of the 2000 Long-Term Incentive Plan, and to all regular management employees of the Company pursuant to the terms of the 2000 Long-Term Incentive Plan or the 2005 Long-Term Incentive Plan, based on remaining shares authorized for grant under the 2000 Long-Term Incentive Plan. The Committee also authorized a grant of performance-based restricted stock units to members of the Executive Team, including the Named Executive Officers, on that same date pursuant to the terms of the 2000 Long-Term Incentive Plan. In determining the October 2006 grant of both stock options and restricted stock units, the Committee used the same criteria to determine the allocation of the available shares amongst all eligible employees as it had with respect to the October 2005 grant of stock options and restricted stock units. The design of the performance-based restricted stock unit awards granted to executives on October 26, 2006 is essentially the same as for those granted in October 2005, except that the designated performance period is September 1, 2006-August 31, 2008 and the designated service period is September 1, 2006-August 31, 2009 and the number of restricted stock units granted was determined by dividing the grant value by the fair market value on the grant date. Further, the grant date was moved from the last Friday of October to the last Thursday of the month for administrative reasons.

Before giving final approval to the equity grants described above, the Committee also reviewed the projected effect of the new grants and outstanding grants from prior years on the Company’s income.

The Committee and its consultant reviewed its grant date practices for stock options, restricted stock unit and other equity awards and determined that current practice is aligned with best practice guidelines. Grants of equity awards are never back-dated: the grant date of annual and other grants is always on or after the date the Committee or its delegate approves the grants.

restricted stock approved by the restricted stock committee are reported to the full board at the following meeting. Equity grants must be within the overall maximum number of shares approved by the Committee. The number of shares approved took into consideration competitive grant practices and the impact on the Company’s earnings per share. Grants to executive officers can only be made by the Committee and are not delegated to management.

Impact of Pay on Retirement Benefits.Base pay and regular annual incentive awards, but not long-term compensation, are treated as eligible pay under the terms of the Company’s pension and savings plans. The Company sponsors tax-qualified pension and savings plans, as well as non-qualified “parity” pension and savings plans providing benefits to all employees whose benefits under the tax-qualified plans are limited by the Code. With the exception of Mr. Burson who was awarded a Supplemental Executive Retirement Plan when he was hired, the Company does not provide its executives with any special retirement benefits that are not provided to other employees. The Company’s total accrued liabilities for all of its U.S. non-qualified pension and savings plans (including Mr. Burson’s special arrangement) is equal to approximately 3.3% percent of its total accrued liabilities for U.S. qualified and non-qualified pension and savings plan benefits.

Chief Executive Officer Compensation

The Committee meets no less than annually in executive session to evaluate the performance of the Chief Executive Officer and to determine his compensation. The Committee has complete discretion each year in determining whether Mr. Grant’s base pay should be adjusted, and in establishing his target opportunity under the annual incentive plan, the targeted value of his long-term incentive plan opportunity, and his actual incentive awards under both plans. All equity awards and grant prices have been adjusted to reflect the Company’s two-for-one stock split that was paid on July 28, 2006.

On October 24, 2005, after reviewing Mr. Grant’s performance and relevant market data, the Committee determined to increase his total annualized base pay from $1,050,000 to $1,100,000, effective as of January 1, 2006. Also on October 24, 2005, the Committee determined that Mr. Grant’s annual incentive opportunity for the fiscal year 2006 performance period would remain at the same level as for fiscal year 2005, with target-level performance at 100% of year-end base pay. On October 28, 2005, Mr. Grant received a grant of 336,920 stock options at a grant price of $29.2175 under the 2000 Long-Term Incentive Plan, upon the same terms and conditions approved by the Committee for all management-level employees. Mr. Grant also received a grant of 37,440 performance-based restricted stock units at a grant price of $29.2175 under the plan, upon the same terms and conditions approved by the Committee for other executive officers. Under the terms of this grant, depending on Company performance during fiscal years 2006 and 2007, between zero and 74,880 units will become available for vesting. Any available units will vest if he meets the additional service requirement described above. Upon settlement of the units, Mr. Grant will receive a corresponding number of shares of our stock.

On August 31, 2006, 68,640 restricted stock units from Mr. Grant’s February 2004 grant vested as a result of his completion of the requisite service period. These units had become available for this vesting as a result of the Committee’s determination, in October 2005, that the Company’s earnings per share and cash flow for fiscal years 2004 and 2005 had met the performance goals for the units at the outstanding level. These units in accordance with a prior election were deferred until retirement.

On October 23, 2006, the Committee again met in executive session to review Mr. Grant’s performance and compensation. The Committee considered Mr. Grant’s strong leadership and the Company’s financial performance, and, after reviewing relevant market data, the Committee determined to increase his total annualized base pay to $1,144,000, effective as of January 1, 2007. Also on October 23, 2006, the Committee reconfirmed Mr. Grant’s annual incentive opportunity at target-level performance to remain at 100% of fiscal year-end base pay for the 2007 fiscal year performance period. The Committee also evaluated Mr. Grant’s performance against corporate goals and objectives and in recognition of the attainment of the results, determined to pay him a bonus under the Fiscal Year 2006 Annual Incentive Plan in the amount of $1,958,000, or 178% of his target award, which was paid in November 2006. On October 26, 2006, Mr. Grant received a grant of 248,960 stock options at a grant price of $44.06 also upon the same terms and conditions approved

34

by the Committee for all management level employees, and 33,200 performance-based restricted stock units at a grant price of $44.06, also upon the same terms and conditions as approved by the Committee for other members.

Also on October 23, 2006, after evaluating the Company’s performance with respect to the financial goals of the performance-based restricted stock unit award made to Mr. Grant in October 2004, the Committee determined that based on Company performance, 100,160 units, or 200% of his target award, would be made available for vesting after the additional service requirement of the award has been met. If Mr. Grant meets the additional service requirement, he will receive a corresponding number of shares of stock upon settlement of his units, as described above.

Compensation for the Other Named Executive Officers

The cash bonus awards to the other Named Executive Officers were generally based upon the same factors as determined the funding of the incentive pool under the terms of the Annual Incentive Plan for the fiscal year 2006 performance period (paid in November 2006) based on both Company and individual performance. The Committee has complete discretion each year in determining base pay adjustments, Annual Incentive Plan targets, actual Annual Incentive Plan awards, as well as long-term incentive values granted.

