SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Telik, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (6) | Amount Previously Paid: |

| | (7) | Form, Schedule or Registration Statement No.: |

TELIK, INC.

3165 Porter Drive

Palo Alto, CA 94304

Notice of Annual Meeting of Stockholders to be Held on May 12, 2010

To the Stockholders of Telik, Inc.:

NOTICEIS HEREBY GIVEN that the Annual Meeting of Stockholders ofTELIK, INC., a Delaware corporation (the “Company”), will be held onWEDNESDAY, MAY 12, 2010at11:00 a.m. local time at the Company’s principal executive offices at 3165 Porter Drive, Palo Alto, CA 94304 for the following purposes:

(1) To elect two directors named herein to hold office until the 2013 Annual Meeting of Stockholders;

| | (2) | | To ratify the selection of Ernst & Young LLP as the Independent Registered Public Accounting Firm of the Company by the Audit Committee of the Board of Directors of the Company for its fiscal year ending December 31, 2010; and |

| | (3) | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

| | The | | foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. |

The Board of Directors has fixed the close of business on March 19, 2010 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment or postponement.

|

| Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on May 12, 2010 at 11:00 a.m. local time at 3165 Porter Drive, Palo Alto, California 94304. |

| |

The Proxy Statement and Annual Report to stockholders are available at www.telik.com |

By Order of the Board of Directors

/s/ William P. Kaplan

William P. Kaplan

Secretary

Palo Alto, California

April 9, 2010

|

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY OR VOTE BY TELEPHONE OR THE INTERNET AS INSTRUCTED IN THESE MATERIALS, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR YOU TO VOTE BY MAIL. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD ON RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME. |

Electronic Delivery of Stockholder Communications

Our annual meeting materials are available electronically. As an alternative to receiving printed copies of these materials in future years, you can elect to receive an e-mail which will provide an electronic link to these documents as well as allow you the opportunity to conduct your voting online. By registering for electronic delivery, you can conveniently receive stockholder communications as soon as they are available without waiting for them to arrive via postal mail. You can also reduce the number of documents in your personal files, eliminate duplicate mailings, help us reduce our printing and mailing expenses and conserve natural resources.

How to Register for Electronic Delivery

Stockholders of Record

You are a stockholder of record if you hold your shares in certificate form. If you vote on the Internet atwww.investorvote.com, simply follow the directions for enrolling in the electronic delivery service. You also may enroll in the electronic delivery service at any time in the future by going directly towww.investorvote.com and following the instructions.

Beneficial Stockholders

You are a beneficial stockholder if your shares are held by a broker, bank or other nominee. Please check with your bank, broker or relevant nominee regarding the availability of this service.

If you have any questions about electronic delivery, please contact Telik’s Investor Relations Department by phone at (650) 845-7700 or by email atinvestors@telik.com.

TELIK, INC.

3165 Porter Drive

Palo Alto, CA 94304

PROXY STATEMENT

FOR THE 2010 ANNUAL MEETING OF STOCKHOLDERS

May 12, 2010

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Telik, Inc., a Delaware corporation (“Telik” or the “Company”), for use at the Annual Meeting of Stockholders to be held on Wednesday, May 12, 2010, at 11:00 a.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company’s principal executive offices at 3165 Porter Drive, Palo Alto, CA 94304. The Company intends to mail this proxy statement and accompanying proxy card on or about April 9, 2010 to all stockholders entitled to vote at the Annual Meeting. For directions to the annual meeting, please visit the Contact page at www.telik.com.

Solicitation

The Company will bear the entire cost of the solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company’s common stock (“Common Stock”) beneficially owned by others to forward to the beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for these services.

Voting Rights and Outstanding Shares

Only holders of record of Common Stock at the close of business on March 19, 2010, will be entitled to notice of and to vote at the Annual Meeting. At the close of business on March 19, 2010, the Company had outstanding and entitled to vote 53,522,329 shares of Common Stock. Each holder of record of Common Stock on that date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to the proposal from the beneficial owner (even if the nominee has voted on another proposal for which it does have discretionary authority or for which it has received instructions). Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes have no effect and will not be counted toward the vote total for any proposal. Unless a contrary direction is indicated, the grant of a proxy will be counted as affirmative votes for all proposals. Under

1

the rules and interpretations of the New York Stock Exchange (“NYSE”), “non-routine” matters are matters that may substantially affect the rights or privileges of shareholders, such as mergers, shareholder proposals and, for the first time, under a new amendment to the NYSE rules, elections of directors, even if not contested.

