- CRIS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Curis (CRIS) DEF 14ADefinitive proxy

Filed: 24 Apr 03, 12:00am

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Soliciting Material Under Rule 14a-12 | |||

þ | Definitive Proxy Statement | ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

¨ | Definitive Additional Materials |

CURIS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

CURIS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 12, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Curis, Inc., a Delaware corporation (the “Company”), will be held on June 12, 2003 at 10:00 a.m. at the offices of Hale and Dorr LLP, 60 State Street, Boston, Massachusetts 02109 (the “Meeting”) for the purpose of considering and voting upon the following matters:

| 1. | To elect two Class I directors for the ensuing three years; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent public accountants for the current fiscal year; and |

| 3. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

The Board of Directors has no knowledge of any other business to be transacted at the Meeting.

The Board of Directors has fixed the close of business on April 21, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting and at any adjournments thereof.

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2002, which contains consolidated financial statements and other information of interest to stockholders, accompanies this Notice and the enclosed Proxy Statement.

By Order of the Board of Directors,

Christopher U. Missling,Secretary

May 1, 2003

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT BY MAIL IN THE ACCOMPANYING ENVELOPE. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

CURIS, INC.

61 Moulton Street Cambridge, Massachusetts 02138

PROXY STATEMENT

For the Annual Meeting of Stockholders

To Be Held on June 12, 2003

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Curis, Inc., a Delaware corporation (the “Company”), of proxies for use at the Annual Meeting of Stockholders to be held on June 12, 2003 at 10:00 a.m. (Boston time) at the offices of Hale and Dorr LLP, 60 State Street, Boston, Massachusetts 02109 and at any adjournments thereof (the “Meeting”). Except where the context otherwise requires, references to the Company in this Proxy Statement will mean the Company and any of its subsidiaries.

Proxies will be voted in accordance with the instructions of the stockholders. If a proxy is returned signed with no choices specified, it will be voted in favor of the matters set forth in the accompanying Notice of Meeting. A proxy may be revoked by a stockholder at any time before its exercise by delivery of a written revocation to the Secretary of the Company. Attendance at the Meeting will not itself be deemed to revoke a proxy unless the stockholder gives affirmative notice at the Meeting that the stockholder intends to revoke the proxy and vote in person.

On April 21, 2003, the record date for determination of stockholders entitled to vote at the Meeting, an aggregate of 31,750,838 shares of common stock of the Company, $0.01 par value per share (the “Common Stock”), were outstanding and entitled to vote. As a stockholder, you are entitled to one vote at the Meeting for each share of Common Stock registered in your name at the close of business on the record date. The proxy card states the number of shares you are entitled to vote at the Meeting.

The Notice of Meeting, this Proxy Statement, the enclosed proxy card and the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 are first being mailed or provided to stockholders on or about May 1, 2003. The Company will, upon written request of any stockholder and payment of an appropriate processing fee, furnish copies of the exhibits to its Annual Report on Form 10-K. Please address all such requests to Curis, Inc., 61 Moulton Street, Cambridge, Massachusetts 02138, Attention: Secretary.

Votes Required

The holders of a majority of the shares of Common Stock issued and outstanding and entitled to vote at the Meeting will constitute a quorum for the transaction of business at the Meeting. Shares of Common Stock present in person or represented by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for the purpose of determining whether a quorum exists at the Meeting.

The affirmative vote of the holders of a plurality of the votes cast by the stockholders entitled to vote at the Meeting is required for the election of directors. The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent public accountants for the current fiscal year.

1

Shares which abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and will also not be counted as votes cast or shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on the matters to be voted on at the Meeting, each of which requires the affirmative vote of either a plurality of the votes cast or a majority of the shares present in person or represented by proxy and voting on the matter.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this Proxy Statement or the Company’s Annual Report on Form 10-K may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document if you write or call the Company at the following address or telephone number: Curis, Inc., 61 Moulton Street, Cambridge, Massachusetts 02138, Attention: Secretary, (617) 503-6500. If you want separate copies of the Proxy Statement and Annual Report on Form 10-K in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact the Company at the above address or telephone number.

2

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information, as of March 31, 2003, with respect to the beneficial ownership of shares of Common Stock by (i) each person known to the Company to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) each of the Company’s directors and nominees for director, (iii) each of the Chief Executive Officer and the four other most highly compensated executive officers who were serving as executive officers on December 31, 2002, (iv) up to two additional persons who would have been included among the most highly compensated executive officers if such person or persons were serving as such on December 31, 2002 (clauses (iii) and (iv), the “Named Executive Officers”) and (v) all current directors and executive officers as a group.

Name and Address of Beneficial Owner(1) | Number of Shares Beneficially Owned(2) | + | Shares Acquirable Within 60 days(3) | = | Total Beneficial Ownership | Percent of Common Stock Beneficially Owned(4) | |||||||

5% Stockholder: | |||||||||||||

Vulcan Ventures Inc. 505 Union Station 505 Fifth Avenue South, Suite 900 Seattle, WA 98104 | 2,318,663 | — | 2,318,663 | 7.31 | % | ||||||||

Directors and Nominees: | |||||||||||||

James R. McNab, Jr.(5) | 811,616 | 275,210 | 1,086,826 | 3.40 | % | ||||||||

Susan B. Bayh | 16,138 | 122,500 | 138,638 | * |

| ||||||||

Martyn D. Greenacre | 15,138 | 137,500 | 152,638 | * |

| ||||||||

Ruth B. Kunath | 15,138 | 82,756 | 97,894 | * |

| ||||||||

Douglas A. Melton | 163,499 | 239,483 | 402,982 | 1.26 | % | ||||||||

Daniel R. Passeri | 62,378 | 487,499 | 549,877 | 1.71 | % | ||||||||

James R. Tobin | 72,477 | 150,000 | 222,477 | * |

| ||||||||

Other Named Executive Officers: | |||||||||||||

Lee L. Rubin | 9,814 | 514,714 | 524,528 | 1.63 | % | ||||||||

Mark W. Noel | 5,571 | 67,500 | 73,071 | * |

| ||||||||

Doros Platika(6) | 612 | 403,054 | 403,666 | 1.26 | % | ||||||||

All current directors and executive officers as a group (11 persons) | 1,171,769 | 2,152,162 | 3,323,931 | 9.81 | % |

| * | Less than 1% of the outstanding Common Stock. |

| (1) | Unless otherwise indicated, the address of each beneficial owner listed is c/o Curis, Inc., 61 Moulton Street, Cambridge, MA 02138. |

| (2) | For each person, the “Number of Shares Beneficially Owned” column may include shares of Common Stock attributable to the person because of that person’s voting or investment power or other relationship. |

| (3) | The number of shares of Common Stock beneficially owned by each person is determined under rules promulgated by the Securities and Exchange Commission, or SEC. Under these rules, a person is deemed to have “beneficial ownership” of any shares over which that person has or shares voting or investment power, plus any shares that the person may acquire within 60 days, including through the exercise of stock options. For each person named in the table, the number in the “Shares Acquirable Within 60 Days” column consists of shares covered by stock options that may be exercised within 60 days after March 31, 2003. Unless otherwise indicated, each person in the table has sole voting and investment power over the shares listed. The inclusion in the table of any shares, however, does not constitute an admission of beneficial ownership of those shares by the named stockholder. |

3

| (4) | The percent ownership for each stockholder on March 31, 2003 is calculated by dividing (1) the total number of shares beneficially owned by the stockholder by (2) 31,720,838 shares plus any shares acquirable (including stock options exercisable) by that stockholder within 60 days after March 31, 2003. |

| (5) | Consists of 701,828 shares of Common Stock held directly by Mr. McNab and 109,788 shares held by the McNab Family LLC. |

| (6) | Dr. Platika served as President and Chief Executive Officer of the Company until September 20, 2001 when he became Chairman of the Board of Directors. On January 28, 2002, the Company entered into a severance agreement with Dr. Platika. Under the terms of the severance agreement, Dr. Platika remained with the Company in the position of Chairman of the Board of Directors until May 3, 2002 when his employment was terminated. This information is based solely upon information provided by Mr. Platika for last year’s proxy statement and the fact that no options were exercised by Dr. Platika in 2002. The Company does not know or have any reason to believe that such information is not complete or accurate. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors, executive officers and holders of more than 10% of the Common Stock (the “Reporting Persons”) to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Based solely on its review of copies of reports filed by the Reporting Persons furnished to the Company, the Company believes that during the fiscal year ended December 31, 2002, the Reporting Persons complied with all Section 16(a) filing requirements, except as set forth below.

