Exhibit 99.1

Forward Looking Statements

In addition to the historical information contained herein, this presentation contains certain forward-looking statements. The reader of this presentation should understand that all such forward-looking statements are subject to various uncertainties and risks that could affect their outcome. The Company's actual results could differ materially from those suggested by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, variances in the actual versus projected growth in assets, return on assets, loan and lease losses, expenses, changes in the interest environment including interest rates charged on loans, earned on securities investments and paid on deposits, competition effects, fee and other non interest income earned, general economic conditions, nationally, regionally, and in the operating market areas of the Company and its subsidiaries, changes in the regulatory environment, changes in business conditions and inflation, changes in securities markets, data processing problems, a decline in real estate values in the Company's market area, the conduct of the war on terrorism, the threat of terrorism or the impact of potential military conflicts and the conduct of war on terrorism by the United States and its allies, as well as other factors. To gain a more complete understanding of the uncertainties and risks involved in the Company's business, this presentation should be read in conjunction with the Company's annual report on Form 10-K for the year ended December 31, 2004, and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K.

NASDAQ Symbol: AMRB

Market Capitalization: $134 million*

Total Assets: $613 million

Number of Offices: 11 Full Service

1 Convenience

Number of Employees: 127

Headquarters: Rancho Cordova, CA

a Suburb of Sacramento

Founded: 1983

Page 4 of Page 16

Why is AMRB an Attractive Investment?

