February 2006

An Emerging Growth Company

Petrol Oil and Gas, Inc.

Copyright 2005. Presentation and contents of this presentation are copyright by Petrol Oil and Gas, Inc. All rights reserved. Copying of the

presentation is forbidden without the prior written consent of Petrol Oil and Gas, Inc. Information in this presentation is provided without warranty

of any kind, either express or implied, including but not limited to the implied warranties of merchantability, fitness for a particular purpose and the

timeliness of the information. You assume all risk in using the information. In no event will PETROL or its representatives be liable for any direct,

special, indirect or consequential damages resulting from the use of the information. This presentation includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other

similar words. Forward-looking statements are not guarantees of performance. Although PETROL believes its expectations reflected in forward-

looking statements are based on reasonable assumptions, no assurance can be given that these `expectations will be achieved. Important factors that

could cause actual results to differ materially from the expectations reflected in the forward-looking statements include, among others: the timing

and extent of changes in commodity prices for crude oil, natural gas and related products, foreign currency exchange rates and interest rates; the

timing and impact of natural gas demand or prices for oil and gas; the extent and effect of any hedging activities engaged in by PETROL; the extent

of PETROL’s success in discovering, developing, marketing and producing reserves and in acquiring oil and gas properties; the accuracy of reserve

estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; the availability and cost of drilling

rigs, experienced drilling crews and other equipment; the availability of pipeline transportation capacity; the extent to which PETROL can develop

additional producing wells; the results of wells yet to be drilled that are necessary to test whether substantial acreage positions contain suitable

drilling prospects; whether PETROL is successful in its efforts to more intensely develop its acreage and other production areas; political

developments around the world; acts of war and terrorism and responses to these acts; and financial market conditions. In light of these risks,

uncertainties and assumptions, the events anticipated by PETROL’s forward-looking statements might not occur. PETROL undertakes no

obligations to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved

reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under

existing economic and operating conditions. As noted above, statements of proved reserves are only estimates and may be imprecise. Any reserve

estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include not only proved

reserves, but also other categories of reserves that the SEC’s guidelines strictly prohibit PETROL from including in filings with the SEC. Investors

are urged to consider closely the disclosure in PETROL’s Annual Report on Form IO-KSB and Quarterly Reports on Form 10-QSB, available from

PETROL at 3161 E. Warm Springs Road, Suite 300, Las Vegas, NV 89120 (Attn: Investor Relations). You can also obtain these forms from the

SEC by calling 1-800-SEC-0330 or from the SEC’s website at www.sec.gov. In addition, reconciliation and calculation schedules for Non-GAAP

Financial Measures referred to in this presentation can be found on the Petrol Oil and Gas website at www.petroloilandgas.com .

Executive Summary

Corporate Hdqtrs:

OTCBB:POIG

Current Shares Outstanding –27,695,083*

Website – www.petroloilandgas.com

*12/31/05

401 Pearson Ave.

Waverly, KS 66871

Phone (785) 733-2158

Fax (785) 733-2187

3161 E. Warm Springs Rd. #300

Las Vegas, NV 89120

Phone (702) 454-7318

Fax (702) 434-7594

110 E. 5th St.

Piqua, KS 66761

Phone (620) 468-2885

Fax (620) 468-2925

Rte 1

Thayer, KS 66776

Phone (620) 839-5911

Fax (620) 839-5912

Corporate Information Highlights

Kansas Field Offices:

Corporate Growth Strategy

We will continue Growth by building value in the

Company through the development and

acquisition of gas and oil assets that exhibit

consistent, predictable, and long-lived production.

The current focus of the Company is Coal Bed

Methane reservoirs in the central U.S., which

produce both Coal Bed Methane and conventiona

l gas.

Established A Significant Acreage Position in the Cherokee Basin Area

Approximately 165,000 gross acres

Began Publicly Trading in March 2004

Acquired a CBM Producing Gas Field , Petrol-Neodesha in Nov 2004.

Signed a $50 Million Debt Facility in Nov 2005 for CBM and other

Development Projects

Acquired/Operate Oil Producing Properties

Revenue Producing for the last 6 qtrs.

