Reuters Breakingviews: Carl Icahn will struggle to play tough defense

Lauren Silva Laughlin

May 2, 2023

Fire with fire. The Hindenburg crashed in 1937 when pushy investor Carl Icahn was one year old. Nearly nine decades later, a short-selling shop named for the infamous zeppelin is trying to blow up the billionaire’s $14 billion listed fund. If more recent financial history is any guide, defending against such vocal criticism will be tougher than initiating it.

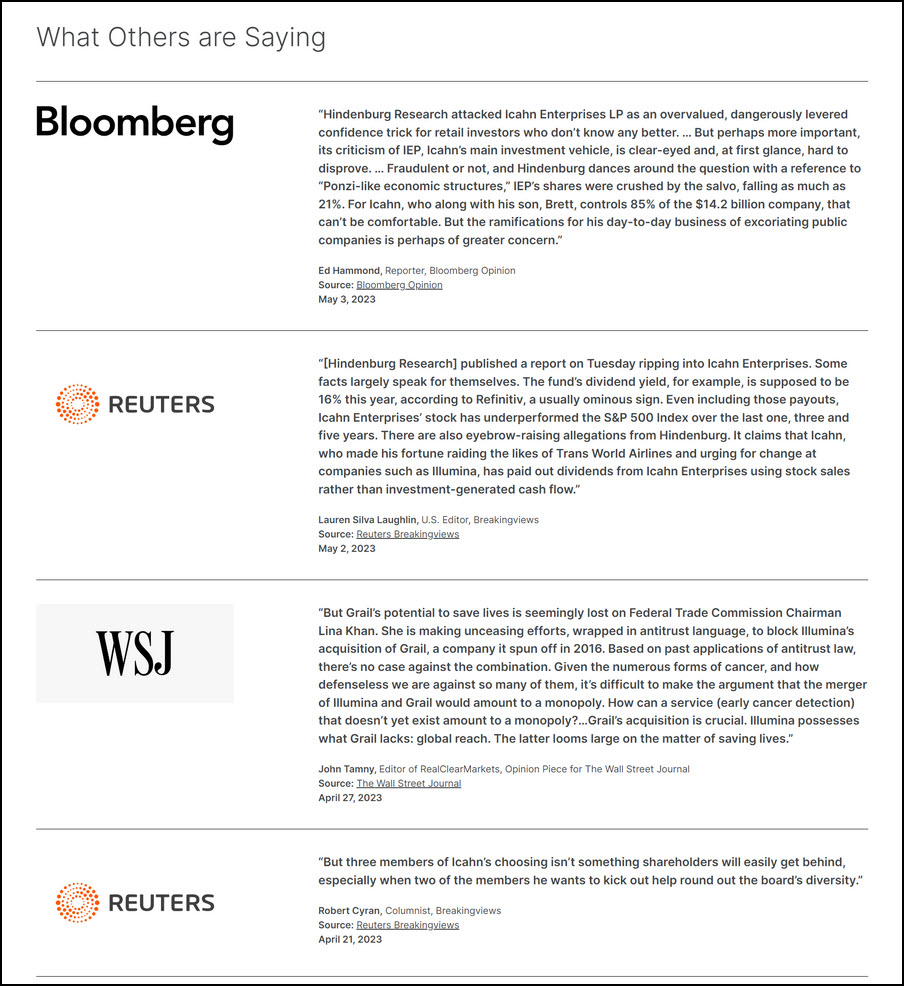

Hindenburg Research, which recently called Indian tycoon Gautam Adani’s empire the largest con in corporate history- an allegation it denies, published a report on Tuesday ripping into Icahn Enterprises. Some facts largely speak for themselves. The fund’s dividend yield, for example, is supposed to be 16% this year, according to Refinitiv, a usually ominous sign. Even including those payouts, Icahn Enterprises’ stock has underperformed the S&P 500 Index over the last one, three and five years.

There are also eyebrow-raising allegations from Hindenburg. It claims that Icahn, who made his fortune raiding the likes of Trans World Airlines and urging for change at companies such as Illumina, has paid out dividends from Icahn Enterprises using stock sales rather than investment-generated cash flow. It is a strong enough allegation to warrant a detailed explanation from Icahn, who issued a broad statement calling the campaign “self-serving.” Also curious is the stock’s high price relative to net asset value, which is some three times more than its most recent marks. By contrast, similar funds operated by fellow activist investors Dan Loeb and Bill Ackman trade much closer to net asset value.

