February 12, 2025 Earnings Conference Call Fourth Quarter 2024

2 Cautionary Statements Regarding Forward-Looking Information This presentation contains certain forward-looking statements within the meaning of federal securities laws that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” “should,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic, and financial performance, are intended to identify such forward-looking statements. Any reference to “E” after a year or time period indicates the information for that year or time period is an estimate. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following important factors that may cause our actual results or outcomes to differ materially from those contained in our forward-looking statements, including, but not limited to: unfavorable legislative and/or regulatory actions; uncertainty as to outcomes and timing of regulatory approval proceedings and/or negotiated settlements thereof; environmental liabilities and remediation costs; state and federal legislation requiring use of low-emission, renewable, and/or alternate fuel sources and/or mandating implementation of energy conservation programs requiring implementation of new technologies; challenges to tax positions taken, tax law changes, and difficulty in quantifying potential tax effects of business decisions; negative outcomes in legal proceedings; adverse impact of the activities associated with the past DPA and now-resolved SEC investigation on Exelon’s and ComEd’s reputation and relationships with legislators, regulators, and customers; physical security and cybersecurity risks; extreme weather events, natural disasters, operational accidents such as wildfires or natural, gas explosions, war, acts and threats of terrorism, public health crises, epidemics, pandemics, or other significant events; lack of sufficient capacity to meet actual or forecasted demand or disruptions at power generation facilities owned by third parties; emerging technologies that could affect or transform the energy industry; instability in capital and credit markets; a downgrade of any Registrant’s credit ratings or other failure to satisfy the credit standards in the Registrants’ agreements or regulatory financial requirements; significant economic downturns or increases in customer rates; impacts of climate change and weather on energy usage and maintenance and capital costs; and impairment of long-lived assets, goodwill, and other assets. New factors emerge from time to time, and it is impossible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. For more information, see those factors discussed with respect to Exelon Corporation, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company, Pepco Holdings LLC, Potomac Electric Power Company, Delmarva Power & Light Company, and Atlantic City Electric Company (Registrants) in the Registrants’ most recent Annual Report on Form 10-K, including in Part I, ITEM A, any subsequent Quarterly Reports on Form 10-Q, and in other reports filed by the Registrants from time to time with the U.S. Securities and Exchange Commission. Investors are cautioned not to place undue reliance on these forward-looking statements, whether written or oral, which apply only as of the date of this presentation. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation.

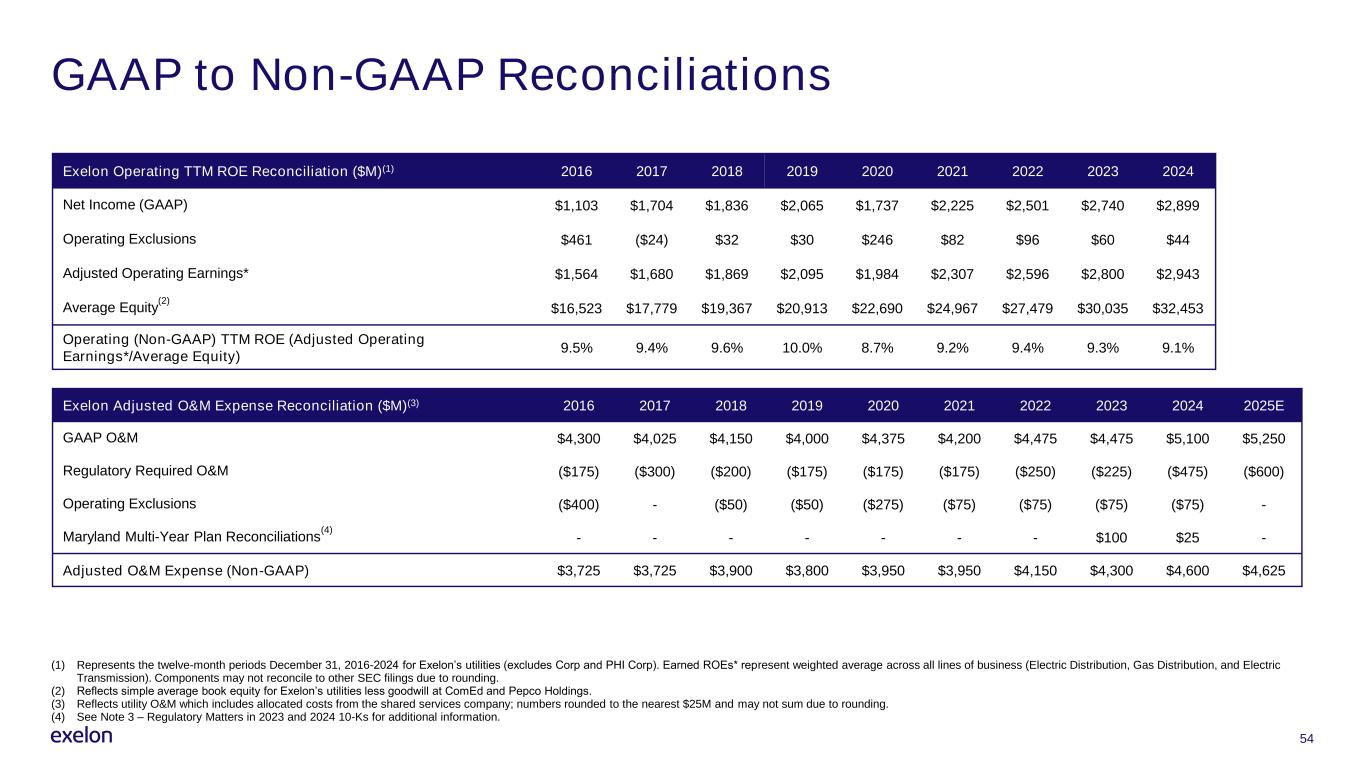

3 Non-GAAP Financial Measures Exelon reports its financial results in accordance with accounting principles generally accepted in the United States (GAAP). Exelon supplements the reporting of financial information determined in accordance with GAAP with certain non-GAAP financial measures, including: • Adjusted operating earnings exclude certain items that are considered by management to be not directly related to the ongoing operations of the business as described in the Appendix. • Adjusted operating and maintenance (O&M) expense excludes regulatory operating and maintenance costs for the utility businesses and certain excluded items. • Operating ROE is calculated using operating net income divided by average equity for the period. The operating income reflects all lines of business for the utility business (Gas Distribution, Electric Transmission, and Electric Distribution). • Adjusted cash from operations primarily includes cash flows from operating activities adjusted for common dividends and change in cash on hand. Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be currently available without unreasonable efforts, as management is unable to project special items (such as effects of hedges, unrealized gains and losses, and legal settlements) for future periods. This information is intended to enhance an investor’s overall understanding of period over period financial results and provide an indication of Exelon’s baseline operating performance by excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this information is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets, and planning and forecasting of future periods. These non-GAAP financial measures are not a presentation defined under GAAP and may not be comparable to other companies’ presentations. Exelon has provided these non- GAAP financial measures as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These non-GAAP measures should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP measures provided in the materials presented. Non-GAAP financial measures are identified by the phrase “non-GAAP” or an asterisk (*). Reconciliations of these non-GAAP measures to the most comparable GAAP measures are provided in the appendices and attachments to this presentation.

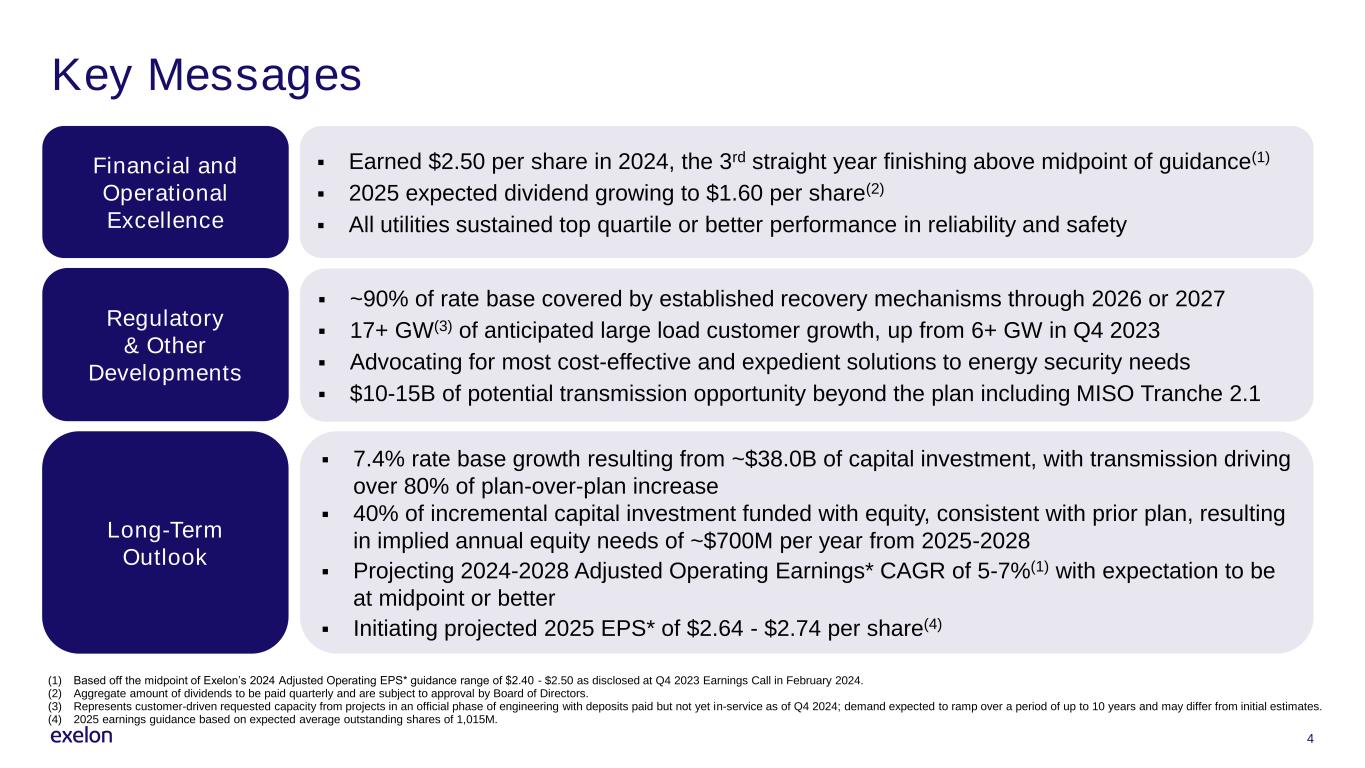

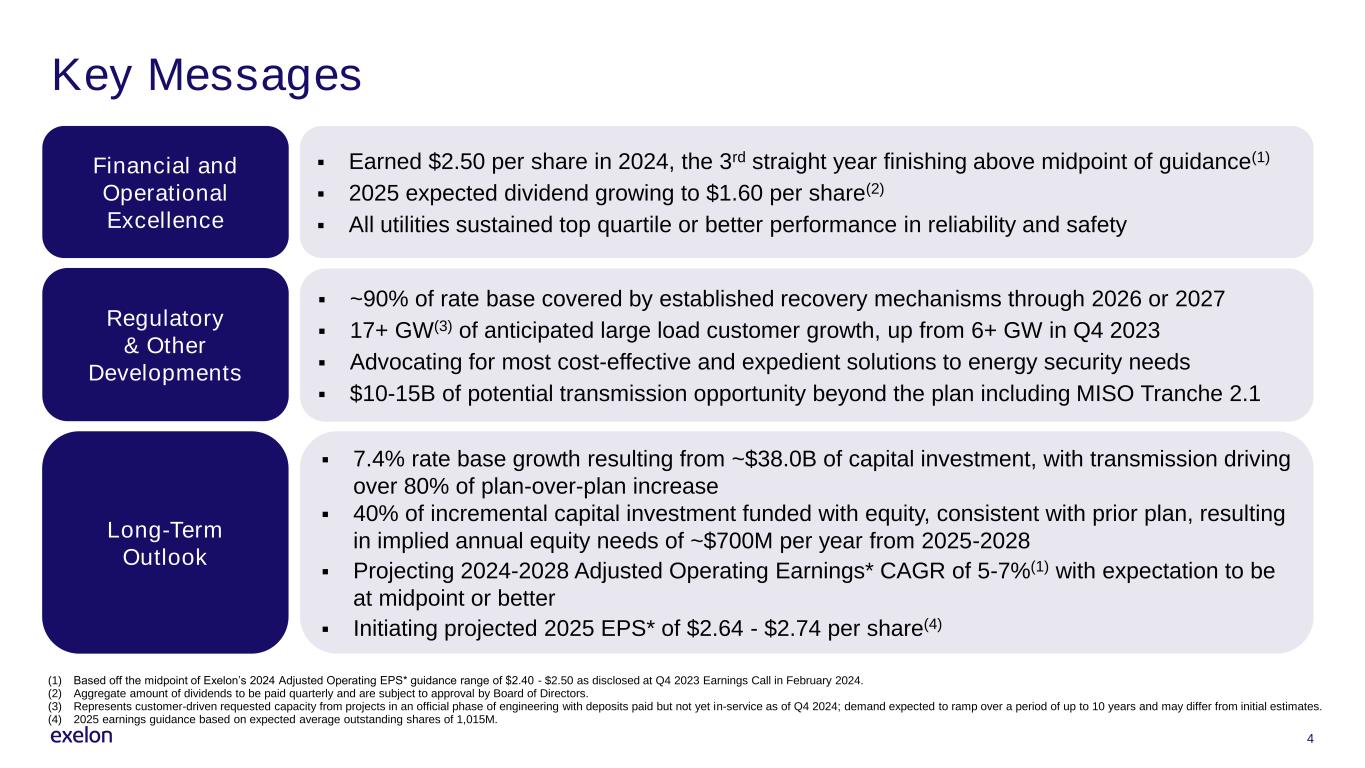

4 Key Messages Financial and Operational Excellence Regulatory & Other Developments Long-Term Outlook ▪ Earned $2.50 per share in 2024, the 3rd straight year finishing above midpoint of guidance(1) ▪ 2025 expected dividend growing to $1.60 per share(2) ▪ All utilities sustained top quartile or better performance in reliability and safety ▪ ~90% of rate base covered by established recovery mechanisms through 2026 or 2027 ▪ 17+ GW(3) of anticipated large load customer growth, up from 6+ GW in Q4 2023 ▪ Advocating for most cost-effective and expedient solutions to energy security needs ▪ $10-15B of potential transmission opportunity beyond the plan including MISO Tranche 2.1 ▪ 7.4% rate base growth resulting from ~$38.0B of capital investment, with transmission driving over 80% of plan-over-plan increase ▪ 40% of incremental capital investment funded with equity, consistent with prior plan, resulting in implied annual equity needs of ~$700M per year from 2025-2028 ▪ Projecting 2024-2028 Adjusted Operating Earnings* CAGR of 5-7%(1) with expectation to be at midpoint or better ▪ Initiating projected 2025 EPS* of $2.64 - $2.74 per share(4) (1) Based off the midpoint of Exelon’s 2024 Adjusted Operating EPS* guidance range of $2.40 - $2.50 as disclosed at Q4 2023 Earnings Call in February 2024. (2) Aggregate amount of dividends to be paid quarterly and are subject to approval by Board of Directors. (3) Represents customer-driven requested capacity from projects in an official phase of engineering with deposits paid but not yet in-service as of Q4 2024; demand expected to ramp over a period of up to 10 years and may differ from initial estimates. (4) 2025 earnings guidance based on expected average outstanding shares of 1,015M.

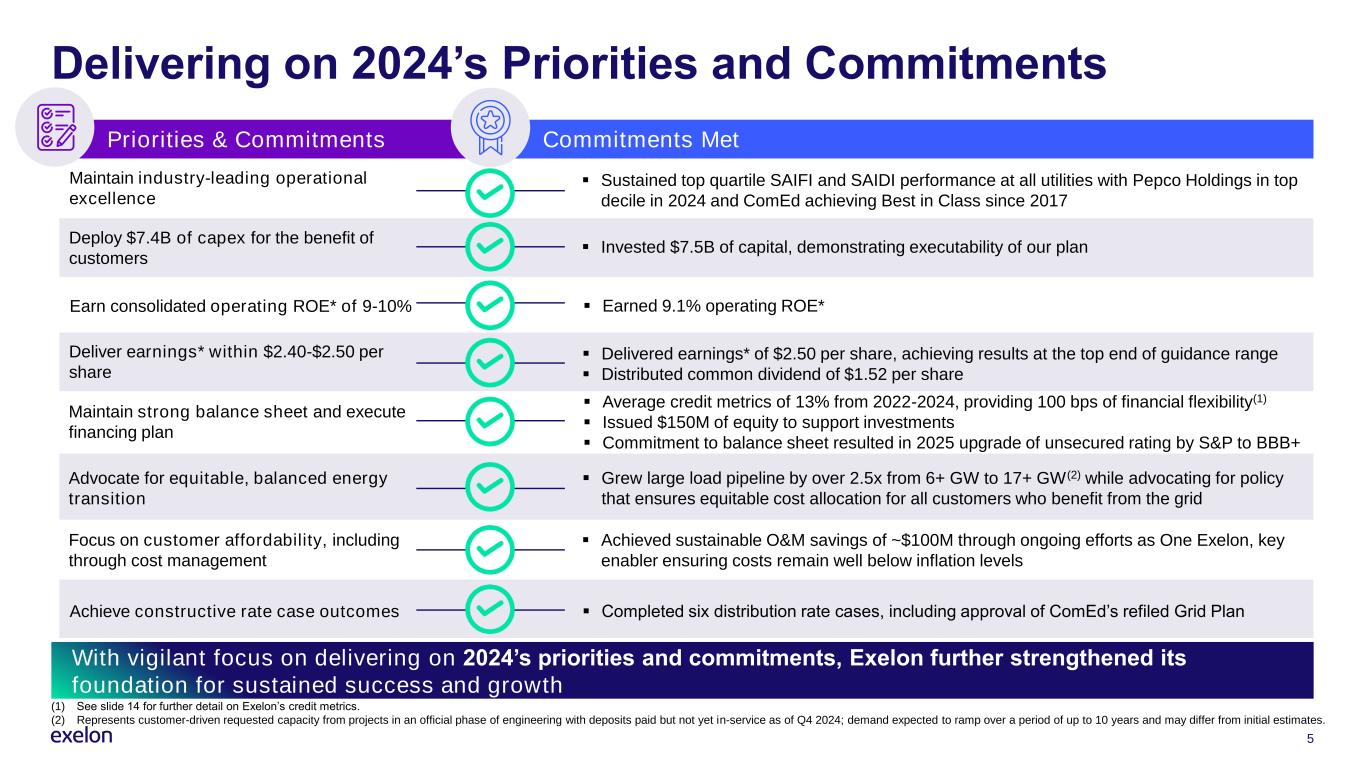

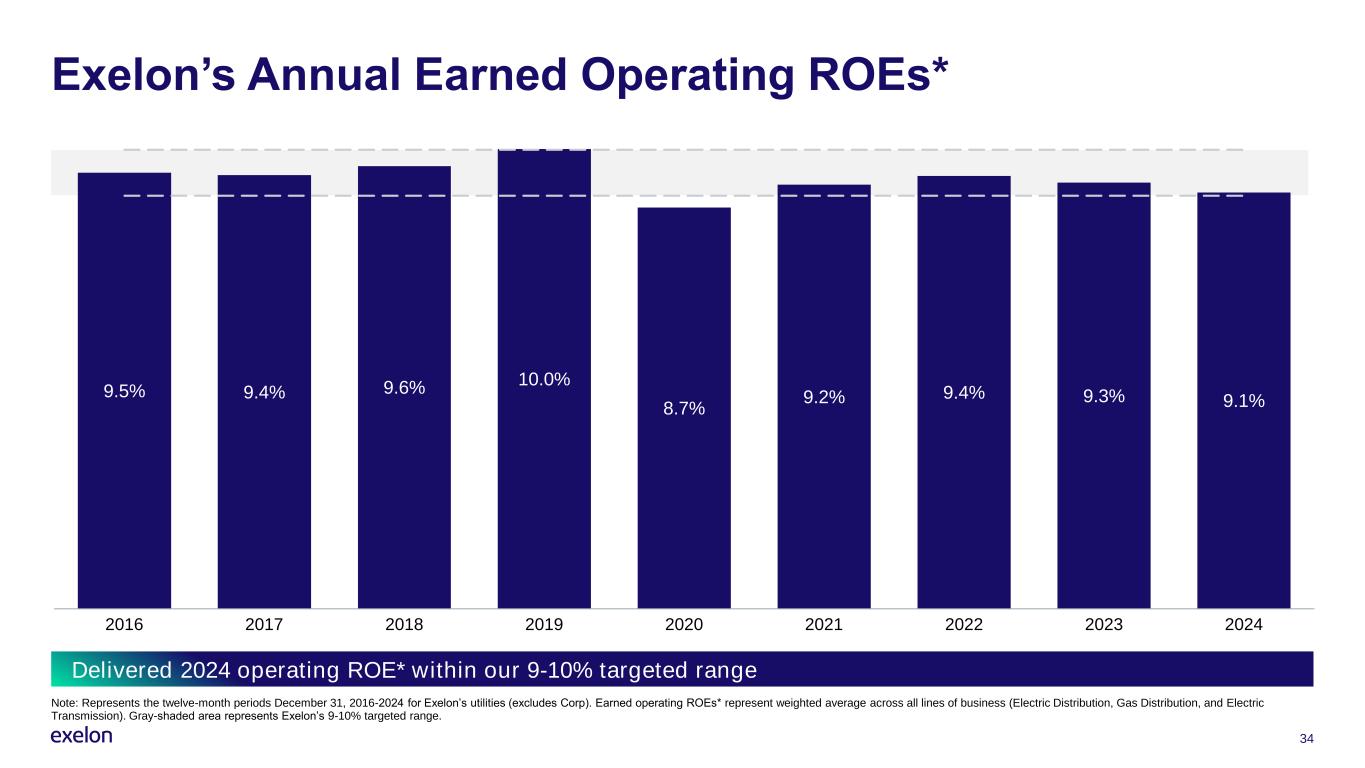

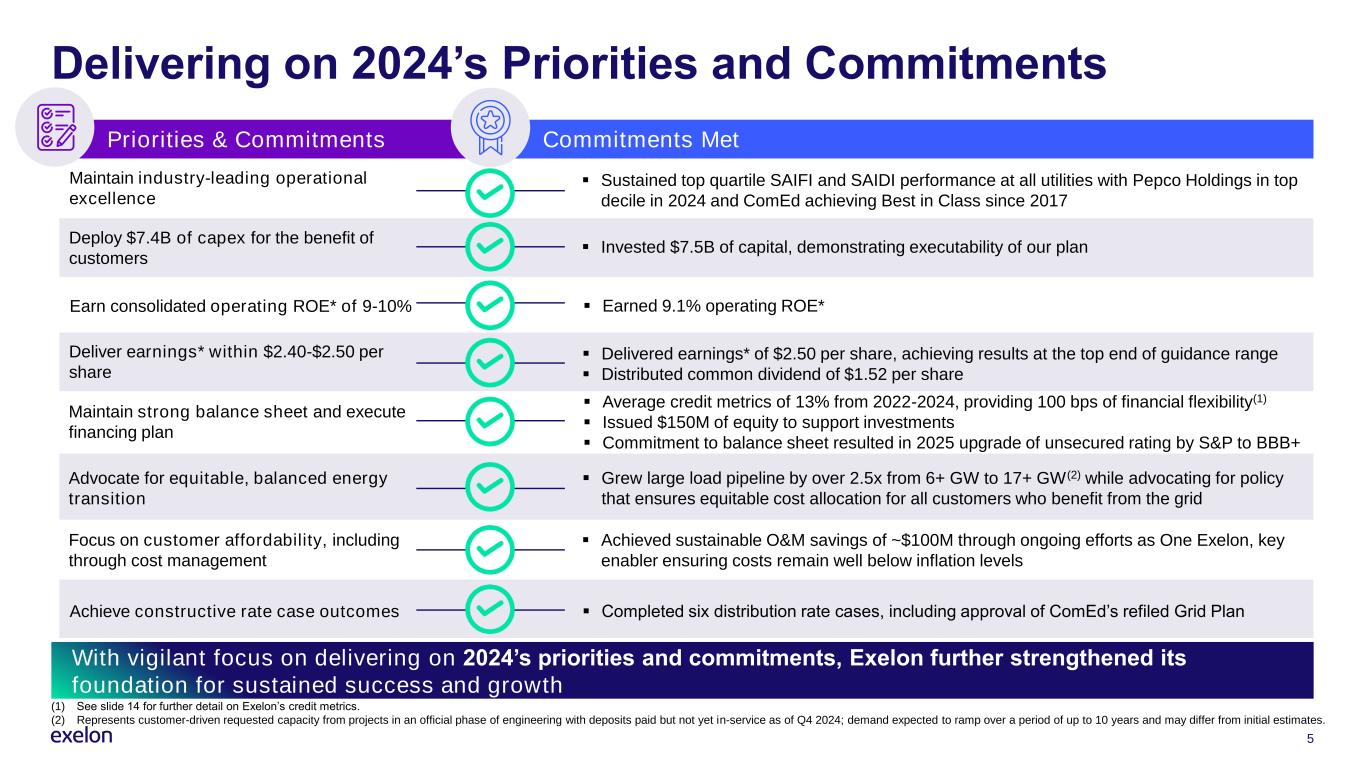

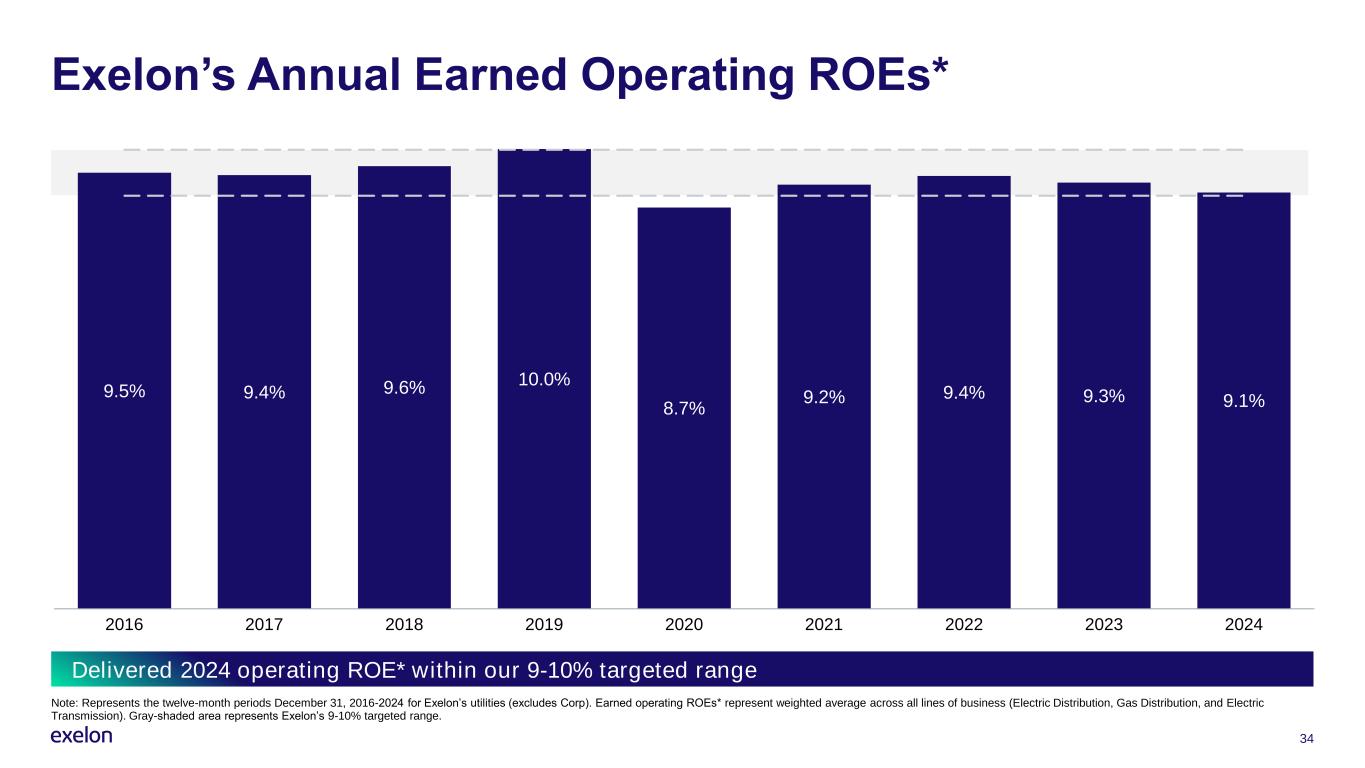

Focus on customer affordability, including through cost management ▪ Earned 9.1% operating ROE* ▪ Invested $7.5B of capital, demonstrating executability of our plan ▪ Sustained top quartile SAIFI and SAIDI performance at all utilities with Pepco Holdings in top decile in 2024 and ComEd achieving Best in Class since 2017 ▪ Delivered earnings* of $2.50 per share, achieving results at the top end of guidance range ▪ Distributed common dividend of $1.52 per share ▪ Grew large load pipeline by over 2.5x from 6+ GW to 17+ GW(2) while advocating for policy that ensures equitable cost allocation for all customers who benefit from the grid ▪ Achieved sustainable O&M savings of ~$100M through ongoing efforts as One Exelon, key enabler ensuring costs remain well below inflation levels ▪ Average credit metrics of 13% from 2022-2024, providing 100 bps of financial flexibility(1) ▪ Issued $150M of equity to support investments ▪ Commitment to balance sheet resulted in 2025 upgrade of unsecured rating by S&P to BBB+ Earn consolidated operating ROE* of 9-10% Deploy $7.4B of capex for the benefit of customers Maintain industry-leading operational excellence Deliver earnings* within $2.40-$2.50 per share Maintain strong balance sheet and execute financing plan Advocate for equitable, balanced energy transition Achieve constructive rate case outcomes ▪ Completed six distribution rate cases, including approval of ComEd’s refiled Grid Plan 5 Delivering on 2024’s Priorities and Commitments Priorities & Commitments Commitments Met With vigilant focus on delivering on 2024’s priorities and commitments, Exelon further strengthened its foundation for sustained success and growth (1) See slide 14 for further detail on Exelon’s credit metrics. (2) Represents customer-driven requested capacity from projects in an official phase of engineering with deposits paid but not yet in-service as of Q4 2024; demand expected to ramp over a period of up to 10 years and may differ from initial estimates.

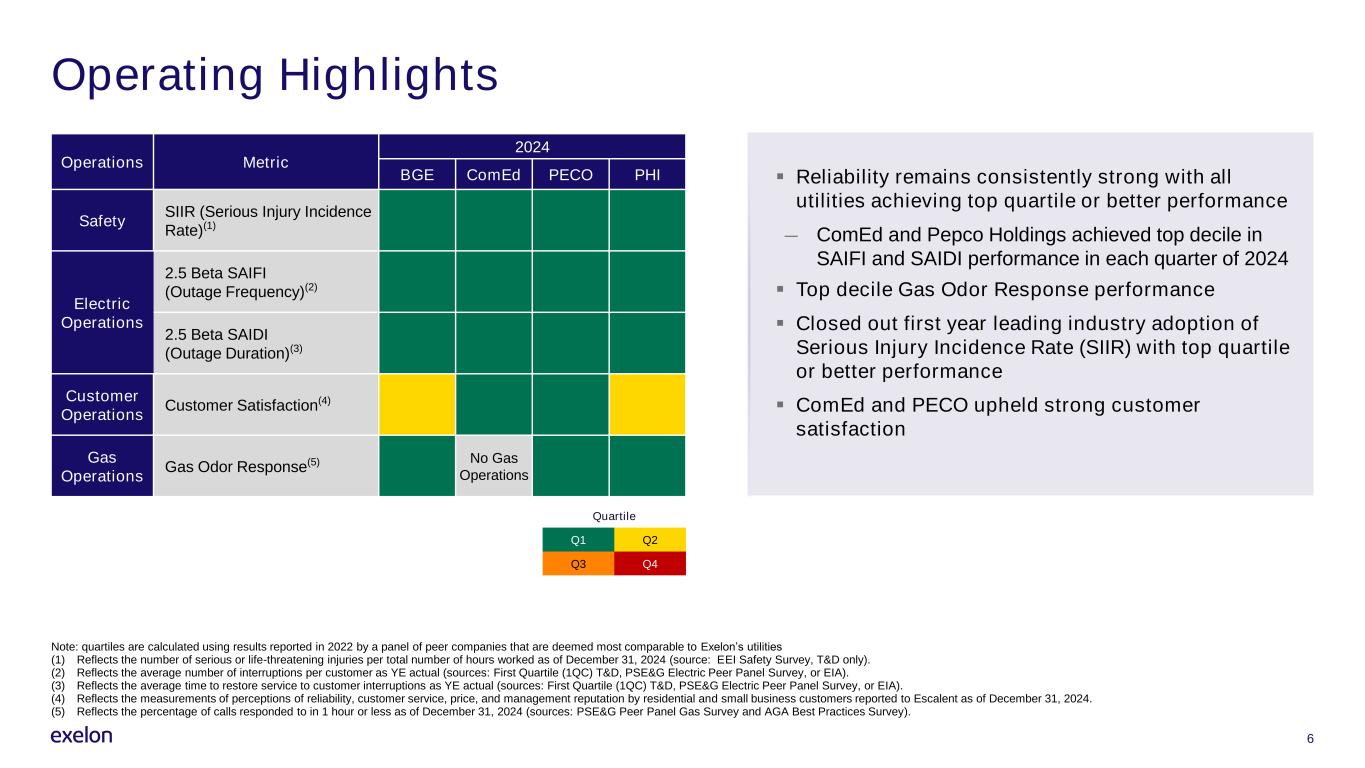

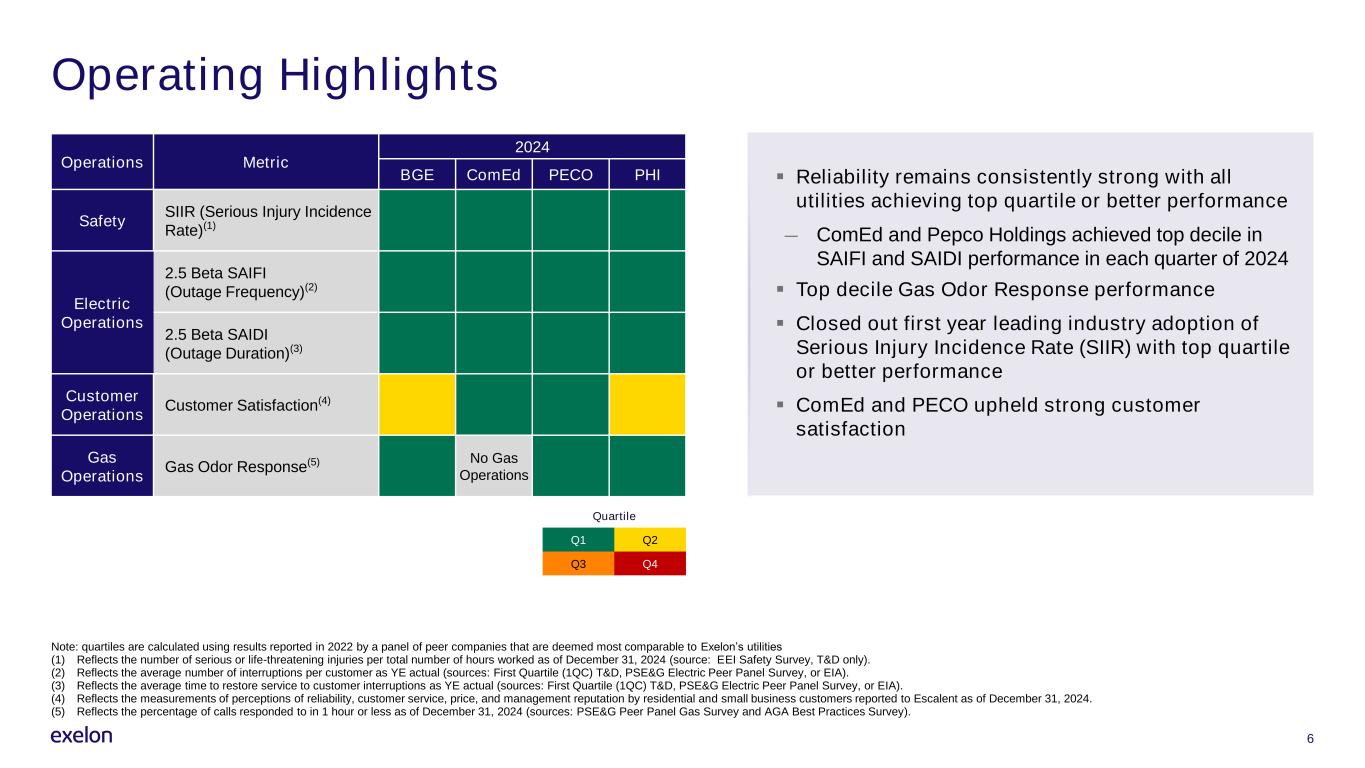

6 Operating Highlights Quartile Q1 Q2 Q3 Q4 Operations Metric 2024 BGE ComEd PECO PHI Safety SIIR (Serious Injury Incidence Rate)(1) Electric Operations 2.5 Beta SAIFI (Outage Frequency)(2) 2.5 Beta SAIDI (Outage Duration)(3) Customer Operations Customer Satisfaction(4) Gas Operations Gas Odor Response(5) No Gas Operations ▪ Reliability remains consistently strong with all utilities achieving top quartile or better performance ― ComEd and Pepco Holdings achieved top decile in SAIFI and SAIDI performance in each quarter of 2024 ▪ Top decile Gas Odor Response performance ▪ Closed out first year leading industry adoption of Serious Injury Incidence Rate (SIIR) with top quartile or better performance ▪ ComEd and PECO upheld strong customer satisfaction Note: quartiles are calculated using results reported in 2022 by a panel of peer companies that are deemed most comparable to Exelon’s utilities (1) Reflects the number of serious or life-threatening injuries per total number of hours worked as of December 31, 2024 (source: EEI Safety Survey, T&D only). (2) Reflects the average number of interruptions per customer as YE actual (sources: First Quartile (1QC) T&D, PSE&G Electric Peer Panel Survey, or EIA). (3) Reflects the average time to restore service to customer interruptions as YE actual (sources: First Quartile (1QC) T&D, PSE&G Electric Peer Panel Survey, or EIA). (4) Reflects the measurements of perceptions of reliability, customer service, price, and management reputation by residential and small business customers reported to Escalent as of December 31, 2024. (5) Reflects the percentage of calls responded to in 1 hour or less as of December 31, 2024 (sources: PSE&G Peer Panel Gas Survey and AGA Best Practices Survey).