On June 13, 2002 and December 13, 2002, Mr. Noel acquired 2,554 and 2,917 shares of Common Stock, respectively. On February 13, 2003, Mr. Noel filed an Annual Statement of Changes in Beneficial Ownership of Securities on Form 5 reflecting these acquisitions.

On September 9, 2002, Mr. McNab acquired 11,000 shares of Common Stock. On September 12, 2002, Mr. McNab filed a Statement of Changes in Beneficial Ownership of Securities on Form 4 reflecting this acquisition.

PROPOSAL 1—ELECTION OF DIRECTORS

Directors and Nominees for Director

The Company has a classified Board of Directors currently consisting of two Class I directors (James R. McNab, Jr. and James R. Tobin), two Class II directors (Douglas A. Melton and Daniel R. Passeri) and three Class III directors (Susan B. Bayh, Martyn D. Greenacre and Ruth B. Kunath) (the “Board”). The Class I, Class II and Class III directors will serve until the annual meetings of stockholders to be held in 2003, 2004 and 2005, respectively, and until their respective successors are elected and qualified. At each annual meeting of stockholders, directors are elected for full three-year terms to succeed those directors whose terms are expiring.

Unless the proxy is marked otherwise, the persons named in the enclosed proxy will vote to elect as Class I directors James R. McNab, Jr. and James R. Tobin, to serve for the ensuing three-year term.

Each Class I director will be elected to hold office until the 2006 Annual Meeting of Stockholders and until his successor is elected and qualified. Each nominee has indicated his willingness to serve, if elected; however, if any nominee should be unable to serve, the person acting under the proxy may vote the proxy for a substitute nominee. The Board has no reason to believe that any nominee will be unable to serve if elected.

4

For each member of the Board whose term of office as a director continues after the Meeting, including those who are nominees for election as Class I directors, there follows information given by each concerning his or her principal occupation and business experience for at least the past five years, the names of other publicly-held companies for which he or she serves as a director, and his or her age and length of service as a director of the Company. There are no familial relationships among any of the directors, nominees for director and executive officers of the Company.

Nominees for Terms Expiring in 2006 (Class I Directors)

James R. McNab, Jr., age 59, has served on the Board since February 2000 and has served as Chairman of the Board since May 1, 2002. Mr. McNab is a co-founder and served as the chairman of the board of directors of Reprogenesis, Inc. from July 1996 to July 2000. Reprogenesis, Inc. is a clinical development, cell therapy, biomaterials and tissue engineering company which was merged, together with Creative Biomolecules, Inc. and Ontogeny, Inc., with and into Curis in July 2000. In addition, Mr. McNab is a co-founder of several other companies, including Parker Medical Associates, a manufacturer and worldwide supplier of orthopaedic and sports-related products which was sold to Smith and Nephew, Inc. in 1995, Sontra Medical, Inc., a drug delivery company, and eNOS Pharmaceuticals, Inc., a drug discovery company working in the field of stroke therapy. Mr. McNab is chairman of Sontra Medical and eNOS. Mr. McNab is a graduate of the University of North Carolina, with an M.B.A., and of Davidson College, with a B.A.

James R. Tobin, age 58, has served on the Board since February 2000. Mr. Tobin was a member of the board of directors of Creative BioMolecules, Inc., an antibody and developmental biology company, from January 1995 to July 2000. Since 1999, Mr. Tobin has served as Chief Executive Officer and President of Boston Scientific Corporation, a medical device company. Mr. Tobin served as President and Chief Executive Officer of Biogen, Inc., a biotechnology company, from February 1997 to December 1998 and President and Chief Operating Officer of Biogen from February 1994 to February 1997. Prior to joining Biogen, Mr. Tobin was with Baxter International Inc., a health care products company, where he served as President and Chief Operating Officer from 1992 to 1994, as Executive Vice President from 1988 to 1992 and in various management positions prior to 1988. He also serves as a director of Boston Scientific Corporation and Applera Corporation, a research tools supplier to the biotechnology industry. Mr. Tobin is a graduate of Harvard Business School, with an M.B.A., and of Harvard College, with a B.A.

Directors Whose Terms Expire in 2004 (Class II Directors)

Douglas A. Melton, age 49, has served on the Board since February 2000. Dr. Melton was the scientific founder of Ontogeny, Inc., a developmental biology and functional genomic discovery engine company, and was a member of the board of directors of Ontogeny from August 1994 to July 2000. Dr. Melton is the Thomas Dudley Cabot Professor of Natural Sciences at Harvard University and an Investigator at the Howard Hughes Medical Institute. Dr. Melton’s work has focused on vertebrate embryogenesis and the molecular biology of embryonic induction. He holds an appointment as biologist at the Massachusetts General Hospital. Dr. Melton’s doctoral work was carried out at Trinity College at Cambridge University and the Medical Research Council Laboratory of Molecular Biology in Cambridge, England. Dr. Melton is a graduate of the University of Illinois, with a B.S., and of Cambridge University, with a B.S.

Daniel R. Passeri, age 42, has served as President and Chief Executive Officer and on the Board since September 2001. From November 2000 to September 2001, Mr. Passeri served as Senior Vice President, Corporate Development and Strategic Planning of the Company. From March 1997 to November 2000, Mr.

5

Passeri was employed by GeneLogic Inc., a biotechnology company, most recently as Senior Vice President, Corporate Development and Strategic Planning. From February 1995 to March 1997, Mr. Passeri was employed by Boehringer Mannheim, a pharmaceutical, biotechnology and diagnostic company, as Director of Technology Management. Mr. Passeri is a graduate of the National Law Center at George Washington University, with a J.D., of the Imperial College of Science, Technology and Medicine at the University of London, with a M.Sc. in biotechnology, and of Northeastern University, with a B.S.

Directors Whose Terms Expire in 2005 (Class III Directors)

Susan B. Bayh, age 43, has served on the Board since October 2000. From 1994 to January 2001, Ms. Bayh served as the Commissioner of the International Commission between the United States and Canada, overseeing compliance with environmental and water level treaties for the United States-Canadian border. Since 1994, Ms. Bayh has also served as Distinguished Visiting Professor at the College of Business Administration at Butler University. From 1989 to 1994, Ms. Bayh served as an attorney in the Pharmaceutical Division of Eli Lilly and Company. Ms. Bayh has served as a director of Corvas International, Inc. and Cubist Pharmaceuticals, Inc., each biotechnology companies, since June 2000, and as a director of Emmis Communications, Inc., a telecommunications company, since June 1994. Ms. Bayh is a graduate of the University of Southern California Law Center, with a J.D., and of the University of California at Berkeley, with a B.A.

