EXHIBIT 99.1

American River Bankshares Announces 13% Loan Growth

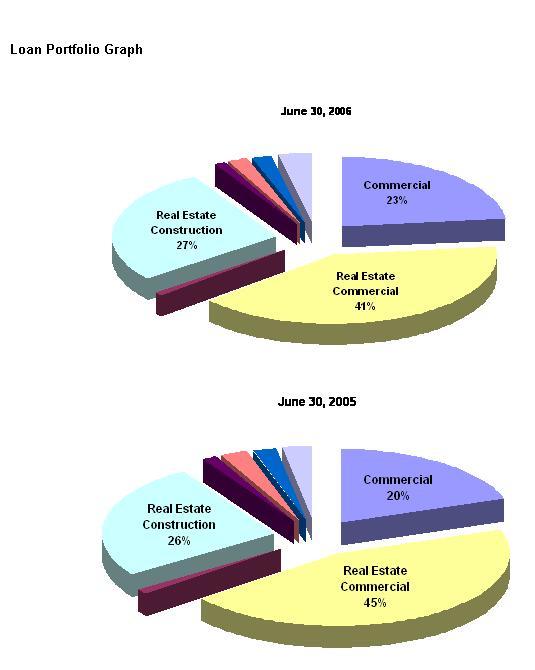

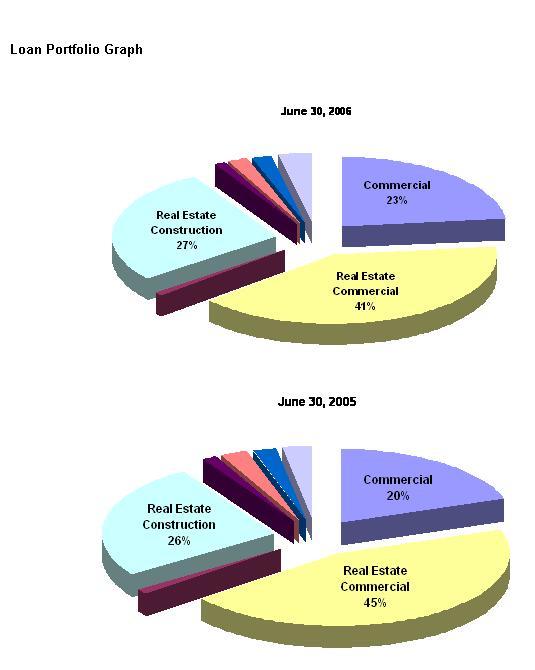

Sacramento, CA, July 19, 2006– American River Bankshares (NASDAQ-GS: AMRB) today reported an increase in net loans of $46,113,000 (13.3%) to $392,175,000 at June 30, 2006 from $346,062,000 as of June 30, 2005. From December 31, 2005, net loans increased $26,604,000 (7.3%) from $365,571,000. Commercial loans were $91,953,000, up 32.1% from $69,604,000 at June 30, 2005. From December 31, 2005 commercial loans increased 17.9% from $77,971,000. For more information on the loan portfolio composition, see the Loan Portfolio Graph.

“Our significant loan growth is a direct result of record loan production in the last two quarters,” said David Taber, President and CEO of American River Bankshares. “Key business relationships remain the driving force behind our long-term success and we continue to focus on business lending as part of our strategic plan.”

Net income for the second quarter of 2006 decreased 2.4% to $2,137,000 from $2,190,000 for the quarter ended June 30, 2005. Diluted earnings per share remained constant at $0.38. Net income for the six months ended June 30, 2006 rose 3.3% to $4,380,000 from $4,241,000 and diluted earnings per share increased 4.1% to $0.77 compared to $0.74 for the six months ended June 30, 2005.

Net interest income for the second quarter of 2006 increased 4.0% to $6,699,000 from $6,439,000 for the second quarter of 2005 and interest income increased 18.1% to $9,463,000 from $8,011,000. For the six months ended June 30, 2006, net interest income increased 5.8% to $13,491,000 from $12,754,000 and interest income increased 18.5% to $18,580,000 from $15,685,000 for the six months ended June 30, 2005.

