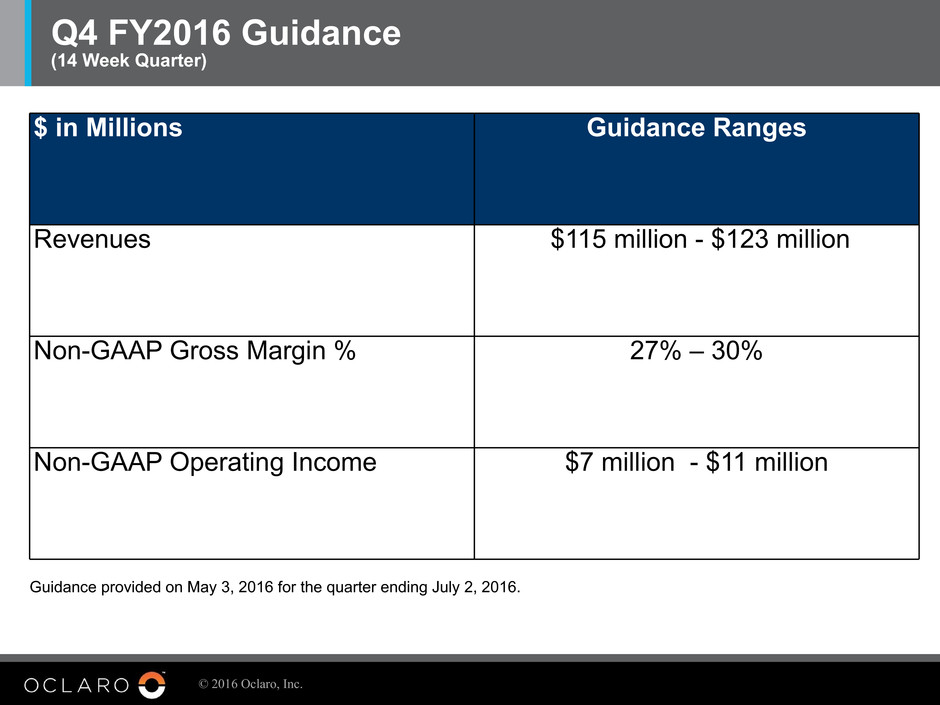

© 2016 Oclaro, Inc. Safe Harbor Statement This presentation, in association with Oclaro’s third quarter of fiscal year 2016 financial results conference call, contains statements about management’s future expectations, plans or prospects of Oclaro and its business, and together with the assumptions underlying these statements, constitute forward-looking statements for the purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements concerning (i) financial guidance for the fiscal quarter ending July 2, 2016 regarding revenues, non-GAAP gross margin, and non-GAAP operating income, (ii) the growth of Oclaro’s 100G product revenues, and (iii) Oclaro’s future financial performance and operating prospects. Such statements can be identified by the fact that they do not relate strictly to historical or current facts and may contain words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “outlook,” “could,” “target,” “model,” "objective," and other words and terms of similar meaning in connection with any discussion of future operations or financial performance. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including (i) Oclaro's ability to timely develop, commercialize and ramp the production of new products to customer required volumes, (ii) Oclaro's ability to respond to evolving technologies, customer requirements and demands, and product design challenges, (iii) Oclaro's dependence on a limited number of customers for a significant percentage of its revenues, (iv) Oclaro's manufacturing yields, (v) Oclaro's ability to effectively manage its inventory, (vi) the risks associated with delays, disruptions or quality control problems in manufacturing, (vii) Oclaro's ability to obtain governmental licenses and approvals for international trading activities or technology transfers, including export licenses, (viii) competition and pricing pressure, (ix) Oclaro's ability to meet or exceed its gross margin expectations, (x) Oclaro's ability to continue increasing the percentage of sales associated with its new products, (xi) the absence of long-term purchase commitments from the majority of Oclaro's long-term customers, (xii) the effects of fluctuations in foreign currency exchange rates, (xiii) Oclaro's dependence on a limited number of suppliers and key contract manufacturers, (xiv) Oclaro's ability to have its manufacturing lines qualified by its customers, (xv) Oclaro's ability to attract and retain key personnel, (xvi) Oclaro's ability to conclude agreements with its customers on favorable terms, (xvii) the impact of financial market and general economic conditions in the industries in which Oclaro operates and any resulting reduction in demand for its products, (xviii) Oclaro's ability to maintain or increase its cash reserves and obtain debt or equity-based financing on acceptable terms or at all, (xix) Oclaro's ability to effectively compete with companies that have greater name recognition, broader customer relationships and substantially greater financial, technical and marketing resources, (xx) Oclaro's ability to service and repay its outstanding indebtedness pursuant to the terms of the applicable agreements, (xxi) Oclaro's ability to further reduce costs and operating expenses, (xxii) the risks associated with Oclaro's international operations, (xxiii) the outcome of tax audits or similar proceedings, (xxiv) the outcome of pending litigation against Oclaro, and (xxv) other factors described in Oclaro’s most recent annual report on Form 10-K, quarterly report on Form 10-Q and other documents it periodically files with the SEC.