QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

AVOCENT CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2002 Annual Meeting of Stockholders of Avocent Corporation, a Delaware corporation, will be held at the Bevill Conference Center & Hotel located on the University of Alabama at Huntsville Campus, 550 Sparkman Drive, Huntsville, Alabama 35805, on Thursday, June 13, 2002, at 10 a.m., local time, for the following purposes:

- 1.

- To elect two Class II directors to serve until the annual meeting of our stockholders in 2005;

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as our independent accountants for the current fiscal year ending December 31, 2002; and

- 3.

- To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof.

Only stockholders of record at the close of business on April 29, 2002 are entitled to notice of, and to vote at, the 2002 Annual Meeting of Stockholders and any adjournment or postponement thereof. A list of these stockholders is kept at the office of our transfer agent, Mellon Investor Services LLC. All stockholders are cordially invited to attend the annual meeting. However, to assure your representation at the meeting, you are urged to mark, sign, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. You may also be able to submit your proxy over the Internet or by telephone. For specific instructions, please refer to the information provided with your proxy card.

Any stockholder attending the meeting may vote in person even if he or she has returned a proxy.

| | | By Order of the Board of Directors, |

|

|

|

| | | Samuel F. Saracino

Secretary |

Huntsville, Alabama

April 29, 2002 |

|

|

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE

MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY AS

PROMPTLY AS POSSIBLE IN THE ENCLOSED, POSTAGE-PREPAID ENVELOPE.

AVOCENT CORPORATION

4991 Corporate Drive

Huntsville, Alabama 35805

PROXY STATEMENT

Annual Meeting of Stockholders

To be held on June 13, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

Date, Time and Place

This proxy statement is furnished to the stockholders of Avocent Corporation, a Delaware corporation, in connection with the solicitation of proxies by our board of directors for use at the 2002 Annual Meeting of Stockholders to be held at the Bevill Conference Center & Hotel located on the University of Alabama at Huntsville Campus, 550 Sparkman Drive, Huntsville, Alabama 35805, on Thursday, June 13, 2002, at 10:00 a.m., local time, and any and all postponements or adjournments thereof, for the purposes set forth in this proxy statement and the accompanying Notice of Annual Meeting of Stockholders. These proxy solicitation materials were first mailed on or about May 10, 2002, to all stockholders entitled to vote at the annual meeting.

Purposes of the Annual Meeting

The purposes of the annual meeting are to:

- •

- Elect two Class II directors to serve until the annual meeting of our stockholders in 2005;

- •

- Ratify the appointment of PricewaterhouseCoopers LLP as our independent accountants for the current fiscal year ending December 31, 2002; and

- •

- To transact such other business as may properly come before the annual meeting, or any postponement or adjournment thereof.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our corporate secretary or our transfer agent, Mellon Investor Services LLC, a written notice of revocation or a duly executed proxy bearing a later date or by attending the annual meeting and voting in person.

Record Date and Share Ownership

Stockholders of record at the close of business on April 29, 2002, the record date, are entitled to notice of, and to vote at, the annual meeting. On April 12, 2002, 44,908,219 shares of common stock, and no shares of our preferred stock, were issued and outstanding, held of record by approximately 235 stockholders. For information regarding security ownership by principal stockholders and management, see the section below entitled, "Security Ownership by Principal Stockholders and Management."

Voting and Solicitation; Quorum

Each share held as of the record date is entitled to one vote. A quorum for the transaction of business at the annual meeting requires the presence, in person or by proxy, of a majority of the votes eligible to be cast by holders of the shares of common stock issued and outstanding on the record date.

Abstentions and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum for the transaction of business. However, broker non-votes will not be counted for the purpose of determining the number of shares entitled to vote with respect to a proposal on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of the voting on a proposal that requires the affirmative vote of a majority of the shares present and entitled to vote. Abstentions will have the same effect as a vote against the proposals.

The solicitation of proxies will be conducted by mail, and we will bear all attendant costs. These costs will include the expense of preparing and mailing proxy solicitation materials for the annual meeting and reimbursements paid to brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials regarding the annual meeting to such beneficial owners. Certain of our directors, officers, and regular employees, without additional compensation, may also solicit proxies, personally or by telephone, telegram, or facsimile.

Stockholder Proposals for the Next Annual Meeting

Any proposal to be presented at our next annual meeting of stockholders must be received at our offices no later than Friday, January 10, 2003, in order to be considered for inclusion in our proxy materials for such meeting. Any such proposals must be submitted in writing, addressed to the attention of our corporate secretary at 4991 Corporate Drive, Huntsville, Alabama 35805, and must otherwise comply with our bylaws and the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended.

In addition, our bylaws establish an advance notice procedure with regard to certain matters, including stockholder proposals not included in our proxy statement, to be brought before an annual meeting of stockholders. In general, nominations for the election of directors may be made by the board of directors or by any stockholder entitled to vote who has delivered written notice to our corporate secretary not less than 90 days in advance of the annual meeting, which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. In the event that less than 100 days notice or prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by the stockholders must be received not later than the close of business on the tenth day following the earlier of the day on which such notice of the date of the annual meeting was mailed or such public disclosure was made. A copy of the full text of the bylaw provisions discussed above may be obtained by writing to our corporate secretary. All notices of proposals by stockholders, whether or not included in our proxy materials, should be sent to our corporate secretary at 9911 Willows Road N.E., Redmond, Washington 98052, Attention: Corporate Secretary.

2

PROPOSAL ONE

ELECTION OF CLASS II DIRECTORS

Avocent was formed by the combination of Apex Inc. and Cybex Computer Products Corporation in a merger transaction that was effective July 1, 2000. Our Certificate of Incorporation provides that our board of directors shall be divided into three classes of directors, designated as Class I, Class II, and Class III. Our board of directors currently consists of seven members, with three members in Class I and two members in each of Classes II and III. Upon the expiration of the term of a class of directors, nominees for that class are elected to serve for a term of three years and until their respective successors have been elected and qualified. The current terms of the Class II directors, John R. Cooper and Edwin L. Harper, expire upon the election and qualification of the directors to be elected at the annual meeting. Following the recommendation of our nominating committee, our board of directors has nominated Messrs. Cooper and Harper for reelection to the board of directors at the annual meeting, to serve until the annual meeting of stockholders to be held in 2005. The terms of the Class I and Class III directors expire at the annual meetings of stockholders to be held in 2004 and 2003, respectively.

Unless otherwise directed, the persons named in the proxy intend to vote all proxies FOR the election of Messrs. Cooper and Harper to the board of directors. The nominees have consented to serve as our directors if elected. If, at the time of the annual meeting, either of the nominees is unable or declines to serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the board of directors. The board of directors has no reason to believe that either of the nominees will be unable, or will decline, to serve as a director.

Set forth below is certain information furnished to us by the director nominees and by each of the incumbent directors whose terms will continue following the annual meeting.

Class I Directors

William H. McAleer, 51, has been one of our directors since July 2000, and prior to that, he served as one of Apex's directors since June 1996. Mr. McAleer is currently Managing Director of Voyager Capital, a venture firm that provides funding to private information technology companies. From 1988 through 1994, he was Vice President Finance, Chief Financial Officer, and Secretary with Aldus Corporation, a publicly traded software company.

