Exhibit 15.1

Global Sources Ltd.

Canon’s Court

22 Victoria Street

Hamilton HM 12, Bermuda

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on June 23, 2017

To Our Shareholders:

NOTICE IS HEREBY given that an annual general meeting (the “Annual General Meeting”) of the shareholders of Global Sources Ltd. (the “Company” or “Global Sources”) will be held on June 23, 2017 at the Board Room, 26th Floor, Tower B, Southmark, 11 Yip Hing Street, Wong Chuk Hang, Hong Kong Special Administrative Region of the People’s Republic of China, at 11:00 a.m., local time, for the following purposes:

| 1) | To re-elect as a director of the Company Mr. David Fletcher Jones, a member of the Board of Directors of the Company (the “Board”) who is retiring by rotation and, being eligible, offering himself for re-election; |

| 2) | To elect as directors of the Company Ms. Funmibi Chima and Mr. Michael J. Scown, each currently a director appointed by the Board to fill a casual vacancy on September 12, 2016; |

| 3) | To fix the maximum number of directors of the Company that comprise the whole Board at nine (9) persons, declare any vacancies on the Board to be casual vacancies and authorize the Board to fill these vacancies on the Board as and when it deems fit; |

| 4) | To extend the duration of The Global Sources Equity Compensation (2007) Master Plan (as amended and restated effective January 1, 2014 (the “Master Plan”)) by five (5) years from its current expiration date of 31 December 2017, and to accordingly amend Section 10.1 of the Master Plan by replacing the words “31 December 2017” appearing therein (in relation to the “Expiration Date” of the Master Plan) with the words “31 December 2022” instead; and |

| 5) | To re-appoint PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company’s independent auditors until the next annual general meeting of the Company. |

The foregoing matters are described more fully in the accompanying Proxy Statement. While this Notice and Proxy Statement and the enclosed form of proxy are being sent only to shareholders of record and beneficial owners of whom the Company is aware as of May 4, 2017, all shareholders of the Company of record on the date of the meeting are entitled to attend the Annual General Meeting. The Company’s audited financial statements for the year ended December 31, 2016, together with the auditor’s report in respect of the financial statements, are included with the mailing of this Notice and Proxy Statement, and will be laid before the Annual General Meeting.

We hope you will be represented at the Annual General Meeting by signing, dating and returning the enclosed proxy card in the accompanying envelope as promptly as possible, whether or not you expect to be present in person. Your vote is important – as is the vote of every shareholder – and the Board appreciates the cooperation of shareholders in directing proxies to vote at the Annual General Meeting.

Your proxy may be revoked at any time by following the procedures set forth in the accompanying Proxy Statement, and the giving of your proxy will not affect your right to vote in person if you attend the Annual General Meeting.

| | By order of the Board of Directors |

| | |

| | Global Sources Ltd. |

| | |

| |  |

| | Chan Hoi Ching |

| | Secretary |

Dated: May 19, 2017

Hamilton, Bermuda

(This page intentionally left blank.)

Global Sources Ltd.

Canon’s Court

22 Victoria Street

Hamilton HM 12, Bermuda

PROXY STATEMENT

For the Annual General Meeting of Shareholders

June 23, 2017

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Global Sources Ltd., an exempted company incorporated in Bermuda (the “Company”), for use at the annual general meeting of shareholders of the Company to be held at the Board Room, 26th Floor, Tower B, Southmark, 11 Yip Hing Street, Wong Chuk Hang, Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”), on June 23, 2017 at 11:00 a.m., local time, and at any adjournments or postponements thereof (the “Annual General Meeting”). Unless the context otherwise requires, references to the Company includes Global Sources Ltd. and its subsidiaries. The proxy is revocable by (i) filing a written revocation with the Secretary of the Company prior to the voting of such proxy; (ii) giving a later dated proxy; or (iii) attending the Annual General Meeting and voting in person. Shares represented by all properly executed proxies received prior to the Annual General Meeting will be voted at the meeting in the manner specified by the holders thereof.

Proxies that do not contain voting instructions will be voted (i) FOR re-electing as a director of the Company Mr. David Fletcher Jones, a member of the Board who is retiring by rotation and, being eligible, offering himself for re-election; (ii) FOR electing as a director of the Company each of Ms. Funmibi Chima and Mr. Michael J. Scown, each currently a director appointed by the Board to fill a casual vacancy on September 12, 2016; (iii) FOR fixing the maximum number of directors that comprise the whole Board at nine (9) persons, declaring any vacancies on the Board to be casual vacancies and authorizing the Board to fill these vacancies on the Board as and when it deems fit; (iv) FOR extending the duration of The Global Sources Equity Compensation (2007) Master Plan (as amended and restated effective January 1, 2014 (the “Master Plan”)) by five (5) years from its current expiration date of 31 December 2017, and to accordingly amend Section 10.1 of the Master Plan by replacing the words “31 December 2017” appearing therein (in relation to the “Expiration Date” of the Master Plan) with the words “31 December 2022” instead; and (v) FOR re-appointing PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company’s independent auditors until the next annual general meeting of the Company. In accordance with Section 84 of the Companies Act 1981 of Bermuda (as amended), the audited financial statements of the Company for the period from January 1, 2016 to December 31, 2016, together with the auditor’s report in respect of the financial statements, enclosed herewith, will be presented at the Annual General Meeting. These statements have been approved by the Board of the Company. There is no requirement under Bermuda law that shareholders approve such statements, and no such approval will be sought at the Annual General Meeting.

The Board has established May 4, 2017 as the date used to determine those record holders and beneficial owners of common shares, US$0.01 par value per share (the “Common Shares”), to whom notice of the Annual General Meeting will be sent (the “Record Date”). On the Record Date, there were 24,243,059 Common Shares issued and outstanding. The holders of the Common Shares are entitled to one vote for each Common Share held. The presence, in person or by proxy, at the Annual General Meeting of at least two (2) shareholders entitled to vote representing more than 50% of the issued and outstanding Common Shares as of the Record Date is necessary to constitute a quorum at the Annual General Meeting. All matters presented at the Annual General Meeting require approval by a simple majority of votes cast at the meeting. Only votes for or against a proposal count. Abstentions and broker non-votes count for quorum purposes only and not for voting purposes. Broker non-votes occur when a broker returns a proxy but does not have the authority to vote on a particular proposal. Brokers that do not receive instructions from the beneficial owners of Common Shares being voted are entitled to vote on the re-appointment of the auditors. Brokers that do not receive instructions from the beneficial owners of the shares being voted are NOT entitled to exercise discretionary voting power with respect to any other matter presented for shareholder approval at the Annual General Meeting.

We hope you will be represented at the Annual General Meeting by signing, dating and returning the enclosed proxy card in the accompanying envelope as promptly as possible, whether or not you expect to be present in person. Your vote is important – as is the vote of every shareholder – and the Board appreciates the cooperation of shareholders in directing proxies to vote at the Annual General Meeting.