Interest expense for the second quarter of 2006 increased 75.8% to $2,764,000 from $1,572,000 for the second quarter of 2005 and for the six months ended June 30, 2006, interest expense increased 73.6% to $5,089,000 from $2,931,000. The increase is mainly related to the rising costs of core deposits as a result of a higher interest rate environment in response to seventeen consecutive 25 basis point increases in the Federal funds rate over the past two years and a 179.2% increase in short-term borrowings to $56,840,000 at June 30, 2006 from $20,359,000 at June 30, 2005.

Total deposits as of June 30, 2006 decreased $29,455,000 (5.8%) to $480,610,000 from $510,065,000 as of June 30, 2005 and from December 31, 2005, decreased $20,096,000 (4.0%) from $500,706,000. The decrease is mainly related to approximately $25 million in disbursements from a bankruptcy trustee account in the second half of 2005 and lower account balances from small business clients that are growing their businesses. As a result of an overhaul in California bankruptcy laws, the Company has seen very little activity from our bankruptcy trustee niche in the first half of this year.

“Our client base has been utilizing their cash assets to mobilize their businesses by buying inventory, equipment and adding jobs,” said Mr. Taber. “We view this strength in our clients’ businesses as a positive sign of a solid regional economy.”

Noninterest income for the second quarter of 2006 increased 2.2% to $597,000 from $584,000 for the second quarter of 2005 and for the six months ended June 30, 2006, noninterest income increased 5.7% to $1,231,000 from $1,165,000. Noninterest expense increased 6.4% to $3,622,000 from $3,403,000 year over year and for the six months ended June 30, 2006, noninterest expense increased 7.9% to $7,260,000 from $6,731,000. This increase is primarily related to higher personnel costs, occupancy expense, professional fees and costs associated with adopting FAS 123(R). The higher personnel costs relates to health care and market-condition salary adjustments, additional staff to address the burden of more stringent compliance and regulatory issues, and in the three bank regions, business development and service personnel to help achieve strategic growth in business banking. The higher occupancy expense relates to the Company’s new administration office lease and the higher professional fees relates to the Company’s decision to outsource its network management. FAS 123(R) was adopted on January 1, 2006 and requires the Company to record stock options as compensation expense. Total expense related to FAS 123(R) amounted to $98,000 for the first six months of 2006.

Page 4 of Page 10

Credit quality remains outstanding, with net recoveries for the two consecutive quarters ended June 30, 2006. Nonperforming loans and leases were 0.07% of total loans and leases compared to 0.37% one year ago. The allowance for loan and lease losses increased to $5,924,000 in the second quarter of 2006 from $5,737,000 in the second quarter of 2005. The provision for loan and lease losses was $156,000 for the second quarter of 2006, an increase from $55,000 for the second quarter of 2005. The reserve as a percentage of loans and leases was 1.49% at June 30, 2006, compared to 1.63% at June 30, 2005.

Performance measures in the second quarter of 2006: the Return on Average Assets (ROAA) was 1.41%, Return on Average Equity (ROAE) was 13.52%, Return on Average Tangible Equity (ROATE) was 18.92% and the efficiency ratio was 48.01%. For quarter ended June 30, 2005, the Company has a ROAA of 1.50%, ROAE of 14.68%, ROATE of 21.13% and an efficiency ratio of 46.72%.

Second Quarter Highlights

| o | | American River Bankshares continues a long history of enhancing shareholder value with its 90th consecutive profitable quarter. The Company is committed to its shareholder value plan developed in 1992 and during the second quarter of 2006, repurchased nearly 90,000 shares totaling $2,430,000 and declared a quarterly cash dividend of 15 cents per share. |

| o | | American River Bank was awarded the 2006 Hands on Sacramento Award for Encouraging Employee Volunteerism at the 18th Annual People Helping People Awards, put on by the Community Service Planning Council. It pays tribute to Sacramento-area companies and individuals serving as role models of outstanding commitment to community service. This award recognizes a business that supports employee volunteer projects as well as encouraging year-round employee volunteerism. |

| o | | Net interest margin for the quarter ended June 30, 2006 remains strong at 4.95% compared to 4.98% for the quarter ended June 30, 2005. |

