Exhibit 99.1

Right People. Right Products. Right Market.

David T. Taber, President & CEO

Mitchell A. Derenzo, Executive Vice President & CFO

Douglas E. Tow, Executive Vice President & CCO

Forward-Looking Statements

FIG Partners

2nd Annual West Coast Conference

February 10, 2011

Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Actual results may differ materially from the results in these forward-looking statements. Factors that might cause such a difference include, among other matters, changes in interest rates, economic conditions, governmental regulation and legislation, credit quality, and competition affecting the Company’s businesses generally; the risk of natural disasters and future catastrophic events including terrorist related incidents; and other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009, and in subsequent reports filed on Form 10-Q and Form 8-K. The Company does not undertake any obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information, future events or otherwise, except as required by law.

Company Profile

Headquarters

Rancho Cordova, CA

a Suburb of Sacramento

Founded Total Assets

1983 $579 million

Shareholders’ Equity 3-Month Average Volume

$90 million 12,428 shares per day

Insider Ownership Institutional Ownership

7% 41%

Diverse and Large Market

$38 Billion in Deposit Potential*

*FDIC market share data for Amador, Placer, Sacramento and Sonoma Counties as of June 30, 2010

Strategic Direction

Organic Growth in Markets We Currently Serve:

● Low-cost core deposits

● Focus on credit quality

Business Banking Niches that Differentiate Us:

● Small business – sales between $1 – $30 million

● High Net Worth individuals (business owners)

● Business Niches: Building Trades, Wholesalers, Manufacturers, Professionals, Faith Based, Fiduciaries and Property Managers.

Relationship Banking:

● Focus not only on the business itself, but its owners, their families and their employees

● Provide 360 degree banking needs for each relationship

Experience Matters…Leadership Counts

| Name | Position | Industry Experience |

| David Taber | President Chief Executive Officer | 27 years |

| Mitchell Derenzo | Executive Vice President Chief Financial Officer | 22 years |

| Doug Tow | Executive Vice President Chief Credit Officer | 34 years |

| Kevin Bender | Executive Vice President Chief Operating Officer | 24 years |

Our Executive Team has been Together for 16 Years

Proactive Credit Management

● Veteran credit management team with an aggressive workout and collection philosophy

● Keys to “Best Practices” portfolio management: Accurate & timely risk ratings, loan watch meetings, regular stress testing and regular third party loan reviews

● Recourse and cash flow lending with primary, secondary and tertiary sources of payments

● Focused on loan types and markets within core competency (industry niches, geography and loan size). Historically proven to be a successful strategy

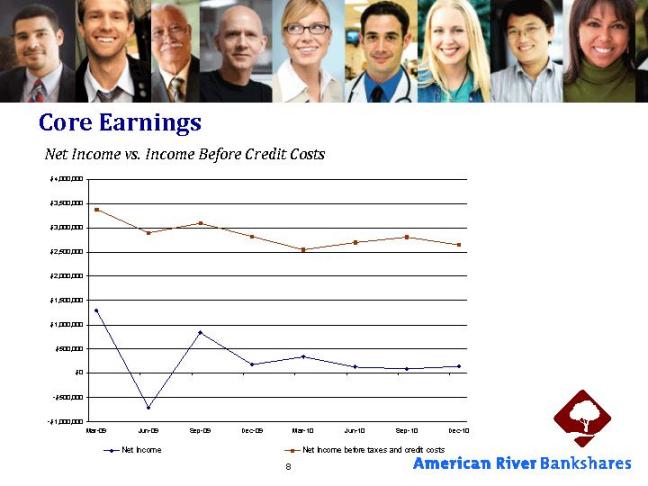

Core Earnings

Net Income vs. Income Before Credit Costs

Core Earnings

Strong & Stable Interest Margin Through Rate Cycles

Success is in the Deposit Mix

Core Deposits

Overall Cost of Deposits (4Q’10):

0.57%

Core deposits consist of noninterest bearing, interest checking, money market and savings.

As of December 31, 2010

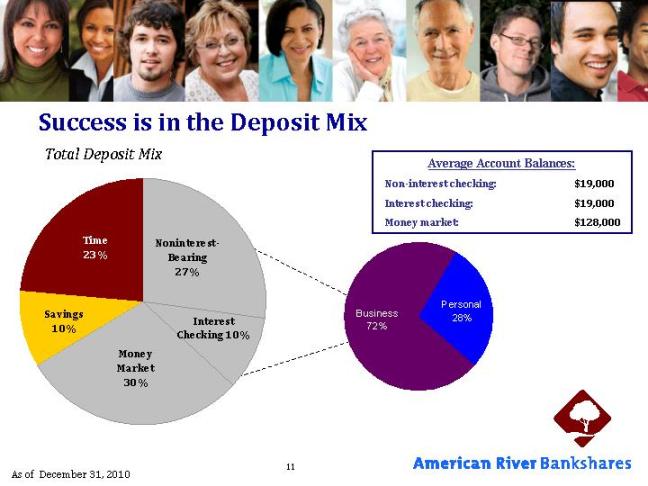

Success is in the Deposit Mix

Total Deposit Mix

Average Account Balances:

Non-interest checking: $19,000

Interest checking: $19,000

Money market: $128,000

As of December 31, 2010

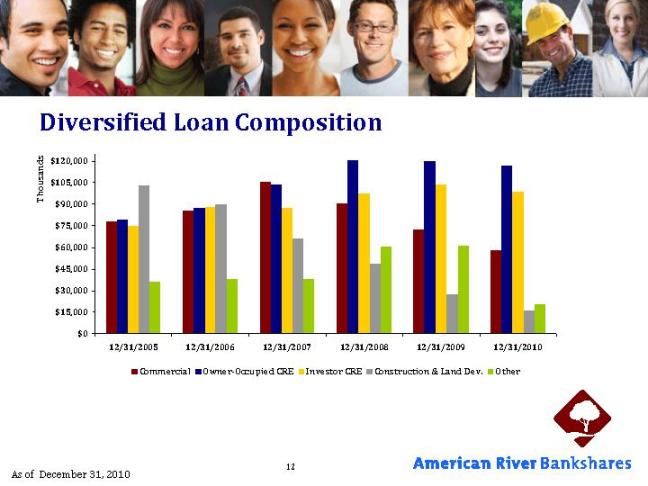

Diversified Loan Composition

As of December 31, 2010

Asset Quality

| | December 31, 2010 | September 30, 2010 |

| Non-performing loans that are current to term* | $3,004,000 | $4,504,000 |

| Non-performing loans that are past due | 19,567,000 | 20,398,000 |

| Other real estate owned (net) | 2,696,000 | 3,067,000 |

| | $25,267,000 | $27,969,000 |

* loans that are current (less than 30 days past due) pursuant to

original or modified terms

Asset Quality

Non-Performing Assets 12/31/10

Loan Losses

Last Eight Quarters

As of December 31, 2010

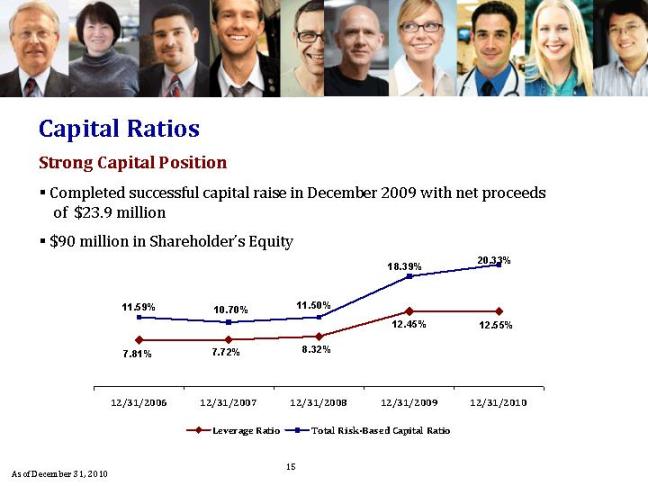

Capital Ratios

Strong Capital Position

● Completed successful capital raise in December 2009 with net proceeds of $23.9 million

● $90 million in Shareholder’s Equity

As of December 31, 2010

The Right Mix of Service and Sales

Sales

● Feet-on-the-Street Prospecting

● Financial Reviews

● Services per Household

● Bank Local

● Result-driven Marketing

The Right Mix of Service and Sales

Service

| Customer Experience Predictive Index (CxPi) | American River Bank | Industry Average |

Useful: How effective are we at meeting your needs? | Excellent (92%) | Good (77%) |

Ease of Use: How easy is it to work with us? | Excellent (95%) | Good (77%) |

Enjoyable: How enjoyable are your interactions with us? | Excellent (96%) | Poor (59%) |

| | | Necessary |

| | | Degree of |

| Loyalty Index | American River Bank | Correlation |

Willingness to Repurchase: How likely are you to use us for future banking | | |

| needs? | Very High (90%) | Very High (70%+) |

Likelihood to Recommend: How likely is it that you would recommend us to | | |

| a friend or colleague? | Very High (90%) | Very High (70%+) |

| | | |

Reluctance to Switch: How likely are you to switch from us to another bank? | Very High (71%) | High (51% -70%) |

Client Satisfaction Survey based on Forrester Research Methodology

Client Satisfaction Survey by American River Bank, 2/1/10 to 7/31/10.

Forrester Research 2008 CxPi Report Average by Industry (Banks)

The AMRB Difference

Strong Core Deposit Base: Low cost funding drives profitability

Organic Growth Opportunities: The four combined counties in which we operate had a total of $38 billion deposits as of June 30, 2010

Strategic Growth Opportunities: Strong capital and liquidity for acquisitions

Business Banking Niches that Differentiate: Small business – sales between $1 – $30M

Relationship Banking: Focus not only on the business itself, but its owners, their families and their employees

Proven Track Record of Efficiency and Bottom Line Focus: AMRB has posted positive earnings per share since 1984 and efficiency ratios well below our peers