SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

PACIFIC MERCANTILE BANCORP

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | $125 per Exchange Act Rules 0-11(c)(1)(ii), or 14a-6(i)(1), or 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| ¨ | | $500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(i)(3). |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

PACIFIC MERCANTILE BANCORP

April 17, 2003

Dear Shareholder:

The Board of Directors and I would like to extend you a cordial invitation to attend the Annual Meeting of Shareholders of Pacific Mercantile Bancorp (the “Company”). The Meeting will be held on Tuesday, May 20, 2003, at 2:00 P.M., at the Sutton Place Hotel, 4500 MacArthur Blvd., Newport Beach, California 92660.

The attached Notice of Annual Meeting and Proxy Statement describe in detail the matters to be acted on at the meeting. We also will discuss the operations of the Company and its wholly owned subsidiaries including, in particular, Pacific Mercantile Bank (the “Bank”). Your participation in Company activities is important, and we hope you will attend.

Whether or not you plan to attend the meeting, please be sure to complete, sign, date and return the enclosed proxy card in the accompanying postage-paid reply envelope, or vote by telephone or the Internet, so that your shares may be voted in accordance with your wishes. Returning the enclosed proxy will not prevent you from voting in person if you choose to attend the Annual Meeting.

Sincerely, |

|

|

Raymond E. Dellerba President and Chief Executive Officer |

949 South Coast Drive, Third Floor, Costa Mesa, California 92626 (714) 438-2500

PACIFIC MERCANTILE BANCORP

949 South Coast Drive, Third Floor

Costa Mesa, California 92626

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 20, 2003

NOTICE TO THE SHAREHOLDERS OF PACIFIC MERCANTILE BANCORP:

The 2002 Annual Meeting of Shareholders of Pacific Mercantile Bancorp (the “Company”) will be held at the Sutton Place Hotel, 4500 MacArthur Blvd, Newport Beach, California 92660, on Tuesday, May 20, 2003, at 2:00 PM., Pacific Time, for the following purposes:

| | 1. | | To re-elect seven incumbent Directors of the Company, who are named in the accompanying Proxy Statement, to serve as Directors for the ensuing year and until their successors are elected and qualified; |

| | 2. | | To ratify the selection of Grant Thornton LLP as the Company’s Independent Certified Public Accountants for fiscal 2003; and |

| | 3. | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only shareholders of record at the close of business on April 8, 2003 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

By order of the Board of Directors |

|

|

Raymond E. Dellerba President and Chief Executive Officer |

April 17, 2003

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU SHOULD COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY.Returning the enclosed proxy will not prevent you from voting in person if you choose to attend the Annual Meeting.

PACIFIC MERCANTILE BANCORP

949 South Coast Drive, Third Floor

Costa Mesa, California 92626

PROXY STATEMENT

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 20, 2003

INTRODUCTION

This Proxy Statement is furnished to you in connection with the solicitation of proxies by the Board of Directors of Pacific Mercantile Bancorp, a California corporation (the “Company”), for use at the 2003 Annual Meeting of Shareholders to be held on Tuesday, May 20, 2003, at 2:00 P.M., Pacific Time, at the Sutton Place Hotel, 4500 MacArthur Blvd., Newport Beach, California 92660, and at any adjournment or postponement thereof (the “Annual Meeting”). This Proxy Statement and the accompanying proxy card are first being mailed to shareholders on or about April 17, 2003.

SOLICITATION OF PROXIES

The Company’s Board of Directors is asking that shareholders complete, sign and return the enclosed Proxy Card, which will enable your shares to be voted at the Annual Meeting. If you do sign and return a Proxy Card to us prior to the Meeting, your shares will be voted in accordance with your instructions indicated on the Proxy Card. If, on the other hand, you sign and return a Proxy Card that does not contain any instructions, your shares will be voted in accordance with the Board of Directors’ recommendations, described below, on each of the proposals to be voted on at the Annual Meeting, which are discussed in this Proxy Statement.

A shareholder giving a proxy may revoke it at any time before it is exercised by sending us a written revocation addressed to the Corporate Secretary, Pacific Mercantile Bancorp, 949 South Coast Drive, Third Floor, Costa Mesa, CA 92626; sending us a later dated Proxy Card with different instructions; or attending the Annual Meeting and voting in person.

VOTING SECURITIES

Holders of record of common stock of the Company at the close of business on April 8, 2003 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 6,399,888 shares of common stock of the Company outstanding and entitled to vote at the Annual Meeting. A majority of those shares, represented in person or by proxy, will constitute a quorum at the Annual Meeting. Shareholders, who withhold authority to vote on the election of directors or abstain on any proposal, and broker non-votes, will be counted in determining the presence of a quorum.

Each shareholder is entitled to one vote for each share of common stock held as of the Record Date, except that if any shareholder in attendance at the Annual Meeting announces an intention to cumulate votes in the election of directors prior to the voting, then all shareholders will be entitled to cumulate votes in that election. In an election of directors held by cumulative voting, each shareholder is entitled to cast a number of votes that is equal to the number of directors to be elected (which at this Annual Meeting will be seven), multiplied by the number of shares which the shareholder is entitled to vote at the Meeting and to cast all of those votes for a single nominee or to distribute them on the same principle among as many nominees as the shareholder may choose. The persons named in the enclosed proxy do not intend, but may chose, to give such notice and vote the shares they represent in that manner.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth below is information regarding the beneficial ownership, as of April 8, 2003, of the Company’s common stock by (i) each person who we knew owned, beneficially, more than 5% of the outstanding shares of common stock of the Company, (ii) each director of the Company, (iii) and each of the current executive officers of the Company who are named in the Summary Compensation Table, and (iv) all of the current directors and executive officers as a group.

