- NS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

NuStar Energy (NS) 8-KFinancial statements and exhibits

Filed: 12 Jun 03, 12:00am

EXHIBIT 99.1

| Lehman Brothers Fixed Income Conference June 12, 2003 |

| Forward Looking Statements Cautionary Statement Regarding Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Securities Litigation Reform Act of 1995 regarding future events and the future financial performance of Valero L.P. All forward- looking statements are based on the partnership's beliefs as well as assumptions made by and information currently available to the partnership. These statements reflect the partnership's current views with respect to future events and are subject to various risks, uncertainties and assumptions. These risks, uncertainties and assumptions are discussed in the prospectus and prospectus supplement, Valero L.P.'s 2002 annual report on Form 10-K and subsequent filings with the Securities and Exchange Commission. |

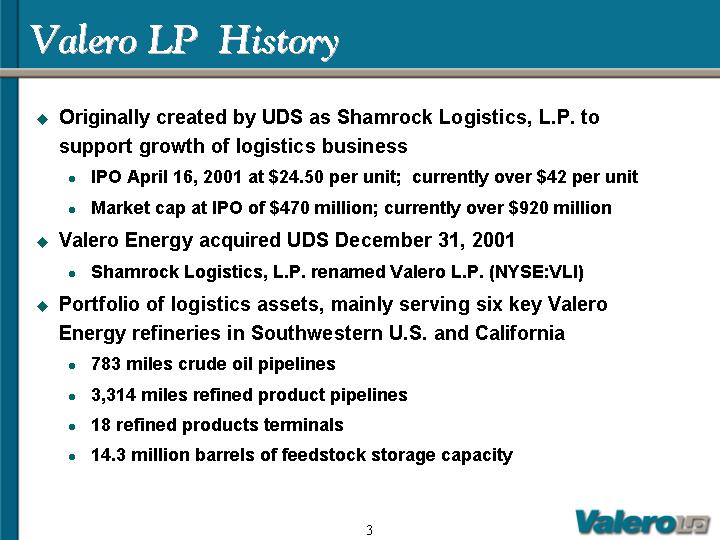

| Originally created by UDS as Shamrock Logistics, L.P. to support growth of logistics business IPO April 16, 2001 at $24.50 per unit; currently over $42 per unit Market cap at IPO of $470 million; currently over $920 million Valero Energy acquired UDS December 31, 2001 Shamrock Logistics, L.P. renamed Valero L.P. (NYSE:VLI) Portfolio of logistics assets, mainly serving six key Valero Energy refineries in Southwestern U.S. and California 783 miles crude oil pipelines 3,314 miles refined product pipelines 18 refined products terminals 14.3 million barrels of feedstock storage capacity Valero LP History |