David P. Vieau, 52, has been one of our directors since April 2001. Since March 2002, Mr. Vieau has been the President and Chief Executive Officer of A123Systems, Inc., a privately-held company that develops advanced power technologies for portable communications and computer systems. From September 1995 through November 2000, he was Vice President of Worldwide Business Development of American Power Conversion Corporation, a publicly traded company that provides power protection, environmental control, and site monitoring services for the personal computer and information systems markets.

Doyle C. Weeks, 56, has been one of our directors since July 2000, and prior to that, he served as one of Cybex's directors since 1998. Mr. Weeks has been our Executive Vice President of Group Operations and Business Development since July 2000, and prior to that, he held the same position at Cybex since August 1998. Mr. Weeks served as Senior Vice President of Finance, Chief Financial Officer, and Treasurer of Cybex from 1995 to August 1998 and as Assistant Secretary of Cybex during 1998.

3

Class II Directors

John R. Cooper, 54, has been one of our directors since July 2000, and prior to that, he served as one of Cybex's directors since 1998. Mr. Cooper has been our President and Chief Executive Officer since March 2002. From April 2001 to November 2001, Mr. Cooper served as Senior Vice President of Finance and Chief Financial Officer of ADTRAN, Inc., a publicly traded company that designs, develops, manufacturers, markets and services a broad range of high-speed digital transmission products utilized by telephone companies and corporate end-users to implement advanced digital data services over existing telephone networks. Mr. Cooper was Vice President and Chief Financial Officer of ADTRAN, Inc. from 1996 to April 2001.

Edwin L. Harper, 57, has been one of our directors since July 2000, and prior to that, he served as one of Apex's directors since October 1996. From September 1999 to March 2001, Mr. Harper served as a director and as President, Chief Executive Officer, and Chief Operating Officer of Manufacturing Technology, Inc., a privately held company that manufactures slicing and dicing equipment for the thin film head, semiconductor, and optics industries. From June 1996 through December 1998, Mr. Harper served as President and Chief Executive Officer of SyQuest Technology, a computer hardware company that filed a petition under Chapter 11 of the Bankruptcy Code in November 1998. Mr. Harper is also a director of Network Associates, Inc., a network security management company.

Class III Directors

Barry L. Harmon, 48, has been one of our directors since July 2000. From July 2000 to September 2001, Mr. Harmon was our Senior Vice President of West Coast Operations. Prior to that, Mr. Harmon was Chief Operating Officer, Chief Financial Officer, and Treasurer of Apex from January to June 2000 and Vice President, Chief Financial Officer, and Treasurer of Apex from January 1999 to January 2000. Mr. Harmon was employed at Electro Scientific Industries, Inc., a publicly traded manufacturer of semi-conductor fabrication equipment, and served as Senior Vice President and Chief Financial Officer from January 1995 to January 1999. Mr. Harmon is also a director of Electro Scientific Industries, Inc.

Stephen F. Thornton, 62, has been our Chairman of our board of directors since July 2000, and prior to that, he served as Chairman of the board of directors of Cybex since 1987. Mr. Thornton was our President and Chief Executive Officer from July 2000 to March 2002, and prior to that, he held the same positions at Cybex since 1984.

Vote Required and Board of Directors' Recommendation

The two nominees receiving the greatest number of votes of the shares present and entitled to vote at the annual meeting will be elected as directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION OF MESSRS. COOPER AND HARPER TO THE BOARD OF DIRECTORS.

Committees of the Board of Directors

During the year 2001, our board of directors had three standing committees: the audit committee, the compensation committee, and the nominating committee. The functions performed by each committee and the members of each committee are described below.

Audit Committee. The audit committee reviews with our independent accountants the scope, results, and costs of the annual audit and our accounting policies and financial reporting. During 2001, the members of the audit committee were John R. Cooper (Chairman), Edwin L. Harper, and William H. McAleer. Mr. Cooper resigned as a member of the audit committee in March 2002 upon his selection as our President and Chief Executive Officer. David P. Vieau was subsequently elected as a

4

member of the audit committee, and the current members of the audit committee are William H. McAleer (Chairman), Edwin L. Harper, and David P. Vieau. Each of Messrs. McAleer, Harper, and Vieau is an "independent director" as defined in Rule 4200(a)(14) of the National Association of Securities Dealers listing standards. The audit committee report is set forth below. The audit committee charter adopted by our board of directors was attached as Annex A to the proxy statement for our annual meeting of stockholders in 2001. The audit committee reviews and reassesses the adequacy of its charter on an annual basis.

Compensation Committee. The compensation committee oversees our compensation and benefits practices and programs. Through November 2001, the members of the compensation committee were Edwin L. Harper (Chairman), John R. Cooper, and William H. McAleer. Mr. Cooper resigned as a member of the compensation committee in November 2001, and David P. Vieau was elected to the compensation committee. The current members of the compensation committee are Edwin L. Harper (Chairman), William H. McAleer, and David P. Vieau.

Nominating Committee. The nominating committee reviews and recommends candidates for election to the board of directors. During 2001, the members of the nominating committee were William H. McAleer (Chairman) and Edwin L. Harper. David P. Vieau was elected to the nominating committee in February 2002, and the current members of the nominating committee are William H. McAleer (Chairman), Edwin L. Harper, and David P. Vieau. The nominating committee accepts nominations by stockholders. See the section above entitled "Stockholder Proposals for the Next Annual Meeting" and our bylaws for the proper proposal procedures.

Board of Directors and Committee Meetings

During 2001, our board of directors met twelve times. There were twelve meetings of the audit committee, six meetings of the compensation committee, and two meetings of the nominating committee during 2001. All directors attended all meetings of the board of directors and of the committees on which they served, except that four directors each missed one meeting of the board of directors, one director missed one meeting of the audit committee, and one director missed one meeting of the nominating committee.

AUDIT COMMITTEE REPORT FOR THE YEAR ENDED DECEMBER 31, 2001

The audit committee oversees the financial reporting process of Avocent Corporation ("Avocent" or the "Company") on behalf of the Company's board of directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in the annual report with management including a discussion of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committee reviewed with PricewaterhouseCoopers LLP, the Company's independent accountants who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments about Avocent's accounting principles and the other matters required to be discussed with the audit committee under generally accepted auditing standards, including Statement on Auditing Standards No. 61 (Communications with Audit Committees). In addition, the audit committee has discussed with PricewaterhouseCoopers LLP their independence from the Company and from the Company's management, and this discussion included consideration of the matters in the written disclosures required by the Independence Standards Board and the potential impact the non-audit services provided by PricewaterhouseCoopers could have on their independence.

The audit committee discussed with PricewaterhouseCoopers the overall scope and plans for their audits. The audit committee meets with the independent accountants, with and without management

5

present, to discuss the results of their examinations, their evaluations of the Company's internal control, and the overall quality of the Company's financial reporting. There were twelve meetings of the audit committee during 2001.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the board of directors, and the board of directors has approved, that the 2001 audited financial statements be included in the annual report on Form 10-K for the year ended December 31, 2001 for filing with the Securities and Exchange Commission. The audit committee and the board of directors have also recommended, subject to stockholder approval, the selection of PricewaterhouseCoopers LLP as the Company's independent accountants for 2002.

