Tm Bioscience - Second Quarter Report 2006 - Restated

Management’s Discussion and Analysis of Operating Results

Vision

The vision of Tm Bioscience (“Tm” or the “Company”) is to revolutionize healthcare by bringing genetic testing into mainstream healthcare. Tm Bioscience is changing the way healthcare professionals manage patients by providing them with affordable, innovative, faster and more accurate tools to diagnose disease and personalize medicine.

Overview

Tm Bioscience is a DNA-based diagnostics company. From 2000 to 2005, the Company focused its resources on building a commercialization engine for the design, development, manufacture, marketing and selling of genetic tests, also referred to as “DNA-based tests”, “nucleic acid tests” or “molecular diagnostics”. For 2006 and beyond, the Company is focused on leveraging this engine to become the global leader in at least one of the three segments of the genetic testing market for which it is developing products: human genetics, personalized medicine and infectious disease.

In the Management’s Discussion and Analysis of Operating Results (MD&A) section of the Tm Bioscience 2005 Progress Report, the Company outlined the market drivers for its products, the capabilities of the Company to commercialize its products, key performance measurements, and provided details on the execution of Tm’s strategy. This quarterly MD&A refers to, and should be read in conjunction with, the 2005 annual MD&A.

Second Quarter Highlights

During the second quarter of 2006, Tm Bioscience’s efforts were directed towards accelerating its regulatory strength and driving top line revenue. The Company made significant progress in advancing its targeted six products towards IVD status. Notably, the Respiratory Viral Panel (RVP) test made significant progress toward FDA and CE mark clearance, with both achievements expected in the second half of 2006. Tm has begun selling the RVP test to select distributors in Europe and early access partners. From its Personalized Medicine product menu, Tm is imminently launching a companion test for Warfarin initially as an IUO but with FDA clearance as an IVD expected late in 2006 or early 2007.

At the same time, Tm continued to realize revenues from its existing product menu, primarily from sales of products from its industry leading Cystic Fibrosis (CF) franchise.

The ID-Tag™ RVP is one of the products nearest to commercial launch within the Company’s development portfolio. Over the last several months, Tm has made progress establishing a market presence and developing the commercial footprint for this product by:

| | • | signing a distribution agreement with a major diagnostics distributor for Turkey |

| | • | signing a distribution agreement with Sanbio b.v. for the Benelux countries (Belgium, The Netherlands and Luxemburg) |

| | • | signing a distribution agreement with RAMCON A/S for the Scandinavian countries (Denmark, Sweden, Finland and Norway) |

| | • | enrolling more than 25 leading healthcare institutions and laboratories across North America, Europe and Asia in the Company’s Early Access Program, which enables key customers and thought leaders to gain experience with the test, establish an environment for rapid adoption prior to flu season and provide feedback to the Company |

Tm intends to continue to sign distribution agreements for the ID-Tag™ RVP across Europe and in other regions over the coming months while its U.S. based sales force targets customers in North America directly. These efforts will facilitate the rapid commercialization of the ID-Tag™ RVP upon achieving U.S. and E.U. regulatory clearance.

Also in the second quarter, the Company underwent its first audit by the FDA, resulting in only a few observations which the Company has already corrected.

Market drivers

Tm Bioscience is developing products for three major segments of the overall DNA testing market. The Company has significantly penetrated the Human Genetics (Tag-It™) segment of the molecular diagnostics market, which is dominated by cystic fibrosis testing. The Company’s menu of CF products currently generates the majority of Tm’s recurring revenue. For 2006, Tm has dedicated most of its resources to the advancement of six products within the Personalized Medicine (Tag-It™ PGx) and Infectious Diseases (ID-Tag™) market segments. The market opportunities for these products are expected to each eventually exceed that of the cystic fibrosis market; by volume of tests performed because within these markets, tests are more likely to be repeated in an individual’s lifetime; by revenue potential because for two of these products, Tm has obtained proprietary genetic content making the products novel to Tm and therefore the Company expects that they will command a higher price.

Capabilities - Our commercialization engine

Over the past five years, the Company has focused its resources on building a commercialization engine for the design, development, manufacture, regulatory approval, marketing and selling of genetic tests, with a focus on high throughput genotyping. This engine is now well established and the Company anticipates modest investment to further increase the capacity of this engine to meet growing demand for the Company’s commercial products. The main components of Tm’s commercialization engine are discussed in the Company’s 2005 Annual Report. During the second quarter, the Company’s capabilities were further strengthened in the following areas:

Instrument partnership:

According to Luminex, during the quarter it expanded its own commercial footprint to more than 3740 systems placed in academic institutions, major pharmaceutical companies, large clinical and public health laboratories, bio-defense facilities, and major medical institutions as well as community hospitals worldwide.

Research and Product Development

In the second quarter, Research was focused on finalizing the RVP test based on field results relayed to the Company through its early access program, completing the first prototype of the Company’s Sepsis product, and finalizing the Warfarin test, slated for market launch in the third quarter of this year.

Product Development and Regulatory Affairs drove the protocols for regulatory approval and manufacturing of the Warfarin and RVP tests, as well as preparing FDA submissions for a number of products in the Company’s menu.

Marketing and Sales

During and subsequent to the second quarter, the Company signed its first three regional distribution agreements for its ID-Tag™ Respiratory Viral Panel, in Turkey and across Northern Europe. Management continues to explore opportunities to sign distribution agreements in each of its product areas for territories outside of North America and in particular anticipates signing additional distributors for its ID-Tag™ Respiratory Viral Panel.

A principal method of market development used by the Company over the last three years has been the Early Access Program, which the Company initially implemented with certain of the leading academic and commercial laboratories in the United States. The Early Access Program allows these laboratories and more recently large tertiary care hospitals which are some of the biggest potential consumers of the Company’s products, to familiarize themselves with the Company’s products and technology prior to their commercialization and provide the Company with feedback on these products. Beginning in the first quarter, as announced in the second quarter, Tm enrolled more than 25 leading healthcare institutions and laboratories across North

America, Europe and Asia into the Early Access Program specifically for the ID-Tag™ RVP. The Company also enrolled participants into the program for its Tag-It™ PGx Warfarin companion test.

