Filed by Illumina, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Illumina, Inc.

Commission File No.: 333-250941

The following are slides from a presentation given by Francis deSouza, President and Chief Executive Officer of Illumina, Inc. (the “Company”), at the J.P. Morgan Healthcare Conference held on January 11, 2021, which were made available on the Company’s Investor Relations website (http://investor.illumina.com).

J.P. Morgan39th Annual Healthcare Conference Francis deSouza President & Chief Executive Officer January 11, 2021

Cautionary Notes on Forward-Looking Statements This presentation contains “forward-looking statements ”within the meaning of the federal securities laws, including Section27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,as amended. In this context, forward looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target, ”similar expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed. Important risk factors that may cause such a difference include, but are not limited to: (i) the impact to our business and operating results of the COVID-19 pandemic, (ii) changes in the rate of growth in the markets we serve; (iii) the volume, timing and mix of customer orders among our products and services, (iv) our ability to adjust our operating expenses to align with our revenue expectations, (v) the outcome of the pending acquisition of GRAIL, Inc., (vi) legislative, regulatory and economic developments, (v) the other risks described in the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and in the registration statement on Form S-4 filed with the SEC on November 25, 2020, and (vii) management’s response to any of the aforementioned factors. 2

Pandemic Highlights Sequencing’s Essential Role in Global Health Identified novel coronavirus Enabled development of vaccines and PCR-based tests Identification of new strains and transmission tracking 3

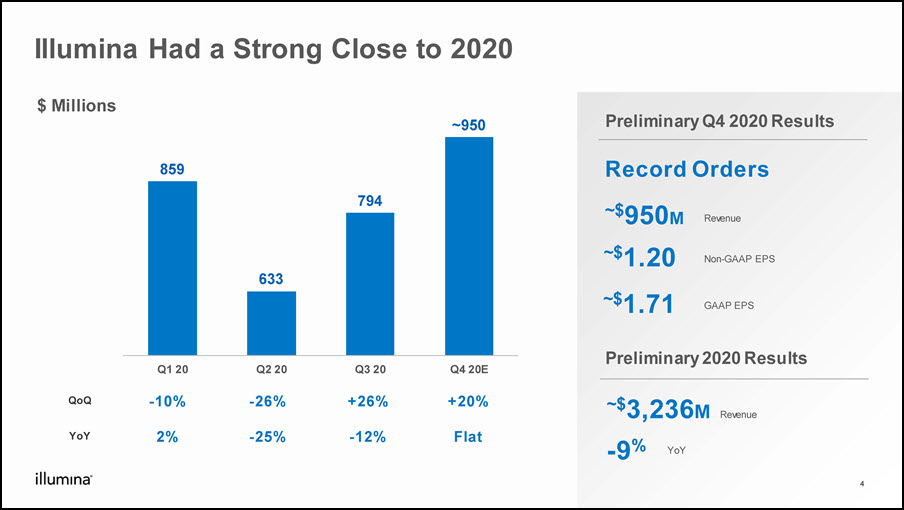

Illumina Had a Strong Close to 2020 -9% ~$3,236M YoY Preliminary 2020 Results ~$950M ~$1.20 Preliminary Q4 2020 Results $ Millions Non-GAAP EPS QoQ -10% -26% +26% +20% YoY 2% -25% -12% Flat ~$1.71 GAAP EPS 4 Record Orders Revenue Revenue

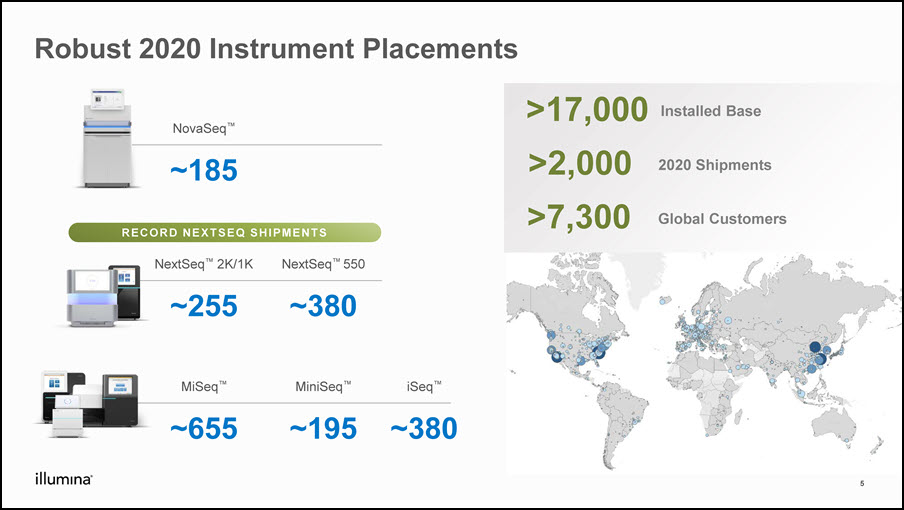

Robust 2020 Instrument Placements NovaSeq™ ~185 MiSeq™ ~655 NextSeq™ 2K/1K ~255 NextSeq™ 550 ~380 MiniSeq™ ~195 iSeq™ ~380 >17,000 2020 Shipments RECORD NEXTSEQ SHIPMENTS 5 >2,000 Installed Base >7,300 Global Customers