6

EXECUTIVE OFFICERS

The following table sets forth information regarding the individuals who served as our executive officers as of Apri1 29, 2002:

Name

| | Age

| | Position

|

|---|

| Stephen F. Thornton* | | 62 | | Chairman of the Board of Directors |

| John R. Cooper* | | 54 | | President and Chief Executive Officer |

| Doyle C. Weeks* | | 56 | | Executive Vice President of Group Operations and Business Development |

| William A. Dambrackas | | 58 | | Senior Vice President of Network Technology |

| R. Byron Driver | | 61 | | Senior Vice President of Operations and Chief Operating Officer |

| Gary R. Johnson | | 52 | | Senior Vice President of Global Sales and Marketing |

| Kieran MacSweeney | | 44 | | Managing Director of International Operations |

| C. David Perry | | 47 | | Senior Vice President of OEM Sales |

| Douglas E. Pritchett | | 46 | | Senior Vice President of Finance, Chief Financial Officer, Treasurer, and Assistant Secretary |

| Samuel F. Saracino | | 51 | | Senior Vice President of Legal and Corporate Affairs, General Counsel, and Secretary |

| Christopher L. Thomas | | 46 | | Senior Vice President of Engineering |

- *

- See "Proposal One—Election of Directors" for biographies of the executive officers who are also on our board of directors.

William A. Dambrackas has been our Senior Vice President of Network Technology since January 2001. Prior to that, he was President and Chief Executive Officer of Equinox Systems Inc., a company that designs and markets server-based communications products for remote access which Mr. Dambrackas founded in 1983 and which we acquired in January 2001.

R. Byron Driver has been our Senior Vice President of Operations and Chief Operating Officer since July 2000. Prior to that, he held the same positions at Cybex since 1995.

Gary R. Johnson has been our Senior Vice President of Global Sales and Marketing since July 2001 and our Senior Vice President of Sales, the Americas, from July 2000 to July 2001. Prior to that, he was Senior Vice President of Sales and Marketing of Cybex since April 1997 and Vice President of Sales Channel Development of Cybex from March 1996 to March 1997.

Kieran MacSweeney has been our Managing Director of International Operations since July 2000. Prior to that, he was Managing Director of International Operations of Cybex since joining Cybex in October 1996.

C. David Perry has been our Senior Vice President of OEM Sales since April 2002 and our Vice President of OEM sales from July 2000 to April 2002. Prior to that, he was Vice President of Worldwide Sales of Apex from November 1998 to June 2002. From March 1997 through September 1998, he served as Vice President of Sales—Commercial Division of Acer America Corporation, a manufacturer and seller of computer hardware. Mr. Perry was employed by Texas Instruments, a computer hardware manufacturer, as Director of North American Channel Sales from 1993 until 1997.

7

Douglas E. Pritchett has been our Senior Vice President of Finance, Chief Financial Officer, Treasurer, and Assistant Secretary since July 2000. Prior to that, he held the same positions at Cybex since September 1998. Prior to joining Cybex as an executive officer, Mr. Pritchett was Chief Financial Officer of Barber Dairies, Inc., a regional dairy, from 1992 to 1998.

Samuel F. Saracino has been our Senior Vice President of Legal and Corporate Affairs, General Counsel, and Secretary since July 2000. Prior to that, he was Vice President of Business Development and General Counsel of Apex since February 1998 and Secretary of Apex since March 1998. From January 1984 to February 1998, Mr. Saracino was a partner at the law firm of Davis Wright Tremaine LLP.

Christopher L. Thomas has been our Senior Vice President of Engineering since July 2000. Prior to that, he served as Senior Vice President of Engineering of Cybex from April 1997 through June 2000, as Vice President of Engineering of Cybex from March 1996 to April 1997, and as Engineering Product Manager of Cybex from February 1995 to March 1996.

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows:

- •

- the compensation earned by our Chief Executive Officer during the last completed fiscal year;

- •

- the compensation earned by our other most highly compensated individuals who served as executive officers during the last completed fiscal year; and

- •

- the compensation received by each such individual for the two preceding fiscal years.

On July 1, 2000, the stockholders of Cybex Computer Products Corporation and Apex Inc. approved a merger, resulting in the formation of Avocent. In the merger, holders of Apex's common stock received 1.0905 shares of Avocent common stock for each share they owned, and holders of Cybex's common stock received one share of Avocent common stock for each share they owned. For ease of comparison, in the following table, and wherever applicable throughout this proxy statement, the number and price of shares have been converted to reflect the exchange ratio resulting from the merger.

8

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| |

Annual Compensation

| |

|

|---|

| |

| | Number of

Securities

Underlying

Options(3)

| |

|

|---|

Name & Principal Position

| |

| | Other

Compensation(4)

|

|---|

| | Year(1)

| | Salary

| | Bonus(2)

|

|---|

Stephen F. Thornton(5)

President and Chief Executive Officer | | 2001

2000

1999 | | $

$

$ | 361,550

325,000

233,754 | | $

$

$ | 18,855

214,813

251,226 | | 60,000

255,000

45,000 | | $

$

$ | 3,864

2,703

2,848 |

Doyle C. Weeks

Executive Vice President of Group Operations and Business Development |

|

2001

2000

1999 |

|

$

$

$ |

258,250

231,250

165,214 |

|

$

$

$ |

13,525

151,925

176,430 |

|

50,000

225,000

37,500 |

|

$

$

$ |

5,250

5,349

4,537 |

Barry L. Harmon(6)

Formerly Senior Vice President of West Coast Operations |

|

2001

2000

1999 |

|

$

$

$ |

255,050

245,000

186,538 |

|

$

$ |

—

133,892

75,000 |

|

40,000

100,000

81,788 |

|

$

$

$ |

133,858

8,500

15,092 |

Samuel F. Saracino

Senior Vice President of Legal and Corporate Affairs, General Counsel, and Secretary |

|

2001

2000

1999 |

|

$

$

$ |

222,788

214,000

196,145 |

|

$

$

$ |

11,779

127,165

50,000 |

|

40,000

100,000

81,788 |

|

$

$

$ |

2,943

8,500

8,000 |

Douglas E. Pritchett

Senior Vice President of Finance, Chief Financial Officer, Treasurer, and Assistant Secretary |

|

2001

2000

1999 |

|

$

$

$ |

222,095

198,750

142,195 |

|

$

$

$ |

11,660

130,230

35,504 |

|

40,000

220,000

22,250 |

|

$

$

$ |

5,250

3,242

1,850 |

C. David Perry

Senior Vice President of OEM Sales | | 2001

2000

1999 | | $

$

$ | 187,408

180,000

180,000 | | $

$

$ | 78,566

97,879

222,304 | | 20,000

—

81,788 | | $

$

$ | 1,951

8,500

73,146 |

- (1)

- Messrs. Thornton, Weeks, and Pritchett were previously executive officers of Cybex and became executive officers of Avocent upon the merger. Similarly, Messrs. Harmon, Saracino, and Perry were previously executive officers of Apex and became executive officers of Avocent upon the merger.