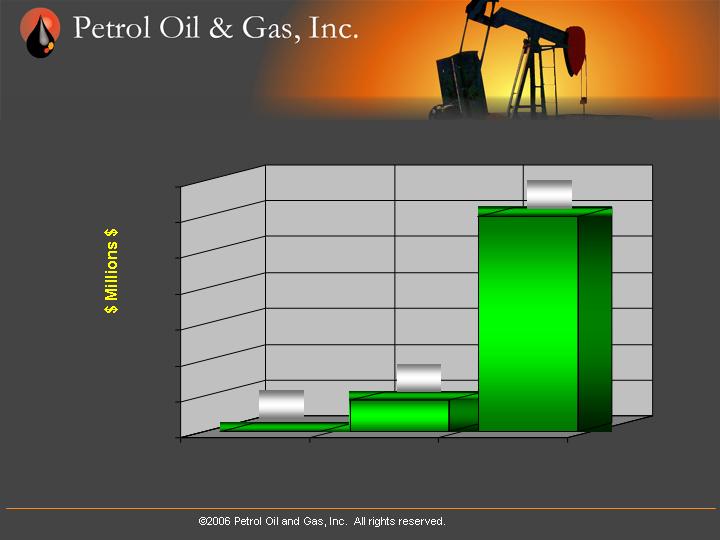

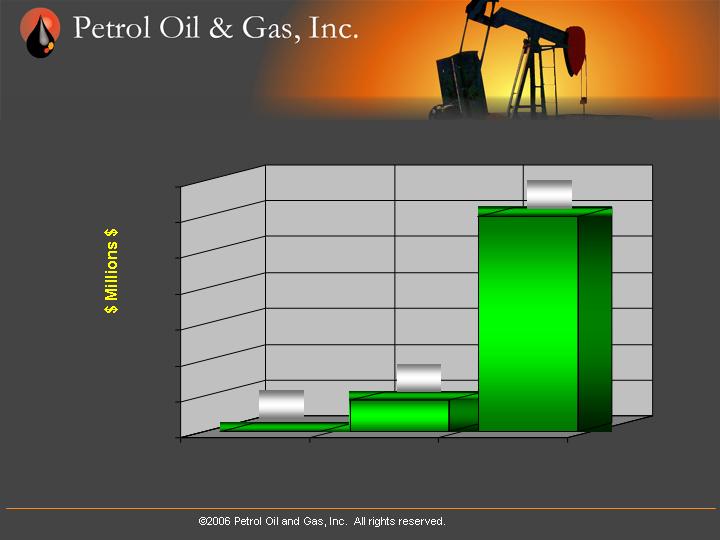

Milestones and Growth

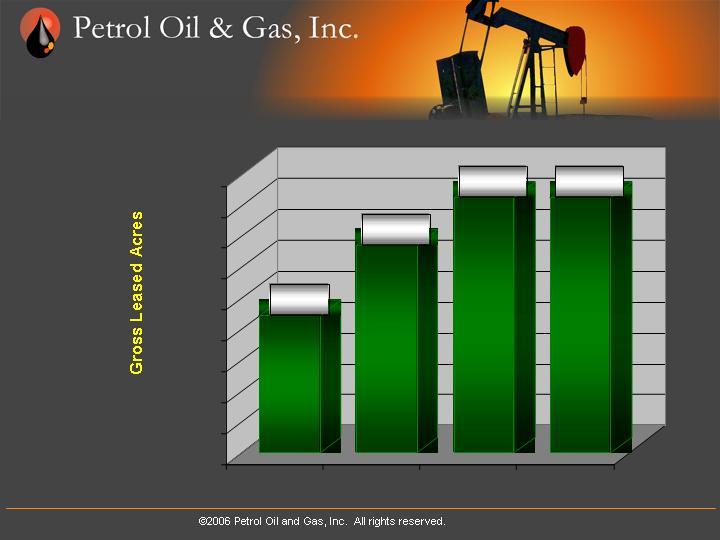

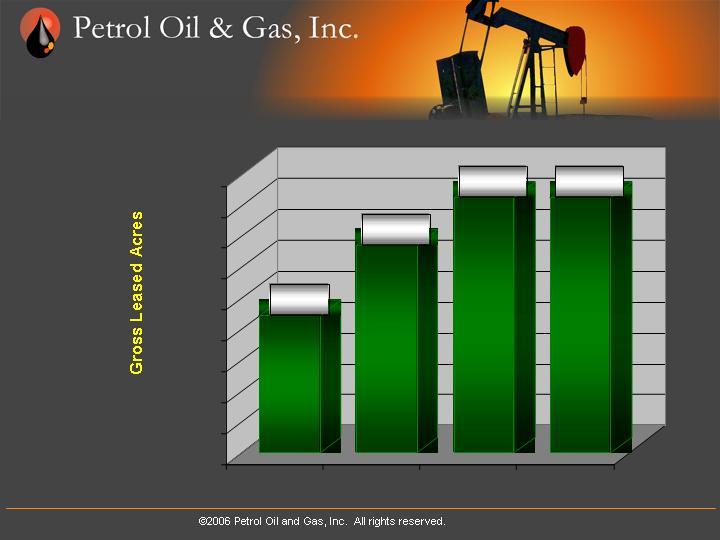

Leased Mineral Acres

88,800

134,000

165,000

165,000

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

2002

2003

2004

2005

Petrol Oil and Gas

Gross Acres

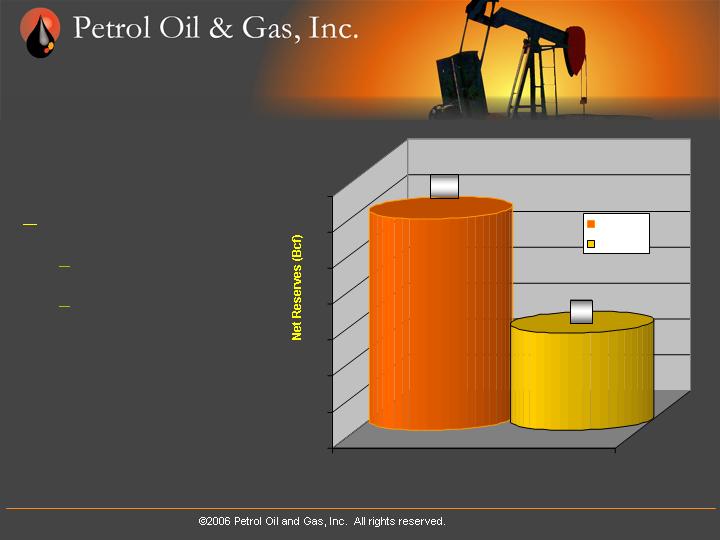

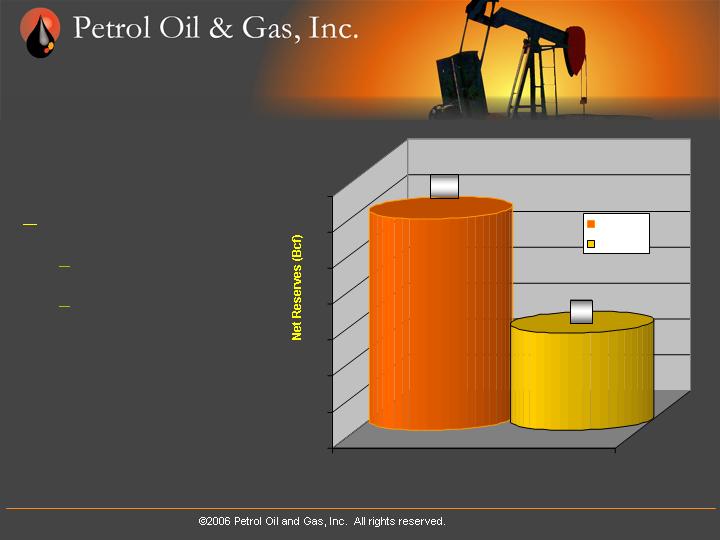

Petrol Net Gas Reserves*

17.2 Bcf Net

11.8 Bcf PROVED

5.4 Bcf Probable

* McCune Engineering Reserve Report

Sept 31, 2005

11.8

5.4

0

2

4

6

8

10

12

14

Bcf

Petrol NET