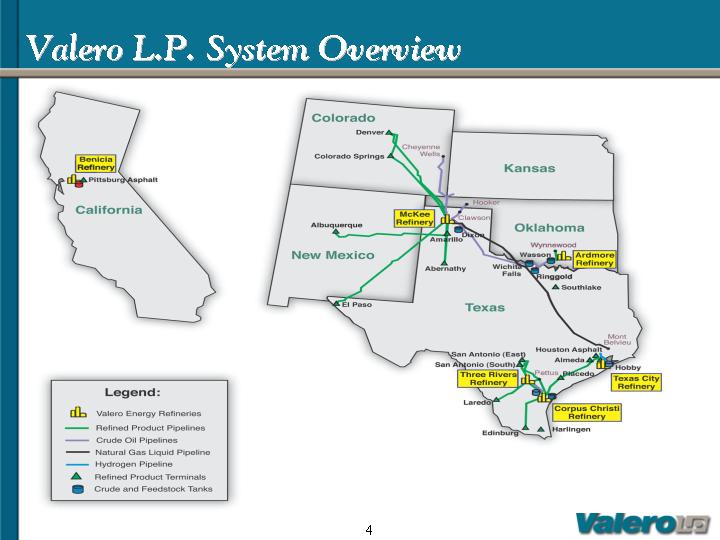

| Valero L.P. System Overview |

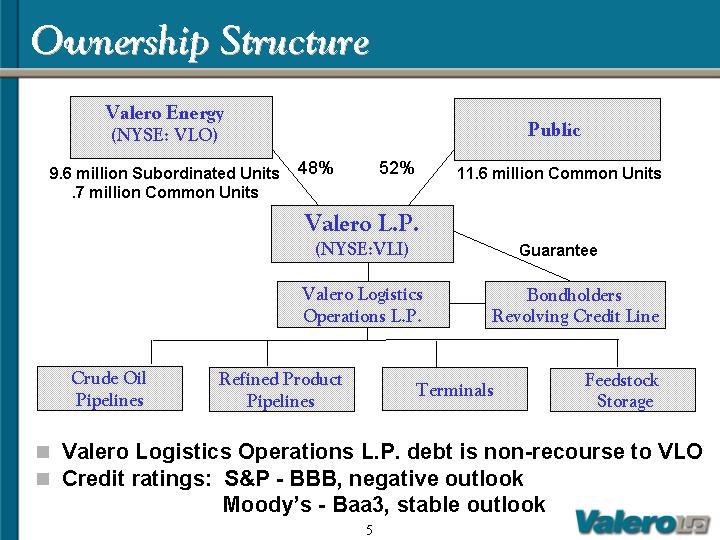

| Ownership Structure Public Valero L.P. (NYSE:VLI) Terminals Crude Oil Pipelines Refined Product Pipelines Valero Energy (NYSE: VLO) 9.6 million Subordinated Units ..7 million Common Units 11.6 million Common Units Feedstock Storage Valero Logistics Operations L.P. debt is non-recourse to VLO Credit ratings: S&P - BBB, negative outlook Moody's - Baa3, stable outlook 48% 52% Valero Logistics Operations L.P. Bondholders Revolving Credit Line Guarantee |

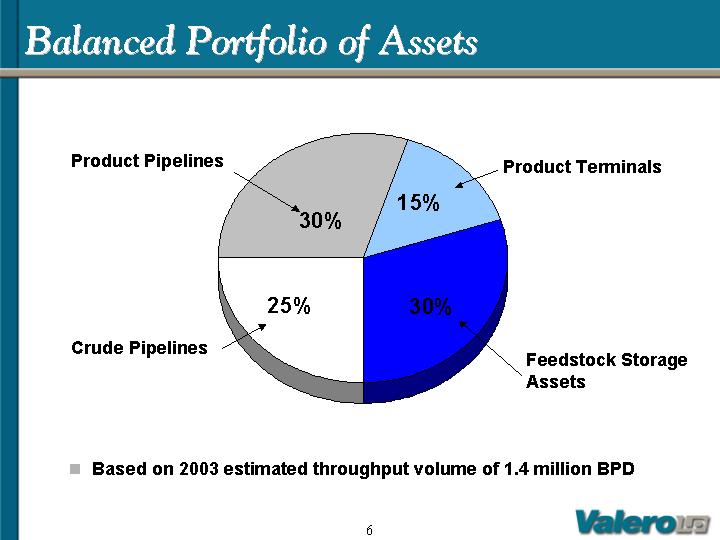

| Balanced Portfolio of Assets Crude Oil Pipelines Products Pipelines Terminals Storage Assets 0.25 0.3 0.15 0.3 Product Pipelines Product Terminals Crude Pipelines Based on 2003 estimated throughput volume of 1.4 million BPD Feedstock Storage Assets |