The individual performance considerations for each of the Named Executive Officers which impacted the Committee’s determination with regards to each officer’s annual incentive award are highlighted below:

| | Mr. Burson: | | Positive progress on litigation and intellectual property matters |

| Mr. Casale: | | Market share and profitability growth in the U.S., Latin America North and Canada |

| Mr. Crews: | | Overall financial management resulting in improved bond ratings and financial capability |

| Dr. Fraley: | | Creation of outstanding product pipeline moving forward at or ahead of schedule |

On October 28, 2005, the four named executive officers listed above received grants of stock options at a grant price of $29.2175 under the 2000 Long-Term Incentive Plan, upon the same terms and conditions approved by the Committee for stock option grants to all management-level employees on that date. Also on October 28, 2005, each of these four executive officers also received a grant of performance-based restricted stock units, upon the same terms and conditions approved by the Committee for restricted stock unit grants to other members of the Executive Team on that date. Similarly, on October 26, 2006, Messrs. Casale and Crews and Dr. Fraley received grants of stock options at a grant price of $44.06 under the 2000 Long-Term Incentive Plan upon the same terms and conditions approved by the Committee for stock option grants to all management-level employees on that date. Also on October 26, 2006, each of these three executive officers also received a grant of performance-based restricted stock units, upon the same terms and conditions as approved by the Committee for restricted stock unit grants to other members of the Executive Team on that date. Mr. Burson will retire from the Company on December 31, 2006 and thus did not receive a grant of stock options or restricted stock units with respect to fiscal year 2007.

On October 23, 2006, after evaluating the Company’s outstanding performance with respect to the financial goals of the performance-based restricted stock unit awards granted to each of the four named executive officers listed above and members of the Executive Team in October 2004, the Committee determined that 200% of each officer’s target-level award would be made available for vesting after his or her additional service requirement has been met. If the executive officer meets the additional service requirement, he or she will receive a corresponding number of shares of stock upon settlement of the units.

Change-of-Control Employment Agreements

As described at page 24, the Company has entered into employment agreements with certain executives that become effective upon a change of control of the Company, providing for specified severance pay and benefits for a fixed period of time upon certain terminations of employment after the change of control. The Committee reviews the continued suitability of the agreements and eligibility with respect to the agreements at least annually. The Committee believes that the agreements serve the interests of the Company and its shareowners by ensuring that if a hostile or friendly change of control is ever under consideration, its executives will be able

35

to advise the board of directors about the potential transaction in the best interests of shareowners, without being unduly influenced by personal considerations, such as fear of the economic consequences of losing their jobs as a result of a change of control.

Role of Executive Officers in Determining Executive Pay

The Company’s Internal People Committee makes a recommendation to the Committee with regards to the Company’s overall pay strategy each year (e.g., overall program design, annual incentive plan design, long-term incentive plan design for management employees). Mr. Grant makes individual pay recommendations for the executive officers to the Committee for its review, consideration and determination. Other members of senior management provide market information to the Committee with regards to Mr. Grant’s and other executive officers’ total compensation. Executives do not recommend or determine any element or component of their own pay package or total compensation amount.

Deductibility of Compensation

The goal of the Committee is to comply with the requirements of Code Section 162(m), to the extent deemed practicable, with respect to options and annual and long-term incentive programs in order to avoid losing the deduction for compensation in excess of $1 million paid to our chief executive officer and four other highest-paid executive officers. We have generally structured our performance-based compensation plans with the objective that amounts paid under those plans and arrangements are tax deductible, including having the plans approved by the Company’s shareowners. However, the Committee may elect to provide compensation outside those requirements when it deems appropriate to achieve its compensation objectives. No exceptions were made to this policy in our 2006 fiscal year other than with respect to the Chief Executive Officer’s annual base pay in excess of $1 million.

Executive and Director Stock Ownership Requirements

The Committee and management also believe that an important adjunct to an incentive program is significant stock ownership by senior executives. Accordingly, the Company has stock ownership requirements for approximately 40 executives, in addition to our non-employee directors. The stock ownership requirements are five times base salary for the Company’s chief executive officer, three times base salary for the eleven other senior executives comprising the Executive Team and one times base salary for the remaining covered executives. In anticipation of the Company’s two-for-one stock split that was paid on July 28, 2006, each covered executive’s ownership requirement was recalibrated based upon the fair market value of a share of the Company’s stock on June 27, 2006 and the executive’s base pay on that date, and each non-employee director’s requirement was set at 5,000 pre-split shares. The requirements were subsequently adjusted for the stock split, effective on July 28, 2006, such that the ownership requirement for non-employee directors is now set at 10,000 post-split shares.

The following are not counted towards satisfaction of the ownership requirements: stock options, whether vested or unvested; restricted shares, other than those granted upon an executive first being hired by the Company; and performance-based restricted stock units before the Company’s performance against goals has been determined by the Committee. Until a covered executive or director has met his or her stock ownership requirement, he or she must retain 50% or 75% (depending on the executive’s existing ownership) of the net-after tax number of shares of Company stock received upon of exercise of a stock option, vesting of restricted stock or settlement of restricted stock units or other equity-based award granted under the Company’s long-term incentive plans, determined by assuming that taxes are paid at the highest marginal rate upon such exercise, vesting or settlement.

The Committee reviews progress towards meeting the ownership requirements at least annually. As of the date of this letter, each of the Named Executive Officers and each director, other than Mr. Harper who was first elected to the board of directors on October 24, 2006, has met his or her stock ownership requirements through holdings of shares of Company stock or share equivalents beneficially owned or, for executives, owned under the Company’s savings and investment plans.

36

Summary

We believe the Company’s compensation programs are designed and administered in a manner consistent with its executive compensation philosophy and guiding principles. The programs continue to emphasize the retention of key executives and rewarding them appropriately for positive results. We continually monitor these programs in recognition of the dynamic marketplace in which the Company competes for talent. The Company will continue to emphasize pay-for-performance and equity-based incentive programs that reward executives for results that are consistent with shareowner interests.

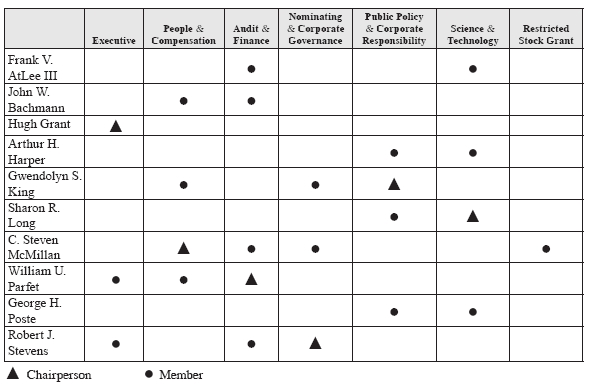

| PEOPLE AND COMPENSATION COMMITTEE |

| C. Steven McMillan,Chair |

| John W. Bachmann |

| Gwendolyn S. King |

| William U. Parfet |

| |

| November 16, 2006 |

Report of the Audit and Finance Committee

The Company’s audit and finance committee operates pursuant to a charter adopted and amended from time to time by the Company’s board of directors. We have numerous oversight responsibilities beyond those related to the audited financial statements and the retention and oversight of the Company’s independent registered public accounting firm. One of the requirements contained in the audit and finance committee charter is that all committee members meet the independence and experience requirements of the listing standards of the NYSE. The board of directors believes that all members of the audit and finance committee meet these requirements and are “independent,” as that term is used in Schedule 14A, Item 7(d)(3)(iv) under the 1934 Act. In addition, under the audit and finance committee’s charter, no director may serve as a member of the audit and finance committee if he or she serves on the audit committees of more than two other public companies unless the board of directors determines that such simultaneous service would not impair his or her ability to serve effectively on the audit and finance committee. Please see the audit and finance committee’s charter, which is attached as Appendix B hereto, for a description of requirements for its members and its responsibilities.

