Exhibit 99.6

OROMIN EXPLORATIONS LTD.

INFORMATION CIRCULAR

(as at June 10, 2010, unless indicated otherwise)

SOLICITATION OF PROXIES

This Information Circular is provided in connection with the solicitation of proxies by the management of Oromin Explorations Ltd. (the “Company”) for use at the annual general meeting of the shareholders of the Company to be held on July 20, 2010 (the “Meeting”), at the time and place and for the purposes set out in the accompanying notice of meeting and at any adjournment thereof. The solicitation will be made by mail and may also be supplemented by telephone or other personal contact to be made without special compensation by directors, officers and employees of the Company. The Company will bear the cost of this solicitation. The Company will not reimburse shareholders, nominees or agents for the cost incurred in obtaining from their principals authorization to execute forms of proxy.

APPOINTMENT AND REVOCATION OF PROXY

Registered Shareholders

Registered shareholders may vote their common shares by attending the Meeting in person or by completing the enclosed proxy.Registered shareholders should deliver their completed proxies to Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9thFloor, Toronto, Ontario, M5J 2Y1 (by mail, telephone or internet according to the instructions on the proxy), not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting, otherwise the shareholder will not be entitled to vote at the Meeting by proxy.

The persons named in the proxy are directors and officers of the Company and are proxyholders nominated by management.A shareholder has the right to appoint a person other than the nominees of management named in the enclosed instrument of proxy to represent the shareholder at the Meeting. To exercise this right, a shareholder must insert the name of its nominee in the blank space provided. A person appointed as a proxyholder need not be a shareholder of the Company.

A registered shareholder may revoke a proxy by:

| (a) | signing a proxy with a later date and delivering it at the place and within the time noted above; | |

| (b) | signing and dating a written notice of revocation (in the same manner as the proxy is required to be executed, as set out in the notes to the proxy) and delivering it to the registered office of the Company, located at 1000 – 840 Howe Street, Vancouver, British Columbia, V6Z 2M1, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof at which the proxy is to be used, or to the Chairman of the Meeting on the day of the Meeting or any adjournment thereof; | |

| (c) | attending the Meeting or any adjournment thereof and registering with the scrutineer as a shareholder present in person, whereupon such proxy shall be deemed to have been revoked; or | |

| (d) | in any other manner provided by law. |

Beneficial Shareholders

The information set forth in this section is of significant importance to many shareholders, as many shareholders do not hold their shares in the Company in their own name.Shareholders holding their shares through banks, trust companies, securities dealers or brokers, trustees or administrators of self-administered RRSP’s, RRIF’s, RESP’s and similar plans or other persons (any one of which is herein referred to as an “Intermediary”) or otherwise not in their own name (such shareholders herein referred to as “Beneficial Shareholders”) should note that only proxies deposited by shareholders appearing on the records maintained by the Company’s transfer agent as registered shareholders will be recognized and allowed to vote at the Meeting. If a shareholder’s shares are listed in an account statement provided to the shareholder by a broker, in all likelihood those shares arenotregistered in the shareholder’s name and that shareholder is a Beneficial Shareholder. Such shares are most likely registered in the name of the shareholder’s broker or an agent of that broker. In Canada the vast majority of such shares are registered under the name of CDS & Co., the registration name for The Canadian Depository for Securities, which acts as nominee for many Canadian brokerage firms. Shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted at the Meeting at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients.Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate party well in advance of the Meeting.

2

Regulatory policies require Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholder meetings. Beneficial Shareholders have the option of not objecting to their Intermediary disclosing certain ownership information about themselves to the Company (such Beneficial Shareholders are designated as non-objecting beneficial owners, or “NOBOs”) or objecting to their Intermediary disclosing ownership information about themselves to the Company (such Beneficial Shareholders are designated as objecting beneficial owners, or “OBOs”).

In accordance with the requirements of National Instrument 54-101Communication with Beneficial Owners of Securities of a Reporting Issuer, the Company has elected to send the notice of meeting, this Information Circular and a request for voting instructions (a “VIF”), instead of a proxy (the notice of Meeting, Information Circular and VIF or proxy are collectively referred to as the “Meeting Materials”) directly to the NOBOs and indirectly through Intermediaries to the OBOs. The Intermediaries (or their service companies) are responsible for forwarding the Meeting Materials to OBOs.

Meeting Materials sent to Beneficial Shareholders are accompanied by a VIF, instead of a proxy. By returning the VIF in accordance with the instructions noted on it, a Beneficial Shareholder is able to instruct the Intermediary (or other registered shareholder) how to vote the Beneficial Shareholder’s shares on the Beneficial Shareholder’s behalf. For this to occur, it is important that the VIF be completed and returned in accordance with the specific instructions noted on the VIF.

The majority of Intermediaries now delegate responsibility for obtaining instructions from Beneficial Shareholders to Broadridge Investor Communication Solutions (“Broadridge”) in Canada. Broadridge typically prepares a machine-readable VIF, mails these VIFs to Beneficial Shareholders and asks Beneficial Shareholders to return the VIFs to Broadridge, usually by way of mail, the Internet or telephone. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting by proxies for which Broadridge has solicited voting instructions. A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote shares directly at the Meeting. The VIF must be returned to Broadridge (or instructions respecting the voting of shares must otherwise be communicated to Broadridge) well in advance of the Meeting in order to have the shares voted. If you have any questio ns respecting the voting of shares held through an Intermediary, please contact that Intermediary for assistance.

3

In either case, the purpose of this procedure is to permit Beneficial Shareholders to direct the voting of the shares which they beneficially own.A Beneficial Shareholder receiving a VIF cannot use that form to vote common shares directly at the Meeting – Beneficial Shareholders should carefully follow the instructions set out in the VIF including those regarding when and where the VIF is to be delivered.

Should a Beneficial Shareholder who receives a VIF wish to attend the Meeting or have someone else attend on their behalf, the Beneficial Shareholder may request a legal proxy as set forth in the VIF, which will grant the Beneficial Shareholder or their nominee the right to attend and vote at the Meeting.

Only registered shareholders have the right to revoke a proxy. A Beneficial Shareholder who wishes to change its vote must, at least seven days before the Meeting, arrange for its Intermediary to revoke its VIF on its behalf.

All references to shareholders in this Information Circular and the accompanying instrument of proxy and notice of Meeting are to registered shareholders unless specifically stated otherwise.

The Meeting Materials are being sent to both registered and non-registered owners of the Company’s shares. If you are a Beneficial Shareholder and the Company or its agent has sent the Meeting Materials directly to you, your name and address and information about your holdings of the Company’s securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf. By choosing to send the Meeting Materials to you directly, the Company (and not the Intermediary holding on your behalf) has assumed responsibility for (i) delivering the Meeting Materials to you and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the VIF.

VOTING OF SHARES AND EXERCISE OF DISCRETION OF PROXIES

If a shareholder specifies a choice with respect to any matter to be acted upon, the shares represented by proxy will be voted or withheld from voting by the proxy holder in accordance with those instructions on any ballot that may be called for. In the enclosed form of proxy, in the absence of any instructions in the proxy, it is intended that such shares will be voted by the proxyholder, if a nominee of management, in favour of the motions proposed to be made at the meeting as stated under the headings in the notice of meeting accompanying this Information Circular. If any amendments or variations to such matters, or any other matters, are properly brought before the Meeting, the proxyholder, if a nominee of management, will exercise its discretion and vote on such matters in accordance with its best judgment.