Icahn is only the latest aggressor to have the tables turned on him. In 2019, Ackman caught an earful from investors after he decided to issue bonds. A special-purpose acquisition company he started also went sideways after he tried to consummate a deal the U.S. Securities and Exchange Commission wouldn’t approve. Loeb gave his own agitators, who he dubbed “inexperienced” investors using “juvenile” tactics, a board seat at London-listed Third Point Investors last year. The biggest defeat came when Nelson Peltz, who has picked fights at Walt Disney and DuPont, was forced to wind down his own publicly traded fund.

What Hindenburg is seeking, however, is far different than the CEO change, stock buyback or breakup that activists like Icahn often seek. It simply wants the stock to fall. By the end of Tuesday, it had lost a fifth of its value, or some $3.4 billion. It’s not obvious the octogenarian’s typical bellicosity will keep it from going further down in flames.

Context News

Short-seller Hindenburg Research issued a report on May 2 that criticized activist investor Carl Icahn’s listed fund Icahn Enterprises, which led to a 20% drop in the company’s shares.

Icahn said in a statement that he stood by public disclosures and that Icahn Enterprises’ performance would speak for itself over the long term.

“We believe the self-serving short seller report published by Hindenburg Research today was intended solely to generate profits on Hindenburg’s short position at the expense of IEP’s long-term unitholders,” Icahn said.

Bloomberg Opinion: Icahn the Hunter Has Become the Hunted

A short seller’s attack on the activist investor’s company could weaken him for future offensives.

Ed Hammond

May 3, 2023 at 6:30 AM EDT

I don’t know what Carl Icahn eats for breakfast. Shark blood? He’s supposed to be the most feared man on Wall Street, after all. Tuesday morning, he got something even less appealing: a short seller.

Hindenburg Research attacked Icahn Enterprises LP as an overvalued, dangerously levered confidence trick for retail investors who don’t know any better. It is unclear whether Icahn will care; he has been called worse — raider, devil, evil Captain Kirk, and so on — but this time he should.

For a start, Hindenburg has a track record, both at being right enough in its theses and being every bit as obstreperous as the notorious activist investor. But perhaps more important, its criticism of IEP, Icahn’s main investment vehicle, is clear-eyed and, at first glance, hard to disprove.

It argues that IEP’s stock trades at a big premium to its assets, which is true. It argues that IEP’s dividend, which at about 15% is the highest yielding of any US large cap company, is unsustainable. The short seller doesn’t purport to have uncovered a complex fraud, as with its most prominent campaigns to date: those against failed electric-vehicle maker Nikola Corp. and the business empire of billionaire Gautam Adani. This, rather, is a takedown of interpretation.

“We think Icahn, a legend of Wall Street, has made a classic mistake of taking on too much leverage in the face of sustained losses: a combination that rarely ends well.” Compare that with the claim that Adani “engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.” Indeed, the only mention of “fraud” in the Icahn Enterprises deck references a 1987 charge against the founder of investment bank Jefferies, who died more than 20 years ago. The Adani deck, by contrast, contained 43 mentions of the word.

But the substantive difference matters little. Fraudulent or not, and Hindenburg dances around the question with a reference to “Ponzi-like economic structures,” IEP’s shares were crushed by the salvo, falling as much as 21%. For Icahn, who along with his son, Brett, controls 85% of the $14.2 billion company, that can’t be comfortable. But the ramifications for his day-to-day business of excoriating public companies is perhaps of greater concern.

An attack from Icahn typically involves several tropes. The usual ones — “you the management and board are the worst thing we’ve ever seen, fire yourself and let us do your job” — are supplemented by references to Icahn’s stellar track record running IEP. The argument of “put me on your board because I am terrifying” is often cloaked as “put me on your board because I have better capital allocation skills than you: Behold IEP.”

Unless he can counter the Hindenburg narrative, Icahn may find his traditional pitch less persuading. His response so far that “performance will speak for itself” has done nothing to arrest the IEP stock slide. Nor is he likely to win much sympathy for the complaint that the report “was intended solely to generate profits on Hindenburg’s short position at the expense of IEP’s long-term unitholders.” As true as that statement may be, the prospect of Icahn having someone generate profits at his expense will be relished by many.

Icahn, like activist investors everywhere, is a master of arbitraging the narrative asymmetry that arises when a private investor attacks a public company. Bound by fair disclosure rules, companies can’t say much beyond boilerplate such as “we value the views of all our shareholders..” Investors have no such limitations and can — and do — savage everything from individual directors to company performance. Unable to resist a dig, Icahn’s fellow activist investor Bill Ackman spoke for many of those targeted executives and directors on Tuesday, highlighting the “karmic quality” of the situation.