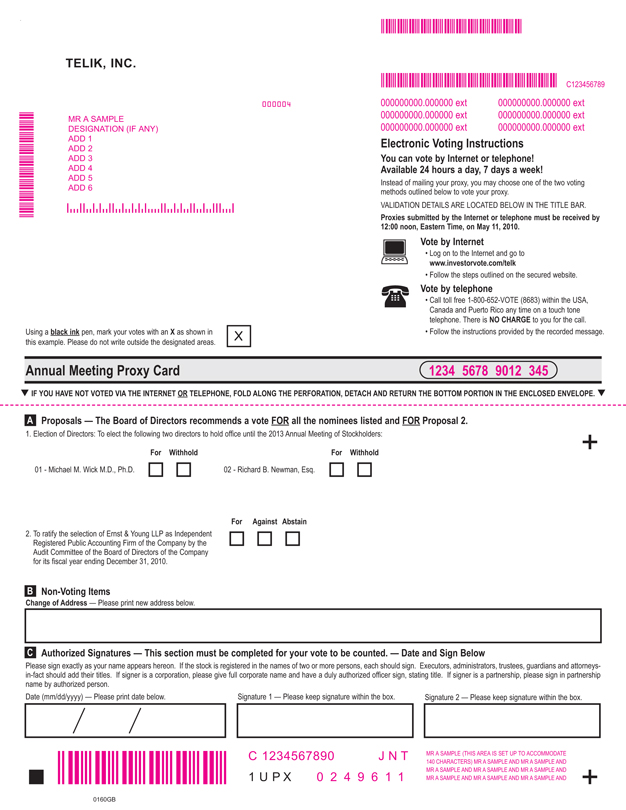

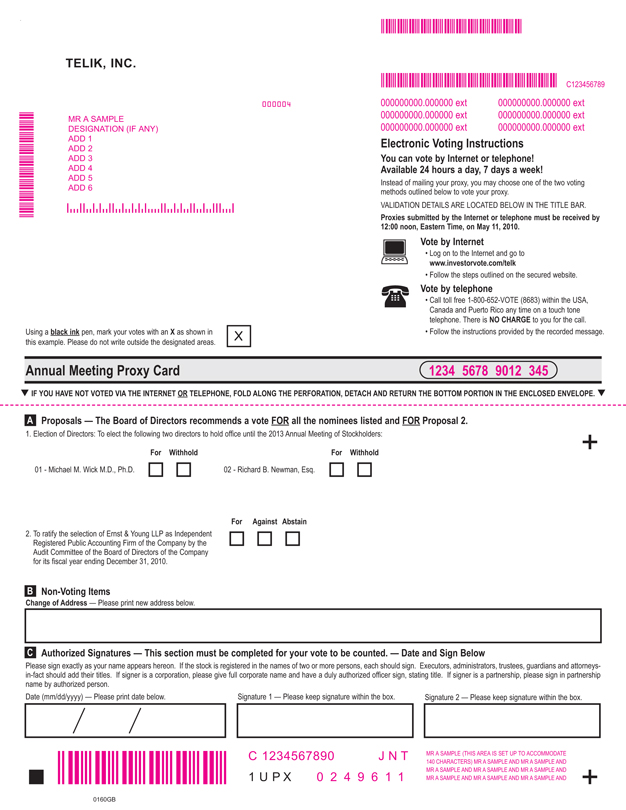

Voting Via the Internet or by Telephone

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The laws of Delaware, under which the Company is incorporated, specifically permit electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that the proxy was authorized by the stockholder.

The telephone and Internet voting procedures below are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

For Shares Registered in Your Name

To vote on the Internet, stockholders of record may go tohttp://www.investorvote.comand follow the on-screen instructions. To vote by telephone, stockholders of record may call toll free 1-800-652-VOTE (8683) in the United States, Canada and Puerto Rico on a touch tone telephone and follow the simple instructions provided by the recorded message. You will need the login validation details provided on your proxy card to vote on the Internet or by telephone.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in “street name” receive instructions for granting proxies from their banks, brokers or other agents, rather than using the Company’s proxy card.

A number of brokers and banks are participating in a program provided through Broadridge Investor Communication Solutions that offers the means to grant proxies to vote shares through the telephone and Internet. If your shares are held in an account with a broker or bank participating in the Broadridge Investor Communication Solutions program, you may grant a proxy to vote those shares by telephone or via the Internet by contacting the website shown on the instruction form received from your broker or bank.

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 12:00 noon, Eastern Time on May 11, 2010. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Revocability of Proxies

Any person granting a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company’s principal executive offices, 3165 Porter Drive, Palo Alto, CA 94304, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

Stockholder Proposals

The deadline for nominating a director and submitting a stockholder proposal for inclusion in the Company’s proxy statement and form of proxy for the Company’s 2011 Annual Meeting of Stockholders

2

pursuant to Rule 14a-8 of the Securities and Exchange Commission is December 10, 2010. Stockholders wishing to submit proposals or director nominations for potential consideration at the 2010 Annual Meeting of Stockholders, but not to be included in the related proxy statement and proxy, must do so no sooner than January 12, 2011 and no later than February 11, 2011. Stockholders are also advised to review the Company’s Amended and Restated Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations. A copy of the Company’s Amended and Restated Bylaws is available without charge upon written request to: Corporate Secretary, Telik, Inc., 3165 Porter Drive, Palo Alto, CA 94304.

PROPOSAL 1

ELECTION OF DIRECTORS

Election of Directors

The Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the Board of Directors of the Company (the “Board of Directors”) shall be divided into three classes, with each class having a three-year term. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until the director’s successor is elected and has duly qualified, or until such directors’ earlier death, resignation or removal.

The Board of Directors is presently composed of five members. There are two directors, Dr. Wick and Mr. Newman, whose term of office expires in 2010. Dr. Wick and Mr. Newman are being nominated for re-election at the Annual Meeting, and if elected, will serve until the 2013 Annual Meeting of Stockholders and until his successor is elected and has duly qualified, or until such director’s earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. If a nominee should be unavailable for election as a result of an unexpected occurrence, shares voted for the unavailable nominee will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that the nominee will be unable to serve.

Set forth below is biographical information for each person nominated for election and for each person whose term of office as a director will continue after the Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE NAMED NOMINEES.

Information Regarding the Board of Directors and Corporate Governance

Nominees for Election for a Three-Year Term Expiring at the 2013 Annual Meeting

Michael M. Wick, M.D., Ph.D., 64, has served as the Company’s Chairman of the Board of Directors since January 2000 and is being nominated for re-election. Dr Wick has served as the Company’s Chief Executive Officer since July 1999 and as its President since June 1998. Dr. Wick served as the Company’s Chief Operating Officer from December 1997 until June 1998, and as Executive Vice President, Research and Development, from December 1997 until June 1998. He has been a member of the Board of Directors since December 1997. Prior to joining the Company in December 1997, Dr. Wick was Senior Vice President of Research for CV Therapeutics, Inc., a public biotechnology company, from May 1995 until December 1997. Dr. Wick served as Executive

3

Director of oncology/immunology and clinical research at Lederle Laboratories, from September 1990 until May 1995, and also directed the Cyanamid/Immunex joint oncology research program. Dr. Wick began his career at Harvard Medical School, where he served as an Associate Professor from July 1981 until June 1994 and Chief of the Melanoma Clinic and Laboratory of Molecular Dermatological Oncology at the Dana Farber Cancer Institute from September 1980 until September 1992. Dr. Wick holds a Ph.D. degree in chemistry from Harvard University and an M.D. degree from Harvard Medical School.

Richard B. Newman, Esq., 71,has served as a member of the Board of Directors since April 2003 and is being nominated for re-election. Mr. Newman is currently President and Treasurer of D&R Products Co., Inc., which designs, develops and manufactures orthopedic, vascular and other surgical medical devices and instruments for major medical device and instrument manufacturers in the United States and Europe. He has served in this role since 1983. Mr. Newman holds an A.B. degree from Harvard College and an LL.B. degree from the Harvard Law School.

Directors Continuing in Office Until the 2011 Annual Meeting

Edward W. Cantrall, Ph.D.,78 has served as a member of the Board of Directors since May 2002. Dr. Cantrall has served as a consultant to biotechnology and genomics companies since May 1998. From November 1997 to May 1998, Dr. Cantrall served as Vice President and General Manager for Molecular Informatics, Inc., a subsidiary of the Perkin-Elmer Corporation, and prior to the acquisition of Molecular Informatics by Perkin-Elmer Corporation in November 1997, he served as President and Chief Executive Officer of Molecular Informatics, Inc. He was Chief Executive Officer and President of the National Center for Genome Resources from January 1995 to November 1996. From September 1986 to July 1994, Dr. Cantrall served as Vice President of Operations at Lederle Laboratories, a division of American Cyanamid Company, a pharmaceutical company which was subsequently acquired by Wyeth Laboratories, Inc. He has served as a member of the Board of Managers of The Health Enterprise Group since 2000. His fields of expertise include pharmaceutical development and manufacturing. Dr. Cantrall holds a Ph.D. degree in organic chemistry from the University of Illinois and an M.B.A. degree in industrial management from Fairleigh Dickinson University.