In reliance on the reviews and discussions referred to below, and exercising our business judgment, the audit and finance committee has recommended to the board of directors (and the board of directors has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2006, for filing with the SEC. In fulfilling our responsibilities, the audit and finance committee, among other things, has reviewed and discussed the audited financial statements contained in the 2006 Form 10-K with the Company’s management and its independent registered public accounting firm.

Management, which is responsible for the financial statements and the reporting process, including the system of internal control, has advised the audit and finance committee that all financial statements were prepared in accordance with accounting principles generally accepted in the United States. Further, the independent registered public accounting firm, which is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, has opined to the shareowners that the audited financial statements conform with such accounting principles. In addition, the audit and finance committee discussed with the independent registered public accounting firm the matters required to be discussed by: Statement on Auditing Standards, AU Section 380 (SAS No. 61), Communication with Audit Committees, as amended; Statement on Auditing Standards, AU Section 722 (SAS 100), Interim Financial Information; and Rule 2-07 of Regulation S-X, Communication with Audit Committees; as well as the auditor’s independence from the Company and its management, including the matters in the written disclosures and letter required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees.

37

Members of the audit and finance committee rely, without independent verification, on the information and representations provided to them by management and on the representations made to them by the independent registered public accounting firm. Accordingly, the oversight provided by the audit and finance committee should not be considered as providing an independent basis for determining that management has established and maintained appropriate internal control over financial reporting, that the financial statements have been prepared in accordance with accounting principles generally accepted in the United States, or that the audit of the Company’s financial statements by the independent registered public accounting firm has been carried out in accordance with auditing standards generally accepted in the United States.

For a detailed listing of the fees billed to the Company by its independent registered public accounting firm, Deloitte and Touche LLP for fiscal years 2005 and 2006, see “Ratification of Independent Registered Public Accounting Firm (Proxy Item No. 2)” at page 13.

| AUDIT AND FINANCE COMMITTEE |

| William U. Parfet,Chair |

| John W. Bachmann |

| C. Steven McMillan |

| Robert J. Stevens |

| |

| October 23, 2006 |

38

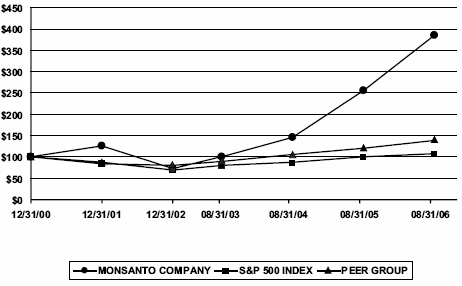

Stock Price Performance Graph

The graph below compares the performance of the Company’s common stock with the performance of the Standard & Poor’s 500 Stock Index (a broad-based market index) and a peer group index over a 68-month period extending through the end of the 2006 fiscal year. In July 2003, we changed from a calendar year end to a fiscal year ending August 31. The Company therefore had an eight-month transition period from January 1, 2003 through August 31, 2003. The measurement periods shown in the performance graph below correspond to our calendar year ends prior to our change in fiscal year, our transition period that ended on August 31, 2003, and our subsequent August 31 fiscal year ends. The graph assumes that $100 was invested on January 1, 2001, in our common stock, the Standard & Poor’s 500 Stock Index and the peer group index, and that all dividends were reinvested.

Because we are involved in the agricultural products and seeds and genomics businesses, no published peer group accurately mirrors our portfolio of businesses. Accordingly, we created a peer group index that includes Bayer AG ADR, Dow Chemical Company, DuPont (E.I.) de Nemours and Company, BASF AG and Syngenta AG. The Standard & Poor’s 500 Stock Index and the peer group index are included for comparative purposes only and do not necessarily reflect management’s opinion that such indices are an appropriate measure of the relative performance of the stock involved, and are not intended to forecast or be indicative of possible future performance of our common stock.

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

| | 12/31/00 | 12/31/01 | 12/31/02 | 08/31/03 | 08/31/04 | 08/31/05 | 08/31/06 |

| MONSANTO COMPANY | 100 | 126.65 | | 73.78 | | 100.46 | | 145.48 | | 256.81 | | 385.42 | |

| S&P 500 INDEX | 100 | 88.11 | | 68.64 | | 79.59 | | 88.71 | | 99.84 | | 108.71 | |

| PEER GROUP | 100 | 84.15 | | 79.65 | | 90.18 | | 105.47 | | 121.44 | | 138.66 | |

In accordance with the rules of the SEC, the information contained in the Report of the People and Compensation Committee on Executive Compensation beginning on page 25, the Report of the Audit and Finance Committee beginning on page 37 and the Stock Price Performance Graph on this page, shall not be deemed to be “soliciting material,” or to be “filed” with the SEC or subject to the SEC’s Regulation 14A, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

39

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires all Company executive officers, directors, and persons owning more than 10% of any registered class of our capital stock to file reports of ownership and changes in ownership with the SEC. Based solely on the reports received by us and on written representations from reporting persons, we believe that all such persons complied with all applicable filing requirements during our 2006 fiscal year, except Robert A. Paley, one of our executive officers, filed an amended Form 3 reporting an additional securities holding.

General Information

Shareowner Proposals

Proposals Included in Proxy Statement

Proposals of shareowners of the Company that are intended to be presented by such shareowners at the Company’s 2008 annual meeting and that shareowners desire to have included in the Company’s proxy materials relating to such meeting must be received by the Company at its principal executive offices no later than 5:00 p.m., Central Time, August 8, 2007, which is 120 calendar days prior to the anniversary of this year’s mailing date. The proposal, including any accompanying supporting statement, may not exceed 500 words. Upon timely receipt of any such proposal, the Company will determine whether or not to include such proposal in the proxy statement and proxy in accordance with applicable regulations governing the solicitation of proxies.

