ADIRA ENERGY LTD.

NOTICE OF SPECIAL MEETING

and

MANAGEMENT INFORMATION CIRCULAR

For the Special Meeting of Shareholders

to be held on May 30, 2012

May 2, 2012

ADIRA ENERGY LTD.

INVITATION TO SHAREHOLDERS

Dear Shareholder:

On behalf of the board of directors, management and employees, we invite you to attend the Adira Energy Ltd. (the “Corporation”) Special Meeting of Shareholders being held on May 30, 2012 (the “Meeting”).

The items of business to be considered at this Meeting are described in the Notice of Special Meeting and the accompanying management information circular. Your vote is important regardless of the number of common shares in the Corporation (“Common Shares”) you own. Whether or not you are able to attend, if you are a registered holder, we urge you to complete the enclosed management form of proxy and return it in the prepaid envelope or using any one of the methods described on the form of proxy by not later than 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or any adjournment thereof. Voting by proxy will not prevent you from voting in person if you attend the Meeting but will ensure that your vote will be counted if you are unable to attend. If you hold your Common Shares through a broker or an intermediary, we urge you to complete the applicable management voting instruction form or provide your voting instructions by other acceptable methods.

We look forward to seeing you at the Meeting.

Sincerely,

(Signed) DENNIS BENNIE

Chairman of the Board

ADIRA ENERGY LTD.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the special meeting (the “Meeting”) of shareholders of Adira Energy Ltd. (the “Corporation”) will be held at the office of Aird & Berlis LLP, Brookfield Place, Suite 1800, 181 Bay Street, Toronto, ON Canada M5J 2T9, on May 30, 2012 at the hour of 9:00 a.m. (Toronto time), for the following purposes:

| | (a) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the by-laws of the Corporation (the “By-laws”) to include additional qualifications and duties of care for the directors and officers of the Corporation (the full text of which is reproduced in the Information Circular). |

| | | |

| | (b) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to require the appointment of outside directors of the Corporation (the full text of which is reproduced in the Information Circular). |

| | | |

| | (c) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to require the appointment of an internal auditor of the Corporation (the full text of which is reproduced in the Information Circular). |

| | | |

| | (d) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to add certain provisions governing special tender offers, purchases of a control block or control and the forced sale of shares of the Corporation (the full text of which is reproduced in the Information Circular). |

| | | |

| | (e) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to include provisions relating to derivative actions and class actions (the full text of which is reproduced in the Information Circular). |

| | | |

| | (f) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to provide shareholders with additional rights to convene shareholder meetings (the full text of which is reproduced in the Information Circular). |

| | | |

| | (g) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to provide that shareholder meeting materials must include “voting papers” as required under Section 39A of the Israeli Securities Law, 5728-1968 (the full text of which is reproduced in the Information Circular). |

| | | |

| | (h) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to create a division of power between the Chief Executive Officer and Chairmen of the Board positions (the full text of which is reproduced in the Information Circular). |

| | | |

| | (i) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to include additional audit committee formation and governance requirements (the full text of which is reproduced in the Information Circular). |

| | | |

| | (j) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to provide shareholders with additional document access rights (the full text of which is reproduced in the Information Circular). |

| | (k) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to require additional approvals for certain interested party transactions (the full text of which is reproduced in the Information Circular). |

| | | |

| | (l) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to include director and officer indemnity provisions (the full text of which is reproduced in the Information Circular). |

| | | |

| | (m) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to allow for the appointment of Co-Chairmen of the board (the full text of which is reproduced in the Information Circular). |

| | | |

| | (n) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the By-laws to include certain definitions required for other by-law amendments, paramountcy provisions and other amendments related to the other bylaw amendment resolutions (the full text of which is reproduced in the Information Circular). |

| | | |

| | (o) | To consider, and if deemed advisable, to pass, with or without variation, a resolution amending the stock option plan of the Corporation to comply with the requirements for listing on the Tel Aviv Stock Exchange (the full text of which is reproduced in the Information Circular). |

| | | |

| | (p) | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

Shareholders of record as at the close of business on Tuesday, May 1, 2012, will be entitled to notice of and to vote at the Meeting. A detailed description of the matters to be acted upon at the Meeting is set forth in the Information Circular.

Copies of: (a) this notice of special meeting of shareholders, (b) the Information Circular, and (c) a Management form of proxy and instructions in relation thereto (the “Management Proxy”) may be obtained at the following office: 120 Adelaide St. West, Suite 1204, Toronto, ON, Canada M5H 1T1 or will be sent to a shareholder without charge upon request by calling (416) 250-1955.

DATEDthe 2nd day of May, 2012.

By Order of the Board of Directors

(Signed) DENNIS BENNIE

Chairman of the Board

NOTE: If you are the holder of Common Shares, kindly fill in, date, sign and return, in the addressed prepaid envelope provided forthat purpose, the enclosed Management Proxy in respect of the Common Shares owned by you and deliver the completedManagement Proxy in the addressed prepaid envelope provided or deposited at the offices of Computershare Investor Services Inc.,Proxy Department, 100 University Avenue, 9thFloor, Toronto, Ontario, Canada M5J 2Y1, on behalf of the Corporation, so as not toarrive later than 9:00 a.m. (Toronto time) on Monday, May 28, 2012, or if the Meeting is adjourned, no later than 48 hours(excluding Saturdays, Sundays and holidays) before the time set for any reconvened meeting at which the Management Proxy is to beused. Management Proxies may not be deposited with the chair of the Meeting prior to the commencement of the Meeting or anyadjournment thereof. Registered shareholders may also vote by telephone (toll free) at 1-866-732-vote (8683) or over the Internet atwww.investorvote.com. Instructions on how to vote by telephone or over the Internet are provided in the Information Circular andManagement Proxy enclosed. Non-registered shareholders should follow the instructions on how to complete their voting instructionform or form of proxy and vote their shares on the Management forms that they receive or contact their broker, trustee, financialinstitution or other nominee. |

ADIRA ENERGY LTD.

MANAGEMENT INFORMATION CIRCULAR

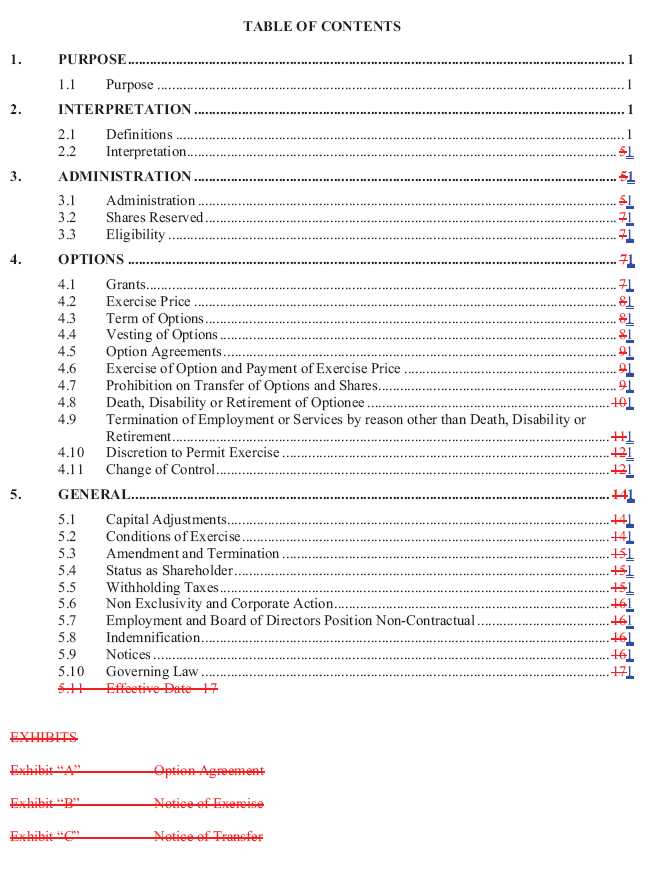

TABLE OF CONTENTS

-i-

ADIRA ENERGY LTD.

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES

This management information circular (the “Information Circular”) is furnished in connection with the solicitation by management (“Management”) of Adira Energy Ltd. (the “Corporation”), of proxies to be used at the special meeting (the “Meeting”) of shareholders of the Corporation (each a “Shareholder” and collectively, the “Shareholders”) to be held at office of Aird & Berlis LLP, Brookfield Place, Suite 1800, 181 Bay Street, Toronto, ON Canada M5J 2T9 on May 30, 2012 at 9:00 a.m. (Toronto time), for the purposes set forth in the accompanying notice of special meeting (the “Notice”). Except as otherwise indicated, information herein is given as at May 2, 2012. The solicitation will be primarily by mail, but proxies may also be solicited personally or by telephone by regular employees or agents of the Corporation. The cost of solicitation will be borne by the Corporation.

In this Information Circular, all references to dollar amounts are to Canadian dollars, unless otherwise specified.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed management form of proxy (“Management Proxy”) are both directors of the Corporation, respectively, and one is also the Executive Vice-President of the Corporation.Registered Shareholders (each a “Registered Shareholder”) have the right to appoint a person to attend and act for him, her or its and on his, her or its behalf at the Meeting other than the persons named above. Such right may be exercised by inserting in the blank space provided the name of the person to be appointed, who need not be a Shareholder, or by completing another proper form of proxy.In either case, as a Registered Holder you can choose from three different ways to vote your common shares in the capital of the Corporation (“Common Shares”) by proxy: (a) by mail or delivery in the addressed prepaid envelope provided or deposited at the offices of Computershare Investor Services Inc. (“Computershare”), Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, on behalf of the Corporation, so as not to arrive later than 9:00 a.m. (Toronto time) on Monday, May 28, 2012, or if the Meeting is adjourned, at the latest 48 hours (excluding Saturdays, Sundays and holidays) before the time set for any reconvened meeting at which the proxy is to be used; (b) by telephone (toll free) at 1-866-732-VOTE (8683); or (c) on the internet atwww.investorvote.com.

In addition to revocation in any other manner permitted by law, a proxy may be revoked by: (a) completing and signing a proxy bearing a later date and depositing it with Computershare, on behalf of the Corporation, so it is received by not later than 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or an adjournment thereof; or (b) providing an instrument in writing to the chair of the Meeting, at the Meeting or any adjournment thereof.

EXERCISE OF DISCRETION BY PROXIES

The persons named in the Management Proxy will vote for, withhold from voting or vote against, as the case may be, the Common Shares in respect of which he is appointed as proxy in accordance with the direction of the Shareholder appointing him.In the event that a Shareholder does not specify in his, her or its instrument of proxy that the named Management Proxy is required to vote for, to withhold from voting or vote against, as applicable, in respect of the matters to be considered at the Meeting, the Common Shares represented by such proxy shall be voted FOR each of the matters referred to therein.

The Management Proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice and with respect to other matters which may properly come before the Meeting. At the time of printing this Information Circular, neither Management nor the directors of the Corporation (each a “Director” and collectively, the “Directors”) are aware of any amendments, variations or other matters intended to come before the Meeting other than those items of business set forth in the attached Notice. However, if any such amendment, variation or other matter properly comes before the Meeting, it is the intention of the persons named in the Management Proxy to vote on such other business in accordance with his judgment.

INFORMATION FOR BENEFICIAL HOLDERS OF SECURITIES

Information set forth in this Section is important to persons other than Registered Holders. Only Registered Holders, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, Common Shares beneficially owned by a non-registered holder (a “Beneficial Holder”) are registered either:

| | (a) | in the name of an intermediary that the Beneficial Holder deals with in respect of the Common Shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| | | |

| | (b) | in the name of a depository (such as The Canadian Depository for Securities Limited (“CDS”)). |

In accordance with Canadian securities law, the Corporation has distributed copies of the Notice, this Information Circular and the Management Proxy (collectively, the “Meeting Materials”) to CDS and intermediaries for onward distribution to Beneficial Holders. Intermediaries are required to forward the Meeting Materials to Beneficial Holders unless a Beneficial Holder has waived the right to receive them.

Intermediaries are required to forward meeting materials to Beneficial Holder unless a Beneficial Holder has waived the right to receive them. Typically, intermediaries will use a service company to forward the meeting materials to Beneficial Holders. Every broker or other intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Holders in order to ensure that their Common Shares are voted at the Meeting. Beneficial Owners will receive either a Management voting instruction form or, less frequently, a Management Proxy. Often, the voting instruction form supplied to a Beneficial Holder by its broker is identical to that provided to Registered Holders. However, its purpose is limited to instructing the Registered Holder how to vote on behalf of the Beneficial Holder. Beneficial Holders should follow the procedures set out below, depending on which type of form they receive.

| | (a) | Management Voting Instruction Form. In most cases, a Beneficial Holder will receive, as part of the Meeting Materials, a Management voting instruction form. If the Beneficial Holder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the Beneficial Holder’s behalf), the Management voting instruction form must be completed, signed and returned in accordance with the directions on the form. If a Beneficial Holder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the Beneficial Holder’s behalf), the Beneficial Holder must complete, sign and return the Management voting instruction form in accordance with the directions provided, together with a form of proxy giving the right to attend and vote. |

-2-

| | (b) | Management Proxy. Less frequently, a Beneficial Holder will receive, as part of the Meeting Materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Beneficial Holder but which is otherwise uncompleted. If the Beneficial Holder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the Non-Registered Holder’s behalf), the Beneficial Holder must complete the Management Proxy and deposit it with Computershare, Proxy Department, 100 University Avenue, 9thFloor, Toronto, Ontario, Canada M5J 2Y1, on behalf of the Corporation, so as not later than 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or any adjournment thereof. If a Beneficial Holder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the Beneficial Holder’s behalf), the Beneficial Holder must strike out the names of the persons named in the Management Proxy and insert the Beneficial Holder’s (or such other person’s) name in the blank space provided and return to Computershare as described above. |

Most brokers now delegate responsibility for obtaining instructions from clients (i.e. Beneficial Holders) to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically mails voting instruction forms or proxy forms, to the Beneficial Holders and asks Beneficial Holders to return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions representing the voting of Common Shares to be represented at the Meeting. A Beneficial Holder receiving a voting instruction form or proxy form from Broadridge, cannot use that voting instruction form or proxy form to vote Common Shares directly at the Meeting. A voting instruction form or proxy form must be returned to Broadridge well in advance of the Meeting in order to have the Common Shares voted. The cost of solicitation by Broadridge will be borne by the Corporation.

Although Beneficial Holders may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of their broker or other intermediary, a Beneficial Holder may attend at the Meeting as proxyholder for the Registered Holder and vote their Common Shares in that capacity. Beneficial Holders who wish to attend the Meeting and indirectly vote their own Common Shares as proxyholder for the Registered Holder should enter their own names in the blank space on the Management voting instruction form or form of proxy provided to them and return the same to their broker or other intermediary (or the agent of such broker or other intermediary) in accordance with the instructions provided by such broker, intermediary or agent well in advance of the Meeting in order to have the Common Shares voted.

Non-Objecting Beneficial Owners

These meeting materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner, and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. By choosing to send these materials to you directly, the Corporation (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions or form of proxy delivered to you.

-3-

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The record date for the determination of Shareholders entitled to receive notice of the Meeting has been fixed as the close of business on Tuesday May 1, 2012 (the “Record Date”). As of the Record Date, 101,768,453Common Shares, each carrying the right to one vote per Common Share at the Meeting, were issued and outstanding. The Corporation will prepare a list of holders of Common Shares as of such Record Date. Each Shareholder named in the list will be entitled to one vote per Common Share shown opposite his or her name on the said list.

To the knowledge of Management and the Directors, as at the date hereof, no person or entity beneficially owns, directly or indirectly, or exercise control or direction over, more than ten percent (10%) of the issued and outstanding Common Shares of the Corporation.

Your vote is important regardless of the number of Common Shares you own. Whether or not you are able to attend, if you are a Registered Holder, we urge you to complete the enclosed Management Proxy and return it in the envelope provided by no later than 9:00 a.m. (Toronto time) on Monday, May 28, 2012. Voting by proxy will not prevent you from voting in person if you attend the Meeting but will ensure that your vote will be counted if you are unable to attend. If you hold your Common Shares through a broker or an intermediary, we urge you to complete the applicable Management voting instruction form or provide your voting instructions by other acceptable methods.

AUDITOR

The auditor of the Corporation is Kost Forer Gabbay & Kasierer, member firm of Ernst and Young Global, and they were first appointed on March 9, 2011.

MATTERS TO BE ACTED UPON AT THE MEETING

1. Background

Whereas the Corporation has previously submitted to the Israeli Securities Commission (“ISA”) and to the Tel Aviv Stock Exchange (“TASE”) a draft prospectus for the listing, of all of the issued and outstanding Common Shares, on the TASE (the “Israeli Prospectus”). The Israeli Prospectus, is subject to detailed review by the TASE and the ISA. Listing of the Common Shares on the TASE is subject to, among other things, acceptance by the TSX Venture Exchange (“TSXV”) and final acceptance by the TASE and the ISA.