Cybex's fiscal year ended on March 31, while Apex's ended on December 31. As a result, the compensation amounts in this table are calculated as follows:

For the year 2001, the compensation of all executive officers is calculated based on compensation earned by each of them from Avocent during the fiscal year ended December 31, 2001.

For the year 2000, the compensation for Messrs. Thornton, Weeks, and Pritchett is calculated based on (i) 25% of the compensation earned by each of them during Cybex's fiscal year ended March 31, 2000, plus (ii) the compensation earned by them from Cybex prior to the merger during the period April 1 through June 30, 2000, plus (iii) the compensation earned by them after the merger during Avocent's fiscal year ended December 31, 2000. For the year 2000, the compensation for Messrs. Harmon, Saracino, and Perry is calculated based on (i) the compensation earned by them from Apex prior to the merger during the period January 1 through June 30, 2000, plus (ii) the compensation earned by them after the merger during Avocent's fiscal year ended December 31, 2000.

For the year 1999, the compensation for Messrs. Thornton and Weeks is calculated based on (i) 75% of the compensation earned by them during Cybex's fiscal year ended March 31, 2000,

9

plus (ii) 25% of the compensation earned by them during Cybex's fiscal year ended March 31, 1999. For the year 1999, the compensation for Mr. Pritchett is calculated based on (i) 75% of the compensation earned by him during Cybex's fiscal year ended March 31, 2000, plus (ii) 43% of the compensation earned by him during Cybex's fiscal year ended March 31, 1999 since Mr. Pritchett joined Cybex in September 1998 midway through Cybex's fiscal year ended March 31, 1999. For the year 1999, the compensation for Messrs. Harmon, Saracino, and Perry is calculated based on the compensation earned by them during Apex's fiscal year ended December 31, 1999.

- (2)

- The amounts listed in this column include bonuses earned in the indicated year and paid in the subsequent year. The amounts exclude bonuses paid in the indicated year but earned in a prior year.

- (3)

- The amounts listed in this column with respect to Messrs. Thornton, Weeks, and Pritchett represent the number of securities underlying options after taking into account the 3-for-2 stock splits effected by Cybex before the merger on April 28, 1998, December 15, 1998, and February 18, 2000, as 50% stock dividends. The amounts listed in this column with respect to Messrs. Harmon, Saracino, and Perry represent the number of securities underlying options after taking into account the 1.0905 exchange ratio resulting from the merger and the 3-for-2 stock split effected by Apex before the merger on March 4, 1999, as a 50% stock dividend.

- (4)

- The amounts listed in this column are itemized as follows:

For the year 2001, Mr. Thornton received $3,864 in employer contributions to Avocent's 401(k) Retirement Plan. For the years 2000 and 1999, Mr. Thornton received $2,703 and $2,848, respectively, in employer contributions to Cybex's 401(k) Retirement Plan.

For the year 2001, Mr. Weeks received $5,250 in employer contributions to Avocent's 401(k) Retirement Plan. For the years 2000 and 1999, Mr. Weeks received $5,349 and $4,537, respectively, in employer contributions to Cybex's 401(k) Retirement Plan.

For the year 2001, Mr. Harmon received $3,362 in employer contributions to Avocent's 401(k) Retirement Plan and $130,496, which was paid in 2002, under the terms of a Separation and General Release Agreement. For the year 2000, Mr. Harmon received $8,500 in employer contributions to Apex's 401(k) Retirement Plan. For the year 1999, Mr. Harmon received $2,692 in employer contributions to Apex's 401(k) Retirement Plan, and moving expense reimbursement of $12,400.

For the year 2001, Mr. Saracino received $2,943 in employer contributions to Avocent's 401(k) Retirement Plan. For the years 2000 and 1999, Mr. Saracino received $8,500 and $8,000, respectively, in employer contributions to Apex's 401(k) Retirement Plan.

For the year 2001, Mr. Pritchett received $5,250 in employer contributions to Avocent's 401(k) Retirement Plan. For the years 2000 and 1999, Mr. Pritchett received $3,242 and $1,850, respectively, in employer contributions to Cybex's 401(k) Retirement Plan.

For the years 2000, Mr. Perry received $8,500 in employer contributions to Apex's 401(k) Retirement Plan. For the year 1999, Mr. Perry received $4,500 in employer contributions to Apex's 401(k) Retirement Plan, and moving expense reimbursement of $68,646.

- (5)

- Mr. Thornton was our President and Chief Executive Officer throughout 2001 and resigned in March 2002. He remains the Chairman of our board of directors.

- (6)

- Mr. Harmon was our Senior Vice President of West Coast Operations from July 2000 through his resignation in September 2001. He remains a member of our board of directors.

10

OPTION GRANTS IN LAST FISCAL YEAR

The following table provides information with respect to stock options granted to the executive officers named in the Summary Compensation Table in the last completed fiscal year. In addition, as required by Securities and Exchange Commission rules, the table sets forth the hypothetical gains that would exist for the options based on assumed rates of annual compound stock price appreciation during the option term.

| |

| | Individual Grants(2)

| |

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation For

Option Term(3)

|

|---|

| |

| | Percent of

Total Options

Granted To

Employees in

Fiscal Year

(%)(4)

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| |

| |

|

|---|

Name(1)

| | Exercise Price

($/sh)(5)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Stephen F. Thornton | | 60,000 | | 3.79% | | $ | 22.36 | | 5/25/2011 | | $ | 843,725 | | $ | 2,138,165 |

Doyle C. Weeks |

|

50,000 |

|

3.16% |

|

$ |

22.36 |

|

5/25/2011 |

|

$ |

703,104 |

|

$ |

1,781,804 |

Barry L. Harmon |

|

40,000 |

|

2.53% |

|

$ |

22.36 |

|

5/25/2011 |

|

$ |

562,483 |

|

$ |

1,425,443 |

Samuel F. Saracino |

|

40,000 |

|

2.53% |

|

$ |

22.36 |

|

5/25/2011 |

|

$ |

562,483 |

|

$ |

1,425,443 |

Douglas E. Pritchett |

|

40,000 |

|

2.53% |

|

$ |

22.36 |

|

5/25/2011 |

|

$ |

562,483 |

|

$ |

1,425,443 |

C. David Perry |

|

20,000 |

|

1.26% |

|

$ |

20.81 |

|

3/12/2011 |

|

$ |

261,777 |

|

$ |

663,395 |

- (1)

- The information provided in this table is based on information pertaining to options granted to them by Avocent during the fiscal year ended December 31, 2001.

- (2)

- No stock appreciation rights were granted to executive officers in our last completed fiscal year.

- (3)

- The potential realizable value illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their terms, assuming the specified compounded rates of appreciation of the market price per share from the date of grant to the end of the option term. Actual gains, if any, on stock option exercise are dependent upon a number of factors, including the future performance of our common stock and the timing of option exercises, as well as the optionees' continued employment throughout the vesting period. There can be no assurance that the amounts reflected in this table will be achieved.

