November 2019 INVESTOR PRESENTATION

FORWARD LOOKING STATEMENTS This presentation contains statements regarding our expectations, beliefs and views about our future financial performance and our business, trends and expectations regarding the markets in which we operate, and our future plans. Those statements constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, can be identified by the fact that they do not relate strictly to historical or current facts. Often, they include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may”. Forward-looking statements are based on current information available to us and our assumptions about future events over which we do not have control. Moreover, our business and our markets are subject to a number of risks and uncertainties which could cause our actual financial performance in the future, and the future performance of our markets (which can affect both our financial performance and the market prices of our shares), to differ, possibly materially, from our expectations as set forth in the forward-looking statements contained in this presentation. In addition to the risk of incurring loan losses, which is an inherent risk of the banking business, these risks and uncertainties include, but are not limited to, the following: the risk that the economic recovery in the United States, which is still relatively fragile, will be adversely affected by domestic or international economic conditions, which could cause us to incur additional loan losses and adversely affect our results of operations in the future; the risk that our results of operations in the future will continue to be adversely affected by our exit from the wholesale residential mortgage lending business and the risk that our commercial banking business will not generate the additional revenues needed to fully offset the decline in our mortgage banking revenues within the next two to three years; the risk that our interest margins and, therefore, our net interest income will be adversely affected by changes in prevailing interest rates; the risk that we will not succeed in further reducing our remaining nonperforming assets, in which event we would face the prospect of further loan charge-offs and write-downs of other real estate owned and would continue to incur expenses associated with the management and disposition of those assets; the risk that we will not be able to manage our interest rate risks effectively, in which event our operating results could be harmed; the prospect that government regulation of banking and other financial services organizations will increase, causing our costs of doing business to increase and restricting our ability to take advantage of business and growth opportunities. Additional information regarding these and other risks and uncertainties to which our business is subject are contained in our Annual Report on Form 10-K for the year ended December 31, 2018 which is on file with the SEC as well as subsequent Quarterly Reports on Form 10-Q that we file with the SEC. Due to these and other risks and uncertainties to which our business is subject, you are cautioned not to place undue reliance on the forward-looking statements contained in this news release, which speak only as of its date, or to make predictions about our future financial performance based solely on our historical financial performance. We disclaim any obligation to update or revise any of the forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. 2

CORPORATE OVERVIEW _________________________________ Pacific Mercantile Bank is a full service business bank serving Southern California . Bank founded in 1999 . $1.4 billion in total assets . 7 locations in Southern California . Focused on middle-market businesses with revenues between $10 to $75 million CORPORATE HEADQUARTERS COSTA MESA, CALIFORNIA 3

INVESTMENT HIGHLIGHTS _________________________________ . Growing commercial bank operating in attractive Southern California markets . New CEO hired in September 2019 to accelerate growth and profitability . Well defined value proposition drives new client acquisition without compromising on pricing and terms . Favorable shifts in loan and deposit mix adding to franchise value . Disciplined expense management driving improved efficiencies . Attractive valuation trading at 1.14x tangible book value(1) (1) Based on closing price on October 28, 2019 4

OFFICE LOCATIONS _________________________________ Newport Beach Century City Irvine Spectrum Costa Mesa La Habra Ontario San Diego 5

EXECUTIVE MANAGEMENT TEAM _________________________________ Financial Tenure at Name Title Services Select Experience PMB Experience . Corporate EVP at SunTrust Banks President & Started in Brad R. Dinsmore ~32 years . Head of U.S. Retail Banking at Citigroup Chief Executive Officer Sep. 2019 . Orange County Market President at Bank of America . EVP & CFO of Carpenter Community BancFund Executive Vice President & . Interim CFO at Manhattan Bancorp Curt A. Christianssen ~22 years ~5 years Chief Financial Officer . CFO and Director of Corporate Development for Dartmouth Capital Group and Eldorado Bancshares . Chief Banking Officer at Pacific Mercantile Bank Executive Vice President & Robert Anderson ~23 years ~6 years . Various positions at Silicon Valley Bank including head of Interim Chief Credit Officer Orange County office . Chief Information Officer at Bank of Manhattan Executive Vice President & Curtis Birkmann ~9 years ~4 years . Senior Software Engineer and Senior Program Manager at Chief Technology Officer Corcen Data International Executive Vice President & . Vice President/Compliance and BSA Manager at California Maxwell G. Sinclair ~23 years ~8 years Chief Compliance Officer Bank & Trust 6

