Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | |

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 Or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-33069

Occam Networks, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 77-0442752

(I.R.S. Employer

Identification Number) |

6868 Cortona Drive

Santa Barbara, California

(Address of principal executive offices) |

|

93117

(Zip Code) |

Registrant's telephone number, including area code:(805) 692-2900

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered: |

|---|

| Common Stock, $0.001 par value | | The NASDAQ Stock Market LLC

(The NASDAQ-GM) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of voting and non-voting common equity held by non-affiliates of the Registrant was approximately $56 million as of June 30, 2008 based upon the closing price on the NASDAQ Global Market reported for such date. Shares held by each officer and director and each person owning more than 10% of the outstanding voting and non-voting stock have been excluded from this calculation because such persons may be deemed to be affiliates of the Registrant. This calculation does not reflect a determination that certain persons are affiliates of the Registrant for any other purpose. The number of shares outstanding of the Registrant's Common Stock on February 27, 2009, was 20,395,070 shares.

DOCUMENTS INCORPORATED BY REFERENCE

This information required by Item 11 of Part III of this Form 10-K is incorporated by reference to the registrant's proxy statement for its 2009 annual meeting of stockholders, for which proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Form 10-K.

OCCAM NETWORKS, INC. AND SUBSIDIARY

ANNUAL REPORT ON FORM 10-K

INDEX

| | | | | |

| |

| | Page |

|---|

PART I | | | | |

| | Item 1. | | Business | | 2 |

| | Item 1A. | | Risk Factors | | 18 |

| | Item 1B. | | Unresolved Staff Comments | | 37 |

| | Item 2. | | Properties | | 37 |

| | Item 3. | | Legal Proceedings | | 37 |

| | Item 4. | | Submission of Matters to A Vote of Security Holders | | 39 |

| | Item 4A. | | Executive Officers of the Registrant | | 40 |

PART II | | | | |

| | Item 5. | | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 42 |

| | Item 6. | | Selected Financial Data | | 44 |

| | Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 48 |

| | Item 7A. | | Quantitative and Qualitative Disclosures about Market Risk | | 62 |

| | Item 8. | | Financial Statements and Supplementary Data | | 62 |

| | Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 62 |

| | Item 9A. | | Controls and Procedures | | 62 |

| | Item 9B. | | Other Information | | 70 |

PART III | | | | |

| | Item 10. | | Directors, Executive Officers and Corporate Governance | | 70 |

| | Item 11. | | Executive Compensation | | 70 |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 70 |

| | Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 71 |

| | Item 14. | | Principal Accountant Fees and Services | | 71 |

PART IV | | | | |

| | Item 15. | | Exhibits and Financial Statement Schedules | | 71 |

| | Signatures | | 74 |

| | Index to Financial Statements | | F-1 |

1

Table of Contents

PART I

ITEM 1. BUSINESS

This Annual Report on Form 10-K for the fiscal year ended December 31, 2008, or this Form 10-K, contains forward-looking statements. These forward-looking statements include, among other things, predictions regarding our future:

- •

- revenues and profits;

- •

- gross margin;

- •

- research and development expenses;

- •

- sales and marketing expenses;

- •

- general and administrative expenses;

- •

- pricing and cost reduction activities;

- •

- income tax provision and effective tax rate;

- •

- realization of deferred tax assets;

- •

- cash flows;

- •

- liquidity and sufficiency of existing cash, cash equivalents, and investments for near-term requirements;

- •

- purchase commitments;

- •

- product development and transitions;

- •

- competition and competing technology;

- •

- outcomes of pending or threatened litigation; and

- •

- financial condition and results of operations as a result of recent accounting pronouncements.

You can identify these and other forward-looking statements by the use of words such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "potential," "continue," or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements.

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth in Item 1A, Risk Factors of this Form 10-K. All forward-looking statements included in this document are based on information available to us on the date hereof. We assume no obligation to update any forward-looking statements.

Corporate Information

In May 2002, Occam Networks, Inc., a private California corporation merged with Accelerated Networks, Inc., a publicly-traded Delaware corporation. We are the successor corporation. Occam Networks was incorporated in California in July 1999. Accelerated was incorporated in California in October 1996 under the name "Accelerated Networks, Inc.," and was reincorporated in Delaware in June 2000. The May 2002 merger of these two entities was structured as a reverse merger transaction in which Accelerated Networks succeeded to the business and assets of Occam Networks. In connection with the merger, Accelerated changed its name to Occam Networks, Inc., a Delaware corporation. Unless the context otherwise requires, references in this Form 10-K to "Occam Networks," "Occam," "we," "us," or "our" refer to Occam Networks, Inc. as a Delaware corporation and include the predecessor businesses of Occam, the California corporation, and Accelerated Networks. As required

2

Table of Contents

by applicable accounting rules, financial statements, data, and information for periods prior to May 2002 are those of Occam, the California corporation. Occam, the California corporation, as a predecessor business or corporation, is sometimes referred to in this Form 10-K as "Occam CA."

Our principal executive offices are located at 6868 Cortona Drive, Santa Barbara, California 93117. Our telephone number at that address is (805) 692-2900. Our website iswww.occamnetworks.com. The contents of our website are not incorporated by reference into this Form 10-K. We provide free of charge through a link on our website access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as amendments to those reports, as soon as reasonably practical after the reports are electronically filed with, or furnished to, the Securities and Exchange Commission, or SEC. Occam is a trademark of Occam Networks, Inc. This Form 10-K also includes other trademarks of Occam and of other companies.

Overview

We develop, market and support innovative broadband access products designed to enable telecom service providers to offer, voice, video and data, or Triple Play, services over both copper and fiber optic networks. Our Broadband Loop Carrier, or BLC, is an integrated hardware and software platform that uses Internet Protocol, or IP, and Ethernet technologies to increase the capabilities of local access networks, enabling our customers to deliver advanced services, including voice-over-IP, or VoIP, websurfing and other high speed data communications services, IP-based television, or IPTV, including high-definition television, or HDTV, or in some cases all three of these services, referred to as Triple Play. Our platform simultaneously supports traditional voice services, enabling our customers to leverage their existing networks and migrate to IP services and networks without disruption. In addition to providing our customers with increased bandwidth, our products provide incremental value by offering software-based features to improve the quality, resiliency and security of Triple Play services. Our BLC products enable all of these services over either traditional twisted-pair copper telephone lines or over newer fiber-to-the-premise, or FTTP, lines.

We market our products through a combination of direct and indirect channels. Our direct sales efforts are focused on the North American independent operating company, or IOC, segment of the telecom service provider market. These are companies that never were a part of the original Bell System. Recently, we have expanded our sales activities to include the Caribbean, Latin America, Pacific Islands and certain other international locations, but sales outside North America continue to represent an insignificant portion of our business. As of December 31, 2008, we shipped our BLC platform to over 300 telecommunications customers.