This Notice, Proxy Statement and enclosed form of proxy are first being mailed on or about May 19, 2017.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning beneficial ownership of Common Shares of the Company issued and outstanding as of February 28, 2017 by (i) each person known by the Company to be the beneficial owner of more than five percent of its issued and outstanding Common Shares, (ii) each director (and nominee for director) and executive officer of the Company and (iii) all directors and executive officers of the Company as a group. Unless otherwise indicated, the address of all directors and officers is: 22nd Floor, Vita Tower, 29 Wong Chuk Hang Road, Aberdeen, Hong Kong.

| | | Shares Beneficially | | Percentage

Of |

| Name and Address of Beneficial Owner(1) | | Owned | | Class(2) |

| Merle Allan Hinrich | | 15,725,904(3) | | 64.92% |

| Craig Pepples | | * | | * |

| Brent Barnes | | * | | * |

| Connie Lai | | * | | * |

| Peter Zapf | | * | | * |

| Sarah Benecke | | * | | * |

| Eddie Heng Teng Hua | | * | | * |

| David Fletcher Jones | | * | | * |

| Funmibi Chima | | * | | * |

| Michael J. Scown | | * | | * |

| All Directors, Nominees for Directors and Executive Officers as a Group (10 persons) | | 16,295,349 | | 67.27% |

| York Lion, L.P. et al. | | | | |

| Ugland House, | | | | |

| South Church Street, Box 309, | | | | |

| Grand Cayman, KY1-1104, | | | | |

| Cayman Islands | | 2,434,649(4) | | 10.05% |

| * | Indicates beneficial ownership of less than 1%. |

| (1) | Each shareholder has sole voting power and sole dispositive power with respect to all shares beneficially owned by him unless otherwise indicated. Based on a Schedule 13D filed on March 27, 2017, by a group comprising GAMCO Asset Management Inc., GAMCO Investors, Inc., Gabelli Funds, LLC, Gabelli & Company Investment Advisers, Inc., MJG Associates, Inc., Teton Advisors, Inc., and Gabelli Foundation, Inc., et al., Mario J. Gabelli is deemed to have beneficial ownership of common shares representing 5.01% of our outstanding common shares as reported on our website as of June 30, 2016 (which was 23,914,616 common shares). |

| (2) | Based upon 24,222,272 Common Shares issued and outstanding as of February 28, 2017. The percentage figures are calculated based on our total issued and outstanding Common Shares (and do not take into account that portion of our total issued Common Shares which are held as treasury shares). |

| (3) | As of February 28, 2017, Mr. Merle Allan Hinrich has the sole power to vote and dispose of 14,125,397 Common Shares beneficially owned by him (representing approximately 58.31% of our total issued and outstanding Common Shares), may be deemed to have shared power with his wife Miriam Hinrich to vote or direct to vote and dispose of 288,254 Common Shares owned by her (representing approximately 1.19% of our total issued and outstanding Common Shares) and may be deemed to have shared power with Hinrich Investments Limited to vote or direct to vote and dispose of 1,312,253 Common Shares owned by Hinrich Investments Limited (representing approximately 5.42% of our total issued and outstanding Common Shares). Hinrich Investments Limited is owned by a nominee company in trust for the Hinrich Foundation, of which Mr. |

Hinrich serves as the chairman of the council of members (the decision-making body), and of which he was the founder and the initial settlor.

Mr. Hinrich, who is our Executive Chairman, may therefore be deemed to beneficially own up to approximately 64.92% of our total issued and outstanding Common Shares as of February 28, 2017 (as described above), and he is deemed our controlling shareholder.

| (4) | Based on Schedule 13D/A filed on May 8, 2017 by a group comprising S. Nicholas Walker (“Mr. Walker”), York Lion, L.P. (“Lion L.P.”) and York GP, Ltd. (“York GP”). Mr. Walker is the Managing Director of York GP, which serves as the general partner of Lion L.P. York GP shares the same address as Lion L.P. Mr. Walker also owns an interest in Lion L.P. Additionally, Mr. Walker’s IRA owns an interest in Lion L.P., and he is the beneficiary of a trust, which owns an interest in Lion L.P. The address for Mr. Walker is Praia do Flamengo 278, Flamengo, Rio de Janeiro, Brazil. |

PROPOSAL NO. 1

RE-ELECTION OF DIRECTORS ELIGIBLE BY ROTATION

Pursuant to the Company’s Bye-Laws, one-third of the directors of the Company (or if their number is not three or a multiple of three, the number nearest to one-third) shall retire from office each year by rotation, with those who have been longest since their last appointment or reappointment retiring first. Those persons who became or were last appointed directors on the same day as those retiring shall (unless they otherwise agree among themselves) be determined by lot.

Mr. David Fletcher Jones is retiring at this year’s Annual General Meeting. He has been nominated to be re-elected to the Board. Management has no reason to believe that the nominee will be unable or unwilling to serve as a director, if elected. Should the nominee not be a candidate at the time of the Annual General Meeting (a situation that is not now anticipated), proxies may be voted for a substitute nominee or nominees, as the case may be, selected by the Board.

Unless specifically instructed to vote against or abstain, proxies will be voted for the re-election and election of the nominee named below to serve until his retirement by rotation pursuant to the Company’s Bye-Laws, until his successor has been duly elected and has qualified or until his earlier removal or vacation of office. Directors shall be elected by a majority of the votes cast, in person or by proxy, at the Annual General Meeting.

Certain biographical information concerning the nominees is set forth below:

| | | First Year Became |

| Name | | a Director |

| | | |

| David Fletcher Jones | | 2000 |

Mr. Joneshas been a director since April 2000. He is the Executive Chairman of VGI Partners, a global absolute return funds manager. He spent 17 years in the private equity industry, and before that he was in management consulting, investment banking and general management. Mr. Jones was Managing Director of CHAMP Private Equity, a leading Australian buyout firm from 2002 to 2011. In 1999, he founded and, until 2002, led the development of UBS Capital’s Australian and New Zealand business. Prior to that, he spent four years with Macquarie Direct Investment, a venture capital firm in Sydney, Australia, and one year at BancBoston Capital in Boston, Massachusetts. Mr. Jones began his career as a consultant with McKinsey & Company in Australia and New Zealand. He is Chairman of Derwent Executive and Chair of the National Museum of Australia. He is a director of EC English Pty Ltd, EMR Capital Pty Ltd and Cape York Partnership Group Limited. Mr. Jones holds a Bachelor of Engineering (First Class Hons.) from the University of Melbourne and a Master of Business Administration from Harvard Business School.

The names and certain biographical information of the other directors of the Company, whose terms are scheduled to expire at the 2018 and 2019 annual general meetings of shareholders of the Company, subject to the retirement by rotation procedures of the Company’s Bye-Laws, are set forth below:

| | | First Year Became | | Year Term |

| Name | | a Director | | Expires |

| | | | | |

| Merle Allan Hinrich | | 2000 | | 2018 |

| | | | | |

| Eddie Heng Teng Hua | | 2000 | | 2018 |

| | | | | |

| Sarah Benecke | | 2000 | | 2019 |

Mr. Hinrichhas been a director since April 2000 and is currently our Executive Chairman. He was our Chief Executive Officer from April 2000 to August 2011. As founder of the business, he was the principal executive officer of our predecessor company, Trade Media Holdings Limited, a Cayman Islands corporation wholly owned by us (“Trade Media”), from 1971 through 1993 and resumed that position in September 1999. From 1994 to August 1999, Mr. Hinrich was chairman of the ASM Group, which included Trade Media. Mr. Hinrich is a director of Trade Media and has also been the Chairman of the Board of Trade Media. Mr. Hinrich graduated from the University of Nebraska with a Bachelor of Arts degree in Business Administration and Mathematics, and then gained a Graduate degree in International Trade at Thunderbird School of Global Management. In 1996, the University of Nebraska awarded Mr. Hinrich an Honorary Doctorate Degree, and in 2010, the Thunderbird School of Global Management conferred upon Mr. Hinrich the honorary degree of Doctor of International Law, in recognition of his global mindset and his role as a true global entrepreneur. In recognition of his highly valued support to Hong Kong Baptist University, the university conferred an Honorary University Fellowship upon him in 2015. After 22 years of service, he retired from the board of trustees of Thunderbird and became a director on the Board of The Thunderbird Independent Alumni Association. He is a member of the Economic Strategy Institute in Washington, D.C., co-founder and former chairman of The Society of Hong Kong Publishers, and the chairman of the council of members of the Hinrich Foundation. Mr. Hinrich is also an Investment Promotion Ambassador with Invest Hong Kong and serves as the International Board Member of the Weizmann Institute of Science.