BOARD OF DIRECTORS _________________________________ Name Title Tenure Select Experience . Founder, Chairman, Chief Executive Officer and Principal of Seapower Carpenter Chairman of the Edward J. Carpenter ~6 years Capital, Inc. Board . Founder, Chairman, Chief Executive Officer and Principal of Carpenter & Company . Partner, Patriot Financial Partners James Deutsch Director ~2 years . President and Chief Executive Officer of Team Capital Bank Added in Brad R. Dinsmore Director . President and CEO of Pacific Mercantile Bancorp Sep 2019 Added in . Co-Founder, President and Chief Executive Officer of Beacon Pointe Advisors Shannon F. Eusey Director May 2019 . Managing Director and Portfolio Manager at Roxbury Capital Management Michael P. Hoopis Director ~6 years . Chief Executive Officer and President of Targus Group International, Inc. Denis P. Kalscheur Director ~4 years . Vice Chairman and Chief Executive Officer of Aviation Capital Group Corp. Added in . Managing Director of Moelis & Company Michele S. Miyakawa Director May 2019 . Investment banking positions at UBS and Donaldson, Lufkin & Jenrette . Chief Credit Officer of Wells Fargo & Company David J. Munio Director ~3 years . Various executive positions at First Interstate Bank . Principal of Kestrel Advisors Stephen P. Yost Director ~5 years . Regional Chief Credit Officer for Comerica Bank 7

MARKET POSITIONING _________________________________ Differentiating Strategy to Target Business Clients “We Help Companies Succeed” Middle-Market Horizon Analytics® Service/Products Businesses • Financial analysis • Customized Commercial • Need for financial • Business planning Loans guidance • Modeling and forecasting • Asset Based Lending • Limited internal financial • Balance sheet • Owner Occupied RE sophistication management • Treasury Management • Limited outside advisory • Scenario analysis • Value driven pricing support Majority of new relationships being brought into the Bank are C&I operating companies 8