Gas Reserves

Proved

Probable

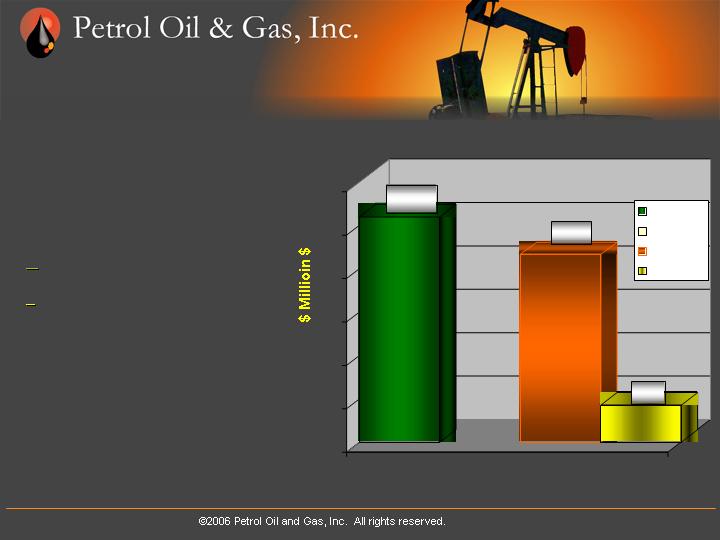

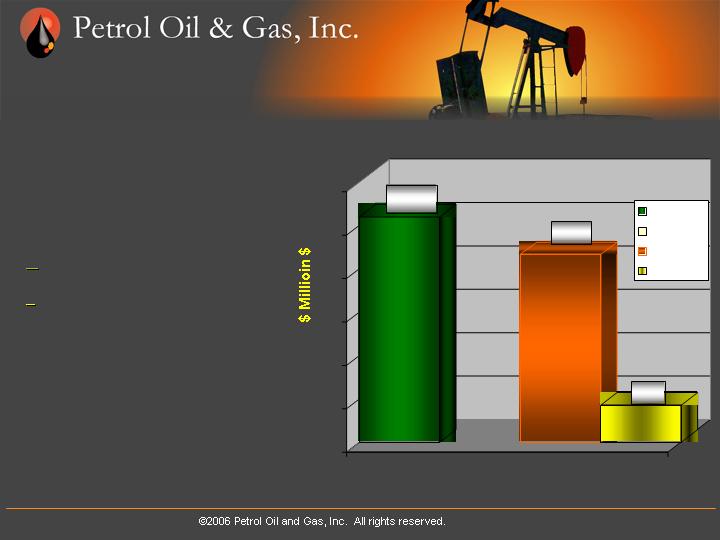

Petrol Net Reserves*

$54 Million PV 10%

$51.83 Million PV 10%

$2.17 Million Future Net OIL

Cash Flow

* McCune Engineering Reserve Report

Dec 31, 2004, Sept 31, 2005

$51.83

$43.22

$8.61

$0

$10

$20

$30

$40

$50

$60

PV 10%

Petrol Gas Reserves

Net Future Value

Net Value

Proved

Probable

Petrol Revenues

*

* Estimated

$0.00

$0.87

$6.00

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

2003

2004

2005

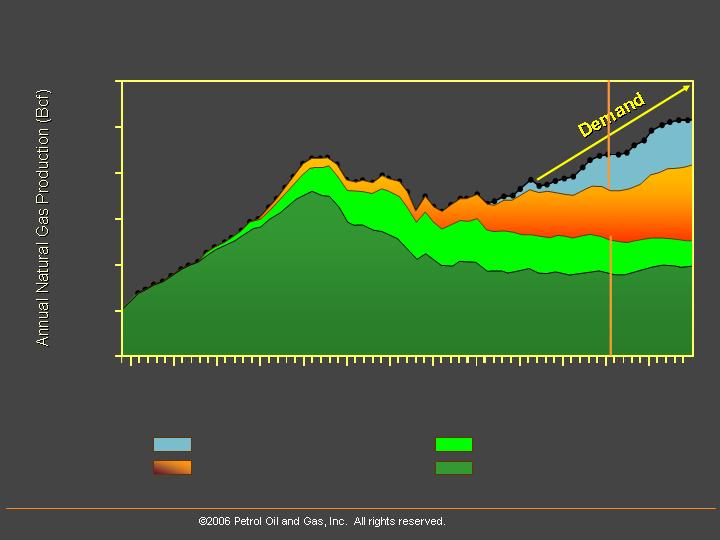

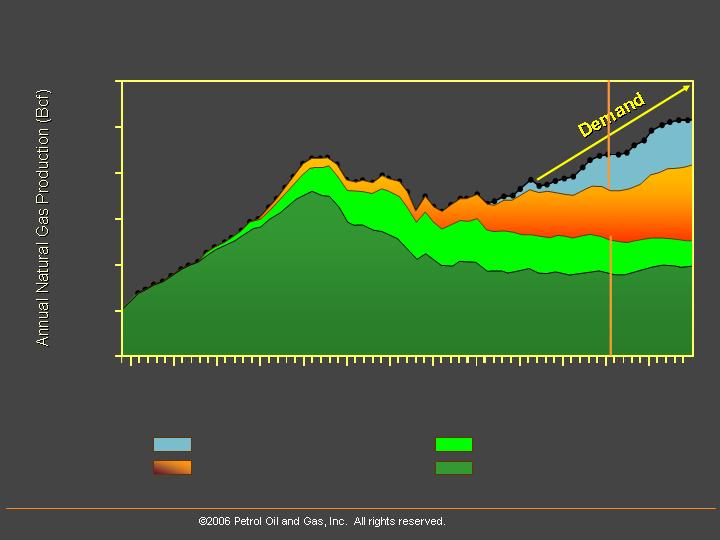