| o | | American River Bank’s offices in the Greater Sacramento Area and Placer County experienced a decrease in total deposits of 10.4% to $303,534,000 at June 30, 2006 from $338,659,000 at June 30, 2005. Year over year, net loans increased 21.3% to $236,821,000 from $195,316,000. |

| o | | North Coast Bank, a division of American River Bank with three offices in Sonoma County, increased total deposits 10.8% to $68,189,000 at June 30, 2006 from $61,588,000 as of June 30, 2005. Year over year, net loans increased 1.4% to $73,629,000 from $72,596,000. |

| o | | Bank of Amador, a division of American River Bank with three offices in Amador County, experienced a decrease in total deposits of 1.3% to $109,459,000 at June 30, 2006 from $110,937,000 at June 30, 2005. Year over year, net loans increased 4.6% to $81,724,000 from $78,149,000. |

| o | | American River Bankshares was selected for the new NASDAQ Global Select Market, which has the highest initial listing standards of any exchange in the world based on financial and liquidity requirements, putting the Company among some of the most well-respected organizations in the nation, including Costco, Intel and Google to name a few. |

| o | | U.S. Banker Magazine (July 2006) ranked AMRB as number thirty-five on their “Top 200 Publicly Traded Community Banks” list for the second consecutive year. The magazine’s annual performance ranking includes banks and thrifts with assets under $1 billion and lists each company by three-year average rate of return on equity. |

Page 5 of Page 10

About American River Bankshares

American River Bankshares [NASDAQ: AMRB] is the parent company of American River Bank (“ARB”), a community business bank serving Sacramento, CA that operates a family of financial services providers, including North Coast Bank [a division of “ARB”] in Sonoma County and Bank of Amador [a division of “ARB”] in Amador County. For more information, please call 916-231-6700 or visitwww.amrb.com;www.americanriverbank.com;www.northcoastbank.com; orwww.bankofamador.com.

Forward-Looking Statement

Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties. Actual results may differ materially from the results in these forward-looking statements. Factors that might cause such a difference include, among other matters, changes in interest rates, economic conditions, governmental regulation and legislation, credit quality, and competition affecting the Company’s businesses generally; the risk of natural disasters and future catastrophic events including terrorist related incidents; and other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, and in reports filed on Form 10-Q and Form 8-K. The Company does not undertake any obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information, future events or otherwise.

Page 6 of Page10

American River Bankshares

Consolidated Balance Sheet (Unaudited)

| June 30,

2006 | June 30,

2005 | %

Change | December 30,

2005 |

|---|

|

| |

| |

| |

| |

ASSETS | | | | | | | | | |

| Cash and due from banks | | $ 27,330,000 | | $ 31,314,000 | | (12.7 | %) | $ 34,825,000 | |

| Federal funds sold | | -- | | 19,400,000 | | n/a | | 1,250,000 | |

| Interest-bearing deposits in bank | | 4,941,000 | | 6,429,000 | | (23.1 | %) | 4,844,000 | |

| Investment securities | | 153,843,000 | | 169,649,000 | | (9.5 | %) | 171,809,000 | |

| Loans and leases: | |

| Real estate | | 278,495,000 | | 256,568,000 | | 8.5 | % | 265,995,000 | |

| Commercial | | 91,953,000 | | 69,604,000 | | 32.1 | % | 77,971,000 | |

| Lease financing | | 7,666,000 | | 8,479,000 | | (9.6 | %) | 7,967,000 | |

| Other | | 20,687,000 | | 17,888,000 | | 15.6 | % | 20,029,000 | |

| Deferred loan and lease originations fees, net | | (702,000 | ) | (740,000 | ) | (5.1 | %) | (712,000 | ) |

| Allowance for loan and lease losses | | (5,924,000 | ) | (5,737,000 | ) | 3.3 | % | (5,679,000 | ) |

|

| |

| |

| |

| |

| Total loans and leases, net | | 392,175,000 | | 346,062,000 | | 13.3 | % | 365,571,000 | |

|

| |

| |

| |

| |

| Bank premises and equipment | | 1,925,000 | | 1,772,000 | | 8.6 | % | 2,090,000 | |

