October 21, 2020 AVANGRID - PNM Resources Strategic Merger Transaction Leading, sustainable U.S. energy company Avangrid Networks Avangrid Renewables Regulated electric utility with strong financial track record Exhibit 99.2

Additional Information Additional Information about the Proposed Transaction and Where to Find It The proposed business combination transaction between PNM Resources and Avangrid will be submitted to the shareholders of PNM Resources for their consideration. PNM Resources will file a proxy statement and other documents with the Securities and Exchange Commission (the “SEC”) regarding the proposed business combination transaction. This document is not a substitute for the proxy statement or any other document which PNM Resources may file with the SEC and send to PNM Resources’ shareholders in connection with the proposed business combination transaction. INVESTORS AND SECURITY HOLDERS OF PNM RESOURCES ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PNM RESOURCES AND THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from PNM Resources’ website (https://www.pnmresources.com/) under the tab “Investor” and then under the heading “SEC Filings.” Participants in the Solicitation Avangrid, PNM Resources, their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction under the rules of the SEC. Information about PNM Resources’ directors and executive officers is set forth in its definitive proxy statement for its 2020 Annual Meeting of Shareholders, which was filed with the SEC on March 31, 2020, and its Form 10-K filed with the SEC on March 2, 2020. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement and other relevant materials PNM Resources intends to file with the SEC.

Forward-Looking Statements FORWARD-LOOKING STATEMENTS Statements made in this press release that relate to future events or expectations, projections, estimates, intentions, goals, targets, and strategies are made pursuant to the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally include statements regarding the potential transaction between PNM Resources and Avangrid, including any statements regarding the expected timetable for completing the potential merger, the ability to complete the potential merger, the expected benefits of the potential merger, projected financial information, future opportunities, and any other statements regarding PNM Resources’ and Avangrid’s future expectations, beliefs, plans, objectives, results of operations, financial condition and cash flows, or future events or performance. Readers are cautioned that all forward-looking statements are based upon current expectations and estimates. Neither Avangrid nor PNM Resources assumes any obligation to update this information. Because actual results may differ materially from those expressed or implied by these forward-looking statements, Avangrid and PNM Resources caution readers not to place undue reliance on these statements. Avangrid’s and PNM Resources’ business, financial condition, cash flow, and operating results are influenced by many factors, which are often beyond its control, that can cause actual results to differ from those expressed or implied by the forward-looking statements. For a discussion of risk factors and other important factors affecting forward-looking statements, please see PNM Resources’ Form 10-K and Form 10-Q filings and the information filed on PNM Resources’ Forms 8-K with the SEC, which factors are specifically incorporated by reference herein and the risks and uncertainties related to the proposed merger with Avangrid, including, but not limited to: the expected timing and likelihood of completion of the pending merger, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending merger that could reduce anticipated benefits or cause the parties to abandon the transaction, the failure by Avangrid to obtain the necessary financing arrangement set forth in commitment letter received in connection with the merger, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that PNM Resources’ shareholders may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed merger in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed merger, and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of PNM Resources to retain and hire key personnel and maintain relationships with its customers and suppliers, and on its operating results and businesses generally. Other unpredictable or unknown factors not discussed in this communication could also have material adverse effects on forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