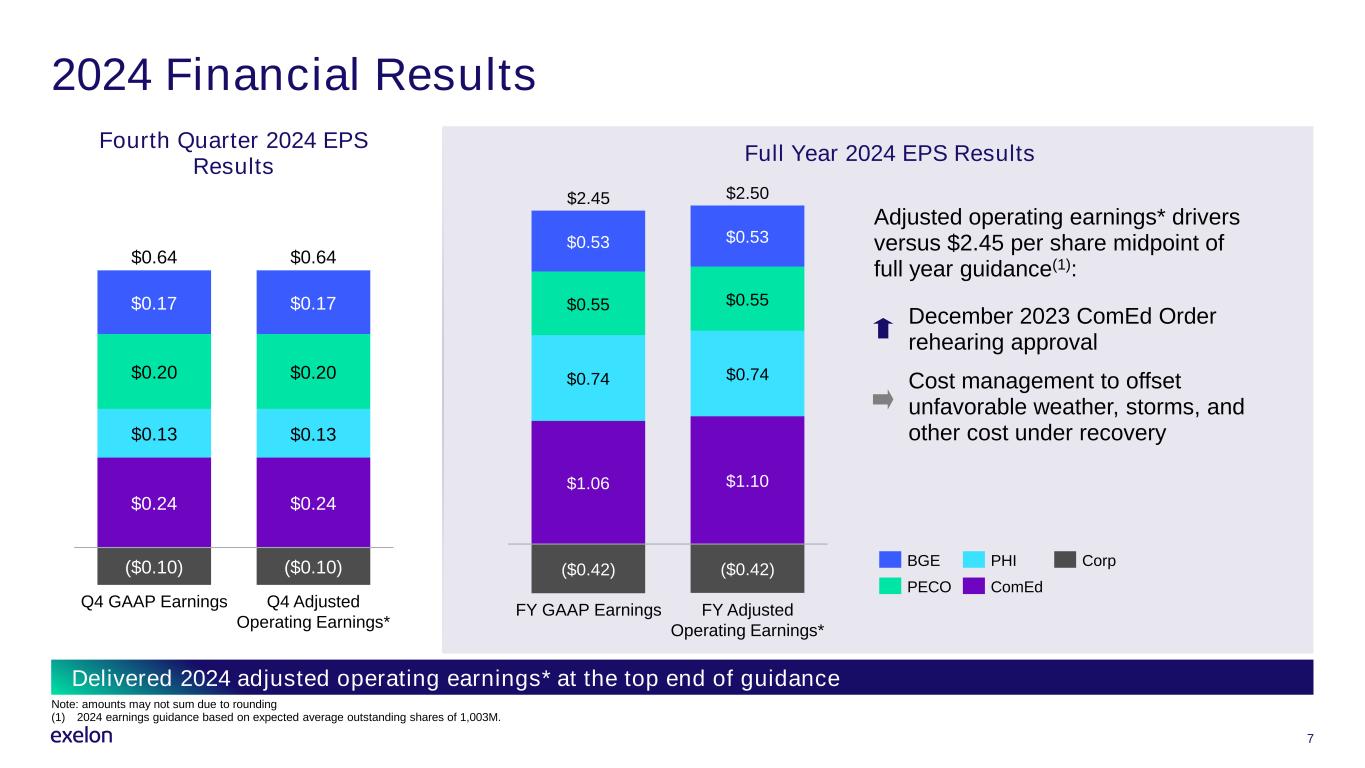

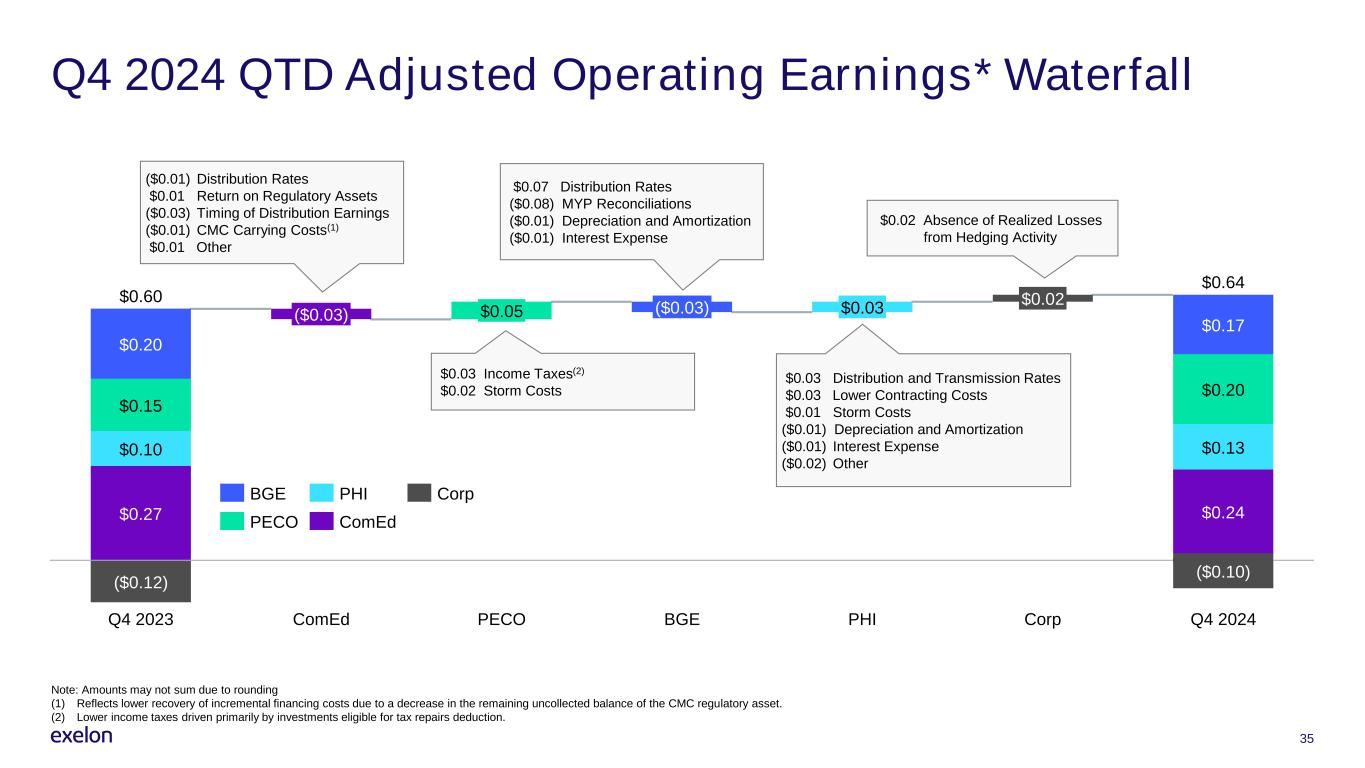

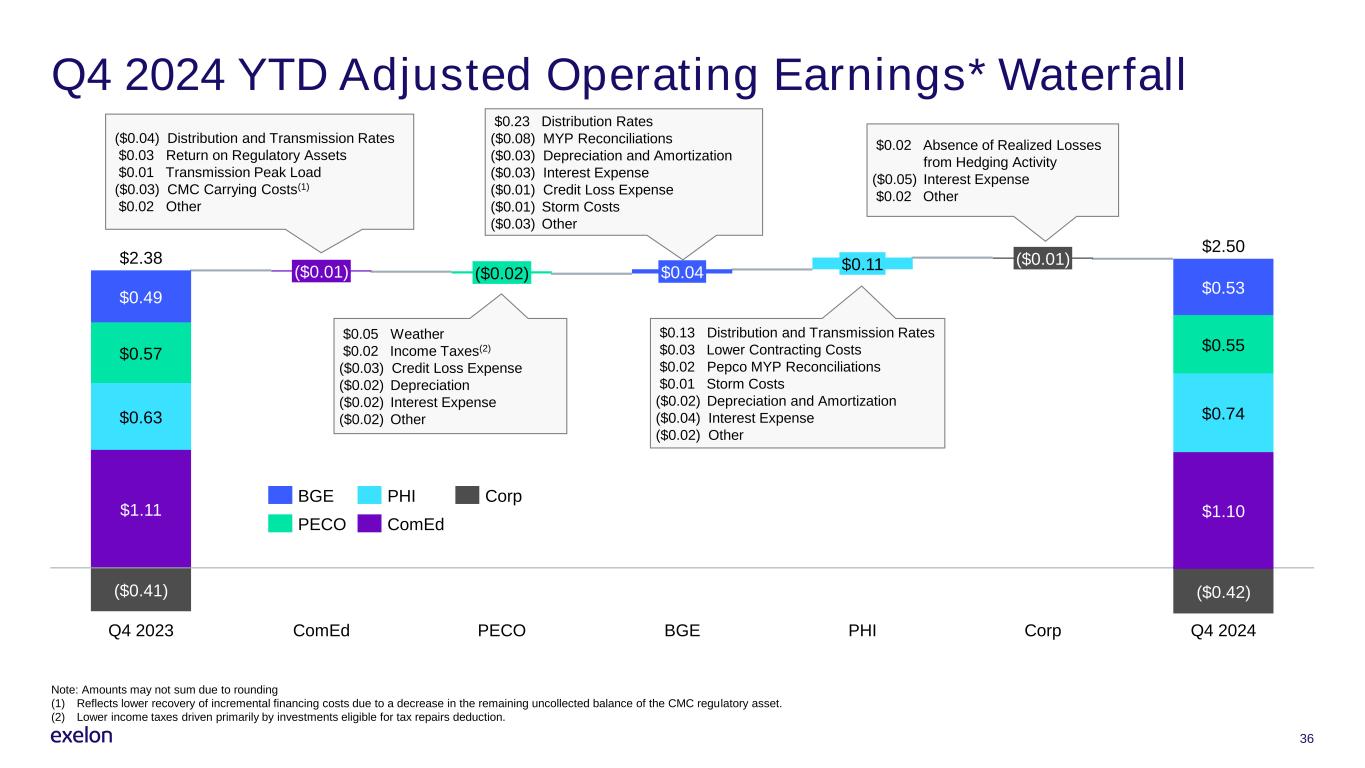

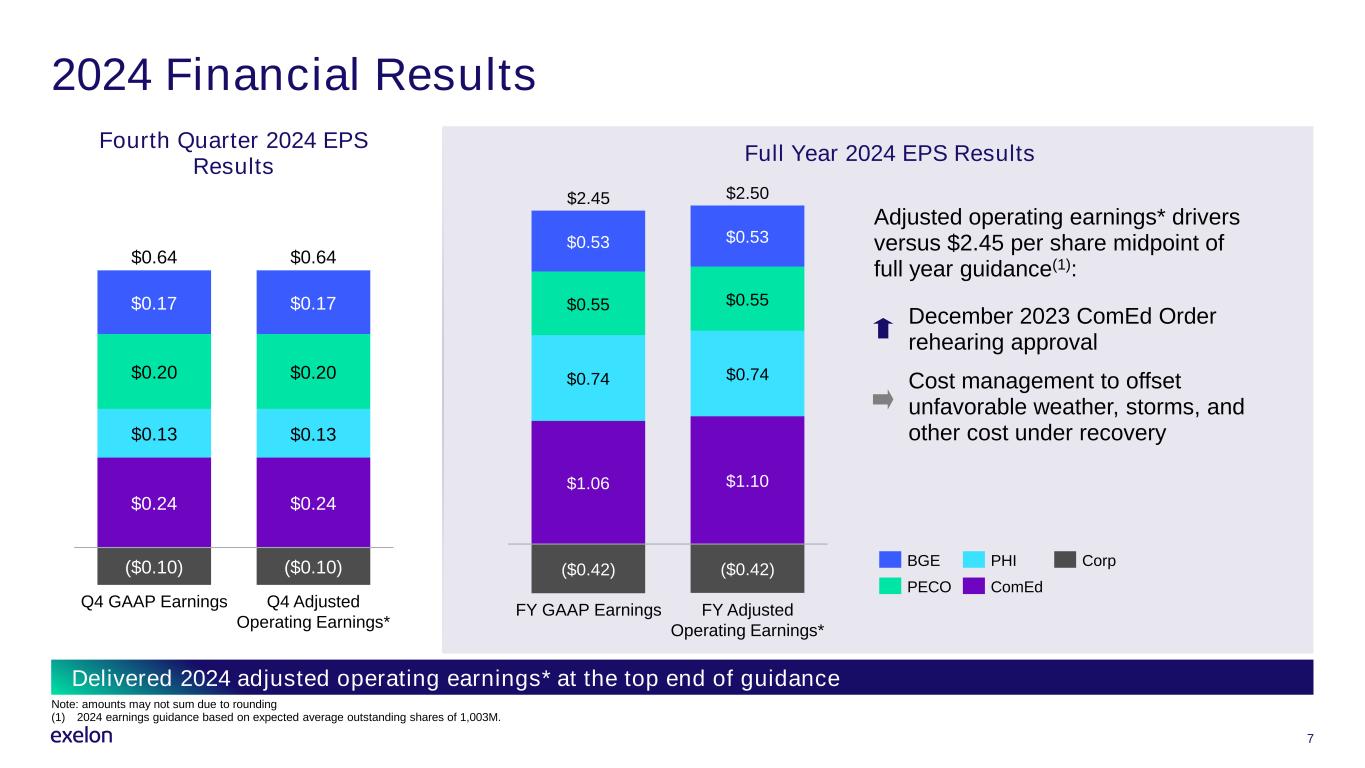

7 2024 Financial Results Fourth Quarter 2024 EPS Results $0.24 $0.24 $0.13 $0.20 $0.17 $0.17 ($0.10) ($0.10) $0.20 $0.13 Q4 GAAP Earnings Q4 Adjusted Operating Earnings* $0.64 $0.64 Note: amounts may not sum due to rounding (1) 2024 earnings guidance based on expected average outstanding shares of 1,003M. Adjusted operating earnings* drivers versus $2.45 per share midpoint of full year guidance(1): December 2023 ComEd Order rehearing approval Cost management to offset unfavorable weather, storms, and other cost under recovery Full Year 2024 EPS Results $1.06 $1.10 $0.74 $0.55 $0.55 $0.53 $0.53 ($0.42) ($0.42) FY GAAP Earnings $0.74 FY Adjusted Operating Earnings* $2.45 $2.50 BGE PECO PHI ComEd Corp Delivered 2024 adjusted operating earnings* at the top end of guidance

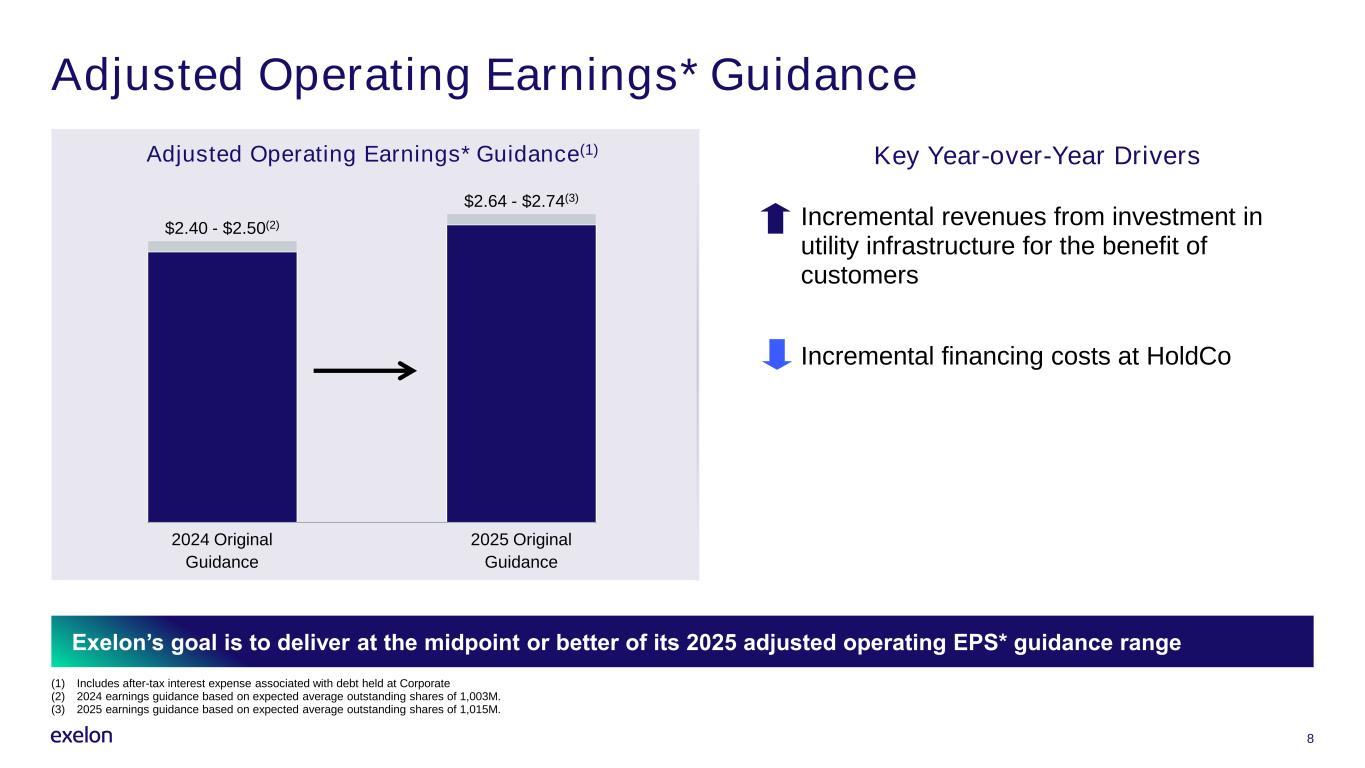

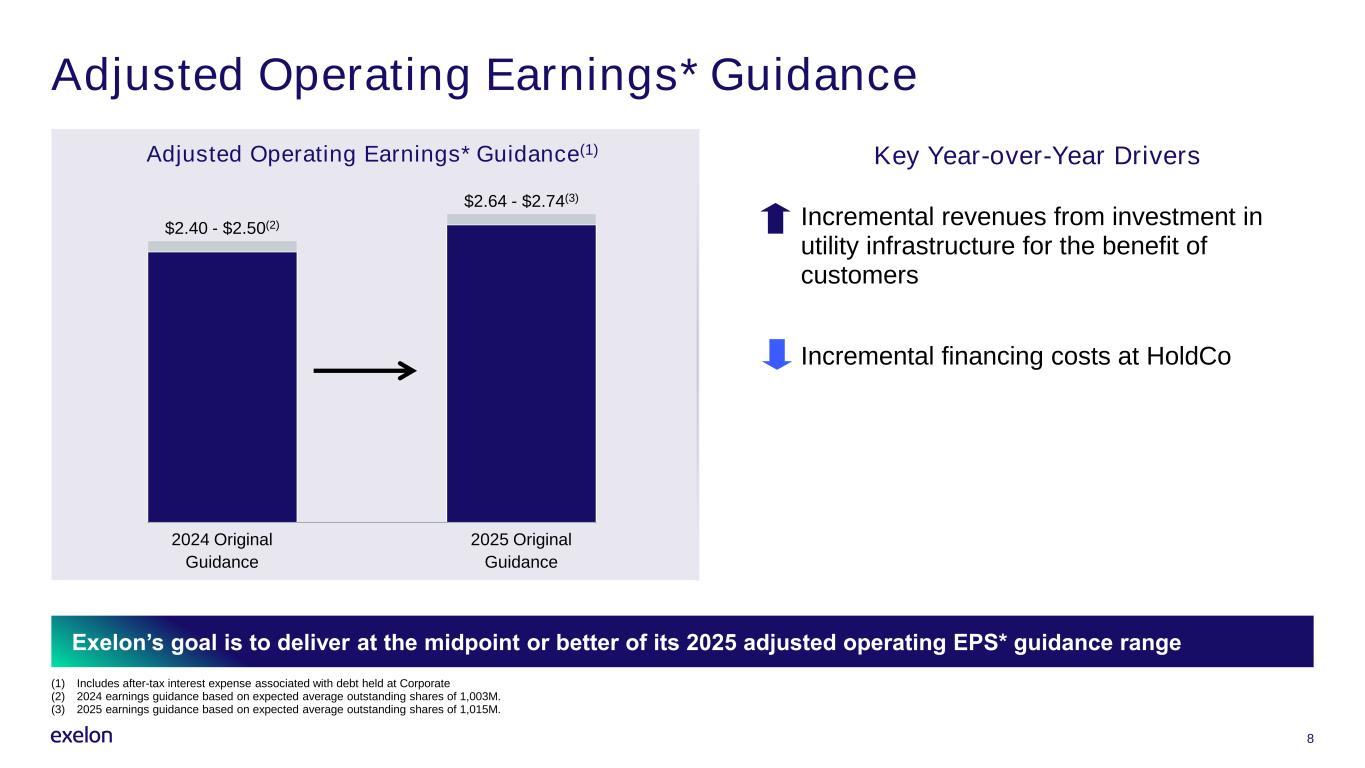

8 Adjusted Operating Earnings* Guidance Key Year-over-Year DriversAdjusted Operating Earnings* Guidance(1) Incremental revenues from investment in utility infrastructure for the benefit of customers Incremental financing costs at HoldCo 2024 Original Guidance 2025 Original Guidance $2.40 - $2.50(2) $2.64 - $2.74(3) (1) Includes after-tax interest expense associated with debt held at Corporate (2) 2024 earnings guidance based on expected average outstanding shares of 1,003M. (3) 2025 earnings guidance based on expected average outstanding shares of 1,015M. Exelon’s goal is to deliver at the midpoint or better of its 2025 adjusted operating EPS* guidance range

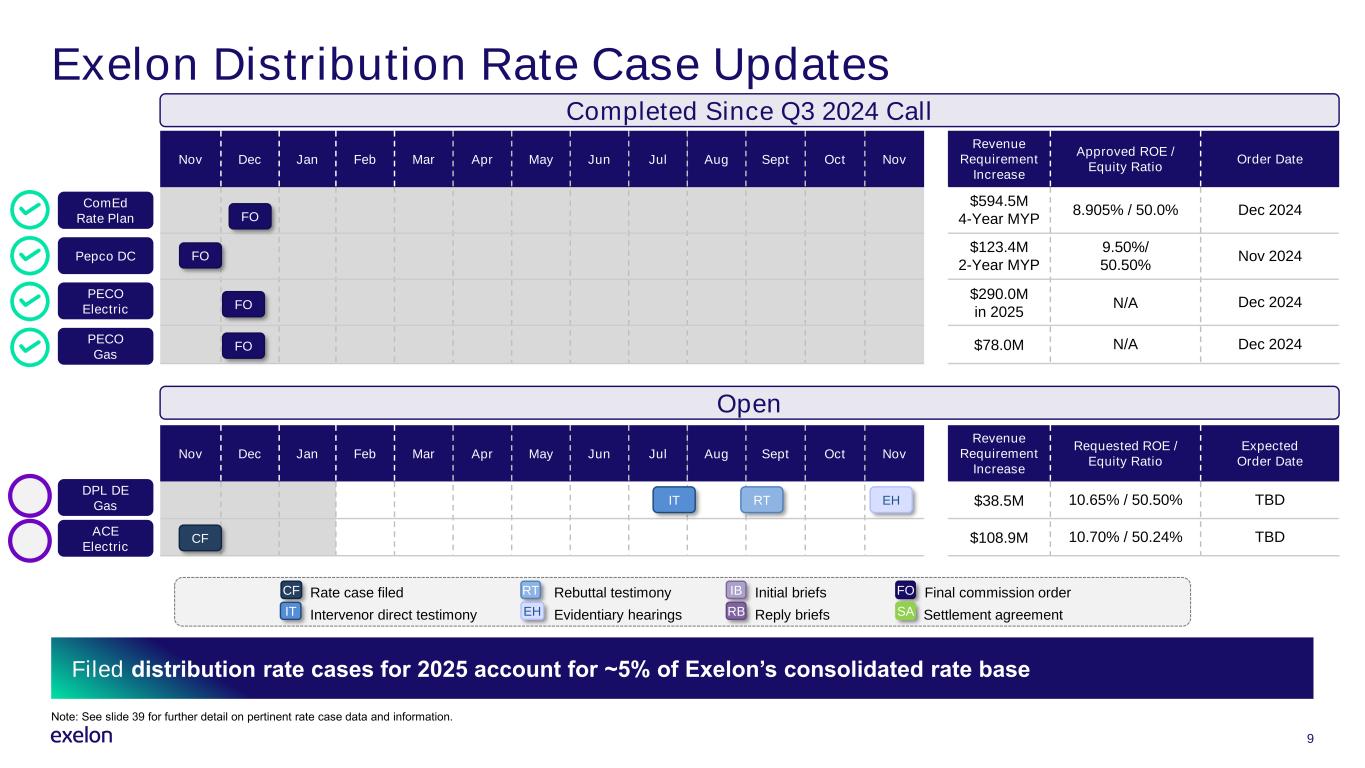

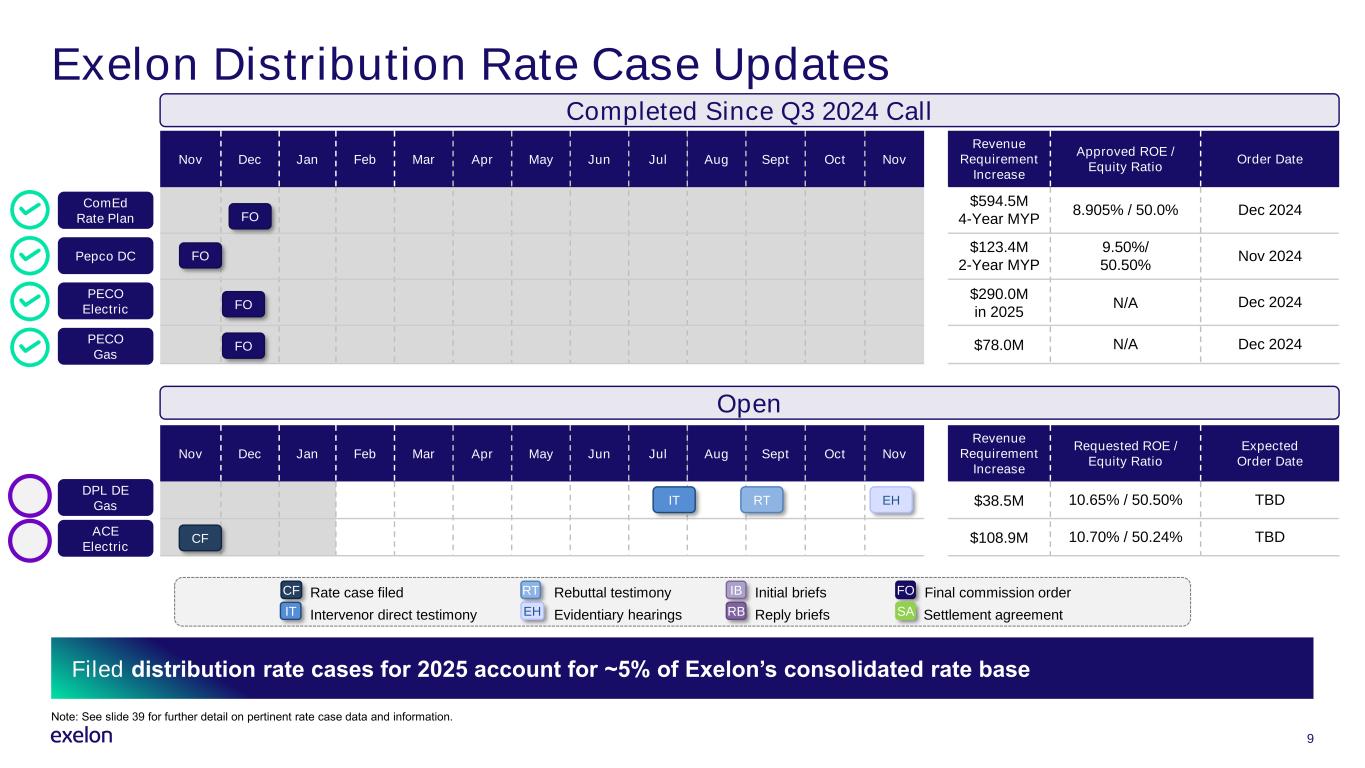

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Revenue Requirement Increase Requested ROE / Equity Ratio Expected Order Date $38.5M 10.65% / 50.50% TBD $108.9M 10.70% / 50.24% TBD 9 Exelon Distribution Rate Case Updates Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Revenue Requirement Increase Approved ROE / Equity Ratio Order Date $594.5M 4-Year MYP 8.905% / 50.0% Dec 2024 $123.4M 2-Year MYP 9.50%/ 50.50% Nov 2024 $290.0M in 2025 N/A Dec 2024 $78.0M N/A Dec 2024 Rate case filed Rebuttal testimony Initial briefs Final commission order Intervenor direct testimony Evidentiary hearings Reply briefs Settlement agreement CF IT RT EH IB RB FO SA Pepco DC PECO Gas PECO Electric ComEd Rate Plan Note: See slide 39 for further detail on pertinent rate case data and information. DPL DE Gas Filed distribution rate cases for 2025 account for ~5% of Exelon’s consolidated rate base ACE Electric FO FO FO FO CF Completed Since Q3 2024 Call Open IT RT EH

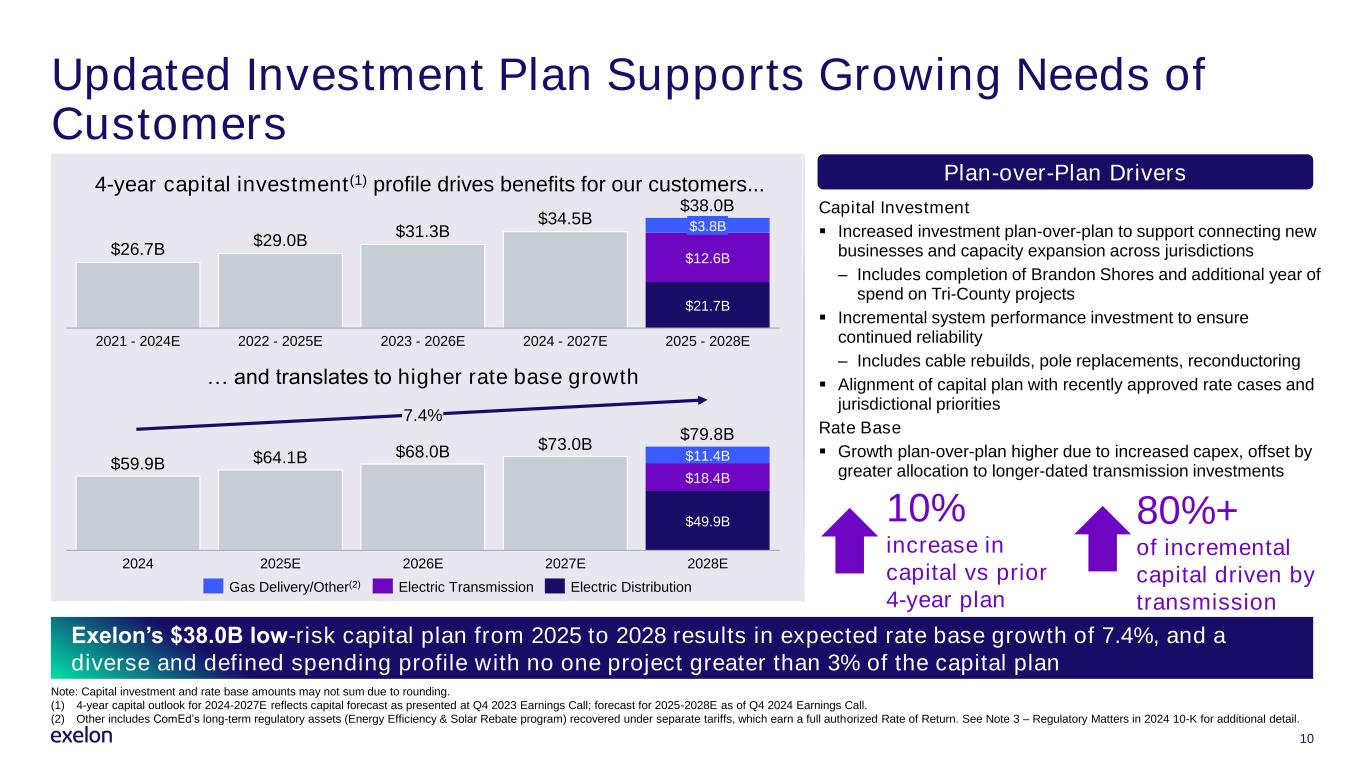

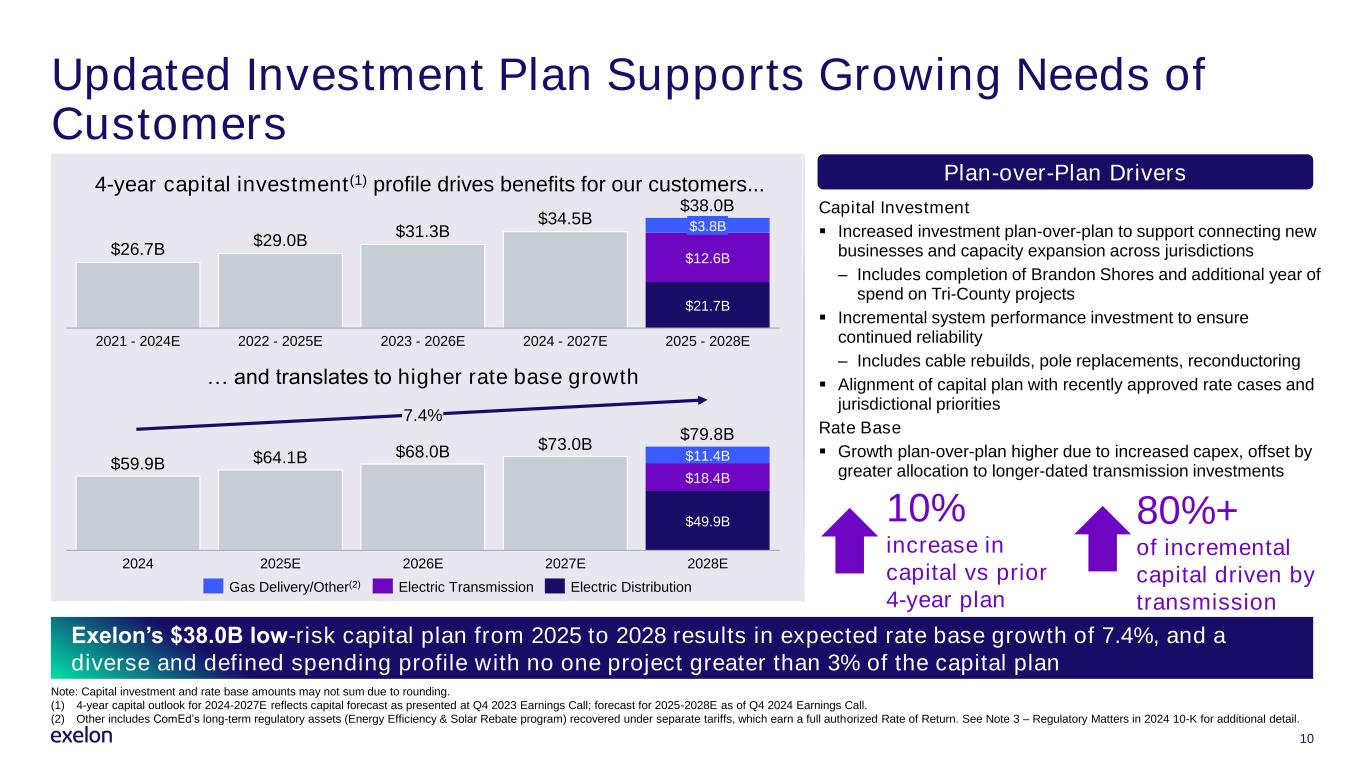

10 Updated Investment Plan Supports Growing Needs of Customers $26.7B $29.0B $31.3B $34.5B $12.6B 2021 - 2024E 2022 - 2025E 2023 - 2026E 2024 - 2027E $3.8B $21.7B 2025 - 2028E $38.0B … and translates to higher rate base growth 4-year capital investment(1) profile drives benefits for our customers... Note: Capital investment and rate base amounts may not sum due to rounding. (1) 4-year capital outlook for 2024-2027E reflects capital forecast as presented at Q4 2023 Earnings Call; forecast for 2025-2028E as of Q4 2024 Earnings Call. (2) Other includes ComEd’s long-term regulatory assets (Energy Efficiency & Solar Rebate program) recovered under separate tariffs, which earn a full authorized Rate of Return. See Note 3 – Regulatory Matters in 2024 10-K for additional detail. Exelon’s $38.0B low-risk capital plan from 2025 to 2028 results in expected rate base growth of 7.4%, and a diverse and defined spending profile with no one project greater than 3% of the capital plan $59.9B $64.1B $68.0B $73.0B $49.9B $18.4B $11.4B 2024 2025E 2026E 2027E 2028E $79.8B 7.4% Gas Delivery/Other(2) Electric Transmission Electric Distribution Capital Investment ▪ Increased investment plan-over-plan to support connecting new businesses and capacity expansion across jurisdictions – Includes completion of Brandon Shores and additional year of spend on Tri-County projects ▪ Incremental system performance investment to ensure continued reliability – Includes cable rebuilds, pole replacements, reconductoring ▪ Alignment of capital plan with recently approved rate cases and jurisdictional priorities Rate Base ▪ Growth plan-over-plan higher due to increased capex, offset by greater allocation to longer-dated transmission investments Plan-over-Plan Drivers 10% increase in capital vs prior 4-year plan 80%+ of incremental capital driven by transmission