Proposals Not Included in the Proxy Statement

If a shareowner wishes to present a proposal at the Company’s annual meeting in the year 2008 or to nominate one or more directors and the proposal is not intended to be included in the Company’s proxy statement relating to that meeting, the shareowner must give advance written notice to the Company prior to the deadline for such meeting determined in accordance with the Company’s bylaws. In general, the Company’s bylaws provide that such notice should be addressed to the Secretary and be received at the Company’s Creve Coeur Campus no less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting. For purposes of the Company’s 2008 annual meeting, such notice must be received not later than October 19, 2007 and not earlier than September 19, 2007. These time limits also apply in determining whether notice is timely for purposes of rules adopted by the SEC relating to the exercise of discretionary voting authority. The Company’s bylaws set out specific requirements that such written notices must satisfy. Any shareowner filing a written notice of nomination for director must describe various matters regarding the nominee and the shareowner, including such information as name, address, occupation and shares held. Any shareowner filing a notice to bring other business before a shareowner meeting must include in such notice, among other things, the text of the proposal or business and the reasons therefore, and other specified matters. Copies of those requirements will be forwarded to any shareowner upon written request.

Other Information

The board of directors knows of no matter, other than those referred to in this proxy statement, which will be presented at the meeting. However, if any other matters, including a shareowner proposal excluded from this proxy statement pursuant to the rules of the SEC, properly come before the meeting or any of its adjournments, the person or persons voting the proxies will vote in accordance with their best judgment on such matters. Should any nominee for director be unable to serve or for good cause will not serve at the time of the meeting or any adjournments thereof, the persons named in the proxy will vote for the election of such other person for such directorship as the board of directors may recommend, unless, prior to the meeting, the board has eliminated that directorship by reducing the size of the board. The board is not aware that any nominee herein will be unable to serve or for good cause will not serve as a director.

The Company will bear the expense of preparing, printing and mailing this proxy material, as well as the cost of any required solicitation. Directors, officers or employees of the Company may solicit proxies on behalf of the Company. We have engaged Morrow & Co., Inc. to assist us in the solicitation of proxies. We expect to

40

pay Morrow approximately $10,000 for these services plus expenses. In addition, the Company will reimburse banks, brokerage firms, and other custodians, nominees and fiduciaries for reasonable expenses incurred in forwarding proxy materials to beneficial owners of the Company’s stock and obtaining their proxies.

You are urged to vote promptly by marking, signing, dating, and returning your proxy card or by voting by telephone or over the Internet. You may revoke your proxy at any time before it is voted; and if you attend the meeting, as we hope you will, you may vote your shares in person.

| By Order of the Board of Directors, |

| MONSANTO COMPANY |

|  |

| DAVID F. SNIVELY |

| Secretary

|

| December 6, 2006 |

41

APPENDIX A

| INFORMATION REGARDING OUR FORMATION |

Prior to Sept. 1, 1997, a corporation that was then known as Monsanto Company (Former Monsanto) operated an agricultural products business (the Ag Business), pharmaceuticals and nutrition business (the Pharmaceuticals Business) and a chemical products business (the Chemicals Business). Former Monsanto is today known as Pharmacia. Pharmacia is now a wholly owned subsidiary of Pfizer Inc., which together with its subsidiaries operates the Pharmaceuticals Business. Our business consists of the operations, assets and liabilities that were previously the Ag Business. Solutia comprises the operations, assets and liabilities that were previously the Chemicals Business. The following table sets forth a chronology of events that resulted in the formation of Monsanto, Pharmacia and Solutia as three separate and distinct corporations. For more information regarding the relationships between Monsanto, Pharmacia, Pfizer and Solutia, please see our annual report on Form 10-K and quarterly reports on Form 10-Q, which are available on our website at http://www.monsanto.com.

| Date of Event | Description of Event |

| Sept. 1, 1997 | l Pharmacia (then known as Monsanto Company) entered into a Distribution Agreement with Solutia related to the transfer of the operations, assets and liabilities of the Chemical Business from Pharmacia (then known as Monsanto Company) to Solutia. l Pursuant to the Distribution Agreement, Solutia assumed and agreed to indemnify Pharmacia (then known as Monsanto Company) for certain liabilities related to the Chemicals Business. |

|

|

|

|

| Dec. 19, 1999 | l Pharmacia (then known as Monsanto Company) entered into an agreement with Pharmacia & Upjohn, Inc. (PNU) relating to a merger (the Merger). |

|

| Feb. 9, 2000 | l We were incorporated in Delaware as a wholly owned subsidiary of Pharmacia (then known as Monsanto Company) under the name “Monsanto Ag Company.” |

|

| March 31, 2000 | l Effective date of the Merger.

l In connection with the Merger, (1) PNU became a wholly owned subsidiary of Pharmacia (then known as Monsanto Company); (2) Pharmacia (then known as Monsanto Company) changed its name from “Monsanto Company” to “Pharmacia Corporation”; and (3) we changed our name from “Monsanto Ag Company” to “Monsanto Company.” |

|

|

|

|

|

| Sept. 1, 2000 | l We entered into a Separation Agreement with Pharmacia related to the transfer of the operations, assets and liabilities of the Ag Business from Pharmacia to us.

l Pursuant to the Separation Agreement, we were required to indemnify Pharmacia for any liabilities primarily related to the Ag Business or the Chemicals Business, and for liabilities assumed by Solutia pursuant to the Sept. 1, 1997 Distribution Agreement, to the extent that Solutia fails to pay, perform or discharge those liabilities. |

|

|

|

|

|

| Oct. 23, 2000 | l We completed an initial public offering in which we sold approximately 15 percent of the shares of our common stock to the public. Pharmacia continued to own 440 million (split-adjusted) shares of our common stock. |

|

|

| July 1, 2002 | l Pharmacia, Solutia and we amended the Sept. 1, 1997, Distribution Agreement to provide that Solutia will indemnify us for the same liabilities for which it had agreed to indemnify Pharmacia and to clarify the parties’ rights and obligations.

l Pharmacia and we amended the Sept. 1, 2000 Separation Agreement to clarify our respective rights and obligations relating to our indemnification obligations. |

|

|

|

|

| Aug. 13, 2002 | l Pharmacia distributed the 440 million (split-adjusted) shares of our common stock that it owned to its shareowners via a tax-free stock dividend (the Monsanto Spinoff).

l As a result of the Monsanto Spinoff, Pharmacia no longer owns any equity interest in Monsanto. |

|

|

|

| April 16, 2003 | l Pursuant to a merger transaction, Pharmacia became a wholly owned subsidiary of Pfizer. |

A-1

APPENDIX B

| AUDIT AND FINANCE COMMITTEE CHARTER |

Purpose

The Audit and Finance Committee is appointed by the Board to assist the Board in the oversight of (1) the integrity of the financial statements of the Company, (2) the independent auditor’s qualifications and independence, (3) the performance of the Company’s internal audit function and the independent auditors, and (4) the compliance by the Company with legal and regulatory requirements.