Industry Background

In recent years, the number of broadband subscribers has increased significantly on a worldwide basis. This growth has been driven, in large part, by increasing demand for bandwidth intensive applications, such as music and video downloads, electronic commerce, telecommuting and online gaming. In addition, services are increasingly being delivered over broadband networks using IP, the underlying communications technology of the Internet. For example, VoIP services are now widely available to consumers, and many telecom service providers have announced or initiated plans to offer IPTV services to their subscribers. The rapid growth in broadband subscribers, coupled with the growing amount and diversity of IP-based services, has strained the capacity of many traditional telecommunications networks. Capacity constraints are being exacerbated as HDTV and other bandwidth-intensive services become more prevalent. We believe the rapid growth in IP-based communications traffic is prompting many telecom service providers to modify their network architectures and substantially upgrade the capacity of their networks.

3

Table of Contents

While telecom service providers historically faced little competition in the market for basic voice services, competition has increased significantly in recent years. Deregulation efforts have generally allowed incumbent, competitive and long-distance telecom service providers to compete with one another. Most cable operators now offer high-speed Internet access and VoIP as part of a Triple Play offering. Specialized service providers such as Vonage Holdings Corp. and eBay's Skype Limited have introduced low-cost VoIP services, and many incumbent service providers have responded by offering their own VoIP services. With the widespread use of mobile telephones, some wireless subscribers have elected to discontinue their traditional wired telephone service. For many telecom service providers, these trends have resulted in pricing pressure for basic voice services, subscriber losses and a reduction in profit margins related to voice services. As consumers now have a greater variety of service providers to choose from, telecom service providers face challenges in differentiating their offerings and retaining customers.

In response to increased competition and pricing pressure for standalone voice services, many telecom service providers are seeking to offer Triple Play services, which provides them with the opportunity to increase revenue per subscriber, create flexible pricing plans and promotions, improve customer loyalty and offer the convenience of a single bill, among other benefits. While traditional voice and data services leave little room for differentiation, and the prices of these services are decreasing steadily, video represents an important source of spending by consumers and has therefore emerged as a critical Triple Play offering. Once largely the domain of broadcasters, cable operators and satellite providers, video is increasingly viewed by telecom service providers as an essential element of their business plans. However, because traditional telecom networks were not designed to carry video traffic, telecom service providers must substantially upgrade the capacity, quality and design of their networks in order to deliver IPTV and other broadband services.

Throughout the past decade, telecom service providers have invested considerable resources to upgrade the capacity of their core and metro networks. Core networks connect cities over long distances, while metro networks connect telecom facilities within cities. However, the access network, which serves as the final connection to a residence or business, represents a significant network capacity bottleneck. The access network was originally designed for low-speed voice traffic and is comprised largely of copper telephone lines. In order to overcome the inherent limitations of the access network, service providers deployed first-generation DSL technology. The most prevalent form of this technology generally enables maximum downstream speeds of 1.5 megabits per second, which is far lower than the data transmission rates offered by competing cable companies. These DSL downstream speeds are adequate for basic data applications such as web browsing and emailing, but are less viable for the concurrent or standalone operation of more bandwidth intensive Triple Play services and applications such as HDTV and two-way video conferencing. More recently, enhanced variations of DSL technology supporting greater throughput, including ADSL2Plus and VDSL2, have been standardized, and in the case of ADSL2Plus, have been widely deployed. Enhanced DSL services support bandwidth intensive applications and create a more competitive alternative to cable services. Some service providers have begun replacing portions of their copper access network with a fiber optic technology known as fiber-to-the-premise, or FTTP. Given the cost and effort of replacing copper telephone lines with fiber optic cables, FTTP is typically deployed by most phone companies in phases over multiple years, depending on the number of lines being replaced or deployed.

4

Table of Contents

Traditional telecom networks were designed to support low-capacity voice calls using complex voice switches and circuit-switched transmission technology, in which a fixed amount of network capacity is reserved throughout the duration of a voice call, regardless of whether signals are being transmitted. While traditional networks adequately support voice calls, they are inherently inefficient in handling large volumes of high-bandwidth communications. With the emergence of the Internet and the growing demand for broadband services, telecom service providers have begun deploying new packet-based technologies, including IP, Ethernet and softswitching, to overcome the limitations of the traditional, circuit-switched telephone network. IP-based networks handle the combination of voice, data and video traffic more efficiently by using bandwidth only when signals are being transmitted. Ethernet is the most widely adopted networking technology for business and home networks, and is being increasingly utilized in telecom networks because of its low cost, simplicity and pervasiveness. Softswitching refers to a network architecture in which the key functions of traditional voice switches are separated and performed by various VoIP gateways and call servers built upon open standards.

Networks employing packet-based technologies are generally simpler, more flexible and cheaper to construct and maintain than traditional circuit-switched voice networks. However, the process of transitioning traditional networks to packet-based technologies is lengthy and costly. Most telecom service providers are therefore implementing packet-based technologies gradually and are seeking products that can coexist in circuit-switched and packet-switched networks. Packet-based technologies were first used in core networks to more cost-effectively process long-distance voice and Internet traffic, and were more recently adopted in many metro networks. The next step in this evolution, which has already begun, is the deployment of packet-based technologies such as Ethernet and IP, in the access portion of the network.

Telecom service providers are seeking to upgrade their access networks to increase capacity, support IP-based services, such as VoIP and IPTV and capitalize on the advantages of packet-based technologies. However, most existing solutions for upgrading access networks are generally insufficient, and include:

- •

- Voice-centric products. Next-generation digital loop carriers, or NGDLCs, were introduced in the early 1990s to deliver basic voice services, and later DSL services, in the access network. NGDLCs are generally voice-centric, relatively expensive to deploy and manage, and lack native support for IP-based services.

- •

- Data-centric products. DSL access multiplexers, or DSLAMs, are used to deliver broadband services over copper telephone lines. While some DSLAMs have been upgraded to natively support IP, these products generally do not support traditional voice services and lack important features for quality of service, reliability and full Triple Play services.

- •

- Passive optical networks. Passive optical networks, or PON, attempt to address the access bottleneck by upgrading the access network by replacing copper wire telephone lines with fiber optic cables and passive components. PON are most suitable for densely populated regions or newly-built networks and have less capacity than other fiber optic technologies such as active Gigabit Ethernet.

We believe telecom service providers are seeking a new class of innovative broadband access products that can address the access network bottleneck, deliver the advantages of packet-based technologies and provide simultaneous support for traditional and newer IP-based services. This new class of product must provide a compelling total cost of ownership, be simple to install and manage and meet the stringent quality and performance standards of telecom service providers.

5

Table of Contents

The Occam Networks Solution

We develop, market and support innovative broadband access products designed to allow telecom service providers to increase the capacity of local access networks and deliver Triple Play services. Our primary product, the Broadband Loop Carrier, or BLC, is an advanced broadband access platform that supports a range of IP-based and traditional services in a single platform. Our BLC platform can be deployed in either a local telecom central office, or closer to the end-user in a remote terminal. We also provide a range of ancillary products as part of our total solution, including optical network terminals and remote terminal cabinets. We believe our products enable service providers to deliver new revenue-generating services while minimizing capital expenditures and operating costs.