Martyn D. Greenacre, age 61, has served on the Board since February 2000. Mr. Greenacre has served as Chief Executive Officer of Life Mist L.L.C., a private company in the field of fire suppression, since September 2001. From June 1993 to July 2000, Mr. Greenacre was a member of the board of directors of Creative BioMolecules, Inc. From June 1997 to June 2001, Mr. Greenacre was Chief Executive Officer of Delsys Pharmaceutical Corporation, a drug formulation company. From 1993 to 1997, Mr. Greenacre was President and Chief Executive Officer of Zynaxis, Inc., a biopharmaceutical company. He has served on the boards of directors of Cephalon, a biotechnology company, since 1992, and Acusphere, Inc., a specialty pharmaceutical company, since June 2001. Mr. Greenacre is a graduate of Harvard Business School, with an M.B.A., and of Harvard College, with a B.A.

Ruth B. Kunath, age 51, has served on the Board since February 2000. From December 1998 to July 2000, Ms. Kunath was a member of the board of directors of Ontogeny, Inc. Since 1992, Ms. Kunath has been biotechnology portfolio manager for Vulcan Ventures, Inc., a venture capital firm founded by Paul G. Allen. Prior to her employment at Vulcan Ventures, Ms. Kunath spent nine years managing Seattle Capital Management Equity assets and eight years as the Senior Portfolio Manager for the healthcare sector of Bank of America Capital Management. Ms. Kunath has served as a director of Vaxgen, Inc., a biotechnology company, since June 1999, and Dendreon Corporation, a biotechnology company, since December 1999. Ms. Kunath is a graduate of DePauw University, with a B.A.

See “Security Ownership of Certain Beneficial Owners and Management” above for a summary of the shares of Common Stock owned by each of the directors and director nominees.

Board and Committee Meetings

The Board met eleven times during 2002. The Board has four committees: the Compensation Committee; the Audit Committee; the Executive Committee; and the Governance and Nominating Committee (formed November 2002), which met three times, seven times, one time and one time, respectively, during 2002. All directors attended at least 75% of the meetings of the Board and of the committees on which they served.

6

The Compensation Committee has the authority and responsibility to establish the compensation of, and compensation policies applicable to, the Company’s executive officers and administers the Company’s 2000 Employee Stock Purchase Plan (the “ESPP Plan”) and 2000 Stock Incentive Plan (the “Incentive Plan”). The current members of the Compensation Committee are Ms. Bayh and Mr. Tobin. For further information concerning the duties and responsibilities of the Compensation Committee, see the discussion below under the heading “Report of the Compensation Committee on Executive Compensation.”

The Audit Committee selects the Company’s independent accountant and reviews and evaluates audit procedures, the results and scope of the audit and other services provided by the Company’s independent public accountants. The current members of the Audit Committee are Ms. Bayh, Mr. Greenacre and Ms. Kunath. For further information concerning the duties and responsibilities of the Audit Committee, see the discussion below under the heading “Report of the Audit Committee of the Board of Directors” and the Audit Committee Charter attached to this Proxy Statement as Appendix A.

The Executive Committee advises the Chief Executive Officer and senior management regarding long-term planning and strategic initiatives. The current members of the Executive Committee are Mr. McNab, Dr. Melton and Mr. Tobin.

The Governance and Nominating Committee (i) provides assistance to the Board in the selection of candidates for election and re-election to the Board and its committees, (ii) advises the Board on corporate governance matters and practices, including developing, recommending, and thereafter periodically reviewing the corporate governance guidelines and principles applicable to the Company, and (iii) oversees an annual evaluation of the performance of the Board and each of its standing committees. The Governance and Nominating Committee has not established procedures for stockholders to recommend nominees for directors beyond those contained in the Company’s by-laws. The current members of the Governance and Nominating Committee are Ms. Bayh and Mr. Greenacre.

Director Compensation

Under the Company’s by-laws, the Board has the authority to fix the compensation paid to directors. In general, non-employee directors receive cash compensation in the following amounts: $10,000 as an annual retainer; $1,000 for each Board meeting attended in person; and $500 for each telephonic Board meeting. Non-employee directors who are members of a committee of the Board receive cash compensation in the amount of $1,000 for each committee meeting attended in person on a day other than a day on which a Board meeting is held. Executive Committee members receive compensation of $3,000 per month. The Chairman of the Board of Directors receives compensation of $10,000 per month.

Employee directors are not compensated for their attendance at Board or committee meetings. Directors are reimbursed for reasonable out-of-pocket expenses incurred in attending any Board or committee meetings.

On June 12, 2002, the Board elected, in lieu of cash consideration, to compensate its non-employee members for both (i) past unpaid services (including unpaid Board meeting attendance fees and deferred compensation for service on the Company’s Executive Committee) and (ii) future services through June 12, 2003 by making restricted stock awards to each such director to purchase a number of shares of Common Stock under the 2000 Stock Incentive Plan as is equal to the amount of cash compensation owed to such director divided by $1.09, which was the current fair market value of the Common Stock on June 12, 2003. In accordance with this arrangement, an

7

aggregate of 352,753 shares of Common Stock were issued to the non-employee directors, as described in greater detail under “—Stock Incentive Plan” below. Under the terms of these agreements, in addition to converting his or her cash compensation into shares of Common Stock, each Director paid cash consideration equal to the par value ($0.01) for each share awarded. The shares were fully vested on October 21, 2002.

2000 Stock Incentive Plan

The Incentive Plan was adopted by the Board in March 2000 and approved by the stockholders of the Company in June 2000. Under the Incentive Plan, directors of the Company are eligible to receive non-statutory options to purchase shares of Common Stock. Beginning on January 1, 2001, the number of shares authorized for issuance under the Incentive Plan increased annually by the lesser of 1,000,000 shares and four percent of the total number of outstanding shares of Common Stock; provided, however, that the number of shares authorized for issuance under the Incentive Plan may not exceed the number of shares subject to outstanding options under the Incentive Plan by more than 6,000,000 shares. As of January 1, 2003, a total of 13,000,000 shares of Common Stock were reserved under the Incentive Plan, a total of 8,464,892 shares of Common Stock were issuable upon exercise of outstanding options granted under the Incentive Plan and a total of 3,657,068 shares were available for future issuance under the Incentive Plan.

Under the Incentive Plan, the Board has the authority to grant options to purchase shares of Common Stock and to determine the number of shares of Common Stock to be covered by each option, the exercise price of each option and the conditions and limitations applicable to the exercise of each option, including conditions relating to applicable federal or state securities laws, as it considers necessary or advisable. Generally, options granted under the Incentive Plan vest ratably over four years.

The Board shall determine the effect on options granted under the Incentive Plan of the disability, death, retirement or other change in the status of a director and the extent to which, and the period during which, the director or the director’s legal representative may exercise rights under such options. No option granted under the Incentive Plan may be exercised after the expiration of ten years from the date of grant.