Mr. Henghas been a director since April 2000. He joined us in August 1993 as deputy to the vice president of finance and was the Chief Financial Officer (previously titled vice president of finance) from 1994 until June 30, 2009. Mr. Heng returned to serve as Interim Chief Financial Officer from June 30, 2010 until August 1, 2010. He received an MBA from Schiller International University in London in 1993, is a Singapore Chartered Accountant, a member of the Institute of Singapore Chartered Accountants, and a Fellow Member of The Association of Chartered Certified Accountants in the United Kingdom. Mr. Heng is currently an audit committee member of Prison Fellowship Singapore, a Christian non-profit organization that provides counseling and skills training to prisoners and financial support to their families. Prior to joining us, he was the regional financial controller of Hitachi Data Systems, a joint venture between Hitachi and General Motors.

Ms. Beneckehas been a director since April 2000 and, since 1993, has been a director of Trade Media. Ms. Benecke was our principal executive officer from January 1994 through August 1999. She joined us in May 1980 and served in numerous positions, including publisher from 1988 to December 1992 and chief operating officer in 1993. From September 1999 to July 2010, Ms. Benecke served as a consultant to Publishers Representatives Ltd. (Hong Kong), a subsidiary of our company. Her consulting work focused largely on the launch, development and expansion of the “China Sourcing Fairs” in Shanghai, Hong Kong, Mumbai, Dubai, Singapore and Johannesburg. Ms. Benecke is also on the boards of Australian media company McPherson Media, Hong Kong art show organizer Asia Contemporary Art Ltd., and Singapore art show organizer Singapore Contemporary Art Ltd. She graduated with a B.A. from the University of New South Wales, Australia.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE FOR THE RE-ELECTION OF MR. DAVID FLETCHER JONES AS A DIRECTOR OF THE COMPANY.

PROPOSAL NO. 2

ELECTION OF MS. FUNMIBI CHIMA AND MR. MICHAEL J. SCOWN

On September 12, 2016, Ms. Funmibi Chima and Mr. Michael J. Scown were each appointed to the Board as a director pursuant to the Board’s authority to fill casual vacancies on the Board, which authority was granted at last year’s annual general meeting. Ms. Chima and Mr. Scown are retiring at this year’s Annual General Meeting, and have been nominated to be elected to the Board as directors. Management has no reason to believe that either Ms. Chima or Mr. Scown will be unable or unwilling to serve as a director, if elected. Should Ms. Chima or Mr. Scown not be a candidate at the time of the Annual General Meeting (a situation that is not now anticipated), proxies may be voted for a substitute nominee, selected by the Board.

Unless specifically instructed to vote against or abstain, proxies will be voted for the election of Ms. Chima and Mr. Scown to each serve until his/her retirement by rotation pursuant to the Company’s Bye-Laws, until his/her successor has been duly elected and has qualified or until his/her earlier removal or vacation of office. As with the other directors eligible for re-election, Ms. Chima and Mr. Scown shall each be elected by a majority of the votes cast, in person or by proxy, at the Annual General Meeting.

| | | First Year Became |

| Name | | a Director |

| Funmibi Chima | | 2016 |

| Michael J. Scown | | 2016 |

Ms. Chimawas appointed by the Board as a director to fill a casual vacancy on September 12, 2016. Since 2015, she has been the Chief Information Officer for Burberry plc, where she oversees Burberry’s technology division that is central to its strategy development. From 2010 to 2015, she held several leadership roles, including most recently the Chief Information Officer for Asia (2014-2015), at Wal-Mart Stores, a multinational retail corporation that operates a chain of hypermarkets, discount department stores and grocery stores. Prior to recent experiences in retailing, she spent over 15 years in the financial services industry. She was the Vice President of Corporate Systems at American Express (New York) from 2006 to 2010. Prior to that, she spent two years at JPMorgan Chase (New York) and a number of years at TXU Gas & Electric (Dallas) and PricewaterhouseCoopers (London) as a consultant. Ms. Chima serves on external boards and participates in mentoring networks which include: World Affairs Council —Washington, DC; STEMconnector®; United Nations ESCAP Task Force; Information Technology Senior Management Forum (ITSMF); Executive Leadership Council (ELC); International Women’s Forum (IWF); and most recently, B20 Employment Taskforce. She received her Bachelor of Arts degree from the University of Hull in the U.K. If her appointment is confirmed at the Annual General Meeting, her regular term as director will expire in 2020.

Mr. Scownwas appointed by the Board as a director to fill a casual vacancy on September 12, 2016. He is the Asia Managing Director, Treasury, for Intel Capital (since 2006). From 1999 to 2006, he served as Intel Capital’s Asia Regional Counsel. Before joining Intel, he practiced law as an associate and partner with Russin & Vecchi, LLC in the firm’s San Francisco and Ho Chi Minh City, Vietnam offices (1988-1998) and worked in hotel development as Asia Assistant Regional Counsel for Marriott International, Inc. (1998-1999). Prior to commencing his legal practice, Mr. Scown served as a Foreign Service Officer with the U.S. Department of State (1985-1988). From 2007 to 2015, he served on the board of directors and audit committee of eLong, Inc., a Nasdaq-listed mobile and online travel service provider in China. He has also served as a director of the Hong Kong Venture Capital and Private Equity Association (2008-2013) and was the Chairman (1995-1996) and a founding member (1994-1998) of the Board of Governors of the American Chamber of Commerce in Vietnam, Ho Chi Minh City Chapter. He is a graduate of U.C. Berkeley (A.B.), the University of San Francisco School of Law (J.D.) and a member of the California Bar. If his appointment is confirmed at the Annual General Meeting, his regular term as director will expire in 2019.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF MS. FUNMIBI CHIMA AND MR. MICHAEL J. SCOWN AS A DIRECTOR OF THE COMPANY.

CORPORATE GOVERNANCE

The Company’s corporate governance practices are established and monitored by the Board. The Board regularly assesses the Company’s governance practices in light of legal requirements and governance best practices.

Committees of the Board

The Company has a separately designated standing audit committee (the “Audit Committee”) established in accordance with Rule 10A-3 promulgated under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). The members of the Audit Committee are Eddie Heng Teng Hua (Chairman), David Fletcher Jones, and Michael J. Scown. Mr. Jones is standing for re-election to the Board, and Mr. Scown is standing for election to the Board at the Annual General Meeting. The Board has determined that Mr. Heng is an “audit committee financial expert” under Item 401(h)(2) of Regulation S-K of the U.S. Securities and Exchange Commission (the “SEC”). None of the Audit Committee members is an “affiliate” of the Company.

The Audit Committee’s charter, as amended, a copy of which is available on the Company’s website athttp://www.corporate.globalsources.com/IRS/COPGOV.HTM, provides that the Audit Committee shall consist of at least three members, all of whom shall, in the opinion of the Board, be “independent” in accordance with the requirements of the SEC and the Nasdaq Stock Market (“Nasdaq”). Members of the Audit Committee shall be considered independent if (i) they have no relationship to the Company which, in the opinion of the Board, would interfere with the exercise of his or her judgment independent of the Company’s management, (ii) do not accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company or any subsidiary of the Company, and (iii) are not affiliated persons of the Company or any subsidiary of the Company.

The primary functions of the Audit Committee consist of:

| 1. | Ensuring that the affairs of the Company are subject to effective internal and external independent audits and control procedures; |

| 2. | Approving the selection of internal and external independent auditors annually; |

| 3. | Reviewing all Forms 20-F, prior to their filing with the SEC; and |

| 4. | Conducting appropriate reviews of all related party transactions for potential conflict of interest situations on an ongoing basis and approving such transactions, if appropriate. |

The Audit Committee held 4 meetings in the fiscal year ended December 31, 2016.

The Company has a separately designated standing compensation committee (the “Compensation Committee”). The members of the Compensation Committee are Sarah Benecke (Chairman), David Fletcher Jones, Eddie Heng Teng Hua, Funmibi Chima and Michael J. Scown. Mr. Jones is standing for reelection to the Board, and Ms. Chima and Mr. Scown are standing for election to the Board, at the Annual General Meeting.

The Compensation Committee’s charter, a copy of which is available on the Company’s website athttp://www.corporate.globalsources.com/IRS/COPGOV.HTM, provides that the Compensation Committee shall consist of at least two members, all of whom shall, be “independent” in accordance with the requirements of the SEC and Nasdaq.

