UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09869

Franklin Floating Rate Master Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(650)312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/24

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| | |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

| | Not Applicable. |

| | |

Franklin Floating Rate Master Series true | |

| Class A |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Floating Rate Master Series for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-internalusefunds-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $56 | 0.53% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class A shares of Franklin Floating Rate Master Series returned 10.10%. The Fund compares its performance to the Morningstar LSTA US Leveraged Loan Index, which returned 10.45% for the same period. The Fund previously compared its performance to the Credit Suisse Leveraged Loan Index, which returned 10.42% for the same period. Effective March 1, 2024, the Morningstar LSTA US Leveraged Loan Index replaced the Credit Suisse Leveraged Loan Index as the Fund’s benchmark. The Fund’s investment manager believes the Morningstar LSTA US Leveraged Loan Index is an appropriate benchmark for the Fund.

| |

Top contributors to performance: |

| ↑ | Prior to March 1, 2024, allocation to equity received from prior restructurings; loan selection in leisure, automotive transportation and financial issuers; underweight in upper-tier loans and overweight in middle-tier loans relative to the benchmark |

| ↑ | Post March 1, 2024, underweight in the housing, cable/wireless video and service industries; underweight in lower-tier loans; and loan selection in telecommunications, aerospace and diversified media issuers |

| |

Top detractors from performance: |

| ↓ | Prior to March 1, 2024, underweight to the housing industry; loan selection in service, retail and telecommunications issuers; and underweight in lower-tier loans |

| ↓ | Post March 1, 2024, allocation to equity received from prior restructurings; loan selection in service, health care and manufacturing issuers; overweight to land transportation industry; and underweight to telecommunications and energy relative to the benchmark |

| Franklin Floating Rate Master Series | PAGE 1 | 0924 |

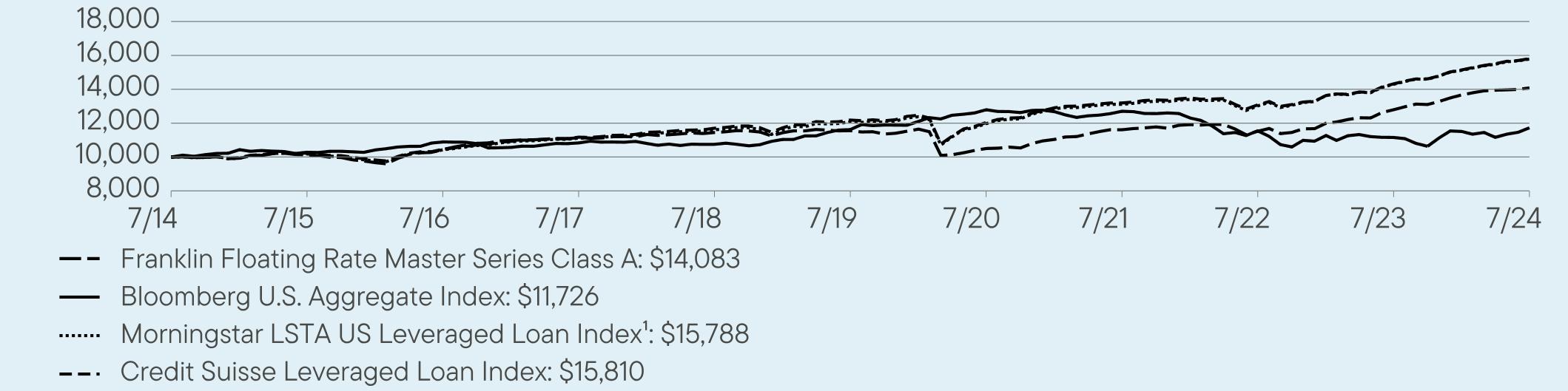

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class A 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A | 10.10 | 4.03 | 3.48 |

Bloomberg U.S. Aggregate Index | 5.10 | 0.19 | 1.60 |

Morningstar LSTA US Leveraged Loan Index1 | 10.45 | 5.50 | 4.67 |

Credit Suisse Leveraged Loan Index | 10.42 | 5.35 | 4.69 |

| 1 | Effective March 1, 2024, the Morningstar LSTA US Leveraged Loan Index replaced the Credit Suisse Leveraged Loan Index as the Fund’s benchmark. The Fund’s investment manager believes the Morningstar LSTA US Leveraged Loan Index is an appropriate benchmark for the Fund. |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $514,935,612 |

Total Number of Portfolio Holdings* | 318 |

Total Management Fee Paid | $2,171,569 |

Portfolio Turnover Rate | 49.16% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Floating Rate Master Series | PAGE 2 | 0924 |

