Oromin Explorations Ltd.

2000 – 1055 West Hastings Street, Vancouver, B.C. V6E 2E9

Phone: (604) 331-8772 Fax: (604) 331-8773

August 18, 2008

| |

SECURITIES AND EXCHANGE COMMISSION | VIA EDGAR |

Judiciary Plaza Office Building

450 Fifth Street, N.W.

Washington, D.C. 20549

Dear Sir or Madam:

RE:

Oromin Explorations Ltd. - (File #0-30614)

Form 6-K

On behalf of Oromin Explorations Ltd., a corporation under the laws of British Columbia, Canada, we enclose for filing, one (1) copy of Form 6-K, including exhibits.

If you have any questions, please contact the undersigned at your convenience.

Very truly yours,

OROMIN EXPLORATIONS LTD.

“Chet Idziszek”_________

per:

Chet Idziszek

President

Enclosures

cc:

Miller Thomson, Attn: Mr. Peter McArthur

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of JULY 2008

OROMIN EXPLORATIONS LTD. (File #0-30614)

(Translation of registrant's name into English)

Suite 2000, 1055 West Hastings St., Vancouver, B.C. Canada, V6E 2E9

(Address of principal executive offices)

Attachments:

·

Oromin Explorations Ltd. – News Release dated July 2, 2008,

·

Oromin Explorations Ltd. – BC FORM 53-901F Material Change,

·

Oromin Explorations Ltd. – Notice of Annual and Special Meeting, Information Circular, Financial Statements Request Form, Proxy and Voting Instruction Form,

·

Oromin Explorations Ltd. – News Release dated July 9, 2008,

·

Oromin Explorations Ltd. – BC FORM 53-901F Material Change

·

Oromin Explorations Ltd. – News Release dated July 16, 2008,

·

Oromin Explorations Ltd. – BC FORM 53-901F Material Change,

·

Oromin Explorations Ltd. – News Release dated July 24, 2008,

·

Oromin Explorations Ltd. – BC FORM 53-901F Material Change

·

Oromin Explorations Ltd. – News Release dated July 29, 2008,

·

Oromin Explorations Ltd. – BC FORM 53-901F Material Change,

·

Oromin Explorations Ltd. – Shareholder Rights Plan Agreement, Schedule A,

·

Oromin Explorations Ltd. – Interim Consolidated Financial Statements for the period ended May 31, 2008.

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F __________

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf of the undersigned, thereunto duly authorized.

OROMIN EXPLORATIONS LTD.

(Registrant)

Date: August 18, 2008

By: “Chet Idziszek”

Chet Idziszek

Its: President

(Title)

OROMIN Suite 2000, Guinness Tower, 1055 West Hastings Street, Vancouver, B.C. Canada V6E 2E9

| | |

EXPLORATIONS LTD. | | Tel: (604) 331-8772 Toll free(877) 529-8475 |

| | Fax: (604) 331-8773 E- mail: info@oromin.com |

| |

July 2, 2008 | Trading Symbol: TSX Venture – OLE OTC/BB - OLEPF Web Site: www.oromin.com |

Oromin’s Year End Financials Delayed

Oromin Explorations Ltd. (the “Company”)(TSX-V: OLE; OTC/BB-OLEPF)advises that its year-end financial filings, due June 30, 2008 (the “Audited Financial Statements”), are delayed, due solely to delays in compiling year-end information from the Company's joint venture interests in Senegal, Africa, from the recent scaling up of operations on its oil & gas project in Argentina, and from the workload of carrying out an audit of internal controls pursuant to U.S. Sarbanes-Oxley legislation. The late filing in no way reflects the financial condition of the Company - the Company is well-funded and exploration on its Sabodala property is going extremely well.

Reflecting the delayed financial filing, the Company requested and the British Columbia Securities Commission (“BCSC”) has granted a Management Cease Trade Order (“MCTO”). Under the terms of the MCTO, the Company will provide bi-weekly update reports as to the completion of the Audited Financial Statements. The MCTO only applies to the Company's directors and senior officers and does not restrict the ability of the Company's public shareholders to buy and sell shares of the Company.

As required by the BCSC, the Notice of Default issued under CSA Notice 57-301 is reprinted in its entirety – see page 2 of this release.

As a consequence to this notice, no director, officer or other insider is permitted to buy, sell or otherwise transact in the shares of the Company until the Audited Financial Statements are filed and the MCTO is removed.

For further information, please contact the Company.

On behalf of the Board of Directors of

OROMIN EXPLORATIONS LTD.

“Chet Idziszek”

Chet Idziszek, President

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY

FOR THE ADEQUACY AND ACCURACY OF THIS RELEASE

Cautionary Statement

This document contains “forward-looking statements” within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration plans and our other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. Such forward-looking statements include, without limitation, estimates of exploration investment and the scope of exploration programs. There can be no assurance that such statements will prove to be accurate, and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations are disclosed in the Company’s documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates or opinions change. Forward-looking statements are subject to risks, uncertainties and other factors, including risks associated with mineral exploration, price volatility in the mineral commodities we seek, and operational and political risks. Readers are advised not to place undue reliance on forward-looking statements.

- 2 -

CSA NOTICE 57-301 (the “Notice”)

Notice of Default

1.

Oromin Explorations Ltd. (the “Company”) is unable to file its audited financial statements for the twelve-month period ending February 29, 2008 (the “Audited Financial Statements”) by June 30, 2008 (the “Filing Deadline”), as required pursuant to National Instrument 51-102 Continuous Disclosure Obligations.

2.

The delay in filing results from delays in compiling year-end information from the Company's joint venture interests in Senegal, Africa, from the recent scaling up of operations on its oil & gas project in Argentina, and from the workload of carrying out an audit of internal controls pursuant to U.S. Sarbanes-Oxley legislation.

3.

The Company expects to file the Audited Financial Statements by July 25, 2008.

4.

August 30, 2008 is the date that is two months after the Filing Deadline and the securities commissions or regulators in British Columbia and Alberta may impose an issuer cease trade order (a “CTO”) if the Audited Financial Statements are not filed by that time. An issuer CTO may be imposed sooner if the Company fails to file Default Status Reports pursuant to Appendix B of CSA Notice 57-301 on time.

5.

The Company confirms that it intends to issue a Default Status Report on a bi-weekly basis, disclosing the requisite details, as required under Appendix B of CSA Notice 57-301, for as long as it remains in default of the Audited Financial Statement Filing Deadline.

6.

The Company is not subject to any insolvency proceedings.

7.

There is no other material information concerning the affairs of the Company that has not been generally disclosed.

OROMIN EXPLORATIONS LTD.