Our solution offers the following key benefits:

Supports multiple services. Our products support a range of IP-based services, including broadband Internet access, VoIP and IPTV, in addition to traditional circuit-switched voice services. The ability to offer bundled Triple Play services allows telecom service providers to increase average revenue per subscriber, increase customer retention and differentiate themselves versus their competitors. In particular, our support for IPTV enables our customers to address competitive threats posed by cable operators and other competitors.

Addresses the access network bottleneck. We have designed our products to address capacity constraints in the local access network. Our platform employs advanced DSL technologies, such as ADSL2Plus, to enable access speeds to the subscriber in excess of 20 megabits per second. In addition, we provide a Point-to-Point Gigabit Ethernet fiber-to-the-premise, or FTTP, blade for our BLC product, enabling dedicated access speeds to the subscriber of up to 1,000 megabits per second. In July of 2008, we released our Gigabit Passive Optical Network (GPON) product family. Our customers are now able to offer copper, point-to-point (GigE) and point-to-multipoint (PON) services from the same BLC. By significantly increasing the capacity of local access networks, our customers are able to offer bandwidth-intensive services such as HDTV, on-line gaming and two-way video conferencing.

Employs packet-based technologies. Our BLC platform features an innovative design that is built upon packet-based technologies, including IP, Ethernet and softswitching. Our IP-based product efficiently utilizes network capacity and natively supports VoIP, IPTV and other IP-based services. Because we utilize Ethernet in the design of our products, our customers benefit from the simplicity and economies of scale related to this pervasive networking technology. Our BLC platform also features an integrated media gateway, which allows our customers to more easily and cost-effectively adopt softswitches within their access networks.

Integrated and flexible platform. Our BLC platform performs many of the functions that have traditionally been derived from standalone products dedicated to circuit-switched voice, VoIP, DSL access, fiber optic access, DSL testing and Ethernet switching. We believe the integration of our platform delivers substantial performance advantages while helping our customers to conserve costs, space and power, and simplify their networks by minimizing the number of discrete components. Our platform also features a modular design, allowing our customers to purchase our product with minimal initial investment, and add capacity and features incrementally as their requirements grow. The BLC platform is economical for low-capacity sites, but can scale to support tens of thousands of telephone subscribers from a single site in the network. With the recent introduction of our GPON family of products, and our shipping of point-to-point Gigabit Ethernet FTTP products, our customers have the flexibility to adopt either copper or fiber optic access technologies from the same system.

Reliable and simple to install and operate. Our products are designed to meet the most stringent performance and reliability standards of telecom service providers. Our field-proven BLC platform contains redundancy features to maximize network uptime and has been designed to withstand harsh environmental conditions. Our products are simple to install and allow for the rapid introduction of

6

Table of Contents

new services. We offer sophisticated network management tools that allow our customers to monitor and optimize the quality of their networks, which is critical when deploying services that are particularly sensitive to network quality, such as VoIP and IPTV.

Strategy

Our objective is to become the leading provider of innovative broadband access products to telecom service providers. Key elements of our strategy include the following:

Extend technology leadership position. Our management team and technical personnel possess a unique combination of expertise in both telecom and data networking technologies. We believe our technical leadership differentiates us from our competitors and has been key to our success in attracting customers to date. We will continue to leverage our technical expertise and invest in research and development to design, engineer and sell innovative products that address our customers' needs.

Continue to enhance and extend our product line. We will continue to enhance our BLC platform to support new technologies and features to address the evolving requirements of our customers. For example, we recently enhanced our BLC platform with support for 10 Gigabit Ethernet transport. We broadened our product line with the introduction of our GPON blade and a line of GPON optical network terminals, or ONTs, providing our customers with a more complete FTTP solution. We also intend to continue to reduce the cost of our new and existing products to bring increased value to our customers.

Focus initially on independent operating companies. We currently focus our direct sales and marketing efforts primarily on North American independent operating companies, or IOCs, because, in our experience, they quickly adopt new technologies and are more willing to purchase products from focused suppliers like us. In addition, a number of favorable regulatory, demographic, financial and competitive factors make IOCs attractive target customers for us. IOCs benefit from government funding for telecom projects aimed at increasing broadband access to rural regions. Some of the areas IOCs serve are experiencing population growth as residents leave cities and suburbs for less populated surrounding areas. IOCs are upgrading their local access networks to support population growth and demand for advanced services by deploying advanced copper and fiber-optic broadband access products such as ours. In addition, IOCs tend to be financially stable with excellent credit and payment characteristics.

Expand customer focus by partnering with market leaders. While we expect to continue concentrating our direct sales efforts on IOCs, we plan to prudently expand our target customer base to include larger telecom service providers in the U.S. and internationally. To assist in these efforts, we will continue to develop distribution relationships with third parties that we believe have strong market positions and customer relationships. We believe this strategy allows us to expand our addressable market while focusing resources on product development and our other core strengths.

Continue to prioritize customer satisfaction. We seek to consistently provide our customers with high levels of support and service throughout the sales cycle and after installation of our products. We believe that our commitment to service and support has been an important contributing factor to our success to date. We continue to expand our customer support and service capabilities to keep pace with the growth in our customer base, and will continue to make customer satisfaction a top priority for our company.

7

Table of Contents

Products

BLC 6000 System. The BLC 6000, our primary product line, was announced in May 2003 and became commercially available in June 2003. The BLC 6000 is an advanced broadband access platform that increases the capacity of local access networks and allows telecom service providers to deliver Triple Play services to their subscribers. The BLC 6000 is a highly-integrated platform that performs functions that have traditionally been delivered by separate voice, video, DSL access, fiber optic access and data networking products. The BLC platform has a modular design composed of a central housing unit, or chassis, and a variety of electronic assemblies or blades to support various services or features. Key elements of the system include:

- •

- Blades. We offer a variety of blades that transmit traffic upstream and downstream, interconnect various networks and convert circuit-switched voice traffic to VoIP, among other functions. Our blades currently support Gigabit Ethernet, 10 Gigabit Ethernet, GPON, ADSL2Plus, and standard telephone service, or POTS. Our current line of blades is summarized in the table below.