The primary function of the Compensation Committee is to approve compensation packages for each of the Company’s executive officers.

The Compensation Committee held 1 meeting in the fiscal year ended December 31, 2016.

The Board has also established an executive committee, and Merle Allan Hinrich, Eddie Heng Teng Hua, and Sarah Benecke serve as the members thereof. The executive committee acts for the entire Board between Board meetings.

Board Meetings

The Board held 4 meetings during the fiscal year ended December 31, 2016. None of the incumbent directors attended fewer than 75% of the Board meetings held in 2016 and the total number of meetings held by all committees of the Board on which he or she served during his or her service in 2016. Members of the Board are encouraged to attend all of our shareholders meetings. However, we do not have a formal policy with respect to such attendance at our shareholder meetings.

MANAGEMENT

Executive Officers of the Company

The names, positions and certain biographical information of the executive officers of the Company who are not directors are set forth below.

| Name | | Position |

| Craig Pepples | | Chief Executive Officer |

| Spenser Au | | Former Chief Executive Officer1 |

| Brent Barnes | | Chief Operating Officer |

| Connie Lai | | Chief Financial Officer |

| Peter Zapf | | Chief Information Officer |

Mr. Peppleswas appointed as our Chief Executive Officer with effect from January 1, 2017. Prior to that, he served as Global Sources’ Deputy Chief Executive Officer since October 1, 2016. Mr. Pepples joined the Global Sources team in 1986 and has been with the Company for more than three decades. During his career, he has moved up the ranks to become manager of the Company’s China sales operations from 1989 to 1992, serving as the China Country Manager from 1992 to 1999, then as the Chief Operating Officer from 1999 to 2010. Most recently, he has worked as Global Sources’ President of Corporate Affairs and Publisher of Chief Executive China. Mr. Pepples has extensive B2B media experience and deep industry knowledge of Greater China and other markets where the Company operates. Mr. Pepples graduated with a B.A. in Linguistics from Yale University and speaks fluent Chinese.

Mr. Auwas appointed as our Chief Executive Officer in August 2011 and retired effective January 1, 2017. Mr. Au first became a team member in 1978 as an account executive for Asian Sources Electronics magazine. The positions through which he advanced to senior management included regional sales manager in 1988, associate publisher in 1991, publisher in 1992 and president of Asian Sales in 1999. Mr. Au has a deep knowledge of Greater China and other markets where the company operates. Mr. Au is a business graduate from the Hong Kong Baptist University.

Mr. Barneswas appointed as our Chief Operating Officer in January 2012. Mr. Barnes is responsible for the Company’s worldwide operations, including community development, content development, trade show operations, and a special brief covering all buyer-facing services. Mr. Barnes began his career managing operations for a lobbyist group in Austin, Texas, and then moved to Mexico City, where he worked in the executive training business for two years. Upon completion of his MBA, Mr. Barnes spent a year working as a Market Analyst for Global Sources in Phoenix, Arizona before moving to Hong Kong to become Executive Assistant to the Chairman and Chief Executive Officer in May of 2000. Since 2003 he has spent time managing each of the core operational departments and assumed the role of General Manager of Content & Community Development in January 2010. Mr. Barnes holds a Bachelor of Arts degree from the University of Texas at Austin and an MBA from the Thunderbird School of Global Management.

Ms. Laiwas appointed as our Chief Financial Officer effective August 2010. Ms. Lai joined Global Sources in June 2007 as financial controller, Hong Kong & China. Prior to joining Global Sources, she was chief financial officer and an executive director of HC International, Inc., a Hong Kong listed

1 Mr. Au retired as the Company’s Chief Executive Officer effective January 1, 2017.

company. Earlier in her career, she spent over four years with PricewaterhouseCoopers Hong Kong. Ms. Lai graduated from the Chinese University of Hong Kong with a bachelor’s degree in professional accountancy. She is also a Member of the Hong Kong Institute of Certified Public Accountants and a Fellow Member of the Association of Chartered Certified Accountants in the United Kingdom.

Mr. Zapfwas appointed as our Chief Information Officer in January 2012. Mr. Zapf began his career in software project management with the United States Air Force. He then joined Global Sources in Phoenix, Arizona, working on the development, sales and marketing of the company’s early software and e-commerce products. Later, he worked as a research analyst at Bear Stearns in New York, focusing on the business-to-business market, after which he joined Hong Kong-based AsiaCommerce, a startup incubator, as Chief Executive Officer. He rejoined Global Sources in 2001, and was chief operating officer from January 2011 to December 2011. Mr. Zapf holds a BS in Electrical Engineering and Engineering and Public Policy from Carnegie Mellon University, an MS in Computer Science from Troy State University, and an MBA from the Thunderbird School of Global Management.

Compensation of Directors and Executive Officers

For the year ended December 31, 2016, the Company and its subsidiaries provided its directors and executive officers as a group aggregate remuneration, pension contributions, allowances and other benefits of $3,883,213 including the non-cash compensation of $921,367 associated with the equity compensation plans.

In 2016, the Company and its subsidiaries incurred $133,250 in costs to provide pension, retirement or similar benefits to their respective officers and directors pursuant to the Company’s retirement plan and pension plan.

Employment Agreements

We have employment agreements with Mr. Merle Allan Hinrich under which he serves as our Executive Chairman. The agreements contain covenants restricting Mr. Hinrich’s ability to compete with us during his term of employment and preventing him from disclosing any confidential information during the term of his employment agreement and for a further period of three years after the termination of his employment agreement. In addition, we retain the rights to all trademarks and copyrights acquired and any inventions or discoveries made or discovered by Mr. Hinrich in the course of his employment. Upon a change of control, if Mr. Hinrich is placed in a position of lesser stature than that of a senior executive officer, a significant change in the nature or scope of his duties is effected, Mr. Hinrich ceases to be a member of the Board or if there is a breach of those sections of his employment agreements relating to compensation, reimbursement, title and duties or termination, we are liable to pay Mr. Hinrich a lump sum cash payment equal to five times the sum of his base salary prior to the change of control and the bonus paid to him in the year preceding the change of control. The agreements may be terminated by either party by giving six months’ notice.

We have employment agreements with each of our other executive officers. Each employment agreement contains a non-competition provision preventing the employee from undertaking or becoming involved in any business activity or venture during the term of employment without notice to us and our approval. The employee must keep all of our proprietary and private information confidential during the term of employment and for a period of three years after the termination of the agreement. We can assign the employee to work for another company if the employee’s duties remain similar. In addition, we retain the rights to all trademarks and copyrights acquired and any inventions or discoveries made or discovered by the employee during the employee’s term of employment. Each employment agreement contains a three- or six-months’ notice provision for termination, and does not have a set term of employment. Bonus provisions are determined on an individual basis.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There were no material related party transactions during the year ended December 31, 2016.

PROPOSAL NO. 3

FIXING BOARD SIZE AND TREATMENT OF VACANCIES

Pursuant to Bye-Law 89 of the Company’s Bye-Laws, the Company shall determine the minimum and maximum number of directors at the Annual General Meeting.

Change of Size of the Board

The Company’s Bye-Laws currently provide for a minimum of two (2) directors on the Board. In October 2000, the Company’s shareholders established the maximum size of the Board at nine (9) members. In each of the last fourteen years, the shareholders voted to maintain the number of directors constituting the Board at nine (9) directors. This proposal would continue to maintain the maximum number of directors constituting the entire Board of the Company at nine (9) directors.

The Company believes that having the ability to appoint nine (9) directors is necessary to ensure that the Company is able to comply with the Nasdaq listing standards that generally require a listed company to maintain a majority of independent directors on its Board and certain of its committees, while retaining as directors officers and members of the Company’s management who are familiar with the Company. Since the annual general meeting of the Company in October 2000, where the shareholders agreed to permit the Board to fill casual vacancies, the shareholders have continued to give the Board the authority to appoint additional directors without a vote of shareholders.

