John Cummings

Salesforce

Investor Relations

415-778-4188

jcummings@salesforce.com

Chi Hea Cho

Salesforce

Public Relations

415-281-5304

chcho@salesforce.com

Salesforce Announces Fiscal 2016 First Quarter Results

Becomes First Enterprise Cloud Computing Company to Reach $6 Billion Revenue Run Rate

| |

| • | Revenue of $1.51 Billion, up 23% Year-Over-Year, 27% in Constant Currency |

| |

| • | Deferred Revenue of $3.06 Billion, up 31% Year-Over-Year, 36% in Constant Currency |

| |

| • | Unbilled Deferred Revenue of Approximately $6.0 Billion, up 25% Year-Over-Year |

| |

| • | Operating Cash Flow of $731 Million, up 54% Year-Over-Year |

| |

| • | Initiates Second Quarter Revenue Guidance of $1.59 Billion to $1.60 Billion |

| |

| • | Raises FY16 Revenue Guidance to $6.52 Billion to $6.55 Billion |

SAN FRANCISCO, Calif. - May 20, 2015 - Salesforce (NYSE: CRM), the Customer Success Platform and world’s #1 CRM company, today announced results for its fiscal first quarter ended April 30, 2015.

“Salesforce has surpassed the $6 billion annual revenue run rate faster than any other enterprise software company, and our current outlook puts us on track to reach a $7 billion revenue run rate later this year,” said Marc Benioff, Chairman and CEO, Salesforce. “Our goal is to be the fastest to reach $10 billion in annual revenue.”

Salesforce delivered the following results for its fiscal first quarter 2016:

Revenue: Total Q1 revenue was $1.51 billion, an increase of 23% year-over-year, and 27% in constant currency. Subscription and support revenues were $1.41 billion, an increase of 22% year-over-year. Professional services and other revenues were $106 million, an increase of 33% year-over-year.

Earnings per Share: Q1 GAAP diluted earnings per share was $0.01, and non-GAAP diluted earnings per share was $0.16. The company’s non-GAAP results exclude the effects of $143 million in stock-based compensation expense, $40 million in amortization of purchased intangibles, $0.8 million in amortization of acquired lease intangibles, $6 million in net non-cash interest expense related to the company’s convertible senior notes, and a one-time gain of $37 million in operating lease termination resulting from a building purchase, and are based on a projected long-term non-GAAP tax rate of 36.5%. Diluted GAAP and non-GAAP earnings per share calculations are based on approximately 664 million diluted shares outstanding during the quarter.

Cash: Cash generated from operations for the fiscal first quarter was $731 million, an increase of 54% year-over-year. Total cash, cash equivalents and marketable securities finished the quarter at $1.92 billion.

Deferred Revenue: Deferred revenue on the balance sheet as of April 30, 2015 was $3.06 billion, an increase of 31% year-over-year, and 36% in constant currency. Unbilled deferred revenue, representing business that is contracted but unbilled and off balance sheet, ended the first quarter at approximately $6.0 billion, up 25% year-over-year.

As of May 20, 2015, the company is initiating revenue, earnings per share, and deferred revenue guidance for its second quarter of fiscal year 2016. In addition, the company is raising its full fiscal year 2016 revenue, earnings per share, and operating cash flow guidance previously provided on February 25, 2015.

Q2 FY16 Guidance: Revenue for the company’s second fiscal quarter is projected to be approximately $1.59 billion to $1.60 billion, an increase of 21% year-over-year.

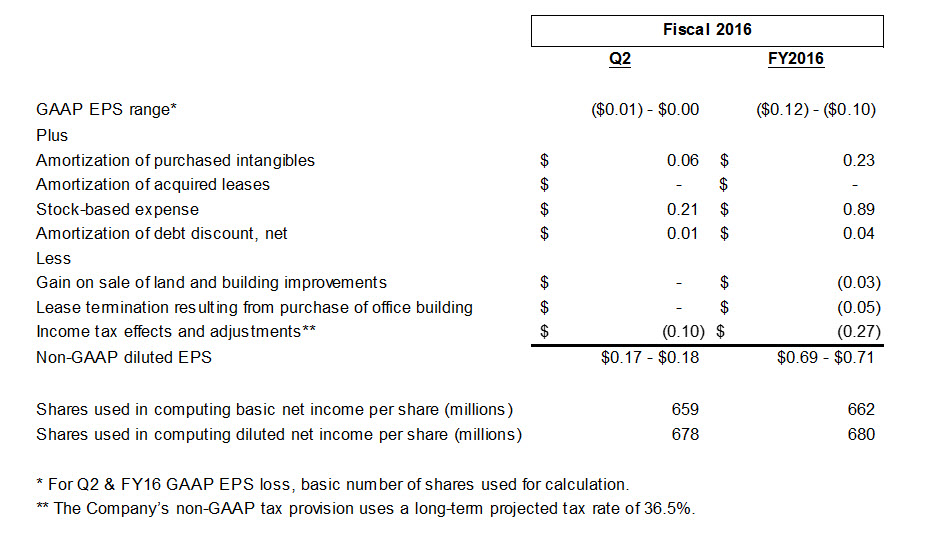

GAAP loss per share is expected to be in the range of ($0.01) to $0.00, while diluted non-GAAP earnings per share is expected to be in the range of $0.17 to $0.18. The non-GAAP estimate excludes the effects of stock-based compensation expense, expected to be approximately $142 million, amortization of purchased intangibles related to acquisitions, expected to be approximately $39 million, amortization of acquired leases, expected to be approximately $1 million, and net non-cash interest expense related to the 0.25% convertible senior notes, due 2018, expected to be approximately $6 million. Per share estimates assume a GAAP tax rate of approximately 70%, which reflects the estimated quarterly change in the tax valuation allowance, and a projected long-term non-GAAP tax rate of 36.5%. Note that the tax valuation allowance adds complexity to this forecast, and can cause volatility in the forecasted GAAP tax rate. The GAAP loss per share calculation assumes an average basic share count of approximately 659 million shares, and the non-GAAP earnings per share calculation assumes an average fully diluted share count of approximately 678 million shares.

