SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under Rule 14a-12

Telik, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

TELIK, INC.

750 Gateway Boulevard

South San Francisco, CA 94080

Notice of Annual Meeting of Stockholders to be held on May 14, 2002

To the Stockholders of Telik, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders of Telik, Inc., a Delaware corporation (the “Company”), will be held on Tuesday, May 14, 2002 at 9:00 a.m. local time at the Company’s offices at 750 Gateway Boulevard, South San Francisco, CA 94080 for the following purposes:

1. To elect two directors to hold office until the 2005 Annual Meeting of Stockholders.

2. To ratify the selection of Ernst & Young LLP as independent auditors of the Company for its fiscal year ending December 31, 2002.

3. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 25, 2002, as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

| | By | Order of the Board of Directors |

South San Francisco, California

April 10, 2002

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

TELIK, INC.

750 Gateway Boulevard

South San Francisco, CA 94080

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

May 14, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Telik, Inc., a Delaware corporation (“Telik” or the “Company”), for use at the Annual Meeting of Stockholders to be held on Tuesday, May 14, 2002, at 9:00 a.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company’s offices at 750 Gateway Boulevard, South San Francisco, CA 94080. The Company intends to mail this proxy statement and accompanying proxy card on or about April 12, 2002, to all stockholders entitled to vote at the Annual Meeting.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

Voting Rights and Outstanding Shares

Only holders of record of Common Stock at the close of business on March 25, 2002, will be entitled to notice of and to vote at the Annual Meeting. At the close of business on March 25, 2002, the Company had outstanding and entitled to vote 27,834,711 shares of Common Stock.

Each holder of record of Common Stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Brokers have discretionary authority to vote on proposals 1 and 2.

Voting Via the Internet or by Telephone

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The law of Delaware, under which the Company is incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspectors of election can determine that such proxy was authorized by the stockholder.

1

The telephone and Internet voting procedures below are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

For Shares Registered in Your Name

Stockholders of record may go tohttp://www.eproxy.com/telk/ to grant a proxy to vote their shares by means of the Internet. They will be required to provide the company number and control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen and the voter will be prompted to submit or revise them as desired. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling toll free1-800-240-6326 and following the recorded instructions.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in “street name” receive instruction for granting proxies from their banks, brokers or other agents, rather than using the Company’s proxy card.

A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communications Services program, you may grant a proxy to vote those shares telephonically or via the Internet by calling the telephone number or contacting the web site shown on the instruction form received from your broker or bank.

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 12:00 noon, Eastern Time on May 13, 2002. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company’s principal executive office, 750 Gateway Boulevard, South San Francisco, California 94080, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Stockholder Proposals

The deadline for submitting a stockholder proposal for inclusion in the Company’s proxy statement and form of proxy for the Company’s 2003 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission is December 9, 2002. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must do so no sooner than January 14, 2003 and no later than February 13, 2003. Stockholders are also advised to review the Company’s Amended and Restated Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations. A copy of the Company’s Amended and Restated Bylaws may be obtained from the Secretary of the Company at Telik, Inc., 750 Gateway Blvd., South San Francisco, CA 94080.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the Board of Directors shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified, or until such directors’ earlier death, resignation or removal.

The Board of Directors is presently composed of five members. There are two directors in the class whose term of office expires in 2002. The Company’s current directors in this class, Drs. Deleage and Martin, will not stand for re-election at the Annual Meeting, and the Company’s management proposes the nominees for election to this class as set forth below. If elected at the Annual Meeting, the nominees would serve until the 2005 annual meeting and until their successors are elected and have qualified, or until such directors’ earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. If a nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. The persons nominated for election have agreed to serve if elected, and management has no reason to believe that these nominees will be unable to serve.

Set forth below is biographical information for the persons nominated and for each person whose term of office as a director will continue after the Annual Meeting.

Nominees for Election for a Three-Year Term Expiring at the 2005 Annual Meeting

Edward W. Cantrall, Ph.D.

Edward W. Cantrall, Ph.D. is nominated for election as a director of the Company. Dr. Cantrall has served as a consultant to biotechnology and genomics companies since May 1998. From November 1997 to May 1998, Dr. Cantrall served as Vice President and General Manager for Molecular Informatics,Inc. (“Molecular Informatics”), a subsidiary of the Perkin-Elmer Corporation, and prior to the acquisition of Molecular Informatics by Perkin-Elmer Corporation in November 1997, he served as President and Chief Executive Officer of Molecular Informatics. He was Chief Executive Officer and President of the National Center for Genome Resources from January 1995 to November 1996. From September 1986 to July 1994, Dr. Cantrall served as Vice President of Operations at Lederle Laboratories, a division of American Cyanamid Company subsequently acquired by Wyeth Laboratories. He has served as a member of the Board of Managers of The Health Enterprise Group since 2000. His fields of expertise include pharmaceutical development and manufacturing. Dr. Cantrall holds a Ph.D. degree in organic chemistry from the University of Illinois and an MBA degree in industrial management from Fairleigh Dickinson University.

Steven R. Goldring, M.D.

Steven R. Goldring, M.D. is nominated for election as a director of the Company. Dr. Goldring has been a Professor of Medicine at Harvard Medical School and Chief of Rheumatology at Beth Israel Deaconess Medical Center since 1996. He has also served as the Director of the New England Baptist Bone and Joint Institute, in collaboration with the Beth Israel Deaconess Medical Center since its establishment in 1996. Dr. Goldring serves on the osteoporosis and rheumatology clinical advisory boards for Merck & Co., Inc. and Eli Lilly and Company, as

3

well as an advisor to numerous biotechnology companies. He has established a clinical research program at Beth Israel Deaconess Medical Center. Dr. Goldring has served as a consultant or Principal Investigator in the pharmaceutical industry, foundation and NIH sponsored research programs, and as a consultant to numerous biotechnology and pharmaceutical companies. He received his medical training at Peter Bent Brigham Hospital and the Massachusetts General Hospital and is the author of numerous scientific publications. Dr. Goldring holds an M.D. degree from Washington University School of Medicine.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE NAMED NOMINEES

Directors Continuing in Office Until the 2003 Annual Meeting

David R. Bethune

David R. Bethunehas served as one of the Company’s directors since December 1999. Since February 2000, he has served as Chairman and Chief Executive Officer of Atrix Laboratories (“Atrix”), a pharmaceutical company, and became acting Chief Executive Officer of Atrix in August 1999. He has also served as a director of Atrix since April 1995. From July 1997 until October 1998, Mr. Bethune was President and Chief Operating Officer of IVAX Corporation, a pharmaceutical company. From March 1995 until June 1997, he served as President and Chief Executive Officer for Aesgen, Inc., a pharmaceutical company. Mr. Bethune has held various positions at American Cyanamid Company, a pharmaceutical company, from February 1988 until February 1995. Mr. Bethune also served as President of Operations and Vice President and General Manager of U.S. Pharmaceuticals for G.D. Searle & Co., a pharmaceutical company, from June 1984 until January 1988. Mr. Bethune is a director of St. Charles Pharmaceutical Co., a pharmaceutical company, and the Female Health Company, a company that sells female health products. Mr. Bethune holds an A.B. degree in accounting and finance from Lenoir-Rhyne College and a Masters degree in executive management from Columbia University.