Steven R. Goldring, M.D., 66,has served as a member of the Board of Directors since May 2002. Dr. Goldring has served as Chief Scientific Officer of the Hospital for Special Surgery in New York since July 2006. From 1996 to July 2006, Dr. Goldring was a Professor of Medicine at Harvard Medical School and Chief of Rheumatology at Beth Israel Deaconess Medical Center. He has also served as the Director of the New England Baptist Bone and Joint Institute, in collaboration with the Beth Israel Deaconess Medical Center since its establishment in 1996. Dr. Goldring serves on the osteoporosis and rheumatology clinical advisory boards for Merck & Co., Inc. and Eli Lilly and Company, as well as an advisor to numerous biotechnology companies. He has established a clinical research program at Beth Israel Deaconess Medical Center. Dr. Goldring has served as a consultant or Principal Investigator in the pharmaceutical industry, and National Institutes of Health sponsored research programs and as a consultant to numerous biotechnology and pharmaceutical companies. He received his medical training at Peter Bent Brigham Hospital and the Massachusetts General Hospital. He is the author of numerous scientific publications. Dr. Goldring holds an M.D. degree from Washington University School of Medicine.

Directors Continuing in Office Until the 2012 Annual Meeting

Herwig von Morzé, Ph.D., 72,has served as a member of the Board of Directors since August 2004. Dr. von Morzé is currently an International Patent Consultant specializing in pharmaceutical patent strategy, patent prosecution and pharmaceutical product life cycle management. Dr. von Morzé was Co-Chair of Heller Ehrman’s Patent and Trademark Practice Group from 1999 to 2003. He has directed patent prosecution and enforcement programs in the pharmaceutical industry for more than 28 years. Dr. von Morzé holds a Ph.D. degree in Organic Chemistry from the University of Vienna, Austria.

4

For a discussion of the specific experience, qualifications and skills upon which the Board of Directors has determined that each of the directors should serve, see the information set forth under the caption “Nominating Committee” of this proxy statement. For biographical information concerning the executive officers of the Company, see the information set forth under the caption “Executive Officers” of this proxy statement. There are no family relationships among any of the Company’s directors or executive officers. Dr. Gail Brown, one of the Company’s key personnel, is the spouse of Dr. Wick, the Company’s President, Chief Executive Officer and Chairman. No director has a contractual right to serve as a member of the Board of Directors.

Board of Directors Committees and Meetings

Board Leadership Structure

The Company’s Board of Directors is currently chaired by the President and Chief Executive Officer of the Company, Dr Wick. The Company believes that combining the positions of Chief Executive Officer and Chairman of the Board helps to ensure that the Board and management act with a common purpose. Integrating the positions of Chief Executive Officer and Chairman can provide a clear chain of command to execute the Company’s strategic initiatives. The Company also believes that it is advantageous to have a Chairman with an extensive history with and knowledge of the Company, and extensive technical and industry experience. Notwithstanding the combined role of Chief Executive Officer and Chairman, key strategic initiatives and decisions involving the Company are discussed and approved by the entire Board of Directors. In addition, meetings of the independent directors of the Company are regularly held, which Dr. Wick does not attend. The Company believes that the current structure and processes maintains an effective oversight of management and independence of the Board of Directors as a whole without separate designation of a lead independent director. However, the Board of Directors will continue to monitor the functioning of the Board and will consider appropriate changes to ensure the effective independent function of the Board in its oversight responsibilities.

Role of the Board in Risk Oversight

One of the Board of Director’s key functions is informed oversight of the Company’s risk management process. The Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through the Board of Directors as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. The Audit Committee considers and discusses with management the Company’s major financial risk exposures and relating monitoring and control of such exposures as well as compliance with legal and regulatory requirements. The Nominating Committee monitors the effectiveness of our corporate governance guidelines. The Compensation Committee assesses and monitors whether our compensation policies and programs have the potential to encourage excessive risk-taking. Any findings regarding material risk exposure to the Company is reported to and discussed with the Board of Directors.

Independence of the Board of Directors and its Committees

The NASDAQ Stock Market (“NADSAQ”) listing standards require that a majority of the members of a listed company’s board of directors qualify as “independent,” as determined by the board of directors.

After review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board of Directors has determined that all of the Company’s directors are independent directors within the meaning of the applicable NASDAQ listing standards, except Dr. Wick, the Chairman of the Board of Directors, Chief Executive Officer, and President, of the Company. Dr. Stefan Ryser, who served as a director and the Company’s Senior Vice President of Corporate Strategy until his resignation in August 1, 2009, also was not an independent director within the meaning of the applicable NASDAQ listing standards.

5

As required under the NASDAQ listing standards, the Company’s independent directors meet in regularly scheduled executive sessions at which only independent directors are present. The Company’s independent directors met three times during the fiscal year ended December 31, 2009.

The Board of Directors has three committees: an Audit Committee, a Compensation Committee and a Nominating Committee. Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee, among other things: evaluates the performance, and assesses the qualifications, of the independent registered public accounting firm; determines and pre-approves the engagement of the independent registered public accounting firm to perform all proposed audit, review and attest services; reviews and pre-approves the retention of the independent registered public accounting firm to perform any proposed, permissible non-audit services; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm for the ensuing year; confers with management and the independent registered public accounting firm regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in the Company’s Annual Report on Form 10-K and recommends whether or not such financial statements should be so included; and discusses with management and the independent registered public accounting firm the results of the annual audit and review of the Company’s quarterly financial statements.

The Audit Committee is currently composed of three outside directors: Drs. Cantrall and Goldring and Mr. Newman. The Audit Committee met five times during the fiscal year ended December 31, 2009. The written Audit Committee Charter is attached as Appendix B to this proxy statement.

The Board of Directors periodically reviews the NASDAQ listing standards’ definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A) of the NASDAQ listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934), and that Dr. Mary Ann Gray was independent pursuant to such rules while serving as a member of the Audit Committee until her term of office on the Audit Committee expired on May 20, 2009. The Board of Directors has determined that Dr. Cantrall qualifies as an “audit committee financial expert,” as defined in applicable Securities and Exchange Commission rules. The Board of Directors made a qualitative assessment of Dr. Cantrall’s level of knowledge and experience based on a number of factors, including his formal education and his service in executive capacities having financial oversight responsibilities. These positions include Chief Executive Officer, President and Vice President of Operations to, and member of the board of directors of, a number of biotechnology and genomics companies, pursuant to which Dr. Cantrall has experience supervising the preparation of financial reports. In addition, Dr. Cantrall holds an M.B.A from Fairleigh Dickinson University. For further information on Dr. Cantrall’s experience, please see his biography under “Directors Continuing in Office Until 2011 Annual Meeting” above.