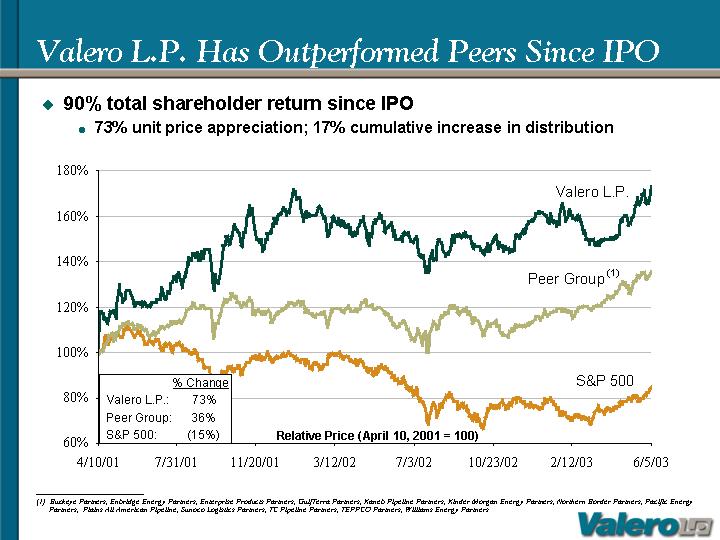

| 7 Valero L.P. Has Outperformed Peers Since IPO u l ___________________________ (1) Buckeye Partners, Enbridge Energy Partners, Enterprise Products Partners, GulfTerra Partners, Kaneb Pipeline Partners, Kinder Morgan Energy Partners, Northern Border Partners, Pacific Energy Partners, Plains All American Pipeline, Sunoco Logistics Partners, TC Pipeline Partners, TEPPCO Partners, Williams Energy Partners 90% total shareholder return since IPO 73% unit price appreciation; 17% cumulative increase in distribution (1) % Change Valero L.P.: 73% Peer Group: 36% S&P 500: (15%) Peer Group S&P 500 Valero L.P. Relative Price (April 10, 2001 = 100) |

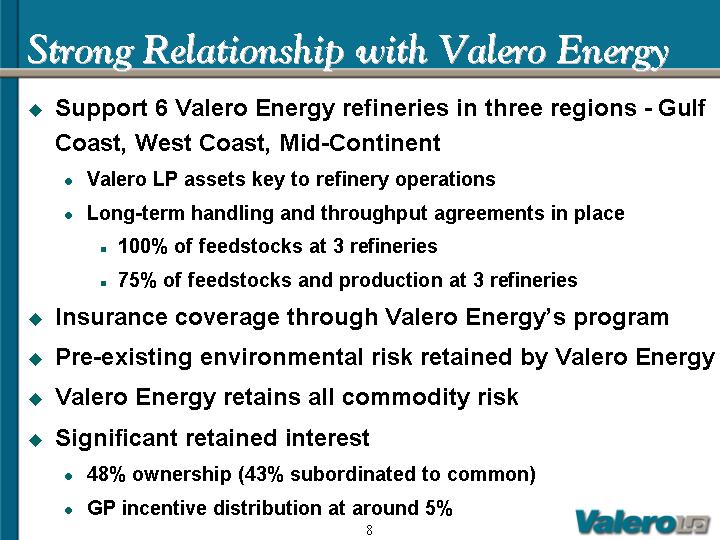

| Strong Relationship with Valero Energy Support 6 Valero Energy refineries in three regions - Gulf Coast, West Coast, Mid-Continent Valero LP assets key to refinery operations Long-term handling and throughput agreements in place 100% of feedstocks at 3 refineries 75% of feedstocks and production at 3 refineries Insurance coverage through Valero Energy's program Pre-existing environmental risk retained by Valero Energy Valero Energy retains all commodity risk Significant retained interest 48% ownership (43% subordinated to common) GP incentive distribution at around 5% |