Superior asset quality

Excellent core deposit base

Growth opportunities in flourishing markets

Strong performance over time

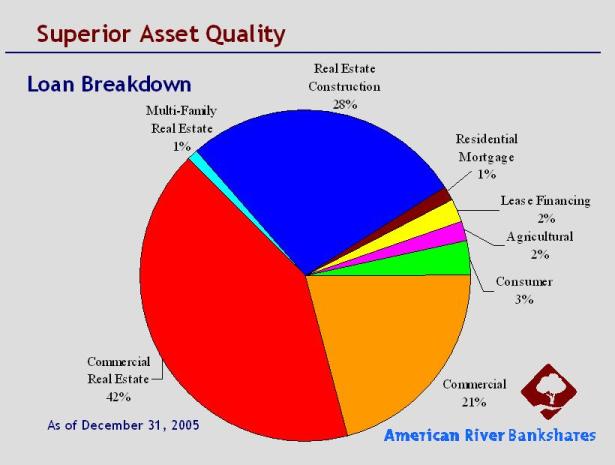

Superior Asset Quality

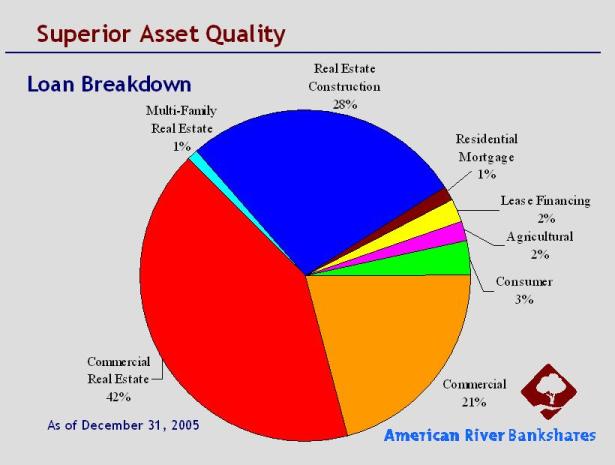

Loan Breakdown

Commercial 21%

Commercial Real Estate 42%

Multi-Family Real Estate 1%

Real Estate and Construction 28%

Residential Mortgage 1%

Lease Financing 2%

Agricultural 2%

Consumer 3%

As of December 31, 2005

Page 5 of Page 16

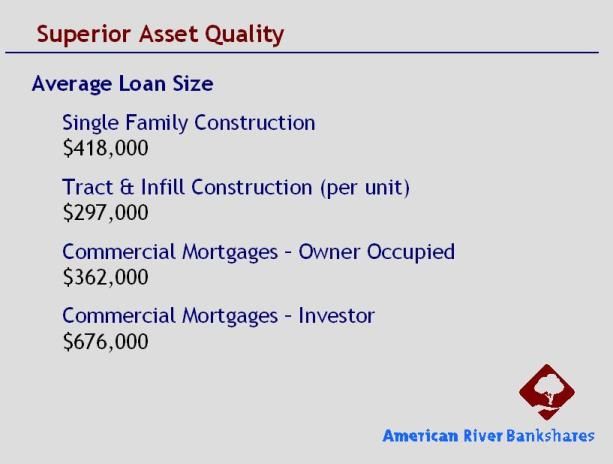

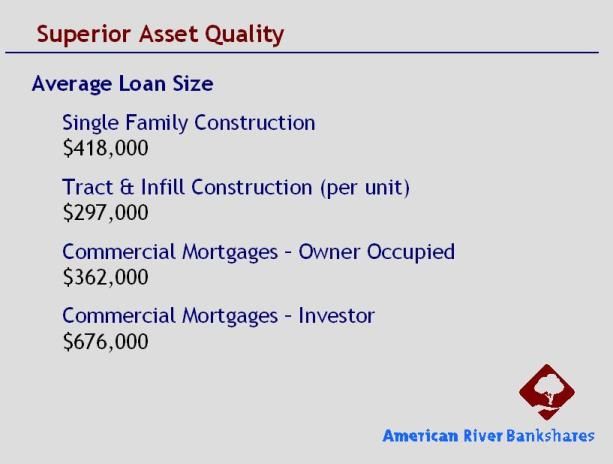

Average Loan Size

Single Family Construction

$418,000

Tract & Infill Construction (per unit)

$297,000

Commercial Mortgages – Owner Occupied

$362,000

Commercial Mortgages – Investor

$676,000

Superior Asset Quality

Solid Credit Quality

| 2001 | 2002 | 2003 | 2004 | 2005 |

|---|

| Allowance for loan and lease losses | | 1 | .32% | 1 | .38% | 1 | .48% | 1 | .54% | 1 | .53% |

| Nonperforming loans and leases | | 0 | .43% | 0 | .09% | 0 | .07% | 0 | .07% | 0 | .02% |

| Net charegeoffs to avg. loans and leases | | 0 | .31% | 0 | .03% | 0 | .08% | 0 | .08% | 0 | .04% |

Page 6 of Page 16

Why is AMRB an Attractive Investment?