Compensation Committee

The Compensation Committee of the Board of Directors reviews, modifies and approves the overall compensation strategy and policies for the Company. The Compensation Committee, among other things:

6

reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s officers; determines and approves the compensation and other terms of employment of the Company’s Chief Executive Officer; determines and approves the compensation and other terms of employment of the other officers of the Company; administers the Company’s stock option and purchase plans, pension and profit sharing plans and other similar programs; and reviews and recommends to the Board of Directors appropriate insurance coverage for the Company’s directors and officers. The Compensation Committee also reviews with management the Company’s Compensation Discussion and Analysis to consider whether to recommend that it be included in proxy statements and other filings. A more detailed description of the Compensation Committee’s processes and procedures for the consideration and determination of executive and director compensation and information related to Compensation Committee Interlocks and Insider Participation can be found under the section entitled “Compensation Discussion and Analysis” of this proxy statement.

The Compensation Committee is currently composed of three outside directors: Drs. Goldring and von Morzé and Mr. Newman. Each of the members of the Compensation Committee is independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Compensation Committee met four times and acted once by written consent during the fiscal year ended December 31, 2009. A copy of the Compensation Committee Charter is attached as Appendix C to this proxy statement.

Nominating Committee

The Nominating Committee of the Board of Directors is responsible for, among other things: identifying, reviewing and evaluating candidates to serve as directors of the Company; reviewing, evaluating and considering incumbent directors; recommending to the Board of Directors for selection candidates for election to the Board of Directors; making recommendations to the Board of Directors regarding the membership of the committees of the Board of Directors; and assessing the performance of the Board of Directors.

The Nominating Committee is currently composed of three outside directors: Drs. Goldring and von Morzé and Mr. Newman. All members of the Nominating Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). Dr. Gray was a member of the Nominating Committee until her term of office on the Board of Directors and Nominating Committee expired on May 20, 2009, at which time Dr. von Morzé joined the Nominating Committee. The Nominating Committee met twice during the fiscal year ended December 31, 2009. The Nominating Committee adopted a written Nominating Committee Charter in 2004 which is attached as Appendix D to this proxy statement.

The Nominating Committee has not established any specific minimum qualifications that must be met for recommendation for a position on the Board of Directors. Instead, in considering candidates for director the Nominating Committee will generally consider all relevant factors, including among others the candidate’s applicable education, expertise and demonstrated excellence in his or her field, the usefulness of the expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, experience and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board of Directors (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its stockholders.

With respect to director nominations, the Nominating Committee has recommended that Dr. Wick and Mr. Newman be nominated for re-election to serve as a directors. The Nominating Committee considered Dr. Wick’s extensive professional experience, including the variety of roles and responsibilities he has undertaken and performed in the biotechnology and pharmaceutical industries, his familiarity with the cancer drug development process, his professional relationships with investigators and key opinion leaders, and his experience in establishing partnering and collaborative business relationships. The Nominating Committee considered Mr. Newman’s professional training and experience in the biomedical industry, his legal training and experience, his relevant financial expertise, and his executive experience establishing and leading a medical company.

7

The Nominating Committee believes that each of the directors continuing in office is qualified to serve. The Nominating Committee considered Dr. Cantrall’s executive experience leading a major pharmaceutical company, his familiarity with the manufacturing and commercialization of new pharmaceuticals and related regulatory matters, his leadership of a biotechnology company involved in building collaborative pharmaceutical development relationships, and his experience in mergers and acquisitions. The Nominating Committee believes that Dr. Cantrall’s financial background and experience is especially valuable in his position as a member of the Audit Committee and qualification as an “audit committee financial expert.” The Nominating Committee considered Dr. Goldring’s role as an internationally recognized academic leader in the development of new medical therapies, his familiarity with the drug regulatory process in the United States, and his experience in basic clinical research administration. The Nominating Committee also believes that Dr. Goldring’s qualifications enable him to make an effective contribution to the medical and clinical understanding of the Board. The Nominating Committee considered Dr. von Morzé’s patent expertise and in particular his knowledge of international patent matters, his knowledge of the Company’s patent estate, and his experience advising a range of pharmaceutical and biotechnology clients on patent and related intellectual property matters.

With respect to diversity, the Nominating Committee seeks a diverse group of individuals who have a complementary mix of backgrounds and skills necessary to provide meaningful oversight of the Company’s activities. As a clinical stage drug development company focused on discovering and developing small molecule drugs, we seek directors who have experience in the medical, regulatory and pharmaceutical industries in general, and also look for individuals who have experience with the operational issues that we face in our dealings with clinical and pre-clinical drug development, collaborations with third parties, and commercialization and manufacturing issues. Some of our directors have strong financial backgrounds and experience in dealing with public companies, to help us in our evaluation of our operations and our financial model. We also face unique challenges as we implement our strategy to develop, manufacture and commercialize our products by entering into relationships with pharmaceutical companies. The Nominating Committee annually reviews the Board’s composition in light of the company’s changing requirements.

The Nominating Committee uses the Board’s network of contacts when compiling a list of potential director candidates and may also engage outside consultants. Pursuant to its charter, the Nominating Committee will consider, but not necessarily recommend to the Board, potential director candidates recommended by stockholders. All potential director candidates are evaluated based on the factors set forth above, and the Nominating Committee has established no special procedure for the consideration of director candidates recommended by stockholders.

Stockholders who wish to recommend individuals for consideration by the Nominating Committee to become nominees for election to the Board of Directors may do so by delivering a written recommendation to the Nominating Committee at the following address: 3165 Porter Drive, Palo Alto, CA 94304 at least 120 days prior to the anniversary date of the mailing of the Company’s proxy statement for the last Annual Meeting of Stockholders. The deadline for nominating a director for the 2011 Annual Meeting of Stockholders is December 10, 2010. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of the Company’s Common Stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Meetings of the Board of Directors and Committees of the Board of Directors

The Board of Directors met five times and acted three times by written consent during the last fiscal year. Each Board member attended 75% or more in the aggregate of the meetings of the Board of Directors held during the period for which he or she was a director. Each committee member attended 75% or more in the aggregate of the meetings of the committees on which he or she served, held during the period for which he or she was a committee member.

8

Attendance at Annual Meeting

It is the Company’s current policy to require directors to attend the Annual Meeting absent extraordinary circumstances. The 2009 Annual Meeting of Stockholders was attended by all of the members of the Board of Directors.

Stockholder Communications with the Board of Directors

The Nominating Committee of the Board of Directors has adopted a process by which stockholders may communicate with the Board of Directors or any of its individual directors. Stockholders who wish to communicate with the Board of Directors may do so by sending a written communication addressed as follows: Telik Board Communication, c/o Stockholder Communications Officer, 3165 Porter Drive, Palo Alto, CA 94304. All communications must state the number of shares owned by the stockholder making the communication. Telik’s Stockholder Communications Officer, or SCO, will review each communication and forward the communication to the Board of Directors, to any individual director to whom the communication is addressed, and/or to any other officer of the Company considered by the SCO to be appropriate.