Authorization of Directors to Fill Casual Vacancies

At the annual general meeting of the Company in October 2000, the shareholders approved a proposal to allow casual vacancies on the Board to be filled by the Board. This proposal was again approved in each of the last sixteen years. This proposal would allow the remaining vacant directorships to be casual vacancies and would authorize the Board to fill those vacancies as and when it deems fit. A casual director so appointed shall hold office only until the next following annual general meeting and shall not be taken into account in determining the directors who are to retire by rotation at the meeting.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE TO FIX THE MAXIMUM NUMBER OF DIRECTORS THAT COMPRISE THE WHOLE BOARD AT NINE (9) PERSONS, TO DECLARE THAT ANY VACANCIES ON THE BOARD BE CASUAL VACANCIES AND TO AUTHORIZE THE BOARD TO FILL THESE VACANCIES ON THE BOARD AS AND WHEN IT DEEMS FIT.

PROPOSAL NO. 4

EXTENSION OF THE GLOBAL SOURCES EQUITY COMPENSATION (2007) MASTER PLAN

Extension of Plan Term

The Board has unanimously approved for submission to a vote of the shareholders a proposal to extend the Master Plan by five (5) years from its current expiration date of 31 December 2017, and to accordingly amend Section 10.1 of the Master Plan by replacing the words “31 December 2017” appearing therein (in relation to the “Expiration Date” of the Master Plan) with the words “31 December 2022” instead (the “Amendment”). The text of the Master Plan, as proposed to be amended, is set forth in Annex A to this Proxy Statement. All discussion of the Master Plan in this Proxy Statement is qualified in its entirety by reference to Annex A. The Board believes that the extension of the Master Plan is necessary to continue providing an incentive for employees, directors and consultants of the Company and its subsidiaries, and of independent contractors of the Company and its subsidiaries, to remain in the employ of or to continue being engaged in the provision of services to the Company and to attract new relevant personnel whose services are considered valuable to the Company. The Board believes that the sense of proprietorship and the stimulation of the active interest of such persons in the development and financial success of the Company and its subsidiaries created by the Master Plan has benefitted the Company since the Master Plan was implemented; and that the Master Plan should continue in its current form into the future.

Remainder of Plan Unchanged

The Amendment would not increase the number of Common Shares of the Company currently available for distribution under the Master Plan, nor would it amend any other provision of the Master Plan as currently in effect.

Description of the Master Plan

The Master Plan was implemented pursuant to an affirmative vote of the shareholders at the 2006 Annual General Meeting and commenced on January 1, 2007. The Master Plan, by its terms, is set to expire on 31 December 2017, having been previously extended by a vote of the shareholders from its original expiration date of 31 December 2012. Under the Master Plan, a plan committee consisting of not less than three and not more than five individuals are appointed by the Board (the “Plan Committee”) and may make grants (each a “Grant”) of Common Shares of the Company to eligible Global Sources Team Members (as such term is defined in the Master Plan). The total number of all Common Shares awarded pursuant to such Grants cannot exceed six million (6,000,000) in the aggregate. The Master Plan further provides that, in the event of one or more reorganizations, recapitalizations, stock splits, reverse stock splits, stock dividends or the like, appropriate adjustments shall be made in the number and/or type of shares or securities for which Common Shares pursuant to Grants then outstanding under the Master Plan may thereafter be vested. Common Shares that are not awarded under the Master Plan are available for future Grants under the Master Plan or any subsequent equity compensation plans.

All Common Shares under a Grant, which have been awarded in accordance with the provisions of the Master Plan, are either (i) issued and allotted by the Company to Estera Services (Bermuda) Limited (previously known as Appleby Services (Bermuda) Ltd.) (the “Trustee”) to be held by it as trustee of a trust known as “The Global Sources Equity Compensation Trust 2007” (the “Trust”), at any time following the award of such Grant, and are eligible for transfer (and shall be subsequently transferred) by the Trustee to the respective Global Sources Team Members who have received Grants pursuant to the Master Plan (the “Grantees”), subject to and in accordance with the applicable vesting rules and other applicable provisions of the Master Plan; or (ii) issued and allotted by the Company directly to the Grantees, subject to and in accordance with the applicable vesting rules and other applicable provisions of the Master Plan.

The Board is authorized to alter, amend, suspend or terminate the Master Plan; provided however that (except as otherwise provided in the Master Plan) it may not deprive any Grantee, without his or her consent, of any of his or her rights under a Grant already awarded pursuant to the Master Plan. However,

the Board may not without shareholder approval (except as otherwise provided in the Master Plan) (i) extend the expiration date of the Master Plan; or (ii) alter the class of persons eligible to receive Grants under the Master Plan.

Vesting of Common Shares Under the Master Plan

The Plan Committee is entitled to determine the periods, schedules, installments, rules, regulations, terms and conditions for the vesting of Common Shares awarded to Grantees under a Grant (the “Vesting Rules”); and such other related benefits, matters, rules and regulations, as may be deemed fit or appropriate by the Plan Committee. Common Shares under a Grant awarded pursuant to the Master Plan shall vest in the Grantee in accordance with the applicable Vesting Rules; provided however that (a) if a Grantee ceases to be eligibly employed by the Company or any subsidiary of the Company or by a relevant independent contractor of the Company or any subsidiary of the Company, for any reason whatsoever, other than because of normal retirement (as such term is defined in the Master Plan), or death or disability, all rights and entitlement of the Grantee to the vesting of Common Shares that have been awarded pursuant to a Grant, but that have not yet vested at the date of the Grantee ceasing to be eligibly employed, automatically terminate and are forfeited, concurrently with such cessation of eligible employment; or (b) if the Grantee dies, becomes disabled, or takes normal retirement while eligibly employed by the Company or any subsidiary of the Company or by a relevant independent contractor of the Company or any subsidiary of the Company, the Grantee (or, in the case of death, the person or persons to whom the Grantee’s rights under the Grant shall have lawfully passed (whether by will, or by the applicable laws of succession or otherwise)) retains the same rights of vesting, with respect to Common Shares already awarded pursuant to the Grant but not yet vested at the time of death, disablement or normal retirement (as the case may be), as would have been available if the Grantee had continued to be eligibly employed.

Transferability

Upon the award of a Grant, the Common Shares awarded to each Grantee under such Grant do not vest in the Grantee, but (subject to the applicable provisions of the Master Plan) (i) will be issued and allotted by the Company to the Trustee and held by the Trustee (as trustee of the Trust) and will only be transferred by the Trustee to the Grantee in accordance with the Vesting Rules prescribed by the Plan Committee; or (ii) will only be issued and allotted by the Company directly to the Grantee in accordance with the Vesting Rules prescribed by the Plan Committee, subject to the provisions of the Master Plan.

Registration of Common Shares

The Company filed with the SEC registration statements on Form S-8 under the U.S. Securities Act of 1933, as amended, with respect to the Common Shares issuable pursuant to the Master Plan on November 7, 2006 and March 5, 2015. Such registration statements remain effective as of the date of this Proxy Statement.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE FOR EXTENDING THE DURATION OF THE MASTER PLAN BY ANOTHER FIVE YEARS, AND TO ACCORDINGLY AMEND SECTION 10.1 OF THE MASTER PLAN BY REPLACING THE WORDS “31 DECEMBER 2017” APPEARING THEREIN (IN RELATION TO THE “EXPIRATION DATE” OF THE MASTER PLAN) WITH THE WORDS “31 DECEMBER 2022” INSTEAD.

PROPOSAL NO. 5

APPOINTMENT OF INDEPENDENT AUDITORS

The Board has recommended that PricewaterhouseCoopers LLP, an independent registered public accounting firm, be re-appointed as the independent auditors of the Company to hold office until the next annual general meeting at a remuneration to be negotiated by management and approved by the Audit Committee. PricewaterhouseCoopers LLP has served as the Company’s independent auditors since August 2008. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual General Meeting and, if he/she so desires, will have the opportunity to make a statement, and in any event will be available to respond to appropriate questions. PricewaterhouseCoopers LLP has advised the Company that it does not have any direct or indirect financial interest in the Company, nor has such firm had any such interest in connection with the Company during the past fiscal year other than in its capacity as the Company’s independent auditors.

