- TXNM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B5 Filing

TXNM Energy (TXNM) 424B5Prospectus supplement for primary offering

Filed: 25 Mar 05, 12:00am

Filed pursuant to Rule 424(b)5

SEC File No. 333-106080

333-121059

Prospectus Supplement to

Prospectus Dated December 16, 2004

4,300,000 Equity Units

(Initially Consisting of 4,300,000 Corporate Units)

6.75% Equity Units

PNM Resources, Inc. is offering 4,300,000 6.75% Equity Units in this offering.

Each Equity Unit will have a stated amount of $50 and will consist of a purchase contract issued by us and, initially, a 1/20, or 5%, undivided beneficial ownership interest in a $1,000 principal amount senior note initially due May 16, 2010, issued by us, which we refer to as a Corporate Unit.

| • | The purchase contract will obligate you to purchase from us, no later than May 16, 2008, for a price of $50 in cash, between 1.5315 and 1.8685 shares of our common stock, subject to anti-dilution adjustments, depending on the average closing price of our common stock over the 20-trading day period ending on the third trading day prior to such date. |

| • | We will pay you quarterly contract adjustment payments at a rate of 1.95% per year of the stated amount of $50 per Equity Unit, or $0.975 per year, as described in this prospectus supplement. |

| • | The senior notes will initially bear interest at a rate of 4.80% per year, payable, initially, quarterly. The senior notes will be remarketed as described in this prospectus supplement. In connection with this remarketing the interest rate on the senior notes will be reset and thereafter interest will be payable at the reset rate. Following the purchase contract settlement date, interest will be payable semi-annually, regardless of whether there was a successful remarketing. |

| • | You can create Treasury Units from Corporate Units by substituting Treasury securities for your undivided beneficial ownership interest in the senior notes or the applicable ownership interest in the Treasury portfolio comprising a part of the Corporate Units, and you can recreate Corporate Units by substituting your undivided beneficial ownership interest in the senior notes or the applicable ownership interest in the Treasury portfolio for the Treasury securities comprising a part of the Treasury Units. |

| • | Your ownership interest in the senior notes, the applicable ownership interest in the Treasury portfolio or the Treasury securities, as the case may be, will be pledged to us to secure your obligation under the related purchase contract. |

| • | If there is a successful remarketing of the senior notes on or prior to the third business day immediately preceding May 16, 2008, and you hold Corporate Units, the proceeds from the remarketing will be used to satisfy your payment obligations under the purchase contracts, unless you have elected to settle with separate cash. |

| • | The Equity Units are initially being offered only in integral multiples of 20 Corporate Units. |

This offering is being made concurrently with an offering of our common stock pursuant to a separate prospectus supplement. This offering and the common stock offering are not contingent upon each other.

Our common stock is listed and traded on the New York Stock Exchange under the symbol “PNM.” The reported last sale price of our common stock on the New York Stock Exchange on March 23, 2005 was $26.76 per share. The Corporate Units have been approved for listing on the New York Stock Exchange under the symbol “PNMPrA.” We expect trading of the Corporate Units on the New York Stock Exchange to commence on or about March 29, 2005. Prior to this offering, there has been no public market for the Corporate Units.

Investing in our Corporate Units involves risks. See “Risk Factors” beginning on page S-24 of this prospectus supplement.

| Per Corporate Unit | Total | |||||

Price to public | $ | 50.00 | $ | 215,000,000 | ||

Underwriting discounts and commissions | $ | 1.50 | $ | 6,450,000 | ||

Proceeds to us | $ | 48.50 | $ | 208,550,000 | ||

The initial public offering price set forth above does not include accumulated contract adjustment payments and accrued interest, if any. Contract adjustment payments on the purchase contracts and interest attributable to the undivided beneficial ownership interests in the senior notes will accrue for purchasers in this offering from March 30, 2005.

To the extent that the underwriters sell more than 4,300,000 Corporate Units, within 30 days from the date of this prospectus supplement, the underwriters have the option to purchase up to an additional 645,000 Corporate Units from us, at the price to public less underwriting discounts and commissions.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Corporate Units to purchasers on March 30, 2005.

| Joint Book-Running Managers | ||||

| Banc of America Securities LLC | JPMorgan | Morgan Stanley | ||

| Citigroup | Merrill Lynch & Co | Wachovia Securities | ||

| U.S. Bancorp Investments, Inc. | RBC Capital Markets | Wells Fargo Securities | ||

| BOSC, Inc. |

Prospectus Supplement dated March 23, 2005.

Prospectus Supplement | ||

| Page | ||

| ii | ||

| ii | ||

| iii | ||

| S-1 | ||

| S-24 | ||

| S-41 | ||

| S-41 | ||

| S-42 | ||

| S-43 | ||

| S-44 | ||

| S-49 | ||

Certain Provisions of the Purchase Contracts and the Purchase Contract and Pledge Agreement | S-62 | |

| S-69 | ||

| S-75 | ||

| S-84 | ||

| S-86 | ||

| S-89 | ||

| S-89 |

Prospectus | ||

| Page | ||

| 1 | ||

| 1 | ||

| 2 | ||

Ratio of Earnings to Fixed Charges and Combined Fixed Charges And Preferred Stock Dividends | 3 | |

| 4 | ||

| 4 | ||

| 5 | ||

| 14 | ||

| 17 | ||

Description of Purchase Contracts and Purchase Contract Units | 18 | |

| 18 | ||

| 20 | ||

| 20 |

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering of Equity Units and certain other matters relating to us and our financial condition. The second part, the base prospectus, gives more general information about securities we may offer from time to time, some of which does not apply to this offering. Generally, when we refer to the prospectus, we are referring to both parts of this document combined.

You should rely only on the information contained in this document or to which this document refers you. We have not authorized, and we have not authorized the underwriters to authorize, anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This document may only be used where it is legal to sell these securities. The information which appears in this document and which is incorporated by reference in this document may only be accurate as of the date of this prospectus supplement or the date of the document in which incorporated information appears. Our business, financial condition, results of operations and prospects may have changed since the date of such information.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Room 1024, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room and their copy charges. You may also read and copy these documents at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005. We also maintain a website atwww.pnm.com. Information contained on our website does not constitute a part of this prospectus.

The SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus and later information that we file with the SEC will automatically update or supersede this information. We incorporate by reference the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended, until such time as all of the securities covered by this prospectus supplement are sold:

| • | Annual Report on Form 10-K for the year ended December 31, 2004. |

| • | Current Reports on Form 8-K dated as of January 3, 2005, February 7, 2005, March 2, 2005, March 7, 2005 and two separate Current Reports dated as of March 15, 2005, one of which was amended by a Current Report on Form 8-K/A dated as of March 15, 2005. |

You may request a copy of these filings, at no cost, by writing or telephoning us at:

PNM Resources, Inc.

Investor Relations

Alvarado Square

Albuquerque, New Mexico 87158

(505) 241-2700

ii

This prospectus supplement contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Examples include discussions as to our expectations, beliefs, plans, goals, objectives and future financial or other performance or assumptions concerning matters discussed in this prospectus supplement including, specifically, our proposed future acquisitions and our expectations with respect to our business following such acquisitions. This information, by its nature, involves estimates, projections, forecasts and uncertainties that could cause actual results or outcomes to differ substantially from those expressed in the forward-looking statement.