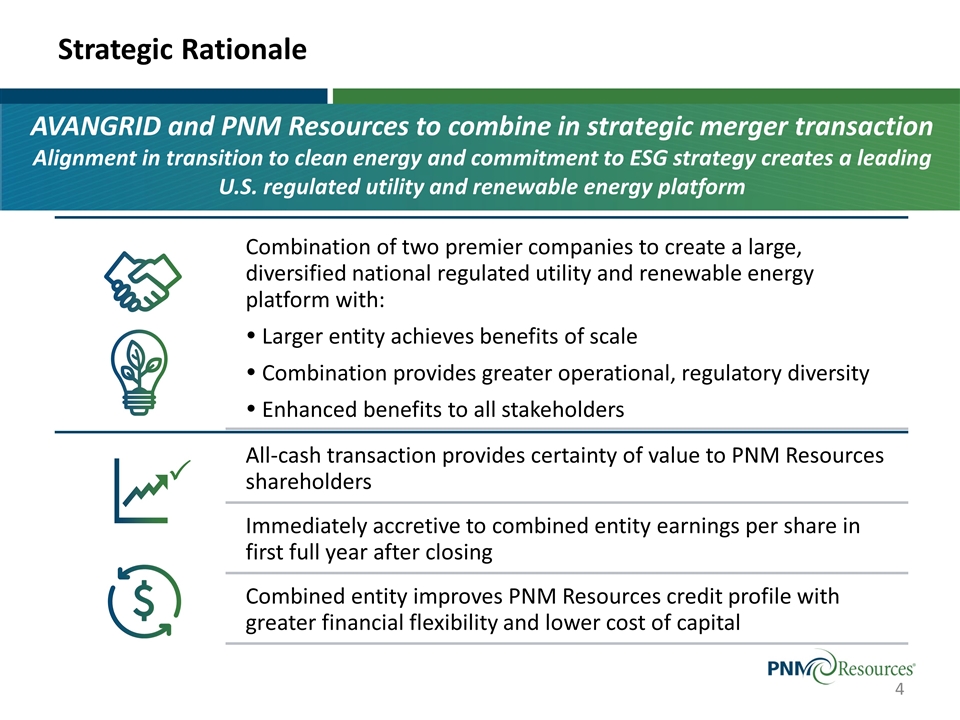

Strategic Rationale AVANGRID and PNM Resources to combine in strategic merger transaction Alignment in transition to clean energy and commitment to ESG strategy creates a leading U.S. regulated utility and renewable energy platform P Combination of two premier companies to create a large, diversified national regulated utility and renewable energy platform with: Ÿ Larger entity achieves benefits of scale Ÿ Combination provides greater operational, regulatory diversity Ÿ Enhanced benefits to all stakeholders All-cash transaction provides certainty of value to PNM Resources shareholders Combined entity improves PNM Resources credit profile with greater financial flexibility and lower cost of capital Immediately accretive to combined entity earnings per share in first full year after closing