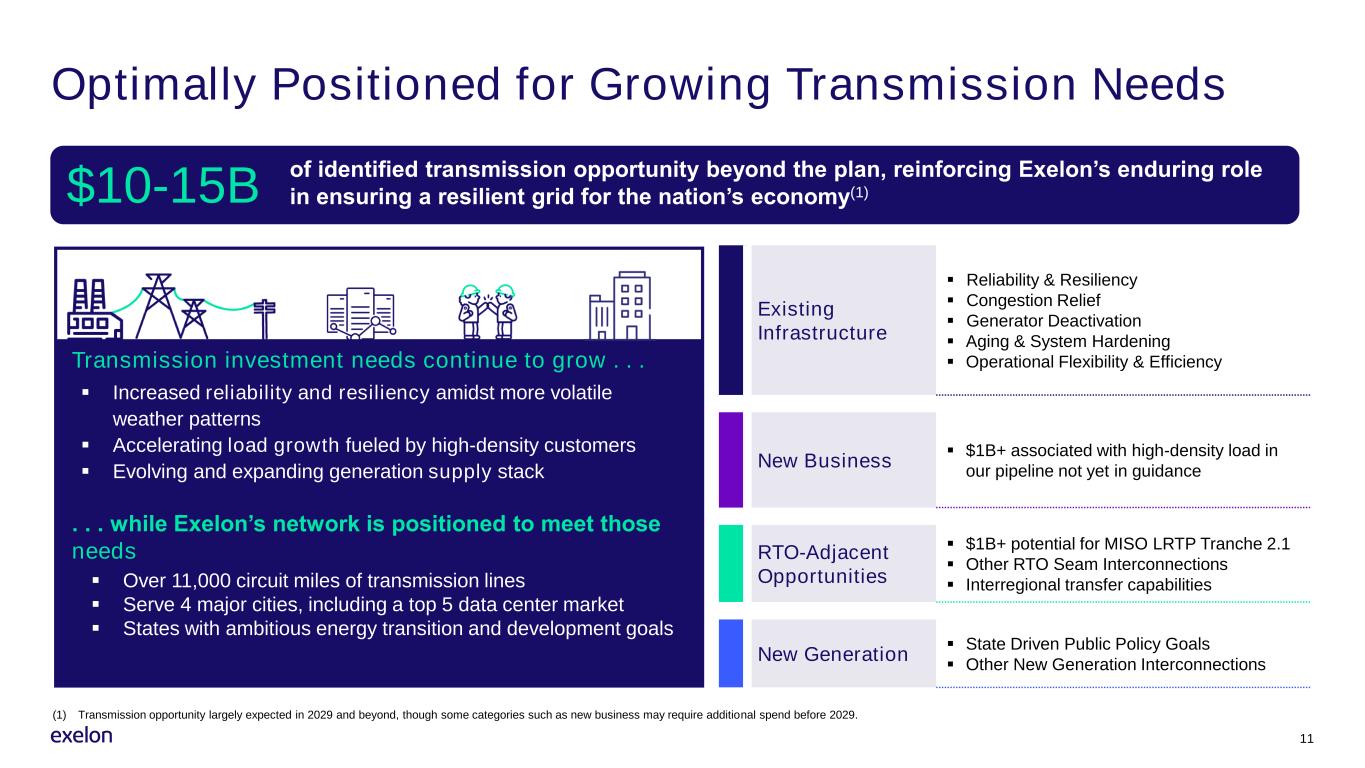

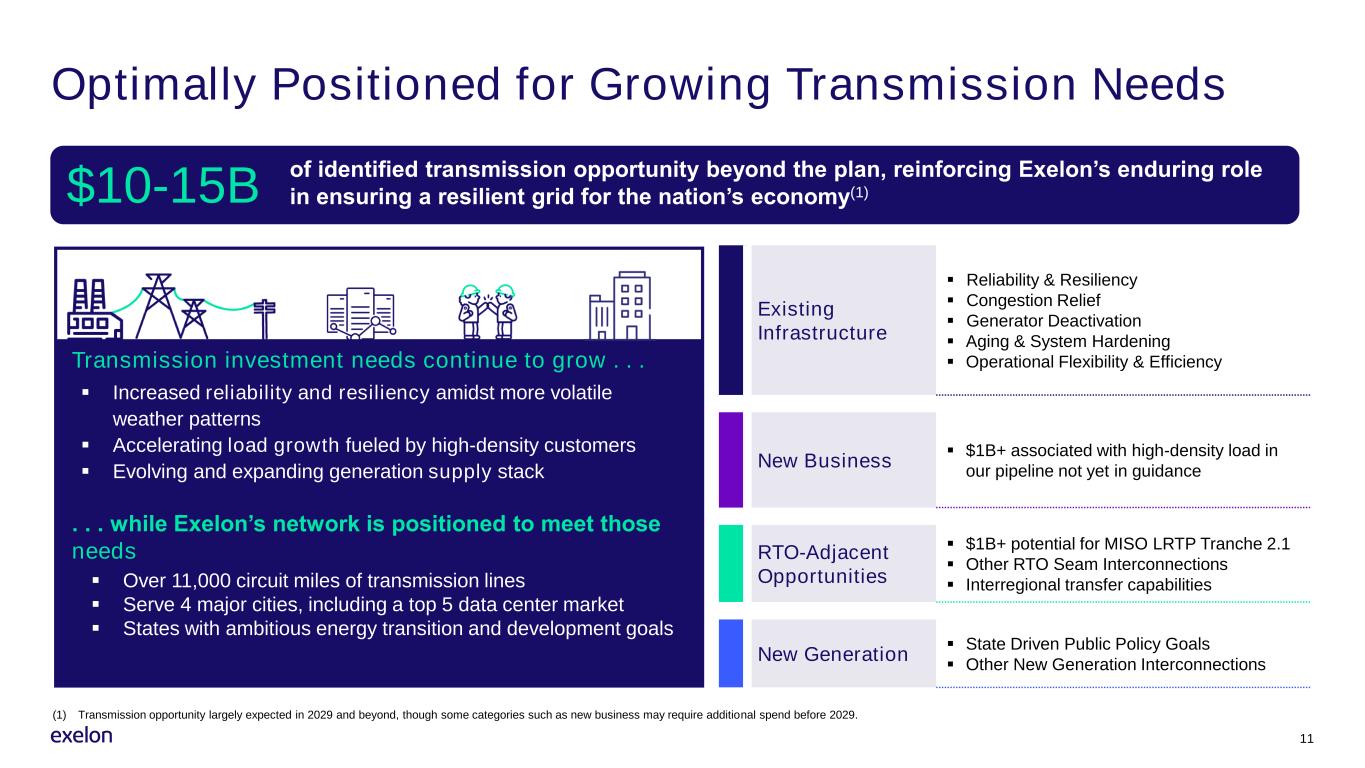

Optimally Positioned for Growing Transmission Needs 11 Existing Infrastructure ▪ Reliability & Resiliency ▪ Congestion Relief ▪ Generator Deactivation ▪ Aging & System Hardening ▪ Operational Flexibility & Efficiency New Business ▪ $1B+ associated with high-density load in our pipeline not yet in guidance RTO-Adjacent Opportunities ▪ $1B+ potential for MISO LRTP Tranche 2.1 ▪ Other RTO Seam Interconnections ▪ Interregional transfer capabilities New Generation ▪ State Driven Public Policy Goals ▪ Other New Generation Interconnections Transmission investment needs continue to grow . . . ▪ Increased reliability and resiliency amidst more volatile weather patterns ▪ Accelerating load growth fueled by high-density customers ▪ Evolving and expanding generation supply stack of identified transmission opportunity beyond the plan, reinforcing Exelon’s enduring role in ensuring a resilient grid for the nation’s economy(1)$10-15B . . . while Exelon’s network is positioned to meet those needs ▪ Over 11,000 circuit miles of transmission lines ▪ Serve 4 major cities, including a top 5 data center market ▪ States with ambitious energy transition and development goals (1) Transmission opportunity largely expected in 2029 and beyond, though some categories such as new business may require additional spend before 2029.

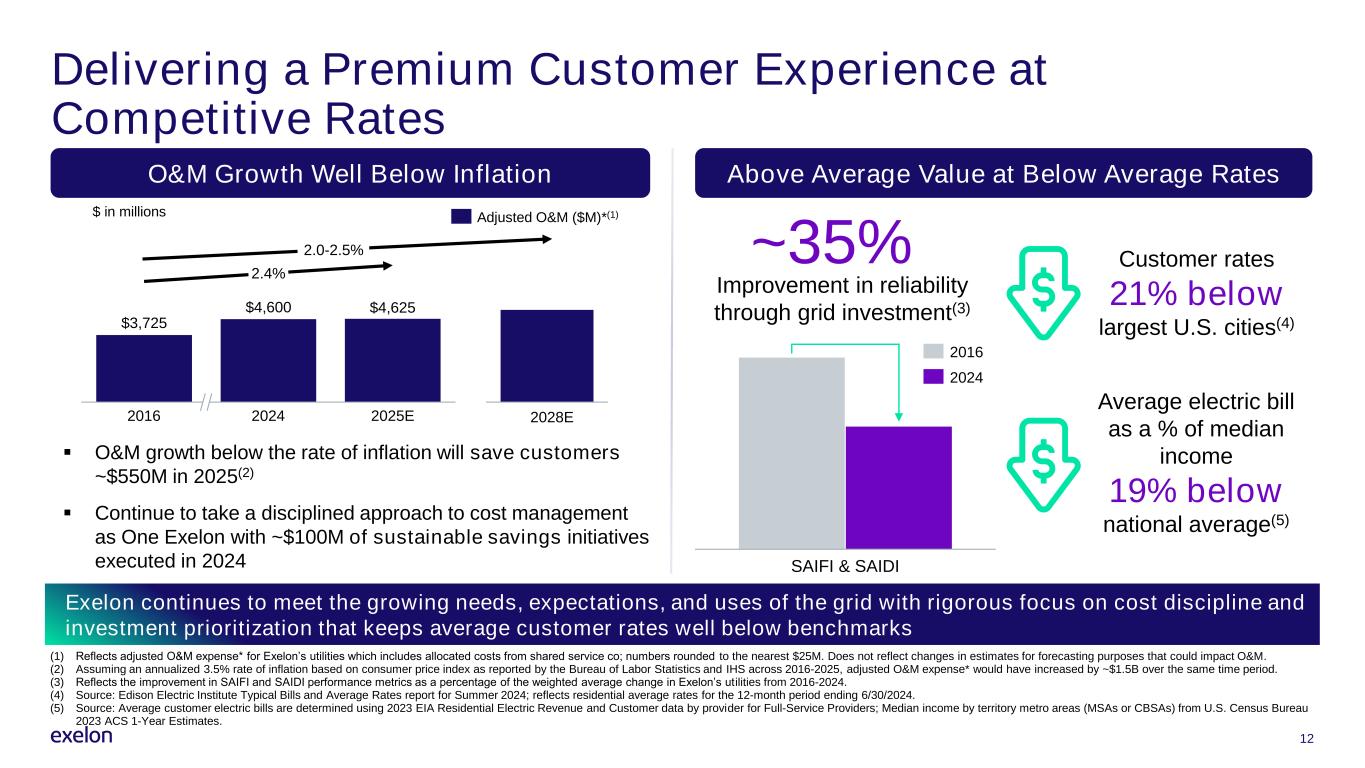

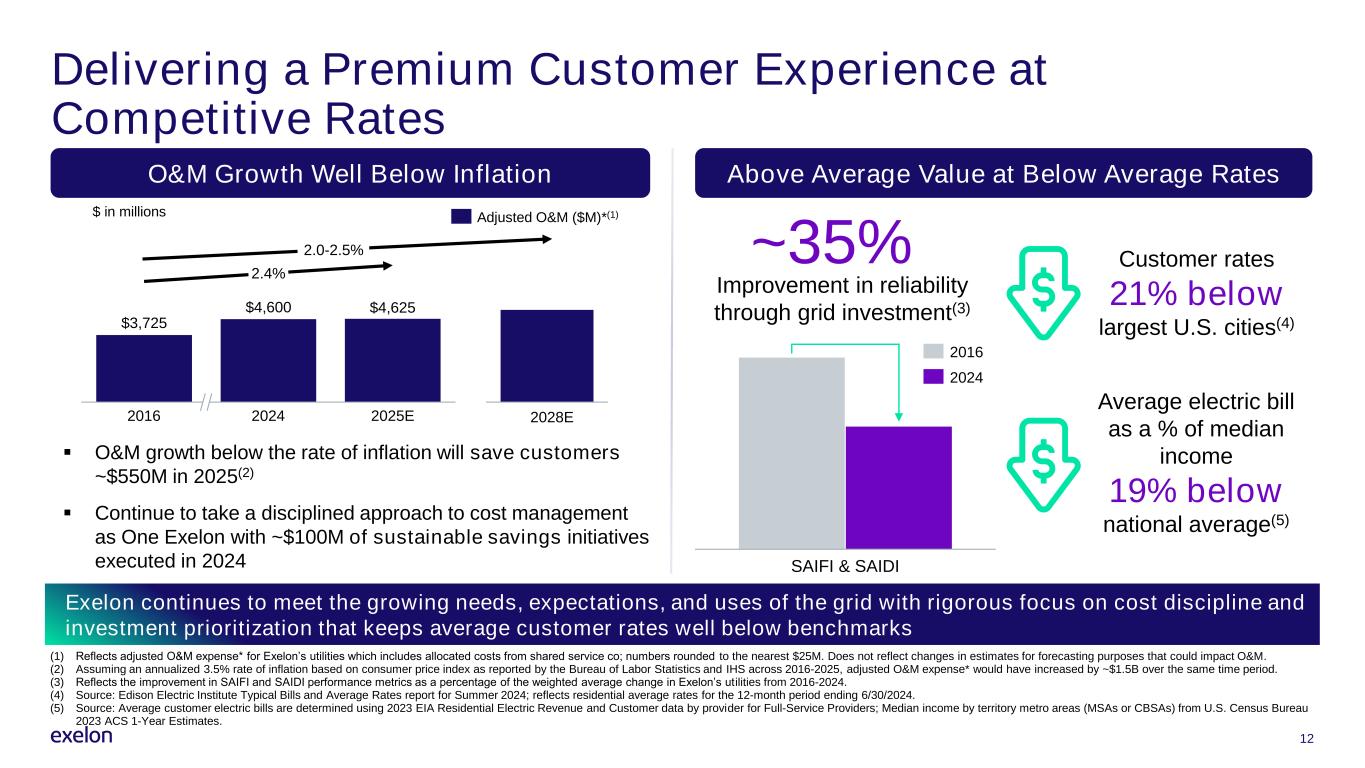

▪ O&M growth below the rate of inflation will save customers ~$550M in 2025(2) ▪ Continue to take a disciplined approach to cost management as One Exelon with ~$100M of sustainable savings initiatives executed in 2024 12 $ in millions (1) Reflects adjusted O&M expense* for Exelon’s utilities which includes allocated costs from shared service co; numbers rounded to the nearest $25M. Does not reflect changes in estimates for forecasting purposes that could impact O&M. (2) Assuming an annualized 3.5% rate of inflation based on consumer price index as reported by the Bureau of Labor Statistics and IHS across 2016-2025, adjusted O&M expense* would have increased by ~$1.5B over the same time period. (3) Reflects the improvement in SAIFI and SAIDI performance metrics as a percentage of the weighted average change in Exelon’s utilities from 2016-2024. (4) Source: Edison Electric Institute Typical Bills and Average Rates report for Summer 2024; reflects residential average rates for the 12-month period ending 6/30/2024. (5) Source: Average customer electric bills are determined using 2023 EIA Residential Electric Revenue and Customer data by provider for Full-Service Providers; Median income by territory metro areas (MSAs or CBSAs) from U.S. Census Bureau 2023 ACS 1-Year Estimates. $3,725 $4,600 2016 2024 2025E $4,625 2.4% Adjusted O&M ($M)*(1) Delivering a Premium Customer Experience at Competitive Rates Exelon continues to meet the growing needs, expectations, and uses of the grid with rigorous focus on cost discipline and investment prioritization that keeps average customer rates well below benchmarks 2.0-2.5% 2028E Above Average Value at Below Average Rates SAIFI & SAIDI 2016 2024 Average electric bill as a % of median income 19% below national average(5) ~35% O&M Growth Well Below Inflation Improvement in reliability through grid investment(3) Customer rates 21% below largest U.S. cities(4)

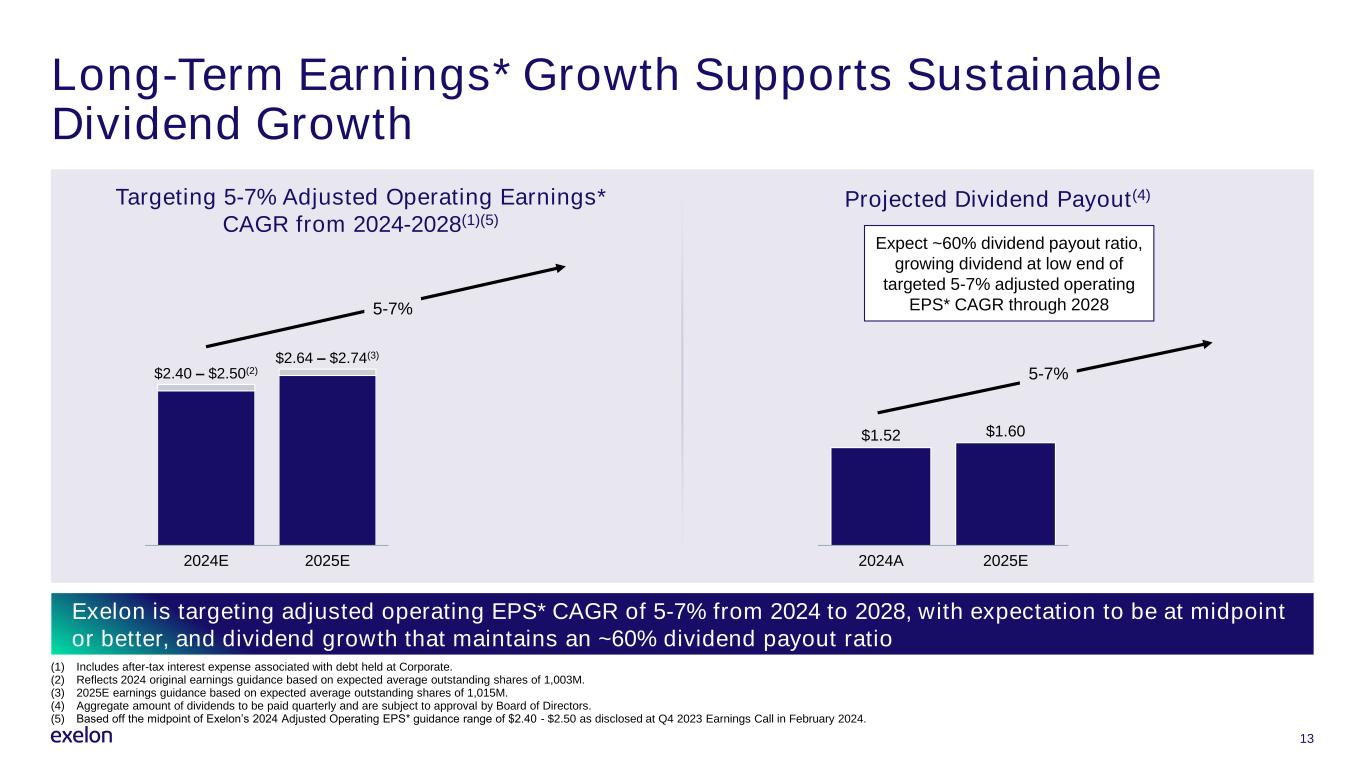

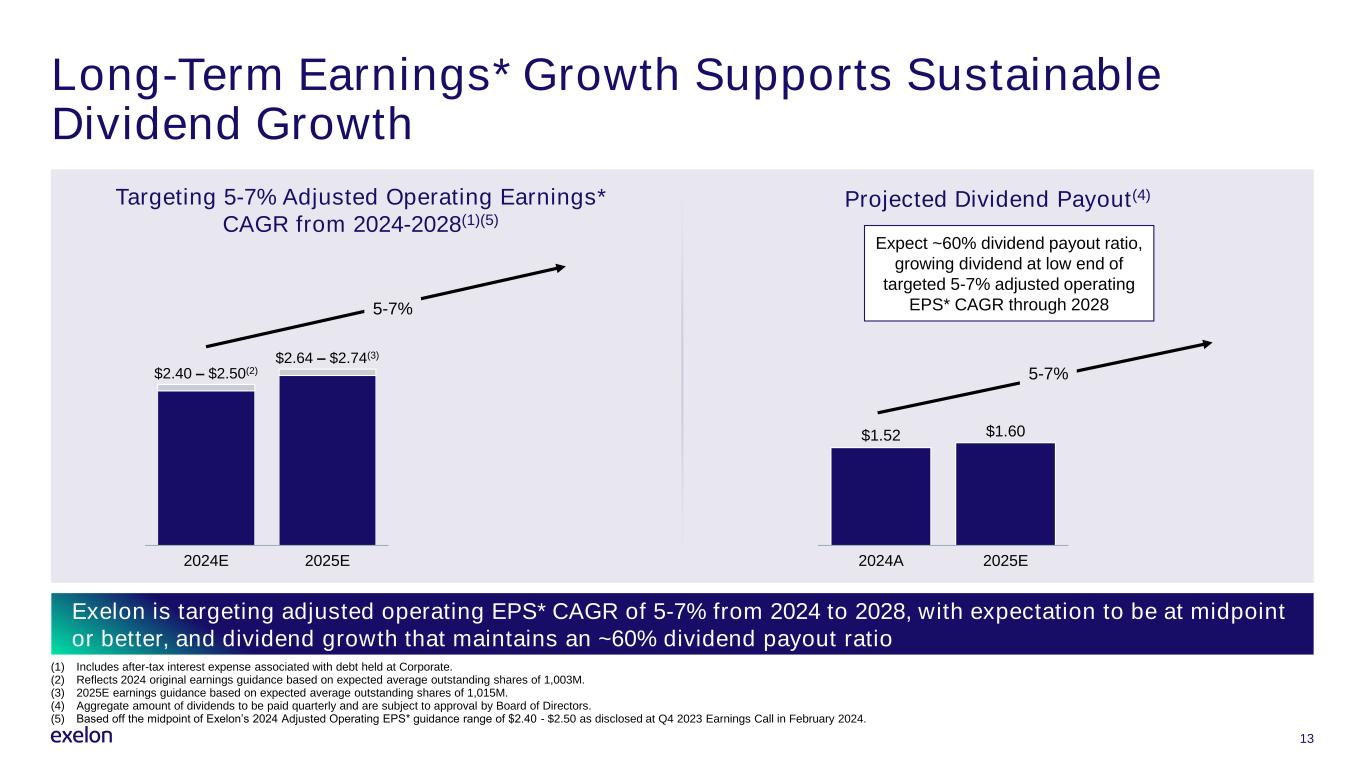

Long-Term Earnings* Growth Supports Sustainable Dividend Growth 13 Targeting 5-7% Adjusted Operating Earnings* CAGR from 2024-2028(1)(5) (1) Includes after-tax interest expense associated with debt held at Corporate. (2) Reflects 2024 original earnings guidance based on expected average outstanding shares of 1,003M. (3) 2025E earnings guidance based on expected average outstanding shares of 1,015M. (4) Aggregate amount of dividends to be paid quarterly and are subject to approval by Board of Directors. (5) Based off the midpoint of Exelon’s 2024 Adjusted Operating EPS* guidance range of $2.40 - $2.50 as disclosed at Q4 2023 Earnings Call in February 2024. Exelon is targeting adjusted operating EPS* CAGR of 5-7% from 2024 to 2028, with expectation to be at midpoint or better, and dividend growth that maintains an ~60% dividend payout ratio 2024E 2025E $2.40 – $2.50(2) $2.64 – $2.74(3) Expect ~60% dividend payout ratio, growing dividend at low end of targeted 5-7% adjusted operating EPS* CAGR through 2028 Projected Dividend Payout(4) 5-7% $1.52 2024A 2025E $1.60 5-7%

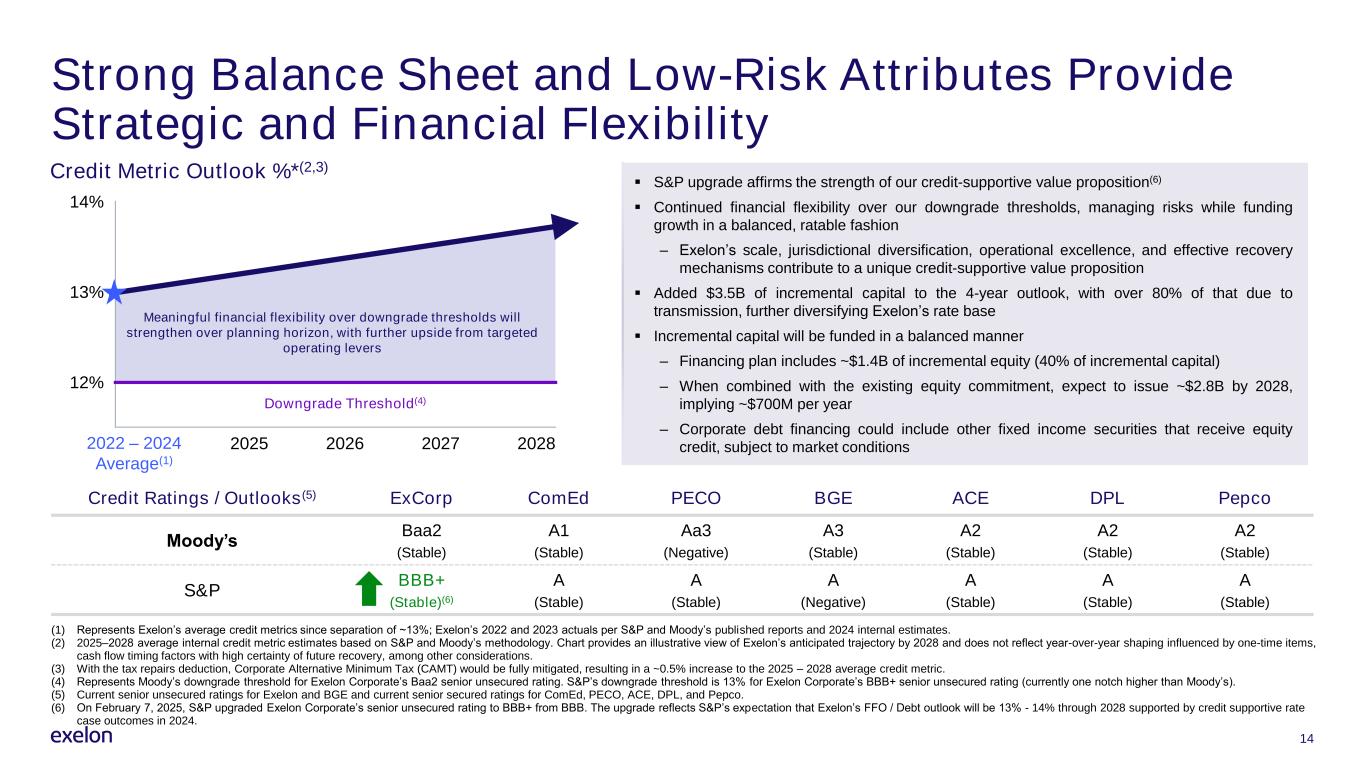

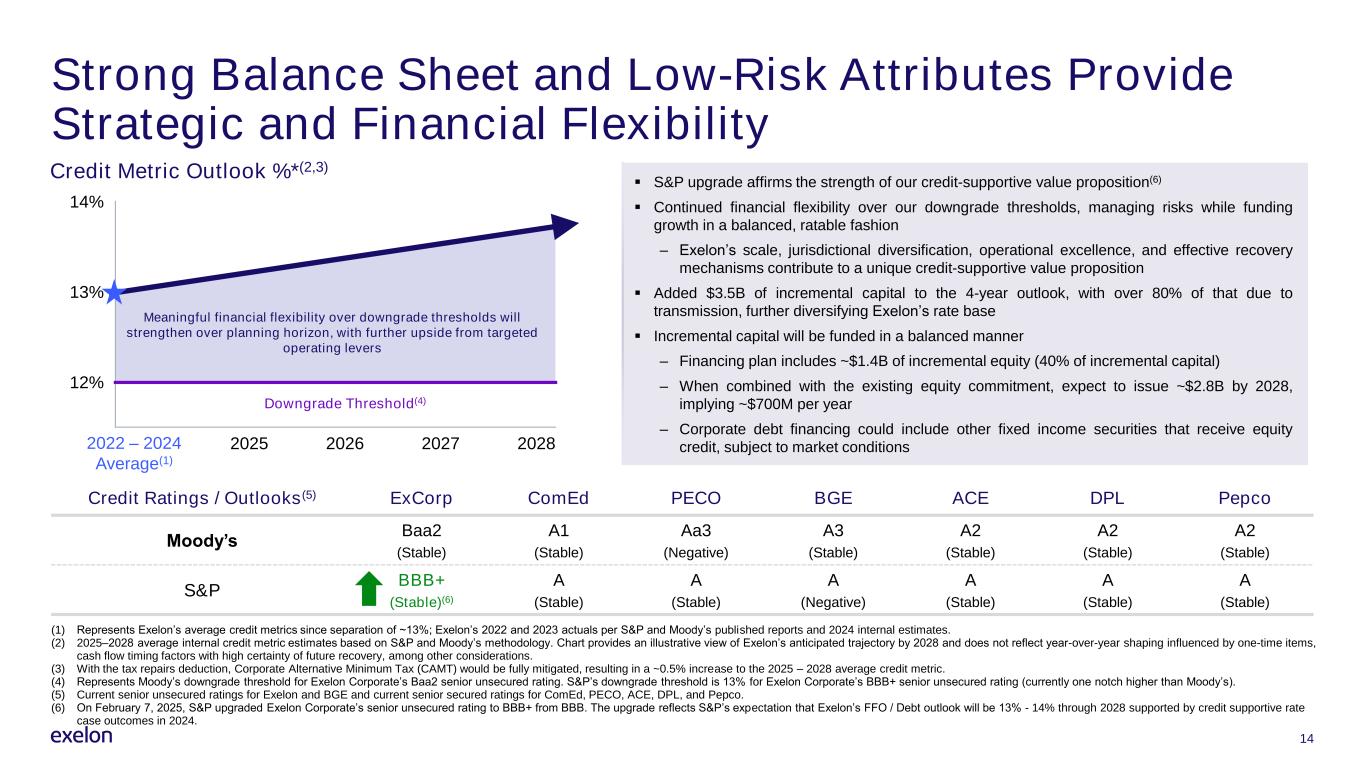

▪ S&P upgrade affirms the strength of our credit-supportive value proposition(6) ▪ Continued financial flexibility over our downgrade thresholds, managing risks while funding growth in a balanced, ratable fashion – Exelon’s scale, jurisdictional diversification, operational excellence, and effective recovery mechanisms contribute to a unique credit-supportive value proposition ▪ Added $3.5B of incremental capital to the 4-year outlook, with over 80% of that due to transmission, further diversifying Exelon’s rate base ▪ Incremental capital will be funded in a balanced manner – Financing plan includes ~$1.4B of incremental equity (40% of incremental capital) – When combined with the existing equity commitment, expect to issue ~$2.8B by 2028, implying ~$700M per year – Corporate debt financing could include other fixed income securities that receive equity credit, subject to market conditions Strong Balance Sheet and Low-Risk Attributes Provide Strategic and Financial Flexibility Credit Metric Outlook %*(2,3) Credit Ratings / Outlooks(5) ExCorp ComEd PECO BGE ACE DPL Pepco Moody’s Baa2 (Stable) A1 (Stable) Aa3 (Negative) A3 (Stable) A2 (Stable) A2 (Stable) A2 (Stable) S&P BBB+ (Stable)(6) A (Stable) A (Stable) A (Negative) A (Stable) A (Stable) A (Stable) (1) Represents Exelon’s average credit metrics since separation of ~13%; Exelon’s 2022 and 2023 actuals per S&P and Moody’s published reports and 2024 internal estimates. (2) 2025–2028 average internal credit metric estimates based on S&P and Moody’s methodology. Chart provides an illustrative view of Exelon’s anticipated trajectory by 2028 and does not reflect year-over-year shaping influenced by one-time items, cash flow timing factors with high certainty of future recovery, among other considerations. (3) With the tax repairs deduction, Corporate Alternative Minimum Tax (CAMT) would be fully mitigated, resulting in a ~0.5% increase to the 2025 – 2028 average credit metric. (4) Represents Moody’s downgrade threshold for Exelon Corporate’s Baa2 senior unsecured rating. S&P’s downgrade threshold is 13% for Exelon Corporate’s BBB+ senior unsecured rating (currently one notch higher than Moody’s). (5) Current senior unsecured ratings for Exelon and BGE and current senior secured ratings for ComEd, PECO, ACE, DPL, and Pepco. (6) On February 7, 2025, S&P upgraded Exelon Corporate’s senior unsecured rating to BBB+ from BBB. The upgrade reflects S&P’s expectation that Exelon’s FFO / Debt outlook will be 13% - 14% through 2028 supported by credit supportive rate case outcomes in 2024. 12% 13% 14% 2022 – 2024 Average(1) 2025 2026 2027 2028 Meaningful financial flexibility over downgrade thresholds will strengthen over planning horizon, with further upside from targeted operating levers Downgrade Threshold(4) 14

15 2025 Business Priorities and Commitments Focused on continued execution of operational, regulatory, and financial priorities to build on the strength of Exelon’s value proposition as the premier T&D energy company ❖ Continue to advocate for equitable and balanced energy transition ❖ Focus on customer affordability, including through cost management ❖ Partner with our jurisdictions to capture growth opportunities, including ensuring energy security needs are met ❖Maintain industry-leading operational excellence ❖ Foster a culture of excellence by prioritizing employee safety and engagement ❖ Deploy $9.1B of capex for the benefit of the customer ❖ Earn consolidated operating ROE* of 9-10% ❖ Achieve constructive rate case outcomes for customers and shareholders ❖ Deliver against operating EPS* guidance of $2.64 - $2.74 per share(1) ❖Maintain strong balance sheet and execute on 2025 financing plan (1) 2025 adjusted operating earnings guidance based on expected average outstanding shares of 1,015M.