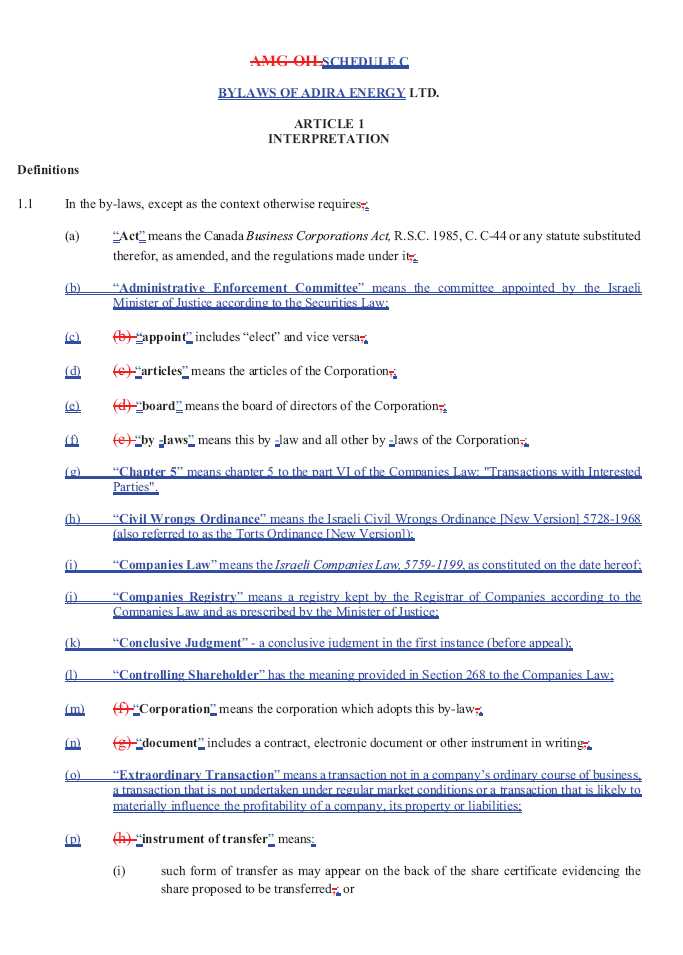

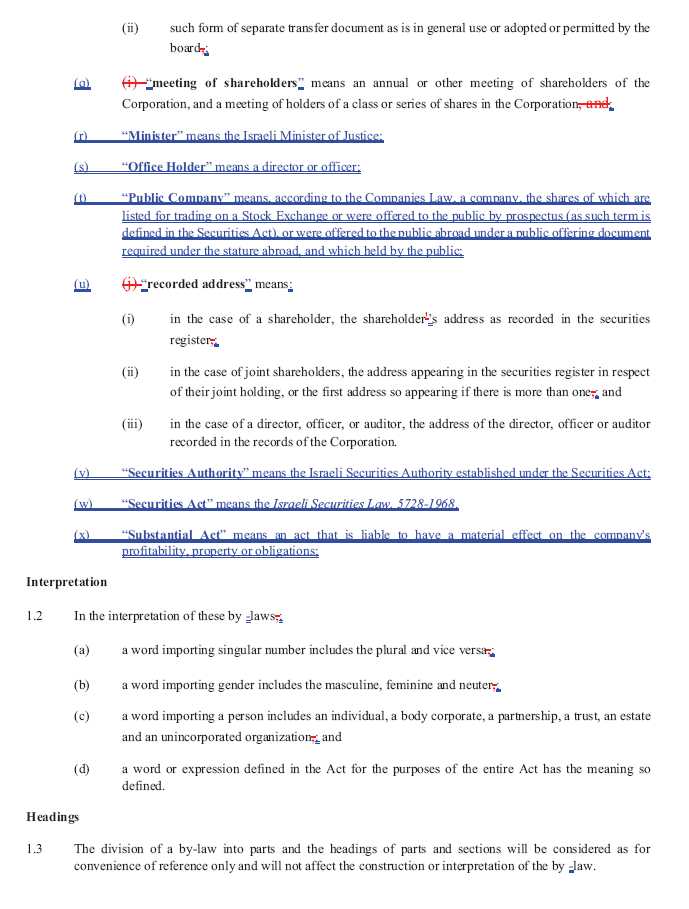

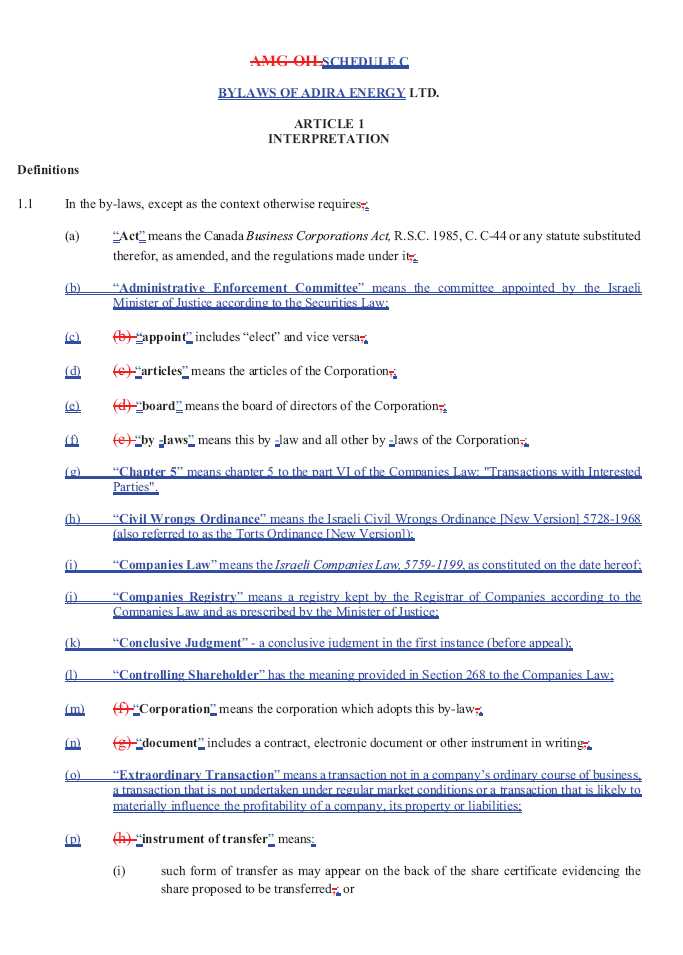

As a condition of listing on the TASE, the ISA requires companies incorporated outside of the State of Israel to adopt the provisions of Section 39A of theIsraeli Securities Law, 5728-1968 (“Section 39A”) which replicates and applies to the Corporation several sections of theIsraeliCompanies Law, 5759-1199 (the “Companies Law”) concerning corporate governance. Section 39A is drafted in Hebrew. An English language translation of Section 39A is attached to this Information Circular as Schedule A. Section 39A includes references to other material legislation. An English language translation of the provisions of other legislation referred to in Section 39A is attached to this Information Circular as Schedule B. The Corporation must adopt all of the Sections of the Companies Law included in Section 39A in order to qualify to list on the TASE.

At the Meeting, Shareholders will be asked to consider, and if deemed advisable approve, with or without variation, ordinary resolutions to confirm amendments to the by-laws of the Corporation which facilitate compliance with Section 39A. The resolutions provide that the amendmentswill take effect only upon the Corporation’s listing on the TASE and certain amendments will only remain in effect until the cessation of the listing of the Common Shares on the TASE.

-4-

A copy of the Corporation’s by-laws showing all proposed amendments is set out as Schedule C to this Circular (the “Amended By-laws”). The Amended By-laws have already been approved by the Directors under Section 103(1) of theCanada Business Corporations Act (the “CBCA”), to take effect upon the listing of the Common Shares on the TASE of which certain amendments will only remain effective until the cessation of the listing of the Common Shares on the TASE.

No dissent rights exist in connection with the action to be taken at the Meeting.

