3,445,552 | ) |

| | | | | | | | | | | |

| Add (deduct) items not involving cash: | | | | | | | | | | |

Depreciation and amortization | | | 421,199 | | | 452,310 | | | 287,816 | |

Amortization of deferred leasehold inducement | | | (16,098 | ) | | (16,098 | ) | | (14,847 | ) |

Accretion of loan discount | | | — | | | — | | | 258,653 | |

Accretion of convertible debenture discount | | | (47,873 | ) | | (47,873 | ) | | — | |

Amortization of deferred financing costs | | | 66,236 | | | 66,236 | | | 96,955 | |

Stock option compensation expense and deferred share units [note 9] | | | 237,537 | | | 237,537 | | | 243,363 | |

Government loan interest accrual | | | 112,099 | | | 112,099 | | | 60,202 | |

Loss (gain) on foreign exchange [note 10] | | | 25,880 | | | 25,880 | | | (1,611 | ) |

| | | | (3,295,503 | ) | | (3,318,715 | ) | | (2,515,021 | ) |

| | | | | | | | | | | |

| Changes in non-cash working capital balances related to operations: | | | | | | | | | | |

Increase in trade accounts receivable | | | (1,064,471 | ) | | (1,064,471 | ) | | (257,956 | ) |

Increase in other accounts receivable | | | (278,391 | ) | | (278,391 | ) | | (109,387 | ) |

Increase in inventory | | | (519,035 | ) | | (519,035 | ) | | (243,427 | ) |

Increase in prepaid expenses | | | (301,730 | ) | | (301,730 | ) | | (67,756 | ) |

Decrease in deferred revenue | | | (13,242 | ) | | (13,242 | ) | | (21,337 | ) |

Decrease in accounts payable and accrued liabilities | | | (2,436,197 | ) | | (2,412,985 | ) | | (551,993 | ) |

Decrease (increase) in income taxes payable | | | (33,108 | ) | | (33,108 | ) | | 9,100 | |

Cash used in operating activities | | | (7,941,677 | ) | | (7,941,677 | ) | | (3,757,777 | ) |

| | | | | | | | | | | |

INVESTING ACTIVITIES | | | | | | | | | | |

| Purchase of capital assets | | | (537,683 | ) | | (537,683 | ) | | (185,751 | ) |

| Purchase of intangible assets | | | (20,481 | ) | | (20,481 | ) | | (34,735 | ) |

| Purchase of short-term investments | | | (9,373,304 | ) | | (9,373,304 | ) | | (12,429,989 | ) |

| Sale of short-term investments | | | 11,329,657 | | | 11,329,657 | | | 6,575,469 | |

Cash provided by (used in) investing activities | | | 1,398,189 | | | 1,398,189 | | | (6,075,006 | ) |

| | | | | | | | | | | |

FINANCING ACTIVITIES | | | | | | | | | | |

| Share issuance costs | | | — | | | — | | | (772,542 | ) |

| Issuance of common shares | | | — | | | — | | | 9,687,771 | |

Cash provided by financing activities | | | — | | | — | | | 8,915,229 | |

Net decrease in cash and cash equivalents during the period | | | (6,543,488 | ) | | (6,543,488 | ) | | (917,554 | ) |

| Cash and cash equivalents, beginning of period | | | 8,972,594 | | | 8,972,594 | | | 1,333,228 | |

Cash and cash equivalents, end of period | | | 2,429,106 | | | 2,429,106 | | | 415,674 | |

| | | | | | | | | | | |

Supplemental cash flow information | | | | | | | | | | |

| Income taxes paid | | | 77,748 | | | 77,748 | | | — | |

| Interest paid | | | 259,539 | | | 259,539 | | | 255,693 | |

See accompanying notes

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

1. BASIS OF PRESENTATION

These consolidated financial statements of Tm Bioscience Corporation ["Tm" or the "Company"] have been prepared in accordance with Canadian generally accepted accounting principles on a going concern basis which presumes the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

As at March 31, 2006, the Company had working capital of $4,172,988 and an accumulated deficit of $68,635,001 resulting from losses in the current and prior periods. As the Company is in the early stages of commercialization for its products, the Company’s ability to continue operations is uncertain and is dependent upon its ability to obtain sufficient financing and improve operating results.

