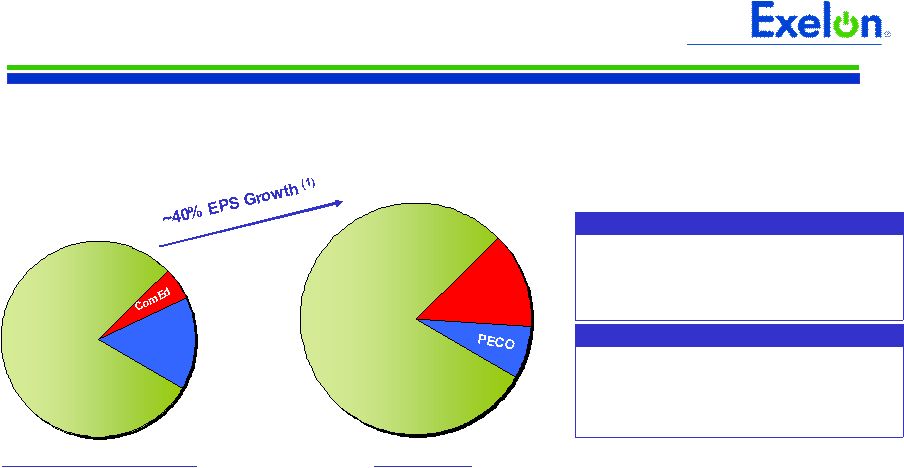

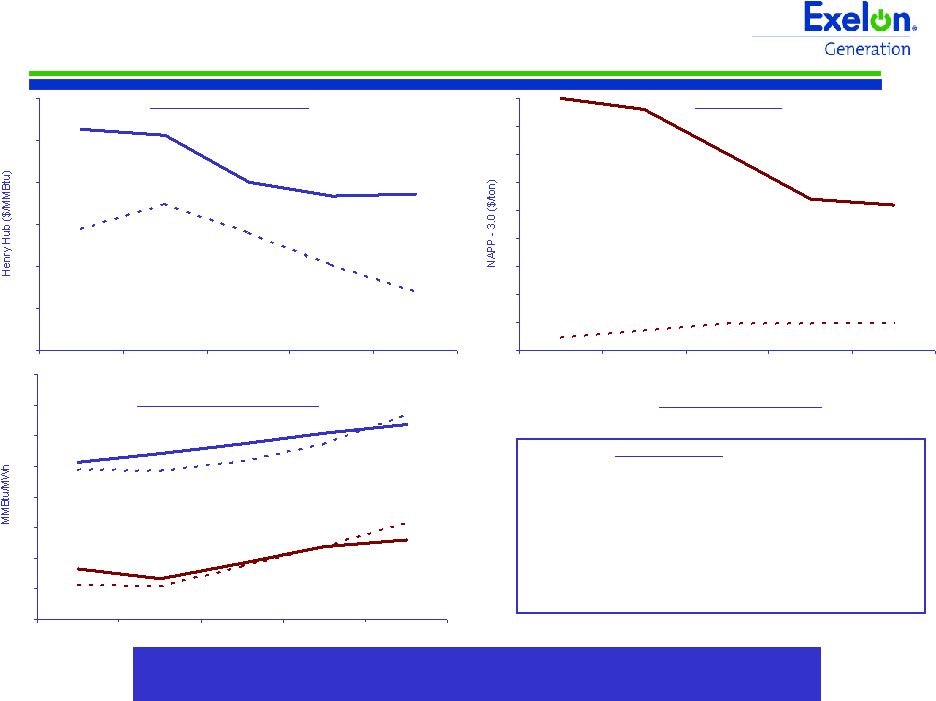

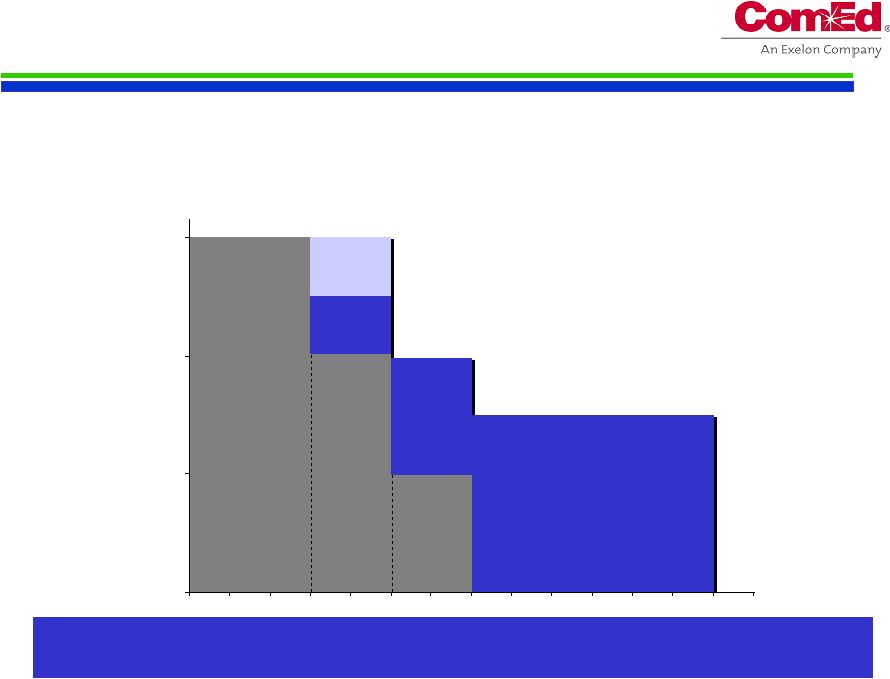

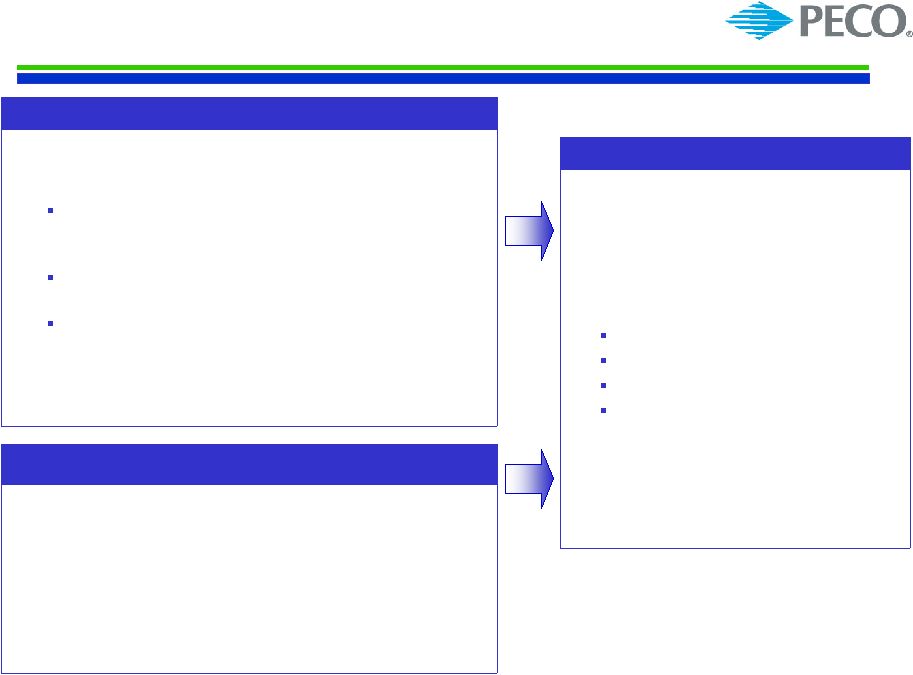

9 Protect Today’s Value • Deliver superior operating performance – Assure safety at all times – Keep the lights on – Maintain nuclear excellence – Enhance environmental performance • Advance competitive markets – Build economic new generation – Provide reliable, affordable, low-carbon products to customers – Support the continued improvement of organized competitive wholesale markets • Protect the value of our generation – Adapt the generation portfolio to a changing marketplace – Hedge market risk appropriately • Build healthy, self-sustaining delivery companies – Pursue fair regulatory treatment and restored financial health for ComEd – Manage PECO’s 2011 transition to market Grow Long-Term Value • Drive the organization to the next level of performance – Continuously improve productivity – Insist on accountability for results and values – Foster positive employee relations – Acquire, develop and retain key and diverse talent • Set the industry standard for low carbon energy generation and delivery through reductions, displacement and offsets – Aggressively pursue cost effective energy efficiency and demand response – Develop and deploy reliable and affordable gas-fired and renewable generation – Increase nuclear production – Become a model of green operations • Pursue and rigorously evaluate new growth opportunities + Exelon’s Strategic Direction |