US Supply & Demand

& CBM Basin Review

Deepwater and Sub Sea Offshore

Coalbed Methane, etc.

30,000

EIA (1949-1990) and NPC (1991-2015)

1950

1960

1970

1980

1990

2000

2010

25,000

20,000

15,000

10,000

5,000

0

Year

Shallow Offshore

Conventional Onshore

Coalbed Methane,

Tight Gas and Shale Gas

Sources of Annual U.S. Gas Supply

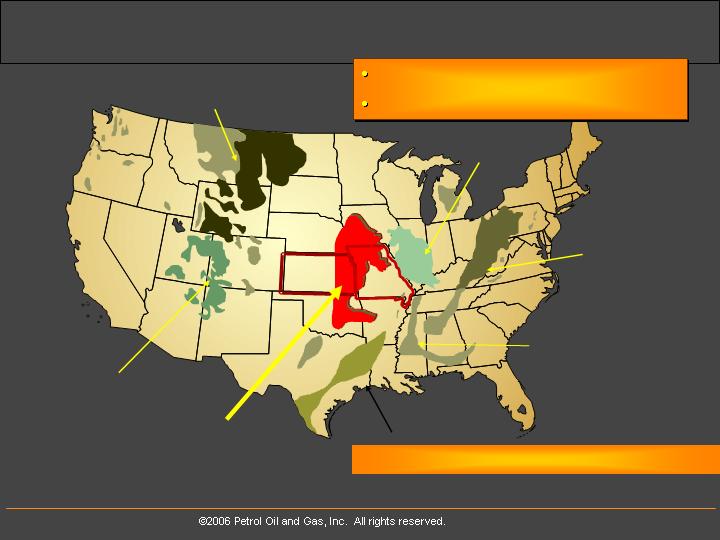

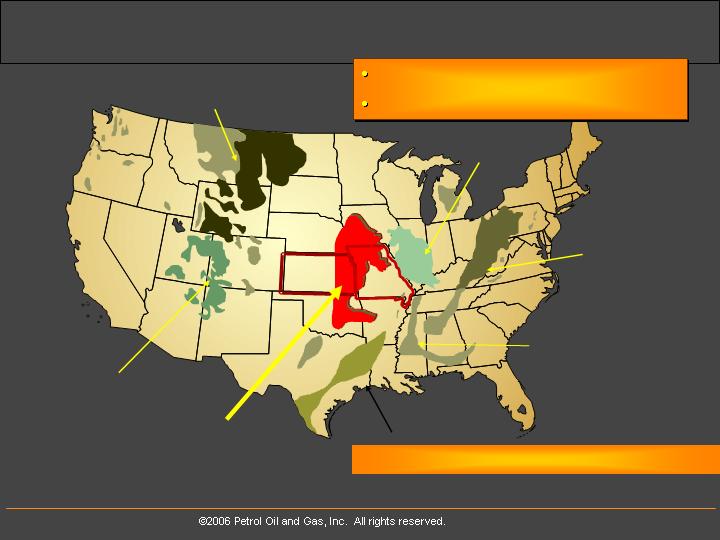

Major U.S. Coal-Bed Methane Gas Basins

Northern Rocky Mountains

and Great plains

Illinois Basin

Appalachian

Basin

Gulf Coast

Colorado Plateau

Black Warrior

United States Geologic Society (USGS)