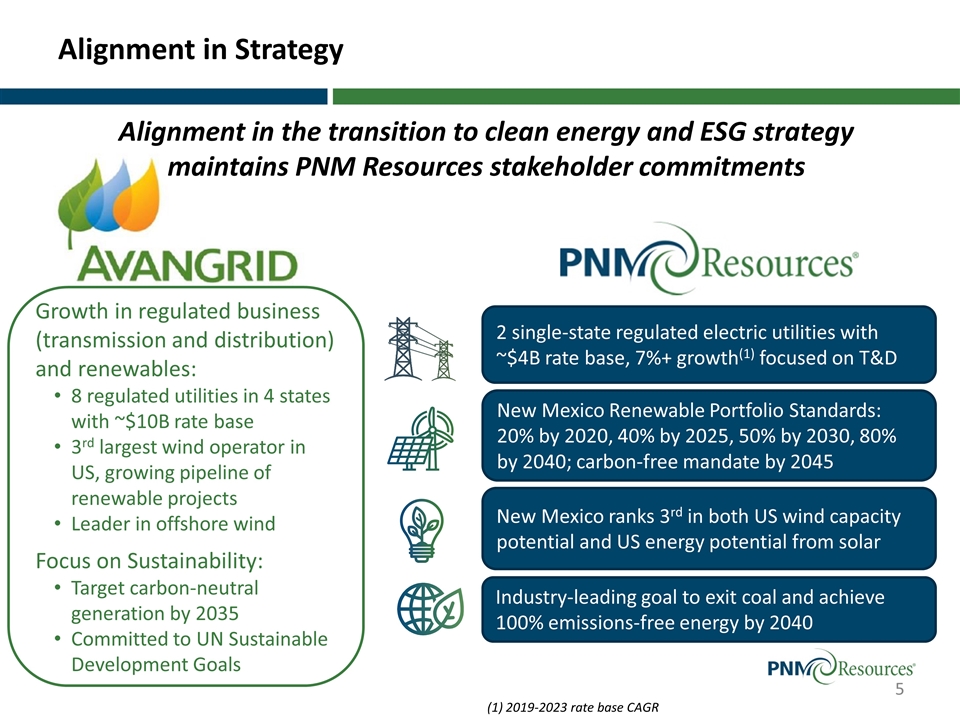

Alignment in Strategy Clean Energy Focus Strong Financial Profile Alignment in the transition to clean energy and ESG strategy maintains PNM Resources stakeholder commitments 2 single-state regulated electric utilities with ~$4B rate base, 7%+ growth(1) focused on T&D New Mexico Renewable Portfolio Standards: 20% by 2020, 40% by 2025, 50% by 2030, 80% by 2040; carbon-free mandate by 2045 New Mexico ranks 3rd in both US wind capacity potential and US energy potential from solar Industry-leading goal to exit coal and achieve 100% emissions-free energy by 2040 Growth in regulated business (transmission and distribution) and renewables: 8 regulated utilities in 4 states with ~$10B rate base 3rd largest wind operator in US, growing pipeline of renewable projects Leader in offshore wind Focus on Sustainability: Target carbon-neutral generation by 2035 Committed to UN Sustainable Development Goals (1) 2019-2023 rate base CAGR

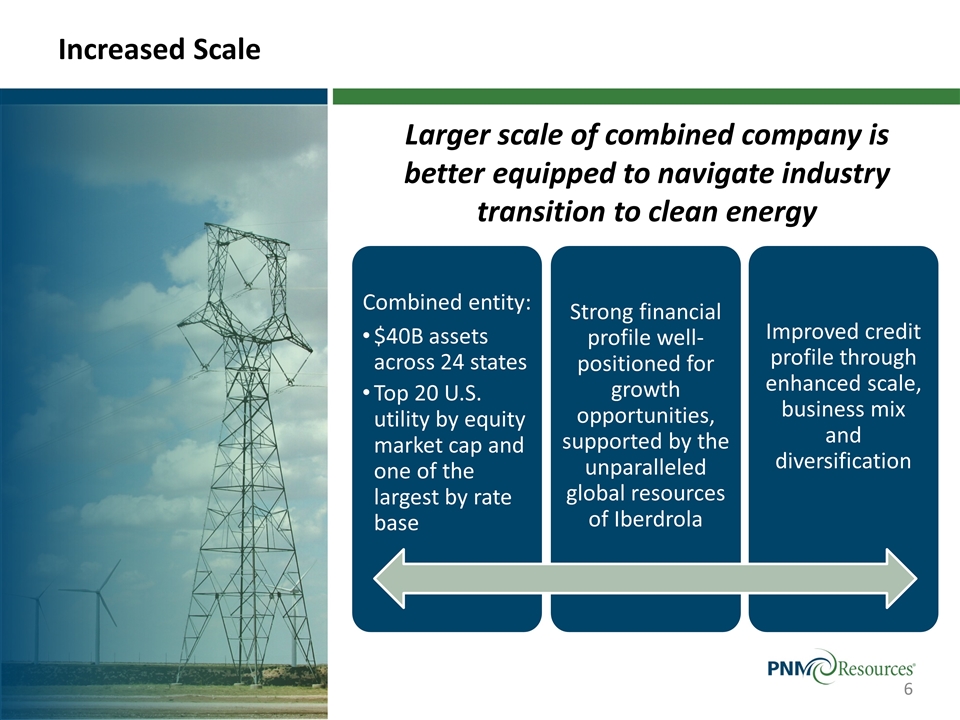

Increased Scale Larger scale of combined company is better equipped to navigate industry transition to clean energy Combined entity: $40B assets across 24 states Top 20 U.S. utility by equity market cap and one of the largest by rate base Strong financial profile well-positioned for growth opportunities, supported by the unparalleled global resources of Iberdrola Improved credit profile through enhanced scale, business mix and diversification