Regulatory and Intellectual Property

A key focus for Tm in 2006 will be to seek regulatory clearance for a number of its products in the Personalized Medicine and Infectious Diseases segments.

During the second quarter, Tm Bioscience successfully completed an audit by the FDA. While the company has successfully completed several audits based on ISO 13485:2003, CMDCAS and customer requirements, this was the first audit from the FDA checking for compliance to 21 CFR 820. As expected, the company successfully completed the audit with only a few observations which the company has already corrected.

Administration and Human Resources

In keeping with the growing complexities of its business, the Company has appointed Dr. Jeremy Bridge-Cook to the position of Senior Vice President of Corporate Development with responsibility for the Company’s marketing, business development and long-term growth initiatives. Mr. Jim Pelot, the Company’s CFO has been appointed Chief Operating Officer, a newly created position intended to increase the Company’s effectiveness within the productization, manufacturing and regulatory functions. Mr. Pelot will retain his position as CFO.

Key performance measurements

Footprint - Tm’s reach into the marketplace

During the second quarter, the Company continued to add new customers for its commercially available menu of products. The Company also continued to promote the adoption of additional product offerings to its existing customer base. To date, approximately 50% of Tm’s customers have adopted two or more products from the Company’s menu.

In North America, sales efforts have been increasingly oriented towards preparations for regulatory clearance and subsequent commercial launch of Tm’s next wave of products. Leading institutions that are potential customers for the Company’s Personalized Medicine products, such as major contract research organizations (CROs), have been key targets of the Company’s sales force. Large hospital based laboratories have been the key targets for the Company’s first infectious disease product, the ID-Tag™ Respiratory Viral Panel.

Outside of North America, the Company has signed several distribution agreements for its ID-Tag™ Respiratory Viral Panel for Northern Europe and Turkey, and anticipates signing additional similar agreements as part its global commercialization strategy for this product.

Velocity - The breadth and rate of growth of Tm’s product pipeline

In 2006, the Company anticipates submitting several products for regulatory clearance. From its Personalized Medicine product menu, Tm is enhancing the regulatory status of its three available drug metabolism tests focused on the P450 family of enzymes. In addition, the Company is imminently commercializing its companion test for Warfarin and will be submitting the test for IVD clearance to the FDA in late 2006. The Personalized Medicine menu will be further strengthened in 2007 with the planned launch of the Company’s test for Sepsis. The Company’s also recently expanded its menu, achieving initial sales of ID-Tag™ Respiratory Viral Panel that are expected to accelerate in the second half of 2006 once regulatory clearance is secured.

Innovation - Tm’s ability to create proprietary products that will revolutionize medicine

For 2006 and beyond, Tm is focused on developing novel, proprietary genetic tests. These products will be innovative because they will contain unique biomarkers and/or leverage the competitive advantages of the Tag-It™ Universal Array platform to address unmet medical needs. Examples of this innovation are the ID-Tag™ Respiratory Viral Panel and the Sepsis test.

Execution - Our strategy

Building shareholder value

The Company believes that significant shareholder value will be created through the exploitation of four dynamics. These dynamics, which represent the Company’s overarching strategy for securing a significant and profitable presence in the rapidly growing genetic testing market, are to:

| | • | demonstrate a capability to commercialize tests, from initial design through to global distribution; |

| | • | deliver standardized quality products compliant with global regulatory requirements; |

| | • | commercialize a broad and ever-growing menu of products; and |

| | • | establish a customer base that consistently adopts Tm’s products. |

The Company’s strategy has been constructed to successfully exploit these dynamics by adding product menu at the highest velocity possible. The Company plans to enhance its offering, within each of its three key market segments, with tailored strategies that have been developed to drive growth. Details of these strategies are described in further detail in the Company’s 2005 Annual Report with an update on the execution of these strategies provided below.

Human Genetics

Tag-it™ - Do I have a genetic disease?

The Company has significantly penetrated the Human Genetics (Tag-It™) segment of the molecular diagnostics market with its menu of CF products, which currently generates the majority of Tm’s recurring revenue. The Company now estimates that it has secured approximately 30%-35% market share of the U.S. CF testing market and maximized its visibility within this market. An estimated 50% of the CF market that is not secured by Tm is accounted for by demand from the two largest reference laboratories in the U.S., LabCorp and Quest. In the fourth quarter of 2005, LabCorp adopted the Tag-It™ reagents which LabCorp has commercialized into an expanded panel for testing 70 mutations in the CFTR gene to supplement a competing product they offer. LabCorp has seen significant growth in the use of Tag-It™ reagents since that time. Quest does not purchase CF products from Tm but does purchase the Tag-It™ AJP reagents. Along with a strong established customer base in the CF market, the Company believes that its uniquely comprehensive CF product line combined with the IVD status and CE Marking (“Conformité Européene”) of its Tag-It™ Cystic Fibrosis kit, place the Company in a strong competitive position to capture additional CF market share.

Personalized Medicine

Tag-It™ PGx - Can I safely take this drug? Will it be effective for me?

Tm Bioscience’s objective within the Personalized Medicine market segment is to establish the Company as the market leader. The Company has developed a comprehensive strategy for achieving this goal which includes:

| | • | Securing IVD regulatory status for the Company’s PGx products |

| | • | Driving physician adoption of PGx tests |

| | • | Offering the most comprehensive PGx menu available on the market |

| | • | Gaining market share with Contract Research Organizations and large pharmaceutical companies |

During the second quarter of 2006, Tm Bioscience made significant progress towards expanding its PGx menu with unique, novel and enhanced products:

P450 - The Tag-It™ PGx Mutation Detection Kits for P450-2D6, P450-2C9 and P450-2C19

The Company remains on track to submit all three of its PGx P450 products for FDA clearance as IVD’s in 2006 with approvals anticipated for late 2006 and early 2007. During the second quarter, Tm continued to make progress towards this objective in conjunction with its validation partners.