Suite 2000 - 1055 West Hastings Street

Vancouver, B.C., V6E 2E9

TELEPHONE: (604) 331-8772

NOTICE OF ANNUAL AND SPECIAL MEETING

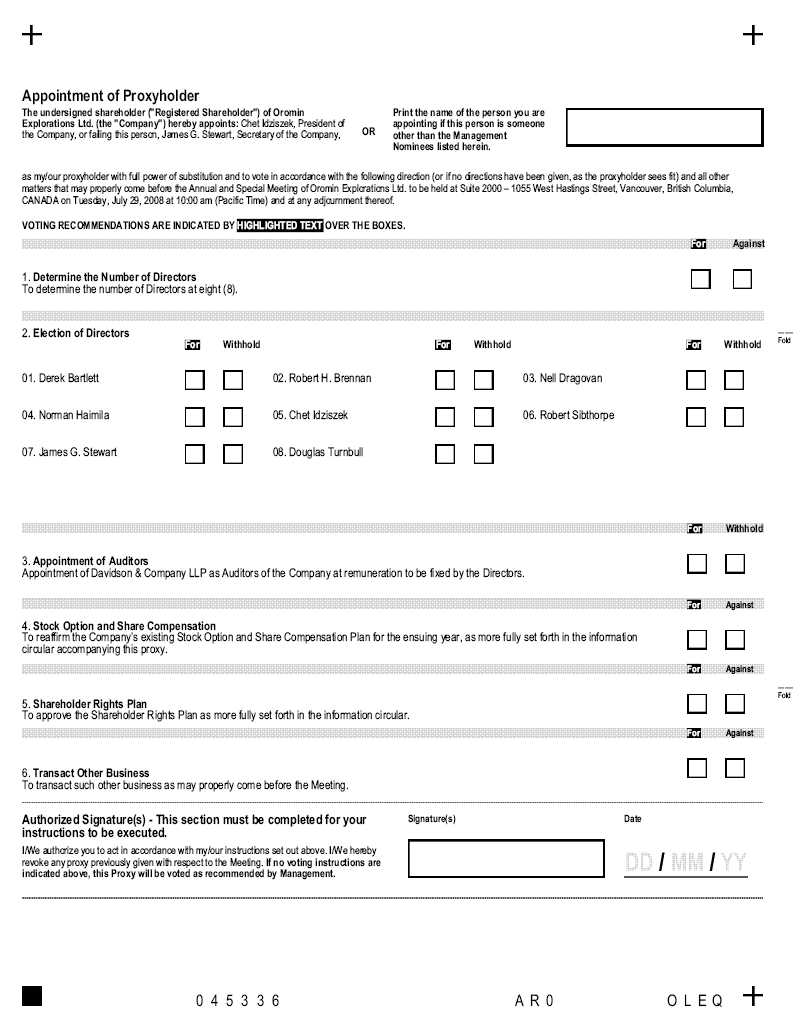

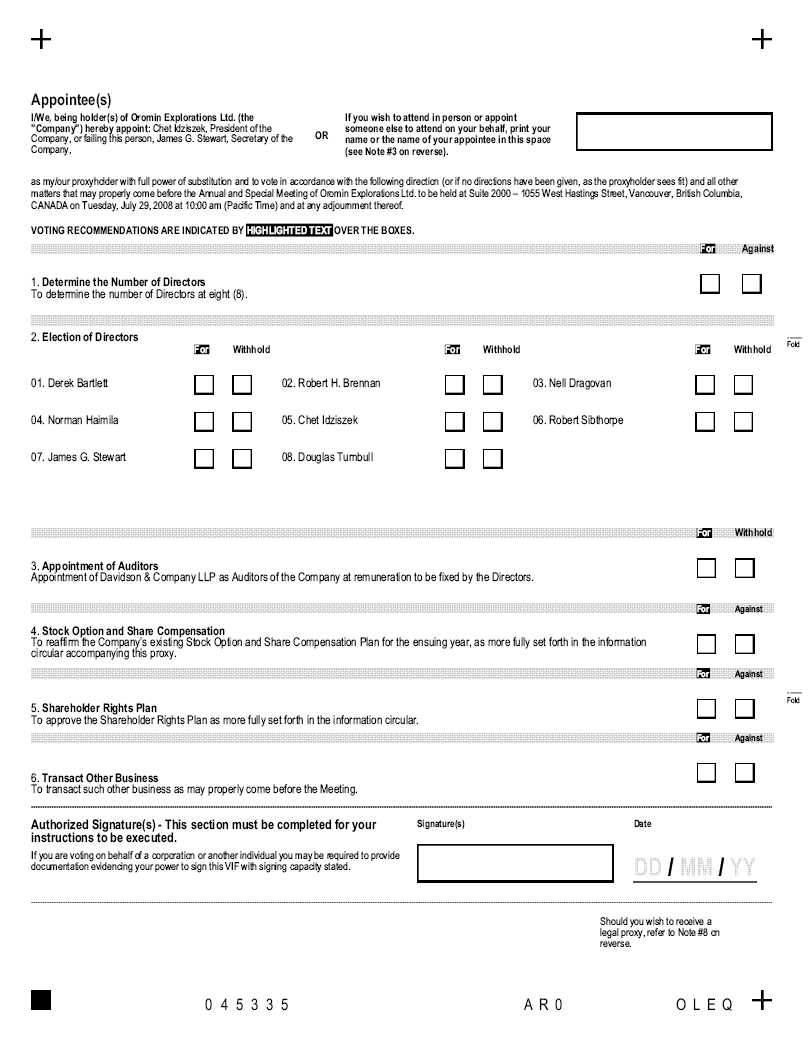

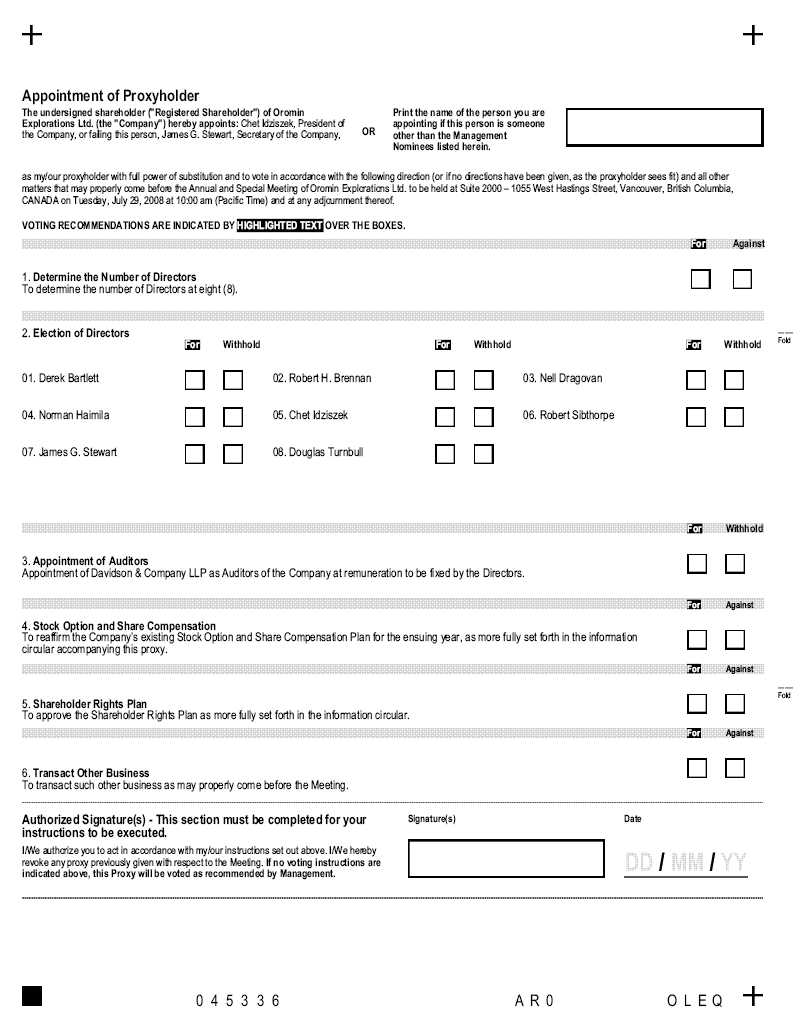

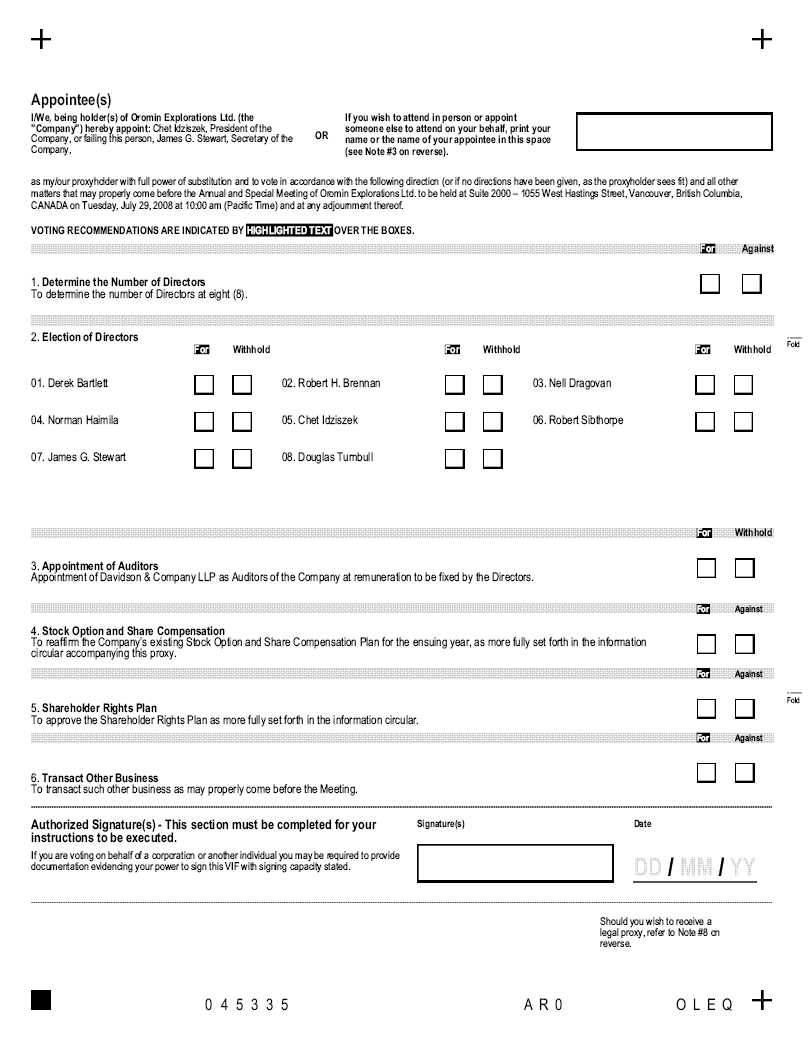

NOTICE IS HEREBY GIVEN THAT the Annual and Special Meeting of shareholders ofOROMIN EXPLORATIONS LTD. (the "Company") will be held at Suite 2000 – 1055 West Hastings Street, Vancouver, British Columbia, onJuly 29, 2008, at the hour of 10:00 A.M., Vancouver time, for the following purposes:

1.

To receive and consider the report of the Directors and the audited consolidated financial statements of the Company together with the auditor's report thereon for the financial year ended February 29, 2008.

2.

To appoint the auditor for the ensuing year and to authorize the directors to fix the remuneration to be paid to the auditor.

3.

To fix the number of directors at eight (8).

4.

To elect directors for the ensuing year.

5.

To reaffirm the Company’s existing Stock Option and Share Compensation Plan for the ensuing year, as more fully set forth in the information circular accompanying this notice (the “Information Circular”).

6.

To consider and, if thought fit, to pass an ordinary resolution to approve, ratify and confirm the Shareholder Rights Plan (the “Plan”) adopted by the Directors on June 27, 2008, the terms of which are more particularly described in the Company’s Information Circular, and any rights issued pursuant to such Plan.

7.

To transact such further or other business as may properly come before the meeting and any adjournments thereof.

The accompanying information circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this notice.

If you are unable to attend the meeting in person, please complete, sign and date the enclosed form of proxy and return the same in the enclosed return envelope provided for that purpose within the time and to the location set out in the form of proxy accompanying this notice.

DATED this 30th day of June, 2008.

BY ORDER OF THE BOARD OF DIRECTORS

“Chet Idziszek”

Chet Idziszek,

(President and Chief Executive Officer)

OROMIN EXPLORATIONS LTD.

INFORMATION CIRCULAR

as at June 30, 2008

SOLICITATION OF PROXIES

This information circular is furnished in connection with the solicitation of proxies by the management of Oromin Explorations Ltd. (the “Company”) for use at the annual and special meeting of the shareholders of the Company (the “Meeting”) to be held at the time and place and for the purposes set forth in the accompanying notice of Meeting and at any adjournment thereof. Unless the context otherwise requires, references to the Company include the Company and its subsidiaries. The solicitation will be by mail and possibly supplemented by telephone or other personal contact to be made without special compensation by regular officers and employees of the Company. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company. The Company does not reimburse shareholders, nominees or agents for the costs incurred in obtaining from their principals authorization to execute forms of proxy.