Proven track record, committed to delivering on financial commitments 7.4% rate base growth with established rate mechanisms in place Strong investment grade credit ratings with plan approaching 200 bps of financial flexibility Diverse and defined capital plan with no one project greater than ~3% of 4-year outlook 16 Sustainable Value as the Premier T&D Energy Company (1) Source: Edison Electric Institute Typical Bills and Average Rates report for Summer 2024; reflects residential average rates for the 12-month period ending June 30, 2024. (2) Based on preliminary analysis of 2024 spend and is subject to finalization upon publication of Exelon’s 2025 Sustainability Report. (3) Based off the midpoint of Exelon’s 2024 Adjusted Operating EPS* guidance range of $2.40 - $2.50 as disclosed at Q4 2023 Earnings Call in February 2024. (4) Aggregate amount of dividends to be paid quarterly and are subject to approval by Board of Directors. Investing in infrastructure for our communities generates 5-7% annualized operating earnings growth(3), which combined with an ~60% dividend payout ratio(4) results in an attractive risk-adjusted total annual return of 9-11% Top quartile reliability, ComEd #1 Outstanding Performance in the Midwest by ReliabilityOne Cost and executional advantage due to size and scale with WSJ recognition as a Best Managed Company ~54% of Exelon’s total supplier spend is spent with local businesses and ~37% spent with diverse suppliers(2) 100+ workforce development programs #3 World’s Most Admired Power Company by Fortune Industry leader in advancing safety #1 in Energy on Fast Company’s Best Workplaces for Innovators 2024 Customer rates 21% below largest U.S. cities(1) Award-winning, innovative solutions for customer choice and affordability, recognized as ENERGY STAR® Partner of the Year Top-tier customer service for site selection across Exelon’s footprint C u s to m e r- F o c u s e d F in a n c ia l E x e c u ti o n O p e ra ti o n a l E x c e ll e n c e T a le n te d , C o m m it te d E m p lo y e e s Consistent Growth, Long-Term Value

17 Additional Disclosures

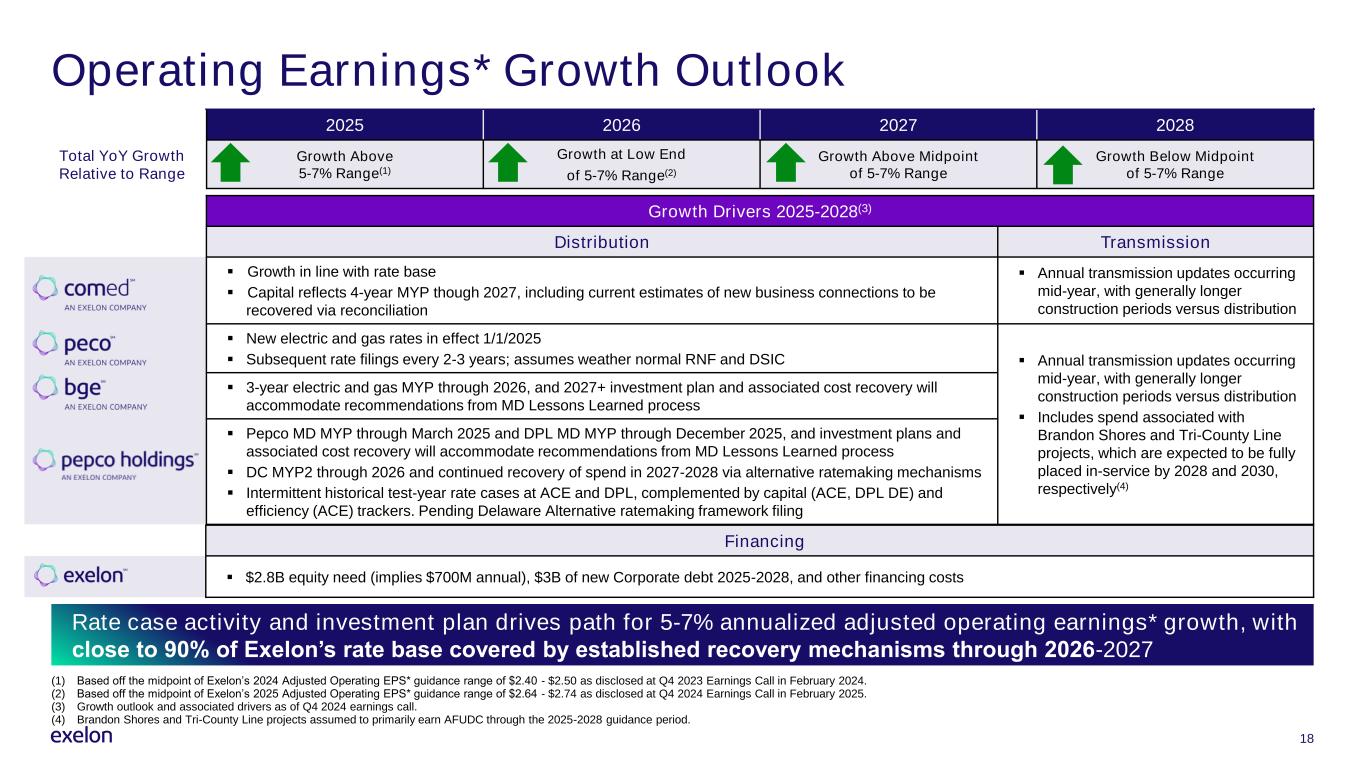

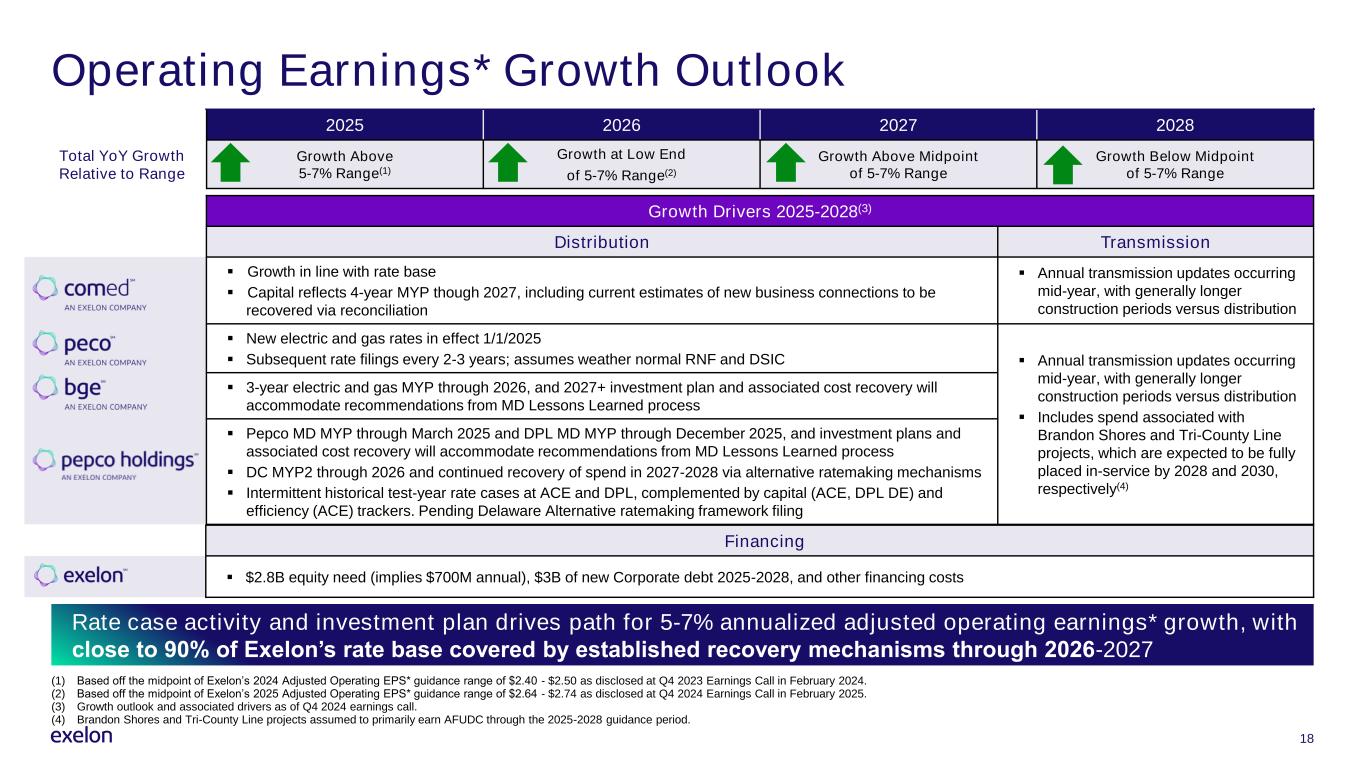

Financing ▪ $2.8B equity need (implies $700M annual), $3B of new Corporate debt 2025-2028, and other financing costs Operating Earnings* Growth Outlook 2025 2026 2027 2028 Total YoY Growth Relative to Range Growth Above 5-7% Range(1) Growth at Low End of 5-7% Range(2) Growth Above Midpoint of 5-7% Range Growth Below Midpoint of 5-7% Range (1) Based off the midpoint of Exelon’s 2024 Adjusted Operating EPS* guidance range of $2.40 - $2.50 as disclosed at Q4 2023 Earnings Call in February 2024. (2) Based off the midpoint of Exelon’s 2025 Adjusted Operating EPS* guidance range of $2.64 - $2.74 as disclosed at Q4 2024 Earnings Call in February 2025. (3) Growth outlook and associated drivers as of Q4 2024 earnings call. (4) Brandon Shores and Tri-County Line projects assumed to primarily earn AFUDC through the 2025-2028 guidance period. Rate case activity and investment plan drives path for 5-7% annualized adjusted operating earnings* growth, with close to 90% of Exelon’s rate base covered by established recovery mechanisms through 2026-2027 18 Growth Drivers 2025-2028(3) Distribution Transmission ▪ Growth in line with rate base ▪ Capital reflects 4-year MYP though 2027, including current estimates of new business connections to be recovered via reconciliation ▪ Annual transmission updates occurring mid-year, with generally longer construction periods versus distribution ▪ New electric and gas rates in effect 1/1/2025 ▪ Subsequent rate filings every 2-3 years; assumes weather normal RNF and DSIC ▪ Annual transmission updates occurring mid-year, with generally longer construction periods versus distribution ▪ Includes spend associated with Brandon Shores and Tri-County Line projects, which are expected to be fully placed in-service by 2028 and 2030, respectively(4) ▪ 3-year electric and gas MYP through 2026, and 2027+ investment plan and associated cost recovery will accommodate recommendations from MD Lessons Learned process ▪ Pepco MD MYP through March 2025 and DPL MD MYP through December 2025, and investment plans and associated cost recovery will accommodate recommendations from MD Lessons Learned process ▪ DC MYP2 through 2026 and continued recovery of spend in 2027-2028 via alternative ratemaking mechanisms ▪ Intermittent historical test-year rate cases at ACE and DPL, complemented by capital (ACE, DPL DE) and efficiency (ACE) trackers. Pending Delaware Alternative ratemaking framework filing

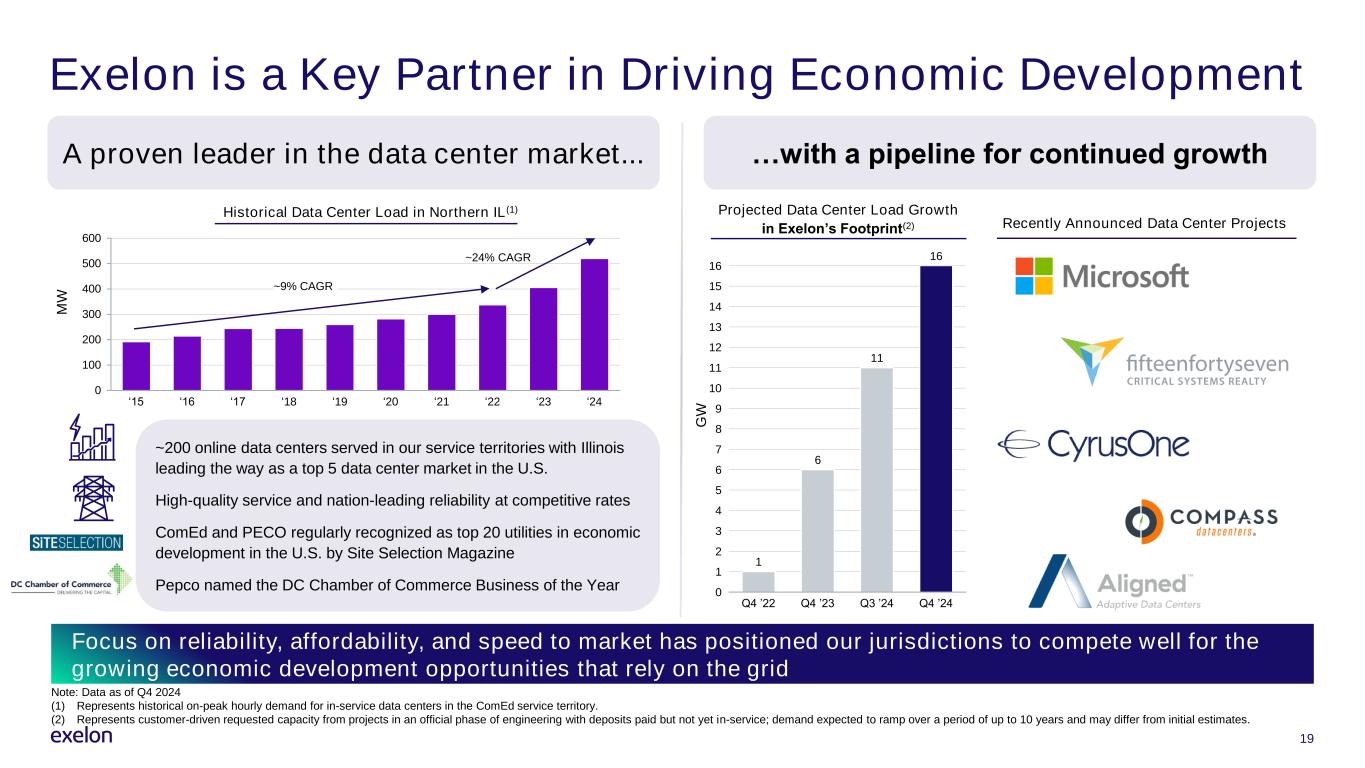

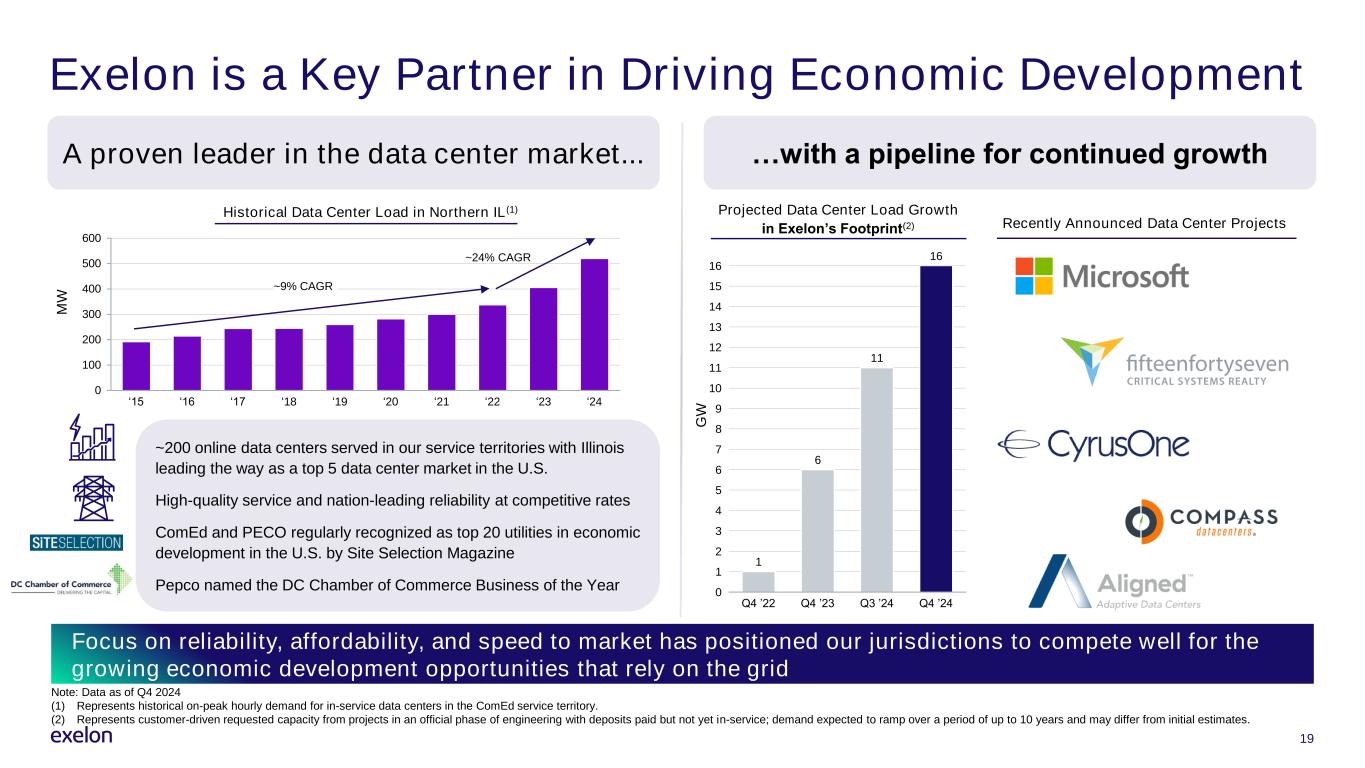

19 Focus on reliability, affordability, and speed to market has positioned our jurisdictions to compete well for the growing economic development opportunities that rely on the grid Exelon is a Key Partner in Driving Economic Development 1 6 11 16 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Q4 ’22 Q4 ’23 Q3 ’24 Q4 ’24 0 100 200 300 400 500 600 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 ‘23 ‘24 ~9% CAGR ~24% CAGR Historical Data Center Load in Northern IL(1) M W Projected Data Center Load Growth in Exelon’s Footprint(2) G W Note: Data as of Q4 2024 (1) Represents historical on-peak hourly demand for in-service data centers in the ComEd service territory. (2) Represents customer-driven requested capacity from projects in an official phase of engineering with deposits paid but not yet in-service; demand expected to ramp over a period of up to 10 years and may differ from initial estimates. Recently Announced Data Center Projects A proven leader in the data center market... …with a pipeline for continued growth ~200 online data centers served in our service territories with Illinois leading the way as a top 5 data center market in the U.S. High-quality service and nation-leading reliability at competitive rates ComEd and PECO regularly recognized as top 20 utilities in economic development in the U.S. by Site Selection Magazine Pepco named the DC Chamber of Commerce Business of the Year

20 Significant Opportunity to Leverage Leading Transmission Network to Meet the Nation’s Energy Needs 3.2 2.7 2.6 2.5 2.4 2.3 2.0 1.9 1.5 1.3 1.2 0.8 0.8 0.8 0.6 Peer A Peer B Peer C EXC Peer E Peer F Peer G Peer H Peer I Peer J Peer K Peer L Peer M Peer N Peer O Peer A Peer B Peer L Peer J Peer G Peer F Peer E Peer O Peer H Peer I Peer M Peer K Peer C EXC Peer N 59% 58% 58% 54% 53% 52% 47% 44% 43% 42% 41% 37% 36% 32% 10% Among the Largest Investors in Transmission ($B)(1) Opportunity as One of the Lowest Investors in Transmission as a % of Total Grid Spending(2) (1) Reflects average annual transmission spend as disclosed by Exelon and 15 comparable peer utilities’ capital plan roll forwards as of Q4 2023. (2) Reflects transmission spend as a percentage of planned electric transmission and distribution capex as disclosed by Exelon and 15 comparable peer utilities’ capital plan roll forwards as of Q4 2023.

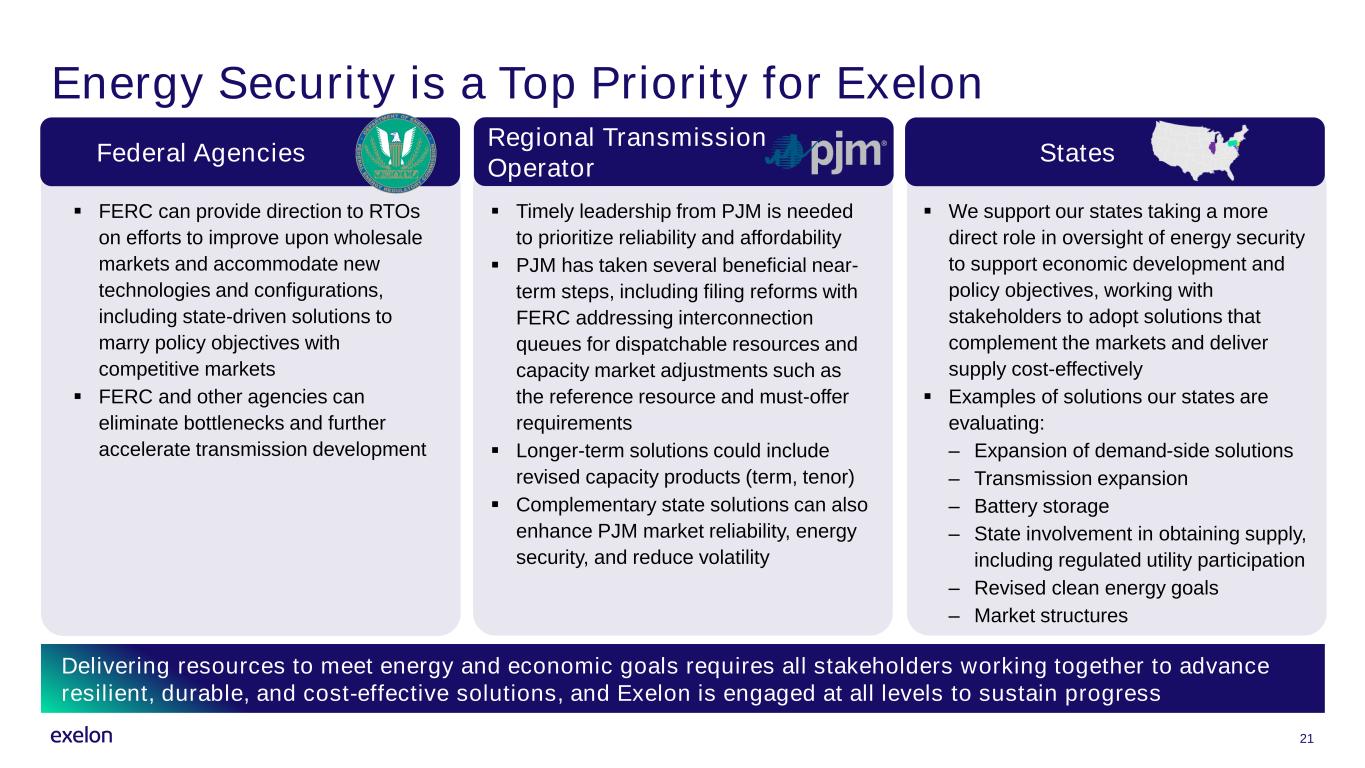

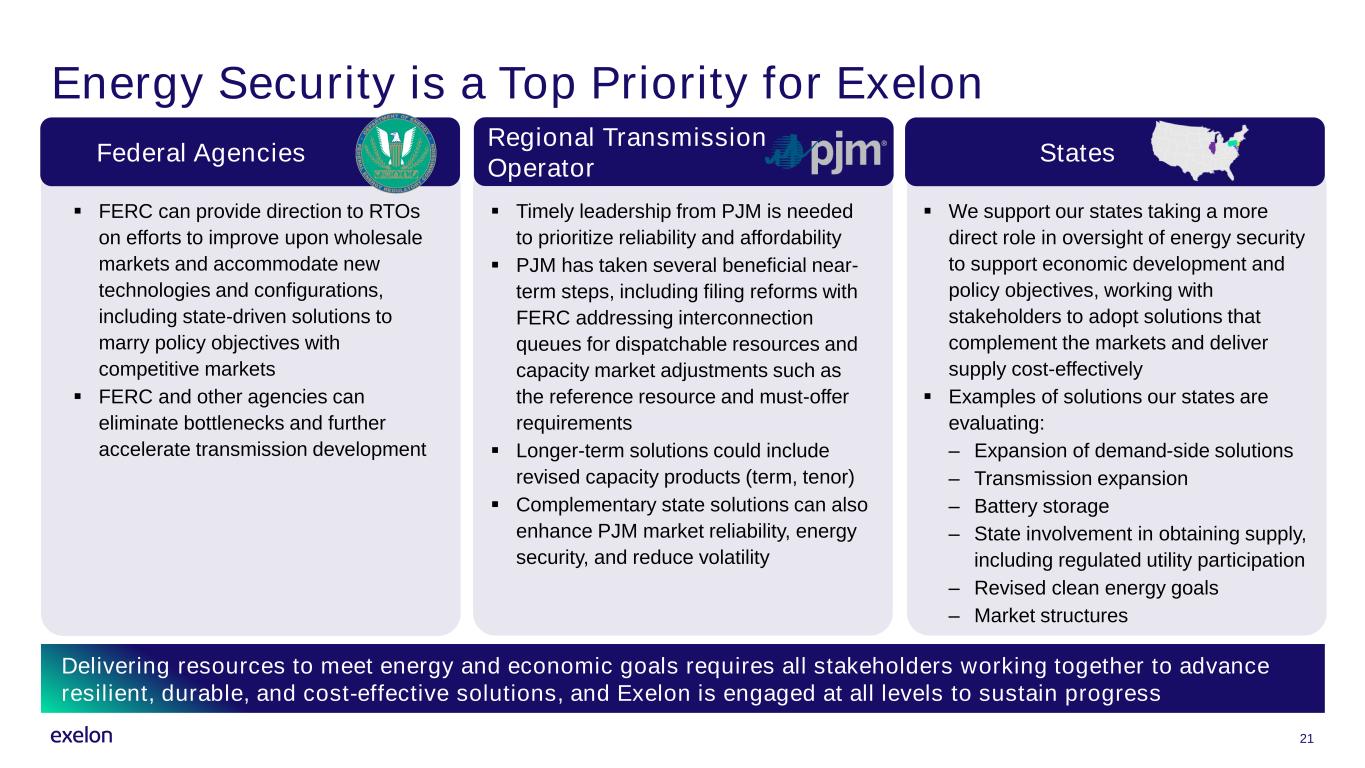

Energy Security is a Top Priority for Exelon Delivering resources to meet energy and economic goals requires all stakeholders working together to advance resilient, durable, and cost-effective solutions, and Exelon is engaged at all levels to sustain progress 21 StatesFederal Agencies ▪ Timely leadership from PJM is needed to prioritize reliability and affordability ▪ PJM has taken several beneficial near- term steps, including filing reforms with FERC addressing interconnection queues for dispatchable resources and capacity market adjustments such as the reference resource and must-offer requirements ▪ Longer-term solutions could include revised capacity products (term, tenor) ▪ Complementary state solutions can also enhance PJM market reliability, energy security, and reduce volatility ▪ FERC can provide direction to RTOs on efforts to improve upon wholesale markets and accommodate new technologies and configurations, including state-driven solutions to marry policy objectives with competitive markets ▪ FERC and other agencies can eliminate bottlenecks and further accelerate transmission development ▪ We support our states taking a more direct role in oversight of energy security to support economic development and policy objectives, working with stakeholders to adopt solutions that complement the markets and deliver supply cost-effectively ▪ Examples of solutions our states are evaluating: – Expansion of demand-side solutions – Transmission expansion – Battery storage – State involvement in obtaining supply, including regulated utility participation – Revised clean energy goals – Market structures Regional Transmission Operator

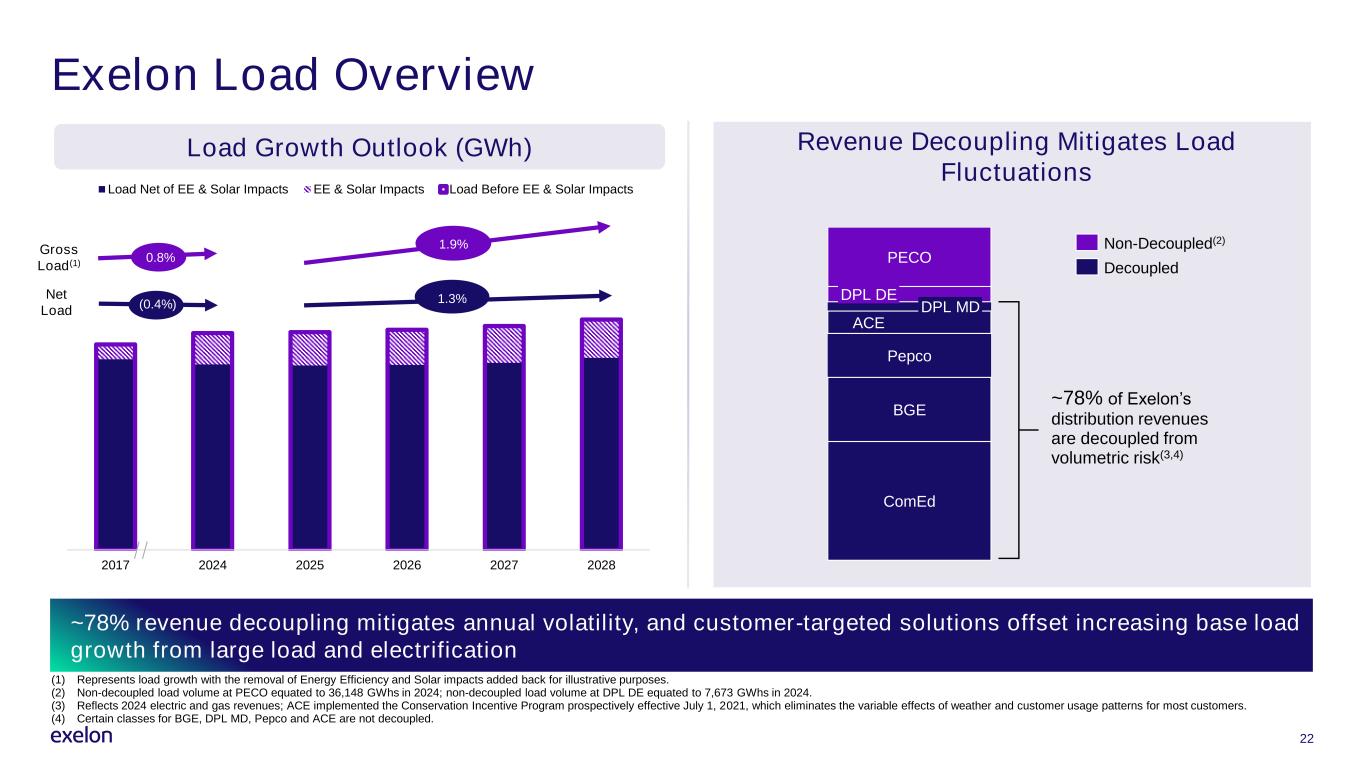

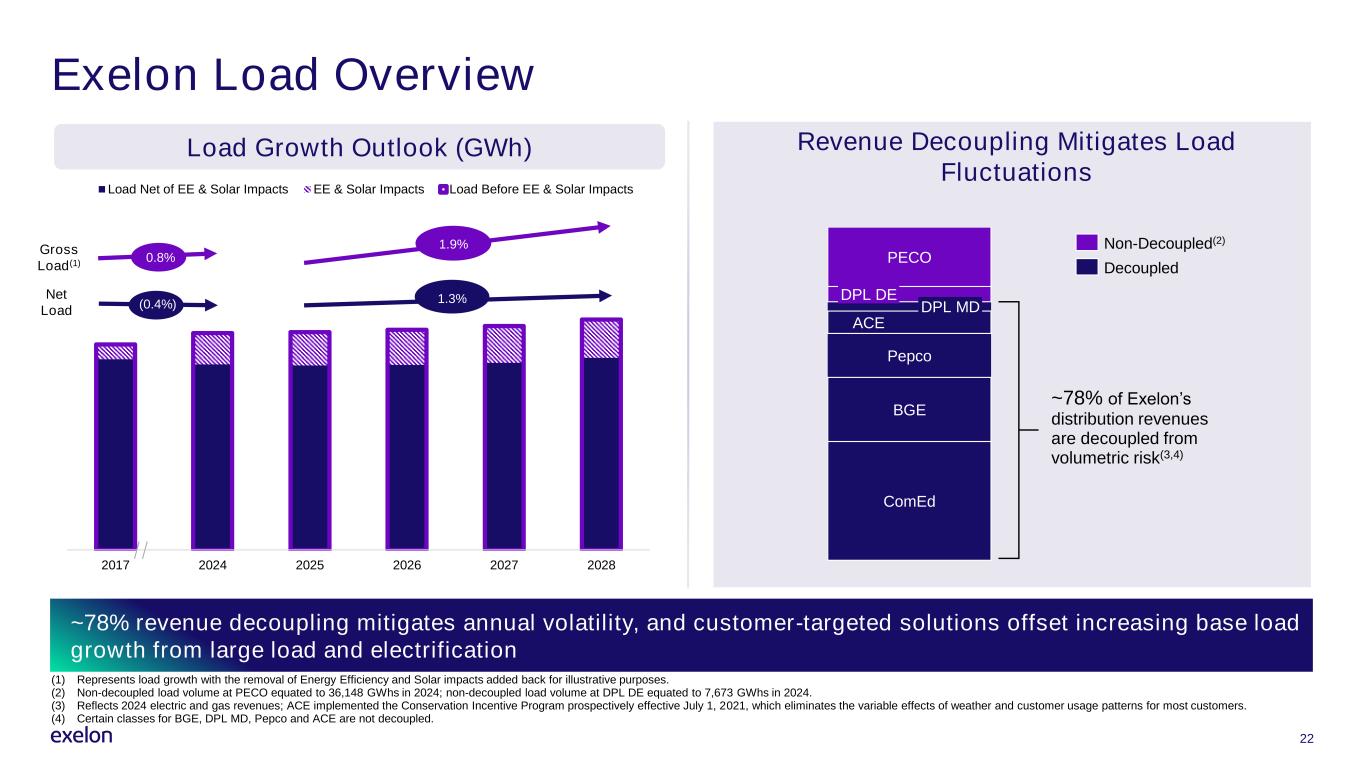

2017 2024 2025 2026 2027 2028 Load Net of EE & Solar Impacts EE & Solar Impacts Load Before EE & Solar Impacts 22 Exelon Load Overview Revenue Decoupling Mitigates Load Fluctuations PECO DPL DE DPL MD ACE Pepco BGE ComEd Non-Decoupled(2) Decoupled ~78% of Exelon’s distribution revenues are decoupled from volumetric risk(3,4) (1) Represents load growth with the removal of Energy Efficiency and Solar impacts added back for illustrative purposes. (2) Non-decoupled load volume at PECO equated to 36,148 GWhs in 2024; non-decoupled load volume at DPL DE equated to 7,673 GWhs in 2024. (3) Reflects 2024 electric and gas revenues; ACE implemented the Conservation Incentive Program prospectively effective July 1, 2021, which eliminates the variable effects of weather and customer usage patterns for most customers. (4) Certain classes for BGE, DPL MD, Pepco and ACE are not decoupled. ~78% revenue decoupling mitigates annual volatility, and customer-targeted solutions offset increasing base load growth from large load and electrification Load Growth Outlook (GWh) 1.3% 1.9% 0.8% (0.4%) Gross Load(1) Net Load

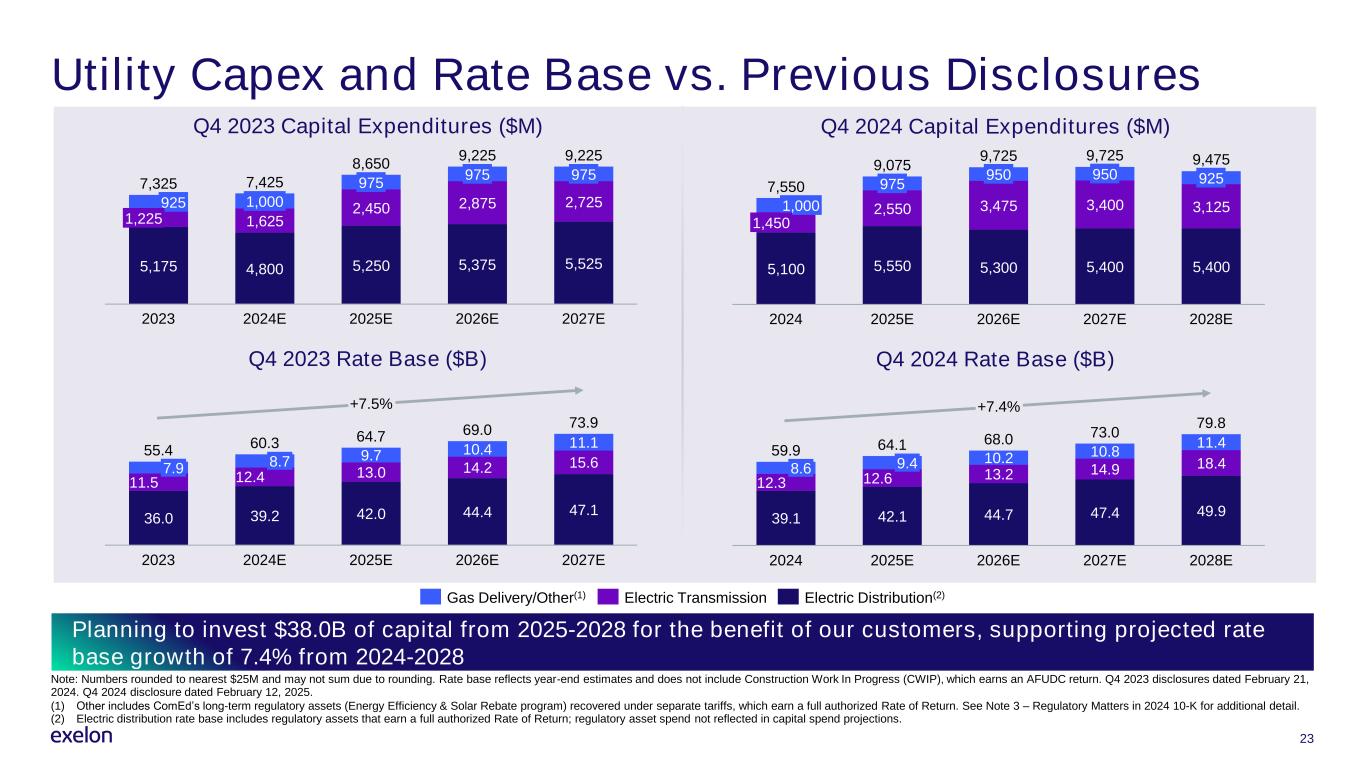

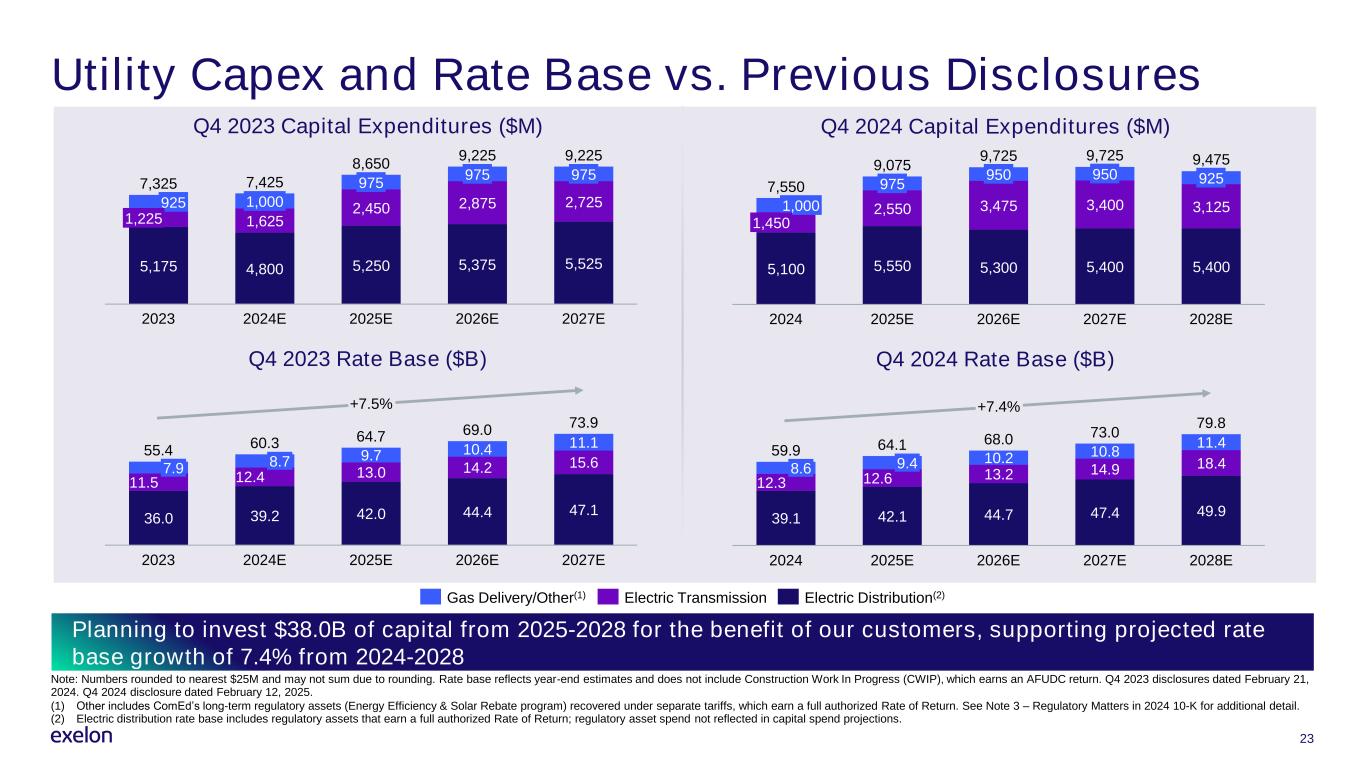

23 Utility Capex and Rate Base vs. Previous Disclosures Q4 2024 Capital Expenditures ($M) Q4 2024 Rate Base ($B) 5,100 5,550 5,300 5,400 5,400 2,550 3,475 3,400 3,1251,000 1,450 2024 975 2025E 950 2026E 950 2027E 925 2028E 7,550 9,075 9,725 9,725 9,475 39.1 42.1 44.7 47.4 49.9 12.3 12.6 13.2 14.9 18.410.2 10.8 11.4 8.6 2024 9.4 2025E 2026E 2027E 2028E 59.9 64.1 68.0 73.0 79.8 +7.4% Gas Delivery/Other(1) Electric Transmission Electric Distribution(2) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates and does not include Construction Work In Progress (CWIP), which earns an AFUDC return. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Other includes ComEd’s long-term regulatory assets (Energy Efficiency & Solar Rebate program) recovered under separate tariffs, which earn a full authorized Rate of Return. See Note 3 – Regulatory Matters in 2024 10-K for additional detail. (2) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Planning to invest $38.0B of capital from 2025-2028 for the benefit of our customers, supporting projected rate base growth of 7.4% from 2024-2028 Q4 2023 Capital Expenditures ($M) Q4 2023 Rate Base ($B) 5,175 5,250 5,525 1,625 2,450 2,875 2,725925 1,225 2023 1,000 4,800 2024E 975 2025E 975 5,375 2026E 975 2027E 7,325 7,425 8,650 9,225 9,225 36.0 39.2 42.0 44.4 47.1 11.5 12.4 13.0 14.2 15.6 9.7 10.4 11.1 7.9 2023 8.7 2024E 2025E 2026E 2027E 55.4 60.3 64.7 69.0 73.9 +7.5%

