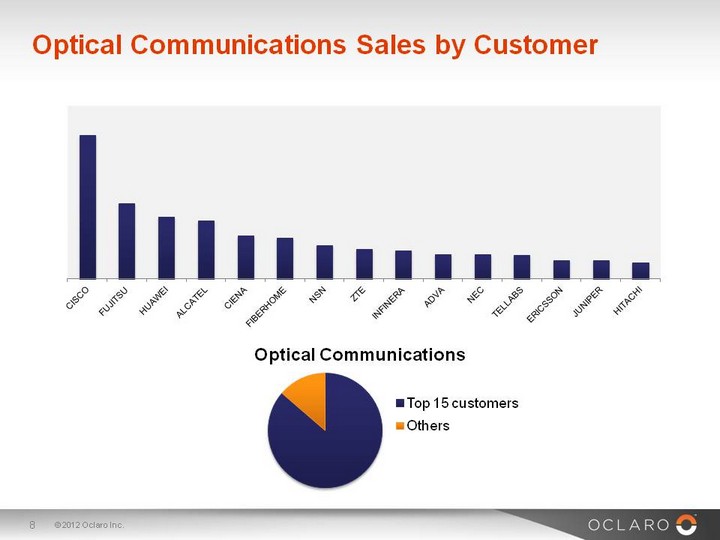

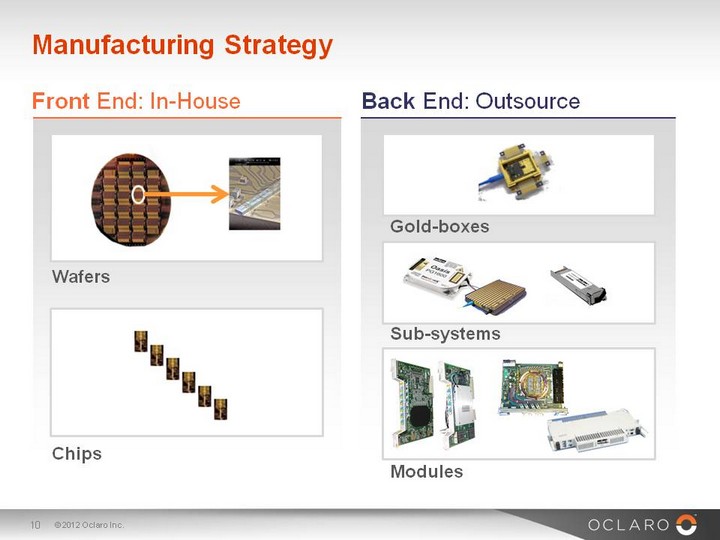

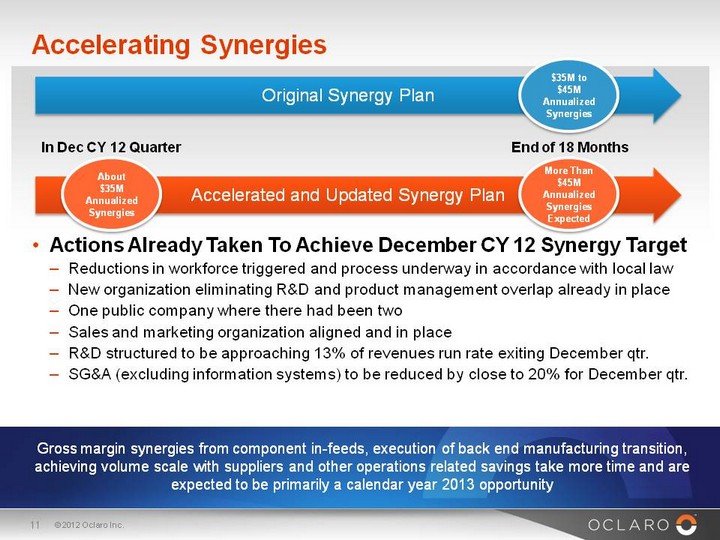

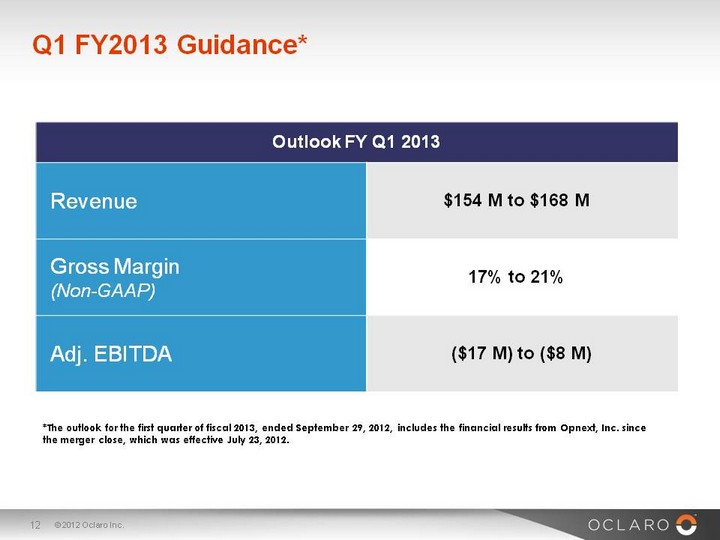

| Safe Harbor Statement This presentation, including the statements made by management, contain statements about management's future expectations, plans or prospects of Oclaro, Inc. and its business, and together with the assumptions underlying these statements, constitute forward-looking statements for the purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements concerning (i) financial targets and expectations, and progress toward our target business model, including financial guidance for the fiscal quarter ending September 29, 2012 regarding revenue, non- GAAP gross margin and Adjusted EBITDA, and (ii) expectations related to the integration of Opnext into Oclaro following the closing of the merger on July 23, 2012, (iii) our market position and future operating prospects, including customer reaction to our merger with Opnext. Such statements can be identified by the fact that they do not relate strictly to historical or current facts and may contain words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "will," "should," "outlook," "could," "target," and other words and terms of similar meaning in connection with any discussion of future operations or financial performance. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including (i) the future performance of Oclaro and its ability to effectively integrate the operations of acquired companies following the closing of acquisitions and mergers, including its merger with Opnext, Inc., (ii) the potential inability to realize the expected benefits and synergies of acquisitions and mergers, (iii) the impact to our operations and financial condition attributable to the flooding in Thailand, (iv) the impact