QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement. |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

ý |

|

Definitive Proxy Statement. |

o |

|

Definitive Additional Materials. |

o |

|

Soliciting Material Pursuant to sec. 240.14a-12.

|

@Road, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | @Road, Inc.

47071 Bayside Parkway

Fremont, CA 94538

www.road.com |

April 27, 2006

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of @Road, Inc. to be held on June 8, 2006. Enclosed are the notice of this meeting, a proxy statement, and a form of proxy. Please note that the meeting will be held at 12:00 p.m. local time, at the Company's facilities located at 47071 Bayside Parkway, Fremont, California 94538.

Details of the business to be conducted at the meeting are given in the attached Notice of 2006 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the meeting, I urge you to vote your shares as soon as possible. Instructions on the proxy card will tell you how to vote your shares by mail. The proxy statement explains more about proxy voting. Please read it carefully.

Thank you for your continued support of @Road.

| | | Sincerely, |

|

|

|

|

|

KRISH PANU

Chairman, President

and Chief Executive Officer |

@ROAD, INC.

47071 Bayside Parkway

Fremont, CA 94538

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 8, 2006

The 2006 Annual Meeting of Stockholders (the "Annual Meeting") of @Road, Inc., a Delaware corporation (the "Company"), will be held at the principal executive offices of the Company, located at 47071 Bayside Parkway, Fremont, California 94538, on Thursday, June 8, 2006, at 12:00 p.m., local time, for the following purposes:

- •

- To elect two (2) Class III directors to the Company's Board of Directors to serve until the 2009 Annual Meeting;

- •

- To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2006; and

- •

- To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The foregoing items of business and the director nominees are more fully described in the Proxy Statement, which is attached to and made a part of this Notice.

The Board of Directors has fixed the close of business on April 20, 2006 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

All Company stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you expect to attend the Annual Meeting in person, you are urged to mark, date, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided to ensure your representation and the presence of a quorum at the Annual Meeting. If you send in your proxy card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

| | | By Order of the Board of Directors, |

|

|

|

|

|

JAMES D. FAY

Secretary |

This notice of annual meeting and proxy statement and form of proxy are being distributed on or about April 27, 2006.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, WE ENCOURAGE YOU TO READ THIS PROXY STATEMENT CAREFULLY AND SUBMIT YOUR PROXY AND VOTING INSTRUCTIONS AS QUICKLY AS POSSIBLE BY SIGNING AND RETURNING THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. IF A QUORUM IS NOT REACHED, THE COMPANY WILL HAVE THE ADDED EXPENSE OF RE-ISSUING THESE PROXY MATERIALS. IF YOU ATTEND THE ANNUAL MEETING AND SO DESIRE, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON.

THANK YOU FOR ACTING PROMPTLY.

@ROAD, INC.

47071 Bayside Parkway

Fremont, CA 94538

PROXY STATEMENT

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of @Road, Inc., a Delaware corporation (the "Company"), for use in voting at the 2006 Annual Meeting of Stockholders (the "Annual Meeting") to be held at the principal executive offices of the Company, located at 47071 Bayside Parkway, Fremont, California 94538, on Thursday, June 8, 2006, at 12:00 p.m., local time, and any adjournment or postponement thereof.

This Proxy Statement, the enclosed proxy card and the Company's Annual Report to Stockholders for the year ended December 31, 2005, including financial statements, were first mailed to stockholders entitled to vote at the Annual Meeting on or about April 27, 2006.

Deadline for Stockholder Proposals

Proposals of stockholders for the 2007 Annual Meeting of Stockholders must be received by the Secretary of the Board of Directors, @Road, Inc., 47071 Bayside Parkway, Fremont, CA 94538, no later than December 29, 2006, and must satisfy the other requirements set forth in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in order to be eligible for inclusion in the proxy statement and form of proxy relating to that meeting.

Proxies solicited by the Company grant the proxy holders discretionary authority to vote on any matter raised at the meeting. If a stockholder intends to submit a proposal at the next meeting of stockholders that is not eligible for inclusion in the proxy statement relating to that meeting, the stockholder must give notice to the Company no later than March 14, 2007. If a stockholder does not comply with the foregoing notice provision and does not also satisfy the requirements of Rule 14a-4(c) under the Exchange Act, the proxy holders will be allowed to use their discretionary voting authority when and if the proposal is raised at the next annual meeting of stockholders.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company (Attention: Corporate Secretary) a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person.

Record Date; Voting Securities; Voting and Solicitation

The close of business on April 20, 2006 has been fixed as the record date (the "Record Date") for determining the holders of shares of common stock of the Company entitled to notice of and to vote at the Annual Meeting.

At the close of business on the Record Date, the Company had approximately 61,237,548 shares of common stock outstanding and held of record by approximately 7,934 stockholders. Each share of common stock outstanding on the Record Date is entitled to one (1) vote on all matters. Shares of common stock may not be voted cumulatively.

At the close of business on the Record Date, the Company had approximately 77,482 shares of preferred stock outstanding and held of record by approximately 13 stockholders. Each share of preferred stock outstanding on the Record Date is entitled to eleven (11) votes on all matters. Shares of preferred stock may not be voted cumulatively. The holders of the preferred stock shall be entitled to vote on all

1

matters submitted to the stockholders of the Company at the Annual Meeting and shall vote together with the holders of the Company's common stock as one class.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections (the "Inspector") with the assistance of the Company's transfer agent. The Inspector will also determine whether or not a quorum is present. The nominees for election as directors at the Annual Meeting will be elected by a plurality of the votes of the shares of common stock and preferred stock present in person or represented by proxy at the Annual Meeting voting as one class. All other matters submitted to the stockholders will require a majority of the votes of the shares of common stock and the shares of preferred stock present in person or represented by proxy at the Annual Meeting voting as one class, as required under Delaware law for the approval of proposals presented to stockholders. In general, Delaware law also provides that a quorum consists of a majority of the shares entitled to vote and present in person or represented by proxy. The Inspector will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum and as negative votes for purposes of determining the approval of any matter submitted to the stockholders for a vote.

Any proxy which is returned using the form of proxy enclosed and which is not marked as to a particular item will be voted FOR the election of both Class III director nominees, FOR ratification of the appointment of the designated independent registered public accounting firm, and as the proxy holders deem advisable on other matters that may come before the meeting, as the case may be, with respect to the item not marked. If a broker indicates on the enclosed proxy or its substitute that it does not have discretionary authority as to certain shares to vote on a particular matter ("broker non-votes"), those shares will not be considered as present with respect to that matter. The Company believes that the tabulation procedures to be followed by the Inspector are consistent with the general requirements of Delaware law concerning voting of shares and determination of a quorum.

The solicitation of proxies will be conducted by mail, and the Company will bear all attendant costs. These costs will include the expense of preparing and mailing proxy solicitation materials for the Annual Meeting and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation materials regarding the Annual Meeting to beneficial owners of the Company's common stock. The Company may conduct further solicitation personally, telephonically or by facsimile through its officers, directors and employees, none of whom will receive additional compensation for assisting with any such solicitation.

PROPOSAL NO. 1

ELECTION OF CLASS III DIRECTORS

Nominees

At the Annual Meeting, the stockholders will elect two (2) Class III directors to serve on the Company's Board until the 2009 Annual Meeting of Stockholders or until their respective successors are elected and qualified. In the event a Class III nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the proxies may be voted for any substitute nominee designated by the present Board or the proxy holders to fill such vacancy, or the size of the Board may be reduced in accordance with the Bylaws of the Company. The Board has no reason to believe that the persons named below will be unable or unwilling to serve as Class III nominees or as Class III directors if elected.