- (4)

- The percentages listed in this column are based on stock options to purchase 1,583,450 shares granted to our employees during the year 2001 but do not include options issued to employees of Equinox Systems Inc. on the conversion and assumption of their options in connection with the acquisition of Equinox on January 3, 2001.

- (5)

- The exercise price may be paid in cash, in shares of common stock valued at fair market value on the exercise date, or through a cashless exercise procedure involving a same-day sale of the purchased shares.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth information with respect to stock options exercised by the executive officers named in the Summary Compensation Table during the last completed fiscal year. In addition, the table sets forth the number of shares covered by stock options as of the last completed fiscal year, and the value of "in-the-money" stock options, which represents the positive spread between the

11

exercise price of a stock option and the market price of the shares subject to such option at the end of the last completed fiscal year.

Name(1)

| | Number of

Shares

Acquired on

Exercise

| | Value

Realized(2)

| | Number of Securities

Underlying

Unexercised Options

at Fiscal Year End

Exercisable/Unexercisable(3)

| | Value of Unexercised

In-The-Money Options

at Fiscal Year End

Exercisable/Unexercisable(4)

|

|---|

| Stephen F. Thornton | | 62,277 | | $ | 1,364,736 | | 197,062/240,563 | | $ | 1,177,726/$675,707 |

Doyle C. Weeks |

|

22,000 |

|

$ |

479,654 |

|

166,782/221,061 |

|

$ |

975,985/$722,096 |

Barry L. Harmon |

|

— |

|

|

— |

|

521,675/— |

|

$ |

3,697,358/— |

Samuel F. Saracino |

|

— |

|

|

— |

|

237,563/121,013 |

|

$ |

2,037,826/$344,389 |

Douglas E. Pritchett |

|

— |

|

|

— |

|

143,125/195,625 |

|

$ |

740,306/$468,731 |

C. David Perry |

|

— |

|

|

— |

|

178,868/101,788 |

|

$ |

1,792,588/$795,858 |

- (1)

- The information provided in this table for the executive officers is based on any options exercised by them during 2001.

- (2)

- The amounts listed in this column are calculated by subtracting the aggregate exercise price of the options from the aggregate market value of the shares of common stock on the date of exercise, and do not necessarily indicate that the optionee sold such stock.

- (3)

- With respect to Messrs. Harmon, Saracino, and Perry, the amounts listed in this column represent the number of securities underlying unexercised options taking into account the 1.0905 exchange ratio resulting from the merger.

- (4)

- The amounts listed in this column are calculated based on the $24.25 closing price of the shares on December 31, 2001, the last day of trading for the fiscal year ended December 31, 2001, as reported on The Nasdaq National Market, less the exercise price of the options.

12

COMPENSATION OF DIRECTORS

We currently pay our outside, non-executive directors an annual cash fee of $25,000 for their service on our board of directors and its committees. In addition, these non-executive directors receive $1,000 for each board of directors and committee meeting attended in person and $500 for each board of directors and committee meeting attended by telephone conference call. The board of directors has discretion to grant options to directors under our option plans.

During 2001, Messrs. Cooper, Harper, and McAleer each received compensation of $19,000, and Mr. Vieau received compensation of $9,500, for their services as directors during our fiscal year ended December 31, 2001. During 2001, Mr. Vieau received options to purchase 30,000 shares of our common stock at an exercise price of $20.80, vesting pro rata over twenty-four (24) months commencing May 2001, and Messrs. Cooper, Harper, and McAleer each received options to purchase 20,000 shares of our common stock at an exercise price of $22.36, vesting pro rata over twenty-four (24) months commencing June 2001.

EMPLOYMENT CONTRACTS AND SEVERANCE AGREEMENTS

We have entered into employment agreements with certain of our executive officers, including each of those executive officers named in the Summary Compensation Table. Under each agreement, the employee receives an annual base salary, subject to annual increases at the discretion of the compensation committee of the board of directors not less than the annual cost of living increase percentage, and is entitled to receive an annual bonus at the discretion of the compensation committee based on our performance and the performance of the executive officer and to participate in stock option plans and all other benefit programs generally available to our executive officers.

Under the terms of the employment agreements, our executive officers have also agreed that during the term of their employment and for a term of twelve (12) months thereafter, they will not compete against us, without our prior written consent, by engaging in any capacity in any business activity in the United States, Canada or Europe that is substantially similar to, or in direct competition with, our business.

Under the terms of the employment agreements, we may terminate an executive officer's employment for "cause," which includes termination by reason of acts of (i) willful dishonesty, fraud, or deliberate injury or attempted injury to us or (ii) the executive officer's willful material breach of the employment agreement that has resulted in material injury to us, in which event, the executive shall receive accrued salary, earned bonus and other benefits through the date of termination but not including severance compensation. If a participating executive officer is terminated by us without cause (including a "constructive termination" of the executive officer's employment by reason of a material breach by us of his employment agreement), he is entitled to receive his accrued salary, earned bonus and other benefits through the date of termination, including severance compensation.

Severance compensation is generally equal to the executive officer's base salary at the rate payable at the time of termination for a period of twelve (12) months following the date of termination and an amount equal to the executive officer's average annual bonus during the two years immediately preceding his termination. However, Doyle C. Weeks is entitled to his base salary for a period of eighteen (18) months after the date of termination. At the executive officer's election, he may receive a lump sum severance amount equal to the present value of such severance payments (using a discount rate equal to the 90-day Treasury bill interest rate in effect on the date of delivery of such election notice). Severance compensation also entitles executive officers, upon termination without cause, to accelerate vesting of any award granted under Avocent's, Apex's, Cybex's, or Equinox's stock option plans and continuation of medical plan benefits for a period of twelve (12) months after the date of termination.

13

If a "change-in-control" occurs and the executive officer terminates his employment within six (6) months or we terminate his employment within eighteen (18) months, the executive officer is immediately entitled to receive accrued salary, earned bonus, and other benefits through the date of termination, including the severance compensation described above. Except for a "change-in-control," executive officers are not entitled to severance compensation for voluntary termination or termination by reason of the executive officer's death or disability.

Under the terms of the employment agreements, we agree to indemnify each executive officer for certain liabilities arising from actions taken by the executive officer within the scope of his employment.

In connection with the resignation of Mr. Harmon as our Senior Vice President of West Coast Operations in September 2001, we entered into a Separation and General Release Agreement under which the vesting of Mr. Harmon's stock options was fully accelerated and Mr. Harmon will receive salary and benefits for a period of one year. In addition, Mr. Harmon received a payment of $130,496 in 2002 representing an amount equal to his average annual bonus during the two years immediately preceding his resignation and his accrued but unused vacation.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The compensation committee is responsible for establishing and monitoring the general compensation policies and compensation plans of Avocent Corporation, as well as the specific compensation levels for executive officers. It also makes recommendations to the board of directors concerning the grant of options under the Avocent Corporation 2000 Stock Option Plan. John R. Cooper, our current President and Chief Executive Officer, will generally participate in all discussions and decisions regarding salaries and incentive compensation for employees, except that he will be excluded from discussions regarding his own salary and incentive compensation.