The Audit and Finance Committee shall prepare the report required by the rules of the Securities and Exchange Commission (the “Commission”) to be included in the Company’s annual proxy statement.

Committee Membership

The Audit and Finance Committee shall consist of three or more members of the Board. The members of the Audit and Finance Committee shall meet the independence and experience requirements of the New York Stock Exchange, Section 10A(m)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and regulations of the Commission. No director may serve as a member of the Audit and Finance Committee if such director serves on the audit committees of more than two other public companies unless the Board determines that such simultaneous service would not impair such director’s ability to serve effectively on the Audit and Finance Committee.

The members of the Audit and Finance Committee shall be appointed by the Board on the recommendation of the Nominating and Corporate Governance Committee. Members shall serve at the pleasure of the Board and for such term or terms as the Board may determine.

Committee Authority and Responsibilities

The Audit and Finance Committee shall have the sole authority to appoint or replace the independent auditor (subject, if applicable, to shareholder ratification), and shall approve all audit engagements and the fees and terms thereof and all non-audit engagements with the independent auditors subject tode minimus exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act that are approved by the Audit and Finance Committee prior to the completion of the audit. The Audit and Finance Committee may consult with management but shall not delegate these responsibilities to management. The independent auditor shall report directly to the Audit and Finance Committee.

The Audit and Finance Committee shall be directly responsible for the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work.

The Audit and Finance Committee may delegate to a member of the committee the authority to approve audit engagements and permitted non-audit engagements with the independent auditors. If any such authority is delegated, any decisions to pre-approve any activity shall be presented to the full Audit and Finance Committee at its next meeting.

The Audit and Finance Committee shall meet as often as it determines, but not less frequently than quarterly. The Audit and Finance Committee may form and delegate authority to subcommittees when appropriate.

The Audit and Finance Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Company shall provide for appropriate funding, as determined by the Audit and Finance Committee, for payment of compensation to the independent auditor for the purpose of rendering or issuing an audit report and to any advisors employed by the Audit and Finance Committee. The Audit and Finance Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. The Audit and Finance Committee shall

B-1

meet with management, the internal auditors and the independent auditor in separate executive sessions at least quarterly. The Audit and Finance Committee may also, to the extent it deems necessary or appropriate, meet with the Company’s investment bankers or with financial analysts who follow the Company.

The Audit and Finance Committee shall make regular reports to the Board with respect to its activities, including any issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance and independence of the Company’s independent auditors or the performance of the internal audit function.

The Audit and Finance Committee shall produce and provide to the Board of Directors an annual performance evaluation of the Committee, which evaluation shall compare the performance of the Audit and Finance Committee with the requirements of this Charter. The performance evaluation shall also encompass a review and reassessment of the adequacy of this Charter, and the Audit and Finance Committee shall recommend to the Board of Directors any improvements to this Charter deemed necessary or desirable by the Audit and Finance Committee. The performance evaluation by the Audit and Finance Committee shall be conducted in such manner as the Committee deems appropriate. The report to the Board of Directors may take the form of an oral report by the Chairperson of the Audit and Finance Committee or any other member of the Audit and Finance Committee designated by the Committee to make this report.

The Audit and Finance Committee, to the extent it deems necessary or appropriate, shall:

Financial Statement and Disclosure Matters

| | 1. | | Review and discuss with management and the independent auditor the annual audited financial statements,including specific disclosures made in management’s discussion and analysis, and recommend to theBoard whether the audited financial statements should be included in the Company’s Form 10-K. |

|

|

| |

| 2. | | Review and discuss with management and the independent auditor the Company’s Form 10-Q, includingthe quarterly financial statements, prior to the filing of its Form 10-Q, including the results of theindependent auditor’s reviews of the quarterly financial statements. |

|

|

| |

| 3. | | Review and discuss with management and the independent auditor (a) analyses prepared by managementand/or the independent auditor setting forth significant financial reporting issues and judgments madein connection with the preparation of the Company’s financial statements, including the development,selection and disclosure of critical accounting estimates and analyses of the effects of alternative GAAPmethods on the financial statements, and (b) major issues regarding accounting principles and financialstatement presentations, including any significant changes in the Company’s selection or application ofaccounting principles, and any major issues as to the adequacy of the Company’s internal controls and anyspecial steps adopted in light of material control deficiencies. |

|

|

|

|

|

|

|

| |

| 4. | | Review and discuss quarterly reports from the independent auditors on: |

| |

| | | (a) | | All critical accounting policies and practices to be used. |

| |

| | | (b) | | All alternative treatments of financial information within generally accepted accounting principlesthat have been discussed with management, ramifications of the use of such alternative disclosuresand treatments, and the treatment preferred by the independent auditor. |

|

|

| |

| 5. | | Discuss with management the Company’s earnings press releases, including the use of “pro forma” or“adjusted” non-GAAP information, as well as financial information and earnings guidance provided toanalysts and rating agencies. Such discussion may be done generally (consisting of discussing the types ofinformation to be disclosed and the types of presentations to be made). |

|

|

|

| |

| 6. | | Discuss with management and the independent auditor the effect of regulatory and accounting initiativesas well as off-balance sheet structures on the Company’s financial statements. |

|

| |

| 7. | | Discuss with management the Company’s major financial risk exposures and the steps managementhas taken to monitor and control such exposures, including the Company’s risk assessment and riskmanagement policies. |

|

|

B-2

| | 8. | | Discuss with the independent auditor any matters that the independent auditor is required to discuss withthe Audit and Finance Committee pursuant to professional and regulatory requirements related to theconduct of an audit. In particular, discuss: |

|

|

| |

| | | (a) | | The adoption of, or changes to, the Company’s significant auditing and accounting principles andpractices as suggested by the independent auditor, internal auditors or management. |

|

| |

| | | (b) | | The management letter provided by the independent auditor and the Company’s response to that letter,as well as other material written communications between the independent auditor and management,such as any schedule of unadjusted differences. |

|

|

| |

| | | (c) | | Any difficulties encountered in the course of the audit work, including any restrictions on the scope ofactivities or access to requested information, and any significant disagreements with management. |

|

| |

| 9. | | Review disclosures made to the Audit and Finance Committee by the Company’s Chief Executive Officerand Chief Financial Officer during their certification process for the Form 10-K and Form 10-Q about anysignificant deficiencies in the design or operation of internal controls or material weaknesses therein andany fraud involving management or other employees who have a significant role in the Company’s internalcontrols. |

|

|

|

|

Oversight of the Company’s Relationship with the Independent Auditor

| | 10. | | Review the experience and qualifications of the senior members of the independent auditor team. |