Stefan Ryser, Ph.D.

Stefan Ryser, Ph.D.has served as one of the Company’s directors since September 1998. Since April 2000, Dr. Ryser has served as a managing director of Bear Stearns Health Innoventures, a venture capital fund. Dr. Ryser served as Chief Executive Officer until April 2000, and has served as a member and delegate of the board of International Biomedicine Management Partners, Inc., a company that manages investments in biotechnology companies on behalf of International BM Biomedicine Holdings Inc., since January 1998. From January 1989 until December 1997, Dr. Ryser held various positions at F. Hoffmann-La Roche Ltd. (“Roche”), a pharmaceutical company, including Scientific Assistant to the President of Global Research and Development, and was responsible for maintaining the scientific liaison between Roche and Genentech, Inc. From January 1991 until December 1997, Dr. Ryser served as a member of the Brussels-based senior advisory group of EuropaBio, a European biotechnology organization. From August 1998 until March 2001, Dr. Ryser was a director of Genaissance Pharmaceuticals, Inc., a genomics company. From August 1999 until January 2002, Dr. Ryser was a director of Cytokinetics, Inc., a privately held biotechnology company. Dr. Ryser is a director of Arena Pharmaceuticals, a biotechnology company; Entelos, Inc. and Achillion Pharmaceuticals, Inc., both privately held biotechnology companies. Dr. Ryser received a Ph.D. degree in molecular biology from the University of Basel.

Director Continuing in Office Until the 2004 Annual Meeting

Michael M. Wick, M.D., Ph.D.

Michael M. Wick, M.D., Ph.D.has served as the Company’s Chairman of the Board of Directors since January 2000, as the Chief Executive Officer since July 1999 and as the President since June 1998. Dr. Wick served as the Company’s Chief Operating Officer from December 1997 until June 1998, and as Executive Vice President, Research and Development, from December 1997 until June 1998. He has been one of the Company’s

4

directors since December 1997. Prior to joining the Company in December 1997, Dr. Wick was Senior Vice President of Research for CV Therapeutics, Inc., a public biotechnology company, from May 1995 until May 1997, and continued as a consultant until December 1997. Dr. Wick served as Executive Director of oncology/immunology and clinical research at Lederle Laboratories, a division of American Cyanamid, a pharmaceutical company, from September 1990 until May 1995, and also directed the Cyanamid/Immunex joint oncology research program. Dr. Wick began his career at Harvard Medical School, where he served as an Associate Professor from July 1981 until June 1994 and Chief of the Melanoma Clinic and Laboratory of Molecular Dermatological Oncology at the Dana Farber Cancer Institute from September 1980 until September 1992. Dr. Wick holds a Ph.D. degree in chemistry from Harvard University and an M.D. degree from Harvard Medical School.

Board of Directors Committees and Meetings

During the fiscal year ended December 31, 2001, the Board of Directors held four meetings and acted once by a written consent. The Board of Directors has an Audit Committee and a Compensation Committee.

The Audit Committee meets with the Company’s independent auditors at least annually to review the results of the annual audit and discuss the financial statements; recommends to the Board of Directors the independent auditors to be retained; oversees the independence of the independent auditors; evaluates the independent auditors’ performance; and receives and considers the independent auditors’ comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee is currently composed of three directors: Drs. Martin and Ryser and Mr. Bethune. The Audit Committee met three times during the last fiscal year. All members of the Company’s Audit Committee are independent (as independence is defined in Rule 4200(a)(15) of the NASD listing standards). The Audit Committee is governed by a written charter approved by the Board of Directors. The Company expects that, if elected at the Annual Meeting, Dr. Cantrall will join the Audit Committee to replace Dr. Martin.

The Compensation Committee makes recommendations concerning salaries and incentive compensation, awards stock options to employees and consultants under the Company’s stock option plans and otherwise determines compensation levels and performs such other functions regarding compensation as the Board of Directors may delegate. The Compensation Committee is composed of three outside directors: Drs. Ryser and Deleage and Mr. Bethune. It did not meet during the last fiscal year, but acted twice by a written consent.

During the fiscal year ended December 31, 2001, each Board member attended 75% or more of the aggregate of the meetings of the Board of Directors and of the committees on which he served, held during the period for which he was a director or committee member, respectively.

Report of the Audit Committee of the Board of Directors*

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. The Company’s management is responsible for the internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and the issuance of a report thereon.

In this context, the Audit Committee met and held discussions with management and Ernst & Young LLP, the Company’s independent auditors. Management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles, and the Audit

| * | | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the company under the Securities Act of 1933 or the Securities Exchange Act of 1934. |

5

Committee has reviewed and discussed the financial statements with management and the independent auditors. The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (“Communication With Audit Committees”) as amended by Statement on Auditing Standards No. 90 (Audit Committee Communications).

In addition, the Audit Committee has discussed with the independent auditors, the auditors’ independence from the Company and its management, including the matters in the written disclosures that were received pursuant to the requirements of the Independence Standards Board No. 1 (Independence Discussions with Audit Committees) and considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission.

The Audit Committee and the Board of Directors also have recommended, subject to stockholder ratification, the selection of Ernst & Young LLP as the Company’s independent auditors.

6

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002, and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements since 1989. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent auditors is not required by the Company’s Bylaws or otherwise. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board of Directors in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Shares represented by executed proxies will be voted, if no abstention or vote against is marked, for the ratification of Ernst & Young LLP as the Company’s independent auditors.