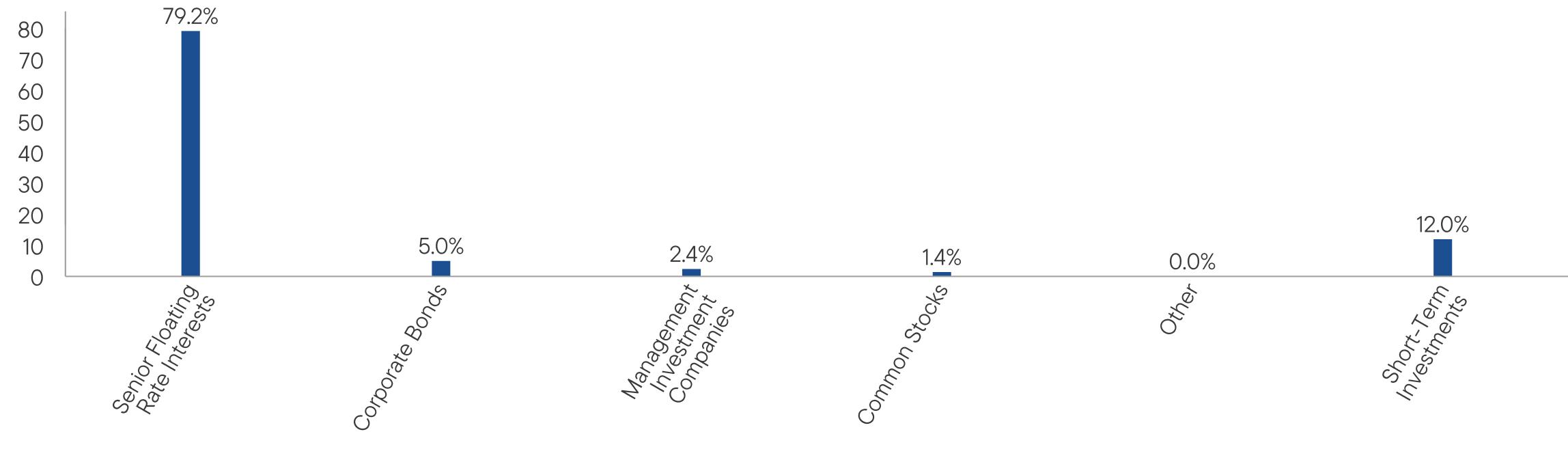

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-internalusefunds-documents, including its: |

| • proxy voting information • financial information • holdings • tax information |

| Franklin Floating Rate Master Series | PAGE 3 | 0924 |

100001013010441111411144611558105041160811523127911408310000102811089210835107491161712793127031154511156117261000010185104281112011611120791197413111130221429415788100001022910460111741170112181120351319013077143181581079.25.02.41.40.012.0

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 19(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Mary C. Choksi and she is “independent” as defined under the relevant Securities and Exchange Commission Rules and Releases.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $92,894 for the fiscal year ended July 31, 2024, and $90,991 for the fiscal year ended July 31, 2023.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning were $140,000 for the fiscal year ended July 31, 2024, and $70,000 for the fiscal year ended July 31, 2023. The services for which these fees were paid included global access to tax platform International Tax View.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $0 for the fiscal year ended July 31, 2024, and $205 for the fiscal year ended July 31, 2023. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant not reported in paragraphs (a)-(c) of Item 4 were $163,638 for the fiscal year ended July 31, 2024 and $94,715 for the fiscal year ended July 31, 2023. The services for which these fees were paid included professional services relating to the readiness

assessment over Greenhouse Gas Emissions and Energy, fees in connection with license for accounting and business knowledge platform Viewpoint, professional fees relating to security counts and professional fees in connection with SOC 1 Reports.

(e) (1) The registrant’s audit committee is directly responsible for approving the services to be provided by the auditors, including:

| (i) | pre-approval of all audit and audit related services; |

| (ii) | pre-approval of all non-audit related services to be provided to the Fund by the auditors; |

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant’s investment adviser or to any entity that controls, is controlled by or is under common control with the registrant’s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of audit committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The aggregate non-audit fees paid to the principal accountant for services rendered by the principal accountant to the registrant and the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant were $303,638 for the fiscal year ended July 31, 2024, and $164,920 for the fiscal year ended July 31, 2023.

(h) The registrant’s audit committee of the board has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) N/A

(j) N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Franklin

Floating

Rate

Master

Series

Financial

Statements

and

Other

Important

Information

Annual

|

July

31,

2024

Financial

Statements

and

Other

Important

Information—Annual

Financial

Highlights

and

Schedule

of

Investments

2

Financial

Statements

21

Notes

to

Financial

Statements

24

Report

of

Independent

Registered

Public

Accounting

Firm

32

Changes

In

and

Disagreements

with

Accountants

33

Results

of

Meeting(s)

of

Shareholders

33

Remuneration

Paid

to

Directors,

Officers

and

Others

33

Board

Approval

of

Management

and

Subadvisory

Agreements

33

Franklin

Floating

Rate

Master

Trust

Financial

Highlights

Franklin

Floating

Rate

Master

Series

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$7.13

$7.00

$7.38

$6.99

$8.18

Income

from

investment

operations

a

:

Net

investment

income

..........................

0.656

b

0.567

b

0.292

b

0.301

b

0.415

Net

realized

and

unrealized

gains

(losses)

...........

0.039

0.165

(0.341)

0.417

(1.141)

Total

from

investment

operations

....................

0.695

0.732

(0.049)

0.718

(0.726)

Less

distributions

from:

Net

investment

income

..........................

(0.695)

(0.602)

(0.331)

(0.328)

(0.464)

Net

asset

value,

end

of

year

.......................

$7.13

$7.13

$7.00

$7.38

$6.99

Total

return

....................................

10.10%

11.00%

(0.73)%

10.51%

(9.13)%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

0.57%

0.56%

0.57%

0.61%

0.58%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

0.53%

0.53%

c

0.53%

c

0.53%

c

0.53%

c

Net

investment

income

...........................

9.12%

8.11%

4.01%

4.19%

5.41%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$514,936

$389,707

$616,607

$430,129

$394,720

Portfolio

turnover

rate

............................

49.16%

11.36%

32.84%

74.82%

16.80%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments,

July

31,

2024

Franklin

Floating

Rate

Master

Series

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Shares

a

Value

%

of

Net

Assets

a

Common

Stocks

Industrial

Machinery

&

Supplies

&

Components

UTEX

Industries,

Inc.

..........................

United

States

120,386

$

5,136,509

1

.00

Leisure

Facilities

a

24

Hour

Fitness

Worldwide,

Inc.

..................

United

States

104,009

19,346

0.00

†

a

Oil

&

Gas

Exploration

&

Production

a

Talos

Energy,

Inc.

.............................

United

States

213,184

2,524,099

0

.49

a

Total

Common

Stocks

(Cost

$

15,206,568

)

...............................

7,679,954

1

.49

Management

Investment

Companies

Asset

Management

&

Custody

Banks

b

Franklin

Senior

Loan

ETF

.......................

United

States

281,166

6,866,074

1

.33

Invesco

Senior

Loan

ETF

.......................

United

States

289,186

6,072,906

1

.18

12,938,980

2

.51

Total

Management

Investment

Companies

(Cost

$

13,304,935

)

.............

12,938,980

2

.51

Preferred

Stocks

Leisure

Facilities

a

24

Hour

Fitness

Worldwide,

Inc.

..................

United

States

246,320

21,553

0

.01

a

Total

Preferred

Stocks

(Cost

$

332,425

)

..................................