General Compensation Policy. Under the supervision of the board of directors, Avocent's compensation policy is designed to attract and retain qualified key executives critical to the Company's growth and long-term success. It is the objective of the board of directors to have a portion of each executive's compensation contingent upon Avocent's performance as well as upon the individual's personal performance. Accordingly, each executive officer's compensation package is comprised of three elements: (i) annual base salary; (ii) annual bonus based on the achievement of certain performance goals established for Avocent and for the executive officer; and (iii) stock-based benefit plans that are designed to strengthen the mutuality of interests between the executive officers and Avocent's stockholders.

The summary below describes in more detail the factors that the board of directors considers in establishing each of the three primary components of the compensation package provided to the executive officers.

Base Salary. The level of base salary is established primarily on the basis of the individual's qualifications and relevant experience, the strategic goals for which he or she has responsibility, the compensation levels at companies which compete with Avocent for business and executive talent, and the incentives necessary to attract and retain qualified management. Base salary is adjusted each year to take into account the individual's performance and to maintain a competitive salary structure. Avocent's performance does not play a significant role in the determination of base salary.

Bonuses. Bonuses are awarded by the compensation committee based on objective and subjective standards. In awarding executive bonuses, the compensation committee considers Avocent's success in achieving specific financial goals and objectives, including revenue growth and earnings growth, and each executive's success in achieving certain individual goals and objectives.

14

Stock-Based Benefit Plans. Avocent utilizes stock option plans to provide executives and other key employees with incentives to maximize long-term stockholder values. Awards by the board of directors take the form of stock options designed to give the recipient a significant equity stake and thereby closely align his or her interests with those of Avocent's stockholders. Factors considered in making such awards include the individual's position in the Company, his or her performance and responsibilities, and internal comparability considerations. In addition, the board of directors has established certain general guidelines in making option grants to executive officers in an attempt to target a fixed number of unvested option shares based upon each individual's position in the Company and his or her existing holdings of unvested options. However, the board of directors is not required to adhere strictly to these guidelines and may vary the size of the option grant made to each executive officer as it determines the circumstances warrant.

Each option grant allows the executive officer to acquire shares of common stock at a fixed price per share (the fair market value on the date of grant) over a specified period of time (up to 10 years). The options typically vest in periodic installments over a three-year or four-year period, contingent upon the executive officer's continued employment with the Company. Accordingly, the option will provide a return to the executive officer only if he or she remains employed by the Company, and then only if the market price of the common stock appreciates over the option term.

Compensation of the Chief Executive Officer. Mr. Thornton served as President and Chief Executive Officer of Avocent from July 1, 2000, when Avocent was formed in the merger transaction between Apex and Cybex, through March 2002. Following the merger, Avocent engaged William M. Mercer, Incorporated to perform a competitive market assessment and evaluation of the Company's executive compensation policies, including those relating to President and Chief Executive Officer, and to recommend an executive compensation philosophy and guidelines. Upon completion of that study and following deliberation by the compensation committee, Mr. Thornton's base salary was increased from $275,000 to $350,000, effective as of July 1, 2000. In 2001, Mr. Thornton received a 3.3% cost of living increase in his annual salary to $361,550 as required under his amended and restated employment agreement. Mr. Thornton was awarded an incentive cash bonus of $18,855 for 2001 for meeting certain corporate performance objectives (including those related to merger integration, reducing headcount, reducing sales and marketing expenses, and receiving customer commitments for the Company's new digital switch) in the fiscal year ended December 31, 2001. In 2001, Mr. Thornton was also granted options to purchase 60,000 shares of common stock at $22.36 per share, which vest over a four-year period.

Mr. Thornton retired as Avocent's President and Chief Executive Officer in March 2002, and Mr. Cooper was selected as President and Chief Executive Officer. In establishing Mr. Cooper's compensation package, the compensation committee again reviewed the Mercer study and also consulted with Heidrick & Struggles, which advised the compensation committee in the search and selection process. Effective March 2002, Mr. Cooper's annual base salary was established at $300,000, with a bonus potential of up to 75% of his base salary based on certain objective and subjective factors consistent with the criteria used to evaluate the other senior executives of the Company. Mr. Cooper is also entitled to all fringe benefits currently offered to Avocent senior executives. In February 2002, Mr. Cooper was granted options to purchase 400,000 shares of common stock at $21.56 per share, which was the fair market value of our stock on the date of his award, vesting over a four-year period.

In connection with the resignation or Mr. Thornton as President and Chief Executive Officer in March 2002 and in recognition of his transitional duties in the management succession, Mr. Thornton's annual salary was reduced to $250,000 for the period March 2002 through June 2002 and to $100,000 for the remainder of 2002. In subsequent years, Mr. Thornton's annual salary will be determined by the Avocent board of directors. For the year 2002, Mr. Thornton will be eligible for a bonus based on certain objective and subjective factors consistent with the criteria used to evaluate the other senior executives of the Company. When Mr. Thornton ceases to be a member of our board of directors, the

15

vesting of his stock options will accelerate, and if he remains Chairman of the board of directors of Avocent during 2002 and 2003, he will be eligible to receive an annual stock option award in those years that is double the option award to outside directors. In his 2000 employment agreement, Mr. Thornton agreed not to compete against us for a term of thirty-six months after the termination of his employment in exchange for a $400,000 cash payment, and we have agreed with him that he is entitled to receive this payment in January 2003 and that the thirty-six month noncompetition period commences when he ceases to be a member of the board of directors of Avocent.

Deductibility of Executive Compensation. The compensation committee has considered the impact of Section 162(m) of the Code, which section disallows a deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the chief executive officer and the four other most highly compensated executive officers, respectively, unless such compensation meets the requirements for the "performance-based" exception to Section 162(m). As the cash compensation paid by Avocent to each of these executive officers is expected to be below $1 million and the compensation committee believes that options granted under the 2000 Plan to such officers and shares purchased under the Avocent Corporation 2000 Employee Stock Purchase Plan by such officers will meet the requirements for qualifying as performance-based, the compensation committee believes that Section 162(m) will not affect the tax deductions available to the Company with respect to the compensation of executive officers. It is the compensation committee's policy to qualify, to the extent reasonable, its executive officers' compensation for deductibility under applicable tax law. However, Avocent may, from time to time, pay compensation to executive officers that may not be deductible.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of our compensation committee or executive officer of Avocent has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