Name

| | Number of Shares Beneficially Owned(1)

| | | Percent of Shares Outstanding

| |

Raymond E. Dellerba | | 378,835 | (2)(3) | | 5.6 | % |

George H. Wells | | 153,289 | (2)(4) | | 2.4 | % |

Ronald W. Chrislip | | 95,894 | (2)(5) | | 1.5 | % |

Julia M. DiGiovanni | | 93,894 | (2)(6) | | 1.5 | % |

Warren T. Finley | | 86,394 | (2)(7) | | 1.3 | % |

John Thomas, M.D. | | 127,394 | (2) | | 2.0 | % |

Robert E. Williams | | 106,344 | (2) | | 1.7 | % |

Nancy Gray | | 2,300 | (2) | | * | |

All directors and officers as a group (8 persons) | | 1,044,344 | (8) | | 15.0 | % |

| * | | Represents less than 1% of the outstanding shares. |

| (1) | | Beneficial ownership includes voting and investment power with respect to shares shown as beneficially owned. Shares subject to options that are exercisable or exercisable on or before June 7, 2003 are deemed outstanding for computing the shares and percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage ownership of any other person or entity. Except as otherwise indicated and except for the effect of community property laws, the persons listed in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. |

| (2) | | Includes the following shares that may be purchased on exercise of options on or before June 7, 2003: Dellerba – 303,035 shares; Wells – 84,789 shares; Mrs. DiGiovanni and Messrs. Chrislip, and Thomas – 31,394 shares each; Messrs. Finley and Williams – 40,344 shares each; and Ms. Gray – 2,000 shares. |

| (3) | | Does not include and Mr. Dellerba disclaims beneficial ownership of 2,500 shares owned by Mr. Dellerba’s mother as custodian of such shares for the benefit of Mr. Dellerba’s minor children |

| (4) | | Does not include and Mr. Wells disclaims beneficial ownership of 2,500 shares owned by his spouse. |

| (5) | | Does not include and Mr. Chrislip disclaims beneficial ownership of 2,650 shares which are owned by certain family members (not residing with him). |

| (6) | | Does not include and Mrs. DiGiovanni disclaims beneficial ownership of 1,500 shares which are owned by certain family members (not residing with her). |

| (7) | | Does not include and Mr. Finley disclaims beneficial ownership of 31,100 shares which are owned by family members (not residing with him). |

| (8) | | Includes a total of 564,695 shares that may be acquired on exercise of stock options on or before June 7, 2003. |

3

ELECTION OF DIRECTORS

(Proposal No. 1)

Seven directors will be elected at the Annual Meeting to hold office until the next annual shareholders meeting is held or until their successors are elected and have qualified. The Board of Directors has nominated for election the persons named below, all of whom are incumbent directors, elected to their positions by the Company’s shareholders. Each of the nominees has consented to serve as a director, if re-elected. Unless otherwise instructed, the proxy holders named in the enclosed proxy intend to vote the proxies received by them for the election of those nominees. If, prior to the Meeting, any nominee of the Board of Directors becomes unable to serve as a director, the proxy holders will vote the proxies received by them for the election of a substitute nominee selected by the Board of Directors.

Vote Required and Recommended of the Board of Directors

Under California law, the seven nominees receiving the most votes from holders of shares of common stock present or represented by proxy and entitled to vote at the Meeting will be elected to serve as Directors of the Company for the ensuing year. As a result, shares as to which the authority to vote is withheld, which will be counted, and broker non-votes, which will not be counted, will have no effect on the outcome of the election of directors.

If any record shareholder gives notice at the Annual Meeting of his or her intention to cumulate votes in the election of Directors, the proxy holders shall have the discretion to allocate and cast the votes represented by the proxies they hold among the nominees named below in such proportions as they deem appropriate in order to elect as many of those nominees as is possible.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED BELOW.

Nominees

The following sets forth the names and is a brief description of the principal occupation and recent business experience of each of the nominees selected by the Board of Directors for election to the Company’s Board of Directors at the Annual Meeting:

Raymond E. Dellerba, age 55, has served as President, Chief Executive Officer and a Director of the Company and the Bank since the respective dates of their inception. From February 1993 to June 1997, Mr. Dellerba served as the President, Chief Operating Officer and director of Eldorado Bank, and as Executive Vice President and a director of Eldorado Bancorp. Mr. Dellerba has more than 30 years of experience as a banking executive, primarily in Southern California and in Arizona.

George H. Wells, age 68, has served as the Chairman of the Board and a Director of the Company and the Bank since the respective dates of their inception. Mr. Wells is a private investor. Mr. Wells was a founding director of Eldorado Bank in 1972 and served as Chairman of that bank and of its parent holding company, Eldorado Bancorp, from 1979 to 1997, when Eldorado Bank was sold. Prior to becoming a private investor, Mr. Wells held various executive positions with Technology Marketing Incorporated, a publicly owned computer development services and software company, including Chairman, President, Treasurer and Chief Financial Officer.

Ronald W. Chrislip, age 51, has served as a Director of the Company and the Bank since the respective dates of their inception. Mr. Chrislip has been an attorney in private practice in the City of Santa Ana since 1976. Mr. Chrislip also has a law office in San Clemente.

Julia M. DiGiovanni, age 83, has served as a Director of the Company and the Bank since the respective dates of their inception. Mrs. DiGiovanni is, and for more than the past five years has been, a private investor. She also served as a director of Eldorado Bank and its parent corporation, Eldorado Bancorp, from October 1995 until 1997. Mrs. DiGiovanni served as a member of the Board of Directors of Mariners Bank, a state chartered bank based in San Clemente, California, from 1991 until 1995, when that Bank was acquired by Eldorado Bank.