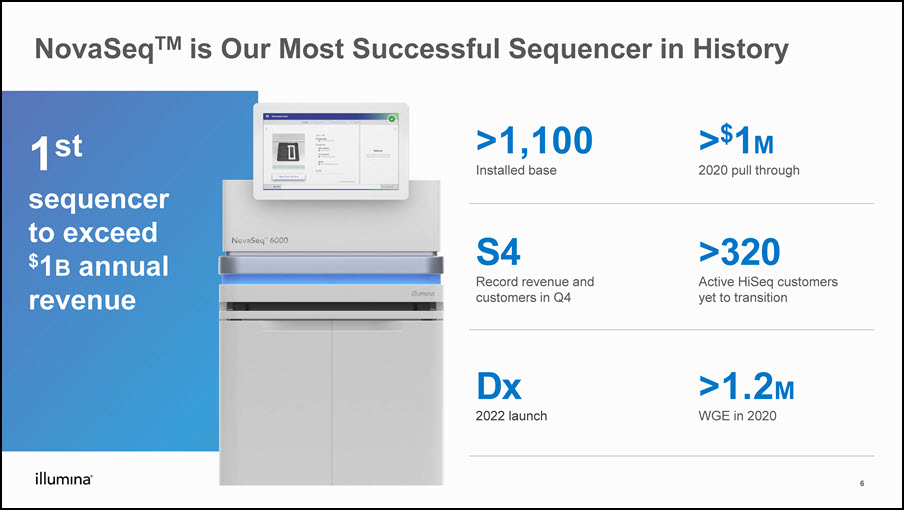

NovaSeqTM is Our Most Successful Sequencer in History 1st sequencerto exceed $1B annual revenue >1,100Installed base >$1M2020 pull through S4Record revenue and customers in Q4 >320Active HiSeq customers yet to transition Dx2022 launch >1.2MWGE in 2020 6

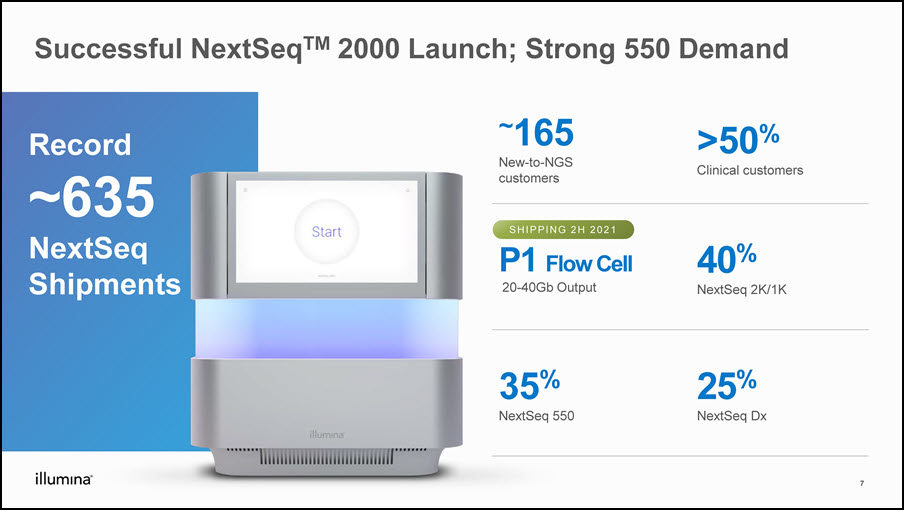

Successful NextSeqTM 2000 Launch; Strong 550 Demand SHIPPING 2H 2021 Record~635 NextSeq Shipments ~165New-to-NGScustomers >50%Clinical customers P1 Flow Cell 20-40Gb Output 40%NextSeq 2K/1K 35%NextSeq 550 25%NextSeq Dx 7

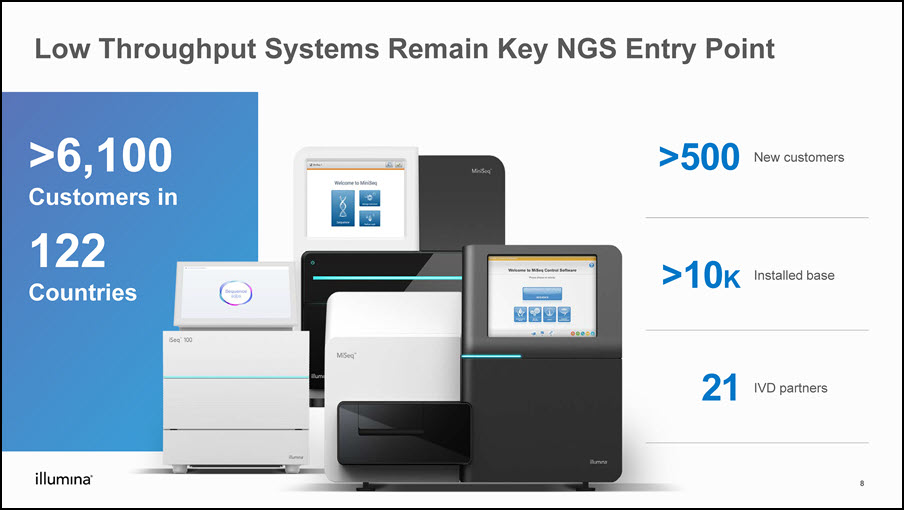

Low Throughput Systems Remain Key NGS Entry Point >500 New customers >10K Installed base 21 IVD partners >6,100 Customers in 122 Countries 8