The instrument of proxy enclosed, in the absence of any instructions in the proxy, also confers discretionary authority on any proxyholder other than the nominees of management named in the instrument of proxy with respect to the matters identified herein, amendments or variations to those matters, or any other matters which may properly be brought before the Meeting. To enable a proxyholder to exercise its discretionary authority a shareholder must strike out the names of the nominees of management in the enclosed instrument of proxy and insert the name of its nominee in the space provided, and not specify a choice with respect to the matters to be acted upon. This will enable the proxyholder to exercise its discretion and vote on such matters in accordance with its best judgment.

At the time of printing this Information Circular, management of the Company is not aware that any amendments or variations to existing matters or new matters are to be presented for action at the Meeting.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

The Company is not aware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of each of the following persons in any matter to be acted upon at the Meeting other than the election of directors or the appointment of auditors:

4

| (a) | each person who has been a director or executive officer of the Company at any time since the beginning of the Company’s last financial year; | |

| (b) | each proposed nominee for election as a director of the Company; and | |

| (c) | each associate or affiliate of any of the foregoing. |

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The authorized capital of the Company consists of an unlimited number of common shares. On June 10, 2010 (the “Record Date”), the Company had 102,909,885 common shares outstanding. All common shares in the capital of the Company are of the same class and each carries the right to one vote. Only those shareholders of record on the Record Date are entitled to attend and vote at the Meeting.

To the knowledge of the directors and executive officers of the Company, as of the date of this Information Circular, only the person set forth below beneficially owns, directly or indirectly, or exercises control or direction over, 10% or more of the common shares of the Company.

| Shareholder | Number of Common Shares | Percentage of Common Shares |

| IAMGOLD Corporation | 16,088,636 | 15.6% |

ELECTION OF DIRECTORS

The directors of the Company are elected annually and hold office until the next annual general meeting of the shareholders or until their successors are elected. The management of the Company proposes to nominate the persons listed below for election as directors of the Company to serve until their successors are elected or appointed. In the absence of instructions to the contrary, proxies given pursuant to the solicitation by the management of the Company will be voted for the nominees listed in this Information Circular.Management does not contemplate that any of the nominees will be unable to serve as a director. If any vacancies occur in the slate of nominees listed below before the Meeting, management will exercise discretion to vote the proxy for the election of any other person or persons as directors.

The following table sets out the names of the nominees for election as directors, the offices they hold within the Company, their occupations, the length of time they have served as directors of the Company, and the number of shares of the Company and its subsidiaries which each beneficially owns directly or indirectly or over which control or direction is exercised as of the date of the notice of meeting:

| Name, jurisdiction of residenceand office held | Principal occupation in the lastfive years | Directorsince | Number of commonshares beneficially owned |

DEREK BARTLETT Ontario, Canada Director(1)(2)(3) | Consultant; Former President of Kingsman Resources Inc. since 1994 and a director of several other junior mining companies. | 2002 | Nil shares |

ROBERT H. BRENNAN Illinois, USA Director(1) | Senior Vice President, CB Richard Ellis – Capital Markets. Financier. | 2006 | 831,845 shares |

| NELL M. DRAGOVAN B.C., Canada Director | Businesswoman. | 2004 | 2,156,904 shares |

| CHET IDZISZEK B.C., Canada Chairman of the Board, Chief Executive Officer, President and Director | Geologist; President of the Company. | 1994 | 6,573,137 shares |

5

| Name, jurisdiction of residenceand office held | Principal occupation in the lastfive years | Directorsince | Number of commonshares beneficially owned |

ROBERT A. SIBTHORPE B.C., Canada Director(1)(2) | Consulting geologist; previously mining analyst for Canaccord Capital Corp. from 1996 to 2001. | 2004 | Nil shares |

| JAMES G. STEWART B.C., Canada Director and Corporate Secretary | Barrister and Solicitor. | 1995 | 746,377 shares (515,877 of these shares are held in name of J.G. Stewart Law Corporation Ltd.) |

| DOUGLAS TURNBULL B.C., Canada Director | Geological Consultant; President of Lakehead Geological Services Inc. | 2002 | 52,000 shares |

| (1) | Members of the Audit Committee. |

| (2) | Members of the Corporate Governance and Compensation Committee. |

| (3) | Member of the Nominating Committee. |

The above information, including information as to common shares beneficially owned, has been provided by the respective directors individually.

Other than as set out below, no proposed director of the Company:

| (a) | is, as at the date of this Information Circular, or has been, within 10 years before the date of this Information Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that, | |

| (i) | was the subject: | ||

| (A) | of a cease trade order; | |||

| (B) | an order similar to a cease trade order; or | |||

| (C) | an order that denied the relevant company access to any exemption under securities legislation for a period of more than 30 consecutive days, |

while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or

| (ii) | was subject to: | ||

| (A) | a cease trade order; | |||

| (B) | an order similar to a cease trade order; or | |||

| (C) | an order that denied the relevant company access to any exemption under securities legislation for a period of more than 30 consecutive days, |

after the proposed director was acting in the capacity as director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer,

| (b) | is, as at the date of this Information Circular, or has been within 10 years before the date of this Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; | |

| (c) | has, within the 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director; or |

6

| (d) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable investor making an investment decision. |

Mr. Derek Bartlett was a director of Diadem Resources Ltd. (“DRL”), a company listed on the TSX Venture Exchange, which was the subject of cease trade orders issued by the Ontario Securities Commission on October 23, 2001 and October 22, 2002 for failure to file required financial information. The required financial information was filed in December, 2001 and December, 2002 and the Ontario Securities Commission orders were revoked on December 17, 2001 and December 24, 2002, respectively.

EXECUTIVE COMPENSATION Compensation Discussion and Analysis

Interpretation

“Named executive officer” (“NEO”) means:

| (a) | a Chief Executive Officer (“CEO”); | |

| (b) | a Chief Financial Officer (“CFO”); | |

| (c) | each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and | |

| (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of that financial year. |

The NEOs who are the subject of this Compensation Discussion and Analysis are Chet Idziszek, President and Chief Executive Officer, Ian Brown, Chief Financial Officer, Nell Dragovan, Director, David Mallo, Vice-President Exploration, and James G. Stewart, Corporate Secretary.

Compensation Program Objectives

The objectives of the Company’s executive compensation program are as follows:

to attract, retain and motivate talented executives who create and sustain the Company’s continued success;

to align the interests of the Company’s executives with the interests of the Company’s shareholders; and

to provide total compensation to executives that is competitive with that paid by other companies of comparable size engaged in similar business in appropriate regions.

Overall, the executive compensation program aims to reflect executive compensation packages for executives with similar talents, qualifications and responsibilities at companies with similar financial, operating and industrial characteristics. The Company is a junior mineral exploration company involved in the business of exploring its resource properties located in Senegal and Argentina and will not be generating significant revenues from operations for a significant period of time. As a result, the use of more conventional performance standards, such as profitability or return on investment, is not considered by the Company to be appropriate in the evaluation of the performance of the NEOs.

7

The Company’s process for determining executive compensation is very simple. The Board has created a Corporate Governance and Compensation Committee consisting of two of its three independent members to determine executive compensation levels. This Committee makes recommendations to the Board concerning components of executive compensation, based on the collective experience and judgment of the members. The Board and the Corporate Governance and Compensation Committee have chosen, at this stage of the Company’s development, to not define formal objectives or criteria to underlie the Company’s determinations of the elements of the compensation program described below.