Our business is influenced by many factors that are difficult to predict, involve uncertainties that may materially affect actual results and are often beyond our ability to control. We have identified a number of these factors in our most recent Annual Report on Form 10-K and we refer you to that report for further information. These factors include:

| • | the availability of cash of TNP, |

| • | risks and uncertainties relating to the anticipated receipt of regulatory approvals for the proposed acquisition of TNP, |

| • | the risks that the businesses will not be integrated successfully, |

| • | the risk that the benefits of the TNP transaction may not be fully realized or may take longer to realize than expected, |

| • | disruption from the TNP transaction may make it more difficult to maintain relationships with customers, employees, suppliers or other third parties, |

| • | conditions in the financial markets relevant to the proposed TNP acquisition, |

| • | fluctuations in interest rates, |

| • | unseasonable weather, |

| • | availability of water supply, |

| • | changes in fuel costs, |

| • | availability of fuel supplies, |

| • | the effectiveness of risk management and commodity risk transactions, |

| • | seasonality and other changes in supply and demand in the market for electric power, |

| • | variability in wholesale power prices, |

| • | volatility surrounding market liquidity, |

| • | changes in the competitive environment in the electric and natural gas industries, |

| • | the performance of generating units and transmission systems, |

| • | our ability to secure long-term power sales, |

| • | the risks associated with completion of construction of the Luna Generating Facility, including construction delays and unanticipated cost overruns, |

| • | state and federal regulatory and legislative decisions and actions, |

| • | the outcome of legal proceedings, |

| • | changes in applicable accounting principles, |

| • | the performance of state, regional and national economies, and |

| • | the other factors described in “Risk Factors” in this prospectus supplement. |

Any forward-looking statement speaks only as of the date on which it is made, and, except as required by the federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made.

iii

This summary highlights information contained elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus. As a result, it does not contain all of the information that you should consider before investing in the Corporate Units. You should read the entire prospectus supplement, including the accompanying prospectus and the documents incorporated by reference, which are described under “Where You Can Find More Information” in this prospectus supplement. This prospectus supplement and the accompanying prospectus contain or incorporate forward-looking statements. Forward-looking statements should be read with the cautionary statements and important factors included in this prospectus supplement under “Forward-Looking Statements.”

PNM Resources, Inc.

We are an energy holding company based in Albuquerque, New Mexico, primarily engaged in the generation, transmission, distribution, sale and marketing of electricity and in the transmission, distribution and sale of natural gas within the State of New Mexico. Our business is conducted through our principal subsidiary, Public Service Company of New Mexico. Our vision is to “Build America’s Best Merchant Utility.” We view a merchant utility as the balanced combination of a strong regulated utility with growth-oriented electric sales in competitive markets. Consistent with our growth strategy, we have entered into an agreement to acquire TNP Enterprises, Inc., or TNP, a Fort Worth-based energy holding company with regulated and competitive subsidiaries. In addition, we recently purchased a one-third interest in the partially constructed, combined cycle Luna Energy Facility near Deming, New Mexico. Upon anticipated completion in mid-2006, our share of this gas-fired combined-cycle plant will add 190 MW to our diverse generation portfolio. The details of both transactions are discussed below in the “Acquisitions” section of this prospectus supplement summary.

We are New Mexico’s largest electricity and natural gas provider, serving approximately 413,000 electric and 471,000 natural gas customers throughout the state. As of December 31, 2004, we had an integrated portfolio of 2,417 MW of generation, which we use to serve both regulated and unregulated load. Pursuant to a long-standing regulatory approach, we use a joint-dispatch method that serves both retail and wholesale markets. During 2004, our sales in the wholesale electric market accounted for approximately 62% of total MWh sales, of which 80% had been purchased for resale. For the year ended December 31, 2004, we generated approximately $1.6 billion in operating revenues, with approximately $659.5 million in gross profits (which is operating revenues less cost of energy sold) representing a 41.1% gross margin. Of those amounts, our wholesale business generated approximately $588.2 million in operating revenues, with approximately $96.4 million in gross profits representing a 16.4% gross margin, while our retail business generated approximately $1.1 billion in operating revenues, with approximately $562.3 million in gross profits representing a 51.9% gross margin. Our utility electric distribution system spans more than 4,098 miles of overhead lines and 4,303 miles of underground cable lines while the gas transmission system stretches about 1,545 miles and the distribution system consists of approximately 11,841 miles of pipe.

We believe that our investment in quality customer service and improved reliability has led to improved relationships with our regulators, legislature and other key stakeholders.

S-1

Our executive offices are located at Alvarado Square, Albuquerque, New Mexico 87158. Our website is located at www.pnm.com. The information contained on our website does not constitute a part of this prospectus supplement or the accompanying prospectus.

In this prospectus supplement, references to “PNM Resources”, “we”, “our” and “us” refer to PNM Resources, Inc. and, unless the context otherwise indicates, do not include our subsidiaries, while references to “PNM” are to our principal subsidiary, Public Service Company of New Mexico.

The 2003 New Mexico Electric Rate Stipulation

In October 2002, PNM entered into a stipulated agreement with several parties pursuant to which PNM committed to a five-year plan to reduce its retail electric rates by 6.5% in two phases (a 4% reduction, which became effective on September 1, 2003, and a 2.5% reduction, which will become effective on September 1, 2005).

This stipulated agreement permits joint dispatch of PNM’s generating assets in both the regulated and wholesale markets, which facilitates the most efficient use of PNM’s generation assets and long-term power purchase agreements to economically serve all power supply obligations. PNM may, at any time during the effectiveness of this stipulated agreement, apply to the New Mexico Public Regulation Commission, or PRC, for any wholesale plants, which are generating plants not included in its jurisdictional rate base, to become jurisdictional assets.

This agreement also provides PNM with flexibility relating to the acquisition and financing of wholesale plants. For example, depending on the particular financing plan for the plant, either no PRC approval will be required or expedited PRC approval will be available for the acquisition and financing if, in either case, each of PNM’s and our senior debt is rated investment grade by Standard & Poor’s Rating Services, or S&P, or, in certain circumstances, by either Fitch, Inc. or Moody’s Investors Service, Inc., or Moody’s. Under the terms of this agreement, PNM may not invest more than $1.25 billion in wholesale plants through January 1, 2010, subject to extension (of which $159.9 million has been invested as of December 31, 2004).

This agreement also permits PNM at any time to transfer all or any portion of its wholesale plants to another legal entity if PNM’s debt-to-capital ratio will not exceed 65% after giving effect to the transfer and S&P confirms that the transfer will not cause PNM’s credit rating to fall below investment grade.

This agreement was approved by the PRC in January 2003. While beneficial to PNM’s retail electric customers, PNM also benefits from the rate certainty this settlement provides it through the end of 2007.

S-2

Our Strengths

| • | Growth in Electric Load and Retail Electric Customer Base. From 2002 to 2004, the growth of our retail customer base and electric load outpaced the national average. Our electric load grew 3.25% from 2002 to 2004, compared to the national average of 1.22% during the same period. Our retail customer base grew each year by an average of 3.1% for electric and 2.0% for natural gas during that period. This growth contributed to our net earnings per diluted share for the year ended December 31, 2004 reaching $1.43. |

| • | Dividend Growth. We have increased the dividends we pay on our common stock at an annualized rate of 4.8% from 2002 through 2004. On December 7, 2004, our board of directors approved a further 15.6% increase in the annual dividend and announced a change in our dividend policy. Primarily as a result of the strong growth of our earnings in 2004 and the stability of our earnings profile, our board of directors has targeted a future payout ratio of 50% to 60% of consolidated earnings, a change from our past measure of 50% to 60% of utility earnings. |

| • | Experienced Wholesale Power Marketing. We have been active in the wholesale market since the 1980s and have been successful in both high and low-price market environments. We are focused on asset-backed electric sales and competitive marketing with a strong emphasis on long-term contracts. This is demonstrated by long-term sales contracts ranging from 1 to 16 years and an average contract maturity as of December 31, 2004 of 7.1 years for our wholesale business. Of our integrated portfolio of 2,417 MW of generation, currently approximately 1,876 MW, or 78%, is dedicated to meeting our obligations with respect to our retail load and long-term electric supply contracts. |