Assuming a quorum is present, the Class III nominees receiving the highest number of affirmative votes of shares entitled to be voted will be elected as Class III directors of the Company for the ensuing three years. Unless marked otherwise, proxies received will be voted FOR the election of the Class III nominees named below. In the event that additional persons are nominated for election as Class III directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of both Class III director nominees listed below.

2

The names of the Class III director nominees, their ages as of the Record Date and certain other information about them are set forth below:

Name of Nominee

| | Age

| | Principal Occupation

| | Director Since

|

|---|

| Kris Chellam (1)(3) | | 55 | | Senior Vice President, Corporate and Enterprise Services, Xilinx, Inc. | | December 1999 |

| James W. Davis (2) | | 57 | | Senior Partner, Key West Technologies, LLC | | October 2004 |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Compensation Committee.

- (3)

- Member of the Nominating and Governance Committee.

Kris Chellam has served as a director of the Company since December 1999. Since July 2005, Mr. Chellam has been Senior Vice President, Corporate and Enterprise Services for Xilinx, Inc. Mr. Chellam joined Xilinx in July 1998 and served as Senior Vice President of Finance and Chief Financial Officer until July 2005. Prior to joining Xilinx, Mr. Chellam served as Vice President, Finance and Administration and Chief Financial Officer of Atmel Corp. for seven years. Prior to that, Mr. Chellam worked for more than 12 years at Intel Corp. in a variety of financial management positions in Europe and the United States. Mr. Chellam is a member of the Institute of Chartered Accountants in England and Wales. He completed his Cambridge Certificate of Education in Malaysia in 1968 and obtained his chartered accountancy degree in London in 1975.

James W. Davis has served as a director of the Company since October 2004. Since 1999, Mr. Davis has been a senior partner at Key West Technologies, LLC, a technology consulting firm. Prior to joining Key West Technologies, LLC, from 1994 to 1995, he served as Director of Intel Corporation's home computing laboratory. From 1968 to 1994, Mr. Davis held various positions at IBM, including Chief Technical Officer of the IBM PC Company Premium Brand and Senior Technical Staff Member.

Other Directors

In addition to its Class III directors, the Company has two other classes of directors: Class I, which consists of Krish Panu and T. Peter Thomas, whose current terms expire at the 2007 Annual Meeting of Stockholders; and Class II, which consists of Charles E. Levine, whose current term expires at the 2008 Annual Meeting of Stockholders.

The names of the Class I and II directors, their ages as of the Record Date and certain other information about them are set forth below:

Name of Director

| | Age

| | Principal Occupation

| | Director Since

| | Class

|

|---|

| Krish Panu | | 48 | | Chairman of the Board, Chief Executive Officer and President, @Road, Inc. | | February 1999 | | I |

| Charles E. Levine(1)(2) | | 53 | | Independent Outside Director | | February 2003 | | II |

| T. Peter Thomas(1)(3) | | 59 | | Managing Director, ATA Ventures | | September 1998 | | I |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Nominating and Governance Committee.

- (3)

- Member of the Compensation Committee.

3

Krish Panu has served as Chief Executive Officer and President and as a director of the Company since February 1999, and he has served as Chairman of the Board since December 1999. Prior to joining the Company, Mr. Panu served as Vice President and General Manager of the Logic Products division of Atmel Corporation, a manufacturer of advanced semiconductors. He held various senior management positions at Atmel Corporation from August 1991 to November 1998. Mr. Panu holds a B.S. in Electrical Engineering, an M.S. in Computer Engineering and an M.B.A. from Wayne State University.

Charles E. Levine has served as a director of the Company since February 2003. From 1997 to 2002, Mr. Levine held various positions with Sprint PCS, a wireless communications company, most recently as President. Before joining Sprint PCS, he was President of Octel Link, a voice mail equipment and services provider, and a Senior Vice President of Octel Services from 1994 to 1996. Mr. Levine also serves on the boards of directors of Viisage Technology, Inc., a biometrics and computer networks company, Lexar Media, a digital media storage company, Somera Communications, a telecommunications service and brokerage company, and Sierra Wireless, Inc., a wireless data products company. Mr. Levine holds a B.A. in Economics from Trinity College and an M.B.A. from the Kellogg School of Management at Northwestern University. He has also completed the Corporate Governance Course at the Business School at Stanford University and is a member of the Institute of Corporate Directors in Canada.

T. Peter Thomas has served as a director of the Company since September 1998. Mr. Thomas has been a Managing Director of ATA Ventures, a venture capital firm, since March 2004. Starting in November 1985, Mr. Thomas was a General Partner of Institutional Venture Partners, a venture capital firm, where he continues to support prior fund responsibilities. Mr. Thomas also serves on the boards of directors of Atmel Corporation, a semiconductor company, and Transmeta Corporation, a semiconductor company, and on the boards of directors of several privately held companies. Mr. Thomas holds a B.S. in Electrical Engineering from Utah State University and an M.S. in Computer Science from the University of Santa Clara.

There are no family relationships among any of the directors or executive officers of the Company.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF EACH CLASS III NOMINEE NAMED ABOVE.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP has served as the Company's independent registered public accounting firm since 1998 and has been appointed by the Board to continue as the Company's independent registered public accounting firm for the year ending December 31, 2006. In the event that ratification of this selection of auditors is not approved by a majority of the shares of common stock voting at the Annual Meeting in person or by proxy, the Audit Committee will reconsider its selection of auditors.

A representative of Deloitte & Touche LLP is expected to be present at the Annual Meeting. This representative will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2006.

4

BOARD MEETINGS, COMMITTEES AND CORPORATE GOVERNANCE

During the period from January 1, 2005 through December 31, 2005 (the "last fiscal year"), the Board met six times. Each member of the Board, except Messrs. Chellam and Thomas, attended at least 75 percent of the meetings of the Board and the committees of which he was a member during the last fiscal year. Our Board has determined that Messrs. Chellam, Davis, Thomas and Levine each qualify as an "independent" director under the Nasdaq Marketplace Rules as currently in effect. Therefore, a majority of the members of our Board are "independent" as such term is defined by the Nasdaq Stock Market rules and regulations. The Board has an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee, each of which is discussed below.

Audit Committee

The Audit Committee consists of three of the Company's non-employee directors, Kris Chellam, Charles E. Levine and T. Peter Thomas, and held six meetings during the last fiscal year. The Audit Committee (i) reviews with the independent registered public accounting firm its independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board, (ii) discusses with the independent registered public accounting firm relationships and services that in the view of the Audit Committee may affect auditor objectivity or independence and takes action or recommends action to the full Board to oversee such independence, (iii) pre-approves all audit services and non-audit services proposed to be provided by the independent registered public accounting firm, (iv) reviews with the independent registered public accounting firm the overall scope and plan for each audit, (v) discusses with management the effectiveness of disclosure, accounting and internal controls, (vi) reviews the Company's interim financial statements and the audited financial statements to be included in the Company's Annual Report on Form 10-K prior to filing with the Securities and Exchange Commission (the "SEC"), (vii) reviews and approves, if appropriate, changes to the Company's accounting principles and practices as suggested by the independent registered public accounting firm or management, (viii) establishes procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls or auditing matters and establishes procedures by which employees of the Company may make confidential, anonymous submissions to the Audit Committee relating to concerns regarding accounting practices, and (ix) reviews and approves all related-party transactions other than compensation transactions. Kris Chellam has been determined by the Board to be a financial expert, as defined by Item 401(h) of Regulation S-K under the Exchange Act. Each member of the Audit Committee meets the independence requirements of the Nasdaq Stock Market and the rules and regulations of the SEC. The Audit Committee acts pursuant to a charter adopted by the committee and approved by the Board. The Audit Committee charter is included in this Proxy Statement as Appendix A and is available on the Company website athttp://www.road.com/corp/news/governance.html.