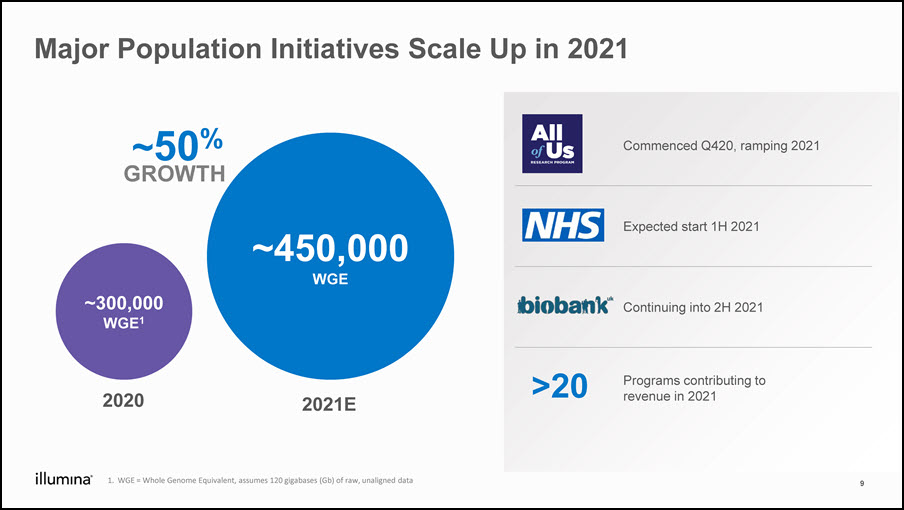

Major Population Initiatives Scale Up in 2021 Whole genome equivalents 2021+40% vs 2020 2020 2021E ~300,000WGE1 ~450,000WGE WGE = Whole Genome Equivalent, assumes 120 gigabases (Gb) of raw, unaligned data Commenced Q420, ramping 2021 Expected start 1H 2021 Continuing into 2H 2021 Programs contributing to revenue in 2021 >20 9 ~50%GROWTH

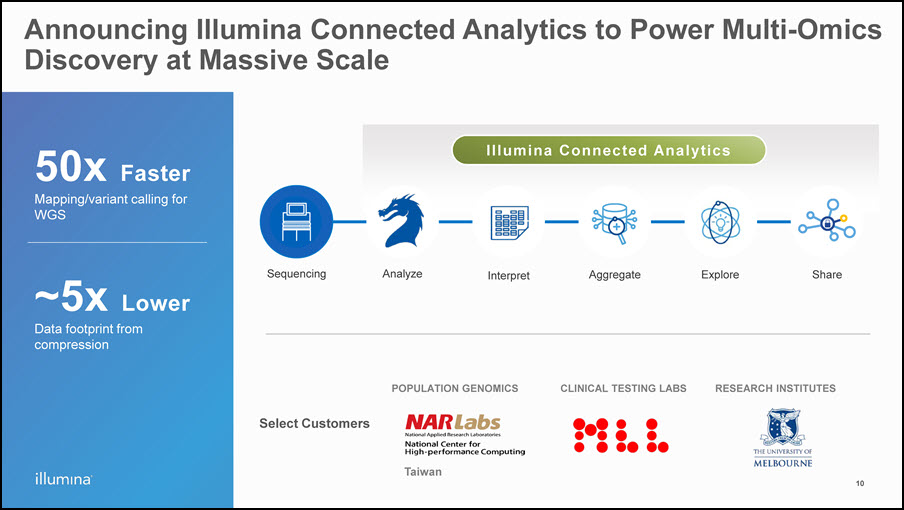

Select Customers 50x FasterMapping/variant calling for WGS ~5x Lower Data footprint from compression Analyze Interpret Aggregate Explore Share Sequencing Announcing Illumina Connected Analytics to Power Multi-Omics Discovery at Massive Scale POPULATION GENOMICS RESEARCH INSTITUTES CLINICAL TESTING LABS Taiwan 10 Illumina Connected Analytics

Illumina is a Leader in Clinical Genomics >$1.5B 2020 Clinical revenue 37 IVD partners 56 Countries with IVDs >130 Channel partners >2100 Clinical employees ~$3B Invested in R&D over last 5 years 11

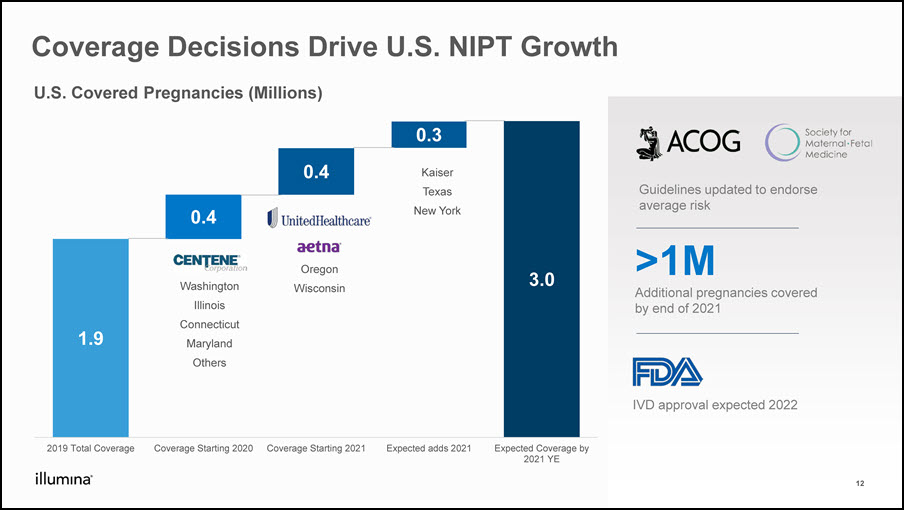

Coverage Decisions Drive U.S. NIPT Growth 12 >1MAdditional pregnancies covered by end of 2021 IVD approval expected 2022 Guidelines updated to endorse average risk U.S. Covered Pregnancies (Millions) WashingtonIllinoisConnecticutMarylandOthers TexasNew York OregonWisconsin