The most significant element that influences the Board’s collective experience and judgment is the progress of development of mineral resources and, where supported by feasibility studies, if any, mineral reserves. In addition, the achievement of encouraging exploration progress such as deposits, zones, and significant sampling, trenching and drilling results influences the Board’s determination of executive compensation levels. The Board does not have specific measurable criteria in place against which to evaluate such progress, but rather uses its collective experience and judgment in evaluating such matters.

Purpose of the Compensation Program

The Company’s executive compensation program has been designed to reward executives for reinforcing the Company’s business objectives and values, for achieving the Company’s performance objectives and for their individual performances.

Elements of Compensation Program

The executive compensation program consists of a combination of base salary and stock option incentives. In most years there is an annual bonus paid in December in a uniform amount to each salaried staff member and officer reflecting achievement of overall corporate goals. The Compensation Committee may also recommend from time to time extraordinary bonuses based on what the committee regards as extraordinary achievement in furthering the Company’s strategic objectives.

Purpose of Each Element of the Executive Compensation Program

The base salary of an NEO is intended to attract and retain executives by providing a reasonable amount of non-contingent remuneration.

In addition to a fixed base salary, each NEO is eligible to receive an annual bonus of uniform amount described above under “Elements of Compensation Program”. The principal determinants underlying this uniform annual bonus are the overall financial health of the Company and the operation of the Company’s exploration programs and associated administration on a cost-effective basis, as judged by the Corporate Governance and Compensation Committee.

Stock options are generally awarded to NEOs on an annual basis based on performance measured against set objectives. The granting of stock options upon hire aligns NEOs’ rewards with an increase in shareholder value over the long term. The use of stock options encourages and rewards performance by aligning an increase in each NEO’s compensation with increases in the Company’s performance and in the value of the shareholders’ investments.

8

Determination of the Amount of Each Element of the Executive Compensation Program

Corporate Governance and Compensation Committee

Since July 2009 the Company’s Board of Directors (the “Board”) has had a committee (the “Corporate Governance and Compensation Committee”) appointed from among independent members of the Board to implement and maintain sound corporate governance policies within the Company and to oversee the Company’s overall human resource policies and procedures. The mandate of the Corporate Governance and Compensation Committee provides that the committee will be comprised of a minimum of two directors, both of whom are independent.

Compensation of the directors and officers of the Company, including the NEOs, is reviewed at least annually by the Corporate Governance and Compensation Committee. The Corporate Governance and Compensation Committee makes recommendations to the Board, which approves the compensation of the directors and officers, including the NEOs’ base salaries, performance bonuses, if any, and incentive stock options, based on such recommendations.

The members of the Corporate Governance and Compensation Committee are Derek Bartlett and Robert Sibthorpe, both of whom are independent.

Base Salary

The base salary review of each NEO takes into consideration the current competitive market conditions, experience, proven or expected performance, and the particular skills of the NEO. Base salary is not evaluated against a formal “peer group”. The Corporate Governance and Compensation Committee relies on the general experience of its members in setting base salary amounts.

Performance Bonuses

The Company’s current bonus regime consists in most but not all years solely of an annual bonus of uniform amount awarded to each employee and officer of the Company, as described above under “Elements of Compensation Program”. In addition, the Board reserves to itself the capacity to make additional bonus awards in recognition of exemplary or otherwise meritorious performance. The making of such awards is based on the overall experience and judgment of the Board rather than being based on objective performance measures. During the financial year ended February 28, 2010 such an additional bonus was awarded to the CEO as set out in footnote 4 to the Summary Compensation Table below.

Stock Options

The award of incentive stock options is a cornerstone of the Company’s compensation plan for all executives and senior employees and is one of the Company’s primary tools for attracting, motivating and retaining qualified executives and senior employees, which is critical to the Company’s future success. The granting of stock options to executives and senior employees is currently the Company’s only long-term remuneration incentive. The maintenance of a program of periodic grants of incentive stock options is a widely observed compensation component used by junior mineral exploration companies.

Link to Overall Compensation Objectives

Each element of the executive compensation program is designed to meet one or more objectives of the overall program.

The fixed base salary of each NEO, combined with the granting of stock options, has been designed to provide total compensation which the Board believes is competitive with that paid by other companies of comparable size engaged in similar business in appropriate regions.

9

The Board does not utilize a benchmarking process whereby a group of so-called “peer group” companies is reviewed by the Board in establishing salary, bonus or stock option based compensation levels. Instead, the Board, on the advice of the Corporate Governance and Compensation Committee, utilizes its collective experience and judgment in establishing and modifying these compensation levels.

Performance Graph

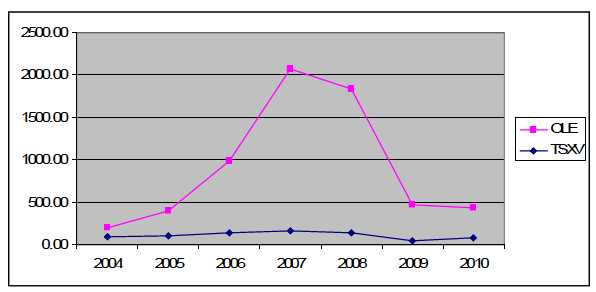

The graph below compares, assuming an initial investment of $100, the yearly percentage change in the cumulative total shareholder return on the Company’s common shares (“OLE”) trading on the TSX Venture Exchange (for the period from March 1, 2004 to December 15, 2008) and the Toronto Stock Exchange (for the period from December 16, 2008 to February 28, 2010) against the cumulative total shareholder return of the S&P/TSX Venture Composite (“TSXV”) Index. The Company uses the TSXV Index throughout the six year period, rather than attempting to incorporate an index based on the Toronto Stock Exchange for all or a portion of the time period, because it believes the TSXV Index is an appropriate broad equity market index to use under the specifications of NI51-102-F6.

For greater clarity, $100.00 invested on March 1, 2004 in shares of the Company or in the S&P TSXV

Composite Index would have had the following values at the dates shown:

| Feb 28, 2005 | Feb 28, 2006 | Feb 28, 2007 | Feb 29, 2008 | Feb 28, 2009 | Feb 28, 2010 | |

| The Company | 300.00 | 855.00 | 1910.00 | 1700.00 | 430.00 | 360.00 |

| S&P TSXV Composite Index | 106.36 | 138.37 | 160.06 | 145.20 | 44.97 | 79.92 |

On December 31, 2008 a new form of executive compensation disclosure, Form 51-102F6 –Statement of Executive Compensation (in respect of financial years ending on or after December 31, 2008)(the “New Form”) came into effect. The New Form requires the disclosure of the total compensation paid to NEOs, which was not required under the previous form. This is the second year in which the Company has prepared its disclosure of executive compensation in accordance with the New Form. In accordance with the requirements of the New Form, the Company presents in the Summary Compensation Table below comparative amounts only for the immediately previous fiscal year ended February 28, 2009 in setting out the total value of executive compensation paid in those years. Therefore, a comparison of the trend shown in the performance graph above with the trend in compensation paid to executive officers over the limited comparative periods presented in the Summary Compensat ion Table, may not be particularly meaningful.

