SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material pursuant to § 240.14a-12 |

Telik, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (6) | Amount Previously Paid: |

| | (7) | Form, Schedule or Registration Statement No.: |

TELIK, INC.

3165 Porter Drive

Palo Alto, CA 94304

Notice of Annual Meeting of Stockholders to be Held on May 25, 2006

To the Stockholders of Telik, Inc.:

Notice is Hereby Given that the Annual Meeting of Stockholders of Telik, Inc., a Delaware corporation (the “Company”), will be held on Thursday, May 25, 2006 at 11:00 a.m. local time at the Company’s principal executive offices at 3165 Porter Drive, Palo Alto, CA 94304 for the following purposes:

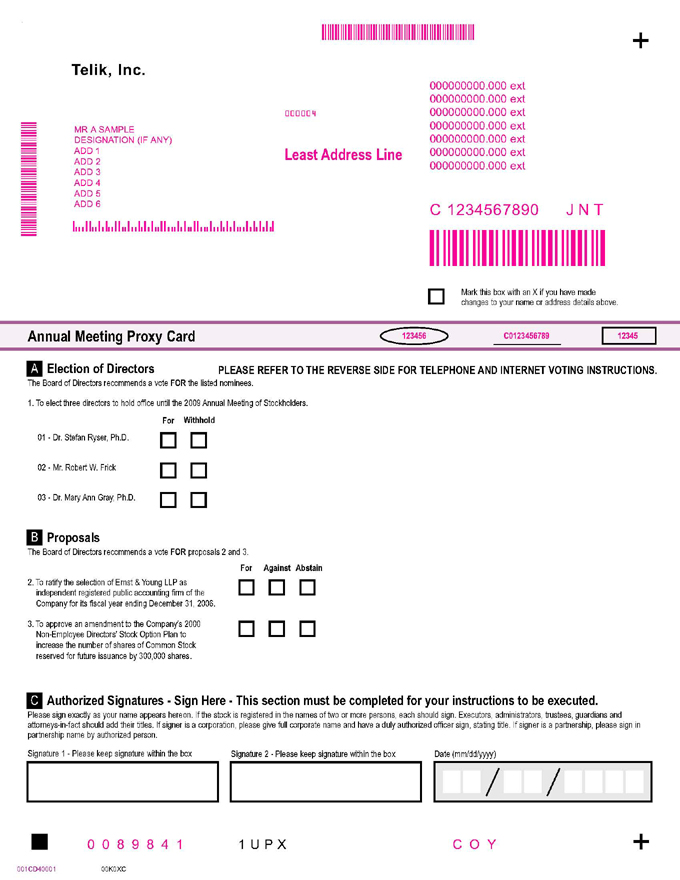

| | (1) | | To elect three directors to hold office until the 2009 Annual Meeting of Stockholders; |

| | (2) | | To ratify the selection of Ernst & Young LLP as Independent Registered Public Accounting Firm of the Company for its fiscal year ending December 31, 2006; |

| | (3) | | To approve an amendment to the Company’s 2000 Non-Employee Directors’ Stock Option Plan to increase the number of shares of common stock reserved for future issuance by 300,000 shares; and |

| | (4) | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 28, 2006 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment or postponement.

By Order of the Board of Directors

/s/ William P. Kaplan

William P. Kaplan

Secretary

Palo Alto, California

April 14, 2006

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY OR VOTE BY TELEPHONE OR THE INTERNET AS INSTRUCTED IN THESE MATERIALS, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR YOU TO VOTE BY MAIL. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD ON RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

Electronic Delivery of Stockholder Communications

Our annual meeting materials are available electronically. As an alternative to receiving printed copies of these materials in future years, you can elect to receive an e-mail which will provide an electronic link to these documents as well as allow you the opportunity to conduct your voting online. By registering for electronic delivery, you can conveniently receive stockholder communications as soon as they are available without waiting for them to arrive via postal mail. You can also reduce the number of documents in your personal files, eliminate duplicate mailings, help us reduce our printing and mailing expenses and conserve natural resources.

How to Register for Electronic Delivery

Stockholders of Record

You are a stockholder of record if you hold your shares in certificate form. If you vote on the Internet atwww.computershare.com/expressvote, simply follow the directions for enrolling in the electronic delivery service. You also may enroll in the electronic delivery service at any time in the future by going directly towww.computershare.com/expressvote and following the instructions.

Beneficial Stockholders

You are a beneficial stockholder if your shares are held by a broker, bank or other nominee. Please check with your bank, broker or relevant nominee regarding the availability of this service.

If you have any questions about electronic delivery, please contact Telik’s Investor Relations Department by phone at (650) 845-7700 or by email atinvestors@telik.com.

TELIK, INC.

3165 Porter Drive

Palo Alto, CA 94304

PROXY STATEMENT

FOR THE 2006 ANNUAL MEETING OF STOCKHOLDERS

May 25, 2006

INFORMATION CONCERNING SOLICITATION AND VOTING

General

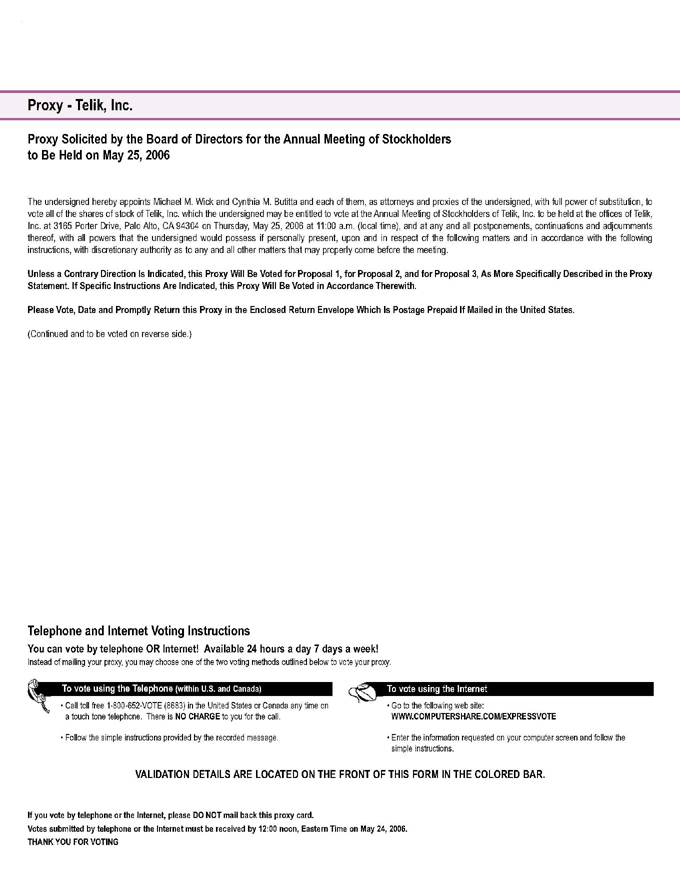

The enclosed proxy is solicited on behalf of the Board of Directors of Telik, Inc., a Delaware corporation (“Telik” or the “Company”), for use at the Annual Meeting of Stockholders to be held on Thursday, May 25, 2006, at 11:00 a.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company’s principal executive offices at 3165 Porter Drive, Palo Alto, CA 94304. The Company intends to mail this proxy statement and accompanying proxy card on or about April 14, 2006 to all stockholders entitled to vote at the Annual Meeting.