| • | Fuel Diversity. As of December 31, 2004, we had an integrated portfolio of 2,417 MW of generation, consisting of 1,729 MW of owned and leased generation and 688 MW of long-term contracts. As of December 31, 2004, based on capacity to generate electricity, our fuel mix was composed of 40% coal, 21% natural gas, 16% nuclear, 15% long-term power purchases and 8% wind. We strive to optimize fuel and operating costs in our utilization of our generating assets. In 2004, our actual generation, by MWh, consisted of 66% coal, 2% natural gas, 27% nuclear and 5% wind. In addition, we have been very successful in reducing our coal-related fuel costs. During the last three years, we have dropped our average cost of coal by 13.5%. We believe this is largely due to our recent transition from a surface coal mine to an underground mining operation to serve the San Juan Generating Station, which has resulted in lower fuel costs, higher coal quality, increased production and improved overall efficiency. |

| • | Positive Regulatory Framework. We have enjoyed a strong working relationship with the PRC. We believe this is favorably influenced by our customer satisfaction. We are among the leading electric utilities in reliability and have improved our customer satisfaction scores by 13% and 27% over the last four years for residential and business customers, respectively (based on a survey commissioned by us and conducted by a market research firm that conducts national utility customer satisfaction surveys). Our stipulated agreement approved by our regulators, discussed above, provides us with a degree of regulatory certainty by fixing our electric rates through 2007. This agreement allows us to acquire additional wholesale generation assets without regulatory approval through the end of 2009 under certain conditions, and permits us to continue to dispatch or source electric supply from both regulated and unregulated generation. |

S-3

| • | Strong Credit Quality. We have enhanced our credit profile and improved our credit ratings. In 2004, S&P increased PNM’s senior unsecured debt credit rating from BBB- to BBB, and Moody’s increased PNM’s senior unsecured debt credit rating from Baa3 to Baa2. Additionally, in 2004, both S&P and Moody’s began rating PNM’s short-term debt. This has allowed PNM to access the A-2/P-2 commercial paper market, which reduced its short-term borrowing rates by 50 to 60 basis points. PNM’s investment grade rating gives it access to the wholesale energy market on more favorable terms, including reduced or no collateral requirements with counterparties. Based on our current financing plan, S&P and Moody’s have affirmed PNM’s senior unsecured debt credit ratings and assigned our senior unsecured debt credit ratings of BBB- and Baa3, respectively, in each case after giving effect to the proposed TNP acquisition. |

| • | Refinancing Experience. We embarked on an aggressive program to systematically lower our average cost of debt beginning in 2003. Since inception, we have refinanced $482 million of debt securities, reducing interest expense by more than $15 million annually and lowering PNM’s average cost of debt to below 5%. We believe this demonstrated capability will be integral to achieving a successful integration of TNP. |

| • | Strong Risk Management. We have formulated a comprehensive set of risk management controls, policies and procedures, the implementation of which is overseen by senior-level management and our board of directors. Our risk-control organization is responsible for foreseeing and evaluating risks, and establishing and enforcing comprehensive polices, procedures and limits on an enterprise-wide basis. |

| • | Experienced and Disciplined Management Team. Our management team has successfully led us through both the regulatory and industry changes of the past several years, including the enactment and subsequent repeal of a New Mexico restructuring law. We have executed on our measured growth plans by operating an efficient regulated utility while expanding our wholesale business. Our growth strategy is to maintain a balance of regulated and wholesale earnings that add value from both a strategic and financial perspective. We believe that the Luna acquisition and the proposed TNP acquisition will further the successful implementation of our strategy. |

S-4

Our Strategy

Our vision is to “Build America’s Best Merchant Utility.” To achieve this objective, our management intends to:

| • | Grow Regulated and Unregulated Operations. We intend to grow both our retail and wholesale business by expanding our current operations and by acquiring additional value-enhancing assets. As evidenced by the Luna acquisition and the proposed TNP acquisition, we intend to continue to grow our revenues by expanding our geographic coverage in the Southwest, a region which not only shows rapid customer and load growth, but which we know well. We plan to focus on best practices in integrating our acquisitions to create a stronger presence in the Southwest market. We also intend to increase our presence in the Southwest market by buying generating assets and selling power from these assets through long-term contracts. In addition, we expect that the acquisition of First Choice Power as part of the proposed TNP acquisition, as discussed below, will provide a solid foundation for entry into the competitive retail market in Texas. |

| • | Acquire Additional Generating Assets in the Southwest Region. We intend to enhance and diversify our presence in the Southwest region through the acquisition of quality generation assets to serve our retail and wholesale load while maintaining diversity of fuel mix. We plan to increase long-term sales contracts in tandem with increases in our generation capacity. We expect to do this through the addition of gas-fired generation plants, the evaluation of new coal technologies and the acquisition of coal-fired facilities, the acquisition or development of renewable or clean technology resources and the use of long-term purchase contracts for power. As in the past, we intend to continue a disciplined approach to any acquisition, to match acquisitions to demand and hedge capacity with long-term contracts. |

| • | Maintain Prudent Cost Controls. Our management continues to maintain cost control procedures and expects to implement similar cost control procedures at TNP once the acquisition is complete. As a result of PNM’s coal contract, its fuels group has also been able to hedge our exposure to coal prices at the San Juan Generating Station for the next 12 years, which we believe will help us improve or maintain gross margins if coal costs rise. |

| • | Continue to Improve Credit Strength and Reduce Cost of Capital. A high priority and long-term commitment is to maintain our investment grade rating in any type of regulatory or commodity price scenario. We believe TNP offers an opportunity to derive additional value through the stronger credit profile of the combined entity. We have reduced PNM’s weighted average cost of long-term debt from 6.56% at December 31, 2002 to 4.77% at December 31, 2004. In addition, as discussed below, we expect to reduce TNP’s current financing costs by at least $40.0 million annually, on a pre-tax basis, through the refinancing of TNP’s high cost capital. |

| • | Commitment to Corporate Citizenship. We are committed to our guiding principle, “Do the Right Thing.” This commitment serves as the cornerstone of our ethics and compliance efforts and underscores our effort to ensure that dealings with our customers, employees, shareholders and business partners are above reproach. This is evidenced by our environmental sustainability program with aggressive five-year goals for reducing water usage, improving air quality, reducing waste streams and becoming a leader in the development of renewable energy. |

S-5

Acquisitions

Proposed Acquisition of TNP Enterprises, Inc.

On July 25, 2004, we announced the proposed $1.024 billion acquisition of TNP, including its principal subsidiaries Texas-New Mexico Power Co., or TNMP, and First Choice Power. We expect the proposed TNP acquisition to be accretive to our earnings and free cash flow in the first full year after closing.

TNP is the privately owned holding company of TNMP and First Choice Power. TNMP provides transmission and distribution services to retail electric providers in Texas’ competitive electricity market, serving approximately 207,000 retail customers in Texas and approximately 49,000 in New Mexico. First Choice Power is one of the state’s retail electric providers with approximately 56,000 retail customers in Texas.

This transaction is subject to customary closing conditions and remaining regulatory approvals, including from the PRC, the Public Utility Commission of Texas, or PUCT, and the SEC under the Public Utility Holding Company Act of 1935, or the Holding Company Act. No shareholder approval is required for the acquisition. We believe that all conditions precedent to closing, including final resolution of regulatory proceedings, can be met so that closing can occur in the second quarter of 2005. We will lead the integration efforts and implementation of the transition plan that will be executed upon receiving regulatory approvals.

On February 2, 2005, we were notified that the proposed acquisition of TNP had received anti-trust clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 from the Federal Trade Commission.