21,553

0

.01

Warrants

a

a

a

a

a

Warrants

Industrial

Machinery

&

Supplies

&

Components

a,c

UTEX

Industries,

Inc.

,

2/20/49

....................

United

States

321

30

0.00

†

Total

Warrants

(Cost

$

–

)

...............................................

30

0.00

†

Principal

Amount

*

a

Corporate

Bonds

Aerospace

&

Defense

d

TransDigm,

Inc.

,

Senior

Secured

Note

,

144A,

6.375

%

,

3/01/29

...................................

United

States

1,500,000

1,529,776

0

.30

Air

Freight

&

Logistics

d

Rand

Parent

LLC

,

Senior

Secured

Note

,

144A,

8.5

%

,

2/15/30

...................................

United

States

1,950,000

1,929,793

0

.37

Automotive

Parts

&

Equipment

d

Tenneco,

Inc.

,

Senior

Secured

Note

,

144A,

8

%

,

11/17/28

United

States

1,500,000

1,362,370

0

.26

Cable

&

Satellite

d

Directv

Financing

LLC

/

Directv

Financing

Co-Obligor,

Inc.

,

Senior

Secured

Note

,

144A,

5.875

%

,

8/15/27

...

United

States

1,100,000

1,060,121

0

.21

Cargo

Ground

Transportation

d

First

Student

Bidco,

Inc.

/

First

Transit

Parent,

Inc.

,

Senior

Secured

Note

,

144A,

4

%

,

7/31/29

...............

United

States

500,000

456,456

0

.09

Casinos

&

Gaming

d

Caesars

Entertainment,

Inc.

,

Senior

Secured

Note

,

144A,

6.5

%

,

2/15/32

..............................

United

States

1,400,000

1,419,350

0

.27

d

International

Game

Technology

plc

,

Senior

Secured

Note

,

144A,

5.25

%

,

1/15/29

.........................

United

States

400,000

392,522

0

.08

1,811,872

0

.35

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

Corporate

Bonds

(continued)

Construction

Materials

d

Cemex

SAB

de

CV

,

Senior

Bond

,

144A,

5.2

%

,

9/17/30

.

Mexico

750,000

$

733,768

0

.14

Diversified

Chemicals

d

SCIH

Salt

Holdings,

Inc.

,

Senior

Secured

Note

,

144A,

4.875

%

,

5/01/28

.............................

United

States

1,100,000

1,026,721

0

.20

Diversified

Support

Services

d

Neptune

Bidco

US,

Inc.

,

Senior

Secured

Note

,

144A,

9.29

%

,

4/15/29

.............................

United

States

900,000

882,192

0

.17

Health

Care

Facilities

d

CHS/Community

Health

Systems,

Inc.

,

Senior

Secured

Note

,

144A,

8

%

,

12/15/27

.....................

United

States

1,500,000

1,502,505

0

.29

Health

Care

Services

d

MPH

Acquisition

Holdings

LLC

,

Senior

Secured

Note

,

144A,

5.5

%

,

9/01/28

.........................

United

States

453,000

354,109

0

.07

d,e

Radiology

Partners,

Inc.

,

Senior

Secured

Note

,

144A,

PIK,

7.775

%

,

1/31/29

.........................

United

States

1,718,476

1,611,794

0

.31

1,965,903

0

.38

Health

Care

Supplies

d

Bausch

+

Lomb

Corp.

,

Senior

Secured

Note

,

144A,

8.375

%

,

10/01/28

............................

United

States

320,000

329,175

0

.06

Independent

Power

Producers

&

Energy

Traders

d

Calpine

Corp.

,

Senior

Secured

Note

,

144A,

4.5

%

,

2/15/28

United

States

1,100,000

1,054,430

0

.21

Integrated

Telecommunication

Services

d

Altice

France

SA

,

Senior

Secured

Note

,

144A,

5.125

%

,

7/15/29

.......

France

800,000

561,880

0

.11

Senior

Secured

Note

,

144A,

5.5

%

,

10/15/29

........

France

1,270,000

894,687

0

.17

1,456,567

0

.28

Investment

Banking

&

Brokerage

d

Jane

Street

Group

/

JSG

Finance,

Inc.

,

Senior

Secured

Note

,

144A,

4.5

%

,

11/15/29

....................

United

States

800,000

757,953

0

.15

IT

Consulting

&

Other

Services

d

Fortress

Intermediate

3,

Inc.

,

Senior

Secured

Note

,

144A,

7.5

%

,

6/01/31

..............................

United

States

600,000

615,954

0

.12

Movies

&

Entertainment

d

Banijay

Entertainment

SAS

,

Senior

Secured

Note

,

144A,

8.125

%

,

5/01/29

.............................

France

600,000

621,797

0

.12

Multi-line

Insurance

d

Acrisure

LLC

/

Acrisure

Finance,

Inc.

,

Senior

Secured

Note

,

144A,

4.25

%

,

2/15/29

....................

United

States

529,400

487,678

0

.09

Oil

&

Gas

Storage

&

Transportation

Cheniere

Energy,

Inc.

,

Senior

Note

,

4.625

%

,

10/15/28

..

United

States

450,000

441,642

0

.09

Passenger

Airlines

d

Allegiant

Travel

Co.

,

Senior

Secured

Note

,

144A,

7.25

%

,

8/15/27

...................................

United

States

1,200,000

1,120,209

0

.22

d

American

Airlines,

Inc.

,

Senior

Secured

Note

,

144A,

8.5

%

,

5/15/29

..............................

United

States

1,300,000

1,339,177

0

.26

d

American

Airlines,

Inc.

/

AAdvantage

Loyalty

IP

Ltd.

,

Senior

Secured

Note

,

144A,

5.5

%

,

4/20/26

.........

United

States

577,091

573,728

0

.11

d

Delta

Air

Lines,

Inc.

/

SkyMiles

IP

Ltd.

,

Senior

Secured

Note

,

144A,

4.5

%

,

10/20/25

....................

United

States

197,760

196,825

0

.04

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

Corporate

Bonds

(continued)

Passenger

Airlines

(continued)

d

United

Airlines,

Inc.