APPOINTMENT OF PROXIES

The persons named in the accompanying instrument of proxy are directors and/or officers of the Company, and are proxyholders nominated by management. A SHAREHOLDER HAS THE RIGHT TO APPOINT A PERSON TO ATTEND AND ACT ON ITS BEHALF AT THE MEETING OTHER THAN THE NOMINEES OF MANAGEMENT NAMED IN THE ENCLOSED INSTRUMENT OF PROXY. TO EXERCISE THIS RIGHT, A SHAREHOLDER MUST STRIKE OUT THE NAMES OF THE NOMINEES OF MANAGEMENT NAMED IN THE INSTRUMENT OF PROXY AND INSERT THE NAME OF ITS NOMINEE IN THE BLANK SPACE PROVIDED ON THE PROXY. A PERSON APPOINTED AS PROXYHOLDER NEED NOT BE A SHAREHOLDER OF THE COMPANY.

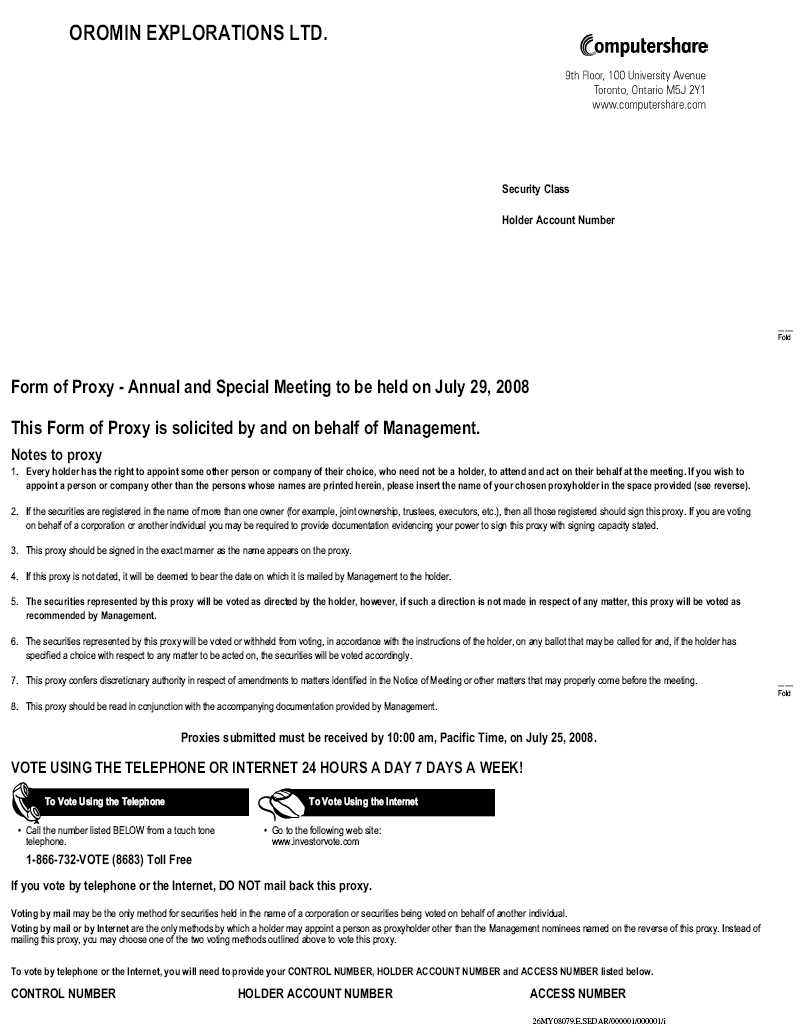

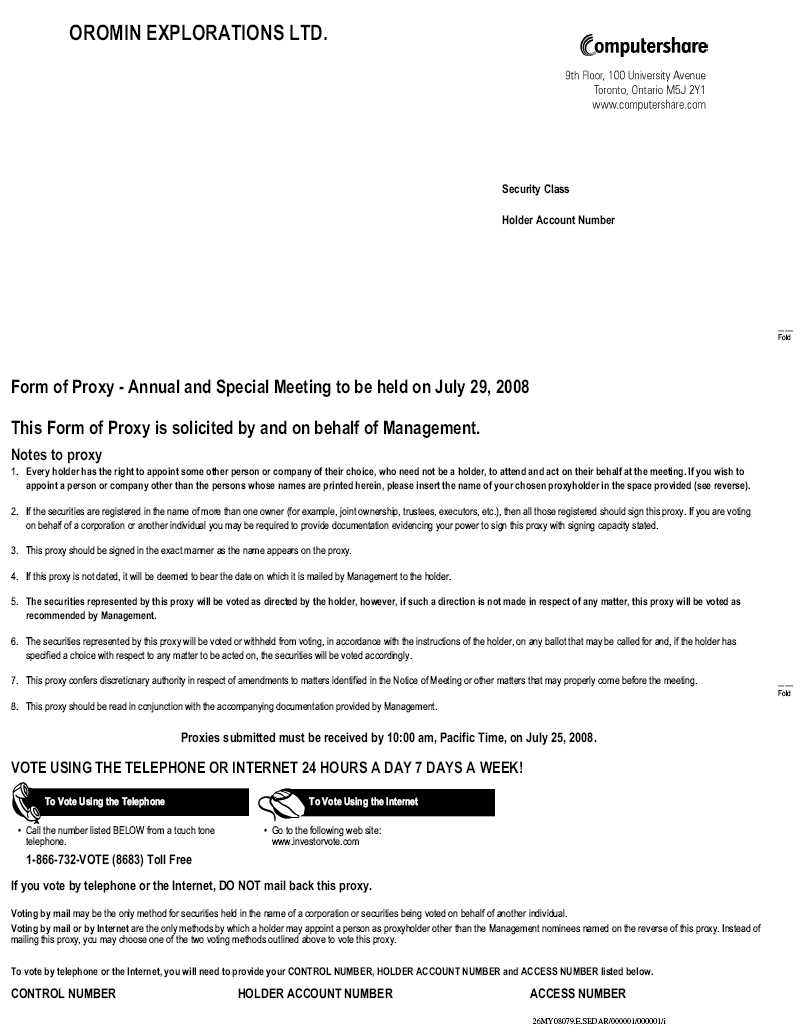

A form of proxy will only be valid if it is duly completed and signed as set out below and must be received either by mail, fax, telephone or internet voting with the Company’s registrar and transfer agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 (Fax: 1-866-249-7775 or outside North America Fax: 416-263-9524) or the Company’s head office, Suite 2000 – 1055 West Hastings Street, Vancouver, B.C., V6E 2E9 (Fax: 604-331-8773) no later than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the commencement of the Meeting or any adjournment thereof.

An instrument of proxy must be signed by the shareholder or its attorney in writing, or, if the shareholder is a corporation, it must either be under its common seal or signed by a duly authorized officer.

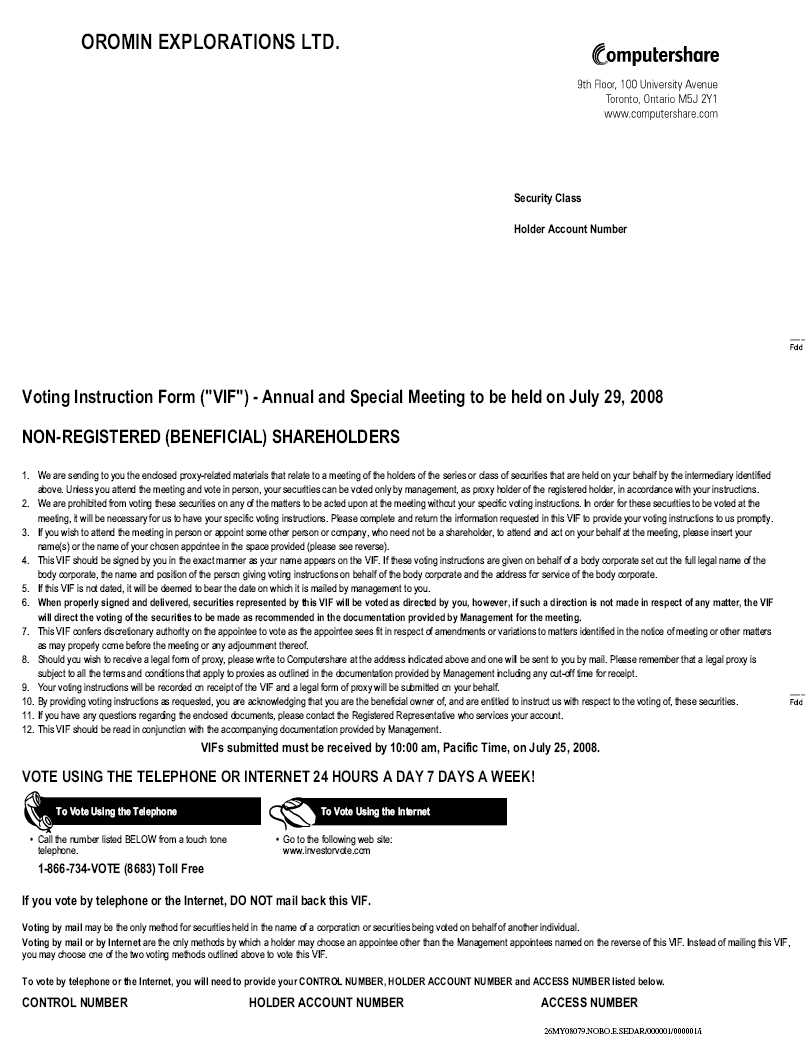

ADVICE TO BENEFICIAL SHAREHOLDERS

The information set forth in this section is of significant importance to many shareholders, as many shareholders do not hold their shares in the Company in their own name.Shareholders holding their shares through their brokers, intermediaries, trustees or other persons (collectively, an “Intermediary”) or otherwise not in their own name (such shareholders referred to herein as “Beneficial Shareholders”) should note that only proxies deposited by shareholders appearing on the records maintained by the Company’s transfer agent as registered shareholders will be recognized and allowed to vote at the Meeting. If a shareholder’s shares are listed in an account statement provided to the shareholder by a broker, in all likelihood those shares arenot registered in the shareholder’s name and that shareholder is a Beneficial Shareholder. Such shares ar e most likely registered in the name of the shareholder’s broker or an agent of that broker.