Audit Fees. During the fiscal year ended December 31, 2001, the aggregate fees billed by Ernst & Young LLP for the audit of the Company’s financial statements and for the reviews of the Company’s interim financial statements were $117,600.

Financial Information Systems Design and Implementation Fees. During the fiscal year ended December 31, 2001, no fees were billed by Ernst & Young LLP for information technology consulting.

All Other Fees. During fiscal year ended December 31, 2001, the aggregate fees billed by Ernst & Young LLP for professional services other than audit and information technology consulting fees were $77,750 primarily for services provided in connection with the Company’s follow-on public offering.

The Audit Committee has determined the rendering of all non-audit services by Ernst & Young LLP is compatible with maintaining the auditors’ independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

7

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information regarding the Company’s executive officers, directors, nominees for director and key personnel.

Name

| | Age

| | Position

|

Executive Officers, Directors and Director Nominees: | | | | |

| Michael M. Wick, M.D., Ph.D. | | 56 | | President, Chief Executive Officer and Chairman |

| Cynthia M. Butitta | | 47 | | Chief Operating Officer and Chief Financial Officer |

| Reinaldo F. Gomez, Ph.D. | | 56 | | Senior Vice President, Product Development |

| David R. Bethune | | 61 | | Director |

| Jean Deleage, Ph.D.* | | 61 | | Director |

| David W. Martin, Jr., M.D.* | | 61 | | Director |

| Stefan Ryser, Ph.D. | | 42 | | Director |

| Edward W. Cantrall, Ph.D. | | 70 | | Director Nominee |

| Steven R. Goldring, M.D. | | 58 | | Director Nominee |

|

Key Personnel: | | | | |

| Gail L. Brown, M.D. | | 51 | | Senior Vice President and Chief Medical Officer |

| Jacqueline A. Dombroski, Ph.D. | | 46 | | Vice President, Regulatory Affairs and Quality Assurance |

| W. David Henner, M.D., Ph.D. | | 53 | | Vice President, Clinical Research and Development |

| James E. Keck, Ph.D. | | 45 | | Vice President, Biology Research |

| Robert T. Lum, Ph.D. | | 39 | | Vice President, Preclinical Development |

| Graeme R. Martin, Ph.D. | | 46 | | Chief Technical Officer |

| Steven R. Schow, Ph.D. | | 52 | | Vice President, Chemistry Research |

Set forth below is biographical information for each of the executive officers and key personnel.

Biographical information about Dr. Wick is included under the caption “Director Continuing in Office Until the 2004 Annual Meeting.” Biographical information about Mr. Bethune and Dr. Ryser is included under the caption “Directors Continuing in Office Until the 2003 Annual Meeting.” Biographical information about Drs. Cantrall and Goldring is included under the caption “Nominees for Election for a Three-Year Term Expiring at the 2005 Annual Meeting.” Biographical information about Drs. Deleage and Martin is not included because their term of office will expire and they are not standing for re-election at the Annual Meeting.

Cynthia M. Butitta has served as the Company’s Chief Operating Officer and Chief Financial Officer since March 2001. She served as the Company’s Chief Financial Officer since August 1998. From September 1997 through February 2001, Ms. Butitta also provided financial consulting services as a partner in Altair Capital Associates LLC, which she co-founded in November 1998, and Butitta Consulting Services LLC, which she founded in September 1997. From December 1995 until September 1997, Ms. Butitta was Vice President of Finance and Administration and Chief Financial Officer for Connetics, Inc., a biotechnology company. From June 1994 until December 1995, she was Vice President of Finance and Administration and Chief Financial Officer for InSite Vision, Inc., a biotechnology company. Ms. Butitta is a director of Catalyst Semiconductor, Inc., a semiconductor products company. Ms. Butitta holds a B.S. degree in business and accounting from Edgewood College in Madison, Wisconsin, and an M.B.A. degree in finance from the University of Wisconsin, Madison.

Reinaldo F. Gomez, Ph.D. has served as the Company’s Senior Vice President, Product Development since January 2002 and as Vice President, Product Development since September 2000. He served as the Company’s Vice President, Corporate Alliances from January 1998 until September 2000 and as Vice President, Research

| * | | Drs. Deleage and Martin are not standing for re-election to the Company’s Board of Directors. |

8

and Development from September 1996 until December 1997. From August 1995 to September 1996, Dr. Gomez served as the Company’s Vice President, Project Management. Dr. Gomez served as the Company’s Chief Executive Officer from July 1992 to August 1995. He served as the Company’s President from May 1991 until August 1995, and as one of the Company’s directors from May 1991 until January 1997. Over a ten-year period prior to that, Dr. Gomez held various research positions at Genentech, Inc., a biotechnology company, including that of Vice President of Discovery Research. During his tenure at Genentech, Dr. Gomez directed that company’s major drug development effort for tissue plasminogen activator (t-PA), which led to the filing of the application for FDA marketing approval in 1986. He previously served on the faculty of the Massachusetts Institute of Technology (“MIT”) as Associate Professor in Nutrition and Food Science. Dr. Gomez received his B.S. and M.S. degrees in food science from the University of Florida and his Ph.D. in nutrition and food science from MIT.

Gail L. Brown, M.D.has served as the Company’s Senior Vice President and Chief Medical Officer since November 2001. Dr. Brown has served as a consultant to the Company on matters related to clinical development of the Company’s products since October 1998. Prior to joining the Company, Dr. Brown was a Managing Director at The Palladin Group, LP, and Tanager Capital Group, LLC, entities specializing in investment advisory services, from January 2001 to October 2001. She was a co-founder and partner of Altair Capital Associates LLC, specializing in biotechnology investment advisory services, from November 1998 to January 2001. Dr. Brown has served as a consultant and a member of clinical and scientific advisory boards at numerous public and private biotechnology companies from 1995 to 2001. She began her career at the Harvard Medical School, where she served on the faculty in the Department of Medicine, Division of Hematology and Oncology from 1980 to 1995. Dr. Brown received her M.D. degree from The University of Rochester School of Medicine, and an M.B.A. degree in finance from St. Mary’s College of California School of Economics and Business Administration.