16

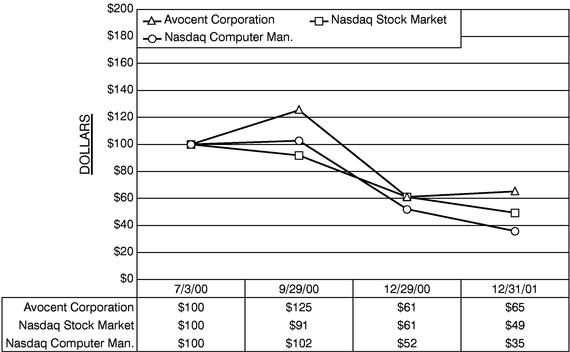

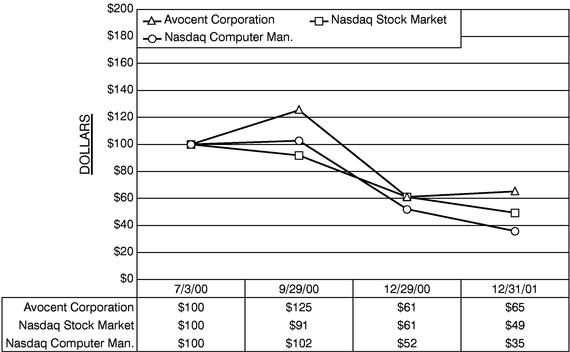

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total stockholder return data for our common stock to the cumulative return of (i) the NASDAQ US Index and (ii) the NASDAQ Computer Index for the period beginning July 3, 2000, the date our common stock was first traded, and ending on December 31, 2001. The graph assumes that $100 was invested on July 3, 2000. The graph further assumes that such amount was initially invested in our common stock at a per share price of $44.25, the price at which such stock was first publicly traded, and reinvestment of any dividends. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

The information contained above under the captions "Audit Committee Report for the year Ended December 31, 2001," "Compensation Committee Report on Executive Compensation," and "Stock Performance Graph" shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate it by reference into such filing.

17

SECURITY OWNERSHIP BY PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table indicates the number of shares of our common stock beneficially owned as of April 12, 2002 by: (i) each person or entity known to be the beneficial owner of more than 5% of our outstanding stock; (ii) each of the executive officers listed in the Summary Compensation Table; (iii) each of our directors; and (iv) all directors and executive officers as a group. Except as otherwise indicated, each person has sole investment and voting powers with respect to the shares shown as beneficially owned, subject to community property laws where applicable. Ownership information is based upon information furnished by the respective individuals.

Name and Address of Beneficial Owner(1)

| | Number of Shares

Beneficially

Owned

| | Percentage of Shares

Beneficially

Owned

|

|---|

J. & W. Seligman & Co., Inc.(2)

100 Park Avenue, Eighth Floor

New York, NY 10017 | | 3,988,960 | | 8.88 |

Fidelity Management and Research(3)

One Federal Street

Boston, MA 02110 |

|

3,734,925 |

|

8.32 |

Alliance Capital Management L.P.(4)

1345 Avenue of the Americas

New York, NY 10105 |

|

3,516,541 |

|

7.83 |

Franklin Resources, Inc.(5)

One Franklin Parkway

San Mateo, CA 94403 |

|

3,396,725 |

|

7.56 |

Stephen F. Thornton(6) |

|

982,455 |

|

2.18 |

John R. Cooper(7) |

|

60,458 |

|

* |

Doyle C. Weeks(8) |

|

222,875 |

|

* |

Samuel F. Saracino(9) |

|

280,305 |

|

* |

Douglas E. Pritchett(10) |

|

184,771 |

|

* |

C. David Perry(11) |

|

248,453 |

|

* |

Edwin L. Harper(12) |

|

91,109 |

|

* |

Barry L. Harmon(13) |

|

204,000 |

|

* |

William H. McAleer(14) |

|

71,739 |

|

* |

David P. Vieau(15) |

|

16,875 |

|

* |

All executive officers and directors as a group (15 persons)(16) |

|

3,164,619 |

|

6.72 |

- *

- Less than one percent.

- (1)

- Unless otherwise indicated, each person or entity named below has an address in care of our principal executive offices located at 4991 Corporate Drive, Huntsville, Alabama 35805. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. Shares of Common Stock subject to options that are currently exercisable or exercisable within 60 days of April 12, 2002 are deemed outstanding for the purpose of computing the percentage ownership of the person or entity holding the options but are not treated as outstanding for the

18

purpose of computing the percentage ownership of any other person or entity. The numbers reflected in the percentage ownership columns are based on 44,908,219 shares of our common stock outstanding.

- (2)

- Based solely on a Schedule 13G/A filed with the Securities and Exchange Commission on February 14, 2002.

- (3)

- Based solely on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2002.

- (4)

- Based solely on a Schedule 13G/A filed with the Securities and Exchange Commission on February 12, 2002.

- (5)

- Based solely on a Schedule 13G filed with the Securities and Exchange Commission on February 13, 2002.

- (6)

- Includes (i) 367,065 shares owned directly by Mr. Thornton; (ii) 179,343 shares owned by his spouse; (iii) 170,422 shares held by the Thornton Family Limited Partnership, of which Mr. Thornton is a general partner and as to which he may be deemed to share voting and investment power; (iv) 13,125 shares held by the Thornton Charitable Trust, of which Mr. Thornton is a related person and as to which he may be deemed to have share voting and investment power, and (v) 252,500 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (7)

- Includes (i) 4,000 shares held by Mr. Cooper in his Individual Retirement Account; and (ii) 56,458 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (8)

- Includes 222,875 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (9)

- Includes 277,076 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (10)

- Includes (i) 4,746 shares owned directly by Mr. Pritchett; (ii) 800 shares held by his minor child; (iii) 6,975 shares held by him in his Individual Retirement Account; and (iv) 172,250 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (11)

- Includes 224,762 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (12)

- Includes 71,480 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (13)

- Includes 100,000 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (14)

- Includes 71,739 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (15)

- Includes 16,875 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002.

- (16)

- Includes (i) 2,184,031 shares issuable upon exercise of stock options currently exercisable or exercisable within 60 days of April 12, 2002; (ii) 168 shares held by the spouse of R. Byron Driver, Senior Vice President of Operations of the Company; and (iii) 5,000 shares held by the spouse of Gary R. Johnson, Senior Vice President of Global Sales and Marketing.

19

PROPOSAL TWO

TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS

OUR INDEPENDENT ACCOUNTANTS FOR THE YEAR ENDED DECEMBER 31, 2002

The board of directors has appointed the firm of PricewaterhouseCoopers LLP to conduct an audit in accordance with generally accepted auditing standards of our financial statements for the fiscal year ending December 31, 2002. A representative of that firm is expected to be present at the annual meeting to respond to appropriate questions and will be given an opportunity to make a statement if he or she so desires. PricewaterhouseCoopers has represented to us that neither the firm nor any of the partners has any direct financial interest in us. This appointment is being submitted for ratification at the meeting. If not ratified, the board of directors will reconsider this appointment, although the board of directors will not be required to appoint different independent accountants. PricewaterhouseCoopers LLP has served as our independent accountants since July 2000.

Vote Required and Board of Director's Recommendation

The affirmative vote of the holders of a majority of the shares of our common stock present or represented and voting at the annual meeting will be required to approve this proposal.

THE BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT ACCOUNTANTS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2002, AND UNANIMOUSLY RECOMMENDS A VOTE "FOR" APPROVAL OF THIS APPOINTMENT.

Fees Billed to Us by PricewaterhouseCoopers during Fiscal 2001

Audit Fees:

Fees for the 2001 fiscal year audit by PricewaterhouseCoopers LLP of our annual financial statements and their review of the financial statements included in our quarterly reports on Form 10-Q totaled $465,293.