Superior asset quality

Excellent core deposit base

Growth opportunities in flourishing markets

Strong performance over time

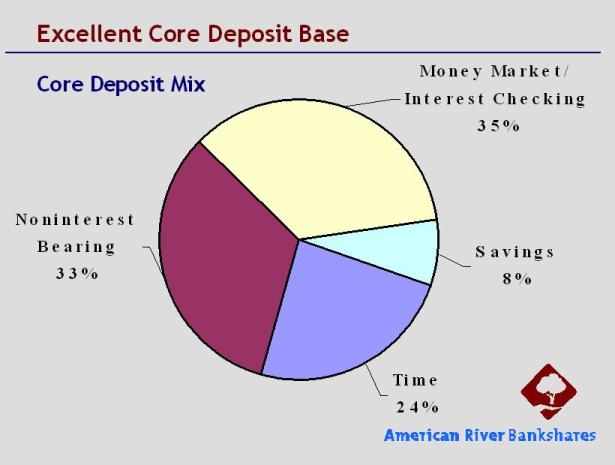

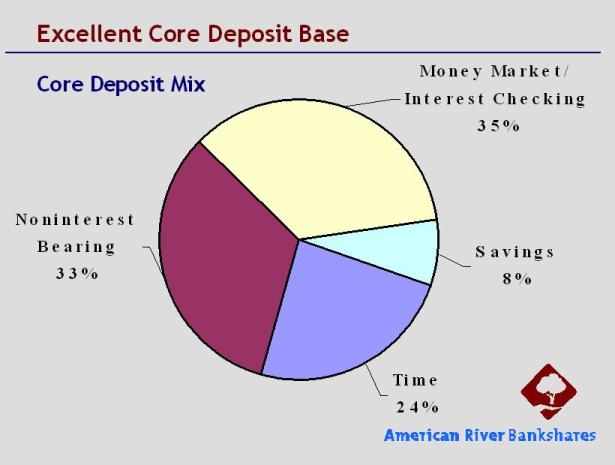

Time 24%

Noninterest Bearing 33%

Money Market/ Interest Checking 35%

Savings 8%

Page 7 of Page 16

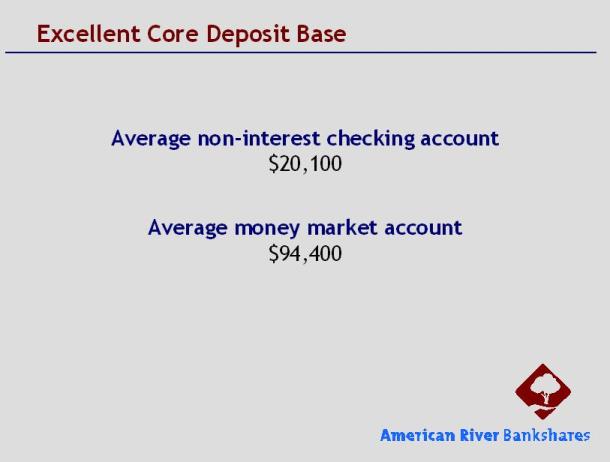

Excellent Core Deposit Base

Average non-interest checking account $20,100

Average money market account $94,400

Excellent Core Deposit Base

Top Industries

Non-Profits

- Faith-Based Organizations

- Trade Associations

- Cause-Based

Professionals

- Doctors

- Lawyers

- Dentists

High Net Worth Individuals

Building Related

- Contractors

- Home Builders

- Material Suppliers

- Professional Support

Trustees

Manufacturing

Page 8 of Page 16

Why is AMRB an Attractive Investment?