On balance sheet deferred revenue growth for the second fiscal quarter is projected to be in the mid- to high-20s percentages year-over-year.

Full Year FY16 Guidance: Revenue for the company’s full fiscal year 2016 is projected to be approximately $6.52 billion to $6.55 billion, an increase of 21% to 22% year-over-year, which includes an FX headwind of approximately $175 million to $200 million.

GAAP loss per share is expected to be in the range of ($0.12) to ($0.10) while diluted non-GAAP earnings per share is expected to be in the range of $0.69 to $0.71. The non-GAAP estimate excludes the effects of stock-based compensation expense, expected to be approximately $603 million, amortization of purchased intangibles related to acquisitions, expected to be approximately $155 million, amortization of acquired leases, expected to be approximately $3 million, gains on sales of land and building improvements, expected to be approximately $20 million, net non-cash interest expense related to the 0.25% convertible senior notes, due 2018, expected to be approximately $24 million, and lease termination resulting from the first quarter purchase of an office building, expected to be a gain of approximately $37 million. Per share estimates assume a GAAP tax rate of approximately 195%, which reflects the estimated annual change in the tax valuation allowance, and a projected long-term non-GAAP tax rate of 36.5%. Note that the tax valuation allowance adds complexity to this forecast, and can cause volatility in the forecasted GAAP tax rate. The GAAP loss per share calculation assumes an average basic share count of approximately 662 million shares, and the non-GAAP earnings per share calculation assumes an average fully diluted share count of approximately 680 million shares.

Operating cash flow growth for the company’s full fiscal year 2016 is projected to be approximately 24% to 25% year-over-year.

The following is a per share reconciliation of GAAP earnings per share to diluted non-GAAP earnings per share guidance for the second quarter and full fiscal year:

Quarterly Conference Call

Salesforce will host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss its financial results with the investment community. A live web broadcast of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor. A live dial-in is available domestically at 866-901-SFDC or 866-901-7332 and internationally at 706-902-1764, passcode 38351690. A replay will be available at (800) 585-8367 or (855) 859-2056 until midnight (ET) Jun. 19, 2015.

About Salesforce

Salesforce, the Customer Success Platform and world's #1 CRM company, empowers companies to connect with their customers in a whole new way. Salesforce has headquarters in San Francisco, with offices in Europe and Asia, and trades on the New York Stock Exchange under the ticker symbol "CRM." For more information about Salesforce, visit: www.salesforce.com.

###

Non-GAAP Financial Measures: This press release includes information about non-GAAP earnings per share and non-GAAP tax rates (collectively the “non-GAAP financial measures”). Non-GAAP earnings per share estimates exclude the impact of the following items: stock-based compensation, amortization of acquisition-related intangibles, amortization of acquired leases, the net amortization of debt discount on the company’s convertible senior notes, and gains/losses on conversions of the company’s convertible senior notes, gains/losses on sales of land and building improvements, and termination of office leases, as well as income tax adjustments. The purpose of the non-GAAP tax rate is to quantify the excluded tax adjustments and the tax consequences associated with the above excluded items. The company reports a projected long-term tax rate to eliminate the effects of non-recurring and period specific items which can vary in size and frequency. This projected long-term non-GAAP tax rate could be subject to change in the future for a variety of reasons, for example, significant changes in the company’s geographic earnings mix including acquisition activity, or fundamental tax law changes in major jurisdictions where the company operates. These non-GAAP financial measures are not measurements of financial performance prepared in accordance with U.S. generally accepted accounting principles. The method used to produce non-GAAP financial measures is not computed according to GAAP and may differ from the methods used by other

companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP.

The primary purpose of these non-GAAP measures is to provide supplemental information that may prove useful to investors who wish to consider the impact of certain non-cash items on the company’s operating performance. Non-cash stock-based compensation, amortization of acquisition-related intangible assets, amortization of acquired leases, the net amortization of debt discount on the company’s convertible senior notes, gains/losses on the sales of land and building improvements and termination of office leases, and gains/losses on conversions of the company’s convertible senior notes, are being excluded from the company’s FY16 financial results because the decisions which gave rise to these expenses were not made to increase revenue in a particular period, but were made for the company’s long-term benefit over multiple periods. While strategic decisions, such as those related to the issuance of equity awards, resulting in stock-based compensation, the acquisitions of companies, real estate activity, or the issuance of convertible senior notes, are made to further the company’s long-term strategic objectives and impact the company’s statement of operations under GAAP measures, these items affect multiple periods and management is not able to change or affect these items in any particular period. As such, supplementing GAAP disclosure with non-GAAP disclosure using the non-GAAP measures provides management with an additional view of operational performance by excluding expenses that are not directly related to performance in any particular period, and management uses both GAAP and non-GAAP measures when planning, monitoring, and evaluating the company’s performance.

In addition, the majority of the company’s industry peers report non-GAAP operating results that exclude certain non-cash or non-recurring items, such as certain one-time charges. As significant unusual or discrete events occur, such as real estate activity, the results may be excluded in the period in which the events occur. Management believes that the provision of supplemental non-GAAP information will enable a more complete comparison of the company’s relative performance.