| | | | |

Model | | Function | | Description |

|---|

| 6150 | | Lifeline POTS | | Provides 48 POTS ports, multiple Gigabit Ethernet ports, and four T1 ports and converts analog voice traffic to VoIP |

| 6151 | | Lifeline POTS | | Provides 48 POTS ports and converts analog voice traffic to VoIP |

| 6152 | | Lifeline POTS | | Provides 48 ports of POTS, multiple Gigabit Ethernet ports, and converts analog voice traffic to VoIP |

| 6214 | | ADSL2plus | | Provides 48 ADSL2plus ports with integrated POTS splitters for data and video |

| 6244 | | ADSL2Plus and POTS Blade | | Provides for 24 combination POTS and ADSL2Plus ports for voice, data, and video service delivery and multiple Gigabit Ethernet ports for optical fiber transport and blade interconnection |

| 6246 | | ADSL2plus and POTS | | Provides 24 combination POTS and ADSL2plus ports for voice, data and video service delivery and multiple Gigabit Ethernet ports and four T1 ports |

| 6252 | | ADSL2plus and POTS | | Provides 48 combination POTS, multiple Gigabit Ethernet ports and ADSL2plus ports for voice, data and video service delivery |

| 6312 | | Optical Line Termination | | Provides 20 Gigabit Ethernet ports for customer data and video services, optical fiber transport and blade interconnection |

| 6314 | | Optical Line Termination | | Provides 16 Gigabit Ethernet ports for customer data and video services and two optical 10 Gigabit Ethernet transport ports and two copper 10 Gigabit interconnection ports |

| 6322 | | GPON Optical Line Termination | | Provides 4 GPON OLT ports for customer voice, data and video services, one optical 10 Gigabit Ethernet transport port and two copper 10Gigabit interconnection ports |

| 6440 | | Optical Packet Transport | | Provides 8 T1 ports and Gigabit Ethernet ports for optical fiber transport and blade interconnection |

| 6450 | | 10Gigabit Optical Aggregation | | Provides 16 Gigabit Ethernet ports for customer subnetworks and two optical 10 Gigabit Ethernet transport ports and two copper 10 Gigabit interconnection ports |

| 6640 | | Subscriber Trunk Gateway | | Interconnects VoIP to traditional voice switches using the TR-08 or GR-303 voice interface protocols |

| 6660 | | Emergency Standalone | | Provides local dialing to emergency service facilities and calls between local POTS subscribers during network outages |

Chassis. Our chassis house our blade products, perform cooling, power and cable distribution and are offered in two model types. The BLC 6001 chassis houses a single blade and can be deployed as a

8

Table of Contents

standalone unit for low-capacity applications or stacked for medium-capacity applications. The BLC 6012 chassis houses up to twelve blades for deployment in high-capacity applications.

OccamView. OccamView is a distributed element management system that allows our customers to remotely manage Triple Play services from any secure web browser. OccamView features an open architecture that can be integrated into a wide variety of telecom network management systems.

Optical network terminals. Our ON 2300 and ON 2400 series of optical network terminals, or ONTs, reside at either residential or business locations and terminate active Gigabit Ethernet or Gigabit PON FTTP services delivered by the BLC platform. Voice, video and data traffic from the customer premises is fed to the ONT which converts the traffic into optical signals for transmission to the BLC platform. We have introduced two families of ONTs for residential and business applications.

| | | | |

Model | | Function | | Description |

|---|

| ON 2300 | | Optical Network Terminal Series | | Enables the connection of single family and multi-dwelling units to Point-to-Point GigE FTTH networks |

| ON 2400 | | Optical Network Terminal Series | | Enables the connection of single family and multi-dwelling units to GPON FTTH networks |

Remote terminal cabinets. We offer a series of remote terminal cabinets that house our BLC platform and protect the system from harsh environmental conditions. We source these cabinets from third parties who integrate our BLCs with a variety of accessory devices into the cabinets. We offer our customers versions for low-, medium- and high-density deployments in a variety of geographical areas. Our cabinets are environmentally controlled, and we believe they deliver reliable protection with a high degree of deployment flexibility.

We currently have under development products, features and functions that we believe will further enhance our product family. These development activities are generally focused on the following areas:

- •

- reducing the overall cost of solutions;

- •

- software for improving operation, administration, and maintenance (OAM) of Occam products, while improving the ease of deployment for customers;

- •

- improving the scalability of networks that are built with our products; and

- •

- additional elements of our FTTx family, such as a broader range of ONTs for business and Multi-Dwelling Units, or MDUs, and expanded support for 10Gigabit Ethernet aggregation.

Technology

We have a set of differentiated hardware and software technology elements and skills that we apply to the development of our products. We have recruited a technical staff that possesses a unique combination of telecom and data networking expertise, which we believe provides a critical advantage in the design of our products. Our technical staff is responsible for the introduction of several key developments, including Point-to-Point Gigabit Ethernet FTTP, 10 Gigabit transport, Ethernet Protection Switching, Emergency Standalone service, and Network Security Management.

In October 2007, we purchased certain assets of Terawave Communications, Inc., including its gigabit passive optical networking, or GPON, technology. We believe this acquisition, along with the subsequent hiring of certain former Terawave technical personnel, augmented our skills with knowledge of GPON and other standards associated with its development and eventual deployment.

9

Table of Contents

Key components of our technology and expertise include:

IP/Ethernet architecture. Our system architecture is based upon IP and Ethernet technologies. We selected this design because we believe that IP and Ethernet will account for a growing portion of communications traffic, and that telecom service providers will increasingly adopt IP and Ethernet technologies in local access networks. Because our platform processes IP and Ethernet traffic natively, we believe our platform is more efficient, scalable and cost-effective than competing products based on legacy technologies. We believe that our IP/Ethernet-based design will allow for continued cost-reductions due the significant economies of scale associated with these pervasive technologies.

Telecom expertise. Transitioning telecom networks to IP will be a lengthy process, and telecom service providers will continue to deliver circuit-switched voice services for the foreseeable future. For this reason, we have designed our products to support a range of legacy switching, signaling and transport protocols and have recruited engineering personnel with expertise in these areas. In order to help telecom service providers maintain the reliability of their networks as they transition to IP, we have designed our products with key resiliency features, including Emergency Standalone, clustering and Ethernet Protection Switching.

Data networking expertise. Our products are designed for the secure and reliable delivery of critical services over IP networks. Our engineering staff has expertise in the areas of switching, routing, native IP security management and VoIP signaling protocols such as SIP and MGCP. To assist in the deployment of broadband Internet services, we have designed our products with integrated subscriber management, automated provisioning and policy enforcement tools.

Video delivery expertise. Delivering video services over telecom access networks is challenging because these networks were not designed to carry bandwidth-intensive traffic, and video is more sensitive to disruption than other services, such as Internet access. We have designed our platform to address these challenges and assist our customers in the rapid delivery of IPTV services. For example, our BLC platform provides sufficient capacity to support multiple channels of HDTV and provides integrated video diagnostic tools for proactive video service quality management. We also believe our customers benefit from the experience we have gained in a multitude of IPTV deployments.

Transport and access interfaces. Our products interface with a wide variety of communications networks. We have applied our diverse expertise in access and transport interfaces to design a family of blades, providing our customers with significant flexibility in the deployment of our products. Specific interface technologies supported by our platform include: Gigabit Ethernet, 10 Gigabit Ethernet, GPON, ADSL2plus, DS1 and standard POTS telephone service.