Communications with the Audit Committee

Stockholders who wish to communicate with the Audit Committee to report complaints or concerns related to accounting, internal controls or auditing may do so using the Audit Committee procedures for the receipt of such communication. The procedures allow submissions of complaints and concerns either online or telephonically, and a more detailed description of the procedures to be followed is posted on the Company's website athttp://www.road.com/corp/news/governance.html. If you are a non-employee stockholder, please include your name, address and other contact information with any submitted communications. Stockholders may also provide informal feedback to those directors who attend the Annual Meeting.

5

Compensation Committee

The Compensation Committee consists of non-employee directors T. Peter Thomas and James W. Davis. The Compensation Committee held one meeting during the last fiscal year, and conducted all other committee business through unanimous written consents. Its functions are to establish and administer the Company's policies regarding executive management salaries and cash incentives and long-term equity incentives. The Compensation Committee administers the Company's 1996 stock option plan, 2000 stock option plan and 2000 employee stock purchase plan, subject to certain exceptions. Each member of the Compensation Committee meets the independence requirements of the Nasdaq Stock Market as well as the rules and regulations of the SEC.

Nominating and Governance Committee

The Nominating and Governance Committee consists of non-employee directors Kris Chellam and Charles E. Levine. The Nominating and Governance Committee held no meetings during the last fiscal year. The purpose of the Nominating and Governance Committee is (i) to identify individuals qualified to serve as directors of the Company, and recommend nominees for election as directors; (ii) to develop and recommend to the Board corporate governance guidelines; (iii) to provide oversight with respect to corporate governance and ethical conduct; and (iv) to evaluate the Board's performance. The Nominating and Governance Committee believes the Board should be comprised of directors who have expertise in various fields that may prove useful to the Company; who possess the highest personal and professional ethics and who are willing and able to devote the required time to Company business. The Nominating and Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Each member of the Nominating and Governance Committee meets the independence requirements of the Nasdaq Stock Market. The Nominating and Governance Committee acts pursuant to a written charter adopted by the committee and approved by the Board, and such charter has been made available on the Company's website athttp://www.road.com/corp/news/governance.html.

The Nominating and Governance Committee will consider candidates recommended by stockholders. Stockholders may recommend individuals for the Nominating and Governance Committee to consider as potential director candidates by submission to the Nominating and Governance Committee, c/o Corporate Secretary, @Road, Inc., 47071 Bayside Parkway, Fremont, California 94538. Stockholder submissions should include, at a minimum, the name, address, and biographical information for the potential candidate for director, including relevant professional experience. In order for stockholder suggestions regarding possible candidates for director to be considered by the Nominating and Governance Committee, such information should be provided to the Nominating and Governance Committee in writing between ninety (90) and one hundred twenty (120) days prior to the date of the next scheduled annual meeting. The Nominating and Governance Committee will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis. Candidates submitted by stockholders pursuant to the foregoing process will be evaluated in the same manner as other candidates for nomination are evaluated. Director candidates will also be selected based on input from members of the Board, senior management of the Company and, if the Nominating and Governance Committee deems appropriate, a third-party search firm.

The Nominating and Governance Committee believes the Company is well-served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for Board membership, the Nominating and Governance Committee will nominate incumbent directors who continue to be qualified for Board service and are willing to continue as directors. If an incumbent director is not standing for re-election, or if a vacancy on the Board occurs between annual stockholder meetings, the Nominating and Governance Committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought.

6

Code of Ethics

The Company has adopted a code of business conduct and ethics for directors, officers (including the Company's principal executive officer, principal financial officer and principal accounting officer/controller) and employees. Such code is known as the Code of Ethics. The Code of Ethics is available on the Company's website athttp://www.road.com/corp/news/governance.html. Any amendment(s) to the Code of Ethics that applies to the Company's principal executive officer, principal financial officer or principal accounting officer/controller, and any waiver(s), including an implicit waiver(s), of any provision of the Code of Ethics granted to one of these officers, shall be posted on the Company's website within five (5) business days following the date of the amendment or the date such waiver was granted.

Board Compensation

On January 25, 2005, the Board adopted an amended and restated Non-Employee Director Compensation Policy. Under the amended and restated Non-Employee Director Compensation Policy, beginning April 1, 2005, non-employee directors are compensated as follows: (i) $10,000 per calendar quarter for serving on the Board; (ii) $2,500 per calendar quarter for serving as chairperson of the Audit Committee; and (iii) $1,250 per calendar quarter for serving as chairperson of each committee of the Board other than the Audit Committee. A qualifying director must be a non-employee director for the full calendar quarter to earn cash compensation for such quarter. Payment for earned Board compensation is scheduled to be made within thirty (30) days of the end of each calendar quarter.

The Company's directors are eligible to participate in the Company's 1996 stock option plan and 2000 stock option plan. Directors who are employees of the Company are eligible to participate in the Company's 2000 employee stock purchase plan (the "ESPP") and directors who are not employees of the Company are eligible to participate in the Company's 2000 directors' stock option plan (the "Directors' Plan").

Under the ESPP, eligible employees are permitted to purchase common stock through payroll deductions, which may not exceed 20% of an employee's total compensation. Stock is purchased at a price equal to the lower of 85% of the fair market value of the common stock at the beginning of the offering period or at the end of the purchase period. In addition, no employee may purchase more than 2,700 shares of common stock under the ESPP in any one purchase period for offering periods beginning before May 1, 2005, and no more than 1,800 shares of common stock under the ESPP in any one purchase period for offering periods beginning after May 1, 2005. Employees may end their participation in the ESPP at any time during an offering period, and participation ends automatically on termination of employment. Mr. Panu did not participate in the ESPP during 2005.

Under the Directors' Plan, each individual who becomes a non-employee director after September 29, 2000 will receive an automatic initial grant of an option to purchase 40,000 shares of common stock upon his or her first appointment or election to the Board. These automatic grants to purchase 40,000 shares will vest and become exercisable as to 1/4 of the total number of shares subject to the option on the 12 month anniversary of the date of grant and as to 1/48 of the total number of shares subject to the option each month thereafter; provided, that immediately prior to a change-of-control transaction, such grants shall be automatically fully vested. The Directors' Plan also provides for the automatic annual grant of an option to purchase 10,000 shares of common stock on the date of each annual meeting of the Company's stockholders to each non-employee director who has served on the Board for at least six months prior to such meeting. These automatic grants to purchase 10,000 shares will vest and become exercisable in installments of 1/12 of the total number of shares subject to the option each month following the date of grant; provided, that immediately prior to a change-of-control transaction, such grants shall be automatically fully vested. All options granted under the Directors' Plan will have a term of 10 years and an exercise price equal to the fair market value of the Company's common stock on the date of grant. Therefore, pursuant to the Directors' Plan, Messrs. Chellam, Davis, Levine and Thomas each were granted

7

an option to purchase 10,000 shares of common stock on June 9, 2005, the date of last year's annual meeting of stockholders, with an exercise price of $2.65 per share. Messrs. Chellam, Davis, Levine and Thomas will each be granted an option to purchase 10,000 shares of common stock on the date of the Annual Meeting. Additionally, directors may receive reimbursement for reasonable travel expenses relating to attendance at Board meetings.