10

It should also be noted that the compensation of the Company’s executive officers is based on the overall judgment and experience of the Board, upon advice of the Corporate Governance and Compensation Committee, and, given the Company’s current stage of development, is not based in a substantial way on the Company’s share price performance.

The above performance graph shows that the Company’s share price has significantly outperformed the TSXV Index over the six year period set out. Between the 2009 financial year and the 2010 financial year this was not the case; the Company’s year-end share price diminished between 2009 and 2010 by 16.28% while the TSXV Index increased by 77.70%.

It can be observed from the Summary Compensation Table below that compensation levels of the NEO’s have increased from the 2009 financial year to the 2010 financial year. This is not reflective of, nor under the compensation principles of the Board is it intended to be reflective of, the Company’s share price performance, as stated above. As stated previously, a very significant element which enters into the Board’s use of its collective experience and judgment is the development of mineral resources and, where supported by feasibility studies, if any, reserves, and in addition the achievement of encouraging exploration progress such as deposits, zones, and significant sampling, trenching and drilling results. The Board does not have specific measurable criteria in place against which to evaluate such progress, but rather uses its collective experience and judgment in evaluating such matters.

Option-based Awards

In evaluating option grants to executive officers under the Company’s stock option plan (the “Plan”), the Board and the Corporate Governance and Compensation Committee considers a number of factors, including, but not limited to: (i) the number of options and the vesting conditions, if any, that attach to options already held by such executive officer; (ii) a fair balance between the number of options held by the executive officer concerned and the other executives of the Company, in light of their responsibilities and objectives; and (iii) the value of the options as a component in the executive officer’s overall compensation package.

Vesting conditions for stock options granted under the Plan are determined at the discretion of the Board and the Corporate Governance and Compensation Committee. It has been the Company’s practice in recent years that options granted to all except newly engaged option beneficiaries fully vest immediately at the time of grant. In some but not all cases options granted to newly engaged option beneficiaries also fully vest immediately at the time of grant; in other cases vesting periods ranging up to two years have been imposed. The imposition, or not, of vesting periods is solely at the discretion of the Board, who include the factors set out in the preceding paragraph in determining vesting periods if any.

The Company has an informal policy that incentive stock options are granted to an extensive range of NEO’s, directors, officers who are not NEO’s, employees and consultants. Approximately one-half of options granted in most large-scale, multiple-beneficiary option grants, are granted to the NEO’s and to the directors of the Company. Of that amount, approximately 60% are typically granted to NEO’s and approximately 40% to directors who are not NEO’s. Within the 60% granted to NEO’s, approximately one-third is typically granted to the CEO and the remainder is approximately split among the other NEO’s. Within the 40% granted to directors who are not NEO’s, the grants are typically equal. The Board, on the advice of the Corporate Governance and Compensation Committee, believes that this basis recognizes to a reasonable degree, based on the Board’s collective experience and judgment, the contributions of the NEO’s and of the direct ors who are not NEO’s to the long-term success of the Company. There are not rigid formulas in place, but rather general principles and precedents within the Company’s history and approach to the granting of option-based awards.

The Board, on the advice of the Corporate Governance and Compensation Committee, does take into account previous grants of option-based awards when considering new grants.

11

Summary Compensation Table

The following table presents information concerning all compensation paid, payable, awarded, granted, given, or otherwise provided, directly or indirectly, to NEOs by the Company and its subsidiaries for services in all capacities to the Company during the two most recently completed financial years:

| Name andprincipal position | Year | Salary ($) | Bonus ($) | Option-basedawards(3) ($) | All othercompensation ($) | Totalcompensation ($) |

| Chet Idziszek President and CEO | 2010 2009 | 184,360 172,200 | 182,240(4) 2,000 | 265,210 503,048 | Nil Nil | 631,990 677,248 |

| Ian Brown CFO | 2010 2009 | 99,992 55,000 | 4,800 2,000 | 116,030 125,762 | Nil Nil | 220,822 182,762 |

| Nell Dragovan Director | 2010 2009 | 102,860 82,200 | 4,800 2,000 | 116,030 167,683 | Nil Nil | 223,690 251,883 |

| David Mallo Vice-President Exploration | 2010 2009 | Nil Nil | 6,000 5,000(1) | 182,332 335,365 | 190,648(1) 188,760(1) | 378,980 529,125 |

| James G. Stewart Corporate Secretary | 2010 2009 | Nil Nil | 4,800 2,000 | 116,030 209,603 | 270,150(2) 149,100(2) | 390,980 360,703 |

(1) The “other compensation” to Mr. Mallo was paid by Oromin Joint Venture Group Limited (“OJVG”) pursuant to a consulting agreement for professional services provided by Mr. Mallo. Mr. Mallo’s bonuses are exceptions to the uniform bonus paid to most employees and officers of the Company. This is based on the fact that Mr. Mallo spends 100% of his time on the affairs of the Company, including OJVG; other NEO’s spend a portion of their time on other entities related by having a number of directors and/or senior officers in common.

(2) The “other compensation” to Mr. Stewart consists of fees paid to J. G. Stewart Law Corporation Ltd. for legal services.

(3) The amounts shown in this category are the “fair values” as determined at the date of grant using the Black-Scholes option pricing model (“BSOPM”), and are the same values as used by the Company in determining stock-based compensation for accounting purposes. The Board of Directors believes there are significant arguments in valuation theory that the use of the BSOPM for ascribing a compensation cost reportable under the New Form may provide inappropriate values. However, the use of values determined using the BSOPM is accepted by the Canadian Securities Administrators and the Canadian Institute of Chartered Accountants, and under the circumstances the Board of Directors has accepted this basis of valuation.

(4) For the year ended February 28, 2010 Mr. Idziszek’s bonus consisted of two parts; first, the amount of $4,800 representing the uniform bonus awarded to other NEO’s and employees as described above under the heading “Performance Bonuses”; and, second, the amount of $177,620 awarded by the Board on the recommendation of the Corporate Governance and Compensation Committee in recognition of the CEO’s exemplary performance in closing a financing with gross proceeds of $20,000,000 in July 2009.

Note 10 “Related Party Transaction” to the Company’s audited financial statements for the year ended February 28, 2010 describes a significant payment accrued in July 2009 in respect of the CEO. The Company does not regard this amount as “compensation” as discussed in this report; however, the Company takes this opportunity to refer readers to that portion of the audited financial statements.

Incentive Plan Awards - Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information in respect of all share-based awards and option-based awards outstanding at the end of the most recently completed financial year to each NEO of the Company:

12

| Option-based Awards | Share-based Awards | ||||||

| Name | Number ofsecuritiesunderlying unexercisedoptions (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options ($) | Number of shares or unitsof shares that have notvested (#) | Market orpayout valuethat of share-basedawards that have not vested ($) | |

| Chet Idziszek | 300,000 550,000 300,000 400,000 | $0.70 $1.90 $3.25 $1.12 | September 15, 2010 February 15, 2011 March 26, 2013 July 10, 2014 | $6,000 Nil Nil Nil | Nil Nil Nil Nil | N/A N/A N/A N/A | |

| Ian Brown | 200,000 75,000 175,000 | $2.80 | April 20, 2012 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A | |

| Nell Dragovan | 75,000 100,000 175,000 | $1.90 | February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A | |

| David Mallo | 20,000 100,000 200,000 275,000 | $0.80 | November 22, 2010 February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil Nil | Nil Nil Nil Nil | N/A N/A N/A N/A | |

| James G. Stewart | 75,000 125,000 175,000 | $1.90 $3.25 | February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A | |

As set out in Notes 8 and 17 to the Company’s audited financial statements for the year ended February 28, 2010, effective March 9, 2010 holders of the options set out in the table above with exercise prices of $1.12 or greater agreed to the cancellation of those options.