Network management. Our network provisioning and management system, OccamView, enables our customers to monitor the status of their network, services and equipment through a web-based graphical user interface. OccamView interfaces with commonly used telecom network management systems and features a variety of tools to facilitate service provisioning, activation, monitoring and access to service profiles.

Customers

For the year ended December 31, 2008, Goldfield Telecom, a value-added reseller and network operator, and Rural Telephone Services, an IOC, accounted for 11% and 10% of our revenue, respectively. For the year ended December 31, 2007, Goldfield Telecom, and Farmers Telephone Cooperative each accounted for 10% of our revenue. For the year ended December 31, 2006, no single customer accounted for 10% or more of our revenue.

To date, we have primarily focused our sales and marketing efforts on independent operating companies, or IOCs. We believe there are more than 1,100 IOCs in North America. These companies

10

Table of Contents

vary in size ranging from small, rural companies serving limited geographic areas with a limited number of lines to large independent providers serving multiple states. We have chosen to focus on IOCs because of the following favorable characteristics:

- •

- Receptive to innovative technologies. Because most IOCs operate relatively small networks, they tend to adopt new technologies more quickly than large service providers. In addition, the typical sales cycle for IOCs is generally shorter than that of large service providers. We believe these factors have allowed us to increase our sales in a relatively short time frame with limited sales and marketing expenditures.

- •

- Accessible for focused suppliers. We believe IOCs make equipment purchase decisions based primarily on product technical merits and the level of sales and support attention received, areas in which we believe we compete favorably. Furthermore, we believe competition among equipment suppliers in the IOC market is more moderate than in the market for large service providers.

- •

- Favorable demographic trends. We believe that certain IOCs are experiencing subscriber growth in their markets as individuals move from urban and suburban areas to less populated regions. Many IOCs are also experiencing an increase in demand by their customers for Triple Play services, including IPTV. As a result, many IOCs that we target have a strong incentive to upgrade the capacity and capabilities of their local access networks by purchasing our products.

- •

- Financially stable and well funded. Most IOCs have lengthy operating histories in the industry, and based on our experience to date, have strong credit profiles and payment practices. In addition, many IOCs receive government funding for broadband access expansion projects under the RUS program. We believe the financial health of IOCs, along with government funding, has contributed to the rapid adoption of our products to date.

We also believe there are significant opportunities to sell our products to large telecom service providers, including the national local exchange carriers, competitive local exchange carriers and international telecom service providers.

Sales and Marketing

We have implemented a three-pronged sales strategy composed of the following elements:

- •

- Direct sales. Our direct sales organization focuses on IOCs in North America by establishing and maintaining direct relationships with prospective customers. Our direct sales force is responsible for identifying sales opportunities and advising prospective customers on the benefits of our products and tailoring our products to their specific needs. We also employ a team of sales engineering personnel in our sales process in order to address prospective customers' technical issues. A substantial majority of our sales to date have been through our direct sales efforts.

- •

- Strategic partner relationships. We have established strategic relationships with third parties to market our solutions to larger telecom service providers. We also expect that strategic relationships will be a key component of our international expansion strategy. We believe these relationships allow us to expand our addressable market while focusing our resources on our core strengths.

- •

- Value-added resellers. We utilize value-added resellers to service small customers in North America that would not be cost-effective for us to address directly. In addition, these value-added resellers provide a range of services, including network design and product installation and configuration, that facilitate the deployment of our products by customers with limited internal capabilities.

11

Table of Contents

Our marketing efforts are designed to create brand awareness with these customers and to demonstrate our technological leadership and cost advantages in the broadband access equipment market. We educate potential customers about our products and the benefits of our solutions through industry publications and trade shows. We also conduct education programs to describe our products and the benefits of our solutions for senior management of engineering design firms who design networks for IOCs.

An important element in our marketing strategy is the development of relationships with companies who have an established presence in our target market segments. We have developed the Occam Packet Access Network Alliance, whereby independent companies work with us to define broader solutions, perform interoperability tests, develop joint-business cases and provide cooperative customer support.

In March 2005, we entered into a strategic relationship with Tellabs and certain of its subsidiaries in which we granted Tellabs, Inc., or Tellabs, certain exclusive and non exclusive rights to our BLC products. In March 2006, we amended this strategic relationship to, among other things, (i) add a requirement that Tellabs purchase directly from us a certain percentage of the BLC products that it sells to listed exclusive customers. Tellabs' exclusivity expired with respect to the large IOCs in March 2007 and the exclusivity with respect to the remaining large incumbent local exchange carriers expired in March 2008. Tellabs is obligated to pay us a royalty for each BLC product sold to one of the listed exclusive customers and each FTTC product sold to any customer by Tellabs under this strategic relationship. We do not expect to realize a material amount of revenues from the Tellabs relationship.

Technical Service and Customer Support

Our technical service and customer support organization is responsible for customer training, post-sales technical support and maintenance. We have established a technical assistance center and a test and interoperability lab, which allows us to provide effective and timely customer support 24 hours a day, seven days a week. We work with various third-party engineering, furnishing and installation companies to assist our customers with the design engineering, staging, installation and initial activation of our products. We also employ a staff of interoperability and test engineers to ensure that our products are interoperable with various standards-based network elements including voice gateways, softswitches, DSLAMs, Ethernet switches, DSL modems, optical network terminals, integrated access devices and residential gateways.

Our equipment is typically implemented as a part of the service provider's local access network, and is sometimes combined with additional work by the service provider to update the copper wire or to install new fiber optic cable. As a result, a large percentage of the work is done in the late spring, summer and early fall in portions of the country that experience colder weather, including snow and ice. As a result, there can be seasonality to Occam shipments biased towards these seasons.

Research and Development

We have a team of engineers dedicated to conducting research and development in specific technology areas that are strategic to our business. Our research and development team has expertise covering a range of telecom and data networking technologies, including digital loop carrier, voice signaling, call control, IP and Ethernet networking, DSL, optical networking and network management.

We expect to continue to make substantial investments in research and development. Research and development expenses, including amortization of stock-based compensation, were approximately $19.0 million, $13.3 million, $9.6 million during the fiscal years ended December 31, 2008, 2007 and 2006, respectively. Our primary research and development center is based in Santa Barbara, California. We have additional development centers in Fremont and Camarillo, California.

12

Table of Contents

Patents and Intellectual Property

We rely on a combination of patent, copyright and trademark and trade secret laws, confidentiality procedures and contractual provisions to protect our proprietary rights with respect to our technology and proprietary information. We have been issued 24 patents, we also have several additional patent applications pending and we intend to file more patent applications. Our issued patents expire over the next 10 to 15 years. Our patent strategy is designed to protect corporate technology assets, provide access to additional technology through cross licensing opportunities and create opportunities for additional revenue through technology licensing. We cannot provide any assurance that any patents will be issued from pending applications or that any issued patents will adequately protect our intellectual property.