| |

| 11. | | Obtain and review a report from the independent auditor at least annually regarding (a) the independent auditor’s internal quality-control procedures, (b) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and (d) all relationships between the independent auditor and the Company. Evaluate the qualifications, performance and independence of the independent auditor, including reviewing and evaluating the lead audit partner of the independent auditor and considering whether the auditor’s quality controls are adequate and the provision of permitted non-audit services is compatible with maintaining the auditor’s independence, and taking into account the opinions of management and the internal auditor. The Audit and Finance Committee shall present its conclusions with respect to the independent auditor to the Board and, if so determined by the Audit and Finance Committee, recommend that the Board take additional action to satisfy itself of the qualifications, performance and independence of the auditor. |

| |

| 12. | | In the event the independent auditor notifies the Company that it is the subject of any inquiry or investigation by governmental or professional authorities, or that an audit of the Company has been selected for review by the PCAOB, discuss with the independent auditor and management any issues that arise as a result of that inquiry, investigation or review that could significantly reflect on the independent auditor’s qualifications to serve as the Company’s independent auditor or have a significant impact on the Company’s accounting, financial reporting or disclosure. |

| |

| 13. | | Ensure the rotation of the audit partners of the independent auditor as required by law. Consider whether, in order to assure continuing auditor independence, it is appropriate to adopt a policy of rotating the independent auditing firm on a regular basis. |

| |

| 14. | | Recommend to the Board policies for the Company’s hiring of employees or former employees of the independent auditor who participated in any capacity in the audit of the Company. |

| |

| 15. | | Discuss with the independent auditor issues on which they have consulted with their national office regarding accounting, auditing and reporting matters. |

| |

| 16. | | Meet with the independent auditor prior to the audit to discuss the planning and staffing of the audit. |

Oversight of the Company’s Internal Audit Function

| | 17. | | Review the appointment and replacement of the senior internal auditing executive. |

B-3

| | 18. | | Review the significant reports to management prepared by the internal auditing department andmanagement’s responses. |

|

| |

| 19. | | Discuss with the independent auditor and management the internal audit department responsibilities,budget and staffing and any recommended changes in the planned scope of the internal audit. |

|

Compliance Oversight Responsibilities

| | 20. | | As applicable, receive from the independent auditor any required reports related to Section 10A(b) andRule 13b2-2(b) under the Exchange Act. |

|

| |

| 21. | | Receive reports from management, including the Company’s Director of Business Conduct and seniorinternal auditing executive, concerning the Company’s and its subsidiaries’ and foreign affiliated entities’conformity with the Company’s Code of Business Conduct and applicable legal requirements. Reviewreports and disclosures of insider and affiliated party transactions. Advise the Board with respect to theCompany’s policies and procedures regarding compliance with the Company’s Code of Business Conductand applicable laws and regulations. |

|

|

|

|

|

| |

| 22. |

| Establish procedures for the receipt, retention and treatment of complaints received by the Companyregarding accounting, internal accounting controls or audit matters, and the confidential, anonymoussubmission by employees of concerns regarding questionable accounting or auditing matters. |

|

|

| |

| 23. |

| Discuss with management and the independent auditor any correspondence with regulators orgovernmental agencies and any employee complaints or published reports that raise material issuesregarding the Company’s financial statements or accounting policies. |

|

|

| |

| 24. | | Discuss with the Company’s General Counsel legal matters that may have a material impact on thefinancial statements or the Company’s compliance policies. |

|

Financial Oversight

| | 25. | | In discharging its finance oversight responsibilities, the Audit and Finance Committee shall: |

| |

| | | (a) | | Review and discuss the Company’s financial plans, policies and budgets to ensure their adequacy andsoundness in providing for the Company’s current operations and long-term growth. |

|

| |

| | | (b) | | Review, discuss and make recommendations to the Board concerning proposed equity, debt or othersecurities offerings and private placements. |

|

| |

| | | (c) | | Review and make recommendations to the Board concerning its dividend policy and dividends to bepaid. |

|

Employee Benefit Plans Investment Fiduciary Function

| | 26. | | Appoint the members and monitor the performance of the Company’s Pension and Savings FundsInvestment Committee, which serves as fiduciary responsible for the control and management of the assetsof each employee pension or welfare benefit plan sponsored by the Company. |

|

|

Limitation of Audit and Finance Committee’s Role

While the Audit and Finance Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit and Finance Committee to determine that management has established and maintained appropriate internal control over financial reporting, that the Company’s financial statements and disclosures are complete and accurate and have been prepared in accordance with accounting principles generally accepted in the United States, or that the audit of the Company’s financial statements by the independent auditor has been carried out in accordance with auditing standards generally accepted in the United States. Management is responsible for the financial statements and the reporting process, including the system of internal controls, and the independent auditor is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States.

B-4

APPENDIX C

| BOARD OF DIRECTORS |

| INDEPENDENCE STANDARDS |

ATTACHMENT A

to

BOARDOF DIRECTORS’ CHARTER

AND CORPORATE GOVERNANCE GUIDELINES

INDEPENDENCE STANDARDS

An independent Director is one whom the Board affirmatively determines has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Board of Directors has adopted the following categorical standards to assist it in the determination of each Director’s independence. The Board of Directors will determine the independence of any Director with a relationship to the Company that is not covered by these standards and the Company will disclose the basis of such determinations and the identity of all directors who have been determined to be independent in the Company’s annual proxy statements.

A Director will be presumed to be independent if the Director:

1) Has not been an employee of the Company for at least three years, other than in the capacity as a former interim Chairman, Chief Executive Officer or other executive officer;

2) Has not, within the past three years, worked on the Company’s audit as a partner or employee of a firm that is the Company’s internal or external auditor, and is not a current partner or employee of such a firm;

3) Has not, during the last three years, been employed as an executive officer by a company for which an executive officer of the Company concurrently served as a member of such company’s compensation committee;

4) Has no immediate family members (i.e., spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law and anyone (other than domestic employees) who shares the Director’s home) who did not satisfy the foregoing criteria; provided, however, that, with respect to the employment criteria, such Director’s immediate family member may (i) serve or have served as an employee other than a partner in a firm that is the Company’s internal or external auditor, unless such family member has participated in the firm’s audit, assurance or tax compliance (other than tax planning) practice within the past three years, or personally worked on the Company’s audit during that time; and (ii) serve or have served as an employee but not as an executive officer of the Company during such period.