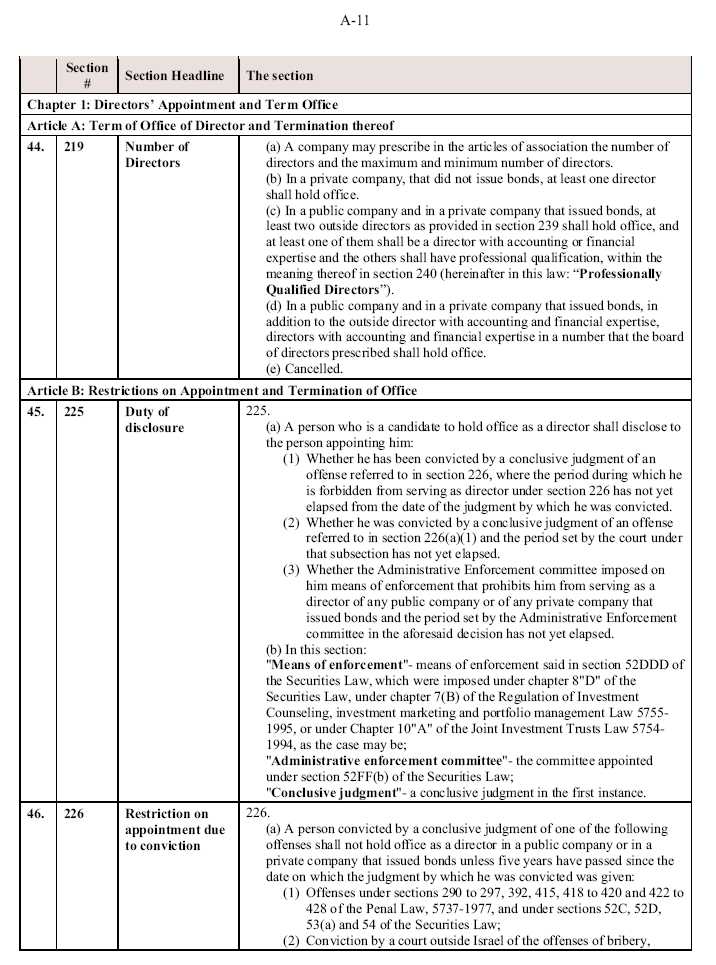

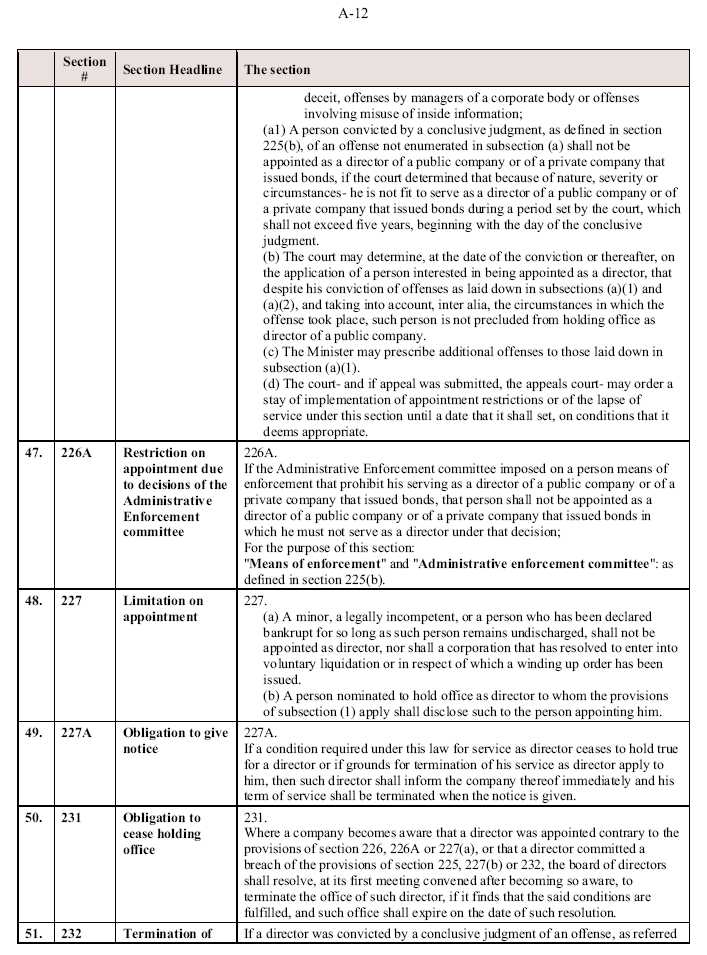

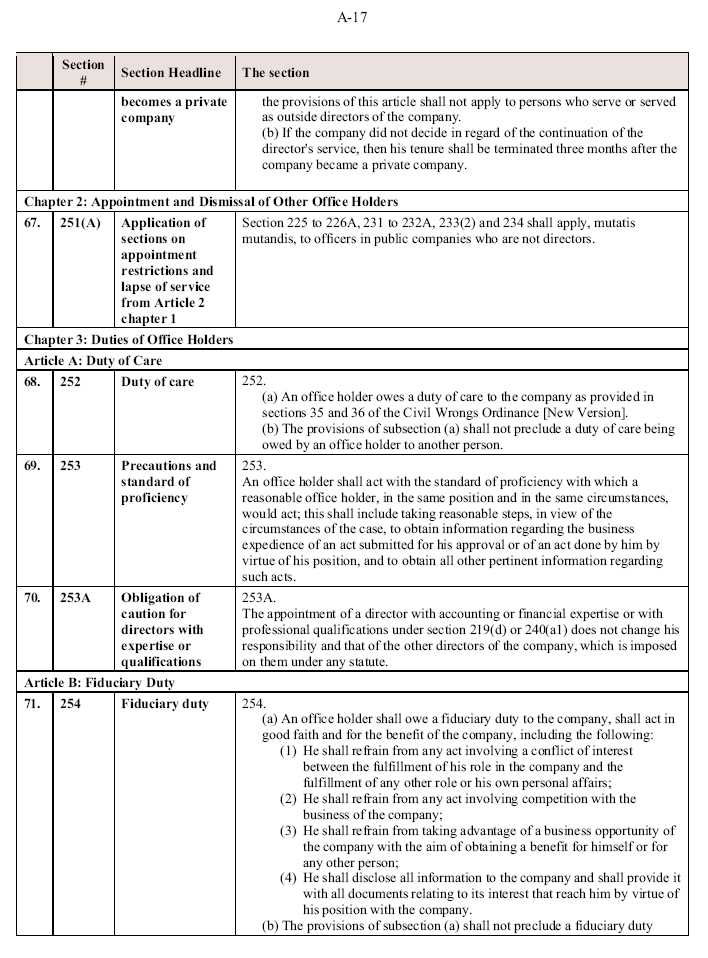

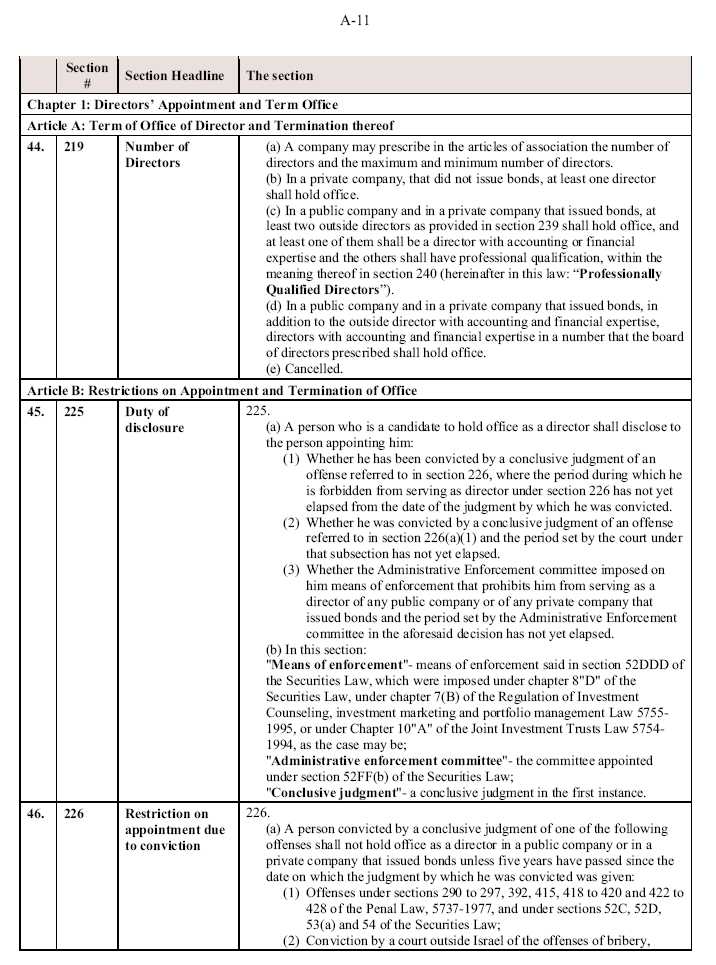

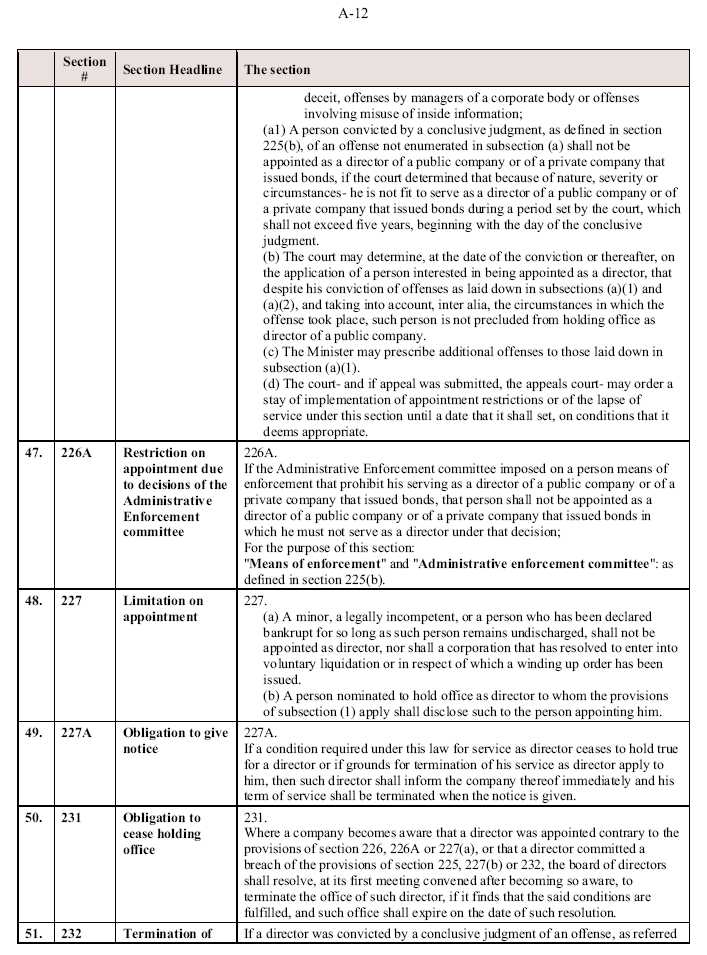

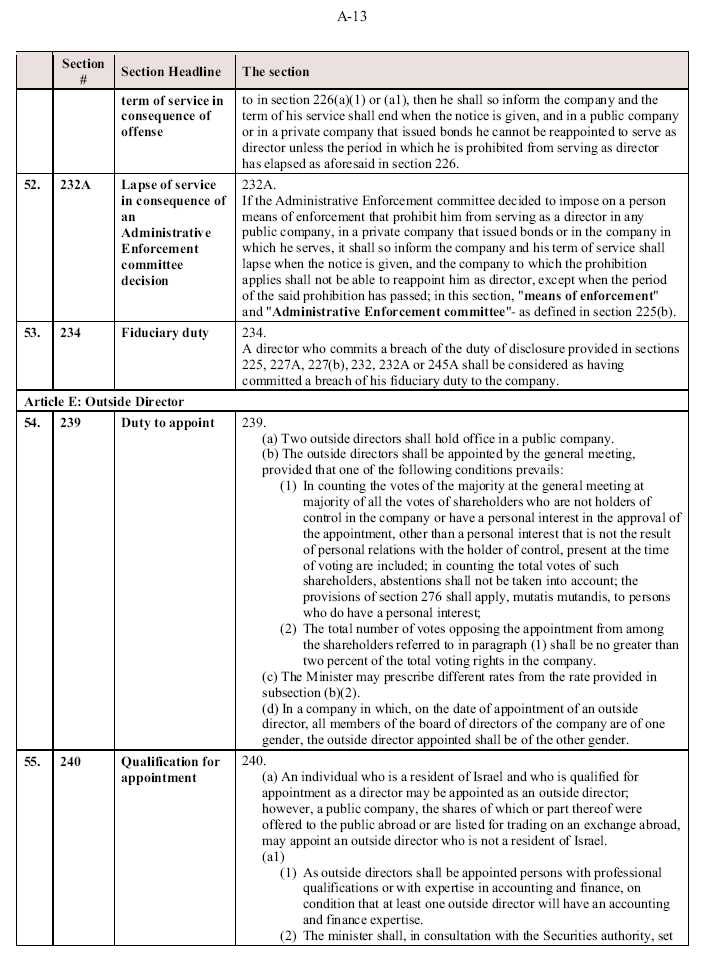

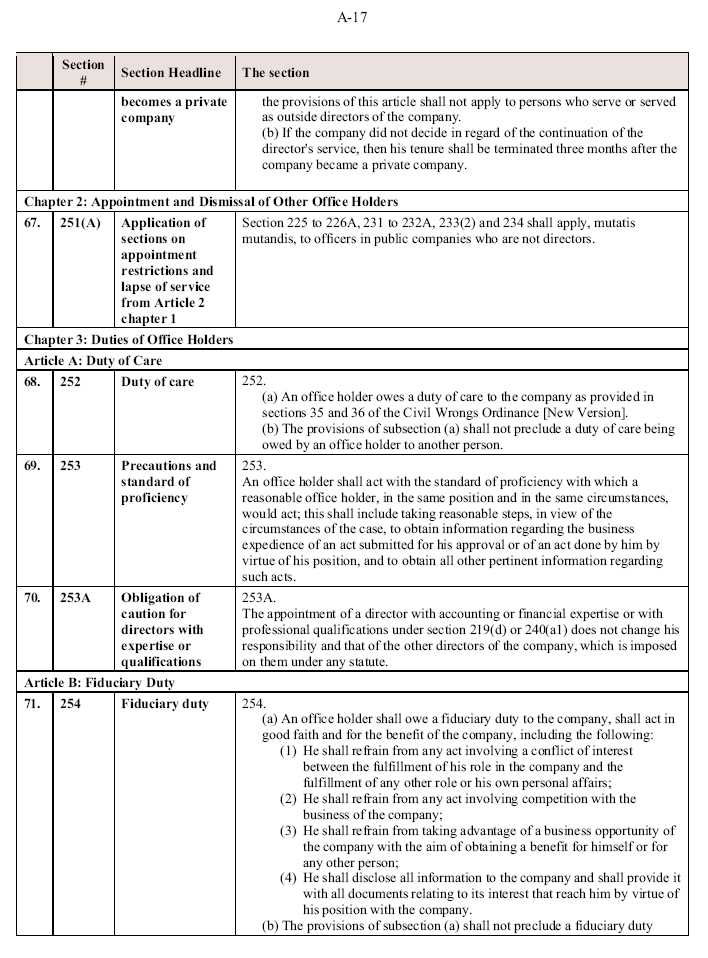

2. Resolution: Qualifications and Duty of Care for Directors and Officers

Section 39A requires that directors and officers (any of the foregoing, “Office Holders”) convicted of certain acts may not be appointed as Office Holders of a TASE listed company. The provisions governing the disclosure of such convictions can be found at Sections 225-226A, 231-232A, 234 and 251A of Section 39A (see Schedule A of this Information Circular) and the corresponding by-law amendments are found at Sections 1.1(b), 1.1(k) and Article 4 of the Amended By-laws (see Schedule C of this Information Circular).

(i) ConclusiveJudgement

Section 39A provides that a person convicted by a “conclusive judgment” (as defined in Section 225(b) of the Companies Law) of one of the following offenses shall not be an Office Holder of the Corporation when a public company (as such term is defined in Section 39A, see the “Definitions” section of the Amended Bylaws) or a private company that issued bonds, unless five years have passed since the date of the issuance of the relevant judgement:

| | (a) | the offenses listed in Section 226(a)(1) of the Companies Law (see Schedule B of this Information Circular); |

| | | |

| | (b) | conviction by a court outside Israel of bribery, deceit, offenses by managers of a corporate body or offenses involving misuse of insider information; or |

| | | |

| | (c) | convicted by a “conclusive judgment” (as defined in Section 225(b) of the Companies Law), of an offense not enumerated in this section if the Israeli court determined that because of nature, severity or circumstances he is not fit to serve as an Office Holder of a public company or of a private company that issued bonds during a period set by the court, which period shall not exceed five years, beginning with the day of the “conclusive judgment”. |

(ii) Duty ofCare

Section 39A prescribes a duty of care and standard of proficiency for Office Holders of public companies. These standards are in addition to those mandated by the CBCA.

An Office Holder owes a duty of care to the Corporation, as provided in Sections 35 and 36 of theCivil Wrongs Ordinance [New Version], 5728-1968 (see Schedule B of this Information Circular for an English translation of such provisions). An Office Holder shall exercise a level of skill which an Office Holder would have used in the same position and under the same circumstances acting reasonably. Among other things the Office Holder will use reasonable means considering the circumstances of the case, to gather information pertaining to the business advisability of an act which is brought for his or her approval or an act which is performed by him or her by virtue of his or her position, and to gather any other information of significance with regard to such acts.

-5-

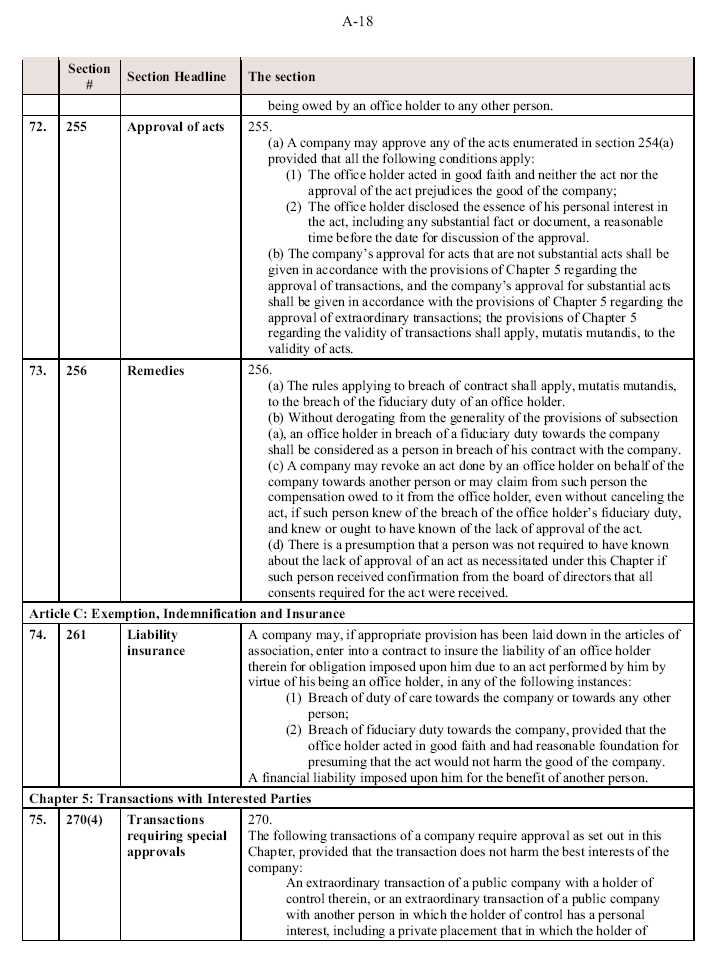

(iii) FiduciaryDuty

In addition, an Office Holder owes a fiduciary duty to the Corporation (which does not detract from any other duty owing to any other person), and shall act in good faith and in the best interests thereof, including: refraining from any act which poses a conflict of interest between the fulfilment of his or her position with the Corporation and the fulfilment of another of his or her positions or his or her personal affairs, refrain from any act which constitutes competition with the Corporation’s business, refraining from using a business opportunity of the Corporation in the aim of gaining a benefit for himself or herself another, refrain from revealing to another company any item of information or delivering any document pertaining to the Corporation’s affairs which came into his or her possession by virtue of his or her status in the Corporation. Additionally officers shall disclose all information to the Corporation relating to his or her interest in any transaction by virtue of his or her position with the Corporation. The Corporation can approve the engagement of officersin these acts in certain circumstances. Certain remedies are also provided for in Section 39A.

Provisions relevant to the Office Holder’s duty of care can be found at Sections 252 to 256 of Section 39A (see Schedule A of this Information Circular) and the corresponding by-law amendments are found at Section 1.1(g), 1.1(h), 1.1(o), 1.1(x) and Article 9 of the Amended By-laws (see Schedule C of this Information Circular).

(iv) Resolution

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Sections 1.1(b), 1.1(g), 1.1(h), 1.1(k), 1.1(o), 1.1(x), Articles 4 and 9, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from theShareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

