1

Curt Anastasio

President and CEO

Master Limited

Partnership

Investor Conference

March 1, 2005

Investor Notice

Valero L.P. has filed on January 25, 2005 an amended Form S-4 Registration Statement with the

Securities and Exchange Commission (SEC) regarding its proposed mergers with Kaneb Services LLC

(“Kaneb Services”) and Kaneb Pipe Line Partners, L.P. (“Kaneb Partners”). Valero L.P., Kaneb

Services and Kaneb Partners have also filed other relevant documents with the SEC. Investors and

security holders are urged to read carefully the Form S-4 Registration Statement and other relevant

documents, because they contain important information regarding Valero L.P., Kaneb Services, Kaneb

Partners and the merger.

A definitive joint proxy statement/prospectus has been sent to security holders of Valero L.P., Kaneb

Services, and Kaneb Partners seeking their approval of the merger transactions. The date for the

special meetings of the unitholders of Valero L.P. and Kaneb Partners and shareholders of Kaneb

Services has been set for March 11, 2005. Investors and security holders may obtain a free copy of the

registration statement and other relevant documents containing information about Valero L.P., Kaneb

Services, and Kaneb Partners, without charge, at the SEC’s web site at www.sec.gov. Copies of the

definitive joint proxy statement/prospectus and the SEC filings that will be incorporated by reference in

the joint proxy statement/prospectus may also be obtained for free by directing a request to Kaneb

Services or the respective partnerships.

Valero L.P., Kaneb Services, Kaneb Partners, and the officers and directors of Kaneb Services and of

the respective general partners of Valero L.P. and Kaneb Partners may be deemed to be participants in

the solicitation of proxies from their security holders. Information about these persons can be found in

Valero L.P.’s, Kaneb Services’, and Kaneb Partner’s respective Annual Reports on Form 10-K filed with

the SEC, and additional information about such persons may be obtained from the Form S-4

Registration Statement.

2

Valero L.P. Forward Looking Statements

Cautionary Statement Regarding Forward-Looking Statements

This presentation includes forward-looking statements within the

meaning of the Securities Litigation Reform Act of 1995 regarding

future events and the future financial performance of Valero L.P.

All forward-looking statements are based on the partnership's

beliefs as well as assumptions made by and information currently

available to the partnership. These statements reflect the

partnership's current views with respect to future events and are

subject to various risks, uncertainties and assumptions. These

risks, uncertainties and assumptions are discussed in Valero

L.P.’s 2003 annual report on Form 10-K, the amended Form S-4

Registration Statement filed by Valero L.P. on January 25, 2005,

and subsequent filings with the Securities and Exchange

Commission.

3

A leading publicly traded growth MLP in the U.S. (NYSE:VLI)

Market cap at IPO of $470 million; currently around $1.4 billion

Total shareholder return of over 90 percent since Valero Energy acquired

UDS

Increased quarterly distribution from $.60 to $.80 per unit

Has delivered outstanding distribution growth while maintaining one of

the strongest distribution coverage ratios in our peer group

Owns and operates diversified portfolio of logistics assets, serving

8 Valero Energy refineries

3,800 miles of refined product pipelines

800 miles of crude oil pipelines

22 refined product terminals

4.5 million barrels of refined product storage capacity

60 crude oil storage tanks

12.5 million barrels of crude oil storage capacity

Valero L.P.