Communications with Directors

Stockholders who wish to communicate with the Board of Directors may do so by writing a letter to the Chairman of the Board, c/o Corporate Secretary, @Road, Inc., 47071 Bayside Parkway, Fremont, California 94538.

While the Company does not have a formal policy regarding attendance by directors at the Company's annual meetings, the Company encourages all incumbent directors to attend its stockholder meetings. Four of the Company's current directors attended the Company's 2005 annual meeting.

8

MANAGEMENT

The Company's executive officers and directors and their ages as of the Record Date are set forth in the table below. No officer or director of the Company, and no associate of an officer or director of the Company, is a party adverse to the Company or to any of its subsidiaries in any material proceeding, nor does any officer or director (or associate thereof) have a material interest in any material proceeding that is adverse to the Company or any of its subsidiaries.

Name

| | Age

| | Position

|

|---|

| Krish Panu* | | 48 | | Chairman of the Board, Chief Executive Officer and President |

| Michael Martini | | 56 | | Chief Financial Officer and Senior Vice President |

| Thomas Allen | | 52 | | Executive Vice President, Service Delivery and Systems |

| Michael Walker | | 51 | | Chief Technology Officer and Executive Vice President |

| Leo Jolicoeur | | 48 | | Chief Marketing Officer and Executive Vice President |

| Kenneth Colby | | 52 | | Senior Vice President, Customer Operations |

| Kris Chellam* | | 55 | | Director |

| James W. Davis* | | 57 | | Director |

| Charles E. Levine* | | 53 | | Director |

| T. Peter Thomas* | | 59 | | Director |

- *

- Biographical information for the directors is included in the discussion of Proposal No. 1 above.

Michael Martini has served as Senior Vice President and Chief Financial Officer of the Company since June 2005. Prior to joining the Company, Mr. Martini served as Senior Vice President and Chief Financial Officer of SPL WorldGroup B.V., a software development company for the utility and energy industry from January 2002 until January 2005. In that position, he was responsible for global finance and accounting operations, tax, treasury, business and financial planning and analysis, mergers and acquisitions activities, as well as leading the IT organization. From April 1998 to April 2001, Mr. Martini served as Chief Financial Officer and Vice President of High Speed Data Operations of the West Region of TCI Communications, a regional cable television, broadband data and telecommunications company. In that position, he was responsible for accounting operations, audit, financial analysis, business planning, capital management, IT and billing systems, and acquisitions for West Region TCI/ATT cable properties. Mr. Martini holds a B.S. in Finance from California State University, Sacramento, and an M.B.A. from Golden Gate University.

Thomas Allen has served as the Company's Executive Vice President, Service Delivery and Systems since October 2005. Mr. Allen served as Chief Operating Officer and Executive Vice President of the Company from March 2003 to October 2005, as Chief Operating Officer and Senior Vice President from August 2000 to March 2003, and as Vice President, Information Technology and Management Systems from August 1999 to July 2000. From June 1999 to August 1999, Mr. Allen served as Director of Operations of IPass, an Internet services company. Mr. Allen holds a B.S. in Industrial Engineering from State University of New York at Buffalo, and an M.B.A. from California State University, San Jose.

Michael Walker has served as the Chief Technology Officer and Executive Vice President of the Company since January 2005. Mr. Walker served as the Company's Senior Vice President of Engineering from October 2002 to January 2005, as the Company's Senior Vice President and Customer Satisfaction Officer from May 2002 to October 2002, and as the Company's Vice President of Engineering from July 1999 to May 2002. Prior to joining the Company, Mr. Walker served as Vice President of Engineering at Silicon Wireless, a communications equipment company, from April 1997 to July 1999. Mr. Walker holds a BASc (EE) from Queen's University in Canada and a Masters of Engineering degree from Simon Fraser University.

9

Leo Jolicoeur has served as Chief Marketing Officer and Executive Vice President of the Company since October 2005. Mr. Jolicoeur served as Chief Marketing Officer and Senior Vice President of the Company from August 2004 to October 2005. Mr. Jolicoeur was a director of Uptilt, Inc., a CRM services company, from October 2002 until August 2004. From January 2000 until October 2002, Mr. Jolicoeur served as Vice President, Product Marketing and Service Operations at WebEx Communications, an Internet conferencing company. From January 1999 until January 2000, Mr. Jolicoeur served as Vice President of Business Development at ThirdVoice, an Internet communications company. Mr. Jolicoeur holds a B.S. in Computer Science and Finance from Boston College.

Kenneth Colby has served as Senior Vice President, Customer Operations of the Company since July 2005. Mr. Colby served as Senior Vice President, Operations of Vidus Limited from March 2004 to June 2005. Vidus Limited was acquired by @Road, Inc. on February 28, 2005, and is a wholly owned subsidiary of @Road, Inc. From January 2003 to January 2004, Mr. Colby was Senior Director, Professional Services, EMEA at Sybase, Inc., a database software company, where he was responsible for the sales and delivery of value added professional services. From February 2002 to January 2003, Mr. Colby was Managing Director of Mir Terotek Solutions Ltd., a software company, where he focused on the development of a software consulting group. From July 2000 to January 2002, Mr. Colby served as Managing director, EMEA of Mincom Pty, a software company, where he was responsible for sales, marketing, finance and services. Mr. Colby holds a B.S. in Management and Technology from the U.S. Naval Academy.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the Company's common stock and preferred stock as of March 31, 2006 by:

- •

- Each of the Company's directors and each of the Company's executive officers named in the Summary Compensation Table of this Proxy Statement (the "Named Executive Officers"),

- •

- All directors and executive officers as a group, and

- •

- Each person who is known by the Company to own beneficially more than 5% of the Company's common stock or preferred stock as set forth in such person's most recent filing on Schedule 13D or Schedule 13G with the SEC.

Percentage of beneficial ownership for each stockholder is based on 61,233,004 shares of common stock outstanding as of March 31, 2006 and 77,482 shares of preferred stock outstanding as of March 31, 2006. Shares of common stock subject to each option exercisable within 60 days of March 31, 2006 are deemed to be outstanding and to be beneficially owned by the person holding such option for the purpose of computing the number of shares of common stock beneficially owned by that person, as well as the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Except as otherwise noted, the address of each person listed in the table is c/o @Road, Inc., 47071 Bayside Parkway, Fremont, California 94538, and the persons listed in the table have sole voting and investment power with respect to all shares of common stock and preferred stock shown as beneficially owned by them, subject to community property laws where applicable. Beneficial ownership is determined

10

in accordance with the rules of the SEC and includes voting and investment power with respect to the shares.