On February 3, 2005, we announced that we had reached an agreement in Texas that represents a significant step in the process of completing our acquisition of TNP. The settlement agreement is among us, TNMP, several cities in Texas, the Office of Public Utility Counsel in Texas and other intervenors. The settlement agreement outlines terms and conditions necessary for the PUCT to deem the acquisition to be in the public interest, and includes a two-year electric rate freeze, a rate reduction in TNMP’s retail delivery rates and a synergy savings credit. The settlement agreement is unopposed. On February 10, 2005, the Texas administrative law judge assigned to hear the acquisition case passed the settlement to the PUCT for its action. The PUCT is expected to consider the agreement at its March 31, 2005 open meeting.

On February 28, 2005, we announced that we had also reached an agreement with parties in New Mexico. The stipulation agreement is among us, TNMP, the staff of the PRC, the New Mexico State Attorney General’s office and the New Mexico Industrial Energy Consumers. The stipulation agreement was unopposed, and includes a stipulation among the parties to it that the proposed TNP acquisition should be approved by the PRC, and includes rate reductions for TNMP’s New Mexico electric customers and certain rate credits for our New Mexico customers resulting from synergy savings. The stipulation agreement was filed with the PRC on February 28, 2005, and still must be approved by the PRC. A hearing has been scheduled before a PRC hearing examiner on April 11, 2005.

S-6

On March 2, 2005, the Federal Energy Regulatory Commission, or FERC, issued an order approving the proposed acquisition. The FERC determined that the acquisition was in the public interest. The FERC approved our request for the use of an independent market monitor to mitigate any competitive harm. We believe that the order does not contain any conditions that are burdensome, unusual or not customary to utility acquisitions.

We believe that the proposed TNP acquisition is consistent with our strategic plan of balancing stable and predictable revenue streams with prudent and measured growth opportunities. Upon the consummation of the proposed TNP acquisition, we will serve approximately 1.2 million customers, with 725,000 electric customers and 471,000 gas customers. Of the electric customers, approximately 163,000 will be price-to-beat customers in Texas and 56,000 will be retail customers in Texas. We believe TNMP’s utility operations will provide an additional stable source of revenue and cash flow.

The proposed TNP acquisition will strengthen our position as a leading energy provider in the growing Southwest region, providing market, customer and regulatory diversity. In addition, we expect First Choice Power’s established retail customer base and operations, when combined with our generation source hedging, financial strength and power-marketing expertise, to present additional potential to improve margins and increase market penetration in Texas.

Based on reported results for the fiscal year ended December 31, 2004, our operating revenues combined with those of TNP would exceed $2.3 billion. The combined company would serve a number of growing communities, including Albuquerque, Santa Fe, and Alamogordo in New Mexico, as well as suburban areas around Dallas-Fort Worth, Houston, and Galveston in Texas. Through First Choice, we would also serve customers throughout the Electric Reliability Council of Texas region.

Acquisition of Luna Energy Facility

On November 12, 2004, we purchased a one-third interest in a partially constructed, combined-cycle power plant near Deming, New Mexico, called the Luna Energy Facility, which we refer to as the Luna acquisition. The facility is designed to be capable of producing 570 MW (of which we will be entitled to 190 MW) when completed, which we expect to be in mid-2006.

Two other equal co-purchasers along with us paid a combined $40 million for the Luna Energy Facility and will invest an aggregate of approximately $100 million to complete construction. Construction was suspended in September 2002 when the plant was approximately 50% complete. We will manage the plant’s construction and operation once completed. On February 24, 2005, we signed a contract with Fluor Enterprises, Inc. to resume construction of the plant. In keeping with our environmental sustainability program and the conditions of the Luna Energy Facility’s permits, we intend to use treated effluent water from the City of Deming to reduce the plant’s use of fresh water by one-third and to install a selective catalytic reduction system to dramatically reduce emissions of nitrogen oxide.

We believe that the Luna Energy Facility strategically fits well into our portfolio of generation assets because of its location in southern New Mexico, its low capital costs, its efficient heat rate, its anticipated low dispatch costs and its use of clean burning gas technology. We anticipate that the plant will be jointly dispatched as part of PNM’s overall generation portfolio.

S-7

Financing Plan

The following table shows the expected sources and uses of capital from our completed and planned financings in connection with the Luna construction and the proposed TNP acquisition and recapitalization. We expect that this recapitalization will result in a net long-term debt and preferred stock reduction of approximately $500 million. We expect the proposed recapitalization to occur approximately 30 days after the closing of the proposed TNP acquisition to allow for certain prescribed redemption notice periods. Overall, we expect that the refinancing of high cost TNP capital will help generate pre-tax interest and preferred dividend savings of at least $40.0 million annually. See also “Use of Proceeds.” The amounts in this table are estimates.

| Sources | (in millions) | ||

PNM Resources Cash | $ | 80.0 | |

TNP Cash (1) | 141.0 | ||

PNM Resources Debt Issuance (2) | 100.0 | ||

PNM Resources Common Stock Issuance to Public (3) | 87.8 | ||

PNM Resources Equity Units Issuance to Cascade (4) | 100.0 | ||

PNM Resources Equity Units Issuance to Public (5) | 208.3 | ||

PNM Resources Common Stock Issuance to TNP Stockholders (6) | 82.5 | ||

PNM Resources Short-Term Borrowings | 58.9 | ||

Total | $ | 858.5 | |

| Uses | |||

TNP Long-Term Debt Call (7) | $ | 275.0 | |

TNP Term Bank Loan Repayment (8) | 111.0 | ||

TNP Preferred Stock Redemption (9) | 197.0 | ||

TNP Purchase Consideration (10) | 165.0 | ||

Accrued Interest and Dividends on TNP Long-Term Debt and Preferred Stock | 10.4 | ||

Early Redemption Premium on TNP Long-Term Debt | 13.8 | ||

Early Redemption Premium on TNP Preferred Stock | 19.7 | ||

Luna Construction Costs (11) | 36.6 | ||

Other Merger Costs | 30.0 | ||

Total | $ | 858.5 | |

See footnotes on following page.

S-8

| (1) | Estimated amount of cash expected to be on TNP’s balance sheet as of the closing date of the proposed TNP acquisition. |

| (2) | On November 15, 2004, as part of our $400 million, unsecured revolving credit facility, we entered into a floating-to-fixed interest rate swap to finance the debt component of the proposed acquisition of TNP. This agreement fixes the interest rate on $100 million of borrowings under the revolving credit facility at 4.97% through November 2009. |

| (3) | Represents the estimated net proceeds of our concurrent offering of 3,400,000 shares of common stock pursuant to a separate prospectus supplement assuming the underwriters’ option to purchase up to510,000 additional shares of common stock is not exercised. |

| (4) | On August 13, 2004, we entered into an agreement with Cascade Investment LLC, or Cascade, under which Cascade agreed to invest $100 million in equity units to be issued by us with an initial coupon not to exceed 6.625% per year. The transaction is expected to close upon the consummation of the proposed TNP acquisition. The senior notes that will be components of the equity units are expected to be remarketed to satisfy the obligation to purchase between 3,981,600 and 4,778,000 shares of our common stock, computed based upon a reference price of $20.93 and a threshold appreciation price of $25.116 (or, at the option of Cascade, between 398,160 and 477,800 shares of our convertible preferred stock, whereby each share of preferred stock would be convertible into ten shares of our common stock), following the third anniversary of the initial issuance. As of the date of this prospectus supplement, Cascade intends to exercise its right to purchase shares of convertible preferred stock in lieu of shares of common stock. See “Description of Capital Stock – Potential Changes in Voting Rights” in the accompanying prospectus. |

| (5) | Represents the estimated net proceeds from this offering and assumes that the underwriters’ option to purchase up to 645,000 additional equity units is not exercised. |

| (6) | Represents the 50% of the total consideration for the proposed TNP acquisition that is payable in shares of our common stock, the other 50% being payable in cash. We currently estimate the number of shares to be approximately 4.1 million, based on the agreed-upon fixed per share amount of $20.20. |

| (7) | Represents TNP’s 10.25% senior subordinated notes due 2010. |

| (8) | Represents TNP’s term bank loan due December 2006. As of December 31, 2004, the effective interest rate on this loan was approximately 7.5%. |

| (9) | Represents TNP’s senior redeemable cumulative preferred stock with no par value, with a current distribution rate of 14.50%, the dividends under which become payable in cash beginning October 1, 2005. |

| (10) | The purchase price is subject to upward or downward adjustments in certain circumstances. |

| (11) | Represents our one-third share of the total estimated construction cost of $110 million which will be expended over the next 12 to 15 months. |

S-9

The Offering

What are Corporate Units?