,

Senior

Secured

Note

,

144A,

4.375

%

,

4/15/26

...................................

United

States

1,165,000

$

1,136,687

0

.22

4,366,626

0

.85

Personal

Care

Products

d

Coty,

Inc.

,

Senior

Secured

Note

,

144A,

5

%

,

4/15/26

....

United

States

392,000

388,100

0

.08

Security

&

Alarm

Services

d

Allied

Universal

Holdco

LLC

,

Senior

Secured

Note

,

144A,

7.875

%

,

2/15/31

.............................

United

States

500,000

509,039

0

.10

d

Allied

Universal

Holdco

LLC

/

Allied

Universal

Finance

Corp.

,

Senior

Note

,

144A,

9.75

%

,

7/15/27

.........

United

States

1,600,000

1,599,842

0

.31

2,108,881

0

.41

Wireless

Telecommunication

Services

d

Vmed

O2

UK

Financing

I

plc

,

Senior

Secured

Bond

,

144A,

4.25

%

,

1/31/31

.........................

United

Kingdom

360,000

305,258

0

.06

Total

Corporate

Bonds

(Cost

$

27,690,671

)

...............................

27,195,538

5

.28

f

Senior

Floating

Rate

Interests

Advertising

g

,h

MH

Sub

I

LLC

(Micro

Holding

Corp.)

,

First

Lien,

CME

Term

Loan

,

9.594

%

,

(

1-month

SOFR

+

4.25

%

),

5/03/28

United

States

3,834,510

3,829,890

0

.74

Aerospace

&

Defense

e

Alloy

Finco

Ltd.

,

First

Lien,

Term

Loan,

B

,

PIK,

14

%

,

3/08/28

...................................

United

Kingdom

3,407,100

3,321,923

0

.64

g

,h

Bleriot

US

Bidco,

Inc.

,

First

Lien,

2023

CME

Term

Loan

,

8.585

%

,

(

3-month

SOFR

+

3.25

%

),

10/31/30

.......

United

States

89,061

89,625

0

.02

h

Dynasty

Acquisition

Co.,

Inc.

,

First

Lien,

2024

Specified

Refinancing

CME

Term

Loan,

B1

,

8.844

%

,

(

1-month

SOFR

+

3.5

%

),

8/24/28

......

United

States

416,396

418,826

0

.08

First

Lien,

2024

Specified

Refinancing

CME

Term

Loan,

B2

,

8.844

%

,

(

1-month

SOFR

+

3.5

%

),

8/24/28

......

United

States

160,552

161,488

0

.03

3,991,862

0

.77

a

a

a

a

a

a

h

Air

Freight

&

Logistics

Clue

Opco

LLC

,

First

Lien,

CME

Term

Loan,

B

,

9.752

%

,

(

3-month

SOFR

+

4.5

%

),

12/19/30

...............

United

States

2,972,523

2,743,862

0

.54

Rand

Parent

LLC

,

First

Lien,

CME

Term

Loan,

B

,

9.071

%

,

(

3-month

SOFR

+

3.75

%

),

3/18/30

...............

United

States

3,105,632

3,103,271

0

.60

5,847,133

1

.14

a

a

a

a

a

a

Airport

Services

g

,h

LaserShip,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

10.096

%

,

(

3-month

SOFR

+

4.5

%

),

5/08/28

........

United

States

4,337,140

3,399,234

0

.66

Alternative

Carriers

h

Zayo

Group

Holdings,

Inc.

,

First

Lien,

Initial

Dollar

CME

Term

Loan

,

8.458

%

,

(

1-month

SOFR

+

3

%

),

3/09/27

.

United

States

623,553

558,968

0

.11

Aluminum

h

Arsenal

AIC

Parent

LLC

,

First

Lien,

2024

CME

Term

Loan,

B

,

9.094

%

,

(

1-month

SOFR

+

3.75

%

),

8/19/30

.

United

States

584,322

587,390

0

.11

h

Apparel,

Accessories

&

Luxury

Goods

g

ABG

Intermediate

Holdings

2

LLC

,

First

Lien,

2024

Refinancing

CME

Term

Loan

,

8.097

%

,

(

1-month

SOFR

+

2.75

%

),

12/21/28

..........................

United

States

832,727

836,995

0

.16

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

f

Senior

Floating

Rate

Interests

(continued)

h

Apparel,

Accessories

&

Luxury

Goods

(continued)

Champ

Acquisition

Corp.

,

First

Lien,

Initial

CME

Term

Loan

,

11.096

%

,

(

3-month

SOFR

+

5.5

%

),

12/19/25

..

United

States

1,435,014

$

1,442,548

0

.28

Flash

Charm,

Inc.

,

First

Lien,

Term

Loan,

B2

,

8.748

%

,

(

1-month

SOFR

+

3.5

%

),

3/02/28

................

United

States

2,066,738

2,057,727

0

.40

Hanesbrands,

Inc.

,

First

Lien,

Initial

CME

Term

Loan,

B

,

9.094

%

,

(

1-month

SOFR

+

3.75

%

),

3/08/30

........

United

States

1,786,432

1,794,810

0

.35

Tory

Burch

LLC

,

First

Lien,

Initial

CME

Term

Loan,

B

,

8.708

%

,

(

1-month

SOFR

+

3.25

%

),

4/14/28

........

United

States

571,091

572,830

0

.11

6,704,910

1

.30

a

a

a

a

a

a

h

Application

Software

AppLovin

Corp.

,

First

Lien,

Amendment

No.

1

Replacement

CME

Term

Loan,

10-I

,

7.844

%

,

(

1-month

SOFR

+

2.5

%

),

10/25/28

United

States

997,500

1,002,388

0

.20

First

Lien,

Delayed

Draw

CME

Term

Loan,

B

,

7.844

%

,

(

1-month

SOFR

+

2.5

%

),

8/15/30

................

United

States

1,797,462

1,803,780

0

.35

g

Boxer

Parent

Co.,

Inc.

,

First

Lien,

CME

Term

Loan,

B

,

9.005

%

,

(

12-month

SOFR

+

3.75

%

),

7/02/31

.......