Title of

Class

| | Name of Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percent of

Class

| |

|---|

| Common | | Institutional Venture Partners VIII(1)

3000 Sand Hill Road, Bldg. 2, Suite 290

Menlo Park, California 94025 | | 7,170,512 | | 11.7 | % |

| Common | | Institutional Venture Partners X(2)

3000 Sand Hill Road, Bldg. 2, Suite 290

Menlo Park, California 94025 | | 3,500,000 | | 5.7 | % |

| Common | | NV Partners III-BP LP(3)

Walker House, Georgetown

Grand Cayman, Cayman Islands | | 3,473,868 | | 5.7 | % |

| Common | | Krish Panu(4) | | 4,112,000 | | 6.6 | % |

| Common | | Thomas Allen(5) | | 774,194 | | 1.3 | % |

| Common | | Michael Walker(6) | | 555,964 | | * | |

| Common | | Leo Jolicoeur(7) | | 256,249 | | * | |

| Common | | Martin Knestrick(8) | | 16,247 | | * | |

| Common | | Kris Chellam(9) | | 220,833 | | * | |

| Common | | James Davis(10) | | 24,366 | | * | |

| Common | | Charles E. Levine(11) | | 57,833 | | * | |

| Common | | T. Peter Thomas(12)

3000 Sand Hill Road, Bldg. 2, Suite 290

Menlo Park, California 94025 | | 497,333 | | * | |

| Common | | All directors and executive officers as a group (11 persons)(13) | | 6,613,163 | | 10.4 | % |

| Preferred | | Osborne Clarke

One London Wall, London, EC2Y 5EB, UK | | 51,871 | | 66.9 | % |

| Preferred | | NV Partners III-BP LP

Walker House, Georgetown

Grand Cayman, Cayman Islands | | 24,865 | | 32.1 | % |

| Preferred | | Martin Knestrick(8) | | 112 | | * | |

| Preferred | | All directors and executive officers as a group (11 persons) | | 195 | | * | |

- *

- Less than one percent of the outstanding shares of the applicable class of securities.

- (1)

- Includes 100,601 shares held by IVM Investment Fund, VIII, LLC, 6,595,273 shares held by Institutional Venture Partners, VIII, L.P., 25,138 shares held by IVM Investment Fund VIII-A, LLC, 12,000 shares held by Jacqueline Stewart directly and by retirement plan and 437,500 shares held by T. Peter Thomas. T. Peter Thomas, a director of the Company, Samuel Colella, Reid Dennis, R. Thomas Dyal, Timothy Haley, Ruthann Quindlen, Rebecca Robertson, L. James Strand, William Tai and Geoffrey Yang are managing directors of the general partner or managing members of IVM Investment Fund, VIII, LLC, Institutional Venture Partners, VIII, L.P. and IVM Investment Fund VIII-A, LLC and share voting and dispositive power with respect to the shares held by each such entity. Each managing director or member disclaims beneficial ownership of these shares except to the extent of his or her pecuniary interest.

- (2)

- Includes 2,866,966 shares held by Institutional Venture Partners X, L.P. and 633,034 shares held by Institutional Venture Partners X GmbH & Co. Beteiligungs KG. Norman Fogelsong, Todd Chaffee, Reid Dennis, Mary Jane Elmore, Stephen Harrick and Dennis Phelps are managing directors of the

11

general partner or managing members of Institutional Venture Partners X, L.P. and Institutional Venture Partners X GmbH & Co. Beteiligungs KG and share voting and dispositive power with respect to the shares held by each entity. Each managing director or member disclaims beneficial ownership of these shares except to the extent of his or her pecuniary interest. T. Peter Thomas, a director of the Company, has a de minimus limited partnership interest in Institutional Venture Partners X, L.P., does not have any voting or dispositive power with respect to the shares held by such entity, and disclaims beneficial ownership of these shares except to the extent of his pecuniary interest.

- (3)

- Includes 1,129 shares held by Stephen Socolof directly. NVPG, LLC is the general partner of NVP III-BT, LP. Andrew Garman, Stephen Socolof and Thomas Uhlman are the managing members of NVPG, LLC, and share voting and dispositive power with respect to the shares held by such entity. Each managing member disclaims beneficial ownership of these shares except to the extent of his pecuniary interest.

- (4)

- Includes 21,250 shares held by Mr. Panu as Custodian for Tara Panu and Nikhil Panu under the California Transfer to Minor Act, 2,951,350 shares held by Krish Panu and Nina Panu, Trustees of the Krish and Nina Panu 2000 Family Trust and 945,000 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006. Also includes 159,400 shares held by Latha K. Nagarajan, as Trustee of the Panu Children's Trust, as to which Mr. Panu disclaims any beneficial ownership because he does not have voting or dispositive authority over such shares.

- (5)

- Includes 500 shares held by Mr. Allen's spouse, and 688,750 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006.

- (6)

- Includes 80,000 shares held by Walker Hamada Family Limited Partnership. Also includes 347,500 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006.

- (7)

- Includes 125,000 shares held by the Jolicoeur Family Trust and 131,249 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006.

- (8)

- As of January 15, 2006, Mr. Knestick's employment with the Company terminated.

- (9)

- Includes 176,500 shares held by Kris Chellam & Evelyne Chellam, TTEES for the Chellam Family Trust, 3,000 shares held by Kumar Ganapathy, Trustee FBO Misha David Chellam, Trust U/A dtd. 1/20/95 and 3,000 shares held by Kumar Ganapathy, Trust FBO Tamara Anne Chellam, Trust U/A dtd. 1/20/95. Also includes 38,333 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006.

- (10)

- Includes 24,166 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006.

- (11)

- Includes 50,833 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006.

- (12)

- Includes 12,000 shares held by Mr. Thomas's spouse, Jacqueline Stewart, directly and by retirement plan. Includes 48,333 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006. Excludes 100,601 shares held by IVM Investment Fund, VIII, LLC, 6,595,273 shares held by Institutional Venture Partners, VIII, L.P. and 25,138 shares held by IVM Investment Fund VIII-A, LLC. See note (1).

- (13)

- Includes 2,285,808 shares issuable upon exercise of options exercisable within 60 days after March 31, 2006 and 3,532,000 shares held by affiliates of the directors and executive officers of the Company.

12

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows the compensation earned by (a) the individual who served as the Company's chief executive officer during the year ended December 31, 2005; (b) the four other most highly compensated individuals who served as an executive officer of the Company during the year ended December 31, 2005; and (c) the compensation received by each such individual for the Company's two preceding fiscal years.

Summary Compensation Table

| |

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

| |

|---|

| |

| | Annual Compensation

| |

| |

|---|

| |

| | Securities

Underlying

Options/

SARS(#)

| |

| |

|---|

Name & Principal Position

| | Fiscal

Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation($)

| | All Other

Compensation($)

| |

|---|

Krish Panu

Chairman of the Board, Chief Executive Officer and President | | 2005

2004

2003 | | $

| 317,115

305,769

270,000 | | $

| 200,000

120,833

— | | —

—

— | | 80,000

100,000

100,000 | | —

—

— | |

Thomas Allen

Executive Vice President, Service Delivery and Systems |

|

2005

2004

2003 |

|

|

227,115

209,615

180,577 |

|

|

101,250

79,167

— |

|

—

—

— |

|

50,000

60,000

60,000 |

|

—

—

— |

|

Michael Walker

Chief Technology Officer and Executive Vice President |

|

2005

2004

2003 |

|

|

213,173

203,846

184,462 |

|

|

97,500

81,867

— |

|

—

—

— |

|

50,000

60,000

60,000 |

|

—

—

— |

|

Leo Jolicoeur

Chief Marketing Officer and Executive Vice President |

|

2005

2004

2003 |

|

|

227,115

74,423

— |

|

|

80,000

11,559

— |

|

—

—

— |

|

50,000

300,000

— |

|

—

—

— |

|

Martin Knestrick(1)

Managing Director, Europe |

|

2005

2004

2003 |

|

|

186,255

—

— |

|

|

—

—

— |

|

19,857

—

— |

(2)

|

283,753

—

— |

|

227,377

—

— |

(3)

|

- (1)

- As of January 15, 2006, Mr. Knestick's employment with the Company terminated.