Jacqueline A. Dombroski, Ph.D. has served as the Company’s Vice President, Regulatory Affairs and Quality Assurance since August 2001. Prior to joining the Company, Dr. Dombroski served as Senior Regulatory Consultant, Worldwide Regulatory Affairs at Parexel International Corporation, a full service clinical research and development organization, from 1997 to 2001. She served as Director of Regulatory Affairs at Alkermes, Inc., a biotechnology company, from 1995 to 1997. Previously, she served as US and International Regulatory Affairs Consultant at the Weinberg Consulting Group, Inc., a Washington, DC-based consulting firm, from 1993 to 1995. Dr. Dombroski earned a Bachelor of Pharmacy and a Ph.D. in microbiology from The School of Pharmacy at London University.

W. David Henner, M.D., Ph.D. has served as the Company’s Vice President of Clinical Research and Development since January 2001. Dr. Henner has served as a member of the Company’s Scientific Advisory Board since 1994. Prior to joining the Company, Dr. Henner served on the faculty of Oregon Health Sciences University from 1988 to 2001 where he was Professor of Medicine and Pharmacology. He served as the Director of the Hormonal and Reproductive Cancers Program of the Oregon Cancer Center from 1993 to 2001. Dr. Henner began his career at the Harvard Medical School and the Dana Farber Cancer Institute where he served as an Assistant Professor in Medicine from 1982 to 1988. Dr. Henner received his Ph.D. in microbiology and his M.D. degree from the University of Pennsylvania and an M.B.A. degree from the University of Oregon.

James G. Keck, Ph.D. has served as the Company’s Vice President, Biology Research since May 2001. Prior to joining the Company, Dr. Keck served as a Senior Director of Discovery for GeneTrace Systems Inc., a biotechnology company, from March 2000 to April 2001. He served as President and Chief Scientific Officer of Strata Biosciences Incorporated, a biotechnology company for which he was the scientific founder and which subsequently merged with GeneTrace Systems Inc., from April 1999 to March 2000, and as Vice President of Research from September 1997 to April 1999. Prior to that, he served as Head of the Protein Expression Department at Berlex Biosciences Inc., a biotechnology company, from July 1995 to August 1997. Dr. Keck holds an M.S. degree from North Carolina State University and a Ph.D. degree from University of Southern California.

9

Robert T. Lum, Ph.D.has served as the Company’s Vice President, Preclinical Development since January 2002 and as Director, Medicinal Chemistry since January 2000. Dr. Lum joined the Company in February 1998 as Associate Director, Medicinal Chemistry. Prior to joining the Company, Dr. Lum served as Assistant Director, Medicinal Chemistry, at CV Therapeutics, Inc. from January 1994 to January 1998. Prior to 1994, he was a Scientist at Arris Pharmaceutical Corporation and an Associate Senior Investigator at Smithkline Beecham Corporation. Dr. Lum has authored numerous scientific publications and patents. Dr. Lum holds a Ph.D. degree in chemistry from the Massachusetts Institute of Technology and a B.S. degree from the University of California at Berkeley.

Graeme R. Martin, Ph.D.has served as the Company’s Chief Technical Officer since July 2001. Prior to joining the Company, Dr. Martin was associated with Roche Bioscience, a unit of Hoffmann-La Roche Inc. From 1996 to early 2001, he was Head of the Department of Molecular Pharmacology in the Neurobiology Unit, and also served as Acting Vice President and Head of Central Nervous System Research. From 1978 through 1995, Dr. Martin was at Wellcome Research Laboratories, serving most recently as a Senior Research Scientist and Head of the Receptor Pharmacology Unit. Dr. Martin is editor of several professional journals, including the Journal of Pharmacological and Toxicological Methods and Current Opinion in Central and Peripheral Nervous System Drugs. Dr. Martin holds a Ph.D. in pharmacology from University College, London and a B.SC. (Hons) in pharmacology from the University of Bath.

Steven R. Schow, Ph.D. has served as the Company’s Vice President, Chemistry Research since March 2000. He served as the Company’s Senior Director of Medicinal Chemistry from March 1998 until March 2000. Prior to joining the Company, Dr. Schow served as a Director of Medicinal Chemistry at CV Therapeutics, Inc., a biotechnology company, from May 1995 to March 1998. He served as a Senior Group Leader at Lederle Laboratories, a division of American Cyanamid, a pharmaceutical company, from November 1991 until May 1995. Dr. Schow holds a Ph.D. degree in organic chemistry from the University of California at San Diego.

The Company’s executive officers are appointed by the Board of Directors and serve until their successors are elected or appointed. There are no family relationships among any of the Company’s directors or executive officers. Dr. Brown, one of the Company’s key personnel, is the spouse of Dr. Wick, the Company’s President, Chief Executive Officer and Chairman. No director has a contractual right to serve as a member of the Company’s Board of Directors.

10

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s Common Stock as of March 1, 2002 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its Common Stock.

| | | Beneficial Ownership(1)

| |

Beneficial Owner

| | Number of Shares

| | Percent of Total

| |

Wellington Management Company, LLP(2) 75 State Street Boston, MA 02109 | | 3,701,365 | | 13.3 | % |

|

Sanwa Kagaku Kenkyusho Co., Ltd. 35 Higashi-ku Nagoya 461, Japan | | 2,445,301 | | 8.8 | % |

|

Morgan Stanley Dean Witter & Co.(3) 1585 Broadway New York, NY 10036 | | 2,055,250 | | 7.4 | % |

|

Biomedicine LP c/o UBS (Cayman Island) Ltd. P.O. Box 852 George Town Grand Cayman, Cayman Island | | 1,481,607 | | 5.3 | % |

|

| Michael M. Wick, M.D., Ph.D.(4) | | 738,140 | | 2.6 | % |

|

| Cynthia M. Butitta(5) | | 197,104 | | * | |

|

| Reinaldo F. Gomez, Ph.D.(6) | | 343,652 | | 1.2 | % |

|

| David R. Bethune(7) | | 12,271 | | * | |

|

| Jean Deleage, Ph.D.(8) | | 877,325 | | 3.2 | % |

|

| David W. Martin, Jr., M.D.(9) | | 26,052 | | * | |

|

| Stefan Ryser, Ph.D.(10) | | 10,333 | | * | |

|

| Edward W. Cantrall, Ph.D. | | — | | * | |

|

| Steven R. Goldring, M.D. | | — | | * | |

|

| All executive officers, directors and director nominees as a group (9 persons)(11) | | 2,204,877 | | 7.6 | % |

| (1) | | This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 27,827,810 shares outstanding on March 1, 2002, adjusted as required by rules promulgated by the SEC. |

| (2) | | Wellington Management Company, LLP (“WMC”), an investment adviser registered with the SEC under Section 203 of the Investment Advisers Act of 1940, as amended, is deemed a beneficial owner of these |