The Equity Units offered by us will initially consist of 4,300,000 Corporate Units, each with a stated amount of $50. You can create Treasury Units from Corporate Units in the manner described below under “How can I create Treasury Units from Corporate Units?”

What are the components of a Corporate Unit?

Each Corporate Unit initially consists of a purchase contract and a 1/20, or 5%, undivided beneficial ownership interest in $1,000 principal amount of our senior notes initially due May 16, 2010. The undivided beneficial ownership interest in senior notes corresponds to $50 principal amount of our senior notes. The senior notes will be issued in minimum denominations of $1,000 and integral multiples of $1,000, except in certain limited circumstances. Your undivided beneficial ownership interest in senior notes comprising part of each Corporate Unit is owned by you, but it will be pledged to us through the collateral agent to secure your obligation under the related purchase contract. If a special event redemption occurs prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, the senior notes comprising part of the Corporate Units will be replaced by the Treasury portfolio described below under “What is the Treasury portfolio?”, and the applicable ownership interest in the Treasury portfolio will then be pledged to us through the collateral agent to secure your obligation under the related purchase contract.

What is a purchase contract?

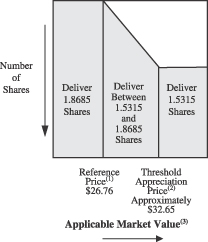

Each purchase contract that is a component of a Corporate Unit obligates you to purchase, and obligates us to sell, on May 16, 2008, which we refer to as the purchase contract settlement date, for $50 in cash, a number of newly issued shares of our common stock equal to the “settlement rate.” The settlement rate will be calculated, subject to adjustment under the circumstances set forth in “Description of the Purchase Contracts – Anti-Dilution Adjustments,” as follows:

| • | if the applicable market value of our common stock is greater than or equal to approximately $32.65, which we refer to as the threshold appreciation price, the settlement rate will be 1.5315 shares of our common stock; |

| • | if the applicable market value of our common stock is less than the threshold appreciation price but greater than $26.76, which we refer to as the reference price, the settlement rate will be a number of shares of our common stock equal to $50 divided by the applicable market value, rounded to the nearest ten thousandth of a share; and |

| • | if the applicable market value of our common stock is less than or equal to the reference price, the settlement rate will be 1.8685 shares of our common stock. |

“Applicable market value” means the average of the closing price per share of our common stock on the New York Stock Exchange on each of the twenty consecutive trading days ending on the third trading day immediately preceding the purchase contract settlement date, subject to adjustment as set forth in “Description of the Purchase Contracts – Anti-Dilution Adjustments.” The reference price equals the last reported sale price of our common stock on the New York Stock Exchange on March 23, 2005. The “threshold appreciation price” represents a 22% appreciation over the reference price.

S-10

We will not issue any fractional shares of our common stock upon settlement of a purchase contract. Instead of a fractional share, you will receive an amount of cash equal to this fraction multiplied by the applicable market value.

You may satisfy your obligation to purchase our common stock pursuant to the purchase contracts as described under “How can I satisfy my obligation under the purchase contracts?” below.

Can I settle the purchase contract early?

You can settle a purchase contract at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, in the case of Corporate Units, and on or prior to the second business day immediately preceding the purchase contract settlement date, in the case of Treasury Units, by paying $50 cash, in which case 1.5315 shares of our common stock will be issued to you pursuant to the purchase contract. In addition, if we are involved in a merger in which at least 30% of the consideration for our common stock consists of cash or cash equivalents, you will have the right to settle a purchase contract early at the settlement rate in effect immediately prior to the closing of that merger. You may only elect early settlement in integral multiples of 20 Corporate Units and 20 Treasury Units. If the Treasury portfolio has replaced the senior notes as a component of the Corporate Units, holders of Corporate Units may settle early on or prior to the second business day immediately preceding the purchase contract settlement date only in integral multiples of 5,000 Corporate Units. See “Description of the Purchase Contracts – Early Settlement” and “ – Early Settlement Upon Cash Merger.”

Your early settlement right is subject to the condition that, if required under the U.S. federal securities laws, we have a registration statement under the Securities Act of 1933 in effect and an available prospectus covering the shares of common stock and other securities, if any, deliverable upon settlement of a purchase contract. We have agreed that, if required by U.S. federal securities laws, we will use our commercially reasonable efforts to have a registration statement in effect and to provide a prospectus covering those shares of common stock or other securities to be delivered in respect of the purchase contracts being settled.

What is a Treasury Unit?

A Treasury Unit is an Equity Unit created from a Corporate Unit and consists of a purchase contract and a 1/20, or 5%, undivided beneficial ownership interest in a zero-coupon U.S. Treasury security with a principal amount of $1,000 that matures on May 15, 2008 (the business day preceding the purchase contract settlement date or earlier) (CUSIP No. 912820CY1) which we refer to as a Treasury security. The ownership interest in the Treasury security that is a component of a Treasury Unit will be owned by you, but will be pledged to us through the collateral agent to secure your obligation under the related purchase contract.

How can I create Treasury Units from Corporate Units?

Each holder of Corporate Units will have the right, at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, to substitute for the related undivided beneficial ownership interest in senior notes or applicable ownership interests in the Treasury portfolio, as the case may be, held by the collateral agent, Treasury securities with a total principal amount at

S-11

maturity equal to the aggregate principal amount of the senior notes underlying the undivided beneficial ownership interests in senior notes for which substitution is being made. Because Treasury securities and the senior notes are issued in minimum denominations of $1,000, holders of Corporate Units may make this substitution only in integral multiples of 20 Corporate Units. If the Treasury portfolio has replaced the senior notes as a component of the Corporate Units, holders of Corporate Units may substitute Treasury securities for the applicable ownership interests in the Treasury portfolio only in integral multiples of 5,000 Corporate Units. This substitution will create Treasury Units, and the senior notes underlying the undivided beneficial ownership interest in senior notes, or the applicable ownership interests in the Treasury portfolio, will be released to the holder and such senior notes will be separately tradable from the Treasury Units.

How can I recreate Corporate Units from Treasury Units?

Each holder of Treasury Units will have the right, at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, to substitute for the related Treasury securities held by the collateral agent, senior notes or applicable ownership interests in the Treasury portfolio, as the case may be, having a principal amount equal to the aggregate principal amount at stated maturity of the Treasury securities for which substitution is being made. Because Treasury securities and the senior notes are issued in minimum denominations of $1,000, holders of Treasury Units may make these substitutions only in integral multiples of 20 Treasury Units. If the Treasury portfolio has replaced the senior notes as a component of the Corporate Units, holders of Treasury Units may substitute applicable ownership interests in the Treasury portfolio for Treasury securities only in integral multiples of 5,000 Corporate Units. This substitution will recreate Corporate Units and the applicable Treasury securities will be released to the holder and will be separately tradable from the Corporate Units.