- 2 -

In Canada the vast majority of such shares are registered under the name of CDS & Co., the registration name for The Canadian Depository for Securities, which acts as nominee for many Canadian brokerage firms. Shares held by Intermediaries, such as those held on behalf of a broker’s client, can only be voted at the Meeting at the direction of the Beneficial Shareholder. Regulatory policies require Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholder meetings, and without specific instructions Intermediaries are prohibited from voting the shares of Beneficial Shareholders. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate party well in advance of the Meeting.

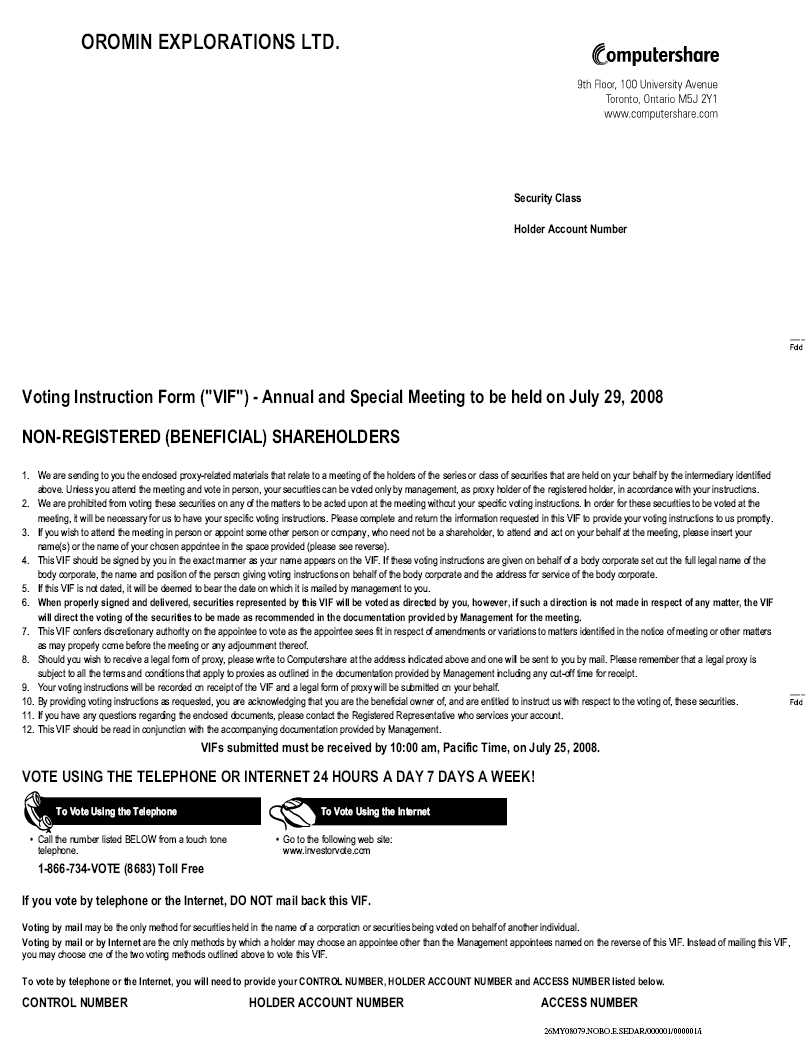

Materials pertaining to the Meeting which are sent to Beneficial Shareholders will generally be accompanied by one of the following forms:

(a)

A form of proxywhich has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Beneficial Shareholder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, it does not need to be signed by the Beneficial Shareholder. In this case, the Beneficial Shareholder who wishes to submit a proxy should otherwise properly complete the form of proxy and deposit it as set out under the heading “Appointment of Proxies”. If a Beneficial Shareholder wishes to appear in person at the Meeting, it should strike out the names of the nominees of management named in the instrument of proxy and insert its name or the name of its nominee in the blank space provided on the proxy prior to the proxy being deposited.

(b)

A voting instruction form (“VIF”)which is not signed by the Intermediary, and which, when properly completed and signed by the Beneficial Shareholder andreturned to the Intermediary (or its service company), will constitute voting instructions which the Intermediary must follow. The VIF may consist of a one page pre-printed form or a regular printed instrument of proxy accompanied by a page of instructions which often includes a removable label containing a bar-code and other information. If the form of VIF is the former, the Beneficial Shareholder must properly complete and sign the VIF and return it to the Intermediary in the manner specified in the VIF. If the form of VIF is the latter, the Beneficial Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary in the manner specified in the VIF.

By properly returning the VIF in accordance with the instructions noted on it, a Beneficial Shareholder is able to instruct the Intermediary (or other registered shareholder) how to vote the Beneficial Shareholder’s shares on its behalf. For this to occur, it is important that the VIF be completed and returned in accordance with the specific instructions noted on the VIF.

The vast majority of Intermediaries delegate responsibility for obtaining instructions from Beneficial Shareholders to Broadridge Investor Communication Solutions, Canada (“Broadridge”) formerly known as ADP Investor Communications in Canada. Broadridge typically prepares a machine-readable VIF instead of a proxy, mails these VIFs to Beneficial Shareholders and asks Beneficial Shareholders to return the VIFs to Broadridge, usually by way of mail, the Internet or telephone. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting by proxies for which Broadridge has solicited voting instructions. A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote shares directly at the Meeting. The VIF must be returned to Broadridge (or instructions resp ecting the voting of shares must otherwise be communicated to Broadridge) well in advance of the Meeting in order to have the shares voted. If you have any questions respecting the voting of shares held through an Intermediary, please contact that Intermediary for assistance.

- 3 -

Should a Beneficial Shareholder who receives a VIF wish to attend the Meeting or have someone else attend on its behalf, the Beneficial Shareholder may request a legal proxy as set forth in the VIF, which will grant the Beneficial Shareholder or its nominee the right to attend and vote at the Meeting as set out under the heading “Appointment of Proxies”.

All references to shareholders in this information circular and the accompanying instrument of proxy and notice of Meeting are to registered shareholders unless specifically stated otherwise.

These materials pertaining to the Meeting are being sent to both registered shareholders and Beneficial Shareholders. Beneficial Shareholders have the option of not objecting to their Intermediary disclosing certain ownership information about themselves to the Company (such Beneficial Shareholders are designated as non-objecting beneficial owners, or “NOBOs”) or objecting to their Intermediary disclosing ownership information about themselves to the Company (such Beneficial Shareholders are designated as objecting beneficial owners, or “OBOs”).

In accordance with the requirements of National Instrument 54-101 of the Canadian Securities Administrators, the Company has elected to send these materials pertaining to the Meeting directly to the NOBOs and indirectly through Intermediaries to the OBOs. The Intermediaries are responsible for forwarding the meeting materials to OBOs.

If you are a Beneficial Shareholder and the Company or its agent has sent these materials pertaining to the Meeting directly to you, your name and address and information about your holdings of the Company’s securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf. By choosing to send these Meeting materials to you directly, the Company (and not the Intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the VIF or instrument of proxy, as the case may be.

REVOCATION OF PROXIES

A proxy may be revoked by:

(a)

signing a proxy bearing a later date and depositing it at the place and within the time aforesaid;

(b)

signing and dating a written notice of revocation (in the same manner as the proxy is required to be executed, as set out in the notes to the proxy) and either delivering the same to the registered office of the Company, located at 1000 – 840 Howe Street, Vancouver, British Columbia, V6Z 2M1, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof at which the proxy is to be used, or to the Chairman of the Meeting on the day of the Meeting or any adjournment thereof;

(c)

attending the Meeting or any adjournment thereof and registering with the Scrutineer thereat as a shareholder present in person, whereupon such proxy shall be deemed to have been revoked; or

(d)

in any other manner provided by law.

Only registered shareholders have the right to revoke a proxy. A Beneficial Shareholder who wishes to change its vote must, at least seven days before the Meeting, arrange for its Intermediary to revoke its proxy on its behalf.

- 4 -

VOTING OF SHARES AND EXERCISE OF DISCRETION OF PROXIES

If a shareholder specifies a choice with respect to any matter to be acted upon, the shares represented by proxy will be voted or withheld from voting by the proxyholder in accordance with those instructions on any ballot that may be called for. In the enclosed form of proxy, in the absence of any instructions in the proxy, it is intended that such shares will be voted by the proxyholder, if a nominee of management, in favour of the motions proposed to be made at the Meeting as stated under the headings in the notice of meeting to which this information circular is attached. If any amendments or variations to such matters, or any other matters, are properly brought before the Meeting, the proxyholder, if a nominee of management, will exercise its discretion and vote on such matters in accordance with its best judgment.

The instrument of proxy enclosed, in the absence of any instructions in the proxy, also confers discretionary authority on any proxyholder (other than the nominees of management named in the instrument of proxy) with respect to the matters identified herein, amendments or variations to those matters, or any other matters which may properly be brought before the Meeting. To enable a proxyholder to exercise its discretionary authority a shareholder must strike out the names of the nominees of management in the enclosed instrument of proxy and insert the name of its nominee in the space provided, and not specify a choice with respect to the matters to be acted upon. This will enable the proxyholder to exercise its discretion and vote on such matters in accordance with its best judgment.

At the time of printing this information circular, management of the Company is not aware that any amendments or variations to existing matters or new matters are to be presented for action at the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

Only those common shareholders of record on June 17, 2008, (the “Record Date”) will be entitled to vote at the Meeting or any adjournment thereof, in person or by proxy. On June 17, 2008, 65,184,906 common shares without par value were issued and outstanding, each share carrying the right to one vote. The Company is authorized to issue unlimited common shares without par value.

To the best of the knowledge of management of the Company, as of the Record Date no shareholder beneficially owns, directly or indirectly, or exercises control or direction over, shares carrying 10% or more of the voting rights attached to all outstanding shares of the Company, except the following:

| | |

Name | No. of Common Shares Owned or Controlled | Percentage of Outstanding Common Shares |

Chet Idziszek | 6,809,537 shares | 10.5% |

ELECTION OF DIRECTORS

The directors of the Company (the “Directors”) are elected at each annual general meeting and hold office until the next annual general meeting, unless a Director resigns or is otherwise removed in accordance with the Articles of the Company or the provisions of theBusiness Corporations Act (British Columbia). In the absence of instructions to the contrary, the enclosed proxy will be voted for the nominees herein listed.