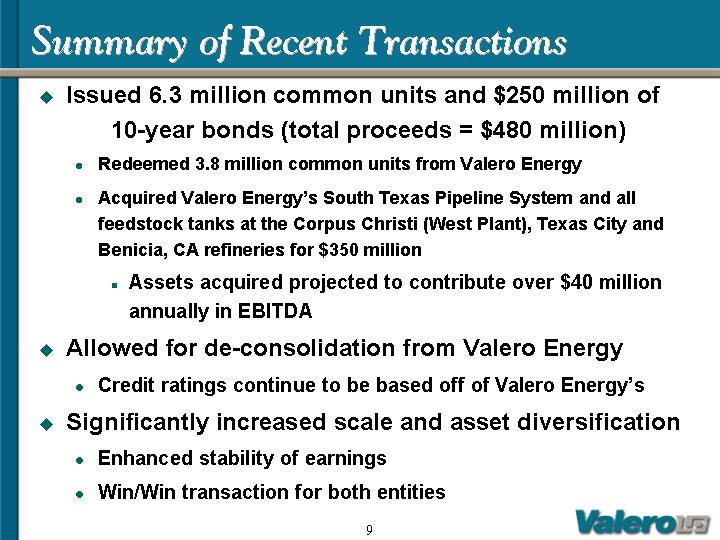

| Summary of Recent Transactions Issued 6.3 million common units and $250 million of 10-year bonds (total proceeds = $480 million) Redeemed 3.8 million common units from Valero Energy Acquired Valero Energy's South Texas Pipeline System and all feedstock tanks at the Corpus Christi (West Plant), Texas City and Benicia, CA refineries for $350 million Assets acquired projected to contribute over $40 million annually in EBITDA Allowed for de-consolidation from Valero Energy Credit ratings continue to be based off of Valero Energy's Significantly increased scale and asset diversification Enhanced stability of earnings Win/Win transaction for both entities |

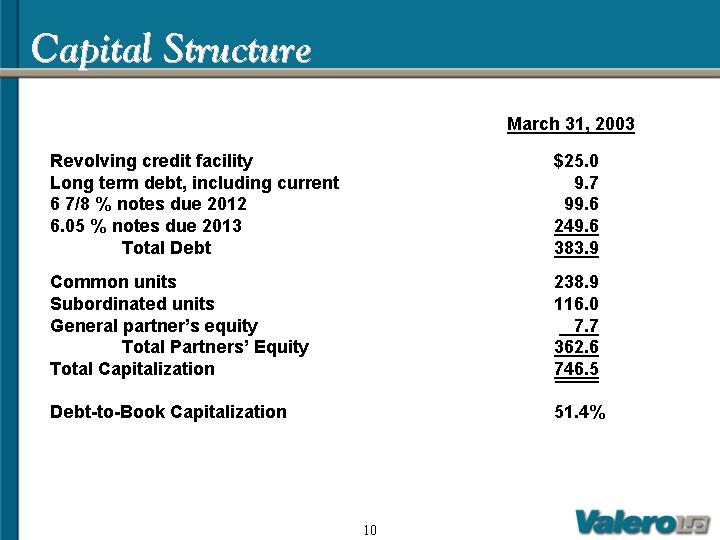

| Capital Structure March 31, 2003 Revolving credit facility $25.0 Long term debt, including current 9.7 6 7/8 % notes due 2012 99.6 6.05 % notes due 2013 249.6 Total Debt 383.9 Common units 238.9 Subordinated units 116.0 General partner's equity 7.7 Total Partners' Equity 362.6 Total Capitalization 746.5 Debt-to-Book Capitalization 51.4% |