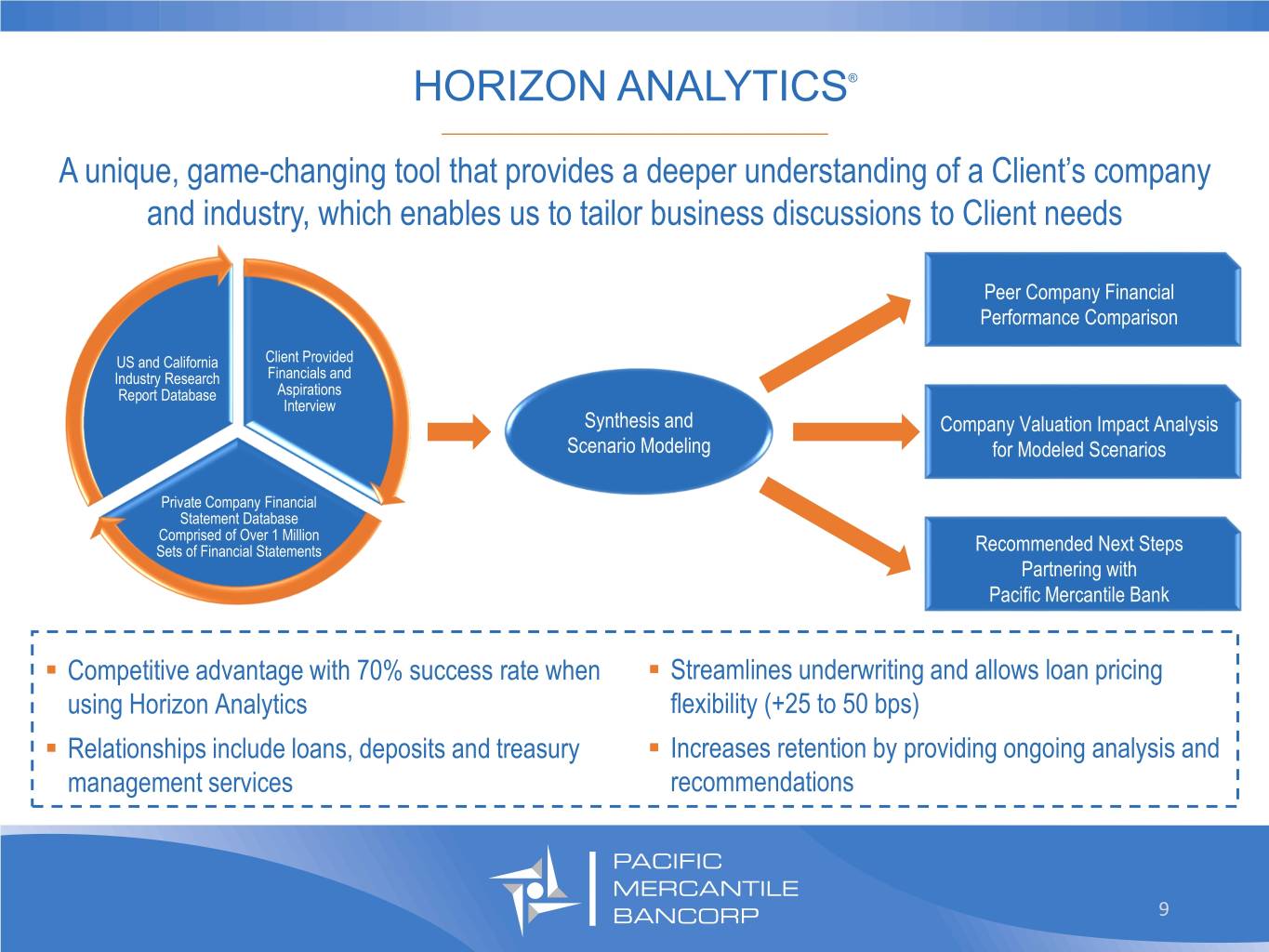

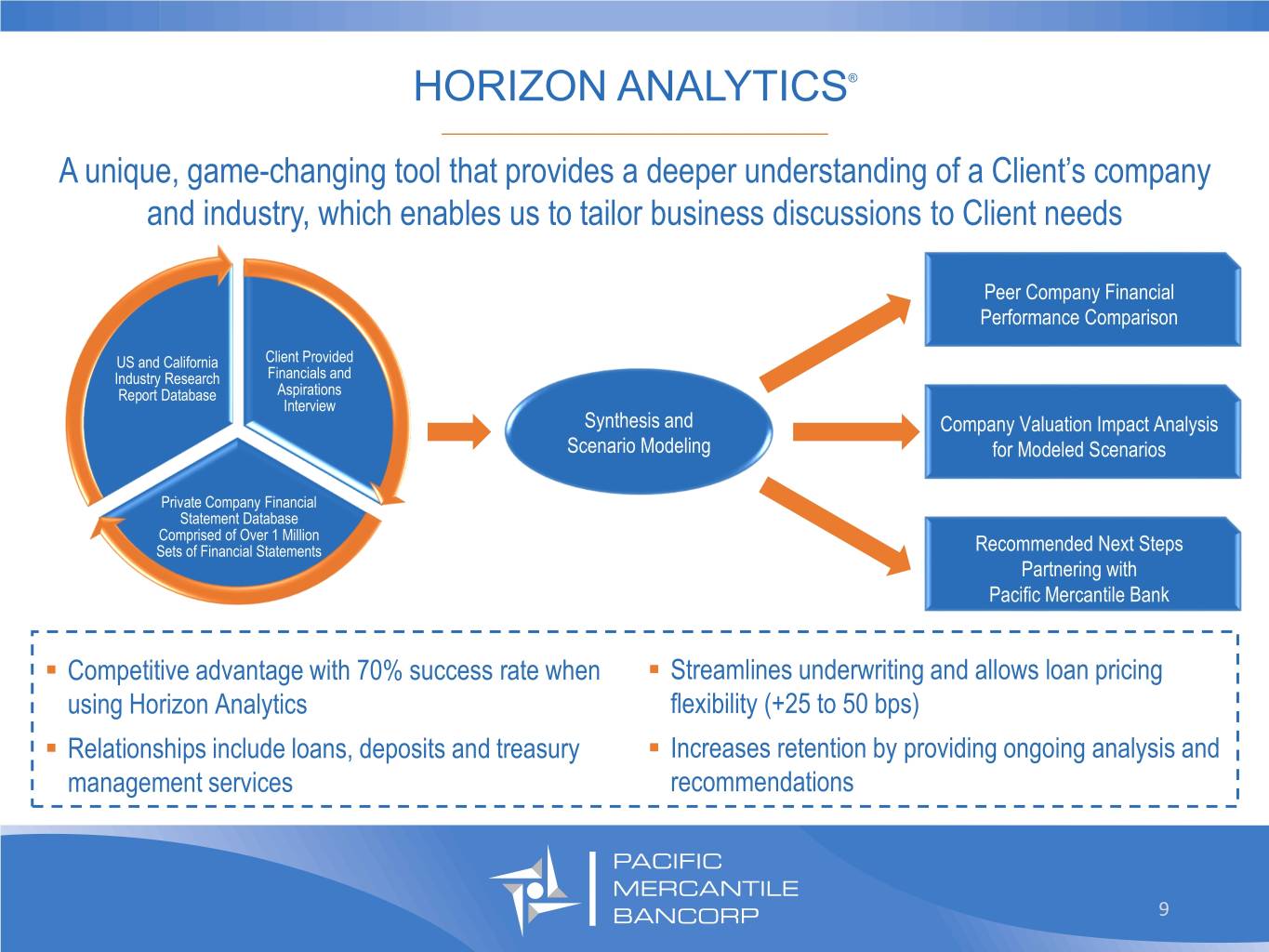

HORIZON ANALYTICS® _________________________________ A unique, game-changing tool that provides a deeper understanding of a Client’s company and industry, which enables us to tailor business discussions to Client needs Peer Company Financial Performance Comparison US and California Client Provided Industry Research Financials and Report Database Aspirations Interview Synthesis and Company Valuation Impact Analysis Scenario Modeling for Modeled Scenarios Private Company Financial Statement Database Comprised of Over 1 Million Sets of Financial Statements Recommended Next Steps Partnering with Pacific Mercantile Bank . Competitive advantage with 70% success rate when . Streamlines underwriting and allows loan pricing using Horizon Analytics flexibility (+25 to 50 bps) . Relationships include loans, deposits and treasury . Increases retention by providing ongoing analysis and management services recommendations 9