Incentive Plan Awards – Value Vested or Earned During the Most Recently Completed Financial Year

The following table presents information concerning value vested with respect to option-based awards and share-based awards for each NEO during the most recently completed financial year:

| Name | Option-based awards –Value vested during the year ($) | Share-based awards – Valuevested during the year ($) | Non-equity incentive plancompensation – Value earnedduring the year ($) |

| Chet Idziszek | 265,210 | Nil | Nil |

| Ian Brown | 116,030 | Nil | Nil |

| Nell Dragovan | 116,030 | Nil | Nil |

| David Mallo | 182,332 | Nil | Nil |

| James G. Stewart | 116,030(1) | Nil | Nil |

| (1) | The value vested in respect of Mr. Stewart is related to an option grant to J. G. Stewart Law Corporation Ltd. |

13

Director Compensation

Director Compensation Table

The following table sets forth information with respect to all amounts of compensation provided to the directors of the Company for the most recently completed financial year.

| Name | Feesearned ($) | Share-basedawards ($) | Option-basedawards(4) ($) | Bonus ($) | All othercompensation ($) | Total ($) |

| Derek Bartlett(1) | 16,000 | Nil | 116,030 | Nil | Nil | 132,030 |

| Robert H. Brennan | 4,000 | Nil | 116,030 | Nil | Nil | 120,030 |

| Robert A. Sibthorpe | 4,000 | Nil | 116,030 | Nil | Nil | 120,030 |

| Douglas Turnbull(3) | Nil | Nil | 116,030 | Nil | 126,630 | 242,660 |

(1) Mr. Bartlett was paid a cash fee of $1,000 per month for the period March 2009 through October 2009 and $2,000 per month for the period November 2009 through February 2010 for acting as the Company’s Lead Director.

(2) Commencing November 2009 Messrs’ Brennan and Sibthorpe were paid a cash fee of $1,000 per month for their services as independent directors.

(3) Mr. Turnbull’s “other compensation” represents fees billed to the Company, including its subsidiaries and joint venture entities, by Lakehead Geological Services Inc. for professional services carried out by Mr. Turnbull.

(4) The amounts shown in this category are the “fair values” as determined at the date of grant using the Black-Scholes option pricing model (“BSOPM”), and are the same values as used by the Company in determining stock-based compensation for accounting purposes. The Board of Directors believes there are significant arguments in valuation theory that the use of the BSOPM for ascribing a compensation cost reportable under the New Form may provide inappropriate values. However, the use of values determined using the BSOPM is accepted by the Canadian Securities Administrators and the Canadian Institute of Chartered Accountants, and under the circumstances the Board of Directors has accepted this basis of valuation.

Share-Based Awards, Options-Based Awards and Non-Equity Incentive Plan Compensation

Incentive Plan Awards - Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information in respect of all share-based awards and option-based awards outstanding at the end of the most recently completed financial year to the directors of the Company:

14

| Option-based Awards | Share-based Awards | |||||

| Name | Number ofsecurities underlyingunexercisedoptions (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-moneyoptions ($) | Number of shares or units of shares thathave not vested (#) | Market orpayout value of share-basedawards that havenot vested ($) |

| Derek Bartlett | 50,000 100,000 175,000 | $ 1.90 $ 3.25 $ 1.12 | February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A |

| Robert H. Brennan | 200,000 125,000 175,000 | $ 1.90 $ 3.25 $ 1.12 | February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A |

| Robert A. Sibthorpe | 50,000 100,000 175,000 | $ 1.90 $ 3.25 $ 1.12 | February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A |

| Douglas Turnbull | 75,000 100,000 175,000 | $ 1.90 $ 3.25 $ 1.12 | February 15, 2011 March 26, 2013 July 10, 2014 | Nil Nil Nil | Nil Nil Nil | N/A N/A N/A |

As set out in Notes 8 and 17 to the Company’s audited financial statements for the year ended February 28, 2010, effective March 9, 2010 holders of the options set out in the table above with exercise prices of $1.12 or greater agreed to the cancellation of those options.

Incentive Plan Awards – Value Vested or Earned During the Most Recently Completed Financial Year

The following table presents information concerning value vested with respect to option-based awards and share-based awards for the directors of the Company during the most recently completed financial year:

| Name | Option-based awards –Value vested during theyear ($) | Share-based awards – Valuevested during the year ($) | Non-equity incentive plancompensation – Value earnedduring the year ($) |

| Derek Bartlett | 116,030 | Nil | Nil |

| Robert H. Brennan | 116,030 | Nil | Nil |

| Robert A. Sibthorpe | 116,030 | Nil | Nil |

| Douglas Turnbull | 113,030 | Nil | Nil |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLAN

The following table sets out, as of the end of the most recently completed financial year, all required information with respect to compensation plans under which equity securities of the Company are authorized for issuance:

15

| Plan Category | Number of securities tobe issued upon exerciseof outstanding options,warrants and rights (a) | Weighted-averageexercise price ofoutstanding options,warrants and rights (b) | Number of securitiesremaining available for futureissuance under equitycompensation plans(excluding securitiesreflected in column (a)) (c) |

| Equity compensation plans approved by securityholders | 9,420,000 | $ 1.92 | 863,488 |

| Equity compensation plans not approved by securityholders | Nil | Nil | Nil |

| Total | 9,420,000 | 863,488 |

CORPORATE GOVERNANCE

The Company has adopted a corporate governance manual (the “Manual”). The Manual sets out the operating guidelines for the Board, guidelines for individual directors, the mandates of the Company’s committees, the terms of reference for the chair of the Board (the “Chair”) and the chairs of the Company’s committees, the Company’s code of business conduct and ethics and the Company’s disclosure policy. A copy of the Manual is available under the Company’s profile on SEDAR at www.sedar.com.

Board of Directors

Independence

The definition of independence used by the Company is that used by the Canadian Securities Administrators, which is set out in section 1.4 of National Instrument 52-110Audit Committees(“NI 52-110”). A director is independent if he has no direct or indirect material relationship to the Company. A “material relationship” is a relationship which could, in the view of the Board, be reasonably expected to interfere with the exercise of the director’s independent judgment. Certain types of relationships are by their very nature considered to be material relationships and are specified in section 1.4 of NI 52-110.

The Board of Directors presently has seven (7) directors, three (3) of whom are independent. Derek Bartlett, Robert Brennan and Robert A. Sibthorpe are considered to be independent directors. Chet Idziszek, Nell M. Dragovan, James G. Stewart and Douglas Turnbull are not considered to be independent as they are deemed to have a material relationship with the Company, by virtue of Mr. Idziszek being the President and Chief Executive Officer of the Company, Ms. Dragovan being a salaried executive of the Company and a member of Mr. Idziszek’s immediate family, Mr. Stewart being the Secretary of the Company and Mr. Turnbull as he receives consulting fees for the provision of geological services.