Superior asset quality

Excellent core deposit base

Growth opportunities in flourishing markets

Strong performance over time

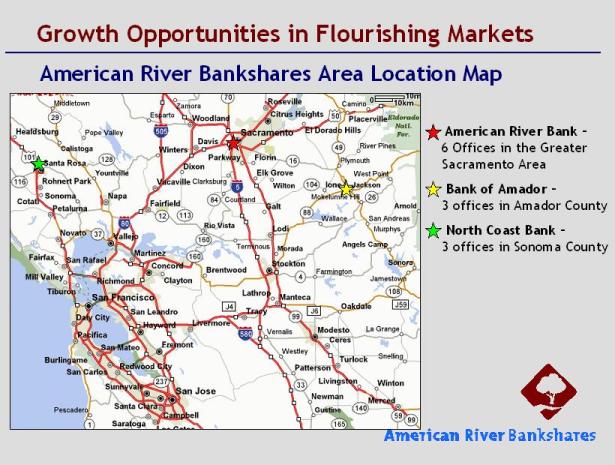

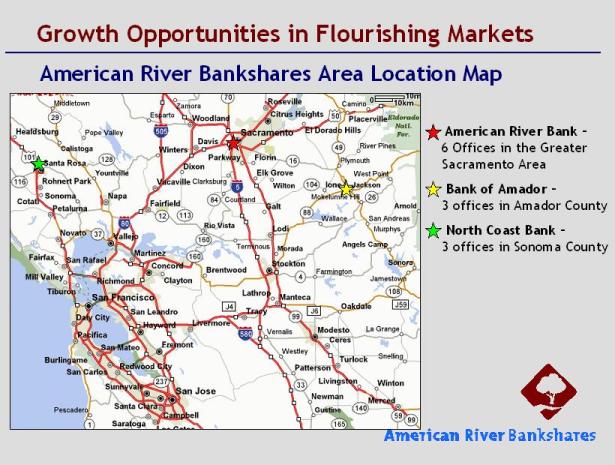

Growth Opportunities in Flourishing Markets

American River Bankshares Area Location Map

American River Bank -

6 Offices in the Greater Sacramento Area

Bank of Amador -

3 offices in Amador County

North Coast Bank -

3 offices in Sonoma County

Page 9 of Page 16

Growth Opportunities in Flourishing Markets

Niches

Small Business: Sales $1 to $20 million

Not-for-Profit Organizations

Building Trades

Residential Construction

Commercial Real Estate

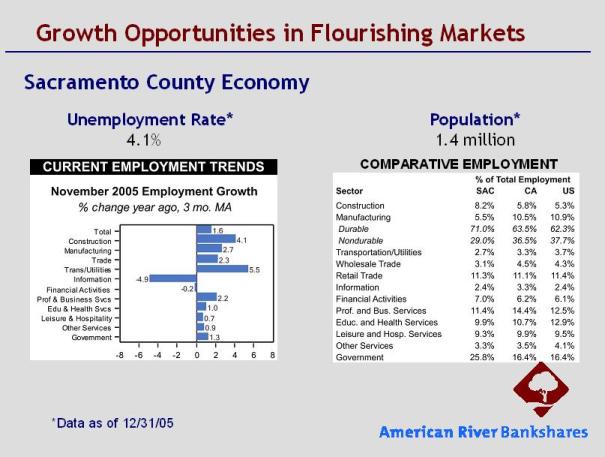

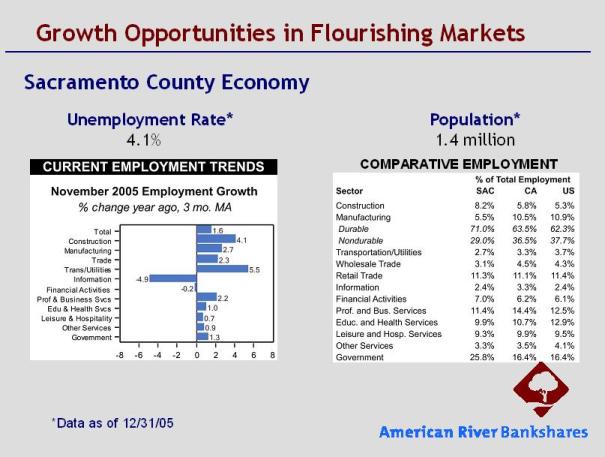

Growth Opportunities in Flourishing Markets

Sacramento County Economy