- (2)

- This compensation represents sales commissions paid to Mr. Knestrick.

- (3)

- This compensation represents severance payments of $126,923 made to Mr. Knestrick upon the termination of his employment and gains on the exercise of non-statutory stock options of $100,454.

13

OPTION/SAR GRANTS IN LAST FISCAL YEAR

The following table provides certain information with respect to stock options granted to the Named Executive Officers in the last fiscal year. In addition, as required by SEC rules, the table sets forth the hypothetical gains that would exist for the options based on assumed rates of annual compound stock price appreciation during the option term.

| | Individual Grants

| |

| |

|

|---|

| |

| | Percentage of

Total Options

Granted to

Employees in

Fiscal

Year(%)(1)

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term(3)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| |

| |

|

|---|

Name

| | Exercise

Price

($/SH)(2)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Krish Panu(4) | | 80,000 | | 2.75 | | 3.90 | | August 21, 2015 | | 196,215 | | 497,248 |

| Thomas Allen(4) | | 50,000 | | 1.72 | | 3.90 | | August 21, 2015 | | 122,634 | | 310,780 |

| Michael Walker(4) | | 50,000 | | 1.72 | | 3.90 | | August 21, 2015 | | 122,634 | | 310,780 |

| Leo Jolicoeur(4) | | 50,000 | | 1.72 | | 3.90 | | August 21, 2015 | | 122,634 | | 310,780 |

| Martin Knestrick | | 30,814 | (5) | 1.06 | | 2.00 | | December 31, 2005 | | 38,758 | | 98,219 |

| | | 252,939 | (6) | 8.68 | | 4.36 | | March 6, 2015 | | 693,554 | | 1,757,602 |

- (1)

- The Company granted stock options representing 2,766,877 shares to employees and assumed stock options representing 146,074 shares in connection with the Company's acquisition of Vidus Limited in the last fiscal year.

- (2)

- The exercise price may be paid in cash, in shares of common stock valued at fair market value on the exercise date or through a cashless exercise procedure involving a same-day sale of the purchased shares.

- (3)

- The potential realizable value illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their terms, assuming the specified compounded rates of appreciation of the market price per share from the date of grant to the end of the option term. Actual gains, if any, on stock option exercises are dependent upon a number of factors, including the future performance of the Company's common stock and the timing of option exercises, as well as the optionees' continued employment throughout the vesting period. There can be no assurance that the amounts reflected in this table will be achieved.

- (4)

- Options vest 10% on the first annual anniversary of the grant date, 30% on the second annual anniversary of the grant date, 30% on the third annual anniversary of the grant date and 30% on the fourth annual anniversary of the grant date. The options have a 10-year term, but are subject to earlier termination in connection with termination of employment.

- (5)

- These options were 100% vested upon the date of grant.

- (6)

- 191,310 of these options terminated on January 15, 2006, and the remaining 61,629 options terminated on February 14, 2006.

14

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth certain information with respect to stock options exercised by the Named Executive Officers during the year ended December 31, 2005. In addition, the table sets forth the number of shares covered by stock options as of December 31, 2005, and the value of "in-the-money" stock options, which represents the positive spread between the exercise price of a stock option and the market price of the shares subject to such option at the end of the year ended December 31, 2005.

| |

| |

| | Number of Unexercised

Options at Fiscal

Year End(#)(1)

| | Value of Unexercised

"In-The-Money" Options at

Fiscal Year End($)(2)

|

|---|

| | Shares

Acquired on

Exercise

(#)

| |

|

|---|

Name

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Krish Panu | | — | | — | | 945,000 | | 270,000 | | 1,786,575 | | 316,200 |

| Thomas Allen | | — | | — | | 668,750 | | 204,000 | | 1,738,626 | | 205,020 |

| Michael Walker | | — | | — | | 347,500 | | 144,000 | | 675,572 | | 186,420 |

| Leo Jolicoeur | | — | | — | | 100,000 | | 250,000 | | 195,000 | | 462,500 |

| Martin Knestrick(3) | | 30,814 | | 100,454 | | 61,629 | | 191,310 | | 61,013 | | 189,397 |

- (1)

- No stock appreciation rights (SARs) were outstanding during the year ended December 31, 2005.

- (2)

- Based on the $5.23 per share closing price of the Company's common stock on The Nasdaq Stock Market on December 30, 2005, less the exercise price of the options.

- (3)

- As of January 15, 2006, Mr. Knestick's employment with the Company terminated.

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT

AND CHANGE-IN-CONTROL ARRANGEMENTS

In 2000, the Company entered into an agreement with Krish Panu that provides that following a change-in-control transaction, subject to limitations, the vesting of any stock option or restricted stock held by Mr. Panu shall be automatically 50% vested, and Mr. Panu shall receive payments equal to his monthly salary for 12 months thereafter. Additionally, if Mr. Panu's employment is terminated involuntarily other than for cause within 12 months following a change-of-control transaction, then subject to limitations, the vesting of any stock option or restricted stock held by Mr. Panu shall be automatically fully vested.

The Company has entered into agreements with the remaining Named Executive Officers, other than Martin Knestrick, which provide that in the event of an involuntary termination within:

- •

- one year following a change-of-control transaction and the employee was employed by the Company for less than one year prior to the change-of-control transaction, the vesting of any stock option or restricted stock held by the employee shall automatically be accelerated as though the employee maintained his employment with the Company for 12 months following the involuntary termination, or

- •

- one year following a change-of-control transaction and the employee was employed by the Company for at least one year prior to the change-of-control transaction, the vesting of any stock option or restricted stock held by the employee shall automatically be accelerated as though the employee maintained his employment with the Company for 24 months following the involuntary termination.

15

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The following is a report of the Compensation Committee of the Board of Directors (the "Committee") describing the compensation policies applicable to the Company's executive officers during the year ended December 31, 2005. The Committee is responsible for establishing and monitoring the compensation policies and specific compensation levels for executive officers. Executive officers who are also directors have not participated in deliberations or decisions involving their own compensation.

Compensation Policy

Under the supervision of the Board, the Company's compensation policy is designed to attract and retain qualified key executives critical to the Company's growth and long-term success. It is the objective of the Board to have a portion of each executive's compensation contingent upon the Company's performance as well as upon the individual's personal performance. Accordingly, each executive officer's compensation package is composed of three elements: (i) base salary which reflects individual performance and expertise, (ii) variable bonus awards payable in cash and tied to the achievement of certain performance goals that are established from time to time for the Company and for such individuals, and (iii) long-term stock-based incentive awards which are designed to strengthen the mutuality of interests between the executive officer and the Company's stockholders.