Solicitation

The Company will bear the entire cost of the solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company’s common stock (“Common Stock”) beneficially owned by others to forward to the beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for these services.

Voting Rights and Outstanding Shares

Only holders of record of Common Stock at the close of business on March 28, 2006, will be entitled to notice of and to vote at the Annual Meeting. At the close of business on March 28, 2006, the Company had outstanding and entitled to vote 52,252,623 shares of Common Stock. Each holder of record of Common Stock on that date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to the proposal from the beneficial owner (even if the nominee has voted on another proposal for which it does have discretionary authority or for which it has received instructions). Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes have no effect and will not be counted toward the vote total for any proposal. Unless a contrary direction is indicated, the grant of a proxy will be counted as affirmative votes for all proposals.

1

Voting Via the Internet or by Telephone.

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The laws of Delaware, under which the Company is incorporated, specifically permit electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that the proxy was authorized by the stockholder.

The telephone and Internet voting procedures below are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

For Shares Registered in Your Name

To vote on the Internet, stockholders of record may go tohttp://www.computershare.com/expressvote and follow the on-screen instructions. To vote by telephone, stockholders of record may call toll free 1-800-652-VOTE (8683) in the United States and Canada on a touch tone telephone and follow the simple instructions provided by the recorded message. You will need the login validation details provided on your proxy card to vote on the Internet or by telephone.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in “street name” receive instructions for granting proxies from their banks, brokers or other agents, rather than using the Company’s proxy card.

A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares through the telephone and Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communication Services program, you may grant a proxy to vote those shares by telephone or via the Internet by contacting the website shown on the instruction form received from your broker or bank.

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 12:00 noon, Eastern Time on May 24, 2006. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Revocability of Proxies

Any person granting a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company’s principal executive office, 3165 Porter Drive, Palo Alto, CA 94304, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

Stockholder Proposals

The deadline for nominating a director and submitting a stockholder proposal for inclusion in the Company’s proxy statement and form of proxy for the Company’s 2007 Annual Meeting of Stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission is December 17, 2006. Stockholders wishing to submit proposals or director nominations for potential consideration at the 2007 Annual Meeting of Stockholders, but not to be included in the related proxy statement and proxy must do so no sooner than

2

January 26, 2007 and no later than February 25, 2007. Stockholders are also advised to review the Company’s Amended and Restated Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations. A copy of the Company’s Amended and Restated Bylaws is available without charge upon written request to: Corporate Secretary, Telik, Inc., 3165 Porter Drive, Palo Alto, CA 94304.

PROPOSAL 1

ELECTION OF DIRECTORS

Election of Directors

The Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the Board of Directors of the Company (the “Board of Directors”) shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until the director’s successor is elected and has duly qualified, or until such directors’ earlier death, resignation or removal.

The Board of Directors is presently composed of eight members. There are three directors, Drs. Ryser and Gray and Mr. Frick, whose term of office expires in 2006. They are being nominated for re-election at the Annual Meeting, and if elected, each of the nominees will serve until the 2009 Annual Meeting of Stockholders and until his or her successor is elected and has duly qualified, or until such director’s earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. If a nominee should be unavailable for election as a result of an unexpected occurrence, shares voted for the unavailable nominee will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that the nominee will be unable to serve.

Set forth below is biographical information for each person nominated for election and for each person whose term of office as a director will continue after the Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE NAMED NOMINEES.

Nominees for Election for a Three-Year Term Expiring at the 2009 Annual Meeting

Stefan Ryser, Ph.D.,46, has served as a member of the Board of Directors since September 1998 and is being nominated for re-election. Since April 2000, Dr. Ryser has served as a managing partner of Bear Stearns Health Innoventures L.P., a venture capital fund, and is a managing director of Bear Stearns Asset Management. Dr. Ryser served as an executive officer and a member of the board of International Biomedicine Management Partners, Inc., an investment management company, from January 1998 to April 2000. From January 1989 until December 1997, Dr. Ryser held various positions at F. Hoffmann-La Roche Ltd., a pharmaceutical company, including the Scientific Assistant to the President of Global Research and Development, and was responsible for maintaining the scientific liaison between F. Hoffmann-La Roche and Genentech, Inc. Dr. Ryser is a director of Achillion Pharmaceuticals, Inc., Raven Biotechnologies, Inc. and TolerRx, Inc., all privately held biotechnology companies. Dr. Ryser holds a Ph.D. degree in molecular biology from the University of Basel.

3

Robert W. Frick, 68,has served as a member of the Board of Directors since April 2003 and is being nominated for re-election. From 1963 to 1974 and from 1976 until his retirement in 1988, Mr. Frick served in various capacities at Bank of America, including Vice Chairman of the Board of Directors, Chief Financial Officer, head of the World Banking Group for Bank of America, Managing Director of BankAmerica International, and President of Bank of America’s venture capital subsidiary. Mr. Frick is currently an Adjunct Professor of Business Strategy in the graduate business program at St. Mary’s College, and serves as Chairman of K.E.S. Management Company and as Chairman and CEO of GAC Confections, L.L.C. He is a director of Charles Schwab Trust Company and Charles Schwab Bank, subsidiaries of The Charles Schwab Corporation, and Lucas Film Limited, all privately held companies. Mr. Frick holds a B.S. degree in Civil Engineering and an M.B.A. degree from Washington University in St. Louis, Missouri.

Mary Ann Gray,Ph.D.,53, has served as a member of the Board of Directors since August 2003 and is being nominated for re-election. From 1999 to 2003, Dr. Gray served as a Senior Analyst and Portfolio Manager for the Federated Kaufmann Fund. Prior to 1999, Dr. Gray led the biotechnology equity research groups at Raymond James & Associates, Warburg Dillon Read and Kidder Peabody. Currently, Dr. Gray is President of Gray Strategic Advisors, LLC. She also serves on the Board of Directors of Dyax Corporation and Acadia Pharmaceuticals, Inc. Dr. Gray began her career as a scientist focused on new cancer drug development at Schering-Plough Corporation and NeoRx Corporation. Dr. Gray holds a Ph.D. degree in pharmacology from the University of Vermont.

Directors Continuing in Office Until the 2007 Annual Meeting

Michael M. Wick, M.D., Ph.D.,60, has served as the Company’s Chairman of the Board of Directors since January 2000. Dr Wick has served as the Company’s Chief Executive Officer since July 1999 and as its President since June 1998. Dr. Wick served as the Company’s Chief Operating Officer from December 1997 until June 1998, and as Executive Vice President, Research and Development, from December 1997 until June 1998. He has been a member of the Board of Directors since December 1997. Prior to joining the Company in December 1997, Dr. Wick was Senior Vice President of Research for CV Therapeutics, Inc., a biotechnology company, from May 1995 until May 1997. Dr. Wick served as Executive Director of oncology/immunology and clinical research at Lederle Laboratories from September 1990 until May 1995, and also directed the Cyanamid/Immunex joint oncology research program. Dr. Wick began his career at Harvard Medical School, where he served as an Associate Professor from July 1981 until June 1994 and Chief of the Melanoma Clinic and Laboratory of Molecular Dermatological Oncology at the Dana Farber Cancer Institute from September 1980 until September 1992. Dr. Wick holds a Ph.D. degree in chemistry from Harvard University and an M.D. degree from Harvard Medical School.