Unemployment Rate* Population*

4.1% 1.4 million

*Data as of 12/31/05

Page 10 of Page 16

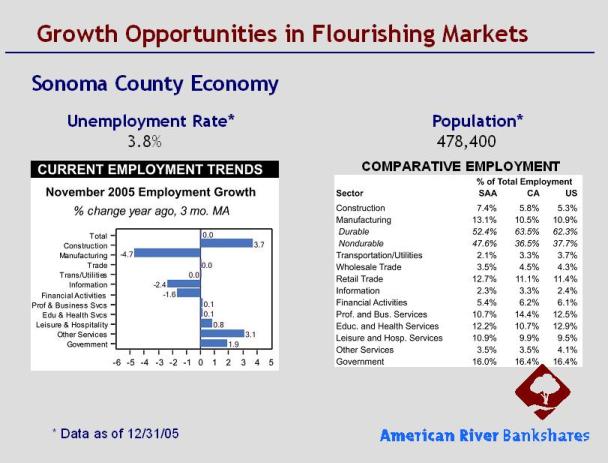

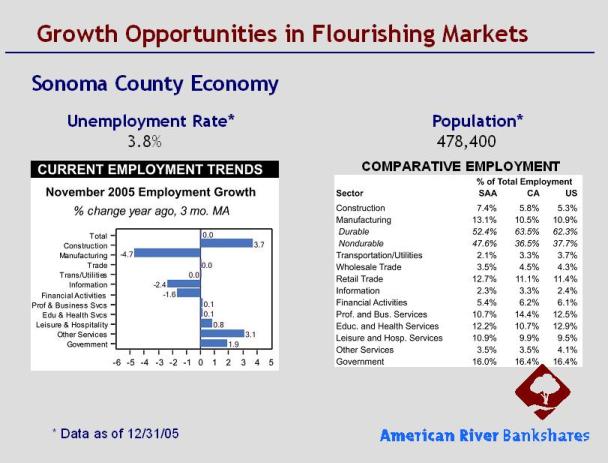

Growth Opportunities in Flourishing Markets

Sonoma County Economy

Unemployment Rate* Population*

3.8% 478,400

* Data as of 12/31/05

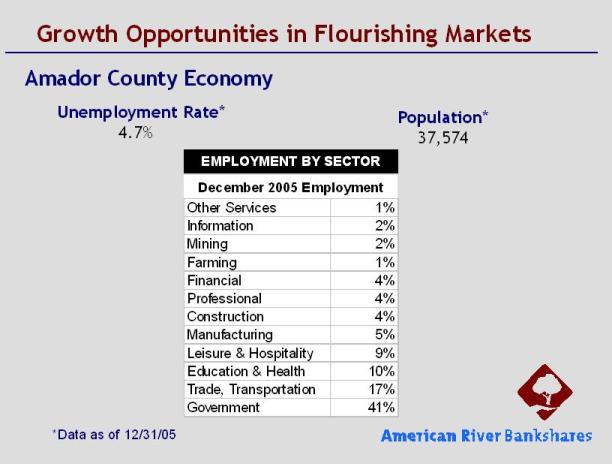

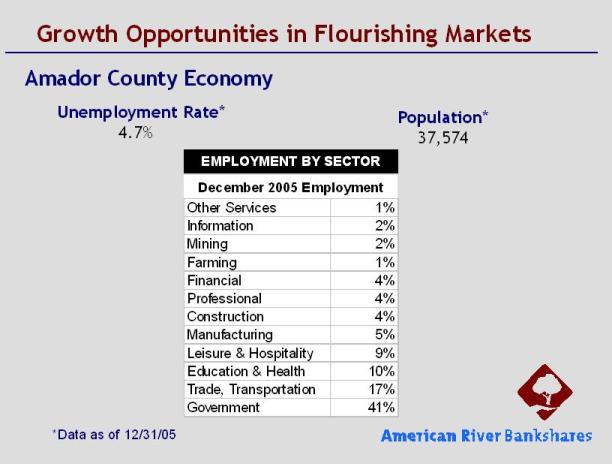

Growth Opportunities in Flourishing Markets

Amador County Economy

Unemployment Rate* 4.7%

Population* 37,574

* Data as of 12/31/05

Page 11 of Page 16

Growth Opportunities in Flourishing Markets

Bank of Amador Merger Results - One Year Together

22 years of excellence

18% deposit market share

High asset quality

Residential construction specialty

Potential for small business relationships

Why is AMRB an Attractive Investment?