ComEd Capital Expenditure Forecast Q4 2024 Capital Expenditures ($M) Project ~$13.9B of capital being invested from 2025-2028 1,775 2,225 2,250 2,450 2,450 450 975 1,400 1,175 950 2024 2025E 2026E 2027E 2028E 2,250 3,200 3,650 3,625 3,375 Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Other includes ComEd’s long-term regulatory assets (Energy Efficiency & Solar Rebate program) recovered under separate tariffs, which earn a full authorized Rate of Return. See Note 3 – Regulatory Matters in 2024 10-K for additional detail. (2) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Rate Base 2024: 36% of Total Exelon Rate Base 7% 21% 72% Other(1) Electric Transmission Electric Distribution(2) $21.3B 24 Q4 2023 Capital Expenditures ($M) 1,600 1,975 2,000 2,250 550 875 1,150 900 2024E 2025E 2026E 2027E 2,150 2,850 3,150 3,150

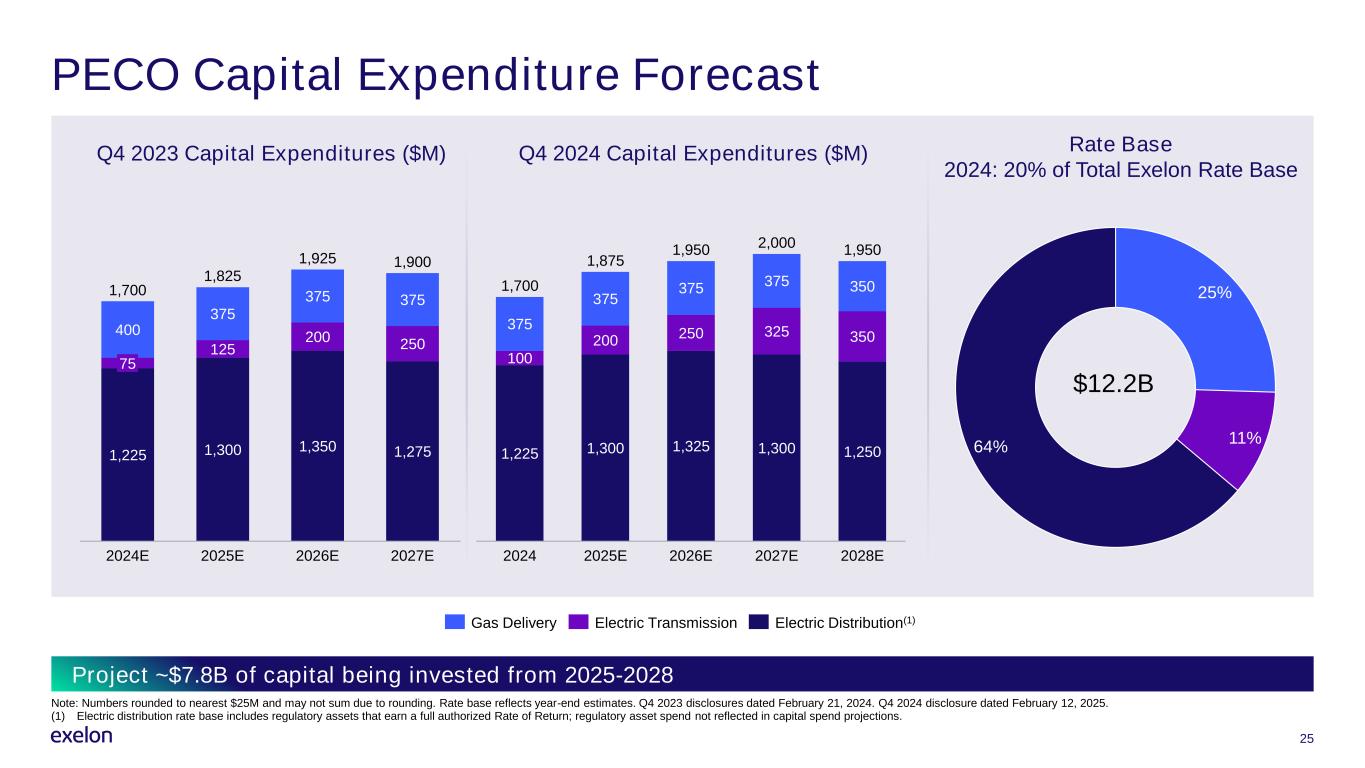

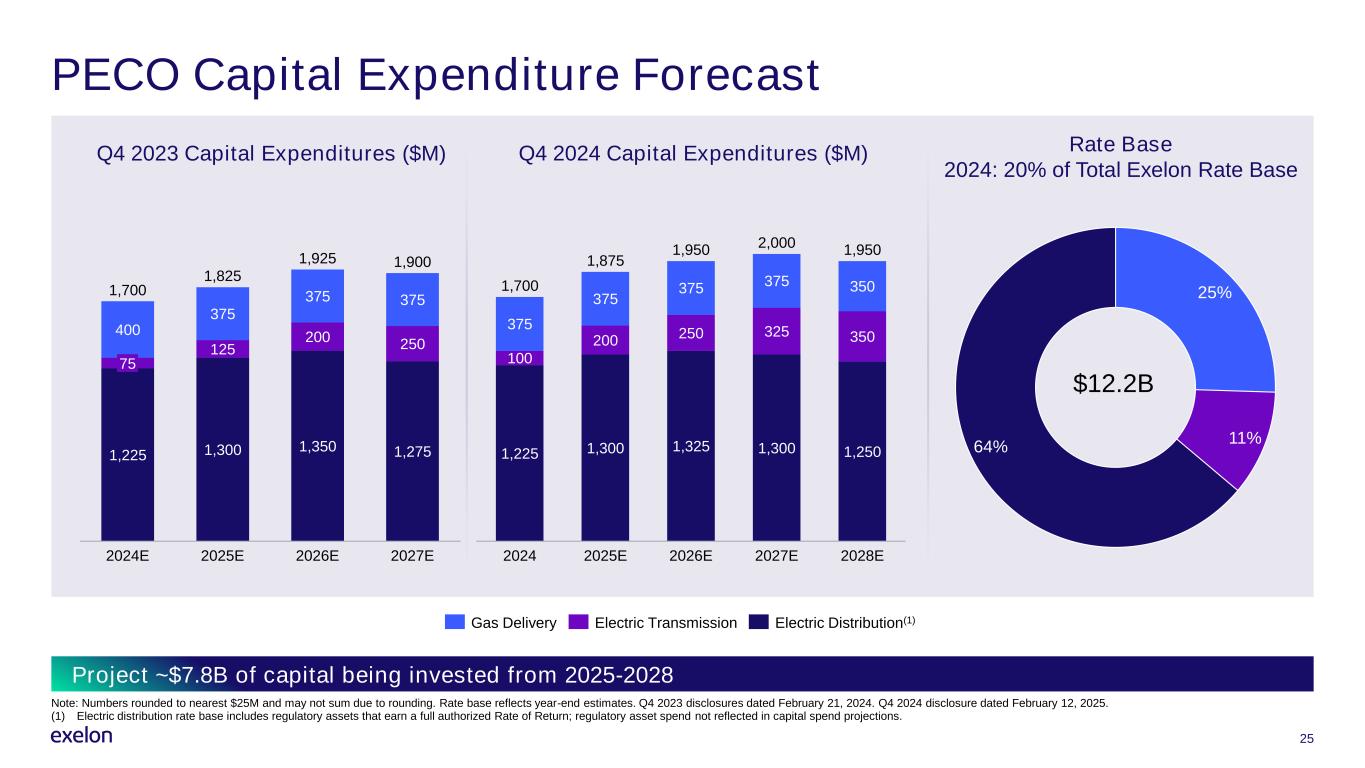

Project ~$7.8B of capital being invested from 2025-2028 25 PECO Capital Expenditure Forecast 1,225 1,300 1,325 1,300 1,250 100 200 250 325 350 375 375 375 375 350 2024 2025E 2026E 2027E 2028E 1,700 1,875 1,950 2,000 1,950 Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Rate Base 2024: 20% of Total Exelon Rate Base 25% 11% 64% Gas Delivery Electric Transmission Electric Distribution(1) $12.2B Q4 2024 Capital Expenditures ($M) 1,225 1,300 1,350 1,275 125 200 250 400 375 375 375 75 2024E 2025E 2026E 2027E 1,700 1,825 1,925 1,900 Q4 2023 Capital Expenditures ($M)

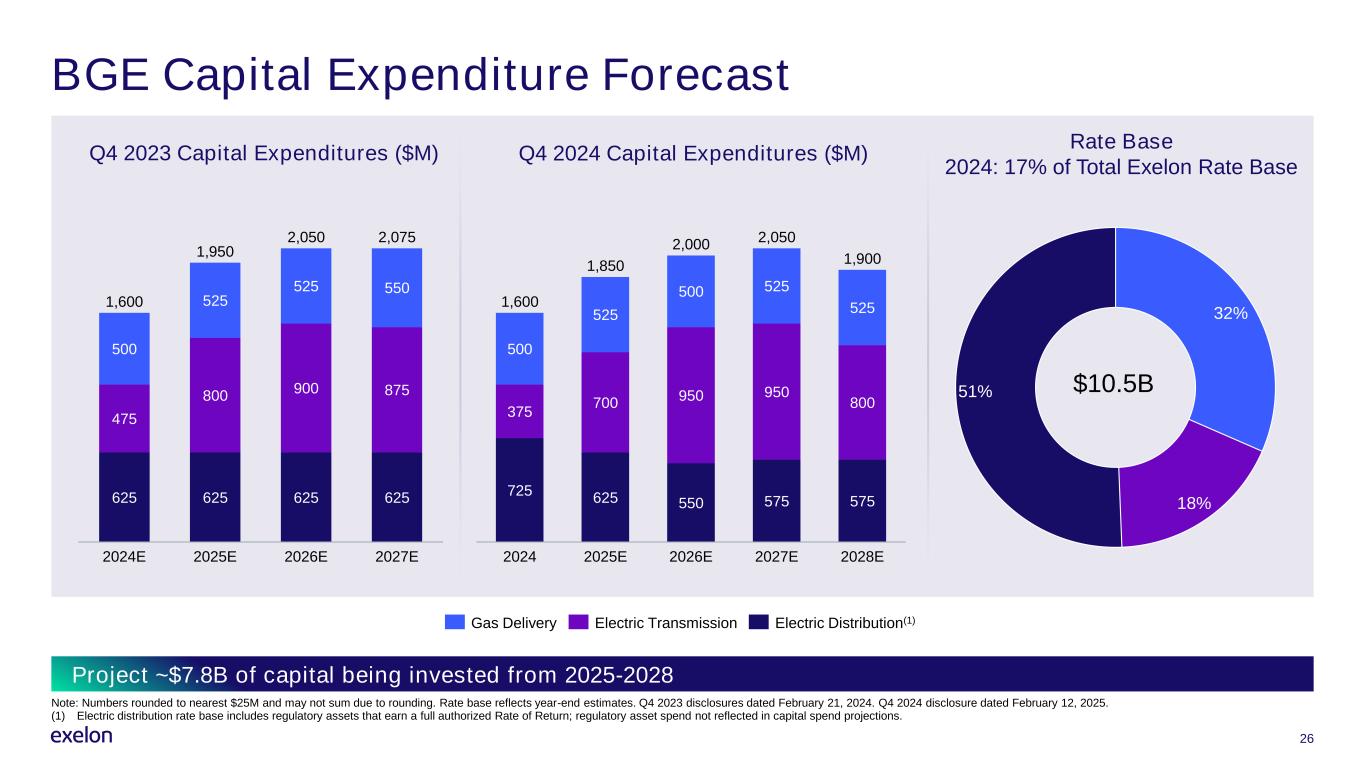

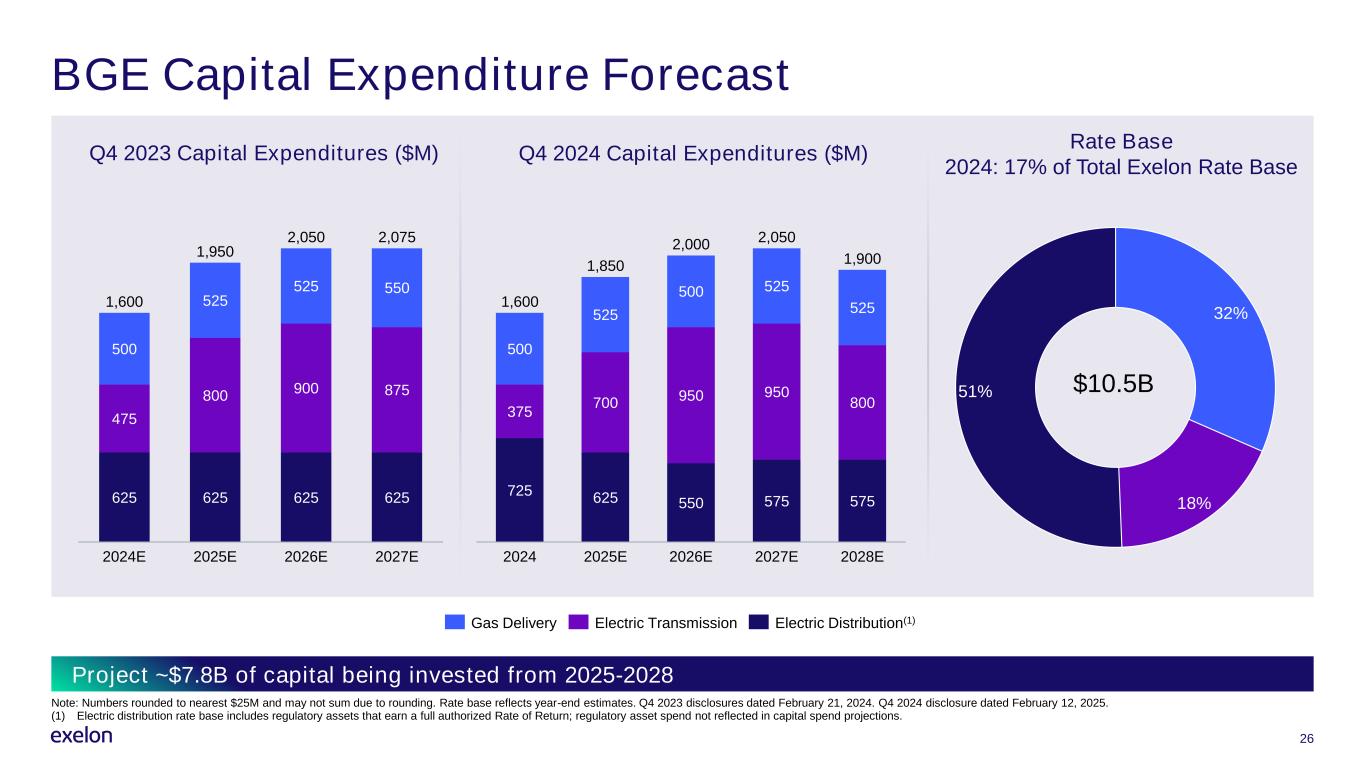

Project ~$7.8B of capital being invested from 2025-2028 26 BGE Capital Expenditure Forecast 725 625 550 575 575 375 700 950 950 800 500 525 500 525 525 2024 2025E 2026E 2027E 2028E 1,600 1,850 2,000 2,050 1,900 625 625 625 625 475 800 900 875 500 525 525 550 2024E 2025E 2026E 2027E 1,600 1,950 2,050 2,075 Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Rate Base 2024: 17% of Total Exelon Rate Base 32% 18% 51% Gas Delivery Electric Transmission Electric Distribution(1) $10.5B Q4 2024 Capital Expenditures ($M)Q4 2023 Capital Expenditures ($M)

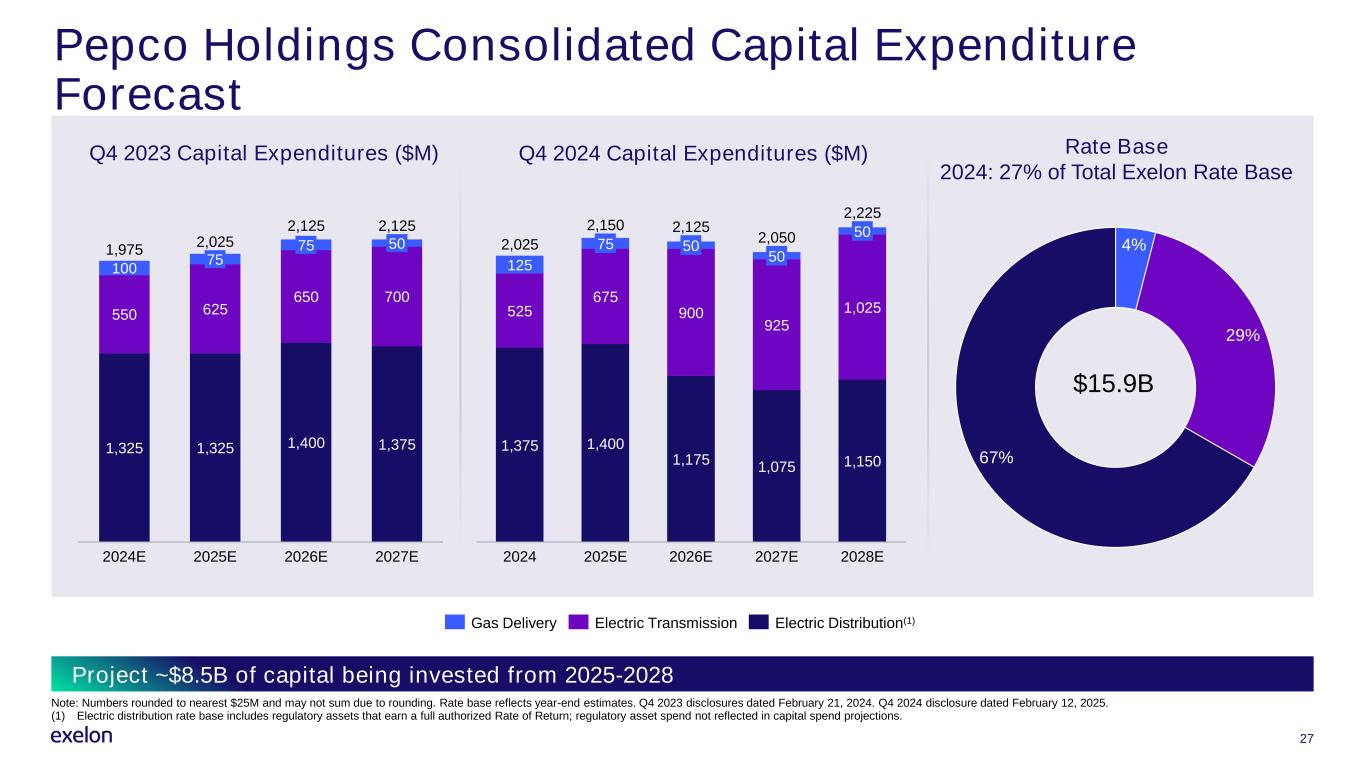

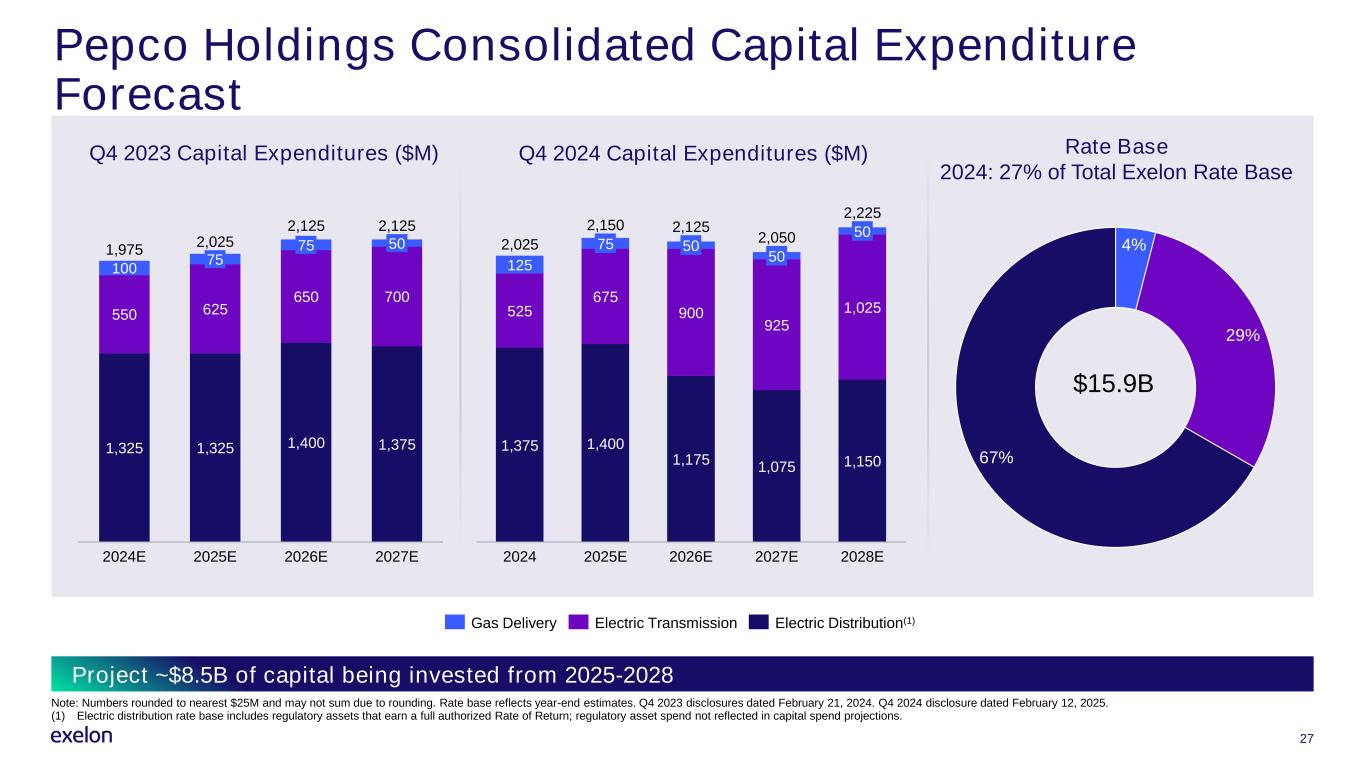

27 Pepco Holdings Consolidated Capital Expenditure Forecast 1,375 1,400 1,175 1,075 1,150 525 675 900 925 1,025 125 2024 75 2025E 50 2026E 50 2027E 50 2028E 2,025 2,150 2,125 2,050 2,225 1,325 1,325 1,400 1,375 550 625 650 700 100 2024E 75 2025E 75 2026E 50 2027E 1,975 2,025 2,125 2,125 Project ~$8.5B of capital being invested from 2025-2028 Rate Base 2024: 27% of Total Exelon Rate Base 4% 29% 67% Gas Delivery Electric Transmission Electric Distribution(1) $15.9B Q4 2024 Capital Expenditures ($M)Q4 2023 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

Project ~$2.0B of capital being invested from 2025-2028 28 ACE Capital Expenditure Forecast 300 250 225 225 100 225 275 225 275 2024 2025E 2026E 2027E 2028E 400 500 525 450 500 275275 275 300 275 150 250 225 175 2024E 2025E 2026E 2027E 425 525 525 450 Electric Transmission Electric Distribution(1) Rate Base 2024: 6% of Total Exelon Rate Base 37% 63% $3.8B Q4 2024 Capital Expenditures ($M)Q4 2023 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

Project ~$2.5B of capital being invested from 2025-2028 29 DPL Capital Expenditure Forecast 325 325 300 300 175 175 250 275 350 125 75 50 50 50 2024 2025E 2026E 2027E 2028E 625 575 600 600 700 275 325 300 325 325 200 200 225 250 100 75 75 50 2024E 2025E 2026E 2027E 600 575 625 625 Gas Delivery Electric Transmission Electric Distribution(1) Rate Base 2024: 7% of Total Exelon Rate Base 15% 32% 54% $4.3B Q4 2024 Capital Expenditures ($M)Q4 2023 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

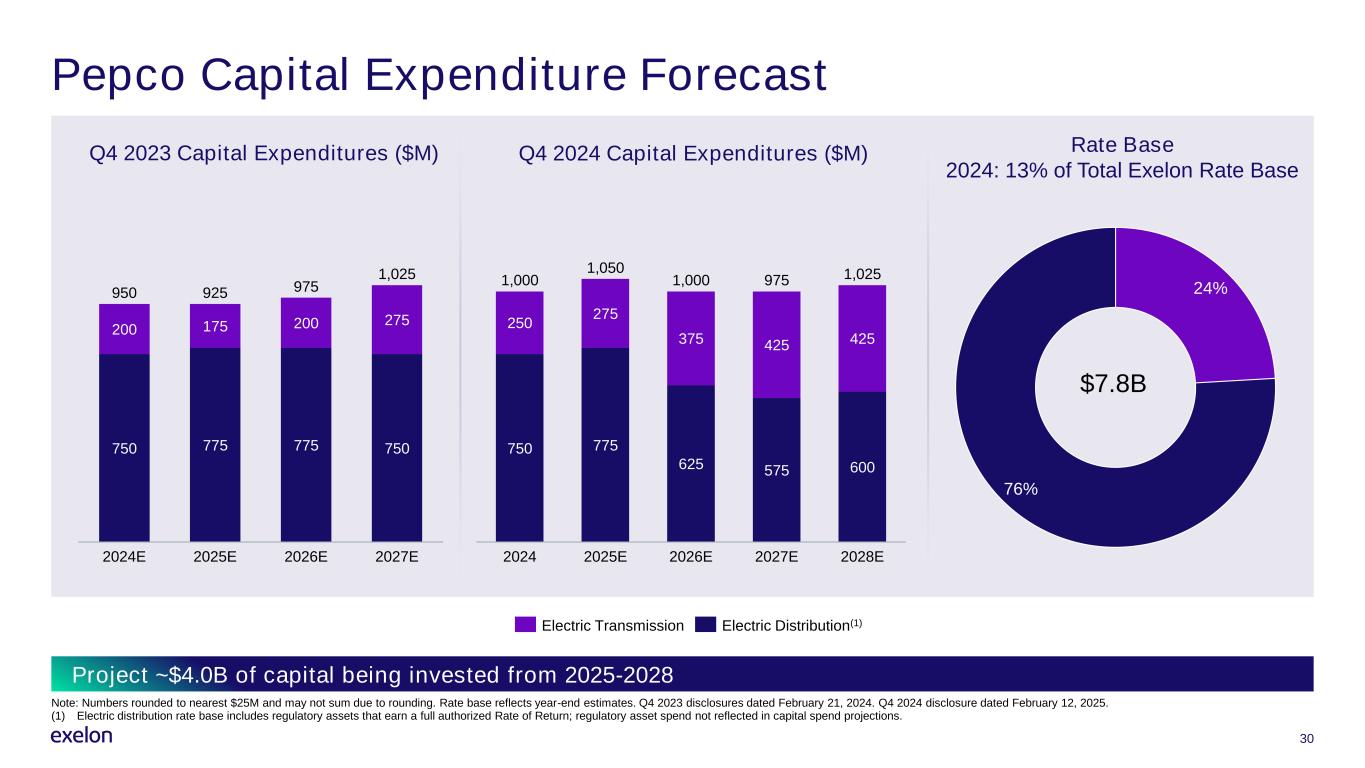

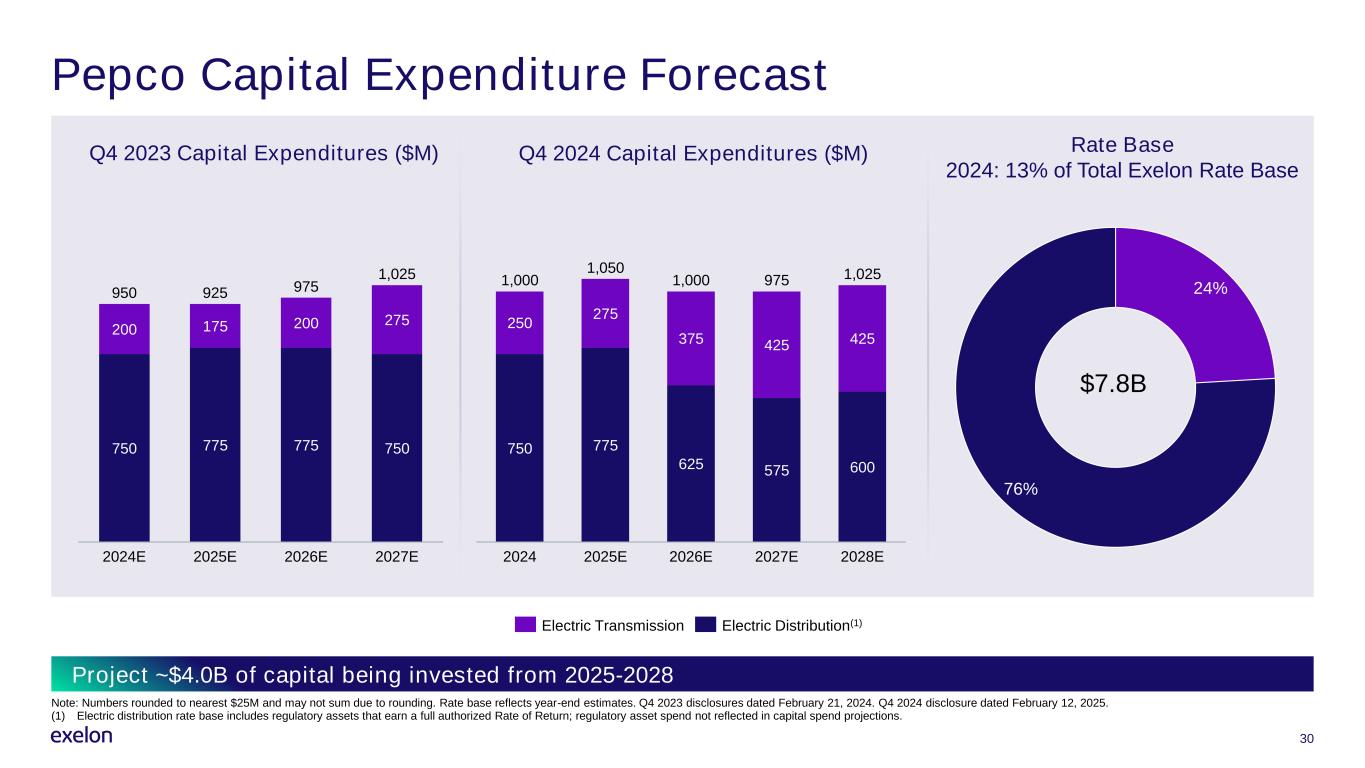

30 Pepco Capital Expenditure Forecast 750 775 625 575 600 250 275 375 425 425 2024 2025E 2026E 2027E 2028E 1,000 1,050 1,000 975 1,025 750 775 775 750 200 175 200 275 2024E 2025E 2026E 2027E 950 925 975 1,025 Electric Transmission Electric Distribution(1) Project ~$4.0B of capital being invested from 2025-2028 Rate Base 2024: 13% of Total Exelon Rate Base 24% 76% $7.8B Q4 2024 Capital Expenditures ($M)Q4 2023 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2023 disclosures dated February 21, 2024. Q4 2024 disclosure dated February 12, 2025. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

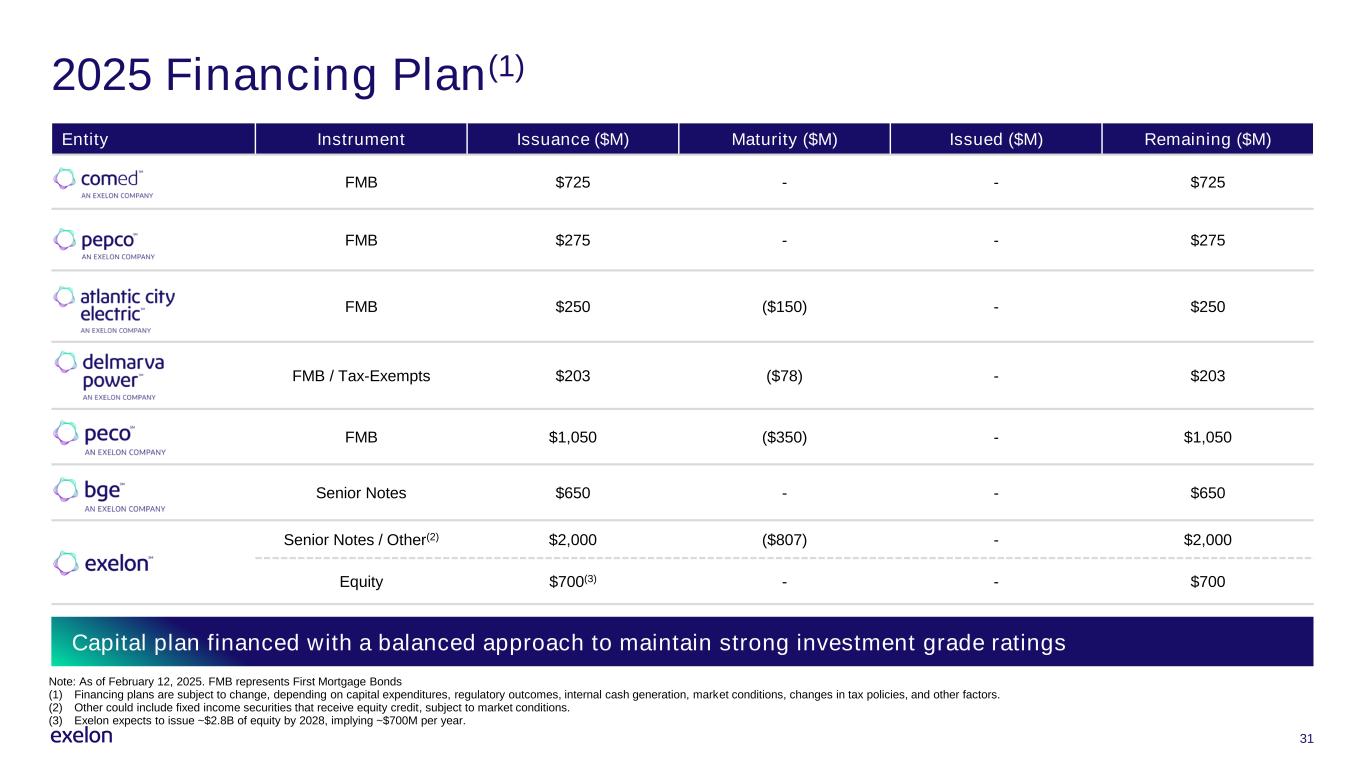

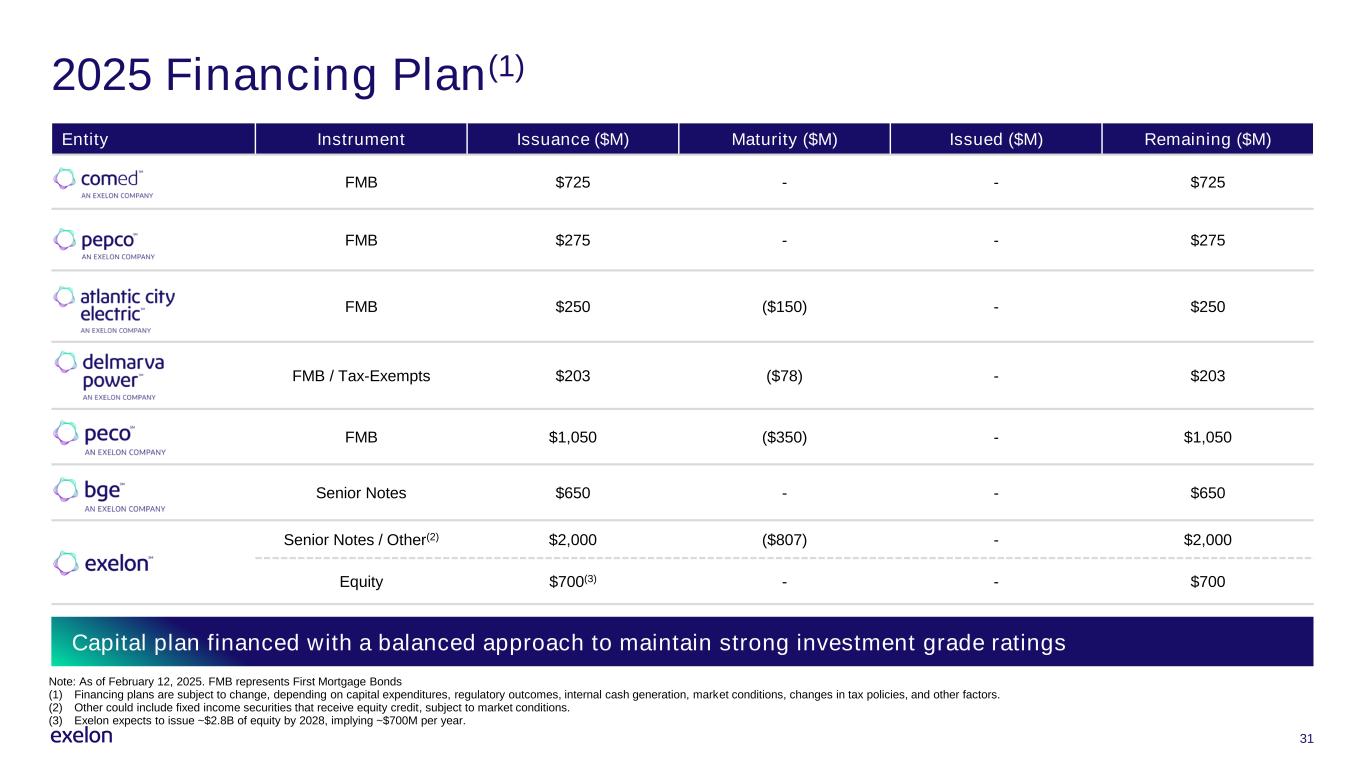

2025 Financing Plan(1) Capital plan financed with a balanced approach to maintain strong investment grade ratings Entity Instrument Issuance ($M) Maturity ($M) Issued ($M) Remaining ($M) FMB $725 - - $725 FMB $275 - - $275 FMB $250 ($150) - $250 FMB / Tax-Exempts $203 ($78) - $203 FMB $1,050 ($350) - $1,050 Senior Notes $650 - - $650 Senior Notes / Other(2) $2,000 ($807) - $2,000 Equity $700(3) - - $700 31 Note: As of February 12, 2025. FMB represents First Mortgage Bonds (1) Financing plans are subject to change, depending on capital expenditures, regulatory outcomes, internal cash generation, market conditions, changes in tax policies, and other factors. (2) Other could include fixed income securities that receive equity credit, subject to market conditions. (3) Exelon expects to issue ~$2.8B of equity by 2028, implying ~$700M per year.