These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue operations in the normal course of business. Such adjustments could be material.

2. ACCOUNTING POLICIES

These consolidated financial statements include the accounts of Tm, its wholly owned U.S. subsidiaries, Tm Technologies, Inc., and Tm Bioscience, Inc., and two wholly owned Canadian subsidiaries, Tm Bioscience PGX Inc. and Tm Bioscience HG Inc. All intercompany balances and transactions have been eliminated. The consolidated financial entity shall be referred to herein as the "Company". There were no new applicable pronouncements under Canadian Generally Accepted Accounting Principles ["GAAP"] which would result in changes to accounting policies since the year ended December 31, 2005. These consolidated financial statements have been prepared in accordance with Canadian GAAP using the same accounting policies as were applied in the audited consolidated financial statements for the year ended December 31, 2005. Additions to accounting policies since year-end 2005 reflecting new transaction types are disclosed below. These interim consolidated financial statements do not include all of the disclosure included in the Company’s annual audited consolidated financial statements. Accordingly, these interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2005.

Intangible assets

Intangible assets related to genetic marker licenses which are acquired during the research and development phase of a product’s life are amortized from the date of acquisition, over a 5 year expected product life cycle inclusive of the research and development period.

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

3. RESTATEMENTS

(a) Intangible Assets

The Company reviewed its accounting for the rights acquired from Sirius Genomics Inc. (“Sirius”) on March 17, 2006 and has determined that the amounts payable for the rights should be classified as an intangible asset related to a marker license rather than a license fee advance. The Company has therefore reclassified the first $2,000,000 payment to Sirius as an intangible asset and has recorded the second $2,000,000 payment as an intangible asset and an accrued liability as at the inception of the agreement. The second payment had been previously disclosed in the Management Discussion and Analysis as a commitment due within one year and in the notes to the consolidated financial statements. As an intangible asset with an economic life associated with the related products, the value of the marker license will be amortized straight line over 5 years. Until the first commercial sale, the amortization will be charged to research and development, after which it will be charged to cost of goods sold. For the three month period ended March 31, 2006, the Company has charged amortization expense of $31,111 on this intangible asset to research and development. These non-cash adjustments are reflected in the consolidated financial statements. In addition, the agreement with Sirius provides for interest to be earned by the Company on the payments made with respect to acquiring the rights to the markers. As the collection of these amounts form part of a right of offset related to future royalties payable to Sirius which is predicated on the commercial success of the associated commercial product, the Company will not recognize any interest earned on the payments until they are realized through the right of offset.

(b) Royalties

Under CICA Handbook Section 3290, “Contingencies”, the Company is required to accrue amounts for contingent liabilities which are likely to occur. Such a situation existed in the first quarter of 2006 when negotiations with the owner of a genetic license for certain markers incorporated in the Company’s cystic fibrosis test had progressed to a point where an agreement was determined to be likely, but where the Company was still negotiating on the royalty rate to achieve the best possible outcome. It is the Company’s view that a reasonable assessment of a royalty rate given the uncertainty surrounding the outcome of the negotiations would be $20,000 USD. The Company has accrued $23,212 as a one time charge to cost of goods sold for this estimated content license. This non-cash adjustment is reflected in the financial statements.