4

Warren T. Finley, age 71, has served as a Director of the Company and the Bank since the respective dates of their inception. Mr. Finley also is the Chairman of the Management and Incentive Committee of the Bank. Mr. Finley is an attorney who is, and for more than 40 years has been, engaged in the private practice of law in Orange County, California. Mr. Finley also served as a director of Eldorado Bank and its parent holding company, Eldorado Bancorp, from 1972 to 1997.

John Thomas, M.D., age 53, has served as a Director of the Company and the Bank since the respective dates of their inception. Dr. Thomas is a licensed physician who is, and for more than the past 15 years has been, engaged in the private practice of medicine, specializing in the practice of Radiation Oncology. He also serves as, and for more than the past 7 years has been, the Medical Director of the Red Bluff Tumor Institute. He is a Diplomate and Fellow of the American Board of Radiology, a Fellow of the American College of Radiation Oncology, and a member of the Standards Committee for the American College of Radiation Oncology.

Robert E. Williams, age 60, has served as a Director of the Company and the Bank since the respective dates of their inception and is Chairman of the Company’s Audit Committee. Mr. Williams is, and for more than 20 years has been, a certified public accountant, with Robert E. Williams Accountancy Corporation, a firm that he established in 1978. Mr. Williams is also in association with the accounting firm of Williams, Magdaleno and Crellin.

There are no family relationships among any of the officers or directors of the Company.

Meetings of the Board of Directors

The Board of Directors of the Company held 12 meetings during the calendar year ended December 31, 2002. Each incumbent director attended at least 75% of the aggregate of the number of meetings of the Board and the number of meetings held by all committees of the Board on which he or she served (during the periods that he or she served).

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon information made available to the Company, the Company believes that all filing requirements under Section 16(a) of the Securities Exchange Act of 1934 applicable to its directors and officers were satisfied with respect to the Company’s fiscal year ended December 31, 2002. To the Company’s knowledge, no one owns as much as 10% of its shares.

Committees of the Board of Directors

In addition to meeting as a group, the Directors have established committees to review and supervise various aspects of the operations of the Company and the Bank. These committees include the following.

The Audit Committee provides oversight of the Company’s audit and compliance programs and coordinates audit matters with the Company’s independent auditors. The Audit Committee also selects the Company’s outside auditors. See “Report of the Audit Committee” included below in this Proxy Statement. The members of the Audit Committee are Robert E. Williams, its Chairman, George H. Wells, and Warren T. Finley. None of them are or have been officers or employees of the Company or the Bank and in all other respects meet the applicable audit committee membership standards of NASDAQ. The Audit Committee held 9 meetings in 2002.

The Management and Incentive Committee, which is the Company’s compensation committee, has the authority to approve the salaries and grants of bonuses and options to the management of the Company and the Bank, and oversees the development and implementation of compensation and benefit programs that are designed to enable the Company and the Bank to retain existing, and attract new, management personnel and thereby remain competitive with other financial institutions in its market areas. Warren Finley serves as Chairman of this Committee, and the other members of that Committee are Raymond E. Dellerba, Julia M. DiGiovanni and Ronald W. Chrislip. Barbara I. Palermo, Executive Vice President of Administration and Human Resources of the Bank, is also a member of this Committee. Mr. Dellerba and Ms. Palermo do not participate in the Committee’s deliberations or decisions with respect to their respective compensation and benefits. The Management and Incentive Committee held 3 meetings in 2002.

5

COMPENSATION OF EXECUTIVE OFFICERS

The following table sets forth compensation received in each of the fiscal years in the three year period ended December 31, 2002, by the Company’s Chief Executive Officer, and the other executive officers whose aggregate cash compensation for services rendered to the Company in all capacities in 2002 exceeded $100,000 (collectively, the “Named Officers”):

Name and Positions

| | Year

| | Annual Compensation

| | Long-Term Compensation Awards Shares Underlying Options (#)

|

| | | Salary

| | Bonuses (1)

| |

Raymond E. Dellerba President and Chief Executive Officer of the Company and the Bank | | 2002 2001 2000 | | $ | 219,800 160,000 138,400 | | $ | 140,000 82,900 141,300 | | 37,076 90,000 150,000 |

|

Nancy Gray(2) Executive Vice President and Chief Financial Officer | | 2002 | | $ | 74,083 | | $ | 16,000 | | 10,000 |

|

John J. McCauley(3) Executive Vice President and Chief Operating Officer of the Company and the Bank | | 2002 2001 2000 | | $ | 109,000 119,000 110,300 | | $ | — — 22,000 | | — — 31,000 |

|

John P. Cronin(4) Executive Vice President and Chief Information Officer of the Company and the Bank | | 2002 2001 2000 | | $ | 101,700 116,700 100,000 | | $ | — — 13,500 | | — — 30,000 |

| (1) | | With the exception of Mr. Dellerba, whose bonus compensation is determined pursuant to his employment agreement with the Bank, bonuses paid to the Named Officers were awarded, on a discretionary basis, by the Board of Directors. Of the bonus awarded to Mr. Dellerba in 2002, $56,000 related to services performed in 2001. |

| (2) | | Ms. Gray’s employment with the Company and the Bank commenced on May 1, 2002. Her annual salary is $119,000. |

| (3) | | Mr. McCauley’s employment terminated on April 9, 2002. |

| (4) | | Mr. Cronin’s employment terminated on April 30, 2002. |

In addition to the compensation set forth in the Table above, each executive officer receives health and life insurance benefits and other incidental job-related benefits, and is entitled to participate in any incentive compensation programs that may be adopted for management employees of the Company or the Bank. Also, an automobile is provided to Mr. Dellerba for use on Company business. Mr. Dellerba also receives certain additional benefits under an employment agreement with the Bank, the terms of which are summarized below.

