JOINT PROXY STATEMENT/PROSPECTUS

Dear Stockholders of Banc of California, Inc. and Shareholders of Pacific Mercantile Bancorp:

Banc of California, Inc., a Maryland corporation, which we refer to as BOC, and Pacific Mercantile Bancorp, a California corporation, which we refer to as PMB, have entered into a definitive merger agreement, which we refer to as the merger agreement, pursuant to which PMB will merge with and into BOC, with BOC as the surviving corporation, which we refer to as the merger. Promptly following the merger, Pacific Mercantile Bank, a wholly-owned subsidiary of PMB, which we refer to as PM Bank, will merge with and into Banc of California, National Association, a wholly-owned subsidiary of BOC, which we refer to as BOC Bank, with BOC Bank as the surviving bank, which we refer to as the bank merger, and collectively with the merger, the mergers.

Before we complete the mergers, each of BOC and PMB will hold a special meeting of its stockholders and shareholders, respectively.

The special meeting of stockholders of BOC will be held virtually via the Internet on Wednesday, June 23, 2021, which we refer to as the BOC special meeting, to vote on the following proposals:

| • | to approve the merger, which we refer to as the BOC merger proposal; |

| • | to approve the issuance of BOC common stock in connection with the merger, which we refer to as the BOC stock issuance proposal; and |

| • | to approve one or more adjournments of the BOC special meeting, if necessary or appropriate, including adjournments to permit further solicitation of proxies if there are insufficient votes at the time of the BOC special meeting to approve the BOC merger proposal or BOC stock issuance proposal, which we refer to as the BOC adjournment proposal. |