Shareholder approval will be sought to fix the number of Directors of the Company at eight (8).

The Company is required to have an audit committee. Members of this committee are as set out below.

- 5 -

Management of the Company proposes to nominate each of the following persons for election as a Director. Information concerning such persons, as furnished by the individual nominees, is as follows:

| | | |

Name, Municipality of Residence and Position | Previous Service As a Director | Number of common shares beneficially owned or, directly or indirectly, controlled(1) | Principal Occupation or employment and, if not a previously elected Director, occupation during the past 5 years |

DEREK BARTLETT Mississauga, Ontario

Director and Audit Committee Member | Since 2002 | 5,000 shares | Consultant; Former President of Kingsman Resources Inc. and Saville Resources Inc. since 1994 and a director of several other junior mining companies. |

ROBERT H. BRENNAN

Chicago, Illinois

Director | Since April 2006 | 1,321,761 shares | Senior Vice President, CB Richard Ellis – Capital Markets. Financier. |

NELL M. DRAGOVAN

Vancouver, British Columbia

Director | Since 2004 | 1,936,904 shares | Businesswoman |

NORMAN HAIMILA

Hermann, Missouri

Director and Audit Committee Member | Since 2001 | 95,000 shares | Consulting Geologist |

CHET IDZISZEK

Vancouver, British Columbia

President and Director | Since 1994 | 6,809,537 shares | Geologist; President of Madison Minerals Inc., a mineral exploration company |

ROBERT A. SIBTHORPE

Vancouver, British Columbia

Director and Audit Committee Member | Since 2004 | Nil shares | Consulting geologist; previously mining analyst for Canaccord Capital Corp. from 1996 to 2001. |

JAMES G. STEWART

Vancouver, British Columbia

Director and Corporate Secretary | Since 1995 | 626,377 shares(2) | Barrister and Solicitor |

DOUGLAS TURNBULL

Coquitlam, British Columbia

Director | Since 2002 | 46,000 shares | Geological Consultant; President of Lakehead Geological Services Inc. |

|

Note: (1) Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as at the Record Date, based upon information furnished to the Company by individual Directors. Unless otherwise indicated, such shares are held directly. (2) Of these shares 495,877 shares are held indirectly in the name of J.G. Stewart Law Corporation Ltd., a private company controlled by James G. Stewart. |

Except as noted below, no proposed director:

(a)

is, as at the date of this information circular, or has been, within 10 years before the date of this information circular, a director, chief executive officer or chief financial officer of any company (including the Company) that,

(i)

was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer;

- 6 -

(ii)

was subject to an event that resulted, after the director, chief executive officer or chief financial officer ceased to be a director, chief executive officer or chief financial officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

(b)

is, as at the date of this information circular, or has been within 10 years before the date of this information circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

(c)

has, within the 10 years before the date of this information circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director; or

(d)

has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable investor making an investment decision.

Mr. Derek Bartlett was a director of Diadem Resources Ltd. (“DRL”), a company listed on TSX Venture Exchange, which was the subject of cease trade orders issued by the Ontario Securities Commission on October 23, 2001 and October 22, 2002 for failure to file required financial information. The required financial information were filed in December, 2001 and December, 2002 and the Ontario Securities Commission orders were revoked on December 17, 2001 and December 24, 2002 respectively.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth all annual and long term compensation for services in all capacities to the Company and its subsidiaries for the three most recently completed financial years in respect of the Chief Executive Officer and the Chief Financial Officer as at February 29, 2008, and the other three most highly compensated executive officers of the Company as at February 29, 2008, whose individual total compensation for the most recently completed financial year exceeded $150,000 (of which there were none) and any individual who would have satisfied these criteria but for the fact that individual was not serving as such an officer at the end of the most recently completed financial year (collectively the “Named Executive Officers” or “NEOs”).

The Company currently has two Named Executive Officers: Chet Idziszek, President and Chief Executive Officer; and Ian Brown, Chief Financial Offer. Until March 31, 2007, Naomi Corrigan was the Chief Financial Officer. Mr. Brown commenced his duties April 15, 2007. Ms. Corrigan continues as a consultant.

The following table sets forth the summary of the compensation paid for the past three fiscal years to the Named Executive Officers:

- 7 -

| | | | | | | | |

Name and Principal Position | Fiscal Year Ended

| Annual Compensation | Long Term Compensation | All Other Compen-sation

($) |

Awards | Payouts |

Salary

($) | Bonus

($) | Other Annual Compen-sation ($) | Securities Under Options Granted (#) | Shares/

Units Subject to Resale Restric-tions

($) | LTIP Payouts

($) |

Chet Idziszek,

President and CEO | Feb. 29, 2008

Feb. 28, 2007

Feb. 28, 2006 | $162,153

$144,812

$138,000 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

850,000 | N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

Ian Brown,

CFO | Feb. 29, 2008

Feb. 28, 2007

Feb. 28, 2006 | $44,500

N/A

N/A | Nil

N/A

N/A | Nil

N/A

N/A | 200,000

N/A

N/A | N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

Naomi Corrigan,

Former CFO | Feb. 29, 2008

Feb. 28, 2007

Feb. 28, 2006 | $7,970

$42,283

$34,189 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

30,000 | N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

Long Term Incentive Plans

The Company does not have a Long Term Incentive Plan pursuant to which it provides compensation intended to motivate performance over a period greater than one financial year.

Options and SARs Granted During the Most Recently Completed Financial Year

The following table sets forth a summary of share options granted to the Named Executive Officers during the fiscal year ended February 29, 2008:

| | | | | |

NEO Name | Securities Under Options / SARs Granted (#) | % of Total Options / SARs Granted | Exercise or Base Price ($ / Security) | Market Value of Securities Underlying Options / SARs at Date of Grant ($ / Security) | Expiration Date |

Chet Idziszek,

President and CEO | Nil | N/A | N/A | N/A | N/A |

Ian Brown, CFO | 200,000 | 100% | $2.80 | $2.79 | April 20, 2012 |

Naomi Corrigan,

Former CFO | Nil | N/A | N/A | N/A | N/A |

|

Note: (1) The exercise price of stock options is set at not less than 100% of the market value (as defined in the Company’s Incentive Stock Option Plan) of a common share of the Company on the date of grant. The exercise price of stock options may only be adjusted in the event that specified events cause a change in the Company’s share capital. Options vest immediately upon grant, with some exceptions in cases such as new optionees where vesting terms may be imposed at the discretion of the Board of Directors. |

- 8 -

Aggregated Option/SAR Exercises During the Most Recently Completed Financial Year and Financial Year-End Option/SAR Values

The following table sets forth a summary of share options exercised by and remaining outstanding to the Named Executive Officers for the fiscal year ended February 29, 2008:

| | | | |

Name | Shares Acquired on Exercise

(#) | Aggregate Value Realized

($) | Unexercised Options at Fiscal Year-End Exercisable/Unexercisable | $ Value of Unexercised In-the-Money Options (1) Exercisable/Unexercisable |

Chet Idziszek,

President | Nil | Nil | 1,145,000/Nil | $2,564,250/Nil |

Ian Brown, CFO | Nil | Nil | 100,000/100,000 | $60,000/$60,000 |

Naomi Corrigan,

Former CFO | Nil | Nil | 30,000/Nil | $45,000/Nil |

|

Note: (1) Value of unexercised in-the-money options calculated using the closing price of $3.40 for the common shares of the Company on the TSX Venture Exchange on February 29, 2008, less the exercise price of in-the-money options. |

Termination of Employment, Change in Responsibilities and Employment Contracts

During the most recently completed financial year there were no employment contracts between the Company or its subsidiaries and a NEO, and no compensatory plans, contracts or arrangements where a NEO is entitled to receive more than $100,000 from the Company or its subsidiaries, including periodic payments or instalments, in the event of:

(a)

the resignation, retirement or any other termination of the NEO’s employment with the Company and its subsidiaries;

(b)

a change of control of the Company or any of its subsidiaries; or

(c)

a change in the NEO’s responsibilities following a change in control.

Compensation of Directors

The Company has no arrangements, standard or otherwise, pursuant to which directors are compensated for providing services in their capacity as directors, for committee participation or for involvement in special assignments during the most recently completed financial year or subsequently up to and including the date of this information circular, except that directors are compensated for their actual expenses incurred in pursuance of their duties as directors and certain directors may be compensated for services rendered as consultants or experts. In this regard, Norman Haimila and a corporation controlled by Douglas Turnbull were paid or accrued $121,543 and $128,420 respectively for geological consulting services rendered and a company controlled by J.G. Stewart was paid or accrued $76,750 for professional services rendered. Ms. Nell Dragovan received $61,000 in salary.