700 Tcf CBM Reserves

7% of Total US Gas Production, 2000

Western Interior

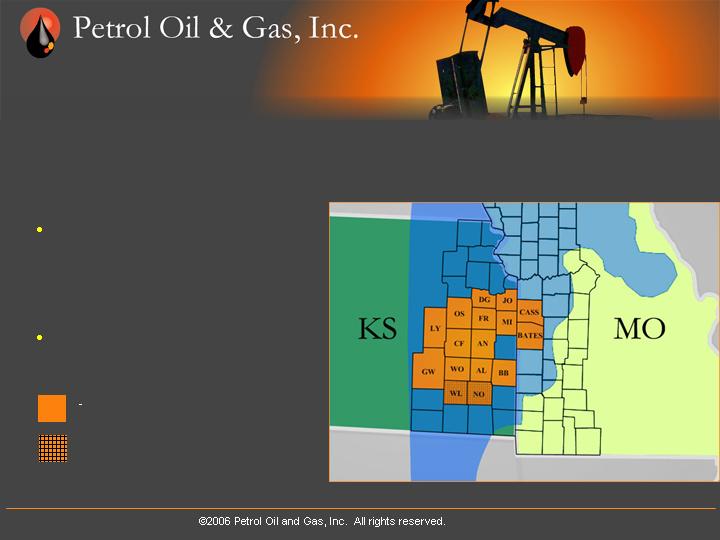

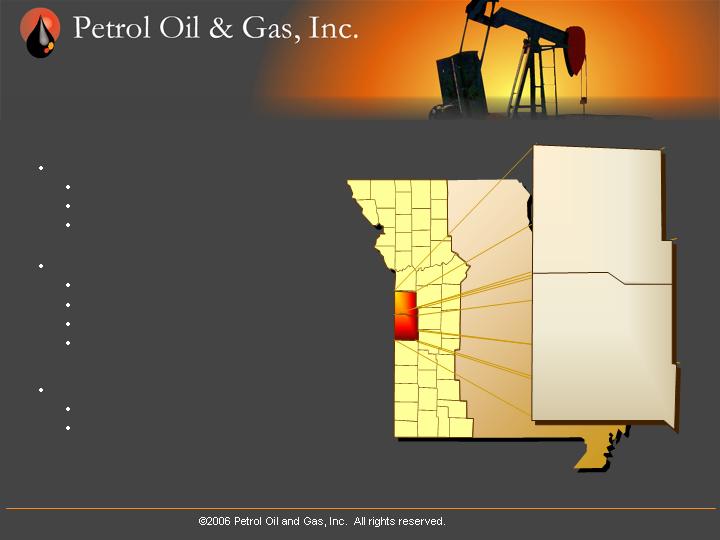

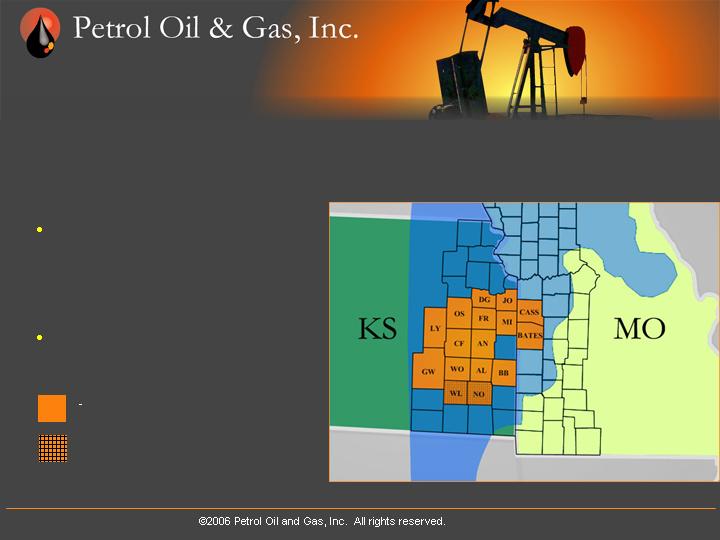

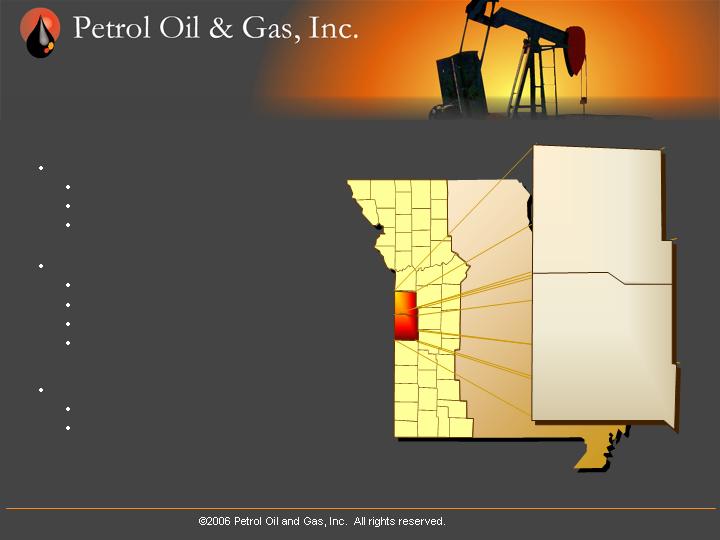

Petrol’s Leases are located in the Cherokee Basin and

Bourbon Arch along the Kansas and Missouri border.

Relatively New CBM Basin –

Production of Cherokee Group

Coals became active in the early

’90s.

4 major transmission pipelines

serve this basin

Current Counties with Petrol leases

(16 counties )