Richard B. Newman, 67,has served as a member of the Board of Directors since April 2003. Mr. Newman is currently President and Chief Executive Officer of D&R Products Co., Inc., which designs, develops and manufactures orthopedic, vascular and other surgical medical devices and instruments for major medical device and instrument manufacturers in the United States and Europe. He has served in this role since 1983. Mr. Newman holds an A.B. degree from Harvard College and an LL.B. degree from Harvard Law School.

Herwig von Morzé, Ph.D., 68,has served as a member of the Board of Directors since August 2004. Dr. von Morzé is currently an International Patent Consultant specializing in pharmaceutical patent strategy, patent prosecution and pharmaceutical product life cycle management. Dr. von Morzé was Co-Chair of Heller Ehrman’s Patent and Trademark Practice Group from 1999 to 2003. He has directed patent prosecution and enforcement programs in the pharmaceutical industry for more than 25 years. Dr. von Morzé holds a Ph.D. degree in organic chemistry from the University of Vienna, Austria.

Directors Continuing in Office Until the 2008 Annual Meeting

Edward W. Cantrall, Ph.D.,74, has served as a member of the Board of Directors since May 2002. Dr. Cantrall has served as a consultant to biotechnology and genomics companies since May 1998. From

4

November 1997 to May 1998, Dr. Cantrall served as Vice President and General Manager for Molecular Informatics, Inc., a subsidiary of the Perkin-Elmer Corporation; and prior to the acquisition of Molecular Informatics by Perkin-Elmer Corporation in November 1997, he served as President and Chief Executive Officer of Molecular Informatics, Inc. He was Chief Executive Officer and President of the National Center for Genome Resources from January 1995 to November 1996. From September 1986 to July 1994 Dr. Cantrall served as Vice President of Operations at Lederle Laboratories, a division of American Cyanamid Company, a pharmaceutical company which was subsequently acquired by Wyeth Laboratories, Inc. He has served as a member of the Board of Managers of The Health Enterprise Group since 2000. His fields of expertise include pharmaceutical development and manufacturing. Dr. Cantrall holds a Ph.D. degree in organic chemistry from the University of Illinois and an M.B.A. degree in industrial management from Fairleigh Dickinson University.

Steven R. Goldring, M.D., 62,has served as a member of the Board of Directors since May 2002. Since 1996, Dr. Goldring has been a Professor of Medicine at Harvard Medical School and Chief of Rheumatology at Beth Israel Deaconess Medical Center. He has also served as the Director of the New England Baptist Bone and Joint Institute, in collaboration with the Beth Israel Deaconess Medical Center since its establishment in 1996. Dr. Goldring serves on the osteoporosis and rheumatology clinical advisory boards for Merck & Co., Inc. and Eli Lilly and Company, as well as an advisor to numerous biotechnology companies. He has established a clinical research program at Beth Israel Deaconess Medical Center. Dr. Goldring has served as a consultant or principal investigator in the pharmaceutical industry, foundation and National Institutes of Health sponsored research programs and as a consultant to numerous biotechnology and pharmaceutical companies. He received his medical training at Peter Bent Brigham Hospital and the Massachusetts General Hospital. He is the author of numerous scientific publications. Dr. Goldring holds an M.D. degree from Washington University School of Medicine.

Board of Directors Committees and Meetings

Independence of the Board of Directors and its Committees

The Nasdaq Stock Market (“Nasdaq”) listing standards require that a majority of the members of a listed company’s board of directors qualify as “independent,” as determined by the board of directors.

After review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board of Directors has determined that all of the Company’s directors are independent directors within the meaning of the applicable Nasdaq listing standards, except Dr. Wick, the Chairman of the Board of Directors and Chief Executive Officer of the Company.

As required under the Nasdaq listing standards, the Company’s independent directors will meet in regularly scheduled executive sessions at which only independent directors are present. The Company’s independent directors met once during the fiscal year ended December 31, 2005. Persons interested in communicating with any director may address correspondence to the director in care of the Company at 3165 Porter Drive, Palo Alto, CA 94304.

The Board of Directors has three committees: an Audit Committee, a Compensation Committee and a Nominating Committee. Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee, among other things: evaluates the performance, and assesses the qualifications, of the Company’s independent

5

registered public accounting firm, determines and pre-approves the engagement of the independent registered public accounting firm to perform all proposed audit, review and attest services; reviews and pre-approves the retention of the independent registered public accounting firm to perform any proposed, permissible non-audit services; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm for the ensuing year; confers with management and the independent registered public accounting firm regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in the Company’s Annual Report on Form 10-K and recommends whether or not such financial statements should be so included; and discusses with management and the independent registered public accounting firm the results of the annual audit and review of the Company’s quarterly financial statements.

Three directors comprise the Audit Committee: Drs. Cantrall and Ryser and Mr. Frick. The Audit Committee met seven times and acted once by written consent during the fiscal year ended December 31, 2005. The written Audit Committee Charter was amended and restated in February 2004, and it is attached as Appendix A to the proxy statement for the Company’s annual meeting of stockholders held on May 26, 2005, as filed with the Securities and Exchange Commission on April 13, 2005.

The Board of Directors periodically reviews the Nasdaq listing standards’ definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent, as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards and Section 10(A)(3)(b)(1) of the Securities Exchange Act of 1934. The Board of Directors has determined that Dr. Cantrall qualifies as an “audit committee financial expert,” as defined in applicable Securities and Exchange Commission rules. The Board of Directors made a qualitative assessment of Dr. Cantrall’s level of knowledge and experience based on a number of factors, including his formal education and his service in executive capacities having financial oversight responsibilities. These positions include Chief Executive Officer, President and Vice President of Operations to, and member of the board of directors of, a number of biotechnology and genomics companies, pursuant to which Dr. Cantrall has experience supervising the preparation of financial reports. In addition, Dr. Cantrall holds an M.B.A. For further information on Dr. Cantrall’s experience, please see his biography under “Directors Continuing in Office Until the 2008 Annual Meeting” above.

Compensation Committee

The Compensation Committee of the Board of Directors reviews, modifies and approves the overall compensation strategy and policies for the Company. The Compensation Committee, among other things: reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s officers; determines and approves the compensation and other terms of employment of the Company’s Chief Executive Officer; determines and approves the compensation and other terms of employment of the other officers of the Company; administers the Company’s stock option and purchase plans, pension and profit sharing plans and other similar programs; and reviews and recommends to the Board of Directors appropriate insurance coverage for the Company’s directors and officers.