During 2002, the following grants were made to the non-employee directors pursuant to the Incentive Plan:

Date of Issuance | Options | Restricted Stock | ||||||||||

Name | Underlying Shares | Exercise Price | Shares | Sale Price | ||||||||

Ms. Bayh | 6/5/02 | 75,000 | $ | 1.50 | ||||||||

6/12/02 | 15,138 | $ | 1.09 | |||||||||

Mr. Greenacre | 6/5/02 | 75,000 | $ | 1.50 | ||||||||

6/12/02 | 15,138 | $ | 1.09 | |||||||||

Ms. Kunath | 6/5/02 | 75,000 | $ | 1.50 | ||||||||

6/12/02 | 15,138 | $ | 1.09 | |||||||||

Mr. McNab | 6/05/02 | 250,000 | $ | 1.50 | ||||||||

6/12/02 | 162,385 | $ | 1.09 | |||||||||

Dr. Melton | 6/5/02 | 150,000 | $ | 1.50 | ||||||||

3/12/02 | 25,000 | $ | 2.73 | |||||||||

6/12/02 | 72,477 | $ | 1.09 | |||||||||

Mr. Tobin | 6/5/02 | 150,000 | $ | 1.50 | ||||||||

6/12/02 | 72,477 | $ | 1.09 | |||||||||

8

2000 Director Stock Option Plan

The 2000 Director Stock Option Plan (the “Director Plan”) was adopted by the Board in March 2000 and approved by the stockholders of the Company in June 2000. A maximum of 500,000 shares are reserved for issuance under the Director Plan. Under the Director Plan, directors of the Company who are not employees of the Company or any subsidiary of the Company are eligible to receive non-statutory options to purchase shares of Common Stock. As of January 1, 2003, a total of 240,000 shares of Common Stock were issuable upon exercise of outstanding options granted under the Director Plan and 260,000 shares were available for future issuance.

Pursuant to the Director Plan, each non-employee director receives options to purchase 25,000 shares of Common Stock on the date of his or her initial election. These option grants vest ratably over four years on (a) the first anniversary of the date of grant and (b) the day before the annual meeting of stockholders each year thereafter. In addition, each non-employee director (other than a director who was initially elected to the Board at any such annual meeting or, if previously, at any time after the prior year’s annual meeting) receives options to purchase 5,000 shares of Common Stock on the date of each annual meeting of stockholders, provided that such director continues to serve as a director immediately after such annual meeting. In accordance with this provision, on June 12, 2002, options to purchase 5,000 shares of Common Stock at an exercise price of $1.09 per share were granted under the Director Plan to each of Susan B. Bayh, Martyn D. Greenacre, Ruth B. Kunath, James R. McNab, Jr., Douglas A. Melton, and James R. Tobin. The options granted annually vest immediately upon the date of grant and the exercise price of options granted under the Director Plan equals the closing price of the Common Stock on the date of grant as reported on the NASDAQ National Market (or such other nationally recognized exchange or trading system if the Common Stock is no longer traded on the NASDAQ National Market).

On September 25, 2002, options to purchase 50,000 shares of Common Stock at an exercise price of $1.09 per share were granted under the Director Plan to each of Susan B. Bayh, Martyn D. Greenacre and James R. McNab. These options were granted for service as Chairperson of the Governance and Nominating Committee, Chairman of the Audit Committee and Chairman of the Board of Directors, respectively. These options became exercisable in full on the date of grant.

In the event an optionee ceases to serve as a director of the Company each option shall terminate, and may no longer be exercised, on the earlier of (a) the date ten years after the date of grant of such option or (b) the first anniversary of the date on which the optionee ceases to serve as a director of the Company; provided, however, that in the event that a non-employee director has served as a director of the Company for at least five years, each option held by such director shall terminate, and may no longer be exercised, on the date ten years after the date the applicable option was granted.

9

Compensation of Executive Officers

Summary Compensation

The following table sets forth certain information with respect to the annual and long-term compensation of each of the Named Executive Officers for the years ended December 31, 2000, 2001 and 2002.

SUMMARY COMPENSATION TABLE

Annual Compensation | Long Term Compen-sation Awards | ||||||||||||||||||

Restricted Stock Awards ($) | Securities Underlying Options (#) | All Other Compensation ($) | |||||||||||||||||

Name and Principal Position | Year(1) | Salary ($) | Bonus ($) | Other ($) | |||||||||||||||

Daniel R. Passeri(2) President and Chief Executive Officer | 2002 2001 2000 | $

| 297,308 276,981 41,346 | $

| 25,000 — — |

$

| — 9,562 — | $

| 50,000 — — | 425,000 525,000 200,000 |

$

| — 21,797 2,518 | |||||||

Lee L. Rubin(3) Senior Vice President of Research and Chief Scientific Officer | 2002 2001 2000 |

| 300,000 266,558 232,096 |

| — — — |

| — — — |

| — — — | 350,000 200,000 300,000 |

| — 5,250 — | |||||||

Mark W. Noel(4) Vice President, Technology Management and Business Development | 2002 2001 2000 |

| 171,654 127,385 — |

| — — — |

| — — — |

| — — — | 125,000 60,000 — |

| — 22,332 — | |||||||

Doros Platika(5) Former Chairman | 2002 2001 2000 |

| 125,798 364,942 335,481 |

| — — — |

| — 38,643 60,603 |

| — — — | — 500,000 1,000,000 |

| 1,381,391 50,923 72,774 | |||||||

| (1) | The Company is the surviving company of a merger among the Company, Creative BioMolecules, Inc., Ontogeny, Inc. and Reprogenesis, Inc. which was completed on July 31, 2000. Accordingly, the summary compensation information provided in this table for 2000 includes compensation paid in part by the Company and in part by the Company’s predecessors. |

| (2) | Mr. Passeri joined the Company on November 1, 2000. On June 14, 2002, Mr. Passeri was awarded 43,478 shares of restricted Common Stock in lieu of $50,000 cash compensation. These shares were fully vested on October 21, 2002. On June 15, 2002, Mr. Passeri’s annual salary was reduced from $325,000 to $275,000. The value of the aggregate restricted stock holdings on December 31, 2002, based upon the closing price of the Company’s Common Stock on such date ($1.03) was $44,782. Other annual compensation received by Mr. Passeri in 2001 consists of tax reimbursement relating to taxable relocation expenses. All other compensation received by Mr. Passeri in 2001 consists of a relocation reimbursement in the amount of $16,547 and a 401(k) contribution made by the Company in the amount of $5,250. All other compensation received by Mr. Passeri in 2000 consists of a relocation reimbursement in the amount of $2,518. |

| (3) | All other compensation received by Dr. Rubin in 2001 consists of a 401(k) contribution made by the Company. |

| (4) | Mr. Noel was named Vice President, Technology Management and Business Development on March 12, 2001 and was named an executive officer of the Company on June 12, 2002. All other compensation received by Mr. Noel in 2001 consisted solely of a relocation reimbursement by the Company. |

10

| (5) | All other compensation received by Dr. Platika in 2002 consists of the following items: |

Severance compensation | $ | 98,942 | |||

Forgiveness of principal and interest |

| 529,737 | ($29,737 in accrued interest) | ||

Tax reimbursement (August 1, 2001 Note) |

| 269,866 | |||

Forgiveness of principal and interest |

| 273,754 | ($73,754 in accrued interest) | ||

Tax reimbursement (June 17, 1996 Note) |

| 209,093 | |||

Total | $ | 1,381,392 |

Other annual compensation received by Dr. Platika in 2001 consists of tax reimbursement relating to forgiveness of principal and interest on debt arrangements with the Company. All other compensation received by Dr. Platika in 2001 consists of forgiveness of principal and interest in the amount of $45,675 and a 401(k) contribution made by the Company in the amount of $5,250. Other annual compensation received by Dr. Platika in 2000 consists of tax reimbursement relating to forgiveness of principal and interest on debt arrangements with the Company. All other compensation received by Dr. Platika in 2000 consists of forgiveness of principal and interest in the amount of $71,634 and insurance premiums of $1,140.