Code of Conduct

The Company has adopted the Telik, Inc. Code of Conduct, a code of ethics with which every employee, director and consultant is expected to comply. The Code of Conduct was filed with the Securities and Exchange Commission with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004. If the Company makes any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver as required by applicable laws.

Report of the Audit Committee of the Board of Directors*

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. The Company’s management is responsible for the internal controls and the financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and the issuance of a report thereon.

In this context, the Audit Committee met and held discussions with management and Ernst & Young LLP, the Company’s independent registered public accounting firm. Management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AV Section 380) and as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

In addition, the Audit Committee has discussed with the independent registered public accounting firm, the firm’s independence from the Company and its management, including the matters in the written disclosures and letter that were received from the independent accountants pursuant to the applicable requirements of the PCAOB, and considered the compatibility of non-audit services with the firm’s independence.

| * | | The material in this report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended. |

9

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee met with the independent registered public accounting firm, with and without management present, to discuss the results of its annual audit and quarterly reviews, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee has recommended that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009, for filing with the Securities and Exchange Commission.

The Audit Committee also has selected, subject to stockholder ratification, Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010.

The Audit Committee:

Edward W. Cantrall

Steven R. Goldring

Richard B. Newman

10

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010, and has further directed management to submit to the stockholders for ratification the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements since 1989. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is not required by the Company’s Amended and Restated Bylaws or otherwise. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board of Directors in their discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for the purpose of determining whether this matter has been approved. Shares represented by executed proxies will be voted, if no abstention or vote against is marked, for the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm.

Independent Registered Public Accounting Firm Fee Information

The following summarizes the fees billed by Ernst & Young LLP for audit, tax and other professional services for the years ended December 31, 2009 and 2008:

| | | | | | |

| | | December 31, |

| | | 2009 | | 2008 |

Audit Fees (1) | | $ | 462,000 | | $ | 614,000 |

Audit-Related Fees (2) | | | — | | | — |

Tax Fees (3) | | | — | | | — |

All Other Fees (4) | | | — | | | — |

| | | | | | |

Total Fees | | $ | 462,000 | | $ | 614,000 |

| | | | | | |

| (1) | | Audit Fees were for services associated with the annual audit, the reviews of the Company’s Annual Report on Form 10-K, and quarterly reports on Form 10-Q. |

| (2) | | There were no audit-related fees billed for the fiscal years ended December 31, 2009 and 2008. |

| (3) | | Tax Fees would be for services in connection with tax compliance, tax planning and tax advice. As stated above, the Company incurred no such fees in the fiscal years ended December 31, 2009 and 2008. |

| (4) | | There were no other fees for services by Ernst & Young LLP for the fiscal years ended December 31, 2009 and 2008. |

11

The charter of the Audit Committee requires that the Audit Committee pre-approve the engagement of the Company’s independent registered public accounting firm, Ernst & Young LLP, to perform all proposed audit, review and attest services, as well as engagements to perform any proposed permissible non-audit services. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting. It is the Company’s practice to present any such proposed engagement to the Audit Committee for approval, either at a regularly scheduled or special meeting. In 2009, all of the services and related fees described above were approved by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

12

EQUITY COMPENSATION PLAN INFORMATION

The following table provides certain information with respect to all of the Company’s equity compensation plans in effect as of December 31, 2009.

Equity Compensation Plan Information

| | | | | | | | |

| | | (a) | | (b) | | (c) | |

Plan Category | | Number of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights | | Weighted-average

Exercise Price of

Outstanding Options,

Warrants and Rights | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (a)) (1) | |

Equity compensation plans approved by security holders | | 12,596,938 | | $ | 6.99 | | 3,209,085 | (2) |

Equity compensation plans not approved by security holders | | — | | | N/A | | — | |

Total | | 12,596,938 | | $ | 6.99 | | 3,209,085 | (2) |

| (1) | | Each year on January 1, until January 1, 2010, the aggregate number of shares of Common Stock that may be issued pursuant to stock awards under the 2000 Equity Incentive Plan (the “Incentive Plan”) is automatically increased by the lesser of 1,500,000 shares or 5% of the total number of shares of Common Stock outstanding on that date, or such lesser amount as may be determined by the Board of Directors. The Incentive Plan expired in March 2010 and no stock awards will be granted under this plan. In addition, each year on January 1, until January 1, 2010, the aggregate number of shares of Common Stock that may be issued pursuant to stock awards under the 2000 Employee Stock Purchase Plan is automatically increased by the lesser of 150,000 shares or 1% of the total number of shares of Common Stock outstanding on that date, or such lesser amount as may be determined by the Board of Directors. |

| (2) | | Includes 706,949 shares issuable under the 2000 Employee Stock Purchase Plan. |

13

EXECUTIVE OFFICERS

The following table sets forth information regarding the Company’s executive officers and key personnel. Please see “Proposal 1—Election of Directors” for comparable information for the Company’s Board of Directors.

Executive Officers:

| | | | |

Name | | Age | | Position |

Michael M. Wick, M.D., Ph.D. | | 64 | | President, Chief Executive Officer and Chairman |

Cynthia M. Butitta | | 55 | | Chief Operating Officer and Chief Financial Officer |

Marc L. Steuer | | 63 | | Senior Vice President, Business Development |

William P. Kaplan, Esq. | | 56 | | Vice President, General Counsel and Corporate Secretary |

Key Personnel:

| | | | |

Name | | Age | | Position |

Gail L. Brown, M.D. | | 59 | | Senior Vice President and Chief Medical Officer |

Steven R. Schow, Ph.D. | | 60 | | Vice President, Research |

Set forth below is biographical information for each of the executive officers and key personnel.

Biographical information about Dr. Wick is included under the caption “Nominee for Election for a Three-Year Term Expiring at the 2013 Annual Meeting.”

Cynthia M. Butitta has served as the Company’s Chief Operating Officer and Chief Financial Officer since March 2001. She has served as the Company’s Chief Financial Officer since August 1998. From September 1997 through February 2001, Ms. Butitta provided financial consulting services as a partner in Altair Capital Associates LLC, which she co-founded in November 1998, and Butitta Consulting Services LLC, which she founded in September 1997. From December 1995 until September 1997, Ms. Butitta was Vice President of Finance and Administration and Chief Financial Officer for Connetics, Inc., a biotechnology company. From June 1994 until December 1995, she was Vice President of Finance and Administration and Chief Financial Officer for InSite Vision, Inc., a biotechnology company. From June 2000 to February 2002, Ms. Butitta was a director of Catalyst Semiconductor, Inc., a semiconductor products company. Ms. Butitta holds a B.S. degree in business and accounting from Edgewood College and an M.B.A. degree in finance from the University of Wisconsin, Madison.