of continued uncertainty in world financial markets and any resulting reduction in demand for our products, (v) our ability to maintain our gross margin, (vi) the effects of fluctuating product mix on our results, (vii) our ability to timely develop and commercialize new products, (viii) our ability to respond to evolving technologies and customer requirements, (ix) our dependence on a limited number of customers for a significant percentage of our revenues, (x) our ability to effectively compete with companies that have greater name recognition, broader customer relationships and substantially greater financial, technical and marketing resources than we do, (xi) our ability to effectively and efficiently transition to an outsourced back-end assembly and test model, (xii) increased costs related to downsizing and compliance with regulatory compliance in connection with such downsizing, competition and pricing pressure, (xiii)the potential lack of availability of credit or opportunity for equity based financing, (xiv) the risks associated with our international operations, (xv)the outcome of tax audits or similar proceedings, (xvi) the outcome of pending litigation against the company, (xvii) our ability to increase our cash reserves and obtain financing on terms acceptable to us, and (xviii) other factors described in Oclaro's most recent annual report on Form 10-K, most recent quarterly reports on Form 10-Q, Form 10Q/A, registration statement on Form S-4 and other documents we periodically file with the SEC. The forward-looking statements included in this announcement represent Oclaro's view as of the date of this announcement. Oclaro anticipates that subsequent events and developments may cause Oclaro's views and expectations to change. Oclaro specifically disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this announcement. |