-6-

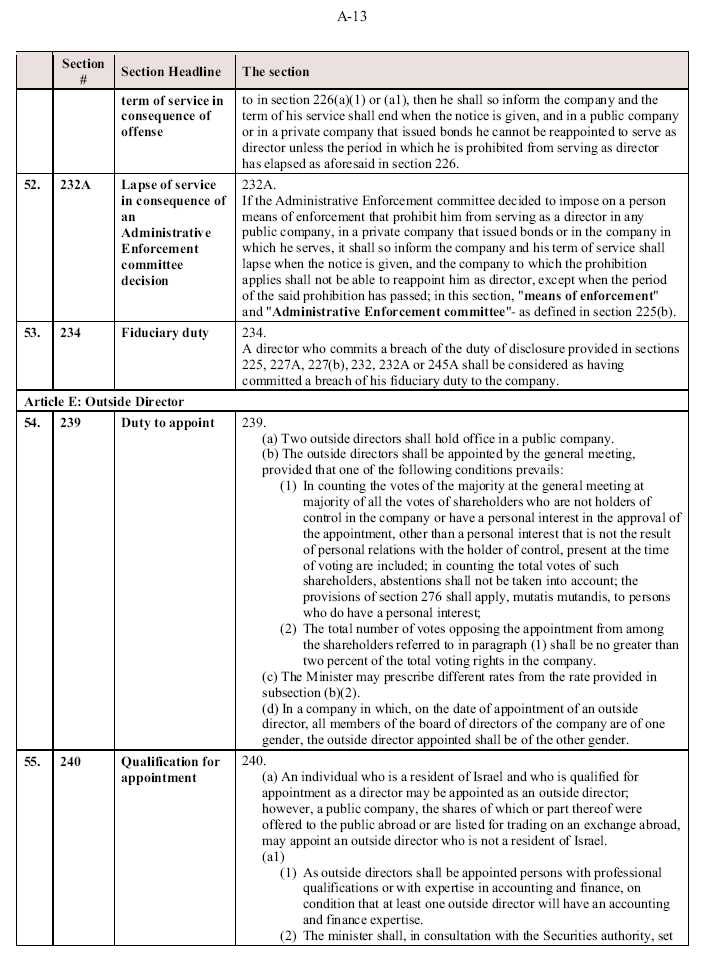

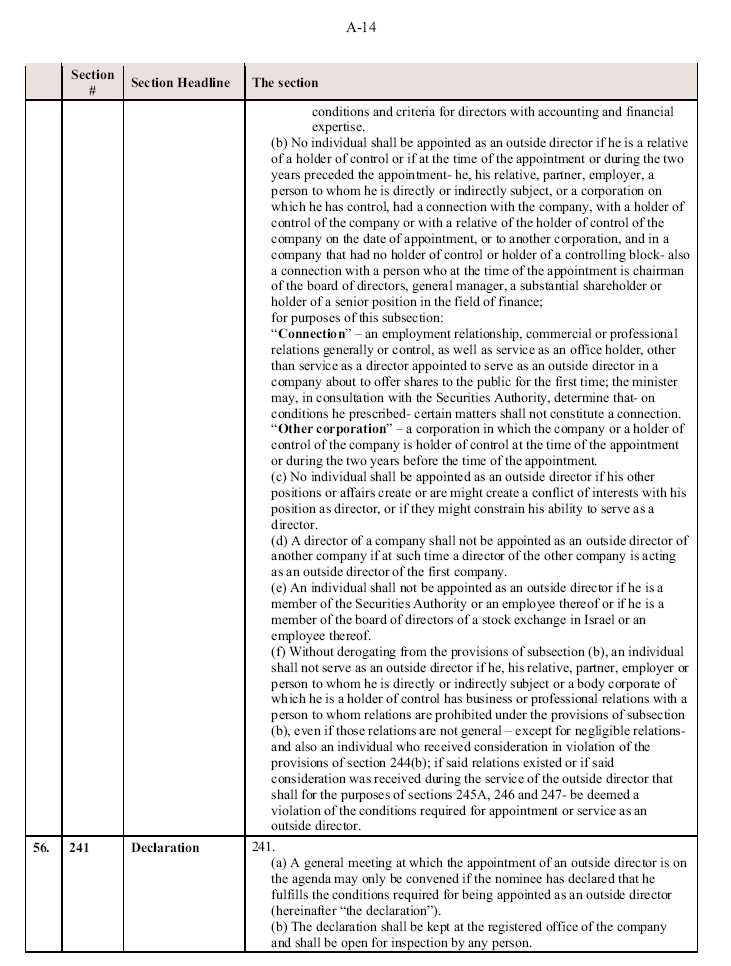

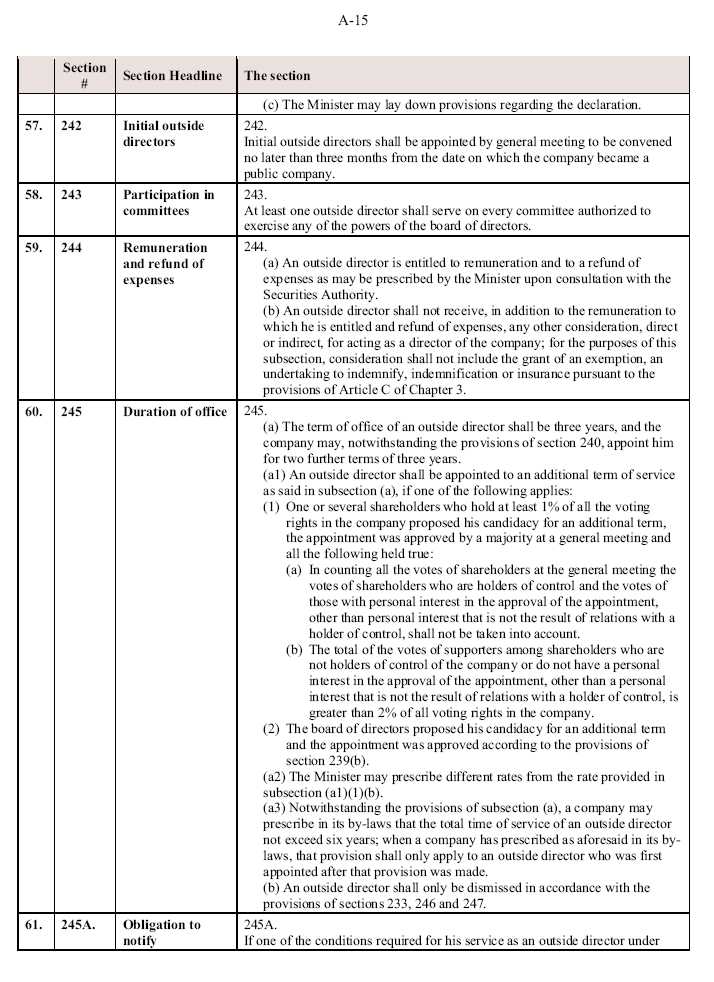

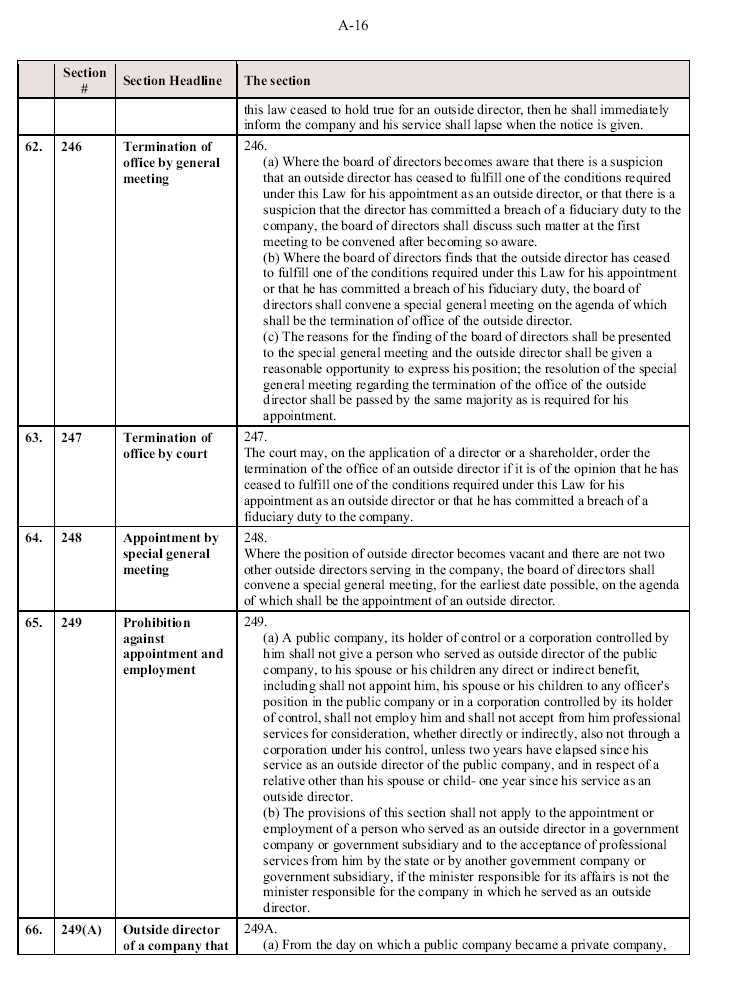

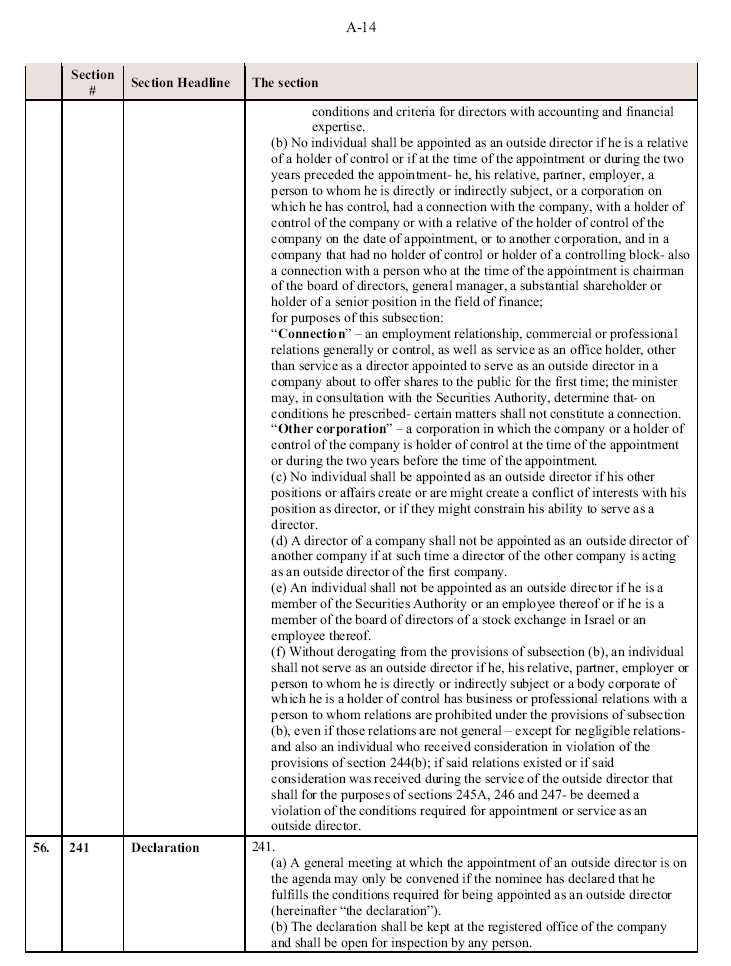

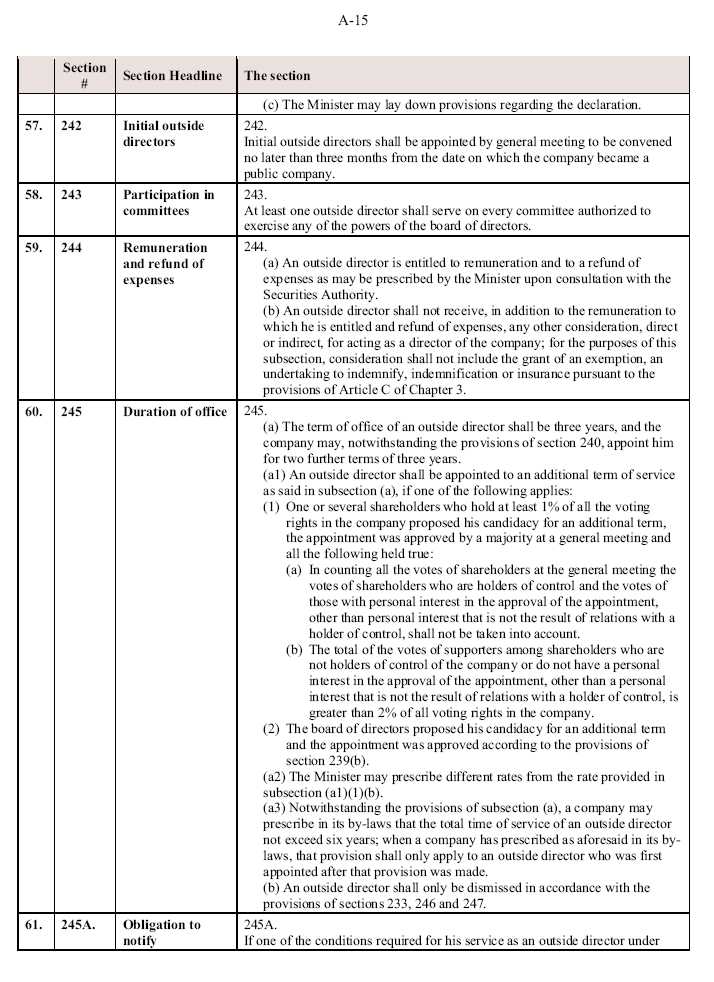

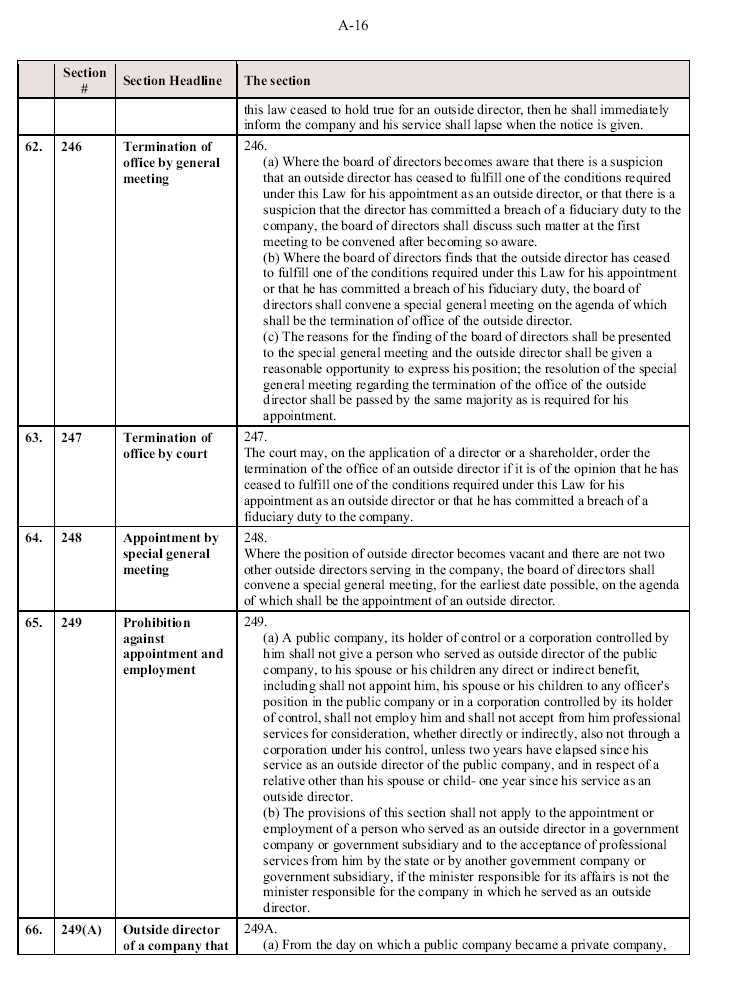

3. Resolution: Outside Directors

Section 39A requires that companies listed on the TASE shall have two or more “outside directors”. At least one outside director must have accounting and financial expertise and all other outstanding directors must have professional qualifications. The outside directors shall be appointed at a the general meeting by a majority of the votes who are participating in the vote, which includes at least a majority of all of the votes of the shareholders who are neither the controlling shareholders of the company nor have a personal interest in the approval of the appointment, other than a personal interest which is not the result of such person’s contacts with the controlling shareholder.

An outside director shall be an individual who is not:

| | (i) | a relative of a controlling shareholder; |

| | | |

| | (ii) | a relative, partner, employer (or equivalent), directly or indirectly, or a corporation controlled by such person, on the date of the appointment or in the two years which preceded the date of the appointment, have any link to the Corporation, to the controlling shareholder of the Corporation or to a relative of a controlling shareholder of the Corporation, on the appointment date, or to a different corporation, and in a company which has no controlling shareholder or anyone holding a controlling block – also a link to whomever is, on the appointment date, the chairman of the board of directors, the Chief Executive Officer, a material shareholder or the most senior financial officer. |

For the purposes of the foregoing, “Control” means the ability to direct the activity of a corporation, excluding an ability deriving merely from holding an office of director or another office in the corporation, and a person shall be presumed to control a corporation if he or she holds half or more of a certain type of “means of control” of the corporation; and

“Means of control” means, in a corporation, any one of the following:

| | (i) | the right to vote at a general meeting of a company or a corresponding body of another corporation; or |

| | | |

| | (ii) | the right to appoint directors of the corporation or its general manager. |

Outside directors are entitled to such remuneration as prescribed by the Minister under Section 39A.

The first outside directors must be appointed at a general meeting convened no later than three months from the date on which the Corporation is listed on the TASE. The term of office of an outside director is usually three years however, the TSXV has required this be shortened to the regular periods of appointment for directors of the Corporation. Shareholders of the Corporation may elect the same outside director for a total of nine years each.

At least one outside director shall serve on every committee that is empowered to exercise one of the functions of the board of directors of the Corporation (the “Board”).

-7-

All outside directors shall be members of the audit committee of the Corporation (the “Audit Committee”) and the chairman of the Audit Committee must be an outside director. The quorum for discussions and for the adoption of decisions by the Audit Committee will be a majority of the committee's members, with the condition that a majority of those present must be independent directors and at least one of them being an outside director.

The provisions relating to the appointment, qualifications and obligations of outside directors are found in Sections 239 to 249A of Section 39A (see Schedule A of this Information Circular) and the corresponding by-law amendments are found at Section 5.4, 5.11 and 6.1(e) of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Sections 5.4, 5.11 and 6.1(e) substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

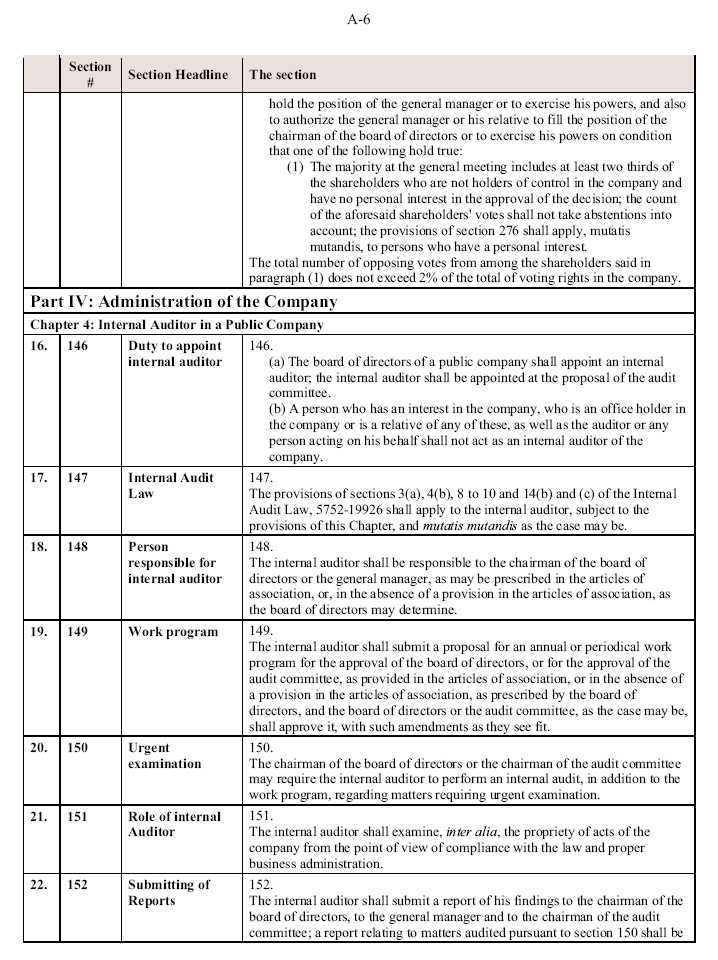

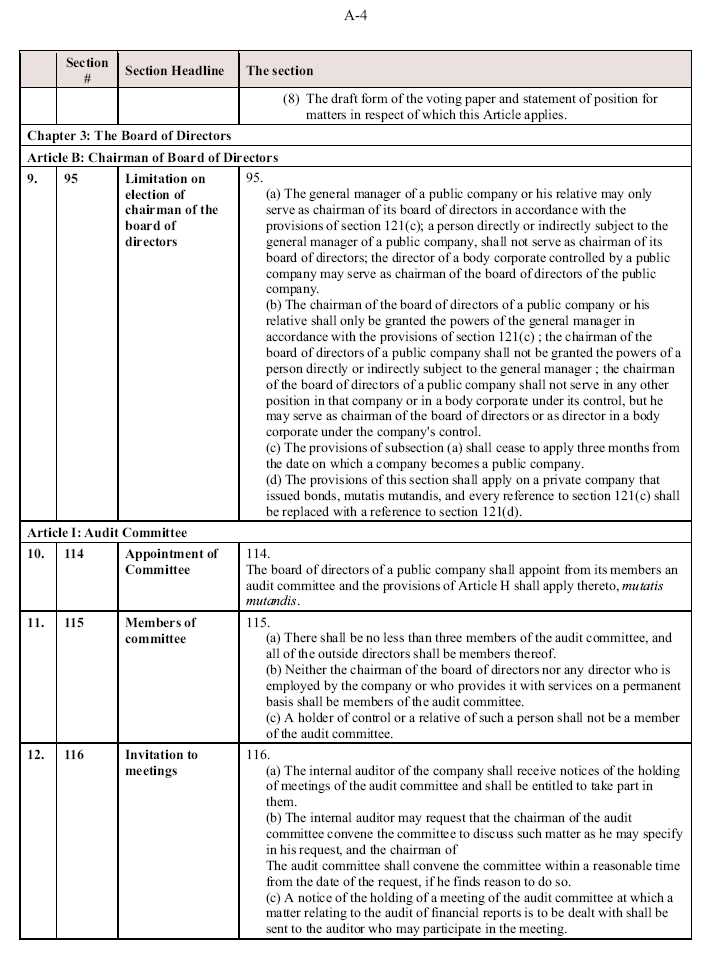

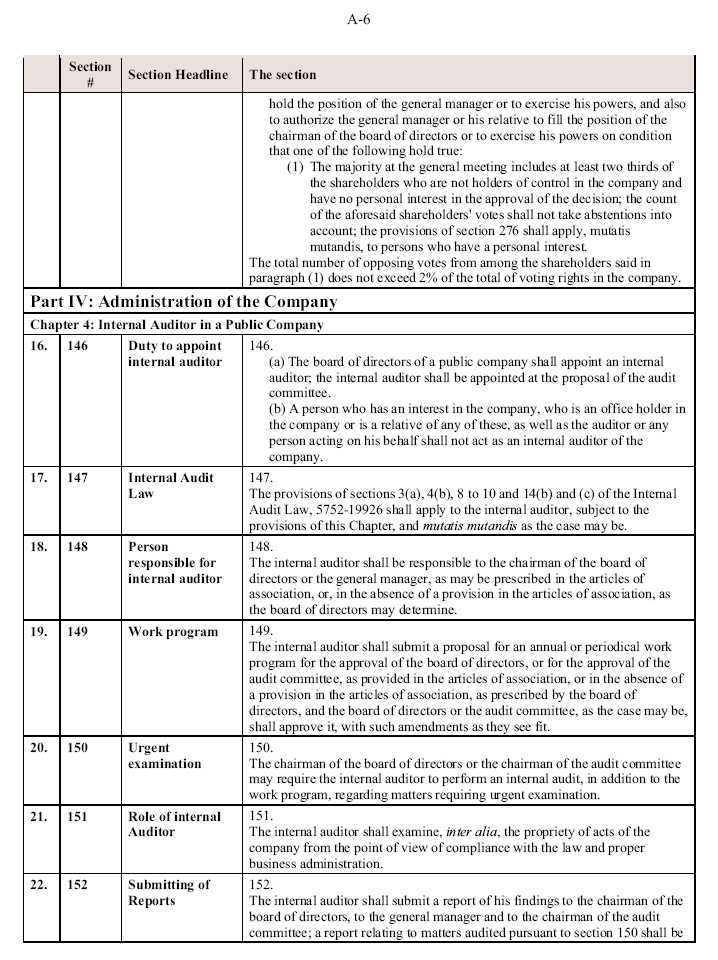

4. Resolution: Internal Auditor

Section 39A requires the Corporation to appoint an “internal auditor” who will be appointed by the Board at the proposal of the Audit Committee. The position may not be held by anyone who has an interest in the Corporation, is an officer or is relative of such a person. The internal auditor may not be affiliated with the external auditor. The internal auditor shall submit proposals for work programs to the Board or the Audit Committee for approval as well as report to them on his or her findings. The internal auditor is charged with examining, among other things, the propriety of acts of the company from the point of view of compliance with the law and proper business administration. The internal auditor cannot be terminated or suspended without his or her consent unless the Board resolves so, after hearing from the Audit Committee and the internal auditor themselves.