Three directors currently comprise the Compensation Committee: Drs. Ryser and Goldring and Mr. Newman. Each of the members of the Compensation Committee is independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Compensation Committee met three times and acted four times by written consent during the fiscal year ended December 31, 2005.

Nominating Committee

The Nominating Committee of the Board of Directors is responsible for, among other things: identifying, reviewing and evaluating candidates to serve as directors of the Company; reviewing, evaluating and considering

6

incumbent directors; recommending to the Board of Directors for selection candidates for election to the Board of Directors; making recommendations to the Board of Directors regarding the membership of the committees of the Board of Directors; and assessing the performance of the Board of Directors.

Three directors comprise the Nominating Committee: Drs. Ryser and Gray and Mr. Newman. All members of the Nominating Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Nominating Committee met twice during the fiscal year ended December 31, 2005. The Nominating Committee adopted a written Nominating Committee Charter in 2004, and it is attached as Appendix B to the proxy statement for the Company’s annual meeting of stockholders held on May 26, 2005, as filed with the Securities and Exchange Commission on April 13, 2005.

The Nominating Committee has not established any specific minimum qualifications that must be met for recommendation for a position on the Board of Directors. Instead, in considering candidates for director the Nominating Committee will generally consider all relevant factors, including among others the candidate’s applicable expertise and demonstrated excellence in his or her field, the usefulness of the expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, experience and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board of Directors (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its stockholders.

The Nominating Committee uses its network of contacts (and those of other members of the Board of Directors) when compiling a list of potential director candidates and may also engage outside consultants (such as professional search firms). However, pursuant to its charter, the Nominating Committee also considers potential director candidates recommended by stockholders. All potential director candidates are evaluated based on the factors set forth above, and the Nominating Committee has established no special procedure for the consideration of director candidates recommended by stockholders.

The Nominating Committee will consider director candidates recommended by stockholders. Stockholders who wish to recommend individuals for consideration by the Nominating Committee to become nominees for election to the Board of Directors may do so by delivering a written recommendation to the Nominating Committee at the following address: 3165 Porter Drive, Palo Alto, CA 94304 at least 120 days prior to the anniversary date of the mailing of the Company’s proxy statement for the last Annual Meeting of Stockholders. The deadline for nominating a director for the 2007 Annual Meeting of Stockholders is December 17, 2006. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of the Company’s Common Stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Meetings of the Board of Directors and Committees of the Board of Directors

The Board of Directors met four times and acted once by written consent during the last fiscal year. Each Board member attended 75% or more of the aggregate of the meetings of the Board of Directors held during the period for which he or she was a director. Each committee member attended 75% or more of the aggregate of the meetings of the committees on which he or she served, held during the period for which he or she was a committee member.

Attendance at Annual Meeting

It is the Company’s current policy to require directors to attend the Annual Meeting absent extraordinary circumstances. The 2005 Annual Meeting of Stockholders was attended by all but one of the members of the Board of Directors.

7

Stockholder Communications with the Board of Directors

The Nominating Committee of the Board of Directors has adopted a process by which stockholders may communicate with the Board of Directors or any of its individual directors. Stockholders who wish to communicate with the Board of Directors may do so by sending a written communication addressed as follows: Telik Board Communication, c/o Stockholder Communications Officer, 3165 Porter Drive, Palo Alto, CA 94304. All communications must state the number of shares owned by the stockholder making the communication. Telik’s Stockholder Communications Officer, or SCO, will review each communication and forward the communication to the Board of Directors, to any individual director to whom the communication is addressed, and/or to any other officer of the Company considered by the SCO to be appropriate.

Code of Ethics

The Company has adopted the Telik, Inc. Code of Conduct, a code of ethics with which every employee, director and consultant is expected to comply. The Code of Conduct was filed with the Securities and Exchange Commission with the Company’s Annual Report on Form 10-K in 2004.

Report of the Audit Committee of the Board of Directors*

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. The Company’s management is responsible for the internal controls and the financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and the issuance of a report thereon.

In this context, the Audit Committee met and held discussions with management and Ernst & Young LLP, the Company’s independent registered public accounting firm. Management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees) as amended by Statement on Auditing Standards No. 90 (Audit Committee Communications).

In addition, the Audit Committee has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management, including the matters in the written disclosures that were received pursuant to the requirements of the Independence Standards Board No. 1 (Independence Discussions with Audit Committees) and considered the compatibility of non-audit services with the firm’s independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee met with the independent registered public accounting firm, with and without management present, to discuss the results of its examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee has recommended that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, for filing with the Securities and Exchange Commission.

| * | | The material in this report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934. |

8

The Audit Committee also has selected, subject to stockholder ratification, Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006.

The Audit Committee:

Edward W. Cantrall

Stefan Ryser

Robert W. Frick

9

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006, and has further directed management to submit to the stockholders for ratification the selection of an independent registered public accounting firm at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements since 1989. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is not required by the Company’s Amended and Restated Bylaws or otherwise. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board of Directors in their discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Shares represented by executed proxies will be voted, if no abstention or vote against is marked, for the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm.

Independent Registered Public Accounting Firm Fee Information

The following summarizes the fees billed by Ernst & Young LLP for audit, tax and other professional services during the years ended December 31, 2005 and 2004:

| | | | | | |

| | | December 31,

|

| | | 2005

| | 2004

|

Audit Fees (1) | | $ | 495,000 | | $ | 454,000 |

Audit-Related Fees (2) | | | — | | | — |

Tax Fees (3) | | | — | | | — |

All Other Fees (4) | | | — | | | — |

| | |

|

| |

|

|

Total Fees | | $ | 495,000 | | $ | 454,000 |

| | |

|

| |

|

|

| (1) | | Audit Fees were for services associated with the annual audit, the reviews of the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q and follow-on public offerings. |

| (2) | | There were no audit-related fees, as set forth in Item 9(e)(2) of Schedule 14A, for the fiscal years ended December 31, 2005 and 2004. |

| (3) | | Tax Fees would be for services in connection with tax compliance, tax planning and tax advice. As stated above, the Company incurred no such fees in the fiscal years ended December 31, 2005 and December 31, 2004. |

| (4) | | There were no other fees for services by Ernst & Young LLP for the fiscal years ended December 31, 2005 and December 31, 2004. |

10

The charter of the Audit Committee requires that the Audit Committee pre-approve the engagement of the Company’s independent registered public accounting firm, Ernst & Young LLP, to perform all proposed audit, review and attest services, as well as engagements to perform any proposed permissible non-audit services. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting. It is the Company’s practice to present any such proposed engagement to the Audit Committee for approval, either at a regularly scheduled or special meeting.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

11

PROPOSAL 3

APPROVAL OF AMENDMENT TO THE COMPANY’S 2000 NON-EMPLOYEE DIRECTORS’ STOCK OPTION PLAN

In March 2000, the Board of Directors adopted, and the stockholders subsequently approved, the Company’s 2000 Non-Employee Directors’ Stock Option Plan, or the Directors’ Plan. As of March 1, 2006, 300,000 shares of Common Stock were authorized for issuance under the Directors’ Plan, options covering 48,541 shares of Common Stock had been exercised, options (net of canceled or expired options) covering an aggregate of 230,000 shares of Common Stock had been granted and outstanding under the Directors’ Plan and only 21,459 shares of Common Stock (plus any shares that might in the future be returned to the Directors’ Plan as a result of cancellations or expiration of options) remained available for future grant under the Directors’ Plan.