Warfarin - The Tag-It™ PGx CYP2C9+VKORC1 Mutation Detection Kit

Tm Bioscience has developed a companion test for Warfarin which it expects to submit for FDA clearance in 2006. The FDA’s Clinical Pharmacology Subcommittee of the Advisory Committee on Pharmaceutical Science voted in November 2005 in favor of changing Warfarin’s label to reflect the fact that genetic information from two genes, CYP450 2C9 and VKORC1, can be useful in deciding a patient’s individual dose. The Company anticipates the FDA may relabel Warfarin in Q4, 2006.

Tm’s goal is to secure a dominant position in this market upon the anticipated relabeling of Warfarin. During the second quarter, the Company initiated an Early Access Program (EAP) for the Tag-It™ PGx CYP2C9+VKORC1 Mutation Detection Kit with key customers and opinion leaders. The first prototype kits were shipped to the participants who provided feedback at the end of the quarter The Company continues to support key opinion leaders in educational events that will drive the adoption of genetic testing in this area. The Company is launching this product initially as an IUO, anticipated in the third quarter of 2006.

The Company remains on track to submit this product for FDA clearance as an IVD in 2006 with approval anticipated for late 2006 or early 2007.

Sepsis - The Tag-It™ Severe Sepsis Test

In early 2006, Tm acquired an exclusive commercial license to patents from Sirius Genomics for specific biomarkers related to two drugs, Xigris® and vasopressin, used to treat severe sepsis. Tm Bioscience plans to incorporate these markers into a companion diagnostic for use by critical care physicians in order to treat patients with severe sepsis more effectively. Given the large market potential of this test as well as its potential importance in the selection of drugs and therapies that impact patient morbidity and mortality, the Company expects this test to achieve notable market penetration across North America and Europe, anticipating revenue that could be in excess of $100 million in the aggregate over the first three years following commercial launch. The Company intends to submit this product for FDA clearance as an IVD and for CE marking with clearances anticipated in 2007. The Company completed its first prototype of the assay during the second quarter.

Infectious Diseases

ID-Tag™ - Have I acquired an infection?

The ID-Tag™ Respiratory Viral Panel (RVP)

The ID-Tag™ RVP is a comprehensive assay for the detection of various strains of respiratory viruses and subtypes, including H5 (Avian Flu). Tm is positioning the ID-Tag™ RVP as an essential diagnostic tool in the fight against respiratory viral illnesses.

The Company expects that the ID-Tag™ RVP will address two key markets. First, it is expected to serve as a cornerstone diagnostic product in the clinical setting for the more efficient management and treatment of patients who may be infected by respiratory viruses. The product is also expected to play a key role in improving influenza surveillance efforts, helping to manage potential pandemic threats such as those posed by the Avian Flu, and the Company is actively promoting its adoption within the global public health community.

In the U.S. and Canada, Tm’s sales force is directly marketing the ID-Tag RVP to hospital based laboratories and public health labs. To drive sales, Tm is establishing market presence by enabling key customers and thought leaders to gain experience with the test through its Early Access Program. In the first and second quarters, Tm secured more than 25 leading healthcare institutions and laboratories across North America, Europe and Asia as participants in the program. Tm is also raising awareness of the product among clinical and public health labs through tradeshows and public relations and advertising campaigns.

Outside of the North America, Tm intends to commercialize the ID-Tag™ RVP via a network of distributors. During the second quarter, the Company signed a distribution agreement with a major diagnostics distributor for Turkey and a distribution agreement with Sanbio b.v. for the Benelux countries (Belgium, The Netherlands and Luxemburg). Subsequent to the end of the quarter, Tm signed a distribution agreement with RAMCON A/S for the Scandinavian countries (Denmark, Sweden, Finland and Norway). The Company anticipates signing additional distribution agreements for territories in Europe, Asia and the rest of the world.

The Company remains on track for gaining regulatory clearance for the ID-Tag™ RVP as an IVD in the U.S. and Europe, with clearance anticipated in the second half of 2006.

Quarterly Results

Summary

For the quarter ended June 30, 2006, the Company reported a net loss of $4,989,502 or ($0.10) per share, compared with a net loss of $3,675,783 or ($0.09) per share, for the corresponding period in 2005, an increase in net loss of $1,313,719. For the six months ended June 30, 2006 and 2005, the net loss was $9,138,308 and $7,121,335 and ($0.19) and ($0.18) per share, respectively. For the quarter ended June 30, 2006, revenues grew $1,084,880 to $3,074,786 resulting in a 42% gross margin, as compared to gross margin of 41% in the corresponding period in 2005. For the six months ended June 30, 2006 and 2005, revenue growth of $2,917,672 and the increase in cost of goods sold of $1,597,352 resulted in a 44% gross margin (42% for 2005). For the six months ended June 30, 2006 increases in sales, general and administrative expenses of $3,354,490 ($1,945,992 for the three months ended June 30, 2006) reflect the Company’s investments in the medical and regulatory, marketing and business development and quality assurance functions, as well as in the intellectual property and human resources functions. This was driven by product line growth, expanded licensing activities, increased marketing program expenditures and the Company’s drive to secure FDA clearance on a large number of products in 2006. Other contributing factors were increases in facilities, professional services and validation studies and design control activities associated with RVP and Warfarin clinical trials and EAPs.

For the six months ended June 30, 2006, research and development expense increased by $176,360 (increased by $188,842 for the three months ending June 30, 2006) primarily due to the amortization of the Sirius marker license related to sepsis biomarkers, partially offset by the inclusion of Scientific Research and Experimental Development (SR&ED) tax credits received in the second quarter of 2006.

For the six months ended June 30, 2006, interest expense from long-term debt increased by $146,513 (increased by $9,537 for the three months ended June 30, 2006). The increased interest expense reflects the increased debt resulting from additional funds advanced from TPC which grew by 93% year over year. Of the increase, $24,008 ($20,162 for the three months ended June 30, 2006) related to cash interest paid.

Gain on foreign exchange increased by $233,033 for the six months ended June 30, 2006 ($260,523 for the three months ended June 30, 2006) due to the strengthening Canadian dollar and its effect on the US dollar denominated debt. For the six months ended June 30, 2005, other financial expense decreased from a net expense in 2005 of $148,007 to $37,497 in 2006; for the three months ended June 30, 2006, other financial expense decreased from a net expense of $77,266 to net expense of $15,736. These reductions in net expense are primarily due to an increase in interest income on short-term investments from the $10 million public offering closed in the fourth quarter of 2005.