11

| | shares as the result of acting as investment advisor to its various investment advisory clients, none of which is known to have beneficial ownership of more than five percent of the Company’s Common Stock, except Wellington Trust Company, N.A., a wholly-owned subsidiary of WMC and a bank as defined in Section 3(a)(6) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). WMC disclaims any pecuniary interest (as such term is defined in Rule 16a-1(a) promulgated under the Exchange Act) in such shares. |

| (3) | | Morgan Stanley Dean Witter & Co. (“MSDW”) is deemed a beneficial owner of these shares as a result of being the parent company of a business unit that holds the shares. No accounts managed on a discretionary basis by MSDW holds more than five percent of the Company’s Common Stock. |

| (4) | | Includes 690,667 shares issuable to Dr. Wick pursuant to options exercisable within 60 days of March 1, 2002 and 38,000 shares held in the name of Dr. Wick’s spouse. |

| (5) | | Includes 95,833 shares issuable to Ms. Butitta pursuant to options exercisable within 60 days of March 1, 2002. |

| (6) | | Held by Dr. Gomez, by him and his spouse as trustees of a family trust and by his minor child who resides with him. Includes 229,897 shares issuable to Dr. Gomez pursuant to options exercisable within 60 days of March 1, 2002. |

| (7) | | Includes 11,771 shares issuable to Mr. Bethune pursuant to options exercisable within 60 days of March 1, 2002. |

| (8) | | Dr. Deleage, a director of the Company whose term in office expires at the time of the Annual Meeting, is a principal of Alta Partners. Alta Partners provides investment advisory services to several venture capital funds including, Alta BioPharma Partners L.P. and Alta Embarcadero BioPharma Partners, LLC. Alta BioPharma Partners L.P. beneficially owns 803,064 shares of Common Stock and Alta Embarcadero BioPharma Partners, LLC beneficially owns 30,269 shares of Common Stock. Shares shown as beneficially owned by Dr. Deleage also include 22,552 shares issuable to him pursuant to options exercisable within 60 days of March 1, 2002. |

| (9) | | Includes 20,052 shares issuable to Dr. Martin, a director of the Company whose term in office expires at the time of the Annual Meeting, pursuant to options exercisable within 60 days of March 1, 2002. |

| (10) | | Includes 8,333 shares issuable to Dr. Ryser pursuant to options exercisable within 60 days of March 1, 2002. |

| (11) | | Includes shares described in the notes above, as applicable. Includes shares which certain executive officers, directors and principal stockholders of the Company have the right to acquire pursuant to options exercisable within 60 days of March 1, 2002. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2001, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

12

EXECUTIVE COMPENSATION

Compensation of Directors

The Company does not provide cash compensation to non-employee directors for serving on the Board of Directors or for attendance at Committee meetings. The members of the Board of Directors are eligible for reimbursement for their expenses incurred in connection with attendance at Board and Committee meetings in accordance with Company policy.

Each non-employee director of the Company also receives stock option grants under the 2000 Non-Employee Directors’ Stock Option Plan (the “Directors’ Plan”). Only non-employee directors of the Company or an affiliate of such directors (as defined in the Internal Revenue Code) are eligible to receive options under the Directors’ Plan. Options granted under the Directors’ Plan are not intended by the Company to qualify as incentive stock options under the Internal Revenue Code.

Option grants under the Directors’ Plan are non-discretionary. On the effective date of the Company’s initial public offering of its Common Stock, each non-employee director was granted an option to purchase 20,000 shares of the Common Stock. Each person who is elected or appointed to be a non-employee director for the first time after such date will be granted an option to purchase 20,000 shares of Common Stock upon such election or appointment. On the day following each Annual Meeting of Stockholders (or the next business day should such date be a legal holiday), each member of the Company’s Board of Directors who is not an employee of the Company or, where specified by the non-employee director, an affiliate of such director, is automatically granted under the Directors’ Plan, without further action by the Company, the Board of Directors or the stockholders of the Company, an option to purchase 5,000 shares of the Company’s Common Stock or an option to purchase an amount of shares prorated for the part of the year served as a non-employee director. No other options may be granted at any time under the Directors’ Plan.

The exercise price of options granted under the Directors’ Plan is 100% of the fair market value of the Common Stock subject to the option on the date of the option grant. The options have a term of 10 years. 25% of the shares subject to the options will vest on the first anniversary of the grant date and the remainder will vest in equal monthly installments over the next three years. The vesting of each option will cease on the date the non-employee director holding such option ceases to provide services (whether as a director or consultant) to the Company or one of the Company’s affiliates. Options will terminate three months after the non-employee director’s service with the Company or its affiliates terminates. However, if such termination is due to the non-employee director’s death, or if the non-employee director dies within three months after his or her service terminates, the exercise period will be extended to 18 months following death. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change of control transaction involving the Company, the options outstanding under the Directors’ Plan may be assumed or substituted by the surviving entity. Otherwise, the vesting of the options held by those directors whose continuous service has not terminated shall accelerate in full and the options will terminate if not exercised at or prior to such change of control transaction.

During the last fiscal year, the Company granted options covering 5,000 shares to each non-employee director of the Company, at an exercise price per share of $7.17. The fair market value of such Common Stock on the date of grant was $7.17 per share (determined in accordance with the terms of the Directors’ Plan based on the closing sales price reported on the Nasdaq National Market). As of March 1, 2002, options covering 20,000 shares had been exercised under the Directors’ Plan.