Superior asset quality

Excellent core deposit base

Growth opportunities in flourishing markets

Strong performance over time

Page 12 of Page 16

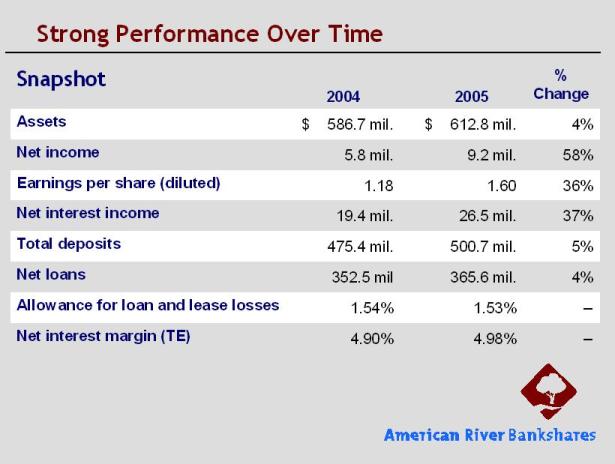

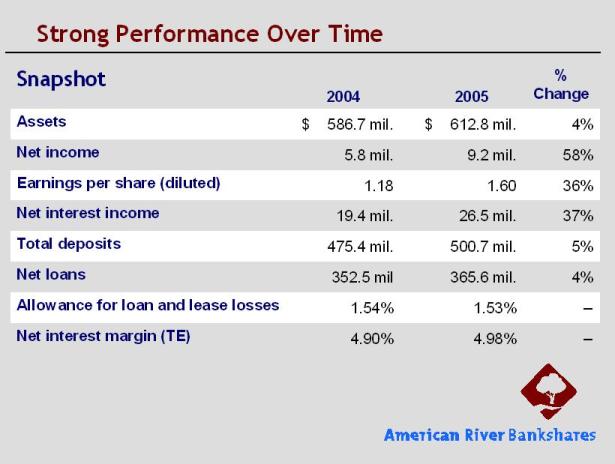

Strong Performance Over Time Snapshot

2004 2005 % Change

Assets $ 586.7 mil. $ 612.8 mil. 4%

Net income 5.8 mil. 9.2 mil. 58%

Earnings per share (diluted) 1.18 1.60 36%

Net interest income 19.4 mil. 26.5 mil. 37%

Total deposits 475.4 mil. 500.7 mil. 5%

Net loans 352.5 mil 365.6 mil. 4%

Allowance for loan and lease losses 1.54% 1.53% --

Net interest margin (TE) 4.90% 4.98% --

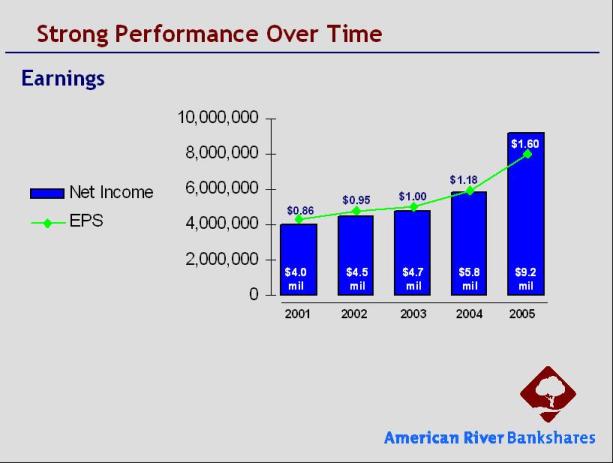

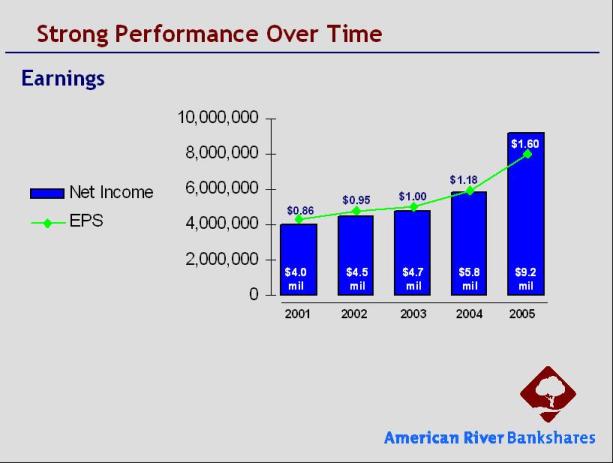

Strong Performance Over Time

Page 13 of Page 16

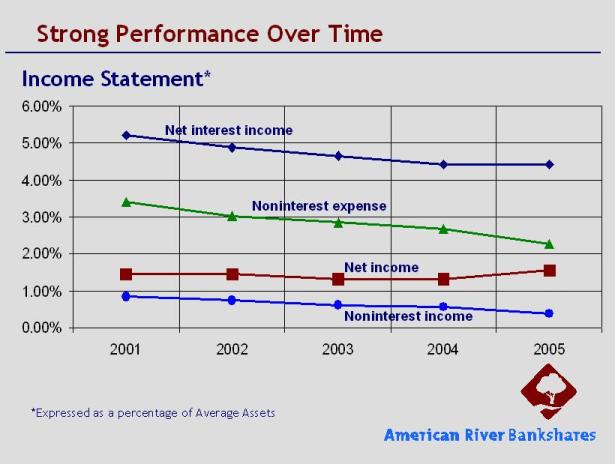

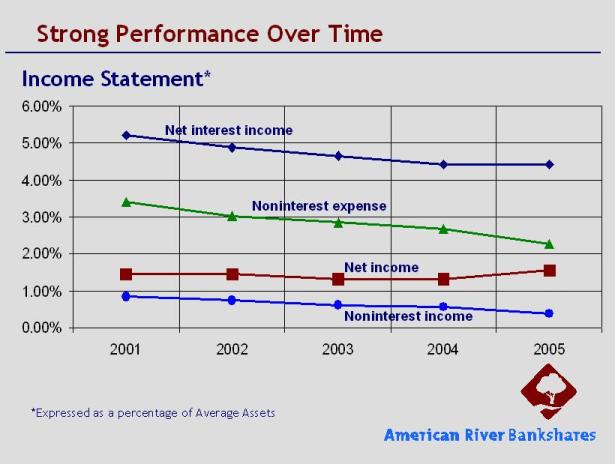

Strong Performance Over Time

Income Statement

Strong Performance Over Time

Leadership

American River Bankshares

David Taber, President and CEO, 23 years in the banking industry

Mitchell Derenzo, Chief Financial Officer, 20 years in the banking industry

Doug Tow, Chief Credit Officer, 29 years in the banking industry

Kevin Bender, Chief Information Officer, 22 years in the banking industry

Community Bank

Greg Patton, President of ARB, 23 years in the banking industry

Ray Byrne, President of NCB, 18 years in the banking industry

Larry Standing, President of BNKA, 45 years in the banking industry

Page 14 of Page 16

Strong Performance Over Time

Shareholder Value

88 consecutive profitable quarters

Semi-annual cash dividend from 1992-2003