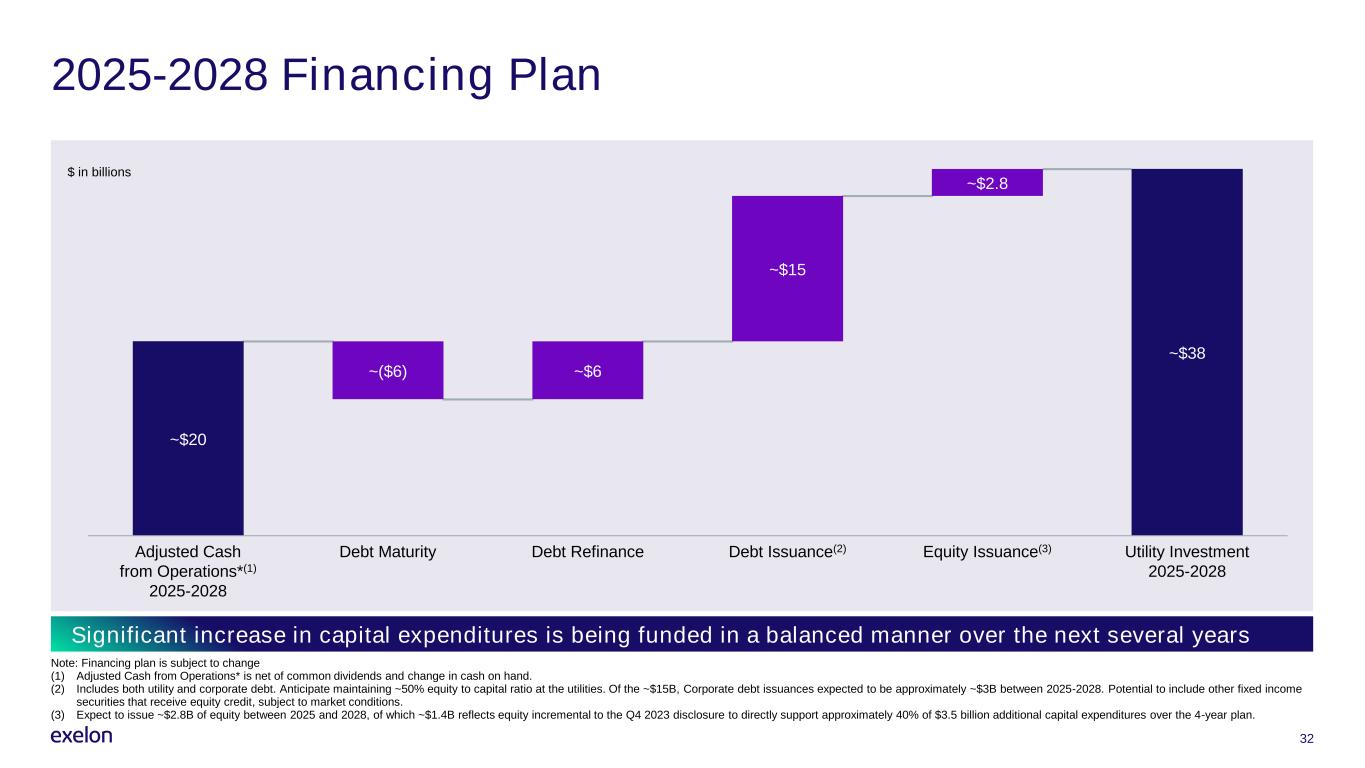

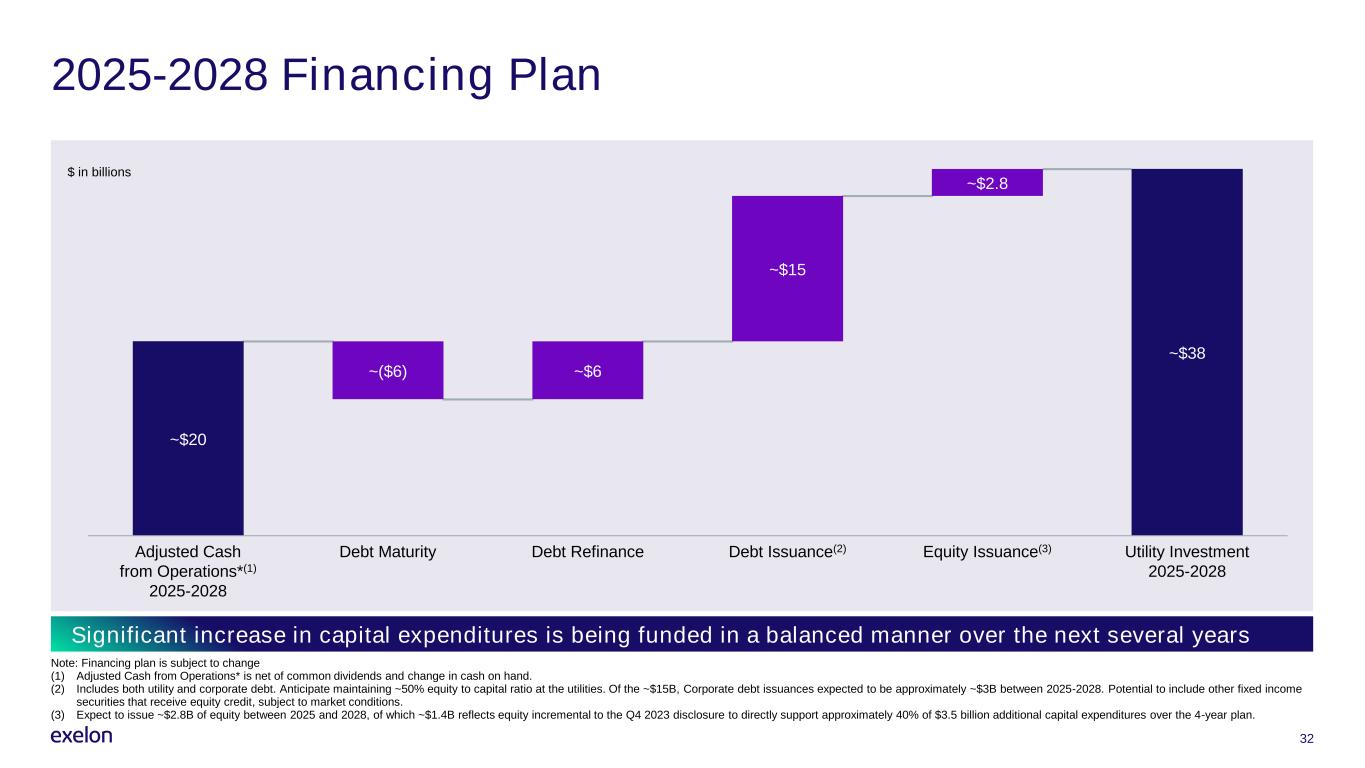

32 2025-2028 Financing Plan ~$20 ~$38 ~($6) ~$6 ~$15 ~$2.8 Adjusted Cash from Operations*(1) 2025-2028 Debt Maturity Debt Refinance Debt Issuance(2) Equity Issuance(3) Utility Investment 2025-2028 $ in billions Note: Financing plan is subject to change (1) Adjusted Cash from Operations* is net of common dividends and change in cash on hand. (2) Includes both utility and corporate debt. Anticipate maintaining ~50% equity to capital ratio at the utilities. Of the ~$15B, Corporate debt issuances expected to be approximately ~$3B between 2025-2028. Potential to include other fixed income securities that receive equity credit, subject to market conditions. (3) Expect to issue ~$2.8B of equity between 2025 and 2028, of which ~$1.4B reflects equity incremental to the Q4 2023 disclosure to directly support approximately 40% of $3.5 billion additional capital expenditures over the 4-year plan. Significant increase in capital expenditures is being funded in a balanced manner over the next several years

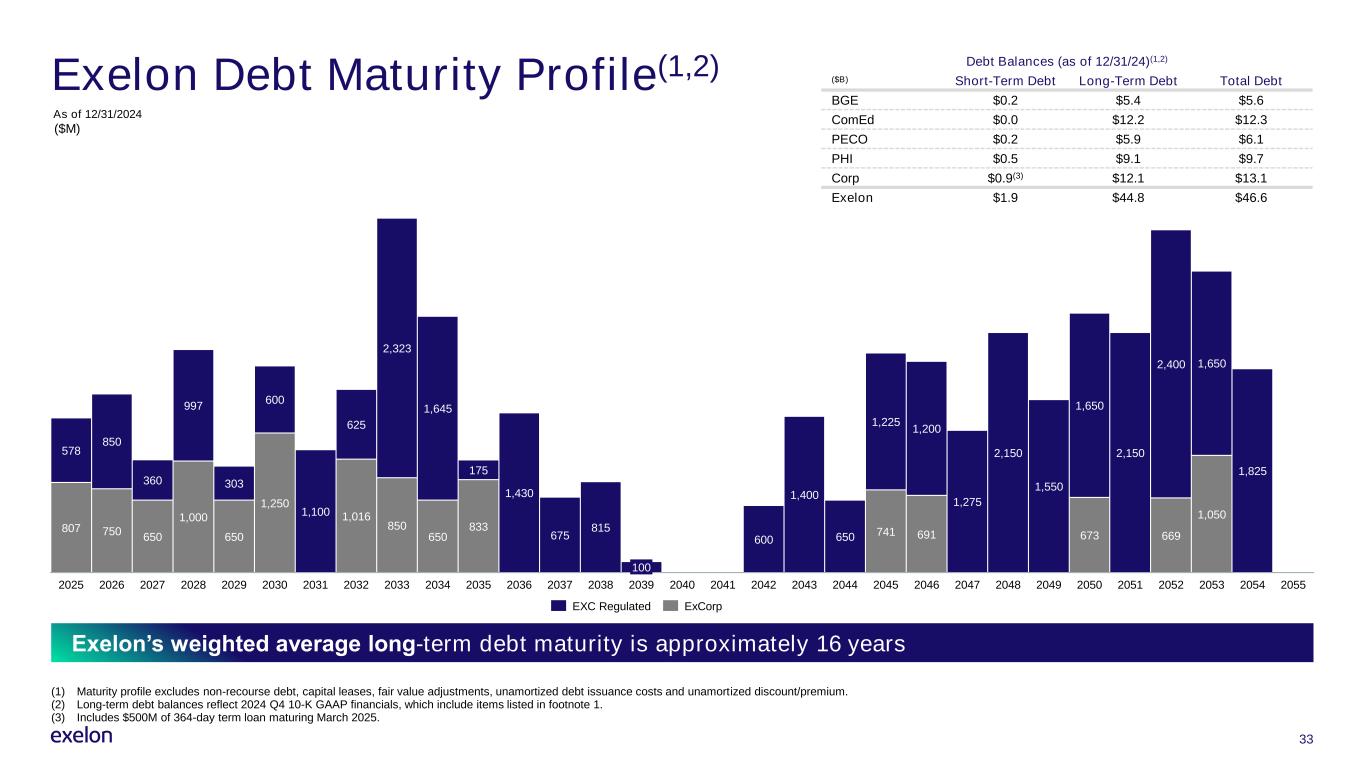

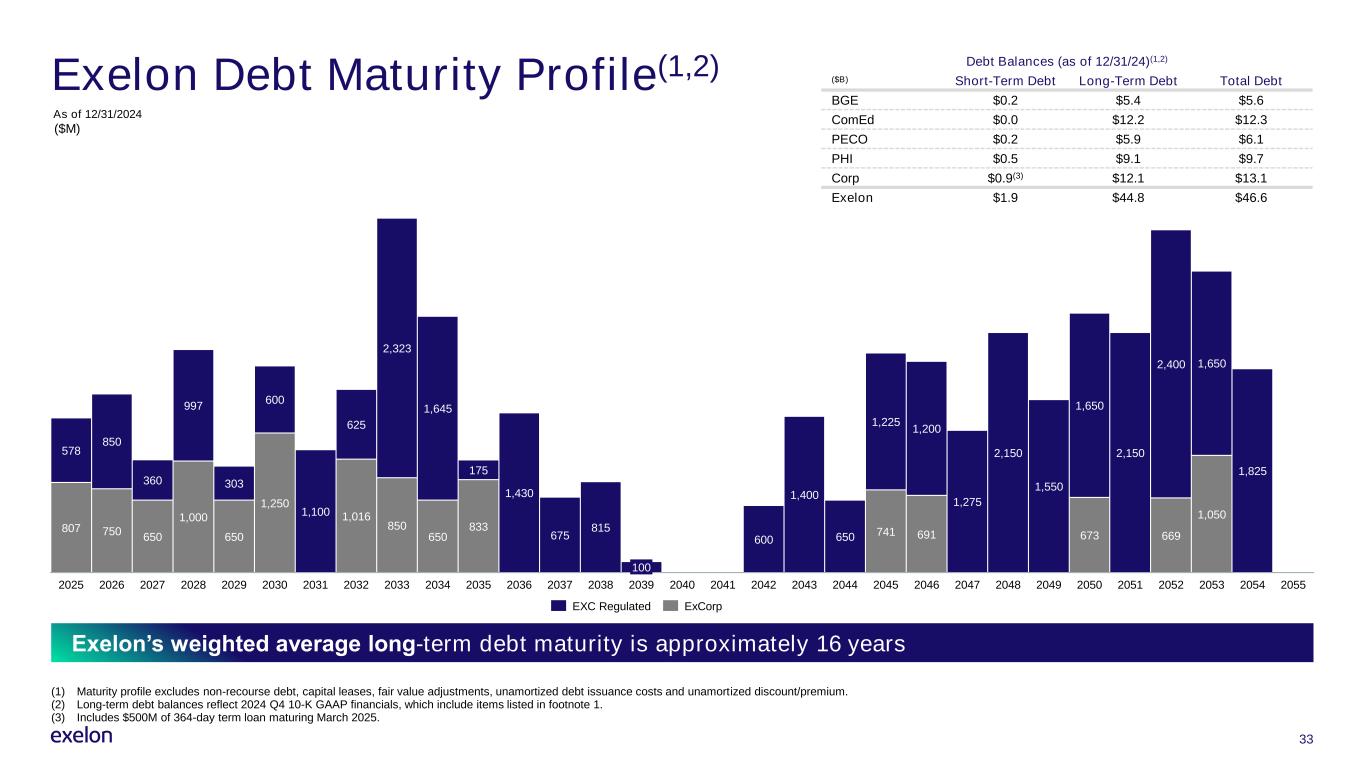

Exelon Debt Maturity Profile(1,2) Debt Balances (as of 12/31/24)(1,2) ($B) Short-Term Debt Long-Term Debt Total Debt BGE $0.2 $5.4 $5.6 ComEd $0.0 $12.2 $12.3 PECO $0.2 $5.9 $6.1 PHI $0.5 $9.1 $9.7 Corp $0.9(3) $12.1 $13.1 Exelon $1.9 $44.8 $46.6 807 750 650 1,000 650 1,250 1,100 1,016 850 650 833 1,430 675 815 600 1,400 650 741 691 1,275 2,150 1,550 673 2,150 669 1,050 1,825 578 850 360 997 303 600 625 2,323 1,645 175 1,225 1,200 1,650 2,400 1,650 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 20402025 2042 2043 2044 2045 2046 2047 2048 2049 2050 2051 2052 2053 2054 2055 100 2041 (1) Maturity profile excludes non-recourse debt, capital leases, fair value adjustments, unamortized debt issuance costs and unamortized discount/premium. (2) Long-term debt balances reflect 2024 Q4 10-K GAAP financials, which include items listed in footnote 1. (3) Includes $500M of 364-day term loan maturing March 2025. Exelon’s weighted average long-term debt maturity is approximately 16 years ($M) As of 12/31/2024 EXC Regulated ExCorp 33

34 Exelon’s Annual Earned Operating ROEs* 9.5% 9.4% 9.6% 10.0% 8.7% 9.2% 9.4% 9.3% 9.1% 2016 2017 2018 2019 2020 2021 2023 20242022 Note: Represents the twelve-month periods December 31, 2016-2024 for Exelon’s utilities (excludes Corp). Earned operating ROEs* represent weighted average across all lines of business (Electric Distribution, Gas Distribution, and Electric Transmission). Gray-shaded area represents Exelon’s 9-10% targeted range. Delivered 2024 operating ROE* within our 9-10% targeted range

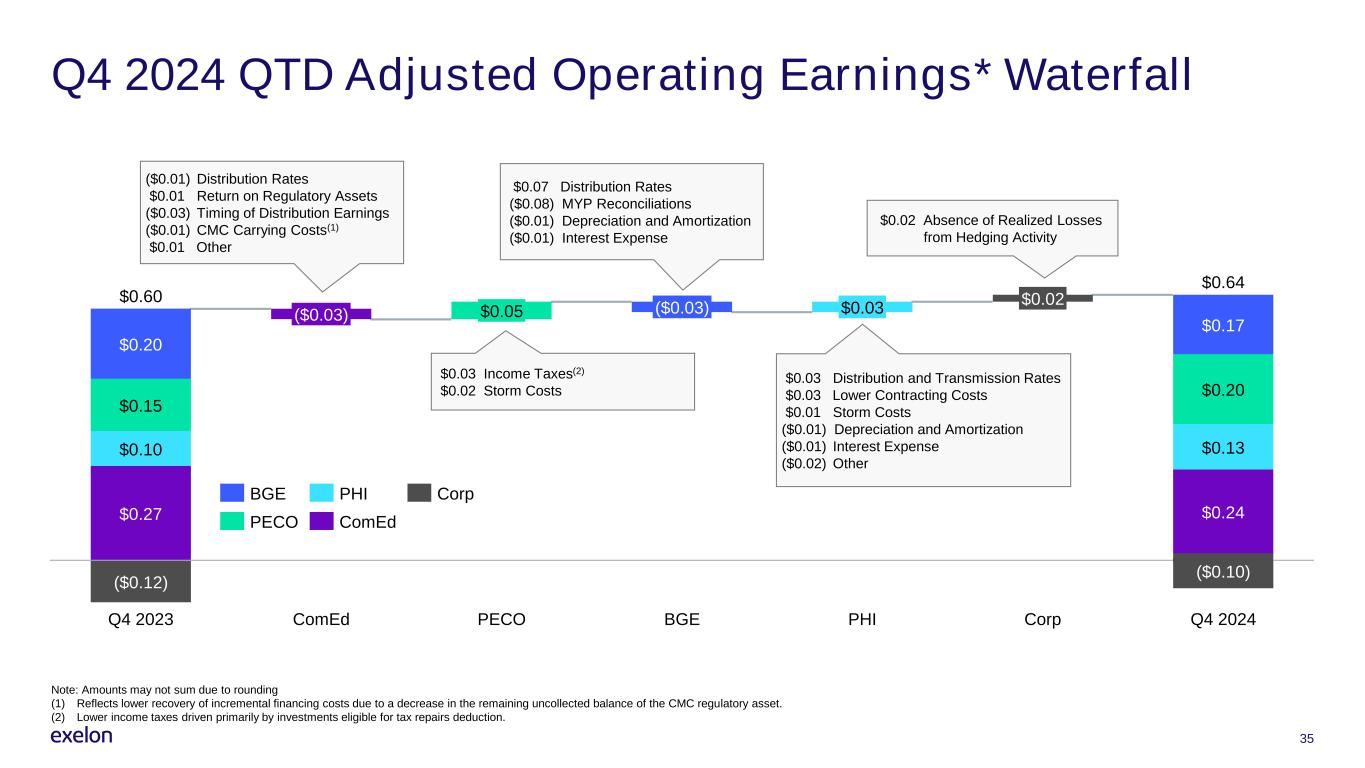

Q4 2024 QTD Adjusted Operating Earnings* Waterfall $0.27 $0.10 $0.24 $0.15 $0.13 $0.20 $0.20 ($0.12) $0.17 Q4 2023 ($0.03) ComEd $0.05 PECO ($0.03) BGE $0.03 PHI $0.02 Corp ($0.10) Q4 2024 $0.60 $0.64 ($0.01) Distribution Rates $0.01 Return on Regulatory Assets ($0.03) Timing of Distribution Earnings ($0.01) CMC Carrying Costs(1) $0.01 Other $0.03 Income Taxes(2) $0.02 Storm Costs 35 BGE PECO PHI ComEd Corp $0.02 Absence of Realized Losses from Hedging Activity $0.07 Distribution Rates ($0.08) MYP Reconciliations ($0.01) Depreciation and Amortization ($0.01) Interest Expense $0.03 Distribution and Transmission Rates $0.03 Lower Contracting Costs $0.01 Storm Costs ($0.01) Depreciation and Amortization ($0.01) Interest Expense ($0.02) Other Note: Amounts may not sum due to rounding (1) Reflects lower recovery of incremental financing costs due to a decrease in the remaining uncollected balance of the CMC regulatory asset. (2) Lower income taxes driven primarily by investments eligible for tax repairs deduction.

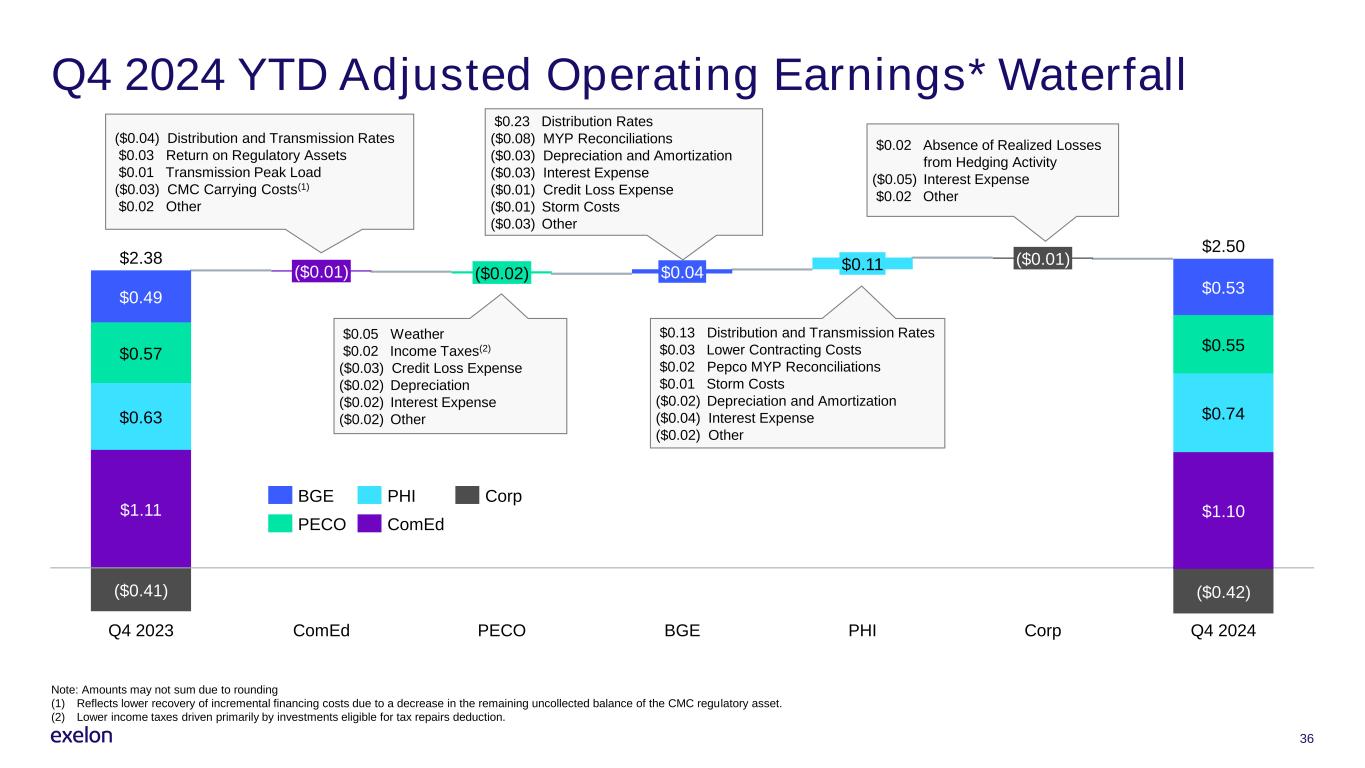

Q4 2024 YTD Adjusted Operating Earnings* Waterfall $1.11 $0.63 $0.74 $0.57 $0.55 $0.49 $0.53 ($0.41) ($0.42) Q4 2023 ($0.01) ComEd ($0.02) PECO $0.04 BGE $0.11 PHI ($0.01) Corp $1.10 Q4 2024 $2.38 $2.50 36 BGE PECO PHI ComEd Corp ($0.04) Distribution and Transmission Rates $0.03 Return on Regulatory Assets $0.01 Transmission Peak Load ($0.03) CMC Carrying Costs(1) $0.02 Other $0.05 Weather $0.02 Income Taxes(2) ($0.03) Credit Loss Expense ($0.02) Depreciation ($0.02) Interest Expense ($0.02) Other $0.23 Distribution Rates ($0.08) MYP Reconciliations ($0.03) Depreciation and Amortization ($0.03) Interest Expense ($0.01) Credit Loss Expense ($0.01) Storm Costs ($0.03) Other $0.13 Distribution and Transmission Rates $0.03 Lower Contracting Costs $0.02 Pepco MYP Reconciliations $0.01 Storm Costs ($0.02) Depreciation and Amortization ($0.04) Interest Expense ($0.02) Other $0.02 Absence of Realized Losses from Hedging Activity ($0.05) Interest Expense $0.02 Other Note: Amounts may not sum due to rounding (1) Reflects lower recovery of incremental financing costs due to a decrease in the remaining uncollected balance of the CMC regulatory asset. (2) Lower income taxes driven primarily by investments eligible for tax repairs deduction.

37 Exelon Adjusted Operating Earnings* Sensitivities Interest Rate Sensitivity to +50bp 2025E 2026E Cost of Debt (1) $(0.01) $(0.01) Exelon Consolidated Effective Tax Rate 17.1% 20.1% Exelon Consolidated Cash Tax Rate(2) 9.1% 13.4% (1) Reflects full year impact to a +50bp increase on Corporate debt net of pre-issuance hedges as of December 31, 2024. Through December 31, 2024, Corporate entered into $1.3B of pre-issuance hedges through interest rate swaps. (2) Includes the impact of CAMT.

38 Rate Case Details

39 Exelon Distribution Rate Case Updates Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Revenue Requirement Increase Approved/Requested ROE / Equity Ratio Expected/Received Order Date $594.5M (1,2) 4-Year MYP 8.905% / 50.0% Dec 2024 (2) $123.4M (1,3) 2-Year MYP 9.50%/ 50.50% Nov 2024 $290.0M(1,4) in 2025 N/A(4) Dec 2024 $78.0M(1,4) N/A (4) Dec 2024 $38.5M(1,5) 10.65% / 50.50% Q1 2026 $108.9M(1,6) 10.70% / 50.24% Dec 2025 Rate case filed Rebuttal testimony Initial briefs Final commission order Intervenor direct testimony Evidentiary hearings Reply briefs Settlement agreement CF IT RT EH IB RB FO SA Pepco DC PECO Gas PECO Electric ComEd Rate Plan EH IB RB Note: Unless otherwise noted, based on schedules of Illinois Commerce Commission (ICC), Maryland Public Service Commission (MDPSC), Pennsylvania Public Utility Commission (PA PUC), Delaware Public Service Commission (DPSC), Public Service Commission of the District of Columbia (DCPSC), and New Jersey Board of Public Utilities (NJBPU) that are subject to change. (1) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. (2) On December 19, 2024, the ICC approved a $594.5M increase over four years with year-over-year increases of approximately $301M in 2024, $80M in 2025, $102M in 2026, and $111M in 2027. Separately, on October 31, 2024, ComEd received a Final Order from the ICC approving $623M of its 2023 formula rate reconciliation under docket 24-0304. (3) Reflects 2-year cumulative multi-year plan approved by the DCPSC on November 26, 2024, and includes Revenue Requirement increases of $99.7M and $23.7M with rates effective January 1, 2025 and January 1, 2026, respectively. (4) Base rate revenue for electric distribution increase of $354M, which is partially offset by a one-time credit of $64M in 2025, resulting in a net revenue increase of $290M in 2025. Revenue requirement excludes the Distribution System Improvement Charge (DSIC) revenues being rolled into base distribution rates of $64M and $18M for electric distribution and gas distribution, respectively. The settlement did not stipulate any ROE or Equity Ratio. (5) Requested revenue requirement excludes the transfer of $6.4M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. As permitted by Delaware law, Delmarva Power may implement full proposed rates on April 20, 2025, subject to refund. (6) Excludes the requested transfer of $11.1 million of Infrastructure Investment Program costs (“IIP”) and $8 million of Sales and Use Tax into distribution rates. As permitted by regulations, ACE intends to put interim rates in effect on August 21, 2025, subject to refund. EH IB RB EH IB RB DPL DE Gas CF SA SA FO ACE Electric CF FO FO FO IT

