Filed by Suzano Papel e Celulose S.A. pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Fibria Celulose S.A.

Filer’s Commission File Number: 333.198.020

Subject Company’s Commission File Number: 001-15018

Date: April 27, 2018

Announcement Regarding the Merger

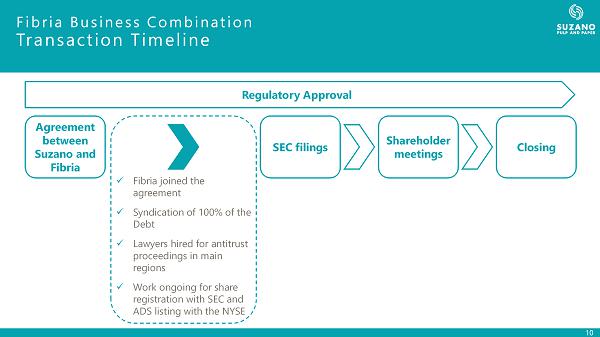

On April 26, 2018, Suzano Papel e Celulose S.A., a Brazilian corporation (“Suzano”), made available on its website a presentation on its results for the first quarter of 2018, which includes summary information on the timeline, along with an update on the status of key steps, for the combination of the operations and the shareholdings of Suzano and Fibria Celulose S.A. (“Fibria”), by means of a corporate reorganization. A copy of the above-mentioned presentation is attached as Exhibit 1.

No Offer or Solicitation

This communication is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to subscribe for or buy shares, nor is it a substitute for any offer materials that Suzano will, if required, file with the U.S. Securities and Exchange Commission (“SEC”). No offer of securities will be made in the United States except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, or pursuant to an exemption therefrom.

Additional Information and Where to Find It

In connection with the proposed transaction, Suzano may file with the SEC relevant materials, including, in the case of a registered offering in the U.S., a registration statement on Form F-4 (unless an exemption from registration is available) containing a prospectus and other documents regarding the proposed transaction. INVESTORS ARE URGED TO READ THE FORM F-4 AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SUZANO, FIBRIA AND THE PROPOSED TRANSACTION AND RELATED MATTERS. The Form F-4 (if and when filed) and all other documents filed with the SEC in connection with the proposed transaction will be available when filed, free of charge, on the U.S. SEC’s website at www.sec.gov. In addition to the Form F-4 (if and when filed) and all other documents filed by Suzano with the SEC in connection with the proposed transaction will be made available, free of charge, on Suzano’s website athttp://www.suzano.com.br.

Forward-Looking Statements

This communication may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management’s current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the company or the transaction, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

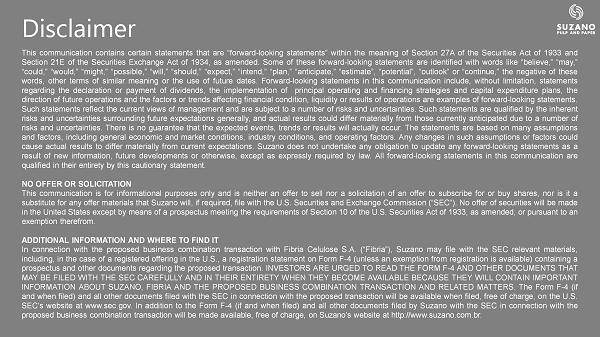

EXHIBIT 1

Earnings Conference Call 1Q18

This communication contains certain statements that are “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , as amended . Some of these forward - looking statements are identified with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate”, “potential”, “outlook” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates . Forward - looking statements in this communication include, without limitation, statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward - looking statements . Such statements reflect the current views of management and are subject to a number of risks and uncertainties . Such statements are qualified by the inherent risks and uncertainties surrounding future expectations generally, and actual results could differ materially from those currently anticipated due to a number of risks and uncertainties . There is no guarantee that the expected events, trends or results will actually occur . The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors . Any changes in such assumptions or factors could cause actual results to differ materially from current expectations . Suzano does not undertake any obligation to update any forward - looking statements as a result of new information, future developments or otherwise, except as expressly required by law . All forward - looking statements in this communication are qualified in their entirety by this cautionary statement . NO OFFER OR SOLICITATION This communication is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to subscribe for or buy shares, nor is it a substitute for any offer materials that Suzano will, if required, file with the U . S . Securities and Exchange Commission (“SEC”) . No offer of securities will be made in the United States except by means of a prospectus meeting the requirements of Section 10 of the U . S . Securities Act of 1933 , as amended, or pursuant to an exemption therefrom . ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed business combination transaction with Fibria Celulose S . A . (“ Fibria ”), Suzano may file with the SEC relevant materials, including, in the case of a registered offering in the U . S . , a registration statement on Form F - 4 (unless an exemption from registration is available) containing a prospectus and other documents regarding the proposed transaction . INVESTORS ARE URGED TO READ THE FORM F - 4 AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SUZANO, FIBRIA AND THE PROPOSED BUSINESS COMBINATION TRANSACTION AND RELATED MATTERS . The Form F - 4 (if and when filed) and all other documents filed with the SEC in connection with the proposed transaction will be available when filed, free of charge, on the U . S . SEC’s website at www . sec . gov . In addition to the Form F - 4 (if and when filed) and all other documents filed by Suzano with the SEC in connection with the proposed business combination transaction will be made available, free of charge, on Suzano’s website at http : //www . suzano . com . br . Disclaimer