The Board believes that the principal objective of the Company is to generate economic returns with the goal of maximizing shareholder value, and that this is to be accomplished by the Board through its stewardship of the Company. In fulfilling its stewardship function, the Board’s responsibilities will include strategic planning, appointing and overseeing management, succession planning, risk identification and management, environmental oversight, communications with other parties and overseeing financial and corporate issues. Directors are involved in the supervision of management.

16

The Chairman, Mr. Idziszek, is not independent. In accordance with the Manual and in order to facilitate the exercise independent judgment by the Board, the independent members of the Board have elected from among themselves a lead director (the “Lead Director”), Mr. Bartlett, who will chair regular meetings of the independent directors and carry out such other duties as the independent directors may from time to time determine.

The Manual further provides that after each meeting of the Board the independent members of the Board will meet without the non-independent directors and management. In accordance with the Manual, the Board will meet a minimum of four times per year, at least once every quarter, and may call special meetings as required.

During the most recently completed financial year, the Board of Directors did not meet as a whole, however all decisions were reached after management canvassed Board members individually. Certain of the independent directors met four times without the non-independent members of the Board in attendance.

Other Directorships

The directors of the Company are also directors of the following other reporting issuers:

| Current Director / Nominee | Other Directorships of other Reporting Issuers |

| Derek Bartlett | Cadman Resources Inc. Lucky Strike Resources Ltd. Newport Gold Inc. Waseco Resources Inc. X-Cal Resources Ltd. |

| Nell M. Dragovan | Madison Minerals Inc. |

| Chet Idziszek | Lund Gold Ltd. Madison Minerals Inc. |

| Robert A. Sibthorpe | Klondex Mines Ltd. Madison Minerals Inc. TTM Resources Inc. |

| James G. Stewart | Bayswater Uranium Corporation Cascade Resources Inc. Kingsman Resources Ltd. Lund Gold Ltd. Madison Minerals Inc. Paget Minerals Corp. Salmon River Resources Ltd. |

| Douglas Turnbull | Dagilev Capital Corp. Grizzly Discoveries Inc. Salmon River Resources Ltd. |

17

Operating Guidelines for the Board of Directors

A copy of the operating guidelines for the board of directors (the “Operating Guidelines”) is attached to this Circular as Schedule A.

Position Descriptions

The Manual sets out positions descriptions for the Chair and for the chair of each committee of the Board, as well as a position description for the CEO of the Company.

Orientation and Continuing Education

The Operating Guidelines include a description of the measures taken by the Board to orient new directors and provide continuing education for its directors. See “New Director Orientation” and “Continuing Education” in the Operating Guidelines attached to this Circular as Schedule A.

Ethical Business Conduct

The Manual contains a Code of Business Conduct and Ethics (the “Code”) which is intended to document the principles of conduct and ethics to be followed by the Company’s directors, officers and employees. The purpose of the Code is to

Promote integrity and deter wrongdoing

Promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest.

Promote avoidance of absence of conflicts of interest.

Promote full, fair, accurate, timely and understandable disclosure in public communications made by the Company.

Promote compliance with applicable governmental laws, rules and regulations.

Promote and provide a mechanism for the prompt, internal reporting of departures from the Code.

Promote accountability for adherence to the Code.

Provide guidance to the Company’s directors, officers and employees to help them recognize and deal with ethical issues.

To help foster a culture of integrity, honesty and accountability throughout the Company.

In the Board’s regular meetings, the Board considers the Company’s operations and business activities in light of the Code. The Board expects management to operate the business of the Company in a manner that enhances shareholder value and is consistent with the highest level of integrity. The Board does not monitor compliance with the Code, but satisfies itself regarding compliance with the Code by periodic discussions with senior management.

A copy of the Code may be obtained by any shareholder (without charge) by contacting the Secretary of the Company by mail, at Suite 2000, Guinness Tower, 1055 West Hastings Street, Vancouver, B.C., V6E 2E9, by e-mail, at jstewart@mine-tech.com, or by telephone at 604 331-8772. A copy of the Code is also included in the Manual, which is available under the Company’s profile on SEDAR at www.sedar.com.

Nomination of Directors

During the financial year ended February 28, 2010, the Company appointed a committee (the “Nominating Committee”) to assist the Board in fulfilling its responsibilities with respect to the identification and evaluation of qualified candidates and recommending such candidates for nomination to the Board and its various committees. The mandate of the Nominating Committee provides that the committee will be comprised of a minimum of one director, who will be independent.

18

The sole member of the Nominating Committee is Derek Bartlett, who is an independent director.

The Nominating Committee has the following responsibilities and powers:

1. to set the criteria for selecting new directors;

2. to identify, assess and make recommendations to the Board as to qualified candidates for nomination for election to the Board, and Board committees, with a view to the independence and expertise required for effective governance and satisfaction of applicable regulatory requirements, including consideration of nominees recommended by shareholders;

3. in making its recommendations to the Board, to consider the competencies and skills that the Board considers to be necessary for the Board, as a whole, to possess, the competencies and skills that the Board considers each existing director to possess, the competencies and skills each new nominee will bring to the Board and the ability of each new nominee to devote sufficient time and resources to his or her duties as a director;

4. to review and report to the Board on matters relating to the nomination of directors, and in so doing, to do the following:

| (a) | develop criteria for selection of directors and procedures to identify possible nominees, | |

| (b) | review and assess qualifications of Board nominees, | |

| (c) | submit to the Board for consideration and decision names of the nominees to be brought forward to the next annual general meeting of shareholders or to be appointed to fill vacancies in between annual general meetings, | |

| (d) | through the chair of the Nominating Committee, approach nominees, | |

| (e) | consider and recommend to the Board appropriate retirement ages of directors, and | |

| (f) | determine if any director’s qualifications or credentials since his or her appointment have changed or other circumstances arisen so as to warrant a recommendation that such director resign; |

5. to make recommendations to the Board as to which directors should be classified as independent and which should be classified as non-independent;

6. to act as a forum for concerns of individual directors in respect of matters that are not readily or easily discussed in a full Board meeting, including the performance of management or individual members of management or the performance of the Board or individual members of the Board;

7. to develop and recommend to the Board for approval, and periodically review, structures and procedures designed to ensure that the Board can function independently of management;

8. to conduct periodic reviews of the Company’s corporate governance policies and make policy recommendations aimed at enhancing Board and committee effectiveness;

9. to consider and, from time to time, make recommendations to the full Board as to the appropriate size of the Board, with a view to facilitating effective decision making;

10. to develop for approval by the Board and periodically review orientation and education programs for new directors;

19

11. to develop for approval by the Board procedures for reviewing and assessing the effectiveness of the Board as a whole, the committees of the Board and the contribution of each individual director, and then carry out such reviews and assessments on an annual basis;

12. to perform any other activities consistent with the mandate of the Nominating Committee, as the Nominating Committee or the Board deems necessary or appropriate; and

13. to review and assess its effectiveness, contribution and the mandate of the Nominating Committee annually and recommend any proposed changes thereto to the Board.

The Nominating Committee will meet at lease once per year and may call special meetings as required.

Compensation

See “Executive Compensation - Compensation Discussion and Analysis - Determination of the Amount of Each Element of the Executive Compensation Program”, above, for a disclosure in relation to the process by which the Board determines compensation for the Company’s directors and officers and the independence of the Corporate Governance and Compensation Committee.