Marc L. Steuer has served as the Company’s Senior Vice President, Business Development since October 2002. Prior to joining the Company, from 1994 to 2002, Mr. Steuer was associated with Pharmacyclics, Inc., a biotechnology company, most recently as Senior Vice President, Business Development. From 1992 to 1994, Mr. Steuer was with SciClone Pharmaceuticals, Inc., serving as Vice President, Finance and Chief Financial Officer and later as Executive Vice President, Business Development and Commercial Affairs. He also has held senior management positions at Pilkington Visioncare Group, a major division of Pilkington, plc, Syntex Corporation and international management consulting firms. Mr. Steuer holds B.S. and M.S. degrees in electrical engineering from Columbia University and an M.B.A. degree from New York University.

William P. Kaplan, Esq.has served as the Company’s Vice President and General Counsel since February 2006 and Vice President, Legal Affairs since April 2003. Mr. Kaplan has also served as the Company’s Corporate Secretary since May 2003. From 2000 to 2003, Mr. Kaplan was Vice President, General Counsel and Corporate Secretary of iPrint Technologies, a developer of Internet print technology. Prior to iPrint, Mr. Kaplan served as Vice President and General Counsel of Resumix, a publisher of enterprise human resources software

14

subsequently acquired by Yahoo!. He also served as General Counsel of Netcom On-Line Communication Services, an Internet service provider, and Ungermann-Bass, a global manufacturer of network and telecommunications equipment. Mr. Kaplan has practiced law since 1982. He holds a B.A. degree in mathematics from the University of California, Santa Barbara, and a Juris Doctor degree from the School of Law at the University of California, Davis.

Gail L. Brown, M.D.has served as the Company’s Senior Vice President and Chief Medical Officer since November 2001. Dr. Brown has served as a consultant to the Company on matters related to clinical development of the Company’s product candidates since October 1998. Prior to joining the Company, Dr. Brown was a Managing Director at The Palladin Group, LP, and Tanager Capital Group, LLC, entities specializing in investment advisory services, from January 2001 to October 2001. She was a co-founder and partner of Altair Capital Associates LLC, specializing in biotechnology investment advisory services, from November 1998 to January 2001. Dr. Brown has served as a consultant and a member of clinical and scientific advisory boards at numerous public and private biotechnology companies from 1995 to 2001. She began her career at the Harvard Medical School, where she served on the faculty in the Department of Medicine, Division of Hematology and Oncology from 1980 to 1995. Dr. Brown received her M.D. degree from The University of Rochester School of Medicine and an M.B.A. degree in finance from St. Mary’s College of California School of Economics and Business Administration.

Steven R. Schow, Ph.D., has served as the Company’s Vice President, Research since March 2000. He served as the Company’s Senior Director of Medicinal Chemistry from March 1998 until March 2000. Prior to joining the Company, Dr. Schow served as a Director of Medicinal Chemistry at CV Therapeutics, Inc., a biotechnology company, from May 1995 to March 1998. He served as a Senior Group Leader at Lederle Laboratories, a division of American Cyanamid from November 1991 until May 1995. Dr. Schow was a post doctoral fellow in organic chemistry at the University of California at Los Angeles and the University of Pennsylvania. Dr. Schow holds a Ph.D. degree in organic chemistry from the University of California at San Diego and a B.S. degree in chemistry from California State University, Los Angeles.

The Company’s executive officers are appointed by the Board of Directors and serve until their successors are elected or appointed.

15

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of Common Stock by: (a) each director; (b) each nominee for director; (c) each of the executive officers named in the Summary of Compensation Table; (d) all executive officers and directors of the Company as a group; and (e) all those known by the Company to be beneficial owners of more than five percent of its Common Stock. All of the information in this table is as of March 1, 2010, unless otherwise noted in the appropriate footnote to the table.

Pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended, shares are deemed to be beneficially owned by a person if that person has the right to acquire shares (for example, upon exercise of an option) within sixty days of the date that information is provided. In determining the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by the person (and only that person) by reason of such acquisition rights. As a result, the percentage of outstanding shares held by any person in the table below does not necessarily reflect the person’s actual voting power. As of March 1, 2010, there were 53,522,329 shares of Common Stock outstanding.

| | | | | | | | | | | |

Beneficial Owner (1) | | Number of

Shares

Owned (2) | | | Right to

Acquire

within 60

days (3) | | | Beneficial

Ownership

Total | | Percent of

Total | |

Entities affiliated with Eastbourne Capital Management, L.L.C. (4) | | 11,850,000 | | | — | | | 11,850,000 | | 22.14 | % |

1101 Fifth Avenue, Suite 370, San Rafael, CA 94901 | | | | | | | | | | | |

Entities affiliated with OppenheimerFunds, Inc. (5) | | 10,463,730 | | | — | | | 10,463,730 | | 19.55 | % |

Two World Financial Center, 225 Liberty Street, New York, NY 10281-1008 | | | | | | | | | | | |

Michael M. Wick, M.D., Ph.D. | | 179,207 | (6) | | 2,152,500 | (7) | | 2,331,707 | | 4.19 | % |

Cynthia M. Butitta | | 43,861 | | | 845,208 | | | 889,069 | | 1.64 | % |

Marc L. Steuer | | 8,823 | | | 325,000 | | | 333,823 | | * | |

William P. Kaplan, Esq. | | 2,685 | | | 311,250 | | | 313,935 | | * | |

Edward W. Cantrall, Ph.D. | | 54,000 | (8) | | 48,334 | | | 102,334 | | * | |

Steven R. Goldring, M.D. | | — | | | 48,334 | | | 48,334 | | * | |

Richard B. Newman, Esq. | | 23,472 | (9) | | 43,334 | | | 66,806 | | * | |

Herwig von Morzé, Ph.D | | 22,000 | | | 38,334 | | | 60,334 | | * | |

All executive officers and directors as a group (8 persons) (10) | | 334,048 | | | 3,812,294 | | | 4,146,342 | | 7.23 | % |

| (1) | | This table is based upon information supplied by officers, directors, principal stockholders and Schedules 13G/A filed with the Securities and Exchange Commission. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 53,522,329 shares outstanding on March 1, 2010. |

| (2) | | Excludes shares issuable pursuant to stock options exercisable within 60 days of March 1, 2010. |

| (3) | | Shares issuable pursuant to stock options exercisable within 60 days of March 1, 2010. |

| (4) | | The amount shown and the following information were provided by Eastbourne Capital Management, L.L.C. (“Eastbourne”) pursuant to the Schedule 13G/A filed on February 12, 2010, indicating beneficial ownership as of December 31, 2009. The Schedule 13G/A indicates that Eastbourne has shared voting and |