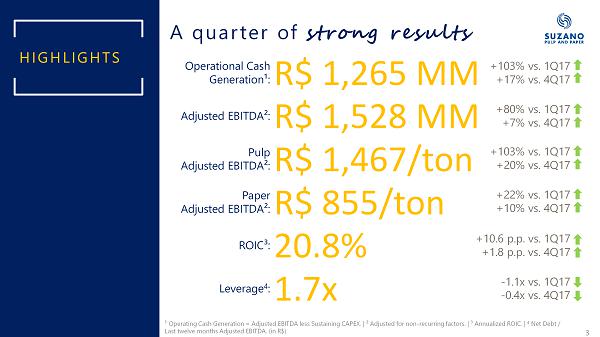

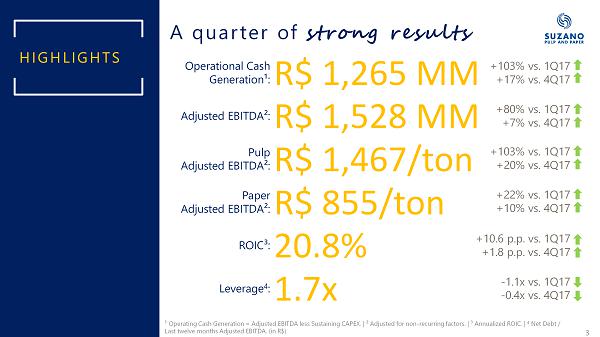

Pulp Adjusted EBITDA²: R$ 1,467/ton +103% vs. 1Q17 +20% vs. 4Q17 A quarter of strong results Adjusted EBITDA²: R$ 1,528 MM +80% vs. 1Q17 +7% vs. 4Q17 Operational Cash Generation¹: R$ 1,265 MM +103% vs. 1Q17 +17% vs. 4Q17 ¹ Operating Cash Generation = Adjusted EBITDA less Sustaining CAPEX. | ² Adjusted for non - recurring factors. | ³ Annualized ROIC . | 4 Net Debt / Last twelve months Adjusted EBITDA. (in R$) 3 ROIC³: 20.8% +10.6 p.p. vs. 1Q17 +1.8 p.p. vs. 4Q17 HIGHLIGHTS Paper Adjusted EBITDA²: R$ 855/ton +22% vs. 1Q17 +10% vs. 4Q17 Leverage 4 : 1.7x - 1.1x vs. 1Q17 - 0.4x vs. 4Q17

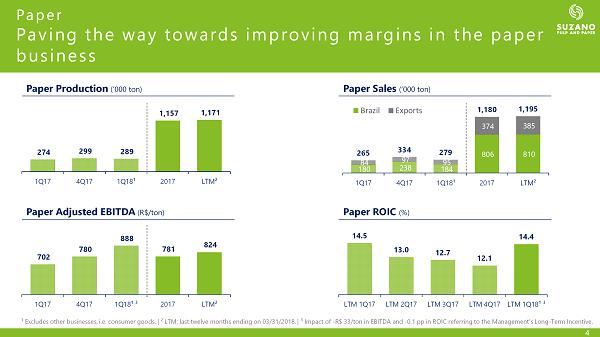

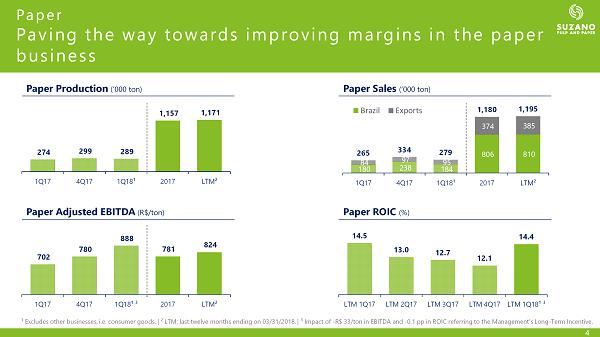

180 238 184 806 810 84 97 95 374 385 265 334 279 1,180 1,195 1Q17 4Q17 1Q18¹ 2017 LTM² Brazil Exports 274 299 289 1,157 1,171 1Q17 4Q17 1Q18¹ 2017 LTM² 702 780 888 781 824 1Q17 4Q17 1Q18¹ ³ 2017 LTM² 14.5 13.0 12.7 12.1 14.4 LTM 1Q17 LTM 2Q17 LTM 3Q17 LTM 4Q17 LTM 1Q18¹ ³ Paper Paving the way towards improving margins in the paper business 4 ¹ Excludes other businesses, i.e. consumer goods . | ² LTM: last twelve months ending on 03/31/2018 . | ³ Impact of - R$ 33/ton in EBITDA and - 0.1 pp in ROIC referring to the Management’s Long - Term Incentive. Paper Production (‘000 ton) Paper Sales (‘000 ton) Paper Adjusted EBITDA (R$/ton) Paper ROIC (%)