While we rely on patent, copyright, trademark and trade secret laws to protect our technology, we also believe that factors such as the technological and creative skills of our personnel, new product developments, frequent product enhancements and product reliability are essential to establishing and maintaining a technology leadership position. We selectively license technologies from third parties when necessary or useful.

We maintain a program to identify and obtain patent protection for our inventions. It is possible that we will not receive patents for every application we file. Furthermore, our issued patents may not adequately protect our technology from infringement or prevent others from claiming that our products infringe the patents of those third parties. Our failure to protect our intellectual property could materially harm our business. In addition, our competitors may independently develop similar or superior technology, duplicate our products, or design around our patents. It is possible that litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others. Litigation could result in substantial costs and diversion of resources and could materially harm our business.

We may receive in the future, notice of claims of infringement of other parties' proprietary rights. Infringement or other claims could be asserted or prosecuted against us in the future, and it is possible that past or future assertions or prosecutions could harm our business. Any such claims, with or without merit, could be time-consuming, result in costly litigation and diversion of technical and management personnel, cause delays in the development and release of our products, or require us to develop non-infringing technology or enter into royalty or licensing arrangements. Such royalty or licensing arrangements, if required, may require us to license back our technology or may not be available on terms acceptable to us, or at all. For these reasons, infringement claims could materially harm our business.

Manufacturing

We outsource significant portions of our manufacturing operation to third parties and have entered into a manufacturing outsourcing contract with Flash Electronics, located in Fremont, California, for the manufacture of our BLC 6000 blade products, as well as our ONT products. This agreement provides for material procurement, board level assembly, testing, purchase commitments and quality control by the manufacturer, and delivery to our end customers. Our products are manufactured in the United States, China and Mexico. We design, specify and monitor all applicable testing in order to meet our internal and customer quality standards. Occam is ISO certified. ISO is a series of standards agreed to by the International Organization for Standardization covering various aspects of design, development, production of equipment and distribution. We have several single or limited source suppliers. Although our products could be redesigned to avoid using any sole source supplier, it would be expensive and time consuming to make such a change.

13

Table of Contents

Competition

Competition in our market is intense and we expect competition to increase. The market for broadband access equipment is dominated primarily by large suppliers such as Alcatel- Lucent SA, Motorola, Tellabs and ADTRAN Inc. While these suppliers focus primarily on large service providers, they have competed, and may increasingly compete, in the IOC market segment. In addition, a number of companies, including Calix, have developed, or are developing, products that compete with ours, including within our core IOC segment.

Our ability to compete successfully depends on a number of factors, including:

- •

- the performance of our products relative to our competitors' products;

- •

- our ability to properly define and develop new products, differentiate those products from our competitors' and deliver them at competitive prices;

- •

- our ability to market and sell our products through effective sales channels;

- •

- the protection of our intellectual property, including our processes, trade secrets and know-how; and

- •

- our ability to attract and retain qualified technical, executive and sales personnel.

Although we believe we compete favorably on the basis of product quality and performance, many of our existing and potential competitors are larger than we are with longer operating histories, and have substantially greater financial, technical, marketing or other resources; and a larger installed base of customers than we do. In addition, many of our competitors have broader product lines than we do, so they can offer bundled products, which may appeal to certain customers.

As the market for our products evolves, winning customers early in the growth of this market is critical to our ability to expand our business and increase sales. Service providers are typically reluctant to switch equipment suppliers once a particular supplier's product has been installed due to the time and cost associated with such replacements. As a result, competition among equipment suppliers to secure initial contracts with key potential customers is particularly intense and will continue to place pressure on product pricing. If we are forced to reduce prices in order to secure customers, we may be unable to sustain gross margins at desired levels or maintain profitability.

Governmental Regulation

The markets for our products are characterized by a significant number of laws, regulations and standards, both domestic and international, some of which are evolving as new technologies are deployed. Our products, or the deployment of our products, are required to comply with these laws, regulations and standards, including those promulgated by the Federal Communications Commission, or FCC, and counterpart foreign agencies. Subject to certain statutory parameters, we are required to make available to our customers, on a reasonably timely basis and at a reasonable charge, such features or modifications as are necessary to permit our customers to meet those capability requirements. In some cases, we are required to obtain certifications or authorizations before our products can be introduced, marketed or sold. While we believe that our products comply with all current applicable governmental laws, regulations and standards, we cannot assure that we will be able to continue to design our products to comply with all necessary requirements in the U.S in the future. Accordingly, any of these laws, regulations and standards may directly affect our ability to market or sell our products.

In addition, the Federal Communications Commission and state public utility commissions regulate our customers, including the rates that our customers may charge for telecommunications services. In particular, our IOC customers, but also others including regional Bell operating companies and

14

Table of Contents

competitive local exchange carriers, receive substantial revenue from intercarrier compensation (including interstate and intrastate access charges) and federal and state universal service subsidies. In 2001, the FCC initiated a rulemaking proceeding to seek comment as to whether and how the FCC should change its rules governing intercarrier compensation. Beginning in late 2000 and continuing into 2004, the telecom industry experienced a severe downturn, and many telecom service providers filed for bankruptcy. Those companies that survived the downturn substantially reduced their investments in new equipment. In addition, uncertain and volatile capital markets depressed the market values of telecom service providers and restricted their access to capital, resulting in delays or cancellations of certain projects. More recently, we believe capital expenditures among IOCs have been adversely affected as our customers consider their investment and capital expenditure decisions in light of the industry transition from copper wire to fiber. Because many of our customers are IOCs, their revenues are particularly dependent upon intercarrier payments (primarily interstate and intrastate access charges) and federal and state universal service subsidies. The FCC and some states are considering changes to both intercarrier payments and universal service subsidies, and such changes could reduce IOC revenues. Furthermore, many IOCs use government supported loan programs or grants to finance capital spending. Changes to those programs, such as the United States Department of Agriculture's Rural Utility Service loan program, could reduce the ability of IOCs to access capital. The recent turmoil in the U.S. lending markets and current uncertainty in global economic conditions has had an impact on the overall U.S. economy and the spending patterns of our customers and prospects. Any decision by telecom service providers to reduce capital expenditures, whether caused by the economic downturn, changes in government regulations and subsidies, or other reasons, would have a material adverse effect on our business, consolidated financial condition and results of operations.

Furthermore FCC regulatory policies that affect the availability of broadband access services may impede the penetration of our customers in their respective markets, affecting the prices that our customers are able to charge, or otherwise affecting the ability of our customers to market their services and grow their business. For example, FCC regulations addressing interconnection of competing networks, collocation, unbundling of network elements and line sharing impact our potential regional Bell operating company, IOC and competitive local exchange provider customers.

Legislation is also currently before the United States Congress that could affect the demand for our products. Various proposals before the United States Congress would alter the regulatory regime for franchising multichannel video providers, the regulatory status and obligations of VoIP, broadband video and broadband data providers, and the extent to which broadband Internet access providers are subject to non-discrimination or other duties with respect to applications or service provided over broadband networks. Some of these issues are also being considered by state legislatures in various forms.