Option Grants in Last Fiscal Year

The following table sets forth stock options granted by the Company during the fiscal year ended February 29, 2008 to directors who are not Named Executive Officers of the Company:

- 9 -

| | | | | |

Name | Securities Under Options Granted (#) | % of Total Options Granted in Fiscal Year | Exercise or Base Price ($/Security) (1) | Market Value of Securities Underlying Options on Date of Grant ($/Security) | Expiration Date |

Derek Bartlett | Nil | N/A | N/A | N/A | N/A |

Robert H. Brennan | Nil | N/A | N/A | N/A | N/A |

Nell Dragovan | Nil | N/A | N/A | N/A | N/A |

Norman Haimila | Nil | N/A | N/A | N/A | N/A |

Robert Sibthorpe | Nil | N/A | N/A | N/A | N/A |

James G. Stewart | Nil | N/A | N/A | N/A | N/A |

Douglas Turnbull | Nil | N/A | N/A | N/A | N/A |

|

Notes:

(1) The exercise price of stock options is set at not less than 100% of the market value (as defined in the Company’s Incentive Stock Option Plan) of a common share of the Company on the date of the grant. The exercise price of stock options may only be adjusted in the event that specified events cause a change in the Company’s share capital. Options vest immediately upon grant. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End-Option Values

The following table sets forth details of all exercises of stock options during the fiscal year ended February 29, 2008, by directors who are not Named Executive Officers of the Company, and the fiscal year-end value of unexercised options on an aggregated basis:

| | | | |

Name | Securities Acquired on Exercise

(#) | Aggregate Value Realized

($) | Unexercised Options at Fiscal Year-End

(#)

Exercisable | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(1)

Exercisable |

Derek Bartlett | Nil | Nil | 145,000 | $374,250 |

Robert H. Brennan | Nil | Nil | 200,000 | $300,000 |

Nell Dragovan | Nil | Nil | 295,000 | $805,500 |

Norman Haimila | Nil | Nil | 75,000 | $112,500 |

Robert Sibthorpe | Nil | Nil | 50,000 | $75,000 |

James G. Stewart | Nil | Nil | 195,000 | $490,500 |

Douglas Turnbull | Nil | Nil | 95,000 | $175,500 |

|

Notes:

(1) Value of unexercised in-the-money options calculated using the closing price of common shares of the Company on the TSX Venture Exchange on February 29, 2008, which was $3.40, less the exercise price of in-the-money stock options. |

There were no repricings of stock options held by directors and Named Executive Officers of the Company during the fiscal year ended February 29, 2008.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out, as of the end of the Company’s fiscal year ended February 29, 2008, all required information with respect to compensation plans under which equity securities of the Company are authorized for issuance:

- 10 -

| | | |

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

Equity compensation plans approved by securityholders | 3,958,000 | $1.50 | 2,539,258 |

Equity compensation plans not approved by securityholders | Nil | Nil | Nil |

TOTAL | 3,958,000 | $1.50 | 2,539,258 |

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

None of the directors or senior officers of the Company or any subsidiary thereof, or any associate or affiliate of the above, is or has been indebted to the Company at any time since the beginning of the last completed fiscal year of the Company.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No informed person or proposed nominee for election as a director, or any associate or affiliate of any of the foregoing, has or has had any material interest, direct or indirect, in any transaction or proposed transaction since the commencement of the Company’s most recently completed financial year, which has materially affected or will materially affect the Company, other than the following two transactions.

By an agreement dated March 12, 2007 between the Company and Lund Gold Ltd. ("Lund"), the Company sold all of its interest in the Carneirinho exploration project in Brazil to Lund in consideration of the issuance to the Company of 1,197,906 common shares of Lund at the ascribed price of $0.31 per share for a total ascribed transaction value of $371,351, this consideration being the cash amount that the Company had spent on acquisition, exploration and development of the Carneirinho project. Chet Idziszek, the President and a director of the Company, and J. G. Stewart, the Secretary and a director of the Company, were at that time and are to date also directors of Lund.

By an agreement dated March 11, 2008 the Company purchased 250,000 common shares of Surge Global Energy, Inc. ("Surge") at the price of USD $0.13 per share for a total purchase price of USD $32,500 from Chet Idziszek, the President and a director of the Company. The purchase price was set at the fair value of the Surge shares as established by quotations in the public market where Surge shares trade, and this transaction was made to facilitate the repurchase by the Company from Surge of a 17.52% interest in the Santa Rosa oil and gas project.

APPOINTMENT OF AUDITOR

Management proposes that Davidson & Company LLP, Chartered Accountants, be appointed as the auditor of the Company for the ensuing year and that the directors be authorized to fix their remuneration. Davidson & Company were first appointed the auditor of the Company on February 27, 2003 when PricewaterhouseCoopers LLP resigned as the auditor of the Company and the directors appointed Davidson & Company LLP to fill the vacancy.

- 11 -

AUDIT COMMITTEE

General

The Audit Committee is a standing committee of the Board, the primary function of which is to assist the Board in fulfilling its financial oversight responsibilities, which will include monitoring the quality and integrity of the Company’s financial statements and the independence and performance of the Company’s external auditor, acting as a liaison between the Board and the Company’s external auditor, reviewing the financial information that will be publicly disclosed and reviewing all audit processes and the systems of internal controls management that the Board has established.

Terms of Reference for the Audit Committee

The Board has adopted Terms of Reference for the Audit Committee, which sets out the Audit Committee’s mandate, organization, powers and responsibilities. The Audit Committee’s Terms of Reference is attached as Schedule “A” to this information circular.

Composition

The Audit Committee consists of the following three directors. Also indicated is whether they are ‘independent’ and ‘financially literate’.

| | |

Name of Member | Independent(1) | Financially Literate(2) |

Derek Bartlett | Yes | Yes |

Norman Haimila | No | Yes |

Robert A. Sibthorpe | Yes | Yes |

|

Notes: (1) A member of the Audit Committee is independent if he or she has no direct or indirect ‘material relationship’ with the Company. A material relationship is a relationship which could, in the view of the Board, reasonably interfere with the exercise of a member’s independent judgment. An officer of the Company, such as the president, and the members of his or her immediate family are deemed to have a material relationship with the Company. (2) A member of the Audit Committee is financially literate if he or she has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements. |

Because the shares of the Company are listed on the TSX Venture Exchange, it is categorized as a venture issuer. As a result, National Instrument 52-110Audit Committees (“NI 52-110”) exempts the Company’s Audit Committee from having all independent members.

Audit Committee Oversight

Since the commencement of the Company’s most recently completed financial year, there has not been a recommendation of the Audit Committee to nominate or compensate an external auditor which was not adopted by the Board.

- 12 -

Reliance on Certain Exemptions

Since the commencement of the Company’s most recently completed financial year, the Company has not relied on the exemption in section 2.4 (De Minimis Non-audit Services) of NI 52-110 or an exemption from NI 52-110, in whole or in part, granted under Part 8 (Exemptions) of NI 52-110.

Pre-Approval Policies and Procedures

The Audit Committee has not adopted specific policies and procedures for the engagement of non-audit services, however, as provided for in NI 52-110 the Audit Committee must pre-approve all non-audit services to be provided to the Company or its subsidiaries, unless otherwise permitted by NI 52-110.

External Auditor Service Fees (By Category)

| | | | |

Financial Year Ending | Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) |

February 29, 2008 | $60,000 | Nil | Nil | Nil |

February 28, 2007 | $45,500 | $7,500 | $5,500 | Nil |

|

Notes: (1) The aggregate fees billed by the Company’s auditor for audit fees. (2) The aggregate fees billed for assurance and related services by the Company’s auditor that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not disclosed in the ‘Audit Fees’ column. (3) The aggregate fees billed for professional services rendered by the Company’s auditor for tax compliance, tax advice and tax planning. These services involved the auditor’s provision of a tax opinion in connection with a flow-through share financing undertaken by the Company and the filing of the Company’s annual tax returns. (4) The aggregate fees billed for professional services other than those listed in the other three columns. |

Exemption

Pursuant to section 6.1 of NI 52-110, the Company is exempt from the requirements of Part 3Composition of the Audit Committeeand Part 5Reporting Obligations of NI 52-110 because it is a venture issuer.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

The Company is not aware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of each of the following persons in any matter to be acted upon at the Meeting other than the election of directors or the appointment of auditors:

(a)

each person who has been a director or executive officer of the Company at any time since the beginning of the Company’s last financial year;

(b)

each proposed nominee for election as a director of the Company; and

(c)

each associate or affiliate of any of the foregoing.

- 13 -

CORPORATE GOVERNANCE DISCLOSURE

The Company’s Board of Directors (the “Board”) believes that the principal objective of the Company is to generate economic returns with the goal of maximising shareholder value, and that this is to be accomplished by the Board through its stewardship of the Company. In fulfilling its stewardship function, the Board’s responsibilities will include strategic planning, appointing and overseeing management, succession planning, risk identification and management, environmental oversight, communications with other parties and overseeing financial and corporate issues. The Board believes that good corporate governance practices provide an important framework for timely response by the Board to situations that may directly affect shareholder value. The Board is committed to practising good corporate governance, and has adopted a corporate governance manual that contains numerous g uidelines to help it practice good corporate governance.

Board Independence

The Board must have the capacity, independently of management, to fulfil its responsibilities. Independence is based upon the absence of relationships and interests that could compromise the ability of a director to exercise judgement with a view to the best interests of the Company. To facilitate independence, the Company is committing to the following practices:

1.

The recruitment of strong, independent directors.

2.

A majority of the directors being independent.

3.

All committees of the Board being constituted of a majority of independent directors, and solely independent directors if possible.

Of the eight nominees for directors of the Company, Derek Bartlett, Robert Brennan, Robert A. Sibthorpe and Douglas Turnbull are independent. The remaining four directors, Norman Haimila, Chet Idziszek, Nell M. Dragovan and J.G. Stewart, are not independent because they are deemed to have a material relationship with the Company, by virtue of Dr. Haimila being the Vice President Exploration (Petroleum) of the Company, Mr. Idziszek being the President and Chief Executive Officer of the Company, Ms. Dragovan being a member of his immediate family and Mr. Stewart being the Secretary of the Company.

Other Directorships

Certain of the directors of the Company are also currently directors of the following other reporting issuers:

| |

Name | Reporting Issuer |

| |

Derek Bartlett | Cadman Resources Inc. |

| Kingsman Resources Ltd. |

| Newport Gold Inc. |

| Saville Resources Ltd. |

| Waseco Resources Ltd. |

| X-Cal Resources Ltd. |

| |

Nell M. Dragovan | Madison Minerals Inc. |

| |

Chet Idziszek | Cadman Resources Inc. |

| IMA Exploration Inc. |

| Lund Gold Ltd. |

| Madison Minerals Inc. |

- 14 -

| |

Name | Reporting Issuer |

Robert A. Sibthorpe | Black Pearl Minerals Consolidated Inc. |

| Klondex Mines Ltd. |

| Madison Minerals Inc. |

| TTM Resources Inc. |

| |

J.G. Stewart | Bayswater Uranium Corporation |

| Buffalo Gold Ltd. |

| Cascade Resources Inc. |

| CMYK Capital Inc. |

| Kingsman Resources Ltd. |

| Longview Capital Partners Incorporated |

| Lund Gold Ltd. |

| Madison Minerals Inc. |

| Salmon River Resources Ltd. |

| |

Douglas Turnbull | Buffalo Gold Ltd. |

| Dagilev Capital Corp. |

| Grizzly Diamonds Ltd. |

| Kola Mining Corp. |

| Salmon River Resources Ltd. |

Orientation and Continuing Education

New directors of the Company are provided with an orientation and education program which includes written information about the duties and obligations of directors, the business and operations of the Company, documents from recent board meetings and opportunities for meetings and discussion with senior management and other directors. Specific details of the orientation of each new director are tailored to that director’s individual needs and areas of interest.