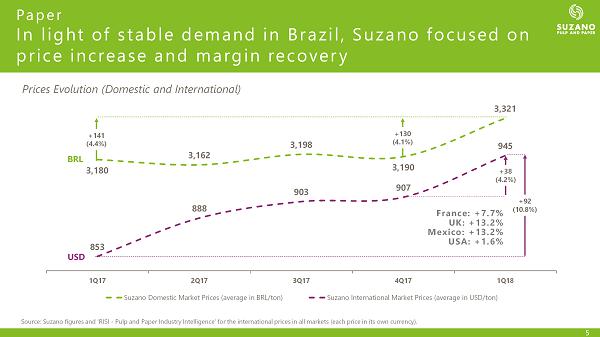

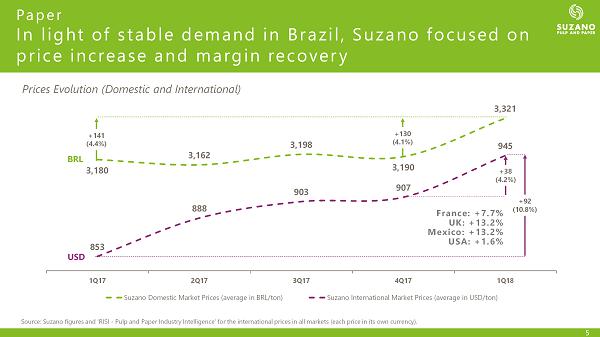

Paper In light of stable demand in Brazil, Suzano focused on price increase and margin recovery 3,180 3,162 3,198 3,190 3,321 853 888 903 907 945 840 860 880 900 920 940 960 980 1,000 2,800 2,900 3,000 3,100 3,200 3,300 3,400 1Q17 2Q17 3Q17 4Q17 1Q18 Suzano Domestic Market Prices (average in BRL/ton) Suzano International Market Prices (average in USD/ton) Prices Evolution (Domestic and International) BRL USD Source: Suzano figures and ‘RISI - Pulp and Paper Industry Intelligence’ for the international prices in all markets (each price in its own currency). +141 (4.4%) +130 (4.1%) +38 (4.2%) +92 (10.8%) France: +7.7% UK: +13.2% Mexico: +13.2% USA: +1.6% 5

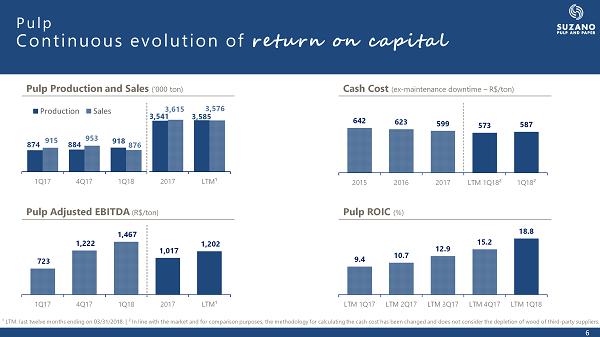

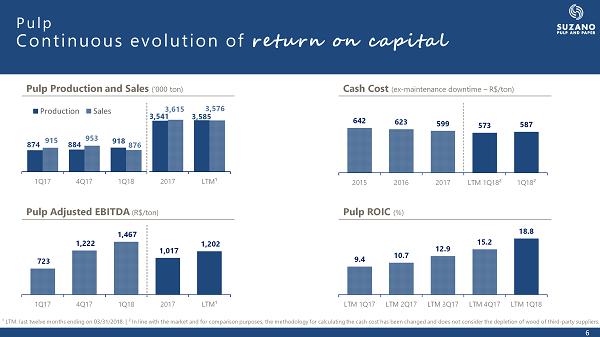

874 884 918 3,541 3,585 915 953 876 3,615 3,576 1Q17 4Q17 1Q18 2017 LTM¹ Production Sales 874 884 918 915 953 876 1Q17 4Q17 1Q18 Production Sales 723 1,222 1,467 1,017 1,202 1Q17 4Q17 1Q18 2017 LTM¹ Pulp Adjusted EBITDA (R$/ton) Pulp ROIC (%) Pulp Continuous evolution of return on capital 6 ¹ LTM: last twelve months ending on 03/31/2018. | ² In line with the market and for comparison purposes, the methodology for cal culating the cash cost has been changed and does not consider the depletion of wood of third - party suppliers. 9.4 10.7 12.9 15.2 18.8 LTM 1Q17 LTM 2Q17 LTM 3Q17 LTM 4Q17 LTM 1Q18 642 623 599 573 587 2015 2016 2017 LTM 1Q18² 1Q18² Pulp Production and Sales (‘000 ton) Cash Cost (ex - maintenance downtime – R$/ton)