4. SHORT-TERM INVESTMENTS

Short-term investments consist of the following:

| | | Balance as at | | | Balance as at | |

| | | | March 31,2006 | | | December 31,2005 | |

| | | | $ | | | $ | |

| Commercial paper and government bonds | | | 5,050,682 | | | 7,007,035 | |

| Guaranteed investment certificates | | | 35,000 | | | 35,000 | |

| | | | 5,085,682 | | | 7,042,035 | |

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

4. SHORT-TERM INVESTMENTS (continued)

The Company invests cash on hand in fully liquid commercial paper and government bonds. At March 31, 2006, annualized yield to maturity on short-term investments ranged from 3.22% to 3.91% [December 31, 2005 - 2.20% to 2.40%]. Interest income for the three months ended March 31, 2006 was $89,244 [2005 - $39,185]. The Company purchases only investment-grade instruments comprised of bonds with a rating of A or better, as well as bankers’ acceptances and money market instruments with a rating of R1Mid or higher.

5. INVENTORY

Inventory consists of the following:

| | | Balance as at | | | Balance as at | |

| | | March 31,2006 | | | December 31,2005 | |

| | | | $ | | | $ | |

| Raw materials | | | 497,881 | | | 940,640 | |

| Work-in-process | | | 2,245,539 | | | 1,884,821 | |

| Finished goods | | | 1,352,436 | | | 762,206 | |

| Packaging | | | 42,893 | | | 32,047 | |

| | | | 4,138,749 | | | 3,619,714 | |

6. INTANGIBLE ASSETS

On March 17, 2006, the Company signed an agreement with Sirius for an exclusive commercial license to patents from Sirius for specific biomarkers related to drugs used to treat severe sepsis and risk of sepsis.

Under the terms of the agreement, the Company will provide up front payments totalling $4,000,000 to acquire the license. These license payments have been accounted for as an intangible asset and will be amortized over 5 years. Until the Company commercializes a product resulting from the biomarkers, the amortization will be charged to research and development, after which time it will be charged to cost of goods sold.

The $4,000,000 of license payments to Sirius have a right of offset against royalties payable to Sirius upon commercialization of products developed by the Company from the biomarkers. The up front payments are comprised of two separate payments of $2,000,000 each. The first $2,000,000 was due upon signing of the agreement, and was paid on April 3, 2006, and the second payment is due September 6, 2006

The $4,000,000 up front payments bear interest on an annual rate at a floor of 10%, a ceiling of 25% and a rate between the floor and ceiling that varies in accordance with Sirius’ performance.

Interest earned forms part of the right of set-off against future royalties payable to Sirius. As

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

6. INTANGIBLE ASSETS (continued)

receipt of the interest is contingent on the successful commercialization of products by the Company, the interest is not being accrued at this time.

Development costs incurred will be shared equally between the two parties. Commercialization costs incurred will be shared equally until such time as a product operating profit is generated, after which time they will be included in the calculation of net profit. The Company will pay a royalty to Sirius equal to 50% of the net profit on the commercialization of the products. Any such payments will be made to Sirius after offset of the up front payments plus accrued interest.

7. LONG-TERM DEBT

Long-term debt is as follows:

| | | | $ | | | $ | | | | |

| | | TPC | | | Convertible | | | Total | |

| | | | [a] | | | debentures | | | | |

| | | | | | | [b] | | | | |

Principal outstanding - December 31, 2005 | | | 3,100,026 | | | 10,467,000 | | | 13,567,026 | |

| Less: amount representing future imputed interest | | | (856,876 | ) | | (1,406,215 | ) | | (2,263,091 | ) |

| Add: loan interest accrual | | | 205,828 | | | - | | | 205,828 | |

Recorded loan balance - December 31, 2005 | | | 2,448,978 | | | 9,060,785 | | | 11,509,763 | |

| Add: imputed interest charge | | | 56,616 | | | 280,627 | | | 337,243 | |

| Less: repayments due transferred to current liabilities | | | - | | | (328,500 | ) | | (328,500 | ) |

| Add: loan interest accrual | | | 55,483 | | | - | | | 55,483 | |

| Add: foreign exchange loss | | | - | | | 40,004 | | | 40,004 | |

Increase (decrease) in loan balance | | | 112,099 | | | (7,869 | ) | | 104,230 | |