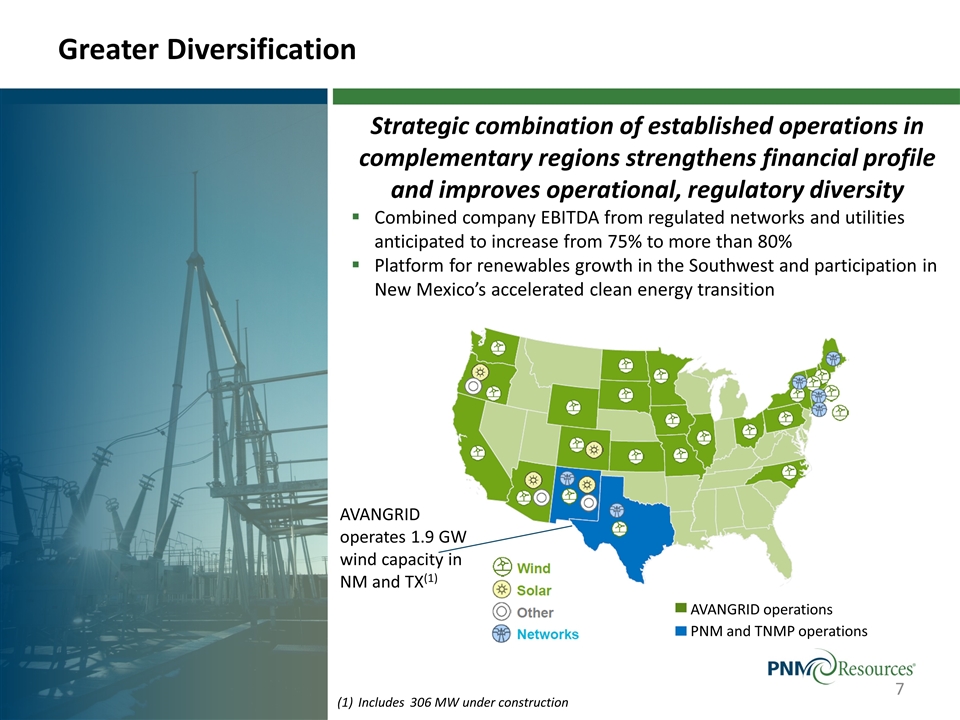

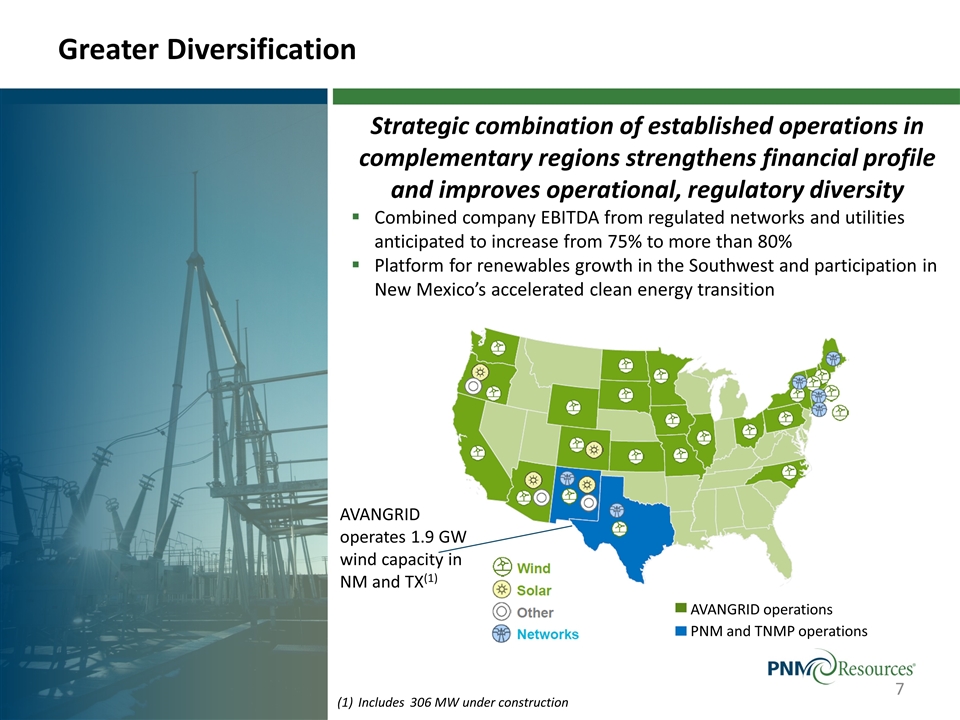

Greater Diversification Strong Financial Profile Strategic combination of established operations in complementary regions strengthens financial profile and improves operational, regulatory diversity Combined company EBITDA from regulated networks and utilities anticipated to increase from 75% to more than 80% Platform for renewables growth in the Southwest and participation in New Mexico’s accelerated clean energy transition AVANGRID operations PNM and TNMP operations Avangrid operates 1.9 GW wind capacity in NM and TX(1) (1) Includes 306 MW under construction

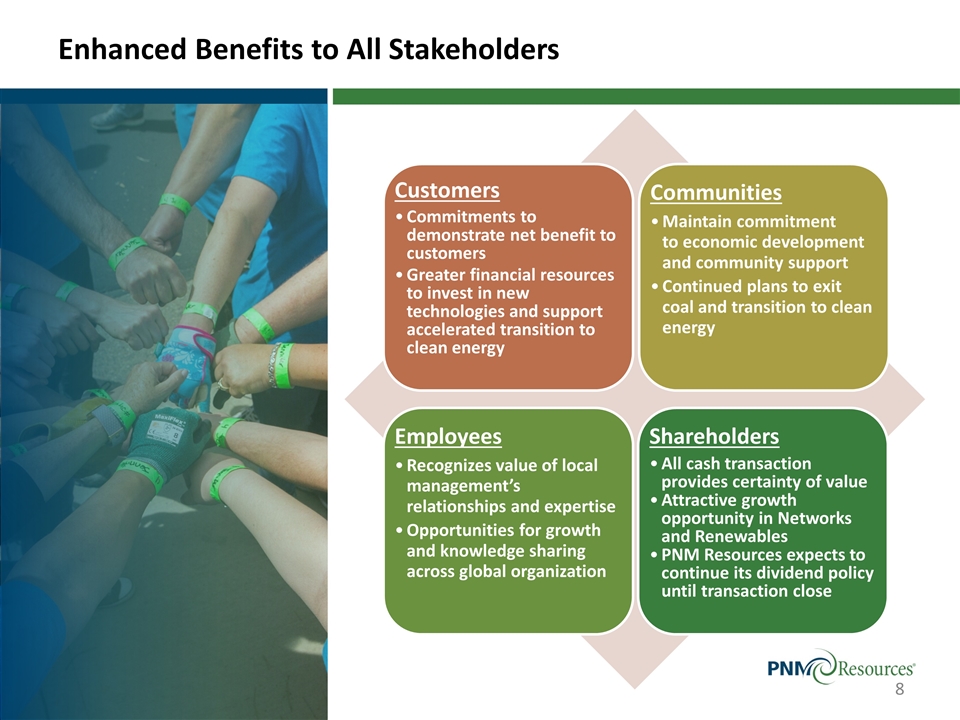

Enhanced Benefits to All Stakeholders Clean Energy Focus Strong Financial Profile Communities Employees Commitments to demonstrate net benefit to customers Maintain commitment to economic development and community support Continued plans to exit coal and transition to clean energy Recognizes value of local management’s relationships and expertise Shareholders Customers All cash transaction provides certainty of value Greater financial resources to invest in new technologies and support accelerated transition to clean energy Attractive growth opportunity in Networks and Renewables PNM Resources expects to continue its dividend policy until transaction close Opportunities for growth and kn owledge sharing across global organization