State regulation of telecommunications networks and service providers may also affect the regulatory environment of our market. As discussed above, states generally regulate the rates for intrastate telecommunications services, particularly those offered by incumbent local exchange carriers such as the RBOCs and IOCs, and some states provide state universal service subsidies to our customers. State regulators also, for example, typically settle disputes for competitive access to some incumbent local exchange carrier network elements or collocation in incumbent local exchange carrier offices, which competitive carriers use to offer various services. State regulators may also regulate and arbitrate disputes concerning interconnection of networks of incumbent local exchange carriers and competitive carriers. To the extent that our customers are adversely affected by these changes in the regulatory environment, our business, operating results, and financial condition may be harmed.

In addition to federal and state telecommunications regulations, an increasing number of other domestic laws and regulations are being adopted to specifically address broadband and telecommunications issues such as liability for information retrieved from or transmitted over the Internet, online content regulation, user privacy, taxation, consumer protection, security of data and

15

Table of Contents

access by law enforcement, as well as intellectual property ownership, obscenity and libel. For instance, the FTC has recommended that Congress enact legislation to ensure adequate protection of online privacy and federal online privacy legislation is currently pending in Congress. The adoption of this or other restrictive legislation could increase the costs of communicating over the Internet or decrease the acceptance of the Internet as a commercial and advertising medium, thus dampening the growth of the Internet. Because our customers use our products to facilitate both commercial and personal uses of the Internet, our business could be harmed if the growth of the Internet were adversely affected by such regulations or standards.

Countries in the European Union, or EU, have also adopted laws relating to the provision of Internet services, the use of the Internet, and Internet-related applications. For example, in the United Kingdom, an Internet service provider, or ISP, may be liable for defamatory material posted on its sites. In Germany, an ISP may be liable for failing to block access to content that is illegal in the country. In addition, the EU has adopted a data protection directive to address privacy issues, impacting the use and transfer of personal data within and outside the EU. The application of this directive within the EU and with respect to U.S. companies that may handle personal data from the EU is unsettled. Similarly, countries in Europe restrict the use of encryption technology to varying degrees, making the provision of such technology unclear. Other laws relating to Internet usage are also being considered in the EU.

The applicability of laws, regulations and standards affecting the voice telephony, broadband telecommunications and data industry in which we and our customers operate is continuing to develop, both domestically and internationally. We cannot predict the exact impact that current and future laws, regulations and standards may have on us or our customers. These laws, regulations and standards may directly impact our products and result in a material and adverse effect on our business, financial condition and results of operations. In addition, should our customers be adversely impacted by such regulation, our business, financial condition and results of operations would likely be adversely affected as well.

Employees

As of December 31, 2008, we employed 212 full-time employees in the United States and 3 full-time employees in Canada. Of our total number of employees, 80 were in engineering, 80 were in sales, marketing and customer service, 37 were in finance, IT and administration and 18 were in operations and manufacturing . None of our employees is represented by collective bargaining agreements. We consider our relations with employees to be good.

Facilities

We have lease agreements related to the following properties:

- •

- approximately 51,000 square feet in Santa Barbara, California, used primarily for executive offices and for research and product development, administrative, and sales and marketing purposes, which expires in February 2014, and which we initially occupied in June 2007;

- •

- approximately 36,000 square feet of space in Fremont, California, used primarily for executive offices and for research and product development, administrative, and sales and marketing purposes, which expires in June 2015, and which we initially occupied in June 2008 and;

- •

- approximately 2,930 square feet in Camarillo, California, used primarily for research and product development purposes, which expires in November 2009;

We believe that our facilities adequately meet our current requirements for the foreseeable future and that we will be able to secure additional facilities as needed on commercially acceptable terms.

16

Table of Contents

Backlog

Our backlog primarily consists of purchase orders from customers for products to be delivered within the next several quarters. Our backlog as of December 31, 2008 was approximately $20 million. Due in part to factors such as the timing of product release dates, customer purchase orders, product availability, allowing customers to delay scheduled delivery dates without penalty, allowing customers to cancel orders within negotiated time frames without significant penalty, and other factors that may adversely affect or delay our ability to recognize revenue under applicable revenue recognition rules, our backlog may not be indicative of future revenue during any subsequent quarter.

Geographic Information

During our last three years, substantially all of our revenue was generated within North America, and all of our long-lived assets are located within the United States.

17

Table of Contents

ITEM 1A. RISK FACTORS

This Annual Report on Form 10-K, or Form 10-K, including any information incorporated by reference herein, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, referred to as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, referred to as the Exchange Act. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expect," "plan," "intend," "forecast," "anticipate," "believe," "estimate," "predict," "potential," "continue" or the negative of these terms or other comparable terminology. The forward-looking statements contained in this Form 10-K involve known and unknown risks, uncertainties and situations that may cause our or our industry's actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these statements. These factors include those listed below in this Item 1A and those discussed elsewhere in this Form 10-K. We encourage investors to review these factors carefully. We may from time to time make additional written and oral forward-looking statements, including statements contained in our filings with the SEC. We do not undertake to update any forward-looking statement that may be made from time to time by or on behalf of us, whether as a result of new information, future events or otherwise, except as required by law.

Before you invest in our securities, you should be aware that our business faces numerous financial and market risks, including those described below, as well as general economic and business risks. The following discussion provides information concerning the material risks and uncertainties that we have identified and believe may adversely affect our business, our financial condition and our results of operations. Before you decide whether to invest in our securities, you should carefully consider these risks and uncertainties, together with all of the other information included in this Annual Report on Form 10-K.

Risks Related to Outstanding Litigation and Internal Controls

An adverse resolution of outstanding litigation resulting from the restatement in October 2007 of our historical financial statements could have a material adverse effect on our business, operating results, or financial condition.

On October 16, 2007, following a seven month review of our historic revenue recognition practices that was led by our audit committee, we filed our Annual Report on Form 10-K for the year ended December 31, 2006, which included our consolidated financial statements for the year ended December 31, 2006 and which restated our financial statements for the years ended December 26, 2004 and December 25, 2005, for each of the interim quarterly periods in fiscal 2004 and 2005, and the first three interim quarterly periods of fiscal 2006. Following the announcement of the commencement of the audit committee review in March 2007, we, certain of our directors and executive officers and others became defendants in a consolidated federal securities class action. The consolidated complaint alleges that the various defendants violated sections 10(b) and 20(a) of the Exchange Act and SEC Rule 10b 5 promulgated thereunder, as well as sections 11 and 15 of the Securities Act, by making false and misleading statements and omissions relating to our financial statements and internal controls with respect to revenue recognition. We cannot provide any assurances that the final outcome of this consolidated securities class action will not have a material adverse effect on our business, results of operations, or financial condition. Litigation and any related proceedings can be time-consuming and expensive and could divert management time and attention from our business, which could have a material adverse effect on our revenues and results of operations. In addition, an adverse resolution of the outstanding litigation could have a material adverse effect on our financial condition if we are required to use our available cash resources to settle the litigation or satisfy any judgment. This litigation is still in the relatively early procedural stages, and we cannot predict its outcome. In addition, we cannot at this time predict whether our insurance coverage will be sufficient to cover any liability or whether our carriers may seek to rescind or deny coverage.