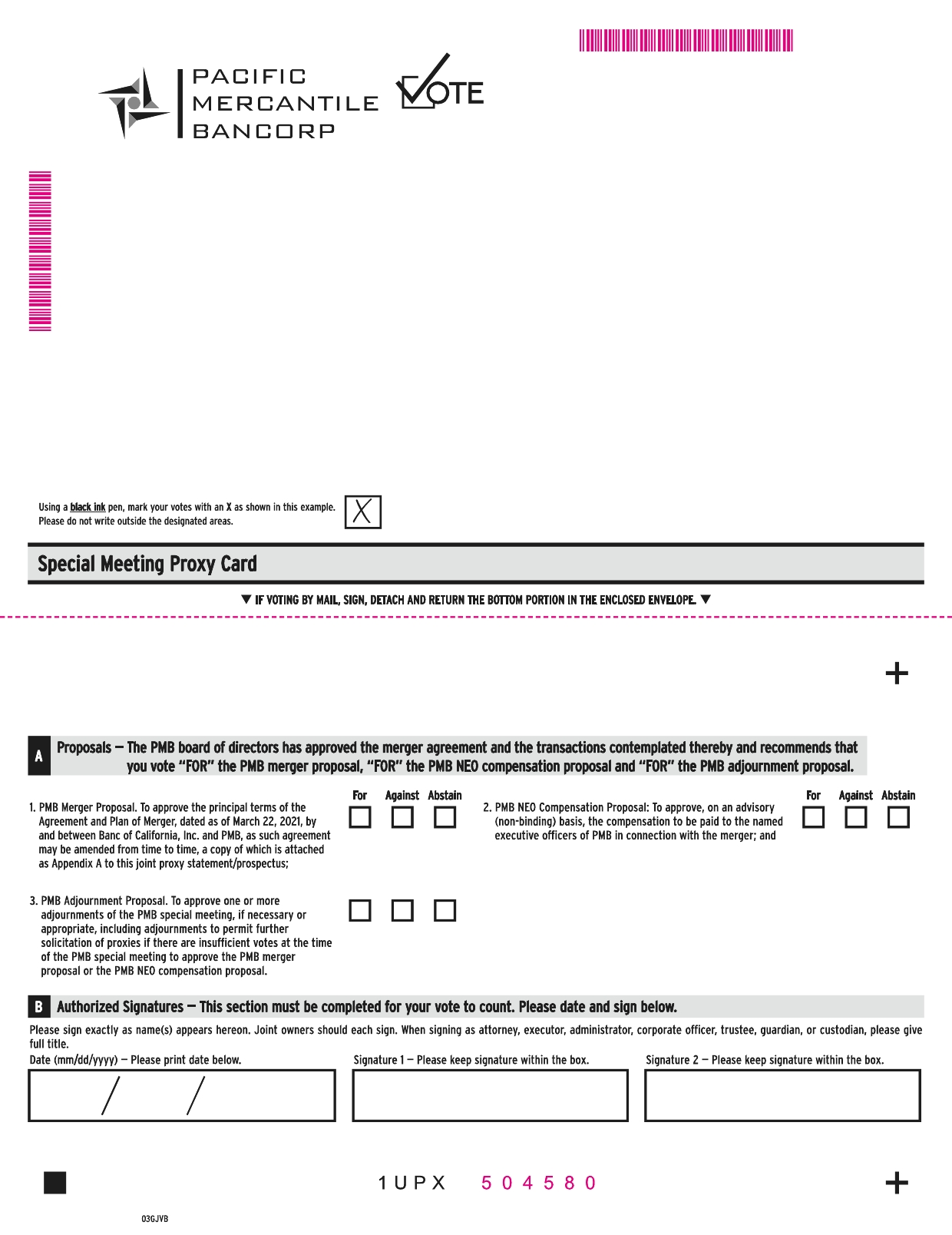

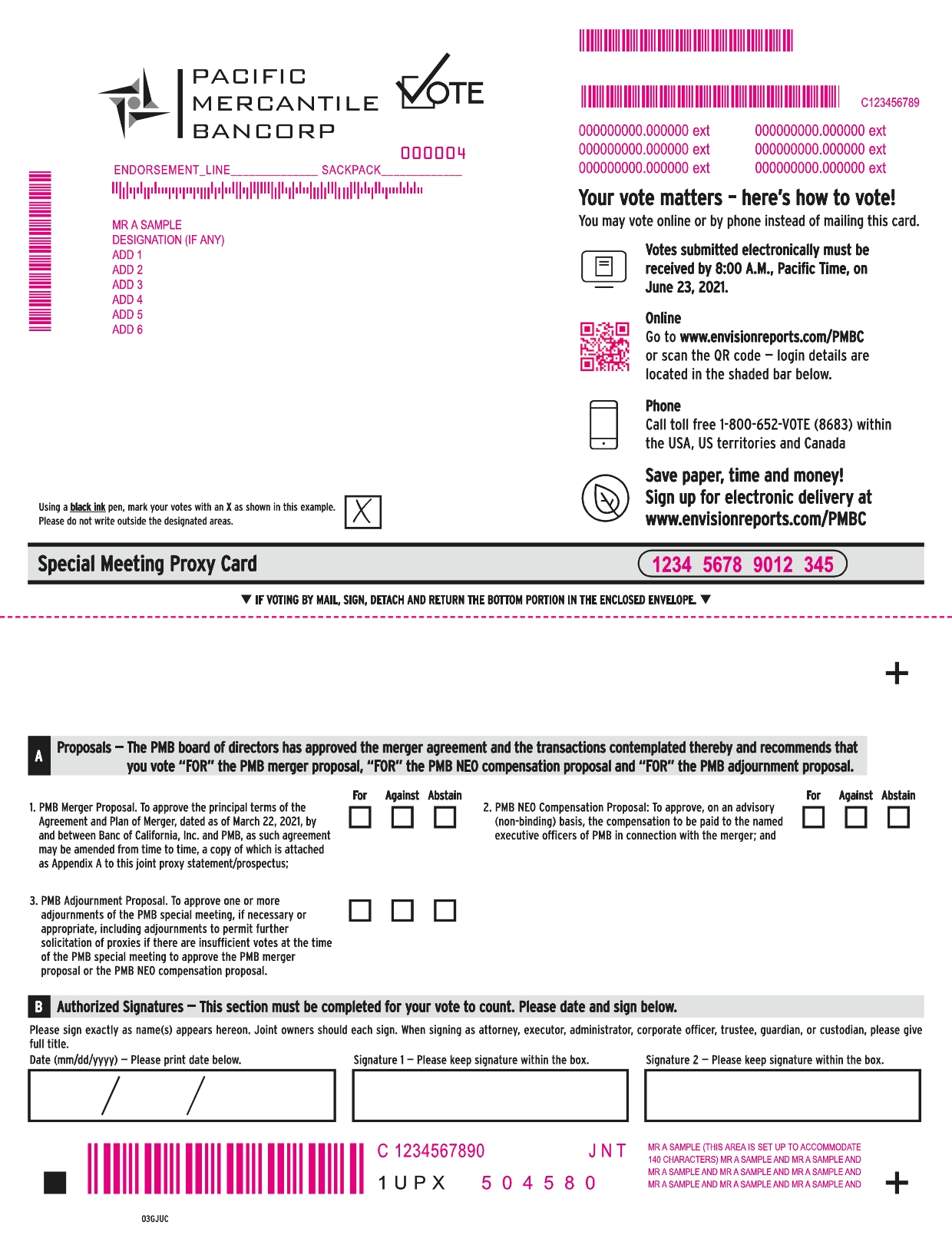

The special meeting of shareholders of PMB will be held in the first floor Training Room at PMB’s offices at 949 South Coast Drive, Costa Mesa, California 92626 on Wednesday, June 23, 2021, which we refer to as the PMB special meeting, to approve the following proposals:

| • | to approve the principal terms of the merger agreement, which we refer to as the PMB merger proposal; |

| • | to approve, on a non-binding, advisory basis, the compensation to be paid in connection with the merger to the named executive officers, or NEOs, of PMB, which we refer to as the PMB NEO compensation proposal; and |

| • | to approve one or more adjournments of the PMB special meeting, if necessary or appropriate, including adjournments to permit further solicitation of proxies if there are insufficient votes at the time of the PMB special meeting to approve the PMB merger proposal or PMB NEO compensation proposal, which we refer to as the PMB adjournment proposal. |

At the effective time of the merger, each PMB common share, other than excluded shares, will be converted into the right to receive 0.50 of a share of BOC common stock, with cash paid in lieu of a fractional share of BOC common stock.

The market value of the merger consideration will fluctuate with the price of BOC common stock. Based on the closing price of BOC common stock on March 22, 2021, the last trading day before the public announcement of the signing of the merger agreement, the value of the per share merger consideration payable to holders of PMB common shares was $9.77. Based on the closing price of BOC common stock on May 10, 2021, the last practicable date before the date of this joint proxy statement/prospectus, the value of the per share merger consideration payable to holders of PMB common shares was $8.86. You should obtain current price quotations for PMB common shares and BOC common stock. BOC common stock is traded on the New York Stock Exchange under the symbol “BANC,” and PMB common shares are traded on the Nasdaq Global Select Market under the symbol “PMBC.” The New York Stock Exchange is referred to herein as the NYSE and the Nasdaq Global Select Market is referred to herein as Nasdaq.

The proposed merger is expected to be accretive to the combined company’s earnings per share in 2022, and BOC believes that PMB is a strong strategic fit with similar management and culture. The board of directors of BOC has approved the merger and the issuance of BOC common stock in connection with the merger, and determined that the merger and the issuance of BOC common stock in connection with the merger are advisable and fair to and in the best interests of BOC and its stockholders. The BOC board of directors recommends that the BOC stockholders vote “FOR” the BOC merger proposal, “FOR” the BOC stock issuance proposal and “FOR” the BOC adjournment proposal. The board of directors of PMB has approved the merger agreement and the transactions contemplated thereby, and determined that the merger agreement and the transactions contemplated thereby are fair to and in the best interests of PMB and its shareholders. The PMB board of directors recommends that the PMB shareholders vote “FOR” the PMB merger proposal, “FOR” the PMB NEO compensation proposal and “FOR” the PMB adjournment proposal.

Your vote is very important. To ensure your representation at the BOC special meeting or the PMB special meeting, as applicable, please complete and return the enclosed proxy card or submit your proxy by telephone or through the Internet. Whether or not you expect to attend the respective special meeting, please vote promptly. Submitting a proxy now will not prevent you from being able to vote your shares via the Internet during the BOC special meeting or in person at the PMB special meeting.

If you hold your shares of BOC common stock in “street name” through a bank, broker or other nominee, you should follow the directions provided by your bank, broker or other nominee regarding how to instruct your bank, broker or other nominee to vote your shares. Without those instructions, your shares will not be voted, which will have the same effect as voting against the BOC merger proposal.

If you hold your PMB common shares in “street name” through a bank, broker or other nominee, you should follow the directions provided by your bank, broker or other nominee regarding how to instruct your bank, broker or other nominee to vote your shares. Without those instructions, your shares will not be voted, which will have the same effect as voting against the PMB merger proposal.

This joint proxy statement/prospectus provides you with detailed information about the proposed merger.

You are encouraged to read the entire joint proxy statement/prospectus, including the appendices and the documents incorporated by reference, carefully. In particular, you should read the “Risk Factors” section beginning on page 21 for a discussion of the risks you should consider in evaluating the proposed merger and how it will affect you.We thank you for your continued support.

Sincerely,

/S/ Jared Wolff | | | /S/ Brad Dinsmore |

| | | |

Jared Wolff

President and Chief Executive Officer

Banc of California, Inc. | | | Brad Dinsmore

Chief Executive Officer

Pacific Mercantile Bancorp |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the merger, the issuance of the BOC common stock in connection with the merger or the other transactions described in this document, or passed upon the adequacy or accuracy of the disclosures in this document.

The securities to be issued in connection with the merger are not savings accounts, deposits or other obligations of any bank or savings association and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

This document is dated Thursday, May 13, 2021 and is first being mailed to BOC stockholders and PMB shareholders on or about Friday, May 14, 2021.