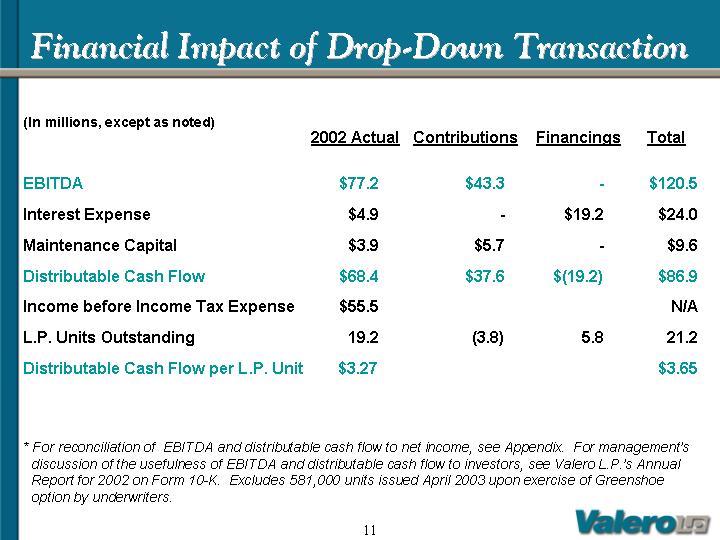

| Financial Impact of Drop-Down Transaction (In millions, except as noted) 2002 Actual Contributions Financings Total EBITDA $77.2 $43.3 - $120.5 Interest Expense $4.9 - $19.2 $24.0 Maintenance Capital $3.9 $5.7 - $9.6 Distributable Cash Flow $68.4 $37.6 $(19.2) $86.9 Income before Income Tax Expense $55.5 N/A L.P. Units Outstanding 19.2 (3.8) 5.8 21.2 Distributable Cash Flow per L.P. Unit $3.27 $3.65 * For reconciliation of EBITDA and distributable cash flow to net income, see Appendix. For management's discussion of the usefulness of EBITDA and distributable cash flow to investors, see Valero L.P.'s Annual Report for 2002 on Form 10-K. Excludes 581,000 units issued April 2003 upon exercise of Greenshoe option by underwriters. |

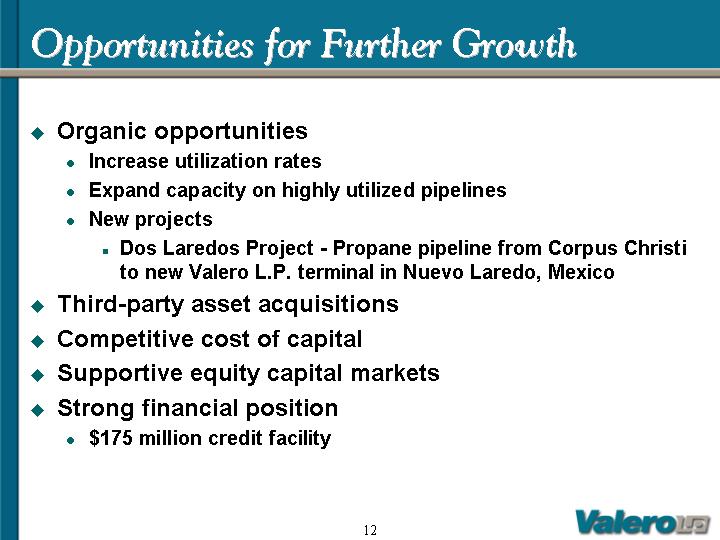

| Opportunities for Further Growth Organic opportunities Increase utilization rates Expand capacity on highly utilized pipelines New projects Dos Laredos Project - Propane pipeline from Corpus Christi to new Valero L.P. terminal in Nuevo Laredo, Mexico Third-party asset acquisitions Competitive cost of capital Supportive equity capital markets Strong financial position $175 million credit facility |

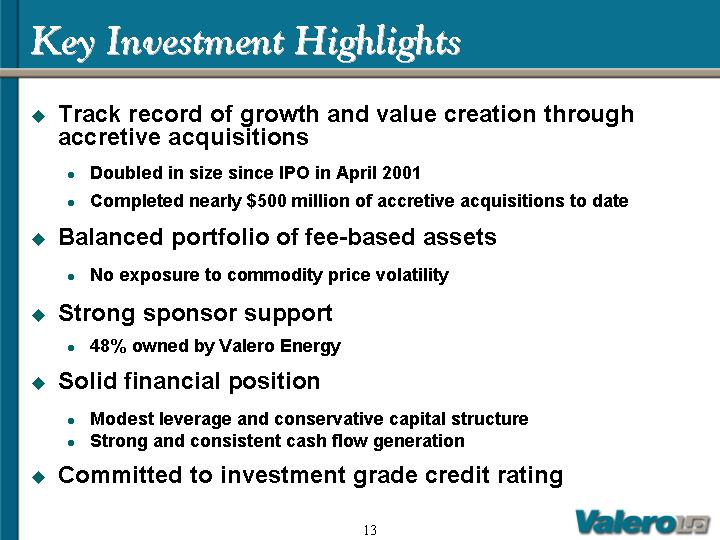

| Key Investment Highlights Track record of growth and value creation through accretive acquisitions Doubled in size since IPO in April 2001 Completed nearly $500 million of accretive acquisitions to date Balanced portfolio of fee-based assets No exposure to commodity price volatility Strong sponsor support 48% owned by Valero Energy Solid financial position Modest leverage and conservative capital structure Strong and consistent cash flow generation Committed to investment grade credit rating |