18

Table of Contents

Potential indemnification obligations set forth in our charter documents or in contracts between us and various officers, directors, and third parties could have a material adverse effect on our business, operating results or financial condition.

Under Delaware law, our bylaws, and indemnification agreements to which we are a party, we may have an obligation to indemnify certain current and former officers and directors, as well as certain underwriters and stockholders, in relation to outstanding litigation or other related matters. Such indemnification may have a material adverse effect on our business, results of operations, and financial condition to the extent insurance does not cover our costs. The insurance carriers that provide our directors' and officers' liability policies may seek to rescind or deny coverage, either in whole or part, with respect to pending litigation, or we may not have sufficient coverage under such policies, in which case our business, results of operations, and financial condition may be materially and adversely affected.

If we fail to establish and maintain proper and effective internal controls, our ability to produce accurate financial statements on a timely basis could be impaired, which would adversely affect our consolidated operating results, our ability to operate our business and our stock price.

In connection with the 2007 audit committee review of our revenue recognition practices and our resulting financial restatement, we determined that we did not have adequate internal financial and accounting controls to produce accurate and timely financial statements. Among weaknesses and deficiencies identified in our review, we determined that we had a material weakness with respect to revenue recognition. Since the restatement was completed in October 2007, we have implemented new processes and procedures to improve our internal controls and have expanded our finance and accounting staff. Nevertheless, as of December 31, 2008, our chief executive officer and chief financial officer determined that our internal controls over financial reporting were not effective to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external reporting in accordance with generally accepted accounting principles in the United States. Failure on our part to have effective internal financial and accounting controls could cause our financial reporting to be unreliable, could have a material adverse effect on our business, operating results, and financial condition, and could adversely affect the trading price of our common stock.

Ensuring that we have adequate internal financial and accounting controls and procedures in place to produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. Our audit committee's investigation of revenue recognition issues identified weaknesses and other control deficiencies relating principally to revenue recognition and the processes and procedures associated with customer transactions and interaction with and review by our finance department. As part of its internal control deficiencies letter dated October 15, 2007, our current independent registered public accounting firm identified a material weakness relating to revenue recognition. Our independent registered public accounting firm noted that we did not have policies and procedures in place to ensure that modifications to, or side agreements associated with, our standard terms of contract are properly documented and approved. Our independent registered public accounting firm also cited a lack of understanding of the accounting consequences of modifications to standard terms by certain sales employees and a lack of communication among our sales, engineering, and finance departments to ensure that all sales transactions are properly tracked, documented, approved, and recorded.

In their October 2007 letter, our independent registered public accounting firm identified additional control deficiencies that it determined to be significant deficiencies but that it did not deem to be material weaknesses. In particular, it identified a significant deficiency relating to segregation of duties, noting among other things that in certain instances journal entries and account reconciliations were approved by the preparer of the entry or reconciliation. Our independent registered public

19

Table of Contents

accounting firm also noted a significant deficiency relating to post-closing adjusting journal entries and recommended that we reassess the timeline of our financial statement process to ensure that we have reasonable time to conclude a thorough financial statement closing process. Finally, our independent registered public accounting firm identified significant deficiencies relating to recording certain purchase transactions, where parts were ordered and accepted by our engineering department, without approval or involvement of our finance department, and where fixed assets were not properly classified for depreciation purposes.

In connection with the audit of our consolidated financial statements for the year ended December 31, 2007 and the effectiveness of our internal control over financial reporting as of December 31, 2007, our independent registered public accounting firm again identified a material weakness and some significant deficiencies in our internal control over financial reporting in a letter dated March 10, 2008. Specifically, our independent registered public accounting firm noted a continuing material weakness relating to revenue recognition and our policies and procedures to ensure that modifications to, or side agreements associated with, our standard terms of contract were properly approved, documented, tracked and recorded.

In connection with the preparation and related audit of our financial statements for the year ended December 31, 2008, our management concluded that the same material weakness reported on December 31, 2007 continued to exist on December 31, 2008 with respect to revenue recognition policies and procedures. In addition, management identified significant deficiencies relating to (i) approval processes for credit memos and special pricing terms and (ii) segregation of duties in our order management group. Management noted that each of the audit committee's 2007 recommendations had been completed but determined that a number of these remediation efforts had not been in place or tested for a sufficient period to conclude that they were effective. In particular, we implemented standardized terms and conditions for customer quotes, contracts, and invoices in the fourth quarter of fiscal 2008, but only a small portion of our revenues in 2008 were generated in transactions entered under these standardized terms. In addition, management concluded that the controls implemented to date have largely been focused on error detection and that we need to implement additional preventative controls designed to address potential errors before they occur.

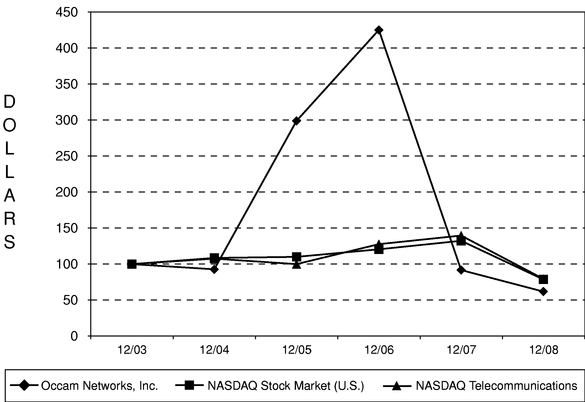

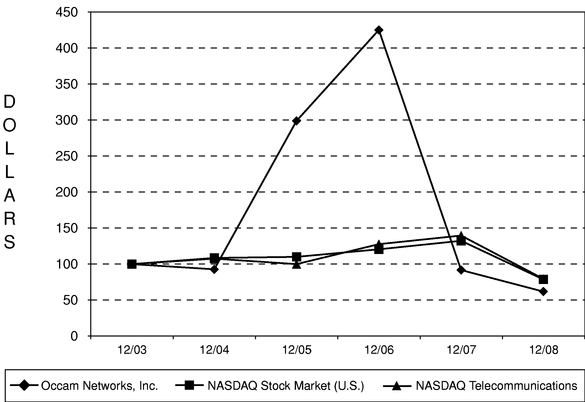

Any failure on our part to remedy identified control deficiencies, or any additional delays or errors in our financial reporting, whether or not resulting from the identified material weakness relating to revenue recognition or any significant deficiencies, would have a material adverse effect on our business, results of operations, or financial condition and could have a substantial adverse impact on the trading price of our common stock.