AllianceBernstein

2

Proprietary - For AllianceBernstein L.P. use only

Cautions regarding Forward-Looking Statements

Certain statements provided by management in this presentation are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual

results to differ materially from future results expressed or implied by such forward-looking statements. The most significant of these factors

include, but are not limited to, the following: the performance of financial markets, the investment performance of sponsored investment

products and separately managed accounts, general economic conditions, future acquisitions, competitive conditions, and government

regulations, including changes in tax regulations and rates and the manner in which the earnings of publicly traded partnerships are taxed. We

caution readers to carefully consider such factors. Further, such forward looking statements speak only as of the date on which such statements

are made; we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such

statements. For further information regarding these forward-looking statements and the factors that could cause actual results to differ, see

“Risk Factors” in Item 1A. Any or all of the forward-looking statements that we make in this presentation, Form 10-K or any other public

statements we issue may turn out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and those

listed below could also adversely affect our revenues, financial condition, results of operations, and business prospects.

The forward-looking statements referred to in the preceding paragraph include statements regarding:

• Current market turmoil offering unusual investment opportunity, and a firm-wide resumption of organic growth: The actual

performance of the capital markets and other factors beyond our control will affect our investment success for clients and asset flows.

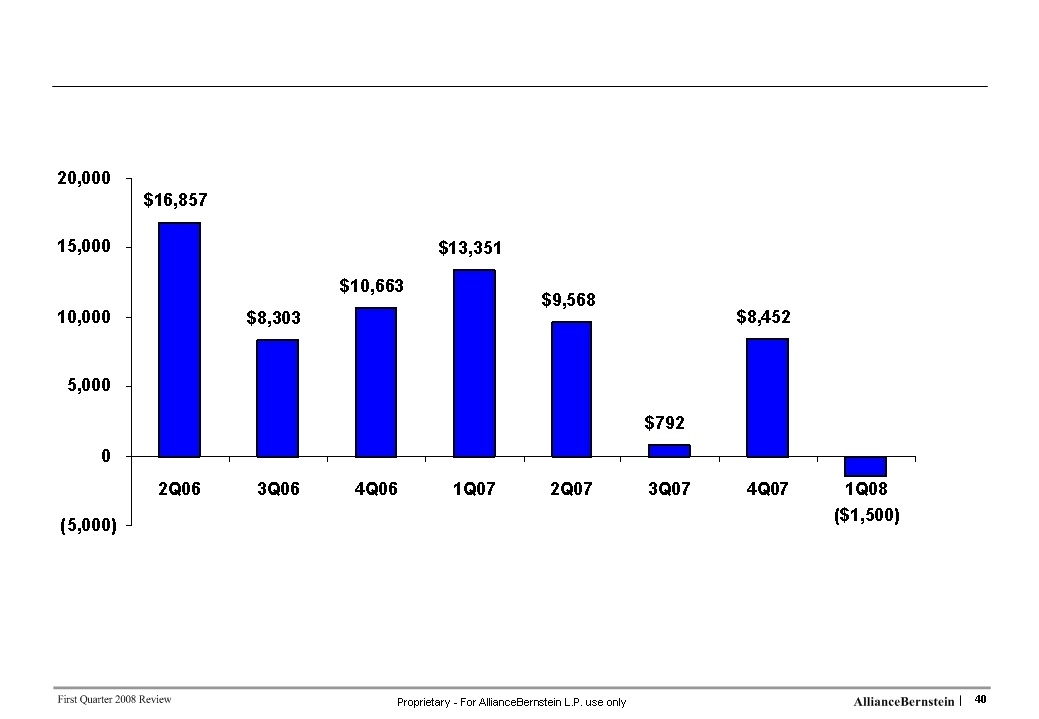

• Our backlog of new institutional mandates not yet funded growing to over $16 billion: Before they are funded, institutional

mandates do not represent legally binding commitments to fund and, accordingly, the possibility exists that not all mandates will be

funded in the amounts and at the times we currently anticipate.

• Lower compensation expense in future periods resulting from a decline in the value of investments related to employee

deferred compensation plans: The actual performance of the capital markets and other factors beyond our control will affect the value

of these investments.

• Our ability to recover a significant portion of costs incurred to conclude employment-related arbitrations: Our ability to recover

a significant portion of these costs depends on the willingness of our insurer to reimburse us under an existing policy.

• A substantially slower headcount growth rate in 2008: Management will determine the rate at which headcount will grow (or

contract) in future periods based on how we believe our business will function most efficiently and effectively. Management’s

determination in this regard is largely dependent on the actual performance of the capital markets and other factors beyond our control.

Cautions regarding Forward-Looking Statements