Audit Fees

Audit fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2015 and 2016, for review of the Company’s annual financial statements and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years, totaled approximately $837,044 and $846,841, respectively.

Audit-Related Fees

The audit-related fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2015, for assurance and related services, totaled approximately $10,583 and consisted of fees for professional services relating to accounting workshops and training conducted for the Company. The audit-related fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2016, for assurance and related services, totaled approximately $10,364 and consisted of fees for professional services relating to accounting workshops and training conducted for the Company.

Tax Fees

Tax fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2015, for tax compliance, tax advice and tax planning, totaled approximately $48,822 and consisted of review of tax returns for five subsidiaries of the Company, filing of quarterly value added tax returns for a subsidiary, assistance with value added tax matters in a local jurisdiction, assistance with certain tax matters in a local jurisdiction and permissible tax advice to a subsidiary. Tax fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2016, for tax compliance, tax advice and tax planning, totaled approximately $26,128, and consisted of review of tax returns for five subsidiaries of the Company, filing of quarterly value added tax returns for a subsidiary, assistance with value added tax matters in a local jurisdiction and assistance with certain tax matters in a local jurisdiction.

All Other Fees

There were no fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2015 and 2016, for products and services not included in the foregoing categories. The audit committee has approved 100% of the services described above under “Tax Fees”.

Recommendation of the Board

THE BOARD RECOMMENDS A VOTE FOR THE RE-APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP, AN INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, AS THE COMPANY’S INDEPENDENT AUDITORS UNTIL THE NEXT ANNUAL GENERAL MEETING OF THE COMPANY.

SOLICITATION STATEMENT

The Company shall bear all expenses in connection with the solicitation of proxies. In addition to the use of the mails, solicitations may be made by the Company’s regular employees, by telephone, telegraph or personal contact, without additional compensation. The Company shall, upon their request, reimburse brokerage houses and persons holding Common Shares in the names of their nominees for their reasonable expenses in sending solicited material to their principals.

OTHER MATTERS

There is no business other than that described above to be presented for action by the shareholders at the Annual General Meeting.

SHAREHOLDER PROPOSALS

In order to be properly brought before the next annual general meeting of shareholders of the Company, any matter to be presented by a Shareholder at such meeting, including the nomination of a person to be appointed a director, must be submitted to the Company between February 23, 2018 and March 25, 2018, provided, however, that if and only if the next annual general meeting is not scheduled to be held within a period that commences thirty days before and ends thirty days after June 23, 2018, any shareholder notice of any such proposal must be submitted to the Company by the later of (i) the close of business on the date ninety days prior to the actual date of such meeting or (ii) the close of business on the tenth day following the date on which the date of such meeting is first publicly announced or disclosed. Shareholder proposals may only be submitted by shareholders or nominee holders that hold of record at least 1% of the Company’s Common Shares entitled to vote on such matter.

AUDITED FINANCIAL STATEMENTS

The Company has sent, or is concurrently sending, all of its shareholders of record as of the Record Date a copy of its audited financial statements for the fiscal year ended December 31, 2016.

| | By Order of the Company, |

| | |

| |  |

| | Chan Hoi Ching |

| | |

| | Secretary |

Dated: May 19, 2017

Hamilton, Bermuda

[This page intentionally left blank.]

ANNEX A

THE GLOBAL SOURCES

EQUITY COMPENSATION (2007) MASTER PLAN

(AMENDED EFFECTIVE AS OF JUNE 23, 2017)

CONTENTS

| No. | Section | Page |

| | | |

| 1. | Name of the Plan | 3 |

| | | |

| 2. | Purpose of the Plan | 3 |

| | | |

| 3. | Shares Subject to the Plan | 3 |

| | | |

| 4. | Eligible Persons | 3 |

| | | |

| 5. | No Payment | 4 |

| | | |

| 6. | Non-transferability | 4 |

| | | |

| 7. | Adjustments | 4 |

| | | |

| 8. | Vesting of Shares and forfeiture of unvested Shares | 4 |

| | | |

| 9. | Transfer of Shares | 5 |

| | | |

| 10. | Plan Duration | 6 |

| | | |

| 11. | Administration | 6 |

| | | |

| 12. | Government Regulations | 6 |

| | | |

| 13. | Costs and Expenses | 6 |

| | | |

| 14. | Amendment or Termination of the Plan | 7 |

| | | |

| 15. | Limitation of Liability | 7 |

| | | |

| 16. | Governing Law and Jurisdiction | 7 |

THE GLOBAL SOURCES EQUITY COMPENSATION (2007) MASTER PLAN

(AMENDED EFFECTIVE AS OF JUNE 23, 2017)

| 1.1 | This equity compensation plan shall be known as “The Global Sources Equity Compensation (2007) Master Plan” (the “Plan”). |

| 2.1 | Under this Plan, grants (“Grants”), or individually a grant (“Grant”), of common shares of One United States Cent (US$0.01) par value each (the “Shares”) of Global Sources Ltd. (the “Company”), may be awarded from time to time to Global Sources Team Members (as defined in Section 4.1 below), by the Plan Committee (as defined in Section 3.3 below); provided however that the total number of all Shares awarded pursuant to such Grants shall not exceed six million (6,000,000) in the aggregate. |

| 3. | Shares Subject to the Plan |

| 3.1 | All Shares under a Grant, which have been awarded in accordance with the provisions of this Plan: |

| (a) | shall be issued and allotted by the Company to Appleby Trust (Bermuda) Ltd. (now known as Appleby Services (Bermuda) Ltd.) (“Trustee”)to be held by it as trustee of a trust to be known as “The Global Sources Equity Compensation Trust 2007” (the “Trust”), at any time following the award thereof, and shall be eligible for transfer (and shall be subsequently transferred) by the Trustee to the respective Global Sources Team Members who have received Grants pursuant to this Plan (each a “Grantee”, and collectively the “Grantees”), subject to and in accordance with the applicable vesting rules and other applicable provisions of this Plan (including but not limited to the provisions of Section 7 below with regard to any adjustments (if applicable)); or |

| (b) | shall be issued and allotted by the Company directly to the Grantee, subject to and in accordance with the vesting rules and other applicable provisions of this Plan (including but not limited to the provisions of Section 7 below with regard to any adjustments (if applicable)). |

| 3.2 | Shares which are not awarded under this Plan shall be available for the award of any future Grant or Grants under this Plan or any subsequent equity compensation plans. |

| 3.3 | The document for the establishment of the Trust (“Trust Document”)shall provide for a plan committee (“Plan Committee”) to determine the award and allocation of Grants, Shares and other related benefits to the Grantees. The Plan Committee shall be constituted by the Company pursuant to the Trust Document, and shall consist of not less than three (3) and not more than five (5) individuals to be appointed by the Company’s board of directors. The details of the Plan Committee’s powers, functions and terms of reference shall be set out in the Trust Document. |

| 4.1 | In this Plan, a “Global Sources Team Member” shall mean any person who is at the time of a Grant (made pursuant to this Plan) employed or engaged (“eligibly employed”) as an employee, director or consultant of: |

| (a) | the Company or any of its subsidiaries (the Company and its subsidiaries being hereinafter collectively referred to as the “Global Sources Group”); or |

| (b) | any independent contractor of any Global Sources Group entity, as determined by the Plan Committee from time to time (“Other Relevant Entity”). |

| 4.2 | Global Sources Team Members are eligible to be Grantees. |

| 4.3 | The award of Grants shall be determined by resolution of the Plan Committee. The Plan Committee shall also be entitled to determine who amongst the various potentially eligible Grantees shall actually be awarded Shares under a Grant; the number of Shares which may be awarded to a Grantee under a Grant; the applicable periods, schedules, instalments, rules, regulations, terms and conditions for the vesting of Shares awarded to Grantees under a Grant (“Vesting Rules”); and such other related benefits and matters, and such other rules and regulations for the carrying out of the Plan, as may be deemed fit or appropriate by the Plan Committee (to the extent not inconsistent with the provisions of this Plan) (“Other Rules/Matters”). |