The Company also provides continuing education opportunities to directors so that they may maintain or enhance their skills and abilities as directors and ensure that their knowledge and understanding of the Company’s business remains current.

Ethical Business Conduct

The Company has adopted a Code of Business Conduct and Ethics (the “Code”) which is intended to document the principles of conduct and ethics to be followed by the Company’s directors, officers and employees. The purpose of the Code is to:

1.

Promote integrity and deter wrongdoing.

2.

Promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest.

3.

Promote avoidance or absence of conflicts of interest.

4.

Promote full, fair, accurate, timely and understandable disclosure in public communications made by the Company.

5.

Promote compliance with applicable governmental laws, rules and regulations.

- 15 -

6.

Promote and provide a mechanism for the prompt, internal reporting of departures from the Code.

7.

Promote accountability for adherence to the Code.

8.

Provide guidance to the Company’s directors, officers and employees to help them recognise and deal with ethical issues.

9.

To help foster a culture of integrity, honesty and accountability throughout the Company.

Nomination of Directors

The Board as a whole is responsible for identifying and evaluating qualified candidates for nomination to the Board.

In identifying candidates, the Board considers the competencies and skills that the Board considers to be necessary for the Board, as a whole, to possess, the competencies and skills that the Board considers each existing director to possess, the competencies and skills each new nominee will bring to the Board and the ability of each new nominee to devote sufficient time and resources to his or her duties as a director.

Compensation

The Board as a whole is responsible for reviewing the adequacy and form of compensation paid to the Company’s executives and key employees, and ensuring that such compensation realistically reflects the responsibilities and risks of such positions.

In fulfilling its responsibilities, the Board evaluates the performance of the Company’s chief executive officer and other senior management in light of corporate goals and objectives, and makes recommendations with respect to compensation levels based on such evaluations.

Other Board Committees

The Board has not established any committees other than the Audit Committee.

Assessments

The Board has the responsibility for carrying out a review and assessment of the overall performance and effectiveness of the Board, its committees and contributions of individual directors on an annual basis. The objective of this review will be to facilitate a continuous improvement in the Board’s execution of its responsibilities.

PARTICULARS OF MATTERS TO BE ACTED UPON

Approval of Stock Option and Share Compensation Plan

The Company has a “rolling” stock option plan (the “Plan”), which makes a maximum of 10% of the issued and outstanding shares of the Company available for issuance thereunder.

The purpose of the Plan is to provide directors, officers and key employees of, and certain other persons who provide services to the Company and its subsidiaries, with an opportunity to purchase shares of the Company at a specific price, and subsequently benefit from any appreciation in the value of the Company’s shares. This provides an incentive for such persons to contribute to the future success of the Company and enhances the ability of the Company to attract and retain skilled and motivated individuals, thereby increasing the value of the Company’s shares for the benefit of all shareholders.

- 16 -

The Plan was approved by shareholders of the Company at the last annual general meeting held on July 31, 2007. In accordance with the policies of the TSX Venture Exchange (the “Exchange”), a rolling plan such as the Plan requires the approval of the shareholders of the Company on an annual basis.

The maximum number of common shares that may be issued upon exercise of stock options granted under the Plan will be that number of shares which is 10% of the issued and outstanding shares of the Company. The exercise price of stock options granted will be determined by the Company’s Board of Directors and will be priced in accordance with the policies of the Exchange, and will not be less than the closing price of the Company’s shares on the Exchange on the date prior to the date of grant less any allowable discounts. All options granted under the Plan will have a maximum term of five years.

The Plan provides that it is solely within the discretion of the Company’s Board of Directors to determine who should receive options and how many they should receive. The Board may issue a majority of the options to insiders of the Company. However, the Plan provides that in no case will the Plan or any existing share compensation arrangement of the Company result, at any time, in the issuance to any option holder, within a one year period, of a number of shares exceeding 5% of the Company’s issued and outstanding share capital.

In addition, the Plan provides that a maximum of 250,000 bonus shares (“Bonus Shares”), in the aggregate, may be issued in any calendar year to eligible persons, excluding directors, in consideration of the fair value of the extraordinary contribution to the Company by the recipient as determined by the Board, in its discretion, and shall be issued at a deemed price determined by the Board at the time of issuance of such Bonus Shares, but such price shall not be less than the market price. The granting of Bonus Shares pursuant to the Plan shall be subject to such further shareholder and regulatory approval as may be required by the Exchange.

The full text of the Plan is available for review by any shareholder up until the day preceding the Meeting at the Company’s head office, located at Suite 2000, 1055 West Hastings Street, Vancouver, British Columbia, and will also be available at the Meeting.

Upon the approval of the Plan by the Company’s shareholders, shareholder approval will not be required or sought on a case-by-case basis for the purpose of the granting of options to and the exercise of options under the Plan.

At the Meeting, shareholders will be asked to approve an ordinary resolution approving the Plan. The text of the resolution to be considered and, if thought fit, approved at the Meeting is substantially as follows:

“BE IT RESOLVED THAT:

1.

Subject to the approval of the TSX Venture Exchange, the Company’s stock option plan, which makes a total of 10% of the issued and outstanding shares of the Company available for issuance thereunder along with 250,000 bonus shares as described in the Company’s Information Circular dated June 30, 2008, be and is hereby approved.

2.

Any one director or officer of the Company be and is hereby authorized and directed to perform all such acts, deeds and things and execute all such documents and other instruments as may be required to give effect to the true intent of this resolution.”

Approval of the resolution will require the affirmative vote of a majority of the votes cast at the Meeting in respect thereof.

Management of the Company recommends that the shareholders vote in favour of the approval of the Plan, and the persons named in the enclosed form of proxy intend to vote for such approval at the Meeting unless otherwise directed by the shareholders appointing them.

- 17 -

Shareholder Rights Plan

Adoption of the Shareholder Rights Plan

Members will be asked at the Annual and Special Meeting to consider and, if deemed advisable, to approve a resolution to ratify the establishment of a shareholder rights plan (the “Rights Plan”).

On June 27, 2008, the Board unanimously approved the adoption of the Rights Plan to become effective on June 27, 2008 and the entering into by the Company of a shareholder rights plan agreement dated June 27, 2008 (the “Rights Agreement”) with Computershare Investor Services Inc., as Rights Agent.

Purpose of Rights Plan

The Rights Plan is adopted by the Company to ensure that any takeover bid made for the common shares of the Company would be made to all shareholders and provide the Board with sufficient time to consider any such offer and explore alternatives to allow shareholders to receive full and fair value for their common shares. Under provincial securities legislation, a take-over bid generally means an offer to acquire voting or equity shares of a company that, together with shares already owned by the bidder and certain parties related thereto, amount to 20% or more of the outstanding shares of that company. A take-over bid can be completed in between 21 and 30 days, which the Board believes is too short a time period for the Board to adequately assess the offer and, if necessary, develop other alternatives in offer to maximize shareholder value.

The Rights Plan is intended to encourage any person seeking to acquire control of the Company to make an offer that represents fair value to all shareholders and to provide the Board of the Company with sufficient time to assess and evaluate the offer, to permit competing bids to emerge and, as appropriate, to explore and develop alternatives to maximize value for shareholders.

The Rights Plan is not intended to deter take-over bids. Take-over bid contests for corporate control provide a singular opportunity for shareholders to obtain a once and for all gain. After the acquisition of effective control of a company, the opportunity for this one time gain normally does not recur. Like most companies, effective control of the Company can be secured through the ownership of less than 50% of its common shares. Without a Rights Plan, it would be possible for a bidder to acquire effective control over a relatively short period of time using various techniques permitted under the securities legislation in Canada, without ever making the bid available to all shareholders.

The Rights Plan is designed to protect the Company’s shareholders from this occurrence by virtue of the substantial dilution that could be experienced by a person or group that attempts to acquire control of the Company otherwise than pursuant to a Permitted Bid or a Competing Bid (as defined below). However, the Rights Plan will not interfere with any take-over which fits the criteria of a Permitted Bid, and, as a Permitted Bid, receives the approval of the shareholders as contemplated in the Rights Agreement, or with any merger or other business combination approved by the Company (such approval would be evidenced by the Board waiving the application of the Rights Plan to a particular take-over bid or by redeeming the Rights (as defined below) under certain circumstances).

The Rights Plan establishes rules for determining Beneficial Ownership (as defined below) of the common shares. Anyone seeking to acquire 20% or more of the outstanding common shares must, according the Rights Plan, either make a Permitted Bid or negotiate with the Board to avoid triggering the dilutive effects of the Rights Plan.

The Board is of the view that the Rights Plan will encourage persons seeking to acquire control of the Company to do so by means of a Permitted Bid which would be available to all shareholders, and as a result the Rights Plan will likely deter unfair, coercive bid tactics and strategies that do not treat all shareholders equally. Recent decisions of the Ontario Securities Commission indicate that a shareholder rights plan can be appropriately used for these purposes.

- 18 -

To qualify as a Permitted Bid under the Rights Plan, a take-over bid must be made for all common shares and must be open for 60 days after the bid is made. If at least 50% of the common shares held by persons independent of the bidder are deposited or tendered pursuant to the bid and not withdrawn, the bidder may take up and pay for such shares. The bid must then remain open for a further period of 10 business days on the same terms. This allows a shareholder to decide whether the bid is adequate on its own merits without being influenced by the likelihood that the bid will succeed. It also provides a shareholder who has not already tendered to a bid an opportunity to do so if at least 50% of common shares have been tendered to that bid.