Betting against Icahn is risky. He has won often and spectacularly enough to ensure that, and it’s folly to suddenly pivot to view him as prey and no longer predator. Icahn’s ugliest fight was against Ackman in 2013, when the two battled ferociously and publicly over Herbalife Ltd. That same year he launched seven campaigns against companies including Apple Inc. and Dell Inc.

He won’t back down from this fight. But it may come at the cost of weakening him for whomever he picks on next time.

The Wall Street Journal: Lina Khan Blocks Cancer Cures

Illumina’s acquisition of Grail would save lives, and it’s crazy for the FTC to call it a monopoly.

John Tamny

April 27, 2023 12:52 pm ET

Pancreatic cancer is almost always fatal because it’s already in late stages by the time it’s caught. Imagine being able to diagnose it while it’s still at stage 1. That can now be done thanks to Grail, a company with a mission to detect cancer early, when it can still be cured.

But Grail’s potential to save lives is seemingly lost on Federal Trade Commission Chairman Lina Khan. She is making unceasing efforts, wrapped in antitrust language, to block Illumina’s acquisition of Grail, a company it spun off in 2016. Based on past applications of antitrust law, there’s no case against the combination. Given the numerous forms of cancer, and how defenseless we are against so many of them, it’s difficult to make the argument that the merger of Illumina and Grail would amount to a monopoly. How can a service (early cancer detection) that doesn’t yet exist amount to a monopoly?

None of this seems to matter to Ms. Khan, whose main objective appears to be restraining the growth of successful businesses. The FTC’s in-house administrative-law judge ruled against her arguments and approved the merger, but Ms. Khan overruled that decision this month. In the meantime, Illumina is prohibited from working to improve access to cancer detection.

Things are no better across the Atlantic. The European Union invented new rules to block the merger—never mind that Grail isn’t available in Europe and won’t be for years. There isn’t even a market to regulate given the total lack of competing cancer blood tests. What antitrust regulators are doing has health implications well beyond the medically advanced U.S., as medical care is relatively primitive in much of the world.

Grail’s acquisition is crucial. Illumina possesses what Grail lacks: global reach. The latter looms large on the matter of saving lives. Precisely because Grail’s blood-testing technology can detect cancer ahead of its most lethal stages, it’s essential for hospitals in poorer countries lacking the ability to treat advanced stages of cancer.

For those in whom cancer is discovered late, the only realistic answer is making one’s way to Western hospitals. Early detection would save money in advanced countries by catching cancer at stages where it’s easier to treat.

Grail finds cancer while it’s treatable, and Illumina possesses the global reach to help those who won’t survive absent early treatment. The sooner they’re allowed to work together—the sooner Lina Khan stops standing between them—the more lives that can be saved.

Mr. Tamny is editor of RealClearMarkets, vice president of FreedomWorks and author of “When Politicians Panicked: The New Coronavirus, Expert Opinion and a Tragic Lapse of Reason.”

Reuters Breakingviews: Icahn may fall short in quest of the holy Grail

Robert Cyran

April 21, 2023

Nor Moses. Carl Icahn doesn’t want Jesus Christ’s help in saving Illumina, but the U.S. Securities and Exchange Commission might be emboldening him. The $35 billion seller of DNA sequencing machines used in research is a rich target for the corporate agitator after the company’s purchase of cancer detection firm Grail became disaster. Changes in the way investors vote in contests failed to help activists in Walt Disney and Salesforce. Icahn may be overestimating how much they can help him.

He first launched his battle against Illumina in February. Icahn is seeking three board seats including one that would replace CEO Francis deSouza. The company sought to make a deal, offering to change out two directors including one that was Icahn’s choice and one that was mutually agreeable. Icahn declined, saying that he would accept none of deSouza’s nominees even if it were “Jesus Christ, who admittedly was a great man.”

Icahn’s stubbornness is counter to how activists have recently handled situations. Nelson Peltz earlier this year demanded a board seat at Disney before backing away. Elliott popped up in Salesforce in January, and just three months later decided not to proceed with director nominations. Meantime, Icahn owns just 1.4% of Illumina’s shares, and he continues to battle despite the fact that State Street, which owns a stake over twice as big, has publicly warned companies over quick activist settlements.

One difference is how new rules implemented by the SEC are playing out. So-called universal proxy rules allow investors to pick and choose board members put forward on a slate. That helps activists isolate candidates rather than having to argue for the full boat.

That new rule only helps so much in both Icahn’s case and the others. In the case of Disney and Salesforce, the shareholder bases were too big and disparate, making it harder to get shareholders to engage. At Illumina, 10 investors own 45% of the stock, according to Refinitiv, almost twice as high as Disney. So Icahn doesn’t have to persuade as many people to get momentum.