What payments am I entitled to as a holder of Corporate Units?

Holders of Corporate Units will be entitled to receive quarterly cash distributions consisting of their pro rata share of interest payments on the senior notes, equivalent to the rate of 4.80% per year on the undivided beneficial ownership interest in senior notes (or distributions on the applicable ownership interests in the Treasury portfolio if the senior notes have been replaced by the Treasury portfolio) and contract adjustment payments payable by us at the rate of 1.95% per year on the stated amount of $50 per Corporate Unit until the earliest of the purchase contract settlement date, the early settlement date (in the case of a cash merger early settlement) and the most recent quarterly payment date on or before any early settlement of the related purchase contracts (in the case of early settlement other than upon a cash merger). Our obligations with respect to the contract adjustment payments will be subordinated and junior in right of payment to our obligations under any of our senior indebtedness.

What payments will I be entitled to if I convert my Corporate Units to Treasury Units?

Holders of Treasury Units will be entitled to receive quarterly contract adjustment payments payable by us at the rate of 1.95% per year on the stated amount of $50 per Treasury Unit. There will be no distributions in respect of the Treasury securities that are a component of the Treasury Units but the holders of the Treasury Units will continue to receive the scheduled quarterly interest payments on the senior notes that were released to them when they created the Treasury Units as long as they continue to hold such senior notes.

S-12

Do you have the option to defer current payments?

No, we do not have the right to defer the payment of contract adjustment payments in respect of the Corporate Units or Treasury Units or the payment of interest on the senior notes.

What are the payment dates for the Corporate Units and Treasury Units?

The payments described above in respect of the Equity Units will be payable quarterly in arrears on February 16, May 16, August 16 and November 16 of each year, commencing August 16, 2005. We will make these payments to the person in whose name the Equity Unit is registered at the close of business on the first day of the month in which the payment date falls.

What is remarketing?

Unless the Treasury portfolio has replaced the senior notes as a component of the Corporate Units as a result of a special event redemption, remarketing of the senior notes will be attempted on May 9, 2008 (the fifth business day immediately preceding the purchase contract settlement date) and, if the remarketing on that date fails, on May 12, 2008 (the fourth business day immediately preceding the purchase contract settlement date) and, if the remarketing on that date fails, on May 13, 2008 (the third business day immediately preceding the purchase contract settlement date), the fifth, fourth and third business days, respectively, immediately preceding the purchase contract settlement date of May 16, 2008. The remarketing agent will use its reasonable efforts to obtain a price for the senior notes to be remarketed that results in proceeds of at least 100% of the aggregate principal amount of such senior notes.

Upon a successful remarketing, the portion of the proceeds equal to the total principal amount of the senior notes underlying the Corporate Units will automatically be applied to satisfy in full the Corporate Unit holders’ obligations to purchase common stock under the related purchase contracts. If any proceeds remain after this application, the remarketing agent will remit such proceeds for the benefit of the holders. We will separately pay a fee to the remarketing agent for its services as remarketing agent. Corporate Unit holders whose senior notes are remarketed will not be responsible for the payment of any remarketing fee in connection with the remarketing.

What happens if the senior notes are not successfully remarketed?

Unless the Treasury portfolio has replaced the senior notes as a component of the Corporate Units as a result of a special event redemption, if (1) despite using its reasonable efforts, the remarketing agent cannot remarket the senior notes in a remarketing on or prior to May 13, 2008 (the third business day immediately preceding the purchase contract settlement date) at a price equal to or greater than 100% of the aggregate principal amount of the senior notes remarketed, or (2) the remarketing has not occurred because a condition precedent to the remarketing has not been fulfilled, in each case resulting in a failed final remarketing, holders of all senior notes will have the right to put their senior notes to us for an amount equal to the principal amount of their senior notes, plus accrued and unpaid interest, on the purchase contract settlement date. A holder of Corporate Units will be deemed to have automatically exercised this put right with respect to the senior notes underlying such Corporate Units unless, prior to 5:00 p.m., New York City time, on the second business day immediately prior to the purchase contract settlement date, the holder provides written notice of an intention to settle the related purchase contracts with separate cash and on or prior to the business day immediately preceding the

S-13

purchase contract settlement date delivers to the collateral agent $50 in cash per purchase contract. This settlement with separate cash may only be effected in integral multiples of 20 Corporate Units. Unless a holder of Corporate Units has settled the related purchase contracts with separate cash on or prior to the purchase contract settlement date, the holder will be deemed to have elected to apply a portion of the proceeds of the put price equal to the principal amount of the senior notes against such holder’s obligations to us under the related purchase contracts, thereby satisfying such obligations in full, and we will deliver to the holder our common stock pursuant to the related purchase contracts.

Do I have to participate in the remarketing?

You may elect not to participate in any remarketing and to retain the senior notes underlying the undivided beneficial ownership interests in senior notes comprising part of your Corporate Units by (1) creating Treasury Units at any time on or prior to the seventh business day immediately prior to the purchase contract settlement date or (2) notifying the purchase contract agent of your intention to pay cash to satisfy your obligation under the related purchase contracts on or prior to the seventh business day before the purchase contract settlement date and delivering the cash payment required under the purchase contracts to the collateral agent on or prior to the sixth business day before the purchase contract settlement date. You can only elect to satisfy your obligation in cash in increments of 20 Corporate Units. See “Description of the Purchase Contracts – Notice to Settle with Cash.”

If I am holding a senior note as a separate security from the Corporate Units, can I still participate in a remarketing of the senior notes?

If you hold senior notes separately you may elect, in the manner described in this prospectus supplement, to have your senior notes remarketed by the remarketing agent along with the senior notes underlying the Corporate Units. See “Description of the Senior Notes – Optional Remarketing of Senior Notes that are not Included in Corporate Units.” You may also participate in any remarketing by recreating Corporate Units from your Treasury Units at any time on or prior to the seventh business day immediately prior to the purchase contract settlement date.

How can I satisfy my obligation under the purchase contracts?

You may satisfy your obligations under the purchase contracts as follows:

| • | in the case of the Corporate Units, through the automatic application of the portion of the proceeds of the remarketing of the senior notes equal to the principal amount of the senior notes underlying the Corporate Units, as described under “What is remarketing?” above; |

| • | through early cash settlement as described under “Can I settle the purchase contract early?” above; |

| • | in the case of Corporate Units, through cash settlement as described under “Do I have to participate in the remarketing?” above; |

| • | through the automatic application of the proceeds of the Treasury securities, in the case of Treasury Units, or the proceeds from the Treasury portfolio equal to the principal amount of the senior notes in the case of Corporate Units if the Treasury portfolio has replaced the senior notes as a component of the Corporate Units; or |

S-14

| • | in the case of Corporate Units, if the senior notes are not successfully remarketed, through exercise of the put right or the delivery of separate cash as described under “What happens if the senior notes are not successfully remarketed?” above. |

In addition, the purchase contract and pledge agreement that governs the Corporate Units and Treasury Units provides that your obligations under the purchase contracts will be terminated without any further action upon the termination of the purchase contracts as a result of our bankruptcy, insolvency or reorganization.

If you settle a purchase contract early (other than as a result of a cash merger early settlement), or if your purchase contract is terminated as a result of our bankruptcy, insolvency or reorganization, you will have no right to receive any accrued but unpaid contract adjustment payments.

What interest payments will I receive on the senior notes or on the undivided beneficial ownership interests in senior notes?