5) Has not received, and has no immediate family member who has received, during any twelve-month period within the last three years, more than $100,000 in direct compensation from the Company (other than in his or her capacity as a member of the Board of Directors or any committee of the Board or pension or other deferred compensation for prior service, provided that such compensation is not contingent in any way on continued service); provided, however, that neither compensation received by a Director for former service as an interim Chairman or CEO or other executive officer nor compensation received by a Director’s immediate family member for service as a non-executive employee shall be considered in determining independence;

6) Is not a current executive officer or employee, and has no immediate family member who is a current executive officer, of a company that made payments to, or received payments from, the Company for property or services in any of the last three fiscal years in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues as measured against the most recent completed fiscal year.

C-1

7) Has not been, and has no immediate family member who has been, an executive officer of a foundation, university, non-profit trust or other charitable organization, for which charitable contributions from the Company and its respective trusts or foundations, account or accounted for more than 2% or $1 million, whichever is greater, of such charitable organization’s consolidated gross revenues, in any single of the last three fiscal years, unless the Company discloses all contributions made to the recipient organization in its annual proxy statement; and

8) Does not serve, and has no immediate family member who has served, as an executive officer or general partner of an entity that has received an investment from the Company or any of its subsidiaries, unless such investment is less than $1 million or 2% of such entity’s total invested capital, whichever is greater, in any of the last three years.

In addition to the foregoing, in order to be considered independent for purposes of serving on the Company’s Audit and Finance Committee, a member of the Audit and Finance Committee may not, other than in his or her capacity as a member of the Audit and Finance Committee, the Board of Directors, or any other Board committee:

1) Accept, directly or indirectly, any consulting, advisory or other compensatory fee from the Company or any subsidiary of the Company, other than in the Director’s capacity as a director or committee member or any pension or other deferred compensation for prior service, provided that such compensation is not contingent in any way on continued service; or

2) Be an “affiliated person” of the Company or any subsidiary of the Company, as such term is defined by the Securities and Exchange Commission.

C-2

APPENDIX D

| BOARD OF DIRECTORS |

| DESIRABLE CHARACTERISTICS OF DIRECTORS |

ATTACHMENT B

to

BOARDOF DIRECTORS’ CHARTER

AND CORPORATE GOVERNANCE GUIDELINES

DESIRABLE CHARACTERISTICSOF DIRECTORS

| 1. | | Personal Characteristics |

| |

| l | | Integrity and Accountability: | | High ethical standards, integrity and strength of character in his or herpersonal and professional dealings and a willingness to act on and beaccountable for his or her decisions. |

|

|

| |

| l | | Informed Judgment: | | Demonstrate intelligence, wisdom and thoughtfulness in decision-making. Demonstrate a willingness to thoroughly discuss issues, askquestions, express reservations and voice dissent. |

|

|

| |

| l | | Financial Literacy: | | An ability to read and understand balance sheets, income and cashflow statements. Understand financial ratios and other indices forevaluating Company performance. |

|

|

| |

| l | | Mature Confidence: | | Assertive, responsible and supportive in dealing with others. Respectfor others, openness to others’ opinions and the willingness to listen. |

|

| |

| l | | High Standards: | | History of achievements that reflect high standards for himself orherself and others. |

|

| |

| 2. | | Core Competencies1 |

| |

| l | | Accounting and Finance: | | Experience in financial accounting and corporate finance, especiallywith respect to trends in debt and equity markets. Familiarity withinternal financial controls. |

|

|

| |

| l | | Business Judgment: | | Record of making good business decisions and evidence that duties asa Director will be discharged in good faith and in a manner that is inthe best interests of the Company. |

|

|

| |

| l | | Management: | | Experience in corporate management. Understand managementtrends in general and in the areas in which the Company conducts itsbusiness. |

|

|

| |

| l | | Crisis Response: | | Ability and time to perform during periods of both short-term andprolonged crisis. |

|

| |

| l | | Industry/Technology: | | Unique experience and skills in an area in which the Companyconducts its business, including science, manufacturing andtechnology relevant to the Company. |

|

|

| |

| l | | International Markets: | | Experience in global markets, international issues and foreign businesspractices. |

|

____________________

| 1 | | The Board as a whole needs the core competencies represented by at least several directors. |

D-1

| l | | Leadership: | | Understand and possess skills and have a history of motivating high-performing, talented managers. |

| |

| l | | Strategy and Vision: | | Skills and capacity to provide strategic insight and direction byencouraging innovations, conceptualizing key trends, evaluatingstrategic decisions, and challenging the Company to sharpen its vision. |

|

|

| |

| 3. | | Commitment to the Company |

| |

| l | | Time and Effort: | | Willing to commit the time and energy necessary to satisfy therequirements of Board and Board Committee membership. Expectedto attend and participate in all Board meetings and Board Committeemeetings in which they are a member. Encouraged to attend allannual meetings of shareholders. A willingness to rigorouslyprepare prior to each meeting and actively participate in the meeting.Willingness to make himself or herself available to management uponrequest to provide advice and counsel. |

|

|

|

|

|

|

|

| |

| l | | Awareness and Ongoing

Education: | | Possess, or be willing to develop, a broad knowledge of both criticalissues affecting the Company (including industry-, technology- andmarket-specific information), and director’s roles and responsibilities(including the general legal principles that guide board members). |

|

|

|

| |

| l | | Other Commitments: | | In light of other existing commitments, ability to perform adequatelyas a Director, including preparation for and attendance at Boardmeetings and annual meetings of the shareholders, and a willingnessto do so. |

|

|

|

| |

| l |

| Stock Ownership: | | Pursuant to the Monsanto Company Executive and Director StockOwnership Requirements, if a non-employee director owns less than10,000 shares or share equivalents of the Company’s common stock,the director is required to retain a specified portion of the shares ofCompany stock received as the result of exercising a stock optionor pursuant to a restricted stock grant or other equity-based awardgranted under the Company’s long term incentive plans until theapplicable stock ownership requirement is met. The required retentionis net of the number of shares equal in value to the tax obligationswith respect to the award, assuming such taxes are paid at the highestmarginal rate. The retention percentage is 75% if a director owns orbeneficially owns less than 5,000 shares of Company common stockand 50% if a director owns or beneficially owns more than 5,000 butless than 10,000 shares of Company common stock. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 4. | | Team and Company Considerations |

| |

| l | | Balancing the Board: | | Contributes talent, skills and experience that the Board needs as ateam to supplement existing resources and provide talent for futureneeds. |

|

|

| |

| l | | Diversity: | | Contributes to the Board in a way that can enhance perspectiveand experiences through diversity in gender, ethnic background,geographic origin, and professional experience (public, private, andnon-profit sectors). Nomination of a candidate should not be basedsolely on these factors. |