-8-

Provisions governing the appointment, qualifications and work program of the internal auditor can be found at Sections 146-153 of Section 39A (see Schedule A of this Information Circular) and the corresponding by-law amendment is found at Section 6.3 of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Section 6.3, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

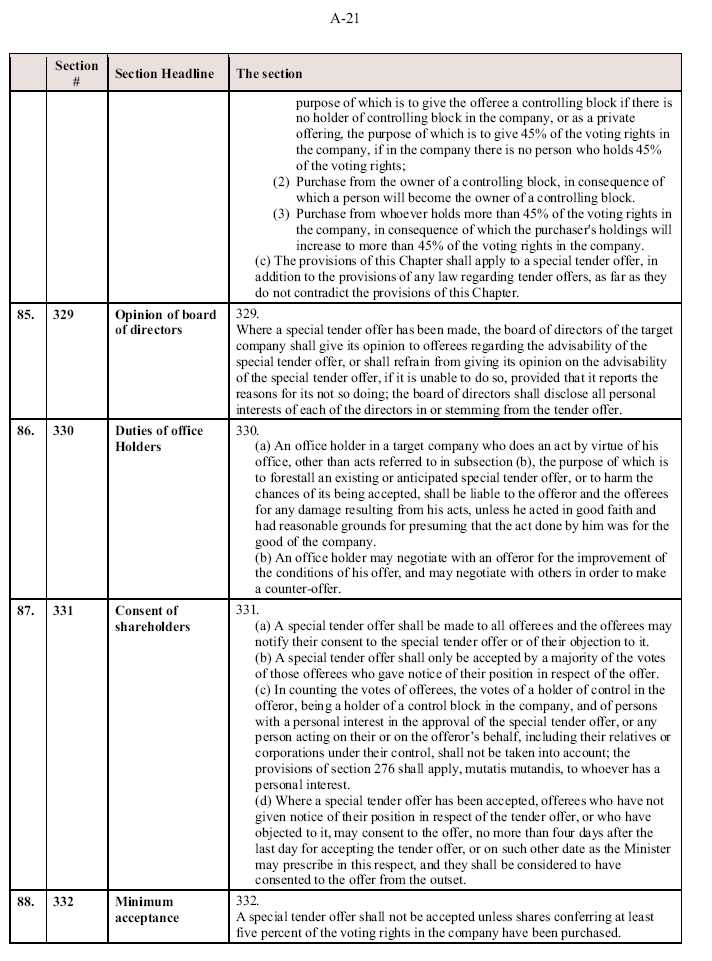

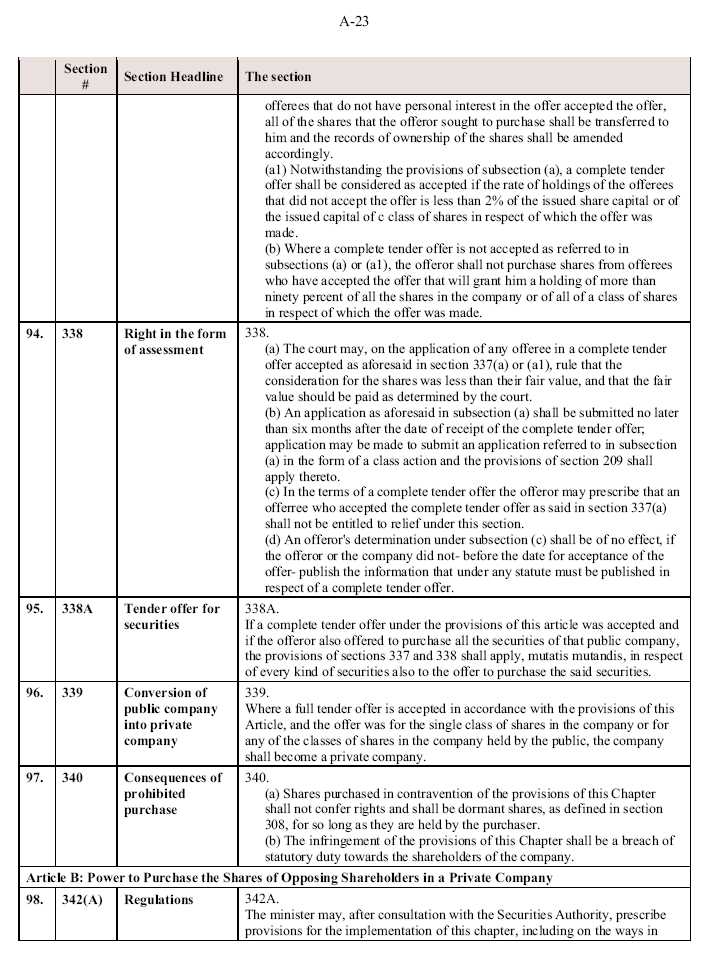

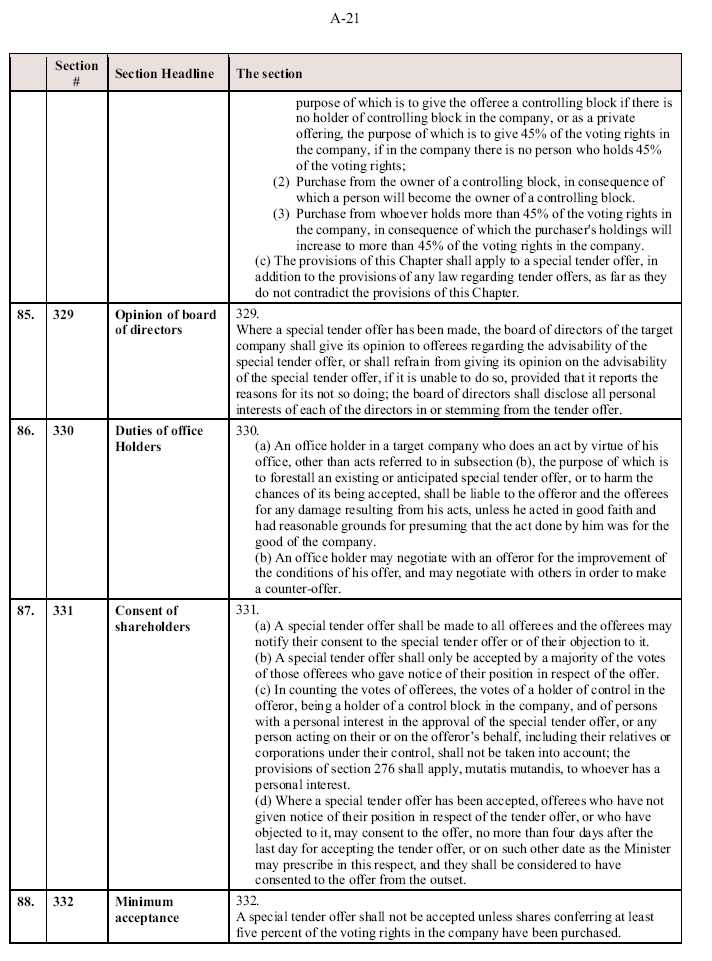

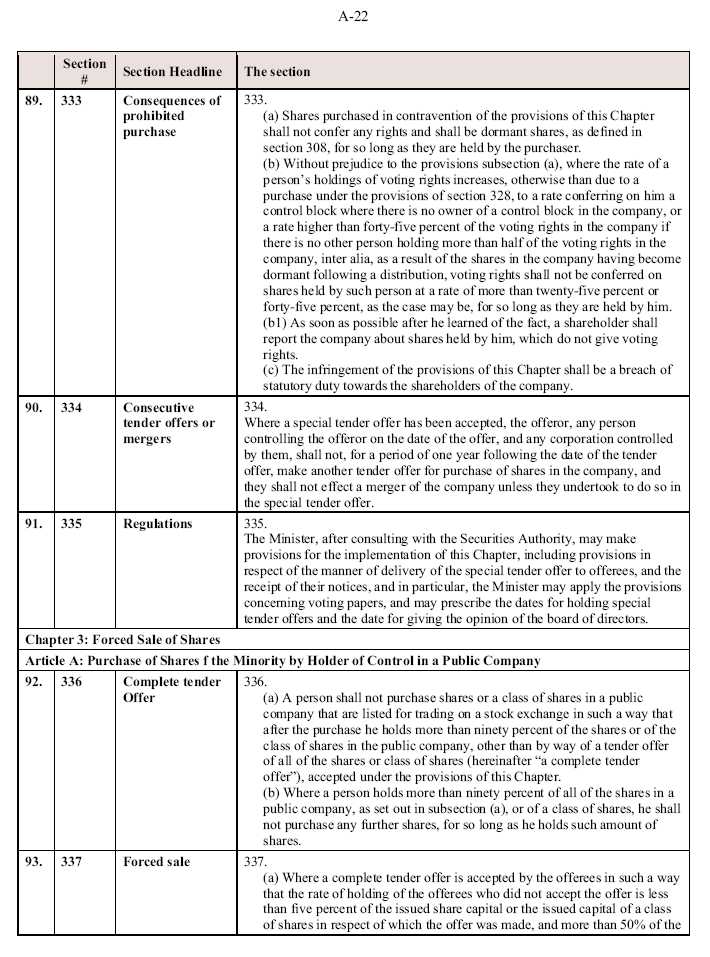

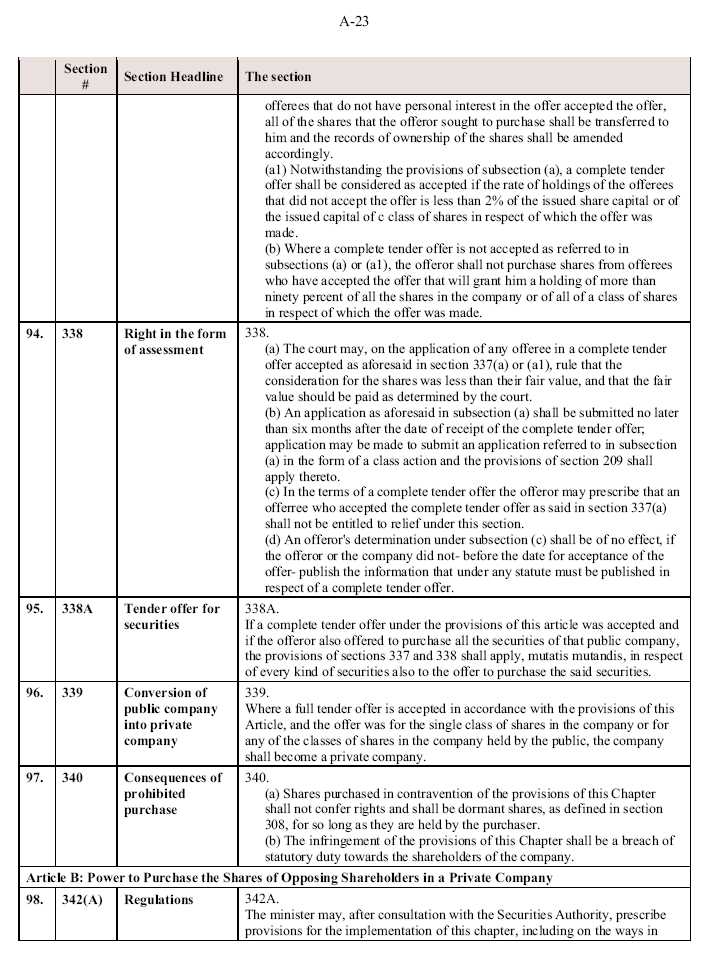

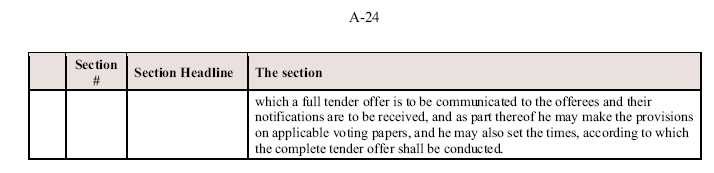

5. Resolution: Special Tender Offer, Purchase of the Minority Shares and Forced Sale

Sections 328 to 340 and 342(A) of Section 39A include provisions relating to special tender offers, the purchase of minority shares and forced sales. These provisions can be found at Sections 328 to 340 and 342(A) of Section 39A (see Schedule A of this Information Circular) and the corresponding bylaw amendments are found at Section 10.5 of the Amended By-laws (see Schedule C of this Information Circular).

(i) Special Tender Offers

Pursuant to Section 39A no purchase shall be performed in a public company as a result of which a person shall become the holder of a controlling block, if there is no holder of a controlling block in the company, and no purchase shall be performed, as a result of which the purchaser's rate of holdings shall exceed 45% of the voting rights in the company, if there is no other person holding more than 45% of the voting rights in the company, except through a special tender offer.

-9-

The aforesaid provisions shall not apply to:

| | (1) | a purchase of shares in a private placement, provided that the purchase was approved in a general meeting as a private placement the purpose of which is to confer on the offeree a controlling block if there is no controlling block in the company, or as a private placement the purpose of which is to confer 45% of the voting rights in the company, if in the company there is no other person holding 45% of the voting rights in the company; |

| | | |

| | (2) | a purchase from a holder of a controlling block, as the result of which a person will become the holder of a controlling block; or |

| | | |

| | (3) | a purchase from another who holds more than 45% of the voting rights in the company, as the result of which the rate of the purchaser's holdings will exceed 45% of the voting rights in the company. |

The Directors shall express their opinion to the offerees regarding the advisability of the special tender offer, or refrain from expressing their opinion regarding the advisability of the special tender offer, if it is unable to do so, provided that they shall report the reasons for refraining. The Directors shall also disclose any personal interest which each Director has in the tender offer or which is derived therefrom.

A special tender offer shall be accepted if agreed to by a majority of the votes of the offerees having announced their position in respect thereof, the count of the offerees' votes excluding the votes of the offerror's controlling shareholder and anyone who has a personal interest in the acceptance of the special tender offer, or the holder of a controlling block in the company, or anyone on behalf of them or the offerror. If a special tender offer shall have been accepted, the offerees who did not announce their position in respect of the tender offer or who objected thereto may agree to the offer no later than 4 days from the final date to accept the tender offer, and they shall be deemed as having agreed to the offer from the outset.

A special tender offer shall not be accepted unless shares conferring at least 5% of the voting rights in the Corporation shall have been purchased according thereto.

In addition, various provisions by virtue of theSecurities Regulations (Purchase Offer), 5760-2000, apply to a special tender offer, on issues such as acceptance dates, equality among offerees, prohibition of acts during the acceptance period, and other regulatory matters. A copy of theSecurities Regulations (Purchase Offer), 5760-2000 can be found at Schedule B to this Information Circular.

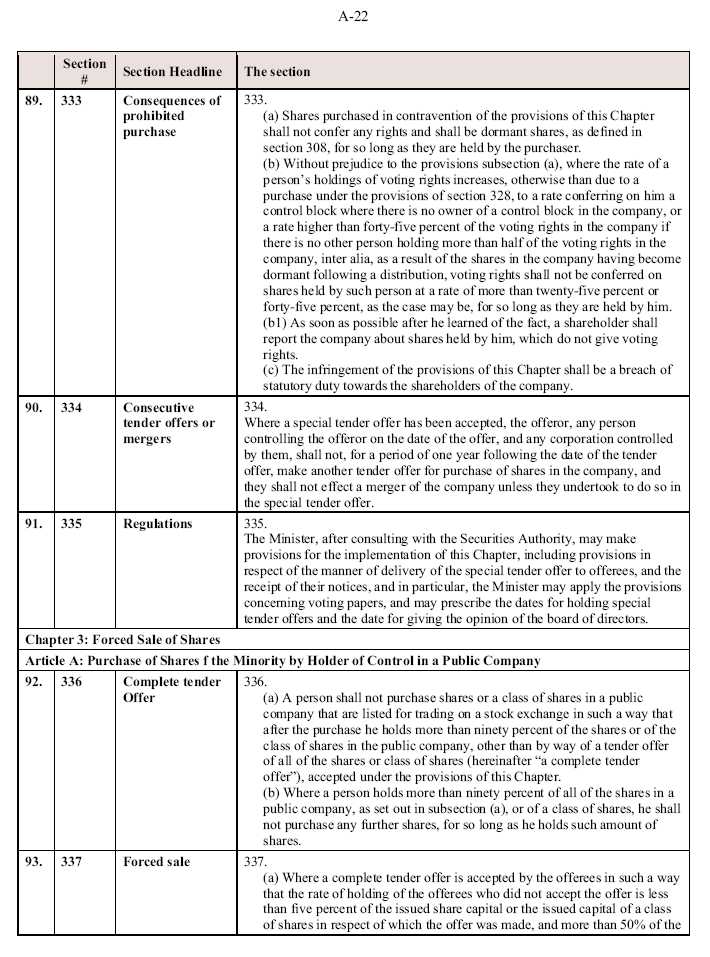

(ii) Purchase of Minority Shares in the Company and Forced Sale

According to Section 39A, a purchase of the minority shares of a public company by the controlling shareholder shall be performed through a full tender offer. Section 39A mandates that a person shall not purchase shares of a public company or voting rights in such company or a class of shares of a public company, such that after the purchase they shall have a holding of more than 90% of the public company's shares or the class of the shares, other than by way of a tender offer for all of the shares or the class of the shares, a full tender offer, pursuant to the provisions of Section 39A.