The summary below describes in more detail the factors that the Board considers in establishing each of the three primary components of the compensation package provided to the executive officers:

1. Base Salary. The level of base salary is established primarily on the basis of the individual's qualifications and relevant experience, the strategic goals for which he or she has responsibility, the compensation levels at companies which compete with the Company for business and executive talent, and the incentives necessary to attract and retain qualified management. Base salary is adjusted annually to take into account the individual's performance and to maintain a competitive salary structure. Company performance does not play a significant role in the determination of base salary.

2. Cash Bonuses. Cash bonuses are awarded on a discretionary basis to executive officers on the basis of their success in achieving designated individual goals and the Company's success in achieving specific company-wide goals, such as revenue growth, earnings and customer satisfaction.

3. Stock Options. The Company has utilized its stock option plans to provide executive officers and other employees with incentives to maximize long-term stockholder value. Awards under these plans by the Board take the form of stock options designed to give the recipient a significant equity stake in the Company and thereby more closely align his or her interests with those of the Company's stockholders. Factors considered in making such awards include the individual's position in the Company, his or her performance and responsibilities, and internal comparability considerations.

Each option grant allows the executive officer to acquire shares of the Company's common stock at a fixed price per share (the fair market value on the date of grant) over a specified period of time (up to 10 years). The options typically vest in periodic installments over a four-year period, contingent upon the executive officer's continued employment with the Company. Accordingly, the option will provide a return to the executive officer only if he or she remains in the Company's service, and then only if the market price of the common stock has appreciated since the option grant.

Compensation of the Chief Executive Officer

Krish Panu has served as the Company's President and Chief Executive Officer since February 1999. His base salary for the year ended December 31, 2005 was $317,115. In addition, he received a bonus of $200,000 and an option to purchase 80,000 shares of common stock.

16

The factors discussed above were applied in establishing the amount of Mr. Panu's salary and stock option grant. Significant additional factors in establishing Mr. Panu's compensation were the Company's achievement of revenue, expense and profitability targets; successful completion of large customer deployments; the acquisition and integration of Vidus Limited; the size of his current ownership interest in the Company, including portions that were unvested; and changes in the compensation for similarly situated chief executive officers.

Deductibility of Executive Compensation

The Committee has considered the impact of Section 162(m) of the Internal Revenue Code adopted under the Omnibus Budget Reconciliation Act of 1993, which section disallows a deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the CEO and four other most highly compensated executive officers, respectively, unless such compensation meets the requirements for the "performance-based" exception to Section 162(m). As the cash compensation paid by the Company to each of its executive officers is expected to be below $1 million and the Committee believes that options granted under the Company's 1996 stock option plan and 2000 stock option plan to such officers will meet the requirements for qualifying as performance-based, the Committee believes that Section 162(m) will not affect the tax deductions available to the Company with respect to the compensation of its executive officers. It is the Committee's policy to qualify, to the extent reasonable, its executive officers' compensation for deductibility under applicable tax law. However, the Company may from time to time pay compensation to its executive officers that may not be deductible.

| | | Compensation Committee: |

|

|

T. Peter Thomas, Chairperson

James W. Davis |

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee or executive officer of the Company has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity. See the discussion of the Compensation Committee under the heading, "Board Meetings, Committees and Corporate Governance" above for additional information on the Compensation Committee.

17

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors (the "Audit Committee") is composed of three independent directors and operates under a written charter adopted by the Board in July 2000, as amended from time to time, a copy of which is attached hereto as Appendix A and posted on the Company's website athttp://www.road.com/corp/news/governance.html. Each member of the Audit Committee is in compliance with The Nasdaq Marketplace Rules for independence of audit committee members.

The Audit Committee (i) reviews with the independent registered public accounting firm its independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board, (ii) discusses with the independent registered public accounting firm relationships and services that in the view of the Audit Committee may affect auditor objectivity or independence and take action or recommend action to the full Board to oversee such independence, (iii) pre-approves all audit services and non-audit services proposed to be provided by the independent registered public accounting firm, (iv) reviews with the independent registered public accounting firm the overall scope and plans for their respective audits, (v) discusses with management the effectiveness of the disclosure, accounting and internal controls, (vi) reviews the Company's interim financial statements prior to filing with the SEC and reviews the audited financial statements to be included in the Company's Annual Report on Form 10-K, (vii) reviews and approves, if appropriate, changes to the Company's accounting principles and practices as suggested by the independent registered public accounting firm or management, (viii) establishes procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls or auditing matters and establishes procedures by which employees of the Company may make confidential, anonymous submissions to the Audit Committee relating to concerns regarding accounting practices, and (ix) reviews and approves all related-party transactions other than compensation transactions.

The Audit Committee held 6 meetings during the last fiscal year. The meetings were designed to facilitate and encourage communication among the Audit Committee, management and the Company's independent registered public accounting firm, Deloitte & Touche LLP. Management represented to the Audit Committee that the Company's financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The Audit Committee reviewed and discussed the audited consolidated financial statements for the last fiscal year with management and the independent registered public accounting firm.

The Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended.

The Audit Committee has received and reviewed the written disclosures and the letter from the independent registered public accounting firm, Deloitte & Touche LLP, as required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. Additionally, the Audit Committee has discussed with Deloitte & Touche LLP the issue of its independence from the Company.

Based on its review of the audited consolidated financial statements and the various discussions noted above, the Audit Committee recommended to the full Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

The Audit Committee recognizes the importance of maintaining the independent and objective viewpoint of the Company's independent registered public accounting firm. For this reason, the Company has adopted a Policy Regarding the Approval of Audit and Non-audit Services Provided by the Independent Auditor. Under this policy, the Audit Committee must pre-approve all audit and permissible non-audit services provided by the Company's independent registered public accounting firm.

18

Pre-approvals may be granted for specific services performed by the Company's independent registered public accounting firm, as well as for classes of permitted services or similarly defined predictable or recurring services, which may include the audit services, audit-related services, tax services, merger and acquisition diligence services and other enumerated services. Pre-approval may be provided for up to one year. In addition, the Audit Committee has considered whether and concluded that the non-audit services provided by Deloitte & Touche LLP during the last fiscal year are compatible with maintaining its independence from the Company. In the last fiscal year, all of the fees paid to the independent registered public accounting firm under the categories Audit-Related Fees and Tax Fees described below were approved by the Audit Committee prior to services being rendered.

The Audit Committee may delegate pre-approval authority to one or more of its members. Such member must report any decisions to the Audit Committee at each of its regularly- scheduled meetings. As of the effective date of the Policy, the Audit Committee has delegated this authority to the Chairman of the Committee.

Fees Billed for Services Rendered by Independent Registered Public Accounting Firm

For the fiscal years ended December 31, 2005 and December 31, 2004, Deloitte & Touche LLP, and its affiliates, the Company's independent registered public accounting firm and principal accountant, billed the fees set forth below.

| | Fiscal Year

ended

12/31/2005

| | Fiscal Year

ended

12/31/2004

|

|---|

| Audit Fees(1) | | $ | 1,375,660 | | $ | 1,209,375 |

| Audit-Related Fees(2) | | $ | 92,500 | | $ | 410,572 |

| Tax Fees(3) | | $ | 9,000 | | $ | 25,893 |

| All Other Fees | | | — | | | — |

| Total Fees | | $ | 1,477,160 | | $ | 1,645,840 |

- (1)

- "Audit Fees" billed in the fiscal year ending December 31, 2005 represented fees for the Company's independent registered public accounting firm performing the following services: the audit of the Company's annual consolidated financial statements and internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002, reviews of the Company's quarterly consolidated financial statements, consents and other services related to SEC matters. "Audit Fees" billed in the fiscal year ending December 31, 2004 represented fees for the Company's independent registered public accounting firm performing the following services: the audit of the Company's annual consolidated financial statements and internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002, reviews of the Company's quarterly consolidated financial statements, consents and other services related to SEC matters.