13

COMPENSATION OF EXECUTIVE OFFICERS

Summary of Compensation

The following table shows for the fiscal years ended December 31, 2001, 2000 and 1999, compensation awarded or paid to, or earned by, the Company’s Chief Executive Officer and its other two most highly compensated executive officers at December 31, 2001 (the “Named Executive Officers”). There were no other executive officers during this period.

| | | Year

| | Annual Compensation

| | Long-Term Compensation

|

| | | | | Securities Underlying | | Other |

Name and Principal Position

| | | Salary

| | Bonus

| | Options

| | Compensation

|

Michael M. Wick(1) President, Chief Executive Officer and Chairman | | 2001 2000 1999 | | $ | 400,000 300,000 270,000 | | $ | 100,000 150,000 — | | — 200,000 150,000 | | — — — |

|

Reinaldo F. Gomez Senior Vice President, Product Development | | 2001 2000 1999 | | | 214,583 180,000 209,467 | | | 56,250 5,000 — | | — 25,000 — | | — — — |

|

Cynthia M. Butitta(2) Chief Operating Officer and Chief Financial Officer | | 2001 2000 1999 | | | 232,387 120,000 120,000 | | | 68,750 5,000 — | | 250,000 50,000 — | | — — — |

| (1) | | Dr. Wick was promoted to Chief Executive Officer in July 1999 and Chairman in January 2000. |

| (2) | | Ms. Butitta was promoted to the position of Chief Operating Officer and Chief Financial Officer in March 2001. |

14

STOCK OPTION GRANTS AND EXERCISES

The Company grants options to its employees, including executive officers, under its 2000 Equity Incentive Plan (the “Incentive Plan”). As of March 1, 2002, options to purchase a total of 2,169,771 shares were outstanding under the Incentive Plan and options to purchase 2,654,805 shares remained available for grant thereunder. Prior to the Company’s initial public offering, the Company granted options to its employees, including executive officers, under its 1996 and 1988 Stock Option Plans, which both terminated as of the effective date of the initial public offering, and outside the plans. No new stock options are being granted under the 1996 and 1988 Stock Option Plans and, as of March 1, 2002, 1,522,406, shares are outstanding under these plans and none are outstanding outside the plans. Options generally vest over a four-year period. Generally, 25% of the initial option grant vests on the one-year anniversary of employment and the remainder vests in a series of equal monthly installments beginning on the one-year anniversary of employment and continuing over the next three years of service. Subsequent options granted generally vest according to a similar schedule beginning on the date of grant. The exercise price per share is equal to the fair market value of the Company’s Common Stock on the date of grant, as determined in accordance with the provisions of the 2000 Equity Incentive Plan based on the closing prices for the Company’s Common Stock on the Nasdaq National Market. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change of control transaction involving the Company, the options outstanding under the Company’s option plans may be assumed or substituted by the surviving entity. Otherwise, the vesting of the options outstanding under the Incentive Plan and the 1996 Stock Option Plan, held by those participants whose continuous service has not terminated, shall accelerate in full and the options will terminate if not exercised at or prior to such change of control transaction, while the options outstanding under the 1988 Stock Option Plan will terminated without acceleration.

The following tables show for the fiscal year ended December 31, 2001, certain information regarding options granted to, exercised by, and held at year end by, the Named Executive Officers:

Option Grants in Last Fiscal Year

| | | Individual Grants

| | | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

| | | Number of Securities Underlying Options

| | Percentage of Total Options Granted to Employees in Fiscal | | | Exercise Price(2)

| | Expiration Date

| |

Name

| | | Year(1)($/sh)

| | | | | 5% ($)

| | 10% ($)

|

| Michael M. Wick | | — | | — | | | | — | | — | | | — | | | — |

President, Chief Executive Officer and Chairman | | | | | | | | | | | | | | | | |

|

| Cynthia M. Butitta | | 250,000 | | 16.2 | % | | $ | 3.81 | | 3/14/11 | | $ | 600,075 | | $ | 1,514,475 |

Chief Operating Officer and Chief Financial Officer | | | | | | | | | | | | | | | | |

|

| Reinaldo F. Gomez | | — | | — | | | | — | | — | | | — | | | — |

Senior Vice President, Product Development | | | | | | | | | | | | | | | | |

| (1) | | The percentage of total options was calculated based on options to purchase an aggregate of 1,538,250 shares of Common Stock granted to employees under the Company’s stock option plans in 2001. |

| (2) | | All options were granted at the fair market value of the Company’s Common Stock on the date of grant. |

| (3) | | The potential realizable value is calculated based on the term of the option at its time of grant. It is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option and that the option is exercised and sold on the last day of its term for the appreciated stock price. No gain to the option holder is possible unless the stock price increases over the option term. The 5% and 10% assumed rates of appreciation are derived from the rules of the SEC and do not represent the Company’s estimate or projection of the future Common Stock price. |

15

Aggregated Option Exercises in Last Fiscal Year, and

Fiscal Year End Option Values

Name

| | Shares Acquired on Realized Exercise(#)

| | Value ($)(1)

| | Number of Securities Underlying Options at December 31, 2001(#) Exercisable/Unexercisable

| | Value of In-the-Money Options at December 31, 2001($) Exercisable/Unexercisable(2)

|

Michael M. Wick President, Chief Executive Officer and Chairman | | — | | — | | 636,500/262,500 | | $ | 7,241,850/$2,126,250 |

|

Cynthia M. Butitta Chief Operating Officer and Chief Financial Officer | | — | | — | | 18,751/281,249 | | | 152,155/2,642,219 |

|

Reinaldo F. Gomez Senior Vice President, Product Development | | — | | — | | 219,480/35,937 | | | 2,589,706/281,131 |

| (1) | | The value realized is based on the fair market value of the Company’s Common Stock on the date of exercise minus the exercise price. |

| (2) | | Amounts shown in the value of unexercised in-the-money options at December 31, 2001 column are based on the fair market value of $13.50 per share, representing the closing price on Nasdaq National Market on December 31, 2001, without taking into account any taxes that may be payable in connection with the transaction, multiplied by the number of shares underlying the option, less the aggregate exercise price payable for these shares. |

EMPLOYMENT, SEVERANCE AND CHANGE OF CONTROL AGREEMENTS

The Company entered into an employment agreement with Michael M. Wick, M.D., Ph.D. in August 1999 upon his promotion to the position of Chief Executive Officer. In December 1999, Dr. Wick was elected Chairman of the Board of Directors which became effective in January 2000. Either the Company or Dr. Wick may terminate his employment at any time for any reason. If Dr. Wick is terminated without cause, he is entitled to receive as severance, continued payment of his base salary and health care benefits for twelve months. The monthly vesting of stock options will also continue for the same twelve months.

The Company entered into an employment agreement with Cynthia M. Butitta in February 2001 which became effective in March 2001 upon her promotion to the position of Chief Operating Officer and Chief Financial Officer. This agreement superseded Ms. Butitta’s July 1998 employment agreement with the Company. Ms. Butitta was granted an option to purchase 250,000 shares of the Company’s Common Stock at an exercise price of $3.81 per share. Either the Company or Ms. Butitta may terminate her employment at any time. There are no severance provisions.