4

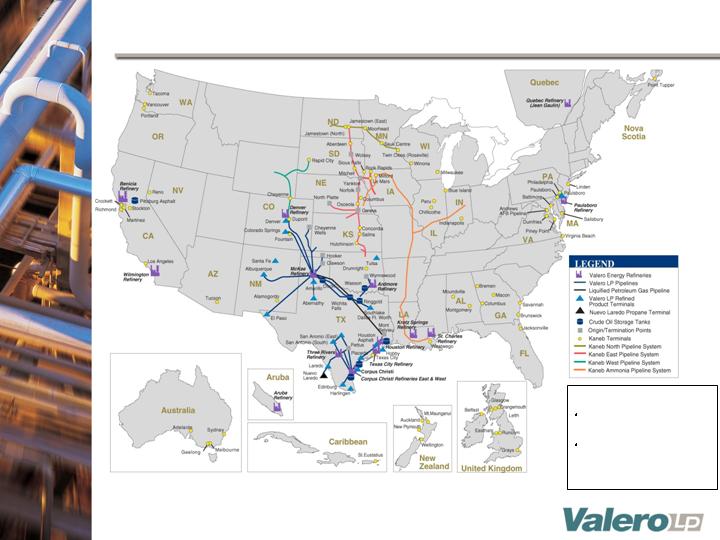

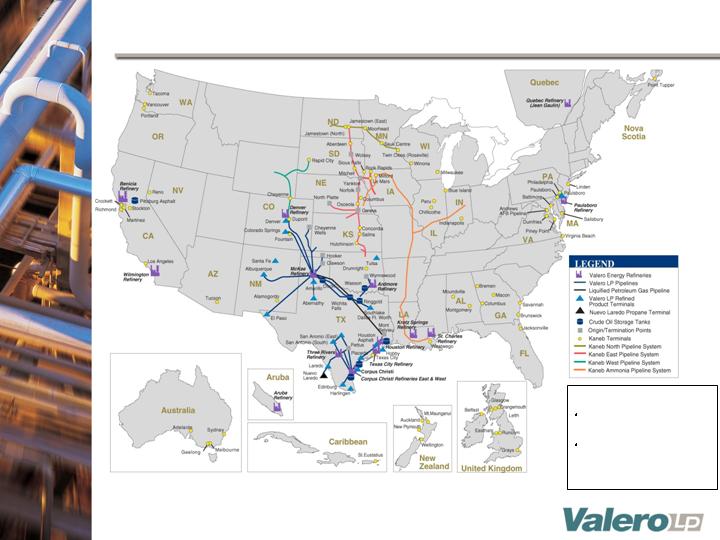

Valero L.P. System Overview

5

Refined Product Pipelines

3,800-mile pipeline system -

24 refined product pipelines

39% of 2004 revenues

Transports refined product from

Valero Energy’s McKee, Three

Rivers, Corpus Christi and

Ardmore refineries to

terminals/3rd party pipelines

Market Distribution – Mexico,

Texas, Oklahoma, Colorado, New

Mexico, Arizona and other Mid-

continent states

6

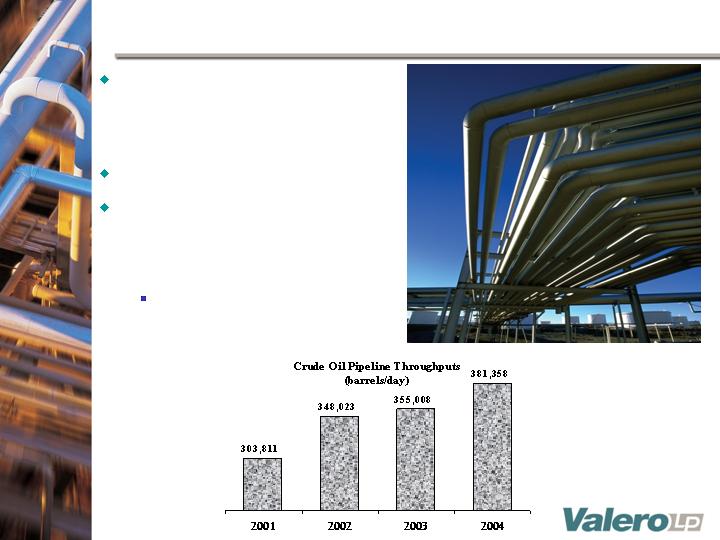

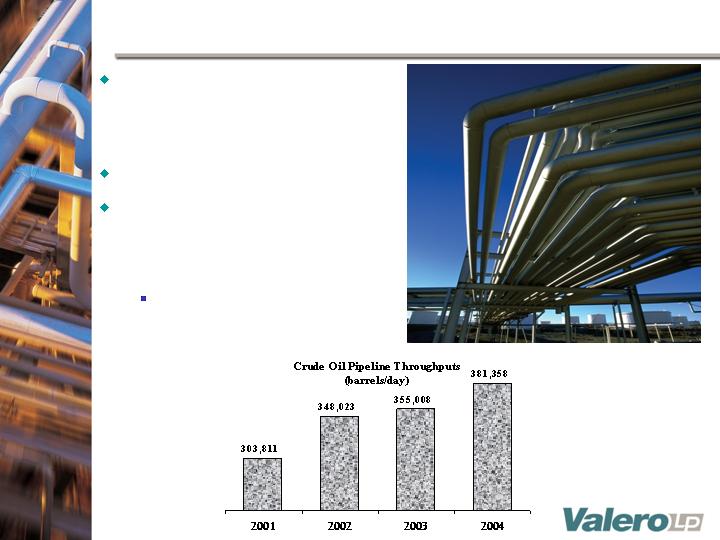

Crude Oil Pipelines

800-mile pipeline system

comprised of 9 crude oil

pipelines

24% of 2004 revenues

Transports to Valero Energy’s

McKee, Three Rivers and

Ardmore refineries

Markets – Texas, Oklahoma,

Kansas and Colorado

7

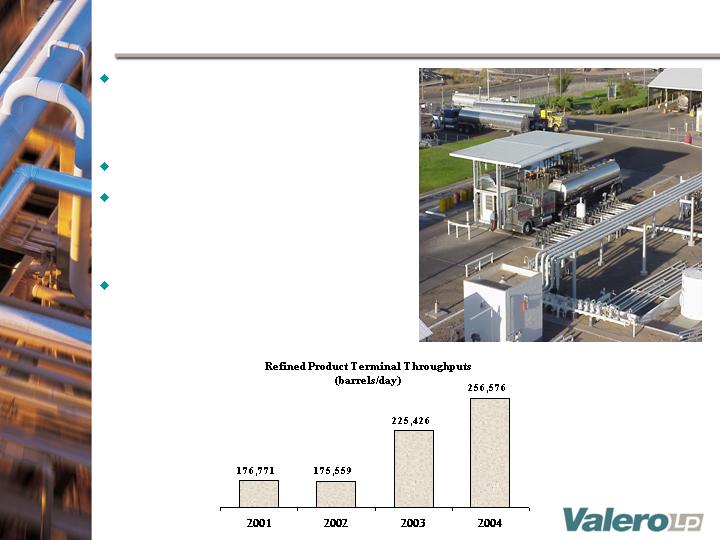

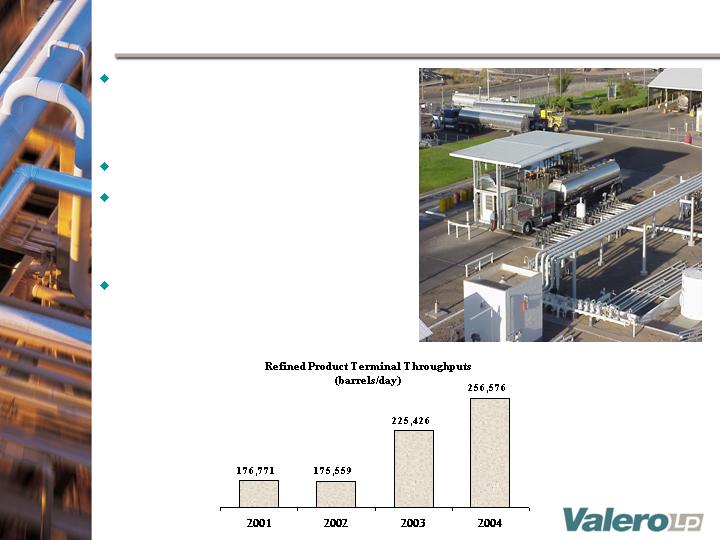

Refined Product Terminals

22 terminals with 4.5 million

barrels of refined product

storage capacity

18% of 2004 revenues

Located in Texas, Colorado, New

Mexico, California, Oklahoma,