Sales and Cost of goods sold

Total quarterly revenues increased by $1,084,880 from $1,989,906 in 2005 to $3,074,786 in 2006. Year to date revenues increased by $2,917,672 from $3,065,188 in 2005 to $5,982,860 in

2006. Product sales for the second quarter of 2006 were $2,905,280, an increase of 80% over 2005 product sales of $1,617,649. This quarterly growth is primarily driven by sales of Tag-It™ CF70 reagents, increased demand from Genzyme since their mid-2005 launch of the CFplus™ test and market uptake of the Tag-It™ Ashkenazi Jewish Panel (AJP). Year-to-date product sales in 2006 were $5,405,645 as compared with $2,659,585 for the same period in 2005, for growth of 103%. This growth is primarily driven by Genzyme and by the adoption by the growing customer base of the Company’s expanded menu selections, primarily Tag-It™ Ashkenazi Jewish Panel (AJP) and Tag-It™ CF70 reagents. The Company has also begun generating initial sales of its RVP test, and expects these sales to grow as it expands its distribution network and continues its Early Access Program.

Luminex instrument placements continued in the quarter through direct customer purchases of $137,959 for the second quarter of 2006 as compared with $349,423 in 2005. Year-to-date instrument sales in 2006 were $431,083 compared to $349,423 in 2005. At June 30, 2006, instrument sales represented 7% of the total year-to-date revenues (2005 - 11%) and 4% of the quarterly revenues (2005 - 18%). This trend supports the Company’s expectation that instrument sales as a percentage of the Company’s total revenues will continue to decline.

Licensing and development fees received in the quarter reflect royalties on the sales by Luminex of “FlexMap beads”™, development fees reflecting the on-going pro-rata recognition of deferred milestone revenue and contract research fees. These fees grew from $56,181 in the first half of 2005 to $146,133 in the same period in 2006 due primarily to $81,627 in revenue earned in the first quarter of 2006 from the collaborative development program for the Oncovue™, Intergenetics breast cancer risk test, and the pro-rata recognition of the milestone payment received from Genzyme in the second quarter of 2005.

Standard reagent product margins were 59% for the quarter ended June 30, 2006 as compared with 61% for the same period in 2005. Year-to-date standard reagent product margins were 59% for 2006 as compared with 62% in 2005. Standard reagent product margin is calculated by subtracting standard reagent cost of goods sold, genetic content and bead royalties costs and reagent rental depreciation from reagent product sales. The result is then divided by reagent product sales for the period. The measure of standard reagent product margins provides information on the margins of the Company excluding inefficiencies and yield volatility associated with the early stages of the Company’s manufacturing and revenue scale-up. The 3% year-to-date comparative decline is due in part to non-recurring favourable adjustments in the first quarter of 2005 to royalties which had been overpaid in 2004 and in part to an increased royalty rate payable to Luminex in accordance with the revised supply agreement concluded at the end of the first quarter of 2006.

This quarter includes a decrease in yield and a no change in capacity utilization as compared to the same period in 2005. Period charges related to shrinkage, scrap and excess and obsolescence (collectively the yield expense) increased to 6% of product revenues for the second quarter of 2006 from 4% of gross margin in the second quarter of 2005, primarily related to provision increases as detailed in the MD&A section on Inventory Provisions. Year-to-date yield expense decreased from 5% in 2005 to 4% of product revenues in 2006. Capacity utilization was consistent at 7% of product revenues for the second quarter of both 2006 and 2005. Overall capacity utilization for the year-to-date shows improvement, with a decrease in the associated period expense from 9% in 2005 to 6% of product revenues in 2006. As the Company continues to expand its customer base with the launch of the RVP and Warfarin tests, the Company continues to expect improvements in capacity utilization and a declining impact of yield expense on margins.

Cost of goods sold for the quarter also includes instrument costs of $134,809 (2005 - $335,670). Year-to-date cost of goods sold for the first half of 2006 includes instrument costs of $419,441 (2005 - $335,670). Total margins were 43% for the second quarter of 2006 vs. 41% for the second quarter of 2005 as compared with YTD margins of 44% for 2006 and 42% for 2005.

Expenses

Total expenses, excluding cost of goods sold, for the three-month period ended June 30, 2006 increased by $2,134,834 to $5,880,886 as compared with $3,746,052 in the same period in 2005. Year to date total expenses, excluding cost of goods sold were $10,550,691 in 2006, compared to $7,019,841 in 2005. Sales, general and administration (SG&A) for the second quarter of 2006 grew by $1,945,992 to $4,598,037 from $2,652,045 in 2005. Year to date SG&A was $8,240,441 in 2006 and $4,885,951 in 2005 and reflect the Company’s investments in the medical and regulatory, marketing and business development and quality assurance functions, as well as in the intellectual property and human resources functions. The increase in headcount reflects the Company’s growing customer base and expanded licensing activities as well as its 2006 drive for regulatory clearance on multiple products. In Marketing, product managers were added to specifically drive growth into new markets, and to a lesser extent, increase presence within existing markets and product lines. During 2006, the Company improved its employee benefits plan in order to remain competitive within the market resulting in an increase in expenses of approximately $212,500 for the six months ($106,250 for the three months) ended June 30, 2006. Other contributing factors were increases in facilities related to headcount growth, increased marketing program expenditures on the new products, professional services and validation studies and design control activities associated with RVP and Warfarin clinical trials and EAPs.

Research and development expense for the quarter and six months ended June 30, 2006 and 2005 increased by $188,842 and $176,360 respectively, primarily due to amortization of the Sirius marker license of $200,000 in the quarter, as well as by headcount growth towards the end of 2005 from the Company’s investment in research and product development infrastructure focused to ensure capability to expand the Company’s product menu in 2006. These were partially offset by the inclusion of SR&ED tax credits of approximately $204,000 in 2006.

