AllianceBernstein.com

1

Cautions Regarding Forward-Looking Statements

Certain statements provided by management in this news release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following: the performance of financial

markets, the investment performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends, future

acquisitions, competitive conditions, and current and proposed government regulations, including changes in tax regulations and rates and the manner in which the

earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions readers to carefully consider such factors. Further, such forward-looking statements speak

only as of the date on which such statements are made; AllianceBernstein undertakes no obligation to update any forward-looking statements to reflect events or

circumstances after the date of such statements. For further information regarding these forward-looking statements and the factors that could cause actual results to

differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for the year ended December 31, 2010. Any or all of

the forward-looking statements made in this news release, Form 10-K, other documents AllianceBernstein files with or furnishes to the SEC, and any other public

statements issued by AllianceBernstein, may turn out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and “Cautions

Regarding Forward-Looking Statements”, and those listed below, could also adversely affect AllianceBernstein’s financial condition, results of operations and business

prospects.

The forward-looking statements referred to in the preceding paragraph include statements regarding :

<The pipeline of new institutional mandates not yet funded: Before they are funded, institutional mandates do not represent legally binding commitments to fund

and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at the times currently anticipated.

<Our confidence that we will outperform in equities in the months ahead which, combined with an improved risk appetite on the part of investors, will lead to

improved flows: We cannot predict the timing or degree of global market growth, nor our absolute or relative investment performance for our clients. The actual

performance of the capital markets and other factors beyond our control will affect our investment success for clients and asset flows. Furthermore, improved flows

depend on a number of factors, including our ability to deliver consistent, competitive investment performance, which cannot be assured, conditions of financial markets,

changes and volatility in political, economic, capital market or industry conditions, consultant recommendations, and changes in our clients’ investment preferences, risk

tolerances and liquidity needs.

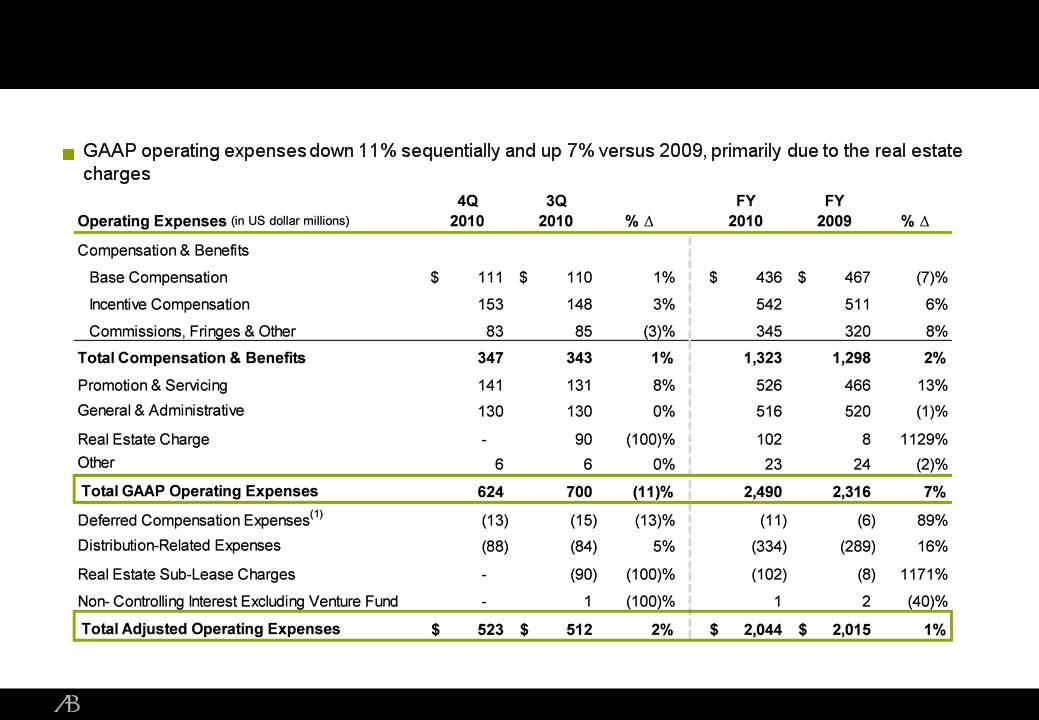

<The degree to which the $89.6 million real estate charge we recorded during the third quarter of 2010 will reduce occupancy costs on existing real estate in

2011 and subsequent years: The charge we recorded during the third quarter and our estimates of reduced occupancy costs in future years are based on existing sub-

leases, as well as our current assumptions of when we can sub-lease the remaining space and current market rental rates, which are factors largely beyond our control. If

our assumptions prove to be incorrect, we may be forced to take an additional charge and/or our estimated occupancy cost reductions may be less than we currently

anticipate.

<Our intention to continue to engage in open market purchases of Holding Units, from time to time, to help fund anticipated obligations under our incentive

compensation award program: The number of Holding Units needed in future periods to make incentive compensation awards is dependent upon various factors,

some of which are beyond our control, including the fluctuation in the price of a Holding Unit.

<Our confidence that we will deliver consistent, long-term value to all of our stakeholders: Changes and volatility in political, economic, capital market or industry

conditions can result in changes in demand for our products and services or impact the value of our assets under management, all of which may significantly hinder our ability

to execute on our strategy.

ability to execute on our strategy.