The Corporate Governance and Compensation Committee will review management prepared policies and make recommendations to the Board regarding the following matters:

| 1. | the development of appropriate corporate governance guidelines, including the development of a set of corporate governance principles and guidelines that is specifically applicable to the Company and the annual review of such recommendations with any applicable policy recommendations aimed at enhancing Board and committee effectiveness; |

| 2. | compensation, philosophy, policies and guidelines for senior officers, as well as supervisory and management personnel of the Company and any subsidiary companies; |

| 3. | corporate benefits for senior management; |

| 4. | incentive plans, along with global payment information as it applies to senior management bonus and discretionary bonus plans; |

| 5. | review and approval of corporate goals and objectives relevant to CEO compensation; |

| 6. | evaluation of the performance of the CEO in light of corporate goals and objectives and making recommendations to the Board with respect to compensation levels based on such evaluations; |

| 7. | making recommendations to the Board with respect to non-CEO officer and director compensation, incentive compensation plans and equity based plans; |

| 8. | policies regarding the Company’s incentive stock option plan and the granting of stock options to directors, management and employees of the Company; |

| 9. | compensation levels for directors and committee members, including the compensation of the chair of the Board and the chair of any Board committees, to ensure compensation realistically reflects the responsibilities and risk involved in being an effective director. Compensation should be commensurate with the time spent by directors in meeting their obligations and should be transparent and easy for shareholders to understand; |

| 10. | succession plan for the CEO and other executives and key employees of the Company, in conjunction with the CEO; |

| 11. | any material changes in human resources policy, procedure, remuneration and benefits; |

| 12. | review of executive compensation disclosure in all public disclosure documents before the Company publicly discloses such information; |

20

| 13. | the Corporate Governance and Compensation Committee will review and assess its effectiveness, contribution and this Mandate annually and recommend any proposed changes thereto to the Board; |

| 14. | perform any other activities consistent with this Mandate, as the Corporate Governance and Compensation Committee or the Board deems necessary or appropriate; and |

| 15. | the Corporate Governance and Compensation Committee will have the authority to delegate any specific tasks to individual Corporate Governance and Compensation Committee members. |

Other Board Committees

The Board has not established any committees other than the Audit Committee, the Corporate Governance and Compensation Committee and the Nominating Committee.

Assessments

The Nominating Committee is responsible for developing, for approval by the Board, procedures for reviewing and assessing the effectiveness of the Board as a whole, the committees of the Board and the contribution of each individual director. The Nominating Committee will carry out such reviews and assessments on an annual basis.

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

None of the directors or executive officers of the Company or any subsidiary thereof, has more than “routine indebtedness” to the Company or any subsidiary thereof.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Unless otherwise disclosed herein, no informed person or proposed nominee for election as a director, or any associate or affiliate of any of the foregoing, has or has had any material interest, direct or indirect, in any transaction or proposed transaction since the commencement of the Company’s most recently completed financial year, which has materially affected or will materially affect the Company or any of its subsidiaries, other than as disclosed by the Company during the course of the year or as disclosed herein.

APPOINTMENT OF AUDITOR

The management of the Company intends to nominate Davidson & Company LLP of Vancouver, British Columbia for appointment as auditors of the Company. Forms of proxy given pursuant to the solicitation of the management of the Company, will, on any poll, be voted as directed and, if there is no direction, be voted for the appointment of Davidson & Company LLP of Vancouver, British Columbia at a remuneration to be fixed by the directors. Davidson & Company were first appointed auditors of the Company on February 27, 2003.

PARTICULARS OF MATTERS TO BE ACTED UPON

It is not known whether any matters will come before the Meeting other than those set forth in the notice of meeting, but if any other matters do arise, the persons named in the proxy intend to vote on any poll, in accordance with their best judgment, exercising discretionary authority with respect to amendments or variations of matters ratified in the notice of meeting and other matters which may properly come before the Meeting or any adjournment.

21

ADDITIONAL INFORMATION

Additional information on the Company is available on the internet on SEDAR at www.sedar.com. Financial information is provided in the Company’s financial statements and management discussion and analysis which are available on SEDAR. The audited financial statements for the year ending February 28, 2010, together with the auditor’s report will be presented at the Meeting. You may request copies of the Company’s financial statements and management discussion and analysis by completing the request card included with this Information Circular, in accordance to the instructions therein.

DATED June 10, 2010.

| BY THE BOARD OF DIRECTORS OF OROMIN EXPLORATIONS LTD. | |

| “Chet Idziszek” | |

| Chet Idziszek | |

| President and Chief Executive Officer |

SCHEDULE A

OPERATING GUIDELINES FOR THE BOARD OF DIRECTORS

General

The board of directors (the “Board”) acknowledges responsibility for the stewardship of Oromin Explorations Ltd. (the “Company”). The Board believes that the principal objective of the Company is to generate economic returns with the goal of maximizing shareholder value. This is to be accomplished by the Board through its stewardship of the Company. In fulfilling its stewardship function, the Board’s responsibilities will include strategic planning, appointing and overseeing management, succession planning, risk identification and management, environmental oversight, communications with other parties and overseeing financial and corporate issues.

The Board believes that good corporate governance practices provide an important framework for a timely response by the Board to situations that may directly affect shareholder value. The Board is committed to practicing good corporate governance and has adopted these guidelines to help it practice good corporate governance.

These guidelines, as set out below, define the role of the Board and outline how the Board will operate to carry out its duties of stewardship and accountability.

The Board-Management Relationship

While the Board is called upon to “manage” the business of the Company by law, this is generally carried out by proxy through the Company’s chief executive officer (the “CEO”), who is appointed by the Board and charged with the day-to-day leadership and management of the Company. The Board will satisfy itself, to the extent feasible, as to the integrity of the CEO and other “executive officers”1of the Company and that they are creating a culture of integrity throughout the Company.

The CEO’s prime responsibility is to lead the Company. The CEO formulates corporate policies and proposed actions and presents them to the Board for approval. The Board approves the goals of the business, the objectives and policies within which it is managed, and then steps back and evaluates management’s performance. Reciprocally, the CEO keeps the Board fully informed of the Company’s progress towards the achievement of its goals and of all material deviations from the goals or objectives and policies established by the Board, in a timely and candid manner.

Once the Board has approved the Company’s goals, objectives and policies it acts in a unified and cohesive manner in supporting and guiding the CEO, subject to its duty to act in the best interests of the Company.

Board Independence

The Board must have the capacity, independently of management, to fulfill its responsibilities. Independence is based upon the absence of relationships and interests that could compromise the ability of a director to exercise judgment with a view to the best interests of the Company. The Board must be able to make an objective assessment of management and assess the merits of management initiatives. Therefore, the Company is committed to the following practices:

| 1. | the recruitment of strong, “independent”2directors; |

|

1An “executive officer” is an individual who is (a) a chair, vice-chair or president; (b) a vice-president in charge of a principal business unit, division or function including sales, finance or production; or (c) performing a policy-making function in respect of the Company.