Interest expense from long-term debt increased from $672,095 in the second quarter of 2005 to $681,632 in the second quarter in 2006, an increase of $9,537 (increase of $146,513, from $1,246,643 to $1,393,156, for the six months ended the same date). Of the increase in the second quarter, $20,162 ($24,008 for the six months ended June 30, 2006) related to cash interest paid, due to an increase in net debt of $2.0 million associated with the refinancing of its debenture with a convertible instrument in November of 2005. This was partially offset by a reduction to the current quarter interest expense due to an accretion calculation adjustment as well as a reduction in the amount of the accretion of related warrant expense. A significant portion of the year-to-date increase is a result of additional advances from TPC in late 2005 and the second quarter of 2006.

For the six months ended June 30, 2006, other financial expense decreased from a net expense in 2005 of $148,007 to $37,497 in 2006 due to an increase in interest income on short-term investments generated from the $10 million public offering closed in the fourth quarter of 2005. These same factors contribute to the second quarter decrease of $61,530 in other financial expense from $77,266 in 2005 to $15,736 in 2006.

Capital and Liquidity

Working capital deficiency at June 30, 2006 was $820,615 including cash and cash equivalents and short-term investments of $2,844,564, compared with $12,807,061 and $16,014,629, respectively as at December 31, 2005.

The purchase of capital assets for the quarter amounted to $589,535 and intangible assets to $2,090,329. For the second quarter of 2005, the amounts were $465,363 and $6,155 respectively.

The majority of capital asset additions ($339,022) in the second quarter of 2006 relate to Luminex instruments which the Company has placed in a variety of evaluation studies with potential customers, the majority of which relate to the evaluation of the Company’s RVP test by Early Access Partners. An additional $62,229 relates to headcount related capital such as furniture and computer equipment. The second quarter of 2006 also included the purchase of equipment under capital lease of $83,715.

The purchase of intangible assets in the quarter reflects the first $2,000,000 payment to Sirius Genomics Inc. (“Sirius”) under its March 17, 2006 agreement for the rights acquired from Sirius.

On December 12, 2003, the Company entered into an agreement with the Ministry of Industry of the Government of Canada under which the government will invest up to $7,300,000 of the Company's $25,000,000 project to establish novel processes, capabilities and facilities relating to the development of several genetic tests. Funds of $551,384 were received from TPC in the second quarter of 2006 (2005 - $nil) bringing the outstanding balance of the TPC funds advanced to $3,651,410. In the second quarter of 2006, the Company submitted a claim for reimbursements of approximately $652,000 to TPC which will bring the program current up to March 31, 2006.

The program initially stated a project completion date of July 31, 2006. Management is currently in the process of obtaining an extension of the program and expansion of the projects that are deemed to be eligible expenditures under the program. Management is confident that the Company’s TPC agreement will be extended and that future claims to the full available loan will be recovered. If the Company were only able to submit claims up until July 31, 2006, the amount of the Other Asset after accretion for any claims submitted up to the project completion date would be reversed, with the corresponding charge to Contributed Surplus since this amount relates to warrants issued to TPC during fiscal 2005 based on the full value of the expected financing.

Operating activities used $1,674,778 of cash in the quarter. $3,774,701 of the cash used related to the consolidated statement of loss and deficit, and $2,099,923 was provided by changes in non-cash working capital balances. Of the $2,099,923, trade receivables increased $482,281 in the last quarter due to two larger customer orders received and filled late in the quarter, neither of which had orders in the prior quarter. Inventory decreased by $592,338 as coupled beads manufactured earlier in 2006 and in 2005 were depleted to replenish finished goods stores for product sold in the quarter. Finally, accounts payable and accrued liabilities increased by $1,550,749, which was offset by increases in accruals related to royalties, bonuses and professional fees.

In the second quarter of 2006, foreign exchange gain was $270,091 as compared to a gain of $9,568 during the second quarter of 2005. This amount is comprised of a gain of $367,412 related to U.S. denominated long-term debt and a loss of $94,328 due to the declining Canadian dollar against the Company’s U.S. dollar denominated receivables.

At quarter end, 95% of the Company’s trade accounts receivable was denominated in U.S. dollars. This exposure was more than offset as 26% of the Company’s accounts payable and accruals, as well as the convertible portion of its long-term debt is also denominated in U.S. dollars. The Company’s net exposure to the U.S. dollar at quarter end is a liability of $12,742,575 (measured in CDN dollars). A 1% appreciation or devaluation of the Canadian against the U.S. dollar would result in a net foreign exchange gain or loss respectively of $127,426.

Since its inception, the Company has been financing its infrastructure and product development as well as its commercialization activities from public equity financing, debt and revenue from the sales of its products and licenses related to its technologies. The Company has also received funds from government agencies and from development agreements with Corporate partners. As at June 30, 2006, the Company had a deficiency of working capital of $0.9 million and cash and cash equivalents and short-term investments of $2.8 million. The Company expects revenue and margins from its existing products to continue to grow quarter over quarter through 2006. The Company will also be investing in enhancing the regulatory status of its product menu, and undertaking significant marketing and sales efforts in the areas of PGx and infectious disease. In order to pursue its expanded regulatory drive, submit products for FDA certification in 2006, as well as open new markets for its RVP and sepsis tests, all the while continuing to serve its growing customer base, the Company foresees a need for growth capital. Management remains responsive to market conditions and will seek additional capital from traditional sources or through strategic partnerships as opportunities arise.

Quarterly selected financial information 2006, 2005 and 2004

| | | 2006 | | 2005 | | 2004 |

| | | 2nd quarter | | | 1st quarter | | | | 4th quarter | | | 3rd quarter | | | 2nd quarter | | | 1st quarter | | | | 4th quarter | | | 3rd quarter | |

Revenue | | $ | 3,074,786 | | $ | 2,908,074 | | | $ | 2,401,329 | | $ | 2,207,652 | | $ | 1,989,906 | | $ | 1,075,283 | | | $ | 1,369,985 | | $ | 1,098,954 | |

Net Loss | | | ($4,989,502 | ) | | ($4,227,048 | ) | | | ($4,956,963 | ) | | ($3,089,168 | ) | | ($3,675,783 | ) | | ($3,445,552 | ) | | | ($3,291,392 | ) | | ($3,039,447 | ) |