In February 2006, the Board of Directors amended the Directors’ Plan, subject to stockholder approval, to increase the number of shares of Common Stock authorized for issuance under the Directors’ Plan by 300,000 shares. The Board of Directors believes that the increase in the number of shares available under the Directors’ Plan will promote the interests of the Company and its stockholders and enable the Company to attract and retain the caliber of directors important to the Company’s success.

Stockholders are requested in this Proposal 3 to approve the Directors’ Plan, as amended. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the Directors’ Plan, as amended. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted toward a quorum, but are not counted for any purpose in determining whether this matter has been approved.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 3.

12

The material terms of the Directors’ Plan, as amended, are summarized below. For a complete description, please refer to the actual Directors’ Plan, which has been filed with the SEC as Appendix B to this proxy statement and may be accessed from the SEC’s website at www.sec.gov. The following summary is qualified in its entirety by reference to the complete text of the Directors’ Plan. Any stockholder that wishes to obtain a copy of the actual plan document may do so by written request to: Corporate Secretary, Telik, Inc., 3165 Porter Drive, Palo Alto, CA 94304.

General

The Directors’ Plan provides for the automatic grant of nonstatutory stock options to the Company’s non-employee directors. Options granted under the Directors’ Plan are not intended to qualify as “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code. See “Federal Income Tax Information” below for a discussion of the tax treatment of nonstatutory stock options.

Purpose

The Board of Directors adopted the Directors’ Plan to secure and retain the services of qualified people capable of filling non-employee board positions and to provide incentives for these individuals to apply their maximum efforts for the success of Telik and its stockholders.

Administration

The Board of Directors administers the Directors’ Plan. The Board of Directors has the power to construe and interpret the Directors’ Plan. The Directors’ Plan specifies the persons to whom or the dates on which options will be granted, the number of shares to be subject to each option, the time or times during the term of each option within which all or a portion of the option may be exercised, the exercise price and the type of consideration or the other terms of the option.

Eligibility

The Directors’ Plan provides that options may be granted only to the Company’s non-employee directors. A “non-employee director” is defined in the Directors’ Plan as a director who is not otherwise an employee of Telik or any of the Company’s affiliates. Currently, there are seven directors eligible to participate in the Directors’ Plan.

Stock Subject to the Directors’ Plan

Currently 300,000 shares of Common Stock are authorized for issuance under the Directors’ Plan. Subject to this Proposal 3 to increase the shares authorized by 300,000, an aggregate of 600,000 shares of Common Stock is reserved for issuance under the Directors’ Plan. If options granted under the Directors’ Plan expire or otherwise terminate without being exercised, the shares of Common Stock not acquired pursuant to such options again become available for issuance under the Directors’ Plan.

13

2000 Non-Employee Directors’ Stock Option Plan

| | | | | | | |

Plan Category

| | Total Number of Options Granted

and Outstanding as of December 31, 2005

| | Average Exercise Price per Share (1)

| | Number of Options to be Granted in 2006

|

Edward W. Cantrall, Ph.D. | | 35,000 | | $ | 13.41 | | 5,000 |

Robert W. Frick | | 30,000 | | $ | 15.38 | | 5,000 |

Steven R. Goldring, M.D. | | 35,000 | | $ | 13.41 | | 5,000 |

Mary Ann Gray, Ph.D. | | 30,000 | | $ | 18.98 | | 5,000 |

Richard B. Newman | | 30,000 | | $ | 15.38 | | 5,000 |

Stefan Ryser, Ph.D. | | 45,000 | | $ | 11.00 | | 5,000 |

Herwig von Morzé, Ph.D. | | 25,000 | | $ | 17.79 | | 5,000 |

| | |

| | | | |

|

Total | | 230,000 | | | | | 35,000 |

| (1) | | All options were granted at the closing fair market value on the date of grant. |

Terms of Options

The following is a description of the terms of options under the Directors’ Plan. Individual option grants may not be more restrictive than the terms described below:

Option Grants. Subject to stockholder approval of this Proposal, pursuant to the terms of the Directors’ Plan, each person who for the first time becomes a non-employee director will be granted, upon the date of his or her initial appointment or election to be a non-employee director, a one-time option to purchase 20,000 shares of Common Stock. In addition, on the day following each annual meeting of the stockholders, each person who continues to serve as a non-employee director on that date will be granted, without further action of the board of directors, an option to purchase 5,000 shares of Common Stock;provided, however,that if the person has not been serving as a non-employee director for the entire period since the preceding annual meeting, then the number of shares subject to the annual grant shall be reduced pro rata for each full quarter prior to the date of grant during which the person did not serve as a non-employee director.

Exercise Price; Payment. Options granted under the Directors’ Plan are granted at the fair market value of the stock on the date of the grant as reported on the Nasdaq National Market. The exercise price of options granted under the Directors’ Plan must be paid (i) in cash or check at the time the option is exercised, (ii) by delivery of other Common Stock or (iii) pursuant to a program developed under Regulation T as promulgated by the Federal Reserve Board that, prior to the issuance of Common Stock, results in either the receipt of cash (or check) or the receipt of irrevocable instructions to pay the aggregate exercise price from the sales proceeds.

Option Exercise. Options granted under the Directors’ Plan become exercisable in cumulative increments, or “vest,” during the optionholder’s service as a director of the Company or during any subsequent employment of the optionholder and/or service by the optionholder as an employee or a consultant to the Company or an affiliate of the Company (collectively, “service”), provided there is no interruption or termination of such service. Options granted under the Directors’ Plan vest at a rate of 1/4 (25%) one year after the date of grant of the option and 1/48 per month thereafter over a period of three years, so that the options become fully vested after four years of service. Options granted under the Directors’ Plan do not permit exercise prior to vesting. To the extent provided by the terms of an option, an optionholder may satisfy any federal, state or local tax withholding obligation relating to the exercise of the option (in addition to the Company’s right to withhold from any compensation paid to the optionholder by the Company) by cash payment upon exercise, by authorizing the Company to withhold a portion of the stock otherwise issuable to the optionholder, by delivering already-owned Common Stock or by a combination of these means.

Term. The term of options under the Directors’ Plan is ten years. Options granted under the Directors’ Plan terminate three months after termination of the optionholder’s service unless (i) termination of service is

14

due to the optionholder’s disability, in which case the option may be exercised (to the extent the option was exercisable at the time of the termination of service) at any time within twelve months of the termination of service; or (ii) the optionholder dies before the optionholder’s service has terminated, or within three months after termination of the optionholder’s service, in which case the option may be exercised (to the extent the option was exercisable at the time of the optionholder’s death) within eighteen months of the optionholder’s death by the optionholder’s estate, by a person who acquired the right to exercise the option by bequest or inheritance or by a person designated to exercise the option upon the optionholder’s death.