| Accounts receivable servicing receivable, net | | 2,211,000 | | 2,376,000 | | (6.9 | %) | 2,000,000 | |

| Intangible assets | | 17,986,000 | | 18,208,000 | | (1.2 | %) | 18,152,000 | |

| Accrued interest and other assets | | 12,051,000 | | 10,842,000 | | 11.2 | % | 12,222,000 | |

|

| |

| |

| |

| |

| | | $ 612,462,000 | | $ 606,052,000 | | 1.1 | % | $ 612,763,000 | |

|

| |

| |

| |

| |

| LIABILITIES & EQUITY | | | | | | | | | |

| Noninterest-bearing deposits | | $ 155,282,000 | | $ 154,917,000 | | 0.2 | % | $ 164,397,000 | |

| Interest checking, money market & savings | | 197,210,000 | | 241,389,000 | | (18.3 | %) | 217,417,000 | |

| Time deposits | | 128,118,000 | | 113,759,000 | | 12.6 | % | 118,892,000 | |

|

| |

| |

| |

| |

| Total deposits | | 480,610,000 | | 510,065,000 | | (5.8 | %) | 500,706,000 | |

|

| |

| |

| |

| |

| Short-term borrowings | | 56,840,000 | | 20,359,000 | | 179.2 | % | 39,386,000 | |

| Long-term debt | | 8,238,000 | | 10,801,000 | | (23.7 | %) | 4,270,000 | |

| Accrued interest and other liabilities | | 4,301,000 | | 3,747,000 | | 14.8 | % | 5,655,000 | |

|

| |

| |

| |

| |

| Total liabilities | | 549,989,000 | | 544,972,000 | | 0.9 | % | 550,017,000 | |

| Total equity | | 62,473,000 | | 61,080,000 | | 0.2 | % | 62,746,000 | |

|

| |

| |

| |

| |

| | | $ 612,462,000 | | $ 606,052,000 | | 1.1 | % | $ 612,763,000 | |

|

| |

| |

| |

| |

| Nonperforming loans and leases to total loans and leases | | 0.07 | % | 0.37 | % | | | 0.02 | % |

| Net chargeoffs to average loans and leases (annualized) | | 0.00 | % | 0.02 | % | | | 0.04 | % |

| Allowance for loan and lease loss to total loans and leases | | 1.49 | % | 1.63 | % | | | 1.53 | % |

| Leverage Ratio | | 7.8 | % | 7.5 | % | | | 7.7 | % |

| Tier 1 Risk-Based Capital Ratio | | 10.2 | % | 10.4 | % | | | 10.6 | % |

| Total Risk-Based Capital Ratio | | 11.5 | % | 11.6 | % | | | 11.9 | % |

Page 7 of Page 10

American River Bankshares

Consolidated Statement of Income (Unaudited)

| | | | For the Six Months

Ended June 30 | | |

|---|

| | | |

| | |

| Second

Quarter

2006 | Second

Quarter

2005 | ‰

Change | 2006 | 2005 | ‰

Change |

|---|

|

| |

| |

| |

| |

| |

| |

| Interest income | | $9,463,000 | | $8,011,000 | | 18.1 | % | $18,580,000 | | $15,685,000 | | 18.5 | % |

| Interest expense | | 2,764,000 | | 1,572,000 | | 75.8 | % | 5,089,000 | | 2,931,000 | | 73.6 | % |

|

| |

| |

| |

| |

| |

| |

| Net interest income | | 6,699,000 | | 6,439,000 | | 4.0 | % | 13,491,000 | | 12,754,000 | | 5.8 | % |

| Provision for loan and lease losses | | 156,000 | | 55,000 | | 183.6 | % | 240,000 | | 272,000 | | (11.7 | %) |

| Total noninterest income | | 597,000 | | 584,000 | | 2.2 | % | 1,231,000 | | 1,165,000 | | 5.7 | % |

| Total noninterest expense | | 3,622,000 | | 3,403,000 | | 6.4 | % | 7,260,000 | | 6,731,000 | | 7.9 | % |

|

| |

| |

| |

| |

| |

| |

| Income before taxes | | 3,518,000 | | 3,565,000 | | (1.3 | %) | 7,222,000 | | 6,916,000 | | 4.4 | % |