16

| | dispositive power with respect to 11,850,000 shares. According to the Schedule 13G/A, Richard Jon Barry holds shared voting and dispositive power with respect to 11,850,000 shares, Black Bear Fund I, L.P. holds shared voting and dispositive power with respect to 3,407,021 shares, Black Bear Fund II, L.L.C holds shared voting and dispositive power with respect to 3,284,750 shares, and Black Bear Offshore Master Fund, L.P. holds shared voting and dispositive power with respect to 3,294,590 shares. Barry and Eastbourne each disclaims beneficial ownership of Common Stock, except to the extent of its or his respective pecuniary interest therein. Barry and Eastbourne filed the Schedule 13G/A jointly as a group, but disclaim membership in a group, within the meaning of Rule 13d-5(b) (“Rule 13(d)-5(b)”) under the Securities Exchange Act of 1934, as amended (the “1934 Act”) , with Black Bear Offshore, Black Bear I, Black Bear II or any other person or entity. Black Bear Offshore, Black Bear I and Black Bear II each filed jointly with the other Filers, but not as a member of a group, and each disclaims membership in a group, within the meaning of Rule 13d-5(b), with the other Filers or any other person or entity. In addition, the filing of the Schedule 13G/A on behalf of Black Bear Offshore, Black Bear I or Black Bear II should not be construed as an admission that either of them are, and each disclaim that it is, the beneficial owner (as defined in Rule 13(d)-3 under the 1934 Act), of any Common Stock. |

| (5) | | The amount shown and the following information were provided by OppenheimerFunds, Inc. pursuant to the Schedule 13G/A filed on February 3, 2010, indicating beneficial ownership as of December 31, 2009. The Schedule 13G/A indicates that OppenheimerFunds, Inc. has shared voting and dispositive power with respect to 10,463,730 shares. According to the Schedule 13G/A, Oppenheimer Global Opportunities Fund has shared voting and dispositive power with respect to 10,463,730 shares. |

| (6) | | Includes 46,816 shares held by Dr. Wick’s spouse. |

| (7) | | Includes 980,208 shares issuable to Dr. Wick’s spouse pursuant to stock options exercisable within 60 days of March 1, 2010. |

| (8) | | Includes 20,000 shares held by Dr. Cantrall’s spouse. |

| (9) | | Includes 15,000 shares held by the D&R Products Co., Inc. 401(k) and Profit Sharing Plan, of which Mr. Newman and his spouse are trustees. |

| (10) | | See footnotes 6-9 above. |

17

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company and written representations, the Company believes that all Forms 3, 4 and 5 required to be filed were filed on time during the fiscal year ended December 31, 2009.

18

COMPENSATION OF DIRECTORS

Employee directors do not receive any separate compensation for their Board of Directors activities. Non-employee directors receive the compensation described below.

Each non-employee director of the Company was entitled to receive quarterly cash compensation of $8,000 from the Company for serving on the Board of Directors during the year ended December 31, 2009. The members of the Board of Directors are also eligible for reimbursement of their expenses incurred in connection with attendance at Board of Directors and Committee meetings in accordance with Company policy.

Each non-employee director of the Company also was entitled to receive stock option grants under the 2000 Non-Employee Directors’ Stock Option Plan, as amended February 20, 2008 (the “Directors’ Plan”). Only non-employee directors of the Company or an affiliate of such directors (as defined in the Internal Revenue Code) are eligible to receive options under the Directors’ Plan. Options granted under the Directors’ Plan are not intended by the Company to qualify as incentive stock options under the Internal Revenue Code.

Option grants under the Directors’ Plan are non-discretionary. Each person who was elected or appointed to serve as a non-employee director for the first time was granted an option to purchase 20,000 shares of Common Stock upon such election or appointment. On the day following each Annual Meeting (or the next business day should such date be a legal holiday), each member of the Company’s Board of Directors who was not an employee of the Company or, where specified by the non-employee director, an affiliate of the director, was automatically granted under the Directors’ Plan without further action by the Company, the Board of Directors or the stockholders of the Company, an option to purchase 10,000 shares of Common Stock or an option to purchase an amount of shares prorated for the part of the year served as a non-employee director. The Directors’ Plan expired by its terms in March 2010 and no further grants will be made to new or existing directors thereunder.

The exercise price of options granted under the Directors’ Plan is 100% of the fair market value of Common Stock subject to the option on the date of the option grant (determined in accordance with the terms of the Directors’ Plan based on the closing sales price reported on the NASDAQ Global Market). The options have a term of 10 years. Options granted under the Directors’ Plan vest as follows: 25% of the shares subject to each option will vest on the first anniversary of the grant date and the remainder will vest in equal monthly installments over the next three years. The vesting of each option will cease on the date the non-employee director holding the option ceases to provide services (whether as a director or consultant) to the Company or one of the Company’s affiliates. Options terminate three months after the non-employee director’s service with the Company or its affiliates terminates. However, if termination of service is due to the non-employee director’s death, or if the non-employee director dies within three months after his or her service terminates, the exercise period will be extended to 18 months following death. No option is exercisable after the expiration of 10 years from the date it was granted. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change of control transaction involving the Company, the options outstanding under the Directors’ Plan may be assumed or substituted by the surviving entity. Otherwise, the vesting of the options held by those directors whose continuous service has not terminated accelerate in full and the options terminate if not exercised at or prior to the change of control transaction.

On May 21, 2009, the Company granted options covering 10,000 shares to each of Drs. Cantrall, Goldring, von Morzé and Mr. Newman at an exercise price of $0.52 per share. The exercise price per share for each option is equal to the fair market value of Common Stock on the date of grant (determined in accordance with the terms of the Directors’ Plan based on the closing sales price reported on the NASDAQ Global Market).

19

As of March 1, 2010, options to purchase a total of 245,000 shares of Common Stock were outstanding under the Directors’ Plan. The Directors’ Plan expired in March 2010 and no new options will be granted under this plan.

2009 Director Compensation Table

| | | | | | | | |

Name of Director | | Fees

Earned

or Paid

in Cash

($) | | Option

Awards

($) (1) | | All Other

Compensation

($) | | Total

($) |

Edward W. Cantrall, Ph.D. | | 32,000 | | 4,061 | | — | | 36,061 |

Robert W. Frick (2) | | 8,000 | | -0- | | — | | 8,000 |

Steven R. Goldring, M.D. | | 32,000 | | 4,061 | | — | | 36,061 |

Mary Ann Gray, Ph.D. (3) | | 16,000 | | -0- | | — | | 16,000 |

Richard B. Newman, Esq. | | 32,000 | | 4,061 | | — | | 36,061 |

Herwig von Morzé, Ph.D | | 32,000 | | 4,061 | | — | | 36,061 |

| (1) | | The amounts in this column represent the full grant date fair values of the options granted computed in accordance with FASB Accounting Standard Codification 718, or “ASC 718”, “Compensation-Stock Compensation”, excluding the effect of estimated forfeitures. For additional information on the valuation assumptions with respect to these grants, refer to the “Stock-based Compensation” and “Valuation Assumptions” under the “Notes to the Financial Statements” in the Company’s Form 10-K for the year ended December, 31, 2009, as filed with the SEC. |

| (2) | | Mr. Frick resigned from the Board of Directors on February 20, 2009. |

| (3) | | Dr. Gray did not stand for reelection at the Company’s annual meeting of stockholders on May 20, 2009, at which time her term of office expired. |