| 5.1 | There shall be no payment by a Grantee for Shares awarded under a Grant. |

| 6.1 | Any Grant and any Shares awarded thereunder (whether unvested or vested) shall be nontransferable by the Grantee, except in accordance with the provisions of Section 9 below. |

| 7.1 | If the outstanding Shares then subject to this Plan are changed into or exchanged for a different number or kind of shares or securities, as a result of one (1) or more reorganisations, recapitalisations, stock splits, reverse stock splits, stock dividends or the like, appropriate adjustments shall be made in the number and/or type of shares or securities for which Shares pursuant to Grants then outstanding under this Plan may thereafter be vested. |

| 8. | Vesting of Shares and forfeiture of unvested Shares |

| 8.1 | Shares under a Grant awarded pursuant to this Plan shall vest in the Grantee in accordance with the applicable Vesting Rules, subject however to the provisions of Section 8.2 below. |

| 8.2 | In the case of any Grant awarded hereunder: |

| (a) | if a Grantee ceases to be eligibly employed by any Global Sources Group entity or any Other Relevant Entity, for any reason whatsoever, other than because of “normal retirement” (as defined in Section 8.3 below) (in which case the provisions of this Section 8.2(a) shall apply), or death or disability (in which case, the provisions of Section 8.2(b) below shall apply), all rights and entitlement of the Grantee to the vesting of Shares which have been awarded pursuant to the Grant, but which have not yet vested at the date of the Grantee ceasing to be eligibly employed, shall automatically terminate and be forfeited, concurrently with such cessation of eligible employment; or |

| (b) | if the Grantee shall die, become disabled, or take normal retirement while eligibly employed by a Global Sources Group entity or Other Relevant Entity, or, in the case of death, the person or persons to whom the Grantee’s rights under the Grant shall have lawfully passed (whether by will, or by the applicable laws of succession or otherwise), shall retain the same rights of vesting, with respect to Shares already awarded pursuant to the Grant but not yet vested at the time of death, disablement or normal retirement (as the |

case may be), as would have been available if the Grantee had continued to be eligibly employed.

| 8.3 | For the purposes hereof, “normal retirement” shall mean retirement (from active employment or engagement) by the person eligibly employed: |

| (a) | on or after the normal retirement date specified in the applicable pension plan or other applicable retirement policy; or |

| (b) | if there is no such applicable pension plan or other applicable retirement policy, on or after such normal retirement age as may be prescribed by the Plan Committee (if and to the extent not in contravention of any minimum retirement age prescribed by the applicable law, if any, otherwise the minimum retirement age for the purposes of this subsection (b) shall be that prescribed by the applicable law instead); or |

| (c) | where, notwithstanding that such retirement occurred before the relevant date referred to in subsection (a) or (b) above, the Plan Committee considers (in its sole and absolute discretion) that such retirement shall be treated as a “normal retirement” for the purposes of this Section 8. |

| 9.1 | Upon award of a Grant, the Shares awarded to each Grantee under such Grant shall not vest in the Grantee, but: |

| (a) | shall be issued and allotted by the Company to the Trustee and held by the Trustee (as trustee of the Trust) and shall only be transferred by the Trustee to the Grantee in accordance with the Vesting Rules prescribed by the Plan Committee; or |

| (b) | shall only be issued and allotted by the Company directly to the Grantee in accordance with the Vesting Rules prescribed by the Plan Committee, subject however to the provisions of this Section 9 and any other applicable provisions of this Plan. |

| 9.2 | At the time when Shares (awarded pursuant to a Grant) are to vest in a Grantee pursuant to the Vesting Rules, the Grantee may direct the Trustee to transfer or the Company to issue and allot (as the case may be) such Shares to such person as the Grantee directs; provided that, in the event of the Grantee directing the Trustee to transfer or the Company to issue and allot (as the case may be) the Shares to someone other than the Grantee, the Grantee shall be responsible for (i) any and all compliance with applicable laws and regulations pertaining to such transfer or such issue and allotment (as the case may be) and the eligibility of such other person to accept such transfer or such issue and allotment (as the case may be) and to receive and hold the Shares; and (ii) any and all obligations, liabilities or taxes incurred as a consequence of, or arising from or in connection with, such direction and transfer or issue and allotment (as the case may be). |

| 9.3 | If a Grantee ceases to be eligibly employed by reason of death, disability or normal retirement, before Shares (awarded pursuant to a Grant) have vested in the Grantee pursuant to the Vesting Rules, then the Grantee (or the personal representative of the Grantee as the case may be) may direct the Trustee to transfer or the Company to issue and allot (as the case may be) to the Grantee (or the personal representative, as the case may be), or to such person as the Grantee (or the personal representative of the Grantee, as the case may be) directs, such Shares, at the time when such Shares are to vest pursuant to the Vesting Rules; provided that, in the event of the Grantee (or the personal representative of the Grantee, as the case may be) directing the Trustee to transfer or the Company to issue and allot (as the case may be) the Shares to someone other than the Grantee, the Grantee (or the personal representative of the Grantee, as the case may be) shall be responsible for (i) any and all compliance with applicable laws and regulations pertaining to such transfer or |

such issue and allotment (as the case may be) and the eligibility of such other person to accept such transfer or such issue and allotment (as the case may be) and to receive and hold the Shares; and (ii) any and all obligations, liabilities or taxes incurred as a consequence of, or arising from or in connection with, such direction and transfer or issue and allotment (as the case may be).

| 10.1 | This Plan shall commence on 1 January 2007 (“Commencement Date”) and shall expire on 31 December2017 2022(“Expiration Date”), unless terminated earlier in accordance with the provisions of this Plan. |

| 10.2 | No Grants may be awarded after the expiration or termination of this Plan. |

| 11.1 | This Plan shall be managed and administered by the Trustee, subject always to the directions of the Plan Committee as provided under the Trust Document. |

| 11.2 | The interpretation and construction by the Plan Committee of any of the provisions of this Plan or of any Grants awarded hereunder shall be final and binding upon Grantees and their respective successors, unless otherwise determined by the Company’s board of directors, in which case such determination of the Company’s board of directors shall be final and binding. |

| 11.3 | The Trustee, the Plan Committee, the Company’s board of directors and the Company shall not be liable for any action taken, or determination made, in good faith, in connection with this Plan. |

| 11.4 | The Plan Committee may, subject to the provisions of this Plan, issue a certificate or other form or forms of instruments (including but not limited to any addendum, supplementary, ancillary, secondary or subsidiary document(s) to this Plan) as the Plan Committee may (in its sole and absolute discretion) determine, for the purposes of documenting and/or evidencing Grants awarded under this Plan, and the Vesting Rules and any Other Rules/Matters pertaining thereto. |

| 11.5 | The Company or its board of directors may delegate any of its powers, rights, duties and/or responsibilities under this Plan to the Plan Committee, who may discharge the same with the authority and in the place and stead of the Company or its board of directors (as the case may be). |

| 12. | Government Regulations |

| 12.1 | The Trustee shall not transfer or the Company shall not issue and allot (as the case may be) any Shares under any Grant upon the vesting thereof, unless and until all applicable licences, permissions and authorisations required to be granted by the Government of Bermuda, or by any authority or agency thereof, if any, shall have been duly received. |

| 13.1 | All costs and expenses with respect to the adoption of this Plan and in connection with the registration of Shares shall be borne by the Company; provided, however, that (except as otherwise specifically provided in this Plan or in any agreement between the Company and a Grantee), the Company shall not be obliged to pay any costs or expenses (including but not limited to any legal fees) incurred by any Grantee in connection with any Grant or Shares held or transferred by any Grantee. |