Each optionholder’s option agreement provides that if the exercise of the option following the termination of the optionholder’s service would be prohibited because the issuance of stock would violate the registration requirements under the Securities Act of 1933, as amended, then the option will terminate on the earlier of (i) the expiration of the term of the option or (ii) three months after the termination of the optionholder’s service during which the exercise of the option would not be in violation of the registration requirements.

Other Provisions. The option agreement may contain such other terms, provisions and conditions not inconsistent with the Directors’ Plan as determined by the Board of Directors.

Restrictions on Transfer

An option is transferable only by will or by the laws of descent and distribution and, during the lifetime of the optionholder, only as the option by its terms specifically provides. However, the optionholder may, by delivering written notice to the Company in a form satisfactory to the Company, designate a third party who, in the event of the death of the optionholder, will thereafter be entitled to exercise the option.

Adjustments

Transactions in which the Company does not receive consideration, such as certain recapitalizations, stock dividends, stock splits or change in corporate structure, may change the class and number of shares of Common Stock subject to the Directors’ Plan and outstanding options. If these transactions occur, the Directors’ Plan will be appropriately adjusted as to the class and the maximum number of shares of Common Stock subject to the Directors’ Plan and outstanding options. The options thereafter issuable under the Directors’ Plan will similarly be adjusted as to the class, number of shares and price per share of Common Stock subject to the options.

Effect of Certain Corporate Events

The Directors’ Plan provides that in the event of a dissolution or liquidation of the Company, all outstanding options under the Directors’ Plan will terminate. The Directors’ Plan provides that, in the event of (i) a sale, lease or other disposition of substantially all of the Company’s securities or assets, (ii) a merger or consolidation in which Telik is not the surviving corporation or (iii) a reverse merger in which the Company is the surviving corporation but the shares of Common Stock outstanding prior to the merger are converted by virtue of the merger into other property, such as securities or cash, any surviving or acquiring corporation may assume options outstanding under the Directors’ Plan or may substitute similar options (including an option to acquire the same consideration paid to the stockholders in the transaction) for those options then outstanding under the Directors’ Plan. If any surviving or acquiring corporation in such a transaction does not assume the options or substitute similar options, then for options held by optionholders whose service has not terminated, the vesting of the options (and, if applicable, the time during which the options may be exercised) will be accelerated in full and the options will terminate if not exercised at or prior to the transaction’s effective date.

Duration, Amendment and Termination

The Board of Directors may terminate or periodically suspend the Directors’ Plan at any time without stockholder approval or ratification. Unless sooner terminated, the Directors’ Plan will terminate on the day

15

before the tenth anniversary of its adoption by the Board of Directors. Any termination or suspension of the Directors’ Plan will not impair the rights or obligations related to options granted while the Plan was in effect except with the consent of the option holder.

The Board of Directors may also amend the Directors’ Plan at any time. However, except for the adjustments described in the two preceding sections, no amendment of the Directors’ Plan will be effective unless approved by the Company’s stockholders to the extent stockholder approval is necessary to satisfy the requirements of Rule 16b-3 of the Securities Exchange Act of 1934, as amended, or any Nasdaq National Market or securities exchange listing requirements. The Board of Directors may submit any other amendment to the Directors’ Plan for stockholder approval. However, no amendment of the Directors’ Plan or any outstanding option may impair the rights under any option granted under the Directors’ Plan prior to the amendment unless the optionholder consents in writing.

Federal Income Tax Information

All options granted under the Directors’ Plan are nonstatutory stock options and generally have the following federal income tax consequences:

There are no tax consequences to the optionholder or the Company by reason of the grant of a nonstatutory stock option. Upon exercise of a nonstatutory stock option, the optionholder normally will recognize taxable ordinary income equal to the excess of the stock’s fair market value on the date of exercise over the option exercise price. If the optionholder becomes an employee, the Company is required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Internal Revenue Code and the satisfaction of a tax reporting obligation, the Company will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by the optionholder.

Upon disposition of the stock, the optionholder will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for the stock plus any amount recognized as ordinary income upon exercise of the option. The gain or loss will be long-term or short-term depending on whether the stock was held for more than one year.

At present, long-term capital gains are generally subject to lower tax rates than ordinary income or short-term capital gains. The maximum long-term capital gains rate for federal income tax purposes is currently 15% while the maximum ordinary income rate and short-term capital gains rate is effectively 35%.

16

EQUITY COMPENSATION PLAN INFORMATION

The following table provides certain information with respect to all of the Company’s equity compensation plans in effect as of December 31, 2005.

EQUITY COMPENSATION PLAN INFORMATION

| | | | | | | | |

| | | (a)

| | (b)

| | (c)

| |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

| | Weighted-average Exercise Price of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (1)

| |

Equity compensation plans approved by security holders | | 8,465,649 | | $ | 13.55 | | 2,149,250 | (2) |

Equity compensation plans not approved by security holders | | -0- | | | N/A | | -0- | |

| | |

| |

|

| |

|

|

Total: | | 8,465,649 | | $ | 13.55 | | 2,149,250 | (2) |

| | |

| |

|

| |

|

|

| (1) | | Each year on January 1, until January 1, 2010, the aggregate number of shares of Common Stock that may be issued pursuant to stock awards under the 2000 Equity Incentive Plan is automatically increased by the lesser of 1,500,000 shares or 5% of the total number of shares of Common Stock outstanding on that date, or such lesser amount as may be determined by the Board of Directors. In addition, each year on January 1, until January 1, 2010, the aggregate number of shares of Common Stock that may be issued pursuant to stock awards under the 2000 Employee Stock Purchase Plan is automatically increased by the lesser of 150,000 shares or 1% of the total number of shares of Common Stock outstanding on that date, or such lesser amount as may be determined by the Board of Directors. |

| (2) | | Includes 600,888 shares issuable under the 2000 Employee Stock Purchase Plan. |

17

MANAGEMENT

The following table sets forth information regarding the Company’s executive officers and key personnel.

| | | | |

Name

| | Age

| | Position

|

Executive Officers: | | | | |

Michael M. Wick, M.D., Ph.D. | | 60 | | President, Chief Executive Officer and Chairman |

Cynthia M. Butitta | | 51 | | Chief Operating Officer and Chief Financial Officer |

Marc L. Steuer | | 59 | | Senior Vice President, Business Development |

William P. Kaplan, Esq. | | 52 | | Vice President, General Counsel and Corporate Secretary |

| | |

Key Personnel: | | | | |

Gail L. Brown, M.D. | | 55 | | Senior Vice President and Chief Medical Officer |

Reinaldo F. Gomez, Ph.D. | | 60 | | Senior Vice President, Product Development |

Michael K. Inouye | | 50 | | Senior Vice President, Commercial Operations |

Paul M. Mendelman, M.D. | | 58 | | Senior Vice President, Clinical Development |

Set forth below is biographical information for each of the executive officers and key personnel.

Biographical information about Dr. Wick is included under the caption “Directors Continuing in Office Until the 2007 Annual Meeting.”