The following table shows for each named non-employee director (a) the grant date of each option granted to the named non-employee directors in 2009 fiscal year, (b) the exercise price, (c) the grant-date fair value of that option as calculated in accordance with ASC 718 and (d) the aggregate number of shares subject to all outstanding options held by that individual as of December 31, 2009:

| | | | | | | | |

Name of Director | | Option Grant Date | | Exercise

Price Per

Share

($) | | ASC 718 Grant-

date Fair

Value

($) | | Number of Shares

of Common Stock

Subject to All

Outstanding

Options Held as of

December 31, 2009 |

Edward W. Cantrall, Ph.D. | | May 21, 2009 | | 0.52 | | 4,061 | | 65,000 |

Steven R. Goldring, M.D. | | May 21, 2009 | | 0.52 | | 4,061 | | 65,000 |

Richard B. Newman, Esq. | | May 21, 2009 | | 0.52 | | 4,061 | | 60,000 |

Herwig von Morzé, Ph.D | | May 21, 2009 | | 0.52 | | 4,061 | | 55,000 |

20

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis of compensation arrangements of our named executive officers for 2009 should be read together with the compensation tables and related disclosures set forth below.

This Compensation Discussion and Analysis provides information about the material components of our executive compensation program during 2009 for:

| | • | | Dr. Michael M. Wick, our President, Chief Executive Officer, and Chairman of the Board of Directors (our “Chief Executive Officer”); |

| | • | | Cynthia M. Butitta, our Chief Operating Officer and Chief Financial Officer; |

| | • | | Marc L. Steuer, our Senior Vice President, Business Development; |

| | • | | William P. Kaplan, our Vice President, General Counsel, and Corporate Secretary; and |

| | • | | Dr. Stefan Ryser, our Senior Vice President, Corporate Strategy. (1) |

In this Compensation Discussion and Analysis, these executive officers are referred to collectively as the “Named Executive Officers” and Telik, Inc. is referred to as “our,” “us,” “we,” or the “Company.”

This Compensation Discussion and Analysis provides an overview of our executive compensation philosophy and objectives, the governance of our executive compensation program, and each compensation element that we provide. In addition, we explain how and why the Compensation Committee of our Board of Directors (the “Committee”) arrived at specific compensation policies and decisions involving our executives during 2009.

Executive Compensation Philosophy and Objectives

Compensation Philosophy

We use our executive compensation program to ensure the successful execution of our annual and long-term strategic business plan, thereby creating long-term value for our stockholders. To achieve these goals, our executive compensation program is designed to motivate, reward and retain our executives and align their interests with those of our stockholders, all within the context of responsible cost management. In practice, this means that to successfully design our executive compensation program, the Committee must take into account the competitive market for qualified executive talent in the life sciences field, our industry’s long product cycles, the level of risk associated with executing our business plan, and the competition from much larger and better capitalized companies.

Compensation Objectives

Consistent with this philosophy, our executive compensation program is designed to achieve four primary objectives:

| | • | | Establish a direct correlation between compensatory rewards and both business results and individual performance; |

| | • | | Align the interests and objectives of management and employees with driving our growth and creating stockholder value; |

| | • | | Share the enterprise value created by our executives through the distribution of equity to them; and |

| | • | | Provide health and welfare protection to assist our executives and their families, and retirement security through a tax-qualified retirement savings program. |

| (1) | | Dr. Ryser resigned from the Company effective August 1, 2009. |

21

Compensation Mix

Consistent with these objectives, the Committee provides a mix of compensation elements primarily composed of base salary, an annual incentive award, and long-term incentive compensation in the form of equity awards. Each of these elements is discussed in greater detail below. In addition, we provide our executives, including the Named Executive Officers, with health and welfare benefits and a tax-qualified retirement savings program on substantially the same terms and conditions as these benefits are provided to our other full-time salaried employees. With the exception of our Chief Executive Officer, we do not provide severance benefits to our executives, including the other Named Executive Officers.

The Committee determines the form and amount of each compensation element independent of each other compensation element to ensure the desired objectives for that element (as described below) are met. Generally, the Committee does not evaluate the mix between short-term and long-term compensation or between cash and equity compensation in making its decisions. Upon completing its determination of each compensation element, the Committee reviews the value of the total direct compensation of each executive to ensure that, in the aggregate, this amount is reasonable, appropriate from an internal equity standpoint and consistent with market norms and competitive compensation practices.

Compensation Positioning

In determining the compensation of our executives, including the Named Executive Officers, the Committee considers the following factors:

| | • | | Our continued development of our drug candidates; |

| | • | | Our executives’ individual performance during the year; |

| | • | | Our executives’ contributions during the year; |

| | • | | Competitive compensation practices as reflected by our peer group (as described below); |

| | • | | The scope of each executive’s role compared to the roles of similarly-situated executives at companies in our peer group; and |

| | • | | Our financial condition and cash flow. |

While the Committee does not seek to set any individual compensation element or the total direct compensation of our executives at a specific percentile level or within a specific percentile range of market practice, it does assess the competitiveness of our executive compensation program by reviewing the executive compensation practices of a select group of life science companies (the “Peer Group”) when appropriate.

For 2009, the Committee did not set the executive compensation program based on compensation levels of our peer group companies or market practices. Instead, the Committee decided at the beginning of the year not to make any adjustment to the Named Executive Officers compensation until there was better visibility on the state of the economy and the direction of the Company. Accordingly, the Committee decided to keep executive base salaries at their 2008 levels and to not pay any cash bonuses for 2009.

Governance of Executive Compensation Program

Role of the Compensation Committee

The Committee acts on behalf of our Board of Directors to fulfill its responsibilities to set and oversee the compensation of our executives. Specifically, the Committee reviews and approves the (i) base salaries, (ii) annual incentive award opportunities and payouts, (iii) long-term incentive compensation, (iv) post-employment payments and benefits, and (v) other compensation and benefits, if any, for our executives, including the Named Executive Officers.

22

The Committee reviews annually the base salaries, as well as the annual incentive award opportunities, of our executives, including the Named Executive Officers, with any compensation adjustments or changes becoming effective on January 1st of each year. Equity awards are generally considered and made at this same time following consideration of corporate and individual performance. For 2009, the Committee decided at the beginning of the year not to make any adjustment to the Named Executive Officers compensation until there was better visibility on the state of the economy and the direction of the Company.

The Committee regularly reports to, and consults with, our Board of Directors on the results of its reviews and any actions it takes or proposes to take with respect to compensation policies and decisions for our executives, including the Named Executive Officers.

Role of Management