TruSightTM Software SuiteNovaSeqTM / NextSeqTMDNA PCR-Free library prep >400 LabsUsing NGS for GDT <24 HOURWGS Turnaround >8xGreater odds of diagnosis with NGS WGS IVDTo be launched Illumina Solutions Expanding Coverage and Illumina Solutions Drive Whole Genome Sequencing for Genetic Disease Testing 13 Global WGS Coverage (Millions) 125SwedenAustraliaEngland + WalesU.S. 30U.S.Germany 169

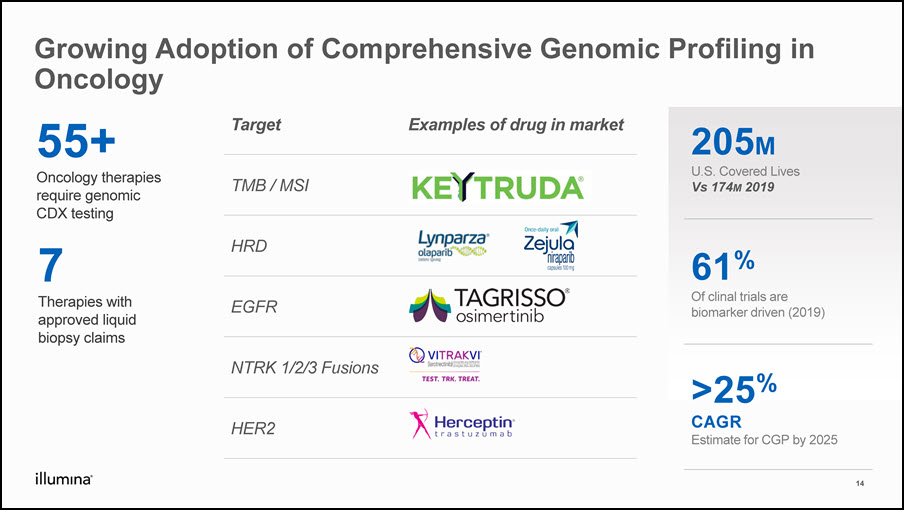

Growing Adoption of Comprehensive Genomic Profiling in Oncology 205MU.S. Covered LivesVs 174M 2019 61%Of clinal trials are biomarker driven (2019) >25%CAGREstimate for CGP by 2025 55+Oncology therapies require genomic CDX testing 14 Target Examples of drug in market TMB / MSI HRD EGFR NTRK 1/2/3 Fusions HER2 7Therapies with approved liquid biopsy claims

TSO 500 is a Market Leading Distributable CGP Panel +130%2020 Revenue Growth 250+Global Customers HRD IVD LaunchEU and U.S. in 2021 TSO 500 Tissue/Liquid Biopsy Collaboration Partners NEW PHARMA PARTNERSHIPS EXISTING CDX PARTNERSHIPS 15

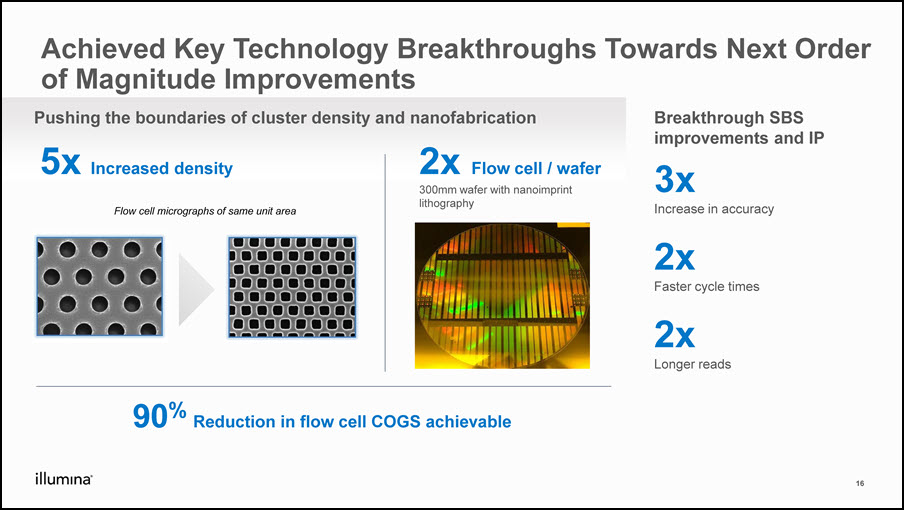

Achieved Key Technology Breakthroughs Towards Next Order of Magnitude Improvements 90% Reduction in flow cell COGS achievable Breakthrough SBS improvements and IP 5x Increased density 2x Flow cell / wafer300mm wafer with nanoimprint lithography Pushing the boundaries of cluster density and nanofabrication 3x Increase in accuracy2x Faster cycle times2x Longer reads Flow cell micrographs of same unit area 16