If a full tender offer has been accepted by the offerees such that:

-10-

| | (1) | the rate of the holdings of the offerees who did not accept the offer constitutes less than 5% of the issued share capital or the issued capital of the class of shares regarding which the offer was made; and |

| | | |

| | (2) | more than one half of the offerees who have no personal interest in accepting the offer accepted the same, |

all of the shares which the offeror sought to purchase for his possession will be transferred and the registrations of the holdings of the shares shall be modified accordingly. Notwithstanding the foregoing, a full tender offer will be accepted if the rate of holdings of the offerees who did not accept the offer constitutes less than 2% of the issued share capital or the issued capital of the class of shares regarding which the offer was made.

A court in the State of Israel may, at the request of anyone who was an offeree in a full tender offer which was accepted, rule that the consideration for the shares was lower than their fair value, and that the fair value shall be paid, as the Israel court shall determine.

(iii) Resolution

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Section 10.5, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

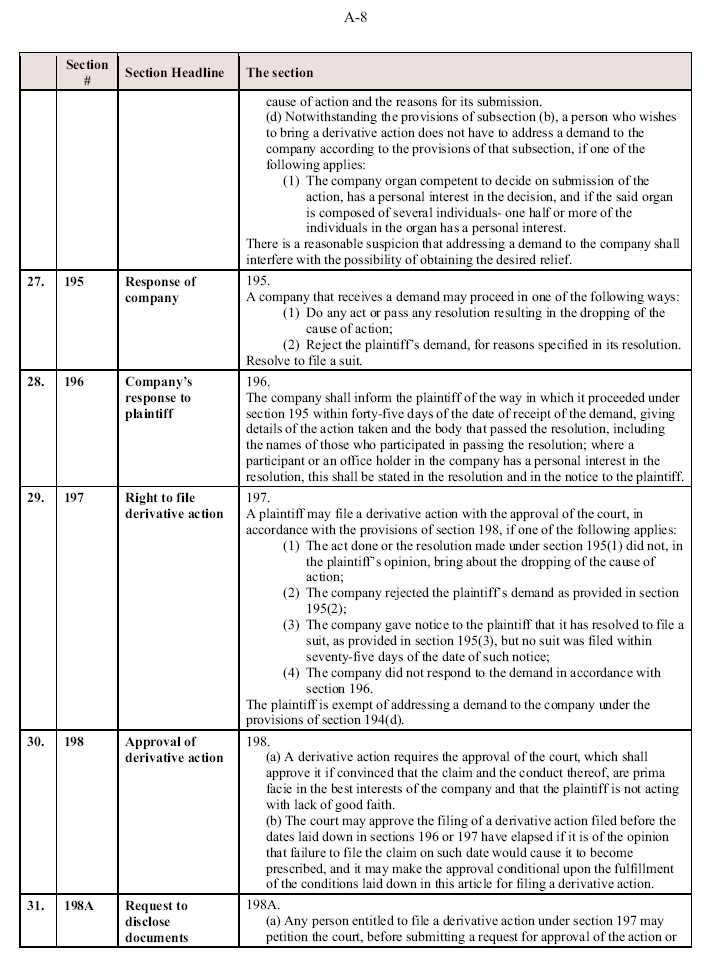

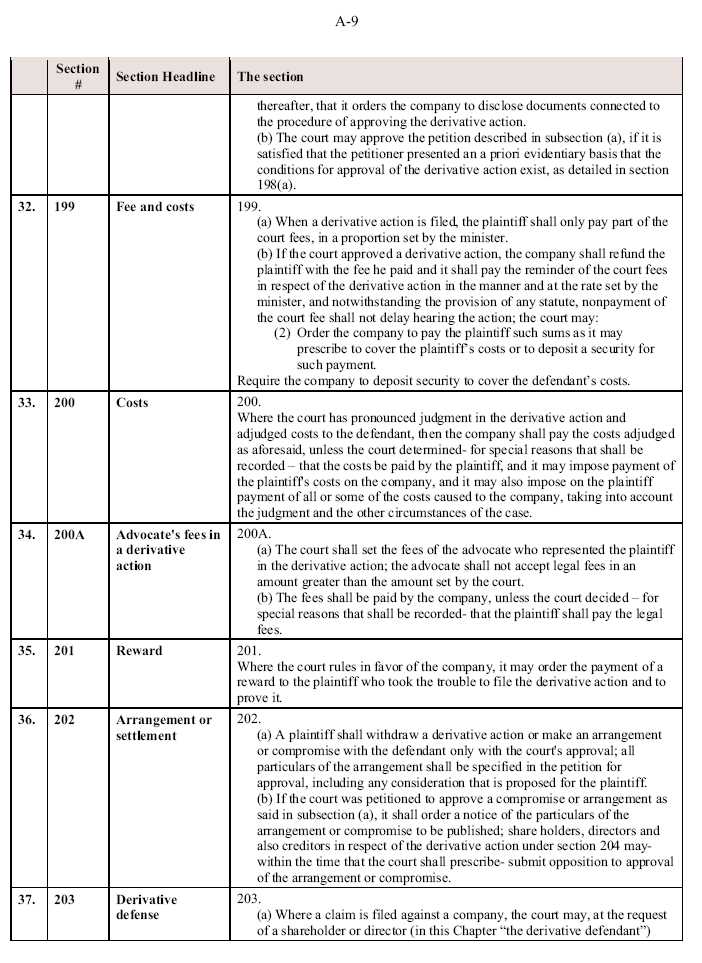

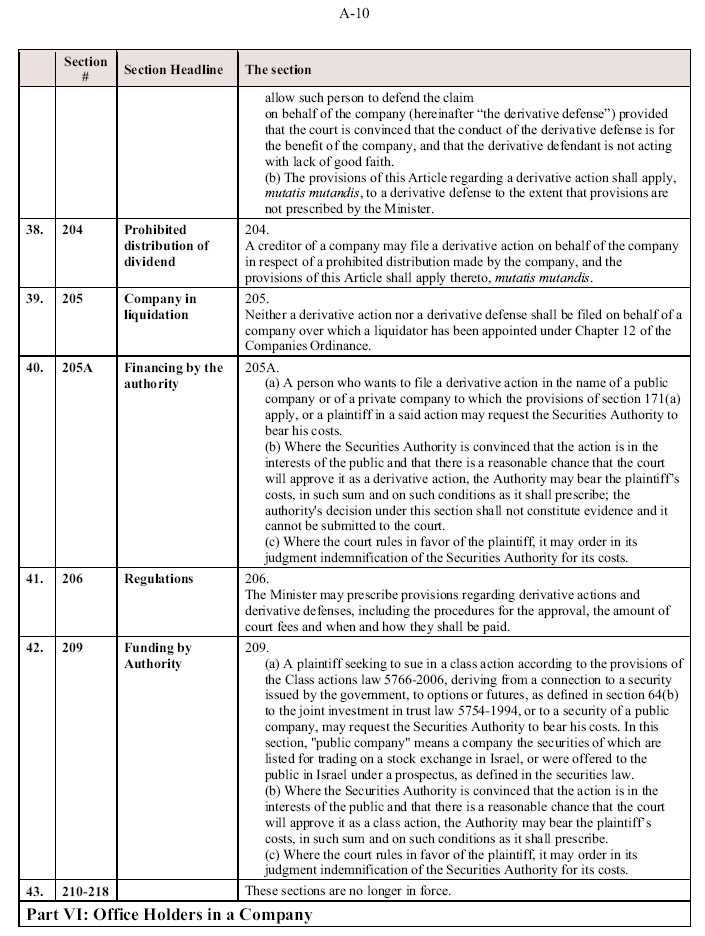

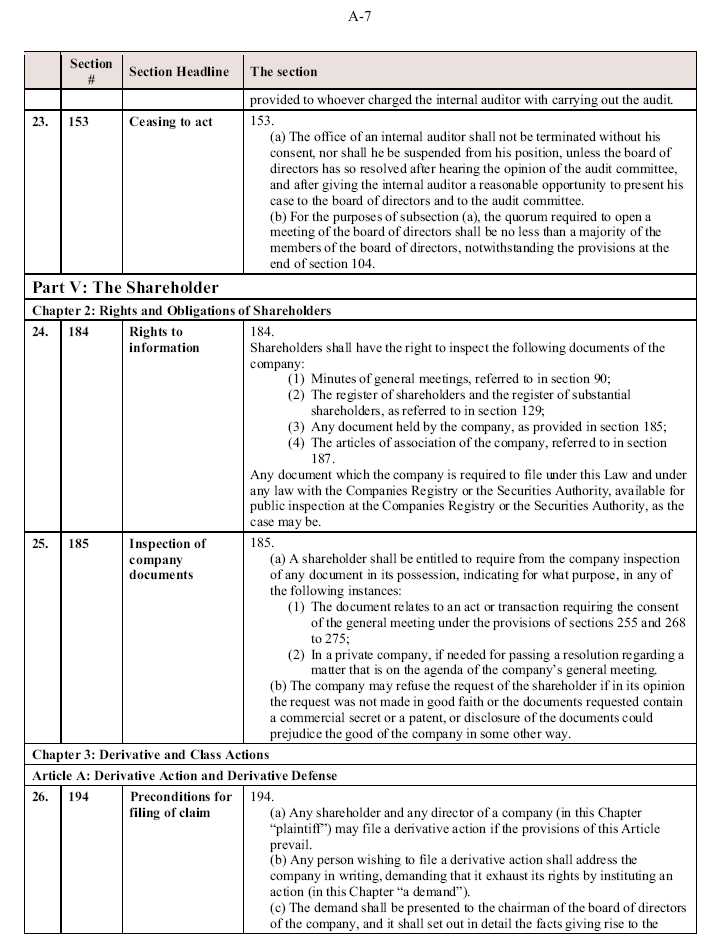

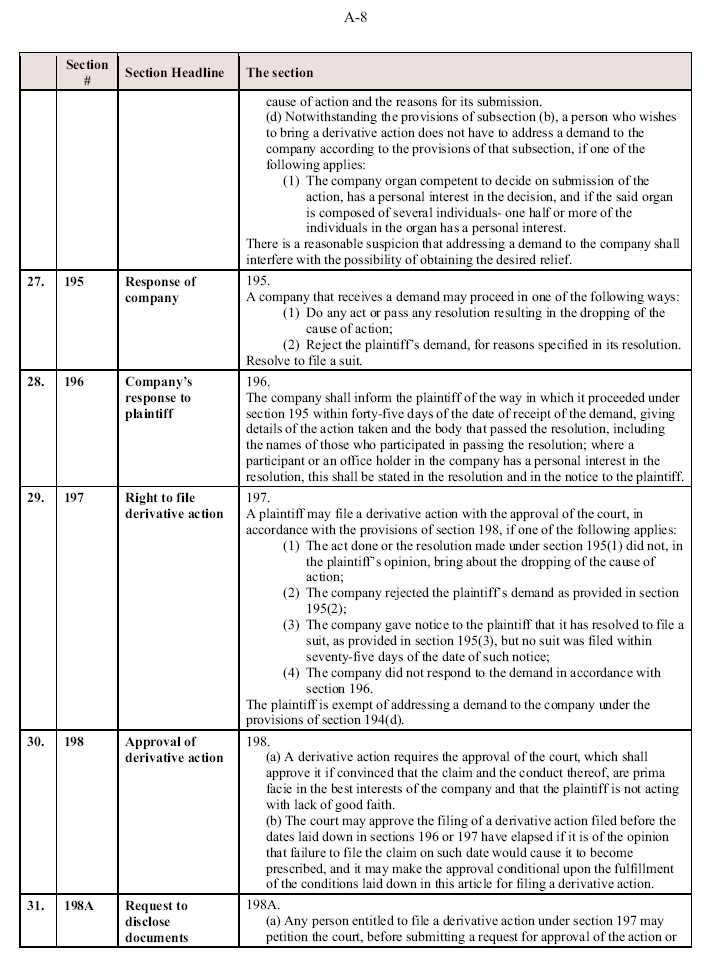

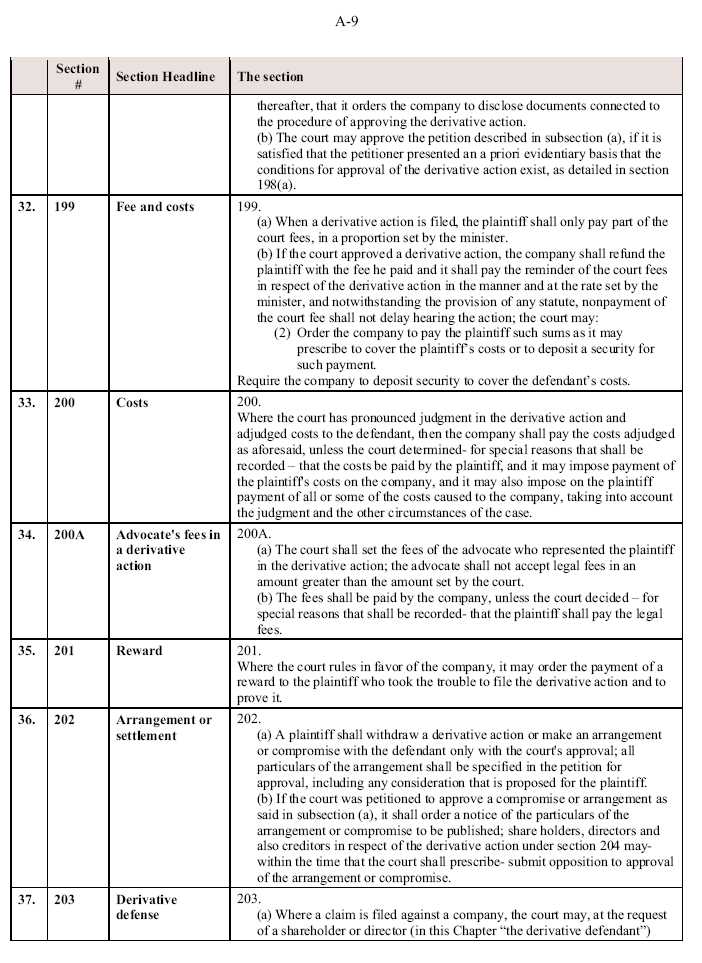

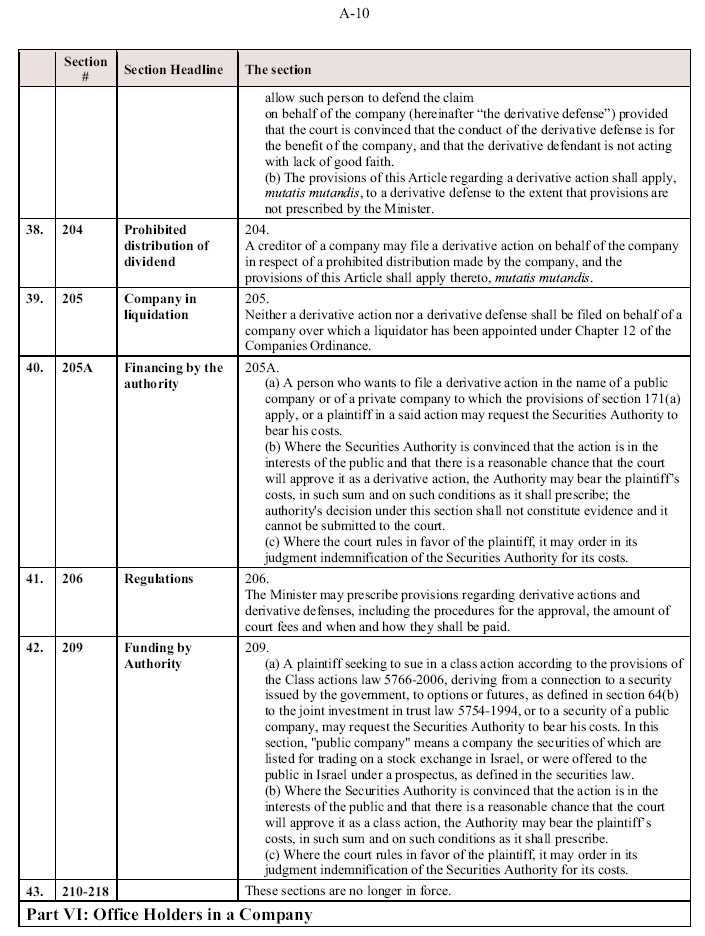

6. Resolution: Derivatives and Class Actions

Sections 194 to 218 of the Companies Law provide that any shareholder and any directormay file a derivative action if the circumstances set out in Section 194 of the Companies Law apply. The person must write to the Corporation and the demand will be presented to the chairman of the Board. A submission does not have to be filed with the Corporation if the part of the Corporation responsible for approving the submission of the action has a personal interest in the action (and if the approving part is composed of more than one person-if half or more of the persons has a personal interest in the action) and there is a reasonable suspicion that the submission to the Corporation would interfere with the possibility of obtaining the desired relief. Where a claim is submitted to the Corporation it must inform the plaintiff of its course of action (act or pass a resolution resulting in the dropping of the cause of action, reject the demand or file suit). The plaintiff can then bring a suit at the fulfillment of one of the following: (1) they feel the Corporation’s actions did not result in the dropping of the course of action; (2) the Corporation rejected the demand of the plaintiff; (3) the Corporation informed the plaintiff that it intended to file suit and the suit was not filed within 75 days of the Corporation’s notice to the plaintiff; (4) the Corporation did not respond to the submission as required; or (5) the plaintiff is not obliged to file a submission to the Corporation (and may therefor bring the action as it chooses). A court may approve of the action if the claim is in the best interest of the Corporation and the plaintiff is not acting with lack of good faith. These timelines may be abridged if the court finds that the timelines shall prevent the filing of the suit due to time limitations applying on the suit. The Corporation shall pay the fees for a derivative action as directed by the court and as determined by the Minister of Justice. Application can also be made for the ISA to pay the costs. Arrangements for settlement are prescribed.