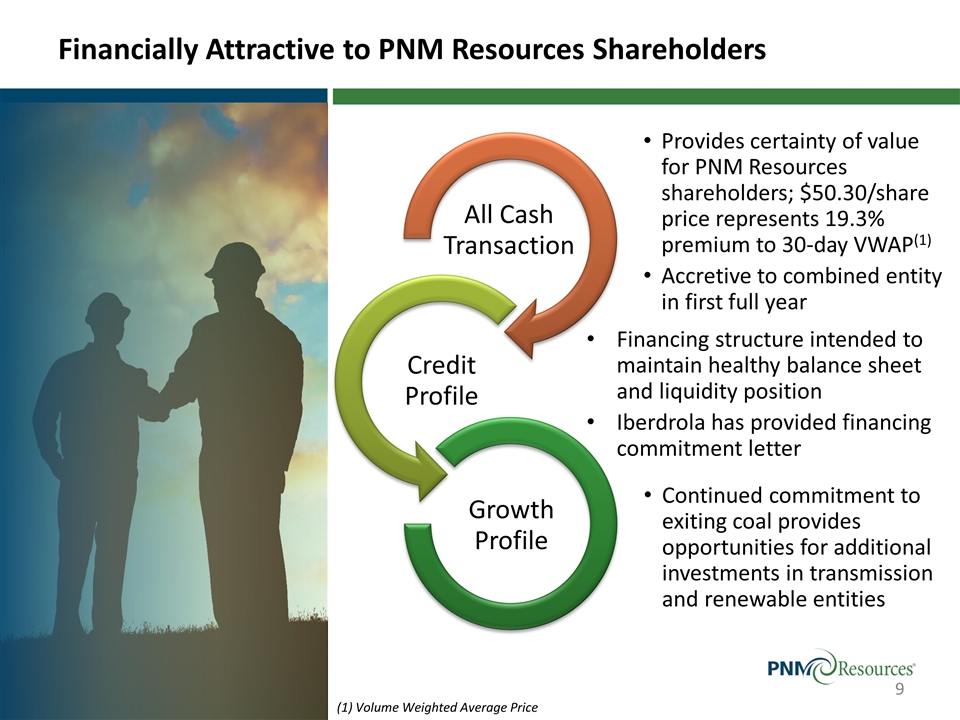

Financially Attractive to PNM Resources Shareholders Clean Energy Focus Strong Financial Profile Financing structure intended to maintain healthy balance sheet and liquidity position Iberdrola has provided financing commitment letter Continued commitment to exiting coal provides opportunities for additional investments in transmission and renewable entities Provides certainty of value for PNM Resources shareholders; $50.30/share price represents 19.3% premium to 30-day VWAP(1) Accretive to combined entity in first full year (1) Volume Weighted Average Price All Cash Transaction Credit Profile Growth Profile