United

States

6,000,000

5,980,020

1

.16

g

Central

Parent

LLC

,

First

Lien,

CME

Term

Loan,

B

,

8.585

%

,

(

3-month

SOFR

+

3.25

%

),

7/06/29

........

United

States

4,161,007

4,125,555

0

.80

Cloud

Software

Group,

Inc.

,

First

Lien,

Initial

Dolla

CME

Term

Loan,

B

,

9.335

%

,

(

3-month

SOFR

+

4

%

),

3/30/29

.................

United

States

3,794,128

3,797,145

0

.74

g

First

Lien,

Third

Amendment

CME

Term

Loan

,

9.835

%

,

(

3-month

SOFR

+

4.5

%

),

3/20/31

................

United

States

454,545

456,934

0

.09

Cloudera,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

9.194

%

,

(

1-month

SOFR

+

3.75

%

),

10/09/28

..............

United

States

1,693,875

1,649,410

0

.32

ConnectWise

LLC

,

First

Lien,

Initial

CME

Term

Loan

,

9.096

%

,

(

3-month

SOFR

+

3.5

%

),

9/29/28

.........

United

States

791,878

790,492

0

.15

Cornerstone

OnDemand,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

9.208

%

,

(

1-month

SOFR

+

3.75

%

),

10/16/28

..

United

States

878,957

826,589

0

.16

ECI

Macola/Max

Holding

LLC

,

First

Lien,

2024

Extending

CME

Term

Loan

,

9.085

%

,

(

3-month

SOFR

+

3.75

%

),

5/31/30

...................................

United

States

1,904,640

1,919,525

0

.37

Epicor

Software

Corp.

,

First

Lien,

Term

Loan,

E

,

8.594

%

,

(

1-month

SOFR

+

3.25

%

),

5/30/31

...............

United

States

3,233,514

3,259,172

0

.63

Flexera

Software

LLC

,

First

Lien,

CME

Term

Loan,

B2

,

8.826

%

,

(

3-month

SOFR

+

3.5

%

),

3/03/28

.........

United

States

328,743

330,449

0

.06

Genesys

Cloud

Services

Holdings

II

LLC

,

First

Lien,

2024

Incremental

Dollar

CME

Term

Loan

,

9.208

%

,

(

1-month

SOFR

+

3.75

%

),

12/01/27

.......

United

States

918,462

925,731

0

.18

First

Lien,

Dollar

CME

Term

Loan,

B4

,

8.844

%

,

(

1-month

SOFR

+

3.5

%

),

12/01/27

...............

United

States

3,260,180

3,282,773

0

.64

IGT

Holding

IV

AB

,

First

Lien,

CME

Term

Loan,

B2

,

4.162

%

,

(

1-day

SOFR

+

3.4

%

),

3/31/28

...........

Sweden

995,174

997,453

0

.19

Mitchell

International,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.594

%

,

(

1-month

SOFR

+

3.25

%

),

6/17/31

...

United

States

1,800,000

1,783,575

0

.35

Polaris

Newco

LLC

,

First

Lien,

Dollar

CME

Term

Loan

,

9.514

%

,

(

3-month

SOFR

+

4

%

),

6/02/28

..........

United

States

2,853,583

2,860,717

0

.56

Project

Alpha

Intermediate

Holding,

Inc.

,

First

Lien,

2024

Refinancing

CME

Term

Loan

,

9.002

%

,

(

3-month

SOFR

+

3.75

%

),

10/28/30

..........................

United

States

1,897,132

1,907,405

0

.37

g

Project

Boost

Purchaser

LLC

,

First

Lien,

Initial

CME

Term

Loan

,

8.786

%

,

(

3-month

SOFR

+

3.5

%

),

7/16/31

....

United

States

3,089,541

3,099,844

0

.60

Project

Ruby

Ultimate

Parent

Corp.

,

First

Lien,

CME

Term

Loan,

B1

,

8.958

%

,

(

1-month

SOFR

+

3.5

%

),

3/10/28

.

United

States

446,642

448,763

0

.09

Rocket

Software,

Inc.

,

First

Lien,

CME

Term

Loan

,

10.094

%

,

(

1-month

SOFR

+

4.75

%

),

11/28/28

......

United

States

1,364,459

1,371,329

0

.27

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

f

Senior

Floating

Rate

Interests

(continued)

h

Application

Software

(continued)

Severin

Acquisition

LLC

,

First

Lien,

CME

Term

Loan

,

8.252

%

,

(

3-month

SOFR

+

3

%

),

8/01/27

..........

United

States

229,615

$

230,441

0

.05

UKG,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.555

%

,

(

3-month

SOFR

+

3.25

%

),

2/10/31

...............

United

States

2,688,198

2,699,354

0

.52

VS

Buyer

LLC

,

First

Lien,

2024

Initial

CME

Term

Loan

,

8.579

%

,

(

1-month

SOFR

+

3.25

%

),

4/14/31

........

United

States

456,621

459,048

0

.09

46,007,892

8

.94

a

a

a

a

a

a

h

Asset

Management

&

Custody

Banks

g

Edelman

Financial

Engines

Center

LLC

(The)

,

First

Lien,

2024

Refinancing

CME

Term

Loan

,

8.594

%

,

(

1-month

SOFR

+

3.25

%

),

4/07/28

......................

United

States

2,720,263

2,726,071

0

.53

First

Eagle

Holdings,

Inc.

,

First

Lien,

CME

Term

Loan,

B2

,

8.33

%

,

(

3-month

SOFR

+

3

%

),

2/22/29

...........

United

States

1,795,500

1,783,515

0

.35

g

GTCR

Everest

Borrower

LLC

,

First

Lien,

CME

Term

Loan,

B

,

8.262

%

,

(

12-month

SOFR

+

3.25

%

),

6/03/31

.....

United

States

696,517

691,294

0

.13

Russell

Investments

US

Institutional

Holdco,

Inc.

,

First

Lien,

2027

CME

Term

Loan

,

10.252

%

,

(

3-month

SOFR

+

5

%

),

5/28/27

..............................