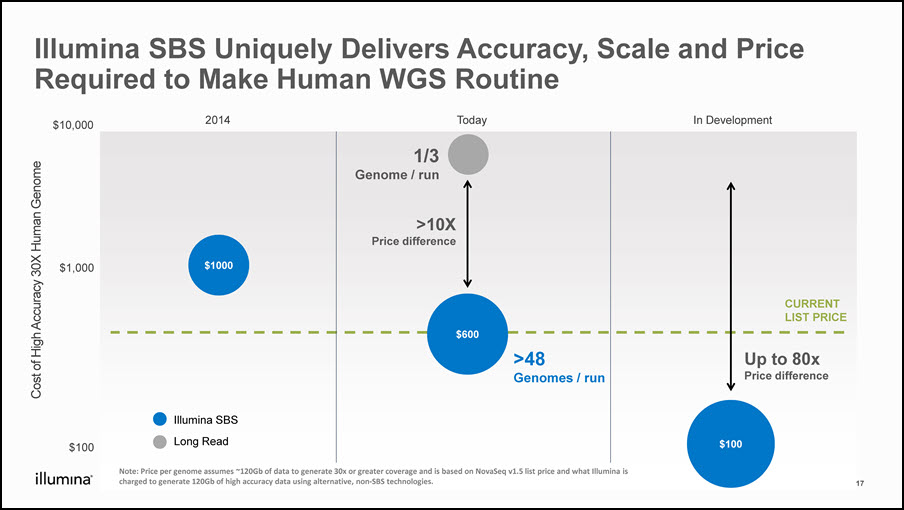

Cost of High Accuracy 30X Human Genome Illumina SBS Uniquely Delivers Accuracy, Scale and Price Required to Make Human WGS Routine 2014 Today In Development CURRENT LIST PRICE $10,000 $1,000 $100 $100 $1000 Up to 80xPrice difference $600 >10XPrice difference 1/3 Genome / run >48 Genomes / run Long Read Illumina SBS 17 Note: Price per genome assumes ~120Gb of data to generate 30x or greater coverage and is based on NovaSeq v1.5 list price and what Illumina is charged to generate 120Gb of high accuracy data using alternative, non-SBS technologies.

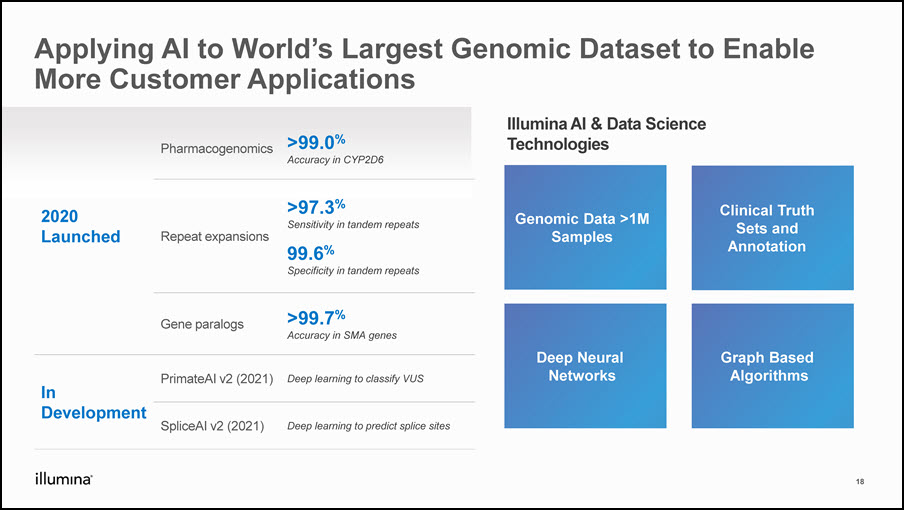

Applying AI to World’s Largest Genomic Dataset to Enable More Customer Applications 18 2020 Launched Pharmacogenomics >99.0% Accuracy in CYP2D6 Repeat expansions >97.3% Sensitivity in tandem repeats99.6% Specificity in tandem repeats Gene paralogs >99.7% Accuracy in SMA genes In Development PrimateAI v2 (2021) Deep learning to classify VUS SpliceAI v2 (2021) Deep learning to predict splice sites Illumina AI & Data Science Technologies Genomic Data >1MSamples Clinical Truth Sets and Annotation Deep Neural Networks Graph Based Algorithms

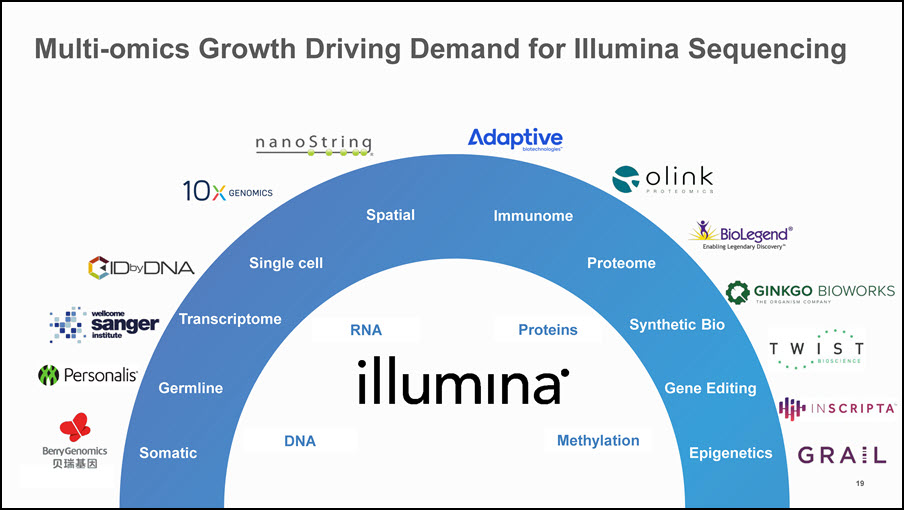

Multi-omics Growth Driving Demand for Illumina Sequencing Transcriptome Epigenetics Immunome Gene Editing Proteome Somatic DNA Proteins Methylation Spatial Single cell Germline RNA Synthetic Bio 19