11

Option Grants

The following table sets forth certain information concerning grants of stock options made to each of the Named Executive Officers during 2002. The Company has never granted any stock appreciation rights.

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4) | |||||||||||||||||||

Name | Securities Underlying Options | Percent of Total Options Granted to Employees in 2002(3) | Exercise Price Per Share($) | Market Price Per Share | Expiration Date | |||||||||||||||

5% | 10% | |||||||||||||||||||

Daniel R. Passeri | 300,000 125,000 | (1) (2) | 8.1 3.4 | %

| $

| 1.50 1.09 | $

| 1.34 1.09 | 06/05/12 09/25/12 | $

| 191,117 84,367 | $

| 550,498 213,055 | |||||||

Lee L. Rubin | 250,000 100,000 | (1) (2) | 6.8 2.7 |

|

| 1.50 1.09 |

| 1.34 1.09 | 06/05/12 09/25/12 |

| 159,264 67,494 |

| 458,748 170,444 | |||||||

Mark W. Noel | 75,000 50,000 | (1) (2) | 2.0 |

|

| 1.50 1.09 | | 1.34 | 06/05/12 |

| 47,779 33,747 |

| 137,624 85,222 | |||||||

Doros Platika | — |

| — |

|

| — |

| — | — |

| — |

| — | |||||||

| (1) | These options become fully exercisable on November 6, 2007. However, the options provide for accelerated vesting upon the achievement of certain events as follows: (i) 50% vest upon the execution of a new corporate partnering agreement or series of partnering agreements which generate at least $10 million for the Company by January 1, 2003, (ii) an additional 25% vest upon the execution of a new corporate partnering agreement or series of partnering agreements which generate at least $10 million for the Company by October 1, 2003, and (iii) 25% vest if the Company’s market capitalization is in excess of $300 million for at least ten consecutive trading days. On October 1, 2002, the Company entered into a new partnering agreement and, as a result, 50% of these options became fully exercisable. |

| (2) | These options become fully exercisable over a period of four years with 25% becoming exercisable after one year and 6.25% becoming exercisable quarterly thereafter. |

| (3) | During 2002, the Company granted to its employees options to purchase a total of 3,691,800 shares of Common Stock. |

| (4) | Amounts reported in these columns represent amounts that may be realized upon exercise of the options immediately prior to the expiration of their terms assuming the specified compound rates of appreciation (5% and 10%) on the market value of the Common Stock on the date of option grant over the term of the options. These numbers are calculated based on rules promulgated by the Securities and Exchange Commission and do not reflect the Company’s estimate of future stock price growth. Actual gains, if any, on stock option exercises and Common Stock holdings are dependent on the timing of such exercise and the future performance of the Common Stock. There can be no assurance that the rates of appreciation assumed in this table can be achieved or that the amounts reflected will be received by the option holder. |

12

Fiscal Year-End Option Value Table

The following table summarizes certain information regarding the number and value of stock options held as of December 31, 2002 by each of the Named Executive Officers. No stock options were exercised during 2002 by the Named Executive Officers.

FISCAL YEAR-END OPTION VALUES

Name | Shares Acquired on Exercise | Value Realized ($) | Number of Securities Underlying Unexercised Options at December 31, 2002 (#) | Value of Unexercised In-The-Money Options at December 31, 2002 (1)($) | |||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

Daniel R. Passeri | — | — | 421,875 | 728,125 |

| — | — | ||||||

Lee L. Rubin | — | — | 455,339 | 484,375 |

| — | — | ||||||

Mark W. Noel | — | — | 63,750 | 121,500 |

| — | — | ||||||

Doros Platika | — | — | 403,054 | — | $ | 39,140 | — | ||||||

| (1) | Value based upon the last sales price per share ($1.03) of the Common Stock on December 31, 2002, as reported on the NASDAQ National Market, less the exercise price. |

Equity Compensation Plan Information

The following table provides information as of December 31, 2002 regarding shares outstanding and available for issuance under the Company’s existing equity compensation plans.

Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column) | |||||

Equity compensation plans approved by security holders | 8,704,892 | $ | 8.30 | 2,917,068 | |||

Equity compensation plans not approved by security holders(1) | — |

| — | �� | — | ||

Total | 8,704,892 | $ | 8.30 | 2,917,068 | |||

| (1) | All of the Company’s existing equity compensation plans have been approved by shareholders. |

13

Employee Stock Purchase Plan Participation Table

The following table provides certain information regarding Common Stock purchased as of December 31, 2002 by the Named Executive Officers under the Company’s 2000 Employee Stock Purchase Plan.

Name | Shares Purchased | Price Paid Per Share ($) | Market Price Per Share ($) | |||||

Daniel R. Passeri | — |

| — |

| — | |||

Lee L. Rubin | — |

| — |

| — | |||

Mark W. Noel(1) | 2,917 | $ | 0.90 | $ | 1.06 | |||

Doros Platika | — |

| — |

| — | |||

| (1) | Pursuant to the Company’s 2000 Employee Stock Purchase Plan, 2,554 shares were purchased on June 14, 2002 at a discount of 15% of the closing price per share of the Common Stock on June 14, 2002, which price was the lower of the closing price on the beginning of the purchase period (December 15, 2001) and at the end of the purchase period (June 14, 2002). Also pursuant to the Company’s 2000 Employee Stock Purchase Plan, 2,917 shares were purchased on December 13, 2002 at a discount of 15% of the closing price per share of the Common Stock on December 13, 2002, which price was the lower of the closing price on the beginning of the purchase period (June 15, 2002) and at the end of the purchase period (December 13, 2002). |

Employment Agreements

On September 20, 2001 the Company entered into a five-year employment agreement with Mr. Passeri. Under the agreement, Mr. Passeri will serve as President and Chief Executive Officer of the Company. As amended, the Company will pay Mr. Passeri a base salary of $275,000 per annum, which salary will be subject to annual review by the Board. In addition, Mr. Passeri will be entitled to participate in the Company’s medical and other benefit programs and may be entitled to receive an annual bonus based on the achievement of specific objectives established by the Board. If the Company terminates Mr. Passeri’s employment without cause, or Mr. Passeri terminates his employment for good reason, then the Company will pay Mr. Passeri his base salary accrued through the date of termination, and pay Mr. Passeri in equal bi-weekly installments over a twelve-month period following such termination, a severance amount equal to his annual base salary as in effect at the time of termination; provided, however, that such severance payments during the second six months of the severance period will be reduced by compensation, if any, earned by Mr. Passeri as an employee or a consultant of another company. If the Company terminates Mr. Passeri’s employment for cause, or Mr. Passeri terminates his employment without good reason or Mr. Passeri’s employment is terminated due to his death or disability, the Company will pay Mr. Passeri his base salary accrued through the date of termination.

On January 28, 2002 the Company entered into a severance agreement with Dr. Platika. Under the terms of the agreement, Dr. Platika was retained by the Company as Chairman of the Company until May 3, 2002 when his employment was terminated and he received severance payments as outlined above in footnote 5 of the “Summary Compensation Table” under the heading “Compensation of Executive Officers.”

14

Report of the Compensation Committee on Executive Compensation

Overview and Philosophy

The Compensation Committee is responsible for establishing the compensation of, and the compensation policies with respect to, the Company’s executive officers, including the Chief Executive Officer, and administering the Company’s ESPP Plan and Stock Incentive Plan. The Compensation Committee is currently comprised of two non-employee directors, Ms. Bayh and Mr. Tobin. Mr. Tobin is the Chairman of the Compensation Committee.