United

States

2,535,213

2,257,501

0

.44

7,458,381

1

.45

a

a

a

a

a

a

h

Automobile

Manufacturers

American

Trailer

World

Corp.

,

First

Lien,

CME

Term

Loan,

B

,

9.194

%

,

(

1-month

SOFR

+

3.75

%

),

3/03/28

......

United

States

1,470,567

1,440,487

0

.28

Thor

Industries,

Inc.

,

First

Lien,

USD

CME

Term

Loan,

B3

,

7.594

%

,

(

1-month

SOFR

+

2.25

%

),

11/15/30

....

United

States

266,585

267,584

0

.05

1,708,071

0

.33

a

a

a

a

a

a

h

Automotive

Parts

&

Equipment

Adient

US

LLC

,

First

Lien,

CME

Term

Loan,

B2

,

8.094

%

,

(

1-month

SOFR

+

2.75

%

),

1/31/31

...............

United

States

1,178,140

1,185,827

0

.23

Clarios

Global

LP

,

First

Lien,

CME

Term

Loan,

B

,

8.344

%

,

(

1-month

SOFR

+

3

%

),

5/06/30

.................

United

States

585,616

587,903

0

.11

DexKo

Global,

Inc.

,

First

Lien,

2023

Incremental

CME

Term

Loan

,

9.585

%

,

(

3-month

SOFR

+

4.25

%

),

10/04/28

..............

United

States

392,763

393,009

0

.07

First

Lien,

Closing

Date

Dollar

CME

Term

Loan

,

9.346

%

,

(

3-month

SOFR

+

3.75

%

),

10/04/28

.......

United

States

1,325,866

1,322,743

0

.26

First

Brands

Group

LLC

,

First

Lien,

2021

CME

Term

Loan

,

10.514

%

,

(

3-month

SOFR

+

5

%

),

3/30/27

.........................

United

States

2,760,837

2,747,461

0

.53

First

Lien,

2022-2

Incremental

CME

Term

Loan

,

10.514

%

,

(

3-month

SOFR

+

5

%

),

3/30/27

..........

United

States

2,922,301

2,911,342

0

.57

Second

Lien,

2021

CME

Term

Loan

,

14.014

%

,

(

3-month

SOFR

+

8.5

%

),

3/30/28

................

United

States

1,871,447

1,796,589

0

.35

Highline

Aftermarket

Acquisition

LLC

,

First

Lien,

Initial

CME

Term

Loan

,

9.944

%

,

(

1-month

SOFR

+

4.5

%

),

11/09/27

..................................

United

States

228,103

229,423

0

.05

Tenneco,

Inc.

,

First

Lien,

CME

Term

Loan,

B

,

10.426

%

,

(

3-month

SOFR

+

5

%

),

11/17/28

................

United

States

919,895

878,831

0

.17

TI

Group

Automotive

Systems

LLC

,

First

Lien,

2021

Refinancing

CME

Term

Loan,

B

,

8.708

%

,

(

1-month

SOFR

+

3.25

%

),

12/16/26

.....................

United

States

991,781

995,916

0

.19

13,049,044

2

.53

a

a

a

a

a

a

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

f

Senior

Floating

Rate

Interests

(continued)

Automotive

Retail

h

RealTruck

Group,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.958

%

,

(

1-month

SOFR

+

3.5

%

),

1/31/28

.........

United

States

2,352,522

$

2,350,075

0

.46

h

Broadcasting

g

Gray

Television,

Inc.

,

First

Lien,

CME

Term

Loan,

D

,

8.457

%

,

(

1-month

SOFR

+

3

%

),

12/01/28

..........

United

States

2,535,756

2,361,233

0

.46

iHeartCommunications,

Inc.

,

g

First

Lien,

CME

Term

Loan

,

8.458

%

,

(

1-month

SOFR

+

3

%

),

5/01/26

...............................

United

States

2,634,564

2,224,323

0

.43

First

Lien,

Second

Amendment

Incremental

CME

Term

Loan

,

8.708

%

,

(

1-month

SOFR

+

3.25

%

),

5/01/26

...

United

States

300,000

250,999

0

.05

Nexstar

Media,

Inc.

,

First

Lien,

CME

Term

Loan,

B4

,

7.958

%

,

(

1-month

SOFR

+

2.5

%

),

9/18/26

.........

United

States

485,655

487,886

0

.10

Univision

Communications,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.708

%

,

(

1-month

SOFR

+

3.25

%

),

1/31/29

United

States

875,056

853,591

0

.17

6,178,032

1

.21

a

a

a

a

a

a

Broadline

Retail

g

,h

Peer

Holding

III

BV

,

First

Lien,

CME

Term

Loan,

B5

,

8.228

%

,

(

12-month

SOFR

+

3

%

),

6/20/31

..........

Netherlands

1,707,942

1,717,549

0

.33

h

Building

Products

AZZ,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.594

%

,

(

1-month

SOFR

+

3.25

%

),

5/14/29

...............

United

States

524,825

529,527

0

.10

Cornerstone

Building

Brands,

Inc.

,

First

Lien,

CME

Term

Loan,

C

,

9.829

%

,

(

1-month

SOFR

+

4.5

%

),

5/15/31

............................

United

States

821,918

798,974

0

.16

First

Lien,

New

CME

Term

Loan,

B

,

8.679

%

,

(

1-month

SOFR

+

3.25

%

),

4/12/28

......................

United

States

926,326

880,171

0

.17

EMRLD

Borrower

LP

,

First

Lien,

Initial

CME

Term

Loan,

B

,

7.844

%

,

(

1-month

SOFR

+

2.5

%

),

5/31/30

.......

United

States

328,383

328,918

0

.06

MIWD

Holdco

II

LLC

,

First

Lien,

2024

Incremental

CME

Term

Loan

,

8.844

%

,

(

1-month

SOFR

+

3.5

%

),

3/28/31

United

States

449,102

451,107

0

.09

Quikrete

Holdings,

Inc.

,

First

Lien,

CME

Term

Loan,

B1

,

7.844

%

,

(

1-month

SOFR

+

2.5

%

),

4/14/31

.......................