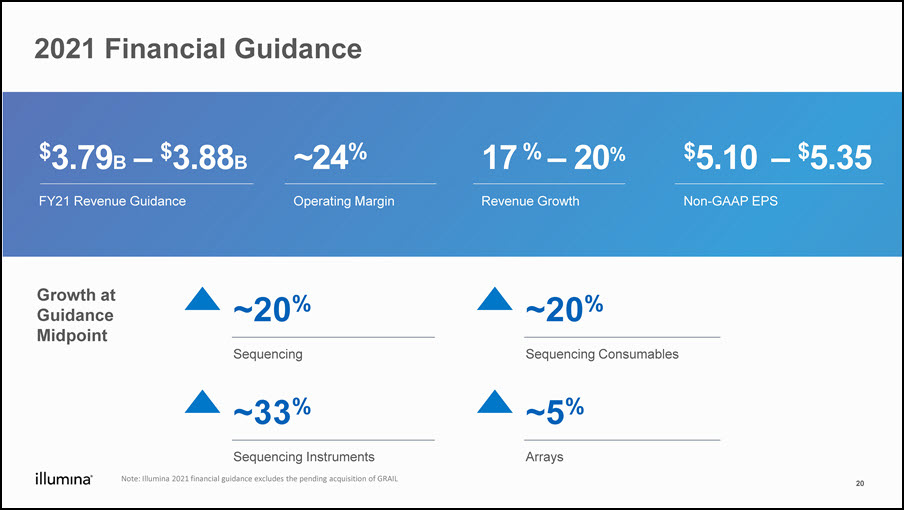

2021 Financial Guidance $3.79B – $3.88BFY21 Revenue Guidance ~24%Operating Margin 17 % – 20%Revenue Growth $5.10 – $5.35Non-GAAP EPS Growth at Guidance Midpoint ~20%Sequencing ~20%Sequencing Consumables ~33%Sequencing Instruments ~5%Arrays 20 Note: Illumina 2021 financial guidance excludes the pending acquisition of GRAIL

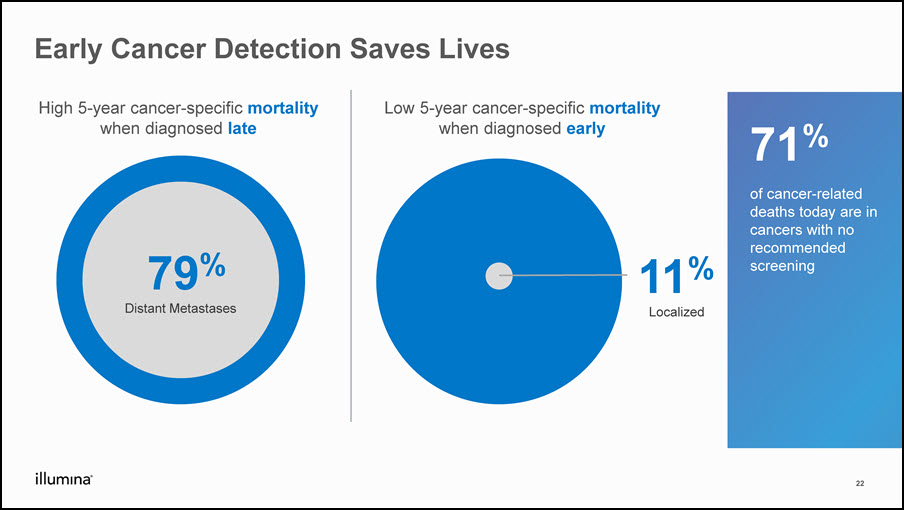

Early Cancer Detection Saves Lives 22 Low 5-year cancer-specific mortalitywhen diagnosed early High 5-year cancer-specific mortalitywhen diagnosed late 79%Distant Metastases 11%Localized 71% of cancer-related deaths today are in cancers with no recommended screening