-11-

The provisions relating to derivate and class actions can be found at Sections 194 to 218 of the Companies Law (see Schedule A of this Information Circular). The corresponding by-law amendments are found at Article 15 of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Article 15, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

-12-

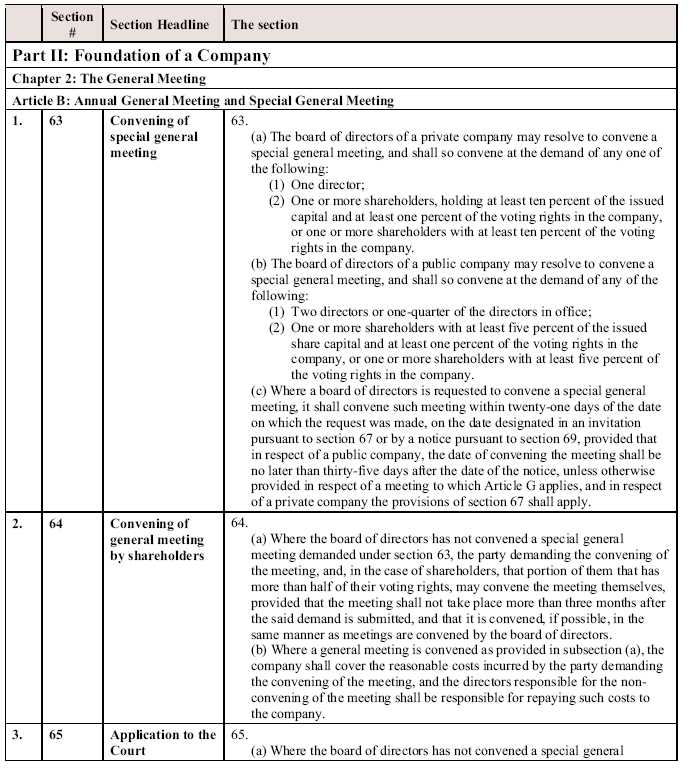

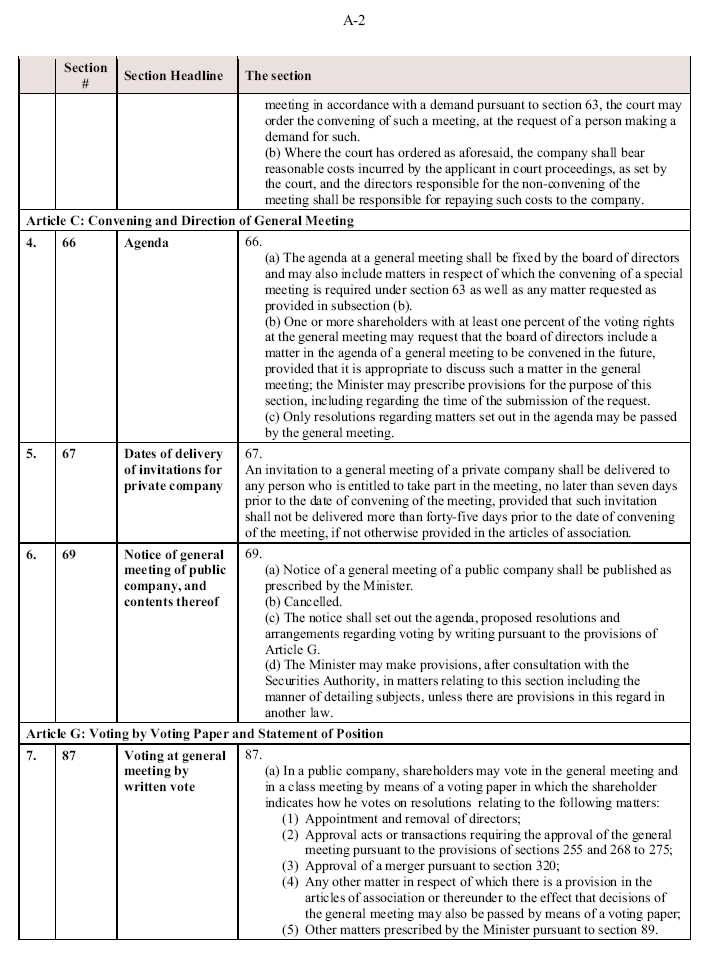

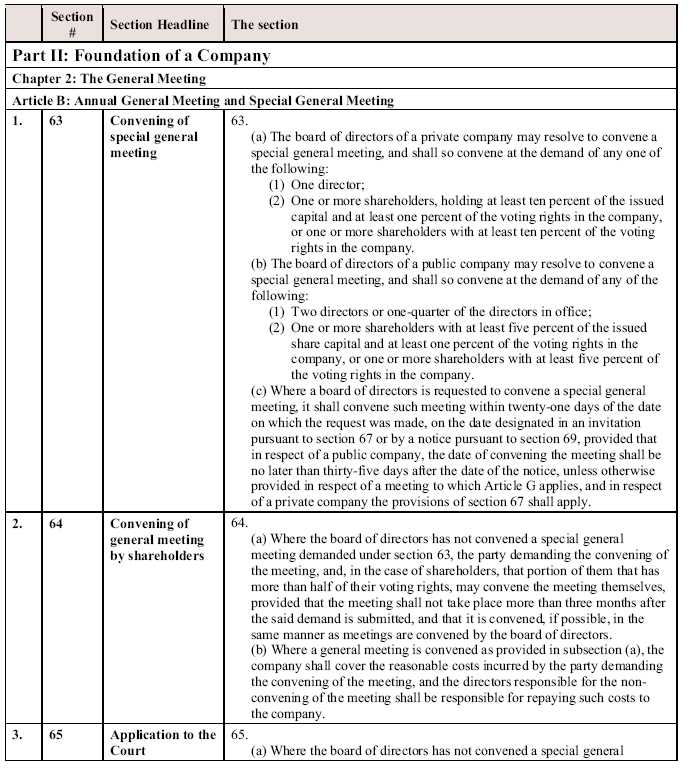

7. Resolution: Shareholder Rights to Convening of Meetings

Section 39A provides certain thresholds and requirements for the ways in which a Shareholder may request a meeting of shareholders be convened. In addition to the rights Shareholders have under the CBCA, with the amendment of the by-laws, they will also the rights provided for under Section 39A. These provisions can be found at Sections 63-66 of Section 39A (see Schedule A of this Information Circular) and the corresponding by-law amendments are found at Section 12.1 -12.9 of the Amended Bylaws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Sections 12.1-12.9, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

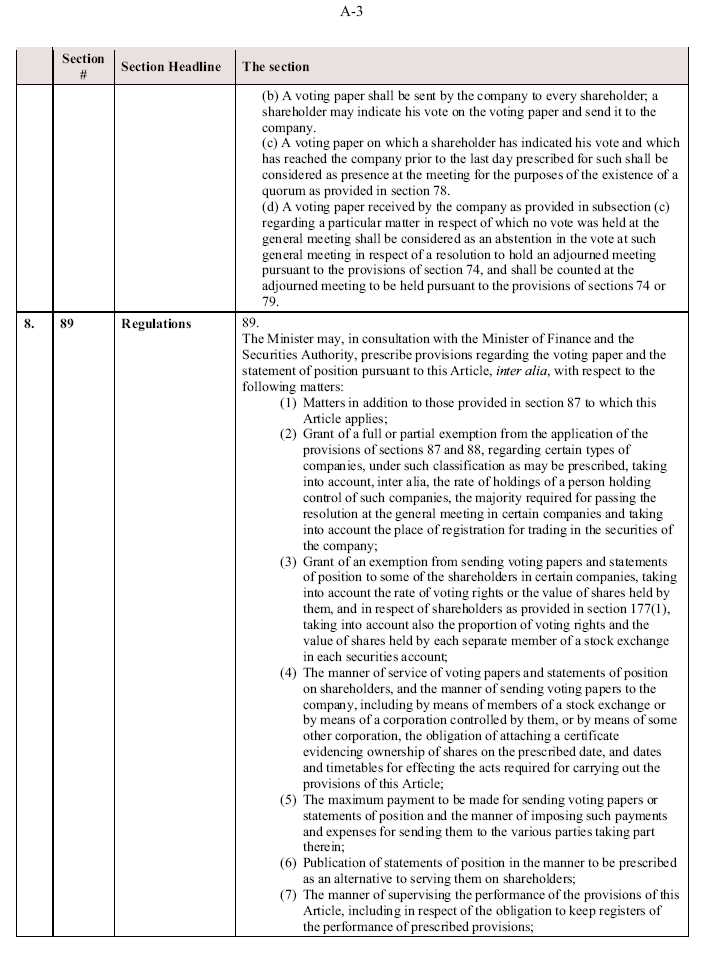

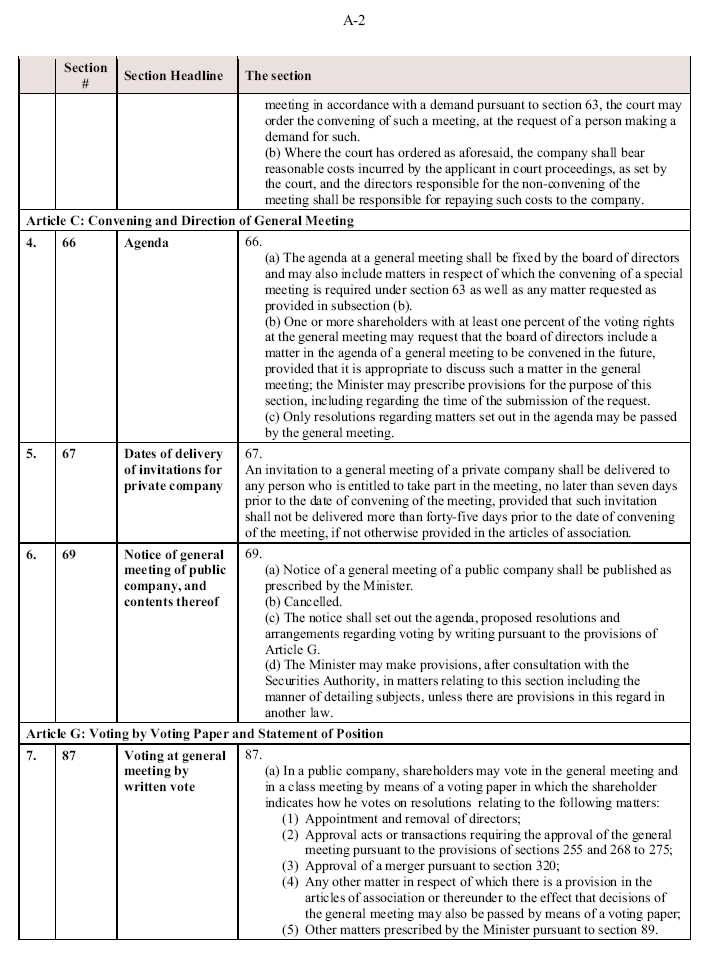

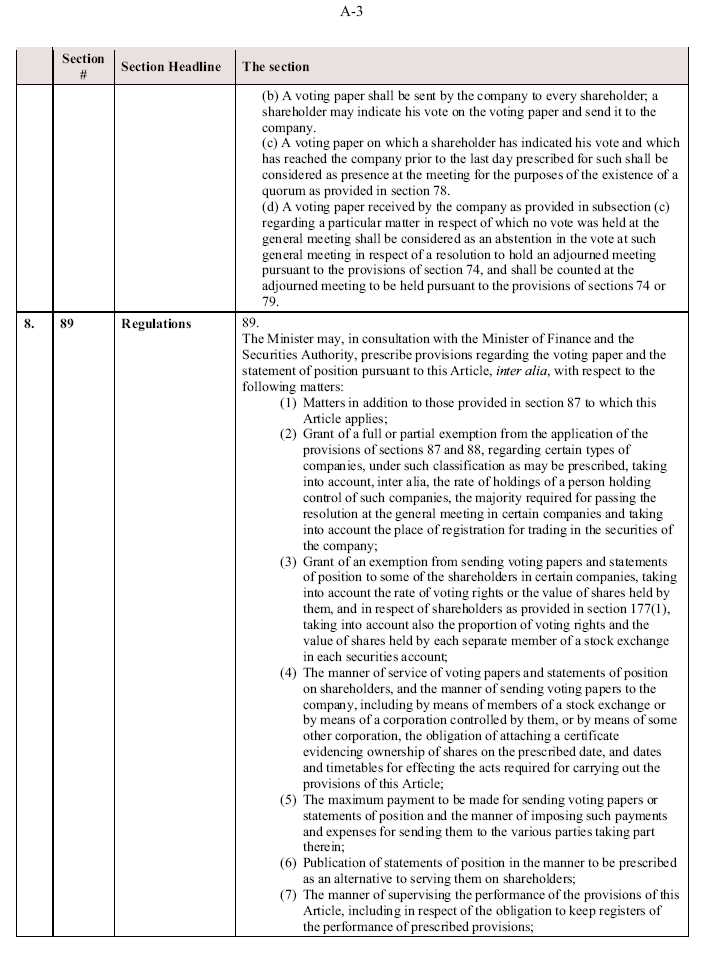

8. Resolution: Written Proxy

Section 87 of Section 39A (see Schedule A of this Information Circular) provides a right for Shareholders to vote by “written proxy”. The corresponding by-law amendment can be found at Section 12.10 of the Amended By-laws (see Schedule C of this Information Circular).

Section 39A provides that the Shareholders may vote at general meetings and at meetings of share classes by written proxy on resolutions on the subject of:

| | (i) | appointments and terminations of directors; |

| | | |

| | (ii) | approval of acts or transactions which require the approval of the general meeting under the provisions of Sections 255 and 268 to 275 of Section 39A; |

| | | |

| | (iii) | approval of a merger pursuant to Section 320 of Section 39A; |

-13-

| | (iv) | the authorization of the chairman of the Board or his relative to fill the position of Chief Executive Officer or exercise his powers, and authorization of the Chief Executive Officer or his relative to fill the position of chairman of the Board or exercise his powers pursuant to Section 121(c) of Section 39A; |

| | | |

| | (v) | any other issue regarding which it was determined by the articles or bylaws of the Corporation that the general meeting's resolutions shall be adopted by way of a written proxy; and |

| | | |

| | (vi) | as well as any other issues which will be determined by the Minister of Justice of Israel. |

The written proxy shall be dispatched by the Corporation to all of the shareholders thereof. A shareholder who will state the manner of his vote in the written proxy and submit the same to the Corporation by the final date which was scheduled therefor, shall be deemed as present at the meeting with regard to the presence of a legal quorum.

According to theCompanies Regulations (Voting in Writing and Position Statements), 5766-2005, if, on the record date for a general meeting which has on its agenda any of the above-listed issues, the controlling shareholder of the Corporation holds sufficient shares to pass such resolution even if all other shareholders participated in the vote and vote against such resolution, a written proxy shall not be necessary. See Schedule B of this Information Circular for a full copy of theCompanies Regulations (Voting in Writing and Position Statements), 5766-2005.

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Section 12.10, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

-14-

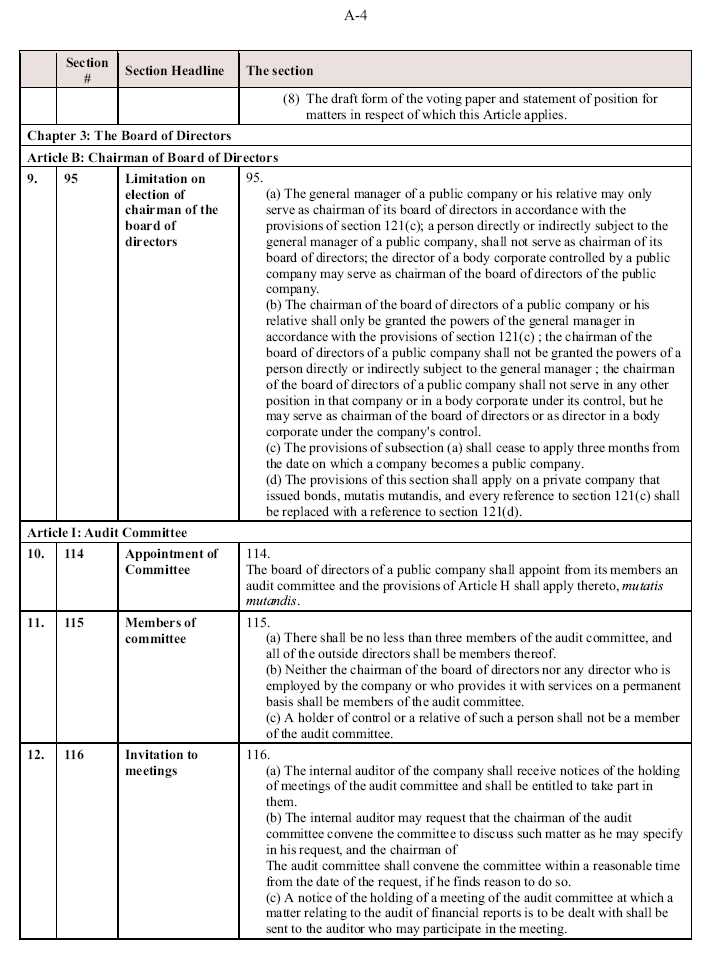

9. Resolution: Division of Power Between Chairmen and Chief Executive Officer

Section 39A provides for the division of power between the Co-Chairmen of the board and the Chief Executive Officer. The relevant provisions of Section 39A are Sections 95 and 121(c) (see Schedule A of this Information Circular) and the corresponding amendments to the Corporation’s by-law can be found at Section 5.6 of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Section 5.6 and Section 5.7, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

10. Resolution: Additional Requirements for Audit Committee

Section 39A requires the appointment of an Audit Committee and applies certain rules to its operation and governance. The amendments will result in a requirement that all of the outside directors (see Section 3 of “Matters to be Acted Upon at the Meeting”) are members of the Audit Committee and that neither a Co-Chairmen of the Board nor any director that is an employee or provides the Corporation with services on a permanent basis may serve on the Audit Committee. Additionally, no holder of control or a relative of such person may serve on the Audit Committee. The amendments will also provide the Audit Committee with greater scope of responsibility in reviewing and managing the Corporation’s internal affairs.