United

States

884,879

888,702

0

.17

First

Lien,

CME

Term

Loan,

B2

,

7.594

%

,

(

1-month

SOFR

+

2.25

%

),

3/19/29

......................

United

States

554,278

556,420

0

.11

4,433,819

0

.86

a

a

a

a

a

a

h

Cable

&

Satellite

DIRECTV

Financing

LLC

,

First

Lien,

2024

Refinancing

CME

Term

Loan,

B

,

10.708

%

,

(

1-month

SOFR

+

5.25

%

),

8/02/29

.............................

United

States

220,385

220,419

0

.04

Virgin

Media

Bristol

LLC

,

First

Lien,

Advance

CME

Term

Loan,

Q

,

8.693

%

,

(

1-month

SOFR

+

3.25

%

),

1/31/29

.

United

States

1,788,848

1,721,972

0

.33

1,942,391

0

.37

a

a

a

a

a

a

h

Cargo

Ground

Transportation

g

Albion

Financing

3

SARL

,

First

Lien,

2024

Amended

USD

CME

Term

Loan

,

9.826

%

,

(

3-month

SOFR

+

4.25

%

),

8/17/29

...................................

Luxembourg

616,114

621,893

0

.12

First

Student

Bidco,

Inc.

,

First

Lien,

2022

Incremental

CME

Term

Loan,

B

,

8.435

%

,

(

3-month

SOFR

+

3

%

),

7/21/28

..........

United

States

1,108,241

1,112,591

0

.22

First

Lien,

Initial

CME

Term

Loan,

B

,

8.596

%

,

(

3-month

SOFR

+

3

%

),

7/21/28

.........................

United

States

1,756,726

1,763,068

0

.34

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

f

Senior

Floating

Rate

Interests

(continued)

h

Cargo

Ground

Transportation

(continued)

First

Student

Bidco,

Inc.

(continued)

First

Lien,

Initial

CME

Term

Loan,

C

,

8.596

%

,

(

3-month

SOFR

+

3

%

),

7/21/28

.........................

United

States

535,746

$

537,680

0

.10

Kenan

Advantage

Group,

Inc.

(The)

,

First

Lien,

CME

Term

Loan,

B3

,

9.094

%

,

(

1-month

SOFR

+

3.75

%

),

1/25/29

...................................

United

States

2,381,215

2,390,740

0

.47

6,425,972

1

.25

a

a

a

a

a

a

h

Casinos

&

Gaming

g

Bally's

Corp.

,

First

Lien,

CME

Term

Loan,

B

,

8.794

%

,

(

3-month

SOFR

+

3.25

%

),

10/02/28

..............

United

States

4,064,385

3,901,342

0

.76

Caesars

Entertainment,

Inc.

,

First

Lien,

2023

Incremental

CME

Term

Loan,

B

,

8.097

%

,

(

3-month

SOFR

+

2.75

%

),

2/06/30

...................................

United

States

1,417,945

1,425,034

0

.28

Entain

plc

,

First

Lien,

CME

Term

Loan,

B3

,

8.014

%

,

(

6-month

SOFR

+

2.75

%

),

10/31/29

..............

United

Kingdom

1,026,393

1,029,493

0

.20

Fertitta

Entertainment

LLC

,

First

Lien,

Initial

CME

Term

Loan,

B

,

9.079

%

,

(

1-month

SOFR

+

3.75

%

),

1/29/29

.

United

States

2,012,271

2,019,505

0

.39

Flutter

Entertainment

plc

,

First

Lien,

CME

Term

Loan,

B

,

7.585

%

,

(

3-month

SOFR

+

2.25

%

),

11/25/30

.......

Ireland

1,834,287

1,839,258

0

.36

Light

&

Wonder

International,

Inc.

,

First

Lien,

CME

Term

Loan,

B1

,

8.079

%

,

(

1-month

SOFR

+

2.75

%

),

4/16/29

United

States

1,677,169

1,690,796

0

.33

Ontario

Gaming

GTA

LP

,

First

Lien,

CME

Term

Loan,

B

,

9.585

%

,

(

3-month

SOFR

+

4.25

%

),

8/01/30

........

Canada

1,147,455

1,153,824

0

.22

Penn

National

Gaming,

Inc.

,

First

Lien,

CME

Term

Loan,

B

,

8.194

%

,

(

1-month

SOFR

+

2.75

%

),

5/03/29

......

United

States

1,344,075

1,350,977

0

.26

Raptor

Acquisition

Corp.

,

First

Lien,

CME

Term

Loan,

B

,

9.609

%

,

(

3-month

SOFR

+

4

%

),

11/01/26

..........

United

States

1,559,832

1,570,751

0

.30

Scientific

Games

Holdings

LP

,

First

Lien,

2024

Refinancing

Dollar

CME

Term

Loan

,

8.318

%

,

(

3-month

SOFR

+

3

%

),

4/04/29

.........................

United

States

3,615,195

3,613,839

0

.70

19,594,819

3

.80

a

a

a

a

a

a

h

Communications

Equipment

CommScope,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.708

%

,

(

1-month

SOFR

+

3.25

%

),

4/06/26

........

United

States

1,199,810

1,126,700

0

.22

Delta

Topco,

Inc.

,

First

Lien,

Second

Amendment

CME

Term

Loan

,

8.846

%

,

(

3-month

SOFR

+

3.5

%

),

11/30/29

United

States

2,771,408

2,777,186

0

.54

3,903,886

0

.76

a

a

a

a

a

a

h

Construction

&

Engineering

Artera

Services

LLC

,

First

Lien,

CME

Term

Loan,

C

,

9.835

%

,

(

3-month

SOFR

+

4.5

%

),

2/18/31

.........

United

States

816,136

820,091

0

.16

Brand

Industrial

Services,

Inc.

,

First

Lien,

CME

Term

Loan,

C

,

9.748

%

,

(

3-month

SOFR

+

4.5

%

),

8/01/30

..

United

States

968,447

970,751

0

.19

Chromalloy

Corp.

,

First

Lien,

CME

Term

Loan

,

9.082

%

,

(

3-month

SOFR

+

3.75

%

),

3/27/31

...............