| Appendix |

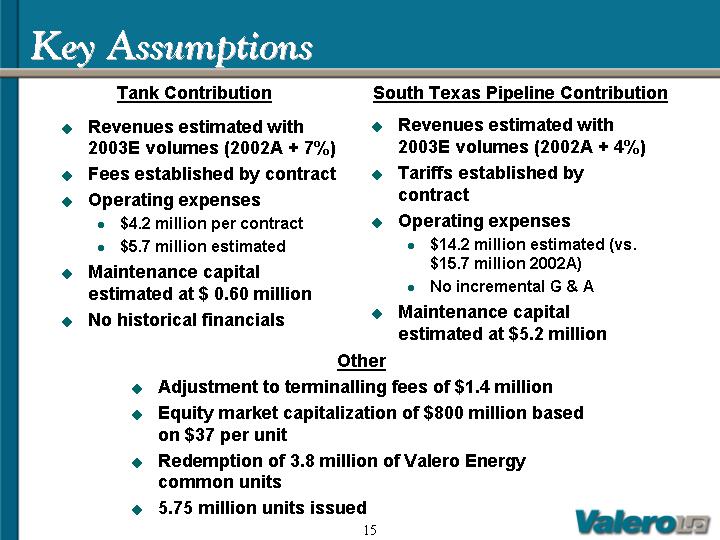

| Key Assumptions Revenues estimated with 2003E volumes (2002A + 7%) Fees established by contract Operating expenses $4.2 million per contract $5.7 million estimated Maintenance capital estimated at $ 0.60 million No historical financials Revenues estimated with 2003E volumes (2002A + 4%) Tariffs established by contract Operating expenses $14.2 million estimated (vs. $15.7 million 2002A) No incremental G & A Maintenance capital estimated at $5.2 million Tank Contribution South Texas Pipeline Contribution Other Adjustment to terminalling fees of $1.4 million Equity market capitalization of $800 million based on $37 per unit Redemption of 3.8 million of Valero Energy common units 5.75 million units issued |

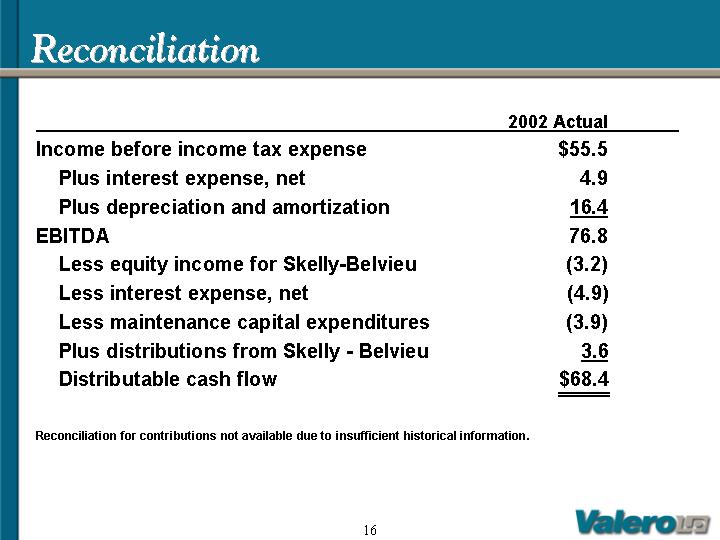

| Reconciliation 2002 Actual Income before income tax expense $55.5 Plus interest expense, net 4.9 Plus depreciation and amortization 16.4 EBITDA 76.8 Less equity income for Skelly-Belvieu (3.2) Less interest expense, net (4.9) Less maintenance capital expenditures (3.9) Plus distributions from Skelly - Belvieu 3.6 Distributable cash flow $68.4 Reconciliation for contributions not available due to insufficient historical information. |