OPERATING COMPANY HIGHLIGHTS _________________________________ . Target operating companies with annual revenues between $10 million and $75 million . Identified industry verticals for which there are over 20,000 businesses in service area . Primarily manufacturing, distribution and service industries . 2017 – acquired 33 operating company relationships . 2018 – acquired 62 operating company relationships . First nine months of 2019 – acquired 54 operating company relationships . Average loan commitment of ~$2.5 million; 30% - 40% self funded in core deposits 10

ENHANCING BANKER PRODUCTIVITY _________________________________ • All C&I bankers being trained in Horizon Analytics® More effectively leverage • Horizon Analytics® incorporated into all business development efforts Horizon Analytics® • Horizon Analytics® increases win rate and improves loan pricing Dedicated real estate • 30% of assets will be managed by 20% of bankers lending group created • Enables 80% of sales force to focus solely on operating companies Increase time spent on • Reduced administrative responsibilities for relationship managers • Allows C&I bankers to spend more time with existing clients and business development new prospects Align development goals • More focus on operating companies and incentives • Higher variable opportunity for top performers 11

FINANCIAL PERFORMANCE OVERVIEW _________________________________ Adjusted Pre-Tax Pre-Provision Income* $15.0 $12.8 $10.1 $10.0 ($ in millions)in ($ $4.8 $4.6 $5.0 $3.8 $3.9 $4.3 $2.9 $3.5 $0.0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 YTD 2018 YTD 2019 Adjusted Return on Average Assets* Adjusted Return on Average Equity* 0.98% 9.50% 1.00% 10.00% 0.79% 0.77% 7.74% 7.54% 0.72% 6.90% 7.35% 0.61% 4.39% 0.50% 0.45% 5.00% 0.25% 2.47% 0.00% 0.00% 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 *2018 figures exclude income from PMAR and the reversal of the valuation allowance against the Company’s deferred tax assets ($11.1 million), applying a normalized tax rate of 30.0%; 12 see Non-GAAP reconciliation table in appendix

IMPROVING OPERATING LEVERAGE _________________________________ Efficiency Ratio* 100% 97.5% 94.7% 90% YTD19 vs. YTD18* . Revenue up 6.7% . Non-interest expense up 2.0% 80% 78.5% 73.4% 70% 68.9% 60% 2015 2016 2017 YTD 2018 YTD 2019 *YTD 2018 excludes income from PMAR; see Non-GAAP reconciliation table in appendix 13

LOAN PORTFOLIO FOCUS ON RELATIONSHIP LENDING _________________________________ Other Consumer, 2.1% 7.8% $ 1.16 Billion as of September 30, 2019 CRE: all other, 18.9% Multifamily, 14.9% Average Yield of 5.45% in 3Q19 CRE: owner-occupied, 18.7% Commercial, 37.6% 56.3% Relationship Loans 14

LOAN PRODUCTION TRENDS _________________________________ . Focused sales execution and leveraging the competitive advantages of Horizon Analytics . Growth in core portfolios (C&I and owner-occupied CRE) mitigated by payoffs Fundings/Runoff/Utilization ($ in millions) $150.0 64% $130.1 63.4% 63.3% $99.2 $100.0 62% 62.1% $92.2 $84.5 $75.2 $78.3 $52.9 $54.9 $54.5 $50.0 60% $38.6 60.1% 59.7% $0.0 58% 3Q18 4Q18 1Q19 2Q19 3Q19 Loan Fundings Payoffs/Paydowns C&I Line Utilization Rate 15

DRIVERS OF LOAN GROWTH _________________________________ . Focus on operating companies driving growth in C&I loan portfolio . C&I loan growth impacted by payoffs stemming from imprudent credit structures and pricing being offered by the competition in our market . Balance sheet management resulting in growth in other non-core loan categories Total Loans Outstanding Total C&I Loans Outstanding All Other Loans Outstanding ($ in millions) ($ in millions) ($ in millions) $1,400 $500 $800 5.0% C&I Loan Growth Over Past 12 Months $726 $444 $436 $1,200 $1,162 $700 $415 $670 $666 $1,094 $1,081 $649 $1,065 $400 $394 $1,000 $600 $800 $300 $500 12/31/17 12/31/18 9/30/18 9/30/19 12/31/17 12/31/18 9/30/18 9/30/19 12/31/17 12/31/18 9/30/18 9/30/19 16

ASSET QUALITY _________________________________ . Increase in NPAs in 3Q19 attributable to two commercial loan relationships . Broader credit trends in portfolio remain healthy . Credit costs expected to be low for foreseeable future NPAs/Total Assets NCOs/Average Loans (annualized) 2.00% 2.40% 1.96% 1.50% 1.90% 1.40% 1.00% 0.93% 0.90% 0.54% 0.54% 0.50% 0.41% 0.40% 0.10% 0.10% -0.04% -0.02% 0.02% 0.00% -0.10% 3Q18 4Q18 1Q19 2Q19 3Q19 3Q18 4Q18 1Q19 2Q19 3Q19 17