Option Grants to Executive Officers

Set forth in the following table is information relating to the options that were granted in fiscal 2002 to Raymond E. Dellerba and Nancy Gray, who were the only Named Officers that received options during that year.

Name

| | Number of Shares Underlying Options

| | Percent of Total Options Granted in Fiscal 2002

| | | Exercise Price(1) ($/Share)

| | Expiration Date

| | Potential Realizable Value of Options at Assumed Annual Rates of Stock Price Appreciation (2)

|

| | | | | | 5%

| | 10%

|

Raymond E. Dellerba | | 37,076 | | 36.3 | % | | $ | 7.75 | | 1-01-2012 | | $ | 180,560 | | $ | 457,925 |

Nancy Gray | | 10,000 | | 9.8 | % | | $ | 7.99 | | 5-20-2012 | | $ | 50,200 | | $ | 127,300 |

| (1) | | Options are granted at an exercise price that is equal to the fair market value of the underlying shares of stock on the date of grant. The closing price per share of the Company’s common stock on December 31, 2002, as reported by NASDAQ, was $7.23. |

6

| (2) | | Potential realizable value is based on the assumption that our common stock appreciates at the annual rates of 5% and 10%, compounded annually from the date of grant and to the expiration of the ten-year term of the options. These amounts are calculated based on Securities and Exchange Commission requirements and do not reflect our projection or estimate of future stock price growth. |

Of the total number of options granted in 2002, options to purchase a total of 55,000 shares of our common stock were granted to other employees of the Company (other than the officers named in the table above). These options become exercisable in periodic installments over a five (5) year period following the grant of the options and, if and to the extent not exercised, will expire in 2012.

Option Exercises and Fiscal Year-End Option Values

Neither Mr. Dellerba nor Ms. Gray exercised options during fiscal 2002.

The following table provides information with respect to the value of unexercised “in-the-money” options held by Mr. Dellerba as of December 31, 2002, who was the only one of the Named Officers that held any “in the money” options as of that date.

Name

| | Number of Securities Underlying Unexercised Options at FY-End (#)

| | Value of Unexercised In-the-Money Options at FY-End ($) (1)

|

| | Exercisable

| | Unexercisable(2)

| | Exercisable

| | Unexercisable

|

Raymond E. Dellerba | | 215,530 | | — | | $ | 448,662 | | $ | — |

| | (1) | | The value of unexercised options has been calculated on the basis of the fair market value of the Company’s common stock on December 31, 2002 less the applicable exercise price per share, multiplied by the number of shares underlying such options. |

Employment Agreement

Mr. Dellerba is employed as President and Chief Executive Officer of the Bank under a multi-year employment agreement. The original term of the agreement was three years, ending on April 23, 2002, subject to automatic renewals for additional successive one-year periods through the year 2013, unless sooner terminated by either party. Neither party has elected, by advance notice, to terminate the agreement. As a result, Mr. Dellerba’s employment agreement will remain in effect until at least April 23, 2004.

Salary. Under the employment agreement, Mr. Dellerba is entitled to receive annual base salary in an amount which is not less than the median salary for chief executive officer of banks headquartered in the Western United States that are of comparable size to the Bank. Based on that formula, his base annual salary, which was $160,000 in fiscal 2001, was increased during 2002 to $240,000. Mr. Dellerba’s employment agreement also provides that if the Bank or the Company hires another executive at a compensation level that exceeds the compensation that is then payable to Mr. Dellerba, Mr. Dellerba’s compensation and benefits will be adjusted upward to be at least equal to that of the other executive.

Bonus Compensation. Mr. Dellerba’s employment agreement provides that he will receive a bonus in an amount which will be determined by mutual agreement of the Bank and Mr. Dellerba on the basis of the Company’s pretax profits for the year, after consultation with an independent compensation consultant, but in no event less than 35% of Mr. Dellerba’s base salary, or 3.5% of the Company’s pre-tax profits for that year, whichever is greater.

Participation in Management Equity Plans. Mr. Dellerba’s employment agreement provides that he is entitled to participate in the Company’s equity compensation plans and that he will receive at least one-sixth of all stock options issued to all employees and other participants in such plans. In addition, following the calendar year in which the Company achieves a ratio of net earnings to average total assets (exclusive of any good will) of at least one percent (1%), Mr. Dellerba will receive fully vested options to purchase, at an exercise price equal to the then fair market value of Company shares, a number of Company shares equal to 0.5% of the sum of the number of Company shares then outstanding and the number of shares subject to then outstanding stock options. For the year ended December 31, 2002, that ratio was less than 1% and, therefore, no options were granted pursuant to that provision of his employment agreement.

7

Transaction-Based Compensation. Mr. Dellerba’s employment agreement provides that if there occurs a change of control of the Company, by means of a private sale of shares, a sale of all or substantially all of its assets or a merger, either during the term of his employment or within 24 months of a termination of his employment by the Company, other than for cause or due to his death, disability or voluntary resignation, Mr. Dellerba will be entitled to receive a one time bonus in an amount equal to one percent (1%) of the gross proceeds of that change of control transaction. If the Company, the Bank or any other of Company’s subsidiaries completes a public offering of its shares, then Mr. Dellerba would receive a bonus equal to 1% of the increase in shareholder’s equity during the year in which that offering is consummated (net of any increase attributable to any net profits earned). Payment of any such transaction-based compensation will be payable to Mr. Dellerba, at his election, either in cash or in shares of Company stock.

