1 ComEd Electric Distribution Rate Case June 30, 2010 Exhibit 99.2 |

2 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (1) Exelon’s 2009 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Exelon’s First Quarter 2010 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors, (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 12 and (3) other factors discussed in filings with the Securities and Exchange Commission (SEC) by Exelon Corporation and Commonwealth Edison Company (Companies). Readers are cautioned not to place undue reliance on these forward- looking statements, which apply only as of the date of this presentation. None of the Companies undertakes any obligation to publicly release any revision to its forward- looking statements to reflect events or circumstances after the date of this presentation. |

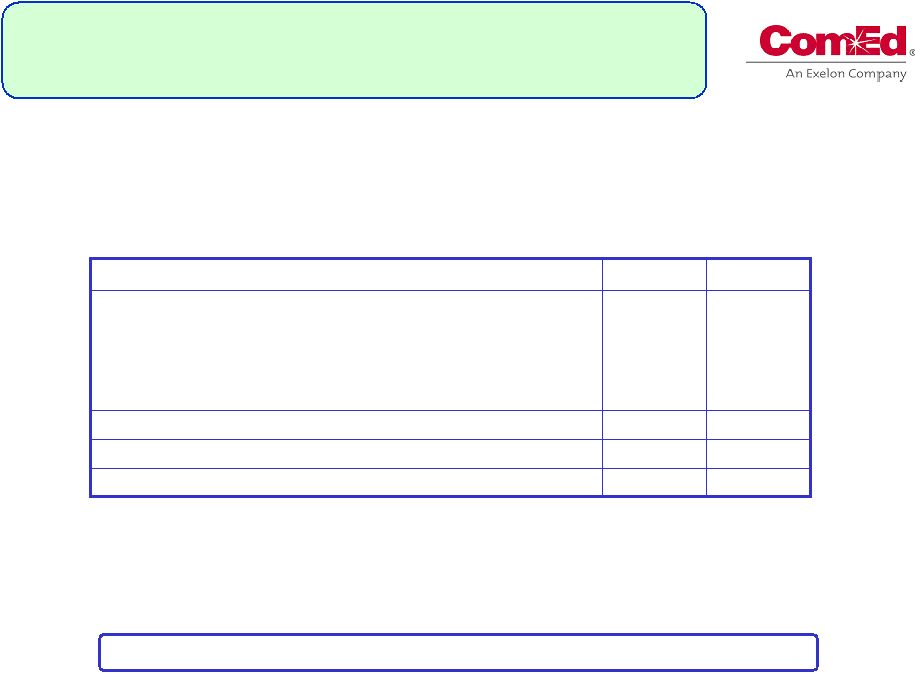

3 Delivery Service Rate Case Filing Summary $396 Total ($2,337 million revenue requirement) (6) $45 Other adjustments (5) $22 Bad debt costs (resets base level of bad debt to 2009 test year) $55 Pension and Post-retirement health care expenses (4) $95 Capital Structure (3) : ROE – 11.50% / Common Equity – 47.33% / ROR – 8.99% $179 (2) Rate Base: $7,717 million (1) Requested Revenue Increase ($ in millions) Primary drivers of rate request are new plant investment, pension/retiree health care and cost of capital (1) Filed June 30, 2010 based on 2009 test year, including pro forma capital additions through June 2011, and certain other 2010 pro forma adjustments. (2) Includes increased depreciation expense. (3) Requested capital structure does not include goodwill; ICC docket 07-0566 allowed 10.3% ROE, 45.04% equity ratio and 8.36% ROR. ROE includes 0.40% adder for energy efficiency incentive. (4) Reflects 2010 expense levels, compared to 2007 expense levels allowed in last rate case. (5) Includes reductions to O&M and taxes other than income, offset by wage increases, normalization of storm costs and the Illinois Electric Distribution Tax, other O&M increases, and decreases in load. (6) Net of Other Revenues. Note: ROE = Return on Equity, ROR = Return on Rate Base. |

4 Alternative Regulation (Alt Reg) Proposal • ComEd plans to make a companion Alt Reg filing proposing to recover the costs of smart grid and other projects outside of the traditional rate case process – 9-month statutory process • The proposal includes a “flow-through mechanism” to recover capital carrying costs and incremental O&M, as incurred • Costs and investments will be rolled in to future rate cases, when they occur • Assured savings to customers – $2 million on capped O&M costs for program costs (excluding CARE) • Includes an incentive/penalty mechanism for performance above or under budget Alt Reg Proposal is permitted under ICC section 9-244 $30 $15 Man-hole refurbishment and cable replacement - $10 Expanded funding for low income CARE programs $5 - Electric Vehicle Fleet Purchase $55 $40 - $10 - $20 Accelerated Smart Grid Deployment • 190,000 additional AMI Meters and Outage Management System Interface • Accelerated deployment of Distribution Automation • Customer Applications Capital O&M $ millions |