United

States

866,575

854,794

0

.17

Radar

Bidco

SARL

,

First

Lien,

USD

CME

Term

Loan,

B

,

9.568

%

,

(

3-month

SOFR

+

4.25

%

),

3/27/31

........

Luxembourg

487,013

489,755

0

.09

g

USIC

Holdings,

Inc.

,

First

Lien,

CME

Term

Loan

,

9.092

%

,

(

3-month

SOFR

+

3.5

%

),

5/14/28

................

United

States

2,406,942

2,339,548

0

.45

Zekelman

Industries,

Inc.

,

First

Lien,

2024

CME

Term

Loan

,

7.6

%

,

(

1-month

SOFR

+

2.25

%

),

1/24/31

.....

United

States

385,990

387,540

0

.08

5,862,479

1

.14

a

a

a

a

a

a

Franklin

Floating

Rate

Master

Trust

Schedule

of

Investments

Franklin

Floating

Rate

Master

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Principal

Amount

*

a

Value

%

of

Net

Assets

a

a

a

a

a

a

f

Senior

Floating

Rate

Interests

(continued)

Construction

Machinery

&

Heavy

Transportation

Equipment

h

ASP

Blade

Holdings,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

9.596

%

,

(

3-month

SOFR

+

4

%

),

10/13/28

.....

United

States

2,506,375

$

1,879,155

0

.36

Consumer

Finance

g

,h

Neon

Maple

US

Debt

Mergersub,

Inc.

,

First

Lien,

CME

Term

Loan

,

8.153

%

,

(

12-month

SOFR

+

3

%

),

7/18/31

United

States

1,684,665

1,681,506

0

.33

Data

Processing

&

Outsourced

Services

h

SS&C

Technologies,

Inc.

,

First

Lien,

CME

Term

Loan,

B8

,

7.344

%

,

(

1-month

SOFR

+

2

%

),

5/09/31

..........

United

States

2,330,982

2,342,252

0

.45

h

Distributors

AIP

RD

Buyer

Corp.

,

First

Lien,

2023

Incremental

CME

Term

Loan

,

9.844

%

,

(

1-month

SOFR

+

4.5

%

),

12/22/28

United

States

315,000

316,706

0

.06

BCPE

Empire

Holdings,

Inc.

,

First

Lien,

Amendment

No.

5

Refinancing

CME

Term

Loan

,

9.344

%

,

(

1-month

SOFR

+

4

%

),

12/11/28

........................

United

States

2,255,885

2,263,510

0

.44

Core

&

Main

LP

,

First

Lien,

Term

Loan,

C

,

7.589

%

,

(

3-month

SOFR

+

2.25

%

),

2/10/31

...............

United

States

523,684

525,975

0

.10

Verde

Purchaser

LLC

,

First

Lien,

Initial

CME

Term

Loan

,

9.835

%

,

(

3-month

SOFR

+

4.5

%

),

11/30/30

........

United

States

1,971,698

1,977,041

0

.39

5,083,232

0

.99

a

a

a

a

a

a

Diversified

Banks

g

,h

Chrysaor

Bidco

SARL

,

First

Lien,

CME

Term

Loan,

B

,

8.737

%

,

(

12-month

SOFR

+

3.5

%

),

5/15/31

........

Luxembourg

475,915

478,594

0

.09

h

Diversified

Chemicals

INEOS

US

Finance

LLC

,

First

Lien,

2030

Dollar

CME

Term

Loan

,

8.597

%

,

(

1-month

SOFR

+

3.25

%

),

2/18/30

Luxembourg

514,800

513,330

0

.10

INEOS

US

Petrochem

LLC

,

First

Lien,

2030

Dollar

CME

Term

Loan,

B

,

9.194

%

,

(

1-month

SOFR

+

3.75

%

),

3/14/30

...............

United

States

538,043

538,267

0

.11

First

Lien,

New

CME

Term

Loan,

B1

,

9.694

%

,

(

1-month

SOFR

+

4.25

%

),

4/02/29

......................

United

States

2,380,295

2,383,270

0

.46

g

LSF11

A5

Holdco

LLC

,

First

Lien,

2024

Refinancing

CME

Term

Loan

,

8.958

%

,

(

1-month

SOFR

+

3.5

%

),

10/16/28

United

States

1,640,948

1,646,076

0

.32

Lummus

Technology

Holdings

V

LLC

,

First

Lien,

2024

CME

Term

Loan,

B

,

8.958

%

,

(

1-month

SOFR

+

3.5

%

),

12/31/29

..................................

United

States

821,033

826,099

0

.16

SCIH

Salt

Holdings,

Inc.

,

First

Lien,

Incremental

CME

Term

Loan,

B1

,

8.755

%

,

(

3-month

SOFR

+

3.5

%

),

3/16/27

...................................

United

States

2,140,174

2,150,030

0

.42

8,057,072

1

.57

a

a

a

a

a

a

Diversified

Financial

Services

h

Mercury

Borrower,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

8.958

%

,

(

1-month

SOFR

+

3.5

%

),

8/02/28

.........

United

States

2,527,509

2,536,203

0

.49

h

Diversified

Support

Services

Amentum

Government

Services

Holdings

LLC

,

First

Lien,

CME

Term

Loan,

B3

,

9.35

%

,

(

1-month

SOFR

+

4

%

),

2/15/29

...................................

United

States

1,758,730

1,766,301

0

.34

APi

Group

DE,

Inc.

,

First

Lien,

Repriced

2021

Incremental

CME

Term

Loan

,

7.347

%

,

(

1-month

SOFR

+

2

%

),

1/03/29

...................................

United

States

106,293

106,719

0

.02

CCI

Buyer,

Inc.

,

First

Lien,

Initial

CME

Term

Loan

,

9.335

%

,

(

3-month

SOFR

+

4

%

),

12/17/27

..........

United

States

1,771,616

1,775,124

0

.34

g

Neptune

BidCo

US,

Inc.

,

First

Lien,

Dollar

CME

Term

Loan,

B

,

10.404

%

,

(

3-month

SOFR

+

5