Retirement Benefits. Pursuant to a Supplemental Retirement Plan (the “Retirement Plan”) established by the Bank and amended in fiscal 2002, subject to his meeting certain vesting requirements described below, upon reaching age 65, Mr. Dellerba would become entitled to receive thereafter 180 equal monthly payments each in an amount equal to 60% of his average monthly base salary during the three (3) years preceding the date of his retirement or other termination of employment (the “retirement payments”). Prior to the amendment, the Retirement Plan provided for a retirement benefit consisting of 180 monthly payments of $8,333 each. Mr. Dellerba’s right to receive the retirement payments vests monthly during the term of his employment at a rate equal to 1.5 monthly retirement payments for each month of service with the Bank. Accelerated vesting of Mr. Dellerba’s right to receive retirement payments under that Plan will occur on the happening of the following events: (i) a termination of Mr. Dellerba’s employment by the Bank “without cause” or by him due to a “good reason event” (as such term is defined in the Retirement Plan), in which case he would become entitled to receive 24 monthly retirement payments or, if greater, the number of monthly retirement payments that had become vested prior to that termination of employment; or (ii) a Change in Control of the Company (as defined in the Retirement Plan) or the death of Mr. Dellerba while still employed by the Bank, in which event his right to receive all 180 monthly retirement payments will become vested. If Mr. Dellerba should die prior to the time the Bank has made all of his vested retirement payments, then those payments will be made thereafter to Mr. Dellerba’s heirs. In order to assure that there will be funds to pay the retirement payments, the Bank has established a trust into which it is obligated to make periodic contributions (which, however, will remain subject, under certain specified circumstances, to the claims of the Bank’s creditors).

Severance Benefits. If Mr. Dellerba’s employment is terminated without cause by the Bank or he elects to terminate his employment with the Bank due to changes that the Company unilaterally makes to the terms or conditions of his employment that adversely affect him, Mr. Dellerba will become entitled to receive a lump sum cash payment equal to his base salary and target bonus for the remainder of the term of his employment agreement or for the succeeding twenty-four (24) months, whichever is longer. He also will be entitled to a continuation of his health insurance and other benefits for a period of two (2) years. Additionally, on any such termination, all unvested options and other unvested equity compensation to which he would otherwise be entitled will become vested.

Other Benefits. Mr. Dellerba receives, in addition to standard employee health, life insurance, welfare and other benefits, the use of a company-paid automobile.

Director Compensation

During fiscal 2002, the Chairman of the Board received $350, and each other non-employee director received $250, for each meeting of the Company’s Board of Directors that they attended. In addition, non-employee directors, including the Chairman, received $500 for each meeting of the Bank’s Board of Directors, and $100 for each Committee meeting, they attended, up to a maximum of $600 per month. The Chairman of the Board also received an additional stipend of $100 per month as compensation for his additional responsibilities as Chairman.

Effective January 1, 2003, Board fees payable to the non-employee directors were increased to $500 for each Company Board meeting, $750 for each Bank Board meeting, they attend. The fees payable to the Chairman were also changed, effective January 1, 2003. The Chairman now receives $700 for each Company Board meeting, $950 for each Bank Board meeting, and $500 for each PMB Securities Board meeting, he attends. Payment for attendance at a committee meeting of either entity shall remain the same at $100 per meeting, not to exceed an additional $100 per month per director in any given month.

8

Certain Transactions

The Bank has had, and in the future may have, banking transactions in the ordinary course of its business with directors, principal stockholders and their associates, including the making of loans to directors and their associates. Such loans and other banking transactions are made on the same terms, including interest rates and collateral securing the loans, as those prevailing at the time for comparable transactions with persons of comparable creditworthiness who have no affiliation with the Company or the Bank. In addition, such loans are made only if they do not involve more than the normal risk of collectibility of loans made to non-affiliated persons and do not present any other unfavorable features.

Compensation Committee Interlocks and Insider Participation

The members of the Board of Directors’ Management and Incentive Committee, which performs the functions of a compensation committee, are Warren T. Finley, Ronald W. Chrislip and Julia M. DiGiovanni, all of whom are non-employee Directors of the Company and the Bank, and Raymond E. Dellerba, the President and Chief Executive Officer of the Company and the Bank and Barbara I. Palermo, Executive Vice President of Administration of the Bank. The primary role of Mr. Dellerba and Ms. Palermo on the Committee is to provide input on the performance of other executive officers and key management employees, and neither Mr. Dellerba nor Ms. Palermo participate in the deliberations, and neither of them votes on decisions, regarding their respective compensation.

No executive officer of the Company served on the board of directors or compensation committee of any entity that has one or more executive officers serving as members of the Company’s Board of Directors or Management and Incentive Committee.

REPORT OF THE MANAGEMENT AND INCENTIVE COMMITTEE

The Management and Incentive Committee is responsible for approving salaries, awarding bonuses and granting options to our management, and overseeing the development and implementation of compensation and benefit programs that are designed to enable the Company and Bank to retain existing, and attract new, management personnel and thereby remain competitive with other financial institutions in its market areas.

The following report is submitted by the Management and Incentive Committee members with respect to the executive compensation policies established by the Committee and the compensation of executive officers in the fiscal year ended December 31, 2002.