Provisions applying to the Audit Committee requirements can be found at Sections 114-117 of Section 39A (see Schedule A of this Information Circular) and Article H referred to in such Sections (see Schedule B). The corresponding amendments to the Corporation’s by-laws can be found at Section 6.2 of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

-15-

| “IT IS HEREBY RESOLVED, THAT: |

| | |

| 1. | the amendment of the by-laws of the Corporation to include Section 6.2, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

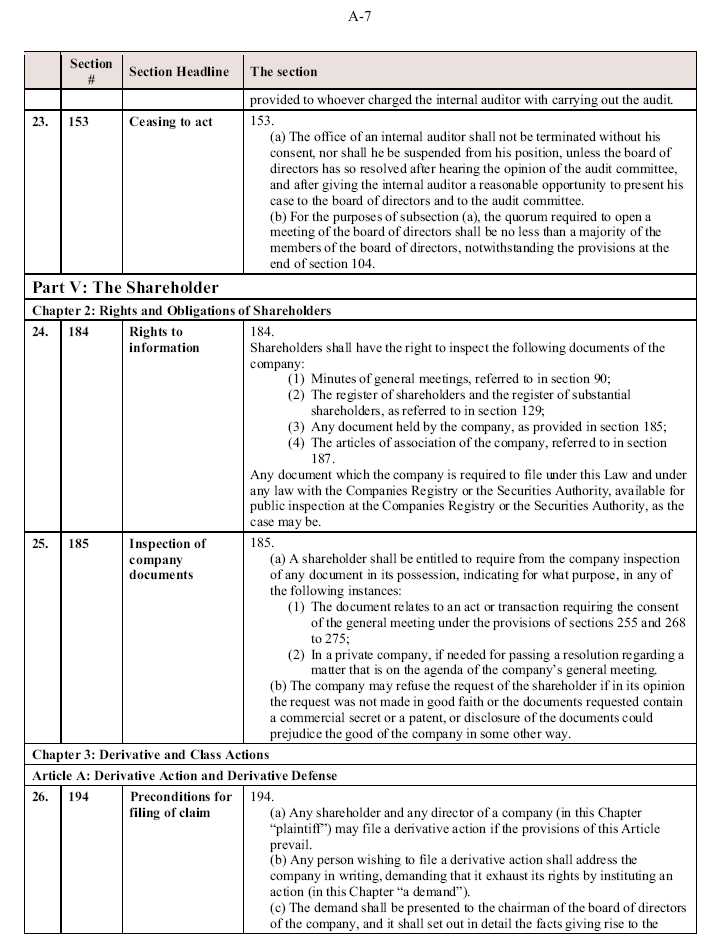

11. Resolution: Shareholder Right to Access

Sections 184-185 of Section 39A provides Shareholders with a statutory right to access to certain corporate documents (see Schedule A of this Information Circular). The corresponding by-law amendment can be found at Sections 1.1(j), 1.1(v), 1.1(w) and Article 13 of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Sections 1.1(j), 1.1(v), 1.1(w) and Article 13, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

-16-

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

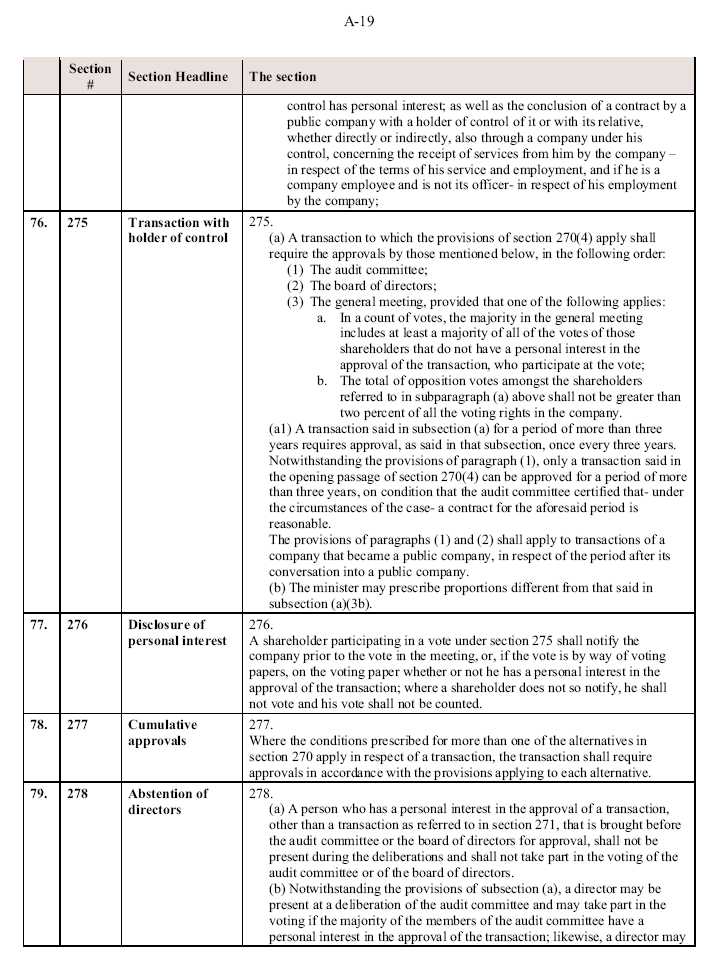

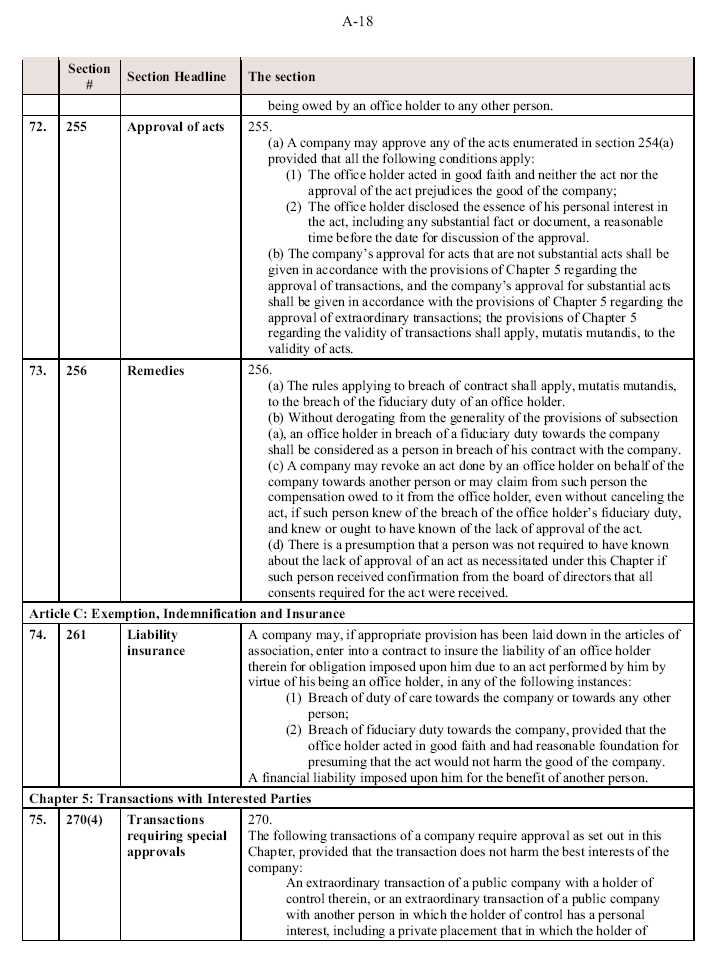

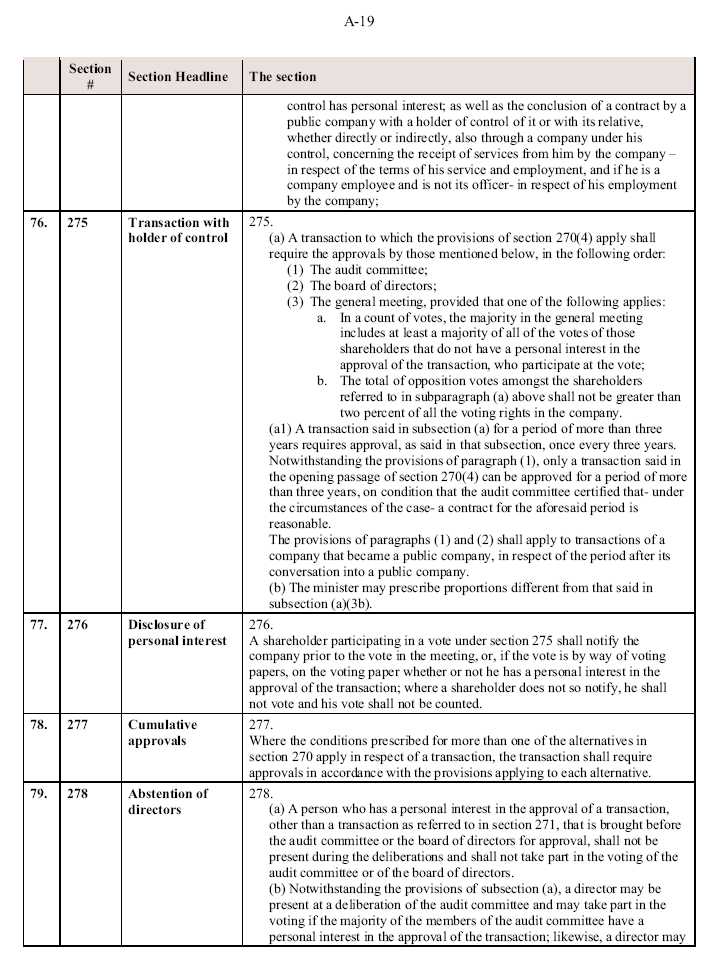

12. Resolution: Transaction Approvals

Sections 270(4) and 275 to 282 of Section 39A provide that certain transactions will require the approval of the Audit Committee, the Board and Shareholders (see Schedule A of this Information Circular). Approval by Shareholders will require a majority of the votes, including the majority of those Shareholders that do not have a personal interest in the approval of the transaction, and opposing votes of not greater than 2% of the voting rights attached to the Common Shares.

Transactions that will require such approvals will include:

| | (i) | an extraordinary transaction with a holder of control or with another persons in which the holder of control has a personal interest, including a private placement; and |

| | | | |

| | (ii) | the entering into of a contract with a holder of control or its relative, directly or indirectly, or with a company under its control, concerning: |

| | | | |

| | | (1) | the receipt of services by the Corporation; or |

| | | | |

| | | (2) | terms of service of employment. |

For the purposes of this Section, “holder of control” includes a person who holds 25% or more of the voting rights in the general meeting of the company if there is no other person who holds more than 50% of the voting rights in the company; for the purpose of a holding, two or more persons holding voting rights in a company each of which has a personal interest in the approval of the transaction being brought for approval of the company shall be considered to be joint holders; and

“relative” means spouse, brother or sister, parent, parent's parent, offspring or the offspring, brother, sister or the parent of the spouse or the spouse of each of these.

Generally, ongoing contracts will require approval once every three years. This approval requirement will operate in addition to Canadian securities law requirements.

A Shareholder participating in such vote shall notify the Corporation whether they have a personal interest in the transaction. Details on how to notify the Corporation are contained in Section 276 of Section 39A (see Schedule A of this Information Circular).

The corresponding by-law amendments relating to the approvals required for certain transactions can be found at Section 1.1(l) and Article 8 of the Amended By-laws (see Schedule C of this Information Circular).

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

-17-

| “IT IS HEREBY RESOLVED, THAT: |

| | |

| 1. | the amendment of the by-laws of the Corporation to include Section 1.1(l) and Article 8, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

13. Resolution: Director and Officer Indemnity

The Amended By-laws of the Corporation include Sections 7.4 and 7.5 which provide that the Corporation will indemnify its directors and officers and purchase insurance for them (see Schedule C of this Information Circular). The Board believes this is common for public corporations in Canada and has been in compliance with these provisions historically. The Board feels it would be appropriate to codify these protections in the by-laws of the Corporation.

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Sections 7.4 and 7.5, substantially in the form attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

-18-

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

14. Resolution: Appointment of Co-Chairs

The Amended By-laws of the Corporation include Sections 5.8 which provide that the Board may appoint two people to act as co-chairs of the Corporation. The Corporation may appoint a second Chairman if it is determined to be in the best interest of the Corporation. Sections 2.2, 2.7, 5.1, 5.5 and 12.11 contain consequential amendments in order to implement the possibility of two Chairmen.

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to include Sections 2.2, 2.7, 5.1, 5.5, 5.8 and 12.11 as set out in the draft by-laws attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, is hereby authorized and approved; and |

| | |

| 2. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

15. Resolution: Definitions, Title, Companies Law Amendments & Paramountcy

The Amended By-laws include defined terms used in many of the new sections of the Amended Bylaws and reflect the change of the name of the Corporation that took place in 2009. The Amended Bylaws also include a provision that provides that in the event that the applicable Israeli minister prescribes legislation, provided such legislation does not conflict with the CBCA or Canadian laws, the Corporation shall comply with such legislation. The Amended By-Laws also include a paramountcy provision that provides that in the event of any conflict between the Corporation’s bylaws and the CBCA and Canadian securities laws, the CBCA and Canadian securities laws will govern. This is a generally established principal of law in Canada and the Board feels it would be appropriate to codify this principal in the by-laws of the Corporation. The Amended By-laws also include minor amendments to existing sections in order to properly reflect the new sections added.

-19-

The Shareholders will be requested at the Meeting to pass the following ordinary resolution:

“IT IS HEREBY RESOLVED, THAT:

| 1. | the amendment of the by-laws of the Corporation to revise the name of the Corporation, as set out in the draft by-laws attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, is hereby authorized and approved; |

| | |

| 2. | the amendment of the by-laws of the Corporation to include Sections 1.1(i), 1.1(r), 1.1(s), 1.1(t), 1.4, 1.5 and to amend Sections 7.1, 7.2 and 12.21, as set out in the draft by-laws attached as Schedule C to the Management Information Circular of the Corporation dated May 2, 2012, effective upon commencement of the trading of the Common Shares on the TASE, and which will remain effective until the cessation of the listing of the Common Shares on the TASE, is hereby authorized and approved; and |

| | |

| 3. | any director or officer of the Corporation is hereby authorized for, on behalf of, and in the name of the Corporation to do and perform or cause to be done or performed all such things, to take or cause to be taken all such actions, to execute and deliver or cause to be executed and delivered all such agreements, documents and instruments, contemplated by, necessary or desirable in connection with the amendment of the by-laws in accordance with the foregoing resolution, as may be required from time to time and contemplated and required in connection therewith, or as such director or officer in his or her discretion may consider necessary, advisable or appropriate in order to give effect to the intent and purposes of the foregoing resolutions, and the doing of such things, the taking of such actions and the execution of such agreements, documents and instruments shall be conclusive evidence that the same have been authorized and approved hereby.” |

The persons named in the Management Proxy intend to vote FOR the resolution amending the by-laws of the Corporation as set out above in the absence of directions to the contrary from the Shareholders appointing them. In order to pass the resolution must be approved by a majority of the votes cast by the shareholders who vote in respect of the resolution.

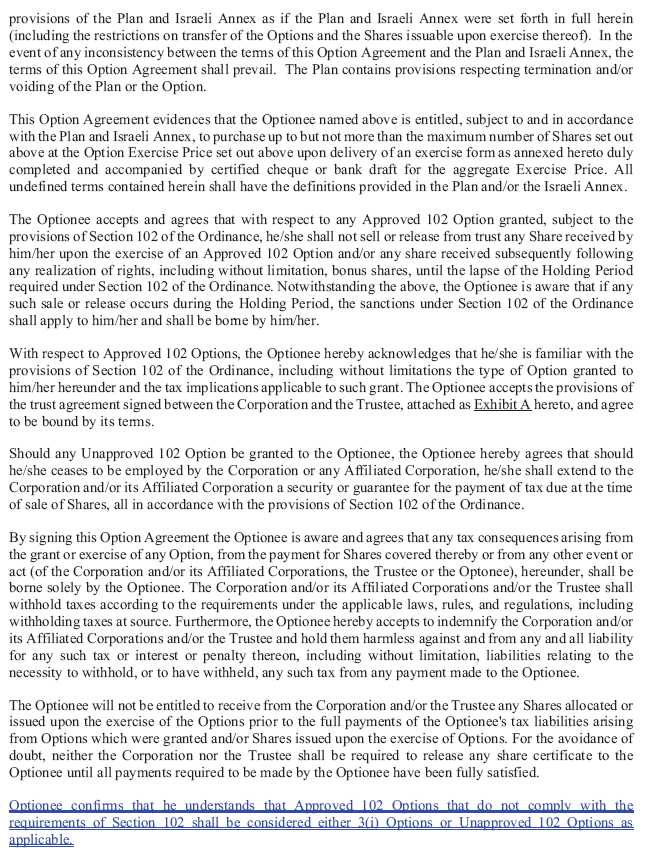

16. Resolution: Amendment of the Stock Option Plan

Shareholders have previously approved the Corporation’s stock option plan in substantially its current form (the “Stock Option Plan”), which is known as a “rolling plan”. In order to comply with TASE listing requirements, some minor amendments are required. The full text of the amended Stock Option Plan is attached as Schedule D to this Management Information Circular and is black-lined to highlight the changes from the existing Stock Option Plan (the “Amended Stock Option Plan”). Capitalized terms used in this Section 16 have the definitions given to such terms in the Amended Stock Option Plan.

The Amendments to the Stock Option Plan do not affect any current or future accounting treatment in the financial statements.

The material changes and amendments to the Stock Option Plan, are as follows:

-20-

| | 1. | Subsection 5.1(c) was added, which provides that a cash dividend and/or any rights offering to other shareholders of the Company shall not trigger any adjustment to the options granted under the Stock Option Plan. |

| | | |