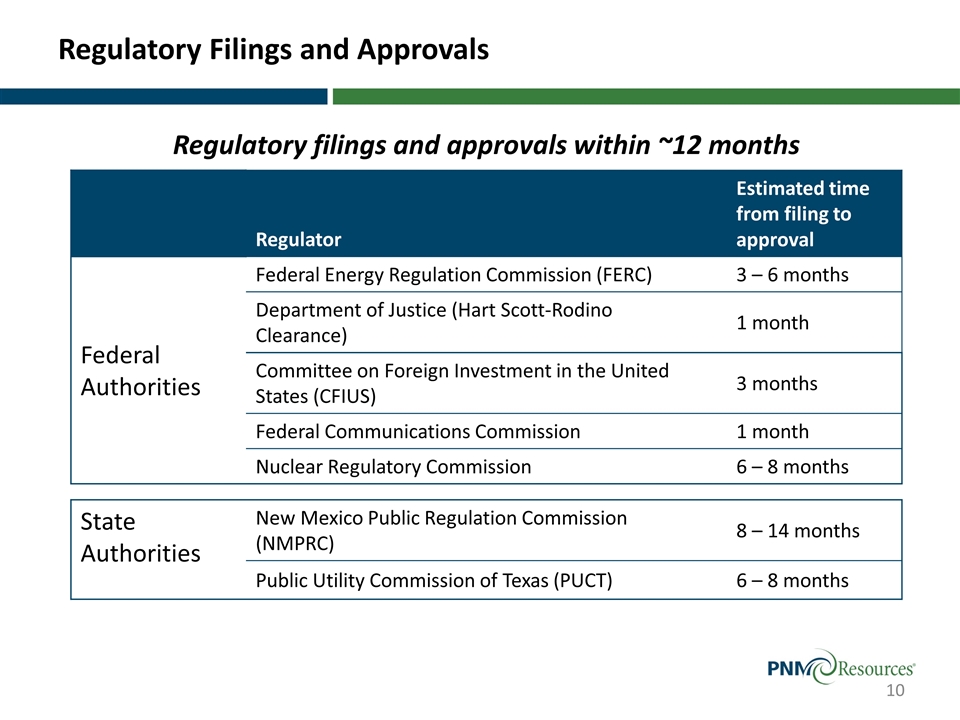

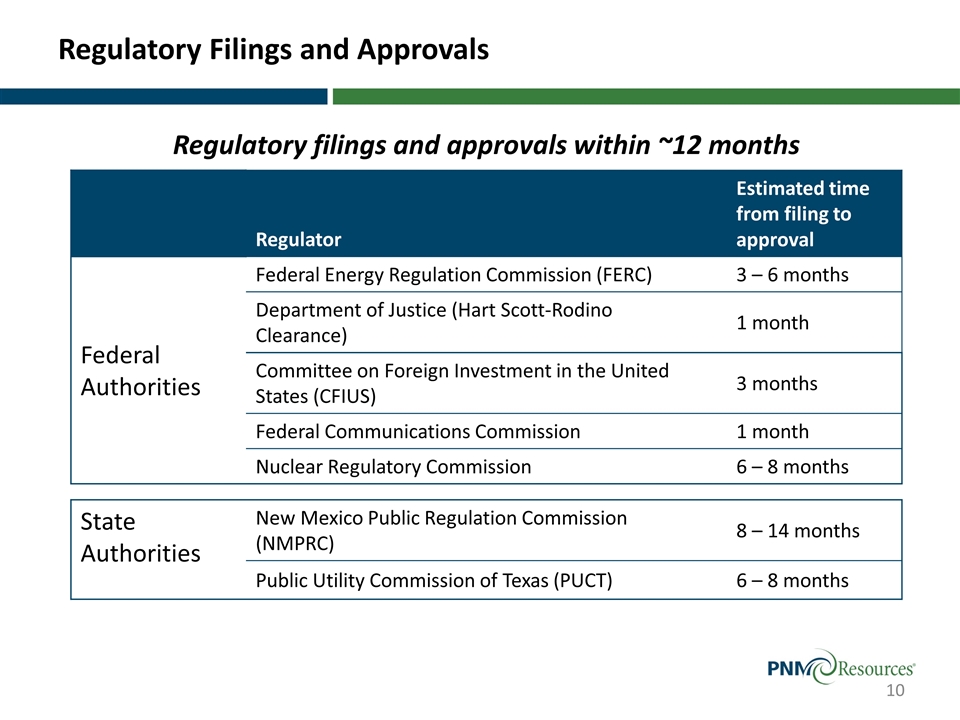

Regulatory Filings and Approvals Regulator Estimated time from filing to approval Federal Authorities Federal Energy Regulation Commission (FERC) 3 – 6 months Department of Justice (Hart Scott-Rodino Clearance) 1 month Committee on Foreign Investment in the United States (CFIUS) 3 months Federal Communications Commission 1 month Nuclear Regulatory Commission 6 – 8 months State Authorities New Mexico Public Regulation Commission (NMPRC) 8 – 14 months Public Utility Commission of Texas (PUCT) 6 – 8 months Regulatory filings and approvals within ~12 months