7 • Focus on ramp - up projects in Bahia and Maranhão and on integration of operations with Fábrica de Papel da Amazônia S . A . - Facepa • Segmented results to be presented starting from 2 H 18 Next steps • Max Pure®: focus on North and Northeast of Brazil • Mimmo ®: launched on the 2 nd quarter Own Brands Consumer Goods Efforts toward branding consolidation and growth

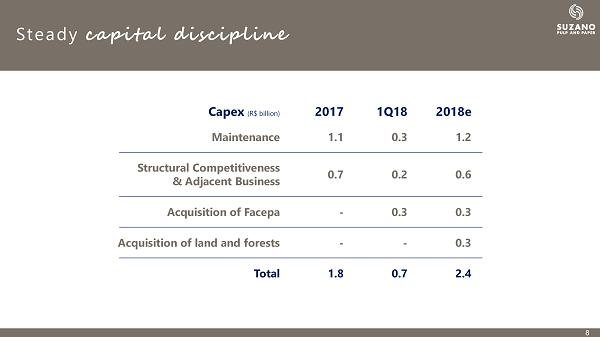

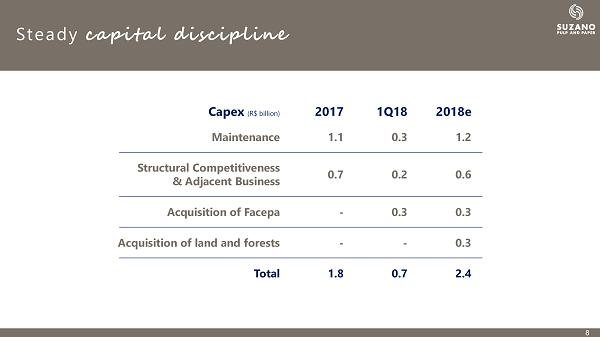

1Q18 Maintenance 0.3 0.3 Acquisition of Facepa Steady capital discipline 0.7 Total Structural Competitiveness & Adjacent Business 0.2 - Acquisition of land and forests Capex (R$ billion) 2017 1.1 - 1.8 0.7 - 8 2018e 1.2 0.3 2.4 0.6 0.3

Continuous improvement of financial metrics Leverage¹ (in times) Amortization Schedule (R$ million) 1,845 552 950 1,795 136 62 140 1,547 782 330 359 2,099 1,175 4,266 3,392 1,334 1,280 2,154 2,235 1,237 4,406 Cash 9M18 2019 2020 2021 2022 2023 onward Local Currency Foreign Currency Net Debt: R$ 9.3 billion (US$ 2.8 billion) Average Debt Maturity: 85 months Average Cost of Debt (in US$): 4.6% p.a. based on market swap curve Achievement of Investment Grade 9 ¹ Leverage measured by net debt over Adjusted EBITDA of the last twelve months. 4.2x 2.7x 2.6x 2.1x 1.7x 3.8x 2.3x 2.9x 2.0x 1.7x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 5.0x Dec/14 Dec/15 Dec/16 Dec/17 Mar/18 Leverage (in R$) Leverage (in US$)

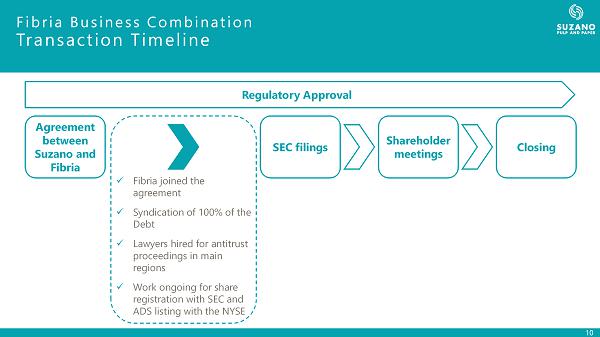

10 Regulatory Approval Agreement between Suzano and Fibria SEC filings Shareholder meetings Closing x Fibria joined the agreement x Syndication of 100% of the Debt x Lawyers hired for antitrust proceedings in main regions x Work ongoing for share registration with SEC and ADS listing with the NYSE Fibria Business Combination Transaction Timeline

Investor Relations www.suzano.com.br/ir ri@suzano.com.br