The adoption of the Rights Plan does not affect the duty of the Board to act honestly and in good faith with a view to the best interests of the Company and its shareholders. It is not the intention of the Board in adopting the Rights Plan to secure the continuance in office of the existing members of the Board or to avoid an acquisition of control of the Company in a transaction that is considered to be fair and in the best interests of the shareholders. The rights of the shareholders under existing law to seek a change in the management of the Company or to influence or promote action of management in a particular manner will not be affected by the Rights Plan.

Summary Description of the Rights Plan

The following is a summary of the principal terms of the Rights Plan.

Authority

On June 27, 2008, the Board of the Company approved the adoption of the Rights Plan and the entering into by the Company of the Rights Agreement with Computershare Investor Services Inc., as Rights Agent.

Purpose of Rights Plan

The Rights Plan was adopted by the Company to ensure that any take-over bid made for the common shares would be made to all shareholders and to provide the Board with sufficient time to consider any such offer and explore alternatives. The Rights Plan is intended to encourage any person seeking to acquire control of the Company to make an offer that represents fair value to all shareholders and to provide the Board of the Company with sufficient time to assess and evaluate the offer and, as appropriate, to explore and develop alternatives to maximize value for shareholders.

The Rights Plan is designed to protect all shareholders from certain bids to acquire control of the Company by virtue of the substantial dilution that could be experienced by a person or group that attempts to acquire control of the Company otherwise than pursuant to a Permitted Bid or a Competing Permitted Bid (as defined below). However, the Rights Plan should not interfere with any takeover which, as a Permitted Bid, receives the approval of the shareholders as contemplated in the Rights Agreement, or any merger or other business combination approved by the Company (because the Board may waive the application of the Rights Plan to a particular take-over bid or redeem the Rights (as defined below) under certain circumstances).

The Rights Plan establishes rules for determining Beneficial Ownership (as defined below) of the common shares. Anyone seeking to acquire 20% or more of the outstanding common shares must, according to the Rights Plan, make a Permitted Bid or negotiate with the Board to avoid triggering the dilutive effects of the Rights Plan.

Attributes of Rights

To implement the Rights Plan, the Board authorized the issuance to holders of record at 12:01 a.m. on June 27, 2008 (the “Record Time”) of one right (a “Right”) in respect of each outstanding common share of the Company outstanding as of the Record Time.

- 19 -

Each Right will entitle the registered holder thereof to purchase from the Company one common share at an exercise price of $20.00 per common share subject to adjustment (the “Exercise Price”) during the term of, in accordance with and subject to the provisions of the Rights Plan.

The Company has entered into the Rights Agreement with Computershare Investor Services Inc. (as Rights Agent) regarding the exercise of the Rights, the issuance of certificates evidencing the Rights and other related matters.

Until a Right is exercised, the holder thereof will not have any rights as a shareholder of the Company, including, without limitation, the right to vote or receive dividends.

The issue of Rights is not taxable to the Company or to holders of common shares. The Company will receive no proceeds from the issuance of the Rights.

Trading of Rights

Until the Separation Time (as defined below), the Rights will be evidenced by certificates for the common shares with which such Rights are associated. As soon as practicable following the Separation Time, separate certificates evidencing the Rights will be mailed to shareholders, and thereafter the separate certificates will evidence the Rights. Until the Separation Time, the Rights will be transferred with, and only with, the associated common shares.

Separation Time

The Rights will become exercisable and begin to trade separately from the associated common shares at the Separation Time, which is defined to be the close of business on the tenth Business Day (as defined in the Rights Agreement) after the earlier to occur of:

1.

the first date of public announcement or other disclosure that an Acquiring Person (as defined below) has become such; and

2.

the date of commencement of, or first public announcement of any intention to make an acquisition of common shares of the Company pursuant to a takeover bid (other than a Permitted Bid or a Competing Permitted Bid) that would result in the beneficial ownership by a person (or group of affiliated or associated persons) of 20% or more of the outstanding common shares (a “Take-over Bid”), provided that if a Take-over Bid expires, is cancelled, terminated or is otherwise withdrawn prior to the Separation Time, such Take-over Bid will be deemed never to have been made.

Certificates for common shares issued after the Record Time and prior to the Separation Time will contain a legend incorporating the Rights Agreement by reference.

As soon as practicable following the Separation Time, separate certificates evidencing the Rights (the “Rights Certificates”), will be mailed to the holders of record (other than an Acquiring Person), as of the Separation Time, of common shares and the Rights Certificates alone will evidence the Rights.

Acquiring Person

A person becomes an “Acquiring Person” (as defined in the Rights Agreement) generally when such person (together with affiliated or associated persons) has acquired “Beneficial Ownership” (as defined below) of 20% or more of the outstanding common shares of the Company, other than as a result of certain events that include:

- 20 -

1.

an acquisition or redemption by the Company of common shares which, by reducing the number of common shares of the Company outstanding, increases the proportionate number of common shares held by such Acquiring Person to greater than 20% of the outstanding common shares of the Company;

2.

share acquisitions made pursuant to a Permitted Bid (as defined below) or a Competing Permitted Bid (as defined below);

3.

share acquisitions with respect to which the Board has waived the exercisability of the Rights; and

4.

share acquisitions as a result of certain pro rata distributions to the holders of voting securities of the Company, including pursuant to a dividend reinvestment plan, a stock dividend, a stock split or a rights offering.

The definition of Acquiring Person also excludes a person who is the Beneficial Owner of 20% or more of the outstanding common shares as of the Record Time, provided that such person does not acquire additional common shares which amount to more than 2% of the number of common shares outstanding from time to time, other than pursuant to warrants or other share acquisition rights held as of the Record Time. Currently, the Company has no shareholder which beneficially owns more than 20% or more of the outstanding common shares.

Beneficial Ownership

Under the Rights Plan a person will be deemed the “Beneficial Owner”, and to have “Beneficial Ownership” of, and to “Beneficially Own”:

1.

any securities as to which such person or any affiliate of such person is or may be deemed to be the direct or indirect owner at law or in equity and for this purpose, a person shall be deemed to be an owner at law or in equity of all securities:

(a)

owned by a partnership of which such person or any affiliate of such person is a partner;

(b)

owned by a trust of which such person or any affiliate of such person has a beneficial interest and which is acting jointly or in concert with that person or of which the person has a 50% or greater beneficial interest;

(c)

owned jointly or in common with others;

(d)

of which such person or any of the affiliates of such person is deemed to be the beneficial owner pursuant to the Securities Act (Ontario) for the purposes of insider trading or take-over bids whether or not such Beneficial Owner or deemed Beneficial Owner is the holder of record of such securities;

2.

any securities as to which such person or any affiliate or associate of such person has

(a)

the right to acquire (whether such right is exercisable immediately or after the lapse or passage of time and whether or not on condition or the happening of any contingency or otherwise) pursuant to any agreement, arrangement, pledge or understanding (other than customary agreements with and between underwriters and banking group or selling group members with respect to a bona fide public offering or private placement of securities and other than pledges of securities in the ordinary course of business), or upon the exercise of any conversion right, exchange right, right (other than the Rights), warrant or option, or otherwise or

- 21 -

(b)

the right to vote such securities (whether such right is exercisable immediately or after the lapse or passage of time and whether or not on condition or the happening of any contingency or otherwise), pursuant to any agreement, arrangement or understanding or otherwise; and

3.

any securities which are Beneficially Owned within the meaning of paragraphs 1 or 2 above by any other person or entity with which such person or any affiliate or associate of such person has any agreement, arrangement or understanding (whether or not in writing) with respect to or for the purpose of acting jointly or in concert in acquiring, holding, voting or disposing of any common shares of the Company (other than customary agreements with and between underwriters and banking group or selling group members with respect to a bona fide public offering or private placement of securities or agreements between a fiduciary acting as such and another person where the fiduciary has no investment authority (including none of the rights of control or direction) and no beneficial interest in the securities owned by the other person) or acquiring, holding or disposing of a significant portion of the property or assets of the Com pany or any subsidiary of the Company;

provided, however, that a person shall not be deemed the “Beneficial Owner”, or to have “Beneficial Ownership” of, or to “Beneficially Own”, any security:

4.

solely because such security has been deposited or tendered pursuant to any tender or exchange offer or take-over bid made by such person or made by any affiliate or associate of such person or made by any other person referred to in paragraph 3 above until such deposited or tendered security has been taken up or paid for, whichever shall first occur; or

5.

solely because such person or any affiliate or associate of such person or any other person referred to in paragraph 3 above has or shares the power to vote or direct the voting of such security pursuant to a revocable proxy given in response to a public proxy solicitation or solely because any such person has an agreement, arrangement or understanding with respect to a particular shareholder proposal or a particular matter to come before a meeting of shareholders, including the election of directors; or

6.

solely because such person or any affiliate or associate of such person or any other person referred to in paragraph 3 above has or shares the power to vote or direct the voting of such security in connection with or in order to participate in a public proxy solicitation; or

7.

solely because

(a)

such person or any affiliate or associate of such person or any other person referred to in paragraph 3 above, holds or exercises voting or dispositive power over such security; provided that the ordinary business of any such person (the “Investment Manager”) includes the management of investment funds for others and such voting or dispositive power over such security is held by the Investment Manager in the ordinary course of such business in the performance of such Investment Manager’s duties for the account of any other person (a “Client”) who is not an associate or affiliate of the Investment Manager; or

(b)

such person (the “Trust Company”) is licensed to carry on the business of a trust company under the laws of Canada or any province thereof and, as such, acts as trustee or administrator or in a similar capacity in relation to the estates of deceased or incompetent persons or in relation to other accounts and holds or exercises voting or dispositive power over such security in the ordinary course of such duties for the estate of any such deceased or incompetent person (each an “Estate Account”) or for such other accounts (each an “Other Account”) where neither such estate nor any beneficiary thereof is an affiliate of the Trust Company and the Trust Company is not an associate of such estate or beneficiary; or

- 22 -

(c)

the ordinary business of any such person includes acting as an agent of the Crown in the management of public assets (the “Crown Agent”); or

(d)