Net Loss per share | | $ | (0.10 | ) | $ | (0.09 | ) | | $ | (0.12 | ) | $ | (0.07 | ) | $ | (0.10 | ) | $ | (0.09 | ) | | $ | (0.09 | ) | $ | (0.09 | ) |

Contractual arrangements and commitments

| | | | Total | | | Less than 1 year | | | 1 - 3 years | | | 4 - 5 years | | | After 5 years | |

| Convertible debenture | | $ | 10,765,626 | | $ | 4,815,599 | | $ | 5,950,027 | | | ¾ | | | ¾ | |

| TPC | | $ | 6,556,121 | | $ | 168,437 | | $ | 3,002,007 | | $ | 3,385,677 | | | ¾ | |

| Operating leases | | $ | 2,546,456 | | $ | 973,391 | | $ | 1,563,904 | | $ | 9,161 | | | ¾ | |

| Capital lease obligations | | $ | 125,662 | | $ | 34,033 | | $ | 62,831 | | $ | 28,798 | | | ¾ | |

| Purchase obligations | | $ | 282,497 | | $ | 275,988 | | $ | 3,004 | | $ | 3,004 | | $ | 501 | |

Deferred share units(1) | | $ | 438,575 | | $ | 20,500 | | | ¾ | | | ¾ | | $ | 418,075 | |

Total Contractual Arrangements | | $ | 20,714,937 | | $ | 6,287,948 | | $ | 10,581,773 | | $ | 3,426,640 | | $ | 418,576 | |

| | (1) | - Payment of Deferred share units is not made until the last business day in December of the first calendar year commencing after the director leaves the Board, and may be in cash or in common shares of the Company, at the discretion of the director. As the directors are elected annually, the DSUs which are not currently due have been classified as ‘After 5 years’. |

Disclosure controls

The Company's Chief Executive Officer and Chief Financial Officer have evaluated the Company's disclosure controls and procedures and have concluded that such controls and procedures are effective, as at the end of the period covered by this report.

Restatements

(a) Intangible Assets

The Company reviewed its accounting for the rights acquired from Sirius Genomics Inc. (“Sirius”) on March 17, 2006 and has determined that the amounts payable for the rights should be classified an intangible asset related to a marker license rather than a license fee advance. The Company has therefore reclassified the first $2,000,000 payment to Sirius as an intangible asset and has recorded the second $2,000,000 payment as an intangible asset and an accrued liability as at the inception of the agreement. As an intangible asset with an economic life associated with the related products, the value of the marker license is being amortized straight line over 5 years. Until the first commercial sale, the amortization is being charged to research and development, after which it will be charged to cost of goods sold. For the three-month and six-month periods ended June 30, 2006, the Company has charged amortization expense of $200,000 and $231,111, respectively, on this intangible asset to research and development. In addition, the

agreement with Sirius provides for interest to be earned by the Company on the payments made with respect to acquiring the rights to the markers. As the collection of these amounts form part of a right of offset related to future royalties payable to Sirius which is predicated on the commercial success of the associated commercial product, the Company will not recognize any interest earned on the payments until they are realized through the right of offset. The Company had reported interest income of $48,767 from Sirius previously. The revised accounting treatment has no impact on cash flow, and is reflected in the restated consolidated financial statements.

(b) Royalties

Under CICA Handbook Section 3290, Contingencies, the Company is required to accrue amounts for contingent liabilities which are likely to occur. Such a situation existed in the first quarter of 2006 when negotiations with the owner of a genetic license for certain markers incorporated in the Company’s cystic fibrosis test had progressed to a point where an agreement was determined to be likely, but where the Company was still negotiating on the royalty rate to achieve the best possible outcome. It is the Company’s view that a reasonable assessment of a royalty rate given the uncertainty surrounding the outcome of the negotiations would be $20,000 USD. This non-cash adjustment of $23,213 to accounts payable and accrued liabilities and cost of goods sold was reflected in the restated consolidated financial statements as at and for the three-month period ended March 31, 2006. For the three-month and six-month periods ended June 30, 2006, the foreign exchange gain on the U.S. dollar denominated accrual relating to this restatement is $888.

(c) Bonus accrual

The Company has reviewed its bonus accrual for 2006 and has determined that the bonus accrual for the second quarter was understated due to retroactive bonus rate adjustments approved late in the second quarter, and certain adjustments to sales compensation. The increase in the accrual is $79,221 and resulted in an increase/(decrease) to cost of goods sold of $(12,790) research and development of $(19,306), and sales, general and administrative expenses of $111,317. This non-cash adjustment is reflected in the restated consolidated financial statements.

(d) Manufacturing Adjustments

In May of 2006, the Company undertook a detailed study of its manufacturing operating efficiency. The study concluded at the end of the third quarter and the Company analyzed in detail the results of the study relative to the overhead rates it had set for the year and the calculation of its standard-to-actual quarterly revaluation of inventory. In so doing, it determined that its basis for calculating overhead absorption for the year was using an incorrect number of standard available hours for each manufacturing technician, resulting in an under-absorption of overhead and direct labour costs into inventory. It also determined that its quarterly calculation on the release of standard-to-actual variances into cost of goods sold contained an error. The net impact of these two non-cash adjustments is decrease inventory and increase cost of goods sold for the quarter by $21,236. This adjustment is reflected in the restated consolidated financial statements.

Critical accounting estimates

During the second quarter of 2006, the Company commenced a capital lease of equipment. The “Capital assets” portion of the Company’s Significant Accounting Policies as reported in its 2005 Annual Report is hereby expanded as per the addition below:

Capital assets

Capital assets include equipment under capital lease which is recorded at the present value of the future minimum lease payments less accumulated depreciation. The rate and method used to depreciate equipment under capital lease over its estimated useful life is as follows:

| Equipment under capital lease | 10 years straight-line |

Intangible assets

Intangible assets related to genetic marker licenses which are acquired during the research and development phase of a product’s life are amortized from the date of acquisition, over a 5 year expected product life cycle inclusive of the research and development period.

Provision for doubtful accounts

The Company relies on its credit approval process and historical experience to evaluate the exposure to the potential for non-performing receivables. At June 30, 2006, trade accounts receivable were outstanding from large and financially sound commercial laboratories. A provision was made during the quarter for $97,511 for one invoice for which collection is uncertain. Management estimates that no further provision for doubtful account is required as at June 30, 2006.