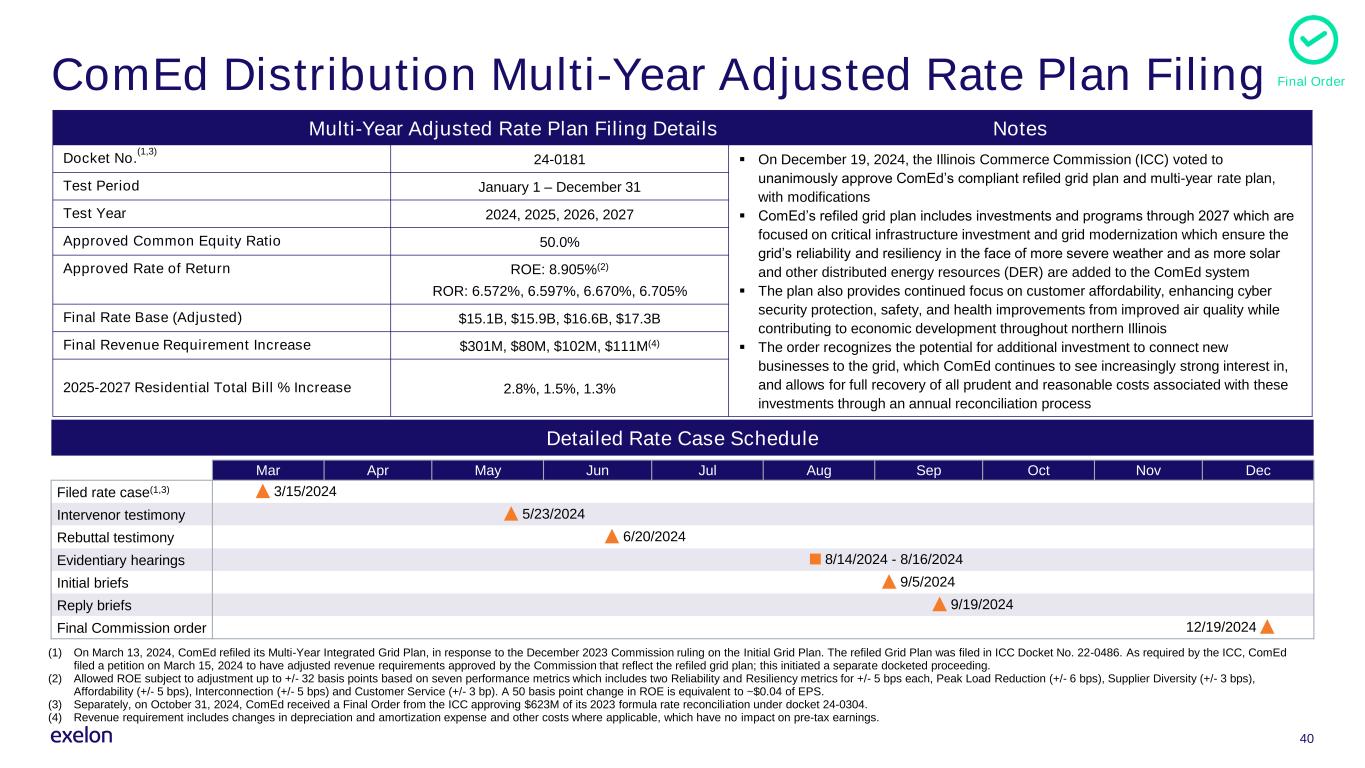

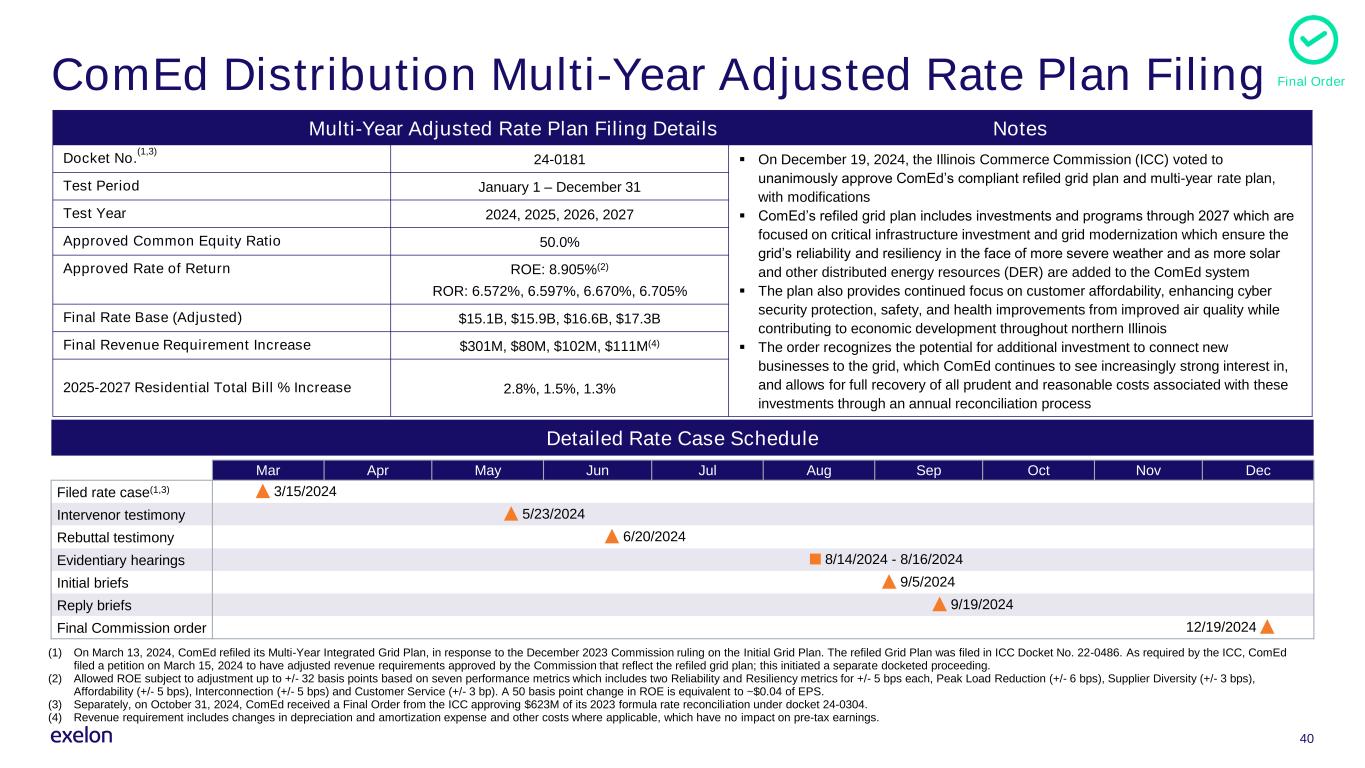

40 ComEd Distribution Multi-Year Adjusted Rate Plan Filing Multi-Year Adjusted Rate Plan Filing Details Notes Docket No. (1,3) 24-0181 ▪ On December 19, 2024, the Illinois Commerce Commission (ICC) voted to unanimously approve ComEd’s compliant refiled grid plan and multi-year rate plan, with modifications ▪ ComEd’s refiled grid plan includes investments and programs through 2027 which are focused on critical infrastructure investment and grid modernization which ensure the grid’s reliability and resiliency in the face of more severe weather and as more solar and other distributed energy resources (DER) are added to the ComEd system ▪ The plan also provides continued focus on customer affordability, enhancing cyber security protection, safety, and health improvements from improved air quality while contributing to economic development throughout northern Illinois ▪ The order recognizes the potential for additional investment to connect new businesses to the grid, which ComEd continues to see increasingly strong interest in, and allows for full recovery of all prudent and reasonable costs associated with these investments through an annual reconciliation process Test Period January 1 – December 31 Test Year 2024, 2025, 2026, 2027 Approved Common Equity Ratio 50.0% Approved Rate of Return ROE: 8.905%(2) ROR: 6.572%, 6.597%, 6.670%, 6.705% Final Rate Base (Adjusted) $15.1B, $15.9B, $16.6B, $17.3B Final Revenue Requirement Increase $301M, $80M, $102M, $111M(4) 2025-2027 Residential Total Bill % Increase 2.8%, 1.5%, 1.3% Detailed Rate Case Schedule Mar Apr May Jun Jul Aug Sep Oct Nov Dec Evidentiary hearings 9/5/2024Initial briefs Intervenor testimony 9/19/2024 8/14/2024 - 8/16/2024 Reply briefs Final Commission order 5/23/2024 Filed rate case(1,3) 3/15/2024 6/20/2024 12/19/2024 Rebuttal testimony (1) On March 13, 2024, ComEd refiled its Multi-Year Integrated Grid Plan, in response to the December 2023 Commission ruling on the Initial Grid Plan. The refiled Grid Plan was filed in ICC Docket No. 22-0486. As required by the ICC, ComEd filed a petition on March 15, 2024 to have adjusted revenue requirements approved by the Commission that reflect the refiled grid plan; this initiated a separate docketed proceeding. (2) Allowed ROE subject to adjustment up to +/- 32 basis points based on seven performance metrics which includes two Reliability and Resiliency metrics for +/- 5 bps each, Peak Load Reduction (+/- 6 bps), Supplier Diversity (+/- 3 bps), Affordability (+/- 5 bps), Interconnection (+/- 5 bps) and Customer Service (+/- 3 bp). A 50 basis point change in ROE is equivalent to ~$0.04 of EPS. (3) Separately, on October 31, 2024, ComEd received a Final Order from the ICC approving $623M of its 2023 formula rate reconciliation under docket 24-0304. (4) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. Final Order

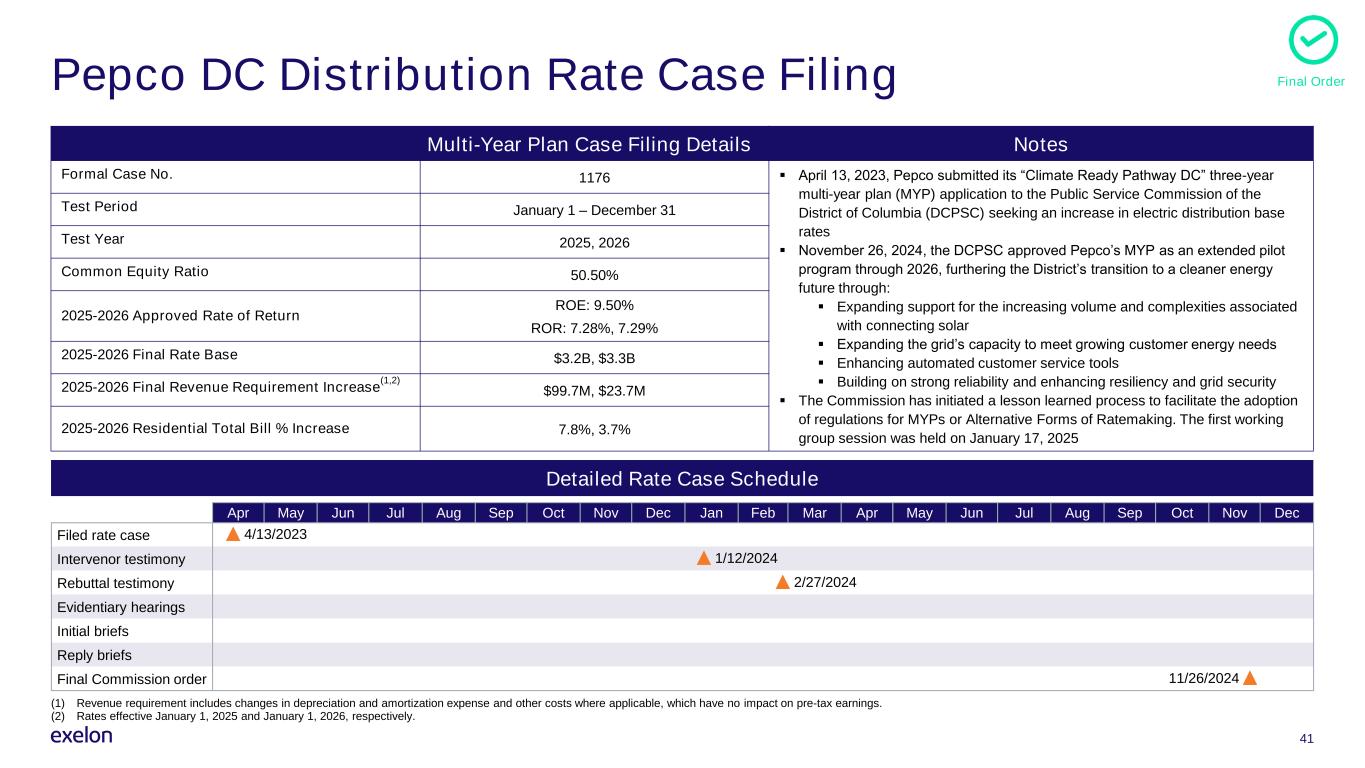

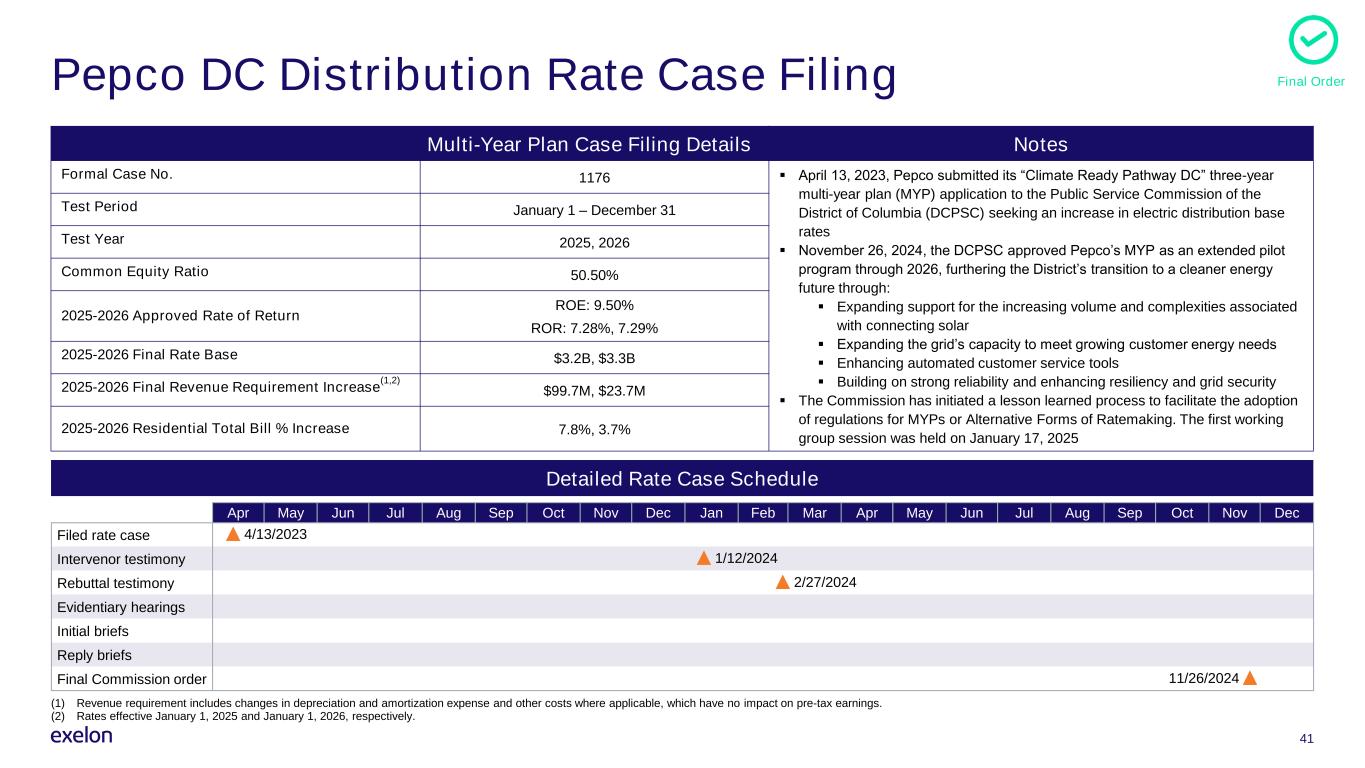

41 Pepco DC Distribution Rate Case Filing Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Rebuttal testimony Filed rate case Evidentiary hearings 4/13/2023 1/12/2024 Reply briefs Final Commission order Intervenor testimony 2/27/2024 11/26/2024 Initial briefs Multi-Year Plan Case Filing Details Notes Formal Case No. 1176 ▪ April 13, 2023, Pepco submitted its “Climate Ready Pathway DC” three-year multi-year plan (MYP) application to the Public Service Commission of the District of Columbia (DCPSC) seeking an increase in electric distribution base rates ▪ November 26, 2024, the DCPSC approved Pepco’s MYP as an extended pilot program through 2026, furthering the District’s transition to a cleaner energy future through: ▪ Expanding support for the increasing volume and complexities associated with connecting solar ▪ Expanding the grid’s capacity to meet growing customer energy needs ▪ Enhancing automated customer service tools ▪ Building on strong reliability and enhancing resiliency and grid security ▪ The Commission has initiated a lesson learned process to facilitate the adoption of regulations for MYPs or Alternative Forms of Ratemaking. The first working group session was held on January 17, 2025 Test Period January 1 – December 31 Test Year 2025, 2026 Common Equity Ratio 50.50% 2025-2026 Approved Rate of Return ROE: 9.50% ROR: 7.28%, 7.29% 2025-2026 Final Rate Base $3.2B, $3.3B 2025-2026 Final Revenue Requirement Increase (1,2) $99.7M, $23.7M 2025-2026 Residential Total Bill % Increase 7.8%, 3.7% Detailed Rate Case Schedule (1) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. (2) Rates effective January 1, 2025 and January 1, 2026, respectively. Final Order

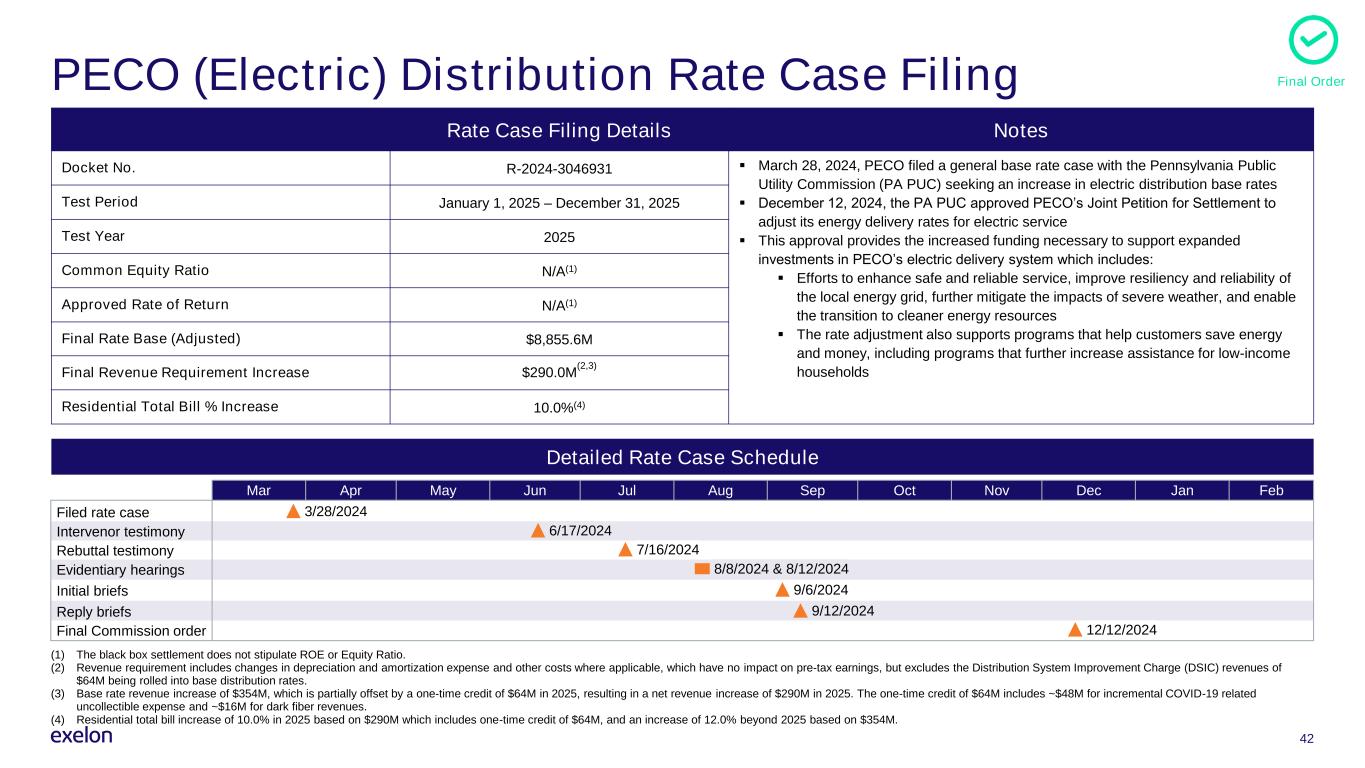

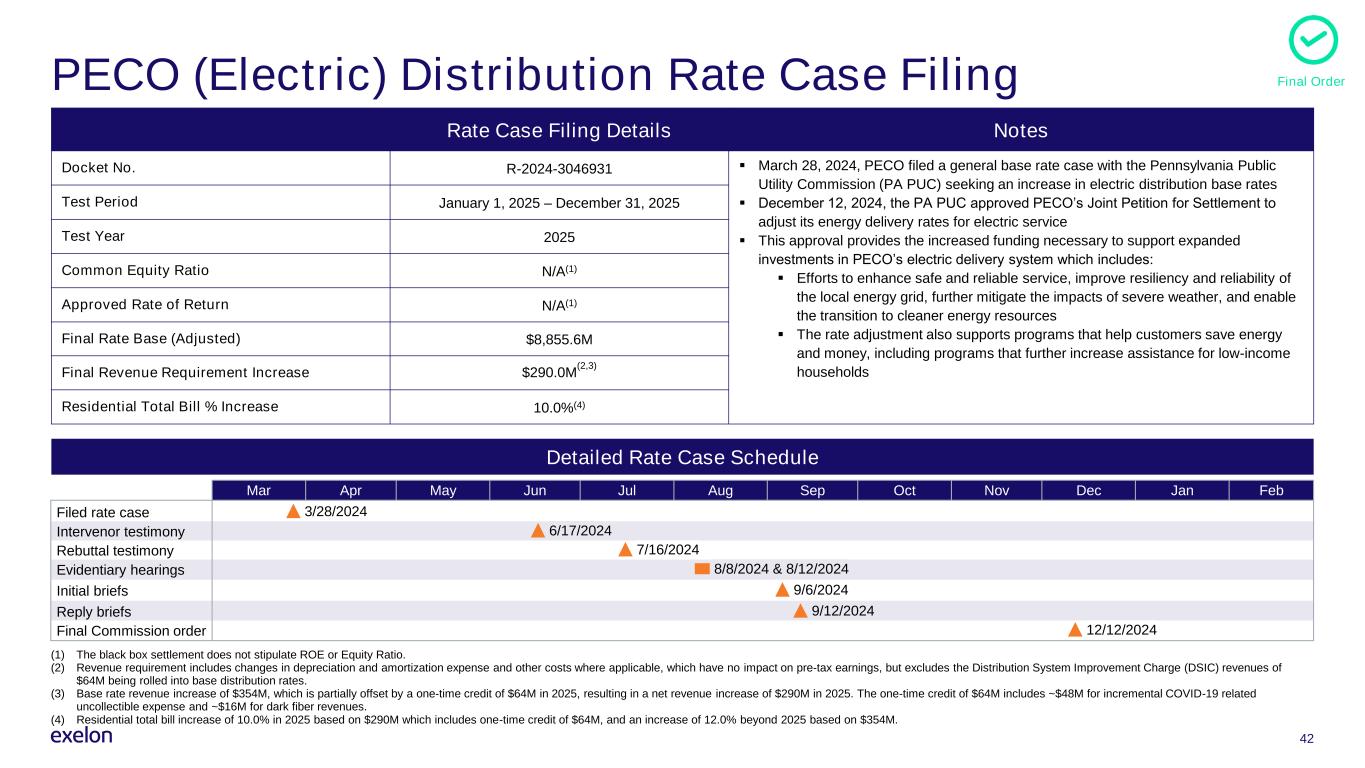

42 PECO (Electric) Distribution Rate Case Filing Rate Case Filing Details Notes Docket No. R-2024-3046931 ▪ March 28, 2024, PECO filed a general base rate case with the Pennsylvania Public Utility Commission (PA PUC) seeking an increase in electric distribution base rates ▪ December 12, 2024, the PA PUC approved PECO’s Joint Petition for Settlement to adjust its energy delivery rates for electric service ▪ This approval provides the increased funding necessary to support expanded investments in PECO’s electric delivery system which includes: ▪ Efforts to enhance safe and reliable service, improve resiliency and reliability of the local energy grid, further mitigate the impacts of severe weather, and enable the transition to cleaner energy resources ▪ The rate adjustment also supports programs that help customers save energy and money, including programs that further increase assistance for low-income households Test Period January 1, 2025 – December 31, 2025 Test Year 2025 Common Equity Ratio N/A(1) Approved Rate of Return N/A(1) Final Rate Base (Adjusted) $8,855.6M Final Revenue Requirement Increase $290.0M (2,3) Residential Total Bill % Increase 10.0%(4) Detailed Rate Case Schedule Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Initial briefs Intervenor testimony 9/12/2024 6/17/2024 Reply briefs Filed rate case Final Commission order 3/28/2024 Rebuttal testimony 8/8/2024 & 8/12/2024 7/16/2024 Evidentiary hearings 12/12/2024 9/6/2024 (1) The black box settlement does not stipulate ROE or Equity Ratio. (2) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings, but excludes the Distribution System Improvement Charge (DSIC) revenues of $64M being rolled into base distribution rates. (3) Base rate revenue increase of $354M, which is partially offset by a one-time credit of $64M in 2025, resulting in a net revenue increase of $290M in 2025. The one-time credit of $64M includes ~$48M for incremental COVID-19 related uncollectible expense and ~$16M for dark fiber revenues. (4) Residential total bill increase of 10.0% in 2025 based on $290M which includes one-time credit of $64M, and an increase of 12.0% beyond 2025 based on $354M. Final Order

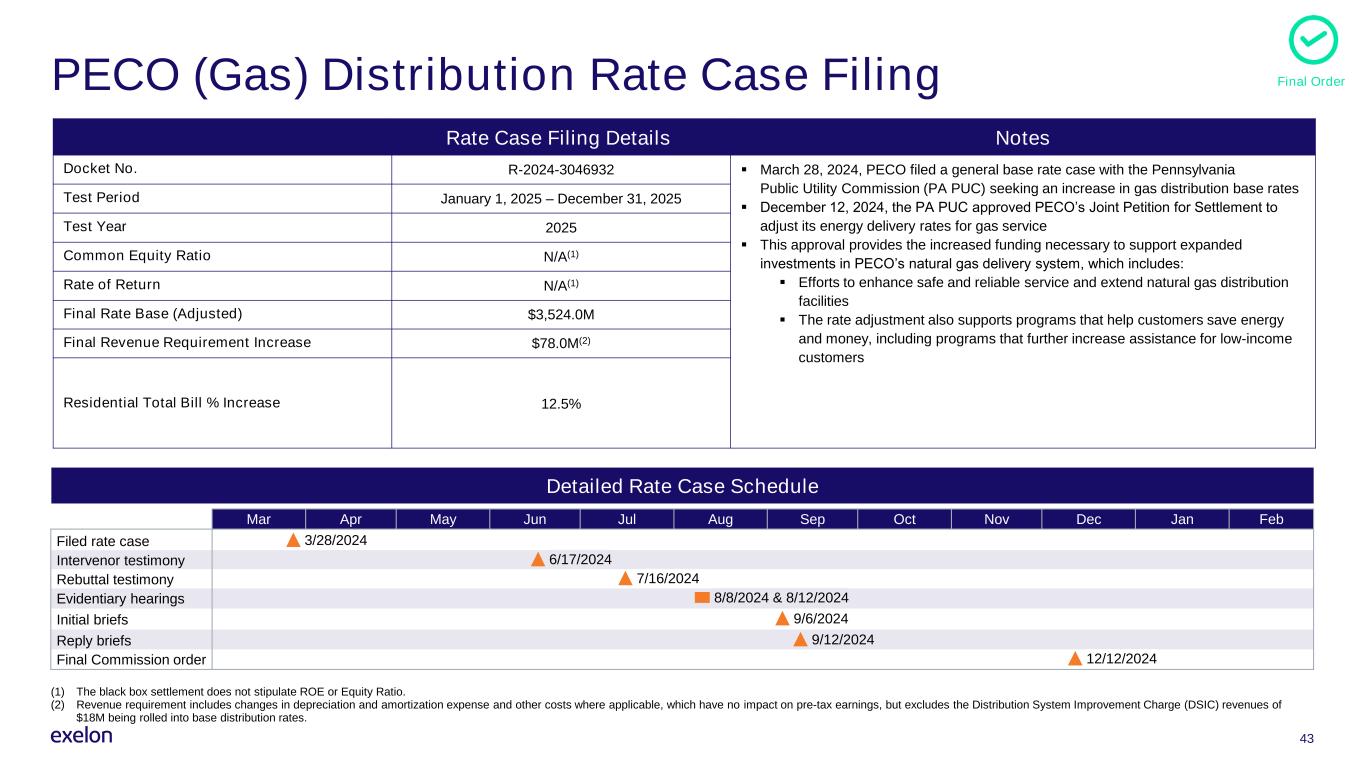

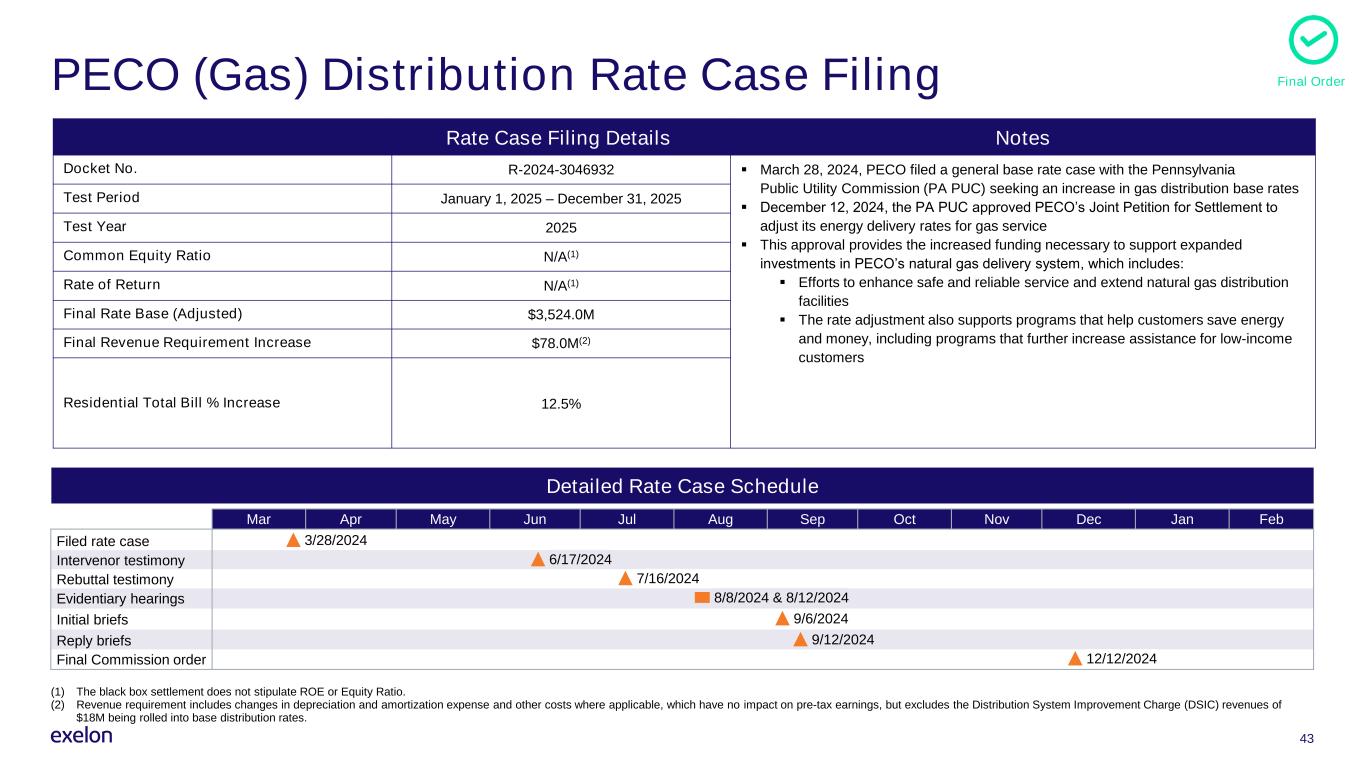

43 PECO (Gas) Distribution Rate Case Filing Rate Case Filing Details Notes Docket No. R-2024-3046932 ▪ March 28, 2024, PECO filed a general base rate case with the Pennsylvania Public Utility Commission (PA PUC) seeking an increase in gas distribution base rates ▪ December 12, 2024, the PA PUC approved PECO’s Joint Petition for Settlement to adjust its energy delivery rates for gas service ▪ This approval provides the increased funding necessary to support expanded investments in PECO’s natural gas delivery system, which includes: ▪ Efforts to enhance safe and reliable service and extend natural gas distribution facilities ▪ The rate adjustment also supports programs that help customers save energy and money, including programs that further increase assistance for low-income customers Test Period January 1, 2025 – December 31, 2025 Test Year 2025 Common Equity Ratio N/A(1) Rate of Return N/A(1) Final Rate Base (Adjusted) $3,524.0M Final Revenue Requirement Increase $78.0M(2) Residential Total Bill % Increase 12.5% Detailed Rate Case Schedule (1) The black box settlement does not stipulate ROE or Equity Ratio. (2) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings, but excludes the Distribution System Improvement Charge (DSIC) revenues of $18M being rolled into base distribution rates. Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Initial briefs Intervenor testimony 9/12/2024 6/17/2024 Reply briefs Filed rate case Final Commission order 3/28/2024 Rebuttal testimony 8/8/2024 & 8/12/2024 7/16/2024 Evidentiary hearings 12/12/2024 9/6/2024 Final Order

44 DPL DE (Gas) Distribution Rate Case Filing Rate Case Filing Details Notes Docket No. 24-1044 ▪ September 20, 2024, Delmarva Power filed an application with the Delaware Public Service Commission (DE PSC) seeking an increase in gas distribution base rates ▪ Size of ask is driven by continued investments in gas distribution system to maintain reliability, customer service, and safety. The filing includes major projects such as: ▪ Pipeline Integrity Management: Inspects and maintains gas mains and valves, ensuring reliable energy and faster leak detection. ▪ Cast Iron Replacement: Upgrading old pipes with safer, more reliable polyethylene, finishing five years ahead of schedule. ▪ LNG Plant Upgrade: Enables efficient refilling during winter, ensuring a stable gas supply during peak demand which allows for improved bill predictability for customers. ▪ DPL is proposing a gas weather normalization adjustment, effective from October to May designed to adjust for differences between normalized, historical and actual weather ▪ The adjustment will provide customers with more bill predictability, while allowing DPL the opportunity to earn its authorized distribution revenues Test Period 9 months estimated + 3 months actual Test Year April 1, 2024 – March 31, 2025 Proposed Common Equity Ratio 50.50% Proposed Rate of Return ROE: 10.65%: ROR: 7.55% Proposed Rate Base (Adjusted) $609M Requested Revenue Requirement Increase $38.5M(1) Residential Total Bill % Increase 18.6% Detailed Rate Case Schedule Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Rebuttal testimony Initial briefs Intervenor testimony Filed rate case 9/20/2024 Evidentiary hearings Reply briefs 7/25/2025 9/5/2025 11/12/2025 - 11/13/2025 Commission order expected(2) (1) Requested revenue requirement excludes the transfer of $6.4M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. As permitted by Delaware law, Delmarva Power may implement full proposed rates on April 20, 2025, subject to refund. (2) There is no statutory deadline by which the Commission needs to rule.

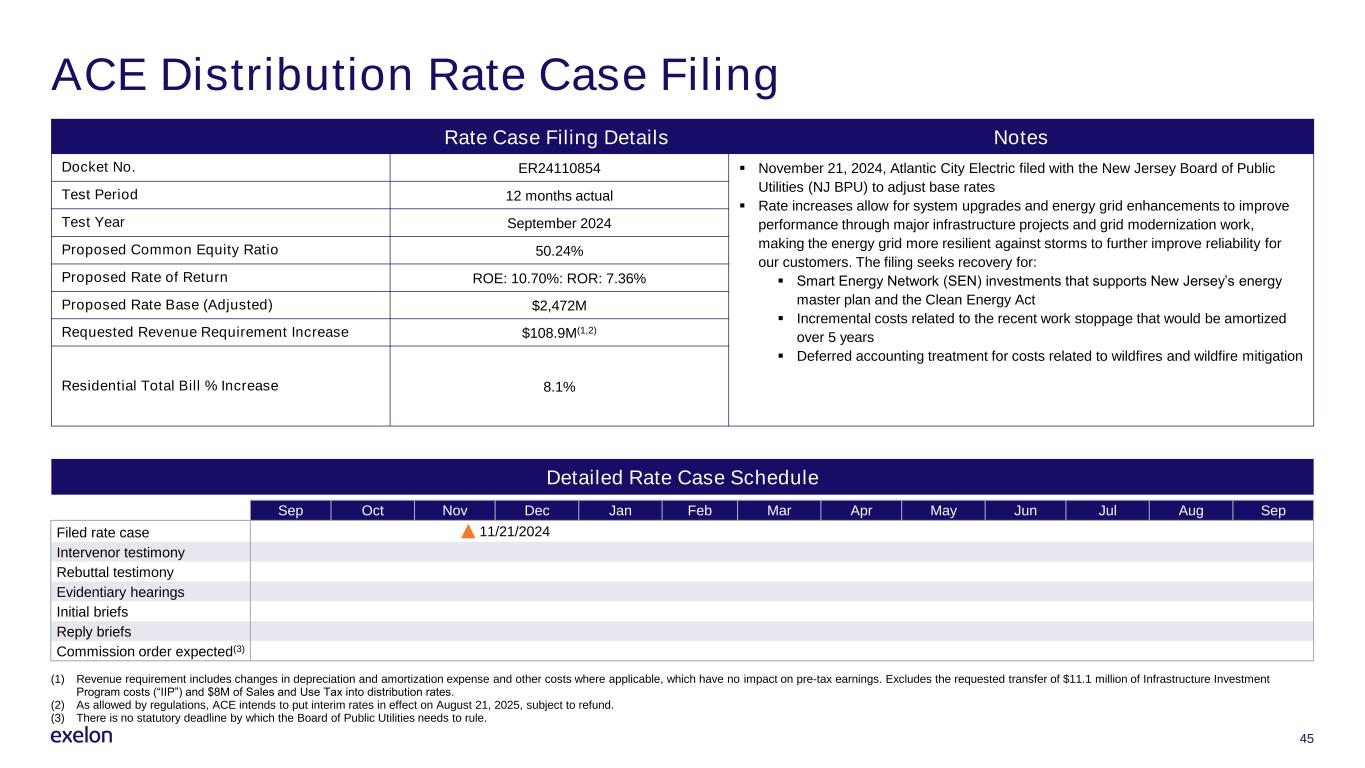

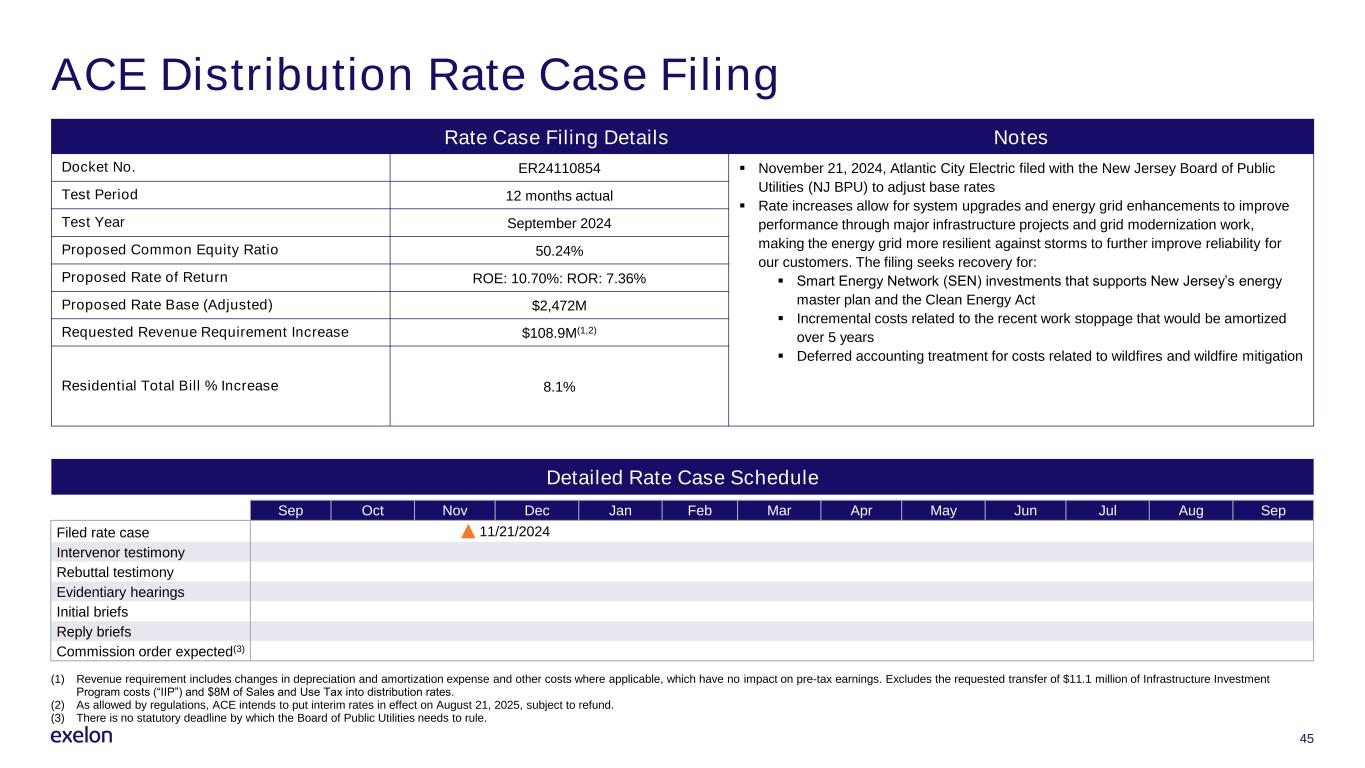

45 ACE Distribution Rate Case Filing Rate Case Filing Details Notes Docket No. ER24110854 ▪ November 21, 2024, Atlantic City Electric filed with the New Jersey Board of Public Utilities (NJ BPU) to adjust base rates ▪ Rate increases allow for system upgrades and energy grid enhancements to improve performance through major infrastructure projects and grid modernization work, making the energy grid more resilient against storms to further improve reliability for our customers. The filing seeks recovery for: ▪ Smart Energy Network (SEN) investments that supports New Jersey’s energy master plan and the Clean Energy Act ▪ Incremental costs related to the recent work stoppage that would be amortized over 5 years ▪ Deferred accounting treatment for costs related to wildfires and wildfire mitigation Test Period 12 months actual Test Year September 2024 Proposed Common Equity Ratio 50.24% Proposed Rate of Return ROE: 10.70%: ROR: 7.36% Proposed Rate Base (Adjusted) $2,472M Requested Revenue Requirement Increase $108.9M(1,2) Residential Total Bill % Increase 8.1% Detailed Rate Case Schedule (1) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. Excludes the requested transfer of $11.1 million of Infrastructure Investment Program costs (“IIP”) and $8M of Sales and Use Tax into distribution rates. (2) As allowed by regulations, ACE intends to put interim rates in effect on August 21, 2025, subject to refund. (3) There is no statutory deadline by which the Board of Public Utilities needs to rule. Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Filed rate case Intervenor testimony Rebuttal testimony Evidentiary hearings Initial briefs Reply briefs Commission order expected(3) 11/21/2024