The senior notes will bear interest initially at the rate of 4.80% per year from the original issuance date to but excluding the purchase contract settlement date, initially payable quarterly in arrears on February 16, May 16, August 16 and November 16 of each year, commencing August 16, 2005, until the purchase contract settlement date. On and after the purchase contract settlement date, interest on each senior note will be payable semi-annually in arrears on May 16 and November 16 of each year, commencing November 16, 2008, at the reset interest rate or, if the interest rate has not been reset, at the rate of 4.80% per year. Interest will be payable to the person in whose name the senior note is registered at the close of business on the first day of the month in which the interest payment date falls.

When will the interest rate on the senior notes be reset and what is the reset rate?

The interest rate on the senior notes will be reset on May 16, 2008 in connection with the remarketing as described above under “What is remarketing?” The reset rate will be the interest rate determined by the remarketing agent as the rate the senior notes should bear in order for the aggregate principal amount of senior notes remarketed to have an aggregate market value on the remarketing date of at least 100% of the aggregate principal amount of such senior notes. The reset rate may be higher or lower than the initial interest rate of the senior notes depending on the results of the remarketing and market conditions at that time. The interest rate on the senior notes will not be reset if there is not a successful remarketing and the senior notes will continue to bear interest at the initial interest rate. The reset rate may not exceed the maximum rate, if any, permitted by applicable law.

When may the senior notes be redeemed?

The senior notes are redeemable at our option, in whole but not in part, upon the occurrence and continuation of a tax event or an accounting event at any time prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, as described in this prospectus under “Description of the Senior Notes – Optional Redemption – Special Event.” Following any such redemption of the senior notes, which we refer to as a special event redemption, the redemption price for the senior notes that are a component of the Corporate Units will be paid to the collateral agent who will use a portion of the redemption price to purchase the Treasury portfolio described below and remit any remaining proceeds to the holders. Thereafter, the applicable ownership interests in the Treasury portfolio will replace the senior notes as a component of the Corporate Units and will be pledged to us

S-15

through the collateral agent. Holders of senior notes that are not a component of the Corporate Units will receive directly the redemption price paid in such special event redemption.

What is the Treasury portfolio?

If a special event redemption as described under “Description of the Senior Notes – Optional Redemption – Special Event” occurs prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, the senior notes will be replaced by the Treasury portfolio. The Treasury portfolio is a portfolio of U.S. Treasury securities consisting of:

| • | U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to May 15, 2008 (the day immediately prior to the purchase contract settlement date) in an aggregate amount equal to the principal amount of the senior notes included in Corporate Units, and |

| • | U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to the business day immediately preceding each scheduled interest payment after the date of the special event redemption and on or prior to the purchase contract settlement date in an aggregate amount at maturity equal to the aggregate interest payment (assuming no reset of the interest rate) that would have been due on such interest payment date on the principal amount of the senior notes included in the Corporate Units. |

What is the ranking of the senior notes?

The senior notes will be our direct, unsecured general obligations and will rank equally with all of our other unsecured and unsubordinated debt. As of December 31, 2004, we had $35 million of outstanding debt that would have ranked equally with the senior notes. The senior notes will not be obligations of or guaranteed by any of our subsidiaries. As a result, the senior notes will be structurally subordinated to all debt and other liabilities of our subsidiaries, which means that creditors and preferred stockholders of our subsidiaries will be paid from their assets before holders of the senior notes would have any claims to those assets. See “Description of the Senior Notes – Agreements by Purchasers.” As of December 31, 2004, our subsidiary, PNM, had 115,293 shares, stated value $100 per share, of cumulative preferred stock outstanding and $1.048 billion aggregate principal amount of debt outstanding. The indenture under which the senior notes will be issued will not limit our ability, or the ability of our subsidiaries, to issue or incur other debt or liabilities (secured or unsecured) or issue preferred stock. As a holding company, we depend on the ability of our subsidiaries to transfer funds to us to meet our obligations, including our obligations to pay interest on the senior notes. See “Risk Factors – Risk Factors Relating to the Equity Units – The senior notes and contract adjustment payments will be effectively subordinated to the debt of our subsidiaries” and “Description of the Senior Notes – Ranking.”

What are the principal United States federal income tax consequences related to Equity Units and senior notes?

An owner of Equity Units will be treated as owning an undivided beneficial interest in the purchase contract and the senior notes, the applicable ownership interests in the Treasury portfolio or Treasury securities constituting the Equity Unit, and by purchasing the Equity Units you will be deemed to have agreed to treat the purchase contracts and senior notes, the applicable ownership

S-16

interests in the Treasury portfolio or Treasury securities in that manner for all tax purposes. In addition, you will be deemed to have agreed to allocate all of the purchase price paid for Equity Units to your undivided interest in senior notes, which will establish your initial tax basis in your interest in each purchase contract as $0 and your initial tax basis in your undivided interest in senior notes as $50. You will be required to include in gross income interest payments on the senior notes when such interest is paid or accrued in accordance with your regular method of tax accounting. If the Treasury portfolio has replaced the senior notes as a component of the Corporate Units as a result of a special event redemption, a beneficial owner of Corporate Units will generally be required to include in gross income its allocable share of any interest payments made with respect to the applicable ownership interests in the Treasury portfolio and, if appropriate, original issue discount on the applicable ownership interests in the Treasury portfolio as it accrues on a constant yield to maturity basis, or, if appropriate, acquisition discount on the applicable ownership interests in the Treasury portfolio. We intend to report contract adjustment payments as income to you, but you may want to consult your tax advisor concerning possible alternative characterizations. For additional information, see “Certain United States Federal Income Tax Consequences.”

S-17

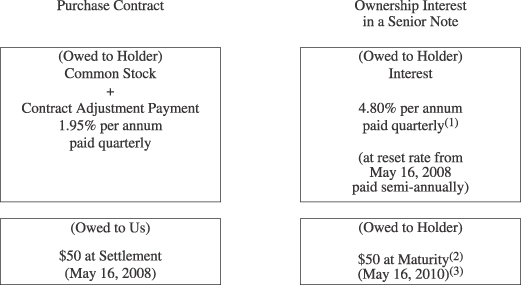

The Offering – Explanatory Diagrams

The following diagrams illustrate some of the key features of the purchase contracts, undivided beneficial ownership interests in senior notes, Corporate Units and Treasury Units.

The following diagrams assume that the senior notes are successfully remarketed, there has not been a special event redemption and the interest rate on the senior notes is reset on the reset effective date.

Purchase Contract

Corporate Units and Treasury Units both include a purchase contract under which the holder agrees to purchase shares of our common stock on the purchase contract settlement date. In addition, these purchase contracts include unsecured, subordinated contract adjustment payments as shown in the diagrams on the following pages.