The objectives of the Company’s executive compensation program are to:

| • | Attract and retain key executives critical to the long-term success of the Company; |

| • | Align the interests of executive officers with the interests of stockholders and the success of the Company; and |

| • | Recognize and reward individual performance and responsibility. |

Executive Compensation Program

General. The Company’s executive compensation program consists of base salary, short-term incentive compensation in the form of cash bonuses and long-term incentive compensation in the form of stock options. In addition, executive officers are entitled to participate in benefit programs that are available to the Company’s employees, generally. These benefit programs include medical benefits, the ESPP Plan and the 401(k) Profit Sharing Plan and Trust.

Base Compensation. Mr. Passeri, the Company’s Chief Executive Officer, is a party to a multi-year employment agreement with the Company. In June 2002, base compensation for Mr. Passeri was set at $275,000, which the Compensation Committee believes is within the range of compensation for chief executives with comparable qualifications, experience and responsibilities at other companies in the same or similar businesses.

For 2002, compensation for other executive officers was set within the range of compensation for executives with comparable qualifications, experience and responsibilities at other companies in the same or similar businesses, based on the determination of the Compensation Committee. In addition, base compensation for each executive officer was determined on a case-by-case basis in light of each individual’s contribution to the Company as a whole, including the ability to motivate others, develop the necessary skills to grow as the Company matures, recognize and pursue new business opportunities and initiate programs to enhance the Company’s growth and success.

Short-Term Incentive Compensation. Under the Company’s Senior Officer Short-Term Incentive Program (the “Short-Term Program”), the Compensation Committee has discretionary authority to award bonuses to individual executive officers. The Compensation Committee believes the Short-Term Program provides significant incentive to the Company’s executive officers because it enables the Compensation Committee to reward outstanding individual achievement. During 2002, the Compensation Committee awarded Mr. Passeri a $25,000 bonus under the Short-Term Program.

Long-Term Incentive Compensation. The Company provides long-term incentives to its executive officers and key employees in the form of stock options. The objectives of this program are to align executive and

15

stockholder long-term interests by creating a strong and direct link between executive compensation and stockholder return, and to enable executives to develop and maintain a significant, long-term stock ownership position in the Common Stock. Stock options are granted at an option exercise price that is determined by the Board as of the date of grant. Historically, the option exercise price has been the fair market value of the Common Stock at the time the option is granted (or, in the case of incentive stock options granted to optionees holding more than 10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary corporation, 110% of the fair market value of the Common Stock at the time the option is granted). Accordingly, these stock options will only have value if the Company’s stock price increases above the fair market value of the Common Stock at the time the options were granted. In selecting executives eligible to receive option grants and determining the amount and frequency of such grants, the Compensation Committee evaluates a variety of factors, including (i) the job level of the executive, (ii) option grants awarded by competitors to executives at comparable job levels and (iii) past, current and prospective service to the Company rendered, or to be rendered, by the executive. During 2002, the Company granted options to purchase an aggregate of 1,600,000 shares of Common Stock to its executive officers at a weighted average exercise price of $1.40 per share. Of this amount, options to purchase 425,000 shares were granted to Mr. Passeri.

Section 162(m). Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), generally disallows a tax deduction to public companies for compensation over $1 million paid to its Chief Executive Officer and its four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation will not be subject to the deduction limit if certain requirements are met. The Compensation Committee generally intends to structure the long-term incentive compensation granted to executive officers under the Incentive Plan to comply with the statute and thereby to mitigate any disallowance of deductions under Section 162(m) of the Code. However, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that do not comply with the exemptions in Section 162(m) of the Code when the Compensation Committee believes that such payments are appropriate, after taking into consideration circumstances such as changing business conditions or the officer’s performance, and are in the best interest of the stockholders. In any event, there can be no assurance that compensation attributable to stock options will be exempted from Section 162(m).

Mr. Passeri’s 2002 Compensation. In determining Mr. Passeri’s 2002 overall compensation, the Compensation Committee considered, among other things, the financial performance of the Company, the Company’s achievement of targeted goals for the development of the Company’s products under development, an assessment of continuing progress of the Company’s business plan, Mr. Passeri’s overall compensation package relative to that of other chief executives in the Company’s industry and past stock and option awards. To ensure a close alignment of Mr. Passeri’s interests with those of the Company’s stockholders, a portion of his overall compensation is paid in restricted stock and option awards, as outlined in detail above. During 2002, Mr. Passeri’s salary was reduced from $325,000 to $275,000. In lieu of the $50,000 of forgone salary, Mr. Passeri received restricted stock valued at approximately the same amount on the date of issuance. The Compensation Committee believes that Mr. Passeri’s 2002 overall compensation has been set at a level that is competitive with other companies in the industry.

Compensation Committee Interlocks and Insider Participation.

During 2002, Ms. Bayh and Mr. Tobin served as a members of the Compensation Committee. Neither Ms. Bayh nor Mr. Tobin has served as an officer or employee of the Company. There was no transaction, or series of similar transactions, during 2002, or any currently proposed transaction, or series of similar transactions, to

16

which the Company was or is to be a party, in which the amount involved exceeds $60,000 and in which Ms. Bayh or Mr. Tobin, or any member of their immediate families, had, or will have, a direct or indirect material interest.

During 2002, no executive officer of the Company served as a director or member of the compensation committee of any other entity whose executive officers served as director or member of the Compensation Committee of the Company.

Submitted by the Compensation Committee of the Board of Directors of Curis, Inc.

James R. Tobin (Chair)

Susan B. Bayh

Report of the Audit Committee of the Board of Directors

The Audit Committee is composed of three independent directors as defined by its charter and the rules of The NASDAQ Stock Market. The Audit Committee operates under a written charter first adopted by the Board of Directors in June 2000 and later amended in September 2000, December 5, 2002 and March 13, 2003. The Audit Committee Charter, as amended, is attached to this Proxy Statement as Appendix A.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. As appropriate, the Audit Committee reviews and evaluates, and discusses with the Company’s management, internal accounting, financial and auditing personnel and the independent auditors, the following:

| • | the plan for, and the independent auditors’ report on, each audit of the Company’s financial statements; |

| • | the Company’s financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to shareholders; |

| • | management’s selection, application and disclosure of critical accounting policies; |

| • | changes in the Company’s accounting practices, principles, controls or methodologies; |

| • | significant developments or changes in accounting rules applicable to the Company; and |

| • | the adequacy of the Company’s internal controls and accounting, financial and auditing personnel. |

The Audit Committee reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2002 and discussed these financial statements with the Company’s management and its independent auditors. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles.

The Audit Committee has reviewed and discussed with the Company’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as amended by the Auditing Standards Board of the American Institute of Accountants (“SAS 61”). SAS 61

17

requires the Company’s independent auditors to discuss with the Company’s Audit Committee, among other things, the following:

| • | methods to account for significant unusual transactions; |

| • | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| • | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| • | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

The Company’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) (“ISBS 1”). ISBS 1 requires auditors annually to disclose in writing all relationships that in the auditors’ professional opinion may reasonably be thought to bear on independence, confirm their independence and engage in discussion of independence. In addition, the Audit Committee discussed with the independent auditors their independence from the Company. The Audit Committee also considered whether the independent auditors’ provision of certain other, non-audit related services to the Company was compatible with maintaining such auditors’ independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company’s Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002.

The Audit Committee and the Board of Directors have also recommended the selection of the Company’s independent public accountants, subject to stockholder ratification.

Submitted by the Audit Committee of the Board of Directors of Curis, Inc.