Recorded loan balance - March 31, 2006 | | | 2,561,077 | | | 9,052,916 | | | 11,613,993 | |

Principal outstanding - March 31, 2006 | | | 3,100,026 | | | 10,183,500 | | | 13,283,526 | |

| Less: amount representing future imputed interest | | | (800,260 | ) | | (1,130,584 | ) | | (1,930,844 | ) |

| Add: loan interest accrual | | | 261,311 | | | - | | | 261,311 | |

Short-term portion - recorded loan balance | | | - | | | 3,235,966 | | | 3,235,966 | |

Long-term portion - recorded loan balance | | | 2,561,077 | | | 5,816,950 | | | 8,378,027 | |

| [a] | This amount represents funds advanced to the Company from Technology Partnerships Canada ["TPC"], a special operating program under the Ministry of Industry of the Government of Canada, under which the Government will invest up to $7,300,000 as detailed in the Company’s audited consolidated financial statements for the year ended December 31, 2005. |

| | |

| [b] | This amount represents amounts financed under the Laurus Master Fund, Ltd. ["Laurus"] convertible term note agreement signed by the Company on November 23, 2005. |

| | |

| | As security for the Company’s performance of its obligations under the Laurus convertible term note [the "Note"], the Company granted Laurus a continuing general security interest over all of the Company’s assets and its Subsidiaries. The Subsidiaries also unconditionally guaranteed the Company’s obligations and liabilities under the Note. As additional security in favour of Laurus, the Company pledged to Laurus its shares in its Subsidiaries. The terms of the Note include no specific financial covenants. |

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

8. CAPITAL STOCK

The authorized capital stock of the Company consists of unlimited preferred shares and unlimited common shares.

The preferred shares are non-voting, issuable in series, having such specific rights and privileges as may be deemed by the Board of Directors at the time of the creation of the series. The preferred shares have priority over the holders of the common shares with respect to dividends and return of capital on dissolution. No preferred shares have been issued. The common shares are voting and entitled to dividends as may be declared by the Board of Directors.

On June 25, 2004, following shareholder approval at the Company’s annual general meeting of shareholders, and all necessary regulatory approvals, the Company’s common shares commenced trading on the TSX on a consolidated basis of one (1) post-consolidation share for every five (5) pre-consolidation common shares. The following charts and figures have been retroactively restated to reflect the change in share number and price:

Issued and outstanding

| | | | | | | | | | Non-employee | |

| | | Common | | | | | | Compensation | |

| | | shares | | | Warrants | | | options | |

| | | | # | | | # | | | # | |

Balance, December 31, 2005 | | | 47,715,224 | | | 5,439,221 | | | 399,425 | |

| | | | | | | | | | | |

Balance, March 31, 2006 | | | 47,715,224 | | | 5,439,221 | | | 399,425 | |

The total number of shares reserved as at March 31, 2006 for the exercise of warrants, compensation options and the deferred share units is 6,035,322.

The maximum number of common shares of the Company issuable upon conversion under the Note varies in accordance with the Cdn.$/U.S.$ foreign exchange rate in effect at the time of each repayment but, for example, is 4,057,185 common shares at the period end exchange rate of Cdn.$1.168 per U.S.$1.00. The Company may repay the Note at any time upon 10 business days’ notice to Laurus for a premium equal to 130% of the principal amount outstanding at the time of such redemption.

| | | | | | | Contributed surplus | |

| | | | | | | | | | | | | | | | | | | | |

| | | Capital | | | | | | | | | | | | Stock | | | Conversion | |

| | | | stock | | | Total | | | Warrants | | | | | | options | | | | |

| | | | $ | | | $ | | | | | $ | | | | $ | | | | |

| | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2005 | | | 66,871,280 | | | 9,937,955 | | | 7,998,511 | | | 307,627 | | | 921,919 | | | 709,898 | |