-Current production

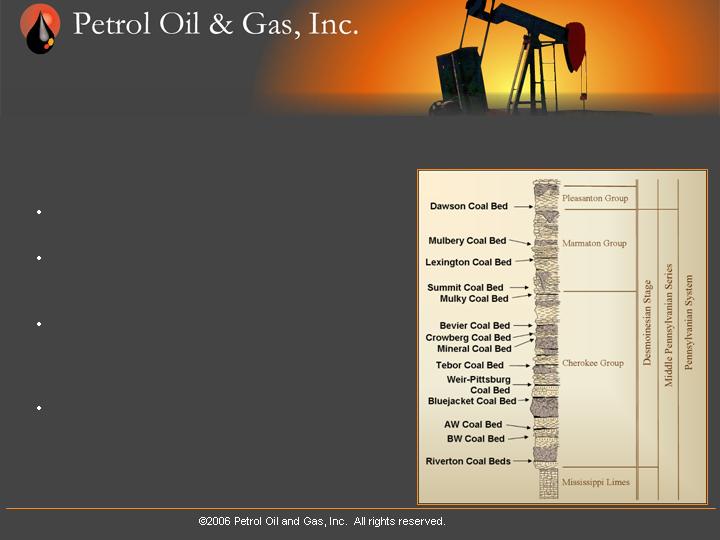

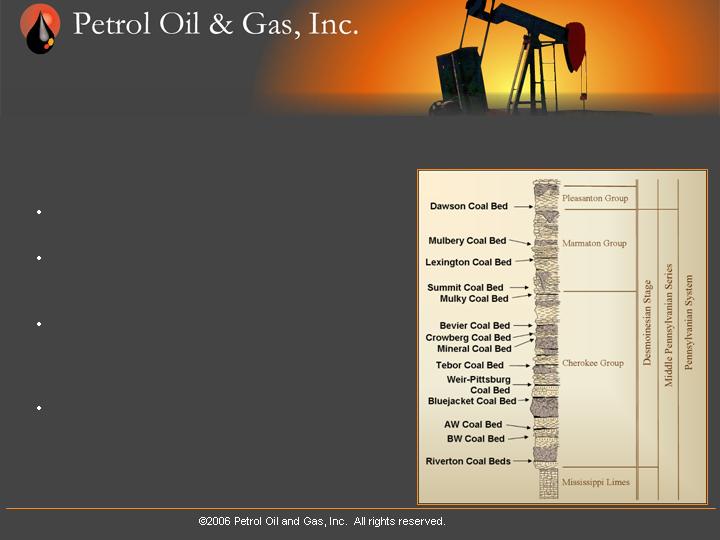

Typical Gas Bearing Coal Beds in Cherokee Rock Groups

Multiple gaseous Coal beds between 12-15 Coals

Thickness in the 12-15 coals in the Cherokee Rock

Group ranges from 8 to 26 feet.

Using an average Total Net thickness of 10 feet and

a gas content of 150 scf/ton, the in-place gas reserve

potential is 1.73 Bcf per section.

Other coal and shale potential is available

throughout Coffey County.

Typical Well Operations and Costs

Drilling Time 1 day

TD 1,200-1,700 ft

Fully Complete/On-line 7-10 days

All in Costs ~$180,000

E&P Project Overview

Petrol-Neodesha -- Wilson, Neosho Co. KS

Coal Creek Project - Hatch Field, Coffey Co. KS

Pomona Gas Project – Pomona Field, Franklin Co. KS

Missouri Gas Project – Belton Field, Cass Co. MO

Oil Field Projects -- South Eastern KS

Current Projects

Neosho

County

Wilson

County

Current Position

10,000 Gross Acres

100% WI

79.5% NRI

Resources/Reserve Est.