Financial Information Systems Design and Implementation Fees:

We did not engage PricewaterhouseCoopers LLP to provide advice to us regarding financial information systems design and implementation during the fiscal year ended December 31, 2001.

All Other Fees:

Fees billed to us by PricewaterhouseCoopers LLP during our 2001 fiscal year for all other non-audit services rendered to us, including transaction and tax related services, totaled $359,921. The audit committee has determined that the non-audit services provided to us by PricewaterhouseCoopers are compatible with the maintenance of their independence.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file reports of ownership of, and transactions in, our securities with the Securities and Exchange Commission and The Nasdaq Stock Market. Such directors, executive officers and ten-percent stockholders are also required to furnish us with copies of all Section 16(a) forms that they file.

Based solely on a review of the copies of such forms received by us, or written representations from certain reporting persons, we believe that during fiscal 2001, our directors, executive officers, and ten-percent stockholders complied with all Section 16(a) filing requirements applicable to them.

20

Certain Relationships and Related Transactions

In 2001, in connection with the opening of our office in Austin, Texas, C. David Perry, currently our Senior Vice President of OEM Sales, moved his principal residence from Redmond, Washington, to Austin, Texas. In connection with the purchase of a new residence by Mr. Perry in the Austin area and pending the sale of his Redmond residence, Apex Solutions Texas L.P., a wholly owned indirect affiliate of Apex, loaned Mr. Perry and his wife $760,000 under the terms of a Promissory Note dated October 31, 2001. The loan was interest free and was payable on the earlier of the first anniversary of the promissory note or the sale of the Redmond residence. The promissory note was also conditioned on the future performance by Mr. Perry of substantial services to Apex and its affiliates. The promissory note was secured by a Deed of Trust from Mr. Perry and his wife on the Redmond residence. The promissory note was repaid in full by Mr. Perry in January 2002.

Except as described above, there was not during fiscal 2001, nor is there currently proposed, any transaction or series of similar transactions to which we were or are to be a party in which the amount involved exceeds $60,000 and in which any of our directors, executive officers, or holders of more than 5% of our common stock, or any member of the immediate family of any of the foregoing persons, had or will have a direct or indirect material interest other than compensation agreements and other arrangements described in "Employment Contracts and Severance Agreements."

OTHER INFORMATION

Our 2001 Annual Report for the fiscal year ended December 31, 2001 will be mailed to the stockholders of record as of April 29, 2002 together with the mailing of this proxy statement. Stockholders who do not receive a copy of the 2001 Annual Report with their proxy statement may obtain a copy by writing to or calling Samuel F. Saracino, Secretary, Avocent Corporation, 9911 Willows Road N.E., Redmond, Washington 98052. His telephone number is (425) 861-5858.

OTHER MATTERS

We know of no other matters to be submitted for consideration by the stockholders at the annual meeting. If any other matters properly come before the annual meeting, it is the intention of the persons named in the enclosed proxy card to vote the shares they represent as the board of directors may recommend.

It is important that your shares be represented at the meeting, regardless of the number of shares which you hold. You are therefore urged to execute and return, at your earliest convenience, the accompanying proxy card in the postage-prepaid envelope enclosed. You may also submit your proxy over the Internet or by telephone. For specific instructions, please refer to the information provided with your proxy card.

| | | BY ORDER OF THE BOARD OF DIRECTORS, |

|

|

|

| | | Samuel F. Saracino,

Secretary |

Huntsville, Alabama

April 29, 2002 | | |

21

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

AVOCENT CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

JUNE 13, 2002

The undersigned stockholder(s) of AVOCENT CORPORATION, a Delaware corporation, hereby acknowledge(s) receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 29, 2002, and hereby appoints Doyle C. Weeks, Samuel F. Saracino, and Douglas E. Pritchett, and each of them, proxies and attorneys-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Annual Meeting of Stockholders of AVOCENT CORPORATION to be held on Thursday, June 13, 2002, at 10:00 a.m., local time, at the Bevill Conference Center & Hotel located on the University of Alabama at Huntsville Campus, 550 Sparkman Drive, Huntsville, Alabama 35805, and at any adjournment or adjournments thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side:

| COMMENTS/ADDRESS CHANGE: PLEASE MARK | | |

| COMMENT/ADDRESS BOX ON THE REVERSE SIDE | | |

(Continued and to be signed on reverse side)

- FOLD AND DETACH HERE -

[LOGO OF AVOCENT]

ANNUAL MEETING OF STOCKHOLDERS

JUNE 13, 2002

10:00 a.m.

Bevill Conference Center & Hotel

University of Alabama at Huntsville Campus

550 Sparkman Drive

Huntsville, Alabama 35805

YOUR VOTE IS IMPORTANT!

Please mark

your votes as

indicated in

this example | /x/

|

THE BOARD OF DIRECTORS RECOMMENDS VOTING "FOR" EACH OF THE FOLLOWING PROPOSALS.

| | | | | | | VOTE FOR ALL NOMINEES

(except as marked to the

contrary below) | | WITHHOLD AUTHORITY

to vote for all nominees |

| 1. | | ELECTION OF DIRECTORS | | | | |

| | | Nominees: | | John R. Cooper (Class II director)

Edwin L. Harper (Class II director) | | / / | | / / |

If you wish to withhold authority to vote for any individual nominee, write the nominee's name on the line below |

|

2. |

|

PROPOSAL TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP as the Company's independent accountants for the fiscal year ending December 31, 2002. |

|

FOR

/ / |

|

AGAINST

/ / |

|

ABSTAIN

/ / |

and, in their discretion, upon such other matter or matters which may properly come before the meeting or any adjournment or adjournments thereof.

| | | I PLAN TO ATTEND THE MEETING | | / / |

|

|

COMMENT/ADDRESS CHANGE

Please mark this if you have written Comments/address on the reverse side |

|

/ / |

|

|

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR EACH PROPOSAL LISTED, AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY COME BEFORE THE MEETING. |

|

|

| | | PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE. | | |

Signature(s) |

|

|

Date: |

|

|

|

, 2002 |

| |

| | | |

| | |

Please sign exactly as name appears above. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

|

- -FOLD AND DETACH HERE -

YOUR VOTE IS IMPORTANT!

THANK YOU FOR VOTING.

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSPROPOSAL ONE ELECTION OF CLASS II DIRECTORSAUDIT COMMITTEE REPORT FOR THE YEAR ENDED DECEMBER 31, 2001EXECUTIVE OFFICERSCOMPENSATION OF EXECUTIVE OFFICERSSummary Compensation TableOPTION GRANTS IN LAST FISCAL YEARAGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUESCOMPENSATION OF DIRECTORSEMPLOYMENT CONTRACTS AND SEVERANCE AGREEMENTSCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONSTOCK PERFORMANCE GRAPHSECURITY OWNERSHIP BY PRINCIPAL STOCKHOLDERS AND MANAGEMENTPROPOSAL TWO TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT ACCOUNTANTS FOR THE YEAR ENDED DECEMBER 31, 2002SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEOTHER INFORMATIONOTHER MATTERS