What he is underestimating is shareholders’ inclinations to break bread. New voting rules can help him with one director, but he, too, has to make the case for each individually. Indeed recent data from Lazard shows there has been a significant shift to smaller activist slates at U.S. companies, with 50% providing one to two nominees versus 31% over the same period last year.

Swapping out a science specialist with one or two grounded in dealmaking isn’t a horrible idea. But three members of Icahn’s choosing isn’t something shareholders will easily get behind, especially when two of the members he wants to kick out help round out the board’s diversity. On that point, even the big man upstairs might take issue.

Context News

Activist Carl Icahn, who owns a 1.4% stake in Illumina, said on March 13 he intended to seek three seats on the board of the $35 billion valued producer of DNA sequencing machines.

In a proxy statement dated April 20, Illumina said it had offered to appoint one Icahn nominee to the company’ and one new independent candidate that already had been under consideration, but Icahn declined the offer.

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding mandates, the future, business plans and other statements that are not historical in nature. These statements are made on the basis of Illumina’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar meaning. Illumina does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements. Among the important factors to which our business is subject that could cause actual results to differ materially from those in any forward-looking statements are: (i) changes in the rate of growth in the markets we serve; (ii) the volume, timing and mix of customer orders among our products and services; (iii) our ability to adjust our operating expenses to align with our revenue expectations; (iv) our ability to manufacture robust instrumentation and consumables; (v) the success of products and services competitive with our own; (vi) challenges inherent in developing, manufacturing, and launching new products and services, including expanding or modifying manufacturing operations and reliance on third-party suppliers for critical components; (vii) the impact of recently launched or pre-announced products and services on existing products and services; (viii) our ability to modify our business strategies to accomplish our desired operational goals; (ix) our ability to realize the anticipated benefits from prior or future actions to streamline and improve our R&D processes, reduce our operating expenses and maximize our revenue growth; (x) our ability to further develop and commercialize our instruments, consumables, and products, including Galleri™, the cancer screening test developed by GRAIL, to deploy new products, services, and applications, and to expand the markets for our technology platforms; (xi) the risks and costs associated with our ongoing inability to integrate GRAIL due to the interim measures imposed on us by the European Commission as a result of their prohibition of our acquisition of GRAIL; (xii) the risks and costs associated with the integration of GRAIL’s business if we are ultimately able to integrate GRAIL; (xiii) the risk that disruptions from the consummation of our acquisition of GRAIL and associated legal or regulatory proceedings, including related appeals, or obligations will harm our business, including current plans and operations; (xiv) the risk of incurring fines associated with the consummation of our acquisition of GRAIL and the possibility that we may be required to divest all or a portion of the assets or equity interests of GRAIL on terms that could be materially worse than the terms on which we acquired GRAIL; (xv) our ability to obtain approval by third-party payors to reimburse patients for our products; (xvi) our ability to obtain regulatory clearance for our products from government agencies; (xvii) our ability to successfully partner with other companies and organizations to develop new products, expand markets, and grow our business; (xviii) uncertainty, or adverse economic and business conditions, including as a result of slowing or uncertain economic growth, COVID-19 pandemic mitigation measures, or armed conflict; (xix) the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments and (xx) legislative, regulatory and economic developments, together with the factors set forth in Illumina’s Annual Report on Form 10-K for the year ended January 1, 2023 under the caption “Risk Factors”, in information disclosed in public conference calls, the date and time of which are released beforehand, and in filings with the Securities and Exchange Commission (the SEC) including, among others, quarterly reports on Form 10-Q.

Illumina has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Illumina’s 2023 Annual Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY ILLUMINA AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Illumina free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Illumina are also available free of charge by accessing Illumina’s website at www.illumina.com.

Illumina, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Illumina. Information about Illumina’s executive officers and directors, including information regarding the direct or indirect interests, by security holdings or otherwise, is available in Illumina’s definitive proxy statement for its 2023 Annual Meeting, which was filed with the SEC on April 20, 2023. To the extent holdings by our directors and executive officers of Illumina securities reported in the proxy statement for the 2023 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

The European Commission adopted an order on September 6, 2022, prohibiting Illumina’s acquisition of GRAIL. We have filed an appeal of the Commission’s decision. The Commission has also adopted an order requiring Illumina and GRAIL to be held and operated as distinct and separate entities for an interim period. Compliance with the order is monitored by an independent Monitoring Trustee. During this period, Illumina and GRAIL are not permitted to share confidential business information unless legally required, and GRAIL must be run independently, exclusively in the best interests of GRAIL. Commercial interactions between the two companies must be undertaken at arm’s length.