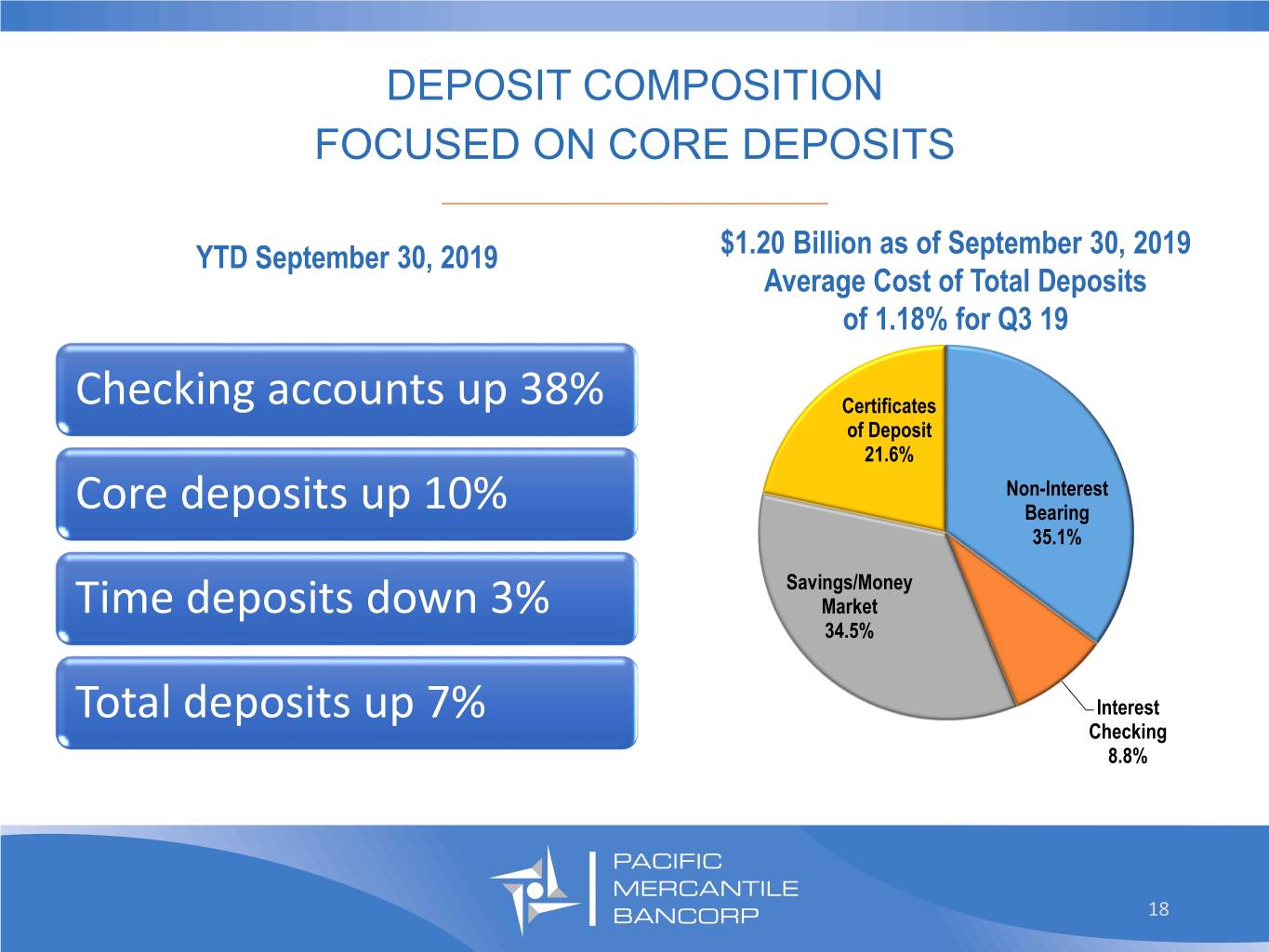

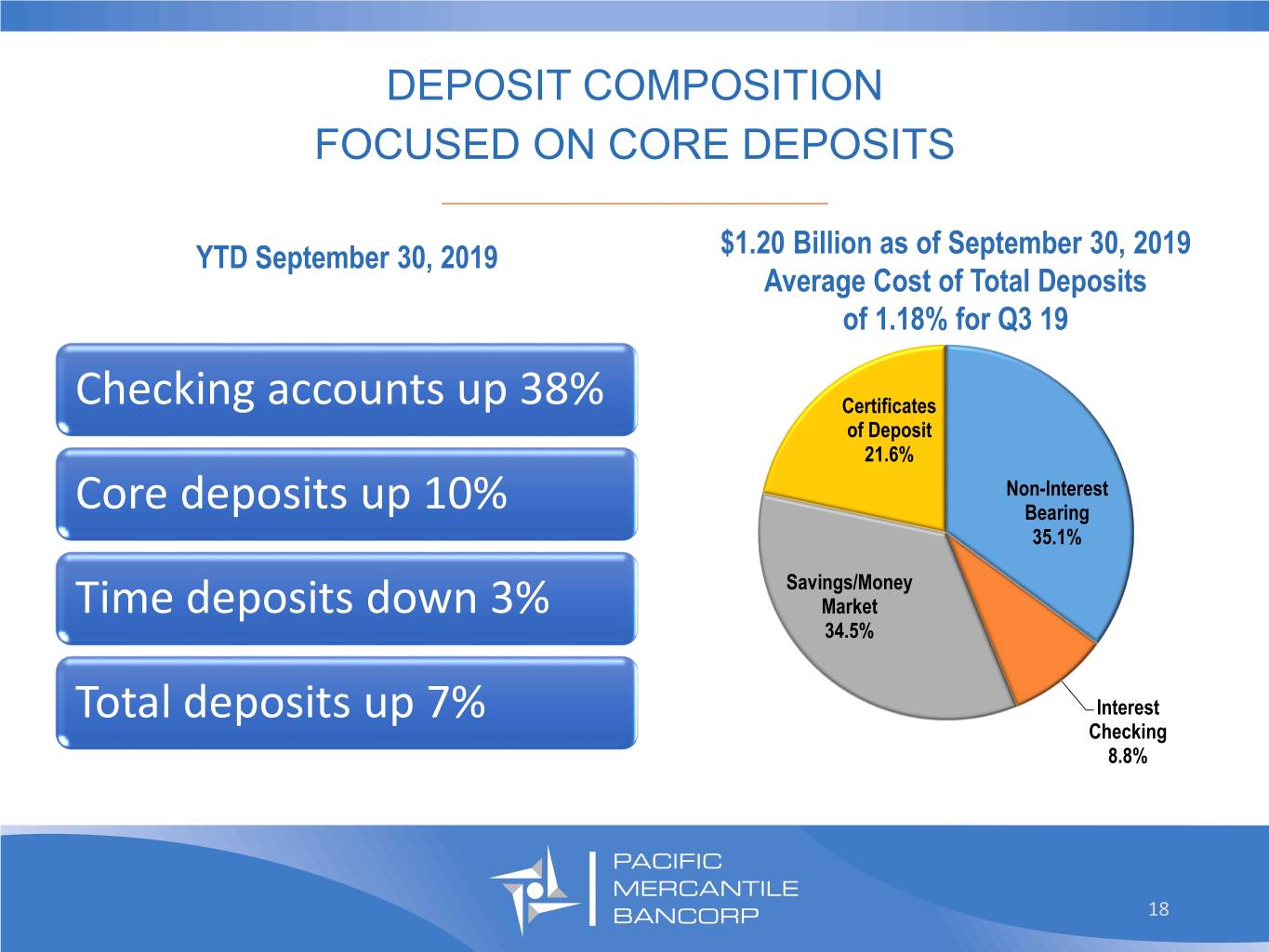

DEPOSIT COMPOSITION FOCUSED ON CORE DEPOSITS _________________________________ YTD September 30, 2019 $1.20 Billion as of September 30, 2019 Average Cost of Total Deposits of 1.18% for Q3 19 Checking accounts up 38% Certificates of Deposit 21.6% Non-Interest Core deposits up 10% Bearing 35.1% Savings/Money Time deposits down 3% Market 34.5% Total deposits up 7% Interest Checking 8.8% 18

NET INTEREST MARGIN _________________________________ Well Positioned for Stable to Increasing Net Interest Margin • Positive factors impacting cost of funds • Growth in DDAs allowing for reduced reliance on time deposits • 55% of MM deposits are indexed or being adjusted point-for-point with decreases • Approximately 40% deposit beta for all non-maturity interest bearing deposits for the July and September rate cuts • $95 million in time deposits maturing in 4Q19 and 1Q20 at weighted average rate of 2.35% (current rates 50 bps lower than maturing rate) • Positive factors impacting loan yields • New loan production focused on higher yielding C&I loans • 60% of total loans are fixed rate • $40 million of variable rate loans within 0-25 bps of floors at 9/30/19 • $70 million of variable rate loans within 26-50 bps of floors at 9/30/19 19

STRONG CAPITAL POSITION _________________________________ PM BANK WELL-CAPITALIZED REQUIREMENT 13.5% 15.0% 12.5% 12.5% 10.0% 10.0% 8.0% 6.5% 5.0% 0.0% COMMON EQUITY TIER 1 TIER 1 CAPITAL RATIO TOTAL CAPITAL RATIO CAPITAL RATIO As of September 30, 2019 20

Strategic Priorities _________________________________ • Accelerate growth and profitability – double acquisition of new operating companies 2019-2020 • Increase business development productivity through realignment of resources to allow bankers more time to spend with clients and new prospects • Leverage success in winning deposit relationships to expand lending opportunities with high quality operating companies • Continue to improve deposit mix with increases in core deposits and reduced reliance on CDs • Maintain stable to increasing net interest margin • Generate higher non-interest income through further growth in SBA gain on sale income • Keep expenses stable to generate increasing operating leverage • Maintain strong asset quality with manageable credit costs 21

Investor Relations: Curt Christianssen ( 7 1 4 ) 4 3 8 - 2 5 3 1 Curt.christianssen@pmbank.com 22

