3. Amendments to Section 2.01(a). (a) effective for periods beginning on the February 2023 Distribution Date, Section 2.01(a) of the Series 2009 Supplement is hereby amended by deleting in their entirety the definitions of the terms “LIBOR” and “Reuters Screen LIBOR01 Page”.

(b) The definition of the term “Interest Period” is hereby amended and restated by replacing such definition in its entirety with the following:

“Interest Period” means, (i) with respect to the March 7, 2023 Distribution Date, the period from and including the period from and including February 7, 2023 to and including the next Payment Period End Date (ii) and with respect to any Distribution Date after March 7, 2023, from and not including a Payment Period End Date to and including the next Payment Period End Date.

(c) Effective for periods beginning on the February 2023 Distribution Date, the definition of the term “Series 2009 Certificate Rate” is hereby amended and restated by replacing such definition in its entirety with the following:

“Series 2009 Certificate Rate” means a per annum rate equal to Compounded SOFR for such Interest Period plus the Applicable Margin.

For the purpose of calculating interest with respect to any interest period for the Series 2009 Certificate:

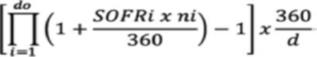

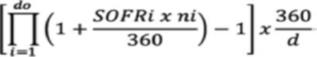

| | • | | “Compounded SOFR” means a rate of return of a daily compounded interest investment calculated in accordance with the formula below, with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point (0.00000005 being rounded upwards): |

where

“do”, for any interest period, is the number of U.S. Government Securities Business Days in the relevant interest period.

“i” is a series of whole numbers from one to do, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant interest period.

“SOFRi”, for any day “i” in the relevant interest period, is a reference rate equal to SOFR in respect of that day.

2