2006 stock option compensation expense | | | - | | | 181,287 | | | - | | | - | | | - | | | - | |

Balance, March 31, 2006 | | | 66,871,280 | | | | | | 7,998,511 | | | 307,627 | | | 1,103,206 | | | 709,898 | |

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

8. CAPITAL STOCK (continued)

Loss per common share

Loss per common share has been calculated on the basis of net loss for the period divided by the weighted average number of common shares outstanding at the period end. After reflecting changes in the Company’s capital share structure due to the Company’s 2004 consolidation with one (1) post-consolidation common share equivalent to five (5) pre-consolidation common shares, the weighted average number of common shares outstanding for the three months ended March 31, 2006 was 47,715,224 [2005 - 37,674,137]. Diluted loss per common share was not calculated as the effect of converting the Laurus Note and exercise of the outstanding warrants, compensation options and employee stock options would be anti-dilutive.

9. STOCK-BASED COMPENSATION PLAN

Under the transitional provision of revised CICA Section 3870, "Stock-Based Compensation and other Stock-Based Payments", the Company has adopted the fair value method of accounting for the stock options granted under its Share Option Plan in the year ended December 31, 2003. The prospective adoption requires that the Company expense, over the vesting period, the fair value of stock options granted, modified or settled during the fiscal years 2003 and subsequent. The fair value was determined on a basis consistent with that used in the Company's disclosure under the former Section 3870 and reported by the Company on a quarterly basis since January 1, 2002. The fair value of direct awards of stock is determined by the quoted market price of the Company's stock and the fair value of stock options is determined using the Black-Scholes option pricing model.

The charge for the three months ended March 31, 2006 related to employee stock options was $176,695 [2005 - $184,684]. The cash proceeds for exercises of employee stock options for the three months ended March 31, 2006 were $nil [2005 - $18,128]. The compensation expense related to options awarded in 2005 to scientific advisory board members, who are deemed non-employees is $4,592 [2005 - $4,179].

In periods prior to January 1, 2003, the Company recognized no compensation expense when stock or stock options were issued to employees.

For the three months ended March 31, 2006, the pro forma compensation charge for stock options granted in 2002 to employees was $12,195 [2005 - $30,597].

The following significant assumptions were used to estimate the fair value of the stock options in 2006:

| | |

| Risk-free rate | 3.19% to 3.66% |

| Expected option life | 36 months to 5 years |

| Expected dividends yield | n/a |

| Calculated option volatility | 0.807 to 1.067 |

While management believes that the estimates used to establish the above noted expected values were rationally determined and consistently applied, the valuation of stock-based compensation using this model is subject to a significant degree of variability.

Tm Bioscience Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2006

(Unaudited)

9. STOCK-BASED COMPENSATION PLAN (continued)

The grant-date fair value of options granted in the three months ended March 31, 2006 to employees is $nil [2005 - $459,371] and to non-employees is $nil [2005 - $6,640].

| | | | Stock Options | | | Weighted Average | |

| | | | | | Exercise Price | |

| | | | # | | | | |

| Granted and Outstanding at December 31, 2005 | | | 2,373,208 | | | 1.92 | |

2006 Activity | | | | | | | |

Granted | | | 89,050 | | | 2.54 | |

Expired | | | (80,000 | ) | | 2.65 | |

Granted and Outstanding at March 31, 2006 | | | 2,382,258 | | | 1.92 | |

Exercisable at March 31, 2006 | | | 1,482,958 | | | 1.86 | |

Deferred share unit plan

As at March 31, 2006, the total deferred share units held by participating directors were 196,675 [2005 - 79,592] and the amount expensed for the three months ended March 31, 2006 was $56,250 [2005 - $54,500].

10. FINANCIAL INSTRUMENTS

Credit risk