| Income taxes | | 1,381,000 | | 1,375,000 | | 0.4 | % | 2,842,000 | | 2,675,000 | | 6.2 | % |

|

| |

| |

| |

| |

| |

| |

| Net income | | $2,137,000 | | $2,190,000 | | (2.4 | %) | $ 4,380,000 | | 4,241,000 | | 3.3 | % |

|

| |

| |

| |

| |

| |

| |

| Basic earnings per share | | $ 0.38 | | $ 0.39 | | (2.6 | %) | $ 0.78 | | $ 0.76 | | 2.6 | % |

| Diluted earnings per share | | $ 0.38 | | 0.38 | | 0.0 | % | 0.77 | | 0.74 | | 4.1 | % |

| Average diluted shares outstanding | | 5,698,170 | | 5,732,376 | | | | 5,712,343 | | 5,739,601 | | | |

| | | | | | | | | | | | | | | |

| Net interest margin as a percentage | | 4.95 | % | 4.98 | % | | | 5.03 | % | 4.97 | % | | |

| | | | | | | | | | | | | | | |

| Operating Ratios: | |

| Return on average assets | | 1.41 | % | 1.50 | % | | | 1.45 | % | 1.47 | % | | |

| Return on average equity | | 13.53 | % | 14.68 | % | | | 13.97 | % | 14.38 | % | | |

| Return on average tangible equity | | 18.92 | % | 21.13 | % | | | 19.56 | % | 20.77 | % | | |

| Efficiency ratio (fully taxable equivalent) | | 48.01 | % | 46.72 | % | | | 47.67 | % | 46.62 | % | | |

Page 8 of Page 10

American River Bankshares

Consolidated Statement of Income (Unaudited)

Trailing Four Quarters

| Second

Quarter

2006 | First

Quarter

2006 | Fourth

Quarter

2005 | Third

Quarter

2005 |

|---|

|

| |

| |

| |

| |

| Interest income | | $9,463,000 | | $9,117,000 | | $8,966,000 | | $8,562,000 | |

| Interest expense | | 2,764,000 | | 2,325,000 | | 2,011,000 | | 1,809,000 | |

|

| |

| |

| |

| |

| Net interest income | | 6,699,000 | | 6,792,000 | | 6,955,000 | | 6,753,000 | |

| Provision for loan and lease losses | | 156,000 | | 84,000 | | 50,000 | | 0 | |

| Total noninterest income | | 597,000 | | 634,000 | | 570,000 | | 594,000 | |

| Total noninterest expense | | 3,622,000 | | 3,638,000 | | 3,298,000 | | 3,464,000 | |

|

| |

| |

| |

| |

| Income before taxes | | 3,518,000 | | 3,704,000 | | 4,177,000 | | 3,883,000 | |

| Income taxes | | 1,381,000 | | 1,461,000 | | 1,610,000 | | 1,507,000 | |

|

| |

| |

| |

| |

| Net income | | $2,137,000 | | $2,243,000 | | $2,567,000 | | $2,376,000 | |

|

| |

| |

| |

| |

| Basic earnings per share | | $ 0.38 | | $ 0.40 | | $ 0.46 | | $ 0.42 | |

| Diluted earnings per share | | $ 0.38 | | 0.39 | | 0.45 | | 0.41 | |

| | | | | | | | |

| Net interest margin as a percentage | | 4.95 | % | 5.12 | % | 5.09 | % | 4.92 | % |

| | | | | | | | |

| Quarterly Operating Ratios: | | | | | | | | | |

| Return on average assets | | 1.41 | % | 1.49 | % | 1.67 | % | 1.54 | % |

| Return on average equity | | 13.53 | % | 14.41 | % | 16.41 | % | 15.32 | % |

| Return on average tangible equity | | 18.92 | % | 20.20 | % | 23.15 | % | 21.74 | % |

| Efficiency ratio (fully tax equivalent) | | 48.01 | % | 47.34 | % | 42.21 | % | 45.44 | % |

Earnings per share have been adjusted for a 5% stock dividend declared in 2005.

Page 9 of Page 10

Page 10 of Page 10