Inventory provisions

At quarter-end, the Company performed a count of 50% of total inventory cost and completed a full reconciliation of its physical inventory. In addition, substantial work was performed to ensure that:

| | • | an appropriate amount of labour and overhead expense was included in year-end inventory balances based on normalized capacity; |

| | • | the full cost of inventories were realizable in the context of the Company’s existing and prospective sales contracts; and |

| | • | the volume of inventories did not exceed a reasonable forecast of future sales. |

Based on these reviews, management has provided appropriately for realization of inventory balances as at June 30, 2006 by expensing $66,928 during the second quarter of 2006 (2005 - $3,505). The year-to-date expense is $88,188 (2005 - $43,598) and the Company is maintaining an aggregate provision of $158,730 as at June 30, 2006 (2005 - $71,599).

This provision is comprised of (i) 33% as the Company’s estimate of inventory in excess of forecast demand (2005 - 44%), (ii) 31% as work-in-process for a key constituent of the Company’s test which is purchased in the lowest commercially-available quantity but which has been estimated to be in excess of usage (2005 - 56%), (iii) 21% as potentially expiring residual semi-finished goods generated from 2005 batches produced for specific product offerings and (iv) 15% as short-dated finished goods.

Equity based instruments

Each time the Company issued equity based instruments, including common share purchase warrants, agent’s compensation options and employee stock options, a value was derived for the instrument using the Black-Scholes option pricing model. The application of this pricing model requires the determination of several variables, including the price volatility of the Company’s stock over a relevant timeframe, a conversion or exercise assumption related to the particular instrument, the determination of a relevant risk free rate and an assumption of the Company’s dividend policy in the future. Management has adopted a consistent implementation of the Black-Scholes model, source of variables and application of a framework to determine appropriate inputs.

Warranties

It is the Company’s revenue recognition policy to provide for estimated warranty expense when product revenue is recognized. Beginning in the third quarter of fiscal 2004, the Company introduced a second form of warranty, reagent rental-based warranty, in addition to its existing product-based warranty. The reagent rental warranty provides service coverage to Luminex instruments placed with customers on reagent rental programs.

With respect to the product-based warranty, the Company’s customers continue to validate specific production lots which each customer had previously ascertained had met appropriate performance characteristics. As a result, management determined that no product warranty provision was required at June 30, 2006 (2005 - nil). Management has provided $68,000 with respect to reagent rental-based instrument extended warranty obligations at June 30, 2006 (2005 - $5,088). This growth is tied to the expansion of the Company’s reagent-rental program as the majority of customers participating in this program have been signed up since July 1, 2005.

Royalties

The Company in engaged in negotiations related to a license for genetic markers on its cystic fibrosis products. The Company has determined that a contract will likely be concluded and has estimated a royalty rate commensurate with that of another license agreement it has on the cystic fibrosis product. The final royalty rate agreed may be materially higher.

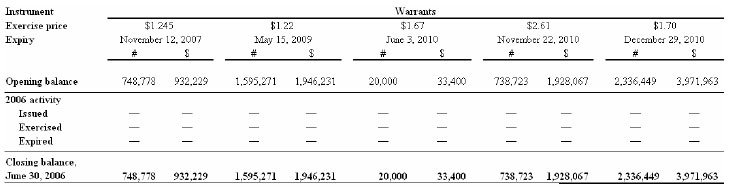

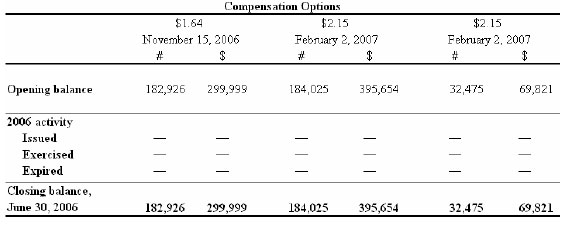

Warrants and compensation options

The following charts depict the potential cash value to the Company of outstanding warrants and compensation options as at June 30, 2006:

Subsequent Event

On September 5, 2006, the Company amended its agreement with Sirius to defer the $2,000,000 license payment originally due on September 6, 2006 to the earlier of 90 days following receipt by the Company from Sirius of certain data related to the biomarkers required for regulatory submission and October 12, 2007. In connection with this deferral, the Company will pay interest

at an annual rate of 16.6% on the deferred amount until the funds are paid to Sirius. As well, interest on the first license payment made in April 2006 will not begin to accrue interest in favour of the Company to be offset against future royalty payments to Sirius until October 12, 2007. Interest accruing in favour of the Company on the second license payment will begin accruing from the date of such payment.

Risks and uncertainties

Prospects for companies in the biotechnology industry generally may be regarded as uncertain given the nature of the industry and, accordingly, investments in biotechnology companies should be regarded as speculative. Biotechnology research and development involves a high and significant degree of risk. An investor should carefully consider the risks and uncertainties described herein and in the Company’s annual information form for the financial year ended December 31, 2005, as well as other information contained in this Management’s Discussion and Analysis of Operating Results. Additional risks and uncertainties not presently known to the Company or that the Company believes to be immaterial may also adversely affect the Company’s business. If any one or more of these risks occur, the Company’s business, financial condition and results of operations could be seriously harmed. Further, if the Company fails to meet the expectations of the public, the market price of the Company’s common share could decline.

Forward-looking statement

This Management’s Discussion and Analysis of Operating Results and accompanying President’s message for the interim period ended June 30, 2006 contains certain forward-looking statements with respect to Tm Bioscience Corporation. These include statements about management’s expectations, beliefs, intentions or strategies for the future, which are indicated by words such as “vision”, “may”, “will”, “should”, “plan”, “anticipate”, “believe”, “intend”, “potential”, “estimate”, “forecast”, “project”, “predict” and “expect” or the negative of these terms or other similar expressions concerning matters that are not historical facts. In particular, statements regarding the Company’s future operating results, economic performance and product development efforts are or involve forward-looking statements. More specifically, statements about the planned development of diagnostic genetic tests, including the Company’s ID-Tag™ RVP panel and sepsis tests, the potential efficacy of such tests, the anticipated timing of the commercial launch, the approximate revenues and earnings that will be generated by such tests and the market penetration Tm will obtain for such tests, are forward-looking statements.