Specifically, management is excluding the following items from its non-GAAP earnings per share for Q1 and its non-GAAP estimates for Q2 and FY16:

| |

| • | Stock-Based Expenses: The company’s compensation strategy includes the use of stock-based compensation to attract and retain employees and executives. It is principally aimed at aligning their interests with those of our stockholders and at long-term employee retention, rather than to motivate or reward operational performance for any particular period. Thus, stock-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period. |

| |

| • | Amortization of Purchased Intangibles and Acquired Leases: The company views amortization of acquisition- and building-related intangible assets, such as the amortization of the cost associated with an acquired company’s research and development efforts, trade names, customer lists and customer relationships, and acquired lease intangibles, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are continually evaluated for impairment, amortization of the cost of purchased intangibles is a static expense, one that is not typically affected by operations during any particular period. |

| |

| • | Amortization of Debt Discount: Under GAAP, certain convertible debt instruments that may be settled in cash (or other assets) on conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-convertible debt borrowing rate. Accordingly, for GAAP purposes we are required to recognize imputed interest expense on the company’s $1.15 billion of convertible senior notes due 2018 that were issued in a private placement in March 2013. The imputed interest rate was approximately 2.5% for the convertible notes due 2018, while the actual coupon interest rate of the notes is 0.25%. The difference between the imputed interest expense and the coupon interest expense, net of the interest amount capitalized, is excluded from management’s assessment of the company’s operating performance because management believes that this non-cash expense is not indicative of ongoing operating performance. Management believes that the exclusion of the non-cash interest expense provides investors an enhanced view of the company’s operational performance. |

| |

| • | Non-Cash Gains/Losses on Conversion of Debt: Upon settlement of the company’s convertible senior notes, we attribute the fair value of the consideration transferred to the liability and equity components of |

the convertible senior notes. The difference between the fair value of consideration attributed to the liability component and the carrying value of the liability as of settlement date is recorded as a non-cash gain or loss on the statement of operations. Management believes that the exclusion of the non-cash gain/loss provides investors an enhanced view of the company’s operational performance.

| |

| • | Gain on Sales of Land and Building Improvements: The Company views the non-operating gains associated with the sales of the land and building improvements at Mission Bay to be a discrete item. Management believes that the exclusion of the gains provides investors an enhanced view of the Company’s operational performance. |

| |

| • | Lease Termination Resulting From Purchase of Office Building: The Company views the non-cash, one-time gain associated with the termination of its lease at 50 Fremont to be a discrete item. Management believes that the exclusion of the gains provides investors an enhanced view of the Company’s operational performance. |

| |

| • | Income Tax Effects and Adjustments: During fiscal 2015, the Company began to compute and utilize a fixed long-term projected non-GAAP tax rate in order to provide better consistency across the interim reporting periods by eliminating the effects of non-recurring and period-specific items such as changes in the tax valuation allowance and tax effects of acquisitions-related costs, since each of these can vary in size and frequency. When projecting this long-term rate, the Company evaluated a three-year financial projection that excludes the impact of the following non-cash items: Stock-Based Expenses, Amortization of Purchased Intangibles, Amortization of Acquired Leases, Amortization of Debt Discount, Gains/Losses on the sales of land and building improvements, Gains/Losses on Conversions of Debt, and Termination of Office Leases. The projected rate also assumes no new acquisitions in the three-year period, and takes into account other factors including the Company’s current tax structure, its existing tax positions in various jurisdictions and key legislation in major jurisdictions where the Company operates. The non-GAAP tax rate is 36.5%. The Company intends to re-evaluate this long-term rate on an annual basis or if any significant events that may materially affect this long-term rate occur. This long-term rate could be subject to change for a variety of reasons, for example, significant changes in the geographic earnings mix including acquisition activity, or fundamental tax law changes in major jurisdictions where the Company operates. |

###

"Safe harbor" statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements about our financial results, which may include expected GAAP and non-GAAP financial and other operating and non-operating results, including revenue, net income (loss), earnings per share, expected revenue run rate, expected tax rates, stock-based compensation expenses, amortization of purchased intangibles, amortization of acquired leases and debt discount, non-cash interest expense and gains/losses on the conversions of debt, gains/losses on the sales of land and building improvements, termination of operating lease, shares outstanding, and changes in deferred tax asset valuation allowances. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the company’s results could differ materially from the results expressed or implied by the forward-looking statements we make.

The risks and uncertainties referred to above include - but are not limited to - risks associated with possible fluctuations in the company’s financial and operating results; the company’s rate of growth and anticipated revenue run rate, including the company’s ability to convert deferred revenue and unbilled deferred revenue into revenue and, as appropriate, cash flow, and the continued growth and ability to maintain deferred revenue and unbilled deferred revenue; errors, interruptions or delays in the company’s service or the company’s Web hosting; breaches of the company’s security measures; the financial impact of any previous and future acquisitions; the nature of the company’s business model; the company’s ability to continue to release, and gain customer acceptance of, new and improved versions of the company’s service; successful customer deployment and utilization of the company’s existing and future services; changes in the company’s sales cycle; competition; various financial aspects of the company’s subscription model; unexpected increases in attrition or decreases in new business; the company’s ability to realize benefits from strategic partnerships and investments; the emerging markets in which the company operates; unique aspects of entering or expanding in international markets, the company’s ability to hire, retain and motivate employees and manage the company’s growth; changes in the company’s customer base; technological developments; regulatory developments; litigation related to intellectual property and other matters, and any related claims, negotiations and settlements; unanticipated changes in the company’s effective tax rate; factors affecting

the company’s outstanding convertible notes and revolving credit facility; fluctuations in the number of shares we have outstanding and the price of such shares; foreign currency exchange rates; collection of receivables; interest rates; factors affecting our deferred tax assets and ability to value and utilize them, including the timing of when we once again achieve profitability on a pre-tax basis; the potential negative impact of indirect tax exposure; the risks and expenses associated with the company’s real estate and office facilities space; and general developments in the economy, financial markets, and credit markets.