Compensation Policies and Objectives

In adopting, and also evaluating the effectiveness of, compensation programs for executive officers, as well as other management employees of the Company and the Bank, the Management and Incentive Committee is guided by three basic principles:

| | • | | The Company and the Bank must be able to attract and retain highly qualified and experienced banking professionals with proven performance records. |

| | • | | A substantial portion of annual executive compensation should be tied to the Bank’s performance, measured in terms of profitability, asset growth and asset quality and other factors that can affect the financial performance of the Bank. |

| | • | | The financial interests of the Company’s senior executives should be aligned with the financial interests of the shareholders, primarily through stock option grants, which reward executives for improvements in the market performance of the Company’s common stock. |

Attracting and Retaining Executives and Other Key Employees

There is substantial competition among banks and other financial institutions and service organizations for qualified banking professionals. In order to retain executives and other key employees, and to attract additional well-qualified banking professionals when the need arises, the Company strives to offer salaries and health care, retirement

9

and other employee benefit programs to its executives and other key employees which are competitive with those offered by other banks and financial services organizations in California.

In establishing salaries for executive officers, the Compensation Committee reviews (i) the historical performance of the executives; and (ii) available information regarding prevailing salaries and compensation programs at banks and other financial organizations which are comparable, in terms of asset-size, capitalization and performance, to the Bank. Another factor, which is considered in establishing salaries of executive officers, is the cost of living in Southern California, which generally is higher than in other parts of the country.

Performance-Based Compensation

During fiscal 2002, discretionary bonuses were awarded to the Named Officers based on their efforts and contribution to the growth and accomplishments achieved by the Company during that year.

CEO Compensation

The Board of Directors decided that it would be prudent and in the Company’s best interests for the Bank to enter into multi-year employment agreement with Raymond Dellerba, its Chief Executive Officer. Accordingly, the Bank entered into such an agreement with Mr. Dellerba in 2000. A description of that agreement is contained above in the Section of this Proxy Statement entitled “Compensation of Executive Officers – Employment Agreement.” The Committee believes that the employment agreement serves to assure continuity and stability in that position and to deter competing banks from attempting to hire away the Chief Executive Officer. Other considerations that led the Board of Directors to approve Mr. Dellerba’s employment agreement were (i) the extent of Mr. Dellerba’s banking experience, developed primarily in Southern California, (ii) the loyal following Mr. Dellerba has developed over the years with businesses based in and individuals residing in the Bank’s market areas in Southern California, which enabled us to attract a substantial number of customers to the Bank without having to incur significant marketing costs, and (iii) the compensation arrangements that other banks and financial services companies in Southern California have entered into with their chief executive officers that have banking experience and track records comparable to that of Mr. Dellerba.

Mr. Dellerba’s employment agreement entitles him to be paid an annual base salary that is not less than the median salary for chief executive officer of banks headquartered in the Western United States that are of comparable size to that of Pacific Mercantile Bank. During fiscal 2002, the Bank grew in size to more than $500 million in total assets from approximately $250 million at December 31, 2001. As a result, during fiscal 2002 Mr. Dellerba’s annual base salary was increased, initially to $200,000 per year in 2002, and to $240,000 per year in fourth quarter 2002. As a result, salary paid to him in fiscal 2002 totaled $219,800. The Board of Directors awarded Mr. Dellerba a bonus of $84,000 based on his contribution to the Company’s growth in fiscal 2002 and $56,000 based on his contribution to the substantial improvement in the Company’s profitability and its growth in fiscal 2001.

Stock Programs

In order to align the financial interests of senior executives and other key employees with those of the shareholders, the Company grants stock options to its senior executives and other key employees on a periodic basis. Stock option grants reward senior executives and other key employees for performance that results in improved market performance of the Company’s stock, which directly benefits all shareholders. Generally, the number of shares included in each stock option grant is determined based on an evaluation of the executive’s importance to the future performance of the Company. As a general rule, the more senior the executive, the greater the number of option shares that are awarded.

Respectfully Submitted,

The Management and Incentive Committee

Warren T. Finley

Ronald W. Chrislip

Julia M. DiGiovanni

Raymond E. Dellerba

Barbara I. Palermo

10

REPORT OF THE AUDIT COMMITTEE

The Role of the Audit Committee. The Company’s management is responsible for the Company’s financial reporting process, including its system of internal control, and for the preparation of its consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors are responsible for auditing those financial statements. The role and responsibility of the Audit Committee is to monitor and review these processes.

In performing those responsibilities, we meet regularly with management to discuss the financial reporting processes that management employs, including the processes used to gather the information needed to prepare the Company’s financial statements. We also meet with the Company’s independent auditors, outside the presence of management, to discuss their role as the Company’s outside auditors, their assessment of the financial reporting processes employed by management, the accounting policies that are critical to a fair presentation of the Company’s financial condition and results of operations and the results of their financial reviews of the Company’s quarterly financial statements and of the audit of the Company’s annual financial statements.

However, we are not accountants or auditors by profession or experts in the fields of accounting or auditing, nor are we employees of the Company or the Bank and we do not undertake to conduct auditing or accounting reviews or procedures at the Company or the Bank. Additionally, our oversight does not provide us with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, our considerations and our discussions with management and the Company’s independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles. As a result, in performing our monitoring and review responsibilities we must necessarily rely, without independent verification, on management’s representation that the Company’s financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and on the representations of the independent auditors included in their report on the Company’s financial statements.

Report of the Audit Committee.We have reviewed and discussed the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2002 with management. We also have discussed with Grant Thornton LLP, the Company’s independent certified public accountants for fiscal year 2002, the matters required to be discussed by the Statement on Auditing Standards No. 61 (Communications with Audit Committees). In addition, we have received the written disclosures and the letter from Grant Thornton, LLP as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and the Audit Committee has discussed the independence of Grant Thornton, LLP with that firm.