Field Production Ave. 2,700 Mcfd

Gas Gathering (60 miles)/Compression

Sales into Southern Star Pipeline

Operations

90 Producing Wells

8 SWD Wells

50-100 New Well Locations

Petrol-Neodesha Project

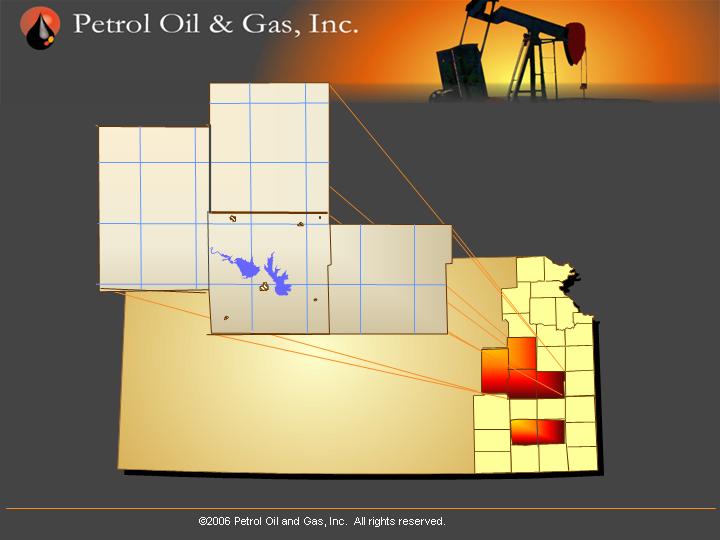

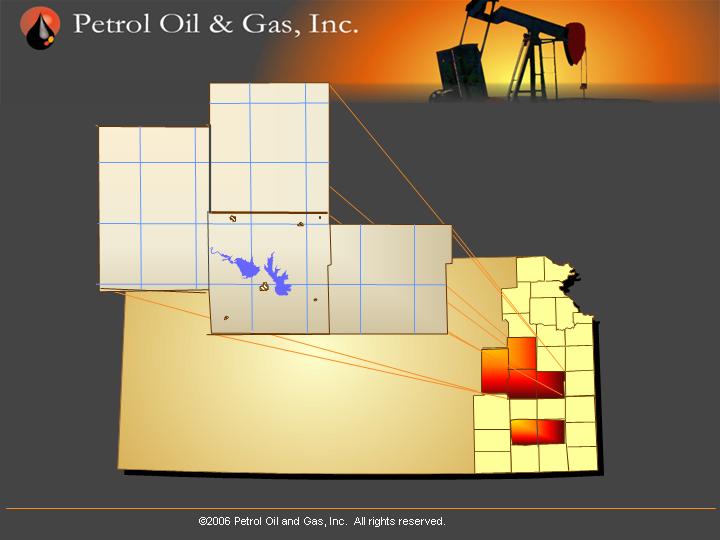

Coal Creek Project

Kansas

Osage

County

Coffey County

Anderson

County

Lyon

County

Petrol-Neodesha

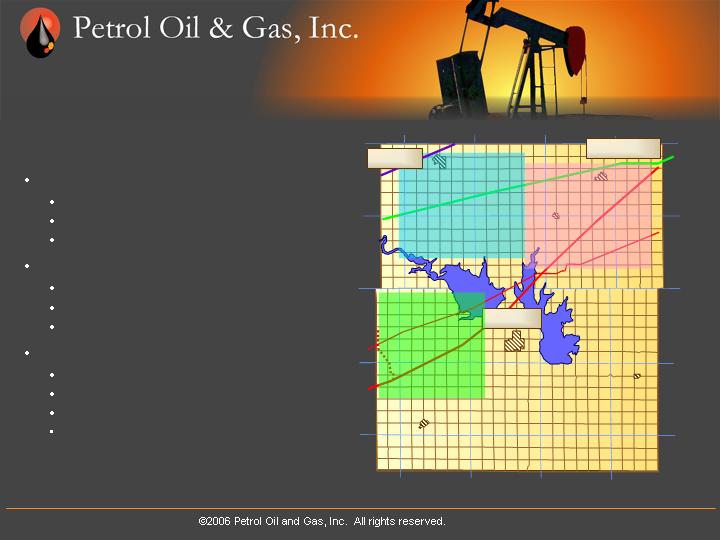

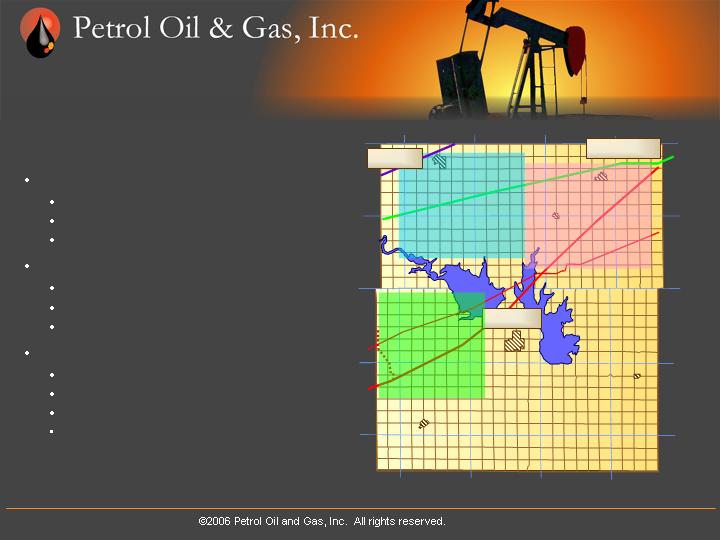

Current Position

92,000 Net Acres

100% WI

84.375% NRI

Resources/Reserve Estimates

Proved 1.9 Bcf

Probable 1.2 Bcf

3 Major Interstate Pipelines

Operations

28 CBM Wells

3 SWD Wells

20 Miles of Gas Gathering Lines

Compressors and Gas Processing

Coal Creek Project

* McCune Engineering Reserve Report Dec 31, 2004

R13E

R14E

R15E

R16E

R17E

T19S

T20S

T21S

T22S

T23S

R13E

R14E

R15E

R16E

R17E

T19S

T20S

T21S

T22S

T23S

Lebo

Waverly

Burlington

Gridley

Aliceville

Halls

Summit

Enbridge

Burlington

Waverly

Lebo

So. Star

CMS Energy

Osage

County

Anderson

County

Franklin

County

Current Position

36,000 Gross Acres

100% WI

84.375% NRI

Resources/Reserve Estimates

Possible CBM/Shale Reserves

Proven Conv. Gas Reserves

2 Major Interstate Pipelines

Operations

13 Conv. Wells

1 SWD Well

Several Miles of pipeline

Pomona Gas Project

Missouri Project

Current Position

15,000 Gross Acres

100% WI

84.375% NRI

Resources/Reserve Estimates

Possible CBM/Shale Reserves

Very Shallow CBM/Shale Gas Reserves

Gassy Coals/Shales Drill Cuttings

1 Major Interstate Pipeline

Operations

5 Exploratory Wells

Extremely Low Well Costs

Cass County

Bates County

* McCune Engineering Reserve Report Dec 31, 2004

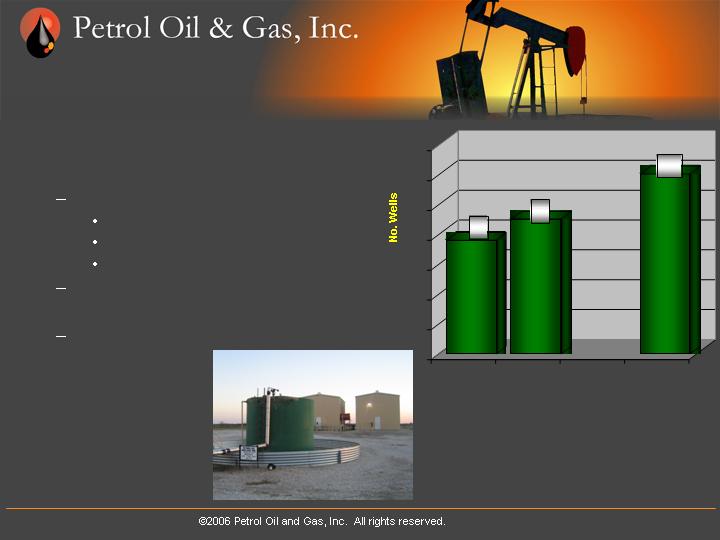

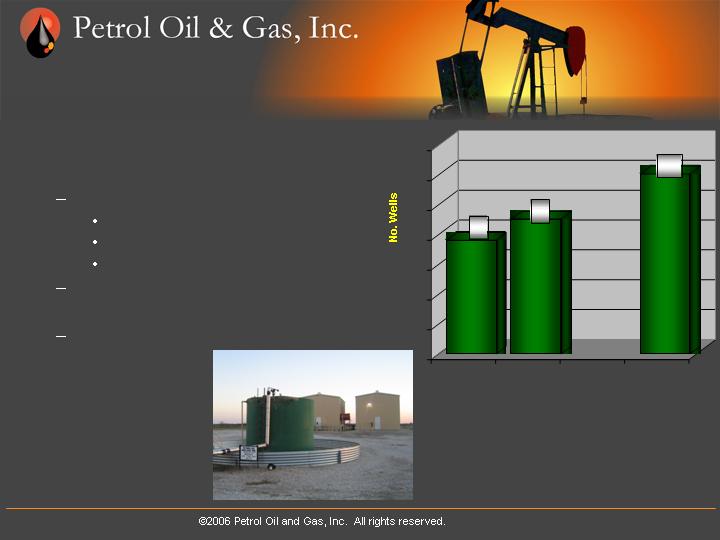

Corporate Development Strategy

Petrol-Neodesha

Infill Drilling Program

14 New Wells in 2005.

24-30 New Wells Planned for 2006

100% Successful