2National Instrument 52-110Audit Committeesdefines “independence” as having no direct or indirect material relationship with the issuer, and a “material relationship” as a relationship which could, in the view of the issuer’s board of directors, be reasonably expected to interfere with the exercise of a director’s independent judgment. Specific individuals considered to have a material relationship with an issuer include:

| (a) | an individual who is, or has been within the last three years, an employee or executive officer of the issuer; | |

| (b) | an individual whose immediate family member is, or has been within the last three years, an executive officer of the issuer; | |

| (c) | an individual who (i) is a partner of a firm that is the issuer’s internal or external auditor, (ii) is an employee of that firm, or (iii) was within the last three years a partner or employee of that firm and personally worked on the issuer’s audit within that time; |

- 2 -

| 2. | a majority of the directors being independent; |

| 3. | delegation of the lead role in the director selection/evaluation process to the Nominating Committee and the lead role in the CEO evaluation process to the Corporate Governance and Compensation Committee; |

| 4. | all committees of the Board being constituted with a majority of independent directors, and solely with independent directors if possible; and |

| 5. | the Board should appoint its chair (the “Chair of the Board”) from among its independent members. |

In the event that the Chair of the Board is also a member of management of the Company, the Board will also elect a “Lead Director” from among the independent directors. Either an independent Chair of the Board or an independent Lead Director will act as the effective leader of the board and ensure that the Board’s agenda will enable it to successfully carry out its duties.

Corporate Strategy

Management is responsible for the development of an overall corporate strategy to be presented to the Board. The Board’s role is to ensure that there is a strategic planning process that takes into account the opportunities and risks of the business of the Company, and then review, question, validate, and ultimately approve the strategy and monitor its implementation. This will entail the Board’s reviewing with management the mission of the business in conjunction with management’s objectives and goals and the strategy by which it proposes to reach those goals, and will include the Board:

| 1. | participating with management in the development of, and ultimately approving, the Company’s strategic plan on an annual basis; |

| 2. | approving the annual business plans that enable the Company to realize its objectives; |

| 3. | approving the annual capital and operating budgets which support the Company’s ability to meet its strategic objectives; |

| 4. | approving the entering into, or withdrawing from, lines of business that are, or are likely to be, material to the Company; |

| 5. | approving material divestitures and acquisitions; and |

| 6. | monitoring the Company’s progress towards its goals, and revising and altering its direction through management in light of changing circumstances. |

Risk Management

The Board is responsible for identifying, with management, the principal risks of the Company’s business and reviewing, approving and monitoring the implementation of appropriate systems to manage those risks. This will include an assessment and evaluation of information provided by management and others (for example, internal and external auditors) about the effectiveness of management control systems, an understanding of principal risks, the impact of risks on the Company’s strategic plan and a determination of whether the Company is achieving a proper balance between risk and returns.

| (d) | an individual whose spouse, minor child or stepchild, or child or stepchild who shares a home with the individual (i) is a partner of a firm that is the issuer’s internal or external auditor, (ii) is an employee of that firm and participates in its audit, assurance or tax compliance (but not tax planning) practice, or (iii) was within the last three years a partner or employee of that firm and personally worked on the issuer’s audit within that time; | |

| (e) | an individual who, or whose immediate family member, is or has been within the last three years, an executive officer of an entity if any of the issuer’s current executive officers serves or served at that same time on the entity’s compensation committee; | |

| (d) | an individual who received, or whose immediate family member who is employed as an executive officer of the issuer received, more than $75,000 in direct compensation from the issuer during any 12 month period within the last three years; | |

| (e) | an individual who accepts, directly or indirectly, any consulting, advisory or other compensatory fee from the issuer or any subsidiary entity of the issuer, other than as remuneration for acting in his or her capacity as a member of the board of directors or any board committee, or as a part-time chair or vice-chair of the board or any board committee; or | |

| (f) | an individual who is an affiliated entity of the issuer or any of its subsidiary entities. |

Reference should be made to National Instrument 52-110 for the other circumstances in which an individual will be considered to have a material relationship with an issuer.

- 3 -

Succession Planning

The Board considers succession planning and management development to be an ongoing process, including annual reports to the Board by the CEO. The CEO’s views as to a successor in the event of unexpected incapacity should be discussed regularly with the Corporate Governance and Compensation Committee, which will lead the development of a succession plan for the Company, including plans for the appointment, training and monitoring of senior management.

Communications

As it is critical that the Company maintain effective communications with other parties, particularly shareholders, regulatory authorities and the public, the Company has implemented the Disclosure Policy. The Board generally feels that it is the function of management to speak for the Company in its communications with other parties, but the Board acknowledges that it is responsible for oversight of the Company’s communications and maintenance of effective communication and for monitoring compliance with the Disclosure Policy. In this regard its responsibilities will include:

| 1. | ensuring the Company has in place effective, productive and appropriate communication processes, particularly with shareholders, regulatory authorities and the public; |

| 2. | ensuring that the financial performance of the Company is adequately reported to shareholders and regulatory authorities on a timely and regular basis; |

| 3. | ensuring the timely reporting of any developments that have a significant and material impact on the Company, the value of its securities or its financial position; |

| 4. | reporting annually to shareholders on the Board’s stewardship for the preceding year (generally, via the Company’s Annual Report); |

| 5. | ensuring the Company has in place systems that accommodate feedback from shareholders, including a process which enables shareholders to directly contact an independent director; and |

| 6. | reviewing and approving the content of the Company’s major communications to shareholders and the investing public, including the Annual Report, the Management Information Circular, the Annual Information Form and any prospectuses that may be issued. |

Financial and Corporate Issues

The Board is responsible for overseeing and resolving financial and corporate issues as they arise. This will include

| 1. | directing management to ensure that legal requirements have been met and documents and records have been properly prepared, approved and maintained; |

| 2. | approving and monitoring compliance with all significant policies and procedures by which the Company is operated; |

| 3. | directing management to ensure the Company operates at all times within applicable laws and regulations and to the highest ethical and moral standards; |

| 4. | reviewing significant new corporate policies or material amendments to existing policies (including, for example, policies regarding business conduct, conflict of interest and the environment); |

| 5. | overseeing the implementation and ongoing quality and integrity of the Company’s accounting and financial reporting systems, management information systems and internal controls; |

| 6. | reviewing operational and financial performance; |

| 7. | approving annual and quarterly financial statements and management’s discussion and analysis and approving their release by management; |

| 8. | approving material agreements and other documents; |

| 9. | declaring dividends; |

- 4 -

| 10. | approving financings, including the issue and repurchase of shares, issue of debt securities, listing of shares and other securities; |

| 11. | recommending changes to the Company’s authorized share capital; |

| 12. | recommending to shareholders the appointment of external auditors and approving auditors’ fees; and |

| 13. | approving the commencement or settlement of litigation that may have a material impact on the Company. |

Evaluation of the Chief Executive Officer

Annual assessment of the CEO’s performance and compensation will generally be delegated to the Corporate Governance and Compensation Committee.

Board Size and Composition

The Board is committed to reviewing its size regularly and will seek to maintain the number of directors which is appropriate for the size of the Company and sufficient to provide an appropriate mix of backgrounds and skills for the stewardship of the Company. In general, the Board believes smaller boards are more cohesive and work more effectively than larger Boards.

A majority of the directors comprising the Board should be independent directors. In the Board’s view, there is no implication that a non-independent director makes less of a contribution to the Company than an independent director or that a non-independent director cannot or does not act independently or in the best interests of the Company. However, any director who is an independent director and whose circumstances change such that he or she might be considered to be a non-independent director must promptly advise the Board of the change in circumstances. The determination of which directors are non-independent and independent will be delegated to the Nominating Committee.

At all meetings of the Board every question will be decided by a majority of the votes cast. In case of an equality of votes, the Chair of the Board will not be entitled to a casting vote.

Criteria for Board Membership