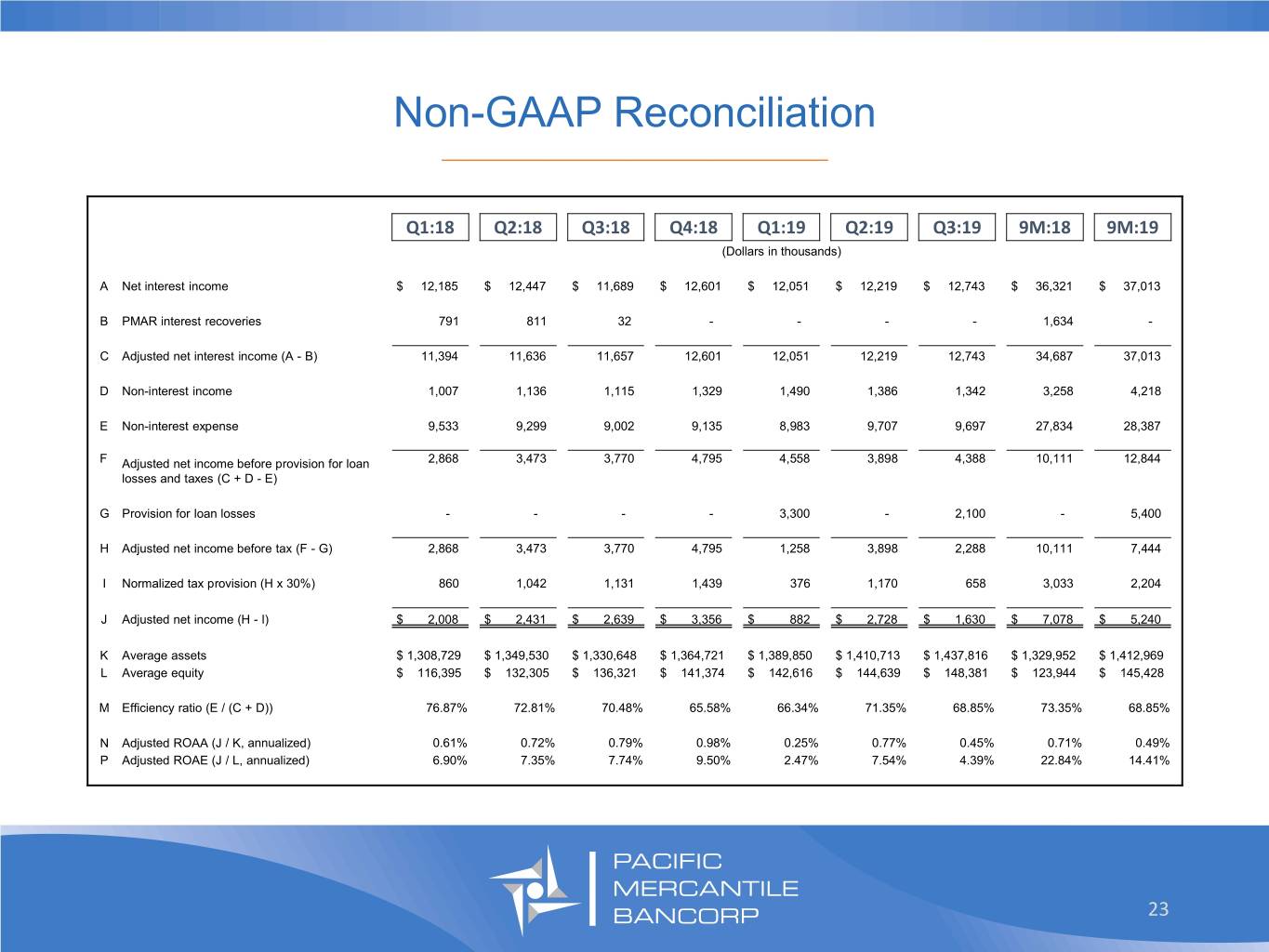

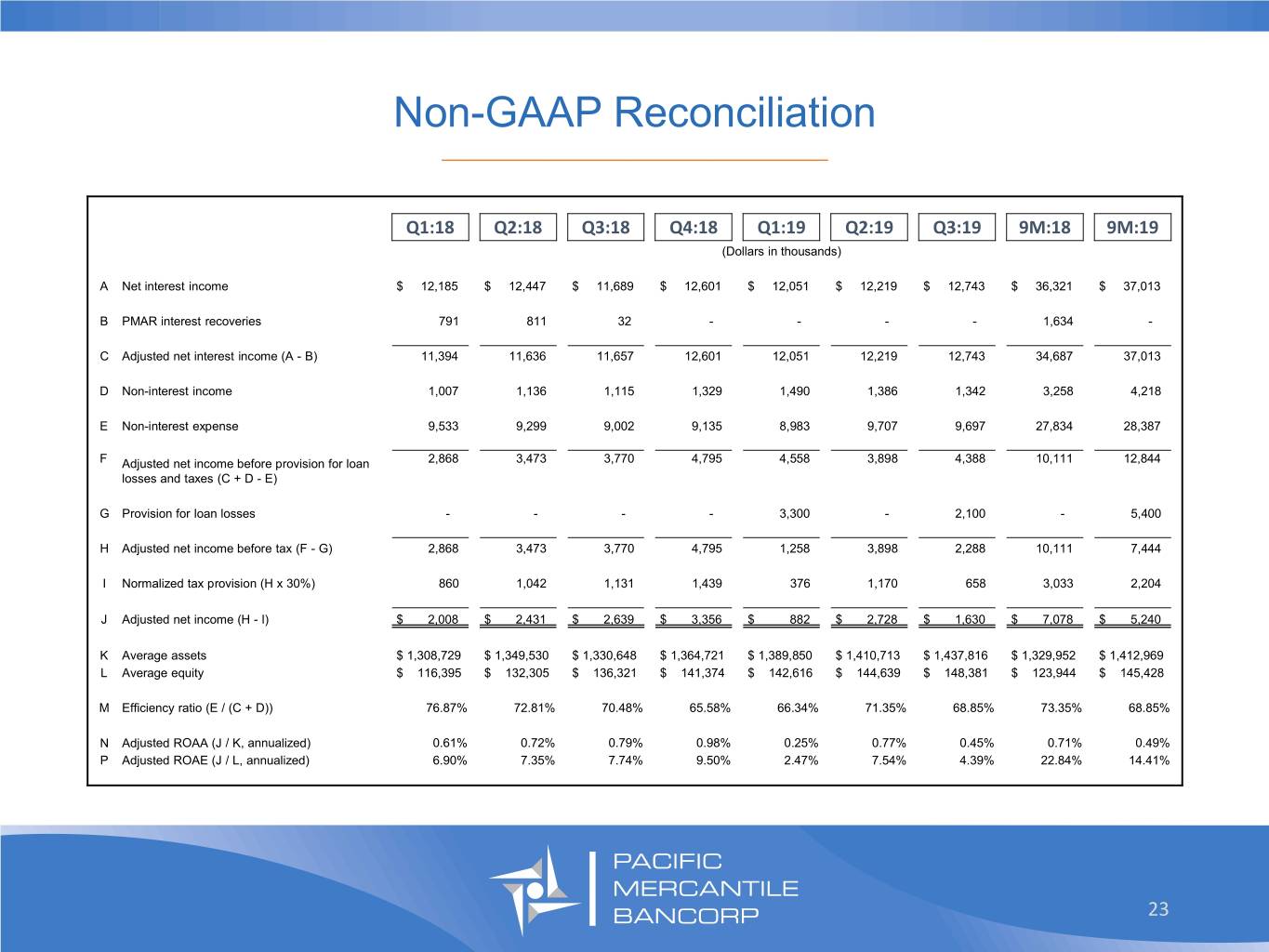

Non-GAAP Reconciliation _________________________________ Q1:18 Q2:18 Q3:18 Q4:18 Q1:19 Q2:19 Q3:19 9M:18 9M:19 (Dollars in thousands) A Net interest income $ 12,185 $ 12,447 $ 11,689 $ 12,601 $ 12,051 $ 12,219 $ 12,743 $ 36,321 $ 37,013 B PMAR interest recoveries 791 811 32 - - - - 1,634 - C Adjusted net interest income (A - B) 11,394 11,636 11,657 12,601 12,051 12,219 12,743 34,687 37,013 D Non-interest income 1,007 1,136 1,115 1,329 1,490 1,386 1,342 3,258 4,218 E Non-interest expense 9,533 9,299 9,002 9,135 8,983 9,707 9,697 27,834 28,387 F Adjusted net income before provision for loan 2,868 3,473 3,770 4,795 4,558 3,898 4,388 10,111 12,844 losses and taxes (C + D - E) G Provision for loan losses - - - - 3,300 - 2,100 - 5,400 H Adjusted net income before tax (F - G) 2,868 3,473 3,770 4,795 1,258 3,898 2,288 10,111 7,444 I Normalized tax provision (H x 30%) 860 1,042 1,131 1,439 376 1,170 658 3,033 2,204 J Adjusted net income (H - I) $ 2,008 $ 2,431 $ 2,639 $ 3,356 $ 882 $ 2,728 $ 1,630 $ 7,078 $ 5,240 K Average assets $ 1,308,729 $ 1,349,530 $ 1,330,648 $ 1,364,721 $ 1,389,850 $ 1,410,713 $ 1,437,816 $ 1,329,952 $ 1,412,969 L Average equity $ 116,395 $ 132,305 $ 136,321 $ 141,374 $ 142,616 $ 144,639 $ 148,381 $ 123,944 $ 145,428 M Efficiency ratio (E / (C + D)) 76.87% 72.81% 70.48% 65.58% 66.34% 71.35% 68.85% 73.35% 68.85% N Adjusted ROAA (J / K, annualized) 0.61% 0.72% 0.79% 0.98% 0.25% 0.77% 0.45% 0.71% 0.49% P Adjusted ROAE (J / L, annualized) 6.90% 7.35% 7.74% 9.50% 2.47% 7.54% 4.39% 22.84% 14.41% 23