46 Approved Electric Distribution Rate Case Financials Approved Electric Distribution Rate Case Financials Revenue Requirement Increase/(Decrease) Allowed ROE Common Equity Ratio Rate Effective Date ComEd (Electric) (1,2) $1,045.0M 8.905% 50.0% Jan 1, 2024 PECO (Electric) (3) $290.0M N/A N/A Jan 1, 2025 BGE (Electric) (4,5) $179.1M 9.50% 52.00% Jan 1, 2024 Pepco MD (Electric) (6) $44.6M 9.50% 50.50% Apr 1, 2024 Pepco D.C. (Electric) (7) $123.4M 9.50% 50.50% Jan 1, 2025 DPL MD (Electric) (8) $28.9M 9.60% 50.50% Jan 1, 2023 DPL DE (Electric) (9) $27.8M 9.60% 50.50% April 24, 2024 ACE (Electric) (10) $45.0M 9.60% 50.20% Dec 1, 2023 (1) Reflects a four-year cumulative multi-year rate plan for January 1, 2024 to December 31, 2027. The MRP was originally approved by the ICC on December 14, 2023, and was subsequently amended on January 10, 2024, April 18, 2024, and December 19, 2024. The December 19, 2024, order provided a total revenue requirement increase of $1.045 billion, inclusive of rate increases of approximately $752 million in 2024, $80 million in 2025, $102 million in 2026, and $111 million in 2027. ComEd originally requested a $1.487 bn increase from 2024-2027. On January 10, 2024, ComEd filed an appeal with the Illinois Appellate Court of various aspects of the ICC’s final order on which rehearing was denied, including the 8.905% ROE, 50% equity ratio, and denial of any return on ComEd’s pension asset. 2023 revenues included $32M in revenue resulting from the debt return earned on ComEd’s $771M distribution pension asset, net of ADIT. (2) Separately, on October 31, 2024, ComEd received a Final Order from the ICC approving $623M of its 2023 formula rate reconciliation under docket 24-0304. (3) The PA PUC issued an order on December 12, 2024 approving the Joint Petition for Settlement with rates effective on January 1, 2025. Base rate revenue increase of $354M, which is partially offset by a one-time credit of $64M in 2025, resulting in a net revenue increase of $290M in 2025. The one-time credit of $64M includes ~$48M for incremental COVID-19 related uncollectible expense and ~$16M for dark fiber revenues. The settlement does not stipulate any ROE, Equity Ratio or Rate Base. (4) Reflects a 3-year cumulative multi-year plan for 2024-2026. The MDPSC awarded incremental revenue requirement increases of $167M, $175M, and $66M with in each rate effective year, respectively. The incremental revenue requirement increase in 2024 reflects $41M increase for electric and $126M increase for gas; 2025 reflects $113M increase for electric and $62M increase for gas; 2026 reflects $25M increase for electric and $41M increase for gas. These include an acceleration of certain tax benefits in 2024 for both electric and gas. (5) Separately, on April 24, 2024, BGE filed with the MDPSC under case number 9645 its request for recovery of the 2023 reconciliation amounts of $79M and $73M for electric and gas, respectively. (6) Reflects a revenue adjustment for one year only. The Order was issued on June 10, 2024, and the Company filed its request for re-hearing on certain portions of the Order on July 9, 2024. In accordance with the Order on Expedited Request for Clarification issued on August 5, 2024, the rates shall stay in effect until Pepco files its next rate case. The Company is in the process of evaluating its options and determining the timeline for its next filing. (7) Reflects a cumulative multi-year plan from 2025 to 2026. The DC PSC approved $123.4M of incremental revenue requirement increase with $99.7M and $23.7M of that increase going into effect with rates on January 1, 2025 and January 1, 2026, respectively. (8) Reflects 3-year cumulative multi-year plan. On October 7, 2022, DPL filed a partial settlement with the MDPSC, which included incremental revenue requirement increases of $16.9M, $6.0M and $6.0M with rates effective January 1, 2023, January 1, 2024, and January 1, 2025, respectively. The MDPSC approved the settlement without modification on December 14, 2022. (9) Revenue requirement excludes the transfer of $14.4M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. Delmarva Power implemented fully proposed rates on July 15, 2023. (10) On November 17, 2023 the NJBPU approved the Company’s Settlement that reflects an overall increase of $45M to base distribution rates which is occurring in two phases. Phase I rates reflecting a $36M increase to base distribution rates became effective as of December 1, 2023. Phase II rates reflecting a $9M increase to base distribution rates became effective as of February 1, 2024.

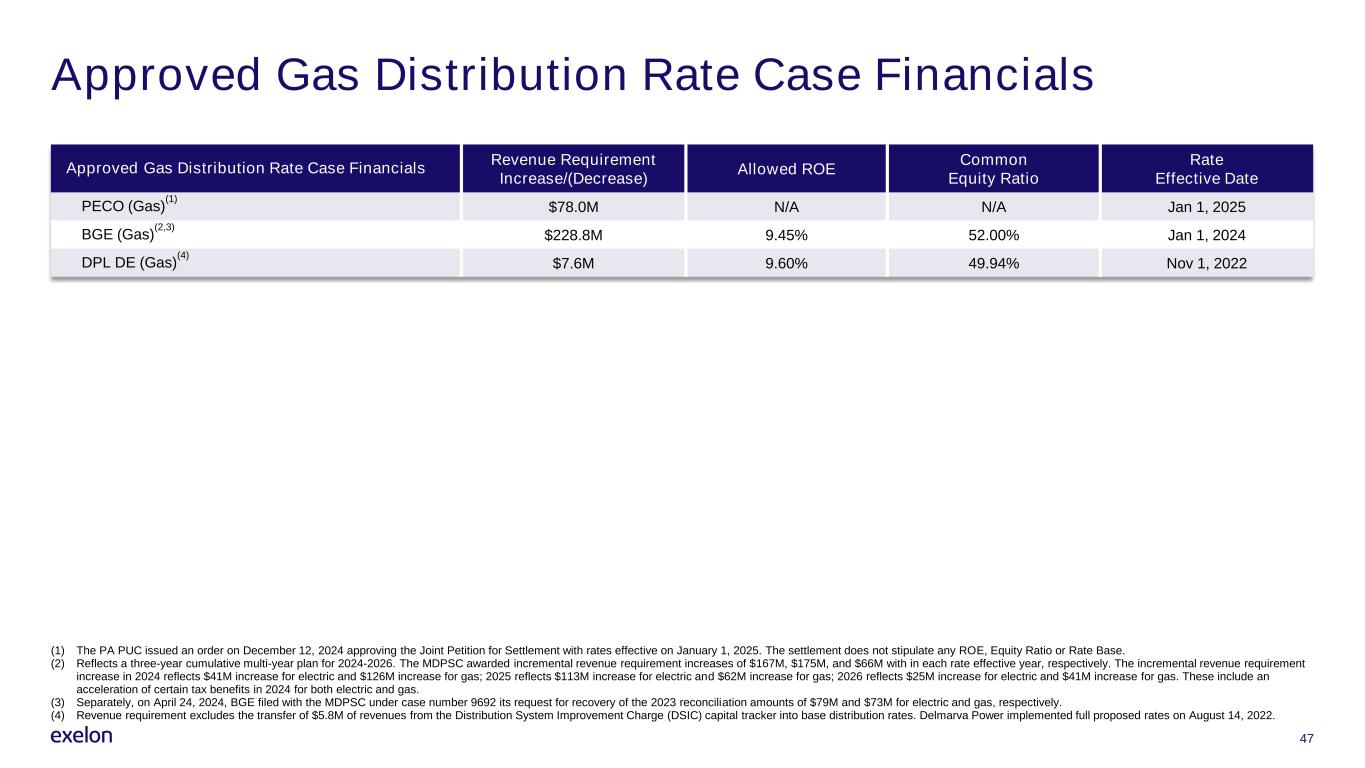

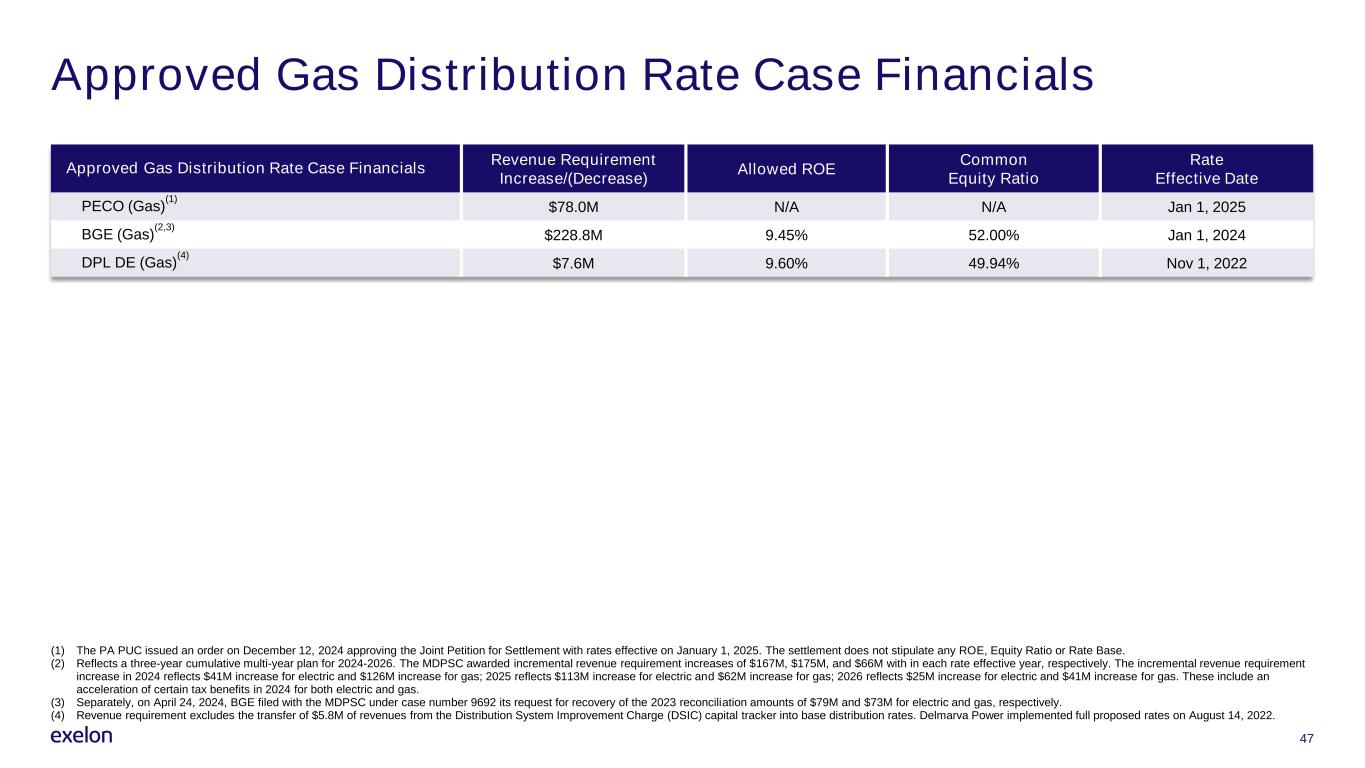

47 Approved Gas Distribution Rate Case Financials Approved Gas Distribution Rate Case Financials Revenue Requirement Increase/(Decrease) Allowed ROE Common Equity Ratio Rate Effective Date PECO (Gas) (1) $78.0M N/A N/A Jan 1, 2025 BGE (Gas) (2,3) $228.8M 9.45% 52.00% Jan 1, 2024 DPL DE (Gas) (4) $7.6M 9.60% 49.94% Nov 1, 2022 (1) The PA PUC issued an order on December 12, 2024 approving the Joint Petition for Settlement with rates effective on January 1, 2025. The settlement does not stipulate any ROE, Equity Ratio or Rate Base. (2) Reflects a three-year cumulative multi-year plan for 2024-2026. The MDPSC awarded incremental revenue requirement increases of $167M, $175M, and $66M with in each rate effective year, respectively. The incremental revenue requirement increase in 2024 reflects $41M increase for electric and $126M increase for gas; 2025 reflects $113M increase for electric and $62M increase for gas; 2026 reflects $25M increase for electric and $41M increase for gas. These include an acceleration of certain tax benefits in 2024 for both electric and gas. (3) Separately, on April 24, 2024, BGE filed with the MDPSC under case number 9692 its request for recovery of the 2023 reconciliation amounts of $79M and $73M for electric and gas, respectively. (4) Revenue requirement excludes the transfer of $5.8M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. Delmarva Power implemented full proposed rates on August 14, 2022.

48 Approved Electric Transmission Formula Rate Financials Approved Electric Transmission Formula Rate Financials Revenue Requirement Increase/(Decrease) Allowed ROE(1) Common Equity Ratio Rate Effective Date(2) ComEd $20M 11.50% 54.82% Jun 1, 2024 PECO $3M 10.35% 53.56% Jun 1, 2024 BGE $53M 10.50% 53.80% Jun 1, 2024 Pepco $73M 10.50% 50.28% Jun 1, 2024 DPL $24M 10.50% 50.52% Jun 1, 2024 ACE $33M 10.50% 50.20% Jun 1, 2024 (1) The rate of return on common equity for each Utility Registrant includes a 50-basis-point incentive adder for being a member of a RTO. (2) All rates are effective June 1, 2024 - May 31, 2025, subject to review by interested parties pursuant to protocols of each tariff.

49 Reconciliation of Non-GAAP Measures

50 Projected GAAP to Operating Adjustments • There are no adjustments between 2025 projected GAAP earnings and adjusted (non-GAAP) operating earnings currently.

51 GAAP to Non-GAAP Reconciliations(1) GAAP Operating Income + Depreciation & Amortization = EBITDA - Cash Paid for Interest +/- Cash Taxes +/- Other S&P FFO Adjustments = FFO (a) Long-Term Debt + Short-Term Debt + Underfunded Pension (after-tax) + Underfunded OPEB (after-tax) + Operating Lease Imputed Debt - Cash on Balance Sheet +/- Other S&P Debt Adjustments = Adjusted Debt (b) S&P FFO Calculation(2) S&P Adjusted Debt Calculation(2) Moody’s CFO (Pre-WC)/Debt (3) = CFO (Pre-WC) (c) Adjusted Debt (d) Moody’s CFO (Pre-WC) Calculation(3) Cash Flow From Operations +/- Working Capital Adjustment + Energy Efficiency Spend +/- Carbon Mitigation Credits +/- Other Moody’s CFO Adjustments = CFO (Pre-Working Capital) (c) Long-Term Debt + Short-Term Debt + Underfunded Pension (pre-tax) + Operating Lease Imputed Debt +/- Other Moody’s Debt Adjustments = Adjusted Debt (d) S&P FFO/Debt (2) = FFO (a) Adjusted Debt (b) Moody’s Adjusted Debt Calculation(3) (1) Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be currently available; therefore, management is unable to reconcile these measures. (2) Calculated using S&P Methodology. (3) Calculated using Moody’s Methodology.

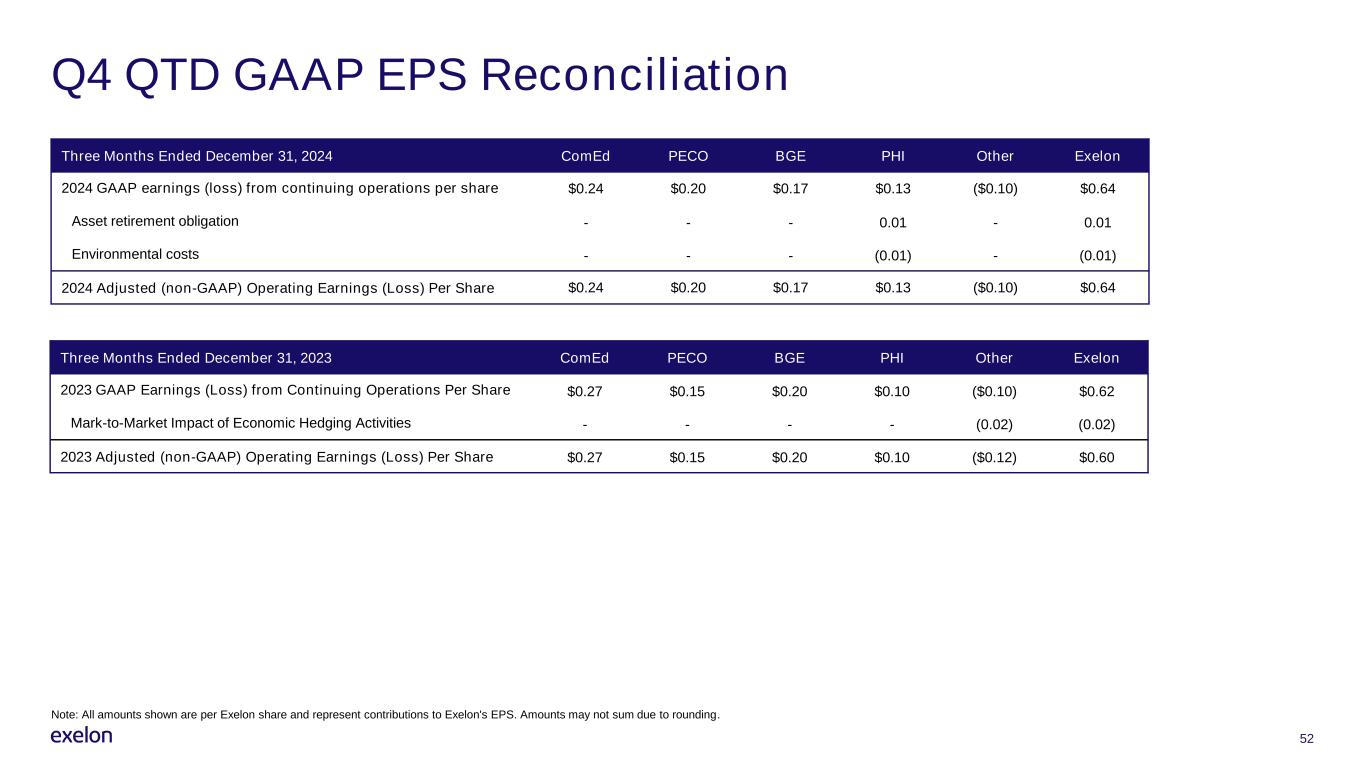

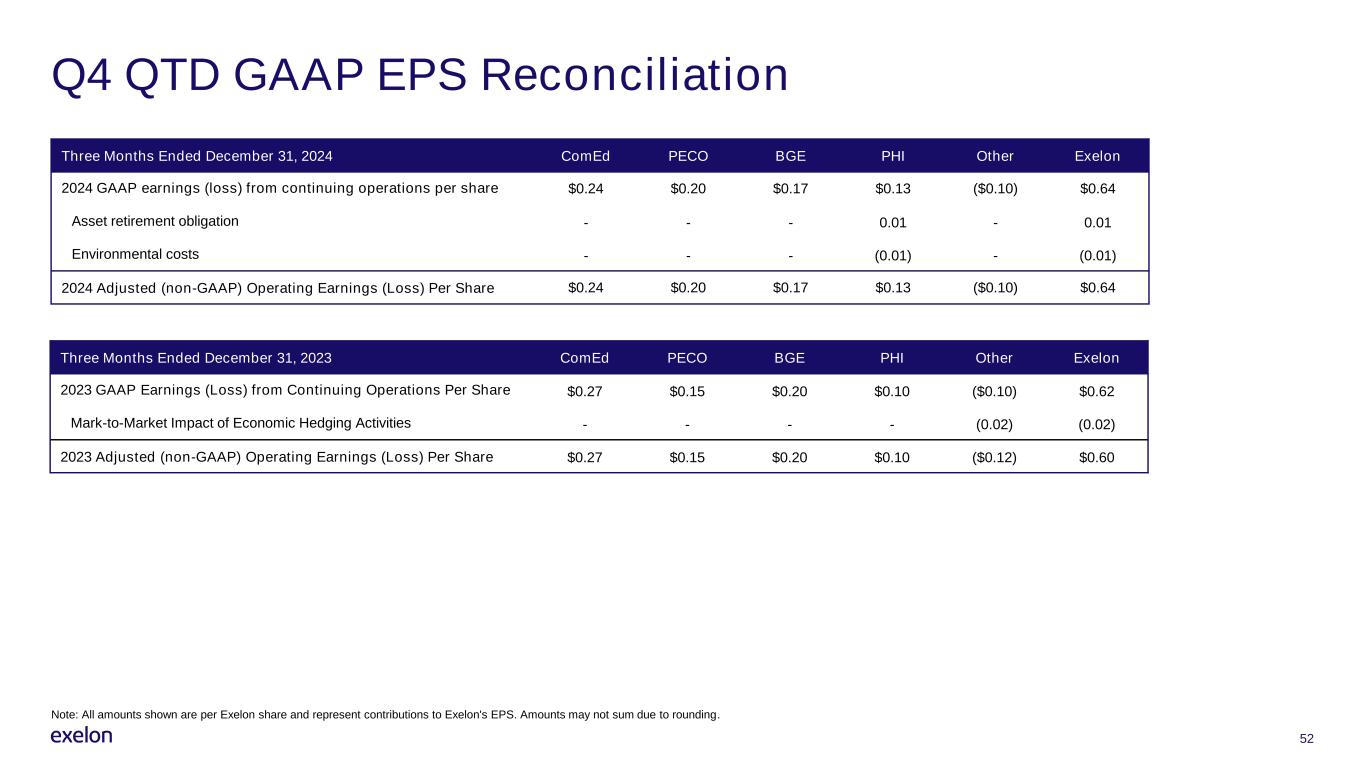

52 Q4 QTD GAAP EPS Reconciliation Three Months Ended December 31, 2024 ComEd PECO BGE PHI Other Exelon 2024 GAAP earnings (loss) from continuing operations per share $0.24 $0.20 $0.17 $0.13 ($0.10) $0.64 Asset retirement obligation - - - 0.01 - 0.01 Environmental costs - - - (0.01) - (0.01) 2024 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.24 $0.20 $0.17 $0.13 ($0.10) $0.64 Note: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not sum due to rounding. Three Months Ended December 31, 2023 ComEd PECO BGE PHI Other Exelon 2023 GAAP Earnings (Loss) from Continuing Operations Per Share $0.27 $0.15 $0.20 $0.10 ($0.10) $0.62 Mark-to-Market Impact of Economic Hedging Activities - - - - (0.02) (0.02) 2023 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.27 $0.15 $0.20 $0.10 ($0.12) $0.60

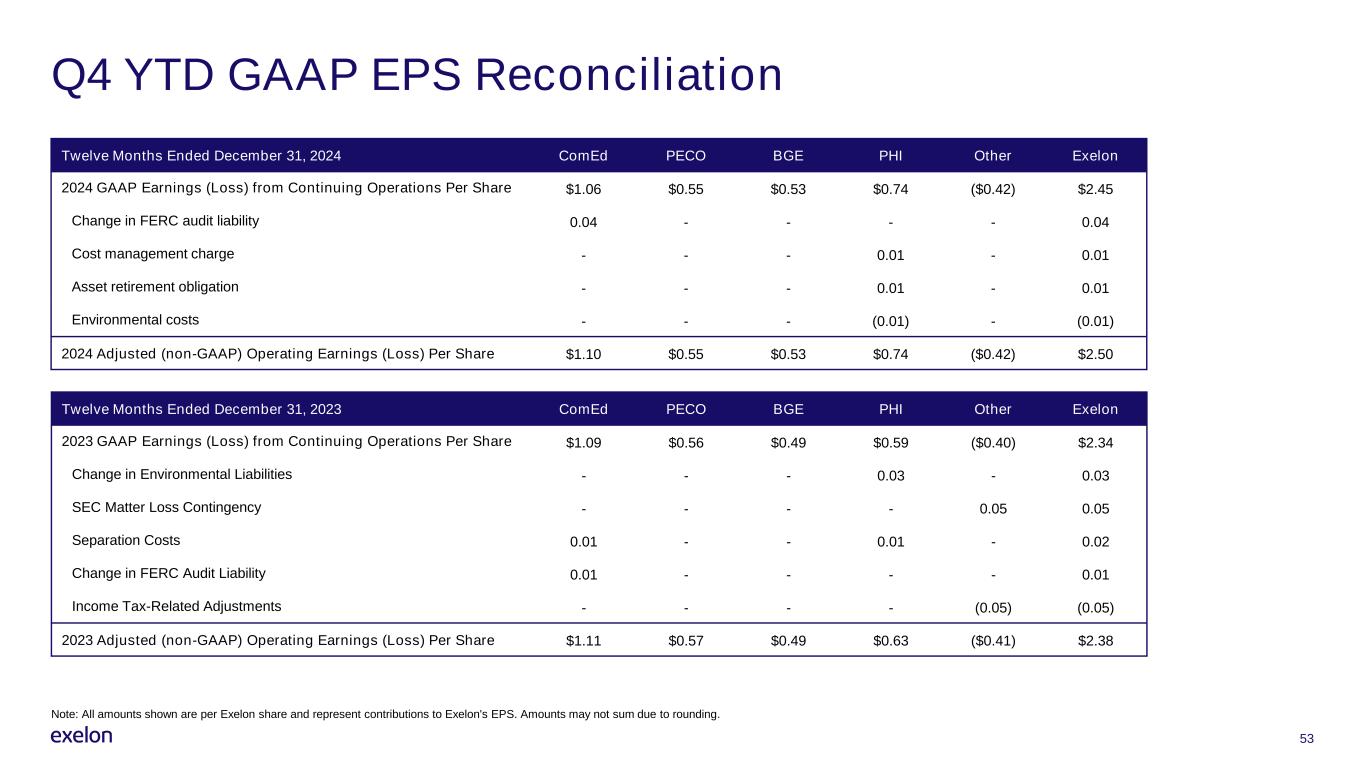

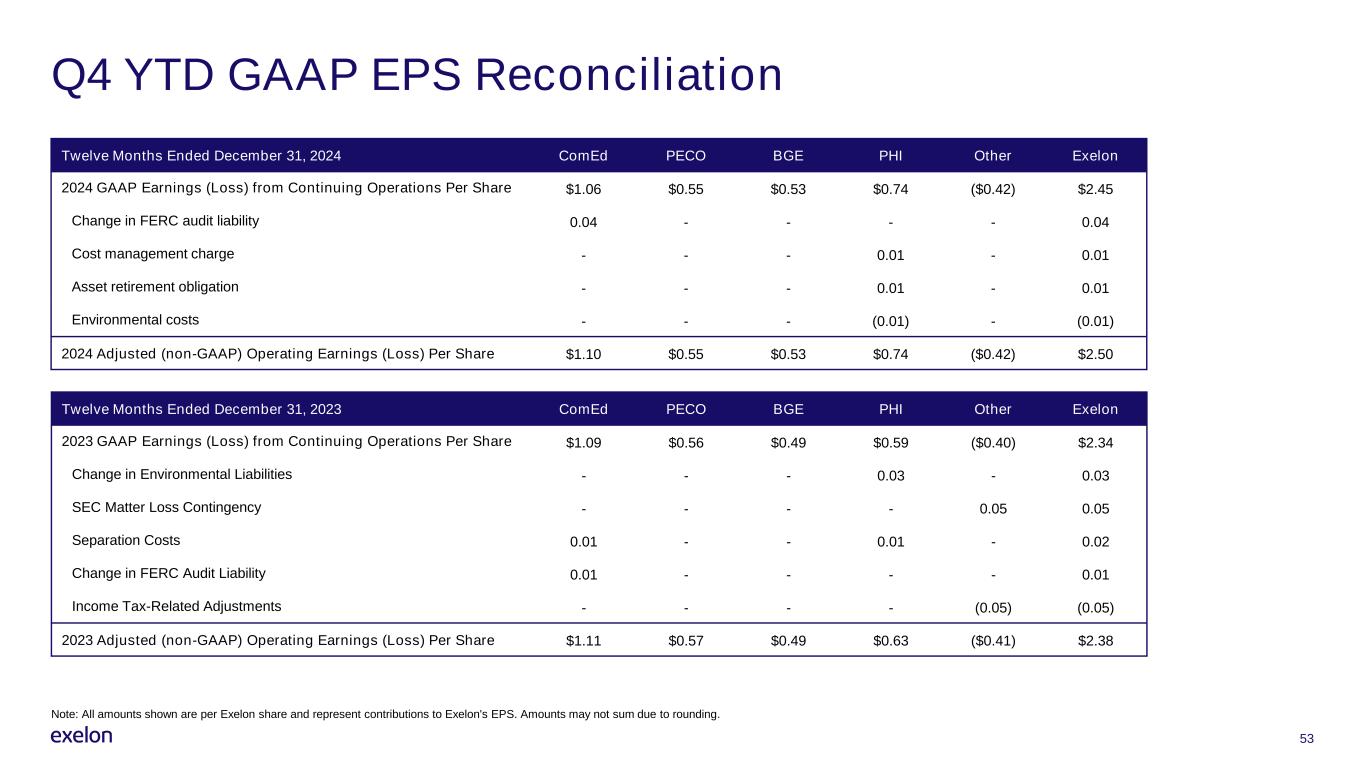

53 Q4 YTD GAAP EPS Reconciliation Twelve Months Ended December 31, 2024 ComEd PECO BGE PHI Other Exelon 2024 GAAP Earnings (Loss) from Continuing Operations Per Share $1.06 $0.55 $0.53 $0.74 ($0.42) $2.45 Change in FERC audit liability 0.04 - - - - 0.04 Cost management charge - - - 0.01 - 0.01 Asset retirement obligation - - - 0.01 - 0.01 Environmental costs - - - (0.01) - (0.01) 2024 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $1.10 $0.55 $0.53 $0.74 ($0.42) $2.50 Note: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not sum due to rounding. Twelve Months Ended December 31, 2023 ComEd PECO BGE PHI Other Exelon 2023 GAAP Earnings (Loss) from Continuing Operations Per Share $1.09 $0.56 $0.49 $0.59 ($0.40) $2.34 Change in Environmental Liabilities - - - 0.03 - 0.03 SEC Matter Loss Contingency - - - - 0.05 0.05 Separation Costs 0.01 - - 0.01 - 0.02 Change in FERC Audit Liability 0.01 - - - - 0.01 Income Tax-Related Adjustments - - - - (0.05) (0.05) 2023 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $1.11 $0.57 $0.49 $0.63 ($0.41) $2.38

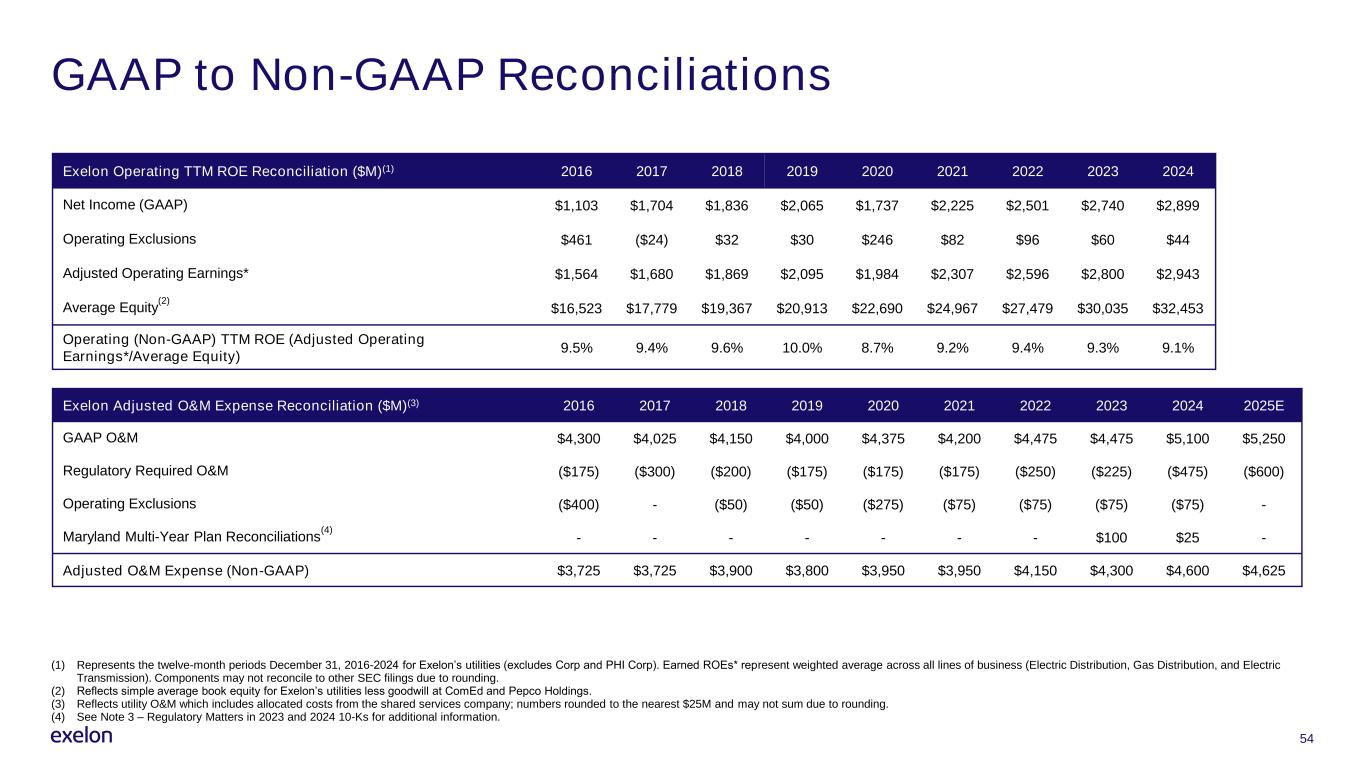

54 GAAP to Non-GAAP Reconciliations (1) Represents the twelve-month periods December 31, 2016-2024 for Exelon’s utilities (excludes Corp and PHI Corp). Earned ROEs* represent weighted average across all lines of business (Electric Distribution, Gas Distribution, and Electric Transmission). Components may not reconcile to other SEC filings due to rounding. (2) Reflects simple average book equity for Exelon’s utilities less goodwill at ComEd and Pepco Holdings. (3) Reflects utility O&M which includes allocated costs from the shared services company; numbers rounded to the nearest $25M and may not sum due to rounding. (4) See Note 3 – Regulatory Matters in 2023 and 2024 10-Ks for additional information. Exelon Operating TTM ROE Reconciliation ($M)(1) 2016 2017 2018 2019 2020 2021 2022 2023 2024 Net Income (GAAP) $1,103 $1,704 $1,836 $2,065 $1,737 $2,225 $2,501 $2,740 $2,899 Operating Exclusions $461 ($24) $32 $30 $246 $82 $96 $60 $44 Adjusted Operating Earnings* $1,564 $1,680 $1,869 $2,095 $1,984 $2,307 $2,596 $2,800 $2,943 Average Equity (2) $16,523 $17,779 $19,367 $20,913 $22,690 $24,967 $27,479 $30,035 $32,453 Operating (Non-GAAP) TTM ROE (Adjusted Operating Earnings*/Average Equity) 9.5% 9.4% 9.6% 10.0% 8.7% 9.2% 9.4% 9.3% 9.1% Exelon Adjusted O&M Expense Reconciliation ($M)(3) 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025E GAAP O&M $4,300 $4,025 $4,150 $4,000 $4,375 $4,200 $4,475 $4,475 $5,100 $5,250 Regulatory Required O&M ($175) ($300) ($200) ($175) ($175) ($175) ($250) ($225) ($475) ($600) Operating Exclusions ($400) - ($50) ($50) ($275) ($75) ($75) ($75) ($75) - Maryland Multi-Year Plan Reconciliations (4) - - - - - - - $100 $25 - Adjusted O&M Expense (Non-GAAP) $3,725 $3,725 $3,900 $3,800 $3,950 $3,950 $4,150 $4,300 $4,600 $4,625

Thank you Please direct all questions to the Exelon Investor Relations team: InvestorRelations@ExelonCorp.com 312-394-2345