16

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

ON EXECUTIVE COMPENSATION*

The Compensation Committee of the Board of Directors (the “Committee”) is responsible for setting and administering the policies which govern annual executive salaries, bonuses (if any) and stock ownership programs. The Committee is composed of three non-employee directors.

Compensation Philosophy

The Committee annually evaluates the performance and determines the compensation of the Chief Executive Officer (“CEO”) and the other executive officers of the Company based upon a mix of the achievement of corporate goals, individual performance and comparisons with other biopharmaceutical companies. The policies of the Committee with respect to executive officers, including the CEO, are to provide compensation sufficient to attract, motivate and retain executives of outstanding ability and potential and to establish an appropriate relationship between executive compensation and the creation of stockholder value. To support this compensation philosophy, the Committee has established a compensation package consisting of three elements: (i) salary; (ii) stock options; and (iii) bonus.

Base Salary. The salaries of executive officers are not determined by the Company’s achievement of specific corporate performance criteria. Instead, the Committee determines the salaries for executive officers based upon review of the individual’s performance, levels of responsibility, prior experience, breadth of knowledge and a review of professional compensation reports and other salary surveys. The compensation reports and surveys focus upon biopharmaceutical companies, such as those that make up the Nasdaq Biotechnology Index. Based upon this information, the salaries of executive officers are set at what the Committee believes to be competitive levels relative to other biopharmaceutical companies.

Stock Option Grants. The stock option grants of executive officers also are not determined by the Company’s achievement of specific corporate performance criteria. The executive officers’ stock options are set at what the Committee believes to be competitive levels, based upon the information noted above and after consideration of the number of stock options authorized for issuance and the total number of stock options to be awarded. In determining where a given officer’s total compensation, including the CEO’s, is set, the Committee subjectively evaluates such factors as the individual’s performance and contribution to the attainment of corporate performance goals.

Bonuses. Based on the reports and surveys of biopharmaceutical companies described above, bonuses are set at what the Committee believes to be competitive levels. However, payment of bonuses is also linked to the attainment of specified corporate goals which the Committee sets at the meeting during which management presents the financial plan for the next year. Among other things, the attainment of these goals determine whether a bonus will be paid to all employees and the amount of funding available for the bonus pool. For the bonus for services rendered in 2001, the corporate performance goals, in order of importance, related to: (i) the completion of fundraising activities, including the Company’s follow-on public offering; and (ii) the advancement of clinical development programs, including advancement of TLK286 clinical trials and the filing of an Investigational New Drug application for TLK199. The Committee set the bonus for each executive officer based on the Committee’s subjective evaluation of the individual’s performance. The Committee determined that the specified corporate goals were attained for services rendered in 2001, based upon the Company’s plans and objectives set by the Board of Directors.

| * | | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934. |

17

Corporate Performance and CEO Compensation

The Committee uses the same procedures described above in setting the annual salary, bonus and stock option awards for the Company’s CEO, Michael M. Wick, M.D., Ph.D. The CEO is not present during the discussion of his compensation.

CEO’s Base Salary. The Committee reviews and establishes the base salary for Dr. Wick based on compensation data for comparable companies and the Committee’s assessment of his past performance and its expectations as to his future contributions in directing the Company’s long-term success. Accordingly, Dr. Wick’s base salary was increased from $300,000 in 2000 to $400,000 in 2001.

CEO’s Stock Option Grants. The Committee determined that, based upon Dr. Wick’s performance in 2001, it was appropriate to grant Dr. Wick a stock option to purchase 150,000 shares of the Company’s common stock. However, due to the timing of the Committee’s meeting, this grant was not approved until February 2002. The Committee believes that the grant to Dr. Wick is necessary to maintain the overall competitiveness of his compensation package and to maintain the strength of the alignment of his interest with those of the Company’s stockholders. The Committee intends to continue to monitor Dr. Wick’s compensation levels in light of his performance and the compensation levels of executives at comparable companies.

CEO’s Bonus. The Committee determined that it was appropriate to award Dr. Wick a bonus in the amount of $100,000 for services provided to the Company in 2001. The Committee assessed the corporate performance goals relating to the completion of fundraising activities, including the Company’s follow-on public offering, and the advancement of clinical development programs, including TLK286 and TLK199, among others. The Committee determined that the specified corporate goals were attained for services rendered in 2001, based upon the Company’s plans and objectives set by the Board of Directors.

Limitation on Deduction of Compensation Paid to Certain Executive Officers

Section 162(m) of the Internal Revenue Code limits the Company to a deduction for federal income tax purposes of no more than $1 million of compensation paid to certain Named Executive Officers in a taxable year. Compensation above $1 million may be deducted if it is “performance-based compensation” within the meaning of the Internal Revenue Code. The Compensation Committee has not yet established a policy for determining which forms of incentive compensation awarded to its Named Executive Officers shall be designed to qualify as “performance-based compensation.”

| | Th | e Compensation Committee: |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company’s Compensation Committee consists of three outside directors: Drs. Ryser and Deleage and Mr. Bethune. None of the members of the Compensation Committee is currently or has been at any time one of the Company’s officers or employees.

18

PERFORMANCE MEASUREMENT COMPARISON*

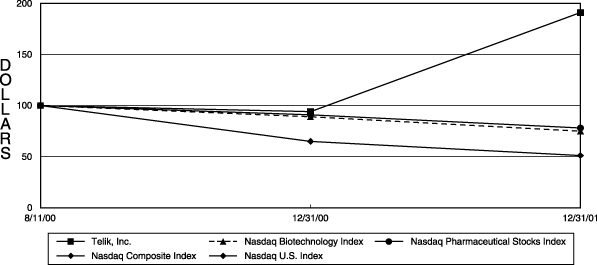

The following graph shows the total stockholder return of an investment of $100 in cash on August 11, 2000 for (i) the Company’s Common Stock, (ii) the Nasdaq Composite Index, (iii) the Nasdaq Biotechnology Index, (iv) the Nasdaq U.S. Index** and (v) the Nasdaq Pharmaceutical Stocks Index**. All values assume reinvestment of the full amount of all dividends and are calculated as of December 31 of each year:

| | | August 11, 2000

| | December 31, 2000

| | December 31, 2001

|

| Telik, Inc. | | $ | 100 | | $ | 94 | | $ | 191 |

| Nasdaq Composite Index | | | 100 | | | 65 | | | 51 |

| Nasdaq Biotechnology Index | | | 100 | | | 89 | | | 75 |

| Nasdaq U.S. Index | | | 100 | | | 65 | | | 51 |

| Nasdaq Pharmaceutical Stocks Index | | | 100 | | | 91 | | | 78 |

| * | | The material in this section is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934 whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

| ** | | The Company has selected the Nasdaq Pharmaceutical Stocks Index and the Nasdaq U.S. Index as its new published industry indices because the Nasdaq Biotechnology Index and the Nasdaq Composite Index are not cumulative total return indices, as required by the regulations promulgated by the Securities and Exchange Commission under the 1934 Act. The total stockholder return for the Nasdaq Composite Index and the Nasdaq U.S. Index is represented on the graph by a single line because the value of the investment at each plotting point was the same for these indices for the period presented. |