Further information on these and other factors that could affect the company’s financial results is included in the reports on Forms 10-K, 10-Q and 8-K and in other filings we make with the Securities and Exchange Commission from time to time. These documents are available on the SEC Filings section of the Investor Information section of the company’s website at www.salesforce.com/investor.

Salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

© 2015 salesforce.com, inc. All rights reserved. Salesforce, Sales Cloud, Service Cloud, Marketing Cloud, AppExchange, Salesforce1, and others are trademarks of salesforce.com, inc. Other brands featured herein may be trademarks of their respective owners.

salesforce.com, inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

|

| | | | | | | | |

| | | Three Months Ended April 30, |

| | | 2015 | | 2014 |

| Revenues: | | | | |

| Subscription and support | | $ | 1,405,287 |

| | $ | 1,147,306 |

|

| Professional services and other | | 105,880 |

| | 79,466 |

|

| Total revenues | | 1,511,167 |

| | 1,226,772 |

|

| Cost of revenues (1)(2): | | | | |

| Subscription and support | | 274,241 |

| | 208,947 |

|

| Professional services and other | | 107,561 |

| | 83,358 |

|

| Total cost of revenues | | 381,802 |

| | 292,305 |

|

| Gross profit | | 1,129,365 |

| | 934,467 |

|

| Operating expenses (1)(2): | | | | |

| Research and development | | 222,128 |

| | 188,358 |

|

| Marketing and sales | | 736,938 |

| | 639,355 |

|

| General and administrative | | 175,811 |

| | 162,095 |

|

| Operating lease termination resulting from purchase of 50 Fremont, net | | (36,617 | ) | | 0 |

|

| Total operating expenses | | 1,098,260 |

| | 989,808 |

|

| Income (loss) from operations | | 31,105 |

| | (55,341 | ) |

| Investment income | | 4,561 |

| | 1,778 |

|

| Interest expense | | (16,675 | ) | | (20,359 | ) |

| Other expense (1)(3) | | (918 | ) | | (10,847 | ) |

| Income (loss) before provision for income taxes | | 18,073 |

| | (84,769 | ) |

| Provision for income taxes | | (13,981 | ) | | (12,142 | ) |

| Net income (loss) | | $ | 4,092 |

| | $ | (96,911 | ) |

| Basic net income (loss) per share | | $ | 0.01 |

| | $ | (0.16 | ) |

| Diluted net income (loss) per share | | $ | 0.01 |

| | $ | (0.16 | ) |

| Shares used in computing basic net income (loss) per share | | 653,809 |

| | 612,512 |

|

| Shares used in computing diluted net income (loss) per share | | 664,310 |

| | 612,512 |

|

| |

| (1) | Amounts include amortization of purchased intangibles from business combinations, as follows: |

|

| | | | | | | | |

| Cost of revenues | | $ | 19,690 |

| | $ | 28,672 |

|

| Marketing and sales | | 20,027 |

| | 14,965 |

|

| Other non-operating expense | | 815 |

| | 0 |

|

| |

| (2) | Amounts include stock-based expense, as follows: |

|

| | | | | | | | |

| Cost of revenues | | $ | 15,381 |

| | $ | 11,810 |

|

| Research and development | | 31,242 |

| | 27,284 |

|

| Marketing and sales | | 70,534 |

| | 67,133 |

|

| General and administrative | | 25,403 |

| | 24,865 |

|

(3) Amount includes approximately $8.5 million loss on conversions of our convertible 0.75% senior notes due January 2015 recognized during the three months ended April 30, 2014.

salesforce.com, inc.

Condensed Consolidated Statements of Operations

As a percentage of total revenues:

(Unaudited)

|

| | | | | | |

| | | Three Months Ended April 30, |

| | | 2015 | | 2014 |

| Revenues: | | | | |

| Subscription and support | | 93 | % | | 94 | % |

| Professional services and other | | 7 |

| | 6 |

|

| Total revenues | | 100 |

| | 100 |

|

| Cost of revenues (1)(2): | | | | |

| Subscription and support | | 18 |

| | 17 |

|

| Professional services and other | | 7 |

| | 7 |

|

| Total cost of revenues | | 25 |

| | 24 |

|

| Gross profit | | 75 |

| | 76 |

|

| Operating expenses (1)(2): | | | | |

| Research and development | | 15 |

| | 16 |

|

| Marketing and sales | | 49 |

| | 52 |

|

| General and administrative | | 11 |

| | 13 |

|

Operating lease termination resulting from purchase of 50 Fremont, net

| | (2 | ) | | 0 |

|

| Total operating expenses | | 73 |

| | 81 |

|

| Income (loss) from operations | | 2 |

| | (5 | ) |

| Investment income | | 0 |

| | 0 |

|

| Interest expense | | (1 | ) | | (1 | ) |

| Other expense (1) | | 0 |

| | (1 | ) |

| Income (loss) before provision for income taxes | | 1 |

| | (7 | ) |

| Provision for income taxes | | (1 | ) | | (1 | ) |

| Net income (loss) | | 0 | % | | (8 | )% |

| |

| (1) | Amortization of purchased intangibles from business combinations as a percentage of total revenues, as follows: |

|

| | | | | | |

| Cost of revenues | | 1 | % | | 2 | % |

| Marketing and sales | | 1 |

| | 1 |

|

| Other non-operating expense | | 0 |

| | 0 |

|

| |

| (2) | Stock-based expense as a percentage of total revenues, as follows: |

|

| | | | | | |

| Cost of revenues | | 1 | % | | 1 | % |

| Research and development | | 2 |

| | 2 |

|

| Marketing and sales | | 5 |

| | 5 |

|

| General and administrative | | 2 |

| | 2 |

|

salesforce.com, inc.

