Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

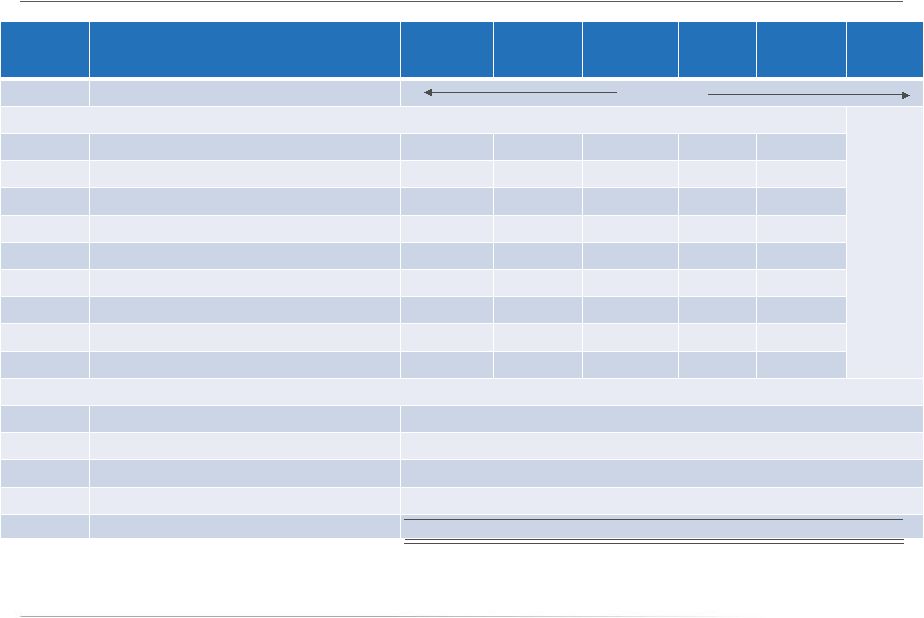

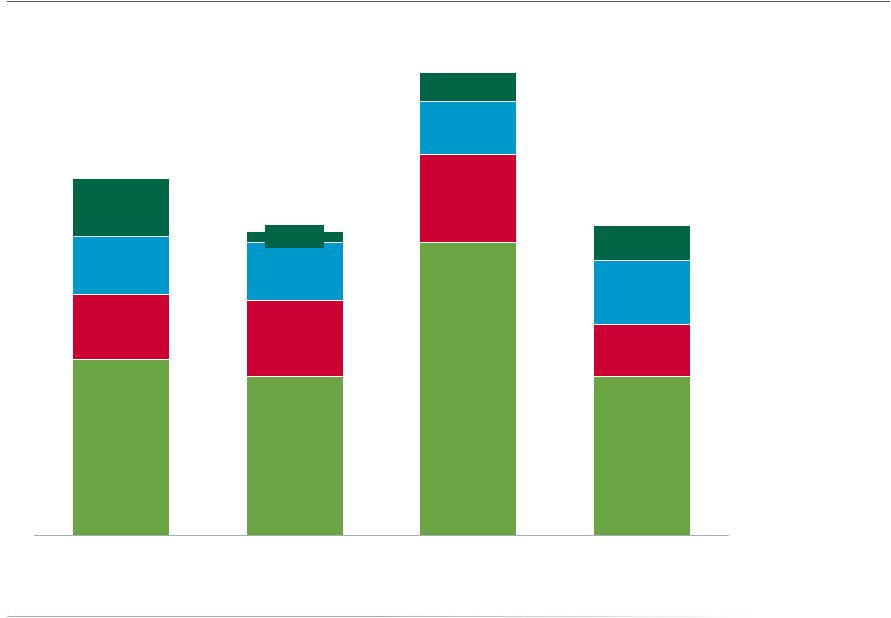

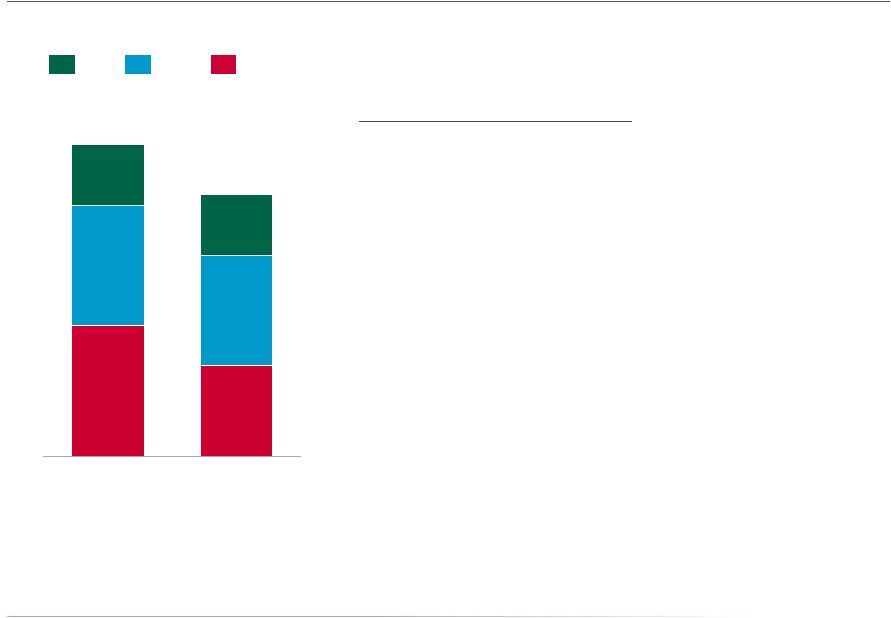

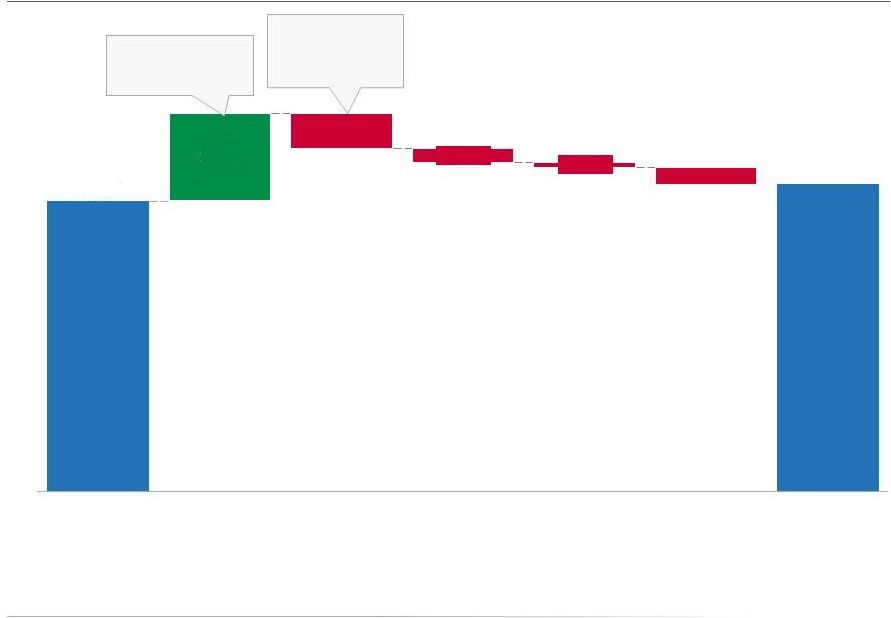

Filing tables

Filing exhibits

EXC similar filings

- 29 Apr 15 Exelon Announces First Quarter 2015 Results

- 27 Mar 15 PECO Requests PUC Approval to Make Additional Infrastructure Investments & Increase Electric Delivery Rates

- 17 Feb 15 Other Events

- 13 Feb 15 Results of Operations and Financial Condition

- 15 Jan 15 Departure of Directors or Certain Officers

- 14 Jan 15 Entry into a Material Definitive Agreement

- 14 Jan 15 Exelon and Pepco Holdings Inc. Reach Settlement Agreement

Filing view

External links