Number of Shares Delivered

Upon Settlement of a Purchase Contract on the

Purchase Contract Settlement Date

Notes:

| (1) | The reference price equals the last reported sale price of our common stock on the New York Stock Exchange on March 23, 2005. |

| (2) | The “threshold appreciation price” represents a 22% appreciation over the reference price. |

| (3) | The “applicable market value” means the average of the closing price per share of our common stock on the New York Stock Exchange on each of the twenty consecutive trading days ending on the third trading day immediately preceding the purchase contract settlement date, subject to adjustment. |

S-18

Corporate Units

A Corporate Unit consists of two components as described below:

Notes:

| (1) | Each owner of an undivided beneficial ownership interest in senior notes will be entitled to 1/20, or 5%, of each interest payment paid in respect of a $1,000 principal amount senior note. |

| (2) | Senior notes will be issued in minimum denominations of $1,000, except in limited circumstances. Each undivided beneficial ownership interest in senior notes represents a 1/20, or 5%, undivided beneficial ownership interest in a $1,000 principal amount senior note. |

| • | The holder of a Corporate Unit owns the undivided beneficial ownership interest in senior notes that forms a part of the Corporate Unit but will pledge it to us through the collateral agent to secure its obligation under the related purchase contract. |

| • | If the Treasury portfolio has replaced the senior notes as a result of a special event redemption prior to the purchase contract settlement date, the applicable ownership interests in the Treasury portfolio will replace the senior notes as a component of the Corporate Unit. Unless the purchase contract is terminated as a result of our bankruptcy, insolvency or reorganization or the holder creates a Treasury Unit, the proceeds from the applicable ownership interest in the Treasury portfolio will be used to satisfy the holder’s obligation under the related purchase contract. |

| (3) | Unless the maturity date is extended as described under “Description of the Senior Notes – Interest Rate Reset and Extended Maturity Date.” |

S-19

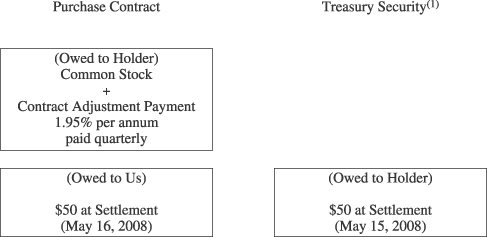

Treasury Units

A Treasury Unit consists of two components as described below:

Notes:

| (1) | The holder of a Treasury Unit owns the ownership interest in the Treasury security that forms a part of the Treasury Unit but will pledge it to us through the collateral agent to secure its obligation under the related purchase contract. Unless the purchase contract is terminated as a result of our bankruptcy, insolvency or reorganization or the holder recreates a Corporate Unit, the proceeds from the Treasury security will be used to satisfy the holder’s obligation under the related purchase contract. |

S-20

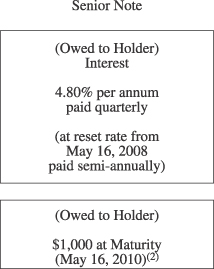

The Senior Notes

Senior notes have the terms described below(1):

Notes:

| (1) | Unless the Treasury portfolio has replaced the senior notes as a component of the Corporate Units, Treasury Units may only be created with integral multiples of 20 Corporate Units. As a result, the creation of 20 Treasury Units will release $1,000 principal amount of the senior notes held by the collateral agent. |

| (2) | Unless the maturity date is extended as described under “Description of the Senior Notes – Interest Rate Reset and Extended Maturity Date.” |

S-21

Summary Financial Data

The summary historical consolidated financial data of PNM Resources, Inc. set forth below has been derived from the consolidated financial statements of PNM Resources, Inc., which have been audited by Deloitte & Touche LLP independent auditors, and incorporated by reference in this prospectus supplement and the accompanying prospectus from PNM Resources, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2004. This information is qualified in its entirety by, and should be read in conjunction with, our consolidated financial statements, including the notes thereto, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for PNM Resources, Inc. and the other information incorporated by reference in this prospectus supplement and the accompanying prospectus. See “Where You Can Find More Information” in this prospectus supplement.

| Year Ended December 31, | |||||||||

| 2004 | 2003 | 2002 | |||||||

| (in millions, except per share data) | |||||||||

Statement of Income Data: | |||||||||

Operating revenues | $ | 1,605 | $ | 1,456 | $ | 1,119 | |||

Operating expenses | 1,492 | 1,337 | 1,017 | ||||||

Operating income | 113 | 119 | 102 | ||||||

Net earnings before cumulative effect of change | |||||||||

in accounting principle | 88 | 59 | 64 | ||||||

Cumulative effect of change in an accounting principle, net of income taxes | — | 36 | — | ||||||

Net earnings | 88 | 95 | 64 | ||||||

Earnings per common share: | |||||||||

Basic | 1.45 | 1.60 | 1.09 | ||||||

Diluted | 1.43 | 1.58 | 1.07 | ||||||

| As of December 31, | |||||||||

| 2004 | 2003 | ||||||||

| (in millions) | |||||||||

Balance Sheet Data: | |||||||||

Total assets | $ | 3,488 | $ | 3,379 | |||||

Long-term debt, less current maturities | 988 | 987 | |||||||

Preferred stock not subject to mandatory redemption | 12 | 12 | |||||||

Total common stockholders’ equity | 1,100 | 1,077 | |||||||

S-22

Risk Factors

You should carefully consider all of the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus as well as the specific factors under “Risk Factors” beginning on the next page.

S-23

In considering whether to purchase the Corporate Units, you should carefully consider all the information we have included or incorporated by reference in this prospectus supplement and the accompanying base prospectus. In particular, you should carefully consider the risk factors described below, as well as the factors listed in “Forward-Looking Statements” in this prospectus supplement. Because a Corporate Unit consists of a purchase contract to acquire shares of our common stock and a senior note issued by us, you are making an investment decision with regard to our common stock and senior notes, as well as the Corporate Units. You should carefully review the information in this prospectus supplement and the accompanying prospectus about all of these securities.

Risk Factors Relating to PNM Resources, Inc.

We may not be able to complete our acquisition of TNP. If we do not complete the acquisition, dilution to our earnings per share will result unless we are able to avoid or mitigate such dilution.

On July 25, 2004, we announced the proposed $1.024 billion acquisition of TNP. Our financing plan for the proposed TNP acquisition is summarized in this prospectus supplement under “Prospectus Supplement Summary – Acquisitions.” Although we have received anti-trust clearance under the Hart-Scott-Rodino Act and FERC approval, the proposed TNP acquisition remains subject to various other regulatory approvals, including the PRC, the PUCT and the SEC, and other customary closing conditions.

Although we expect to complete the transaction by the second quarter of 2005, we cannot be certain that all of the required approvals will be obtained, that the other closing conditions will be satisfied, or that we will have successfully raised sufficient additional capital within that time frame, if at all, or without terms and conditions that may have a material adverse effect on our operations. If we are unable to complete the proposed TNP acquisition, the issuance of the common stock issuable upon settlement of the Equity Units offered by this prospectus supplement and the issuance of our common stock being offered pursuant to a separate prospectus supplement simultaneously with this offering will result in dilution to our earnings per share unless we are able to avoid or mitigate such dilution.

We may fail to successfully integrate acquisitions, including TNP, into our other businesses or otherwise fail to achieve the anticipated benefits of pending and future acquisitions.

As part of our growth strategy, we are pursuing, and intend to continue to pursue, a disciplined acquisition strategy. While we expect to identify potential synergies, cost savings, and growth opportunities prior to the acquisition and integration of acquired companies or assets, we may not be able to achieve these anticipated benefits due to, among other things:

| • | delays or difficulties in completing the integration of acquired companies or assets, |

| • | higher than expected costs or a need to allocate resources to manage unexpected operating difficulties, |

| • | diversion of the attention and resources of our management, |

| • | reliance on inaccurate assumptions in evaluating the expected benefits of a given acquisition, |

S-24

| • | inability to retain key employees or customers of acquired companies, and |

| • | assumption of liabilities unrecognized in the due diligence process. |

With respect to the proposed TNP acquisition, we cannot assure you that we will be able to successfully integrate TNP with our current businesses. The integration of TNP with our other businesses will present significant challenges and, as a result, we may not be able to operate the combined company as effectively as expected. Also, even if PNM manages to realize greater than anticipated benefits from the integration of TNP into its business, as a regulated entity, PNM may be required by its regulators to return these benefits to its ratepayers. In connection with the Texas and New Mexico settlements relating to the proposed TNP acquisition, for example, we agreed to provide ratepayers in Texas and New Mexico with rate credits over various periods of time resulting from anticipated synergy savings from the acquisition. We may also fail to achieve the anticipated benefits of the acquisition as quickly or as cost-effectively as anticipated or may not be able to achieve those benefits at all.