Condensed Consolidated Balance Sheets

(in thousands)

|

| | | | | | | | |

| | April 30,

2015 | | January 31,

2015 |

| | (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 941,956 |

| | $ | 908,117 |

|

| Short-term marketable securities | 77,059 |

| | 87,312 |

|

| Accounts receivable, net | 926,381 |

| | 1,905,506 |

|

| Deferred commissions | 208,101 |

| | 225,386 |

|

| Prepaid expenses and other current assets | 310,983 |

| | 280,554 |

|

| Land and building improvements held for sale | 140,345 |

| | 143,197 |

|

| Total current assets | 2,604,825 |

| | 3,550,072 |

|

| Marketable securities, noncurrent | 903,461 |

| | 894,855 |

|

| Property and equipment, net | 1,737,094 |

| | 1,125,866 |

|

| Deferred commissions, noncurrent | 153,018 |

| | 162,796 |

|

| Capitalized software, net | 421,323 |

| | 433,398 |

|

| Goodwill | 3,791,583 |

| | 3,782,660 |

|

| Other assets, net | 754,378 |

| | 628,320 |

|

| Restricted cash | 0 |

| | 115,015 |

|

| Total assets | $ | 10,365,682 |

| | $ | 10,692,982 |

|

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 928,105 |

| | $ | 1,103,335 |

|

| Deferred revenue | 3,032,771 |

| | 3,286,768 |

|

| Total current liabilities | 3,960,876 |

| | 4,390,103 |

|

| Convertible 0.25% senior notes, net | 1,076,727 |

| | 1,070,692 |

|

| Loan assumed on 50 Fremont | 198,776 |

| — |

| 0 |

|

| Revolving credit facility | 0 |

| | 300,000 |

|

| Deferred revenue, noncurrent | 24,049 |

| | 34,681 |

|

| Other noncurrent liabilities | 870,051 |

| | 922,323 |

|

| Total liabilities | 6,130,479 |

| | 6,717,799 |

|

| Stockholders’ equity: | | | |

| Common stock | 656 |

| | 651 |

|

| Additional paid-in capital | 4,864,652 |

| | 4,604,485 |

|

| Accumulated other comprehensive loss | (28,352 | ) | | (24,108 | ) |

| Accumulated deficit | (601,753 | ) | | (605,845 | ) |

| Total stockholders’ equity | 4,235,203 |

| | 3,975,183 |

|

| Total liabilities and stockholders’ equity | $ | 10,365,682 |

| | $ | 10,692,982 |

|

salesforce.com, inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(Unaudited)

|

| | | | | | | | |

| | | Three Months Ended April 30, |

| | | 2015 | | 2014 |

| Operating activities: | | | | |

| Net income (loss) | | $ | 4,092 |

| | $ | (96,911 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 127,927 |

| | 110,808 |

|

| Amortization of debt discount and transaction costs | | 5,861 |

| | 11,791 |

|

50 Fremont lease termination, net

| | (36,617 | ) | | 0 |

|

| Loss on conversions of convertible senior notes | | 0 |

| | 8,529 |

|

| Amortization of deferred commissions | | 77,155 |

| | 59,855 |

|

| Expenses related to employee stock plans | | 142,560 |

| | 131,092 |

|

| Excess tax benefits from employee stock plans | | (4,224 | ) | | (9,041 | ) |

| Changes in assets and liabilities, net of business combinations: | | | | |

| Accounts receivable, net | | 979,170 |

| | 676,682 |

|

| Deferred commissions | | (50,092 | ) | | (40,896 | ) |

| Prepaid expenses and other current assets and other assets | | (11,274 | ) | | 4,277 |

|

| Accounts payable, accrued expenses and other liabilities | | (239,072 | ) | | (185,599 | ) |

| Deferred revenue | | (264,629 | ) | | (197,500 | ) |

| Net cash provided by operating activities | | 730,857 |

| | 473,087 |

|

| Investing activities: | | | | |

| Business combination, net of cash acquired | | (12,470 | ) | | 0 |

|

| Purchase of 50 Fremont land and building | | (425,376 | ) | | 0 |

|

| Deposit for purchase of 50 Fremont land and building | | 115,015 |

| | 0 |

|

| Non-refundable amounts received for sale of land available for sale | | 2,852 |

| | 30,000 |

|

| Strategic investments | | (144,462 | ) | | (16,246 | ) |

| Purchases of marketable securities | | (207,225 | ) | | (250,536 | ) |

| Sales of marketable securities | | 192,184 |

| | 79,312 |

|

| Maturities of marketable securities | | 14,446 |

| | 7,198 |

|

| Capital expenditures | | (71,087 | ) | | (60,098 | ) |

| Net cash used in investing activities | | (536,123 | ) | | (210,370 | ) |

| Financing activities: | | | | |

| Proceeds from employee stock plans | | 155,015 |

| | 73,795 |

|

| Excess tax benefits from employee stock plans | | 4,224 |

| | 9,041 |

|

| Payments on convertible senior notes | | 0 |

| | (283,892 | ) |

| Principal payments on capital lease obligations | | (16,825 | ) | | (10,594 | ) |

| Payments on revolving credit facility and term loan | | (300,000 | ) | | (7,500 | ) |

| Net cash used in financing activities | | (157,586 | ) | | (219,150 | ) |

| Effect of exchange rate changes | | (3,309 | ) | | 2,689 |

|

| Net increase in cash and cash equivalents | | 33,839 |

| | 46,256 |

|

| Cash and cash equivalents, beginning of period | | 908,117 |

| | 781,635 |

|

| Cash and cash equivalents, end of period | | $ | 941,956 |

| | $ | 827,891 |

|

salesforce.com, inc.