Based on our review of the matters noted above and our discussions with Grant Thornton LLP and the Company’s management, we recommended to the Board of Directors that the Company’s financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

Respectfully Submitted,

The Audit Committee of the Board of Directors

Robert E. Williams

George H. Wells

Warren T. Finley

Notwithstanding anything to the contrary set forth in the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the foregoing Reports of the Management and Incentive Committee and the Audit Committee and the Stock Performance Graph on the following page shall not be incorporated by reference into any such filings.

11

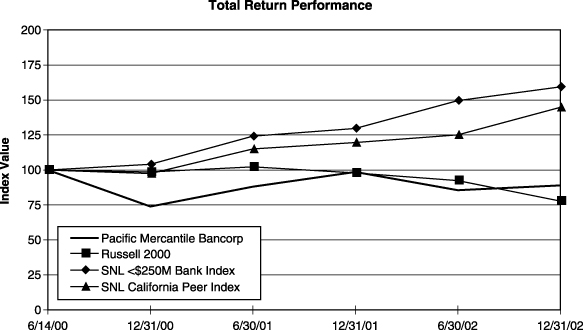

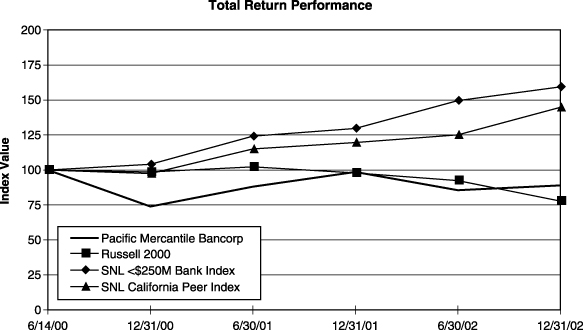

COMPANY STOCK PERFORMANCE

The following graph compares the stock price performance of the Company shares with that of (i) the companies included in the Russell 2000 Index, (ii) an index, published by SNL Securities L.C. (“SNL”), which is made up of publicly traded banks and bank holding companies with assets of up to $250 million, and (iii) a second index, also published by SNL, which is made up of the 12 publicly traded California-based banks and bank holding companies with market capitalizations of up to $75 million (the “California Peer Group Bank Index”). The index of publicly traded banks and bank holding companies with assets of up to $250 million, which was included in last year’s Proxy Statement, includes banks located throughout the United States many of which operate in geographic areas characterized by market and competitive conditions that are significantly different than those in which the Company operates. We decided to include the California Peer Group Bank Index in this year’s Proxy Statement because it is comprised of banks and bank holding companies which operate in markets similar to the Company’s markets and which, therefore, we believe are more representative of and provide a more relevant comparison of financial performance to that of the Company. In future years, the index of banks and bank holding companies with assets of up to $250 million will no longer appear in our Proxy Statements.

Pacific Mercantile Bancorp

| | | 6/14/00

| | 12/31/00

| | 6/30/01

| | 12/31/01

| | 6/30/02

| | 12/31/02

|

Pacific Mercantile Bancorp | | 100.00 | | 73.85 | | 88.00 | | 98.46 | | 85.54 | | 89.05 |

Russell 2000 | | 100.00 | | 95.49 | | 102.14 | | 97.86 | | 92.48 | | 77.82 |

SNL < $250 Million Bank Index | | 100.00 | | 104.04 | | 124.07 | | 129.72 | | 149.64 | | 159.40 |

SNL California Peer Group Index | | 100.00 | | 97.32 | | 114.95 | | 119.59 | | 125.09 | | 144.66 |

The Stock Performance Graph assumes that $100 was invested on June 14, 2000 in the Company and in the Russell 2000 Index, the index of banks and bank holding companies with assets totaling up to $250 million and the California Peer Group Index and that any dividends issued for the indicated periods were reinvested. Shareholder returns shown in the Performance Graph should not be considered indicative of future stock performance.

12

RATIFICATION OF APPOINTMENT OF

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

(Proposal No. 2)

Grant Thornton LLP audited the Company’s consolidated financial statements for the fiscal year ended December 31, 2002. Grant Thornton, LLP has been selected by the Audit Committee of Board of Directors as the Company’s independent public accountants for the fiscal year ending December 31, 2002. Although shareholder approval is not required, the Board of Directors is requesting that the shareholders ratify the selection of Grant Thornton as the Company’s independent certified public accountants. In the event the Grant Thornton’s selection is not ratified by the shareholders, the Audit Committee of the Board of Directors will reconsider that appointment.

Ratification of the selection of Grant Thornton as the Company’s independent public accountants for the fiscal year ending December 31, 2003 requires the affirmative vote of a majority of the shares present in person or represented at the Meeting and voting on this Proposal. Shares voted “abstain” will be counted. Broker non-votes will be counted for quorum purposes, but will not be counted in determining whether or not this Proposal has been approved by the Shareholders and therefore will have no effect on the outcome of the vote.

A representative of Grant Thornton will attend the Annual Meeting, will have an opportunity to make a statement and will be available to respond to appropriate questions.

Fees Paid to Grant Thornton

Grant Thornton’s aggregate fees for professional services for the audit of the Company’s annual consolidated financial statements, and the review of the Company’s interim financial statements included in its quarterly reports on Form 10-Q, for the fiscal year ended December 31, 2002, totaled $123,000.

Grant Thornton did not provide, and it did not bill and it was not paid any fees for, financial information systems design and implementation services in 2002. The aggregate fees paid by the Company for all other services rendered by Grant Thornton to the Company in fiscal 2002, which consisted of tax advisory services, totaled $40,100.