Cynthia M. Butitta has served as the Company’s Chief Operating Officer and Chief Financial Officer since March 2001. She has served as the Company’s Chief Financial Officer since August 1998. From September 1997 through February 2001, Ms. Butitta provided financial consulting services as a partner in Altair Capital Associates LLC, which she co-founded in November 1998, and Butitta Consulting Services LLC, which she founded in September 1997. From December 1995 until September 1997, Ms. Butitta was Vice President of Finance and Administration and Chief Financial Officer for Connetics, Inc., a biotechnology company. From June 1994 until December 1995, she was Vice President of Finance and Administration and Chief Financial Officer for InSite Vision, Inc., a biotechnology company. From June 2000 to February 2002, Ms. Butitta was a director of Catalyst Semiconductor, Inc., a semiconductor products company. Ms. Butitta holds a B.S. degree in business and accounting from Edgewood College and an M.B.A. degree in finance from the University of Wisconsin, Madison.

Marc L. Steuer has served as the Company’s Senior Vice President, Business Development since October 2002. Prior to joining the Company, from 1994 to 2002, Mr. Steuer was associated with Pharmacyclics, Inc., a biotechnology company, most recently as Senior Vice President, Business Development. From 1992 to 1994, Mr. Steuer was with SciClone Pharmaceuticals, Inc., a biopharmaceutical company, serving as Vice President, Finance and Chief Financial Officer and later as Executive Vice President, Business Development and Commercial Affairs. He also has held senior management positions at Pilkington Visioncare Group, a major division of Pilkington, plc, Syntex Corporation and international management consulting firms. Mr. Steuer currently serves on the Board of Directors of EORM, Inc., a private, non-biotechnology company. He holds B.S. and M.S. degrees in electrical engineering from Columbia University and an M.B.A. degree from New York University.

William P. Kaplan, Esq.has served as the Company’s Vice President and General Counsel since February 2006 and Vice President, Legal Affairs since April 2003. Mr. Kaplan has also served as the Company’s Corporate Secretary since May 2003. From 2000 to 2003 Mr. Kaplan was Vice President, General Counsel and Corporate Secretary of iPrint Technologies, a developer of Internet print technology. Prior to iPrint, Mr. Kaplan served as Vice President and General Counsel of Resumix, a publisher of enterprise human resources software subsequently acquired by Yahoo!. He also served as General Counsel of Netcom On-Line Communication Services, an Internet service provider, and Ungermann-Bass, a global manufacturer of network and telecommunications equipment. Mr. Kaplan has practiced law since 1982. He holds a B.A. degree in mathematics from the University of California, Santa Barbara, and a Juris Doctor degree from the School of Law at the University of California, Davis.

18

Gail L. Brown, M.D.has served as the Company’s Senior Vice President and Chief Medical Officer since November 2001. Dr. Brown has served as a consultant to the Company on matters related to clinical development of the Company’s product candidates since October 1998. Prior to joining the Company, Dr. Brown was a Managing Director at The Palladin Group, LP, and Tanager Capital Group, LLC, entities specializing in investment advisory services, from January 2001 to October 2001. She was a co-founder and partner of Altair Capital Associates LLC, specializing in biotechnology investment advisory services, from November 1998 to January 2001. Dr. Brown has served as a consultant and a member of clinical and scientific advisory boards at numerous public and private biotechnology companies from 1995 to 2001. She began her career at the Harvard Medical School, where she served on the faculty in the Department of Medicine, Division of Hematology and Oncology from 1980 to 1995. Dr. Brown received her M.D. degree from The University of Rochester School of Medicine and an M.B.A. degree in finance from St. Mary’s College of California School of Economics and Business Administration.

Reinaldo F. Gomez, Ph.D. has served as the Company’s Senior Vice President, Product Development since January 2002 and as Vice President, Product Development since September 2000. He served as the Company’s Vice President, Corporate Alliances from January 1998 until September 2000 and as Vice President, Research and Development from September 1996 until December 1997. From August 1995 to September 1996, Dr. Gomez served as the Company’s Vice President, Project Management. Dr. Gomez served as the Company’s Chief Executive Officer from July 1992 to August 1995. He served as the Company’s President from May 1991 until August 1995, and as one of the Company’s directors from May 1991 until January 1997. Over a ten-year period prior to that, Dr. Gomez held various research positions at Genentech, Inc., a biotechnology company, including Vice President of Discovery Research. During his tenure at Genentech, Dr. Gomez directed that company’s major drug development effort for tissue plasminogen activator (t-PA), which led to the filing of the application for FDA marketing approval in 1986. He previously served on the faculty of the Massachusetts Institute of Technology (“MIT”) as Associate Professor in Nutrition and Food Science. Dr. Gomez received his B.S. and M.S. degrees in food science from the University of Florida and his Ph.D. in nutrition and food science from MIT.

Michael K. Inouye has served as the Company’s Senior Vice President, Commercial Operations since March 2006. From 1995 to 2004, Mr. Inouye was with Gilead Sciences, Inc., a biopharmaceutical company, most recently as Senior Vice President, Commercial Operations. Mr. Inouye joined Gilead in 1995 as Vice President, Sales and Marketing and was promoted to Senior Vice President, Sales and Marketing in November 2000. Prior to joining Gilead, Mr. Inouye was Vice President, Sales and Marketing at InSite Vision, Inc. from 1994 to 1995. From 1980 to 1994, Mr. Inouye was with Merck and Co., Inc., where he held various sales and marketing management positions, including Senior Director, Marketing Planning and Senior Region Director, Field Sales. He has a B.S. in Food Science and Technology from the University of California, Davis and an M.B.A. from California Polytechnic University in Pomona.

Paul M. Mendelman, M.D. has served as the Company’s Senior Vice President, Clinical Development, since April 2005. From 1996 until 2005, Dr. Mendelman was vice president and therapeutic group leader, clinical development, infectious diseases and vaccines at MedImmune Vaccines. Dr. Mendelman managed the clinical development group for FluMist®, the intranasal influenza viral vaccine that was licensed in June 2003 in the U.S. Previously, Dr. Mendelman was a senior research physician in infectious diseases and vaccines for Merck Research Laboratories. Before joining Merck, he was an associate professor of pediatrics at the University of Washington, School of Medicine in Seattle where he conducted NIH funded research on the cell wall biology of Haemophilus influenza. Dr. Mendelman has over 25 years of experience in academic, clinical and pharmaceutical research with a specialization in pediatric infectious diseases. He is board certified in pediatrics and pediatric infectious diseases and holds an M.D. and a B.S. from Ohio State University.

The Company’s executive officers are appointed by the Board of Directors and serve until their successors are elected or appointed. There are no family relationships among any of the Company’s directors or executive officers. Dr. Brown, one of the Company’s key personnel, is the spouse of Dr. Wick, the Company’s President, Chief Executive Officer and Chairman. No director has a contractual right to serve as a member of the Board of Directors.

19

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s Common Stock by: (i) each director; (ii) each nominee for director; (iii) each of the executive officers named in the Summary of Compensation Table; (iv) all executive officers and directors of the Company as a group; and (v) all those known by the Company to be beneficial owners of more than five percent of its Common Stock. All of the information in this table is as of March 1, 2006.

Pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended, shares are deemed to be beneficially owned by a person if that person has the right to acquire shares (for example, upon exercise of an option) within sixty days of the date that information is provided. In determining the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by the person (and only that person) by reason of such acquisition rights. As a result, the percentage of outstanding shares held by any person in the table below does not necessarily reflect the person’s actual voting power. As of March 1, 2006, there were 52,251,623 shares of Common Stock outstanding.

| | | | | | | | | | | |

Beneficial Owner (1)

| | Number of Shares Owned (2)

| | | Right to Acquire within 60 days (3)

| | | Beneficial Ownership Total

| | Percent of Total

| |

| | | | |

Entities affiliated with Eastbourne Capital

Management, L.L.C. (4) 1101 Fifth Avenue, Suite 160, San Rafael, CA 94901-2916 | | 6,271,909 | | | — | | | 6,271,909 | | 12.0 | % |

| | | | |

Entities affiliated with Oppenheimer Funds, Inc. (5) Two World Financial Center, 225 Liberty Street, 11th Floor, New York, NY 10281-1008 | | 5,031,020 | | | — | | | 5,031,020 | | 9.63 | % |

| | | | |

Entities affiliated with Franklin Resources, Inc., (6) One Franklin Parkway, San Mateo, CA 94403-1906 | | 4,862,725 | | | — | | | 4,862,725 | | 9.31 | % |

| | | | |

Entities affiliated with Delaware Management

Holdings, (7) 2005 Market Street, Philadelphia, PA 19103-7098 | | 3,935,235 | | | — | | | 3,935,235 | | 7.53 | % |

| | | | |

Entities affiliated with Farallon Capital Management, L.L.C and Farallon Partners, L.L.C. (8) One Maritime Plaza, Suite 1325, San Francisco, CA 94111-3503 | | 2,990,200 | | | — | | | 2,990,200 | | 5.72 | % |

| | | | |

William Blair & Company, L.L.C. (9) 222 W. Adams Street, Chicago, IL 60606-5307 | | 2,918,674 | | | — | | | 2,918,674 | | 5.59 | % |

| | | | |

Michael M. Wick, M.D., Ph.D. | | 73,207 | (10) | | 1,672,438 | (11) | | 1,745,645 | | 3.24 | % |

Cynthia M. Butitta | | 31,573 | | | 435,834 | | | 467,407 | | * | |

Marc L. Steuer | | — | | | 174,999 | | | 174,999 | | * | |

William P. Kaplan, Esq. | | 2,685 | | | 80,626 | | | 83,311 | | * | |

Edward W. Cantrall, Ph.D. | | 34,000 | (12) | | 25,625 | | | 59,625 | | * | |

Robert W. Frick | | 10,000 | | | 17,396 | | | 27,396 | | * | |

Steven R. Goldring, M.D. | | — | | | 25,625 | | | 25,625 | | * | |

20

| | | | | | | | | | |

Beneficial Owner (1)

| | Number

of Shares Owned (2)

| | | Right to Acquire within 60 days (3)

| | Beneficial Ownership Total

| | Percent of Total

| |

Mary Ann Gray, Ph.D. | | 5,000 | | | 15,729 | | 20,729 | | * | |

Richard B. Newman, Esq. | | 23,472 | (13) | | 17,396 | | 40,868 | | * | |

Stefan Ryser, Ph.D. | | 2,000 | | | 35,938 | | 37,938 | | * | |

Herwig von Morzé, Ph.D | | — | | | 8,333 | | 8,333 | | * | |

All executive officers and directors as a group (11 persons) | | 181,937 | | | 2,509,939 | | 2,691,876 | | 4.92 | % |

| | (1) | This table is based upon information supplied by officers, directors, principal stockholders and Schedules 13D and 13G filed with the Securities and Exchange Commission. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 52,251,623 shares outstanding on March 1, 2006. |

| | (2) | Excludes shares issuable pursuant to stock options exercisable within 60 days of March 1, 2006. |

| | (3) | Shares issuable pursuant to stock options exercisable within 60 days of March 1, 2006. |

| | (4) | The amount shown and the following information were provided by Eastbourne Capital Management, L.L.C. pursuant to a Schedule 13G/A dated February 8, 2006, indicating beneficial ownership as of December 31, 2005. The Schedule 13G/A indicates that Eastbourne Capital Management, L.L.C. has shared voting and dispositive power with respect to 6,271,909 shares. According to the Schedule 13G/A, Richard Jon Barry holds shared voting and dispositive power with respect to 6,271,909 shares and Black Bear Offshore Master Fund, L.P. holds shared voting and dispositive power with respect to 4,184,199 shares. |

| | (5) | The amount shown and the following information were provided by OppenheimerFunds, Inc. pursuant to a Schedule 13G dated February 6, 2006, indicating beneficial ownership as of December 31, 2005. The Schedule 13G indicates that OppenheimerFunds, Inc. has shared voting and dispositive power with respect to 5,031,020 shares. According to the Schedule 13G, Oppenheimer Global Opportunities Fund has shared voting and dispositive power with respect to 5,000,000 shares. |

| | (6) | The amount shown and the following information were provided by Franklin Resources, Inc. pursuant to a Schedule 13G/A dated February 13, 2006 indicating beneficial ownership as of December 31, 2005. The securities reported are beneficially owned by one or more open or closed-end investment companies or other managed accounts that are investment advisory clients of investment advisers that are direct and indirect subsidiaries (each, an “Adviser Subsidiary” and, collectively, the “Adviser Subsidiaries”) of Franklin Resources, Inc. (“FRI”). Advisory contracts grant to the Adviser Subsidiaries all investment and/or voting power over the securities owned by such advisory clients. Therefore, for purposes of Rule 13d-3 under the Act, the Adviser Subsidiaries may be deemed to be the beneficial owners of the Securities. The voting and investment powers held by Franklin Mutual Advisers, LLC (“FMA”), an indirect wholly-owned Adviser Subsidiary, are exercised independently from FRI and from all other Adviser Subsidiaries (FRI, its affiliates and the Adviser Subsidiaries other than FMA are collectively, “FRI affiliates”). Charles B. Johnson and Rupert H. Johnson, Jr. (the “Principal Shareholders”) each own in excess of 10% of the outstanding common stock of FRI and are the principal stockholders of FRI. FRI and the Principal Shareholders may be deemed to be, for purposes of Rule 13d-3 under the Act, the beneficial owners of securities held by persons and entities advised by FRI subsidiaries. FRI, the Principal Shareholders and each of the Adviser Subsidiaries disclaim any pecuniary interest in any of the Securities. |

| | (7) | Delaware Management Holdings is a holding company and Delaware Management Business Trust is an investment advisor. Both entities may be deemed to beneficially own 3,935,235 shares. |

| | (8) | The amount shown and the following information were provided by Farallon Capital Partners, L.P. pursuant to a Schedule 13G/A dated January 25, 2006, indicating beneficial ownership as of |

21