Martyn D. Greenacre (Chair)

Susan B. Bayh

Ruth B. Kunath

Independent Auditors Fees and Other Matters

Audit Fees

PricewaterhouseCoopers LLP billed the Company an aggregate of $98,400 in fees for 2002 for the audit of the Company’s annual financial statements, review of financial statements included in the Company’s Form 10-Q and services that are normally provided by PricewaterhouseCoopers LLP in connection with statutory and regulatory filings for the fiscal year ended December 31, 2002. 100% of the services described above were approved by the Audit Committee before PricewaterhouseCoopers LLP was engaged to provide these services.

18

Arthur Andersen LLP, the independent auditors of the Company for the fiscal year ending December 31, 2001, billed the Company an aggregate of $100,000 in fees for 2001 for the audit of the Company’s annual financial statements, review of financial statements included in the Company’s Form 10-Q and services that were normally provided by Arthur Andersen LLP in connection with statutory and regulatory filings for the fiscal year ended December 31, 2001. 100% of the services described above were approved by the Audit Committee before Arthur Andersen LLP was engaged to provide these services.

Audit Related Fees

PricewaterhouseCoopers LLP billed the Company an aggregate of $15,000 in 2002 for assurance and related services by PricewaterhouseCoopers LLP that were reasonably related to the performance of the audit or review of the Company’s financial statements during the fiscal year ended December 31, 2002. These fees were billed in connection with professional services from PricewaterhouseCoopers LLP related to a goodwill impairment charge recorded by the Company during the quarter ended June 30, 2002. 0% of the services described above were approved by the Audit Committee before PricewaterhouseCoopers LLP was engaged to provide these services.

Arthur Andersen LLP billed the Company an aggregate of $23,500 in 2001 for assurance and related services by Arthur Andersen LLP that were reasonably related to the performance of the audit or review of the Company’s financial statements during the fiscal year ended December 31, 2001. These fees were billed in connection with professional services from Arthur Andersen LLP related to its audit of financial statements of the Company’s joint venture with Elan Corporation, plc, Curis Newco, Ltd., for professional services related to the Company’s transactions with Micromet AG and Elan Corporation, plc, and for an audit of a government award that the Company was awarded from the National Institute of Standards and Technology. 17% of the services described above were approved by the Audit Committee before Arthur Andersen LLP was engaged to provide these services.

Tax Fees

PricewaterhouseCoopers LLP billed the Company an aggregate of $23,000 in 2002 for professional services rendered for tax compliance, tax advice, and tax planning. Approximately $20,000 of these billings were related to federal and state annual tax compliance filings of Curis, Inc. and its wholly owned subsidiary, Curis Securities Corporation. Approximately $3,000 of these billings related to the Company’s filing of an Annual Return/Report of Employee Benefit Plan on Form 5500. 87% of the services described above were approved by the Audit Committee before PricewaterhouseCoopers LLP was engaged to provide these services.

Arthur Andersen LLP billed the Company an aggregate of $17,000 in 2001 for professional services rendered for tax compliance, tax advice, and tax planning. These billings were related to federal and state annual tax compliance filings of Curis, Inc. and its wholly owned subsidiary, Curis Securities Corporation. 100% of the services described above were approved by the Audit Committee before Arthur Andersen LLP was engaged to provide these services.

All Other Fees

PricewaterhouseCoopers LLP did not bill the Company any fees in 2002 other than the fees described above.

19

Arthur Andersen LLP billed the Company an aggregate of $14,300 in 2001 for professional services in connection with the Company’s registration statement filed on Form S-3 on August 22, 2001. 0% of the services described above were approved by the Audit Committee before Arthur Andersen LLP was engaged to provide these services.

Audit Committee’s Pre-Approval Policies and Procedures

The Audit Committee pre-approves all services (audit and non-audit) to be provided to the Company by the independent auditors; provided, however, that de minimis non-audit services may instead be approved in accordance with applicable SEC rules. The Audit Committee requires the Company to disclose in its SEC periodic reports the approval by the Audit Committee of any non-audit services to be performed by the independent auditor. Since the Audit Committee adopted this pre-approval policy on December 5, 2002, all services (audit and non-audit) provided to the Company by the independent auditors were pre-approved.

20

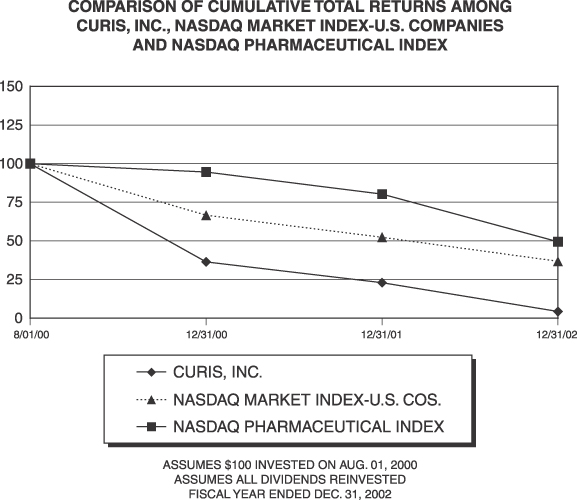

Comparative Stock Performance

The graph below compares the cumulative total stockholder return on the Common Stock for the period from August 1, 2000 through December 31, 2002 with the cumulative total return on (i) NASDAQ Market Index—U.S. Companies and (ii) NASDAQ Pharmaceutical Index. The comparison assumes investment of $100 on August 1, 2000 in the Common Stock and in each of the indices and, in each case, assumes reinvestment of all dividends. Prior to August 1, the Common Stock was not registered under the Securities Exchange Act of 1934, as amended.

21

PROPOSAL 2—RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee has selected PricewaterhouseCoopers LLP as independent public accountants of the Company for the year ending December 31, 2003. PricewaterhouseCoopers LLP has served as the Company’s independent public accountant since April 25, 2002. Although stockholder approval of the Audit Committee’s selection of PricewaterhouseCoopers LLP is not required by law, the Board and the Audit Committee believe that it is advisable to give stockholders an opportunity to ratify this selection. If the stockholders do not ratify the selection of PricewaterhouseCoopers LLP, the Audit Committee will reconsider the matter. A representative of PricewaterhouseCoopers LLP, which served as the Company’s independent public accountants for the year ended December 31, 2002, is expected to be present at the Meeting to respond to appropriate questions and to make a statement if he or she so desires.

On April 25,2002, the Company dismissed Arthur Andersen LLP as its independent public accountants. The decision to dismiss Arthur Andersen LLP was approved by the Company’s Audit Committee. None of the reports of Arthur Andersen LLP on the Company’s financial statements for either of the two fiscal years prior to Arthur Andersen LLP’s dismissal contained an adverse opinion or a disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope or accounting principles. During the Company’s two most recently completed fiscal years and any subsequent interim period preceding the date of the dismissal of Arthur Andersen LLP, the Company had no disagreements with Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of Arthur Andersen LLP, would have caused Arthur Andersen LLP to make reference to the subject matter of the disagreement in connection with its reports on the financial statements of the Company. None of the reportable events listed in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934 occurred with respect to either of the Company’s two most recently completed fiscal years or any subsequent interim period preceding the date of the dismissal of Arthur Andersen LLP.

During the Company’s two most recent fiscal years and the subsequent interim period prior to engaging PricewaterhouseCoopers LLP on April 25, 2002, except as indicated below, neither the Company nor anyone acting on its behalf consulted with PricewaterhouseCoopers LLP regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company by PricewaterhouseCoopers LLP that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a reportable event, as that term is defined in Item 304(a)(1)(v) of Regulation S-K. PricewaterhouseCoopers LLP served as independent public accountants of Ontogeny, Inc. until July 31, 2000, the date it was merged, together with Creative Biomolecules, Inc., with and into the Company.