5 Residential Rate Design – Straight Fixed/Variable Proposal • Filing includes a proposal to gradually move more of residential delivery bill to the fixed customer charge, rather than usage-based kwh component through three step phase-in Current rate design: 37% fixed / 63% variable split Proposed: 60%/40% split in June 2011; 70%/30% in June 2012, and 80%/20% in June 2013 • Mitigates impact of weather and load fluctuations due to weather and economy • Rate design reflects current cost structure and sends appropriate price signals – Fixed costs to be collected via fixed charges (i.e. Customer Charge, Meter Charge) – Variable costs to be collected via variable charges (i.e. per kWh) • Eliminates economic disincentive to promote energy efficiency Proposed Straight Fixed/Variable rate design is consistent with ICC orders in other recent cases |

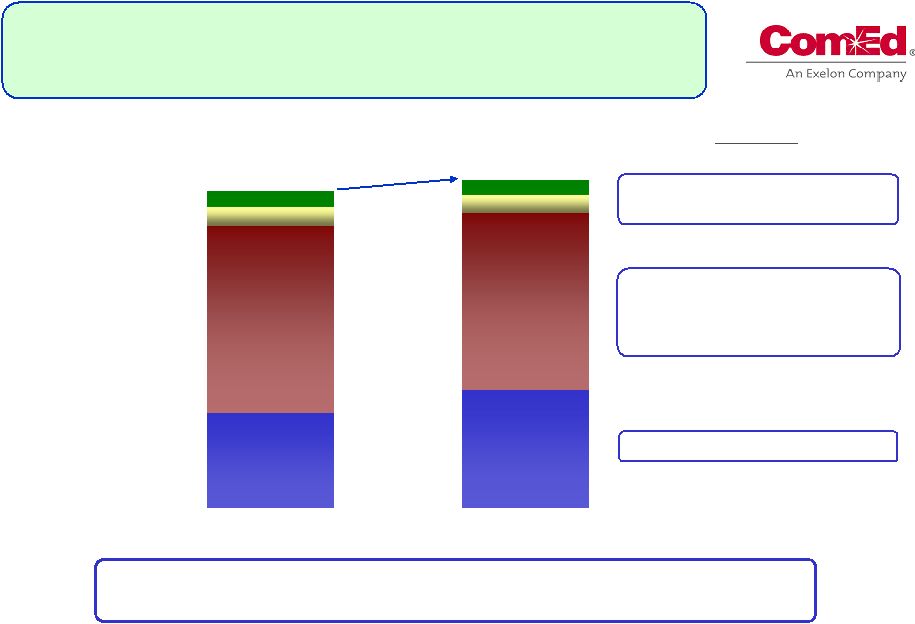

6 3.82 4.73 7.44 7.03 0.73 0.73 0.65 0.60 Residential Rate Impacts 2010 to 2011 (1) (1) Reflects change in distribution rates only. Assumes Energy, Transmission and all other components remain constant as of June 2010, except as noted above. (2) "All Other" includes impact of riders that are applicable to residential bills. Unit rates: cents / kWh All Other (2) Transmission Energy Distribution Approximately 4% increase July 1, 2010 July 1, 2011 Transmission: Subject to FERC formula rate annual update. Comments Energy: Reflects reduced PJM capacity price that PJM has published for the June 2011 – May 2012 planning period. Energy component may vary. Distribution: As proposed. 12.63 13.09 Note: Amounts may not add due to rounding. Proposed residential rate impact of 7% will be mitigated by impact of lower capacity prices resulting in an increase of 4% |

7 Delivery Service Rate Case Filing – Tentative Schedule • Delivery Service Rate Case Filed – June 30, 2010 • Alt Reg Proposal Filed – August / September 2010 • Intervenor and Rebuttal Testimony – 4Q 2010 • Hearings – December 2010 / January 2011 • Administrative Law Judge Order – February 2011 • Final Order Expected – May 2011 • New Rates Effective – June 2011 Note: Dates are based on typical approach to rate cases but the Illinois Commerce Commission (ICC) will set the actual schedule, which is expected in 3Q 2010. |