- (2)

- "Audit-Related Fees" represented fees for the Company's independent registered public accounting firm performing the following services: due diligence related to mergers and acquisitions and financial accounting and reporting consultations.

19

- (3)

- "Tax Fees" represented fees for the Company's independent registered public accounting firm performing the following services: tax compliance and consultations for federal, state, local and international income taxes, sales and use taxes and employee benefit related matters.

| | | Audit Committee: |

|

|

Kris Chellam, Chairperson

Charles E. Levine

T. Peter Thomas |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Management

The Company has entered into change-of-control agreements with some of the Company's officers. See "Employment Contracts, Termination of Employment and Change-in-Control Arrangements" above.

The Company has entered into indemnification agreements with its officers and directors containing provisions which may require the Company, among other things, to indemnify its officers and directors against certain liabilities that may arise by reason of their status or service as officers and directors, other than liabilities arising from willful misconduct of a culpable nature, and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified.

Transactions with Stockholders

On December 15, 2004, the Company entered into an acquisition agreement with Vidus Limited, a company registered in England and Wales ("Vidus") and NVP Partners III-BT, LP, a Cayman Islands limited partnership ("NVP") pursuant to which the Company acquired all the outstanding capital shares of Vidus, effective February 18, 2005 (the "Acquisition"). In connection with the Acquisition, the Company, NVPG LLC (the general partner of NVP) and certain other owners of Vidus (the "Warrantors") entered into a Deed of Warranty and Indemnity dated December 15, 2004 (the "Deed of Warranty"). Pursuant to the Deed of Warranty, certain warranties and indemnity obligations made by NVP LLC and the Warrantors in favor of the Company remain in force and are effective for up to six years following the closing date of the Acquisition. As of March 31, 2006, NVP was the beneficial owner of approximately 5.7% of the Company's issued and outstanding common stock and approximately 32.1% of the Company's issued and outstanding preferred stock. See "Security Ownership of Certain Beneficial Owners and Management" above.

20

STOCK PERFORMANCE GRAPH

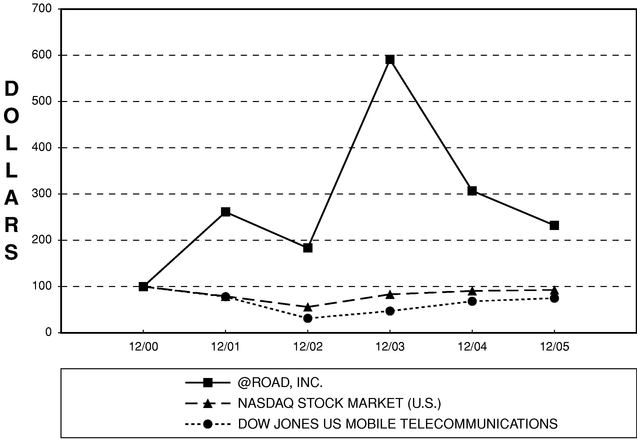

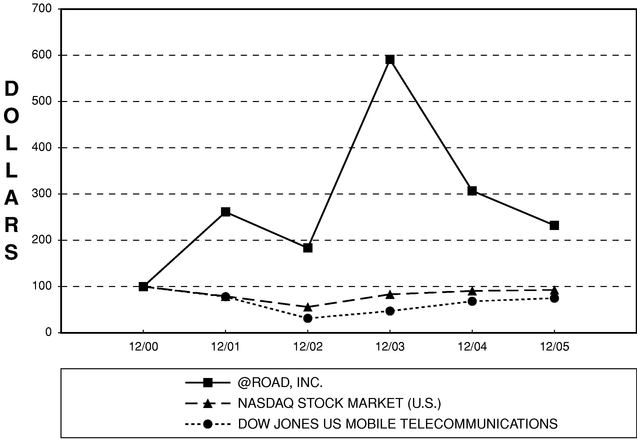

The following graph compares the cumulative total stockholder return data for the Company's common stock since December 31, 2000 to the cumulative return over such period of (i) The Nasdaq Stock Market (U.S.) Index and (ii) The Dow Jones U.S. Mobile Telecommunications Index. The graph assumes that $100 was invested on December 31, 2000 in the common stock of the Company and in each of the comparative indices. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG @ROAD, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE DOW JONES U.S. MOBILE TELECOMMUNICATIONS INDEX

- *

- $100 invested on 12/31/00 in stock or index — including reinvestment of dividends. Fiscal year ending December 31.

Cumulative Total Return

| | 12/00

| | 12/01

| | 12/02

| | 12/03

| | 12/04

| | 12/05

|

|---|

| @ROAD, INC. | | 100.00 | | 261.33 | | 183.56 | | 591.11 | | 307.11 | | 232.44 |

| NASDAQ STOCK MARKET (U.S.) | | 100.00 | | 79.08 | | 55.95 | | 83.35 | | 90.64 | | 92.73 |

| DOW JONES U.S. MOBILE TELECOMMUNICATIONS | | 100.00 | | 78.08 | | 31.38 | | 47.14 | | 68.24 | | 75.01 |

21

SECTION 16 BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's directors, executive officers and persons who own more than 10% of the Company's common stock (collectively, "Reporting Persons") to file with the SEC initial reports of ownership and changes in ownership of the Company's common stock. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file. To the Company's knowledge, based solely on its review of the copies of such reports received or written representations from certain Reporting Persons that no other reports were required, the Company believes that during its year ended December 31, 2005, all Reporting Persons complied with all applicable filing requirements.

EQUITY COMPENSATION PLAN INFORMATION

The following table gives information about the Company's common stock that may be issued upon the exercise of options, warrants and rights under all of the Company's existing equity compensation plans as of December 31, 2005, including the 1996 stock option plan, the 2000 stock option plan, the Directors' Plan and the ESPP. The Company does not have any equity compensation plans not approved by the Company's stockholders.

Plan Category

(a)

| | Number of Securities to

be Issued upon Exercise

of Outstanding Options,

Warrants and Rights

(b)

| | Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(c)

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in

Columns (a))

(d)

| |

|---|

| Equity compensation plans approved by stockholders | | 9,329,212 | (1) | $ | 4.822 | | 3,695,558 | (2) |

| | | 200,000 | (3) | $ | 5.183 | | 960,834 | |

| | | | | | | | 1,521,711 | (4) |

| Equity compensation plans not approved by stockholders | | 41,889 | (5) | $ | 0.67 | | — | |

| | |

| | | | |

| |

| Total | | 9,571,101 | | | | | 6,178,103 | |

| | |

| | | | |

| |

- (1)

- Represents shares subject to options outstanding under the 2000 stock option plan and the 1996 stock option plan.

- (2)

- The 2000 stock option plan includes an "evergreen" feature, which provides for an automatic annual increase in the number of shares available under the plan on the first day of each of the Company's fiscal years through 2010, equal to the lesser of 2,500,000 shares or 4% of the Company's outstanding common stock on the last day of the immediately preceding fiscal year.

- (3)

- Represents shares subject to options outstanding under the Directors' Plan.

- (4)