STOCKHOLDER PROPOSALS FOR 2004 ANNUAL MEETING

Any proposal that a stockholder of the Company wishes to be considered for inclusion in the Company’s proxy statement and proxy for the 2004 Annual Meeting of Stockholders (the “2004 Annual Meeting”) must be submitted to the Secretary of the Company at its offices, 61 Moulton Street, Cambridge, Massachusetts 02138, no later than January 2, 2004.

22

If a stockholder of the Company wishes to present a proposal at the 2004 Annual Meeting, but does not wish to have the proposal considered for inclusion in the Company’s proxy statement and proxy, such stockholder must also give written notice to the Secretary of the Company at the address noted above. The Secretary must receive such notice not less than 60 days nor more than 90 days prior to the 2004 Annual Meeting; provided that, in the event that less than 70 days’ notice or prior public disclosure of the date of the 2004 Annual Meeting is given or made, notice by the stockholder must be received not later than the close of business on the 10th day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever occurs first. The date of our 2004 Annual Meeting of Stockholders has not yet been established, but assuming it is held on June 10, 2004, in order to comply with the time periods set forth in our by-laws, appropriate notice for the 2004 Annual Meeting would need to be provided to the Secretary no earlier than March 12, 2004 and no later than April 10, 2004. If a stockholder fails to provide timely notice of a proposal to be presented at the 2004 Annual Meeting, the proxies designated by the Board will have discretionary authority to vote on any such proposal.

OTHER MATTERS

The Board knows of no other business which will be presented for consideration at the Meeting other than that described above. However, if any other business should come before the Meeting, it is the intention of the persons named in the enclosed proxy card to vote, or otherwise act, in accordance with their best judgment on such matters.

The Company will bear the costs of soliciting proxies. In addition to solicitations by mail, the Company’s directors, officers and regular employees may, without additional remuneration, solicit proxies by telephone, facsimile and personal interviews. The Company will also request brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares and request instructions for voting the proxies. The Company will reimburse such brokerage houses and other persons for their reasonable expenses in connection with this distribution.

THE BOARD HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ACCOMPANYING ENVELOPE. PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE MEETING AND YOUR COOPERATION IS APPRECIATED. STOCKHOLDERS WHO ATTEND THE MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXY CARDS.

By Order of the Board of Directors,

Christopher U. Missling,Secretary

May 1, 2003

23

Appendix A

CURIS, INC.

AUDIT COMMITTEE CHARTER

A. Purpose

The purpose of the Audit Committee is to assist the Board of Directors’ oversight of:

| • | the integrity of the Company’s financial statements; |

| • | the Company’s compliance with legal and regulatory requirements; |

| • | the independent auditor’s qualifications and independence; and |

| • | the performance of the Company’s internal audit function and independent auditors. |

B. Structure and Membership

| 1. | Number. The Audit Committee shall consist of at least three members of the Board of Directors. |

| 2. | Independence. Except as otherwise permitted by the applicable rules of The NASDAQ Stock Market and Section 301 of the Sarbanes-Oxley Act of 2002 (and the applicable rules thereunder), each member of the Audit Committee shall be “independent” as defined by such rules and Act. The Audit Committee shall monitor the Audit Committee’s members throughout the year to confirm that they all remain independent as required by The NASDAQ Stock Market rules. In addition, the Audit Committee will consider whether any members of the Audit Committee have relationships with the Company that may create the appearance of a lack of independence, even though such relationships do not technically disqualify the person from being “independent. |

| 3. | Financial Literacy. Each member of the Audit Committee shall be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement, and cash flow statement, at the time of his or her appointment to the Audit Committee. Unless otherwise determined by the Board of Directors (in which case disclosure of such determination shall be made in the Company’s annual report filed with the SEC), at least one member of the Audit Committee shall be an “audit committee financial expert” (as defined by applicable SEC rules). All members of the Audit Committee shall participate in continuing education programs as set forth in the rules developed by the Nasdaq Listing and Hearings Review Council. |

| 4. | Chair. Unless the Board of Directors elects a Chair of the Audit Committee, the Audit Committee shall elect a Chair by majority vote. |

| 5. | Compensation. The compensation of Audit Committee members shall be as determined by the Board of Directors. No member of the Audit Committee may receive any consulting, advisory or other compensatory fee from the Company other than fees paid in his or her capacity as a member of the Board of Directors or a committee of the Board. |

| 6. | Selection and Removal. Members of the Audit Committee shall be appointed by the Board of Directors. The Board of Directors may remove members of the Audit Committee from such committee, with or without cause. |

A-1

C. Authority and Responsibilities

General

The Audit Committee shall discharge its responsibilities, and shall assess the information provided by the Company’s management and the independent auditor, in accordance with its business judgment. Management is responsible for the preparation, presentation, and integrity of the Company’s financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company’s financial statements and for reviewing the Company’s unaudited interim financial statements. The authority and responsibilities set forth in this Charter do not reflect or create any duty or obligation of the Audit Committee to plan or conduct any audit, to determine or certify that the Company’s financial statements are complete, accurate, fairly presented, or in accordance with generally accepted accounting principles or applicable law, or to guarantee the independent auditor’s report.

Oversight of Independent Auditors

| 1. | Selection. The Audit Committee shall be solely and directly responsible for appointing, evaluating and, when necessary, terminating the engagement of the independent auditor. The Audit Committee may, in its discretion, seek stockholder ratification of the independent auditor it appoints. |

| 2. | Independence. The Audit Committee shall take, or recommend that the full Board of Directors take, appropriate action to oversee the independence of the independent auditor. In connection with this responsibility, the Audit Committee shall perform the following duties: |

| • | Obtain and review a formal written statement from the independent auditor describing all relationships between the independent auditor and the Company, including the disclosures required by Independence Standards Board Standard No. 1. |

| • | Engage actively in dialogue with the independent auditor concerning any disclosed relationships or services that might impact the objectivity and independence of the auditor. |

| • | Review and evaluate the lead partner and other senior members of the independent auditor, taking into account the opinions of management. |

| • | Confirm the regular rotation of the lead audit partner and reviewing partner as required by Section 203 of the Sarbanes-Oxley Act. |

| • | Confirm that the CEO, controller, CFO, and CAO (or other persons serving in similar capacities) were not employed by the independent auditor, or if employed, did not participate in any capacity in the audit of the Company, in each case, during the one-year period preceding the date of initiation of the audit, as required by Section 206 of the Sarbanes-Oxley Act. |

| • | Annually consider whether, in order to assure continuing auditor independence, there should be regular rotation of the independent audit firm. |

| • | Present periodically its conclusions with respect to the independent auditor to the full Board of Directors. |

| 3. | Compensation. The Audit Committee shall have sole and direct responsibility for setting the compensation of the independent auditor. As part of this process the Audit Committee shall compare |

A-2

the fees paid for audit services to those paid by peer companies as a means of assessing whether the scope of audit work is sufficient. The Audit Committee is empowered, without further action by the Board of Directors, to cause the Company to pay the compensation of the independent auditor established by the Audit Committee. |

| 4. | Preapproval of Services. The Audit Committee shall preapprove all services (audit and non-audit) to be provided to the Company by the independent auditor; provided, however, that de minimis non-audit services may instead be approved in accordance with applicable SEC rules. The Audit Committee shall require the Company to disclose in its SEC periodic reports the approval by the Audit Committee of any non-audit services to be performed by the independent auditor. |