Additional Metrics

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | |

| | Apr 30,

2015 | | Jan 31,

2015 | | Oct 31,

2014 | | Jul 31,

2014

| | Apr 30,

2014 | | Jan 31,

2014 |

| Full Time Equivalent Headcount | 16,852 |

| | 16,227 |

| | 15,458 |

| | 15,145 |

| | 14,239 |

| | 13,312 |

|

| Financial data (in thousands): | | | | | | | | | | | |

| Cash, cash equivalents and marketable securities | $ | 1,922,476 |

| | $1,890,284 | | $ | 1,827,277 |

| | $ | 1,671,758 |

| | $ | 1,529,888 |

| | $ | 1,321,017 |

|

| Deferred revenue, current and noncurrent | $ | 3,056,820 |

| | $3,321,449 | | $ | 2,223,977 |

| | $ | 2,352,904 |

| | $ | 2,324,615 |

| | $ | 2,522,115 |

|

| Principal due on our outstanding debt obligations | $ | 1,350,000 |

| | $1,450,000 | | $ | 1,631,635 |

| | $ | 1,691,280 |

| | $ | 1,712,472 |

| | $ | 2,003,864 |

|

Selected Balance Sheet Accounts (in thousands):

|

| | | | | | | |

| | April 30,

2015 | | January 31,

2015 |

| Prepaid Expenses and Other Current Assets | | | |

| Deferred income taxes, net | $ | 44,342 |

| | $ | 35,528 |

|

| Prepaid income taxes | 21,362 |

| | 21,514 |

|

| Customer contract asset (1) | 10,492 |

| | 16,620 |

|

| Other taxes receivable | 25,592 |

| | 27,540 |

|

| Prepaid expenses and other current assets | 209,195 |

| | 179,352 |

|

| | $ | 310,983 |

| | $ | 280,554 |

|

| Property and Equipment, net | | | |

| Land | $ | 183,888 |

| | $ | 0 |

|

| Buildings | 572,164 |

| | 125,289 |

|

| Computers, equipment and software | 1,203,411 |

| | 1,171,762 |

|

| Furniture and fixtures | 75,726 |

| | 71,881 |

|

| Leasehold improvements | 394,674 |

| | 376,761 |

|

| | 2,429,863 |

| | 1,745,693 |

|

| Less accumulated depreciation and amortization | (692,769 | ) | | (619,827 | ) |

| | $ | 1,737,094 |

| | $ | 1,125,866 |

|

| Capitalized Software, net | | | |

| Capitalized internal-use software development costs, net of accumulated amortization | $ | 102,430 |

| | $ | 96,617 |

|

| Acquired developed technology, net of accumulated amortization | 318,893 |

| | 336,781 |

|

| | $ | 421,323 |

| | $ | 433,398 |

|

| Other Assets, net | | | |

| Deferred income taxes, noncurrent, net | $ | 8,930 |

| | $ | 9,275 |

|

| Long-term deposits | 19,163 |

| | 19,715 |

|

| Purchased intangible assets, net of accumulated amortization | 317,565 |

| | 329,971 |

|

| Acquired intellectual property, net of accumulated amortization | 15,595 |

| | 15,879 |

|

| Strategic investments | 318,716 |

| | 175,774 |

|

| Customer contract asset (1) | 407 |

| | 1,447 |

|

| Other | 74,002 |

| | 76,259 |

|

| | $ | 754,378 |

| | $ | 628,320 |

|

| |

| (1) | Customer contract asset reflects future billings of amounts that are contractually committed by ExactTarget’s existing customers as of the acquisition date in July 2013 that will be billed in the next 12 months. As the Company bills these customers this balance will reduce and accounts receivable will increase. |

|

| | | | | | | | |

| | April 30,

2015 | | | January 31,

2015 |

| Accounts Payable, Accrued Expenses and Other Liabilities | | | | |

| Accounts payable | $ | 60,227 |

| | | $ | 95,537 |

|

| Accrued compensation | 308,589 |

| | | 457,102 |

|

| Accrued other liabilities | 380,227 |

| | | 321,032 |

|

| Accrued income and other taxes payable | 128,734 |

| | | 184,844 |

|

| Accrued professional costs | 27,814 |

| | | 16,889 |

|

| Customer liability, current (2) | 10,561 |

| | | 13,084 |

|

| Accrued rent | 11,953 |

| | | 14,847 |

|

| | $ | 928,105 |

| | | $ | 1,103,335 |

|

| Other Noncurrent Liabilities | | | | |

| Deferred income taxes and income taxes payable | $ | 106,499 |

| | | $ | 94,396 |

|

| Customer liability, noncurrent (2) | 288 |

| | | 1,026 |

|

| Financing obligation, building in progress - leased facility | 145,255 |

| | | 125,289 |

|

| Long-term lease liabilities and other | 618,009 |

| | | 701,612 |

|

| | $ | 870,051 |

| | | $ | 922,323 |

|

| |

| (2) | Customer liability reflects the legal obligation to provide future services that were contractually committed by ExactTarget’s existing customers but unbilled as of July 2013. |

Selected Off-Balance Sheet Account

|

| | | |

| | April 30,

2015 | | January 31,

2015 |

| Unbilled Deferred Revenue, a non-GAAP measure | $ 6.0bn | | $ 5.7bn |

Unbilled deferred revenue represents future billings under our non-cancelable subscription agreements that have not been invoiced and, accordingly, are not recorded in deferred revenue.