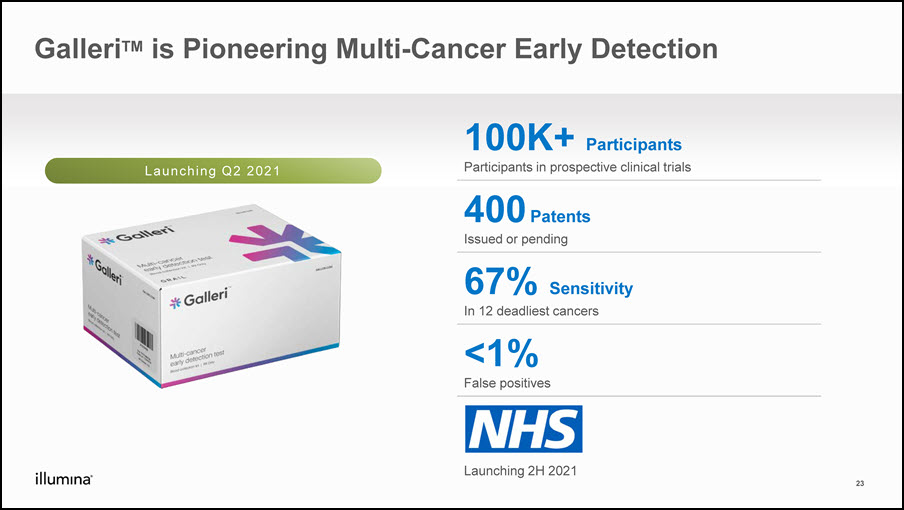

GalleriTM is Pioneering Multi-Cancer Early Detection 100K+ ParticipantsParticipants in prospective clinical trials 400 PatentsIssued or pending 67% Sensitivity In 12 deadliest cancers <1%False positives Launching 2H 2021 Launching Q2 2021 23

GRAIL Announces New MRD Pharma Collaborations 24 New Collaborators

Illumina in 2021 Sequencing Strength Pending GRAIL Acquisition Clinical Momentum 25

Illumina, Inc.Preliminary Results of Operations – Non-GAAP(unaudited) Our performance and financial results are subject to risks and uncertainties, and actual results could differ materially from the preliminary results set forth below. Some of the factors that could affect our financial results are included from time to time in the public reports filed with the Securities and Exchange Commission, including Form 10-K for the fiscal year ended December 29, 2019 filed with the SEC on February 10, 2020, Form 10-Q for the fiscal quarter ended March 29, 2020, Form 10-Q for the fiscal quarter ended June 28, 2020, and Form 10-Q for the fiscal quarter ended September 27, 2020. We assume no obligation to update any forward-looking statements or information. RECONCILIATION BETWEEN PRELIMINARY GAAP AND NON-GAAP EARNINGS PER SHARE ATTRIBUTABLE TO ILLUMINA STOCKHOLDERS: Three Months Ended January 3, 2021 Preliminary GAAP diluted earnings per share attributable to Illumina stockholders $ 1.71 Amortization of acquired intangible assets 0.05 Expenses related to COVID-19 (b) 0.07 Gain on litigation (c) (0.01) Acquisition-related expenses (d) 0.37 Non-cash interest expense (e) 0.08 Strategic investment related gain, net (f) (1.08) Gain on contingent value right (g) (0.02) Incremental non-GAAP tax expense (h) 0.09 Income tax benefit (i) (0.06) Preliminary non-GAAP diluted earnings per share attributable to Illumina stockholders (a) $ 1.20 The preliminary unaudited financial information included in this table is approximate and subject to change. We will report our fourth quarter and full year fiscal 2020 results in February.

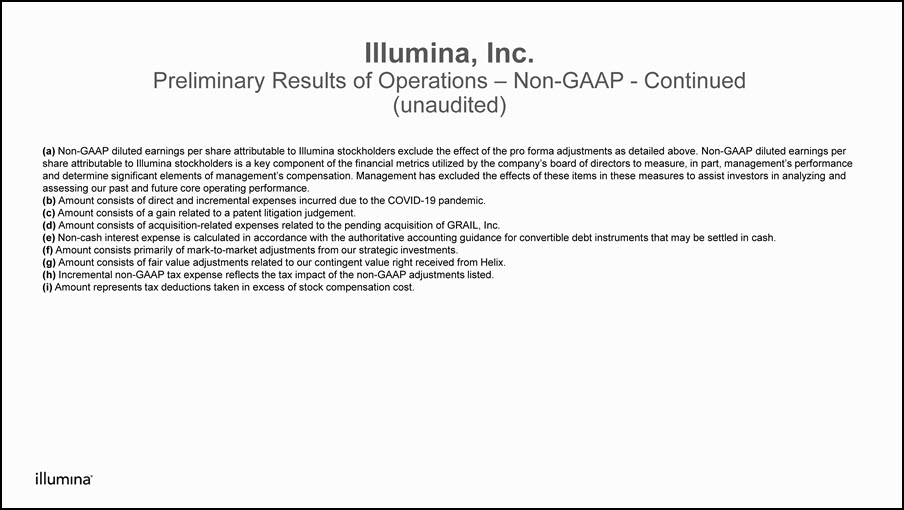

Illumina, Inc.Preliminary Results of Operations – Non-GAAP - Continued(unaudited) (a) Non-GAAP diluted earnings per share attributable to Illumina stockholders exclude the effect of the pro forma adjustments as detailed above. Non-GAAP diluted earnings per share attributable to Illumina stockholders is a key component of the financial metrics utilized by the company’s board of directors to measure, in part, management’s performance and determine significant elements of management’s compensation. Management has excluded the effects of these items in these measures to assist investors in analyzing and assessing our past and future core operating performance.(b) Amount consists of direct and incremental expenses incurred due to the COVID-19 pandemic.(c) Amount consists of a gain related to a patent litigation judgement.(d) Amount consists of acquisition-related expenses related to the pending acquisition of GRAIL, Inc.(e) Non-cash interest expense is calculated in accordance with the authoritative accounting guidance for convertible debt instruments that may be settled in cash.(f) Amount consists primarily of mark-to-market adjustments from our strategic investments.(g) Amount consists of fair value adjustments related to our contingent value right received from Helix. (h) Incremental non-GAAP tax expense reflects the tax impact of the non-GAAP adjustments listed. (i) Amount represents tax deductions taken in excess of stock compensation cost.