|

|

|

|

D-2

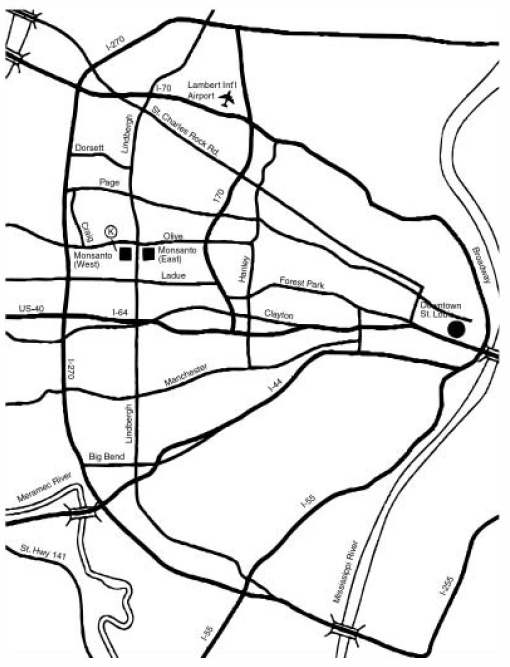

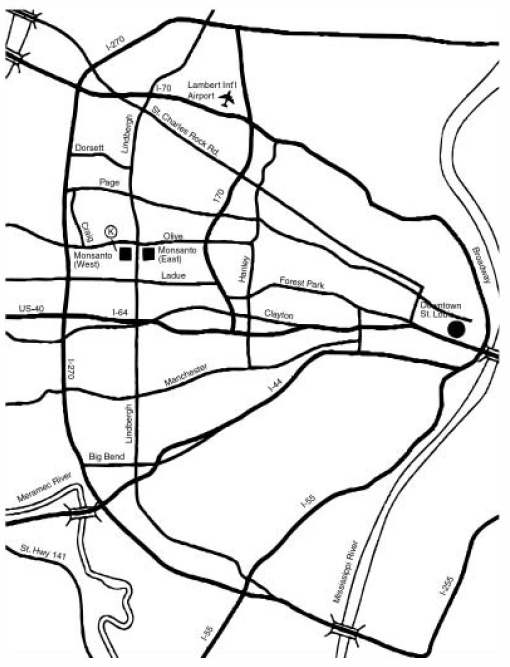

Directions from downtown St. Louis:

Take Interstate 64/Highway 40 west to Lindbergh Boulevard north. Take Lindbergh Boulevard north about 2 ½ miles to the Olive Boulevard west exit. Follow Olive to the first traffic light. Turn left and immediately left again into Monsanto’s Creve Coeur Campus. Please follow the signs to the parking area and entrance to Building K.

Directions from St. Louis International Airport (Lambert):

Take Interstate 70 west to Lindbergh Boulevard south. Take Lindbergh Boulevard south about 6 miles to Olive Boulevard west exit. Follow Olive to the first traffic light. Proceed directly across the intersection and then immediately turn left into Monsanto’s Creve Coeur Campus. Please follow the signs to the parking area and entrance to Building K.

Notice of Annual Meeting

of Shareowners

and Proxy Statement

This Proxy Statement is printed entirely on recycled and recyclable paper. Soy ink, rather than petroleum-based ink, is used throughout.

The Board of Directors recommends a vote FOR items 1 and 2 and AGAINST item 3. | Mark Here

for Address

Change or

Comments | | c |

| | PLEASE SEE REVERSE SIDE |

| | | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| ITEM 1 – | ELECTION OF DIRECTOR

NOMINEES: | | FOR all nominees

listed (except as

marked to the contrary) | | WITHHELD AUTHORITY

to vote for all

nominees listed | | ITEM 2 – | RATIFICATION OF

APPOINTMENT OF

INDEPENDENT

REGISTERED PUBLIC

ACCOUNTING FIRM | | c | | c | | c |

| | | | | | | | | | | | | |

| | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| To be elected for terms expiring in 2010: | | c | | c | | ITEM 3 – | APPROVAL OF SHAREOWNER

PROPOSAL | | c | | c | | c |

01 Frank V. AtLee III

02 Arthur H. Harper

03 Gwendolyn S. King

04 Sharon R. Long, Ph.D. | | | | | | | | | | |

| | | | | | | | | | | | | WILL ATTEND | |

| Withheld for the nominees you list below: (Write that nominee’s name in the space provided below.) | | If you plan to attend the Annual Meeting, please mark the WILL ATTEND box | | | | c | |

| | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| |

| NOTE: Please sign as name appears hereon. Joint to owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. |

| 5 FOLD AND DETACH HERE5 |

WE ENCOURAGE YOU TO TAKE ADVANTAGE OF INTERNET OR TELEPHONE VOTING,

BOTH ARE AVAILABLE 24 HOURS A DAY, 7 DAYS A WEEK.

Internet and telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

INTERNET

http://www.proxyvoting.com/mon Use the internet to vote your proxy. Have your proxy card in hand when you access the website. | OR | TELEPHONE

1-866-540-5760 Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. |

| | |

If you vote your proxy by Internet or by telephone, you do NOT need to mail back your proxy card.

To vote by mail, mark, sign and date your proxy card and return in the enclosed postage-paid envelope.

ChooseMLinkSM for fast, easy and secure 24/7 online access to your future proxy materials, investment plan statements, tax documents and more. Simply log on toInvestor ServiceDirect® atwww.melloninvestor.com/isd where step-by-step instructions will prompt you through enrollment.

You can view the Annual Report and Proxy Statement

on the internet at http://www.monsanto.com

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF MONSANTO COMPANY

The undersigned hereby appoints Hugh Grant and David F. Snively, and each of them, with power to act without the other and with power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as provided on the other side, all the shares of Monsanto Company common stock which the undersigned is entitled to vote and, in their discretion, to vote upon such other business as may properly come before the Annual Meeting of Shareowners of the Company to be held January 17, 2007 or any adjournment thereof, with all powers which the undersigned would possess if present at the meeting.

THIS PROXY CARD, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED. IF NO DIRECTION IS MADE BUT THE CARD IS SIGNED, THIS PROXY CARD WILL BE VOTED FOR THE ELECTION OF ALL NOMINEES UNDER ITEM 1, FOR ITEM 2, AGAINST ITEM 3, AND IN THE DISCRETION OF THE PROXIES WITH RESPECT TO SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

(Continued, and to be marked, dated and signed, on the other side) |

| Address Change/Comments(Mark the corresponding box on the reverse side) |

|

5FOLD AND DETACH HERE5

MONSANTO COMPANY

Annual Meeting of Shareowners

January 17, 2007

2:00 p.m. Central Standard Time

800 N. Lindbergh Blvd.

K Building

Creve Coeur, Missouri 63167

Please present this admission ticket and photo identification for the shareowner named on the front of this card for admittance to the annual meeting. For security purposes, bags and purses will be subject to search at the door. Seating at the meeting will be limited and admittance will be based on space availability.