| 14. | Amendment or Termination of the Plan |

| 14.1 | Subject to the provisions of Section 14.2 below, this Plan may be altered, amended, suspended or terminated by resolution of the Company’s board of directors (acting in their sole and absolute discretion); provided however that, except as otherwise provided in this Plan, no such action shall deprive any Grantee, without his or her consent, of any of his/her rights under a Grant already awarded pursuant to this Plan. |

| 14.2 | Save as herein provided, the Company’s board of directors shall not be entitled to take any action with respect to any of the following matters, except with the approval of a resolution of a majority of the shareholders of the Company in general meeting: |

| (a) | any extension of the Expiration Date of this Plan; or |

| (b) | any alteration of the class of persons eligible to be Grantees under this Plan. |

| 14.3 | For the avoidance of doubt, no amendment of this Plan shall increase the duties and/or responsibilities of the Trustee without its consent. |

| 15. | Limitation of Liability |

| 15.1 | No member of the Company’s board of directors or the Plan Committee, or any person authorised to act on their behalf, shall be personally liable for any action, determination or interpretation taken or made in good faith with respect to this Plan, and all members of the Company’s board of directors or the Plan Committee, and each and any person authorised to act on their behalf, shall, to the extent permitted by law, be fully indemnified and protected by the Company in respect of any such action, determination or interpretation. |

| 16. | Governing Law and Jurisdiction |

| 16.1 | This Plan shall be governed by and interpreted and construed in accordance with the laws of Bermuda; and the Company, the Trustee, the Plan Committee (and its members), and each Grantee, hereby irrevocably submits to the jurisdiction of the courts of Bermuda. |

[This page intentionally left blank.]

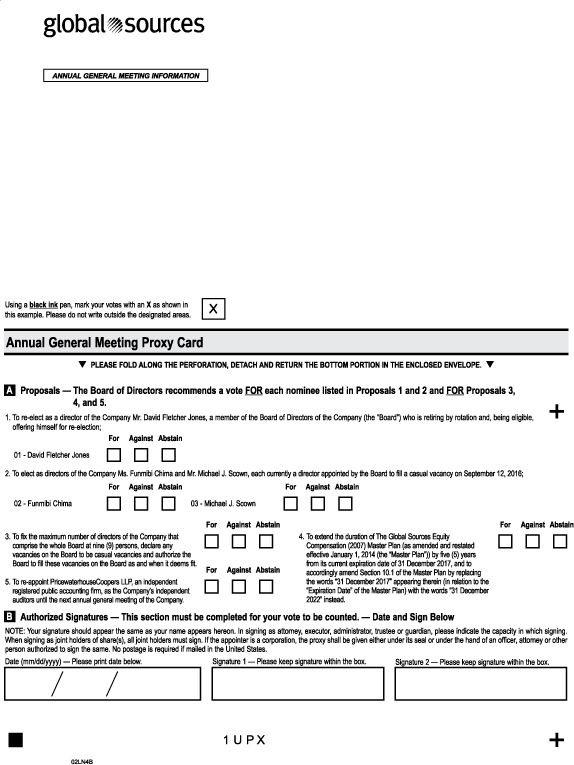

For Against Abstain ANNUAL GENERAL MEETING INFORMATION Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. X 02LN4B 1 U PX + q PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Annual General Meeting Proxy Card . + A Proposals — The Board of Directors recommends a vote FOR each nominee listed in Proposals 1 and 2 and FOR Proposals 3, 4, and 5. 1. To re-elect as a director of the Company Mr. David Fletcher Jones, a member of the Board of Directors of the Company (the “Board”) who is retiring by rotation and, being eligible, offering himself for re-election; 2. To elect as directors of the Company Ms. Funmibi Chima and Mr. Michael J. Scown, each currently a director appointed by the Board to fill a casual vacancy on September 12, 2016; B Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below NOTE: Your signature should appear the same as your name appears hereon. In signing as attorney, executor, administrator, trustee or guardian, please indicate the capacity in which signing. When signing as joint holders of share(s), all joint holders must sign. If the appointer is a corporation, the proxy shall be given either under its seal or under the hand of an officer, attorney or other person authorized to sign the same. No postage is required if mailed in the United States. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. 3. To fix the maximum number of directors of the Company that comprise the whole Board at nine (9) persons, declare any vacancies on the Board to be casual vacancies and authorize the Board to fill these vacancies on the Board as and when it deems fit. 5. To re-appoint PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company’s independent auditors until the next annual general meeting of the Company. For Against Abstain 4. To extend the duration of The Global Sources Equity Compensation (2007) Master Plan (as amended and restated effective January 1, 2014 (the “Master Plan”)) by five (5) years from its current expiration date of 31 December 2017, and to accordingly amend Section 10.1 of the Master Plan by replacing the words “31 December 2017” appearing therein (in relation to the “Expiration Date” of the Master Plan) with the words “31 December 2022” instead. 01 - David Fletcher Jones 02 - Funmibi Chima 03 - Michael J. Scown For Against Abstain For Against Abstain For Against Abstain For Against Abstain

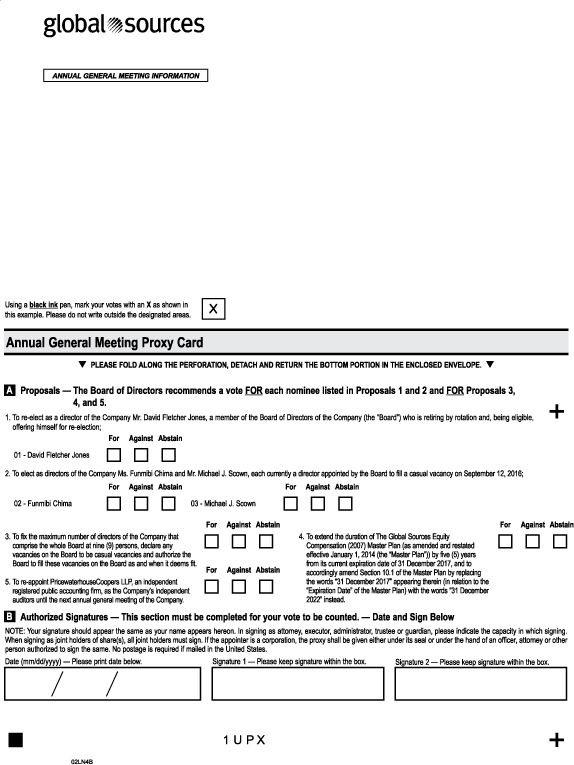

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Proxy for Annual General Meeting of Shareholders – June 23, 2017 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS KNOW ALL MEN BY THESE PRESENTS, that the undersigned shareholder of Global Sources Ltd., an exempted company incorporated in Bermuda (the “Company”), does hereby constitute and appoint Merle Allan Hinrich, Sim Shih Lieh Adrian and Chan Hoi Ching and each of them, with full power to act alone and to designate substitutes, the true and lawful attorneys and proxies of the undersigned for and in the name, place and stead of the undersigned, to vote all Common Shares of the Company which the undersigned would be entitled to vote if personally present at the 2017 Annual General Meeting of Shareholders of the Company to be held at the Board Room, 26th Floor, Tower B, Southmark, 11 Yip Hing Street, Wong Chuk Hang, Hong Kong Special Administrative Region of the People’s Republic of China, on June 23, 2017 at 11:00 a.m., local time, and at any adjournment or postponement thereof. The undersigned hereby revokes any proxy or proxies heretofore given and acknowledges receipt of a copy of the Notice of Annual General Meeting and Proxy Statement, both dated May 19, 2017, and a copy of the Company’s audited financial statements for the fiscal year ended December 31, 2016. PROXY WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. UNLESS OTHERWISE SPECIFIED, THIS PROXY WILL BE VOTED FOR EACH NOMINEE LISTED IN ITEMS 1 AND 2 AND FOR ITEMS 3, 4, AND 5. (To Be Dated And Signed On Reverse Side) . Proxy - GLOBAL SOURCES LTD. C Non-Voting Items Meeting Attendance Mark box to the right if you plan to attend the Annual General Meeting. Change of Address — Please print new address below. + + IF VOTING BY MAIL, YOU MUST COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.