Supplemental Revenue Analysis

|

| | | | | | | |

| Subscription and support revenue by cloud service offering (in millions): | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Sales Cloud | $ | 630.4 |

| | $ | 576.6 |

|

| Service Cloud | 407.7 |

| | 294.8 |

|

| Salesforce1 Platform and Other | 224.0 |

| | 164.9 |

|

| Marketing Cloud | 143.2 |

| | 111.0 |

|

| | $ | 1,405.3 |

| | $ | 1,147.3 |

|

|

| | | | | | | | |

| | | Three Months Ended April 30, |

| | | 2015 | | 2014 |

| Total revenues by geography (in thousands): | | | | |

| Americas | | $ | 1,115,120 |

| | $ | 876,377 |

|

| Europe | | 258,805 |

| | 230,810 |

|

| Asia Pacific | | 137,242 |

| | 119,585 |

|

| | | $ | 1,511,167 |

| | $ | 1,226,772 |

|

| As a percentage of total revenues: | | | | |

| Total revenues by geography: | | | | |

| Americas | | 74 | % | | 71 | % |

| Europe | | 17 |

| | 19 |

|

| Asia Pacific | | 9 |

| | 10 |

|

| | | 100 | % | | 100 | % |

|

| | | | | |

Revenue constant currency growth rates (as compared to the comparable prior periods) | Three Months Ended

April 30, 2015

compared to Three Months

Ended April 30, 2014 | | Three Months Ended

January 31, 2015

compared to Three Months

Ended January 31, 2014 | | Three Months Ended

April 30, 2014

compared to Three Months

Ended April 30, 2013 |

| Americas | 27% | | 29% | | 39% |

| Europe | 28% | | 32% | | 35% |

| Asia Pacific | 27% | | 27% | | 26% |

| Total growth | 27% | | 29% | | 37% |

We present constant currency information to provide a framework for assessing how our underlying business performed excluding the effect of foreign currency rate fluctuations. To present this information, current and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars at the weighted average exchange rate for the quarter being compared to for growth rate calculations presented, rather than the actual exchange rates in effect during that period.

|

| | | |

| | April 30, 2015 compared to

April 30, 2014 | | January 31, 2015 compared to January 31, 2014 |

| Deferred revenue, current and noncurrent constant currency growth rates (as compared to the comparable prior periods) | | | |

| Total growth | 36% | | 35% |

We present constant currency information for deferred revenue, current and noncurrent to provide a framework for assessing how our underlying business performed excluding the effects of foreign currency rate fluctuations. To present the information above, we convert the deferred revenue balances in local currencies in previous comparable periods using the United States dollar currency exchange rate as on the most recent balance sheet date.

Supplemental Diluted Share Count Information

(in thousands)

|

| | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Weighted-average shares outstanding for basic earnings per share | 653,809 |

| | 612,512 |

|

| Effect of dilutive securities (1): | | | |

| Convertible senior notes (2) | 0 |

| | 8,495 |

|

| Warrants associated with the convertible senior note hedges (2) | 0 |

| | 13,220 |

|

| Employee stock awards | 10,501 |

| | 13,773 |

|

| Adjusted weighted-average shares outstanding and assumed conversions for diluted earnings per share | 664,310 |

| | 648,000 |

|

| |

| (1) | The effects of these dilutive securities were not included in the GAAP calculation of diluted net loss per share for the three months ended April 30, 2014 because the effect would have been anti-dilutive. |

| |

| (2) | Upon maturity in fiscal 2015, the convertible 0.75% senior notes and associated warrants were settled. The 0.25% senior notes were not convertible, therefore no dilutive effect for shares outstanding for the three months ended April 30, 2015. |

Supplemental Cash Flow Information

Free cash flow analysis, a non-GAAP measure

(in thousands)

|

| | | | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Operating cash flow | | | |

| GAAP net cash provided by operating activities | $ | 730,857 |

| | $ | 473,087 |

|

| Less: | | | |

| Capital expenditures | (71,087 | ) | | (60,098 | ) |

| Free cash flow | $ | 659,770 |

| | $ | 412,989 |

|

Our free cash flow analysis includes GAAP net cash provided by operating activities less capital expenditures. The capital expenditures balance does not include any costs related to the purchase and activities related to the purchase of 50 Fremont, which includes the underlying land, building in progress - leased facilities and strategic investments.

Comprehensive Income (Loss)

(in thousands)

(Unaudited)

|

| | | | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Net income (loss) | $ | 4,092 |

| | $ | (96,911 | ) |

| Other comprehensive loss, before tax and net of reclassification adjustments: | | | |

| Foreign currency translation and other gains (losses) | (1,855 | ) | | 3,115 |

|

| Unrealized losses on investments | (2,389 | ) | | (5,497 | ) |

| Other comprehensive loss, before tax | (4,244 | ) | | (2,382 | ) |

| Tax effect | 0 |

| | 0 |

|

| Other comprehensive loss, net of tax | (4,244 | ) | | (2,382 | ) |

| Comprehensive loss | $ | (152 | ) | | $ | (99,293 | ) |

salesforce.com, inc.

GAAP RESULTS RECONCILED TO NON-GAAP RESULTS

The following table reflects selected GAAP results reconciled to non-GAAP results

(in thousands, except per share data)