19

CERTAIN TRANSACTIONS

Since October 1998, Gail L. Brown, M.D. has served as a consultant to the Company on matters involving the clinical development of the Company’s products. Dr. Brown is the spouse of Dr. Wick, the Company’s President, Chief Executive Officer and Chairman. From January 1, 2001 through November 25, 2001, the Company paid Dr. Brown an aggregate of $303,000 for professional services to the Company and reimbursed her $22,937 for expenses. On November 26, 2001, Dr. Brown joined the Company as a Senior Vice President and Chief Medical Officer. Her compensation includes an annual salary of $325,000 and an option grant of 350,000 shares at an exercise price of $11.00 per share.

In June 2000, the Company made a loan to Ms. Butitta in connection with the exercise of her option to purchase 96,000 shares of the Company’s Common Stock. This full recourse loan originally had a principal amount of $153,600 and as of March 1, 2002, has a remaining principal amount of $105,600. Ms. Butitta paid a portion of the principal in the amount of $48,000 in December 2001. The loan bears an annual interest rate of 6.5% and is due in June 2003.

In February 2001, the Company entered into amendments to its Collaboration Agreement, License Agreement and Screening Services Agreement with Sanwa Kagaku Kenkyusho Co., Ltd (“Sanwa”) initially entered into in December 1996. Under the collaboration agreement and related license, the Company will receive payments for certain research and development activities, for achievement of specified development milestones, such as initiation of clinical trials and submission of Sanwa’s request for regulatory approval, and for royalties on product sales, if any, in several countries in Asia. The Company has received a total of $8.25 million from Sanwa under the collaboration agreement, including $2.25 million in February 2001, and may receive up to $12.25 million more in the future. Also, in addition to research funding, Sanwa invested an aggregate of $11.0 million in the Company’s equity securities during the years of 1996 through 1998.

The Company completed private placements of the Series H preferred stock, Series I preferred stock and Series J preferred stock in December 1996, September 1997 and October 1998, respectively. The following table sets forth the shares of common stock issued to Sanwa upon conversion at the time of the Company’s initial public offering in August 2000 of Sanwa’s holdings of preferred stock:

Shares of Common Stock Issued to Sanwa Kagaku Kenkyusho Co., Ltd. upon Conversion of:

|

Series H Preferred Stock

| | Series I Preferred Stock

| | Series J Preferred Stock

| | Total Consideration

|

| 540,540 | | 714,285 | | 1,190,476 | | $11,000,000 |

As of March 1, 2002, Sanwa continued to hold 2,445,301 shares, representing 8.8% of the Company’s outstanding common stock.

The Company has entered into indemnification agreements with its directors and certain officers for the indemnification and advancement of expenses to these persons to the fullest extent permitted by law. The Company also intends to enter into those agreements with its future directors and officers.

20

HOUSEHOLDING OF PROXY MATERIALS

The Securities and Exchange Commission has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are Telik stockholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker, direct your written request to: Investor Relations, Attention: Kevin Lee, Controller, Telik, Inc., 750 Gateway Blvd., South San Francisco, CA 94080 or contact Kevin Lee at (650) 244-9303. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

| | By | Order of the Board of Directors |

April 10, 2002

A copy of the Company’s Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended December 31, 2001is available without charge upon written request to: Corporate Secretary, Telik, Inc., 750 Gateway Blvd., South San Francisco, CA 94080.

21

APPENDIX A

FORM OF PROXY

TELIK, INC.

Proxy Solicited by the Board of Directors for the Annual Meeting of Stockholders

to Be Held on May 14, 2002

The undersigned hereby appoints Michael M. Wick, Cynthia M. Butitta and Reinaldo F. Gomez and each of them, as attorneys and proxies of the undersigned, with full power of substitution, to vote all of the shares of stock of Telik, Inc., which the undersigned may be entitled to vote at the Annual Meeting of Stockholders of Telik, Inc. to be held at the offices of Telik, Inc. at 750 Gateway Boulevard, South San Francisco, CA 94080 on Tuesday, May 14, 2002 at 9:00 a.m. (local time), and at any and all postponements, continuations and adjournments thereof, with all powers that the undersigned would possess if personally present, upon and in respect of the following matters and in accordance with the following instructions, with discretionary authority as to any and all other matters that may properly come before the meeting.

Unless a Contrary Direction Is Indicated, this Proxy Will Be Voted for Proposal 1 and for Proposal 2,

As More Specifically Described in the Proxy Statement. If Specific Instructions Are Indicated,

this Proxy Will Be Voted in Accordance therewith.

(Continued and to be signed on other side)

Fold and Detach Here

Please mark ¨

your vote

as indicated

The Board of Directors Recommends a Vote for Proposal 1.

Proposal 1: To elect two directors, Edward W. Cantrall, Ph.D. and Steven R. Goldring, M.D., to hold office until the 2005 Annual Meeting of Stockholders

¨ For | | ¨ Against | | ¨ Abstain |

The Board of Directors Recommends a Vote for Proposal 2.

Proposal 2: To ratify the selection of Ernst & Young LLP as independent auditors of the Company for its fiscal year ending December 31, 2002.

¨ For | | ¨ Against | | ¨ Abstain |

Please Vote, Date and Promptly Return this Proxy in the Enclosed Return Envelope Which Is Postage Prepaid If Mailed in the United States.

Dated , 2002

Signature(s)

Please sign exactly as your name appears hereon. If the stock is registered in the names of two or more persons, each should sign. Executors, administrators, trustees, guardians and attorneys-in-fact should add their titles. If signer is a corporation, please give full corporate name and have a duly authorized officer sign, stating title. If signer is a partnership, please sign in partnership name by authorized person.

A-1