These forward-looking statements are based on certain factors and assumptions. The Company has assumed that it will submit its PGx, sepsis, warfarin and ID-Tag™ RVP tests for regulatory approval in 2006 (and in the case of the sepsis test, possibly 2007), that it will receive the necessary regulatory approvals from the FDA and European regulatory authorities within one year of submission, and that as part of such approval the FDA and European regulatory authorities will have reviewed, as required, clinical and analytical validation of the sepsis, RVP, warfarin and PGx tests. The Company has also assumed that it will have sufficient capital to develop and commercially roll-out and manufacture sufficient quantities of its tests and that phamacogenomic testing and genetic testing for infectious diseases including sepsis will become more widespread. With respect to the sepsis test specifically, the Company has assumed that it will be able to successfully develop the sepsis test in two versions, as a real-time assay and in a TAG-IT TM format. With respect to revenue generation and market penetration of the sepsis test, the Company has assumed that it will launch the sepsis test in the United States in both forms (i.e., as a real-time assay and in a TAG-IT TM format) following receipt of the necessary regulatory approvals, that it will be able to sell the sepsis test at a price ranging from U.S.$300 to U.S.$500 per test, that there will be reimbursement available for this test by both private and public healthcare insurers, that there will be approximately 750,000 sepsis cases a year in each of the United States and the European Union, that the Company will achieve approximately 20% market

penetration in both markets by the third year following launch, that the $U.S./$Cdn. exchange rate and the Euro/$Cdn. exchange rate will remain relatively constant at current rates, that the Company will sell the product directly to hospitals, that there will be no other directly competing technological or competitive advances in the treatment of sepsis, that Xigris® and vasopressin will continue to be widely used in the treatment of sepsis, that the Company will continue to enjoy the exclusive use of the patents to be licensed from Sirius and that these patents are and will remain valid and enforceable. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking statements are not guarantees of future performance and by their nature necessarily involve risks and uncertainties that could cause the actual results to differ materially from those contemplated by such statements including, without limitation: the risk that the factors and assumptions underlying the forward-looking statements may prove to be incorrect; the difficulty of predicting regulatory approvals particularly the timing and conditions precedent to obtaining any regulatory approval; market acceptance and demand for new products; the availability of appropriate genetic content and other materials required for the Company’s products; the Company’s ability to manufacture its products on a large scale; the protection of intellectual property connected with genetic content; the impact of competitive products, currency fluctuations; risks associated with the Company’s manufacturing facility; and any other similar or related risks and uncertainties. Additional risks and uncertainties affecting the Company can be found in the Company’s 2005 Annual report, available on SEDAR at www.sedar.com. If any of these risks or uncertainties were to materialize, actual results of the Company could vary materially from those that are expressed or implied by these forward-looking statements.

You should not place undue importance on forward-looking statements and should not rely on them as of any other date. Except as may be required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Other Information

Additional information relating to the Company, including the Company’s most recently filed annual information form, can be found on SEDAR at www.sedar.com.

The accompanying consolidated financial statements are the responsibility of Management and have been approved by the Audit Committee on behalf of the Board of Directors of the Company. Management is responsible for and has prepared and presented the consolidated financial statements in accordance with accounting principles generally accepted in Canada and has made any significant accounting judgments and estimates required. Management has ensured that financial information contained elsewhere in this Quarterly Report is consistent with the consolidated financial statements.

Management has developed and maintains systems of internal controls designed to provide reasonable assurance that reliable and relevant financial information is produced. Policies and procedures are designed to give reasonable assurance that transactions are properly authorized, assets are safeguarded and financial records properly maintained to provide reliable consolidated financial statements.

The Board of Directors is responsible for reviewing and approving the consolidated financial statements and ensuring management meets their financial reporting responsibilities.

The Audit Committee consists solely of directors who are not officers of the Company and reviews with Management and the external auditors, the quarterly consolidated financial statements of the Company prior to final approval. The Audit Committee also meets during the year with Management and the external auditors to discuss internal control issues, auditing matters, and financial reporting issues. External auditors have free access to the Audit Committee without obtaining prior Management approval.

These consolidated financial statements of Tm Bioscience Corporation ["Tm" or the "Company"] have been prepared in accordance with Canadian generally accepted accounting principles on a going concern basis which presumes the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

As at June 30, 2006, the Company had working capital deficiency of $820,615 and an accumulated deficit of $73,624,503 resulting from losses in the current and prior periods. As the Company is in the early stages of commercialization for its products, the Company’s ability to continue operations is uncertain and is dependent upon its ability to obtain sufficient financing and improve operating results.

These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue operations in the normal course of business. Such adjustments could be material.

These consolidated financial statements include the accounts of Tm, its wholly owned U.S. subsidiaries, Tm Technologies, Inc., and Tm Bioscience, Inc., and two wholly owned Canadian subsidiaries, Tm Bioscience PGX Inc. and Tm Bioscience HG Inc. All intercompany balances and transactions have been eliminated. The consolidated financial entity shall be referred to herein as the "Company". There were no new applicable pronouncements under Canadian Generally Accepted Accounting Principles ["GAAP"] which would result in changes to accounting policies since the year ended December 31, 2005. These consolidated financial statements have been prepared in accordance with Canadian GAAP using the same accounting policies as were applied in the audited consolidated financial statements for the year ended December 31, 2005. Additions to accounting policies since year-end 2005 reflecting new transaction types are disclosed below. These interim consolidated financial statements do not include all of the disclosure included in the Company’s annual audited consolidated financial statements. Accordingly, these interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2005.

Capital assets include equipment under capital lease which is recorded at the present value of the future minimum lease payments less accumulated depreciation. The rate and method used to depreciate equipment under capital lease over its estimated useful life is as follows:

Intangible assets related to genetic marker licenses which are acquired during the research and development phase of a product’s life are amortized from the date of acquisition, over a 5 year expected product life cycle inclusive of the research and development period.