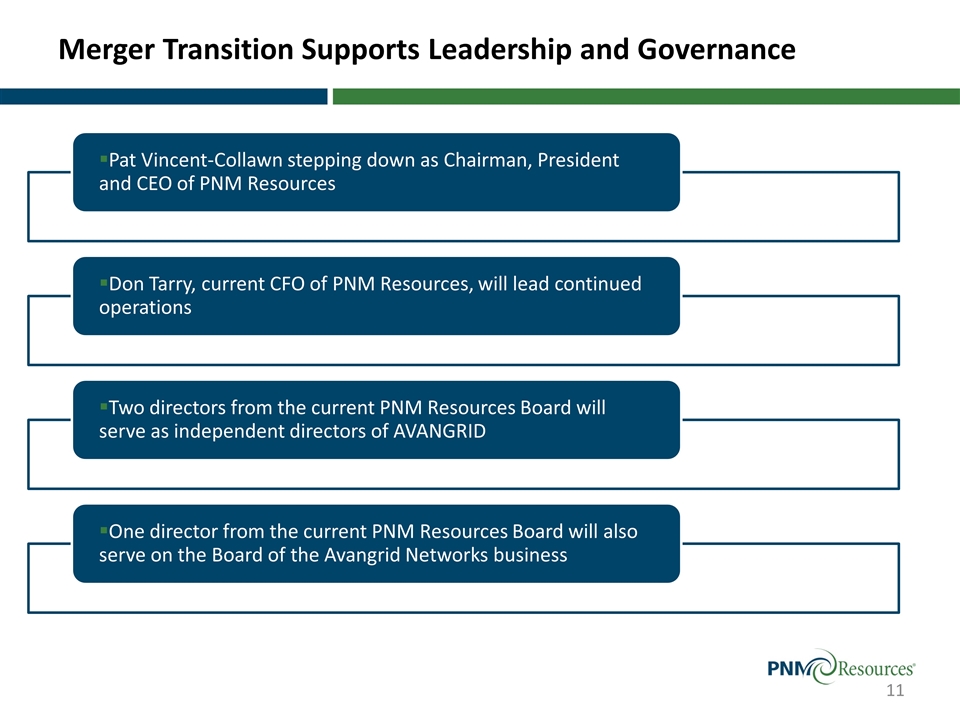

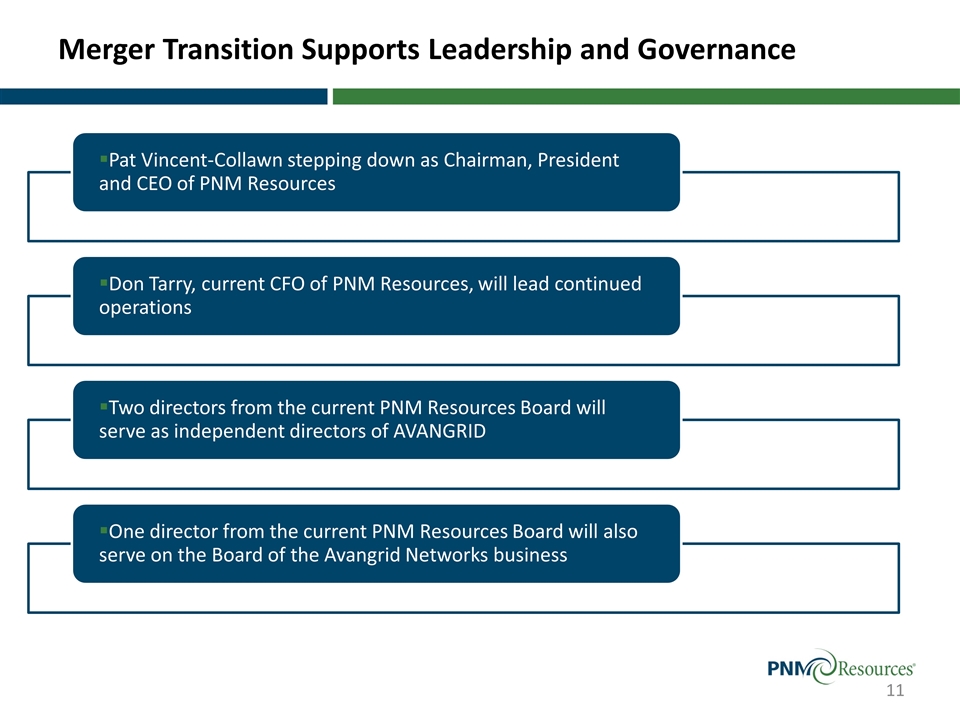

Merger Transition Supports Leadership and Governance Pat Vincent-Collawn stepping down as Chairman, President and CEO of PNM Resources Don Tarry, current CFO of PNM Resources, will lead continued operations Two directors from the current PNM Resources Board will serve as independent directors of AVANGRID One director from the current PNM Resources Board will also serve on the Board of the Avangrid Networks business

Questions and Answers