Quarterly cash dividend since 1Q 2004

4 consecutive dividend increases in 2005

Five-year compound annualized growth rate EPS of 15.5%

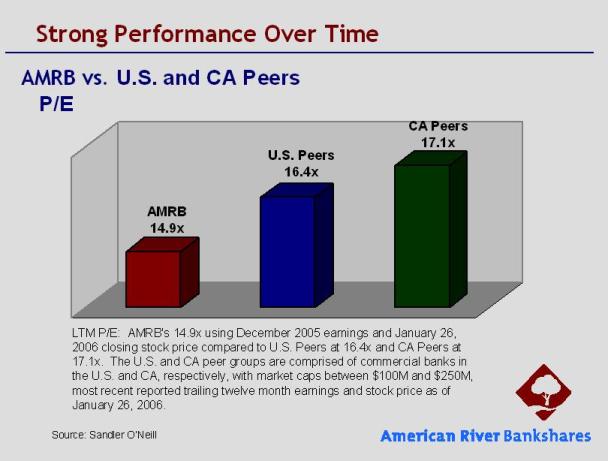

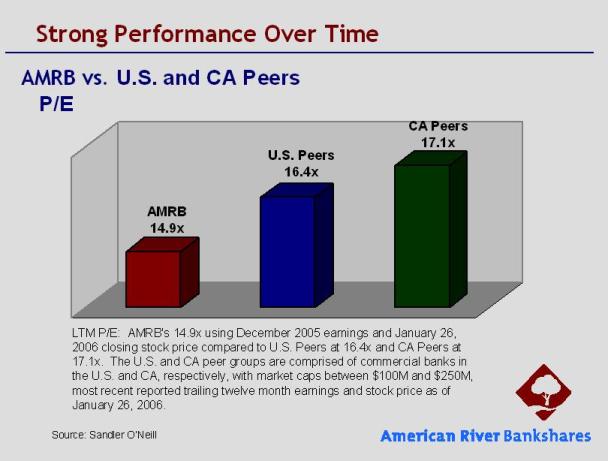

Strong Performance Over Time

AMRB vs. U.S. and CA Peers

P/E

LTM P/E: AMRB's 14.9x using December 2005 earnings and January 26, 2006 closing

stock price compared to U.S. Peers at 16.4x and CA Peers at 17.1x. The U.S. and

CA peer groups are comprised of commercial banks in the U.S. and CA,

respectively, with market caps between $100M and $250M, most recent reported

trailing twelve month earnings and stock price as of January 26, 2006.

Source: Sandler O'Neill

Page 15 of Page 16

Strong Performance Over Time

National Recognition

American River Bankshares was included as a member in the June launch of the new Russell Microcap Index by the Russell Investment Group. The new index was created to track the performance of a universe of 2,000 small-cap companies and offers investors a genuine marketplace of microcap stocks in which to identify opportunities.

U.S. Banker Magazine (July 2005) ranked AMRB as number thirty-five on their "Top 200 Publicly Traded Community Banks" list. The magazine's annual performance ranking includes banks and thrifts with assets under $1 billion and lists each company by three-year average rate of return on equity.

Why is AMRB an Attractive Investment?

Superior asset quality

Excellent core deposit base

Growth opportunities in flourishing markets

Strong performance over time

Page 16 of Page 16