Optimize Gas Gathering System

for 50-100 New Wells

Acquire Additional Nearby

Mineral Leases

Growth Strategy

76

90

120

0

20

40

60

80

100

120

140

2004

2005

2006

Petrol-Neodesha

Production Wells

Growth Strategy

Coal Creek Project

Acquired $50 Million Debt Financing

Initiate an Accelerated Drilling

Program to Prove the Reserves and

Provide New Revenue

Develop the Entire 92,000 Project Area

Approx. 40 production wells 2nd Qtr

2 Gas Gathering Pipelines Systems

3 SWD Wells and other Infrastructure.

Corporate Growth Summary

Consolidated Several Project Areas ~ 165,000 acres

Acquired $50 Million Funding for Coal Creek

Development

Coal Creek Development Can Significantly Enhance

Future Revenue and Asset Value

Applying for AMEX Trading

Asset Impact: Developing Coal Creek Project Phase I

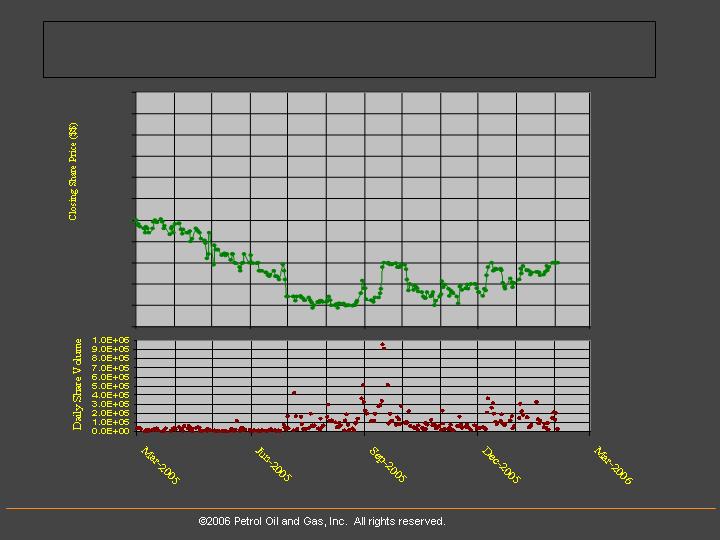

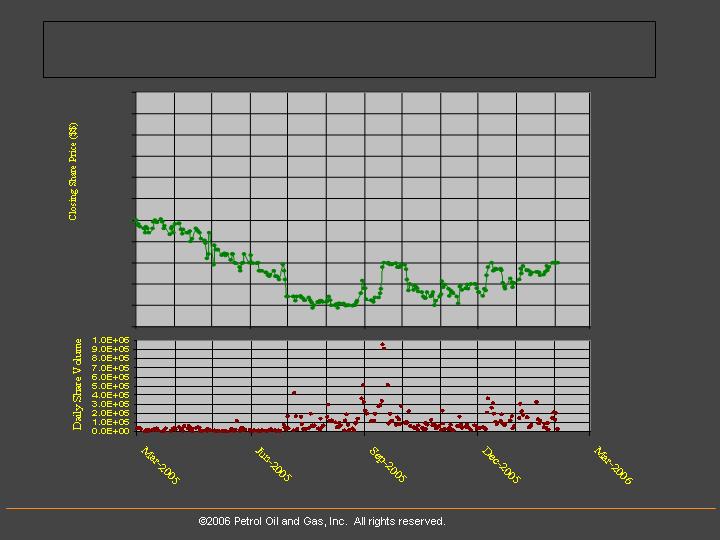

Market & Financial Information

OTC BB: POIG

27.7 MM Shares Issued & Outstanding

$55.4 MM Equity Market Cap

Last 6 Qtrs were Revenue Producing

Cash Flow Positive from Operations.

Filings Up to Date and On Time

Petrol Senior Management Team

Paul Branagan, President /CEO

President & CEO since Company Inception in 2001

30 yrs in Major R&D Projects involving Complex Gas Reservoirs

President of B&A Inc. Oil and Gas Consulting firm to clients such as

Conoco, Mobil and CNPC in China.

Gary Bridwell, Drilling/Production Field Manager

20yrs Field Production Supervision

Former Meritage CBM Explor/Development

Former Field Supervisor Stroud Oil

Owner/Operator Black Rain Energies

W.T. (Bill) Stoeckinger, Geologist

40 yrs E&P Geologist

Worldwide CBM Expertise

25 yrs Int’l E&P Chevron-Texaco

Petrol Historical Stock Trades

$1.25

$1.50

$1.75

$2.00

$2.25

$2.50

$2.75

$3.00

$3.25

$3.50

$3.75

$4.00

Thanks for Your Attention

Visit our Web Site at

www.petroloilandgas.com

Petrol Oil and Gas Inc.

IR Contact: CEOcast, Inc.

Ed Lewis, 212-732-4300, Ext. 225