The Audit Committee has determined the provision by Grant Thornton of, and the fees paid by the Company for, such tax advisory services, were compatible with maintaining its independence.

SHAREHOLDER PROPOSALS

Any shareholder desiring to submit a proposal for action at the Company’s 2004 Annual Meeting of Shareholders and presentation in the Company’s Proxy Statement with respect to such meeting should arrange for such proposal to be delivered to the Company at its principal place of business no later than December 17, 2003 in order to be considered for inclusion in the Company’s proxy statement relating to that meeting. Matters pertaining to such proposals, including the number and length thereof, eligibility of persons entitled to have such proposals included and other aspects are regulated by the Securities Exchange Act of 1934, Rules and Regulations of the Securities and Exchange Commission and other laws and regulations to which interested persons should refer.

13

OTHER MATTERS

We are not aware of any other matters to come before the meeting. If any other matter not mentioned in this Proxy Statement is brought before the meeting, the proxy holders named in the enclosed Proxy will have discretionary authority to vote all proxies with respect thereto in accordance with their judgment.

ADDITIONAL INFORMATION

Proxy Costs

We will pay the costs of soliciting proxies from our shareholders, and plan on soliciting proxies by mail. In order to ensure adequate representation at the Annual Meeting, directors, officers and employees (who will not receive any additional compensation) of the Company or the Bank, may communicate with shareholders, brokerage houses and others by telephone, telegraph or in person, to request that proxies be furnished. We will reimburse banks, brokerage houses, custodians, nominees and fiduciaries for their reasonable expenses in forwarding proxy materials to the beneficial owners of the Company’s shares.

By Order of the Board of Directors |

|

|

Raymond E. Dellerba President and Chief Executive Officer |

April 17, 2003

The Annual Report to Shareholders of the Company for the fiscal year ended December 31, 2002 is being mailed concurrently with this Proxy Statement to all Shareholders of record as of April 8, 2003. The Annual Report is not to be regarded as proxy soliciting material or as a communication by means of which any solicitation is to be made.

COPIES OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2002 WILL BE PROVIDED (WITHOUT EXHIBITS) TO SHAREHOLDERS WITHOUT CHARGE UPON WRITTEN REQUEST TO THE CORPORATE SECRETARY, PACIFIC MERCANTILE BANCORP, 949 SOUTH COAST DRIVE, THIRD FLOOR, COSTA MESA, CALIFORNIA 92626.

14

PROXY

PACIFIC MERCANTILE BANCORP

ANNUAL MEETING OF SHAREHOLDERS—MAY 20, 2003

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby revokes all previous proxies that the undersigned may have given, and hereby appoints George Wells, Raymond E. Dellerba and Warren Finley, and each of them individually, with full power of substitution, as the attorneys and Proxies of the undersigned, with full power of substitution, to represent the undersigned and to vote, as indicated below, all the shares of Common Stock of Pacific Mercantile Bancorp which the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held at the Sutton Place Hotel, 4500 MacArthur Blvd., Newport Beach, California, on Tuesday, May 20, 2003, at 2:00 P.M. Pacific Standard Time, and at any and all adjournments or postponements thereof.

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED BY THE SHAREHOLDER ON THE REVERSE SIDE OF THIS PROXY. IF NO DIRECTION IS GIVEN WITH RESPECT TO ANY PROPOSAL, SUCH SHARES WILL BE VOTED “FOR” THE PROPOSAL. THIS PROXY CONFERS DISCRETIONARYAUTHORITY TO CUMULATE VOTES FOR ANY OR ALL OF THE NOMINEES FOR ELECTION OF DIRECTORS FOR WHICH AUTHORITY TO VOTE HAS NOT BEEN WITHHELD.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO SIGN AND RETURN THIS PROXY, WHICH MAY BE REVOKED AT ANY TIME PRIOR TO ITS USE.

IMPORTANT—PLEASE SIGN AND DATE ON OTHER SIDE AND RETURN PROMPTLY

(Continued and to be signed on reverse side)

Ú FOLD AND DETACH HERE Ú

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | FOR | | | | WITHHOLD AUTHORITY to vote | | | | | | | | | | | | | | | | | | |

| | | | | | | THE NOMINEES LISTED BELOW | | | | (to vote for the nominees listed below) | | | | | | | | FOR | | | | AGAINST | | | | | | ABSTAIN |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

PROPOSAL 1: Nominees:

| | Election of Directors: Raymond E. Dellerba,

George H. Wells, Ronald W. Chrislip, Julia M. DiGiovanni, Warren T. Finley, John Thomas, M.D., and Robert E. Williams. | | | | ¨ | | | | ¨ | | PROPOSAL 2. | | Ratification of the selection of Grant Thornton LLP as Company’s Independent Public Accountants for the fiscal year ending December 31, 2003. | | | | ¨ | | | | ¨ | | | | | | ¨ |

|

INSTRUCTION: To withhold authority to vote for any nominee, print that nominee’s name in the space below.)

| | | | | | | | | | IN THEIR DISCRETION, UPON OTHER BUSINESS, WHICH PROPERLY COMES BEFORE THE MEETING OR ANY ADJOURNMENT OR POSTPONEMENT THEREOF. |

|

Do You Plan to Attend the Meeting? | | YES ¨ | | | | NO ¨ | | | | | | | | | | | | | | | | | | |

Please sign your name

Dated ,2003

Please sign your name exactly as it appears hereon. Executors, administrators, guardians, officers of corporations, and others signing in fiduciary capacity should state their full titles as such.

Please Detach Here

Ú You Must Detach This Portion of the Proxy Card Ú

Before Returning it in the Enclosed Envelope