New Jersey and Mexico

Per barrel handling fee and per

barrel fee for refined product

blending or filtering

8

Crude Oil Storage Tanks

60 crude oil storage tanks with

12.5 million barrels of crude oil

storage capacity

19% of 2004 revenues

Serve Valero Energy’s Benicia,

Corpus Christi and Texas City

refineries

Fee charged for each barrel of

crude oil and certain other

feedstocks delivered

1

1

Acquired March 18, 2003

9

Reported record 2004 earnings of $72.5 million or $3.15 per

limited partner unit

Delivered total unitholder return of over 26 percent

Increased annual distribution by nearly 9 percent

Capped incentive distribution payments to our general

partner at 25 percent

One of only 2 master limited partnerships to have done so

Acquired two state-of-the-art asphalt terminals from Royal

Trading

Commissioned new propane storage and distribution

terminal in Nuevo Laredo, Mexico

Announced agreement to acquire Kaneb Services LLC and

Kaneb Pipe Line Partners, L.P.

2004 Accomplishments

10

Kaneb Acquisition

Valero L.P. (NYSE: VLI) to acquire Kaneb Services (NYSE:

KSL) and Kaneb Pipe Line Partners (NYSE: KPP) for $2.8

billion

VLI will acquire KSL for $43.31 cash per share

VLI will acquire KPP for $61.50 per unit, subject to a fixed

value collar of +/- 5%

Upon closing, Valero Energy (NYSE: VLO) will continue to

own 100% of the GP of VLI and 21% of the common units

Upon closing, VLI management intends to recommend an

increase in its common unit distribution to $3.42 per unit

Expect transaction to close in the second quarter of 2005

11

Creates the largest terminal operator and 2nd largest

petroleum liquids pipeline operator in the U.S.

Transaction is expected to be cash flow accretive

2005 pro forma distributable cash flow accretion of 37

cents per unit

Expect $365 million of 2005 projected pro forma

EBITDA

Expect to achieve at least $25 million annually in

synergies

Greatly expands geographic presence and enhances

growth prospects

Diversifies VLI’s customer base

Strategic Rationale

See Appendix for pro forma assumptions.

1

1

1

12

Combined Operations

Pro Forma Key Statistics:

Around 9,700 miles of crude

and refined product pipeline

100 terminal facilities and 4

crude oil storage tanks with

around 85 million barrels of

storage

13

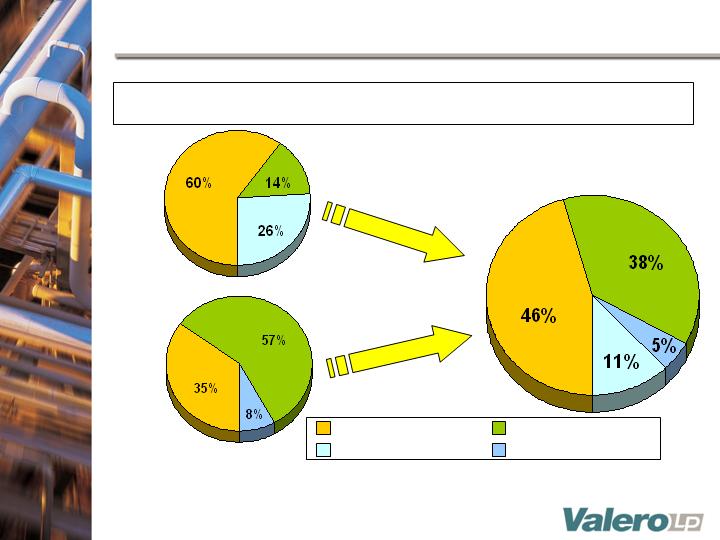

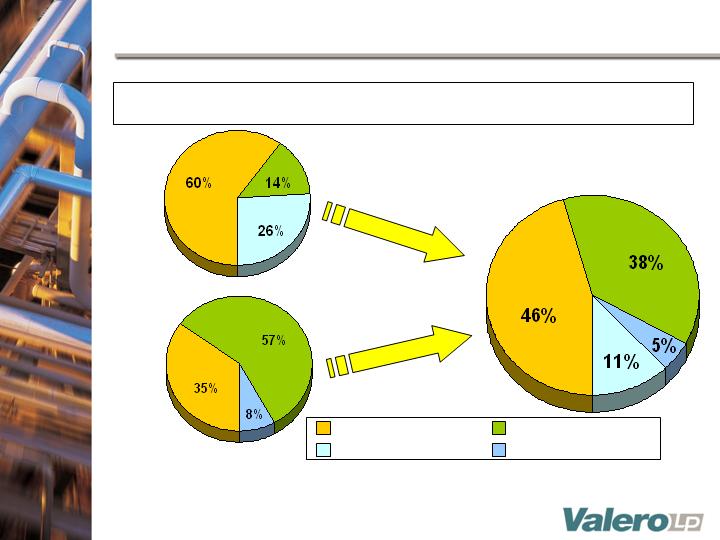

KPP

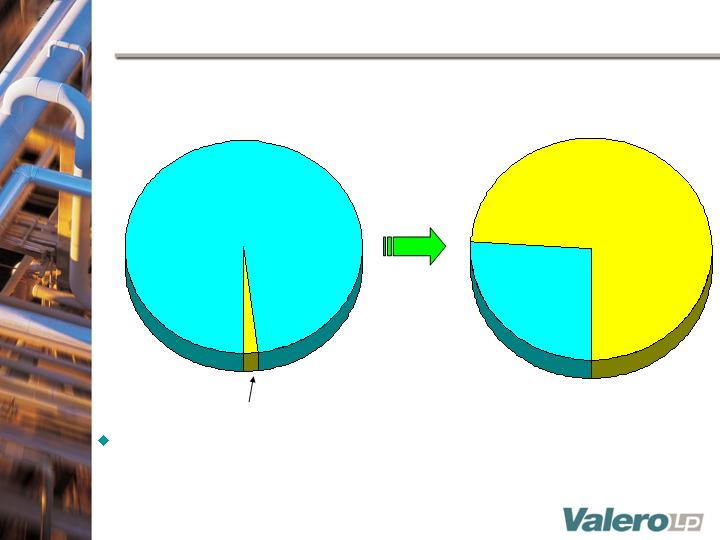

Enhances Earnings Diversity

VLI

Combined Operations

Pipeline Operations Terminal Operations

Crude Oil Storage Tanks Product Sales Operations

Percent of Operating Income by Segment

1 Excludes operating income of Martin Oil, a marketing subsidiary of KSL.

Note: Percentage of total operating income is for the nine months ended

September 30, 2004

1

1

14

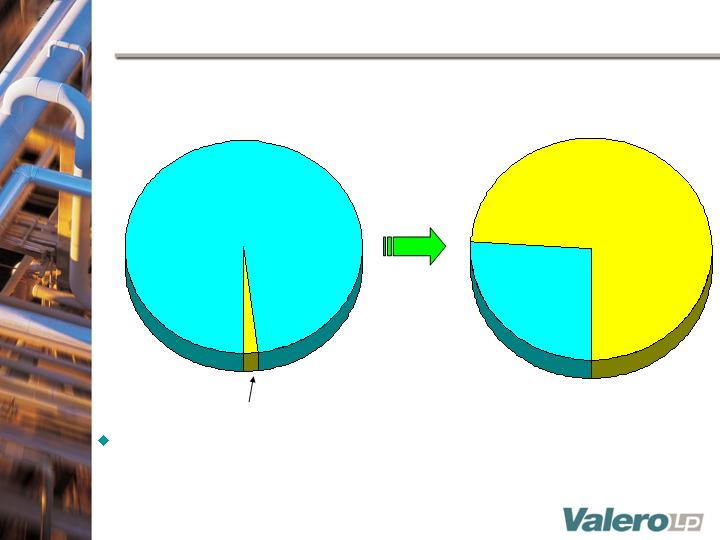

Less Dependence on One Customer

Dependence on McKee System reduced from 40% to 15% of

EBITDA

Valero Energy 98%

Third Parties 2%

Pro Forma Post-Merger

Customer Base1

Valero Energy

26%

Third Parties

74%

Pre-Merger Customer Base

1 Excludes revenue of Martin Oil, a marketing subsidiary of KSL.

Note: Percentages based on total revenues for the nine months ended

September 30, 2004

15

Strategy Going Forward

Successfully integrate Kaneb assets and

employees into the Valero L.P. system

Identify opportunities to grow the newly expanded

base business

Continue to pursue external growth opportunities

Maintain conservative financial structure

Maintain strong distribution coverage and deliver

top-tier distribution growth

16

Appendix

17

Fixed Value Collar

18

Pro Forma Assumptions

1

1

See footnote on slide 20.

19

Closing Date:

Assumed at December 31, 2004

Forecast:

2004: Based on 9 mos. actuals and 4 th quarter

forecasts for each entity as of November 1, 2004

2005: Internal budgets prepared by each entity as

of November 1, 2004

Distribution:

GP’s incentive distribution limited to 25%. Adopt

Kaneb’s distribution of $3.42 per unit.

Distributable cash flow accretion calculated

assuming distribution of all distributable cash flow.

Synergies:

$25 million per year

Units Outstanding:

47.9 million units outstanding pro forma

Fixed Value Collar:

Baseline value set at $61.50 and exchange ratio

of 1.074 VLI units for each KPP unit

Interest Rates:

Interest rate on new term debt at 6.5%

Interest rate on revolving credit debt at 4%

Debt Assumption/Refinancing:

VLI will assume KPP’s public debt and refinance

bank debt

KSL Purchase:

To be paid in cash and debt-financed by VLI in

either the public or bank market

Based on the assumptions set forth on Slide 19. While we believe that the assumptions underlying these budgets and the

other pro forma calculations included in this presentation are reasonable in light of current beliefs concerning future events,

the assumptions are inherently uncertain and are subject to significant business, economic, regulatory (including the effect of

any divestitures that may be required for governmental clearance of the proposed mergers) and competitive risks and

uncertainties that could cause actual results to differ materially from those anticipated. If the assumptions are not realized,

then actual cash available for distribution could be significantly lower.

Reconciliation of Net Income to EBITDA and

Distributable Cash Flow

The following is a reconciliation of net income to EBITDA and distributable cash flow (in thousands):

221,668

Distributable Cash Flow

(46,427)

Less reliability capital

(4,188)

Less income taxes

(92,455)

Less interest expense

364,738

EDITDA

94,034

Plus depreciation & amortization

94,449

Plus net interest expense & other

$176,255

Net income

2005

Projected Pro Forma

91,804

(17,439)

(3,403)

(31,389)

144,035

41,677

32,180

$67,123

Kaneb Partners

YTD 9/30/2004

76,690

(7,030)

-

(15,630)

99,229

24,536

15,630

$59,063

Valero L.P.

n/a

Less VLI’s Skelly interest

n/a

121

Plus income tax expense

n/a

3,055

n/a

1

1

20

Valero L.P. Financial Performance

(Dollars in millions, except EPU)

21

1Q04

2Q04

3Q04

4Q04

FY 04

Total Throughput (MBPD)

1,535

1,589

1,592

1,501

1,554

Revenue

$52.3

$55.7

$58.1

$54.7

$220.8

Operating Expenses

17.9

20.2

21.6

18.6

78.3

G&A

2.0

2.6

3.6

3.1

11.3

Depreciation

7.9

8.3

8.4

8.6

33.2

Operating Income

24.5

24.6

24.5

24.4

98.0

Interest Expense

5.1

5.1

5.4

5.3

20.9

Equity Income from Affiliates

0.6

0.2

0.3

0.3

1.3

Net Income

20.0

19.7

19.4

19.4

78.4

Income Tax Provision

-

-

-

-

-

GP Distribution

1.5

1.5

1.5

1.5

5.9

Net Income applicable to LPs

$18.5

$18.2

$17.9

$17.9

$72.5

EPU

$0.80

$0.79

$0.78

$0.78

$3.15

Common units (in thousands)

23,041

23,041

23,041

23,041

23,041