(Unaudited) |

| | | | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Gross profit | | | |

| GAAP gross profit | $ | 1,129,365 |

| | $ | 934,467 |

|

| Plus: | | | |

| Amortization of purchased intangibles (a) | 19,690 |

| | 28,672 |

|

| Stock-based expense (b) | 15,381 |

| | 11,810 |

|

| Non-GAAP gross profit | $ | 1,164,436 |

| | $ | 974,949 |

|

| Operating expenses | | | |

| GAAP operating expenses | $ | 1,098,260 |

| | $ | 989,808 |

|

| Less: | | | |

| Amortization of purchased intangibles (a) | (20,027 | ) | | (14,965 | ) |

| Stock-based expense (b) | (127,179 | ) | | (119,282 | ) |

| Plus: | | | |

| Operating lease termination resulting from purchase of 50 Fremont, net | 36,617 |

| | 0 |

|

| Non-GAAP operating expenses | $ | 987,671 |

| | $ | 855,561 |

|

| Income from operations | | | |

| GAAP income (loss) from operations | $ | 31,105 |

| | $ | (55,341 | ) |

| Plus: | | | |

| Amortization of purchased intangibles (a) | 39,717 |

| | 43,637 |

|

| Stock-based expense (b) | 142,560 |

| | 131,092 |

|

| Less: | | | |

Operating lease termination resulting from purchase of 50 Fremont, net

| (36,617 | ) | | 0 |

|

| Non-GAAP income from operations | $ | 176,765 |

| | $ | 119,388 |

|

| Non-operating loss (c) | | | |

| GAAP non-operating loss | $ | (13,032 | ) | | $ | (29,428 | ) |

| Plus: | | | |

| Amortization of debt discount, net | 6,059 |

| | 10,984 |

|

| Amortization of acquired lease intangible | 815 |

| | 0 |

|

| Loss on conversion of debt | 0 |

| | 8,529 |

|

| Non-GAAP non-operating loss | $ | (6,158 | ) | | $ | (9,915 | ) |

| Net income | | | |

| GAAP net income (loss) | $ | 4,092 |

| | $ | (96,911 | ) |

| Plus: | | | |

| Amortization of purchased intangibles (a) | 39,717 |

| | 43,637 |

|

| Amortization of acquired lease intangible | 815 |

| | 0 |

|

| Stock-based expense (b) | 142,560 |

| | 131,092 |

|

| Amortization of debt discount, net | 6,059 |

| | 10,984 |

|

| Loss on conversion of debt | 0 |

| | 8,529 |

|

| Less: | | | |

| Operating lease termination resulting from purchase of 50 Fremont, net | (36,617 | ) | | 0 |

|

| Income tax effects and adjustments | (48,291 | ) | | (27,815 | ) |

| Non-GAAP net income | $ | 108,335 |

| | $ | 69,516 |

|

|

| | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

|

| | | | | | | |

| Diluted earnings per share | | | |

| GAAP diluted income (loss) per share (d) | $ | 0.01 |

| | $ | (0.16 | ) |

| Plus: | | | |

| Amortization of purchased intangibles | 0.06 |

| | 0.07 |

|

| Amortization of acquired lease intangible | 0.00 |

| | 0.00 |

|

| Stock-based expense | 0.21 |

| | 0.20 |

|

| Amortization of debt discount, net | 0.01 |

| | 0.02 |

|

| Loss on conversion of debt | 0.00 |

| | 0.01 |

|

| Less: | | | |

| Operating lease termination resulting from purchase of 50 Fremont, net | (0.06 | ) | | 0.00 |

|

| Income tax effects and adjustments | (0.07 | ) | | (0.03 | ) |

| Non-GAAP diluted earnings per share | $ | 0.16 |

| | $ | 0.11 |

|

| Shares used in computing diluted net income per share | 664,310 |

| | 648,000 |

|

| |

| a) | Amortization of purchased intangibles were as follows: |

|

| | | | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Cost of revenues | $ | 19,690 |

| | $ | 28,672 |

|

| Marketing and sales | 20,027 |

| | 14,965 |

|

| | $ | 39,717 |

| | $ | 43,637 |

|

| |

| b) | Stock-based expense was as follows: |

|

| | | | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Cost of revenues | $ | 15,381 |

| | $ | 11,810 |

|

| Research and development | 31,242 |

| | 27,284 |

|

| Marketing and sales | 70,534 |

| | 67,133 |

|

| General and administrative | 25,403 |

| | 24,865 |

|

| | $ | 142,560 |

| | $ | 131,092 |

|

| |

| c) | Non-operating income (loss) consists of investment income, interest expense and other expense. |

| |

| d) | Reported GAAP loss per share was calculated using the basic share count. Non-GAAP diluted earnings per share was calculated using the diluted share count. |

salesforce.com, inc.

COMPUTATION OF BASIC AND DILUTED GAAP AND NON-GAAP NET INCOME (LOSS) PER SHARE

(in thousands, except per share data)

(Unaudited)

|

| | | | | | | |

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| GAAP Basic Net Income (loss) Per Share | | | |

| Net income (loss) | $ | 4,092 |

| | $ | (96,911 | ) |

| Basic net income (loss) per share | $ | 0.01 |

| | $ | (0.16 | ) |

| Shares used in computing basic net income (loss) per share | 653,809 |

| | 612,512 |

|

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Non-GAAP Basic Net Income Per Share | | | |

| Non-GAAP net income | $ | 108,335 |

| | $ | 69,516 |

|

| Basic Non-GAAP net income per share | $ | 0.17 |

| | $ | 0.11 |

|

| Shares used in computing basic net income per share | 653,809 |

| | 612,512 |

|

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| GAAP Diluted Net Income (loss) Per Share | | | |

| Net income (loss) | $ | 4,092 |

| | $ | (96,911 | ) |

| Diluted net income (loss) per share | $ | 0.01 |

| | $ | (0.16 | ) |

| Shares used in computing diluted net income (loss) per share | 664,310 |

| | 612,512 |

|

| | Three Months Ended April 30, |

| | 2015 | | 2014 |

| Non-GAAP Diluted Net Income Per Share | | | |

| Non-GAAP net income | $ | 108,335 |

| | $ | 69,516 |

|

| Diluted Non-GAAP net income per share | $ | 0.16 |

| | $ | 0.11 |

|

| Shares used in computing diluted net income per share | 664,310 |

| | 648,000 |

|