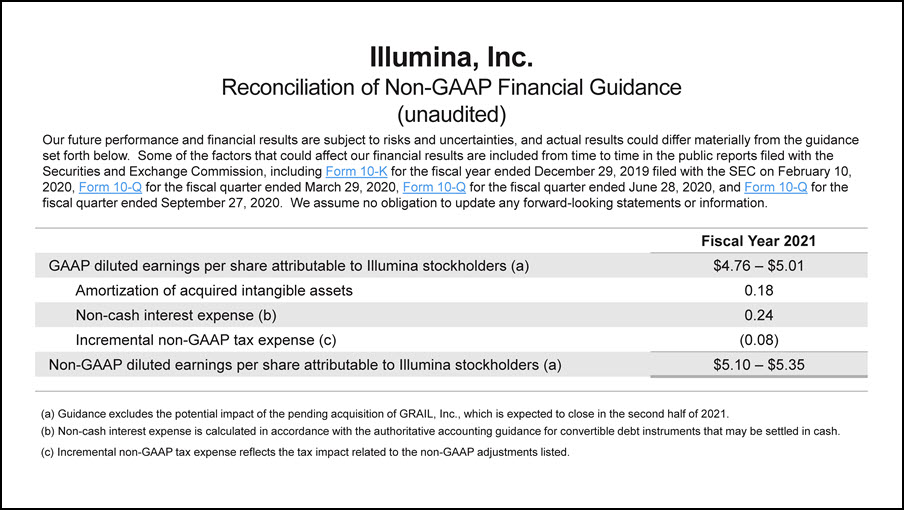

Illumina, Inc.Reconciliation of Non-GAAP Financial Guidance(unaudited) Our future performance and financial results are subject to risks and uncertainties, and actual results could differ materially from the guidance set forth below. Some of the factors that could affect our financial results are included from time to time in the public reports filed with the Securities and Exchange Commission, including Form 10-K for the fiscal year ended December 29, 2019 filed with the SEC on February 10, 2020, Form 10-Q for the fiscal quarter ended March 29, 2020, Form 10-Q for the fiscal quarter ended June 28, 2020, and Form 10-Q for the fiscal quarter ended September 27, 2020. We assume no obligation to update any forward-looking statements or information. Fiscal Year 2021 GAAP diluted earnings per share attributable to Illumina stockholders (a) $4.76 – $5.01 Amortization of acquired intangible assets 0.18 Non-cash interest expense (b) 0.24 Incremental non-GAAP tax expense (c) (0.08) Non-GAAP diluted earnings per share attributable to Illumina stockholders (a) $5.10 – $5.35 (a) Guidance excludes the potential impact of the pending acquisition of GRAIL, Inc., which is expected to close in the second half of 2021.(b) Non-cash interest expense is calculated in accordance with the authoritative accounting guidance for convertible debt instruments that may be settled in cash.(c) Incremental non-GAAP tax expense reflects the tax impact related to the non-GAAP adjustments listed.

Additional Information and Where to Find It

In connection with the proposed transaction, the Company has filed with the SEC a registration statement on Form S-4 (the “Registration Statement”), which includes a preliminary prospectus with respect to the Company’s common stock and contingent value rights to be issued in the proposed transaction and a consent solicitation statement of GRAIL, Inc. (“GRAIL”) in connection with the proposed transaction. The Company may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the consent solicitation statement/prospectus or Registration Statement or any other document which the Company may file with the SEC. INVESTORS AND SECURITY HOLDERS OF GRAIL ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH INCLUDES THE CONSENT SOLICITATION STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Registration Statement, which includes the consent solicitation statement/prospectus, and other documents filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov, through the Company’s Investor Relations page (investor.illumina.com) or by writing to Illumina Investor Relations, 5200 Illumina Way, San Diego, CA 92122.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Cautionary Notes on Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target,” similar expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements, including the failure to consummate the proposed transaction or to make any filing or take other action required to consummate such transaction in a timely matter or at all. Important risk factors that may cause such a difference include, but are not limited to: (i) the proposed transaction may not be completed on anticipated terms and timing, (ii) a condition to closing of the transaction may not be satisfied, including obtaining regulatory approvals, (iii) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the Company’s business after the consummation of the transaction, (iv) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction, (v) any negative effects of the announcement, pendency or consummation of the transaction on the market price of the Company’s common stock and on the Company’s operating results, (vi) risks associated with third-party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (vii) the risks and costs associated with the integration of, and the ability of the Company to integrate, GRAIL’s business successfully and to achieve anticipated synergies, (viii) the risks and costs associated with the development and commercialization of, and the Company’s ability to develop and commercialize, GRAIL’s products; (ix) the risk that disruptions from the proposed transaction will harm the Company’s business, including current plans and operations, (x) legislative, regulatory and economic developments, (xi) the other risks described in the consent solicitation statement/prospectus that is included in the Registration Statement, as well as in the Company’s most recent annual reports on Form 10-K and quarterly reports on Form 10-Q and in the registration statement on Form S-1 filed with the SEC by GRAIL on September 9, 2020, as amended on September 17, 2020, and (xii) management’s response to any of the aforementioned factors.

These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the consent solicitation statement/prospectus that is included in the Registration Statement. While the list of factors presented here is, and the list of factors presented in the Registration Statement are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on the Company’s financial condition, results of operations, credit rating or liquidity. The Company does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.